TOP 10 DRILL RESULTS YTD — MAJOR METALS

Top assays of precious and critical metals from around the world / 9–15

Top assays of precious and critical metals from around the world / 9–15

YUKON | Shares hit new high after recent assays

BY COLIN MCCLELLANDDawson City, Yukon —

Shares in Yukon-focused Snowline Gold (TSXV: SGD; US-OTC: SNWGF) continued their ascent in August, with analysts saying the latest discovery at its Rogue project makes it a pumped-up version of Kinross Gold’s (TSX: K; NYSE: KGC) Fort Knox mine in Alaska.

Snowline reported a new highgrade zone of more than 2 grams gold per tonne at depth in its Valley target on Aug. 3 along with its strongest gold intersections so far. The company said they rank among the Yukon’s best ever.

It’s the latest in a series of drill results that have driven investor interest past the $19 million investment by B2Gold (TSX: BTO) in March, despite the project’s early stage and remote location about 200 km beyond developed roads.

“Valley is Fort Knox on steroids,” Michael Gray, a mining analyst at Agentis Capital, said in a note after Snowline reported 2.5 grams gold per tonne over 553.8 metres from surface including 5 grams over 132 metres from 6 metres downhole.

OBITUARY | Avalon founder pushed for Indigenous participation in mining

BY BLAIR MCBRIDEAs enthusiasm for zero-emission technologies accelerates into the mainstream, Canada has lost one of its earliest and most ardent champions of critical minerals.

Donald Stephen Bubar, founder and longtime president of Avalon Advanced Materials passed away on July 30 at the age of 68. The mining veteran, who worked as a field geologist and with several base and precious metals projects, recognized years before most others the importance of critical minerals for the future economy. And in his decades of involvement with the Prospectors and Developers Association of Canada (PDAC), advocated for greater and earlier engagement with Indigenous communities.

SNOWLINE REPORTED A NEW HIGH-GRADE ZONE OF MORE THAN 2 GRAMS GOLD PER TONNE AT DEPTH IN ITS VALLEY TARGET ON AUG. 3 ALONG WITH ITS STRONGEST GOLD INTERSECTIONS SO FAR. THE COMPANY SAID THEY RANK AMONG THE YUKON’S BEST EVER.

“We consider it a breakthrough to see more than 2 grams gold per tonne mineralization over a broad interval to more than 450 metres vertical depth.”

Snowline is the standard-bearer of a surging exploration scene in

the Yukon along the Tombstone gold belt. It arcs north from British Columbia then sweeps west from the Northwest Territories into Alaska, where Fort Knox has produced more than 9 million oz. gold over 27 years. Along the way is the Yukon’s only operating hard rock gold mine, run by Victoria Gold (TSX: VGCX), plus juniors Banyan Gold (TSXV: BYN; US-OTC: BYAGF), Sitka Gold (CSE: SIG) and St. James Gold (TSXV: LORD) with early-stage projects. Shares in Snowline Gold rose to a record $6.06 apiece on Aug. 9 before easing to $5.15 closer to press time. The company has a market cap of $731.2 million.

Investor darling

The Rogue project, like others along the belt, is on a reduced intrusion-related gold system but the grades in its drill results — like the 2.5 grams gold per tonne over 383.8 metres from surface, including 4.1 grams over 120 metres reported in August — are magnitudes more than Fort Knox’s 1 gram or Victoria’s 0.7 gram gold.

See ROGUE / 8

Bubar was born in Ormstown, Que., the eldest of two children. His early years were spent in Beaconsfield, near Montreal, where his father was a lecturer at McGill University’s MacDonald College. His family moved to Truro, N.S., in 1967 when Bubar’s father John began working at the Nova Scotia Agricultural College at Dalhousie University.

His son Andrew, who was inspired by his father to become a geochemist and now works with First Nations on major projects, believes Bubar’s time in Nova Scotia formed his sense of the connection between community and development.

“It made perfectly intuitive sense… that the people local to a project should benefit from it,” Andrew said. “He saw the writing on the wall that advancing a project requires a social licence to operate. And the importance of buy-in from neighbours.”

Bubar earned his Honours B.Sc. in geology from McGill in 1977 followed by his applied M.Sc. in Mineral Exploration from Queen’s University.

