Canada

EXCLUSIVE | Heap leach accident, landslide halt operations at Eagle mine

BY BLAIR MCBRIDE

Aheavy equipment operator

who was caught in the June 24 heap leach pad accident at Victoria Gold’s (TSXV: VGCX) Eagle mine in Yukon says he’s

shaken up and has filed a workers’ compensation board claim for neck injuries and post-traumatic stress disorder.

Injuries were limited in the heap leach pad accident that dislodged 4 million tonnes of ore, with about 2 million tonnes going over the pad’s

DST is engaged in the development and commercialization of environment-friendly technologies for the treatment of materials in the mining industry. Through the development of patented, proprietary processes, the CLEVR and GlassLock processes, DST extracts precious and base metals from mineralized material, concentrates and tailings, while stabilizing contaminants such as arsenic, which could not otherwise be extracted or stabilized with conventional processes because of metallurgical issues or environmental considerations.

“I needed to hold on because when I

sliding

started

down

the

mountain it was very steep. I braced for impact and slid down the side of the mountain about 200 metres.”

OPERATOR

embankment, according to estimates by the Yukon government. Between 280,000 and 300,000 cubic metres of cyanide-containing solution escaped the pad.

The operator is one of several current and former Victoria Gold workers who have told The Northern Miner about alleged unsafe practices at the mine. These include the company trying to subvert Workers’ Safety and Compensation Board (WSCB) claims, pushing off repairs, and failing to enforce drug and alcohol policies, they claim. (See story on page 13.)

The Northern Miner has agreed not to name the employee, however the company would be aware of his identity through his WSCB claim. According to paperwork shown to the publication, the claim was filed on June 25 after the worker saw an onsite doctor on June 24 and 25.

As of press time on July 29, Victoria had issued three news releases since the accident. It has not responded to multiple requests for comment by The Northern Miner Operations were suspended at Eagle, Yukon’s only producing gold mine, after the company reported that a failure at the pad caused

New LeopardTM DI650i down-the-hole sur face drill rig of fers long-term productivit y and superior stabilit y with robust and reliable main components – seamlessly integrated with state-of -the-ar t technical solutions Scalable automation, easy maintenance and outstanding movabilit y are the features that make LeopardTM DI650i a premium product, which is an honor to own

Leave your paw print and enjoy the smooth, ef ficient ride

Dawson City and the Yukon River viewed from the Midnight Dome lookout point, 887 metres up.

CREDIT: BLAIR MCBRIDE

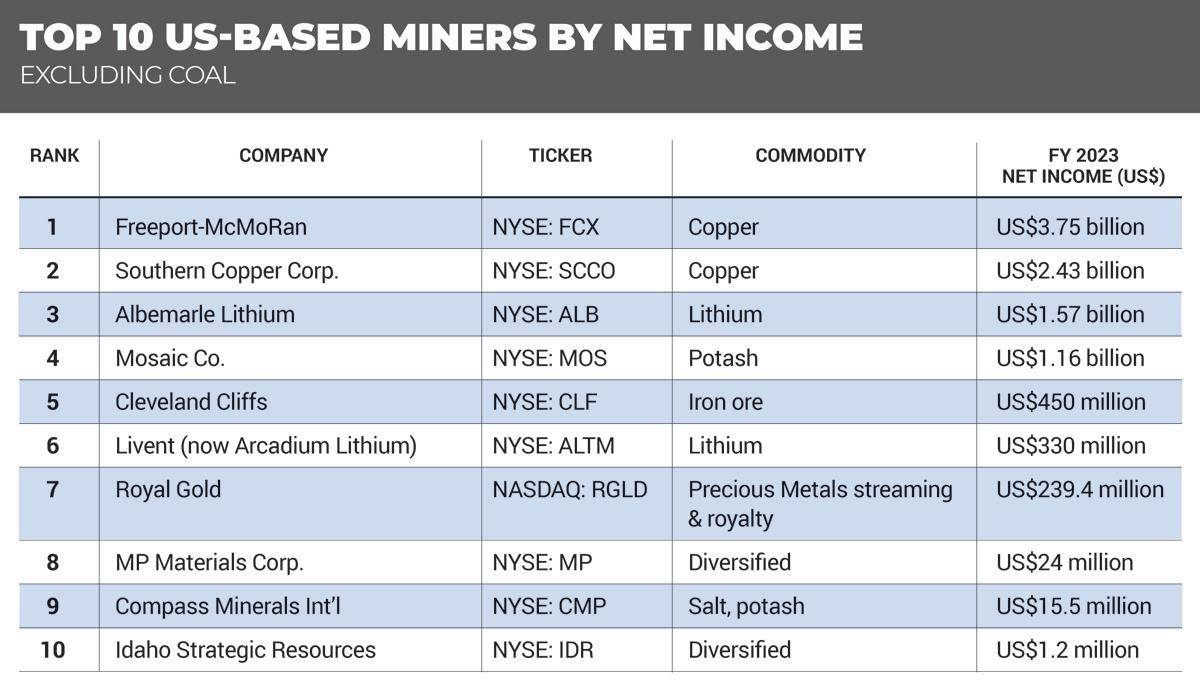

SPECIAL SECTIONS » Canada’s Top 10 35 » US Top 10 39

According to a new report by S&P Global, the United States has the second-longest lead times in the world for developing a new mine.

Mines in the U.S. go from discovery to production in an average of 29 years, longer than in any other country except Zambia at 34 years. Canada is not much better at around 27 years.

“The long U.S. lead times stand in contrast to the country’s sizeable resource base,” the report reads. “The U.S. copper endowment (more than 275 million metric tons in reserves and resources) is comparable to those of Canada and Australia combined and sufficient to satisfy domestic demand for the foreseeable future.”

The report also shows that the United States receives less mining exploration budgets than its advanced economy peers. Investment has been 57% higher in Australia and 81% higher in Canada over the past 15 years. There’s greater certainty that mines can be developed in both countries, S&P said.

The report examines 268 mines worldwide to determine average development times from discovery to production.

Only three mines have come into production in the United States since 2002.

Ghana, the Democratic Republic of Congo, and Laos had some of the shortest development times in the world, at roughly 10 to 15 years, while Australia had an average of 20 years.

The report found that a high rate of litigation against U.S. mining projects has dampened exploration budgets in the country.

BY

The central-Asian country plans to raise the rate to 9% from 6% starting Jan. 1, according to state mining company Kazatomprom.

Then in 2026, a graduated structure based on output would see the tax rate increase to 18% for more than 4,000 tonnes of uranium concentrate U3O8 produced and as little as 4% for less than 500 tonnes, the miner said July 10.

An additional rate of 0.5% is to be charged if market prices are more than US$70 per lb., to as much as 2.5% more at greater than US$110 per lb., Kazatomprom said. The government introduced the measures July 1, the miner said.

The price of uranium was at US$82.45 per lb. near press time, according to Trading Economics. The heavy metal’s price roughly doubled to US$106 per lb. in January from last July.

The country’s tax rates are among the lowest in the world and can be raised by 10-20%, economy minister Alibek Kuantyrov said at the time, according to Brussels-based Nucnet news.

Cameco also has exposure to Kazakstan via its Inkai joint venture with Kazatomprom.

Stock prices in most uranium producers rose after the tax announcement on concerns of supply disruptions in the leading producer after it already reported a shortage of sulphuric acid to process ore.

BY NORTHERN MINER STAFF

A northern Ontario First Nation that has fought pulp and paper mercury poisoning for decades is taking the province to court for more consultation on all mining claims.

The Grassy Narrows First Nation, formally known as the Asubpeeschoseewagong Anishinabek, filed papers on July 12 with the Ontario Superior Court against the provincial Min-

ing Act because it allows claims without Indigenous consent.

That violates Canada’s Constitution and the United Nations Declaration on the Rights of Indigenous Peoples, the community says.

Grassy Narrows wants the court to issue an order preventing Ontario from approving further mining claims in or around its territory, rescind those it’s already granted and establish a timeline for consultation.

There are some 10,000 mining claims in Grassy Narrows’s interim area of interest for mining over more than 2,850 sq. km in the province’s far northwest, according to the court filing.

“We will protect our land and we just want to reiterate that any activity that’s in Grassy Narrows territory, we should be consulted, we should sit down together, and we should be informed,” Grassy Narrows Chief Rudy Turtle said in a news conference at Queen’s Park on July 12.

“These practices have to change. It’s damaging our land. We want our land to remain intact because of our cultural practices, our way of life.”

The case follows a British Columbia Supreme Court ruling last September saying that province must change its rules to ensure First Nations are consulted before prospecting claims are granted to explorers. The court gave B.C. 18 months to change its law.

In a separate move in early July, Grassy Narrows pressed its case about pulp and paper mercury poisoning dating from the 1960s and ’70s to the Inter-American Commission on Human Rights.

In 2018, it declared that mining, staking and exploration was banned on its territory without consent. That followed the community’s 2007 moratorium on any industrial activity without its approval.

BY NORTHERN MINER STAFF

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate ahiyate@northernminer.com

MANAGING EDITOR: Colin McClelland cmcclelland@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head Office

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada: C$130.00 one year;

5% G.S.T. to CDN orders.

