UNDERGROUND MINING UNDERGROUND MINING

> Ventilation on demand

> Elevating safety standards

THE UNIVERSAL LANGUAGE OF MINING MINES OF THE FUTURE THE CANADIAN FAST-TRACKING INITIATIVES

“MAXIMIZE SAFETY AND PRODUCTIVITY BY PROVIDING REAL-TIME AIR QUALITY DATA AND EMERGENCY MESSAGES ON A LARGE DISPLAY THAT INTEGRATES WITH ANY NETWORK.”

Safety in Numbers.

Eliminate guesswork and know with confidence when it’s safe to move about the mine.

SuperBrite™ Marquee Display

SuperBrite™ Marquee Display provides fail-safe, real-time data by ensuring only current information is displayed – preventing unsafe old data from display when network is off-line. Easily integrated into wireless or Ethernet network and written to directly from any Vigilante AQS™ or Zephyr AQS™ stations, SCADA, DCS, PLC or HMI control system.

FEATURES

UNDERGROUND MINING AND VENTILATION

10 Overcoming the barriers to ventilation-on-demand in underground mining.

14 Pre-consolidation of a raise bore hole: A case study.

17 The universal language of mining.

19 Elevating safety standards in underground mining.

34 New crusher designs drive energy efficiency.

INTERNATIONAL MINING

21 Remedies for mining investors in Mexico under the CPTPP amid judicial reform.

25 CEO Interview: A plan to reshape the boron supply chain.

CRITICAL MINERALS

28 Rotary kilns: Advancing critical mineral recovery.

TECHNOLOGY, EQUIPMENT, AND INNOVATION

32 Why custom hydraulic valving is no longer optional.

36 Mines of the future from engineering to operations with digital integration.

38 Decades of opportunity: Looking back at nearly 50 years of mining innovation at SRC.

41 Boosting performance and maximizing bulk material handling efficiency.

DEPARTMENTS

4 EDITORIAL | The smart mine underground: Where efficiency meets sustainability.

6 FAST NEWS | Updates from across the mining ecosystem.

12 LAW AND REGULATIONS | Canadian fast-tracking initiatives in a period of global trade uncertainty. 25 34 41

THE SMART MINE UNDERGROUND: Where efficiency meets sustainability

In recent years, underground mining has seen a rapid acceleration in automation, digitalization, and the use of robotics, which is transforming both operational efficiency and safety. Remote-controlled and autonomous equipment — such as loaders, drilling rigs, and haul trucks — are being integrated with real-time sensor networks, enabling mines to reduce the presence of humans in hazardous underground zones.

Sophisticated data analytics, machine learning (ML), and internet of things (IoT) platforms facilitate predictive maintenance, process optimization, and continuous monitoring of geotechnical conditions, thus anticipating failures and reducing downtime in underground operations. Moreover, modular equipment design, precision manufacturing, and stronger materials are helping suppliers produce machinery that is more durable, easier to service, and adaptable to deeper, more extreme underground environments.

Moreover, the intensifying focus on sustainability, ESG performance, and energy transition in underground mining because of the stricter environmental regulations is urging mining companies to seek ways to reduce carbon footprints, manage water and ventilation more intelligently, and optimize energy use underground.

Electrification of mining fleets and the use of renewable energy sources are gaining ground, allowing for cleaner operations and reduced ventilation costs owing to lower heat and emissions in underground workings. Simultaneously, deeper mining and the exploitation of more remote or geologically complex ore bodies are pushing the industry toward advanced mining methods such as fluidized mining, multi-robot systems, and novel approaches to backfilling and support to maintain safety and stability at depth. Several articles in this issue reflect on all the above-mentioned trends in underground mining.

In our next combined edition (December 2025-January 2026), we will take a look at what is happening around the world as mining grows more interconnected in our shared quest for net-zero, and we will have a feature report on mining in B.C. and Yukon. Editorial contributions can be sent to the Editor in Chief no later than November 15.

NOVEMBER 2025

Vol. 146 – No. 8

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Joseph Quesnel jquesnel@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3

We acknowledge the financial support of the Government of Canada.

Tamer Elbokl, PhD

At Jennmar Canada, we’re committed to delivering cutting-edge products and services that set the standard for safety, performance, and innovation. With state-of-the-art manufacturing facilities in Sudbury, Ontario, and Rouyn-Noranda, Quebec, plus a strategically located distribution center in Saskatoon, Saskatchewan, we offer high-quality, locally produced solutions with faster delivery and streamlined logistics. By manufacturing and sourcing in Canada, we strengthen the local economy while providing responsive service, expert technical support, and customized solutions that help our clients succeed. We proudly offer bilingual service in both English and French to better serve customers across the country.

CANADA LOCATIONS

Sudbury, ON, CANADA (705) 525-0101

Rouyn Noranda, QC, CANADA (819) 797-3866

GLOBAL HEAD QUARTERS

Pittsburgh, PA, USA (412)-963-9071

For more information on our portfolio of diverse and complementary brands visit us at www.jennmar.com

Weber pumpable resins offer many advantages over cementitious grouts:

• Cable bolts can be tensioned 8 minutes after installation, compared to a 12 to 24-hour wait for cement, offering a significant time advantage

• Quick curing to full strength, adjustable setting time, and non-foaming properties

Easily move to Weber resins using the Skid Pod P:

• The Thixo Skid-Pod P is a modular ‘plug and play’ unit, featuring a 1:1 mixing ratio, a retention tank, and versatile capabilities for various injection needs

• It can be installed on or next to any bolter rig, jumbo, boom lift, or utility truck

• MINE CONSTRUCTION | Nova Scotia to start construction of gold mine next year

NexGold Mining announced the Industrial Approval (IA) for the Goldboro gold project has been granted by the Government of Nova Scotia. The IA is one of the last key provincial permits required prior to the commencement of construction and future operations. Construction on the Goldboro gold mine, owned by NexGold Mining, is set to begin in 2026. This approval follows seven years of consultation and study. The Goldboro mine project has a 15-year timeline that includes development, 11 years of operation, and remediation. The province has leased 7.79 km2 of Crown land to NexGold for this mine; part of the mine will be on the Crown land and part will be on company-owned land.

• MINERAL TIES | Canadian-German alliance: Boosting energy ties with mineral pact

Canada is finalizing a critical minerals partnership with Germany that encourages joint public financing of natural-resources projects. Prime Minister Mark Carney says Canada left key minerals such as nickel and cobalt underdeveloped for too long while China and Russia dominate the global critical minerals market.

The critical minerals talks also produced some collaboration work. Rock Tech Lithium and ENERTRAG also signed a memorandum of understanding (MoU) for supplying renewable energy to the planned lithium hydroxide converter in Guben, Germany. The signing took place in the presence of Canadian Prime Minister Mark Carney, Canadian Minister of Energy and Natural Resources Tim Hodgson, Canadian Minister of Innovation, Science, and Industry Mélanie Joly, and Germany’s Federal Minister for Economic Affairs and Energy Katharina Reiche.

• MINING COMPETITION | Sudbury to host premier undergraduate mining competition in 2026

The 8th Annual Goodman Gold Challenge (GGC) is set to take place from January 28 to 30, 2026, at Laurentian University’s Goodman School of Mines in Sudbury, Ontario. The competition, founded by Jonathan Goodman, aims to give undergraduate students an authentic experience in mining investment management.

Unlike typical business contests that rely on fictitious companies or paper simulations, the GGC involves real-time decision-making based on current industry situations. Teams of four students from a single university will analyze three publicly traded mining companies on the TSX or TSX-V, ultimately recommending one for a wealthy client—represented by Mr. Goodman—who is interested in investing in the mining sector.’

