> Proudly Canadian: Proudly Mining

> The mines across the tickle

> Drilling into Manitoba’s untapped potential

> THE FUTURE OF AUTONOMY IN MINING OPERATIONS

> HOW GEOSCIENCE SOFTWARE FLIPPED THE MINING INDUSTRY ON ITS HEAD

> SUBSURFACE INTELLIGENCE EMPOWERS MINERAL EXPLORATION

> A SURFACE SCANNING TECHNOLOGY FROM MARS MISSIONS

MINING IN CANADA

12 Is mineral processing geomimicry? Mining a mineral message (part 3).

14 Proudly Canadian: Proudly mining.

16 History of mining: The mines across the tickle.

18 A tremendous career advocating for mining: An interview with Chris Hodgson.

22 Revival of Thompson nickel belt: Drilling into Manitoba’s untapped potential.

MINING IN THE DIGITAL AGE

24 Panacea versus practicality: The future and promise of autonomy in mining operations.

26 Under the surface: How AI and GenAI are transforming the end-to-end mining landscape.

28 Subsurface intelligence empowers mineral exploration companies to drill less and discover more.

33 How geoscience software flipped the mining industry on its head: An interview with Graham Grant, CEO of Seequent.

37 A surface scanning technology from Mars missions: Laser-induced breakdown spectroscopy.

40 A holistic approach to mine digitalization for strategic success.

45 Mitigating wildfire risk for mining and industrial operations. LUBRICANTS

42 A new era in mining lubrication.

CRITICAL MINERALS, DECARBONIZATIO, AND INTERNATIONAL MINING

43 Five things that will define success in rare earth elements.

53 Decarbonizing mining: Can Chile succeed?

WOMEN IN MINING

55 The cost of the inclusion.

57 The mining industry can play a key role in addressing the scourge of gender-based violence.

REBRANDING MINING

58 The underappreciated valor of Canada’s mining industry.

4 EDITORIAL | The good, the bad, and the tariffed: Mining’s digital lifeline in uncertain times.

6 FAST NEWS | Updates from across the mining ecosystem.

10 LAW AND REGULATIONS | Tips for avoiding delays in British Columbia’s permitting process.

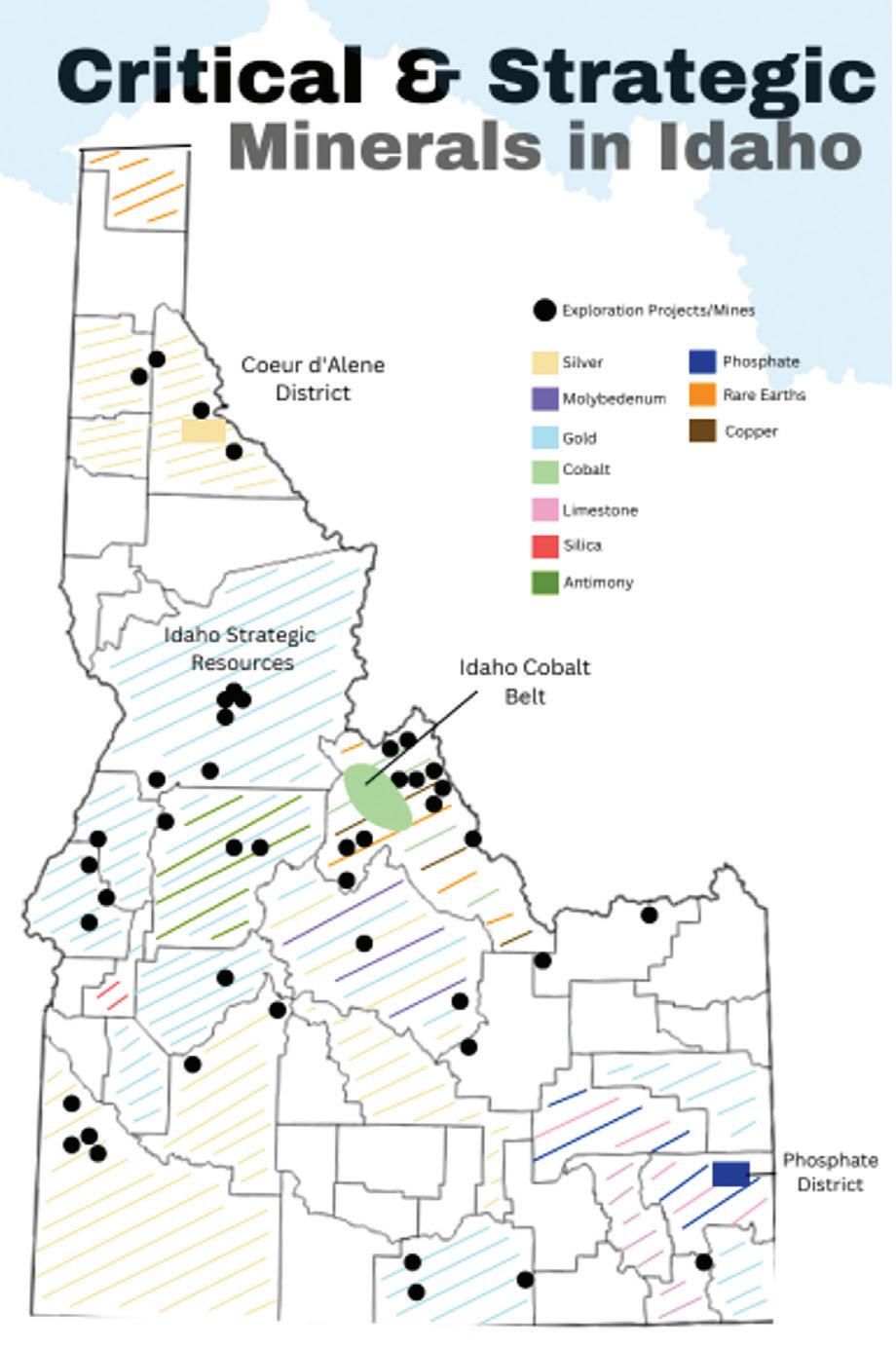

48 MIN(E)D YOUR BUSINESS | Can Idaho’s SPEED Act serve as a model for mine permitting reform?

52 MINING SPOTLIGHTS

Tamer Elbokl, PhD

lthough U.S. tariffs have introduced significant challenges for the Canadian mining industry, they also bring an environment of change that could stimulate strategic shifts, increased efficiency, or investment in domestic capabilities.

The good news is that Prime Minister Mark Carney has publicly endorsed a long-desired mining policy in Canada of a “one project, one review” permitting system. Carney announced recently that he and Canada’s premiers have agreed to eliminate all interprovincial trade barriers and streamline environmental assessments for major projects, including mining projects, high-speed rail, hydroelectricity grids, and pipelines. The plan is touted as a major way to replace duplicative federal and provincial environmental reviews with a single streamlined process. Meanwhile in Ontario, Premier Doug Ford is following through on his vows to expedite the development of the Ring of Fire region as a response to Trump tariffs and get critical minerals projects moving in the province. His recently re-elected majority government is proposing legislation that will speed mining and other major projects across the province in the Ring of Fire and other economic priority zones. However, a coalition of First Nation chiefs has already issued a word of caution.

At first glance, the recent U.S. tariffs seem like nothing but bad news for Canada’s mining sector — all downside, no upside. But dig a little deeper, and even this uncertainty may hold unexpected opportunities. In my opinion, tariffs also introduce a degree of disruption that may create openings for strategic adaptation and innovation.

Digitalization can significantly help the mining industry mitigate the impact of tariffs through several key strategies such as enhancing supply chain management to help mining companies navigate disruptions and maintain steady operations, achieving cost efficiency using automation and artificial intelligence (AI) to streamline operations, using real-time data analysis to provide insights into market trends and tariff impacts, improving productivity using digital innovations like predictive maintenance and automated machinery, diversifying the markets by using digital platforms to facilitate access to new markets and customers and reduce the reliance on regions affected by tariffs, and finally by embracing electrification, the mining industry cannot only reduce its environmental footprint but also strengthen its financial resilience against tariffs.

Leveraging advanced digital technologies enables the mining sector to navigate the multifaceted impacts of tariffs while bolstering operational resilience in an increasingly uncertain global economy.

In this issue, we cover several topics related to “Mining in the Digital Age” on pages 24 to 47, with a special focus on digitalization, the future and promise of autonomy in mining operations, and how AI is transforming the mining landscape.

Additionally, in our “Mining in Canada” section, including a “proudly Canadian” mining article by Steve Gravel on page 14, an article on the history of mining in Bell Island on page 16, and an interview with Chris Hodgson on page 18, we shed some light on how Canada can leverage its natural resources to become a leader in the critical minerals sector amid trade war ambiguity.

If you are planning to be in Montreal to attend CIM CONNECT 2025, please remember to collect a copy of this issue when you visit Earthlabs Media booth # 719.

Finally, our June-July 2025 issue will report on surface (open pit) mining, including reports on blasting and the rise of autonomous trucks, with special features on load and haul. Editorial contributions can be sent directly to the Editor in Chief before May 10.

MAY 2025 Vol. 146 – No. 3

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Joseph Quesnel jquesnel@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3;

E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3

We acknowledge the financial support of the Government of Canada.

• MAJOR ORDER | AT2 Aerospace secures major airship order from Arctic Airships

AT2 Aerospace – a Lockheed Martin spin-out and a pioneer in hybrid airship design and manufacturing – announced a significant purchase order from Arctic

Airships, a leading provider in Alaska of sustainable remote logistics.

The deal represents a major advancement in addressing the unique transportation challenges faced by many mining operations in remote Arctic regions. Approximately 70 percent of Canada’s landmass has neither railway nor road access making airships an appealing option. Mining companies have been exploring the feasibility of airships – including autonomous ones – to reach remote mining sites and in transporting ore.

The AT2 Aerospace order includes

• FIRST REFINERY | Feds commit to funding Electra’s first cobalt sulfate refinery in North America

Electra Battery Materials announced a conditional contribution from the federal government to support completion of North America’s first and only cobalt sulfate refinery.

To date, Electra has arranged US$54 million in non-dilutive funding, including US$34 million in government support – comprised of both a binding contract and a non-binding letter of intent – and a US$20 million strategic investment proposal. In 2023, Electra estimated the capital cost to complete the cobalt refinery at US$60 million, excluding first fills and commissioning costs. Additional non-dilutive funding options are in active development.