7% P.S.T. to BC orders

13% H.S.T. to ON, NL orders

14% H.S.T. to PEI orders

15% H.S.T. to NB, NS orders

U.S.A.: C$172.00 one year Foreign: C$222.00 one year

GST Registration # 809744071RT001 (ISSN 0029-3164)

BY ALISHA HIYATE

What started out as optimism two years ago when the federal government turned its eye to critical minerals, introducing a strategy, incentives, and funding, and pledging faster permitting for mines, has turned into confusion and consternation.

In a classic case of ‘be careful what you wish for,’ the industry fears the government’s new attentions could actually end up hurting the sector.

“We’ve always been asking for (the federal government) to become more involved and recognize the importance of mining,” Dean McPherson, head of global mining with the TMX Group told The Northern Miner in July. “But we didn’t anticipate that they would be taking so many unilateral decisions and policies that lacked consultation and sort of provided more uncertainty to the industry.

“I would say over the past two years we’ve had a lot of reasons to be concerned about the future of Canada’s dominance in the mining space.”

What are these unilateral changes?

Investment overhaul

The industry has complained about surprise changes to the capital gains tax and flow-through funding rules this year. But the most consequential are changes to the Investment Canada Act (ICA) that allow Ottawa to restrict funding from foreign state-owned enterprises or companies connected to them.

Seemingly, no deal involving Chinese critical minerals has been too small to escape the feds’ notice under the ICA. Fed scrutiny and the prospect of a drawn-out approvals process forced SRG Mining and Solaris Resources to cancel their respective $16.9-million and $130-million deals with Chinese companies.

The deals would have given Carbon ONE New Energy Group and Zijin Mining equity stakes of under 20% and representation on the juniors’ boards (two seats in SRG’s case and one in Solaris’). SRG, now known as Falcon Energy Materials, has since redomiciled to the United Arab Emirates where it anticipates fewer barriers to financing.

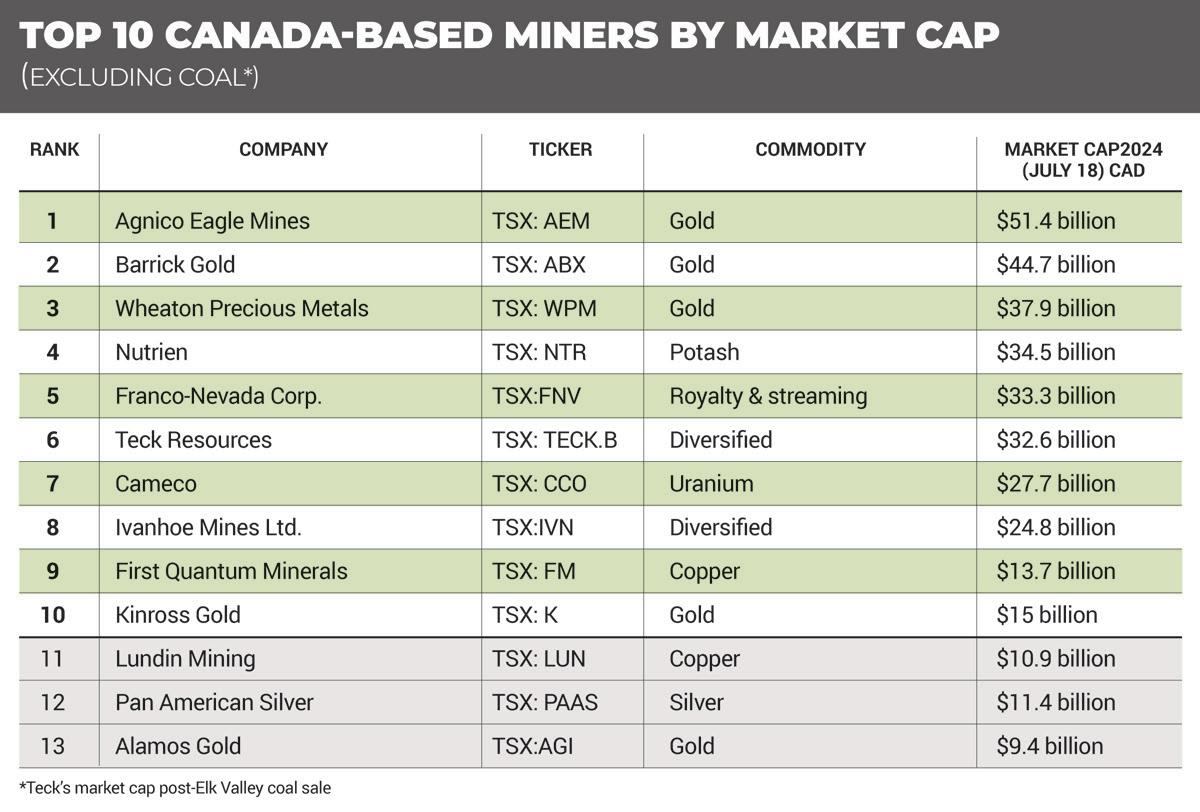

Meanwhile, Chinese funding has in the past given Teck Resources and First Quantum Minerals — both among Canada’s largest miners – a lifeline in tumultuous commodities markets, plugging the funding hole at times when interest from other investors has flagged.

It’s not as though Ottawa hasn’t warned repeatedly that Chinese investment in critical minerals, at a time when the West is trying to build capacity lost to China decades ago, is a no-go.

“We’ve been pretty clear that we are not interested in investment generally from state-owned enterprises,” Jonathan Wilkinson, minister of natural resources said at this year’s PDAC in response to a question from The Northern Miner’s Colin McClelland.

That was just after changes to the ICA, which can be applied regardless of transaction size, came into force in March. At the conference, Wilkinson extended that further, saying the feds would be looking at all deals with Chinese SOEs and related companies, including offtake agreements.

Need for clarity

McPherson and others say that while Canada has to protect its national interests, it’s unclear why the feds are applying national security regulations to projects outside of Canada.

“After Solaris, it became a different discussion because that was an example which nobody could understand,” Krisztian Toth, a partner at law firm Fasken said, noting the project’s location in Ecuador. “It was not a controlling position, it was a very simple investment.”

More recently, Minister of Innovation, Science and Industry FrançoisPhilippe Champagne introduced even more uncertainty when a July 4 statement he issued seemed to cast doubt on the approval of any foreign takeovers of large Canadian miners with critical minerals assets.

Champagne’s statement, intended to clarify Canada’s stance on foreign investment in the sector, instead provoked more questions.

While Wilkinson clarified in a press conference a day later that this would apply to “a very few” Canadian companies — those that are headquartered here, carry out research and development in-country, and have large-scale operations in Canada — McPherson notes that the guidance hasn’t yet been formalized.

“Being someone who has worked in the in the industry for a while, I do know that something that’s not put on paper and recorded officially cannot be taken to the bank,” McPherson said. “So while I take this clarification with goodwill,it would be great to see Minister Champagne come out and provide the clarification that the market is asking for.”

The Northern Miner has emailed Champagne’s office to ask whether it plans to issue additional guidance, but had not received a response by press time.

It’s not too late for Ottawa to address the industry’s concerns. After a tough 2023, financing figures for this year on the TSX and TSXV are looking up, according to TMX Group figures.

But if the sector is really as strategically important to Canada’s economic, climate and national security goals as the government says, it needs to do a better job of communication and coordination with the industry it’s depending on to deliver. TNM

BY JAMES COOPER

Since the July 13 assassination attempt on former president and current presidential candidate Donald Trump in Pennsylvania, there’s been a proliferation of ‘Trump Trade’ ideas circulating across the media.

Up until recently, a Trump re-election in November was seemingly baked in. Investors rushed to align their portfolios for a Republican victory.

But now that U.S. President Joe Biden has withdrawn from the presidential race — an announcement that came on July 21 — Vice-President Kamala Harris, a younger candidate, looks set to inject new vigour into the scuttled Democratic Party.

With that, the ‘Trump Trade’ is cooling.

Early polls already hint that a Harris vs. Trump election will be tight. That’s according to Reuters on July 23.

So, what does that mean?

Investors are now as clueless as ever regarding who might win in November.

It comes back to what Warren Buffett says about mixing politics with your investment strategies… Don’t do it!

And it looks like the Oracle of Omaha was spot on again.

Volatility into November

In Australia, we’re somewhat sheltered from the spectacle unfolding in the States. But as commodity investors, we can’t ignore it altogether.

The world’s largest economy leads the Western rhetoric on war, geopolitics, renewables, nuclear power, and trade tariffs. All of these ‘big issues’ impact the commodity market.

Take lithium. A Democratic win will likely lead to further development of renewables, EVs, and lithium-ion batteries. That could cause a rally in lithium stocks on the ASX.

However, under a Republican administration, fossil fuel companies would flourish, given Trump has been a vocal supporter of domestic oil and gas production.

Echoing former Alaskan Governor Sarah Palin, Trump’s energy policy can be summarized in three words: “Drill, baby drill!”

Trying to guess who might win in this coming election and aligning your portfolio accordingly is a fool’s game.

Each candidate has diverging policies with varying implications for commodity markets, particularly those linked to energy.

Yet, through the fog, some political agendas look far more certain regardless of who wins in November.