In 1994, he started Avalon Ventures (now Avalon Advanced Materials) as a junior miner focusing on base metal and gold projects. It acquired the Separation Rapids lithium project in northwestern Ontario in 1996, marking Bubar’s new focus on non-traditional commodities. Seven years

later, Avalon acquired the Thor Lake (Nechalacho) project in the Northwest Territories, which in 2022 began production of rare earths as a demonstration project. His son recalls as a child hearing Bubar talk about those projects.

BY ANTHONY VACCARO

BY ANTHONY VACCARO

Iam writing to announce an important change in our publication schedule that will directly impact you, our loyal readers. After careful consideration and with a tinge of nostalgia, I am excited to announce that The Northern Miner will be transitioning from its biweekly publication schedule to a new and improved monthly format, effective October 2023. The final biweekly issue will be the current issue, our Sept. 4-17, 2023 edition.

Since its inception in 1915, The Northern Miner has been a cornerstone of the mining industry, providing valuable insights, in-depth analysis, and up-to-date news on the mining sector. Over the years, we have witnessed significant changes in the industry, and we have strived to adapt and evolve our content to meet the needs of our readers.

The decision to switch from biweekly to monthly publication was not taken lightly. We understand the importance of timely information, and it is our commitment to ensure that we continue to

deliver accurate and comprehensive coverage of the mining world. This change will allow us to delve deeper into the trends, challenges, and opportunities the industry faces, enabling us to present you with more in-depth articles, well-researched features, and interviews with key industry experts. Our expanded print issue will also include a more robust markets section featuring more complete and useful data on warrants, precious metals ETFs, top financings and drill result highlights.

While our print frequency may change, our dedication to excellence remains unwavering. Our team of seasoned journalists, analysts, and contributors will continue to work diligently to provide you with the most insightful and relevant content. Additionally, our online platform will be enhanced to cater to your needs for breaking news, multi-media features, commentary and in-depth analysis.

Starting in October, The Northern Miner will be available as a

monthly publication. We kindly ask you to mark your calendars and adjust your reading routines accordingly. No action is required on your part. If you have any concerns, please contact our customer support team at: support@northernminer.com.

Once again, we extend our heart-

felt gratitude for your unwavering support and loyalty throughout our long history. We are excited about the future, and we look forward to continuing to serve you as the mining industry’s most trusted source of information.

we will forge ahead into this new chapter of our journey.

Regards,

FAR NORTH | Rio Tinto donates $250K to evacuee relief, exploration programs delayed

BY BLAIR MCBRIDEExplorers and miners in the Northwest Territories shifted focus to the safety of their staff and communities after the government ordered the evacuation of Yellowknife on Aug. 16 as wildfires edged closer. At just over 20,000 people, Yellowknife is the second largest city in the Far North and serves as a regional hub, including for resource development in Canada’s North.

At press time in late August, almost the entire population of Yellowknife had been evacuated, while more than 330 personnel, including members of the Canadian military, continued to battle fires in the region, said government wildfire monitor NWT Fire. The main threat to the city, a 1,670.8-sq.-km wildfire burning to its west, was 15 km from Yellowknife municipal boundaries..

Sixty North Gold Mining (CSE: SXTY), operator of the fly-in Mon gold project about 45 km north of

Yellowknife, said it had contacted its insurance company about a potential claim for its site.

Sixty North president David Webb said satellite imagery shows fires went through the camp, where there is almost $4 million worth of mining assets. Staff and a watchman at the site were evacuated before the fires reached it.

In a news release on Aug. 24, Sixty North said it had supported a visit by a supplier to Mon on Aug. 21, who reported that all equipment had survived the flames except for a six-trailer 20-person camp, two pick-up trucks and a quad ATV.

Webb, a gold mining veteran with more than 40 years’ experience in the territory, noted that while wildfires in 2004 and 2014 were destructive, this year’s fires are unique because they’ve approached urban areas.