Nickel Belt MP Marc Serré commented: “Canada, with its abundance of critical mineral resources, is uniquely positioned to play an important role in the global energy transition. It is important that the government be there. Electra’s project will provide Canada with a high-quality critical mineral input that will contribute to the net-zero economy and strengthen our mining industry.”

Electra expects the facility to produce about 6,500 tons of cobalt per year, which would support the production of up to one million electric vehicles annually.

The refinery project is in the Northern Ontario town of Temiskaming Shores.

two hybrid airships with an option on eighteen additional airships. The company will be deploying these airships to support logistics in remote regions. AT2 Aerospace expects these advanced aircraft will vastly improve logistics in remote areas by providing access to locations previously considered difficult to reach, while reducing environmental impact and infrastructure requirements.

Dr. Bob Boyd, CEO of AT2 Aerospace, said, “This partnership with Arctic Airships validates our hybrid airship technology as a game-changing solution for the remote logistics sector. Our aircraft not only optimize cargo movement in challenging terrains but also aligns with the industry’s increasing focus on environmental responsibility and cost efficiency.”

• MAJORITY SUPPORT | Falco Resources releases survey showing majority support for Horne 5 underground mine project

Falco Resources published the results of an independent survey of the population of RouynNoranda and Abitibi-Témiscamingue conducted by Léger regarding the Falco Horne 5 underground mine project.

CREDIT: FALCO RESOURCES.A

The results show Falco enjoys strong majority support in Rouyn-Noranda, where 72% of respondents are in favour of the Horne 5 project, and in Abitibi-Témiscamingue, where support reaches 74%. These results demonstrate the population’s significant support for the project, particularly given its economic spin-offs and positive impact on employment.

The company will continue its discussions with the Ministère de l’Environnement, de la Lutte contre les changements climatiques, de la Faune et des Parcs to have the project’s compliance recognized and complete the environmental analysis.

The survey was conducted from February 27 to March 9, 2025, among 500 Abitibi-Témiscamingue residents aged 18 and over. The presumed margin of error is ±4.38%, 19 times out of 20.

The Liebherr Zero Emission Mining Program was established to further develop the roadmap for a decarbonized future. Liebherr strives to provide customers with a range of methods to help meet emission reduction targets and is working to offer products that use alternative energy sources like batteries, electricity, and alternative and hybrid fuels. By 2030, Liebherr Mining will offer entirely fossil fuel free solutions for digging, dozing, and hauling.

• NEW MINING MAP | Sudbury unveils new online map showcasing city’s mining operations

The City of Greater Sudbury has created a new online map that will be showcasing mining facilities, mining suppliers, and any related mining infrastructure.

The city unveiled the new map at the annual Prospectors and Developers Association of Canada (PDAC) convention held in Toronto in March. The city expressed the hope that the map would lead investors and mining operators linking Sudbury with mining.

A notice on social media about the unveiling read: “This map showcases some of the key mining projects happening in the Sudbury Basin and gives a visual overview of the Basin that many have not seen before. We will be updating it regularly as things change, open and evolve.”

The website reads: “Greater Sudbury is home to the largest integrated mining complex in the world. It is located on a famous geological feature that has one of the largest concentrations of nickel-copper sulphides on the planet.”

“We are home to North America’s highest concentration of mining expertise. From capital equipment to consumables, engineering to mine construction and contracting, from mapping to automation and communications – our companies are innovators. If you’re looking for the latest in mining technology or thinking of establishing a presence in the industry – you should be looking to Sudbury.”

MAJOR ACQUISITION | Orla acquires Musselwhite gold mine

Orla Mining completed its acquisition of the Musselwhite gold mine in Ontario from Newmont. Musselwhite is a producing, underground gold mine located on the shore of Opapimiskan Lake in northwestern Ontario. It has been in operation for over 25 years, having produced close to 6 million ounces of gold to date, with a long history of resource growth and conversion.

Based only on the company’s current technical report, Musselwhite has a mine life until 2030. Significant opportunities exist to optimize the operation and extend mine life through known extensions of the ore body.

Jason Simpson, president and CEO of Orla Mining said: “The addition of Musselwhite transforms Orla into a North American-centred, geographically diversified intermediate gold producer with multiple gold-producing assets and a self-funded growth portfolio. Musselwhite strengthens our North American presence and more than doubles our annual gold production. This important Canadian gold mine also offers growth potential through optimization and mine life extension, something we intend to aggressively pursue.”

• HISTORIC EXPLORATION | Nova Scotia grants exploration licences for lithium projects

Nova Scotia’s department of natural resources has granted mineral exploratory licences for three lithium projects in the Yarmouth and Digby counties in the province. The Mining Association of Nova Scotia has hailed the move. The granting of licences comes after much-publicized recent comments by Nova Scotia Premier Tim Houston stating a willingness and necessity to explore new areas of resource development, including mining.

Sean Kirby, executive director of the provincial mining association, commented, “Nova Scotia has tremendous potential to provide the critical minerals needed to achieve climate goals, including lithium. We are excited about several lithium projects in southern Nova Scotia and exploration taking place elsewhere in the province and look forward to contributing to global supply of this key battery metal.”

Kirby added, “The global rush to source critical minerals creates an extraordinary economic opportunity for places like Nova Scotia that have the potential to provide them. The province can contribute to global supply while also generating jobs and government revenues to help pay for programs like health and education.”

The Impact Assessment Agency of Canada (IAAC) and its 15 First Nation partners invited expressions of interest from individuals and organizations that hold knowledge, expertise, information, or datasets that could support the work of the regional assessment.

The IAAC’s website said: “The regional assessment will be conducted in the area centred on the Ring of Fire mineral deposits in northern Ontario, approximately 540 km northeast of Thunder Bay. The regional assessment aims to gather information and data on the region; understand potential effects from past, existing and future development in the Ring of Fire area; and will inform and improve future impact assessments. Indigenous partners and the Impact Assessment Agency of Canada are co-leading the regional assessment and will provide Indigenous communities and organizations, federal and provincial governments, non-government organizations and the public opportunities to meaningfully participate.”

The invitation is part of the on-going conduct phase for the regional assessment of the Ring of Fire area. In addition to information that is currently in the public domain, the IAAC and its First Nation partners recognized that there may be a variety of existing information and datasets held by individuals and groups that may be relevant to the regional assessment.

NexGold Mining announced potential positive outcomes as it works towards the completion of its feasibility study for its Goliath gold complex located in the Wabigoon Greenstone belt in

The federal government is granting a boon to critical mineral exploration in the form of a two-year extension on the 15% mineral exploration tax credit for investors. The tax credit –popular among explorers and investors – was set to expire on March 31st this year.

The move was part of a recent announcement by federal Natural Resources Minister Jonathan Wilkinson. The credit allows investors the credit to invest in flow-through shares of smaller mining firms. Mining industry analysts stated in the Globe and Mail and other media the move would likely free up $110 million to help develop mining sites, primarily in the northern regions in Canada. Much of the critical mineral development in Canada is occurring in that region.

northwestern Ontario. NexGold Mining is a gold-focused company with assets in Canada and Alaska. The company expects the feasibility study in the second quarter of this year. The Goliath gold complex project utilized a combination of open-pit and underground mining methods to extract gold ore.

The company’s feasibility study is being prepared in accordance with National Instrument 43-101 – Standards for Disclosure for Mineral Projects.

NexGold Mining also expects that progressive reclamation opportunities will be incorporated into the feasibility study to assist in the preparation and submission of a detailed mine closure plan. The company’s decision to optimize the mine sequencing will also potentially allow for earlier closure and remediation of the TSF and waste rock storage area, with the goal to be able to segment/isolate potentially acid generating and non-acid generating wastes as soon as possible.

NexGold will also minimize and reduce the areas of disturbance from mining activities through adding input from community engagement activities.

The federal government is using this capital market tool to spur investment and exploration. However, it comes on the heels of political controversies surrounding comments by U.S. President Donald Trump over Canada as well as Greenland that many believe is tied to U.S. interests in critical minerals. At present, China has maintained a stranglehold on critical mineral sites and supply chains. Canada – as well as many provinces and territories – have been racing to develop critical minerals for both economic and environmental reasons.

• DOUBLING SHIPMENTS | Hudbay and AGG set to double critical mineral shipments from Port of Churchill

Arctic Gateway Group (AGG) announced a significant expansion of their critical mineral export partnership with Hudbay Minerals. This year Hudbay and AGG will double the volume of critical minerals shipped through the Port of Churchill. AGG also plans to triple current critical mineral storage capacity at the Port of Churchill, setting the stage for the continued growth of critical mineral exports from the Port of Churchill.

The Arctic Gateway Group is an Indigenous- and community-owned Manitoba company that owns and operates the Port of Churchill, Canada’s only Arctic seaport serviced by rail, as well as the Hudson Bay Railway, which runs from The Pas to Churchill. This announcement comes after last year’s successful shipment of zinc concentrate from the Port of Churchill to international markets.

Chris Avery, CEO of Arctic Gateway group, commented, “AGG is proud to work with Hudbay as we continue to ramp up our operations and are on a strong growth pathway. We’ve restored the Hudson Bay Railway to the best condition it has been in over 25 years, and we’re keeping it strong by investing in new advanced new railway tools. We’ve proven that we’re ready to haul, store and export Western Canada’s critical minerals to international markets and have secured the confidence of private sector partners to do so.”

By Robin Longe

British Columbia is widely recognized as a key jurisdiction for mineral exploration and development, offering significant mineral resources together with a well-established regulatory framework. Nevertheless, the time required to secure necessary permits and authorizations can often become a concern, or even a source of frustration, for mining proponents seeking to advance their projects.

Whether submitting a “Notice of Work” application, applying for a “Mines Act” permit, or undertaking the environmental assessment process, navigating the province’s permitting process is a crucial step towards the successful development of a project. It is important for proponents to recognize that permitting timelines can be influenced by several factors, and while delays in the permitting process may arise from regulatory procedures, they can also be the result of a proponent’s deficient application or the failure to adequately consider and address the potential impacts of a project.

In this article, we offer a few tips and insights into streamlining the permitting process for mineral exploration and development in B.C.

It is important for mining proponents in B.C. to be familiar with and utilize tools and resources available to them. One such example is the Mines Digital Services (MDS) system being developed by the province’s Ministry of Mining and Critical Miner-

als as an initiative to modernize and streamline various processes for B.C.’s mining sector.

