Newly re-elected BC premier creates ministry to tackle mine delays / 8

BY ALISHA HIYATE

U.S.president-elect Donald Trump made two picks for key posts in his administration last week that signal he’s serious about rolling back environmental regulations and speeding up permitting for oil and gas as well as mining projects — a policy that could put pressure on Canada to do the same.

Trump, who has repeatedly promised the U.S. will “drill baby, drill” for fossil fuels, named Lee Zeldin, a former congressman from New York, as his pick on Nov. 11 to head up the Environmental Protection Agency. Zeldin has promised to roll back “left-wing” regulations while also protecting the environment. He’s endorsed Trump’s call to use the EPA to pursue U.S. “energy dominance” and economic growth.

For Interior Secretary, a post that oversees the management and conservation of federal lands in the U.S., Trump announced Doug Burgum, governor of North Dakota

“We’re going to have to finally speed up our permitting in Canada, otherwise we’re going to get left behind.”

PATRICIA MOHR, ECONOMIST

which will focus on increasing domestic energy supplies by better coordinating federal agencies and adding capacity to the electricity grid.

Deregulation and speeding up permitting were key policies for Trump during his first term, and

Trump 2.0

“When Trump 1.0 came in, he put in through executive orders a number of guidelines to start streamlining the permitting process. Most of those were repealed when Biden came in,” Mariage says.

“So Trump is going to be looking to obviously put those back into force, and these nominations are a clear signal that that’s where they’re

Much of the media focus has been on Trump’s support for fossil fuels, a reversal of Biden’s focus on fighting climate change and speeding the energy transition through the Inflation Reduction Act and other legislation. However, Trump also supports domestic production of critical minerals to reduce reliance on China, and has said that U.S. copper and lithium production should be maximized.

Easing of permitting regulations in the U.S. will also have spill-on effects in Canada, where permitting is not quite as slow, but still excruciating, says Patricia Mohr, a former Scotiabank vice-president and

“If they do that south of the border, we’re going to have to finally speed up our permitting in Canada. Otherwise, we’re going to get left behind,” says Mohr, who also sits Horizon Copper (TSXV: HCU) and is also the former editor of Capitalight Research’s critical minerals-focused newsletter.

“It’s going to create pressure on us because, in British Columbia alone, there are at least six latestage mining projects that could

actually be financed and get going. These are industrial mines, not gold mines. These things exist in B.C., but they need to really be pushed by government to get going.”

Mohr admits some commodity prices aren’t cooperating — nickel for example — but says copper demand has held up despite weak growth in China, which accounts for over half of global demand.

The Prospectors & Developers Association of Canada (PDAC), which advocates for improvements to the regulatory framework, agrees reforms are sorely needed to capitalize on the nation’s mineral potential.

“While there is uncertainty around potential policy changes in the U.S., any moves to streamline permitting there could further heighten competitive pressures on Canada,” Jeff Killeen, PDAC’s director, policy and programs, said in an email to The Northern Miner. “We believe changes are urgently needed, including harmonizing federal and provincial approvals to eliminate duplication, setting clear and predictable timelines for permitting, and ensuring regulatory bodies have the resources to manage applications efficiently.”

Tax impact

Mariage says Canada will also have to consider how to attract investment if Trump follows through with pledges to slash taxes.

“The extractive industry is very capital intense and it’s very risky,

Sandvik is the leading partner in mine electrification. Our constantly expanding range of electric equipment produces zero diesel emissions and reduces ventilation and cooling needs in your mine. Our BEV loaders and trucks are designed from the ground up entirely around their battery system and electric driveline. The patented self-swapping battery system enables the industry’s fastest and easiest pit stop.

Go Electric. Go Sandvik.

Aluminum prices are expected to stay elevated this year owing to a tightening market balance, says BMI, a unit of Fitch Solutions Group.

Aluminum demand may rise 3.2% year-on-year in 2024 to 70.4 million tonnes compared with a projected 1.9% growth in supply to 70.6 million tonnes, the analytics firm said in a November report. Beyond this year, BMI expects aluminum prices to remain elevated, as demand is supported by the accelerating shift to a green economy.

Indeed, that less traditional industry in China is propping up demand. The country is by far the largest aluminum consumer, expected to take 63.5% of this year’s global demand, BMI said.

On the supply side, BMI said optimism is increasing due to solid output growth from January to August and an improvement in weather conditions in China’s Yunnan province, a key producing region.

Still, it flagged recent disruptions in the raw material market, which have the potential to constrain aluminum output growth, particularly in China.

Despite stronger demand, the primary global aluminum market is still expected to remain in surplus this year, albeit a surplus that’s four times less than previously projected (96,000 tonnes instead of 384,000 tonnes), BMI said.

The aluminum price is expected to respond, with the firm anticipating a 6% increase in average price levels this year. That represents a notable turnaround from last year, where factors drove prices down by 15.6% compared to 2022 levels.

Growing supply concerns in the raw material market and broader economic developments are driving the price, BMI said. It raised its 2024 aluminum price forecast to US$2,450 per tonne from US$2,400 per tonne.

China plans to curtail exports of graphite, tungsten and magnesium from Dec. 1. It’s part of a wider push to tighten controls on dual-use technologies that are used for civilian and military purposes, BMO Capital Markets said in a mid-November note.

Restrictions on tungsten were not a surprise. BMO research director Colin Hamilton said.

“Magnesium is potentially the bigger issue however given its importance to a number of aluminium alloys, both for the beverage can and automotive industry.”

In related news, America’s economy could see a US$3.4billion hit if China imposes a total ban on gallium and germanium, according to the United States Geological Survey.

China imposed export licensing controls on mineral commodities containing gallium and germanium last year. Gallium prices could increase by more than 150% and germanium prices by 26% if there’s a total ban, the agency predicts.

“Losing access to critical minerals that constitute a small fraction of the value of products like semiconductors and LEDs (light-emitting diodes) can result in billions of dollars in economic losses,” said Nedal Nassar, lead author of the report.

China supplies 60% of the world’s germanium. It’s used in applications such as fibre optic cables, solar cells and infrared technology.

BY MINING.COM STAFF

BHP (NYSE: BHP) is investing billions to expand copper production in Chile by 430,000 to 540,000 tonnes a year, it said in mid-November. The company’s global long-term production is to stabilize around 1.4 million tonnes annually, a

100,000-tonne rise from current levels.

At the Escondida mine, the world’s largest copper operation, BHP plans investments of US$7.3-US$9.8 billion starting in 2028 to counter ore grade declines and offset the 2029 closure of the Los Colorados plant.

The total copper BHP plans to add with the projects is probably higher than what the market expected, BMO metals and mining analyst Alexander Pearce said.

“Capex intensity, however, is lower than some feared, and much of this is in effect sustaining capital to offset grade decline,” he wrote in a note.

Key projects include a new concentrator producing 220,000-260,000 tonnes annually by 2031, an expansion at Laguna Seca adding 50,000-70,000 tonnes by 2030, and leaching facilities contributing 35,000-55,000 tonnes from 2030.

Total Escondida investment is estimated at US$10-US$14 billion.

BHP is also allocating US$2.8-US$3.9 billion to increase output at Pampa Norte mines, aiming to boost production by 125,000-155,000 tonnes annually.

As global copper demand rises—projected to grow 70% by 2050 driven by renewables and EVs—BHP foresees $250 billion in industry investments over the next decade. It sees Chile remaining pivotal, contributing 28% of global copper supply.

BY MINING.COM STAFF

Russian mercenary Wagner Group has generated over US$2.5 billion from illegal gold mining since the country’s invasion of Ukraine, according to a World Gold Council report in November.

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate ahiyate@northernminer.com

MANAGING EDITOR: Colin McClelland cmcclelland@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head Office

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada: C$130.00 one year; 5% G.S.T. to CDN orders.

7% P.S.T. to BC orders

13% H.S.T. to ON, NL orders

14% H.S.T. to PEI orders

15% H.S.T. to NB, NS orders

U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164)

CANADA

BY ALISHA HIYATE

This will be my last editorial for The Northern Miner after 19 years here, and with its sister publications. In December, I’m off to start another adventure outside of mining.