“These ones seem to be multiple fires going after population centres,” he said. “In the past the cities were safe. It changes the focus when it’s moving in on the city of Yellowknife

On July 20, 2023, FTI Consulting Canada Inc. (“FTI”) was appointed as receiver (the “Receiver”) without security, of all of the assets, undertakings and property of Eagle Graphite Corporation (the “Debtor”) acquired for, or used in relation to, a business carried on by the Debtor. FTI, in its capacity as the Receiver of the Debtor, is seeking offers to purchase the Debtors’ right, title and interest in all of the assets, undertakings and property subject to the Receivership Order.

For further information, please contact: Huw Parks at EagleGraphite@fticonsulting.com

and there’s evacuation orders.”

Lithium explorer Li-FT Power (CSE: LIFT), which operates its Hidden Lake camp just 25 km east of the city along the Ingraham Trail, said on Aug. 17 it planned to pull all its personnel from Yellow-

knife on charter flights.

CEO Francis MacDonald said Hidden Lake would be temporarily demobilized, and Li-FT had moved most of its assets out of the camp, with its drills stored at a gravel pit off the Ingraham Trail and drill

TTAYLOR@SELEXLTD.COM

775 843 5838

SELEX

RESOURCESKLONDIKE HIGHLIGHTS

• Turquoise deposit and copper oxide occurrences

• Altered and mineralized quartz feldspar porphyry plugs and dikes

• Propylitic to phyllic/potassic alteration of argillaceous, carbonate sediments and porphyries

• Large regional magnetic/gravity anomaly complex 8km x 6km size

• Geochemical sampling of altered felsic porphyry intrusives points to zoning patterns similar to large porphyry deposits. Eg Ni,Co,V outboard of Cu, Mo

core moved back to Yellowknife.

Rio Tinto donation

At about 300 km northeast of Yellowknife, Rio Tinto’s (NYSE: RIO; LSE: RIO; ASX: RIO) Diavik diamond mine is at a safe distance from the fire, but the company opted to support wildfire response efforts with a $250,000 donation to the United Way Northwest Territories, it said on Aug. 17.

The donation, from its Rio Tinto Disaster Relief Fund, was targeted at immediate crisis requirements such as food, fuel and other needs for territorial communities and evacuees.

“At Diavik, we understand the importance of community resilience and timely support,” said Diavik diamond mine president and CEO Angela Bigg. “Our hearts go out to everyone impacted, which includes many of our own employees.”

In addition to the donation, Rio Tinto was focused on its personnel, many of whom live in communities affected by the wildfires, said a company spokesperson.

“For employees who are currently on site, we are working on securing flights that will assist them to reunite with their loved ones, subject to plane availability. At this time, operations are able to continue safely at a reduced capacity at Diavik, and we continue to evaluate our personnel needs,” the spokesperson added.

De Beers’ infrastructure was also reportedly safe from wildfires, and the company was making accommodations for workers at the Gahcho Kué diamond mine, located about 280 km northwest of the city, senior communications officer Terry Kruger in mid-August.

“Perhaps some people will stay on and work overtime… When you lose people, it does hurt the overall operation,” Kruger said, though he

The newly revised Alternative Minimum Tax (AMT) introduced in the 2023 Federal Budget that will go into effect on Jan. 1, 2024 will significantly reduce the effectiveness of the newly enacted Critical Mineral Exploration Tax Credit, PearTree Canada founder and CEO Ron Bernbaum says.

The 30% CMETC introduced in the 2022 federal budget applies to flowthrough share (FTS) financings for companies exploring for 15 critical minerals including lithium, cobalt, copper, and nickel. Within the first year of the new tax credit, more than $350 million was raised in 38 FTS financings. The CMETC credit resulted in new accretive investment.

Of the $350 million raised in the first 12 months of the CMETC, PearTree funded $225 million or 64% of all the FTS financings in critical mineral exploration raised from about 1,100 subscribers. The average subscription for the FTS by PearTree clients across Canada was $239,000.

“In order to invest $239,000 in flowthrough shares in 2023 the taxpayer required approximately $800,000 in high-rate T4 income in order to take advantage of the exploration tax credit,” Bernbaum explains. “But under the new AMT legislation introduced in the 2023 budget, in order to subscribe for $239,000 in flow-through shares, the taxpayer will require a minimum of $1.2 million of taxable T4 income or minimally about 150% more taxable income in order to invest the same amount.”