The MDS system includes the “MineSpace” platform, which provides several notable functions that proponents should be aware of, including the ability to (i) access mine permits and inspection histories; (ii) submit applications, incidents, and reports; (iii) check the status of submissions; (iv) manage files associated with submissions; and (v) receive in-app notifications regarding activity updates. Notably, miners are now able to receive digital credentials for their Mines Act permits directly through MineSpace, providing a streamlined way to verify the status of a permit.

Used effectively, tools such as MineSpace can help reduce administrative delays and improve communication between proponents and regulators, not only during the permitting process itself, but also throughout the lifecycle of a project.

An in-depth knowledge of the relevant legal framework is important for the preparation of successful permit applications, as it helps proponents understand the rationale behind the authorizations and decisions by regulators.

The primary legislation governing mining activities in B.C. is the “Mines Act,” which applies to all stages of a mining proj-

ect, from exploration and production to reclamation and closure. Before commencing any work on, in, or about a mine, permits must be issued under the Mines Act and, as part of the application process, proponents are required to detail the proposed work as well as plans for conservation and reclamation. Alongside the “Mines Act,” the “Health, Safety, and Reclamation Code” acts as a primary tool for the mining industry, setting out detailed regulatory standards for worker health and safety, environmental protection, and site reclamation, while the “Environmental Management Act” plays a significant role in regulating waste from mining activities. Proponents should also be aware of other provincial acts and regulations, including the “Land Act, Forest Act, Wildlife Act, and the Water Sustainability Act,” which may also apply to a mining project either now or in the future.

In addition to the legislation noted above, proponents should be mindful of any ongoing negotiations with Indigenous groups, including treaties or other agreements, in addition to Indigenous rights or title that has been asserted over the lands comprising a project, any of which may influence applicable consultation requirements associated with the permitting process in question.

Since every project is unique, with its own set of issues of importance to stakeholders, mining proponents in B.C. should always seek to engage in a process of effective and meaningful consultation. Consultation with Indigenous groups and stake-

holders is not only key to building project support but is an integral part of responsible mining and consequently influences the timely approval of permit applications.

Key strategies for engaging in meaningful consultation include the following: (i) engaging with Indigenous groups and other stakeholders early in the planning stage (even prior to any formal consultation); (ii) committing to open and transparent communication throughout a project’s lifecycle; (iii) regularly updating stakeholders on developments while promptly addressing concerns; and (iv) demonstrating commitment through timely action on community interests and the mitigation of potential impacts.

Lastly, to streamline the process overall, it is important for proponents to prioritize the preparation of comprehensive, high-quality application materials, and to adopt a proactive approach to permitting. This includes planning applications well in advance of any intended operations and carefully considering relevant factors, including the project’s location and description, environmental conditions in and around the project, and potential impacts to the project area and the interests of stakeholders.

Robin Longe is a partner in Dentons Canada LLP’s corporate group and acts as co-leader of the firm’s national mining group. Alexander Tatti is an associate in the corporate group of Dentons Canada LLP’s Vancouver office.

By

IWhat have you done today that did not involve a mineral?

n 2018, Gregory Unruh introduced the term “geomimicry,” defining it as the “imitation of physical geological processes in the design and manufacture of products and services.” This prompt a fascinating question: Is mineral processing a reverse of mineral deposit formation? To explore this, the authors compiled the comparison in Table 1, highlighting how Earth’s natural processes and human mineral processing align and diverge.

The Earth’s rock cycle continually constructs and destructs minerals over millions of years through processes like erosion, deposition, and metamorphism. In contrast, humans extract minerals and elements (e.g., potash, copper, gold, and lithium) from deposits and process them into usable forms within hours to months. Mineral processing, as a branch of extractive metallurgy, separates minerals from rock and ore into concentrates that can be further refined. Are these human-made processes mimicking Earth’s geological toolkit, or are they fundamentally distinct?

Mineral processing might appear to reverse nature’s work by breaking apart what nature has concentrated. However, the mechanisms and objectives differ significantly owing to the application of technology. While Earth’s processes are open systems operating slowly and naturally, human systems are closed, industrial, and designed for speed and efficiency. Interestingly, nature does on occasion separate out pure elements such as gold or silver. Yet humans cannot perfectly separate what nature has formed in mineral processing, necessitating refining to achieve greater purity. While nature benefits from abundant energy, an energy balance on either natural or human processing would likely reveal both to be inherently inefficient.

Both nature and humans rely on factors like gravity, water, temperature, and microbes, but humans amplify and modify these processes with tools and technology. For example, water naturally transports particles in some mineral deposits, while

humans use hydraulic systems to extract minerals rapidly. These adaptations allow humans to replicate Earth’s natural forces exponentially faster without ever fully knowing the longterm environmental cost. This is especially concerning when humans may add chemicals or genetically engineered microbes that were not originally present in the ore into the process.

Key differences suggest why geomimicry is not fully applied in mineral processing are as follows:

Timeframe: Nature’s system operates over millions of years, whereas human processes occur almost instantly by comparison. This disparity emphasizes that we must respect the finite nature of Earth’s resources, as replenishment is not feasible on a human timescale.

Spatial flexibility: Earth’s processes are bound to the geological conditions of a specific location, so no deposit will form if the region lacks the necessary conditions (heat, pressure, fluids, etc.), no matter how long the timeframe. Humans, however, can leverage resources from multiple locations globally, shipping ores and raw materials.

Selective concentration: Humans adapt technology to concentrate specific minerals or elements for removal from a property. In contrast, nature’s processes are holistic, shaping entire landscapes and ecosystems.

Landforms changes: Human extraction permanently alters local/regional geology, often leaving behind segregated waste piles. In contrast, nature continuously reshapes landforms and ecosystems without creating permanent depletion.

Earth’s mineral deposits are akin to a savings account built over millions of years. Humans act as both spenders and managers of these resources. Yet, without careful management, we risk exhausting this account, leaving little for future generations. Humans have leveraged incredible ingenuity to develop pro-

Table 1.

PARAMETERS

Landscapes and ecosystems

Geomimicry

Natural accumulation

Nature’s processes inspire human designs for mineral processing

Goal Nature builds mineral deposits over time

Time

Processing

End use

Cost to humans

Mineral recovery

Rock, mineral, element breakage

Supplies

Millions of years

Nature concentrates minerals/elements through physical/ chemical processes including erosion, gravity, hydrothermal activity, magmatic differentiation, metamorphism, precipitation, and sedimentation

Geochemical and microbial interactions with minerals liberate elements (e.g., Na, Ca, K, Zn, Si) that plants metabolize to grow

Unnoticeable, through to natural disasters

Orebody stores 100% of the minerals available

Natural: Mega to nano scale tectonics (e.g., faulting) and erosion break rocks for subsequent mineral/element extraction; plant roots and freeze-thaw cycles also break rocks

Local/regional geology

Transportation Movement by fluids (e.g., water or magma), glaciers, and gravity

Mineral accumulation

Elements

Pressure

Temperature

Water chemistry

Dewatering

Energy source

Sorting

Microbes

Waste

Recycling

Acid rock drainage (ARD) when geology appropriate

Minerals grow, crystallize and deposit

Minerals incorporate various elements

Ambient to several bars

Ambient to 600oC

Meteoric and/or hydrothermal waters transport leachate metal elements/ions

Water in fluids eventually dissipate

Overburden pressures, plate tectonics, and weathering

Rock and ore deposits are homogeneous, layered, or zoned depending upon ore genesis

Aid in deposit formation and mineral/element concentration

Concentrated in the matrix of the orebody

Ongoing process of Earth to construct and deconstruct deposits

Natural sulfuric acid leaches metals, resulting in acid rock drainage (e.g., supergene deposits)

cesses that mimic geological forces, but are we truly respecting Earth’s limitations? Mineral processing is not truly the reverse of mineral deposition, instead, it is an extension of nature’s processes. Earth’s systems will continue to persist, with forces far surpassing human activities.

This brings us back to the reflection in the November 2024 and December-January 2025 articles of the Canadian Mining Journal: What have you done today that did not involve a mineral? As we enjoy the benefits of extracted resources, we must also consider the long-term impacts of our actions. Are we leaving enough for future generations to thrive, or are we depleting Earth’s natural resources value chain?

Synthetic accumulation based on sorting out waste

Human processes sometimes emulate natural processes

Humans deconstruct ore to extract valuable minerals

Hours to months

Humans isolate through industrial techniques (blasting, comminution, flotation, gravity, leaching, magnetics, precipitation, and refining) that employ physical/ chemical processes for a concentrated metal, gem, or industrial mineral

Chemical (microbial) interactions with minerals liberate elements (e.g., Cu, Au, Ag, Fe, Pb, Zn, Si) for commercial products like cell phones

Immense financial investments are required for extraction through to reclamation

Depending on the process employed, recovery can vary significantly (30% to 98%)

Anthropogenic: Humans use blasting, crushing, and cutting techniques to break rocks, enabling mineral/ element extraction and processing

Local/regional/global geology

Movement via equipment such as trucks/conveyors

Existing minerals are recovered and concentrated by processing

Minerals may be processed to extract various elements

Ambient to several bars

Ambient to 200oC

Ground or surface water sources are modified by manufactured chemical solutions

Concentrates are dewatered

Manufactured electricity

Hand and/or mechanical sorting such as cutting, precipitation, and sieving

Aid in mineral decomposition including processes such as bioleaching

Separated out and stored as tailings/waste rock

Selective and inefficient recycling by humans

Concentrated tailings and processing chemicals of appropriate chemistry result in ARD

Let us ponder not only to the power of Earth’s systems but also the responsibility we hold in managing them.

Connections within the industry can expand our knowledge. Bruce Downing, a geoscientist consultant based in Langley, B.C., combines research, education, geochemistry, and industry in geoscience. Donna Beneteau, an associate professor in geological engineering at the University of Saskatchewan, combines academic insight with industry experience in mining. Daniel Hamilton, a metallurgical engineer turned laboratory engineer at at the University of Saskatchewan, bridges practical and research applications in mineral processing.

There are moments in every career when you pause and reflect not just on what you do, but why you do it. For me, that reflection always leads back to a quiet but steady sense of pride. I work in mining innovation in Canada. And to me, that is something worth being patriotic about.

