With

Belinda Parkinson, head of marketing at Unitas Wholesale.

With

Belinda Parkinson, head of marketing at Unitas Wholesale.

Woods Foodservice has announced the return of its Market Day for 2025, an event designed to connect chefs, suppliers and food enthusiasts in a day of culinary inspiration.

This year’s Market Day will take place on 16 September from 11am to 4pm at Woods Foodservice’s warehouse in Uxbridge.

It will include live cooking demonstrations from three of the UK’s top chefs: Chetan Sharma of BiBi, Tom Brown of Pearly Queen, and Adam Byatt of Trinity Restaurants.

Each chef will offer a

glimpse into their culinary world, sharing their philosophies and techniques with a live audience.

Beyond chef demos, Market Day 2025 will offer an array of attractions and activities, including more than 30 exhibitors and complimentary food and beverages, with HG Walter serving up burgers and hot dogs, Brucan Pubs offering fresh salads, Jude’s providing ice cream, and a bus bar serving a wide range of drinks. In addition, Monin will be on hand to craft cocktails and mocktails.

Visitors to Market Day will also be able to test their skills with mini golf, snap a memory in the photo booth, and enter a raffle for a chance to win a grand prize of a £500 voucher for Adam Byatt’s Trinity Restaurants.

There will also be an opportunity to get a behindthe-scenes look at the Woods Foodservice operation with tours of the Caterforce member’s warehouse.

Women in Wholesale has relaunched its Coaching Academy for 2025 with a new group format – allowing even more women to benefit from coaching support.

This year, 34 participants will take part, compared with up to 24 in previous years.

Over half of the new cohort are from wholesale businesses including Booker, Sysco, Reynolds, Savona, LWC Drinks, Pricecheck, Bidfood, Suma Wholesale, Creed Foodservice, Unitas, and Country Range.

The participants will work in small groups, meeting

monthly from September to February for six 90-minute virtual sessions.

Guided by a professional coach and supported by peerto-peer learning, the sessions provide a structured, confidential space to explore leadership challenges, develop strategic thinking and build confidence.

“Whether you’re aiming for promotion, tackling selfdoubt, or refining your leadership skills, the group Coaching Academy offers the tools and support to grow,” said WiW chairperson Clare Bocking.

The Wholesale Group has appointed Mark Aylwin as non-executive chairman and restructured its executive board.

Aylwin (pictured) brings more than 35 years of senior executive experience to the group. His background includes leadership roles at Booker Group, Blueheath, Musgrave, and most recently as chairman of Unitas for over four years.

According to The Wholesale Group, his depth of expertise in wholesale, supply chain, and strategic transformation makes him ideally suited to support the group

in its next stage of growth.

The restructure of the executive board sees Jess Douglas become managing director for people and operations; Tom Gittins, managing director for retail; and Coral Rose, managing director for foodservice. Douglas

and Gittins were previously joint managing directors, while Rose was formerly cochair of The Wholesale Group but before that managing director of Fairway Foodservice and, further back, Country Range Group.

The executive board of The Wholesale Group commented: “The Wholesale Group is unique because of our proven expertise across retail and foodservice wholesale combined with our passion for independent business. We want to sharpen this focus and have consequently restructured the executive board.”

In other news, 26 wholesale businesses are now using The Wholesale Group’s data insight platform, powered by TWC. The wholesalers are reporting weekly sales out data by customer type.

“This is the largest read of wholesale businesses in the sector,” said Gittins.

“It is also the only read that spans all wholesaler types and all product categories. More than 120 suppliers are gaining invaluable insight from the platform to better understand independent wholesale which in turn is driving actionable growth right across the channel.”

Unitas has appointed David Cooke to the newly created role of chief operating officer.

Cooke (pictured) joins Unitas after three-and-a-half years as group commercial director of AF Blakemore. He has also held senior positions at a number of companies including Dutch value retailer HEMA, Superdrug Stores, Sainsbury and Tesco.

His arrival sees Unitas managing director John Kinney move to the position of chief executive officer, and follows the recent appointment of Gurms Athwal as trading director. Athwal will report directly to Cooke and has been appointed to the Unitas board with immediate effect.

Cooke assumes executive responsibility for the trading,

commercial, marketing and retail teams, spearheading initiatives that drive value for members and supplier partners alike.

Kinney said: “David has excellent experience and a track record of delivering growth through collaborative supplier and member relationships, which makes him the ideal leader to accelerate

our ‘Fitter, Fairer, Faster’ strategy.

“Together with Gurms and the wider leadership team, David will help us deliver incremental benefits for members year on year and provide a strong return on investment for our supplier partners.”

Unitas chairman Jason Wouhra added: “David’s appointment strengthens the Unitas executive team and underscores our commitment to continuous improvement and future-proofing the business. Aligning trading, marketing, commercial and retail under a COO puts the group in an even stronger position to respond quickly to market opportunities, and to support members with best-in-class propositions.”

Brakes has launched ‘Get Set Supply!’, a new initiative to support small businesses that want to start supplying wholesale.

According to the wholesaler, ‘Get Set Supply!’ is set to be the most comprehensive support programme for smaller suppliers entering the wholesale market.

Each selected supplier will be mentored by experienced Brakes’ colleagues or established suppliers and offered a programme to drive sales through the wholesaler.

Following an online application process, around 12 shortlisted companies will be invited to a quarterly innovation session attended by customers and key procurement contacts. After the session, successful suppliers will be have their products listed.

Once selected, the new suppliers will be given a programme of support to help them grow within Brakes, including sales presentations, sampling and promotion.

Brakes is also training its merchandising team to provide specific support to food producers in the programme.

Paul Nieduszynski, CEO of Sysco GB, said: “It can

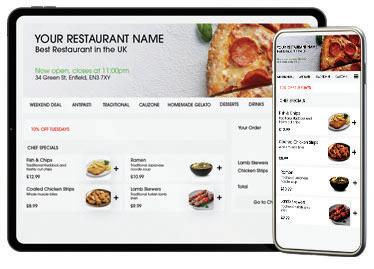

JJ Foodservice has relaunched its digital ordering solution, Foodit, with a new look and a one-stop package designed to help restaurants grow their direct online sales.

Launched by JJ in 2013, Foodit now offers an all-inone restaurant management bundle that includes a fully branded website, tablet, printer, stand, and a Restaurant Management System to receive orders.

Packages start from £799

plus VAT, with commission capped at 10% (up to £300 per week).

There is also an optional iOS/Android mobile app.

The aim is to give food businesses more control over their orders, customer relationships and profitability.

To support restaurants further, the package also comes with free access to video tutorials on subjects that include promoting a website and uploading images, updating menus, applying discounts, and accessing invoices.

sometimes be daunting for small suppliers to try to get into large businesses and, once there, to be successful.

“We want to demystify the process and provide support for around 25 new suppliers every year, giving them the opportunity to start supplying Britain’s foodservice market in a sustainable way.”

“We’re giving business owners the tools and knowledge to take full control of their website,” said Omar ElHaj, JJ’s head of marketing.

“It’s their brand, their customers and their sales –we’re here to support and grow together. Foodit is helping restaurants win back control of their customers while keeping more profits in their own pockets.”

Derby-based SOS Wholesale has gone into administration.

Formerly one of the UK’s largest discount delivered wholesalers, SOS Wholesale operated from a 70,000 sq ft warehouse in Derby, with a sales office in Barnsley. Founded in 1996, it supplied a range of 4,500 lines.

SOS Wholesale’s managing director Vipin Patara (pictured), members of the senior management team, and the full sales and telesales teams, have joined The Soft Drinks Company, a delivered wholesaler in Sheffield that offers a 2,000-strong range of confectionery, drinks, snacks and groceries.