It’s unusual these days to spend nearly 20 years with one entity, so you might ask: what kept me here so long?

Well, there have been some perks. Travel, for one. My work has taken me to a remote exploration camp in the Argentinean Andes; to Canada’s Arctic, and flying by helicopter over craggy fjords on Baffin Island to reach a remote diamond project. I saw a project in Asia, where beer-loving German investors met their match when offered shot after shot of the Chinese spirit baijiu.

I’ve also had the opportunity to meet and cover some of the business world’s most entrepreneurial people. Problem-solvers, risk-takers, people who have an impact in one of the toughest – and most essential – businesses around.

One highlight was interviewing mining legend Pierre Lassonde in his mid-town Toronto home. It had a muti-level library/study, just like in the movies.

I’ve also enjoyed digging into the stories behind new exciting discoveries made by smart young geos like TNM 2021 person of the year Chris Taylor, and 2024 YMP Peter Munk Award winner Scott Berdahl.

The stories that examined and dissected mining’s failures and stickiest challenges — from tailings reforms to the rising clout of Indigenous communities, and guiding coverage of this year’s heap leach failure at the Eagle mine in the Yukon — have been more difficult and complex, but still rewarding.

“I’ve

had the opportunity to meet and cover some of the business world’s most entrepreneurial people.”

A lot has changed in mining over the past 19 years. Here are just a few examples:

Attention to diversity

While women still represent only 15% of the mining workforce globally, there’s much greater recognition now of the importance of diversity in the sector. Rio Tinto released a report two years ago that showed a shocking level of bullying and harassment in the company’s workforce that largely targeted women and minorities. In November it published a follow-up report. Although it identifies some alarming trends since its first report — a rise in bullying as a response to the miner’s “Everyday Respect” initiatives, for example — it’s also something that would never have happened 20 years ago. Rio’s willingness to publicly disclose the troubling findings is commendable and a welcome attempt to address mining’s culture issue.

Canadian diamonds lose their shine

When I first started at the Miner, memories could still easily recall the first exciting 1991 diamond find in Lac de Gras that led to the Ekati mine in the Northwest Territories. One of my first site visits in 2006 was the opening of the Jericho diamond mine in Nunavut, then the third in Canada. That same year, two more mines were being built – Snap Lake in the N.W.T. and Victor in Ontario. Now, the sector’s a sunset industry in Canada, killed by a combination of high costs, a low success rate in finding new, economic mines, and competition from lab-grown diamonds. The Diavik mine is set to close in 2026, leaving just two mines running – Ekati, and Gahcho Kué.

Retail investor migration

While discount brokerages have made DIY investing easy and cheap for retail investors, it’s not exploration plays that they’re buying anymore.

Competition from other speculative assets such as cryptocurrencies have drawn huge amounts of investment since Bitcoin’s birth in 2009. Forbes puts the value of global cryptocurrency at US$3.2 trillion. In comparison, S&P put the value of the global mining sector by market cap at just US$2.2 trillion at the end of 2023.

Critical minerals rise

Western governments have finally come to realize the importance of mining to their economies and national security, and the risk that comes with China’s control of critical minerals supply chains and expertise. They haven’t yet addressed the lengthy permitting timelines that can kill projects and deter investment, but there’s some hope that U.S. president-elect Donald Trump’s deregulation drive could change that.

Before I depart, allow me to say a quick thank you to John Cumming, the former editor-in-chief who hired me and was a great mentor, and to TNM Group president Anthony Vaccaro for promoting me up the ranks.

On a personal note, I’m proud of helping to build a very strong editorial team at the Miner that’s stayed intact for more than two years and produces independent work that’s of value to the industry and to our readers.

I know the publication is in good hands with interim editor-in-chief Colin McClelland, Western editor Henry Lazenby and production/copy editor Blair McBride. TNM

Charting the Trump train’s global economic

BY JAMES COOPER

I’ve been on the road over the last few weeks, attending various mining conferences along Australia’s east coast.

One of the key discussion points has been United States president-elect Donald Trump. How will his hard-hitting policies affect China, a key driver of commodity demand?

The industry has been on edge. Clearly, the market is, too, given the steep sell-off in resource stocks since Trump’s re-election victory two weeks ago.

So, why is this happening?

Well, the market is betting that Trump will deliver on his pre-election promises when he takes office in January. His ‘America First’ agenda has sent the U.S. dollar surging, which is bad news for commodities.

But there are some green shoots under a Trump re-election. As I’ll show you, commodities performed surprisingly well during his first term.

US dollar could be key

Just like today, the dollar rallied on the back of Trump’s victory in 2016. Again, that was based on expectations of what this real estate mogul could deliver for the U.S. economy.

Surprisingly, though, the dollar began a long-term slide once Trump took office in 2017. And stayed low throughout the bulk of his term in office.

Over his four-year term, from 2017 to 2021, the dollar dropped 9.85% against the euro, and against the Japanese yen it fell by 10.79%.

Could dollar weakness happen again under Trump’s second term?

Who knows, but it’s a clear example that Trump’s leadership doesn’t necessarily equate to a strong USD.

Why this matters for resource stocks

As I pointed out earlier, the strength of the dollar has been one of the major forces driving weakness in metal markets over the last two weeks.

Commodities and the dollar are typically negatively correlated. When one appreciates, the other tends to fall.

And perhaps that’s one of the reasons commodities surged during Trump’s first term in office.

At the start of Trump’s presidency in 2017, copper traded for just US$2.50 per pound.

But by the end of his term, copper prices had risen to US$3.50 per pound.

A solid gain of around 40%.

However, iron ore traded for just US$76 per tonne at the start of 2017.

Four years later, it doubled to over US$155 per tonne!

So, you might say, sure, but what about the threat of tariffs on Chinese manufactured goods?

Surely, this looms as a significant threat to the Middle Kingdom’s manufacturing sector and commodity demand?

Well, tariffs are nothing new for China.

According to the US and European Tax Foundation’s Tariff Tracker, the Trump administration imposed nearly US$80 billion in tariffs from 2018 to 2019.

As U.S workers rejoiced in this seemingly ‘America First’ policy, little did they know that they were footing the bill!

Trump’s 2018/2019 tariffs resulted in one of the most significant tax increases in American history.

Meaning the real loser here wasn’t China; it was the American consumer.

Commodities amid tariffs It’s an example of why you shouldn’t abandon commodity investments based solely on Trump’s tariff threats.

China is already well-versed in navigating U.S. and European trade barriers.

As Trump continues chest-beating on tariffs, I suspect it’ll be business as usual in the Middle Kingdom.

Remember, China has a firm foothold in emerging markets, which means it can quickly expand its manufacturing empire in overseas hubs like Southeast Asia.

Capitalizing on cheap labour, China can drive down the prices of its manufactured goods and offset some of the penalties imposed by U.S. sanctions.

Bigger story building America is set to ‘deglobalize’ under Trump.

Meanwhile, China continues to build its international footprint. Strengthening itself as the epicentre for international trade.

Last week, China signed more than US$10 billion worth of agreements with Indonesia, Australia’s closest neighbour. The focus was on expanding trade ties to support infrastructure, green energy, digital technology and agriculture. China is signing deals, building bridges and securing trade routes across Asia, Africa and South America. And emerging economies are entirely on board.

Meanwhile, the U.S. is clamping up, shutting its borders and imposing penalties on nations that want to trade with it!

It’s why Trump’s ‘America First’ agenda has the potential to strengthen China’s position as a global leader while weakening America’s role.

Ultimately, that could erode the strategic advantage the American economy has held for decades as the traditional leader in international trade.

In my mind, that’s what the market is missing as it pours into U.S.-denominated assets following Trump’s election win.

But that’s perhaps the advantage for resource investors.

Picking up steeply discounted mining stocks or finding other avenues to pivot into emerging markets. TNM

James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

The United States sanctioned entities linked to Wagner last year in the United Arab Emirates, Central African Republic (CAR) and Russia, targeting their exploitation of natural resources in CAR and Mali, noted report led by Dominic Raab, former U.K. Deputy Prime Minister. Wagner’s operations fuel conflicts and empower extremist groups including Islamic State and Al-Qaeda in the Sahel region, Raab said.