If the proposed AMT rules had been in effect in 2022, he notes, the same investor would have only invested $159,333, and by extension, the $225 million of FTS purchased by PearTree clients would have been reduced to $150 million, a loss to the Canadian economy of $75 million in exploration activity, “resulting in fewer jobs in rural and remote communities and a lesser likelihood of finding critical mineral deposits of size and quality to warrant mine development.”

Assuming that most investors in flow-through financings have

a similar profile to the PearTree client, then by extension, the $350 million invested in the first year of the CMETC (April 1, 2022 to March 31, 2023) would be about $225 million, or job losses associated with direct northern investment of approximately $125 million.

Alternative Minimum Tax was introduced in 1986 to ensure that all taxpayers pay a minimum level of tax, despite having tax deductions and credits that could otherwise reduce taxable income to zero. With the AMT, the taxpayer first calculates his/ her income under the normal rules followed by an AMT calculation adding back a specific list of deductions and credits, Bernbaum explains. For example, if a taxpayer’s tax liability is $100,000 under the normal calculation and under the AMT rules the tax owing is $120,000, then the taxpayer pays $120,000 and carries forward the unused $20,000, which remains deductible against income earned in the following seven years, after which the AMT deductions expire.

The current AMT federal tax rate is 15%. When you add in the additional provincial tax the current AMT calculation ensures that no one pays less than about 25% with any unused tax deductions and credits carried forward. Under the new legislation, the government is increasing the federal AMT rate to 20.5% (plus provincial tax taking the total minimum to about 32%). The new legislation also adds back for AMT 100% of all capital gains, which includes the artificial capital gain under the flow-through regime. An FTS has a zero-cost for tax purposes.

Since the exploration sector is dependent on a small group of investors unlikely able to increase their income by 150% in 2024 to maintain their current FTS investments, the industry is concerned that these changes will threaten exploration, effectively eliminating about a third of all FTS investment.

FTS, introduced in the 1970s, are issued by exploration companies and offer investors a 100% tax deduction.

From the issuer’s perspective, the FTS

command an issue price premium to market, thus reducing dilution. At the same time, the shareholders’ after-tax risk of investment is reduced.

Since 2007, an increasing proportion of all FTS (now about 75% of all FTS) are donated to registered charities. They are then sold right away to global investors at a discount stripped of tax value. The flowthrough characterization falls off immediately on the donation/sale. If the shares are issued under a private placement, the liquidity end-buyer from charity must be an ‘accredited investor’ and inherits the four-month hold period. As a result, nearly all FTS end up in the hands of global institutional investors.

“Holistically the flow-through regime is an elegant arrangement in which high net worth urban investors take on venture capital risk with the use of funds directly linked to northern job creation. A dollar of tax deduction in Toronto results in a dollar of taxable activity in Timmins,” Bernbaum notes. “And unlike any other sector, while ownership may be foreign the exploration and development jobs are in Canada and when a mine is built, taxes and government royalties are paid to the Canadian fiscal authorities.” FTS financings represent over

three-quarters of all capital raised for Canadian exploration and PearTree alone deploys over $500 million a year, funding about 60 financings all within the FTS program.

Under the FTS regime, upon subscription for the FTS, the adjusted cost base is deemed to be nil for tax purposes. When calculating the capital gain, it’s as if the subscribing taxpayer paid nothing for the FTS. The rationale is that the taxpayer fully deducted the cost of the FTS. However, a $1 tax deduction results in $1 of taxable activity in northern communities. The capital gains tax levied from a zero-cost base when the shares are sold or donated is in fact a double tax recoupment for the fiscal authority. Under the federal system, an FTS purchased at $1, if sold for 60¢, will still attract a 60¢ capital gain and attendant tax, he says.

Quebec recognizes the policy anomaly and unlike the other provinces, which integrate their tax regimes with Ottawa, Quebec’s separate tax regime calculates capital gains from the price paid for the FTS in the example ($1).

“Minimally we are not advocating for the elimination of the capital gains tax even though the gain is a construct of the Income Tax Act (Canada), but rather we recommend

not adding back into the AMT calculation the capital gain up to the initial purchase price,” he continues.

“The simple carve out will go a long way in preserving the incentive and the significant exploration the FTS regime enables in providing Canada with a financing advantage over global competitors exploring for critical minerals and otherwise.”