Patriotism is often associated with flags and anthems, but I believe it can also be found in the work we do. When I think of mining in Canada, not just the mines but the entire supply chain, I see a deeply Canadian story; one of resilience, responsibility, innovation, and collaboration. I see people who go underground or into remote field camps, who work in labs and offices and workshops, all contributing to something much larger than themselves. And I believe that this story deserves more recognition not only within our industry, but also in the broader national conversation.

Mining has played a significant role in shaping Canadian identity, reflecting the country’s history, economy, and cultural development. From Klondike to Sudbury, from Val-d’Or to the Ring of Fire, we have extracted more than ore; we have pulled communities out of the wilderness, built towns and economies, and contributed to national prosperity in ways that are often overlooked or misunderstood.

There is quiet humility to how we operate in this sector. Maybe it is our Canadian nature, but we do not always talk about mining with pride. We let the headlines dwell on controversies or environmental challenges without balancing them

with stories of responsible development, groundbreaking technology, and a deep cultural respect for the land. And yet, those stories exist in abundance especially here in Canada.

When I see a haul truck roll out with sensors that help it avoid a collision or hear about a miner finishing their shift early thanks to AI-assisted decision making or talk to a young tradesperson who just completed their CWB welding certification to work at a mine site in the north, I do not just see progress; I see purpose. I see a country living its values through its resource sector.

Mining innovation is not only transforming operations but also creating opportunities for more meaningful and fulfilling work across the industry. In my own role, I have the privilege of working on the innovative side of mining. Whether it is introducing electric vehicle technologies to underground environments or helping industry partners adopt artificial intelligence and machine learning, the goal is always the same: make mining better, safer, leaner, more efficient, and human centered.

There is something uniquely satisfying about knowing the work you are doing is not just about the bottom line. It is about reducing diesel particulate exposure to workers. It is about minimizing environmental footprints. It is about using data to protect lives, not just optimizing operations. And every time we push a new idea forward or pilot a piece of new technology, I

am reminded that this is Canadian work. This is what it looks like when we apply our values to our industries.

Canadian mining innovation does not chase hype, it builds for longevity. We prioritize environmental, social, and governance (ESG) principles not because it is trendy, but because it is who we are. We push for safety not just to meet regulations, but because we genuinely care about our crew. And when we design or deploy new technologies, we do it with an eye toward integration, sustainability, and long-term benefit not just headlines.

Canadian mining increasingly reflects the nation’s core values of sustainability, inclusivity, and responsible resource development. In many ways, Canada is uniquely positioned to lead in the future of mining not only because of our mineral wealth, but also because of how we approach mining itself.

While we still have much work to do, we have made significant strides in Indigenous engagement and inclusion. A recent positive example is Technica Mining’s collaboration with Atikameksheng Anishnawbek and Wahnapitae First Nation with the Aki-eh Dibinwewziwin Limited Partnership (ADLP), a mine contracting partnership. Moreover, our environmental assessment frameworks, while complex, are among the most robust in the world. Our workforce is highly skilled and increasingly diverse. Our world-renowned tech sector is contributing to solutions to age-old problems, and our colleges and research institutions are rising to meet the industry’s evolving needs.

When you look at the global landscape, Canadian mining stands out not just for the commodities we produce, but for the way we produce them. We are exporting more than just copper or nickel; we are exporting trust, reliability, and a model for how mining can be done ethically and efficiently.

It is time to renew our sense of pride in the mining sector by recognizing its vital contributions to Canada’s economy, communities, and clean energy future. Mining is not just a job. For many, it is a legacy. For others, it is a calling. For all of us, it is an opportunity to build, improve, and lead.

We need to start telling that story more confidently. The average Canadian may not see the connection between their smartphone and a nickel mine in Ontario, or between wind turbines and rare earth elements from our north, but we do. And we should be proud of it. We are not a sunset industry, we are the foundation of every transition that matters, from electrification to decarbonization.

So, to those working in the mining sector across Canada — in the field, in the shop, in the lab, and in the boardroom — I want to say this: your work matters. You are part of something deeply Canadian. Something worth celebrating.

Steve Gravel is the manager of the Centre for Smart Mining at Cambrian College.

By John Sandlos

When I first moved to St. John’s, I heard about Bell Island almost every morning on the radio. If the traffic report said the ferry is moving well on the tickle (a narrow straight in Newfoundland English), that meant commuters to and from what is essentially a bedroom community for the nearby provincial capital had escaped the common delays of rough seas, bad weather, or mechanical breakdown — at least for one day. Eventually, I took my two boys out to Bell Island as they got a bit older, but not so old they would not find the ferry ride a big adventure. Bell Island is not a big place (about 34 km2), but between picking wild cranberries, eating the best fish and chips in the St. John’s area (at Dicks’, right by the ferry terminal), and hanging out at the lighthouse, there was no shortage of things to do.

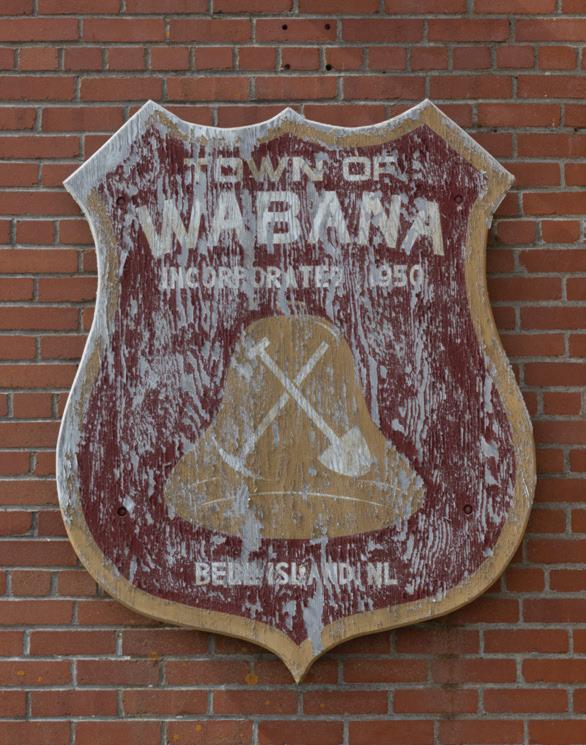

One of the biggest thrills of all was visiting the “No. 2 Mine Tour and Museum” near the main town of Wabana. Here, we learned that the mine had begun in 1895 as a small open pit (surface) iron operation, but an American industrialist, Henry Melville Whitney, purchased some of the Bell Island holdings in 1899 as a source of iron for his new Dominion Iron and Steel Company steel mill in Sydney, Nova Scotia (the remainder of the Bell Island claims were owned by the Scotia Company, who operated a smaller steel mill in Sydney). By 1902, Dominion Iron and Steel and Scotia had depleted the surface deposits at Bell Island and began to push tunnels out under the sea, using room and pillar mining to extract the iron ore. Before the mine closed in 1966, miners had produced nearly 80 million tonnes of ore, 25% of the iron used in Canadian steel production while the mines remained open. The Bell Island mines had doubled its annual ore production between 1935 and 1965, peaking at nearly two million long tonnes of ore annually, but the surbit

face mines of the newly developed Labrador and Quebec iron mining complex were cheaper to operate than the complex sub-seabed mines of Bell Island and yielded a higher-grade ore. The last of the Bell Island mines (No. 3) closed in 1966. The island’s population dwindled from 12,000 to roughly 2,000 people today. As if to drive home this point, at the end of our tour the guide whirled a light toward the end of a tunnel, revealing how seawater had reclaimed much of the former mine.

A mine is always much more than the ore it produces, and Bell Island seems to have more than its fair share of colourful characters. In her popular book, “The Miners of Wabana,” local historian Gail Weir documented the quirky beliefs and habits of the Bell Island miners. Some, for instance, invoked taboos against calling on men who had slept through their shift because it meant certain death for the latecomer. Experienced miners often played pranks on the newbies, sending them to the shop for a fictitious “skyhook” or asking them to fill a wheelbarrow with smoke. Folk beliefs permeated the cultural life of the mines. Miners and their family members often claimed they had seen the ghosts of those killed in accidents, chilling late-night sightings of miners underground or on the surface who left no footprints. Others claimed to have seen, and even spent time with, diminutive faeries, encountering them in the mine and on the surface. Perhaps more tangibly, miners also maintained close relationships with animals, caring for the horses that worked in the mines and sometimes adopting individual rats that lived underground as pets. Of course, work at the Bell Island mines was primarily devoted to drilling, blasting, mucking, and hauling, the same as miners anywhere else in the world. But Weir’s account of Bell Island is

a good reminder of the unique cultural practices that may develop in tandem with a mine.

Bell Island is also exceptional as one of the few places in North America to come under direct German attack during World War Two. Newfoundlanders were aware of the threat from German U-Boats, as news of torpedo attacks on North Atlantic shipping convoys featured prominently in local newspapers. In March 1942, three explosions rocked the south side of St. John’s Harbour as a German submarine bounced torpedoes harmlessly off the rock. But on September 5, 1942, Bell Island iron ore became a target as the submarine U-513 followed a coal boat into Conception Bay and settled on the ocean floor at 20 metres depth close to the ore carrier loading docks. The next day, U-513 sank two ore carriers, the SS Lord Strathcona and the and the SS Saganaga, killing 29 crew members. Although military censors kept news of the attack out of the press, word of mouth accounts of the tragedy spread, and Canadian navy commanders beefed up anti-submarine patrols around Bell Island.

Even so, another attack occurred on November 2, 1942, as U-518 arrived with the explicit mission of attacking iron ore carriers headed for Sydney. Weir interviewed one Bell Island resident, Joe Pynn, who claimed he saw the submarine in the days leading up to the attack and tried to warn the Canadian navy, but nobody believed him. The U-boat aimed its first torpedo at the SS Anna T., but missed, hitting the pier, resulting in a loud explosion that alerted Bell Islanders to the attack. U-518 then sunk the SS Rose Castle, killing 28 crew, and then a Free French ship from North Africa, PLM 27, killing 12 crew. These two attacks compounded other tragedies that had occurred that fall, most notably the sinking of the Caribou on October 14, a passenger

ferry on route from Sydney to Port-aux-Basque, with 167 people lost at sea. At Bell Island, the Canadian Navy managed to prevent further U-boat attacks by installing protective steel netting around the pier, but the heavy toll of U-boat attacks had brought the war home to Newfoundlanders in a terrible way.