Globally, illegal gold mining finances armed groups. In Colombia, it funds the Clan del Golfo, the National Liberation Army and FARC dissidents, who derive 20% of their revenue from such activities. Sudan reportedly loses US$2 billion annually to illicit gold mining.

Artisanal and small-scale mining, involving up to 20 million workers across 80 countries, contributes 20% of global gold production but is fraught with risks like mercury use, child labour, and trafficking. In La Rinconada, Peru, over 4,500 girls have been trafficked for sexual exploitation in mining regions, according to the report.

Raab urged international action, including International Criminal Court investigations into Wagner’s gold trade and stricter border controls by Interpol. It recommends sanctions, such as asset freezes and visa bans, on officials linked to illegal mining operations and calls for G7 and G20 nations to recognize illicit gold flows as a global security threat. BY

A Brazilian court has cleared BHP (NYSE: BHP), Vale (NYSE: VALE) and their joint venture Samarco of criminal responsibility for the 2015 Fundão dam collapse, Brazil’s worst environmental disaster.

The incident released 40 million cubic metres of mining waste. It killed 19 people and polluted the Rio Doce river, reaching the Atlantic Ocean.

The court ruled that federal prosecutors failed to prove the companies caused the disaster.

“The documents, reports, and witness testimonies examined did not identify specific individual actions that directly and decisively contributed to the dam’s collapse,” the court said in its ruling.

The prosecutor’s office said it plans to appeal the decision. Samarco’s then-president, Ricardo Vescovi, was among those acquitted. The ruling affirms the company’s compliance with legislation, he said.

The companies still face civil claims. These include a recent 170-billion reais (US$29.93 billion) settlement with Brazilian authorities for reparations. BHP said it is committed to supporting recovery efforts for affected communities and the environment. Vale declined to comment.

Charges originally included qualified homicide, flooding and environmental crimes. By 2019, authorities dropped the homicide charges. The statute of limitations caused some environmental charges to expire.

Separately, BHP faces a US$47-billion lawsuit in London involving over 600,000 claimants, municipalities and businesses. In July, BHP and Vale agreed to share the cost of any damages awarded.

BY MINING.COM STAFF

Chile-focused Antofagasta aims to become the first mining company to use a hydrogen-powered locomotive in South America. It’s part of the copper producer’s efforts to develop alternatives to fossil fuels, reduce greenhouse gas emissions and make mining more sustainable.

FCAB, the miner’s rail transport division, unveiled in November a hydrogen-powered train that is to connect Antofagasta city and the regional port starting next year.

“This milestone will allow us to learn about this new fuel, which only emits water vapour and hot air, unlike diesel,” Antofagasta CEO Iván Arriagada said in a release. “We want to explore other possible uses of this fuel in the future, when the technology is more mature.”

The 1,000-kilowatt train, developed by China’s largest locomotive manufacturer, CRRC Qishuyan, features a high-capacity battery and an on-board hydrogen storage system operating at 35 megapascals, a high pressure. Its lightweight design reduces the overall weight by about 30 tonnes compared to other hydrogen models.

“Our commitment to the community of Antofagasta and to our clients means we explore all available technologies to progressively reduce our greenhouse gas emissions and, in this way, contribute to combatting climate change,” FCAB general manager David Fernández said in the same release.

The locomotive, seen as key to advancing the group’s decarbonization plan, is to transport sulphuric acid, copper concentrate, anodes, cathodes and other minerals.

BY MINING.COM STAFF

CONTEST | Prizes include physical precious metals in coin or bar form

BY NORTHERN MINER STAFF

The Northern Miner is pleased to announce the winners of our first ever gold and silver giveaway! There were three prizes up for grabs. The first is a 1-oz. Canadian Maple gold coin; the second is a 10-oz. Germania silver bar; and the third prize is a 1-oz. Canadian silver coin.

Thanks to all of our valued readers who entered for a chance to win between the time we opened the giveaway in late May and the time we closed it on Oct. 15. Congratulations to our winners!

1st Place:

Jon Ward

Jon Ward of Vancouver, B.C. has won a 1-oz. Canadian Maple gold coin. John is an investor relations and capital markets professional, leading investor engagement and marketing initiatives for Inventa Capital companies. Currently also serving as the vice-president of corporate development at Targa Exploration, Jon brings expertise in corporate strategy, financial market communications, stakeholder relations, and business development. Originally from Brisbane, Australia, and now based in Vancouver, Jon combines global perspective with industry knowledge to drive growth and connect companies with strategic investment opportunities.

2nd Place:

Kate Stephens

Kate Stephens of Vancouver has won a 10-oz. Germania silver bar. Kate is a seasoned marketing communications professional with over 20 years of experience across the mining, architecture and aerospace industries. For the past decade, she has been with Ausenco, where she is senior marketing manager for North America, leading strategic marketing initiatives that elevate brand awareness. She loves how the team at Ausenco is always pushing boundaries, keeping each day dynamic and rewarding.

3rd Place:

Kevin Blackshaw

Kevin Blackshaw of Bradford, Ont., is the recipient of a 1-oz. Canadian silver coin. Kevin is the director of business development at Quantec Geoscience. He’s been at Quantec for 30 years and has more than four decades of experience in mineral exploration. Kevin is a graduate of the geology technology program at Cambrian College in Sudbury, Ont.

By Blair McBride

Global gold production by volume came to about 3,421 tonnes in 2023. Using data from the World Gold Council, The Northern Miner ranks the top three countries on each of the seven continents by output in 2023. China, already the leader for producing many critical minerals, accounted for about 10% of world yellow metal production last year, though Africa produced the most by continent.

BY BLAIR MCBRIDE

The Prospectors and Developers Association of Canada (PDAC) has unveiled the names of five award winners at its upcoming convention in Toronto on March 2-5.

The Bill Dennis Award goes to the exploration team who discovered the East Gouldie gold deposit at Agnico Eagle Mines’ (TSX: AEM; NYSE: AEM) Canadian Malartic mine in Quebec’s Abitibi region, just west of Val-d’Or. The Canadian Malartic General Partnership, a 50-50 venture between Agnico Eagle and Yamana Gold, made the discovery in 2018, before Agnico and Pan American Silver (TSX: PAAS; NASDAQ: PAAS) acquired Yamana last year.

The Skookum Jim Award, recognizing Indigenous achievement in the industry, will go to David Kritterdlik for his efforts to integrate traditional Inuit knowledge with Western science while working with Agnico Eagle in Nunavut. Among his key achievements is the creation of the Kivalliq Elders Advisory Committee, which gives guidance to the Meliadine and Meadowbank mines on environmental and community issues.

Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) and the UN Women’s Originarias Program are the recipients of the Sustainability Award, which honours leadership in environmental protection and strong community relations. Originarias, a partnership program between Teck and UN Women, has since 2016 worked to empower Indigenous women in Chile’s

northern Tarapacá region by training them in leadership and advocacy skills.

The Onto Discovery Team has been named the winner of the Thayer Lindsley Award, recognizing international mineral discoveries, for its Onto copper-gold deposit find in Sumbawa, Indonesia. In 2020, members of a joint venture between Vale (NYSE:

VALE) subsidiary Eastern Star Resources (80%) and Indonesian miner ANTAM (20%) made the discovery at Onto. It’s a tier-one deposit containing about 2.1 billion tonnes grading 0.86% copper and 0.48 gram gold per tonne. John Robins is the winner of the Viola R. MacMillan Award for his work in mineral discoveries and starting such successful compa-

nies as Kaminak Gold, Northern Empire, and Stornoway Diamond over a 35-year career. Robins is the founder and leader of the Discovery Group alliance of companies, which has generated more than $1 billion in equity raisings. He has helped lead mergers and acquisitions worth more than $3 billion, including the sales of Great Bear Resources to Kinross Gold (TSX: K; NYSE: KGC) for $1.8 billion, and Kaminak Gold to Goldcorp for over $500 million.

“The 2025 award recipients embody the expertise, passion and drive that define excellence in mineral exploration and development,” Raymond Goldie, PDAC president, said in a release. “Their remarkable accomplishments demonstrate the crucial role of innovation, resourcefulness, and leadership in uncovering the minerals that power our modern world.”

