TECHNOLOGY METALS

BY ALISHA HIYATE

BY ALISHA HIYATE

About a decade ago, private equity (PE) funds began to take a greater interest in the mining sector. At the time, financing was hard to come by, and the growth of PE beyond the few players already established in the space promised a potential lifeline for the industry.

U.K.-based Appian Capital Advisory, founded in 2012, was one of the first of that wave of PE entrants, raising US$400 million for its first fund in 2014.

But far from being mining’s saviour, the amount of PE investment in mining has since fizzled, Scherb told The Northern Miner in early July.

“If you compare it to even oil and gas where there are hundreds of general partners or private equity funds, there just isn’t that number

in mining. The barriers to entry are very high. So there has not been a huge influx of capital into our sector — if anything, you’ve seen players disappear.”

Scherb says the reason is that

ESG | New sustainability reporting scheme launched in June

BY ELIZABETH FREELE AND RACHEL DEKKERWe’re entering a new era of sustainability disclosure.

June saw the much-anticipated launch of the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards by the International Sustainability Standards Board (ISSB). The standards mark a significant global shift in financially-relevant sustainability disclosure. Strong investor and regulator support, as well as G7 and G20 endorsement, suggest they will rapidly become expected and indeed even mandatory in many jurisdictions, including Canada and the United States, as soon as 2025.

Capital intensive industries like mining are likely to quickly adopt these investor-focused standards, but in doing so, may risk forgoing other strategic insights on sustainability risk and opportunity and miss out on meaningful engagement. We cover what your company can expect and what questions to ask to ensure your materiality and disclosure efforts

In the works since COP26 in November 2021, the inaugural standards — IFRS S1 and IFRS S2 — seek to provide a common language and single global baseline for investor-focused sustainability reporting to bridge the information gap between companies and investors. Individual jurisdictions can build on the standards to suit their requirements. The standards come into effect at the start of 2024. They will help companies to communicate their sustainability risks and opportunities in a robust, streamlined, comparable, and verifiable manner, providing high-quality decision-useful data to support stronger corporate strategy and more informed investor decision

The standards are designed to be applied together and will be part of a broader suite of sustainability standards. IFRS S1 is the general standard, providing a framework for companies to report on the financially-relevant sustainability risks and oppor-

tunities they face in the short, medium, and long term, as well as governance, strategy, risk management, and metrics and targets. This is supplemented by IFRS S2, which focuses on climate-related risks and opportunities. While future standards on additional material topics are expected, companies are advised to use the general standard guidance to report on them in the interim. ISSB has also offered companies relief from reporting on Scope 3 GHG emissions during the first year.

Alignment with existing standards

The ISSB standards are designed to complement and consolidate existing disclosure standards, amalgamating and building on the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, Sustainability Accounting Standards Board (SASB) Standards, Climate DisSee ISSB / 8

PM40069240

Michael Scherb, Appian Capital Advisory founder and CEO. APPIAN CAPITAL ADVISORY

What miners need to know about the

45 offices worldwide and a global network of af liates.

No matter where you are in the world, chances are we’ve got your project covered.

“I’VE NEVER SEEN A SECTOR AS CRUCIAL TO SOCIETY (THAT’S) AS INEFFICIENT AS THIS SECTOR. PART OF THAT INEFFICIENCY IS THE AVAILABILITY OF CAPITAL. IT’S JUST NOT CUT OUT TO MEET THESE SUDDEN DEMAND SHOCKS LIKE WHAT WE’RE SEEING ON ENERGY TRANSITION.”

MICHAEL SCHERB CEO OF APPIAN CAPITAL ADVISORY

Lithium, copper, rare earths and more / P9–16

Shares in Scotgold Resources (LSE: SQZ) fell more than 18% on Monday after the troubled miner withdrew its full-year guidance as it began a third-party review of its operation on “disappointing” production figures for the first half of 2023.

The company behind the Cononish mine, which received initial approval for the mine in 2018, poured first gold in December 2020 and achieved commercial production in July last year, said the review will take 12 months.

Scotgold said it will initially encompass an assessment of the mine design, schedule and production forecasts.

“[It will also] inform 2023 production forecasts and will also incorporate a second stage of power and ventilation upgrades to improve mine accessibility and enable the mine to operate all development and production equipment simultaneously to improve mine development rates,” it said in a statement.

The miner reiterated concerns over its ability to keep operations going at Scotland’s first commercial gold and silver mine. Despite efforts to optimize production, it has had to revise output targets downward several times in the past year.

Scotgold has now decided to withdrawn 2023 guidance as both

gold production and sales fell in the first half of the year due to a halt in production at its Cononish mine early this year.

Sales of the precious metal dropped to £3.5 million (US$4.5 million) in the first half of the year from £6.3 million in the same period of 2022, as production declined to 2,314 oz. from 4,755 oz. a year prior.

The fall in production was a result of halted development on the 430 west ore drive in late February due to declining gold grades, the company said.

It also said it would update the market on production forecasts once the third-party review is complete and the findings have been analyzed.

Scotgold’s update comes on the heels of the BBC News admission to have broadcasted “fake news” about a non-existent gold discovery made by the company, which caused the miner’s share price to subsequently soar.

When news of this alleged find broke, investors rushed to buy Scotgold shares. This pushed the stock up 54% — adding around £15

million to its valuation – only to fall rapidly in the following days as the company admitted that it has not even drill-tested the said gold vein.

The company’s shares have fallen more than 75% year-to-date, leaving it with a market capitalization of £11.51 million (about US$15 million).

In a verdict published on July 6, the BBC Executive Complaints Unit (ECU) upheld a viewer’s complaint that it had broadcast “fake news” about a non-existent gold discovery.

www.northernminer.com

Fraser Steele, head of the ECU, admitted that news reports on BBC Radio 4 Today, BBC Radio 2 and BBC1 Scotland that the miner had found another vein of gold at its Cononish mine located in the Scottish Highlands “were incorrect and would have misled their audiences.”

The source of the story was BBC Scotland reporter, David Henderson, who first included the misinformation in the report of his mine visit and interview with Scotgold’s then CEO Phil Day published on the BBC News (Scotland Business) website on Jan. 30, 2023.

In the interview, Day told the BBC his company had carried out some testing and believed it was likely there was a second vein containing gold running parallel to the vein it was already mining, which could extend the working life of the mine and potentially increase profits.

However, there were some brief news reports on BBC bulletins on the morning of Jan. 30 which reported Scotgold as having said it had “found another vein of gold at its Cononish mine” (or very similar wording).

In the ECU’s judgment, that was more definitive than the hope or expectation expressed by the company’s former executive and would have left the audience with a misleading impression. As such, the viewer’s complaint was upheld in relation to those reports. TNM

BHP (NYSE: BHP; LSE: BHP; ASX: BHP) and Vale (NYSE: VALE) faced off in a London court on July 12 as part of one of the largest class action lawsuits in history, which could see them fined £36 billion (US$44 billion) for their role in a mining disaster in Brazil that killed 19 people.

The case, brought to trial by around 720,000 Brazilians, centres on who should accept legal and financial responsibility over the deadly 2015 collapse of a dam. The incident at the iron ore mine, owned by BHP and Vale’s iron ore joint venture Samarco, became the country’s worst ever environmental disaster.

Brazilian federal prosecutors had claimed both miners failed to take actions that could have prevented the disaster. But the companies have repeatedly said they were not responsible for the dam’s collapse, adding that they complied with Brazilian law and that safety was and has always been a key concern.

The lawsuit, one of the largest in English legal history, began in 2018, but was thrown out of court two years later. A Court of Appeal ruled in July 2022 that it could proceed.

BHP applied in December to have Vale join the case and contribute to damages if they lose, but the Brazilian miner challenged the

London High Court’s jurisdiction to determine the claim.

The world’s largest miner also attempted to delay the court hear-

ing until mid-2025, but in March a London court granted it just a fivemonth deferral. “BHP currently has no right to

a ‘contribution’ from Vale under Brazilian law,” said court filings submitted by Vale’s lawyers, Reuters reported.

“BHP can have no such right unless and until… it is found liable to the claimants and makes a payment to them,” the documents added.

Vale also said that it has no direct operations in Britain, and therefore London is not the appropriate location for the case.

BHP’s lawyers said that if it is found liable, then Vale should assume its responsibility too, as both companies owned and controlled Samarco equally.

The company has repeatedly said it believes the proceedings are unnecessary because “they duplicate matters already covered by the existing and ongoing work of the Renova Foundation” as well as legal proceedings in Brazil.

“BHP therefore seeks to have Vale share the burden of any such liability, and contribute (50% or more) to any payments made,” BHP’s lawyers said in a filing.