As with so many places where a mine has shut down, Bell Island has harnessed its mining history to re-brand itself as a tourist destination. In addition to the mine tour, the No. 2 Museum displays a collection of remarkable photographs by famous photographer Yousuf Karsh, who visited Bell Island in 1953 to document the working life of the miners for Maclean’s Magazine. In 1990, a group of Wabana residents organized a mural project to commemorate the town’s mining heritage and attract visitors. Scuba diving tours of the shipwrecks are popular, while in 2016 the Royal Canadian Geographic Society funded a diving expedition into the old mining tunnels. From 1997 to 1999, a theatre group produced a play, “Place of First Light: The Bell Island Experience,” based on the lives of historical figures who worked in the mines. In 1988, the Canadian government designated the mine workings of Bell Island as a site of national historical significance, recognizing its contribution to the Atlantic steel industry and its status as Newfoundland’s most important mine.

John Sandlos is a professor in the History Department at Memorial University of Newfoundland and the co-author (with Arn Keeling) of “Mining Country: A History of Canada’s Mines and Miners,” published by James Lorimer and Co. in 2021. His new book, “The Price of Gold: Mining, Pollution and Resistance in Yellowknife” (also co-authored by Arn Keeling), will be released with McGillQueen’s University Press in 2025.

By Tamer Elbokl, PhD

Few figures have shaped Ontario’s mining landscape as profoundly as Chris Hodgson (CH). He has left an indelible mark on Ontario’s mining industry. His career, which spanned both politics and industry leadership, showcases his unwavering dedication to the sector. Hodgson’s journey from natural resources critic to mining minister, and ultimately to a 20year tenure as president of the Ontario Mining Association (OMA), reflects a deep commitment to advancing the sector. In this wide-ranging interview, Hodgson speaks with the Canadian Mining Journal about his unexpected entry into mining, the tough decisions that defined his time in office, and the major strides made under his leadership — from groundbreaking safety reforms to reshaping public perceptions of the industry. With decades of experience bridging government, industry, and communities, he offers insights into the evolution of mining in Ontario and what lies ahead for the province’s critical minerals future.

job for 20 years and is also a former member of the legislature. The OMA approached me in 2004 and asked if I would consider replacing him. I initially wanted to be there for only two years, but it turned out to be 20 years. The OMA is a great group of people to work with. The whole experience was 30 years from my first exposure to mining.

CMJ: WHAT WERE SOME OF THE MOST CHALLENGING DECISIONS THAT YOU HAD TO MAKE AS MINISTER?

CH: One of the most challenging decisions was lifting the Land Caution on the Temagami area and initiating the mineral exploration survey called Operation Treasure Hunt. There was an issue in the 1980s and 1990s that paralyzed the interior government with different factions, and we were able to pull them together. I got along well with the First Nations and the environmentalists in that area. They could see the benefit of mining there and were interested in seeing the potential. It was a great success story.

CMJ: LOOKING BACK, WHAT ARE YOU MOST PROUD OF DURING YOUR TENURE AS PRESIDENT OF THE OMA?

CMJ: TO START OUR CONVERSATION, CAN YOU TELL US ABOUT YOUR JOURNEY SERVING BOTH AS A MINING MINISTER AND AS THE PRESIDENT OF THE OMA?

CH: I was elected to the Ontario legislature in a 1994 by-election, and I was appointed as critic of natural resources. I spent a bit of time with Mike Harris in Northern Ontario in the lead-up to the 1995 provincial election, and after the election, Premier Harris asked me to join his cabinet. It was a small cabinet with only 18 members. I was given what had been three ministries in the previous government: Northern Development, Mines, and Natural Resources, which included parks at that time. My assistant deputy minister in Mines, John Gammon, was very knowledgeable and basically educated me on mining. Through his teachings, meeting miners, and forming working groups that included people from exploration through to operations, I got a good understanding of mining. I retained Northern Development and Mines until 1999 and retired from politics four years later. My predecessor at the OMA was Patrick Reid, who had the

CH: I am proud of our work with Ontario’s chief prevention officer. Through the 1970s and up to 2014, safety incidents resulted in management and labour hiring lawyers spending weeks in judicial inquiries at huge expense. Big reports were issued, but they would just sit on the shelf — they did not improve the numbers in terms of safety. When Ontario created the Mining Tripartite Committee, the government, management, and labour were able to work on issues to improve mine safety. That resulted in a continual improvement in lost time injuries. In the 35 years from 1975 to 2010, the Ontario mining industry achieved a 96% improvement in lost time injury frequency and, today, performs better than the Workplace Safety and Insurance Board (WSIB) industry average (public and private sector).

We worked with George Gritziotis, the chief prevention officer, to set up the Mining Health, Safety, and Prevention Review. That was a very successful collaborative approach that brought all stakeholders closer together instead of it being a confrontational process. All sides learned a lot and brought in

some new ways to improve safety.

We also overhauled the “Mining Act” twice and introduced the “Building More Mines Act.” We helped shape Ontario’s first ever critical mineral strategy. We published economic labour research reports that help the public get a clear snapshot of the economic and social benefits of mining for Ontario.

Some of the accomplishments I am most proud of are our public outreach programs. With “Mining Matters” and the “Canadian Ecology Centre,” we implemented a teachers’ tour, where teachers are exposed to modern mining, learn the benefits and how it works, and then pass that knowledge on to their students. We launched the “This Is Mining” campaign to celebrate the centennial of the OMA, which included an award-winning podcast, and this later evolved into “This Is Mine Life” — an initiative that aims to encourage more young people to consider careers in mining. We ran the “MINED Open Innovation Challenge” in 2017 and 2018 (where university students solved a real-life mining challenge). We worked with Moses Znaimer at the “ideacity conference” to expose a new audience to modern mining. We also hosted the “So You Think You Know Mining” contest from 2009 to 2016, where students put together short videos on mining. For that contest, we gave away thousands of dollars in prizes, we had judges from the Toronto International Film Festival (TIFF), and the premiers and cabinet ministers attended the awards ceremonies. The winners were mostly young people in the arts community who would have never been exposed to mining. It was a lot of fun and a great opportunity to see young people interacting with the mining community.

We recognized the need to redefine mining’s reputation (rebrand mining), reach young people, and make sure that the public understood how essential mining is to our modern society. So, we polled the public every year to make sure our message was getting through. At first, there was a lack of understanding: people thought we were running 19th-century coal mines in Charles Dickens’ world. Now, the polling shows unbelievable support on the environmental side of mining. People realize that if you are going to achieve a carbon-neutral state by 2050, you need mining to be the backbone for those improvements in technology. It all comes from minerals. People also see the need for local supply chains and manufacturing —

the public was ahead of the politicians on this one. Given the current trade situation, everyone is realizing the critical role mining playing in supply chains needed for advanced technologies that play an important role in our geopolitical and economic security.

CMJ: HOW HAS ONTARIO’S MINING SECTOR EVOLVED OVER THE

YEARS? WHAT DO YOU SEE AS ITS BIGGEST ACHIEVEMENTS?

CH: I think safety has always been the top defining aspect in the culture of mining, and in Ontario, we have really improved lost time injuries. We use better technology, like sensors and remote drilling to mitigate the risk of injury. Injuries do still happen, and they are so heartbreaking for families and communities,

so safety has always been the focus. Our industry has been at the forefront of adapting to make sure that mining is done in a more sustainable, environmentally friendly manner. Not only do our products reduce carbon in the world, but we also walk the walk in our operations. Carbon footprints have dramatically decreased, electricity has replaced diesel, and technology is allowing us to reduce pollution and greenhouse gas (GHG) emissions at a faster rate than we used to. For example, real-time monitoring of the airshed around Sudbury was not possible 40 years ago. In the old days, everybody wanted things modelled, but we have shown that modelling can be inexact and twisted to fit someone else’s agenda. Real-time testing avoids those issues. We have not always been early adopters of new technology because it is so expensive, and mistakes are costly, but when a technology is proven to improve safety and environmental protection, our industry has really invested in it. It has been a pleasure to work with miners and see these achievements over the last 30 years.

CMJ: THINKING ABOUT THE PERMITTING PROCESS FOR MINING IN ONTARIO, AND CANADA IN GENERAL, WHAT KIND OF ADVICE WOULD YOU GIVE TO THE POLICYMAKERS TODAY REGARDING MINING REGULATIONS AND PERMITTING?

CH: The OMA has a strong culture of bringing people together, and I think they should continue that type of forum, whether it is a minister-led advisory that we are part of or we are working with labour and management on a new type of forum. The bottom line is that the world has changed. Mining is more important now than it has been in the last five or six generations. We need more mines, shorter permitting time, and robust environmental protection, but the processes must be way more efficient. I think governments are reacting to that at every level in all parties. You must gather the right people and understand the details to sit down and say, “Our goal is to shrink

permitting process from 15 years down to five, or even shorter. What are the key things that we need to do, and how can we then reverse engineer it?” I think the best forum to do that is with the OMA, government, labour, and some environmental groups. Indigenous communities and First Nations must be involved in that reverse engineering to come up with what they need.

CMJ: IN YOUR OPINION, WHAT ARE THE BIGGEST RISKS OR CHALLENGES FOR THE FUTURE OF MINING IN ONTARIO?

CH: We will want to make sure that Ontario is part of the new manufacturing, processing, and supply chains that are being developed, and that they will last for 40 years. Ontario should be the global minerals supplier of choice, and Ontarians and the local population should benefit from this realignment of the supply chains.

CMJ: WHAT IS THE OMA’S ROLE IN THAT PROCESS?

CH: I think the OMA should stick to their values in terms of making sure that Ontario mining is competitive and can grow. Patrick Reid and Priya Tandon (my predecessor and my successor at the OMA, respectively) share the same philosophy of collaboration and making sure that our voice is not only heard but also brings people together to promote more mining. There is no other group that has the breadth of knowledge that the OMA has.

Thirty years ago, we were at the mercy of a global market where commodities were declining in real value for the previous 100 years. Buyers had the advantage, and we had to think

on behalf of the customer. Now, suppliers have the advantage; customers need our product. As they say in real estate, “It is a seller’s market.” That should change the way we regulate and manage and how we look to the future of mining. These changes could last for the next 40 years, so public policy should adapt to that or at least be cognizant of it. The OMA can play a role in promoting that and increasing public knowledge as well.

CMJ: IF YOU HAD THE CHANCE TO IMPLEMENT ONE MAJOR CHANGE IN ONTARIO’S MINING SECTOR TODAY, WHAT WOULD IT BE?