Signal Gold’s Goldboro gold property in Nova Scotia. CREDIT: SIGNAL GOLD

German flag with Canada flag, 3D rendering. CREDIT: ADOBE STOCK IMAGES

Goodman Gold Challenge.

• ADVANCING CONSTRUCTION | Osisko Development raising $203M for Cariboo gold construction

Gold production at the Cariboo gold mine will total about 2 million oz. over 12 years.

Osisko Gold successfully closed its US$203 million bought deal private placement for the Cariboo gold project. The property, 65 km east of Quesnel, B.C., is shovel ready. Both an underground mine and a carbon-in-pulp recovery plant are planned. The offering consisted of two parts. First, the company issued approximately 58.6 million units at the issue price for aggregate gross proceeds of US$120 million. The brokers of the first portion have been paid a cash commission equal to 4.5% of the gross proceeds on that part. Second portion, a non-brokered portion consisting of approximately 40.5 million units for gross proceeds of US$75 million. The second part paid a commission equal to 4.0% of its gross proceeds.

• LANDMARK OFFER | Denison sets $300M offer, company funding Wheeler River project

Denison Mines, a uranium mining, exploration, and development company focused in the Athabasca Basin region of northern Saskatchewan, announced it has upsized and priced its previously announced offering of convertible senior unsecured notes due 2031 for a total principal amount of US$300 million. The company will use the proceeds to support the evaluation and development of its uranium projects, including the Wheeler River Uranium Project, and for general corporate purposes. About US$30.75 million will go toward funding capped call transactions designed to reduce potential dilution upon note conversion.

•

INDIGENOUS OUTREACH | Ontario government claims full Indigenous consultation on Bill 5 amidst criticism

Despite concerns from Indigenous leaders, Ontario’s Minister of Economic Development Vic Fedeli asserts that every First Nation in the province received invitations to participate in consultation sessions regarding Bill 5, aimed at establishing special economic zones for major projects. The legislation has faced criticism from First Nations groups throughout the spring and summer, who fear it could infringe upon their treaty and constitutional rights. They are also concerned about the potential environmental impact on their traditional territories from infrastructure and resource projects.

The province aims to streamline project approvals, particularly for developments deemed strategic and in the national interest, such as the Ring of Fire. In fact, the Ontario government has been explicit for awhile that the Ring of Fire was a top priority project for the province and would be subject to Bill 5 measures.

• SPACE MINING | Scientists may have discovered a new mineral on Mars

Researchers have pinpointed a previously unknown mineral on Mars, indicating the red planet’s surface may be more actively changing than previously believed. While scientists have a solid understanding of Mars’ surface appearance, uncovering its precise composition remains a challenge.

Recently, a team of researchers believes they have identified a completely new mineral, derived from an unusual layer of iron sulfate exhibiting a distinctive spectral signature. In a paper published on August 5 in Nature Communications, astrobiologists led by Janice Bishop from the SETI Institute detailed the detection of an uncommon ferric hydroxysulfate mineral near Valles Marineris, a colossal canyon that runs along Mars’ equator. The region, thought to have once hosted flowing water, could hold vital clues about the natural forces that shaped the planet’s surface and whether microbes once inhabited Mars.

Vic Fedeli, Ontario minister of economic development, has invited all First Nations within Ring of Fire to meetings on Bill 5.

The Wheeler River camp in northern Saskatchewan. CREDIT: DENISON MINES

• PIONEER PASSES | Canadian mining trailblazer passes away

James (Jim) Stockton Redpath, aged 88, passed away on August 2 in St. John’s, Newfoundland, following a courageous 20-year battle with Parkinson’s disease, according to his obituary.

Redpath was a Canadian mining engineer and he is renowned for founding J.S. Redpath Ltd., a mining contracting firm focused on shaft sinking in North Bay, at just 26 years old. The company is now known as Redpath Mining Contractors and Engineers.

Born and raised at a mine site in Val-d’Or, Quebec, Jim Redpath was the eldest son of James and Margaret Redpath. His early summers included working on a small exploration boat in Hudson Bay, an experience that inspired his strong work ethic and deep appreciation for the Canadian North, his obituary noted.

• MINING FUTURE | New Brunswick recalibrating mining’s role in its economic future

CREDIT: ATLANTIC POTASH CORPORATION.

In a move to strengthen its economic resilience amid shifting global trade dynamics, New Brunswick is actively refocusing on its mining sector. With a “trust but diversify” approach to trade, the province aims to unlock dormant resource assets and position itself as a safe haven for critical minerals. Once accounting for 7% of the provincial GDP, mining now contributes less than half that share, but the rising global demand for stable sources of key minerals presents new opportunities.

The province leverages its strategic advantages, including two deepwater ports, well-developed road access to mineral-rich regions, and one of Canada’s fastest-growing container ports. An extensive network of 40,000 km of forestry roads provides logistical benefits, enabling efficient resource extraction and transport. Additionally, close collaboration with Indigenous communities—whose participation is prioritized—further supports plans for renewed mining activity. These factors combine to establish New Brunswick as a promising hub for responsible mineral development.

• HISTORIC INVESTMENT | ABB makes largest investment in Canada to date

ABB will invest over CA$130 million (around US$100 million) to expand R&D and production of its advanced power protection and grid resilience technologies in Canada. The company stated the goal of increasing and securing its position in key power industry sectors across Canada. This will now be ABB’s largest investment.

Over the past decade, ABB has invested around US$275 million in its Canadian operations to support advanced manufacturing, innovation, and workforce development. These investments include upgrades to key facilities, the integration of cutting-edge automation technologies, and the expansion of local capabilities and production capacity.

• FACILITY PROGRESS| Frontier advances lithium conversion facility with definitive feasibility study

Frontier Lithium commenced a definitive feasibility study (DFS) for its lithium conversion facility in Thunder Bay, Ontario. The company’s PAK lithium project now maintains the largest land position and resource in a premium lithium mineral district located in Ontario’s Great Lakes region.

This project now operates with a partnership between Frontier (92.5%) and Mitsubishi (7.5%) The goal is help supply Canada with lithium for the energy sector. A 2025 mine and mill feasibility study (FS) , prepared by DRA shows that it may yield revenue of CA $932 million with a return of 17.9%. This study is now the second of its kind.

Set to open in mid-2027, the new 31,587 m2 facility will feature cutting-edge digital and production automation technologies. CREDIT: CNW GROUP/ABB INC.

Lithium conversion facility rendering on Mission Island.

CREDIT: CNW GROUP/FRONTIER LITHIUM INC.)

Atlantic Potash is advancing a project in New Brunswick.

Jim Redpath, Canadian mining pioneer, died recently at the age of 88. CREDIT: SUPPLIED.

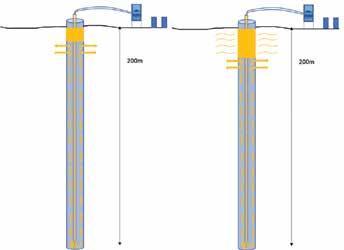

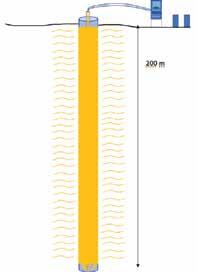

Solving the puzzle:

Overcoming the barriers to ventilation-on-demand in underground mining

Underground mining has long been a balancing act between productivity, safety, and cost. As operations go deeper and get more complex, the need for smarter, more responsive systems has never been greater. One of the most promising innovations is Ventilation-on-Demand (VoD) — a strategy that dynamically adjusts airflow based on real-time conditions, rather than relying on fixed schedules or manual overrides.

The advantages of VoD are widely reported: reduced energy use, improved air quality, enhanced safety for workers, and lower operational costs. Despite its promise, VoD is still not widely used in the global mining sector. The question is no longer whether VoD is effective — it is why it is not the norm.