The trial, which starts on Oct. 7, 2024, is the latest in a series of lawsuits filed in Brazil, Australia and the U.K. resulting from the dam collapse. TNM

Extracting minerals from the ocean floor would negatively impact the tuna industry as the fish is expected to migrate habitat towards areas of the Pacific Ocean currently slated for deep-sea mining activity, a study claims.

The scientific paper, published on July 11 in the Nature Sustainability journal, centred on three species of tuna — eye, skipjack and yellowfin — that are likely to change their migration patterns due to climate change.

The biomass of the species named in the article will increase by an average of 21% by mid-century in the mineral-rich Clarion-Clipperton Zone (CCZ) a vast area between Hawaii and Mexico that is the target of deep-sea miners.

“These projected increases in overlap indicate that the potential for conflict and resultant environmental and economic repercussions will be exacerbated in a climate-altered ocean,” the study states.

Mining the seabed in the CCZ, the paper claims, could damage the US$5.5 billion Pacific tuna industry in several ways. Even companies that plan to scoop up polymetallic nodules located 4,000 metres deep would spawn sediment plumes that could spread over hundreds of feet or more.

Once the mineral-rich potato-sized rocks are transported to the surface and processed, another

plume of mining waste would be released back into the ocean, the paper says.

“There is already uncertainty about the impact of climate change on the health and geographic range of tuna. Deep-sea mining will only add to this uncertainty, further threatening tuna species and associated fisheries,” said study co-author Juliano Palacios Abrantes from the University of British Columbia (UBC).

“Tuna health could also be harmed by the release of toxic metals during mining, while noise and light from around-the-clock extraction operations could affect the breathing and feeding of tuna and the prey that they rely on for food,” noted Diva Amon, the study’s lead author and a deep-sea scientist at the University of California at Santa Barbara.

The peer-reviewed article followed a similar study unveiled in May, which warned that mining the seabed may affect thousands of species recently discovered in the CCZ region, where Canada’s The Metals Company (NASDAQ: TMC), already has two exploration contracts.

It also comes on the heels of a report by non-profit financial think tank Planet Tracker arguing that the price tag of fixing the damage caused by mining the ocean floor would double the cost of extracting the minerals companies have set sights on.

The research was released alongside a letter from Global Tuna Alliance partners, which account for 32% of global sales of the fish. They call for a pause in deep-sea mining development until the socioeconomic and environmental impacts could be more thoroughly analyzed.

Crucial meeting

The publication of the latest study coincides with the July 10-21 meeting of the International Seabed Authority (ISA), the United Nations-affiliated body that regulates deep-sea mining.

The Jamaica-based watchdog received in 2021 a formal request from the tiny Pacific island of

ALASKA | Funding to speed up feasibility study for Graphite Creek project

Nauru for a commercial deep-sea mining licence. The move triggered a clause that put the ISA on a twoyear countdown to consider the application, despite the lack of regulations in place.

Since then, a growing number of countries including Germany, France, Spain, Chile, Costa Rica, New Zealand and Panama among others, have asked the ISA to not rush into enacting mining regulations.

Others, including Norway, are pushing for them as the European nation is opening its sea floor for commercial mineral exploration and extraction in an effort to diversify its economy away from

fossil fuels.

The ISA, created in 1994 to manage mining in international waters while at the same time ensuring the protection of the marine environment, is slated to enact regulations before the end of July.

Mounting pressure to pause the approval of such a set of rules and regulations may cause it to defer the process, though experts say that’s unlikely as the affair will likely take several years.

Under existing rules, a mining application must be approved by the ISA’s Legal and Technical Commission (LTC), which then issues recommendations to the body’s ruling council. For a licence to be granted, it would need the support of one-third of the council’s 36 members.

Ocean floor mining supporters estimate the activity could provide up to 45% of all the world’s critical metal needs by 2065. They also believe that the UN High Seas Treaty agreed in March by member countries won’t jeopardize exploration efforts.

The accord aims to place up to 30% of the world’s oceans that lie outside national boundaries under protection by 2030.

A study commissioned by The Metals Company says that mining metals such as cobalt and nickel from the seafloor dramatically lowers the environmental impact of producing battery metals compared to the traditional way. TNM

M&A | Rio’s 15% share could rise to 19.9% after 12-month option period

BY CECILIA JAMASMIE BY JACKSON CHENGraphite One (TSXV: GPH; US-OTC: GPHOF) has been awarded a Department of Defense Technology Investment Agreement grant of US$37.5 million under the Defense Production Act, funded through the Inflation Reduction Act.

The funding will help the company to accelerate the feasibility study for its Graphite Creek project 35 miles north of Nome, Alaska.

Graphite Creek was recently confirmed by the U.S. Geological Survey to be the country’s largest known graphite resource,

and among the largest in the world.

The company plans to manufacture natural and artificial graphite anode materials and other value‐added graphite products from the concentrate and other materials in a facility expected to be located in Washington State.

The grant to Graphite One follows the designation of graphite as one of the battery materials deemed essential to the country’s national defence. The U.S. currently depends completely on graphite imports, with China being the world’s leading producer.

Shares of Graphite One jumped 22% at press time in Toronto, valuing the company at $203 million. TNM

Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) agreed on July 17 to buy a 15% stake in Australia’s Sovereign Metals (LSE: SVML; ASX: SVM) for A$40.4 million (US$27.6 million), becoming a top investor in the critical minerals developer.

The move by the world’s second largest miner marks its first public step into the graphite sector, as it continues to boost its exposure to battery minerals.

Rio Tinto’s exploration arm Rio Tinto Mining and Exploration will subscribe for an initial 83.1 million shares in Sovereign Metals at a price of A48.6¢ each, reflecting a 10% premium to the explorer’s 45-day volume weighted average share price.

The mining giant will also be granted options over a further 34.5 million shares, with a 12-month option period, which could see Rio’s share in Sovereign increase to 19.99%.

Sovereign will use the funds to advance a definitive feasibility study for its Kasiya project in Malawi, where it aims to produce graphite for lithium-ion batteries and rutile for the pigment and titanium metal industries.

“This landmark agreement is a confirmation of Kasiya’s place as one of the most significant critical mineral discoveries in recent times,” Sovereign’s chairman Ben Stoikovich said in a statement.

The companies will collaborate on technical and marketing aspects for a graphite product from the project, with a focus on supplying purified graphite for the lithium-ion battery anode market.

Rio Tinto already produces titanium dioxide from rutile at its operations in Madagascar, South Africa and Canada. Titanium is used in solar panels, paint and aircraft because of its ability to withstand extreme temperatures. TNM

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS:

tnm@northernminer.com SUBSCRIPTION

It’s a fact. The world can’t reach its collective low carbon ambitions without the acceleration of responsible mining projects that discover, develop, and produce minerals and metals critical to clean energy solutions. Metals like copper, nickel and molybdenum, are found in abundance, right here in British Columbia.

BY DR CHRIS HINDEFortunately, we are told that “The past is another country.” Let’s hope that Leslie Hartley (1895-1972) was correct when he wrote (70 years ago in ‘The Go-Between’) that “they do things differently there.” Safety standards and awareness of risk are certainly much higher now, although the widespread public perception of our industry remains that it is outdated, physical and dangerous.

BY KENDRA JOHNSTONThe province has an incredible and real opportunity to be a key player in the global energy transformation. In particular, copper and other polymetallic deposits will be key to securing the province’s place in the push to a greener economy. Copper is one of the most efficient conductors of heat and electricity and it’s essential for our energy transition. It is used every time we need to conduct electricity, including in electric vehicles - which require up to six times more copper than a combustion engine vehicle.

There are future-facing minerals and metals geographically located in every corner of our province, we just have to find these mineral deposits and get them out of the ground. Mineral exploration companies are like the ‘start-ups’ of the mining industry, using geoscience methods to trace indicators that point to the minerals and metals we critically need. Once found, we identify the most economically feasible deposits with the lowest environmental footprint that can be operated with the highest standards of social responsibility. In doing so, we engage early and engage often with local Indigenous communities, working to become true partners in the stewardship of the land.

“BRITISH COLUMBIA CURRENTLY PRODUCES MORE THAN HALF OF CANADA’S COPPER, BUT THE WORLD IS GOING TO NEED TWICE AS MUCH COPPER BY 2035, A SHORT 12 YEARS FROM NOW. THE TIME IS NOW TO DISCOVER AND PRODUCE MORE — EFFICIENTLY AND RESPONSIBLY — AND WE ARE WELL ON OUR WAY TO MAKING THIS HAPPEN.”