Moreover, adding back to income 50% of the donation receipt — limiting donations of FTS or even cash under an Alternative Minimum Tax regime — will result in reduced funds to FTS issuers and to charities.

“The new AMT rules are a significant disincentive for Canadians giving away their wealth with particular reduction in FTS financings driving critical mineral exploration and more broadly,” he says. “Tax incentives such as the current CMETC work. Tax disincentives are equally destructive in reducing both investment and the donated transfer of wealth in support of social causes.”

The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by PearTree Canada and its subsidiary, PearTree Securities, and produced in cooperation with The Northern Miner. Visit www.peartreecanada.com for more information.

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

After more than seven and a half years on a biweekly printing schedule, The Northern Miner’s print and digital editions will be moving to a monthly schedule as of October. That makes this issue, dated Sept. 4-17, 2023, our last biweekly edition.

embrace our enemy’s enemy

BY DR CHRIS HINDE Special to The Northern MinerPRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada: C$130.00 one year;

The Northern Miner’s roots are in print and we believe there will always be a place for a product you can hold in your hands, read and reread, mark up and collect. For 101 years, The Miner was a weekly. During most of that time, we owned our own printing press. In fact, we even had one in Cobalt, Ont. — where The Northern Miner was born in 1915 — before the publication moved to Toronto in 1929.

BY ALISHA HIYATEBut times have changed. It’s true that print media faces unique challenges in the digital age. However, that doesn’t mean we are abandoning print. Instead, we’re focused on upping both our print and digital games. We see the two mediums as complementary and both as essential to serving our existing readers better while winning new ones.

While digital can’t be beat for speed and features like video that simply can’t be replicated in print, reading in-depth features and analysis is a lot easier on a physical page. We can also make an impact with newspaper layout and choice of images that just isn’t the same on a website.

With that in mind, we see our move to a monthly publishing schedule as an opportunity for rebirth and renewal. Our monthly issue will be bigger and indeed better, with more in-depth news, analysis and interviews, plus more data visualization and infographics. In place of our long-running stock tables, which have lost their appeal in the era of online stock trading, we’ll bring you more valuable data in a format that’s easier — and even fun — to read. You’ll find improved warrant and shorts data, new metals ETFs and gold funds data, more TNM Drill Down data highlighting the best assays of the month provided by Mining Intelligence. All in a visually appealing format that makes the information easier to digest at a glance.

On the digital front, you’ll notice a livelier Northern Miner website. A less hectic print production schedule will allow us to put more time and effort into digital storytelling. If you visit our site regularly, you’ll notice that we’ve been doubling down on video and exploring new and more engaging ways to convey information and get to the heart of a story. That includes video — especially those our writers shoot in the field, bringing our site visits alive and letting you kick the rocks along with them. It also includes data in various forms, such charts and graphs that give a quick but precise overview of exploration projects by region and commodity (lithium and rare earths); and most recently, interactive maps that let you see where the year’s best drill holes were collared.

And of course, we’ve kept our popular free weekly podcast rolling since March 2016, when it was started by former writers Lesley Stokes and Matthew Keevil. (It’s now in the capable hands of host Adrian Pocobelli.)

OUR NEW MONTHLY ISSUE WILL BE BIGGER AND INDEED BETTER, WITH MORE IN-DEPTH NEWS, ANALYSIS AND INTERVIEWS, PLUS MORE DATA VISUALIZATION AND INFOGRAPHICS. IN PLACE OF OUR LONG-RUNNING STOCK TABLES, WHICH HAVE LOST THEIR APPEAL IN THE ERA OF ONLINE STOCK TRADING, WE’LL BRING YOU MORE VALUABLE DATA IN A FORMAT THAT’S EASIER AND EVEN FUN TO READ.

What’s changing?

• The publishing frequency of our print and digital editions from biweekly to monthly, starting after the current issue. Our next issue will be the October 2023 edition. Check out our updated media kit for information about the feature sections in each print issue and important deadlines: https://mediakit.northernminer.com/the-northern-miner/

• The size of the print and digital edition will increase. We will aim to double the size of the paper to 48 pages, up from 24. (When the paper was published weekly, it was often as slim as 16 pages.)