The solution is in a set of persistent, interconnected issues: communication infrastructure, sensor reliability, and precise tracking of both personnel and equipment. These are not merely technical challenges but systemic barriers that need to be addressed in an integrated manner.

1. The communication network

At the heart of any VoD system is the ability to transmit data reliably and in real time. Underground mines, however, provide

By Maestro

puzzle

Maestro ecosystem. CREDIT: MAESTRO

one of the most challenging environments in which to have digital communication. Drifts turn and loop, rock walls absorb or scatter signals, and electromechanical equipment generate signal interference. Add in perpetual dust, water, vibration, and harsh temperatures, and it is no wonder most mines still have outdated or patchwork communications systems.

Without a robust network, VoD systems are essentially blind. Sensors cannot report their readings, control systems cannot respond, and operators are left to make decisions based on incomplete, outdated, or even delayed information. Even momentary loss of sensor connectivity can lead to over-ventilation, wasted energy, or worse: missed warnings of hazardous conditions.

The ideal network for VoD must be strong, expandable, and low maintenance. It must be able to support high-bandwidth information, enable device plug-and-play integration, and support operation by mine personnel without IT specialist expertise. But most importantly, it must be specifically developed for underground use — rather than a surface-based technology derivative.

2. Reliability of sensors in harsh environments VoD depends on a cluster of field sensors to monitor airflow, gas concentrations, temperature, humidity, and other environmental conditions in the surroundings. Sensors are the eyes and ears of the system, providing data that drives ventilation decisions. But underground, sensors face relentless abuse.

Corrosive gases, mechanical shock, water penetration, and extreme temperature swings can degrade sensor performance or cause outright failure. When sensors provide inaccurate readings — or fail to provide readings at all — the consequences can be serious. Ventilation systems may overcompensate, wasting energy, or underperform, putting workers in danger.

Reliability is not just about ruggedized hardware, it is a question of diagnostics, calibration, and redundancy, as well. Sensors need to be able to detect when they are drifting out of spec, alert operators for maintenance, and continue to operate even if part of the system goes down. Mines need confidence in the reliability of their information, especially when lives and regulatory compliance are involved. Furthermore, sensors should be easy to install and maintain. In many cases, the teams maintaining the systems are not the instrumentation specialists, they are electricians, mechanics, or ventilation technicians. A VoD system that demands constant attention from specialists will not be feasible.

3. Following the movement that matters

The third fundamental component of VoD is having real-time awareness of equipment and individuals. Ventilation demands vary wildly depending on activity and occupancy. An empty stope may require minimal air, but an active heading requires full air.

Without accurate monitoring, VoD is guesswork. Mines may ventilate areas unnecessarily, wasting energy, or fail to ventilate occupied areas sufficiently, threatening safety. Normal procedures — manual logs, radio check-ins, or periodic ventilation — are no longer sufficient.

Current tracking systems utilize RFID, Bluetooth, Wi-Fi, and UWB technologies to track people and equipment mobility. But these need to be closely integrated with environmental monitoring and control systems. Simply knowing a person’s location is not enough — the system needs to be able to link that position to air quality information and react accordingly.

The interconnected nature of the challenge

What makes these three challenges particularly difficult is their interdependence. A reliable sensor may not operate without a network. A tracking system cannot influence ventilation decisions without integration. And a robust network is only valuable if it supports the right devices and data stream.

This interconnectivity does not allow for a VoD solution being piecemealed. Mines must approach it at the systems level, investing in platforms that unify data, provide ease of deployment, and enable real-time decision-making. It is not just automation — it is environmental intelligence.

Environmental intelligence goes beyond raw data. It is about understanding patterns, predicting needs, and responding proactively. It is making the underground mine a living system — one that breathes, adapts, and protects its people.

The path forward

The mining sector stands at a crossroad. The technology for VoD is available. The advantages are obvious. Now, what is required is a change of mindset — from reactive to proactive, data-driven operations.

This change requires leadership, investment, and collaboration. It requires suppliers who understand the underground environment, and technologies designed to the realities of mining — not just the theories of automation. It requires modular, interoperable, and scalable systems, so that mines can start small and grow over time.

Most importantly, it requires trust. Operators must trust their data, their systems, and their partners. It is earned through reliability, transparency, and results.

Putting the pieces together

Each of the barriers to VoD — communication, sensing, and tracking — represents a piece of a larger puzzle. Solving that puzzle requires more than just technology. It requires integration, insight, and a deep understanding of the underground mining environment.

Duetto Analytics is Maestro Digital Mine’s intelligent diagnostics and analytics platform. REDIT:

By James Clare, Will Edwards,

The expansion of the Red Chris copper mine in northwestern British Columbia is one of two mining operations among the first five major projects to undergo fast-track approval under Canada’s new Major Projects Office (MPO).

From promises to production: Canadian fast-tracking initiatives in a

At a time of significant global trade tensions, fast-tracking critical mineral projects to secure Canada’s position in the global supply chain has never been more important. This year has seen a flurry of legislation and announcements by Canadian federal and provincial governments aimed at expediting the development of the critical mineral resources. Four new pieces of major legislation have been enacted or introduced, and five new or expanded programs have been announced across the country.

NEW LEGISLATION: Federal, Ontario, B.C., and Nova Scotia

At the time of writing this article, legislations to fast-track critical mineral projects were introduced, passed, and/or enacted federally and provincially in Ontario, B.C., and Nova Scotia, as follows:

Federal

The “Building Canada Act” aims to identify and expedite projects deemed in the national interest, including critical mineral projects and mines, by streamlining federal review and approval processes to increase regulatory certainty.

Ontario

The “Protect Ontario by Unleashing Our Economy Act, 2025” creates authority to designate special economic zones to help advance projects of provincial importance and security, which projects will benefit from streamlined requirements, accelerated permitting, and priority access to services, and seeks to establish a “One Project, One Process” permitting model that streamlines approval processes across government to one process with the goal of reducing review times by 50%.

period of global trade uncertainty

British Columbia

The “Infrastructure Projects Act” allows for the designation of projects, including those that contribute to provincial priorities such as critical mineral supply, as “provincially significant,”” and aims to prioritize and accelerate provincial permitting for designated projects, establish a specific environmental assessment process for expedited assessment of designated projects, and establish a framework for alternative permit authorizations, through an agreement-seeking approach with local governments.

Nova Scotia

The “Making Business Easier Act,” which has been introduced but not yet enacted, provides for the development of a red-tape reduction action plan, implementation of a one-window approach for the issuance of licenses, permits, and other authorizations to reduce administrative burden and reduce the time within which decisions are made, and comprehensive regulatory review to evaluate laws, policies and administrative processes relating to mineral resource projects, and to identify improvements to promote service efficiency and regulatory effectiveness.

Other

initiatives across Canada

Other fast-track initiatives for critical minerals announced this year include the following:

FEDERAL: Major Projects Office (MPO)

The purpose of the MPO is to identify projects that are in national interest, streamline, and accelerate regulatory approval processes and help to structure and co-ordinate financing of

projects as needed, and to work with provinces and territories to create a “One project, One review” approach for environmental assessments.

ONTARIO: Critical Minerals Processing Fund

Included in Ontario’s 2025 Budget, this $500 million fund aims to provide strategic financial support to projects that accelerate the province’s critical minerals processing capacity and made-in-Ontario critical minerals supply chain.

BRITISH COLUMBIA: Fast-tracking resource projects

The B.C. government announced that it was prioritizing 18 resource projects for faster environmental assessment and permitting, including four mines (three involving copper).