CH: I think we must keep getting younger people involved in understanding the importance of mining. We are making some good progress on that, but I would put it into the curriculum around economics. Canada is well-positioned for this new world — our natural resources are really in demand now, especially when the global supply chains are realigning — but we must get more people involved in navigating it. It cannot just be a reaction to some other country’s agenda. We need to be more proactive and more strategic.

CMJ: FINALLY, HOW ARE YOU ENJOYING YOUR RETIREMENT?

CH: I still sit on several boards, so I am keeping active. Marie and I went to Florida for a month and had our family come down to visit. We have four kids and two grandkids. Our youngest daughter just got engaged. So, things are busy, but I am really enjoying it.

Kesiah Stoker is a multi-skilled freelance writer.

(705)

(819) 797-3866

GLOBAL

QUARTERS Pittsburgh, PA, USA (412)-963-9071

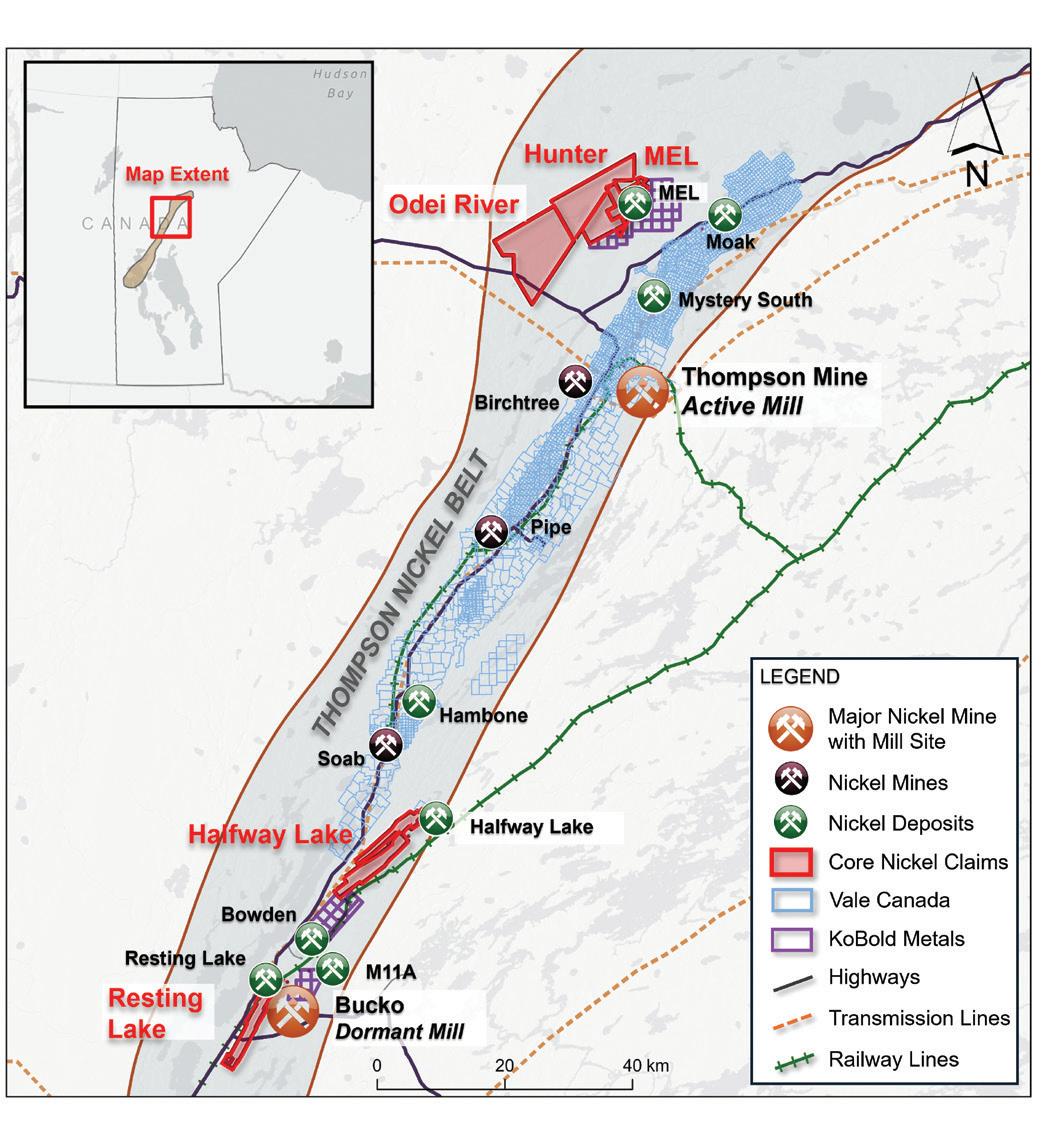

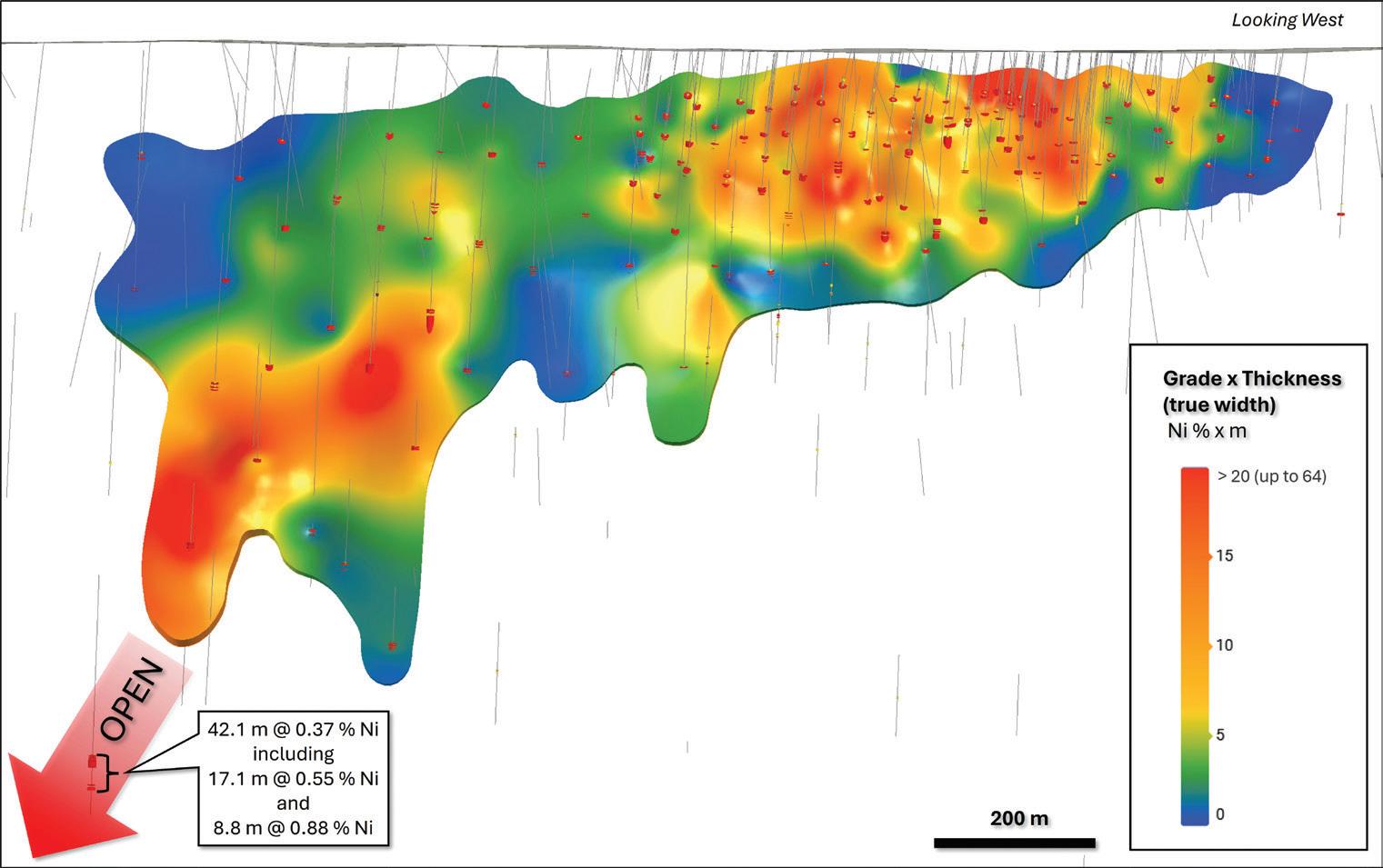

Core Nickel Corp. (CSE: CNCO) is quickly gaining traction as an emerging exploration company targeting highgrade nickel sulfide systems in northern Manitoba. Since listing in late 2023, the company has raised $3.9 million in capital, secured nearly $0.5 million in non-dilutive government funding, launched multiple drill programs, and initiated airborne surveys across key assets — all while firmly establishing itself in the globally significant Thompson Nickel Belt.

The company’s exploration efforts are centered on the Thompson Nickel Belt, the world’s fifth-largest nickel belt and a globally significant source of high-grade nickel sulfide. Though more than five billion lbs. of nickel have been mined from the region, large portions of the belt remain underexplored using modern geological and geophysical techniques. Because of this long history of mining activity, the region boasts exceptional infrastructure to support future development, including all-season highways, rail connections, and access to two nearby nickel mills: Vale’s Thompson Mill, which has a processing capacity of approximately 12,000 tonnes per day (t/d), and the Bucko Mill near Wabowden, which has a capacity of 1,000 t/d. The entire area is powered by Manitoba’s nearly 100% clean hydroelec-

tric grid, providing a significant advantage for low-carbon, sustainable development.

Core Nickel holds 100% ownership in 270 km2 of land across five properties in the Thompson Nickel Belt: Mel, Halfway Lake, Resting Lake, Hunter, and Odei River. The company’s flagship Mel project hosts a historical mineral resource consisting of an indicated resource of 4.28 million tonnes grading 0.875% nickel (Ni), and an inferred resource of 1.01 million tonnes grading 0.839% Ni, using a cut-off grade of 0.5% Ni. The Mel deposit is situated only 20 km from the Thompson Mill and just 10 km from a provincial highway, providing excellent access to processing and transportation infrastructure.