Temperature rises on China-US relations

At the Republican National Convention in mid-July, Trump and his newly minted running mate, J.D. Vance, ramped up the “America First” narrative. Not surprisingly, both politicians were keen to parade China as the bad guy.

There’s little doubt that a

Trump-Vance leadership would seek to intensify trade wars against China, something Trump initiated when he took office in 2017.

Nothing rallies a nation like a common enemy, and Trump looks set to juice this strategy again. But amping up hostilities could be very good for one area of the commodity markets – critical minerals.

China holds a firm grip on supply of rare earths, graphite, and cobalt thanks to its mining and processing dominance. So, why would these types of stocks do well under rising tensions?

Critical minerals remain China’s most effective tool against Western trade hostilities. For the most part, it’s kept this ace up its sleeve.

However, as pressure mounts on the Middle Kingdom, the probability of China weaponizing its trade dominance over these key materials grows. These minerals are crucial for modern-day manufacturing, from defence, tech and renewables.

After a 12-month hiatus, stocks tied to this group of commodities could return with a vengeance if Trump raises the temperature on U.S.-China relations.

The key stocks to watch will be companies already in production or with capacity to supply the West with an alternative supply within three to five years.

A few names pop out here, including Lynas (ASX: LYC), Arafura Rare Earths (ASX: ARU) or the advanced graphite developer Renascor (ASX: RNU).

What about the other side of the political divide?

This is where you don’t need to apply much political guesswork.

The hardline stance against China is one of the few bipartisan policies among Republicans and Democrats.

While the world barely knows what to expect from Harris, so far, it looks as though she’ll follow along with Trump’s Chinabashing style.

Here’s an extract from one of her speeches in late 2022 after visiting Japan:

“China is undermining key elements of the international rules-based order. China has challenged the freedom of the seas. China has flexed its military and economic might to coerce and intimidate its neighbours.”

“We will continue to fly, sail, and operate undaunted and unafraid wherever and whenever international law allows.”

And in 2019, she co-sponsored the Hong Kong Human Rights and Democracy Act, which aims to promote human rights in Hong Kong and sanction officials involved in “undermining Hong Kong’s fundamental freedoms and autonomy.”

These statements certainly aren’t winning any friends in Beijing.

As far as I can tell, the U.S.’s ramp-up against China is as close to a sure bet as you can get, regardless of who wins.

TNM

— James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

BY BLAIR MCBRIDE

The Klondike Gold Rush and later exploration and production elevated the Yukon as a legendary source of gold. But the territory always hosted large critical mineral deposits, and it’s now emerging as a hot spot for energy transition metals. As market conditions and government incentives increasingly favour critical mineral development, exploration companies’ resources for copper, nickel and zinc are reaching parity and even overtaking gold and silver.

Using data from the Yukon Geological Survey, The Northern Miner illustrates how resources of four critical metals sought in the territory have grown over the last 20 years relative to the precious metals.

Barrick consistently delivers sectorleading returns to its shareholders while the benefits it generates for all stakeholders drives economic development and social upliftment in its host countries. Its ability to sustain the profitability which enables this is secured by the world-class growth projects embedded in its asset portfolio. Organic growth alone is expected to increase its attributable gold and copper production by some 30% by the end of this decade, a likely peerless achievement.

BY HENRY LAZENBY

Boca Raton, Fla. — Miners and analysts gathered in a sweaty beach city in southeast Florida last month to ponder why the industry gets the cold shoulder from most investors.

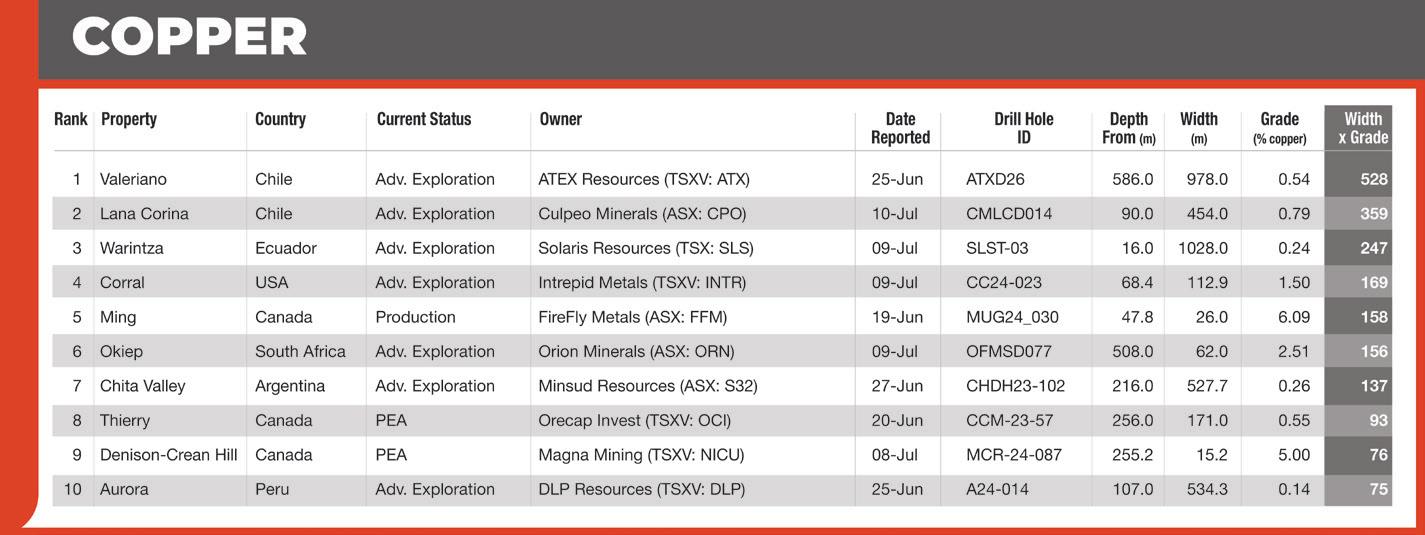

Copper in particular faces a forecasted supply chasm, mining mogul Robert Friedland told the Rule Symposium via a pre-recorded video interview from Telluride, Colo.

“The world is suffering from a shortage of copper metal,” the founder and executive co-chair of Ivanhoe Mines (TSX: IVN) said. But copper prices “fall woefully short” of supporting the development of new projects. The current price is around US$4.60 per pound.

“We see a crisis coming in physical markets and a requirement for much higher prices to enable most of the copper projects that are in development to have a prayer coming in.”

Humanity would have to mine more copper in the next 20 years than we have in human history to meet surging global demand on the back of the energy transition, Friedland told the conference, organized by resource speculator and founder of Rule Investment Media, Rick Rule.

Meanwhile, the cost of new mines has soared. Friedland said recent copper mine builds in Chile and Peru, jurisdictions once credited for having among the biggest and cheapest copper mines, have seen costs soar to about US$45,000 per tonne of daily installed capacity due to inflation, steadily falling grades and dropping output.

While some analysts see nearterm respite for soft copper prices, developers need a sustained price gain to make long-term investment decisions. Last week, BMO Capital Markets and Citigroup analysts

“Gold has rallied 24%, copper 27%, silver 49%, and uranium 60% — indicators of a massive transition regardless of economic ground realities.”

NOMI PRINS FOUNDER OF PRINSIGHTS GLOBAL

said copper prices may rise past the US$10,000-per-tonne (US$4.54 per lb.) mark again in the near term due to a Chinese smelter supply shortage and grid investments in China. Copper posted a record high of US$5.11 per lb. in May.

The International Energy Agency projects that copper demand will increase to 36.4 million tonnes by 2040 from 25.9 million tonnes last year, driven by its growing application in clean technology and electric grid expansion. However, analysts have warned for years that copper prices aren’t high enough to support new builds.

Friedland underlined the critical role of copper in the global economy, given its significance in electrification and renewable energy, and major new demand for modern warfare.

“The global economy needs to find five or six new Kamoa-Kakulasized projects yearly to maintain a 3% gross domestic product growth rate over the next two decades,” Friedland estimated.

Ivanhoe is doing its part to address the copper deficit chal-

lenge with its world-class KamoaKakula copper project in the Democratic Republic of Congo (DRC). The mine is ramping up, producing over 100,000 tonnes of the red metal in the June quarter. The company’s guidance for 2024 is 440,000-480,000 tonnes, with the outlook set to top 600,000 tonnes next year.

Contrarian approach

The current state of the copper market is a consequence of chronic historical underinvestment in production, compounded by increasingly scarce resources, the conference heard.

Symposium host Rule noted that’s a repeated pattern in natural resources that will continue to lead to more boom-and-bust cycles.

Rule pointed to dramatic increases in commodity prices during the 1970s due to underinvestment: oil prices rose from US$2.50 to US$30 per barrel, gold from US$35 to US$850 per oz., and copper from US30¢ to US$1.60 per pound.

Drawing parallels to the present, Rule pointed out that the U.S.

dollar lost 85% of its purchasing power in the 1970s, a situation he believes is re-emerging due to US$6 trillion in quantitative easing in recent years and federal on and off-balance sheet debt of more than US$100 trillion.

“Investing in underappreciated sectors presents an opportunity to invest in high-quality companies at a discount,” Rule said.