MANITOBA: Critical Mineral Office

The Critical Mineral Office is a single-window office to advance the province’s mining sector by attracting investment and provide mining businesses with customized service to streamline processes and speed up project development.

NOVA SCOTIA: Phased approach to industrial approval process for metal mining

The phased approach to the industrial approval process aims to allow companies to move from planning to action faster, provides for the review of mining applications by a specialized team to ensure timely, consistent decisions, and seeks to reduce red tape and uncertainty for the metal mining industry.

What needs to come next?

Geopolitical tensions have pushed countries to rethink their reliance on China for critical minerals. Canada, with its rich resource base, is well-positioned to fill the gap in global supply chains. By accelerating project timelines, the announced measures, if effective, will reduce supply chain vulnerability and attract greater foreign investment thereby helping to solidify Canada’s standing as a top supplier of critical minerals and enhancing Canada’s strategic position in trade discussions.

While the new legislation and initiatives are encouraging, it is more important than ever to Canada’s economy that federal and provincial governments act on their promises by delivering a tangible path to accelerated development of critical mineral projects in Canada and that legal challenges to these initiatives do not derail the progress that has been made.

James Clare is a partner at Bennett Jones in Toronto. He has a corporate commercial and securities law practice, with an emphasis on corporate finance and M&A, focused on assisting clients in the mining and oil and gas sectors.

Will Edwards is a partner at Bennett Jones in Toronto. He advises on a broad range of corporate and securities law matters, with a focus on domestic and cross-border M&A and capital markets transactions. He acts for clients in a wide range of industries, including mining.

Chloe Cho is an associate at Bennett Jones in Montréal. She has broad corporate commercial practice, with a particular focus on M&A, securities, and corporate governance matters.

Building world-class mines since 1962.

Voisey’s Bay Mine, Canada

Pre-consolidation of a raise bore hole: A case study

The project aims to stabilize the first 150 metres of a 550-metre-long, three-metre-diameter raise bore hole through preventive deep resin injection. The method is designed to reinforce ground conditions before excavation progresses, ensuring structural integrity and minimizing potential deformation or collapse in the upper section of the raise.

Context and geotechnical problem

During the design and planning phase of a new ventilation raise bore hole, exploratory drilling campaigns revealed the presence of structurally weak zones, particularly within the first 150 meters from the surface. These zones included lithological contacts, faults, and sections of inconsistent ground — typically poorly cemented or fragmented conglomerates — which, based on experience, represent a significant risk of instability during reaming.

Rather than addressing these problems during excavation, the client chose to implement a preventive pre-consolidation strategy to reinforce the rock mass in critical areas before initiating any mechanical work. This proactive approach allowed the project to anticipate collapses, ensure operational continuity, and enhance the safety of both personnel and equipment.

INTERVENTION PARAMETERS: Bottom-up injection, sectorization, and full control

The solution proposed by Weber Mining was based on deep consolidation using resin injected from the tip of peripheral boreholes drilled around the axis of the future raise bore. Unlike traditional techniques that inject from the surface — offering no guarantee that the product reaches the full depth — this methodology ensures that consolidation begins at the deepest and most critical point by using self-drilling anchor bars. Each anchor was installed inside the freshly drilled borehole without removing the diamond drill pipe until the injection column was fully in place. This technical measure prevents the

collapse of the borehole, which is a common risk in soft or fractured ground. If the borehole collapses afterward, injection is still possible since the resin flows through the channel secured by the anchor bar.

Additionally, each column was equipped with multiple resin outlet ports over its final 25 meters, providing redundancy: even if some outlets become blocked by loose material, others will allow resin to exit and ensure complete coverage of the surrounding ground.

TECHNICAL RESIN: Precision, elasticity, and water resistance

One of the most critical elements was the selection and formulation of the resin. Weber used a two-component product, custom-formulated based on the specific conditions of the project: lithology, moisture content, pump flow rate, and the volume to be consolidated.

The chosen resin offers the following three essential properties:

1) Structural elasticity with high mechanical strength: Once cured, the resin forms a compact yet slightly flexible solid, ideal for absorbing differential deformations without cracking. This unique combination allows it to behave as an adaptive structure in unstable ground conditions. Despite its elasticity, the resin reaches a compressive strength of 35 MPa (5000 PSI) at 50% deformation, demonstrating exceptional load-bearing capacity without compromising ductility.

2) High migration capacity: In its liquid phase, the resin penetrates deeply into fractures, pores, and contact zones. This ensures effective coverage and allows the consolidation of hidden sections of the rock mass without the need for additional drilling. The resin was designed with a 30-minute setting time, allowing sufficient migration within the targeted zone while preventing unwanted spreading beyond the technical perimeter.

3) Water insensitivity: The resin retains its structural properties even in humid or water-saturated environments. This is possible because the components are thoroughly mixed on the surface using a mixing gun and a 13-element static mixer, ensuring that components A and B enter the ground already fully homogenized. The curing reaction is not dependent on environmental conditions and is not affected by the pH of the water, ensuring reliable consolidation even in wet ground.

ing to the next ones.

This phased approach offers the following advantages:

• It allows the team to verify and adjust the methodology based on the ground’s response in each borehole.

• It reduces the risk of simultaneous borehole collapse or resin migration in surrounding borehole during injection.

• It provides early operational data on resin consumption, migration patterns, and saturation pressure.

During each injection, the pump pressure was monitored in real-time. A gradual pressure increase indicated that nearby fractures were becoming saturated with resin, at which point the injection was stopped. The difference between the injected volume and the theoretical volume of the borehole represented the amount of resin effectively consolidated in the rock mass.

Fracture control, uncertainty management, and risk mitigation

The technique also considers the possibility of induced fracturing (fracking) — the formation of new fractures in the ground owing to injection pressure. While Weber’s pumps can reach pressures up to 35 MPa (5,000 PSI), the team typically operates at significantly lower pressures under normal conditions. However, if fracking occurs, the rapid curing time of the resin acts as a containment mechanism: the product solidifies quickly, preventing it from migrating far beyond the intended consolidation zone.

In addition, every anchor column is tested with air pressure

EXECUTION

PLAN: Sequential, phased, and redundant

A layout of eight peripheral boreholes, each 150 metres deep, was designed around the axis of the planned three-metre-diameter raise bore.To ensure operational continuity and minimize risk, the execution was carried out in phases: one or two boreholes were drilled and injected at a time before proceed-

Team. Work.

Start of injection in borehole. CREDIT: WEBER MINING & TUNNELLING.

Anchor bar column instalation. CREDIT: WEBER MINING & TUNNELLING.

End of resin injection in borehole.

UNDERGROUND MINING/VENTILATION

before use to ensure it is not obstructed. All couplings are welded to eliminate internal leakage, and each event is recorded in detail. This information is used to continuously improve performance and guide decision-making in real time.

STRUCTURAL RESULT: Consolidated ring and reinforced micropiles

10-13_CanMiningJrnl_InsertV1.pdf 1 10/13/25 10:47 AM

Once all injections were completed, a three-dimensional structural ring was formed around the future raise bore. The self-drilling anchor bars acted as reinforced micropiles, interconnected through the migration of the resin. To-

Fugitive material escaping from transfer locations creates costly production challenges.

Martin's ApronSeal™ and self-adjusting skirting provide a dust-tight barrier against the belt, while our steel-reinforced, urethane Skirtboard Liners protect sealing components and chute walls from abrasive, transferring material. These field-proven components control material loss, reduce dust emissions, and improve throughput — enhancing safety and maximizing operational efficiency.

gether, they created a composite structure of high resistance — up to 360 kN per anchor — that not only consolidated the surrounding ground but also provided mechanical reinforcement against the stresses generated during reaming.