• You will also see changes in our content both in print and online. Since we will be publishing the newspaper and digital edition less frequently, we will be shifting our content even more towards analysis, commentary, in-depth interviews with key industry players, data insights, and on the website, multi-media.

What’s not changing?

• The Northern Miner will remain in its current newspaper format.

• The publishing frequency and volume of news on our website will stay at the same levels or better.

• Our pricing will remain the same. We recently combined with our sister publication Mining.com under the TNM Group umbrella, with one subscription giving you access to both publications.

• And most importantly, as one of the few players in mining media that is truly independent, our commitment to bring you unbiased news and reporting remains steadfast.

Our strong and experienced editorial team which it is my privilege to lead — consisting of Western Editor Henry Lazenby, Senior Staff Writer Colin McClelland, and Production/Copy Editor Blair McBride — are excited about these changes and along with our incredible Art Director Barb Burrows, are working hard on new features that you’ll see in our first monthly edition in October.

I’d like to extend a heartfelt thank you to our subscribers and advertisers for your continued support. Please don’t hesitate to contact our customer support team at support@northernminer.com or reach out to me (ahiyate@northernminer.com) with any concerns. TNM

Professor J.R.R. Tolkien died 50 years ago, and we can learn from his hero in Lord of the Rings, Frodo Baggins, who made an expedient choice for his guide into Mordor.

Rather like the combatants on Middle-Earth, cursory observers of our conflict over the environment might conclude that there is a sharp distinction between the forces of good and evil, and also that the mining industry is in the wrong camp.

One side of this battle is widely portrayed as dark, slow and cold, and is associated with earth and shadows, while the other is seen as warm and focused, and associated with the sky, positivity and light.

I am drawing these generalized descriptions from, of course, the two principles of Chinese philosophy; Yin (which approximates to the public view of the mining sector) and Yang (the perception, perhaps, of environmental groups).

Yin is associated with everything bad, while Yang is associated with all things good, positive and happy. The Chinese philosophical principle of Yin and Yang is that all things exist as inseparable and contradictory opposites. In terms of cosmology, the universe is created out of a primary chaos of material energy, organised into cycles of Yin and Yang, which are formed into objects and lives.

Opposites perhaps, but these two forces are considered by the Chinese to be interdependent, complementary and mutually transformative. In contrast, the public view miners and environmentalists as quite separate, and that they have girded their loins for combat.

This is a valid opinion, to a point. Loins have been girded (at least in the figurative sense) and there is certainly fighting. However, although environmental organizations are hardly to be counted amongst the natural friends of our industry, we have a common enemy in carbon emissions.

Early renditions of the Bible advised us to gird our loins ahead of difficult endeavours. King James I’s ‘Authorised Version’ of 1611, for example, has numerous references to preparing for conflict by girding loins (essentially hitching up your robe). These rather graphic guidelines for difficult circumstances were replaced in later versions of the Bible with less poetic instructions. The message was the same, however, namely the advantage in conflict of being able to move more easily.

Even with enhanced mobility, most successful campaigns recognise the need for allies. With apologies to Ali ibn Abi Talib, the mining industry has three types of ally; our friends, the friends of friends and the enemies of our enemy.

Those of you with a grounding in Arab history will recall that Ali ibn Abi Talib (c600-661) is considered by Shia Muslims to

have been their first Imam (and so a direct successor of Muhammad, to whom he was a cousin and son-in-law). Over 200 of his sermons, some 80 letters and almost 500 sayings were collated in the 11th century into the book ‘Nahj al-Balagha.’ In addition to categorizing friends, Ali wrote “Your enemies are your enemy, the enemy of your friend and the friend of your enemy.”

Indeed, the Latin phrase ‘Amicus meus, inimicus inimici mei’ (My friend, the enemy of my enemy) had become common throughout Europe by the early 18th century (although the first recorded use in England didn’t come until 1884).

We know that the mining industry needs to play an ever greater role in the clean-energy sector if the latter is to achieve its objectives. We also know that the path to net-zero carbon emissions is fraught with mineral dependencies, from the lithium, nickel and cobalt in electric vehicle batteries to the aluminium, copper and zinc in solar panels.