“The cure for high prices is high prices. The cure for low prices is low prices,” he said, repeating one of his favourite mantras.

Rule stressed the importance of being a contrarian investor, suggesting that attendees look for value in areas where others see risk or disinterest.

He pointed out that generally, the current sentiment around sub-$2 billion market cap mining companies is notably poor, presenting an opportunity to invest in high-quality companies at a discount.

“You can buy the serially successful companies at a small discount to the serial losers. That’s a really good deal if you think about it. The market has been completely

undiscriminating with regards to the quality of leadership,” he said.

Commodities rally

The concentration in the U.S. stock markets poses a big risk to economic stability as a small number of issuers are driving most gains, James Rickards of Paradigm said in the closing session at the conference. About 70% of the stocks in the S&P 500 are down for the year despite the index hitting new highs, driven by a handful of tech stocks.

Still, commodities have seen big gains this year, macroeconomist Nomi Prins of Prinsights Global said during the panel.

“Gold has rallied 24%, copper 27%, silver 49%, and uranium 60% — indicators of a massive transition regardless of economic ground realities,” she said.

Perhaps preaching to the converted, she noted natural resources have a critical role in future economic stability and growth.

“These assets have a tremendously positive trajectory from here, driven by modern geopolitical and energy-related needs.” TNM YMP

EDUCATION | 45 scholarships up for grabs with deadline to apply set for Aug 31

BY HENRY LAZENBY

When Stephen Stewart first joined the mining world in the early 2000s, he stepped into an industry facing a yawning generational talent gap.

“Back in the day, I looked around and realized everyone was either heading to retirement or had stories older than my entire career!” he said in an interview.

Hoping to meet similar-aged peers, Stewart, who’s now chair of Canadian exploration and development company The Ore Group, realized he might need to start his own organization. His lightbulb moment led him to get involved with the Young Mining Professionals networking group, which originated in Vancouver. Stewart helped establish a Toronto branch in 2015.

In 2017, Stewart and Anthony Moreau, CEO of American Eagle Gold (TSX: AE; US-OTC: AMEGF) started the Young Mining

Professionals (YMP) Scholarship Fund. Now in its sixth year, the scholarship attracts 23 sponsors offering 45 scholarships rang-

“The talent gap is the mining industry’s number one concern. Addressing this issue is critical for the aging industry’s future.”

STEPHEN STEWART, CHAIR OF THE ORE GROUP

ing between $1,000 and $10,000, including a $5,000 award by The Northern Miner, to exceptional mining students.

For the industry

Barrick has been the fund’s staunchest supporter since its inception, Stewart noted. Driven with a ‘by the industry for the industry’ mindset, the broad corporate backing amplifies the fund’s financial capacity

Other top-tier opportunities with major miners are available such as $10,000 awards by Agnico Eagle Mines (TSX: AEM; NYSE: AEM) and Barrick Gold (TSX: ABX), and several $5,000 awards from Equinox Gold (TSX: EQX), O3 Mining (TSXV: OIII; US-OTC: OIIIF), Alamos Gold (TSX: AGI; NYSE: AGI), B2Gold (TSX: BTO, NYSE-A: BTG) and Kinross Gold (TSX: K; NYSE: KGC), among others.

Versatile,

INDIGENOUS ISSUES | Constitutional questions swirl around province’s April move

BY HENRY LAZENBY

British Columbia’s formal rec-

ognition of the Haida Nation’s Aboriginal title over a group of islands near the Alaskan panhandle is a reconciliation milestone. But it’s raising legal and economic questions that experts say could end up in the Supreme Court.

On April 14, the B.C. government officially gave the Haida Aboriginal title over Haida Gwaii, formerly the Queen Charlotte Islands. The title confers hereditary rights that predate the arrival of Europeans and include rights to possession, use, and economic benefits of the land.

The Haida say the pact just puts in writing how the First Nation has always asserted sovereignty over the islands. Constitutional lawyers contend the province has exceeded its authority, and the issue could lead to a constitutional challenge.

“The province has created considerable uncertainty regarding the long-term viability of Crown land tenures on Haida Gwaii and elsewhere in British Columbia,” Thomas Isaac, a Vancouver-based partner specializing in Aboriginal law at Cassels Brock & Blackwell, said in an interview.

Recognizing Aboriginal title over fee simple lands — also known as full private property ownership rights and a fundamental component of B.C.’s real property system — while maintaining private property rights is legally contradictory, Isaac said.

The Haida agreement is particularly concerning for the mining industry. It’s wary that B.C., ranked second in Canada in terms of exploration and development spending, with the largest gold major, Newmont (TSX: NGT; NYSE: NEM), investing in the Red Chris and Brucejack mines in its northwest Golden Triangle, could

“This situation creates significant uncertainty for businesses, especially in the mining sector, which relies on stable Crown land authorizations.”

export the concept and tensions across the country.

Progressive BC

B.C. has been a leader in encouraging First Nation participation in projects, passing the United Nations’ backed Declaration on the Rights of Indigenous Peoples Act into provincial law in November 2019, before other jurisdictions. However, not all of its legislation has been progressive. In September, the BC Supreme Court ruled that the province’s mineral claimstaking regime didn’t meet its duty to consult with Indigenous groups. That ruling triggered an 18-month legal review to include a consultation framework.

The Haida First Nation declined several requests for comment in June, saying Haida President Gaagwiis Jason Alsop was unavailable. The Nation said it stands by comments it made in April at the time of B.C.’s move.

“We have always asserted our sovereignty to Haida Gwaii and the surrounding waters,” Alsop said then. “With this agreement in place, we can work toward imple-

menting our title without conflict, based on yahguudang/yahgudáng (respect), with our ownership being properly recognized.”

The B.C. Ministry of Indigenous Relations and Reconciliation says the recognition, known as the Gaayhllxid • Gíhlagalgang “Rising Tide” Haida Title Lands Agreement, encourages negotiation over litigation.

“Recognition of Aboriginal title has been on a trajectory in the courts for 40 years,” communications director Leanne Ritchie said in an email to The Northern Miner “Governments have been advised to stop litigating and to negotiate — find solutions that work for people.”

BC template

Haida Gwaii has seen historical mining for gold, copper, and coal. Most activity occurred in the late 19th and early 20th centuries around the community of Tlell on Graham Island, where gold mining occurred. Coal mining centred around the Skidegate Inlet area.

Premier David Eby appears to support spreading Aboriginal title across the province and the country.

“The stars are aligned in this moment, and if we can — on both sides — demonstrate that this is successful, then I think it makes it more possible to do it in other places in British Columbia, and also in Canada,” Eby told Canadian Press in April. “It’ll provide a bit of a template for everybody about what the world of the possible is.”

Vancouver-based lawyer Robin Junger, counsel on Indigenous law at McMillan, says the precedent set by recognizing Aboriginal title is unclear. There are still issues following the Supreme Court’s recognition of some Tsilhqot’in Nation territory in 2014, which raised the bar on the Crown’s duty to consult and accommodate Aboriginal interests on traditional lands, he

noted. These include operational uncertainties for businesses struggling with permit delays and confusion over regulatory authority. He predicts the Haida islands will fall into a “legal morass” of complexity like the Tsilhqot’in Nation.

“Nobody knows who’s in charge and who’s doing what, Junger told The Northern Miner. “Ten years later, it’s a mess. Nobody knows. It’s completely unclear, and people are losing their businesses… now they can’t get their permits in a timely way or on the same terms.”

The Haida title agreement states that B.C. will maintain jurisdiction over natural resources until transferred, meaning current exploration and mining projects will continue. Still, future projects will likely require the Haida Nation’s consent. Privately owned land is to remain under provincial jurisdiction, with no changes to local government control or public services. Existing interests on Crown land in Haida Gwaii will continue under current terms for two years, but their future is unclear, Isaac says.

“Where a private property owner seeks an approval or authorization from the Crown over fee simple lands, given the recognition of Aboriginal title to those lands, the province will be required as a matter of law to obtain the consent of the Aboriginal title holders,” Isaac explained. “This situation creates significant uncertainty for businesses, especially in the mining sector, which relies on stable Crown land authorizations.”

Junger criticized the legislation requiring provincial authority under the Land Act to be exercised in a way that is “consistent with Aboriginal title” for introducing significant ambiguity into governance and regulatory processes.

The Haida Nation will gain deci-

sion-making power that alters the legal and economic landscape in ways that may not be immediately clear to the public or even fully understood by those affected, Junger said.

Constitutional authority

The government says the co-existence of fee simple and Aboriginal title is possible because the Haida Nation has consented to fee simple interests and other interests and rights in relation to land. The province asserts it is wholly within its constitutional authority to enter the agreement and to bring forward legislation to implement it.

“The Haida Title Lands Agreement was developed with leading legal minds in constitutional, Aboriginal and treaty law,” Ritchie said. “This agreement and legislation demonstrate how creative approaches can solve longstanding issues.”

There will be no change to private property rights, she said.

“The province and Haida Nation will negotiate how different aspects of land and resource governance shift to Haida Nation, starting with protected areas and forestry.”

The B.C. public are generally in favour of the agreement, with a June Angus Reid poll showing 55% support. However, only 30% said it should be a precedent for future land transfers.