Our experience in this project reaffirms that effective consolidation is not

simply about injecting product — it is about deeply understanding ground behaviour, adjusting each system parameter accordingly, and anticipating operational risks through precise engineering.

Anthony Ferrenbach is general manager Americas at Weber Mining and Tunnelling, a division of Jennmar.

Images of the results.

Bridging borders and fostering innovation:

The universal language of mining

When I boarded the plane to Finland, I knew we were heading into something special. Three Cambrian College students, a colleague, and I, were starting a long journey to visit Sandvik’s Load and Haul facility in Turku as part of the final phase of an applied research project we had just completed with them, in which our team designed and fabricated a new technology concept for their battery electric loaders. What I did not expect was how much the trip would reinforce one of my growing convictions about the mining industry. That, despite cultural differences and language barriers, mining has its own universal language, one that bridges borders and fosters innovation.

Verbal divides were quickly bridged by the shared technical language used in mining. In Turku, as we gathered around drawings, CAD models, and the physical prototype that had traveled with us, those barriers melted away. Technical diagrams, engineering shorthand, and the unmistakable vocabulary of mining people carried us forward. More importantly, the prototype we developed in Sudbury was a success. When we demonstrated it in Finland, Sandvik’s engineers were impressed with the design and execution. That sense of shared accomplishment further reinforced the universality of mining innovation. The unspoken gestures, the nod of recognition when a problem is understood, the smile when a solution works, and the quiet admiration of clever design all carried across cultures with ease. This shared ethos of problem-solving and practicality is the common tongue of mining, and it allowed a Finnish engineer and a Canadian student to find common ground almost instantly.

The spirit of collaboration flourished because Sandvik’s research ethos meshed naturally with the Centre for Smart Mining’s applied approach. Our teams gelled quickly, driven by the same curiosity, iterative problem-solving, and insistence on

hands-on validation. This reminded me that mining innovation has always been an international affair. Equipment is designed in one country, manufactured in another, and deployed in mines worldwide, with each region bringing unique expertise. Finland’s history in underground mining and its leadership in battery electric technology complement Sudbury’s decades of hard rock mining experience and current transition toward electrification. When ideas are shared openly across borders, technology adoption accelerates.

The physical setting of our next stop, Tampere, offered its own lessons in mining’s quiet integration into society. Our hosts took us to Sandvik’s test mine, which plays a crucial role in developing and proving new technologies. Unlike Sudbury, where the shape of the city itself announces its mining heritage, Tampere does not outwardly appear to be a mining town. The mine sits just outside the city, with little fanfare or signage to announce its presence. Many locals are only vaguely aware of the world-class innovation unfolding beneath their feet. Adding to its uniqueness is the coexistence of a glass factory directly above. Each time the mine advances with blasting, Sandvik must call the factory to coordinate, ensuring delicate production continues safely above while rock is broken below. This juxtaposition of glassmaking and blasting symbolizes Finland’s practical and careful approach to innovation.

Finland’s innovation culture demonstrated how much attitude matters in technological progress. Research in Tampere is not an afterthought but a central feature of industrial life. Continuous improvement, experimentation, and openness to collaboration are default modes of working. For our students, this was revelatory. They realized that innovation is not just about engineering expertise but about mindset. The willingness to question assumptions, to invite external partners, and to treat students as contributors rather than observers left a profound impression.

L to R: Student researcher Mackenna Kay; student researcher Felicity Barrette; manager, Centre for Smart Mining, Steve Gravel; director of Cambrian R&D, Mike Committo; and student researcher Eric Clement at Sandvik’s underground test mine in Tampere, Finland. CREDIT: STEVE GRAVEL

UNDERGROUND MINING: INNOVATION

The student experience was transformative because they were active participants, not spectators. From the moment we stepped into the test mine, they were immersed in real-world innovation, contributing perspectives, and seeing their work in context. Applied research is designed to bridge theory and practice, but in Tampere the bridge felt tangible. For

a welding student, seeing a fabricated component installed on a battery electric loader validated not only technical skill but also a sense of contribution to global industry. For engineering students, collaborating with Finnish counterparts reinforced that their training was relevant and portable. Their growing confidence showed in every conversation. They

discovered that they belonged in these spaces, and that realization will shape their careers for years to come.

Cross-cultural collaboration matters because it creates the conditions for breakthroughs. No single country or company has a monopoly on good ideas, and mining’s future depends on weaving together diverse perspectives. Canadian students and Finnish engineers, welders and software designers, different regions, and different traditions all bring unique ways of looking at problems. Technology adoption is as much about trust and shared understanding as it is about engineering feasibility. The universal language of mining helps build that trust, and the openness we witnessed in Tampere proved that these bridges can be built quickly and meaningfully.

Looking ahead, these experiences will remain central to the growth of the Centre for Smart Mining. Applied research must continue to be about more than technical solutions; it must prepare the next generation of mining professionals to think globally, act collaboratively, and innovate with courage. Our partnership with Sandvik illustrates this point powerfully. By integrating students directly into the process and encouraging collaboration across borders, we accelerate technology adoption and nurture future leaders at the same time.

Mining is, at its core, a human enterprise built on ingenuity, resilience, and collaboration. In Finland, I saw how these qualities transcend borders, how students are transformed by applied research, and how the universal language of mining unites us in pursuit of safer, smarter, and more sustainable practices. As Sudbury continues to thrive as a hub of mining innovation, and as Turku and Tampere quietly push boundaries from beneath the surface, it becomes clear that the future of mining will not be written in isolation. It will be co-authored across cultures and continents by people willing to share, listen, and build together.

Steve Gravel is the manager of the Centre for Smart Mining at Cambrian College.

Beyond compliance: Elevating safety standards in underground mining

Enhancing critical risk management is vital for driving improvements in safety and operational excellence in the mining sector. According to the International Council on Mining and Metals’ (ICMM) 2024 Safety Performance Report, the mining industry experienced a rise in fatalities in 2024, with 42 reported across ICMM’s 24 member companies. This marks an increase from 36 fatalities in 2023 and 33 in 2022, indicating a troubling upward trend over the past three years.

Forty-three per cent of those fatal incidents occurred underground. Indeed, underground mining presents a unique set of challenges and risks that distinguish it from other subsectors. The tragic mine collapse incident at the El Teniente copper mine in Chile this past summer, which resulted in the loss of six workers, served as stark reminder of that reality.

By proactively reinforcing safety protocols and advancing critical risk management practices, mining organizations can enhance operational resilience and achieve improved outcomes in the future.

Safety and profitability: A dual imperative

Evidence for the relationship between safety and profitability in mining is mounting. According to the 2025 EY Global EHS Maturity Study, organizations that invest in robust environmental, health, and safety (EHS) programs experience significant operational efficiencies and improved business performance. In Canada, 70% of surveyed executives reported their health and safety initiatives positively impacted their bottom line. This correlation emphasizes safety is not merely a regulatory obligation but a strategic business imperative. Companies that prioritize safety can reduce accident rates, enhance organizational reputation, strengthen talent retention, and ultimately drive profitability.

The study further revealed 85% of Canadian respondents attributed operational efficiency improvements to a robust EHS approach. As mining leaders pursue underground projects, integrating safety and fatality prevention into their core operating strategies will remain essential for sustained growth. This dual

UNDERGROUND MINING: SAFETY

focus on safety and profitability can create a virtuous cycle where enhanced safety measures drive better financial performance, opening the door to new avenues of growth investments.

The financial implications of safety can also extend beyond immediate cost savings. Investors are increasingly scrutinizing companies’ safety records and EHS practices, recognizing a strong safety track record can mitigate risks and enhance longterm value. A mining company with a solid safety reputation is more likely to attract investment, new business, and maintain a competitive edge in the market. Integrating safety into business strategy is not just about compliance; it is about positioning the organization for success.