Patara has been appointed managing director of The Soft Drinks Company, having served as a director since September 2023.

The strengthened team positions The Soft Drinks Company as ‘one of the UK’s most dynamic, debt-free, and well-capitalised wholesalers, with revenues expected to grow to £40 million in the near term’.

According to the wholesaler, customers and suppliers will benefit from uninterrupted service, an expanded product offering, and greater operational resilience.

Rick Harrison and Howard Smith from Interpath were appointed joint administrators to SOS Wholesale on 8 September.

Bestway Wholesale has announced the national launch of the Good Food Retail Network in collaboration with Impact on Urban Health and Rice Marketing.

The aim of the initiative is to improve access to healthier, affordable and culturally relevant food in independent convenience stores nationwide.

The Good Food Retail Network builds on a project launched in 2019 by Rice Marketing and Impact on Urban Health, with Bestway as wholesale partner.

A successful 2020 pilot, run through selected Bestway depots, proved that retailers could increase sales and sustainability by stocking healthier options.

The pilot saw over 100 healthier lines (across chilled, frozen, grocery, bakery, confectionery, soft drinks and snacks) promoted in two London Bestway depots, supported by pointof-sale, promotional activity

and stronger shelf labelling. Results showed that simple changes in pricing, placement and promotions can have a measurable impact on purchasing behaviour – and ultimately on health outcomes.

This work has been scaled through Bestway’s national footprint of 62 depots and 100,000 retail customers.

The Good Food Retail Network has now been launched as a scalable model that already includes more than 220 engaged retailers across Costcutter, best-one, Londis, Nisa,

Premier and SPAR, with supplier backing from brands such as Danone, Kind Snacks, KP Snacks, Mars and Nestlé and the support of 13 local authorities.

Research partners, including the University of Oxford’s Healthy Sustainable Places team, have shown interest in the model.

Further to the launch, Bestway will host a series of one-day trade events in seven London depots. Backed by suppliers, the events will feature deep-cut promotions on a wide selection from the ‘Healthier 100’ range.

Sysco has announced that Neil Williams has become managing director of Kentbased kff and Isle of Wightbased Medina Foodservice.

Formerly regional sales director of sister company Brakes, Williams (pictured) has spent more than 10 years in customer-facing and operational roles at Brakes.

In his new post, he replaces Mark Taylor, who has been appointed operations transformation director at Sysco GB.

In other news, Medina Foodservice has expanded its range with the launch of 250 new products.

The wider range includes locally-sourced products, Sysco own-label lines and national brands.

Medina has been serving foodservice businesses on the Isle of Wight and across the south coast for more

than 50 years from its depots in Newport (Isle of Wight) and Millbrook (Southampton).

The business was purchased by Sysco in 2019, which opened up new opportunities, and now Medina has access to Sysco’s own-label range, enabling it to compete with larger national operators on range and price, while retaining its high service levels.

The selection of locallysourced products gives customers greater access to local provenance, while giving producers access to a potentially global market through the Sysco connection.

Parfetts has appointed Mark Bottomley as head of trading for beer, soft drinks and crisps, snacks & nuts.

Bottomley (pictured) joins the employee-owned wholesaler after nearly seven years at Unitas Wholesale, most recently as senior trading controller and before that as trading controller for confectionery, biscuits and protein.

Prior to Unitas, he spent two-and-a-half years at Today’s, firstly as digital business development controller and then as trading controller for soft drinks, crisps & snacks and protein.

Bottomley’s 25-plus years of experience in buying, marketing and sales has also

included stints at Suntory as senior customer business manager and at Country Range Group as trading manager.

In addition, he spent nearly 14 years at Batleys in various roles including retail club manager and wines & spirits buyer.

O’Reillys Wholesale, of Newry in Northern Ireland, has officially launched a new retail convenience symbol offering, MyDaily.

Rolling out across the island of Ireland, MyDaily is designed to represent ‘a fresh chapter’ for convenience retail in Ireland, built on the firm’s promise of ‘convenience you can depend on’.

As part of the rollout, MyDaily is also introducing Evaro Coffee – an exclusive new premium coffee range.

O’Reillys Wholesale is looking forward to partnering with independent retailers to ‘deliver outstanding service and value to communities nationwide’.

The Greenes convenience store in Lurgan, which recently won the Retail NI High Street Hero Awards for Best Convenience Store, is currently under construction to become one of the first MyDaily locations.

“Here’s to exciting times ahead as MyDaily grows –bringing dependable convenience to communities across Ireland,” said a company spokesperson.

A new guide to help wholesalers prepare for climate change has been published by the Scottish Wholesale Association (SWA) in partnership with the Adaptation Scotland programme.

Industry Insights: Climate Change Risks and Adaptation in the Scottish Food & Drink Wholesale Industry highlights the key climate challenges wholesalers face, including extreme weather, supply chain disruptions, and challenges with storage infrastructure – and the actions they can take.

The guide features steps to support the workforce, premises, products, supply chain, and the surrounding environment. It also includes examples from firms showing how they are already adapting and strengthening their business resilience.

SWA’s head of sustainability and communications Ylva Haglund said: “This

new publication is a valuable asset for wholesalers, designed to offer practical, straightforward guidance.”

Key adaptation actions for wholesalers include severe weather planning; floodresilience measures; heat and humidity management; and building resilience in the supply chain, such as working with suppliers in different regions to reduce risks of running out of stock when disruptions happen.

The new resource has

been co-developed by SWA members including Bidfood and Greencity Wholefoods which both feature in case studies within the guide. There was an initial workshop with representatives from 11 companies.

Speaking about its own actions in response to a severe storm in early 2025, Greencity Wholefoods’ HR manager Leigh Galletly said: “When it became apparent that Storm Éowyn posed a significant threat not just to

our ability to deliver but also to life, we kicked into action.

“As a result of that very extreme situation, and knowing that it may well reoccur, Greencity has devised an action plan to be better prepared for similar weather events going forward.”

At Bidfood, head of sustainability Julie Owst said: “Climate change poses many challenges to businesses –operational and financial impacts from extreme weather being just part of a bigger picture of change that businesses need to understand and respond to. Our customers rely on us delivering a reliable service, so taking action to mitigate the impacts of these operational challenges is crucial.”

The guide: https://adaptation.scot/take-action/aguide-to-help-scotlandsfood-and-drink-wholesaleindustry-build-resilience-intheir-businesses/

Booker will host its annual catering trade show at the NEC Birmingham for the first time this year.

Now in its sixth year, the largest event in the Booker calendar will see the wholesaler take 20% more space than last year. There will be more than 250 suppliers, stands and displays.

On 24 September, over 5,000 visitors are expected to attend the event from the UK’s catering, hospitality and on-trade sectors. More than 1,000 representatives from Booker, including category,

sales and branch managers, will be at the event.

In addition to supplier stands, The Chef’s Stage will share menu inspiration in live cooking sessions.

There will also be a butchery zone, a desserts stage, a drinks theatre, and wine sampling. Booker’s drinks division Venus Wine & Spirit Merchants will have a dedicated zone.

Booker’s refreshed ownbrand range will be on show, along with CaterPro, the new own-label packaging and disposables range.

Sheffield-based distributor Pricecheck has been certified as a Great Place to Work for the second year in a row.

The organisation Great Place To Work is regarded as the global authority on workplace culture.

The accreditation, based entirely on anonymous employee feedback, highlights high levels of engagement and workplace satisfaction. It reflects Pricecheck’s commitment to fostering a supportive culture built on employee growth, open communication and teamwork.

Debbie Harrison OBE, joint managing director, said: “We’re thrilled to have been officially certified as a Great Place to Work for another year.

“What makes this achievement so rewarding is knowing it comes directly from our people’s voices.