The company’s strategy includes both expanding the historical resource at Mel and identifying new discoveries within its broader land position. This effort is being supported by a property-wide helicopter-borne versatile time domain electromagnetics (VTEM) and horizontal gradiometer geophysical survey across the Mel and Odei River projects. The survey is designed to identify conductive and magnetic features associated with nickel sulfide mineralization and will support a better understanding of the Mel deposit geology, assist with Mel resource expansion, and progress the understanding of the broader Mel and Odei River property geology. Upon completion of the VTEM survey on Mel and Odei River, Core Nickel’s entire land portfolio will be covered by modern VTEM — one of the most vital tools used in nickel exploration within the Thompson Nickel Belt.

In parallel, Core Nickel has engaged Understood Mineral Resources to initiate a modern resource update for the Mel deposit. This process will incorporate new geological modelling alongside historical and new data to bring the deposit in line with current NI 43-101 standards. As part of this work, the company has launched a re-assay program using available core from past drilling at Mel to validate historical results and improve confidence in the resource model. The re-assay program will help inform the updated resource and support future drilling plans aimed at expanding and upgrading the deposit.

Core Nickel’s inaugural 2024 drill program was focused on the W62 Zone at the Halfway Lake Project, where the company completed three diamond drillholes totaling 797.45 metres. Results confirmed a wide nickel-bearing ultramafic package in hole HFW-002, which returned 91.05 metres grading 0.37% Ni from a vertical depth of approximately 120 metres. The intersection of prominent nickel-bearing ultramafics is encouraging, confirming the presence of nickel in the system. The next phase of exploration will aim to locate areas where nickel has been remobi-

lized and concentrated into higher-grade massive sulfide zones.

To support the ongoing target generation, Core Nickel completed a property-wide VTEM and horizontal magnetic gradiometry survey over the Halfway Lake and Resting Lake properties in the summer of 2024. The survey identified 14 high-priority targets across Halfway Lake. In January 2025, the company commenced a 4,000-metre follow-up diamond drill program on

the Halfway Lake property to begin testing these high-priority targets. Drilling was planned for completion in mid-April 2025, with assay results anticipated in mid- to lateMay. The combination of promising geophysical targets and strong geological indicators from previous drilling makes Halfway Lake a key component of Core Nickel’s discovery-focused exploration strategy.

As Canada pushes to secure a domestic supply of critical minerals for electric vehicles and clean energy technologies, companies like Core Nickel are playing an increasingly important role. With a growing portfolio of prospective targets and a clear operational roadmap, Core Nickel is positioning itself to become a key player in nickel exploration.

The Thompson Nickel Belt remains one of the most compelling underexplored nickel regions globally. With a strong technical team, well-funded exploration plans, and collaborative development philosophy, Core Nickel is aiming to deliver results that match the scale of the opportunity.

By Theresa Sapara and Daniel Morales

In the face of mounting pressures, autonomy in mining is sometimes touted as a potential silver bullet — a transformative solution that promises to address the industry’s most pressing challenges. From enhancing safety and productivity to mitigating labour shortages and advancing sustainability initiatives, the allure of autonomous technology is undeniable. However, while the potential benefits are appealing, successful integration requires resolving multiple practical hurdles. Understanding the true implications of autonomy is key to unlocking its full potential.

Despite its promise, many mining companies, particularly brownfield operations, must address barriers to adopting autonomous technology. These include workforce readiness, capital constraints, network infrastructure, and ensuring appropriate and sustained technical and practical support, especially during the planning and ramp up phases.

Shifting to autonomous operations requires significant workforce readiness, including extensive retraining for employees. Transitioning to unmanned processes represents a substantial shift in operations, requiring new roles, oversight, and organizational adjustments. Traditional roles, such as equipment opera-

tors, will transition to more advanced positions like fleet managers, necessitating new skills and changes in operational modes.

Additionally, maintenance becomes more complex, as it must cover not only mechanical systems but also electronic components and software packages that need regular updates. The procurement of specialized parts can also affect supply chains and overall operational efficiency.

Cybersecurity measures are also crucial for protecting these autonomous fleets from potential threats, ensuring the integrity and safety of mining operations.

Lastly, both a wholesome understanding of the ramp up period and recognition of possible short-term impacts to productivity losses during initial integration phases are equally key

Indeed, EY’s “Top 10 risks and opportunities for mining and metals companies in 2025” report indicates that despite “Innovation” as a category dropping to tenth among top concerns for mining leaders, the industry’s focus on innovation persists, with more than half of global respondents (54%) anticipating increased investment in the coming year. Despite capital, geopolitical and regulatory headwinds, this desire for technological advancement remains strong.

But while autonomy presents attractive advantages, it is capital-intensive and often limited largely to big pocket play-

ers. Looking forward, the standardization of autonomous machines may increase their availability and lower costs, which smaller companies can benefit from. Ultimately, low-cost standardized autonomous machines have shown they can redefine constructive activities, such as mining, farming, and manufacturing. Regardless of subsector, a change management strategy remains fundamental to help determine when the jump to autonomy becomes practical.

Among the various automated technologies at the sector’s disposal, autonomous haulage systems (AHS) are particularly gaining traction. EY’s latest market data reveals mining executives and technical experts alike overwhelmingly view AHS as a pivotal element for the industry’s future, driven by the need for improved safety measures, cost reduction, and productivity enhancement.

Specifically, AHS has the potential to enhance safety by removing operators from hazardous environments, allow better control on wear and tear of equipment, decrease fuel consumption as well as mitigate labour shortages in regions like Australia and Canada.

A final consideration in a mining company’s autonomous transition can include the incorporation of peer reviews into the planning, piloting, or implementation phases. This begins with engaging subject matter experts to confirm the

scope and focus areas of the review and ensuring alignment with specific needs of the present or future autonomous program. Using a structured framework can allow organizations to evaluate critical pillars such as strategy, structure, change management, and operations, scoring each on a readiness scale. Based on subsequent assessments, transparent and independent recommendations can be developed and improvement opportunities tailored to the organization’s context.

By adopting this peer review process, mining companies can gain objective insights into their present and future autonomous initiatives, enabling a clear view of what’s working well and what needs more attention. This approach facilitates access to technical expertise, allowing organizations to effectively mitigate potential business risks. Companies can expect improved stakeholder alignment and enhanced overall readiness for autonomous adoption, leading to a more successful implementation and better operational outcomes.

The path to autonomy in mining is not linear. However, it presents opportunities for companies to enhance safety, productivity, and sustainability. Success in the robotic age will come to those who implement with intention — balancing constraints, leveraging proven technologies like AHS, and learning from peers along the way.

Theresa Sapara and Daniel Morales serve as lead and consulting manager, respectively, with the Americas Metals and Mining Centre of Excellence at EY.

When asked to describe the “mine of the future,” people generally think of one where every aspect of operations is seamlessly intertwined with artificial intelligence (AI). In the mine, you imagine autonomous drones over the pits, computer vision models monitoring ore extraction and handling, and AI-driven robots performing precise drilling and blasting. In the processing plants, AI-based recommendation systems improve the efficiency of mineral separation techniques, constantly learning and adapting to changing conditions. Across the mine site, deep learning algorithms monitor machinery to predict and help prevent failures and optimize maintenance scheduling to minimize downtime.

But the reality is that this vision is not a distant dream but an unfolding reality. According to various industry reports, the mining sector stands to gain over $370 billion in additional value annually by implementing AI and automation technologies, with AI alone capable of increasing productivity by up to 20%. One study found that AI-powered predictive maintenance could reduce equipment downtime by as much as 30%, while also extending the life cycle of machinery. In the realm of ore sorting, AI technologies have shown a 15% to 20% improvement in resource recovery rates. As these technologies continue to evolve, AI and GenAI will only deepen their footprint in the mining sector, enhancing efficiency and driving the industry toward a more sustainable and economically viable future.

The picture drawn at the start of this article is accurate at a high level, but that is exactly what it is: a high-level picture. Under the surface, there are several smaller AI and GenAI systems that can be developed across the entire end-to-end process cycle of any mine. These models/systems come together to create an intelligent ecosystem for how the entire mine operates in the most reliable, efficient, and profitable manner. But it is important to have a more detailed view on what these usecases can be within each part of the mine, and the underlying technical methodologies that enable these use-cases.

• AI-driven ore exploration: AI algorithms analyze geological, geophysical, and geochemical data to identify potential ore deposits. Machine learning (ML) models classify and predict mineralization zones based on historical and remote sensing data.

• Geological pattern recognition: Deep learning models, such as convolutional neural networks (CNNs), detect complex geological patterns in seismic data, satellite imagery, and other geospatial data, aiding in the prediction of mineral locations.

• Predictive resource estimation: Ensemble learning techniques model and predict mineral deposit sizes and grades, improving the efficiency of drilling locations and reducing costs.

• Ore sorting and material characterization: Computer vision models process images from ore sorting systems to identify ore composition and quality, improving the efficiency of material handling.

• Flotation process optimization: Combination of predictive algorithms and optimization models predict and adjust key flotation parameters such as reagent type, pH levels, and airflow to maximize mineral recovery.

• Energy and reagent consumption optimization: AI systems use optimization algorithms to balance energy and reagent usage in the plant, improving the costeffectiveness of mineral processing.

• Ore blend optimization: Metaheuristic optimization models (such as Genetic Algorithms) help optimize ore blending by considering ore quality and quantity, leading to efficient and consistent extraction.

• Material tracing: Predictive models analyze real-time material characteristics (e.g., hardness and mineralogy) to predict ore movement and assist with targeted blasting strategies.

• Optimized fragmentation and blasting; Reinforcement learning (RL) models adjust blast parameters such as charge size and hole placement in real time to optimize fragmentation while minimizing waste and energy usage.

• Autonomous fleet management: Autonomous haul trucks learn

optimal routing, speed, and load balancing for efficient material transport across the mine site, optimizing traffic, congestion, and fuel consumption.

• Load optimization: AI models dynamically adjust loading parameters to minimize haulage costs while maximizing payloads and minimizing fuel consumption.

• Predictive maintenance: Predictive machine learning models analyze sensor data to track equipment degradation, predict failures, and reduce downtime.

• Maintenance advisor: GenAI-based agents trained on equipment manuals, maintenance procedures, and any other documentation, allowing for maintenance personnel to interact with it in a conversational manner to extract information effectively while conducting maintenance.

As organizations march onto their journey to adopt these technologies, they will need to overcome challenges related to adoption and culture change. Building a robust change management pro-

gram is essential to ensure that the benefits of AI and GenAI are fully realized. This journey towards widespread adoption of these technologies will involve continuous learning and adaptation. Organizations must invest in upskilling their workforce, developing the necessary technological infrastructure, and establishing governance and risk management processes. By doing so, they can unlock the full potential and drive significant improvements using these technological advancements.