Critical risk management and practical controls

Critical risk management in underground mining is vital for developing effective safety measures to prevent significant injuries and fatalities. The ICMM outlines several key factors that contribute to critical failures, including non-compliance with established protocols, design flaws, and inadequate risk management.

To address these issues, the ICMM advocates for a critical control management (CCM) approach, which emphasizes identifying and prioritizing essential controls necessary for preventing catastrophic events. ICMM guidance also highlights the importance of continuous monitoring and verification of safety controls.

By shifting focus from safety systems to critical controls, mining companies can pivot from purely compliance-oriented to performance-based safety models. For daily operations, this approach means the frontline can expect clearer safety protocols, better access to training, and more reliable critical controls in their daily operations. It also ensures that their concerns and feedback are valued as part of a continuous improvement process, directly involving them in the creation of a safer and more resilient work environment.

Bridging gaps: Leadership, culture, and technology

Equally important in addressing safety performance gaps are mining leaders who work to create safety cultures that prioritize accountability and continuous improvement.

Strong leadership is crucial in establishing a safety-first organizational mindset. Executives must actively engage with employees, encouraging open communication about safety concerns and promoting a proactive approach to risk man-

agement. Significant injury and fatality prevention requires a mindset shift across the workforce from the C-suite to the operators on the ground. This cultural shift is sine qua non to creating an environment where safety is prioritized at all levels.

Technology also has a role to play, enhancing safety measures and facilitating proactive critical risk management. The 2025 Global EHS Maturity Study indicates that while many organizations utilize integrated EHS platforms, there is still a significant opportunity to invest in advanced technologies that can shift safety management from reactive to proactive. For example, real-time data analytics from in-field verifications can help identify potential control failures before they escalate into major incidents. By embedding safety into the organizational culture and prioritizing technological advancements, mining companies can create best-in-class safety standards that protect their workforce and enhance operational safety and efficiency.

Ultimately, the pursuit of “zero harm” in underground mining should not be viewed as a competing goal to productivity but rather as a concurrent objective that drives success. By recognizing the interconnectedness of safety and profitability, mining leaders can foster a culture of safety that prioritizes the well-being of their workforce while achieving operational excellence. The commitment to safety must be nothing short of unwavering, as it not only protects lives but contributes to the long-term sustainability and profitability of the industry writ large.

Rana Labban is a partner at EY Canada, leading the firm’s environment, health, and safety (EHS) practice. With more than 25 years of multisector experience, Rana develops comprehensive leadership transformation in addition to effective environment, health, and safety management systems.

By Andres Abogado and J. Thomas Hatfield

Remedies for mining investors in Mexico under the CPTPP amid judicial reform

On September 1, 2025, Mexico completed the appointment of its first group of popularly elected judges, including all nine Supreme Judges of Mexico. This unprecedented step gave full effect to the judicial reform enacted in September 2024, which replaced the traditional career judiciary based on competence with a system where candidates are preselected by Congress and chosen by citizens through the ballot box.

The consequence of this reform has been the abandonment of the judicial career path that once ensured competence, independence, and a clear separation of powers. Today, many appointees may lack the rigorous preparation and experience previously required of judges. But more troubling still is the structural bias created by an appointment process controlled by the political branches. Judges now owe their position not to a lifetime of professional advancement but to legislative selection and electoral politics, both dominated

by the governing majority.

This raises the danger that judges will be predisposed to favour the government in disputes, particularly when state policy, finances, or political agendas are at stake. In practice, this alignment with the administrative branch risks transforming courts from guardians of legality into facilitators of government action. These developments have undermined the rule of law and can increase investment risk. Moody’s issued a downgrade citing the weakening of institutional checks and balances and its effect on long-term investment stability. The U.S. Chamber of Commerce, the Washington Office on Latin America, Human Rights Watch, and the Inter-American Commission on Human Rights have all heavily criticized the reform, warning that it erodes judicial independence and increases systemic risk.

The consequences for the mining sector are immediate and severe. Canadian companies operating in Mexico rely on courts to uphold licenses and permits

against arbitrary revocation, to provide recourse in environmental and community disputes, and to ensure that regulatory obligations are applied consistently. If judges are inclined to side with government agencies, litigation before Mexican courts and administrative bodies becomes less a matter of law and more a question of political alignment. A mining company challenging the denial of a concession, for example, may find courts unwilling to contradict the administrative branch. Likewise, disputes with local communities may be decided in line with political interests rather than objective legal principles.

To meet this risk, investors in Mexico should familiarise themselves with the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The CPTPP is a free trade agreement between eleven countries, including Canada and Mexico, that (amongst other things) requires Mexico to accord investments “fair and equitable treatment.” This specifically includes not de-

The Media Luna gold deposit is an advanced stage development project located in Mexico’s western state of Guerrero. CREDIT: TOREX GOLD

San Jose mine in the Taviche mining district, Oaxaca, Mexico.

CREDIT: FORTUNA MINING

INTERNATIONAL MINING: REGULATIONS

nying justice in criminal, civil, and administrative adjudicative proceedings.

A denial of justice can come in many forms, including judicial bias, prolonged delays, denying the right to proper notice, or denying the right to be heard. The politicization of Mexico’s judiciary is especially concerning in environmental matters. Mining projects are often subject to extensive federal and state oversight, and conflicts routinely arise over compliance with environmental standards. Under a system where judges are structurally dependent on government nomination and electoral processes, impartial review of administrative decisions cannot be assumed. This exposes companies to unpredictable outcomes, regardless of their level of compliance or the strength of their legal position.

ects. For example, according to a March 21, 2025, news release, Almaden Minerals Ltd. had its mineral rights first suspended and then cancelled by an order of a Mexican court following a series of administrative and judicial actions that started with a local Ejido community suing the Mexican government over Indigenous consultation.

The legal security that underpinned long-term mining investments in Mexico has entered a period of instability.

The CPTPP functions to both provide substantive protection from unfair and

directly against the Mexican state in an international tribunal for actions of the Mexican judiciary that breach the protections set out in the CPTPP. This distinguishes the CPTPP from the CUSMA (the successor free trade agreement to the NAFTA) which contains its own provisions relating to investor protection but without recourse to ISDS for Canadian investors.

If a company is facing judicial interference, it must be aware of a specific provision in the CPTPP investment chapter that only applies to claims against Mexico, Viet Nam, Chile, and Peru. Under Appendix 9-J, an investor can pursue claims for breach of the obligations set out in the CPTPP either in local courts, or in international arbitration, but not both. This provision has not been interpreted, and it is unclear what would constitute an election if an investor took Mexico to court for breaching its own laws relating to, for example, issuing or revoking permits or licenses. In any situation where an action by an organ of the Mexican state can give rise to a claim under domestic law and the CPTPP, investors must weigh the risk that pursing remedies locally will eliminate the ability to pursue an ISDS claim. Investors would be well-advised to retain ISDS counsel early so not to put a foot wrong and waive a right to bring an

Independence and competence in the Mexican judiciary is no longer guaranteed. Judges may lack the training to decide complex regulatory and environmental disputes, and even when they possess the knowledge, they may be unwilling to rule against the government that controls their appointment and re-election. The legal security that underpinned long-term mining investments in Mexico has entered a period of instability. Investors should take note and plan for maximum protection, including through a review of international treaties such as the CPTPP.

Andres Abogado is a managing partner at Abolaw, and J. Thomas Hatfield is a partner at McMillan LLP.

Becker Mining Canada offers 60 years of innovation and trust

For more than 60 years, Becker Mining Systems has been the trusted partner for underground mining operations worldwide. Known for its integrated energy, automation, communications and transport systems, the company supports the global mining sector with a strong, enduring presence—especially here in Canada.