“This recognition comes in a year of record financial performance, achieved while successfully overhauling our ERP system – a real testament to the resilience and dedication of our team. Hearing such positive feedback is the cherry on top.”

The UK Deposit Management Organisation (UK DMO), which is managing the new Deposit Return Scheme for single-use plastic and metal drinks containers in Northern Ireland, Scotland and England, has appointed John Bason as chair.

Bason (pictured) has experience of working with stakeholders across food and drink and retail supply chains.

He was chair of FareShare for 13 years and finance director of Associated British Foods for more than 20 years.

He also held senior roles at United Biscuits, Bunzl, and Compass Group. He is currently the chair of the strategic advisory board of Primark, chair of Bloomberg Publishing, and non-executive director of SSE.

SPAR’s 2025 Community Cashback campaign has provided direct funding to more than 65 charities and local groups.

Now in its fourth year, the campaign continues to grow in both reach and impact. This year, it was further strengthened by the support of SPAR’s five Regional Distribution Centres (RDCs), each contributing additional funds to boost the central grant pot to £100,000. This enabled SPAR to support even more community organisations nationwide.

Launched in April, the campaign invited SPAR

shoppers to nominate local charities, voluntary groups and good causes.

From youth development and disability support to mental health and community sport, this year’s recipients span a range of sectors.

For more information on the responsib e reta ing of vapour products, visit juu absreta er.co.uk

Co-op Wholesale and Costcutter Supermarkets Group have renewed their partnership with the aim of unlocking greater value for independent retailers.

The deal means that Coop Wholesale (previously known as Nisa) will continue to act as primary wholesaler to Costcutter stores, extending a relationship established in 2018.

The existing contract had been due to expire in December, and news of the new arrangement ends speculation about the future of Costcutter’s supply arrangements following its integration into Bestway.

Katie Secretan, MD of Co-op Wholesale, said: “I am delighted to announce this new agreement which goes further than just a supply deal: we are jointly focused on true partnership as the

key ingredient for mutual success as we collectively support independent retailers to grow through our market-leading propositions.”

Dawood Pervez, MD of Bestway Wholesale, added: “The continuation of our collaboration will see Costcutter stores continue to benefit from the market-leading fullservice convenience model from Co-op Wholesale.”

Hundreds of children took part in the celebratory SPAR Lancashire School Games finale events in Blackpool and Preston.

Run by Active Lancashire and the School Games Organiser Network, the Lancashire School Games have been sponsored by SPAR through its association with James Hall & Co since 2006.

AF Blakemore & Son has appointed CJ Antal-Smith as its new chief commercial officer.

Antal-Smith (pictured) was formerly commercial director at Poundland & Dealz, where she led the commercial, marketing and digital functions through a successful sale process. She also previously held senior commercial roles at Co-op, Halfords, Nando’s and Asda.

Carol Welch, CEO at AF Blakemore, said: “CJ’s track record in commercial leadership, as well as her deep understanding of the customer in the convenience retail space, makes her a powerful addition to our business.

“By bringing the marketing and commercial teams together under her leadership we will strengthen our customer-led strategy, as well as building stronger

partnerships across shoppers, retailers, suppliers and other stakeholders, resulting in a further acceleration in our growth.”

In April, AF Blakemore began supplying more than 80 EG On the Move SPAR stores; in June it launched Blakemore Trade Partners Plus – a £4.5 million investment package – and partnered with Iceland on frozen food; and it recently became the exclusive branded supply partner for M&S.

United Wholesale Scotland (UWS) achieved record turnover of £285 million in the year ending 31 December 2024, up from £281.7 million in 2023.

Gross profit rose from £25.4 million to £26.9 million –representing an increase from 9% to 9.5% – while operating profit was down from £7.6 million to £6.9 million.

The Games are delivered in three distinct clusters in Lancashire – Coastal, Central and Pennine – aligned to local needs. In the 2024-25 academic year, 30,000 children across the county participated in the Games.

The Pennine cluster finale in Burnley was postponed until this month due to the weather.

The Glasgow-based wholesaler, which recently completed its takeover of Time Wholesale in Essex (now called United Rainham), said that the growth was achieved despite a highly competitive market and ongoing pressure on consumer spending.

A company spokesperson added: “Our strategic focus

on optimising the sales mix, enhancing customer and supplier relationships, and using modern technology has led to operational improvements across the business.

“In light of the ongoing challenges posed by widespread inflation and rising costs across all sectors, we remain committed to delivering value, fostering innovation and supporting our loyal customer base.”

As Parfetts opened its Southampton depot, joint managing directors Noel Robinson (left) and Guy Swindell were enthusiastic about building business with retailers in the area.

Described by Parfetts as a landmark moment for independent retail across the South of England, the employee-owned wholesaler officially opened the doors of its new 113,000 sq ft Southampton depot on 3 September.

Enthusiasm from the retail community was evident in the 400 customers that had already registered before the opening. Of those, 90 had been receiving deliveries from the new site at Hedge End Retail Park in the previous couple of months – the orders were picked and packed at the wholesaler’s Birmingham depot and transported overnight to Southampton for delivery to customers the following day.

Three Go Local/Go Local Extra stores had already opened in the area, and another 20 were waiting for conversion to one of Parfetts’ fascias: Go Local, Go Local Extra, Shop & Go and The Local. Approximately 20% of these stores are

new sites or owned by people who are new to retail; the remainder have switched from competitor symbol groups, according to joint managing director Noel Robinson.

Commenting on the buzz of the opening day, joint managing director Guy Swindell said: “The 400 customer registrations are similar to what we saw at our Birmingham branch [opened March 2023] and the turnout is reminiscent of our Birmingham open day, so we are really encouraged by that.”

Customers visiting the new cash & carry could benefit from a special launch promotion running until 13 September. The activity on site also included supplier stands, competitions, food trucks, and the Parfetts executive team on hand to meet customers alongside the depot team.

Southampton is Parfetts’ ninth branch in the UK, and operates on a 24-hour basis – cash & carry by day, distribution

centre by night – the same as the other Parfetts depots.

The C&C/delivered operator is recruiting more delivered customers and serving a base that currently extends east to Twickenham, west to Exeter and north to Oxford. This area connects with the customer base served by Parfetts’ Birmingham branch, reinforcing its commitment to serving customers nationwide.

Parfetts has a field sales team of seven people working out of the Southampton branch, supported by the 50-strong team that work across the estate. “We really value those people out on the road,” said Swindell. “For a lot of independent retailers, that is their key point of contact so we continue to invest in that people resource.”

Parfetts has invested around £5 million to refit the warehouse. “We’re really pleased with the facility – it looks incredible,” Swindell remarked.

“We’ve championed cash & carry, investing in it across the estate. For example, we’ve pushed digital to aid supplier activations, and invested in our team structures and the supply chain. We’ve got what we believe is a really good formula in our other branches and we were keen to move that down here.”

The depot offers a range of around 9,000 lines, similar to the offering at the 100,000 sq ft Birmingham depot but with tweaks to take account of local preferences. General manager Graham Barton – who previously spent 33 years at Palmer & Harvey and seven years at Bestway/Batleys including managing the Fareham depot – has a lot of experience in the area, so Parfetts has taken his guidance on range and depot displays.

He is supported at Southampton by a senior management team that includes Stuart Clark and Glenn Underwood as supply chain managers, Hollie Whitfield as delivered manager, Nigel Drake overseeing goods-in, and Elaine Walker managing front-of-house operations. Many of the team bring established working relationships and a proven track record of working in wholesale. In total, more than 100 new jobs have been created.

Although Bestway and Booker are already operating in Southampton, Parfetts’ opening marks the first new cash & carry in the region in 25 years.