Since its establishment in 1977, the award series has recognized exemplary individuals and companies who have made outstanding contributions to the global mining industry.

Winners will be celebrated during the PDAC 2025 Convention at the Awards Gala & Nite Cap on March 4, 2025, at the Fairmont Royal York Hotel in Toronto. TNM

BY NORTHERN MINER STAFF

High frequency trading has transformed the capital markets since its introduction over 20 years ago – in many ways for the better, says David Campbell, one of the founders of Torontobased consultancy Insight Capital Partners.

But it’s also introduced challenges for junior miners.

“It’s, in my view, inadvertently hurt this sub-sector of the marketplace because of the relative liquidity issues that are occurring, especially when things don’t look good in the sector overall,” he said.

While these traders add liquidity to the market, they use a mathematical approach to trading to maximize their chances of making a profit that can decouple a stock from its fundamental value, Campbell explains.

“When they come into the marketplace, they’ll make a determination of how they should enter their order strategies,” he says. “Because we’ve seen a downtrend in the TSX Venture over the last 10 to 12 years, they will determine statistically, at the automated level, that they are better off to enter their securities from the sell side.”

That activity can overwhelm the pricing signals for small and mid-cap companies, says Campbell, who has over 25 years of experience in capital markets, including running trading desks for large institutional investors, and expertise in electronic trading with Virtu Financial predecessor ITG.

“And therefore, we have what we call ‘heavy’ quotes, meaning the quote looks much heavier for sale and there’s more offerings.”

But what if small and midcap companies could harness electronic trading to their benefit?

Campbell and his business partner Ian Clark at ICP recently launched a market making service based on an algorithm that they say does just that.

‘Balancing’ the quotes

ICP Securities’ proprietary algorithm, ICP Premium, helps balance out quotes for the company’s clients, Campbell says. Launched in January this year, it’s already proven it can make the quotes more attractive to institutions and the high-frequency traders who follow and magnify that activity.

Balancing the quotes in this way will convince some electronic

traders to enter a stock from the buy side instead – because they’re statistically better off doing so.

“Once we do this for enough time and with the consistency of the market maker on the quote operating at the millisecond speed, that combines to send the signals that this quote is balanced,” Campbell says.

In the six-month period ending in June, ICP Premium helped increase liquidity for its clients by 100%, while the market capitalization of companies valued at $50 million or above rose by an average of 22%.

“We are phenomenally delighted with those results given the time period they occurred in,” Campbell said, adding financing was tough because of uncertainty over interest rate cuts at the time.

Since ICP released those initial results, it says it’s almost doubled its client base, about 60% of which are in mining.

ICP Premium also delivers monthly reports with a senior trader available to share real-time insights into a client stock’s trading.

That provides a clearer understanding of what the market is valuing them at, and therefore their true cost of capital.

Incidentally, Campbell says the algorithm hasn’t uncovered any evidence of the naked short-selling some juniors say plagues their stocks.

“We’re not saying it does not exist, but we haven’t seen it in the client bases that we have followed – i.e. we are able to trace securities back to where they come from and where they go.”

Tracking anonymous trading

The “sweet spot” for ICP Premium and where it’s had great success in helping stock prices rise is in companies with a market cap of between $50 and $300 million, which high frequency traders are already active in.

But ICP has also seen positive results in early stage, high-risk companies with market caps under $50 million as the algorithm doubled average daily trading volume compared with the previous 12 months.

And companies with market caps of over $1 billion are also interested in ICP Premium, especially interlisted stocks that see some “gamification” of trading patterns, and to track where anonymous trades are coming from.

“We can help them understand those larger trade flows,” he says. “For example, if we uncover

that we see a predominance of buying coming out of Europe and management knows that they were just at a conference or on a roadshow there, they’ll have a good understanding if they’re getting the kind of response that they’re looking for. It’s very difficult for management teams to untangle that otherwise.”

Although other market makers use automated implementationstyle algorithms, they predominantly enter orders manually, Campbell says. In contrast, the low-latency ICP Premium algorithm is co-located in the same data centres that host the exchange engines, making it at least 20,000 times faster than a human.

ICP Premium’s success comes from adapting the traditional market making service to the new technology that’s been introduced over the past 15 years, Campbell said. And with high-frequency traders representing a growing share of overall institutional activity (around 40% in the United States and 32% in Canada), it’s in companies’ best interest to work with them.

“We’ve applied the same processes, but in a new language that speaks to this new community that has not existed in the market before,” Campbell said.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Insight Capital Partners and produced in co-operation with EarthLabs, which owns The Northern Miner Group. Visit: www. insightcapitalpartners.com for more information.

BY HENRY LAZENBY

British Columbia’s exploration sector has over 60 critical mineral projects waiting for permits. It’s a $38-billion pileup of economic opportunities, some waiting indefinitely, Association for Mineral Exploration (AME) president and CEO Keerit Jutla says.

Without action, B.C. risks falling further behind Ontario and Quebec, whose streamlined policies and targeted funding have helped them attract more exploration funding, Jutla said. His group represents about 5,000 members.

“B.C. can choose to be a worldclass jurisdiction or let opportunity slip away,” Jutla told The Northern Miner in Vancouver in mid-November. “Clear permitting timelines, stable policies, and strong partnerships with Indigenous communities are essential. A project’s viability shouldn’t hinge on bureaucratic delays.”

The permitting backlog poses existential challenges for the exploration industry, said Jutla, a lawyer with a decade of experience in the resources sector. Premier David Eby, leader of the recently re-elected New Democratic Party (NDP) government, signalled he’s aware of the problem by creating a new ministry to oversee advanced critical minerals projects.

In mid-November, he split the Ministry of Energy, Mines and Low Carbon Innovation into two:

Mining and Critical Minerals, and Energy and Climate Solutions. Jagrup Brar, the first minister in the new focused role, will focus on 17 near-construction projects and lead reforms to the Mineral Tenure Act (MTA).

Eby said the restructuring positions B.C. to leverage its copper, lithium, and rare earth reserves, materials that are critical for electric vehicles, batteries, and renewable energy.

“The transition to a low-carbon future represents a generational opportunity we must seize, not abandon,” he said during the new cabinet’s swearing-in ceremony on Nov. 18.

The NDP secured a slim majority in the Oct. 19 election, winning 47 out of 93 seats in the Legislative Assembly.

Jutla said the new ministry’s creation is “a significant and important step” by the government.

“I see this government beginning to implement some of the recommendations industry has made,” he said.

Unworkable status quo

The changes can’t come too soon. Explorers face inconsistent timelines and poor communication. Some companies have abandoned projects or lost funding tied to exploration deadlines. The govern-

ment’s ability to reform regulations will determine if it can seize the moment, Jutla said.

“Explorers need certainty,” he said. “If you’re spending millions on drilling and staking, you can’t have a permit delayed indefinitely.”

Jutla warns that B.C.’s reputation as a mining powerhouse is at stake. B.C. competes with established mining hubs like Australia, Chile, Ontario and Quebec. Their infrastructure and investor-friendly policies attract capital, he said.

Ontario’s Mining Act, for example, mandates consultation before exploration begins. This proactive model contrasts sharply with B.C.’s reactive stance, Jutla said.

Both provinces have funding programs in place to attract exploration, such as Ontario’s annual $13-million Junior Exploration Program. It includes $4 million for critical minerals. Quebec also has large funding mechanisms and fast permitting that attract significant investment. Jutla says both provinces outshine B.C. in offering clear and predictable frameworks.

“Investors will go where they see stability and efficiency,” Jutla said. “Right now, that’s not B.C.” Mineral Act review Four and a half months remain until a B.C. Supreme Court deadline requiring the province’s mines ministry to revise the MTA to meet Indigenous consultation requirements. In September last year, the court ruled that the current act allows automatic registration of

mineral claims without consulting Indigenous communities, which is inconsistent with the province’s duty to consult.

It gave the province 18 months to reform the legislation, requiring explorers to consult with First Nations before registering mineral claims.

Jutla said the government’s initial response has been too slow, adding that any delays in the review process hurts the industry’s ability to contribute and adapt to new regulations.