While the B.C. government said the unique conditions of Haida Gwai justify the agreement – there aren’t any overlapping Aboriginal rights claims, half of the population is Haida, and the community has a 50-year record of self-governance –Junger says others will try to copy the agreement.

“However unique the province may claim Haida is, other Indigenous governments will likely demand the same type of agreement.”

BY MINING.COM STAFF

Nickel prices won’t recover this year, but neither will they tank, according to a new report by BMI, a unit of Fitch Solutions.

Analysts with the credit risk consultancy have maintained their price forecast for 2024 at US$18,000 per tonne (US$8.16 per lb.) as excess supply continues to drag prices down from 2022 levels. At press time, the price was around US$15,516 per tonne (US$7.03 per pound).

Despite the current pressures on nickel prices, Fitch expects upside risks — including potential supply disruptions and a weakening of the U.S. dollar later in the year — to place a floor under prices through 2024. After that, the research and data firm sees a steady rise in prices to 2028 backed by EV battery demand.

Price volatility

Nickel prices plummeted last year,

On the supply side, Fitch anticipates that a significant increase in 2024 (as seen in 2023) fed by production growth in Indonesia and China, will be the core driver of price declines.

with the 2023 average annual price dropping by 15.3% to US$21,688 per tonne from US$25,618 per tonne in 2022. The decline was attributed to an oversaturated market coupled with lacklustre demand.

Fitch expects similar dynamics to cap price growth in 2024 as production in key producers mainland

China and Indonesia surges ahead.

Despite a brief rally earlier in the year that pushed prices to a year-todate high of US$21,615 per tonne on May 20, nickel prices closed at US$17,291 per tonne on June 28, weighed down by deteriorating investor sentiment, Fitch noted.

This level represents a year-todate increase of 4.3% but also a 15.5% month-on-month contraction as market optimism eases. The dramatic reversal in market sentiment since early June has the potential to pressure nickel prices further over last year’s third quarter.

On the supply side, Fitch anticipates that a significant increase in 2024 (as seen in 2023), fed by production growth in Indonesia and China, will be the core driver of price declines. Fitch projects a surplus of 253,000 tonnes in the global nickel market in 2024, up from a surplus of 209,000 tonnes estimated for 2023.

This glut is primarily attributed to Indonesia’s increased production of nickel pig iron and intermediate nickel products, a direct

consequence of heightened investment in its nickel sector following the imposition of a nickel ore export ban in 2020, Fitch noted.

In the first quarter of 2024, Indonesia’s refined nickel production rose 24.7% to 383,000 tonnes, up from 307,000 tonnes during the same period in 2023. Fitch expects production to grow by 17% this year. Outside Indonesia, the world’s second-largest producer of refined nickel, mainland China, registered 2.3% year-over-year growth in the first quarter to 220,000 tonnes.

The LME in May approved new Asian nickel brands as a strategic response to address low inventories and reduce the threat of price volatility, Fitch pointed out.

“Along with the unraveling of Xiang Guangda’s short position that led to prices momentarily breaching US$100,000/tonne, low stocks were a factor that contributed to the price spike in March 2022 and which continue to pose upside price risks,” Fitch reported.

To correct low inventory levels and build up liquidity, Fitch noted, the LME resumed Asian trading hours on March 20, 2023, after halting them last year following the price surge in March 2022. This came alongside other measures aimed at stabilizing the market, such as setting daily trading limits and accelerating the process by which new nickel brands can be delivered on LME contracts.

Beyond 2024, Fitch expects nickel prices to rise steadily to 2028 to around US$21,500 per tonne as the market surplus narrows and EV battery demand for nickel surges. Upward pressure on prices will be partially offset by the continued ramp-up of output in Indonesia, driven by technical advances in converting lower-grade Class 2 nickel ore into higher-grade Class 1 nickel that can be used in batteries. Fitch forecasts prices to reach US$26,000 per tonne in 2033 as the market surplus shrinks to 24,500 tonnes. TNM

OUTLOOK | Fitch sees consolidation ahead

BY HENRY LAZENBY

The lithium market has entered a “new normal” period of stability, with sustained price surges a thing of the past, analysts at FitchSolutions BMI said in a webcast in late June.

“This stabilization is primarily due to a rapidly expanding global supply, which has already pushed the market into surplus,” Sabrin Chowdhury, head of BMI commodities analysis, said from Singapore. “We expect no return to previous highs for lithium. Prices will remain below the peaks of 2022 and 2023 for at least five to 10 years.”

Prices are expected to remain downcast for the next decade, Chowdhury said, an outlook that’s reshaping the industry landscape.

For this year, BMI forecasts mainland Chinese 99.5% lithium carbonate prices to average US$15,500 per tonne, increasing to US$20,000 per tonne in 2025. This starkly contrasts with the over US$72,000 per tonne average in 2022. Similarly, BMI predicts lithium hydroxide monohydrate (56.5% grade) to average US$14,000 per tonne this year and US$20,500 in 2025, down from about US$70,000 per tonne in 2022.

The upshot of extended low lithium prices could be a boon for cost-saving methods and industry M&A, the analysts said. Juniors and developers may have to incorporate new technology, such as direct lithium extraction for brine projects, while the industry’s scores of operators will likely face consolidation.

“Out of 164 total operations in our database, 126 individual com-

panies own these projects,” BMI metals and mining analyst Amelia Haines said on the call. “This creates an optimal environment for mergers and acquisitions, with larger, well-funded miners looking to acquire promising lithium assets to meet growing demand.”

Competitive edge

Technological advancements are poised to impact supply and demand and are fundamental in gaining a competitive edge for entrants to the cutthroat market, the analysts said.

“Relatively new direct lithium extraction technology can potentially reduce production times and environmental impact compared with traditional methods,” senior metals and mining analyst Olga Savina said.

Despite the price decline, many

major producers continue to remain profitable. This is mainly owing to their ability to maintain low production costs. In Australia, for instance, the production cost of mining spodumene is significantly lower for projects like Tianqi Lithium and IGO’s (ASX: IGO) joint Greenbushes mine and Pilbara Minerals’ (ASX: PLS) Pilgangoora. Higher-cost producers Galaxy Resources, Altura Mining and in Canada, Nemaska Lithium, had to curtail production or go bust.

Lithium demand is set to continue its vigorous growth, driven mainly by the electric vehicle (EV) sector. However, advancements such as the rise of lithium –iron phosphate batteries and potential breakthroughs in solid-state batteries, could influence needs, the analysts said.

Global lithium demand from

“We expect no return to previous highs for lithium. Prices will remain below the peaks of 2022 and 2023 for at least five to 10 years.”

SABRIN CHOWDHURY, HEAD OF BMI COMMODITIES ANALYSIS

EVs is expected to increase by about 14% in 2024 and 2025. Worldwide passenger EV sales are forecast to reach 17.6 million units in 2024, up 21.3% year-on-year.

Meanwhile, global lithium production growth is forecast at 16.4% year over year in 2024 to 1.1 million tonnes lithium carbonate equivalent (LCE). It should rise another 19.7% in 2025 to 1.4 million tonnes LCE, Savina said.

By 2028, global lithium mine production and demand are projected to reach an equilibrium at about 1.9 million tonnes, with demand set to overtake supply thereafter.

Australasia

Australia and mainland China will be the primary drivers of produc-

tion growth. Australia, already a leading hard-rock lithium producer, will continue to dominate due to its strong project pipeline, BMI said. Mainland China will keep importing lithium for its battery industry while expanding its domestic production capacity and securing supplies by developing projects overseas.

Emerging players like Argentina and Zimbabwe are also expected to contribute significantly to the global supply.

“Argentina’s growth in the lithium sector looks promising as several major projects begin operation,” Savina said.

Government tailwinds Major economies, including the United States and the European Union, are racing to establish and safeguard critical mineral supply chains. Legislation like the Inflation Reduction Act in the U.S., which provides tax credits for EVs that use critical minerals mined domestically or by free-trade partners, has spurred investment in lithium projects across North and South America.

The European Union’s Critical Raw Materials Act similarly aims to boost onshore production capacity and diversify imports.

“Onshoring mineral production and processing capacity, enhancing recycling capabilities, forming strategic partnerships, and diversifying supply chains are crucial strategies,” Haines said. “These measures aim to reduce external risks and ensure a stable lithium supply for the green energy transition.” TNM

BY ALISHA HIYATE

Some of Canada’s leading mining law firms say their clients are considering leaving the country because the federal government’s clampdown on Chinese investment has closed off an important funding lifeline.

While deals involving China have been more closely scrutinized for several years — notably since the federal government forced Chinese investors to divest from several lithium juniors with assets outside of Canada in 2022 — the tipping point came just this May.

That’s when Solaris Resources (TSX: SLS; NYSE; SLSR) cancelled a $130-million financing with Zijin Mining after it got hung up in a national security review for four months.

Solaris, which is advancing the Warintza copper project in Ecuador towards a prefeasibility study, pulled the deal after the company’s share price rose well above the transaction price and no longer made sense.

“That this transaction cannot be completed in a reasonable timeframe signals that Canada’s critical minerals policy is counterproductive in relation to foreign assets,”

Fallout

The deal may have died quietly, without the government having to make a decision under the Investment Canada Act (ICA), but the fallout may be far-reaching.