“Wherever we go there is competition – we remain focused on Parfetts and the retailers,” said Swindon. “We were pleased to see that we came out top out again in the Lumina report [Symbol Wholesale Index 2025]. Customers were talking about our range, our prices, our service, our big investment in our people, our brand, and the level of the retail club, the marketing support, and the store development and merchandising support that we offer. We are there to partner, to support – we do not dictate – and I think retailers enjoy that relationship.”

Robinson added: “There is an option for everybody here, regardless of size or type of store, and from just needing a top-up cash & carry to a delivered service or being full in on our symbol. We’re very, very flexible.”

Robinson and Swindell confirmed that there will be a 10th Parfetts depot but would not disclose any more information at this stage.

Belinda Parkinson, head of

‘My dad is my hero!’

What have been your biggest achievements in work and outside work?

I spent a large part of my career at Arla where I was lucky to be part of several successful product launches, many of which are still on shelves today. One of the highlights was being part of the innovation team that brought Starbucks Ready to Drink coffee to market. There’s nothing quite like the buzz of seeing someone enjoying a product you helped create.

Outside of work, completing my fifth half Ironman in the Lake District in June and cycling Coast to Coast just two weeks later was a huge personal achievement. I was also part of the MAG team cycling through Tanzania in July.

Who has been the biggest inspiration to you?

My dad is definitely my hero! He was a director at a large company and I was fascinated by his office, his overseas trips and the professional world he was part of. He sparked my ambition to build a career in business.

He’s also the reason I got into triathlon – he’s completed an incredible 18 Ironman races! We actually completed my most recent half Ironman together (pictured above) which was

really special. I’m not quite aiming for a full Ironman myself, but his dedication, determination and resilience, especially coming back from injuries and setbacks, continue to inspire me, both in work and in sport.

What were your ambitions when you were growing up?

From the age of six, I wanted to be a consultant paediatrician. I even did my work experience at Hull Royal Infirmary. I originally signed up for all the sciences and maths at A level, but had a change of heart during the summer holidays. Cue my mum frantically rearranging my subjects before school started! I ended up choosing Business Studies, History and Maths, with a vague idea of doing ‘something in business’.

What are your interests outside work and how do you maintain a work-life balance?

Triathlon is a big part of my life. I’m on the committee for Wakefield Triathlon Club and passionate about making the sport more accessible. I also met my partner, James, through the club, so I like to give back where I can. Outside of triathlon, I’m a big foodie and love cooking and discovering new flavours.

With Covid, the shift to hybrid working was a game-changer for me as it meant I could enjoy more time with my two boys, who were three and seven at the time. At Unitas, I now work two days from home and three days in the office and this, combined with flexible hours, means I can be present for my family without compromising work.

How would you describe your personality?

I’m outgoing and a people person, I love chatting and getting to know others. I can be a bit of a control freak but I’m learning to focus on what I can control and let go of the small stuff. While I’m driven and enjoy pushing myself, I also love a lazy evening on the sofa with a glass of wine and some trash TV.

What is your favourite film, book and song?

Film: I’m a huge Disney fan, I love anything Disney-related! Book: Thinking, Fast and Slow by Daniel Kahneman gave me a new perspective on how people think. Music: Son of a Preacher Man has become my go-to karaoke song!

What would people be surprised to know about you?

In one of my first jobs out of university, I worked for a meat supplier and toured Asda stores dressed as a sausage for Sausage Appreciation Week! CCM

Belinda Parkinson studied Food Marketing and Management at Newcastle University. She went on to work for various FMCG companies including Greencore, Arla and Hothouse Beauty where she held a range of roles in category, innovation and brand/own-brand management. She then became head of marketing for a financial services company before moving into wholesale in 2024 when she joined Unitas Wholesale as head of marketing.

Pricecheck offers a service menu – ranging from warehousing, sales and distribution to marketing and contract packing – that brand owners can tailor to their requirements.

Approximately a third of Pricecheck’s business currently goes through the cash & carry and delivered wholesale channel, and that proportion is growing.

“We’re multi-channel, including multiple retail, high street, value, pharmacy, DIY, fashion, online and of course C&C and delivered wholesale, which is very fast-growing part for us,” reports commercial director Darren Goldney.

“As a distributor, our role is to provide benefits to both our customers in C&C and our brand partners. To do this we have to be a link that makes it more efficient and more added value,” he explains.

“Rather than adding costs, our partnerships are focused on reducing costs. We help our brand partners save in several key areas, including warehousing, optimal purchasing, outbound logistics, sales resources, financing costs, and marketing support, and on some occasions we’ve managed to reduce the prices customers pay as a result.”

Beyond cost savings, Pricecheck adds value through its understanding and focus on the channel. “Sometimes the brand owner has not got the time or resource to do that as well as they’d like,” says Goldney. “This enables us to improve the customer experience in various ways, such as implementing better price-marking strategies, offering contract packing or other tailored solutions, providing smaller and more frequent deliveries, and ensuring customers have direct access to a dedicated account manager. These enhancements help strengthen our partners’ market position and operational efficiency.”

Pricecheck can consolidate brand portfolios for its customers, allowing for smaller, more frequent deliveries, reduced stockholding and cash requirements, improved availability and fewer points of contact. “This streamlined approach helps customers manage risk, cash flow, and inventory more effectively in a challenging market,” says Goldney.

For its brand partners, Pricecheck has become a ‘one-stop shop’, eliminating the need for multiple service providers they may otherwise employ adding costs and complexity.

“Our supplier services menu allows partners to consolidate functions that may have previously spread across various external agencies – such as logistics, warehousing, marketing, ecommerce (including Amazon support), contract packing, and even third-party sales teams,” Goldney explains.

Even when these services are handled in-house, some brand owners are reassessing their core competencies they want to excel at and need to focus on.

“Rather than spreading resources thinly across multiple operational areas, many are choosing to focus more deeply on brand development/meeting consumer needs, while trusting us to manage the rest or parts of it,” Goldney reports.

Pricecheck has a team of more than 50 sales and marketing colleagues, and many are actively involved in the C&C and delivered wholesale channel. Its approach is not focused on order-taking visits, but rather on value-adding visits including business reviews and strategic planning sessions.

In the wholesale sector, Pricecheck represents brands for Jacobs Douwe Egberts Peet’s, Elida Beauty, Church & Dwight, Astonish, Perrigo, Asevi, Malibu, Beiersdorf, and Interlude.

One of its notable successes is with Astonish, the household cleaning brand. Just a few years ago, its presence in the convenience channel was almost non-existent. This year, Pricecheck is on track to distribute close to 1.5 million bottles. “This growth has been driven by getting the fundamentals right: the right price mark, the right case size, and the right level of service and support. It’s a clear example of how we help brands unlock potential in underdeveloped channels,” says Goldney.

Pricecheck is planning to develop its business through the wholesale trade by largely partnering with one key brand owner by category for its brand distribution service.

“We think this gives a ‘2 for 1’,” says Goldney. “Firstly, that approach gives genuine focus for the brand owner’s portfolio, as we understand our success is tied to theirs.

“Secondly, we offer our customers an efficiency advantage by consolidating multiple brands into a single delivery, supported by dedicated service. We also provide an extended ‘top-up’ range of wholesale products where we are not exclusive, giving customers greater convenience and choice to top up and fill gaps, especially where they struggle with other minimum order quantities.”

Robinson Young works hand in hand with its brand partners to ensure that cash & carries and delivered wholesalers are offered the right core range of non-food products.

The wholesale and delivered trade remains a cornerstone of Robinson Young’s operations. “It has been in our DNA for over five decades and continues to be a critical growth channel for the brands we represent,” says chairman Michael Robinson.