On the other hand, the government surprised stakeholders in March, by moving quickly to restrict mineral claim registrations and mining in the Gitxaała and Ehattesaht First Nations’ territories. The measures aim to safeguard Indigenous interests during the MTA reform process, though they were put in place without industry consultation.

The new NDP government has committed to implementing guaranteed permit review timelines while maintaining environmental and safety standards.

However, B.C. leads in prioritizing reconciliation, which Jutla says is the right thing to do. Federal and provincial equity funds now allow First Nations to take ownership stakes in mineral projects, creating long-term benefits for Indigenous communities and fostering partnerships that can strengthen the industry over time.

PERMITTING | BC First Nation says proposed mine will impact health, cultural ties

BY HENRY LAZENBY

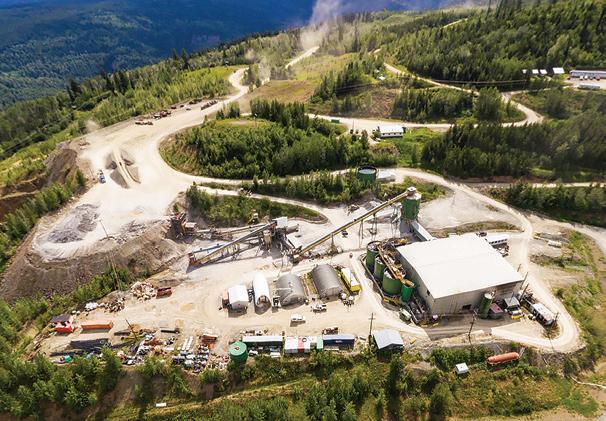

The British Columbia government issued key permits for Osisko Development’s

(TSXV: ODV; NYSE: ODV) Cariboo gold project on Nov. 21, just two weeks after the Xatśūll First Nation said its concerns hadn’t been addressed in the permitting process.

The project, in east-central B.C. threatens community health, cultural sites, and traditional practices due to potential contamination and restricted land access, the nation said in a Nov. 7 statement. Key issues include the potential negative impact on the threatened Southern Mountain subspecies of the Barkerville woodland caribou and concerns over cumulative environmental effects that infringe on Xatśūll’s Aboriginal rights.

“If the permitting processes move ahead without addressing our concerns, any permits that are issued will be highly vulnerable to legal challenges,” Chief Rhonda Phillips said at the time.

The Xatśūll had called on the B.C. government and Osisko to halt the project until its issues are resolved, and its free, prior and informed consent is granted.

The operating permit issued to Barkerville Gold Mines, owned by Osisko, is the first approval under B.C.’s modernized 2018 Environmental Assessment Act.

An Environmental Management Act permit is still pending, with a decision expected soon, to authorize waste management.

A January 2023 feasibility study outlined an initial production start next year. The project received an environmental assessment certificate last October, with final permitting expected by this month. It aims for 164,000 oz. gold annually, peaking at over 220,000 oz. during its 12-year mine life.

The project requires an initial investment of $137 million, with an additional $451 million for expansion, totalling $588 million for the life of the project. It has an after-tax net present value of $502 million at a 5% discount rate and a 21% internal rate of return at a US$1,700 per oz. gold price.

Supports resource projects

The Xatśūll says it wants sustainable development but insists it must be done in accordance with the Declaration on the Rights of Indigenous Peoples Act (DRIPA)

and the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP).

They cite the Mount Polley tailings disaster of Aug. 4, 2014 as an example of how things can go wrong.

“Xatśūll Territory is ‘ground zero’ for the harmful effects of the province’s unilateral regulation of resource extraction activities, which resulted in the ongoing environmental catastrophe of the

Mount Polley tailings failure,” Phillips alleged.

The nation complains it can’t fully exercise its Aboriginal title and rights. Mining disturbances disrupt essential rituals and seasonal gatherings, and erode the Xatśūll’s profound connection to the land and their ancestors, Phillips said.

‘Good faith’

Osisko said in a Nov. 7 press release it would work with Indigenous part-

ners, including the Xatśūll, even as permit decisions were pending.

Osisko Development, through its reviews and permits, addressed 3,500 comments, chair and CEO Sean Roosen said in a news release.

“We have made good faith and reasonable efforts in the past two years to reach agreement with Xatśūll First Nation, including reasonable offers for financial and other benefits along substantially similar frameworks as those offered to, and agreed by, other Indigenous communities,” Roosen said.

The mines ministry said it could not comment, as it is in a caretaker role after the recent elections. The result gave the New Democratic Party 47 of 93 seats, enough to form a majority government.

But, in the background, the ministry said it continued to engage with the Xatśūll about natural resource development in its territory. The province remains committed to timely statutory decision-making, it said in a statement to The Northern Miner Osisko Development shares traded for $2.59 apiece before press time, having touched $1.89 and $4.20 over the past 12 months. It has a market capitalization of $355.1 million. TNM

BY ALISHA HIYATE

Clive Johnson has built a reputation for making successful bets on geologically promising jurisdictions that make others nervous.

As president and CEO of Bema Gold, he led the company on early successful forays into Chile in the late 1980s and Russia in the late 1990s.

And after Bema was acquired by Kinross Gold (TSX: K; NYSE: KGC) in 2007 for its prized Kupol gold-silver mine, at the time under construction in Russia’s Far East, he led Bema’s successor company B2Gold (TSX: BTO) into Nicaragua, the Philippines, Namibia and Mali.

“Part of our strategy is to go where others fear to tread — or to be ahead of the pack,” Johnson told The Northern Miner in an interview. “That’s where you get some very good opportunities.”

Those opportunities can also come with turbulence — for example, skepticism about the company’s entry into Russia, especially at a time when the gold price was under US$300 per ounce.

“A lot of people at the time thought, ‘Clive and the guys, they’ve completely lost the plot. There’s no way they’re gonna succeed in financing and building a mine in the Far East of Russia in a very cold environment, similar to the Yukon.”

More recently, B2Gold shares have been punished this year for the company’s exposure to military-ruled Mali, which is fighting off jihadist insurgents with help from Russia’s Wagner Group.

The country will account for 55% of its 2024 production, and the government has been pressing for greater ownership of gold mines and more taxes after passing a new mining code last year.

Johnson notes that B2Gold reached an agreement in September that keeps the status quo on income

taxes and government ownership (20%) of its large Fekola mine in the country under the previous 2012 code. But he says that the market reaction has been overdone. (B2Gold shares are down 5% yearto-date against gold’s 28% increase this year).

“There’s no evidence at all the government is looking to expropriate or take over the gold mines in the country. They want payments

“Part of our strategy is to go where others fear to tread — or to be ahead of the pack.”

for taxes in the past and they want a bigger piece of the pie going forward,” Johnson said, adding it’s a common trend in the industry internationally. “Mining is a huge part of the economy and they desperately need the revenue.”

Still, the government has detained personnel from Barrick Gold (TSX: ABX; NYSE: GOLD) and Resolute Mining (LSE: RSG; ASX: RSG) — the former for a few days in September — amid talks on taxes and the mining code. Resolute staff, including CEO Terence Holohan, were released on Nov. 20 after being held for 12 days. That came after the company said it would pay US$160 million in taxes Mali said it was owed.

“You never want to see it get to a level like that, and I hope there is a quick resolution,” Johnson said on Nov. 13. “One of the important things to recognize is that every company there, they all have different mining codes and therefore different issues or negotiations with the government about taxation and back taxes.”

Fekola is forecast to produce up to 450,000 oz. gold this year. B2Gold has been reassured enough by its agreement with Mali that it decided to go ahead with its Fekola Regional development, which will see ore trucked to the Fekola mill from satellite deposits about 20 km north, adding 100,000 oz. of gold a year in production. Fekola Regional will be developed under the 2023 mining code with Mali owning 30% of the project (compared to 20% at Fekola).

Judgment calls

These types of judgment calls have sometimes perplexed others, but

they’ve also been at the core of some of Johnson’s biggest successes.

To understand how the Bema and B2Gold teams got their risk appetite, you’d have to go back to the 1970s.

Johnson got his start in exploration as a line cutter and claim staker with B.C. and Yukon focused contractor Bema Industries, started in the 1970s by a group that included his older brother, Ian. It was just a summer job for the 19-year-old to pay his way through university, where he was studying political science.