B.C. currently produces more than half of Canada’s copper, but the world is going to need twice as much copper by 2035, a short 12 years from now. The time is now to discover and produce more — efficiently and responsibly — and we are well on our way to making this happen. B.C. recorded $740 million in mineral exploration spending in 2022, surpassing the previous record of $681 million from 2012.

Mining is something most Canadians want. According to a 2022 public opinion poll conducted by the Mining Association of Canada, 83% say they would like to see more mining projects in Canada provided they have a plan to reduce GHG emissions. Which all the major producers do. However, some are still skeptical of the role our industry could play into the future, especially here in urban B.C. In November 2022, an Angus Reid omnibus poll of urban B.C. residents aged 24 — 44 found that while almost 60% agree that B.C.’s mineral and metal deposits should be mined to power renewable energy, only 40% agree that more mineral exploration and mining projects are essential for a low carbon future. Unfortunately, without ‘more’ mining there will not be enough supply to meet the green energy demand.

As an industry, we are addressing this skepticism head on to demonstrate that ‘more’ doesn’t mean destruction. It means taking action. More means finding the deposits and moving forward with the ones that make the most sense. Not just economically, but environmentally and socially as well. More means efficiencies in the regulatory process, so we get to ‘yes’ or ‘no’ decisions more efficiently. More means early, often and true engagement with Indigenous communities who are generally most impacted and in close proximity to most benefit from the projects. More means local resources discovered and produced following some of the highest regulatory standards in the world. More ‘here,’ means less ‘there’, where we have no control over workplace conditions, the environmental footprint or the social responsibility. More means tens of thousands of new jobs right here, all across B.C., and economic stability for generations to come. TNM

Kendra Johnston is the past president and Chief Executive Officer of AME, the lead association for the mineral exploration and development industry based in British Columbia.

In the past month the U.K. has celebrated two memorable anniversaries. We have marked the founding of the National Health Service (NHS) 75 years ago, and also our 650year unbroken alliance with Portugal. Unfortunately, coming up, there is also a 50th anniversary of the death (on July 30, 1973) of 18 miners in a shaft accident at Markham Vale colliery in South Wales.

Founded on July 5, 1948, the NHS probably needs no introduction, but many North American readers might be new to the Treaty of Peace, Friendship and Alliance that was signed at Saint Paul’s Cathedral in London on June 16, 1373. This formal diplomatic alliance (which followed the Treaty of Tagilde between the two nations one year earlier) is the longest-lasting such treaty in the world. The friendship between our two countries actually dates back to 1147 when English crusaders helped King Alfonso capture Lisbon from the Moors.

These two recent anniversaries are reason for celebration but other anniversaries are poignant, especially those of calamitous mining accidents. Through its long history, mining in the U.K. has been bedevilled by such incidents, and nowhere more so than the South Wales Coalfield.

Coal production in Great Britain (i.e. England, Scotland and Wales) peaked at 290 million tonnes in 1913 (when this small island accounted for 25% of world coal production) with 1.3 million miners working at more than 1,300 collieries. Although the South Wales Coalfield contributed less than 20% of this total production (employing 250,000 men and boys), the region regularly accounted for 30-50% of British coal-mining fatalities.

The first accident to kill more than 100 British miners happened at a Welsh colliery on July 15, 1856. The gas explosion at Cymmer in the Rhondda Valley was caused by defective ventilation and killed 114 miners. This explosion was followed over the next 50 years by nine other mining accidents in South Wales that counted more than 100 casualties. These 10 disasters alone killed a total of 1,620 men and boys. This catalogue of major accidents was followed, in October 1913, by the U.K.’s worst accident when 439 miners died in an explosion at the Senghenydd mine near Cardiff. (Europe’s worst mining accident was in 1906 when 1,099 miners died in a coal-dust explosion at the Courrières mine in northern

As a generalization, the public is unaware of mining’s importance and attributes. Nevertheless, everyone can agree, surely, that the industry is in a much better place now than it was at the time of the Markham Vale tragedy 50 years ago (when, incidentally, I had recently started my mining degree in Cardiff). But how far have we come? Where, and what, is the mining industry now?

Let’s pretend that our industry is being interviewed by the public, who are seeking to understand mining’s attributes. They might ask that popular employer question; “can you describe yourself in just three words?”

This request is not to be confused with the location-finding ‘what3words.’ Celebrating its 10th anniversary this month, the London-based What3words Ltd. uses combinations of three unrelated words from the dictionary to divide the earth into 57 trillion (57 x 1012) unique threemetre square blocks. As precise as any GPS algorithm, and much easier to remember, ‘what3words’ is now used by millions of people and organizations in almost every country.

Unlike the random words used by ‘what3words,’ interviewers are usually looking for adjectives that will enable them to ‘place’ you, rather than a location. Strong adjectives are advisable to describe yourself (i.e. words that are used instead of the lazy combination of ‘very’ and a normal adjective). Such adjectives are more expressive and can still be used with adverbs like ‘really’ or ‘absolutely’. Ever popular ‘interview adjectives’ include determined, practical and assertive, all of which signal strength.

How should the mining industry describe itself when put on the spot? Its choices might include focused, innovative, resourceful, adventurous or scientific.

Be honest but choose your describing words carefully, the mining industry might not get invited back! TNM

Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

A low carbon future requires the acceleration of responsible mining projects, like those in BC

KENDRA JOHNSTON, PAST-PRESIDENT & CEO OF AME

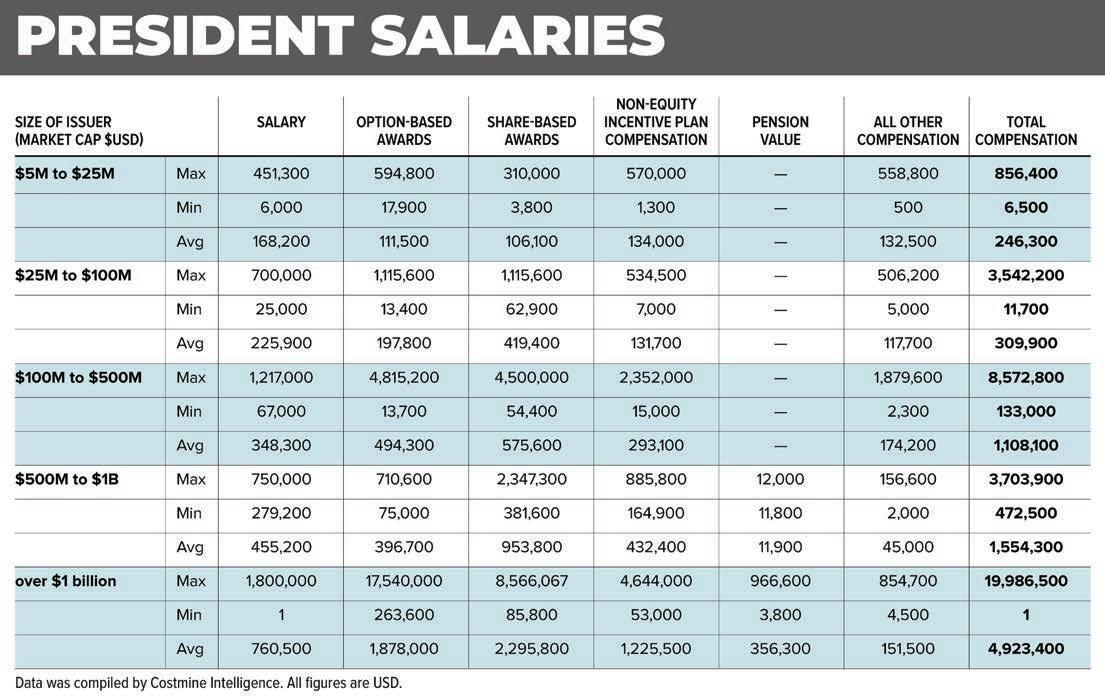

Awhopping US$35 million. That’s what the highest paid mining company CEO earned in 2021, according to data collected by Costmine Intelligence, part of The Northern Miner Group.

The survey also found the average CEO salary for companies with market values of more than US$1 billion to be US$7.8 million a year. Costmine collected the executive compensation data from regulatory disclosures by more than 200 publicly listed Canadian and American mining companies.

Two CEOs accepted just US$1. The survey results are confidential, but one of these executives was likely McEwen Mining CEO Rob McEwen. He describes himself as “chief shareholder,” taking only a US$1 salary and having invested US$220 million personally in the company.

Vice-presidents working for the largest U.S. companies earned a maximum of US$5.6 million a year down to US$242,000 per annum, the report showed. The survey broke down responses by company valuation, from US$25 million to US$100 million, US$100 million to US$500 million, $500 million to $1 billion, and beyond.