He explains that Robinson Young provides a ‘unique bridge’ between non-food FMCG brand owners and the complex wholesale landscape. “Our low minimum order values across a wide portfolio of brands and products allow customers to trial products without heavy commitments. Consequently this allows brand owners to benefit from faster distribution expansion and comprehensive sales reporting,” he points out.

“By consolidating orders across brands, customers enjoy fewer deliveries, simplified admin, and efficient procurement – supported by a single, motivated sales contact who understands their business.”

According to the company, agility is key in today’s volatile market.

“We work hand in hand with our brand partners to ensure that customers are offered the right core range of products – in the most relevant pack formats and at competitive prices – while never compromising on product quality,” says Robinson.

“Our dedicated demand management team does everything possible to mitigate ongoing challenges such as freight volatility, supply delays, and service disruptions. By holding sufficient buffer stock, we aim to smooth demand fluctuations and maintain consistent availability, though recent global events have shown just how unpredictable supply chains can be.”

To further strengthen its service, Robinson Young has partnered with Kinaxia Logistics. This is a strategic move that is already delivering faster, more reliable nationwide deliveries.

“This investment underlines our commitment to

operational excellence and responsive wholesale support,” Robinson adds.

In terms of its client base, Robinson Young has developed and delivered business plans that have translated into strong growth by working collaboratively with major brand owners such as Henkel (Got2b, Bloo, Oust, Dylon), Essity (Bodyform, TENA), and Karium (Pro:Voke, Soft & Gentle). Other key brands it represents include Simple, Bristows, WaterWipes, Wrights, Colour Catcher, Riemann P20, Live, Vosene, Witch, Schwarzkopf, Cuticura, Cidal and Caterpack.

“One standout example of a recent success in the cash & carry industry is our relaunch of the Bloo range with bespoke case labelling for cash & carry visibility. This unlocked major gains in both distribution and rate of sale – with some depots reporting over 100% uplift,” states Robinson.

The relaunch of the Bloo range with bespoke case labelling unlocked major gains in distribution and rate of sale.

The company’s field force is described as among the most extensive in the industry and is fully focused on C&C and delivered wholesale. More than 400 depot visits are completed per month, ensuring that brands stay visible, relevant, and well represented on the ground.

With the aim of further developing its business through the cash & carry/delivered wholesale channel, Robinson Young is doubling down on strategic growth with key buying groups (Unitas, The Wholesale Group, Sugro) and leading wholesalers. Its business development approach includes:

a Joint annual plans with customers and brands.

a Ongoing investment in ‘feet on the ground’ field coverage. a Persuading brand owners to develop wholesale-specific formats (eg PMPs).

a Upgrading its ERP system to drive speed, accuracy and efficiency across all touchpoints.

“Combined with better logistics and market intelligence, these moves are helping us scale smartly and sustainably,” adds Robinson. “Looking ahead, our focus is firmly on attracting new brands and customers by providing exceptional service, strategic insight, and scalable solutions across the UK wholesale market.”

At Robinson Young, we don’t just move products - we grow brands.

For over 50 years we have delivered full service sales, marketing and logistics support to Health, Beauty and Household brands across all retail and ecommerce channels.

Sales Development

Experienced sales team

Supplier to all major UK customers

Warehousing & Logistics

Full capabitities with 98.5% + OTIF

MHRA registered

Brand Management

Collaborative approach

Category insight

Consumer, social and digital media

With a 40-year track record, SHS Sales & Marketing is confident it can help its clients thrive in all market conditions while also driving sustainable growth for its wholesale partners.

As the UK food and drink market becomes increasingly challenging and competitive pressures intensify, SHS Sales & Marketing’s four decades of expertise have never been more valuable.

The business has established itself as a pivotal force in the cash & carry and wholesale trade, with nearly half of its total GB sales generated and earned through this channel. This substantial presence reflects the company’s understanding of how to effectively maximise the channel and grow sales for both cash & carry operators and the brands it represents.

SHS Sales & Marketing claims that what sets it apart is its laser focus on developing brands specifically within the cash & carry and wholesale environment.

While brand owners can concentrate on their core marketing activities or focus on other channels, SHS provides the specialist expertise needed to unlock growth through the network of relationships and detailed insight it has acquired.

Through an understanding of the dynamics of the sector, SHS Sales & Marketing acts as a bridge between brand owners and the channel, translating the specific needs of cash & carry operators into actionable solutions that drive sales.

Efficiency and simplicity are amongst the key requirements for all cash & carry and wholesale operators, something which SHS Sales & Marketing is placed to deliver. It explains that through a streamlined, consolidated service that transforms operational efficiency, multiple brands arrive in a single delivery, dramatically reducing goods-in traffic, cutting road miles, and minimising paperwork – a proposition that delivers both cost savings and environmental benefits in today’s challenging trading environment.

Managing director John Heynen comments: “Our deep channel expertise, developed over many years, means we don’t just represent wholesaler needs to brand owners – we champion them with an authority and understanding that delivers actionable change.’’

According to SHS Sales & Marketing, its success lies in its ability to cut through market noise and bring together brand owners and wholesalers to focus on what truly drives revenue. Rather than overwhelming wholesalers with unwieldy SKU proliferation, the company has systematically developed a process of strategic core range distribution across the portfolio – something that enables cash & carry and wholesalers to concentrate their efforts on the lines guaranteed to deliver maximum sales impact.

This focus on commercial effectiveness extends into new product development, where SHS’s channel expertise transforms product launches from hopeful newcomers into calculated growth drivers. The Nerds confectionery launch exemplifies this approach, whereby SHS Sales & Marketing delivered a comprehensive 360-degree activation that spanned every critical touchpoint – depot engagement, online presence, and impactful in-store execution, all amplified by integrated field sales solutions.

The timing of this launch was also strategically aligned with Nerds’ big NFL Super Bowl sponsorship, demonstrating that SHS Sales & Marketing understands that building a brand isn’t just about putting products on shelves, but aligning tactics at every opportunity.

Looking ahead, SHS Sales & Marketing aims to pursue a holistic development approach with progressive cash & carry and wholesale partners, whose values are aligned with their own.

Encouraging engagement at every level from evolving head office and buying group relationships, through to strong depot partnerships, impactful in-store execution, and comprehensive retail club education, the whole SHS Sales & Marketing team aims to add huge value at each stage of the process.

With tailored and practical in-depot advice covering range optimisation and merchandising excellence, along with identifying category insights that align with emerging trends, brands benefit from working with an organisation that acts on the levers that can most positively affect growth.

As the wholesale and retail landscapes evolve, SHS Sales & Marketing is also embracing digital transformation, delivering activation programmes that reach both trade partners and end consumers, while supporting retail activity on popular brands to drive footfall to stores and depots.

The Conscious Culture Initiative is a new sevenstep process, created by Immediate Impact’s MD Clare Bocking, that helps align a business’s culture with its commercial goals.

To celebrate 10 years of Women in Wholesale, the organisation commissioned new research in March to check the progress being made across the industry. This research highlighted that there are still significant issues for businesses to work on – and that the biggest challenge (67%) for women working in wholesale is the male dominated culture.

“Speaking with wholesaler colleagues following this insight, many were unclear what culture was, how it could impact them and how they could change it!” says Clare Bocking, chair of Women in Wholesale and managing director of Immediate Impact.

“The conversation developed to highlight that culture change wasn’t just a ‘women working in wholesale’ need, there was a broader opportunity that an understanding of culture could support to accelerate total business performance. We know that high-trust cultures deliver 2.5x revenue growth and 2x profit. Culture isn’t a side project – it can be a strategic advantage.”

a Culture impacts success on recruiting and retaining talent.

a Culture is the biggest accelerator of engagement, creativity and productivity.

a A positive culture significantly improves customer experience and warehouse safety.