The Canadian operation – formerly Varis Mine Technology Ltd. – is headquartered in Sudbury, Ontario, next to Canada’s most famous nickel-copper mines. Varis Mine Technology was founded in 1997 and became part of the Becker Group in the mid-2000s; since then the Canadian team has operated as Becker Mining Systems Canada, supporting sites across Canada and internationally.

Albert Bower, CEO of Becker Mining Systems Canada, said from his Sudbury office, “We are unique because each of our products is designed from the ground up for underground mining operations.”

That focus on purpose-built engineering drives Becker’s product development: designing systems for the real conditions mines face - dust, humidity, vibration and confined spaces - rather than adapting surface technologies for below-ground use.

He points out that most people never see what happens below ground. While the surface infrastructure is visible, the real action happens in a vast, complex three-dimensional world that is largely hidden from sight. Reliable communications are essential to safety and productivity, operating vertically and horizontally - often in environments filled with noise and obstacles.

Bower also spoke with pride about Becker’s commitment to a fieldfirst engineering approach. Becker combines system-level engineering with hazardous-area certifications and local project delivery. “The Canadian team provides engineering, project management, onsite commissioning, training and ongoing service - backed by the Becker Group’s global manufacturing and R&D capabilities. This blend of local responsiveness and global scale helps mines reduce integration risk,

NORCAT’s demonstration mine relies on Becker to supply its underground VHF and LTE communications network.

accelerate commissioning, and maintain operations more reliably,” he noted. The company also actively engages in field testing and collaboration with Canadian innovation partners such as NORCAT.

Becker holds at the core of its operating philosophy several views:

• All systems must offer the highest degree of reliability.

• Parts must be readily available if customers need them.

• The company tracks where each system is working.

• As new products are available, they can be replaced in existing systems without the need to exchange the entire system. The company’s mission and vision are clear and deeply aligned. Becker has spent 60 years setting industry standards for efficiency, safety, and sustainability. Its mission is to help mining companies operate more productively and responsibly, while its vision is to shape the future of mining through leading-edge technologies. Becker believes that sustainability and mining can, and should, go hand in hand. Their solutions are designed to make mining not only more profitable, but also more environmentally responsible. Innovations like underground electromobility, IoT integration, and predictive maintenance are at the core of this approach.

Becker provides a full range of mining solutions: communications (Leaky Feeder/LTE networks, remote sensing and blasting modules), proximity detection and collision-avoidance automation and fieldbus control, belt rip detection systems, energy distribution (explosion-rated switchgear, transformer-switchgear combinations and rugged electrical components), haulage and conveyance systems, and the Smartflow® digital platform for operational visi-

bility. These product families are engineered to integrate with one another so customers can deploy coordinated, single-vendor systems rather than stitch multiple point solutions together. “We don’t sell individual boxes,” says Bower. “We deliver systems that work together. That one-vendor accountability shortens project timelines and reduces risk.”

It is an extensive line-up – all designed to boost efficiency, productivity, and environmental stewardship across mining projects. Reach out to Becker with any questions, partnership inquiries, or for additional information. Contact the company at www.Becker-Mining.com.

Albert Bower, CEO of Becker Mining Systems Canada.

CREDIT: BECKER MINING SYSTEMS

Backed by German parent company, Becker Mining Systems Canada is a world leader in underground communications, automation, infrastructure, energy distribution, and digitization.

A plan to reshape the boron supply chain boron supply chain

An interview with Paul Weibel

As the global push for clean energy accelerates, demand for boron — a critical input in everything from electric vehicles (EVs) and wind turbines to semiconductors and defense technologies — is growing fast. 5E Advanced Materials (Nasdaq: FEAM) (ASX:5EA), a company based in California, is positioning itself to become a reliable U.S. supplier of this overlooked but vital mineral. The Canadian Mining Journal sat down with Paul Weibel (PW), CEO of 5E Advanced Materials, to discuss the company’s history, the strategic role of boron in the energy transition, and how 5E Advanced Materials plans to disrupt a market long dominated by a few global players.

Paul Weibel, CEO of 5E Advanced Materials

CMJ: YOU STARTED AT 5E ADVANCED MATERIALS AS CFO BEFORE MOVING INTO THE CEO ROLE. HOW DID THAT TRANSITION UNFOLD, AND WHAT DREW YOU TO THE COMPANY?

PW: I joined about four years ago as CFO. I am a U.S. CPA and started my career at Bear Stearns in 2007 — my first day was when its asset management funds blew up, and the subprime mortgage crisis began. After that experience, I moved to PwC, passed my CPA, then spent about seven and a half years on the buy side focusing on mining and mining services. The opportu-

nity at 5E Advanced Materials came when the company, then listed on the ASX as American Pacific Borates, was preparing for a U.S. listing. The project is based in California, and the goal was to access deeper U.S. capital markets and bring the project to production. What really attracted me was the market structure. The boron market today looks like the lithium market 15 years ago — dominated by a few players, with strong demand growth and supply constraints. Two producers control most of global supply, and one of those, Rio Tinto, has even put its boron business under strategic review. That tells you how tight and valuable this market is becoming. I moved my family from Pennsylvania to California because it was an exciting chance to take a project public, develop a U.S. critical minerals operation, and be part of an industry entering a growth phase. I became CEO about 15 months ago after leading the IPO process and building the company’s U.S. financial systems. That experience gave me a deep understanding of the business — from operations to our mass and energy balances — and a real passion for what we are building.

CMJ: CAN YOU GIVE US A BRIEF HISTORY OF THE FORT CADY MINE AND HOW IT EVOLVED INTO TODAY’S OPERATION?

PW: The deposit is a large colemanite deposit — the “Mercedes-Benz” of borate minerals because it is easy to leach. Back in the 1960s, Duvall and Pennzoil were drilling for oil and gas near Bakersfield, California, and instead hit a rich boron layer about 457 metres below ground. That discovery led to significant exploration and pilot plant work in the 1980s. By the 1990s,

The processing plant at Fort Cady, California.

INTERNATIONAL MINING

the project had secured major permits — a record of decision from the Bureau of Land Management and state-level conditional use and reclamation plans. But the economics were not there at the time; the boron market was oversupplied, and the project went dormant. Around 2016, a group of Australian investors rediscovered the site, recognized where the boron market was heading, and acquired it. They listed it on the ASX, began redevelopment, and updated the permitting. We secured our final underground injection control permit from the U.S. EPA in 2020, with full clearance by late 2023. Today, we have a demonstration plant operating, multiple customer segments qualified, and nearly two years of mining and processing data. It has been about de-risking the project — and we are now positioned to scale to commercial production.

CMJ: BORON IS NOW RECOGNIZED AS A CRITICAL MINERAL BY THE E.U., AND U.K. WHAT MAKES IT SO IMPORTANT IN THE CLEAN ENERGY TRANSITION?

PW: In the U.S., boron appears on several government lists. It is on the Department of War’s critical minerals list because of its essential role in defense — in armour, semiconductors, coatings, and munitions. The DOE also gives it a high criticality score — 21 with a score of 22 needed to secure critical designation — just shy of the threshold for inclusion, and we are optimistic it will make the next round. Boron is pervasive across clean technologies. It is critical in permanent magnets for EVs and wind turbines, in lighter high-strength steels for EVs, and in all forms of glass — from LCD screens to solar panels. It is also used in nuclear power systems and in insulation materials like fibreglass and cellulose, where it provides fire resistance. There are no real substitutes. So, while it may not have the visibility of lithium or copper, it is just as indispensable in building a decarbonized economy. We are working closely with federal agencies to ensure it is properly recognized as such.