As noted in the tables below, stock options and share-based rewards played large roles in executive compensation. As well, non-equity incentive plan compensation kicked in for companies with a market value larger than US$100 million. The executive salary component is part of the larger trend showing labour costs will soon beat oil as a mine’s biggest expense.

Costmine also collected wage and salary by questionnaires submitted by 128 U.S. mines, of which 51 were industrial mineral and aggregate mines, 56 were metal producers and 21 were coal mines. In Canada, 73 mines participated in the survey.

One mine reported offering big game hunting privileges to employees and family as a benefit. Another offered pet insurance. More common benefits included safety equipment and tool allowances, uniform rental, transportation and/or room and board for remote mine sites.

There were also retention bonuses, scholarships for dependent children, education and training assistance, adoption assistance, matching charitable gift programs and health club memberships.

There are a handful of companies that anticipate the executive will make up the difference in no salary with hefty stocks and option packages. Costmine does not track salaries that are reported as ‘nil,’ however compensation through stocks, options, and “other” is accounted for. Because of this, the average total compensation column in the tables may be smaller than the number in the salary column. Regarding the tables, Costmine notes that total compensation represents the minimum and maximum for individual companies and does not add across columns. TNM

ONE MINE REPORTED OFFERING BIG GAME HUNTING PRIVILEGES TO EMPLOYEES AND FAMILY AS A BENEFIT. ANOTHER OFFERED PET INSURANCE. MORE COMMON BENEFITS INCLUDED SAFETY EQUIPMENT AND TOOL ALLOWANCES, UNIFORM RENTAL, TRANSPORTATION AND/ OR ROOM AND BOARD FOR REMOTE MINE SITES.

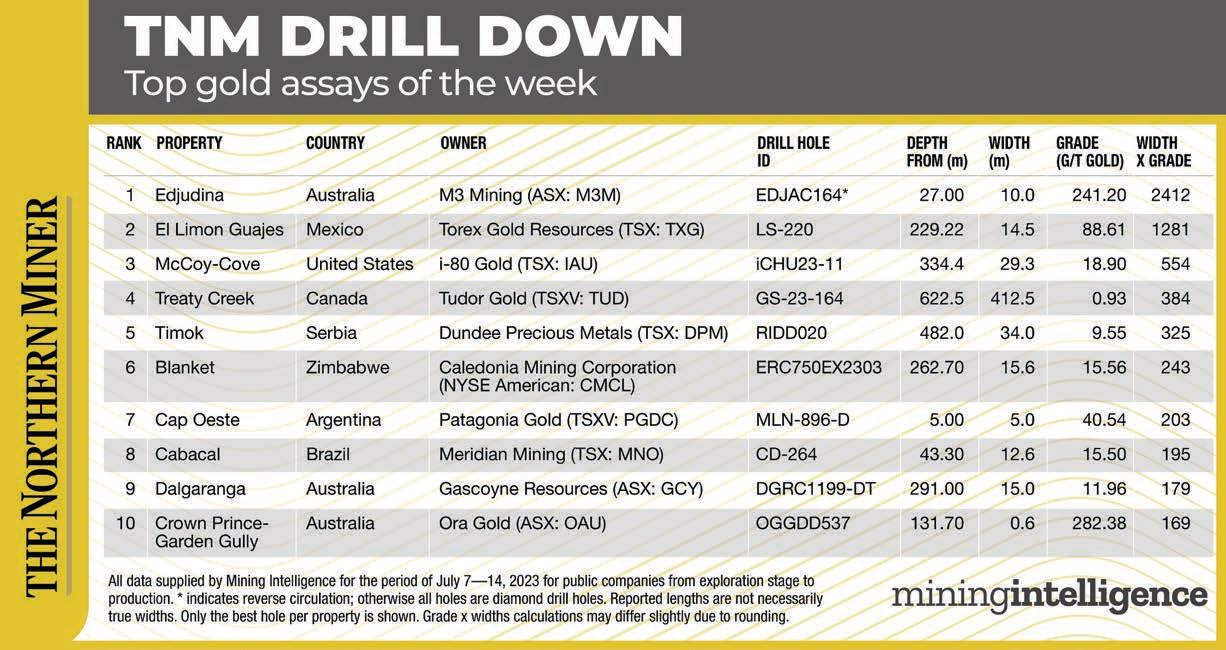

Our TNM Drill Down

features the top gold assays of the week July 7-14. Drill holes are ranked by gold grade x width, as identified by data provider Mining Intelligence. (www.miningintelligence.com)

Western Australia-focused M3 Mining (ASX: M3M) leads the week’s top drill assays, reporting on July 9 the presence of “spectacular” gold mineralization at its Edjudina project, north of the town of Kalgoorlie. The company’s highlight intercept from the El Capitan prospect at Edjudina, came from re-sampled core from hole EDJAC164. The screen fire assays returned 10 metres at 241.2 grams gold per tonne from 27 metres depth. This translates to a high width x grade value of 2,412. The company re-sampled the core from hole EDJAC164, drilled in May, for accuracy, given the coarse mineralization. The hole was originally reported in June at 20 metres of 5.7 grams gold per tonne from 24 metres, including 12 metres at 9 grams gold. M3 has drilled more than 3,182 metres across 74 drill holes, testing north and south extensions of gold mineralization at the pre-resource project.

Torex Gold Resources (TSX: TXG) reported on July 11 ‘impressive’ results from its ongoing drill program at its El Limón Guajes under-

ground mine in Mexico. Torex is exploring in zones referred to as El Limón Deep (ELD), SubSill, Sub-Sill South, El Limón Sur Deep, and El Limón West (together called ELG Underground). The top intercept was from hole LS-220, which hit 14.5 metres grading 88.6 grams gold per tonne from 229.2 metres depth, for a width x grade value of 1,281. Infill and step-out drilling to the south at El Limón Sur Deep successfully extended higher-grade mineralization

outside the current resource block model. The positive results from the underground drilling program support ongoing resource expansion and reserve growth within ELG Underground, which supports the company’s strategic focus on filling the mill with higher-grade feed from 2027 onwards. Open pit proven and probable reserves stand at 8.4 million tonnes grading 3.2 grams gold per tonne for 885,000 oz. metal, and the ELG Underground holds 2.6 million

tonnes grading 5.8 grams gold per tonne for 508,000 ounces.

I-80 Gold (TSX: IAU) reported the week’s third-best drill hit at the McCoy-Cove project in Nevada. Hole iCHU23-11 returned 29.3 metres grading 18.9 grams gold per tonne from 334.4 metres depth for a width x grade value of 554. The new results include the best intercepts to date and demonstrate the continuity of high-grade mineralization in the CSD/Gap zone. The continuing program,

expected to total about 40,000 metres of drilling, is being completed on 30-metre spacings before an updated resource estimate and economic study follow in late 2024 related to the construction of mining operations at McCoy-Cove. This program is focused on the CSD/ Gap and Helen zone portions of the deposit, including mineralization below the pit in the Cove South Deep and 2201 deposits that are not being drilled as part of this program. TNM

to see a lot of downstream activity moving to.”

exposure,’” he says.

“You’re not seeing more private capital, long-term capital, and that’s really what the space needs.”

Ramping up investment

With over US$2 billion in funds to deploy, Appian plans to be “one of the most active investors in the metals and mining space over the next few years.”

This year alone, Appian has made two zinc acquisitions, including a joint venture with Osisko Metals (TSXV: OM) in May, that will see it earn up to 60% in the Pine Point zinc-lead project in the Northwest Territories in return for a $100-million investment. The other was the purchase in June of the Rosh Pinah zinc mine in Namibia from Trevali Mining, which went into receivership earlier this year. The purchases follow an April 2022 $85-million credit finance agreement with Western Potash, which is advancing its Milestone project in Saskatchewan toward production later this year.

The deals target commodities that are critical to society over the medium to long term, but will see structural shortages, Scherb says.

“That goes for anything from tin, which is a soldering agent for microchips and obviously that’s a big geopolitical issue at the moment, to potash, where Russia controls 43% of the world’s supply with Belarus — so Canada is a very interesting destination for us to be investing into,” he explains.

Scherb says Appian, which now has three offices in Canada after opening its latest location in

Vancouver last March, is keen on further investment in Canada.

In general, Appian looks for advanced projects that the team believes it can bring into production and sell within three to five years. “We invest on average around one to three years before production, and we then accelerate those mines into production.”