In conclusion, AI and GenAI are set to revolutionize the mining industry by enabling new levels of efficiency and innovation. The applications are diverse, have potential to be highly impactful, and it is only a matter of time until that “mine of the future” will just be every mine of today.

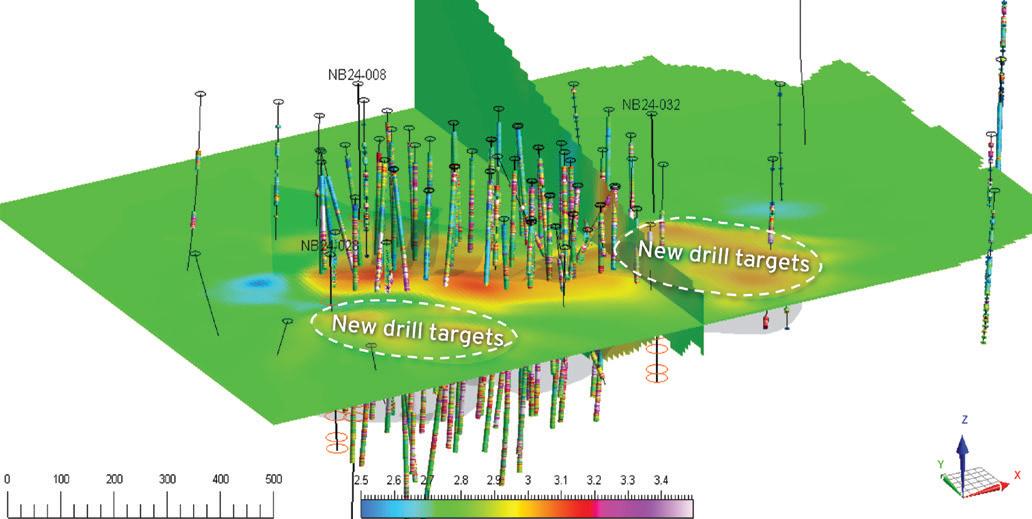

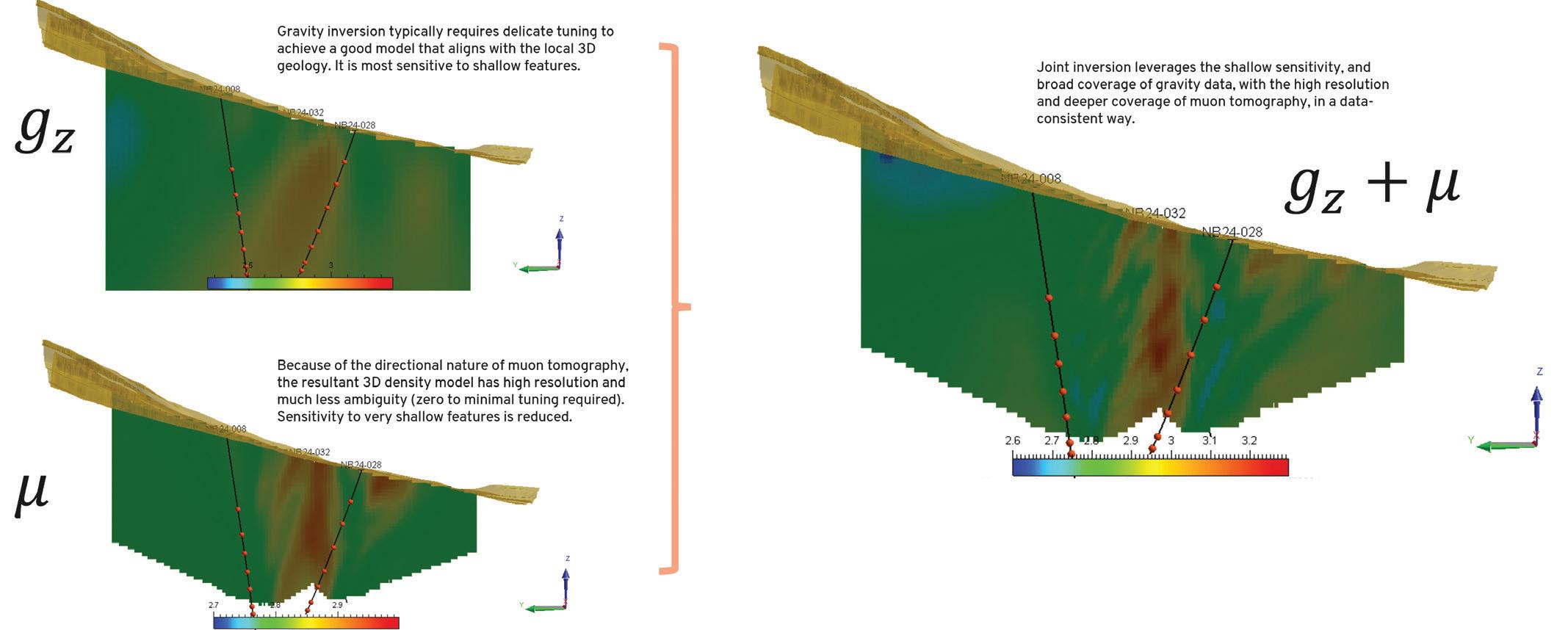

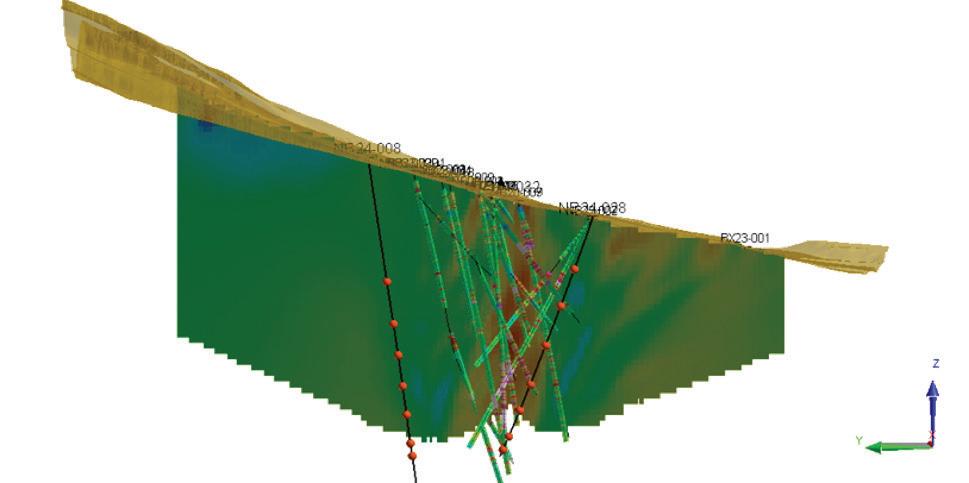

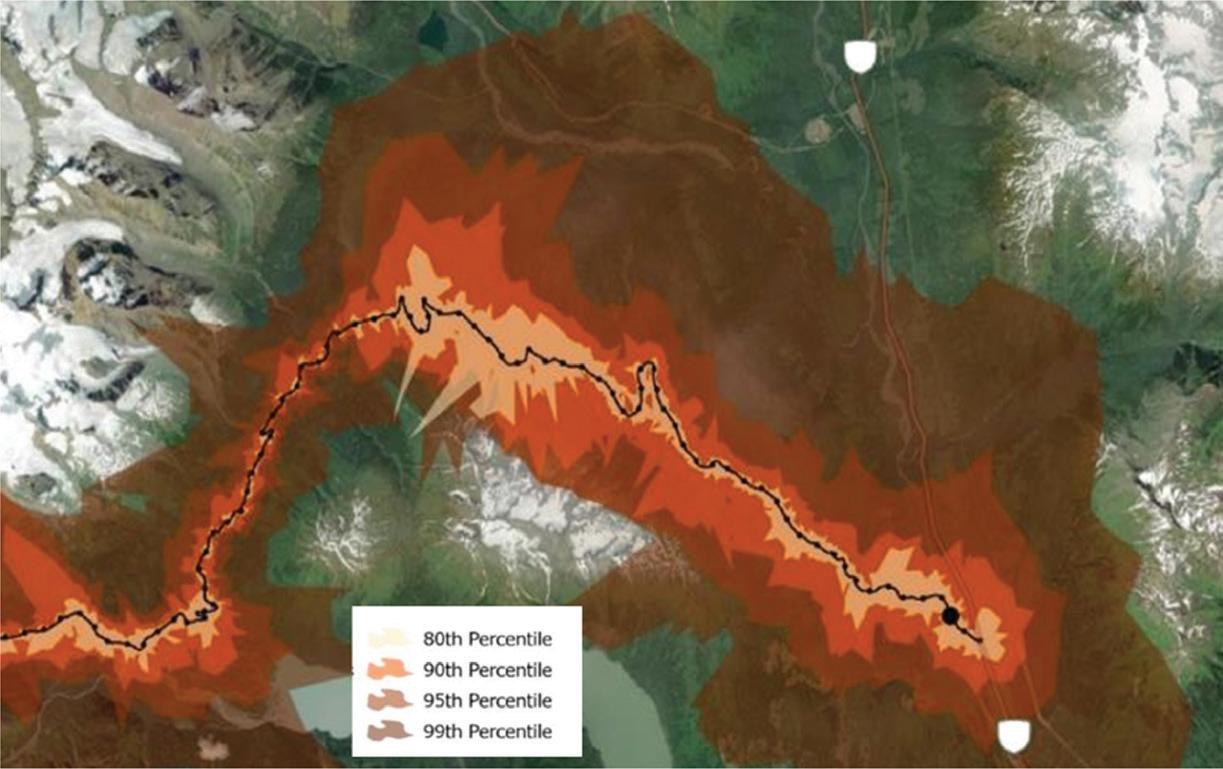

Nimit Patel is an AI/ML leader at QuantumBlack (AI by McKinsey & Company), leading the development and deployment of AI-driven solutions for mines across the U.S and South America. His work has been pioneering in the mining industry and has become a lighthouse case to show successful adoption of AI solutions across multiple phases of the mining life cycle. He is passionate about helping mining companies achieve groundbreaking improvements in equipment uptime, increased efficiency, and reduced processing costs and emissions.