CMJ: THE GLOBAL BORON MARKET IS AN OLIGOPOLY DOMINATED BY TWO PRODUCERS. HOW CAN 5E ADVANCED MATERIALS DISRUPT THAT STRUCTURE?

PW: Our approach is to compete on cost, reliability, and quality. Our preliminary feasibility study (PFS) shows a cash cost of around US$480 per tonne. Add logistics and you are still under US$600 per tonne, which places us competitively on the global cost curve. Demand and supply are reaching parity, and we expect demand to outpace supply from 2025 onward. By producing domestically and efficiently, we can give U.S. and Asian customers a stable alternative source. That is how we will break into this concentrated market.

CMJ: YOUR FEASIBILITY STUDY REVEALED STRONG ECONOMICS. HOW DO YOU PLAN TO TRANSLATE THAT INTO SHAREHOLDER VALUE?

PW: The focus is on de-risking and disciplined execution. Mining projects follow what is called the “Lassonde curve” — excitement during discovery, followed by a long, quiet development phase before production. We are now nearing the end of that development cycle. Phase 1 of our project has a net present value of about US$725 million and a 19% internal rate of return. That is based on conservative assumptions and does not yet factor in optional expansions or downstream derivative products. We have roughly 22 million shares outstanding, so even a simple model puts the stock’s intrinsic value well above current market levels. The key now is to move through front-end engineering design, secure bankable contracts, and align our market cap more closely with our project’s underlying value. In U.S. capital markets, credibility matters. You must do what you say you will do. That has been our approach — deliver milestones, keep promises, and let performance build confidence.

CMJ: WHICH SECTORS AND REGIONS ARE YOU PRIORITIZING AS DEMAND FOR BORON EXPANDS?

PW: We have qualified 14 customers across about six industries, which gives us good diversification. We are supplying boric acid to a domestic group working on boron carbide — critical for defense and armour — and currently 85% of that market depends on China. We have also qualified for textile fibreglass, LCD glass, fertilizers, chemicals, and insulation. The LCD glass segment is particularly demanding, with stringent purity requirements, so qualifying there demonstrates our product quality. Geographically, our focus is the western U.S. and Asia. Türkiye’s producers serve Europe, the Middle East, and Africa efficiently, but our location gives us a competitive edge on the U.S. West Coast and across the Pacific. That mix gives us a balanced portfolio and regional advantage.

CMJ: HOW DOES THE COMPANY PLAN TO MAINTAIN SUSTAINABILITY AND COMMUNITY RESPONSIBILITY AS OPERATIONS SCALE?

PW: Our mining method is solution mining — or in-situ extraction — which has a very low surface footprint. We drill nineinch boreholes and inject solution underground, recovering

boron-bearing fluids to process above ground. Once an area is mined out, we rinse the wells with fresh water, test them, plug, and abandon them below the surface, and allow the desert vegetation to regrow. There is no open pit, no tailings pile — it is as close to minimal impact as mining can get. Most of our workforce comes from nearby communities like Victorville and Barstow, which face high unemployment. So, beyond environmental stewardship, we are creating well-paying jobs and contributing to the local economy. We see this as a project that brings both environmental responsibility and real regional opportunity.

CMJ: WHAT ARE THE KEY MILESTONES AHEAD AS YOU MOVE FROM DEVELOPMENT TO PROFITABILITY?

PW: The project’s total capital requirement is about US$435 million. We already have a US$285 million letter of interest from the U.S. Export-Import Bank for debt financing, and we recently raised about US$8.3 million in a public offering to strengthen liquidity. We are also applying for a smaller EXIM loan — around US$9 to US$10 million — under its Engineering Multiplier Program. That will fund our front-end engineering and design work, which is roughly an US$8 to US$9 million process. That step is critical because it keeps momentum going toward a final investment decision without interruptions. We expect that smaller loans could be underwritten by the end of this year, which would be a major catalyst. At the same time, we are submitting a public comment to get boron included on the U.S. Geological Survey’s critical minerals list — and we are the only pure-play boron stock

TAKING MINING TO A NEW LEVEL

on the market. We are advancing offtake agreements as well. I have calls scheduled with one of the world’s largest specialty glass producers about scaling up supply trials. Within about nine months, we aim to complete the final feasibility study, secure full debt commitments, and reach FID. That is when we can truly say we are ready to disrupt the boron market.

CMJ: THE GLOBAL BUSINESS ENVIRONMENT IS RISKY RIGHT NOW — TARIFFS, GEOPOLITICAL TENSIONS, AND REGULATORY UNCERTAINTY. HOW DO THESE FACTORS AFFECT YOUR PATH FORWARD?

PW: We are fortunate to have all major permits — federal and state — already in place. That is a huge de-risking factor. On the political side, I will stay neutral, but broadly speaking, a U.S. administration that prioritizes regulatory efficiency benefits mining. Streamlined permitting is essential for domestic critical mineral projects like ours. Locally, we are based in San Bernardino County, one of California’s mining friendly counties, and the support here has been outstanding. They see us as job creators and have worked closely with us to move forward responsibly. Of course, compliance is non-negotiable. We take our license to operate very seriously. We underwent our first EPA inspection this summer and performed very well, which reflects how seriously we manage our environmental obligations. So, while global volatility always brings risk, we view our permits, our location, and our community relationships as real strengths — not vulnerabilities.

Rotary kilns: Advancing critical mineral recovery

Canada, like many other nations, faces increasing pressure to establish a reliable supply of critical minerals, from nickel and lithium to graphite and rare earth elements (REEs).

And while potential sources abound, recovering these materials requires advanced processing solutions. With flexible capabilities, rotary kilns emerge as an essential tool in unlocking critical mineral recovery, from sources both new and old.

Growing demand for critical minerals

From defense systems to electric vehicle batteries, advancements in technology, along with a growing global population, continue to drive demand for critical minerals to ever greater heights.

With the push toward a circular economy, and most traditional mineral sources fraught with geopolitical challenges, mineral producers are exploring every potential resource for recovery, pushing the envelope into extracting materials from low-grade ores, industrial wastes, and post-consumer goods.

The complex makeup of these sources, as well as the wide

range of forms in which they exist, often require advanced thermal processing techniques to unlock target components effectively and economically. And this is where rotary kilns excel.

Why rotary kilns

Rotary kilns are just one form of technology employed in the litany of techniques used to recover critical minerals. Their flexible thermal treatment capabilities, along with several other advantages, uniquely position them to accomplish a range of material-specific goals ranging from reduction to calcination.

Using high temperatures and controlled process environments, rotary kilns facilitate chemical reactions and phase changes. Depending on the configuration (direct or indirect), temperature control along the length of the kiln can be achieved for precise reaction management.

Applications in critical mineral recovery

Long proven in the cement industry, the rotary kiln’s high throughput, rugged build, and long-term reliability has led to

Indirect kiln. CREDIT: FEECO

this equipment being employed in a growing list of applications aimed at recovering critical minerals.

1) Lithium recovery from spodumene

While the industry has long relied on the extraction of lithium from brines because of its lower processing costs, extraction from spodumene, a lithium-rich ore found throughout Canada and the world, is making a comeback.

To extract lithium from spodumene, however, the spodumene must first be converted from alpha to beta phase, a process known as decrepitation. This is achieved through calcination in a rotary kiln, in which the ore’s crystal structure is shattered, making it amenable to downstream recovery.

2) Graphite and advanced carbon materials

In addition to lithium production, both natural and synthetic graphite production rely on the high-temperature processing capabilities of rotary kilns, which purify graphite, modify its structure, and prepare it for use in battery anodes. Other advanced carbon materials are also produced through high-temperature treatment, including carbon black, activated carbon, and graphene, among others.