Unfortunately, this truism seems to be lost on most environmental groups. One year ago, Thomas Hochman wrote in City Journal (a publication of the Manhattan Institute for Policy Research, which describes itself as a free-market think tank) that “by the end of the 20th century, protesters had notched so many wins against new mining operations that the U.S. industry had been all but wiped out.”

Hochman argued that, as a result of a sustained campaign against it, the American minerals sector was “hollowed out.” He observed that, since the mid-20th century, America’s critical-mineral import dependence had almost tripled, and China had secured near monopolistic control of the global mineral-supply chain.

In the face of widespread opposition to mining, we must turn, as in so many things, to Charles Darwin (1809-1882) for inspiration. He is widely attributed as saying, “In the long history of humankind, those who learned to collaborate and improvise most effectively have prevailed.” (Incidentally, this source is disputed, and the quote doesn’t appear in Darwin’s seminal work, ‘On the Origin of Species,’ published in 1859.)

Allying with an enemy of one’s enemy has a chequered history (Russia in WWII springs to mind) but, to prevail, the mining industry needs to improvise and to collaborate with those whom we share a foe. Tolkien (1892-1973) gave us a salutary example. Our hopes don’t rest on the shoulders of two little hobbits but, like them, we do need to be shown the way by a Gollum figure.

Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

New Leopard DI650i down-the-hole surface drill rig offers long-term productivity and superior stability with robust and reliable main components – seamlessly integrated with state-of-the-art technical solutions. Scalable automation, easy maintenance and outstanding movability are the features that make Leopard DI650i a premium product, which is an honour to own.

Leave your paw print and enjoy the smooth, efficient ride.

Broken supply chains, geopolitical tensions, war, inflation, rising energy costs, food crisis, droughts, famine, depleting mines. Welcome to the 2020’s!

The age of abundance is dead. The patterns defining this decade suggest more volatility is on the way, especially in the things that matter most — food, energy and shelter.

It’s why investors should be focusing on commodities.

A perfect storm of tight supply that spans minerals, oil, gas, food and water is approaching. The modern world has been spoiled with years of cheap and plentiful supply. But that’s set to change.

Decades of underinvestment in the Old Economy means we are embarking on a new era of shortages.

Mines are being depleted without replacement reserves in sight. Oil, gas and groundwater deposits are turning into giant underground voids. Global crop production is declining alongside severe droughts and war in the Northern Hemisphere.

All this while the planet adds around 1 billion people every decade. And all this while humanity embarks on its most ambitious project yet: Ending its 100-year reliance on fossil fuels.

Demand for commodities is not going to stay still in the years ahead. It will surge.

And the timing couldn’t be worse. We’re on a collision course for global shortages just as the world demands more.

The lifeblood that sustains civilizations is now running on empty — meaning there’s no safety net built into the system to absorb global shocks.

You might remember the consequences of such shocks from last year. Everything from barley to nickel recorded triple digit price gains after war broke out in Ukraine.

The same thing happened a few months earlier as the West opened up from its COVID-19 hibernation.

An assumption that supply was limitless meant we’ve underinvested in the commodity sector. The consequences are now boiling to the surface.

So, how did we get to this point?

Years of falling commodity prices

and stable supply drove global capital out of commodity investments and into the New Economy: Tech.

To give you one example, let’s take the U.S. tech giant NVIDIA (NASDAQ: NVDA). The company currently trades at a price to earnings (PE) ratio of 225.

Now compare that to the world’s largest diversified mining company, BHP (NYSE: BHP; LSE: BHP; ASX: BHP). Right now, it trades at a PE of less than 10!

There’s a deep chasm of value separating those industries that produce luxury ‘nice to have’ items. Social media platforms, entertainment, streaming services, video gaming and smart phones versus those that are critical for human survival.

But you can’t build tech devices without mining. In fact, you can’t build, eat or drink anything with-

out investment in the commodity sector.

Which is why a gross misalignment in capital distribution from the old economy into the new is steering us on a dangerous path. One that promises a critical decline in living standards as we sink into the EVERYTHING shortage.

As an investor bracing for this fallout the solution is simple. Accu-

mulate commodity stocks.

Other than water, food represents the most basic but critical resource for human survival.