Bocking explains that this was where the need for the Conscious Culture Initiative started.

Many large organisations have people and resources responsible for supporting a company’s culture journey, but a lot of companies do not have these internal resources.

“In today’s climate of low engagement and high pressure, culture can

either accelerate or derail total company performance,” she points out.

“Wholesalers highlighted a need for an efficient and effective solution to help them – and the Conscious Culture Initiative has been written specifically to deliver against this need.”

The Conscious Culture Initiative is a seven-step, facilitated change journey that helps align culture with business goals, unlocking creativity, trust and performance at scale.

Bocking says that for many successful entrepreneurial businesses, the legacy culture from the founder owner may not be as relevant and productive for current leaders and workforces. “Without a conscious intervention, this legacy culture is likely to continue, despite potential strategy and leadership changes,” she says.

The Conscious Culture Initiative is flexible to meet different levels of support required. It starts by explaining the

‘Why’ – why culture can be so critical to a company’s performance – and guides the organisation through from thinking to planning and doing. It specifically isn’t a training programme as it needs to be led by the wholesaler or company, supported by their data and is designed to evolve with their strategy. The last three steps in the process can be wholly owned by the company if the understanding and momentum is there.

In addition, for wholesalers, it is worth noting that the FWD can offer members 50% match funding for learning & development or training initiatives.

The key benefits of the Conscious Culture Initiative are:

a Aligns culture with commercial goals. a Builds trust, engagement, and accountability.

a Drives measurable business outcomes. a Champion-led, not consultant-driven.

In summary, the insight from the Women in Wholesale survey highlighted a greater opportunity for wholesalers (and suppliers) to consciously check and refresh their corporate cultures in order to unlock their employee talent and accelerate their commercial performance.

“We are currently in conversation with a couple of wholesalers who have been keen to pilot and benefit from the initiative from the very start. We are excited to bring this opportunity to life with more of you!” says Bocking. Contact: clare@immediateimpact.co.uk or KarenF@thequanticgroup.com

Offering an own-brand range that delivers high shopper appeal and strong margins is a priority for many wholesalers and buying groups in today’s price-conscious marketplace.

Cost-of-living pressures, and specifically rising food prices, have boosted the appeal of retail own-brands, which are becoming an increasingly important part of the sales mix for wholesalers and retailers alike.

Parfetts’ Go Local own label has seen double-digit growth in the last year and now accounts for 22% of total sales.

“It’s a testament to the quality and value provided by the range,” says trading director Cheryl Hope. “An appealing own-label range is very important and becoming more so over time. We offer competitive pricing that builds consumer loyalty and fantastic margins for retailers, plus it gives Go Local retailers a real point of difference.

“It is also a great way of offering choice without stocking a large number of alternative lines – customers understand that the own-label alternative is the value option to the bigger brands.”

Hope says that the team at Parfetts work hard to ensure there is no compromise in quality across the range. “From wine to baked beans, everything is tested, and we invest in working with the best possible producers. We want consumers to keep coming back for more,” she explains.

“The data also tells us that own label is a key factor in increasing basket spend. If customers are saving money in specific categories, they are more likely to shop others, so with a strong ownlabel range, we see an increase in sales across the big brands as well.”

‘Customers understand that the own-label alternative is the value option to the bigger brands’

Cheryl Hope, Parfetts’ trading director

There are now over 250 products in the Parfetts own-label range, across all categories in the business. It has just launched a selection of pet treats to complement its extensive pet food range.

In addition, it has introduced Go Local Paracetamol Tablets, following the successful debut of Go Local Ibuprofen in January. Available in 16-tablet packs, the new SKU is positioned to give retailers industry-leading returns, with a POR of 62.1% at a £1 rsp, which is said to be

more than double the average achieved on branded equivalents.

The vast majority of the Go Local products are price-marked. “Price marking is essential in convenience retail as it gives consumers confidence that they are paying the right price. It builds trust and serves as a tangible visual signpost for value,” explains Hope.

Parfetts has a pipeline of over 35 new own-label products scheduled for development by the end of the year, focusing on impulse, grocery and bakery.

Over at Unitas, CEO John Kinney reports that within the membership, own-brand sales have soared by up to 50% across most of the top 10 convenience categories, including soft drinks, confectionery, pet care, biscuits and tinned grocery.

“That’s why we introduced the Local Living brand as a recognisable, trusted hallmark of that all-important quality range for the cost-conscious shopper,” he says.

He adds: “With 80 new lines currently being assessed and added, we will be offering retailers 200 products that will give that choice and reassurance in the key convenience categories that represent 82% of own-brand sales, including drinks, grocery essentials, personal care, household and snacks.”

Bestway offers a comprehensive own-brand range of over 350 SKUs, which account for more than 10% of its retail and impulse sales.

“Our Best-in brand provides an ergonomic solution that appeals across a diverse retail customer base from independents to symbol fascias,” says retail director Jamie Davison.

“In today’s competitive retail environment, where shoppers are increasingly price-conscious, our own-label products offer a trusted value offer. We provide retailers with a comprehensive range that delivers strong margins and high shopper appeal.”

He adds: “Our continued investment in product development, packaging, and marketing ensures we deliver a strong value proposition that helps retailers meet evolving shopper expectations.”

In addition to its Best-in brand, Bestway has access to more than 2,000 Co-op own-label products, including the Honest Value range, for Costcutter stores.

Bestway views its retailer own brands as a vital part of its offer, designed to help retailers meet the growing consumer demand for value without compromising on quality.

“Our own-brand products offer a credible and profitable alternative to leading brands, giving retailers the flexibility to cater to a broad customer base across multiple fascia types,” says

Davison. “By offering quality products at competitive prices, Bestway’s ownbrands help retailers drive sales, build customer loyalty, and remain competitive in a value-focused market.”

Davison reports that Bestway has plans to add to its own-brand portfolio, but its approach is focused and strategic. “Rather than expanding for the sake of it, we carefully assess market trends, shopper behaviour, and retailer feedback to identify key lines that will deliver real value across all fascia types,” he explains.

“Our goal is to ensure that any additions to the range are commercially viable, meet genuine consumer needs, and support retailers in driving sales and profitability. We’re committed to developing our own-brand offering in a way that’s both sustainable and relevant for today’s value-conscious market.”

Davison believes that price-marking on retailer own-brands is an essential tool in supporting the competitiveness and credibility of independent retailers.

“Price-marked packs offer clear and transparent pricing to consumers, helping build trust and reinforcing the perception of value,” he maintains.

“For our own-brand ranges, such as best-one and Best-in, PMPs are a strategic part of the proposition, designed to drive footfall, encourage impulse purchases, and reassure shoppers that they are getting great quality at a fair price. In a value-driven market, this clarity can be a key differentiator for local stores competing against the multiples.”

He continues: “For our retail customers, price-marked own-label products provide an important balance between consumer trust and strong margin potential.

“By offering PMPs at competitive rrps with built-in retailer margins, we ensure that independent retailers can remain profitable while offering visible value to their shoppers. This supports repeat custom, drives volume, and helps retailers build long-term loyalty in their communities.”

by Phil Atyeo, managing director

How is Caterfood Buying Group presently performing?

We are performing surprisingly well under the difficult trading conditions. Our latest acquisitions have meant we have grown our customer base in the care and education sectors which has provided us with a more stable and sustainable customer base.

We made a difficult decision to exit the Channel Islands [Cimandis closed its Jersey and Guernsey operations] in the last few months, and although this might seem to be concerning for the wider group, that is absolutely not the case and in fact this has now given us the headroom to bring in more members.

How are you helping your members deal with current market challenges?