Its most recent sale brought in US$1 billion for two assets it had acquired in Brazil in 2018 — one out of bankruptcy (Atlantic Nickel for its Santa Rita mine) and the other a greenfield copper-gold asset purchased from Mineracao Vale Verde that Appian developed itself (the Serrote mine). The sale of the two assets plus a gold royalty on Serrote for US$65 million to ACG Corp. came just two weeks before

the Rosh Pinah acquisition.

“We’ve now built nine mines into production in the last six years,” Scherb says. “The mines that we sold in Brazil will be our 10th, 11th and 12th sales exits, so a real strong track record both of building but also of selling to groups who are the logical long-term owners of projects.”

The deal with ACG also highlights one potential new source of capital — downstream companies that need to lock down metals supplies for production. ACG made the acquisition with the help of cornerstone investors including two automakers — Volkswagen and Stellantis.

“You will see this rise of alternative sources of financing led by groups that are downstream that

really need that security of supply,” Scherb said.

Geopolitics is also influencing where Appian is likely to invest, with the “safe-shoring” trend gathering strength as jurisdictions like the United States restrict materials from unfriendly nations and incentivize local production.

“Where I think the (U.S.) Inflation Reduction Act is interesting is around the downstream. For example, we have a graphite mine in Brazil (Graphcoa) that will be in production very soon.”

Scherb says the company’s location studies for a downstream facility indicate the U.S. is the best place for a plant. “Now that wasn’t the answer a year ago or two years ago, but because of that government support, that’s where you’re going

Deal structure

While Appian does a variety of types of deals, including equity, credit, royalties, streams, and equity, its recent experience with Harte Gold has it leaning away from minority stakes in companies. Harte entered creditor protection in late 2021, two years after achieving first production at its Sugar Zone underground mine near White River, Ont. All told, Appian put $100 million in the junior since 2016, including debt, equity and royalty investments.

When Harte was bought by Australia’s Silver Lake Resources last year, Appian received US$22 million for its 2% NSR royalty (compared to the December 2019 purchase price of US$9.5 million) and a $33.4-million repayment of subordinated debt (a 15% premium to its July 2020 investment of US$28 million). But it didn’t fare as well on its equity.

“I think the key lesson learned there is that private equity just simply isn’t the best investor to be taking shares in a public company,” Scherb said. “It’s better to be at the asset level.”

Scherb flags the Pine Point joint venture with Osisko as the type of deal that the Canadian market will see more of in future, with an earn-in investment at the asset level instead of in the company’s equity.

“It’s actually less dilutive for public equity shareholders and the management team, and is a fully funded solution at the asset level so they can focus on delivering that mine into production.”

In the dimly lit Jack Dempsey dinner hall of the Mizpah Hotel in Tonopah, Nev., built in 1906, a group of miners, financiers, analysts and media recently convened to explore the redevelopment of the district’s remaining mineral potential, marking the first meeting of its kind here in over a century.

The group was gathered for a tour of projects near the town, which played a pivotal role in the rise and fall of this desert hamlet’s mining development history.

Nevada’s biggest silver deposits were discovered well over a century ago: Comstock Lode around 1860 and the Tonopah District in the early 1900s.

“Nevada became a state as a result of the Comstock— the silver paid for the Civil War and the winning of the Union,” said Bill Howard, executive chairman of Blackrock Silver (TSXV: BRC) during a June site visit. “It’s often said that if Comstock made Nevada, the Tonopah silver deposits were what paid for keeping Nevada a state. That’s why we’re called the ‘Silver State.’”

Nestled in the heart of Nevada, the Tonopah region holds a rich historical mining legacy and an equally promising future.

Below the town, underneath its historical buildings in the surrounding Esmerelda and Nye counties, remain rich gold and silver deposits which again make sense to explore given the use of new technology and higher metals prices. And there’s a newcomer to the party – high-grade lithium clays abound towards the north, west and south of Tonopah, which have sent local prospectors into a spin with the potential EV windfall.

However, for the time being, the historical Tonopah silver deposits are receiving the brunt of exploration investment, with Blackrock Silver and Suma Silver (TSXV: SSVR; US-OTC: SSVRF) looking to breathe new life into the old silver deposits that gave life to the mining town.

Past boom times

Today, the geological setting of the Ancestral Cascades and their richly mineralized high and low-sulphidation systems form the backdrop to the stage for the town’s (population 2,200) economic reinvigoration. The relentless subduction and volcanic activity formed rich mineral deposits that are now drawing prospectors and fortune-seekers back to Nevada.

One time-worn story holds that prospector Jim Butler, a man driven by curiosity and a touch of luck, stumbled upon the treasure that would define Tonopah’s future. It is said his donkey was stubborn, and when the frustrated man picked up a rock to throw at the animal, he found it was quite heavy, signalling the presence of silver.

Sharing his discovery with assay labs, he faced initial disbelief, but his persistence paid off when significant silver deposits were later confirmed. Spurred by his wife’s encouragement, Butler staked the land and along with his partners named the town Tonopah.

Tonopah quickly became a bustling mining town, boasting a peak population by the 1920s of more than 25,000, attracting many miners hoping to strike it rich. The town today still celebrates its annual ‘Butler Days’. Leasing their claims to

others in exchange for a share of the revenue, Butler and his partners enjoyed considerable success.

Capital poured into the region, consolidating mining operations and the birth of successful companies such as the West End Mining Company and the Jim Butler Mining Company.

Modern explorations have built upon the knowledge and insights gained from the past. According to Howald, extensive mapping and geological studies, including those conducted by the United States Geological Survey, have revealed two calderas separated by millions of years. The northern caldera, rich in silver, and the southern caldera, focused on gold, have provided a roadmap for mining efforts.

Tonopah’s modern promise

In 2020, a new chapter opened for the Tonopah district, with Blackrock spearheading a deal involving Ely Gold Royalties to consolidate mining rights and resources.

To date, the Blackrock team has consolidated patented claims, with the Tonopah West project representing the western extension of the famed Tonopah silver lode with control over more than half of the

overall district.

Historically, it produced 174 million oz. silver and 1.8 million oz. gold from 7.5 million tonnes.

The Tonopah District was mined underground from 1900 to 1930, with peak years producing up to 14 million oz. yearly of silver equivalent.

According to Howald, mining ceased when the old timers met the water table, and pumping technologies were inadequate to deal with ingress. The project’s Victor vein was 24 metres thick, where production ceased and is likely where early mining would resume.

Today, the Tonopah project holds an NI 43-101-compliant underground inferred resource of 3 million tonnes grading 446 grams silver-equivalent per tonne for 42.7 million oz. (The silver-equivalent grade is based on silver and gold prices of US$20 per oz. and US$1,750 per oz., respectively, and recoveries for silver and gold of 87% and 95%, respectively.)

Most promising of Blackrock’s work last year was hole TXC22-

Tonopah West is billed as North America’s most active silver exploration project. Significant intercepts range from 1 to 29 metres in thickness, with grades up to 6,526 grams silver-equivalent (up to 37 grams gold and 2,740 grams silver). The team has described 10 veins ranging from 425 metres up to 3 km in the drill-defined strike, and the deposit remains open to the northwest, south, and at depth.

Howald, who notes that Blackrock is the first group to conduct exploration targeting the historical workings and examining the many historic mines on the property, is optimistic about the knowledge base the company has been able to build to date.

He says Blackrock has used the time between drill programs to update and incorporate all 2022 drill information into its geologic model.

The new model includes Blackrock’s northwest step-out drilling, which is located 1 km northwest of Tonopah West’s DPB resource and increases the strike length of the vein system to over 3 kilometres.

“Step-out drilling continues to expand the mineralized footprint well beyond the April resource boundary and remains open to the south, northwest, and at depth,” he says. He adds that the project’s Denver vein system had also now been tracked an additional 1.6 km just to the northwest beyond the DPB resource area.

The updated geological model will form the basis for an updated resource estimate in the second half of this year. Based on the geologic model, the northwest step-out area is projected to add tonnage at a similar grade.

Meanwhile, next door and directly east of Tonopah, Summa Silver, under the direction of CEO Galen McNamara, is undertaking a similar strategy at its Hughes project.

McNamara is hugely optimistic about the company’s prospects of discovering an eastern extension of the historic Tonopah District.

“Covering five kilometres of its possible eastern extension, the Hughes property represents a unique opportunity to both revitalize a historical district and make discoveries in the shadows of the headframes of some of America’s great historic silver producers,” McNamara says.

074, which cut 4.4 metres grad ing 2.36 grams gold and 162.5 grams silver per tonne (399.3 grams silver equivalent), including 1.5 metres of 712 grams silver-equivalent (3.78 grams gold and 334 grams silver), suggesting a strongly mineralized northwest structure.