“Clients are asking, ‘Should I

get out of Canada? Should I redomicile?’ Is it within my fiduciary duties to look at changing jurisdictions?” Krisztian Toth, a Torontobased partner at Fasken told The Northern Miner. “They’re wondering, ‘Could this happen to me?’”

While on one hand the federal government has been trying to kickstart investment in critical minerals supply chains needed for

the energy transition, its inconsistent moves on Chinese investment have been damaging, he noted.

Toth questions the government’s definition of national security, noting that Zijin’s investment would have bought a minority 15% stake in the company, just one of five board seats, and involved an asset located outside of Canada.

In March, Montreal-based SRG

Mining (TSXV: SRG) cancelled a $16.9-million deal with China’s Carbon ONE New Energy Group to take 19.4% of the graphite miner. The company completed a process to redomicile to the United Arab Emirates in July, while keeping its TSX Venture listing and changing its name to Falcon Energy Materials.

Canada’s not the only one shutting out Chinese investment as Western nations try to compete with the Asian giant, which controls most critical minerals processing and supply chains. Australia recently forced Chinese investors to divest from rare earth developer Northern Minerals (ASX: NTU). The United States is also trying to sideline China with rules that will eventually exclude electric vehicles made with Chinese-sourced materials from EV tax credits.

Closed door Chinese companies have emerged as a key funding source for cash-hungry developers in South America and Africa, where Western miners, investors and governments are missing in action, McMillan lawyers wrote in a bulle-

Solaris P41 >

‘We can raise more money in the Middle East,’ says junior that left Canada for UAE

INVESTMENT | Canadian firms weigh perils, pluses of redomiciling abroad

BY ALISHA HIYATE

The graphite junior that redomiciled to the United Arab Emirates to access funding amid Canada’s clampdown on Chinese investment in critical minerals says it’s the first junior to do so, but it may not be the last.

SRG Mining, now Falcon Energy Materials (TSXV: SRG), completed its move to the Middle East in early July, after first disclosing its plan to relocate in November, and choosing UAE as its new home in February. It’s the first TSX-listed company to redomicile to the Emirates.

“We believe we can raise more money in the Middle East than we can in Canada. So that’s why we just decided to move on,” Bos said.

The London, U.K.-based executive, who spent eight years with Ivanhoe Mines (TSX: IVN) including a stint as EVP Africa advancing its Kamoa-Kakula copper mine, says “more than several” companies have contacted Falcon to ask questions about its redomiciling experience.

SRG decided to make the move after it became clear that a $16.9-million financing that would have given China’s Carbon ONE New Energy Group (C-One) a 19.4% stake in the company wouldn’t necessarily receive a timely approval. The deal was originally announced in June 2023.

Foreign investment scrutiny

Under the Investment Canada Act (ICA), a federal national security review can take up to 200 days.

“In the end, the minister has discretion on what they approve of and what they want to keep reviewing.”

Bos said. “But for a junior company, we don’t always have the time to wait for several quarters, a year, to get these kind of approvals.”

The irony is that SRG Graphite had planned – and still plans – to serve Western markets with production from its Lola project in Guinea, and planned anode facility

in Morocco.

China’s control of both primary mined graphite supply and downstream processing of the battery material is as extensive as its dominance in rare earths, Bos says.

“That’s why there’s a need for a company like ours that can decouple part of the supply chain from China.”

SRG turned to C-One because the funding and expertise it needed to execute those plans wasn’t available from North American markets. A feasibility study update last year showed the project would cost US$185 million to build and could

produce 94,000 tonnes of graphite flakes in concentrate over a mine life of 17 years.

“It’s the funding, it’s the technology, it’s the offtakes, it’s the expertise. It’s a very complicated supply chain, way more complicated than people actually appreciate,” Bos said.

Although based in China, C-One’s investment and technical expertise would have helped the company to build capacity outside of China. With the lowest-cost production in China, any anode plant based elsewhere would have to serve Western markets, he notes.

According to the TSX, 40% of the world’s mining companies are listed on either the TSX or TSX Venture exchanges.

But the fed crackdown could encourage other juniors that need similar access to Chinese funding or expertise to redomicile and to a decline in Canada’s status as a top destination for mining listings and mining funding.

That’s especially so for companies with preproduction assets outside of Canada, warns John Turner, a partner in Toronto at Fasken and leader of the law firm’s global mining group.

“If we start losing these companies to the Middle East or Australia or (elsewhere), we’re killing one of

the few industries where we have a global presence,” he said.

Turner noted that Canada’s got an extensive ecosystem of technical and environmental professionals, investment bankers, legal and accounting firms that support mining and are also sustained by the sector.

Sasa Jarvis, a Vancouver-based partner at McMillan whose practice focuses on corporate and securities law, says Canada could risk being removed from the equation for new companies choosing where to incorporate.

“It undermines the Canadian capital markets,” she said. “It encourages those companies with global assets to redomicile and, with other restrictions in Canadian securities regulation that discourage incorporation in non-traditional jurisdictions, makes Canadian stock exchanges less attractive for new projects when they’re selecting jurisdictions of incorporation.”

“So, with the ability to accept Chinese funding reduced or essentially eliminated, and no new alternative to that capital presented, companies will look at other jurisdictions to incorporate in,” Jarvis added.

“If capital is shifting away from Canada, it’s going to impact Canada’s mining industry, our capital markets, our investment

M&A | In wake of Glencore’s Teck Coal buy, the ‘net benefit’ bar has been raised

BY ALISHA HIYATE

The federal government’s attempt to clarify its rules for foreign investment in mining is instead causing more confusion as the industry grapples with changing rules under the Investment Canada Act (ICA).

But Rio Tinto’s (NYSE: RIO; LSE: RIO; ASX: RIO) interest in buying Teck Resources (TSX: TCK.A/ TCK.B; NYSE: TECK), as reported by Sky News in July, could serve as a test for what the feds will allow as it tries to keep critical minerals available for Canada.

As the federal government formally approved Glencore’s (LSE: GLEN) purchase of a 77% stake in Teck’s coal business in July, Minister of Innovation, Science and Industry François-Philippe Champagne issued a statement saying the government would only greenlight future foreign takeovers of “important Canadian mining companies engaged in significant critical minerals operations... in the most exceptional of circumstances.”

Most such transactions would not pass the “net benefit” test under the ICA, he said.

“This high bar is reflective of the strategic importance of Canada’s critical minerals sector and how important it is that we take decisive action to protect it,” he added.

To meet the net benefit test, Glencore agreed to what Champagne called “strict conditions” intended to protect Canadian jobs and investment in Elk Valley Resources. Those include setting up and maintaining a head office for the subsidiary in Vancouver for at least 10 years and reserving the majority of senior and director roles for Canadians for the same period. It also agreed to earmark an extra $350 million over five years for closure and reclamation, and to maintain Teck’s commitments to First Nations.

While the July 4 statement appears to warn off potential bidders for the rest of Teck’s business, now focused on copper, John Turner, a partner at Fasken and co-leader of its mining group, isn’t sure that’s the case.

“The announcement was not very clear. And if we really are closed to foreign takeovers, the TSX may as well pack its bags and go home,” he said, referring to the importance of mining listings to the exchange.

“In a sense, I’m pleased that this is coming up. If a company like Rio can’t take a run at Teck, then we’ve got real problems.”

Rio Tinto, which bought Canada’s Alcan in 2007 in a $38-billion deal that was subject to a less stringent net benefits test, already has a major presence in Canada, and is headquartered in Australia.

‘Confusing and vague’

The Prospectors and Developers Association of Canada (PDAC) agreed Champagne’s statement was confusing.

“Although the statement was intended to provide clarity, we believe it will only increase opacity in our markets. The mineral industry is struggling to understand the government’s motives regarding the net benefit and national security reviews,” Jeff Killeen, PDAC’s

director of policy and programs said in an emailed statement.

“It has taken nearly a century for Canada to build a highly accessible and transparent capital market, attracting listings from mineral exploration and mining companies worldwide. This dynamic is being put at risk when we hear that net benefit will only be found in transactions that involve large companies with critical minerals ’in the most exceptional of circumstances.’

“This phrase lacks a formal definition, and no regulations have been proposed to clarify how the Investment Canada Act amendments in Bill C-34 will apply to public issuers,” he said.

The amendments were first announced in late 2022 and came into force earlier this year. Killeen noted that part of the rationale for investing in miners is the potential for M&A premiums.

“The uncertainty we have now will put Canadian-listed companies at a strategic disadvantage and create headwinds for valuations when compared to other marketplaces.”

The government has signalled for the past two years that Chinese investment in critical minerals is a non-starter. That became clearer after Solaris Resources (TSX: SLS; NYSE: SLSR), a junior with a development-stage copper-gold project in Ecuador, cancelled a $130-million investment from China’s Zijin Mining after it got hung up in a national security review.

Other development-stage juniors with assets outside the country are now considering redomiciling — packing up and leaving Canada — to avoid ICA reviews, lawyers at Fasken and McMillan have said.

Graphite junior SRG Mining — now Falcon Energy Materials (TSXV: SRG) — completed its move to the

United Arab Emirates last month rather than go through a national security review for a $16.9-million financing with a Chinese firm that it had to cancel anyhow in order to redomicile.