“I was the youngest of the group, and that’s where I learned

a lot about the industry, and being entrepreneurial,” the 67-year-old executive said.

He decided not to return for his third year of studies because the company was growing so rapidly. Instead, working with Bema Industries Johnson found his niche as a problem-solver, doing expediting and logistical work for companies exploring in the Yukon — and found his calling as an entrepreneur.

The group, consisting of original core founders Mike Beley, Rick Barclay, Gary Nordin and Clive’s brother Ian, had plenty of experience in Western Canada. But they weren’t sure they could finance and build a mine there because of uncertainty around permitting, timing and Indigenous support and participation in projects at that time.

So the team decided to merge three of its exploration ventures into Bema Gold and search for international opportunities instead.

Taking a leap

That’s where Johnson’s continued fascination with politics and history has proven useful.

In 1988, Bema was a first mover into Chile, at the time ruled by dictator Augusto Pinochet.

“There were a lot of raised eyebrows about that,” Johnson admits.

But the team saw the major copper producer’s potential for gold and also believed Pinochet’s rule would come to an end. They pounced on an opportunity to acquire the Refugio deposit.

Pinochet’s regime did end in 1990, and Johnson notes the years

BY HENRY LAZENBY

The amount spent to find new mineral sources may grow little next year, even if gold prices continue their record run and president-elect Donald Trump cuts red tape, according to S&P Global mining analysts.

Further easing of interest rates won’t significantly dent a tight financing market that will likely limit next year’s exploration budget increases. And that could raise concerns for majors who increasingly depend on their smaller counterparts for discoveries, analysts said during a Nov. 13 webcast.

“The reality is that juniors often lead the charge in finding new deposits,” Mark Ferguson, director of metals and mining research, said during S&P Global’s quarterly State of the Market webinar.

“When they’re underfunded, the whole pipeline feels it.”

The cautious outlook comes as global exploration budgets for nonferrous metals declined by 3% in 2024 to US$12.5 billion from US$12.9 billion last year, with juniors bearing the brunt of the cuts. Some high commodity prices haven’t helped juniors raise capital. Even gold exploration is hurting.

The effects of shrinking budgets and financing struggles have shown up in S&P’s measure of new exploration activity. Its pipeline activity index (PAI), which tracks drilling, financing and project milestones, dropped to 63 in the third quarter of 2024 — the lowest level since 2016.

As new activity declined, the exploration price index (EPI) rose to a record high at 203. It reflects metals price trends that companies explore for, such as gold, copper, nickel, and others, and not the actual cost of exploration. The rise was due to steadily rising gold prices and a recovery in some other commodity prices.

The gap between the PAI and

EPI shows that, while prices to sell some metals are good, investment in new projects is low. This signals that companies are prioritizing existing assets over high-risk explo ration, S&P said.

“This trend (of lower exploration spending) aligned with a cautious investment landscape and a con servative approach from investors,” associate research analyst Jasper Madlangbayan said. “Juniors have faced some of the hardest hits as financing has dried up.”

Critical minerals

However, there could be resilience in critical minerals as economies shift to renewable energy and elec trification, the analysts said.

“Critical minerals remain a bright spot,” Francesca Price, senior analyst for critical minerals at S&P Global, told the webinar. “There’s still inves tor interest in supply chains that secure access to these resources out side traditional, more geopolitically challenging regions.”

So far this year, overall drill ing rates fell for nearly all metals. Nickel projects had 53% fewer drill holes than the previous quarter.

“Though we’ve seen significant decreases in drilling and new proj ects, there’s still hope for a recov ery if metal prices hold steady,” Madlangbayan said.

For next year, the analysts expect copper prices to average US$9,825 per tonne on the London Metals Exchange compared with US$9,331.50 per tonne in mid-No vember, driven by stock depletion and seasonal demand. Nickel is forecast to average US$16,995 per tonne versus US$15,897 per tonne around now. They expect a surplus to be maintained by high output from Indonesia and China, which together will account for 78.2% of global production by 2028. Geographic contrasts Australia, home to many junior explorers, saw the largest budget drop as juniors struggled to finance projects. Western Australia, a hub

AFRICA | Unrest arcs across continent

BY COLIN MCCLELLAND

Resolute Mining (ASX: RSG; LSE: RSG) said it would pay Mali’s military government

US$160 million to end a tax dispute over the Syama gold mine and secure the release of CEO Terence Holohan and two senior executives.

for gold and base metals, suffered the most, S&P said.

“Australia’s large junior population is simply not able to sup

It was the second time in two months the ruling junta has targeted mining personnel over payments as it moves to enforce a new mining code. It briefly held several Barrick Gold (TSX: ABX; NYSE: GOLD) employees in October. Analysts said the practice could spread across Africa’s troubled Sahel region.

Holohan and his colleagues were released on Nov. 20 after 12 days in an office complex in Bamako, the capital. Resolute said it had signed a protocol about shifting the mine under the coun-

try’s new mining code from previous rules and that all disputes with the government were settled. It plans to follow its initial US$80 million payment with an equal amount within months.

“Further details on other elements of the protocol and the impact of their implementation will be provided following further legal and financial analysis,” the company said. “Operations on site continue as normal and have not been impacted.”

Mali lies in an arc of instability stretching across the continent. Military governments rule from Guinea on the Atlantic to Sudan on the Red Sea. Resolute forecasts that Syama, in the country’s southwest near the border with Cote d’Ivoire, should produce 205,000 oz. to 215,000 oz. gold this year. That’s out of total company guidance for 345,000 oz. to 365,000 oz. gold.

How

M&A | One-third stake fetches $1.5B

BY CECILIA JAMASMIE

Anglo American (LSE: AAL) has agreed to sell its minority stake in an Australian coal mining joint venture for A$1.6 billion ($1.5 billion), marking a significant step in its strategy to focus on copper, iron ore and the Woodsmith fertilizer project in Britain.

The company’s one-third stake in Jellinbah Group is being sold to Zashvin, Anglo said in early November. The Australian power generation operator already owns a third of the venture, alongside Japan’s Marubeni. The transaction is expected to close in the second quarter of 2025. Jellinbah holds a 70% stake in two metallurgical coal mines in Queensland — Jellinbah East and Lake Vermont.

Six interested buyers are in discussion with Anglo for its remaining Australian coal operations, the company said. They’re expected to fetch between US$4 billion and US$5 billion. Potential buyers could include majors such as Peabody Energy (NYSE: BTU), Yancoal Australia (ASX: YAL) and Glencore (LSE: GLEN), according to market speculation.

Anglo announced a restructuring plan in May as part of its successful deflection of a US$49-billion takeover approach from BHP (ASX: BHP), the world’s biggest miner. The plan focused on divesting from diamonds by spinning off or selling its 85% stake in De Beers, the world’s largest diamond producer by value. It also included restructuring its platinum operations and selling its coal assets. Anglo CEO Duncan Wanblad is facing pressure to prove to shareholders that his strategy will generate value for them.

“Our process to sell the rest of our steelmaking coal business — being the portfolio of steelmaking coal mines that we operate in Australia — is now at an advanced stage,” Wanblad said in a statement. “We are on track to agree terms in the coming months.”

“Our process to sell the rest of our steelmaking coal business is now at an advanced stage.”

DUNCAN WANBLAD, CEO, ANGLO AMERICAN

The Jellinbah sale may reassure investors of Anglo’s commitment to its restructuring plan. The sale of its Grosvenor metallurgical coal mine, the company’s larger coal asset, has faced delays due to a fire affecting the operation.

Grosvenor reached first output in 2016 but was closed in mid-2020 after an explosion that seriously injured five workers. It only returned to production in February 2022.

Anglo’s plan to exit the diamond business has also been challenged as the sector experiences a downturn. Sources close to the process have said that Anglo American would prefer to wait for a recovery in the diamond market before letting go of De Beers. The internal view at the company is that De

Beers should command a price that reflects its status as a trophy asset.

The company also is progressing in offloading its platinum business. In September, it sold about 5% of Anglo American Platinum, reducing its stake to 73.7%.

The company’s exposure to world-class copper assets in Latin America has drawn the attention of larger competitors. But Anglo American’s share price has slid to a third lower than BHP’s final allshare offer in May, which valued the company at £31.11 ($56) per share.