“We’re doing the drill-Hokey Pokey, where we take one big step out and then retrace our track to examine what lies in between,” Howald says. “We’re seeing a significant return on investment via the drill bit. We have an all-in discovery cost of US62¢ per oz. of silver equivalent.” (That cost includes exploration, project holding/option costs, and general and administrative costs.)

With over 150,000 metres of drilling completed since June 2020,

The team has assembled a previously underexplored land package of 22.3 sq. km, and the company has just resumed drilling at its Ruby discovery of 2020 and 2021, representing the easternmost portion of the Tonopah District’s known strike length.

Geophysical survey work has identified anomalies indicating sulphide-rich hydrothermal alteration along the eastern strike, supporting the company’s modelling of an east-west structural trend, which will be confirmed through summer drilling targeting the extension of Ruby as well as new targets outside the Tonopah District.

From atop one of Tonopah’s most distinctive features — old mine dumps lining the hillside now known as Tonopah Historic Mining Park — one is surrounded by the rocks that tell Tonopah’s story. Given higher metal prices and the application of modern technologies, the region could be poised for a mining renaissance. TNM

Patriot Battery Metals (TSXV: PMET; ASX: PMT) refuted on July 10 claims in a short-seller report, stating the assertions made by Night Market Research were “factually inaccurate and misleading.” The lithium explorer’s public response came just days after its shares rose on positive metallurgical test work at its Corvette project in Quebec.

Night Market said on July 6 it attributed Patriot’s stock price rally to promotion efforts with unnamed marketing outlets that other “Tier1” developers would avoid.

“Patriot Battery Metals is a rare mining ‘unicorn’ — a lithium explorer ascending to a $2-billion valuation despite having acquired its core asset for $8 million only 16 months ago and lacking an established maiden resource,” the short-sellers’ report said.

The firm also suggested that Patriot had used “curiously timed buyout rumours” to inflate its share price, and said the company’s expectations for Corvette’s resource potential were “sky-high.”

Shares in Patriot were halted on July 10 in Australia after the Vancouver-based lithium junior was asked to respond to the bruising report, in line with Australian Securities and Investments Commission regulations.

“I wouldn’t normally be so direct and that’s not really my style,” chairman Ken Brinsden told The Australian Financial Review. “I just think some of what they have said is pretty frustrating, a bit outrageous and inconsistent with the facts we have presented to our investors.”

Brinsden, who left the top job at Pilbara Minerals (ASX: PLS) in July 2022 and emerged as chairman of Patriot a month later, added the company had enlisted the help of lawyers to deal with Night Market Research’s claims.

“[Our Corvette lithium project in Quebec] is a really significant

discovery in which I have deliberately chosen to get involved,” he told AFR. The executive added he wouldn’t have gotten involved if the lithium project didn’t have all

the key elements including opportunity and development potential. Short-sellers make money as share prices fall. Night Market Research has targeted several com-

panies in the past four years, including New York-listed medical device manufacturer Zynex and Toronto-listed Cielo Waste Solutions.

Patriot shares traded at $15.74 apiece in Toronto at press time, for a market cap of $1.4 billion. The stock has traded in a 52-week window of $1.98 and $17.74.

Aussie majors circling Rumours of Australian players eyeing Patriot as a potential acquisition target have circulated in Australian media on and off this year. In February, it was said that Mineral Resources (ASX: MIN), Pilbara Minerals and Wesfarmers (ASX: WES) were all interested in buying the Canadian junior or, at least, a stake in it.

Australian lithium miners, such as Pilbara, Orocobre (TSX: ORL; ASX: ORE) and Galaxy Resources (ASX: GXY), are seeking to expand their global footprint and diversify their supply sources amid rising demand for battery metals. Analysts say they see Patriot as an attractive opportunity to gain access to the North American market and secure long-term supply contracts with leading battery manufacturers.

In late June, Patriot denied a report in Australian media that it had directed Macquarie Capital to seek out potential buyers for the company. The explorer instead said it had appointed advisers and “key personnel” to support the continued development of Corvette.

Metallurgical testing

Patriot reported high lithium oxide (Li2O) recoveries from heavy liquid separation (HLS) testing on pegmatites from Corvette on July 4. The news, which sent its shares 6% higher by mid-day, came ahead of an initial resource estimate for Corvette due out later in July.

The HLS tests, including magnetic separation on five core samples at the CV13 pegmatite cluster, resulted in spodumene concentrate grading more than 6% Li2O at overall lithium recoveries higher than

70%, the company said. Recoveries were also strong on the lower-grade samples, indicating that the coarsegrained texture of the spodumene is more amenable to liberation.

Previous metallurgical testing was conducted on the CV5 pegmatite cluster, where the company has concentrated drilling so far.

The HLS testing also indicates that an operation at CV13 using only dense media separation (DMS) is possible, the explorer said. DMS is the preferred method of spodumene pegmatite processing due to its lower costs and risks.

“The results of this HLS testwork at CV13 are very positive and indicate strongly that joint processing with CV5 pegmatite material is practical and viable,” said mineral process consultant and project steering group member Brett Grosvenor. “From a project development, risk mitigation, and flowsheet perspective, it is difficult to ask for a better result.”

The five samples were collected from drill holes across the western, central and eastern parts of the 2.2km trend of the CV13 cluster.

Joint processing of pegmatites from CV5 and CV13, located about 3.8 km along trend and west of CV5, would reduce infrastructure impacts at the site in the Eeyou Istchee James Bay region.

Patriot said the data shows that both pegmatites could feed the same process plant, with a marketable spodumene concentrate of more than 5.5% Li2O.

For its next step, the company aims to collect representative drill core samples over the summer and fall to feed a DMS pilot plant. Drilling has so far lengthened the CV5 deposit strike to 3.2 km. The CV lithium trend, discovered by Patriot in 2017 spans more than 25 km across the entire Corvette property.

Patriot suspended field work at Corvette in June along with more than a dozen mining operators in Quebec due to the early and intense wildfire season. TNM

ISSB

closure Standards Board (CDSB) Framework, Integrated Reporting Framework, and metrics from the World Economic Forum. The effort is likely to reduce the complexity, cost, and effort of reporting for companies operating in multiple jurisdictions or struggling to juggle multiple stand-alone frameworks.

The SASB Mining standards and TCFD in particular, have seen rapid uptake across the industry in recent years. Companies already reporting under these will have a head start in aligning with the new global baseline. If your company does not use SASB, you may wish to familiarize yourself with the Metals & Mining or Coal Operations standards and assess your readiness to align disclosure.

The ISSB aims to complement and be compatible with the longstanding Global Reporting Initiative (GRI) sustainability reporting standards, which meet the information needs of a broad range of stakeholders beyond capital markets. Ongoing close collaboration with jurisdictional standard setters, including the Canadian Sustainability Standards Board (CSSB), should also ensure harmonization and interoperability with incoming mandatory reporting requirements, eventu-

ally reducing the reporting burden for companies.

Potential drawbacks

For all the benefit of streamlining reporting into a global standard, the new standards have also sparked some concern. The ISSB refers to ‘sustainability-related financial disclosures’ stipulating their connection with financial statements and alignment with the IFRS accounting standards definition of “materiality.” Critics fear this focus on traditional financial materiality (how ESG and sustainability issues affect financial performance) ignores broader company impacts on society and the environment. Understanding what’s material from the latter perspective is impact materiality, and the combination of both types is referred to as double materiality

The ISSB focus on investors and capital markets presents compatibility challenges for jurisdictions like the European Union, where a double materiality lens has explicitly been adopted in establishing mandatory disclosure requirements, especially on topics like GHG emissions, human rights and diversity. Moreover, the financial materiality lens means the standards do not effectively contemplate the information needs of other stakeholders. This can undermine

company-stakeholder relationships and social acceptability, especially in an industry like ours that often struggles in this area. It also limits companies’ ability to consider and address broader evolving societal expectations of corporate sustainability performance.

Finally, the ISSB lens on what matters is strategically limiting. There is growing awareness that understanding and taking timely action on current and emerging systems-level impacts and risks (“outside the fence” impact materiality topics) are an intrinsic part of business resilience. The standards risk supporting a myopic approach to ESG investment and business strategy, limiting meaningful and effective goal-setting, innovation, and, ultimately, performance.

The uptake of the Standards among miners will likely be extensive. The ISSB standards have strong support from investors and market regulators, including the International Organization of Securities Commissions (IOSCO), which represents over 130 national securities commissions, and the Principles for Responsible Investment network, which represents over US$120 trillion in assets under management.