But the new statement appears to put any foreign investment in question.

“If this actually happens it will make us uncompetitive globally in an industry where we are a world leader,” Turner says.

‘Affects only a very few’

A day after Champagne’s statement, Natural Resources Minister Jonathan Wilkinson dismissed the idea that the tougher ICA require-

ments could limit investment in critical minerals in Canada.

“The new formulation of net benefit applies only to mining companies that actually have large-scale operations in Canada that are currently Canadian companies,” he said at the Energy Ministers Conference Calgary, responding to a question from The Globe and Mail

“It doesn’t affect exploration, it doesn’t affect early development, it doesn’t affect investments coming into the country to develop critical minerals,” he said.

“But what it says is those companies that are headquartered in Canada, their head offices are in Canada, their research and development is done in Canada, are important. It’s important for Canada to have flagship enterprises in an area that is strategic. So, it affects only a very few companies in Canada and I don’t think it will have any impact on investment flows.”

Teck is clearly one of those companies, and any potential acquirer of the miner now knows to expect a takeover could come with onerous or expensive conditions.

Despite Wilkinson’s assurances, mining capital may play it safe until investors are certain about the new rules of the game, both the net benefits test for major deals and national security reviews for all deals.

Rather than cut off foreign sources of capital and risk no new mines getting built, Krisztian Toth, another partner at Fasken specializing in mining M&A, says the feds could consider regulating what comes out of the mine instead.

“As part of an ICA review, they (could) say, ‘we’ll let your deal go through, but fifty per cent has to go to North American markets,’” he said.

That way they could use the ICA as a tool to get the product they want in Canada, he added.

“What they’re doing now is actually protectionism, and I think history has shown protectionism is not strategy, it’s fear-based.” TNM

BY COLIN MCCLELLAND

Mining companies could benefit in cash and technology as major fossil fuel companies such as ExxonMobil (NYSE: XOM), Occidental Petroleum (NYSE: OXY) and Equinor (NYSE: EQNR) invest in lithium, a potential lifeline amid the battery metal’s low prices and oversupply.

ExxonMobil, which has produced some lithium in a pilot project, signed a preliminary agreement in June to send lithium to South Korea-based SK On, a battery maker that’s building plants to supply Hyundai and Ford in the United States. That followed the oil giant’s US$100-million purchase of drilling rights on 485 sq. km of lithium brine assets in Arkansas’ Smackover Formation from Galvanic Energy.

Also in June, Occidental Petroleum said it’s forming a joint venture with a unit of Warren Buffett’s Berkshire Hathaway (NYSE: BRK.B) to produce battery-grade lithium from the brine of 10 geothermal power plants in California. It’s begun feasibility testing.

Chevron (NYSE: CVX) says it’s exploring lithium extraction, and Reuters reported the third-largest petroleum company by market value was speaking with International Battery Metals (CSE: IBAT; US-OTC: IBATF) about licensing brine technology.

Norwegian state oil company Equinor said in May it could pay as much as US$133 million for a 45% stake in Standard Lithium’s (TSXV: SLI) projects in Arkansas and Texas. Standard started a commercial-scale demonstration plant in April. Vulcan Energy Resources (ASX: VUL) told The Northern Miner by email it has oil majors, but wouldn’t say which ones, investing in its €1.3 billion ($2 billion) Zero Carbon lithium project in Germany.

‘Makes sense’

“The move into lithium makes a lot of sense for these large international energy companies,”

Rhidoy Rashid, a senior associate at London-based data and analysis firm Energy Aspects, said by email.

“Unlike some other niche metals, lithium is relatively abundant, so the resource needed to match rising demand for batteries is there, it just needs to be efficiently extracted. The expertise these companies can bring may also help to ramp up lithium supplies from areas where it was previously uneconomic to extract the metal.”

Oil companies are investing exclusively in brine projects (as opposed to hard rock) that may use direct lithium extraction (DLE) methods, which resemble pumping crude in some aspects. They’re tapping their own core capabilities in subsurface exploration, drilling and chemical processing. They have much deeper pockets, with market values that dwarf their mining cousins. Their diversification into green metals can help lift a mining sector that attracted stock market investors when the metal price was high but have since abandoned it.

“Oil companies offer the technology and skills need to identify, characterize and produce lithium-bearing brines from deep underground,” Terry Braun, president of North American opera-

tions for SRK Consulting, said by email. The firm has 45 offices globally and has operated in more than 150 countries.

“The challenge of economically extracting a marketable lithium product once the brine is at the surface is formidable,” Braun said. “Even with the technical expertise of most major oil companies.”

US$1B move

ExxonMobil is aiming to supply enough of the battery metal to power 1 million vehicles by 2030.

It has said a “material” part of its US$20-billion budget for low-carbon projects through 2027 will be spent on lithium.

“It has to be over US$1 billion if it is going to be material,” chairman and CEO Darren Woods said on an April 30 conference call. “We are looking at very large markets into the billions.”

Lithium brines are often found in depleted or abandoned oil wells, like the Leduc field in Alberta where E3 Lithium (TSXV: ETL; US-OTC: EEMMF) is advancing its US$2.5-billion Clearwater project on Canada’s largest resource of the battery metal. The project between Calgary and Edmonton could produce 32,250 tonnes a year of lithium hydroxide monohydrate over half a century, according to a prefeasibility study issued on June 26.

ExxonMobil’s Canadian subsidiary, Imperial Oil (TSX: IMO), has invested $6.4 million for stock and warrants equal to 4.3% of E3.

There is only one commercial DLE operation so far outside of China after companies struggled to lower costs and improve technologies. Arcadium Lithium (NYSE: ALTM; ASX LTM) has been using DLE at its Hombre Muerto operations in Argentina since the 1990s. Most brine operators like Albemarle (NYSE: ALB) and SQM (NYSE: SQM) the world’s two largest lithium producers, use traditional evaporation ponds.

“The challenge of economically extracting a marketable lithium product once the brine is at the surface is formidable. Even with the technical expertise of most major oil companies.”

TERRY BRAUN, PRESIDENT OF NORTH AMERICAN OPERATIONS FOR SRK CONSULTING

Pros and cons

However, DLE is gathering pace because it can produce lithium in hours or days vs months or years on a fraction of the land, and process brines with lower lithium concentrations.

US Magnesium is using DLE from International Battery Metals for a project in Utah and CleanTech Lithium (AIM: CTL) started a DLE pilot plant in Chile. In Canada besides E3, Volt Lithium (TSXV: VLT), EMP Metals (CSE: EMPS; US-OTC: EMPPF) and LithiumBank Resources (TSXV: LBNK; US-OTC: LBNKF) have all started DLE testing. These operations, which in E3’s case, would siphon lithium-laden water from the same wells that used to produce oil, then pump it back into the reservoirs after extract-

ing the battery metal. Even permit requirements and the separation process using water and reinjecting it into wells are more akin to the oil industry than hard rock mining. However, some experts have expressed concerns about the environmental impact of oil companies extracting lithium, likening the process to fracking because it injects liquid underground that could potentially enter water supplies. Marco Tedesco, a climate scientist at Columbia University, has said high water usage and potential pollution are linked to DLE. Some environmentalists have criticized oil companies for greenwashing their operations.

“It pains us to even cover a company like ExxonMobil, as its history in environmentalism is as filthy as the oil it drums up,” Scooter Doll at energy transition website Electrek wrote when the oil giant started lithium drilling. “While this is welcomed news to an extent, it’s not difficult to see the motive behind ExxonMobil’s expansion into lithium, and it sure as hell isn’t about saving the planet.”

Oversupply

While companies use long-term metal pricing to gauge project economics, the surge in oil major investing comes as battery-grade lithium carbonate has plunged to around a three-year low. It was US$11,825 a tonne near press time, down from US$40,675 a year ago, according to The Wall St. Journal. It had been approaching US$76,000 a tonne in January last year.

“The commercial scale economics for the majority of DLE projects are unknown at the present time,” SRK’s Braun said. “DLE technologies or other non-conventional metallurgical flow sheets present a technical risk that could negatively impact project economics and the ability of the mining company to pay the lender.”

A glut in lithium is expected to

continue for close to a decade even as demand increases because of more electric vehicles hitting the market, analysts at FitchSolutions BMI said on a June 27 webcast. The oversupply will force scores of companies to adopt cost-saving technology like DLE and/or face takeover threats, they said.

Global lithium production increased 23% last year to 180,000 tonnes, according to Statista. Energy Aspects’ Rashid says oil major investments in lithium are key for the world to meet rising demand and climate-change fighting goals.

“It is crucial that lithium supplies are unlocked if the world is to keep pace with net zero ambitions,” the analyst told The Northern Miner “We think global lithium production needs to almost triple by 2030 to keep up with the level of electric vehicle adoption required to maintain pace with decarbonization targets.”

The lower price has caused some producers such as Albemarle, which has both hard rock and brine operations, to slash costs and delay projects. That could expose some assets to M&A and provide more opportunities for oil companies to invest. Miners may seek out oil companies as their projects face funding and other headwinds.

Braun says success in DLE technology suits oil companies because of their resources for tests on brines from projects and their capacity to build large projects, starting with DLE pilot programs to assess economic feasibility.