Shares in Anglo American in mid-November traded at £24.89 apiece, valuing the company at £30.7 billion.

Anglo has set the ambitious goal of increasing annual copper production to more than 1 million tonnes by the early 2030s, with the rise coming from its Chilean and Peruvian mines. The company’s copper output slid 13% in this year’s third quarter compared to the same period in 2023. It produced 575,000 tonnes over the first nine months, reflecting a 4% yearover-year decline.

Despite this drop, the company maintained its 2024 copper production guidance, aiming for a fullyear output between 730,000 and 790,000 tonnes. TNM

M&A | Non-diluting deal with Newmont

BY CECILIA JAMASMIE

Orla Mining (TSX: OLA) is buying Newmont’s (TSX: NGT; NYSE: NEM) Musselwhite gold mine in Ontario for US$850 million, enabling it to more than double production of the precious metal as prices hover near record highs.

Orla said Nov. 18 it will pay Newmont US$810 million in cash, with additional instalments contingent on gold prices.

Musselwhite, an underground gold mine in northwestern Ontario, has been operational for over 25 years. It had 1.5 million oz. of proven and probable gold reserves at the end of 2023.

For Orla, which operates the Camino Rojo mine in Mexico, acquiring Musselwhite is a transformative step. The deal will elevate Orla from a single-asset producer to a multi-asset miner, increasing gold output by 140% to 300,000 oz. per year.

“We intend to not only continue to operate Musselwhite, but to seek optimization opportunities and to invest in its future, grow its

GOLD | Sudan project halted

reserves and resources, and extend its mine life,” Orla’s president and CEO Jason Simpson said in a statement. “The mine has a proven history of successful production, cash generation, and reserve replacement, having consistently added to mine life.”

Shares in Orla Mining gained nearly 9% on the news to $6.04 apiece before rising to $6.45 near press time for a market capitalization of $2 billion. They’ve traded in a 52-week range of $3.53 to $7.16.

Free cash flow

This acquisition also boosts Orla’s exposure to record gold prices, which have surged this year as global risk rises and interest rates have started to decline. Musselwhite is expected to generate more than US$150 million in average annual free cash flow over the next six years, the company said.

Orla chose not to issue equity to fund the purchase. Instead, it employed a combination of financing: selling 16% of its pro-

BY CECILIA JAMASMIE

South Africa’s Pan African Resources (LSE: PAF; JSE: PAN) is expanding into Australia with the acquisition of gold junior Tennant Consolidated Mining Group (TCMG) for US$54.2 million.

The move secures ownership of TCMG’s near-production Nobles gold project in Australia’s Northern Territory. Pan African previously held an 8% stake in Tennant.

The asset, scoped to produce 50,000 oz. of the precious metal a year, is scheduled to begin commissioning in June.

The acquisition comes as Pan

African suspends exploration activities in war-torn Sudan and is part of a strategy to secure low-cost production assets in Tier 1 mining

jurisdictions. Payback on the initial A$35.7-million (US$23.3 million) investment is expected within three years, assuming an average gold

price of about US$2,600 per ounce.

“TCMG represents an opportunity to further expand and diversify our near-term low-cost production base,” Pan African CEO Cobus Loots said in a release.

The company had evaluated TCMG’s portfolio for nearly a year before concluding that a friendly takeover aligned with Pan African’s goal of safe, efficient gold mining ventures, Loots said.

Mine construction has already started with the processing plant half done, Pan African said. First gold is scheduled for July.

Force Majeure

Pan African said on Nov. 5 it had declared force majeure on its

exploration efforts in Sudan’s Red Sea state as the civil war disrupted operations.

The conflict continues to create instability and security risks for both personnel and assets, it said.

“Given the ongoing political unrest in Sudan, the decision has been taken to suspend exploration activities in Sudan,” Pan African stated. Issuing a formal notice of force majeure should safeguard its concession rights amid the crisis, it added.

As the country’s official military continues to fight the renegade paramilitary group Rapid Support Forces, Pan African’s pivot to Australia may signal a shift toward lower-risk regions. TNM

BY COLIN MCCLELLAND

Military Metals (CSE: MILI; US-OTC: MILIF) is buying two antimony projects in Slovakia dating from the Soviet era to boost Western supplies for defence applications such as night vision and infrared sensors.

The all-share deal, which also includes a tin project and a small processing plant, values the assets at about $6 million, Vancouverbased Military Metals said on Oct. 30. The antimony projects include Trojarova, where past owners explored in the 1980s and ’90s. A historical report showed it had 1.3 million tonnes grading 4.146% antimony and 0.591 gram gold per tonne in a 2% antimony cut-off scenario, the company said.

Military Metals says Trojarova could be one of Europe’s most significant primary antimony deposits. It plans new drilling to complete a resource at NI 43-101 standards. Geopolitical tensions, export limits and trade sanctions against main producers Russia and China have roughly tripled antimony’s spot price in recent years to around US$29,000 per tonne.

“With a well-established, rich mineral base, this brownfield site enables us to work towards a reliable domestic antimony supply when Europe faces mounting supply chain pressures,” CEO Scott Eldridge said in a release. “This acquisition reflects our commitment to reducing reliance on Chinese imports, ensuring stability for the European market and empowering the West to drive a more resilient, self-sufficient future for critical materials.”

Shares in Military Metals were at 85¢ apiece in mid-November, valuing the company at $27.8 million. The stock has rocketed 1,100% this year from 7¢. It listed in June 2022 at $2.25.

Eastern sources

Almost all global reserves of antimony are concentrated in China, Russia and Tajikistan. China, which mines and processes nearly half of global output, began restricting exports Sept. 15. The United States, Canada, the European Union and Britain classify it as a critical mineral. Besides defence applications, the metal is also used in batteries.

The U.S. doesn’t produce antimony at the moment. But the federal government gave a key environmental approval in September to Perpetua Resources’ (TSX: PPTA; NASDAQ: PPTA)

Stibnite gold project in Idaho, which holds 148 million lb. of antimony, according to a 2020 feasibility report.

In April, the Export-Import Bank of the U.S. said it’s considering lending Perpetua US$1.8 billion. It would be one of Washington’s largest ever investments in a domestic mine.

Military Metals says the EU’s Critical Raw Materials Act has opened financing sources from local European institutions. The company didn’t identify specific financing it might pursue.

Historical drilling Geologists discovered Trojarova in the late 1970s. It was drilled for 63 core holes totalling 14,330 metres plus 1.7 km of underground workings from 1983 to 1995. These included a 300-metre adit connected to a 700-metre drive in the mineralized zone’s footwall with seven crosscuts, the company said.

The Slovak Geological Institute published a multi-volume study on Trojarova in 1992. While the Soviet standards used in the report aren’t the same as Western measures, the project’s historical resource is somewhat similar to inferred tonnes, Military Metals said.

The deal’s second antimony property, Tiennesgrund, features over two dozen small underground workings. Officials reported a long artisanal-scale mining history along its 10-km length, the company said.

Tiennesgrund holds a large fault and shear-hosted antimony-gold vein system. The project in eastern Slovakia has multiple adits, the company said.

Tin project

The nearby Medvedi-Potok tin property also features historical drilling, underground development and a historical tin resource. It hosts a tin vein system in a greisened intrusive.

The processing plant is part of the company’s efficiency and innovation strategy and is a key differentiator in the market, it said.

“We’re taking a transformative step to strengthen Europe’s access to essential raw materials,” the company said.

“With global demand for antimony soaring and critical mineral supply chains becoming increasingly strained geopolitically, Military is seeking to take advantage of a strategic opportunity to acquire an asset that can fill this global demand.” TNM

BY ALISHA HIYATE

South32 (ASX: S32) is shelling out $29.2 million for a 19.9% interest in American Eagle Gold (TSXV: AE), which is in the third year of drilling at its NAK copper-gold discovery in central British Columbia.

South32 is the second major investor to acquire just under a 20% stake in the junior. Teck Resources (TSX: TECK.A/TECK.B; NYSE: TECK) already owns 19.9% of American Eagle, and has the right to maintain that stake. If it does participate, the final amount raised by American Eagle will be higher.