The Canadian Securities Administrators (CSA) has also issued a pub-

lic statement of support. And given the standards build on existing frameworks that are already popular in our industry, investor audiences are likely to expect reporting to align even if your relevant operating jurisdictions do not.

However, miners should consider the caveats. The disclosure framework aspires to foster investor confidence and better risk management practices within the industry. But the narrow investor focus increases the chance of missing material sustainability-related challenges common within the mining industry, especially related to operational community and ecosystem impacts. While recognizing and benefiting from the specific objective of the ISSB Standards, it will be crucial for mining companies to consider the materiality of these broader challenges too, in order to effectively manage their sustainability risks. To adequately prepare, early engagement and understanding of the standards will be crucial to facilitate a smooth transition and ensure compliance when they become effective. Further, companies will need to ensure they have established processes and controls to provide sustainability-related information of the same quality, and at the same time, as their financial statements, because concurrent filing of sustain-

ability and financial disclosure is a key requirement of the ISSB.

Ultimately, the extent to which the new IFRS standards will reshape the landscape of corporate sustainability and ESG reporting remains to be seen. But current support is strong and additional standards on material topics including biodiversity, ecosystem services, human capital and human rights are expected soon. Companies that begin to prepare for alignment now will be better positioned to navigate evolving and emerging voluntary and mandatory sustainability and ESG disclosure expectations. Simultaneously, strategic consideration and management of impacts on people and the planet will see responsible miners continue to benefit from a more holistic and robust approach to risk management and sustainability performance. Only then can companies and the industry as a whole chart a resilient path through the pressing challenges and opportunities of our time.

TNM

Elizabeth Freele and Rachel Dekker are the co-founders and managing partners of mining sustainability think tank and ESG consultancy Sympact. Sympact supports companies in ensuring their social performance and disclosures meet growing expectations.

SITE VISIT | Juniors descend on Tonopah to capitalize on lithium’s EV moment

BY HENRY LAZENBY IN TONOPAH, NEV.While precious metals-focused juniors are working to revive Nevada’s tired Tonopah Silver District, lithium discoveries to the north, west and south of the desert town’s doorstep could again kick the boombust local economy into high gear.

Among a handful of prospectors jumping to capitalize on the battery metal’s EV potential are American Lithium (TSXV: LI), Tearlach Lithium (TSXV: TEA; OTC: TELHF), American Battery Technology Company (US-OTC: ABML) and Century Lithium (TSXV: LCE; US-OTC: CYDVF), all emerging as players in the region’s nascent lithium mining industry, The Northern Miner learnt on a recent tour of the district’s lithium exploration plays. Experts predict a lithium shortage in the next five years due, in part, to insufficient technical expertise as the industry expands globally.

Suppose the Comstock Lode is credited for funding the civil war that created Nevada, and the Tonopah Silver District is credited for paying to keep Nevada an independent state. In that case, lithium stands to chart a new course for the historical mining town, a threehour drive north of Las Vegas.

“The Heller Tuff is mainly a geological formation located in the southern caldera of the Tonopah District, but the Oddie rhyolite, which is where it says ‘Tonopah Mining Park,’ that’s the rhyolite and the Siebert Tuff,” said Blackrock Silver CEO Bill Howard on a recent lithium tour of the region, pointing his finger to a prominent feature on a hillside overlooking Tonopah.

“That’s what everybody’s excited about because it’s full of lithium. So much lithium people don’t know what to do with it all.” While Albemarle (NYSE: ALB) has been producing lithium at the Silver Peak lithium brines mine in the nearby Clayton Valley, discovering highgrade lithium clays in neighbouring basins opens opportunities for new players.

The first stop on the whirlwind tour is American Lithium’s TLC project. The TLC project boasts a distinct freshwater lithium system and easily extractable lithium deposits between Tonopah and a solar power plant.

The lithium found at the TLC is not bound within specific lithium minerals like lithium clays but rather loosely associated with the magnesium smectite mineral. This characteristic of weak binding or association makes it easier to extract the lithium from the sedimentary environment of their deposit.

“Our system is an incredibly low energy system,” said executive vice-president Ted O’Connor. American Lithium aims to mine for 20 years, process and stockpile lithium for another 20 years. According to a February preliminary economic assessment (PEA), the TLC project could yield 24,000 tons of lithium carbonate yearly, and double production to 48,000

tons within four years.

A December resource update for TLC outlined 8.8 million measured and indicated tonnes of lithium carbonate equivalent (LCE) in 2 million tonnes grading 809 parts per million (ppm) lithium. Inferred resources add 1.9 million tonnes LCE in 486 million tonnes at 713 ppm lithium.

The PEA calculated a net present value of US$3.3 billion, using an 8% discount rate with an internal rate of return of 27.5%, giving a 3.5-year capital payback period.

The company has prioritized positive community relationships, engaging with local tribes and fostering a balance between development and preservation. O’Conner says the near-surface deposit is above the water table, and there are no threatened or protected plants or wildlife on the 50-sq.-km property.

Following the example Next door and just west of Tonopah, Blackrock Silver (TSXV: BRC) and Tearlach Lithium’s 30-70%-owned Gabriel project partnership follows in American Lithium’s footsteps. They are also working to explore claystone lithium mineralization.

Led by CEO Chuck Ross, Tearlach brings expertise in lithium exploration and development, while Blackrock contributes insights and assets gained from previous lithium

exploration efforts.

Tearlach Lithium’s geological team, headed by Julie Selway, holds multiple projects in Ontario and has now set its focus on Nevada. The team has drilled over 1,200 metres across 11 holes

at the 16-sq.-km property, returning grades as high as 550 ppm lithium to 1,460 ppm. Ross also points out some wide intercepts of up to 44 metres. Blackrock Silver’s initial discovery of lithium during its search for See GOLD RUSH / 16

high-grade silver veins has paved the way for its partnership with Tearlach.

Ross explains the Blackrock Silver historic drilling intersected clay-

Trusted. Independent. Committed.

Our fit-for-purpose solutions encompass the skills of qualified geologists, geostaticians, analytical chemists, mineralogists, metallurgists, process engineers and mining engineers brought together to provide accurate and timely mineral and process evaluation services across the entire mining life cycle.

DATA | Canada hosts the most projects targeting the strategic minerals

BY BLAIR MCBRIDEWith China dominant in the mining and processing of rare earths, the West faces a daunting task to build supply chains of the critical minerals independent of the Asian superpower. The Northern Miner wanted to find out how the countries of the Americas are faring in exploring and developing the 17 rare metals vital in the manufacturing of cell phones, computers, defence technology and magnets for green energy technologies and electric vehicles.

To help paint a clearer picture of the activity, we turned to data provider Mining Intelligence (MI).

According to the MI database, there are 132 rare earth projects in North and South America, ranging from prospecting to production.

Which rare earths are being explored and mined?

Although rare earth projects often contain many of the 17 elements, not all are economically recoverable. Among the 37 projects in the advanced exploration to production stages, neodymium and praseodymium — widely used in permanent magnets for motors — represent about 50% of the sought-after elements. Lanthanum, used as an alloy with nickel and in hybrid cars makes up about 10% of the target minerals. Other targeted rare earths include terbium, cerium, dysprosium and yttrium.

Where are the projects?

Many rare earths are not uncommon in the earth’s crust, however concentrated deposits are rare. MI data shows that exploration and development is occurring in only seven countries in the Americas.

More than two-thirds of all rare earth activity in the Americas (91 projects) is in Canada, with more than half at the exploration stage. Eight have PEAs, six are in advanced exploration, and two each are in prefeasibility and feasibility stages. Only one is classified as producing.

As it does with lithium, Quebec hosts the majority of rare earths projects in Canada, with 35, mostly in exploration.Ontario and Newfoundland have the second and third highest number of projects.

Though the N.W.T. has only two projects, it also hosts the country’s most advanced rare earths project: Vital Metals’ (ASX: VML; US-OTC: VTMXF) Nechalacho project 110 km southeast of Yellowknife. In April 2022, Vital started shipping rare earth oxides mined at the demonstration-scale project to a processing facility in Saskatoon, but Vital paused the shipping of rare earths in April this year after determining the project wasn’t economic.

After Canada, the United States hosts the most rare earths projects at 24, mostly in the west and southwest, with a few in southern states

such as Arkansas and Tennessee. California is home to the Americas’ only producing rare earths mine: MP Materials’ (NYSE: MP) Mountain Pass mine in California, just west of the border with Nevada. Molybdenum Corp. of America began mining rare earths at the site in 1952. MP Materials revived the project and began selling rare concentrate in 2018. The facility mines bastnaesite ore which is eventually separated into lanthanum, cerium and neodymium and praseodymium oxide. In February, MP made a deal with Sumitomo Corp. to supply the Japanese company with rare earths smelted and separated at its California facility, bypassing China. MP had previously shipped its output to China for processing, with Japanese companies buy it from there.