Our focus is around providing quality products as well as a quality service, which is something we know our customers want, and our retention of customers shows that we are successful in providing that. We have no interest in entering a race to the bottom, likewise we will never compromise on the quality of our own-label products. With the level of growth we have seen, our scale enables us to provide that quality at a more competitive price.

What have been your group’s most recent developments?

With the most recent onboarding of Turner Price, we have developed and enhanced our onboarding process to ensure future acquisitions have an even smoother transition into the group.

I think it is fair to say CFBG is growing at a rapid pace, not just with acquisitions but also from a product and brand perspective. We now have a range of 500 own-label lines which includes our own-brand Caterfood Collection lines, as well a unique range of supplier branded products.

We are also stepping into the world of AI supported software within our South Lincs business, which has given us the opportunity to reinvent the way we operate our sales departments. This has been very well received.

Which of your services have been most used by your members during the past few months?

IT and digital have been our biggest developments, and with the market insights we gain as a group we can develop services and products suited to our members’ customers. We are in the

process of launching a new loyalty scheme – retention within the hospitality sector is something we are trying to support our customers with.

What member events do you have coming up?

We are hosting our annual conference and awards evening in December at the Celtic Manor in Newport, Wales. This will be followed by three ‘Meet the Buyer’ events in 2026.

What are your plans and targets for the next six months?

To continue the expansion of our ownlabel range to ensure we have the right products for our customers. The Caterfood Buying Group is always expanding so there will be a focus on successfully onboarding new members.

What is your group’s USP?

We support and develop eight different and unique business strategies all to deliver the same vision: to bring our members and their communities together through exceptional food. We understand that every business is very diverse and has a USP to its customers, and that is something we embrace and encourage. The Caterfood Buying Group is about our members retaining their independent values and identity whilst having the support of being part of a wider group.

We also encourage a truly collaborative ethos between our eight members –our success is down to us working as one. CCM

“This partnership allows us to maintain full autonomy in making decisions that best serve our local customers, while benefiting from the scale and strength of the fastest growing buying group across England and Wales.

“The CFBG offers a unique proposition to foodservice businesses – combining best-in-class own-brand products with the support of a dedicated central team.”

Simon Davison, MD, South Lincs Foodservice

These skin-on 10mm thickly-coated fries really do pack in something ‘ultra’ when it comes to their appearance, texture, taste and hold time, as well as absorbing less oil during frying and being highly competitive on price. For a really premium fry, order yours today. Each bag contains 2.25kg of the Caterfood Premium Ultra Crunch Skin On 10mm Fries.

4 x 2.25kg | Frozen

by Gary Mullineux, managing director

How is Caterforce presently performing?

Continuing its strong performance from previous years, Caterforce is performing incredibly well as group turnover exceeds £900 million in 2025. The first half of the year has seen growth of 8.1% for the group, strengthened further by the addition of a new wholesale member, Woods Foodservice.

How are you helping your members deal with current market challenges?

Caterforce supports its members with the right product mix at the right prices. We do this through our strategic commodity tendering, competitive group buying and the expansion of our awardwinning own-brand ranges.

Our pricing strategies, underpinned by robust data and insight, ensure members stay agile in a shifting market with rising costs to do business.

We offer more than 400 products across five exclusive award-winning own-brand ranges: Chefs’ Selections, Premium Collection, Eden Grove, Roast 440 and Clene Guard. In 2025, we are expanding our own brand further with the launch of 50 new products.

All of our members benefit from fullservice marketing support, access to an enterprise email platform, use of a professional photography studio, quarterly food trend guides, and monthly creation of marketing content such as brochures, video and social media assets to support their growth.

Members benefit from monthly promotions, managed by our bespoke Price Hub platform. We host a diverse

calendar of events throughout the year, including six supplier presentation days, while our sales team roadshows help educate members’ teams on our exclusive own-brand ranges. We also hold marketing events, such as food study tours. Every two years, we bring the industry together for our flagship conference and awards dinner.

What have been your group’s most recent developments?

As of 1 August, Woods Foodservice joined Caterforce, bringing the total number of members to 10 and further strengthening the group’s reach and influence in the UK’s foodservice sector.

In the first quarter of 2025, we also extended our supplier network with 18 new suppliers.

We are also delighted that Caterforce has been recognised as one of The Sunday Times Best Places to Work 2025.

We also welcomed a new chairman for the group – Graham Jenkins, managing director of Pioneer Foodservice, which has been a member since 1992.

Which of your services have been most used by your members during the past few months?

All members use the new bespoke Price Hub platform for up-to-date and accurate price information.

What member events do you have coming up?

We are holding our supplier presentation days on 1 and 2 October at Edgbaston Park Hotel, Birmingham.

What are your plans and targets for the next six months?

We will continue to support our members by focusing on our top priorities: value, innovation and growth. With no membership fee and an unwavering commitment to delivering commercial returns for all, members benefit from the group buying power, including competitive pricing and a 13% increase in income distribution in the past year.

What is your group’s USP?

For suppliers, Caterforce provides the most cost-effective route to reach 47,000 foodservice customers across the UK and Ireland. For members, collaboration is what sets us apart from all other groups – with no competition clauses in our constitution, members openly share best practice and industry knowledge and expertise. CCM

Number of members: 10

Combined member turnover: £900m New members this year: Woods Foodservice

Number of head office staff: 16

“Being part of Caterforce provides enormous value to our business. The strength of collective buying power, access to exclusive ownbrand ranges and strategic support from an experienced central team contribute to our continued growth.

“The collaborative nature of the group sharing best practices and insights ensures we stay competitive and agile.”

Graham Jenkins, managing director, Pioneer Foodservice, and chairman of Caterforce

47,000

by Martin Ward, chief executive

How is Country Range Group presently performing?

We’re now servicing a whopping 44,000 customers each month, with over 250,000 monthly deliveries to caterers across the UK, Ireland and Europe. In 2022, we set ourselves a target of achieving £1 billion in group turnover by the end of 2026 and we’ve reached this milestone with over a year to spare. Group turnover in 2025 is set to reach £1.15 billion, up 19% on last year.

We’re certainly not going to rest on our laurels though – our new ambitious goal is achieving a group turnover of £1.5 billion by 2028.

Turnover isn’t the only metric we judge our success on. It’s our group’s growing collective purchasing power that really highlights our success and sets us apart from any other buying group. We’re hugely proud that we collectively procured over £370 million of core products and brands for our members in 2025, up 24% on 2024. No other foodservice buying group gets close to that.

How are you helping your members deal with current market challenges?

We’re continuing to invest across the business to ensure our members have all the tools and solutions to support their customers and grow. This has included extensive investment in technology such Authenticate, which provides our members and their customers with all the key product data, trend and traceability information, as well as improving their ESG and supply chain management systems.

Further development of our threetiered own-brand portfolio has ensured our members can offer their customers absolute choice, quality and value when searching for the right foodservice solution. Our Country Range portfolio has seen 13% sales growth this past year, Signature by Country Range is gaining traction, and Catering Essentials continues to attract new customers.

What have been your group’s most recent developments?

For the first time, we took our summer trade expo beyond mainland UK to Belfast. Over 500 delegates and more than 100 suppliers came together, over 1,000 products were showcased, and £4.3 million in orders were placed!

Our CRG roadshows have been another massively positive development. So far in 2025, we’ve delivered five roadshows and showcased our

brands at seven member events. More dates are planned for Q4 and six events are already confirmed for 2026.

What member events do you have coming up?

We have another business development day – on 23-24 September. We also have an operations forum in October where we will sit down with our members to share ideas and plan for 2026. As always, we will hold our ‘An evening with...’ celebration in December.

What are your plans and targets for the next six months?

Our strategic focus remains firmly fixed on the four pillars that underpin our success – scale, sustainability, our own brands and data – but after hitting our turnover target two years early, we’re currently undergoing a full strategic review. This will help us analyse every facet of the group so we can plan effectively as we embark on our new challenge of reaching £1.5 billion turnover.