To gain its initial stake in American Eagle, South32 agreed to pay a 15% premium to the junior’s five-day volume-weighted average trading price on the Venture exchange, the junior said in a Nov. 11 release. The financing will see American Eagle issue 33.3 million shares to South32 at 87.5¢ each. No warrants will be issued in the non-brokered private placement.

The investment will bring American Eagle’s treasury to $37 million, enough to fund expanded drill programs in 2025 and 2026. The company said it will share plans for its 2025 drill program after receiving all assays from this year’s campaign.

“We are very pleased to welcome South32 as a strategic investor in American Eagle. This investment marks our second major mining enterprise that has endorsed our project and our work at the NAK copper-gold porphyry project,”

American Eagle CEO Anthony Moreau said in the release. “This investment underscores NAK’s potential, significantly strengthens our balance sheet, and enhances NAK’s profile.”

The financing gives South32 the right to nominate one director to American Eagle’s board. The companies were due to enter an investor rights agreement when the financing was expected to close around Nov. 26.

Shares in the $140.8-million market cap junior traded for $1.05 apiece before press time in Toronto.

The stock has traded in a 52-week range of 24¢-$1.05. American Eagle is finishing up this year’s 15,000-metre drill program at the NAK porphyry project in B.C.’s northern Babine district. In August, the company reported three holes that returned over 100 meres of 1 gram gold equivalent or better from surface that expanded its at-surface, high-grade “Gold zone.”

The deposit has been traced for 1.2 km north to south, 350 metres east-west, and to 850 metres depth. TNM

REGULATION | Chinese miner to pay up to US$295M

BY CECILIA JAMASMIE

Canada has approved Pan American Silver’s (TSX: PAAS; NYSE: PAAS) sale of its La Arena open-pit mine and project in Peru to Jinteng Mining, a subsidiary of China’s Zijin Mining Group.

The approval, granted under the Investment Canada Act, includes a joint commitment by Pan American and Zijin to establish an offtake agreement for the La Arena II project. This deal will allow the Vancouver-based company to secure 60% of the future copper concentrate produced from La Arena II on commercial terms, with the intent to supply the North American markets once commercial production begins.

Upon closing, Zijin will pay US$245 million in cash and grant Pan American a 1.5% life-of-mine gold net smelter return royalty from the La Arena II project. Once commercial production begins, Zijin will make a further contingent cash payment of US$50 million.

The La Arena property is located in Peru’s La Libertad province on

the Atlantic coast about 500 km north of Lima. It comprises the La Arena gold mine and the La Arena II project, which is in advanced exploration. The open-pit mine has been in operation since 2011. Since acquiring the mine from Tahoe Resources in 2019, Pan American said it has added to resources and reserves through exploration activities and extended the mine life from 2021 to 2026,

with the potential for further extension.

Pan American Silver has silver and gold mines across the Americas, with active operations in Canada, Mexico, Peru, Brazil, Bolivia, Chile and Argentina. The company also owns the Escobal mine in Guatemala, which is closed pending the completion of an ongoing consultation for a possible restart of operations. TNM

| Some funding tied to copper offtake

BY

ABY MINING.COM STAFF

Troilus Gold (TSX: TLG) has inked preliminary deals for US$1.3 billion in loan guarantees from Germany, Scandinavia and Canada to help restart a former copper and gold mine in Quebec.

Export credit agencies EKN for Sweden, Finerva for Finland, Euler Hermes Aktiengesellschaft for Germany and Export Development Canada issued letters of intent in November. The amounts were US$200 million, US$300 million, US$500 million and US$300 million, respectively.

“The partnerships with the Finnish, Swedish and German export credit agencies underscore the strength of the project’s fundamentals and the confidence these global institutions have in Troilus,” CEO Justin Reid said in a Nov. 19 release. Canada’s support highlights “our nation’s leadership in advancing domestic projects with global significance,” Reid said the same week.

The company’s focus is to advance its main gold-copper asset, the former Troilus mine in the Val-d’Or district of Quebec. It mined 2 mil-

lion oz. of gold and almost 70,000 tonnes of copper between 1996 and 2010 and could once again become one of Canada’s largest producers.

Capex covered

Initial development costs for the project to restart the former Troilus mine are estimated at just over US$1 billion, according to a feasibility study released in May. It would be a 22-year open-pit operation with a processing capacity of 50,000 tonnes per day.

The mine is expected to produce an average of 303,000 gold-equivalent ounces (GEOs) per year, or 135.4 million lb. of copper-equivalent annually. Peak production would reach 536,400 GEOs or 237.6 million lb. of copper-equivalent per year.

The German loan is contingent upon Troilus signing an offtake agreement with Hamburg copper smelter Aurubis. The offtake term would be up to 15 years and is subject to standard due diligence including economic, technical, environmental and social assessments.

Finnvera’s support is contingent on strategic partnerships with an unnamed Finnish equipment pro-

vider and Sweden’s Boliden, one of Europe’s largest smelting companies. The equipment collaboration is valued at $50 million to $100 million while an anticipated 10-year copper-gold concentrate offtake agreement with Boliden is estimated at $200 million annually.

Sweden’s EKN is providing cover of about US$200 million or up to a quarter of the offtake agreement with Boliden under the agency’s Swedish Raw Material Guarantee.

Infrastructure

The property has well established infrastructure valued at about US$500 million, Troilus said. This includes an extensive network of all-weather access roads, a 50MW substation and over 60 km of power lines maintained by Hydro-Quebec, a permitted tailings facility, and operating water treatment plants.

The project has an after-tax net present value (at a 5% discount) of $884.5 million and an internal rate of return of 14% under the base case scenario, according to the study.

Shares of Troilus Gold traded at 33¢ apiece in Toronto near press time for a market capitalization of $117.9 million. TNM

QUEBEC | Analysts look for bigger gold resource

BY CANADIAN MINING JOURNAL STAFF

Amex Exploration (TSXV: AMX: US-OTC: AMXEF) stock jumped as much as 21% on Nov. 13 after posting what it called an “exceptional” preliminary economic assessment (PEA) for its Perron gold project in Quebec.

The study outlines a 10-year open-pit and underground mine that will produce 1 million oz. gold in total and 124,000 oz. gold annually over its first five years. The initial capital cost is estimated at $229 million, plus sustaining costs of $230 million.

The PEA gives the project a pretax internal rate of return of 59.5% and a net present value of $948 million (5% discount) with gold at US$2,000 per ounce. The all-in sus-

taining cost for Perron, near the town of Normetal, Que., is forecast at US$807 per ounce. The payback period is estimated at 1.5 years, based on pre-tax numbers.

“This PEA marks an important milestone for Amex and reaf-

firms our view that our fully owned Perron project is a high-quality asset and has the potential of being a highly profitable standalone mining operation with mini-

ldebaran Resources (TSXV: ALDE, US-OTC: ADBRF) shares climbed to a new high of $1.98 following news that it’s teaming up with Nuton, Rio Tinto’s (NYSE: RIO) sulphide leaching technology venture, to advance its Altar copper-gold project in Argentina through to the prefeasibility stage.

Under an agreement signed Nov. 7, Nuton can acquire a 20% indirect interest in Altar by making staged payments totaling US$250 million over two years. For this year, Aldebaran will receive an upfront payment of US$10 million, plus US$20 million after it publishes a new resource estimate that was expected by the end of November.

Nuton would pay another US$30 million upon the delivery of a preliminary economic assessment (PEA) for Altar, slated for mid-2025. Adebaran would receive the remaining US$190 million in 2026 after it publishes a prefeasibility study (PFS).

The Rio venture has the right to terminate the option agreement at any payment stage. If it does, Aldebaran will retain its 80% interest in the project as well as any cash payments made to that point.

“This deal has many benefits to Aldebaran shareholders in that it provides for non-dilutive capital injections to fund future work programs on the Altar project through to completion of a (prefeasibility) if Nuton proceeds through each milestone,” John Black, Aldebaran’s CEO, said in a release.

At its high reached on the announcement, Aldebaran’s market capitalization rose above $300 million for the first time since it spun out from Regulus Resources in 2018. At press time it traded even higher at $2.01 apiece, giving it a market value of $341.4 million.