South of the U.S., Brazil hosts the most projects, with 11. The most advanced project in the country and in South America is held by Serra Verde. The company, which is controlled by global investment firm Denham Capital, plans to start commercial production at its Pela Ema deposit in Goias state by the end of the year. It will produce heavy and light magnetic rare earths including neodymium, praseodymium, terbium and dysprosium.

Chile has three projects at different stages. Aclara Resources’ (TSX: ARA) Penco Module is the most

advanced, after it released a PEA in 2021. In June, Aclara said it had produced its first sample of concentrated high-purity heavy rare earth elements following a commissioning period using ionic clays. It expects to publish a feasibility study for Penco in the third quarter. However, the company hit a roadblock in early July when the Chilean government’s environmental agency halted a review of its environmental impact assessment application due to the presence of a vulnerable tree species

on the project site, near Concepcion. Mexico, Colombia and Peru each have one exploration stage project.

Who owns the projects?

The ownership of rare earths projects in the Americas mirrors their location, with almost two-thirds (64%) of the projects held by Canadian companies. Projects owned by American and Australian companies are at 14% and 13%, respectively. The rest of the projects are owned by companies headquar-

tered in Brazil, Chile and Japan.

Of the projects in stages from “advanced exploration” to PEA to production, Australian, Canadian and U.S.-based companies each hold four projects. Brazil holds one.

Six of the 13 projects are in the U.S. and five are in Canada. Other than Serra Verde’s Pela Ema project, the other advanced project in Brazil is the prefeasibility-stage Araxa project in Minas Gerais state, held by Delaware-based Itafos (TSXV: IFOX).

Two weeks after Lithium Ionic (TSXV: LTH; US-OTC: LTHCF) released an initial resource for its Itinga project, the company has reported grades as high as 1.86% lithium oxide (Li2O) over 5.7 metres from recent drilling at its Bandeira property in eastern Brazil.

Highlights from the summer drilling at Bandeira, part of its flagship Itinga project include 1.74% Li2O over 6.4 metres in hole ITDD23-112, 1.69% Li2O over 7.8 metres in hole ITDD-23-109 and 1.55% Li2O over 7.01 metres in hole ITDD-23-102, the Toronto-based company said on July 11.

“We continue to see strong and consistent results from Bandeira,” said Lithium Ionic CEO Blake Hylands. “Eight of the 13 drills on our properties are at Bandeira, further defining the deposit and improving drill spacing to establish a mineral reserve estimate for the definitive feasibility study targeted for completion by the end of 2023.”

The results come from the company’s ongoing 50,000-metre expansion and definition drilling program for the second half of the year on Itinga’s two main targets of Bandeira and Galvani in Minas Gerais state, about 900 km north of Rio de Janeiro. The project sits between the towns of Araçuaí and Itinga, within Brazil’s prospective “Lithium Valley,” where Companhia Brasileira de Lítio’s Cachoeira lithium mine and Sigma Lithium’s (TSXV; NASDAQ: SGML) Barreiro deposit are located. Lithium Ionic also holds the 141-sq.-km Salinas project.

The reported assays are of “exceptionally high grade,” with

some of the holes exceeding the 1.41% Li2O grade of the current resource, Canaccord Genuity analyst Katie Lachapelle wrote in a research note on July 11.

“With an aggressive drill program underway (about 7,000 metres per month at Bandeira alone), we expect continued results of this nature to support a material upgrading of inferred resources to the measured and indicated category for inclusion in the upcoming feasibility study,” she said.

Lachapelle added that Lithium Ionic is poised to fast track Bandeira into production.

“We forecast first production of spodumene concentrate in 2027 at a low upfront capital cost of US$130 million. In our view, the current mineral resource, before further expansions, can easily support up to 200,000 (tonnes per year) of production at an operating cost of (about) US$450 per tonne

BY HENRY LAZENBY

BY HENRY LAZENBY

(well below the current spodumene concentrate spot price of about US$4,000 per tonne),” she said.

The initial resource, announced on June 27, estimates Itinga hosts 7.6 million measured and indicated tonnes grading 1.4% Li2O, and 11.9 million inferred tonnes grading 1.44%. The resource includes the Bandeira and Galvani deposits which together cover 8.7 sq. km inside LTH’s larger land package of 141.8 sq. km. The resource was based on 181 diamond drill holes and 28,204 metres of drilling.

The holes reported on July 11 have improved drill spacing and established continuity of mineralization between previously drilled holes.

Canaccord gives LTH a target price of $5, well above its share price in Toronto at press time of $2.39, for a market capitalization of $280 million. Its shares traded in a 52-week window of 71¢ and $3.05. TNM

The team of oil and gas industry experts at Volt Lithium (TSXV: VLT) has introduced a new lithium extraction technology that it says achieves 90% recovery rates from its Rainbow Lake brine project in northwestern Alberta. The Volt team, led by CEO Alex Wylie, has harnessed its expertise in fluid movement to tackle lithium extraction from brine reservoirs, he told The Northern Miner in an interview.

“Our pilot plant has given us the data required to prove we can produce lithium consistently from low-grade brines. It potentially opens significant commercial potential with existing oil and gas majors, particularly in North America’s Permian and Montney basins,” Wylie said.

The pilot plant operations were done in a simulated commercial environment at Volt’s equipment supplier’s facility in Regina, Sask.

The innovative extraction idea developed from a partnership between Wylie and another industry expert who he had previously worked with for over 15 years. Wylie has a background in the oil and gas sector, while his partner comes from a family-owned chemicals business in Calgary. Intrigued by the potential of lithium, they embarked on a quest to determine its extractability.

While conventional wisdom dictated that extraction was only feasible from high-concentration brines, the team founded a company called Standard that achieved successful extraction from concentrations as low as 300 mg per litre. That led them to explore the possibilities, particularly in regions like Chile and Argentina, where brines boast exceptionally high lithium concentrations.

The team’s primary objective was to be able to extract lithium from brines across the concentration spectrum. Leveraging their fluid movement expertise gained from the oil and gas industry, they developed a technology that demonstrated high extraction rates during testing at Rainbow Lake.

Pilot project

Using Volt’s proprietary direct lithium extraction (DLE) technology, the company reported in late May that the pilot project achieved 90% lithium recoveries at concentrations as low as 34 mg per litre.

Wylie also says Volt has simulated operating conditions at concentrations of 120 mg per litre and recovered up to 97% lithium. Assuming average annual production of 20,000 tonnes of lithium hydroxide monohydrate, those simulations suggest operating costs would be under $4,000 per tonne.

Volt’s DLE approach involves a two-stage process. The first focuses on removing contaminants from the brine before extraction. By partnering with a water treatment and filtration systems sub-contractor, the team ensured efficient brine treatment, facilitating the subsequent extraction process.

The breakthrough in the company’s technology comes in the second stage, with the development of specialized ion-exchange beads.

Wylie says that unlike traditional beads, the larger, 5-micron specialized beads have 800 times the surface area, enhancing their extraction efficiency.

This advancement allowed the team to consistently extract lithium from brines during various testing stages, including successful pilot projects.

The team scaled up their process from a modest 5 litres at a time in the laboratory to 2,000 litres during the bench testing phase. Encouraged by these results, they transitioned to pilot production, processing 18,000 barrels of fluid daily. According to Wylie, their system returned consistent extraction results, which bodes well for its scalability.

Looking ahead, the team has set their sights on commercial production, with a first-stage goal of processing 60,000 barrels of fluid per day. This milestone would enable the production of 1,000 to 1,500 tonnes per year of lithium hydroxide, translating into substantial revenue potential.

The team’s success to date validates its extraction capabilities and opens new possibilities for lithium extraction from brines with lower concentrations. Volt aims to demonstrate the commercial viability of its system, paving the way for collaborations with oil companies operating in lithium-rich regions like the Permian Basin and Montney.

The team has opted to focus on pilot projects before traditional mining assessments. Wylie says this unconventional approach allows them to leverage actual pilot results to design and optimize future operations. Down the line towards commercialization, Wylie envisions expanding Volt’s operations and unlocking the vast potential of lithium extraction in North America and beyond.

With its potentially gamechanging technology, Volt hopes to leverage its oil and gas expertise in the emerging lithium extraction industry and achieve commercial-scale operations sometime in 2024. Volt shares traded at 25¢ at press time in Toronto, valuing the company at $25.3 million. TNM