“Oil companies invest significant capital and time to develop, test and deploy new technologies at commercial scale,” Braun said. “This is a strategic advantage over companies that have less capital or time to prove a commercial scale DLE application.”

TNM

With files by Henry Lazenby.

BY BLAIR MCBRIDE

Alandslide that’s stopped production at Victoria Gold’s (TSXV: VGCX) Eagle mine in the Yukon may have been inevitable due to the company’s weak approach to safety protocols, current and former employees say. .

Individuals who approached The Northern Miner to share their experiences of working at Eagle told of neglected incidents and repairs, attempts to subvert injury reports and unchecked drug and alcohol use in a supposedly dry camp, confirming what a heavy equipment operator had previously said. They asked not to be named to avoid career repercussions.

“I would see workers constantly complain about specific safety issues,” said a former member of the health, safety and security department, who worked at Eagle for four years. “And it was just pushed off on the backburner. ‘Oh, we’ll get around to it. You know, we don’t have parts, we don’t have time.’”

He said production came first.

The lax safety culture may have contributed to Victoria’s difficult position. No one was seriously injured in the accident, but with operations at Eagle suspended after the June 24 heap leach spill and landslide, the company has no cash flow. It holds $232.5 million in debt. The incident tanked Victoria’s share price by more than 85%, leaving the single-asset company

with a market cap of $42.3 million.

As of press time on July 29, Victoria had issued only three news releases since the accident. It has not responded to multiple requests for comment. The cause of the accident is being investigated.

Avoiding insurance claims

The workers agreed Victoria’s alleged safety negligence stands out in its approach towards Workers’ Safety and Compensation Board (WSCB) claims.

When a worker was injured, the company was supposed to report the incident to the Yukon WSCB. But instead, the worker would be kept on wages, told to stay home and company records wouldn’t show any injuries, the sources said.

“We were directed to send them computers and give them online training so they could stay at home and stay on the payroll, which wouldn’t show any time loss,” the former safety department member said.

The department holds less than a dozen guards, supervisors, emergency response technicians and paramedics, but it lost 14 people over three years from turnover, he said.

A heavy equipment operator, who has worked at Victoria for more than two years, but who was injured more than a year ago, suggested the company avoids WSCB claims to limit payments and to keep insurance rates from increasing. The details of his injuries are being withheld because he’s still

employed by Victoria.

“I got injured there and they do pay you to keep you from WSCB, but only for six or seven months, and then they said they don’t have the (technology) to accommodate you working from home, like administrative work or training work,” he said. “I’ve been fighting with the WSCB and the company because they didn’t give me any support whatsoever.”

But Heather Avery, a spokesperson for the Yukon WSCB, said in response to emailed questions that injured workers who made claims for compensation benefits received them. She also confirmed that Victoria Gold accommodated the workers’ injuries and continued to pay their salary. When employers continue paying the salaries of injured workers, WSCB reimburses them.

“There is no benefit for employers to suppress claims in the Yukon,” she said.

“The number of claims for compensation at any individual employer does not impact their rates,” she added. “When a worker is injured and a claim is submitted, the Claimant Services branch works with the employer to determine the best approach for the injured worker on a case-by-case basis (including accommodating the injured worker with alternate work).”

Companies report lost-time injury statistics publicly, and investors and lenders may use safety metrics as part of their decision-making processes.

According to Victoria Gold’s 2023 sustainability report, posted to its website, its lost-time injury frequency rate rose to 0.70 in 2023 from 0.13 the year before.

‘They went to lunch’

The June 24 accident was the second landslide to occur at Eagle this year, the Yukon government confirmed in a news briefing in late June. The incident in January involved a smaller failure than the recent event and was on a stockpile that wasn’t being leached. In heap operations, ore pads are applied with a solution containing cyanide that separates gold from ore.

Two equipment operators told The Northern Miner that production continued after the January slope failure even though by regulation a safety stand-down, or pause in operations, must follow such events.

“We drove down from the top of the pad (towards) the lunchroom,” said the operator, who was pulled down by the landslide on June 24 while inside his bulldozer. “Before I got out of the truck, I asked (the mine manager) ‘is this a safety standdown or is this a regular lunch?’ He said it’s a regular lunch. I said, ‘I don’t agree with that.’”

Another operator, who wasn’t working on the pad at the time, said there was no pause in operations.

“It’s true that the lock-out procedure didn’t happen there, everyone

BY BLAIR MCBRIDE

The Yukon government is taking over more tasks in the cleanup effort at Victoria Gold’s (TSXV: VGCX) Eagle mine, as the company has missed more conditions of the remediation plan.

The government has hired contractors to build a protective berm under the unstable slope at Eagle to make a safe area to drill groundwater wells, Lauren Haney, deputy minister for Yukon’s Department of Energy, Mines and Resources (EMR), said in a news briefing on July 26. Those wells are needed for monitoring groundwater for potential contamination.

“I wouldn’t frame this as a repercussion, but it is a result of the company not complying with those directions that we are stepping in to undertake construction of the berm ourselves,” Haney said.

The move came one month after a heap leach pad failure unleashed 4 million tonnes of material in a landslide, with half leaving the pad’s containment. Between 280,000 and 300,000 cubic metres of cyanide-containing solution left the containment, according to government estimates. The company has issued three news releases since the accident. It has not responded

to multiple requests for comment from The Northern Miner Yukon Premier Ranj Pillai on July 26 appointed Dennis Berry, president of the Yukon Liquor Corporation, as interim deputy minister of EMR to assist Haney in her role to focus solely on the response to the Eagle accident.

on costs

The Yukon government couldn’t confirm how much the cleanup

work is costing, though Haney implied the government has spent its own funds.

“We’re certainly keeping track of the money spent,” she said during the briefing. “We will make every effort to recover the costs we’re incurring.”

The Northern Miner asked Haney what would trigger the use of a $104-million surety bond the government holds with Victoria Gold for reclamation.

She responded that the government is considering its use but didn’t detail the triggers.

Asked how long Victoria can continue to fund the cleanup, Haney said she doesn’t know, though said the government is aware of Victoria’s low share price.

“It’s not a positive outlook. For now, the company remains on site and is paying its contractors. We’re pleased to see them doing that.”

Although groundwater monitoring near the mine site has revealed an increase in contaminants during week of the briefing, the risk to aquatic life and drinking water is low, said Tyler Williams, a water resources scientist with Yukon’s department of environment.

“We’re observing an increase of cyanide in the water,” Williams

BY BLAIR MCBRIDE

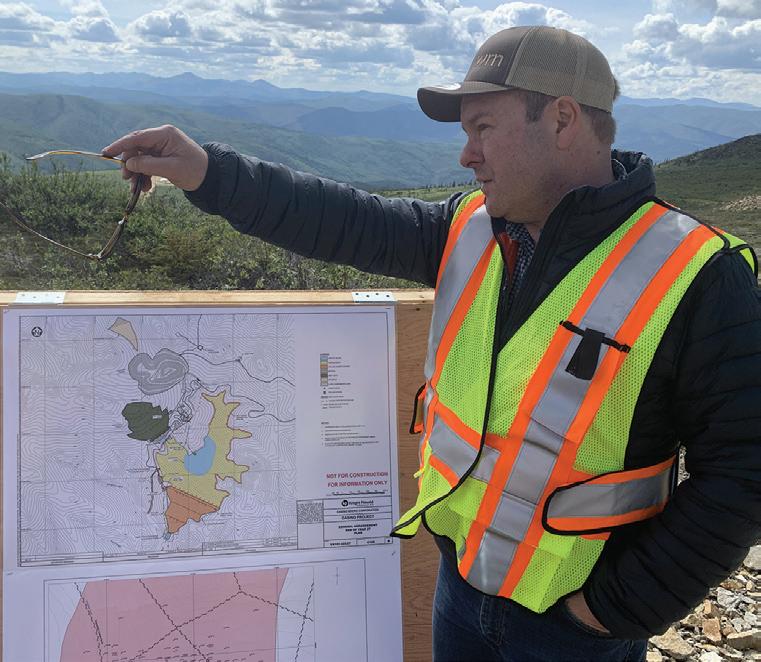

Near Carmacks, Yukon — Western Copper and Gold’s (TSX: WRN; NYSE-AM: WRN) Casino project sits at the potential junction of a trans-Canadian green power conduit while promising metals needed for the energy transition.

The company, which calls Casino the world’s fifth-largest copper-gold project controlled by a junior miner, got a vote of confidence in November when Rio Tinto (LSE: RIO; ASX: RIO) upped its stake in the junior to 9.7% from about 8%. There are also tailwinds as governments push to connect Yukon to British Columbia’s green power grid and the national grid, CEO Sandeep Singh told The Northern Miner in Casino’s hilltop kitchen tent in late June.

“We’re being dragged. The government of Yukon wants this to happen. The First Nations want it to happen,” said Singh, who took the reins at Western Copper and Gold in February.

“It comes with that application to the critical mineral infrastructure fund,” he said referring to the federal government’s $1.5-billion pot to support mining projects, announced last November.

Yukon premier Ranj Pillai asked the federal government earlier in June to provide up to $60 million towards the grid connection. Yukon has already earmarked $1 million towards it. The interconnection would include 763 km of power lines.