What is your group’s USP?

While we see ourselves as the largest foodservice-focused buying group, we’re not just a collection of businesses. We’re a community built on shared values, high standards, and a relentless drive to raise the bar in everything we do for the good of our customers and the industry as a whole.

I don’t think any other buying group has the collective strength, family ethos, foodservice expertise and dynamism of our group. CCM

“From day one, it’s been clear that this is more than just a buying group – it’s a community of like-minded wholesalers who are open, collaborative and driven by shared values. The marketing resources and strategic support available to

members are first-class and the ability to tap into the experience, knowledge and insights of other members is invaluable – especially as we continue to grow.”

Edward Munro, MD, Country Valley Foods

BALANCING YOUR MARGINS WHILST KEEPING CUSTOMERS COMING THROUGH THE DOOR HAS NEVER BEEN SO TOUGH

At Country Range, every product has been produced specifically for foodservice, so we understand the challenges that you face in a commercial kitchen. Our extensive range gives you the flexibility to swap to an own brand alternative that enables you to keep costs down without compromising on quality.

FROM AWARD-WINNING FRIES, DESSERTS AND ICE CREAM TO PREMIUM CONDIMENTS AND INGREDIENTS

Signature by Country Range is the premium product offering to make your menu stand out from the crowd. Everything has been developed for busy kitchens, meaning that you can give your customers a consistent, high quality dining experience even when the going gets tough in the kitchen.

by David Lunt, managing director

How is NBC presently performing?

Despite market challenges, our members are responding well and this is reflected in the group’s sales and purchases through our supplier agreements.

For NDN, we are seeing significant growth against budget, which reflects the support provided by our supplier partners to provide unique combinations of competitive net pricing aligned with manageable inbound and outbound minimum order quantities. With regards to specific product categories, soft drinks have been extremely strong and we continue to make inroads into our foodservice offering through new suppliers and member specific support.

How are you helping your members deal with current market challenges?

By keeping to the basics. Our members require access to brands, at competitive pricing, and in manageable minimum order quantities. As the channel sees further consolidation, we provide an ideal one-stop shop for suppliers wishing to reduce either distribution points, logistics costs or credit risk.

We also provide specific and general support for members, such as the NBC Toolkit, and a wide variety of messaging techniques. In 2025 we estimate that over seven-and-a-half million messages will be pushed towards 45,000 outlets that our members service.

What have been your group’s most recent developments?

Two things of note. Firstly, recognising the benefits that NBC provides to its

members and its supplier partners – a fully integrated business. Secondly, detailing this fully to both new and existing suppliers to support them as a route-to-market solution.

Which of your services have been most used by your members during the past few months?

The most obvious is access to brands. The second is access to information through a variety of messaging tools so that they are fully up to date regarding suppliers, brands, pricing, promotions and new product launches. After access to brands, these items are the priority.

We know that membership can bring significant benefits to our members, such as Candy Box, which joined in the early days and has now developed into a full foodservice operation and rebranded as Spectrum Foodservice. Well done to Joe Marlow!

What member events do you have coming up?

We have had our two major events already this year – both a great success. In April we held our annual Member & Supplier event, and in June we held our first-ever conference – in Prague. Later in the year we are planning the AGM for all member and employee shareholders.

What are your plans and targets for the next six months?

We are currently in the process of transitioning to a new service provider for NDN, our warehousing and logistics service that provides an effective route-tomarket solution. Once this is in place we will have greater capacity, reach and route consolidation opportunities; fewer and more efficient deliveries; and better impacts upon the environment.

What is your group’s USP?

As an independent wholesaler or cash & carry, survival is based upon being able to access brands, competitively, and provide excellent service to their customers. NBC provides this as an integrated business.

By working with the group, suppliers get access to our members through one contact point; their brands get to their consumers through a safe and flexible supply chain, with reduced credit risk exposure, centralised order to cash facilities, and centralised bulk purchasing.

Our members get access to brands at competitive net pricing and manageable minimum order quantities. It does not get much better or simpler than that! CCM

“We decided to join NBC in its first few months of operations. This decision has been the foundation of building our original business – Candy Box – into the foodservice operation we have today.

“Without access to the brands, at great net

prices, and sourcing minimum order quantities that made sense, we would not be able to offer the range of products to the new channels that we now serve.”

Joe Marlow, managing director,

Spectrum Foodservice

NDN is providing access to AG Barr products for members and third party customers that can no longer meet the minimum order quantity.

If you already have an account with NDN you can place an order for AG Barr products by email orders@nbconsortium.co.uk. If you would like to open an account with NDN please email Clare Spindler clare@nbconsortium.co.uk for an application form. Strict Terms and Conditions apply.

Tel: +44 (0) 7425 222523• Email: clare@nbconsortium.co.uk • Visit: nationalbuyingconsortium.co.uk

THESE ARE JUST A FEW OF OUR SUPPLIER PARTNERS

by Daniel Larkin, chief commercial officer

How is Sterling Supergroup presently performing?

Thanks to changes made over the last 12 months, positive impacts across the group are now being seen, resulting in a substantial increase in group interest. This period has seen a new website launched, a rebranding, and a reinvigorated approach to marketing, which has resulted in four new members – the first members to join since 2022.

Alongside this, our own-label brand continues to focus on providing essential products at exceptional prices. This approach, together with a targeted marketing strategy, is seeing members list more lines than ever, which results in an overall boost to the group’s buying power.

How are you helping your members deal with current market challenges?

Challenges will always require strong communication and a forward-thinking outlook supported by robust information. Sterling members receive this through multiple channels to ensure consistent support throughout the year.

One of the most effective tools we have is our member magazine Under Our Hat, containing summarised market information ranging from ingredient to fuel costs. Also, within this magazine, the members are updated on all supplier meetings held at head office, along with outcomes from our monthly members meeting, where we meet to discuss our Sterling Caterers Essentials range, have supplier product presentations, and hear from industry specialists on current affairs affecting wholesale.

What have been your group’s most recent developments?

Our membership engagement is at an all-time high, resulting in increased sales, much improved participation at member events and better pricing. This last year has seen a reduction in our overall own-label cost pricing by around 8%, which is a testament to our collective buying power and collaboration with our suppliers.

What member events do you have coming up?

Sterling Supergroup’s 59th annual conference and exhibition takes place this September in Gloucestershire. 2026 marks our 60th anniversary as the UK’s original foodservice buying group.

We will begin the celebrations with Sterling CONNECT in January, a new event designed to strengthen relationships across the Sterling community

through one-to-one engagement and networking.

To mark our diamond anniversary, we’re hosting a celebratory evening at the Tower of London and taking on the national Three Peaks Challenge for charity.

What are your plans and targets for the next six months?

We’re working towards implementing TWC services to the group, a major step that will transform how we manage data and conduct business. With strong member support, we expect roll-out over the next six months. This marks another milestone in our evolution, following our recent rebrand and renewed focus on strategic marketing.

What is your group’s USP?

Sterling Supergroup is a not-for-profit buying group with a member-led board and no joining fee. All profits are returned to members, ensuring they benefit directly from our shared success. We deliver added value through centralised supplier negotiations, efficient rebate management, and competitive pricing, all with complete transparency.

Members also have exclusive access to our Sterling Caterers Essentials brand. While our award-winning ownlabel products offer exceptional value, we recognise that every member is different. That’s why we offer the flexibility to make decisions that suit their business without pressure from a head office to meet compliance targets. CCM

“As a long-established family business, we wanted the same ethos from our purchasing group, which is exactly what you get with Sterling Supergroup. It is a group that cares, values your opinion, and works for you.