And just like its commodity cousins, the ‘softs’ as some would describe them, have witnessed massive volatility in the early parts of this decade. Wheat futures recorded their lowest price in 60 years on April 13, 2019. That followed years of declining prices.

It set the stage for complacency. But COVID-19 and war in Ukraine laid bare the consequences of underinvestment in a crucial sector.

It’s why, last year, in April 2022, wheat futures exploded 150% from their lows.

But wheat wasn’t the only commodity igniting. The 146-year-old London Metal Exchange (LME) broke down as traders put a squeeze on the nickel market.

On March 7, 2022, Reuters reported nickel had soared 30.7% in a single trading session, the biggest daily percentage gain on record. The LME suspended trading and abandoned contracts.

Without the capacity to deal with extreme volatility, the world’s old-

est and most important commodity exchange now faces a torrent of litigation from traders as they line up for their turn in the London courts to seek compensation.

But last year’s dramatic surge offers a glimpse into the future. Volatility is here to stay. Tight supply in the global market has not been addressed. Meanwhile, demand continues to rise.

It guarantees many more price shocks in the years ahead.

We’re seeing the consequences of underinvestment play out in the real world, too.

The supermarket, fuel station, building costs, power bills, hardware store — you name it, we’re all feeling the pinch. TNM

The Age of Scarcity is upon us. — This column was previously published in Livewiremarkets.com.

James Cooper is a geologist and mining analyst. Based in Melbourne, he’s now the resident commodities analyst at Fat Tail Investment Research and editor for the Diggers & Drillers Publication. You can follow him on X (Twitter) @JCooperGeo.

“When the rest of the world didn’t see the possibilities in lithium during the late ‘90s and early 2000s, he did, and it’s just really cool to see how things have come around in that regard.”

The possibilities Bubar saw in critical minerals went beyond their mining value. For him, they were part of a reindustrialization story, recalls Ian London, executive director of the Canadian Critical Minerals and Materials Alliance (C2M2A), who worked with Bubar at Avalon in 2006.

“One thing Don did do was capture my imagination. I think he was one of the first who recognized opportunities in the critical minerals space,” London said.

Bubar understood that a whole-industry approach would heighten the prominence of critical minerals, instead of the traditional focus on single minerals or companies. London remembers how several years ago that idea met resistance among C2M2A members, and how much of a cultural shift it represented.

“[Bubar] stepped up and said it’s not about the minerals, it’s about the materials. [It’s] what we make from these products!” London said.

“Canada’s tradition has been ‘if we mine it, they will come’. No no no. If we build electric vehicles, we need materials to make them. It’s a very different perspective,” London explained. “The same way as the Chinese said, ‘we’re providing electric vehicles’ …and they get the materials to do it… It’s about capturing the value.”

Pierre Neatby, the recently appointed CEO of Imperial Mining and who first met Bubar when he joined Avalon in 2010, said Bubar could see how critical minerals would fit into the technologies of the future, especially as China began to exercise political power through the rare earths market.

“Don saw technology evolving in a direction where critical metals that had niche applications in projects would become much more important,” Neatby remembers. “Lithium, rare earths, vanadium, scandium, all of that has [now] been classified as critical by the U.S. and EU..”

Social licence advocate

His foresight extended into the social realm as well, in particular engagement with Indigenous communities.

London recalls Bubar created Avalon’s first CSR report in 2010, something “unheard of” at the time for a junior miner.

“Today many juniors still don’t do that. He recognized that’s what customers would look for,” London said.

While today, Indigenous engagement is regarded as a necessary component of ESG priorities in Canada, in 1999, Avalon signed a memorandum of understanding (MOU) with the Wabaseemoong Independent Nations (WIN), whose community lies about 35 km southwest of Separation Rapids. That agreement was renewed in 2013.

“I think he really saw the opportunity that existed for everybody there,” said Andrew Bubar. “He saw the benefits that could go to them. And he recognized the disadvantage that many of those communities had for such a long time. He recognized the injustices of the past.”

In 2009, former Assembly of First Nations (AFN) national chief Phil Fontaine was appointed to Avalon’s board of directors. That followed an MOU inked in 2008 between the AFN and PDAC, where Bubar had served as chair of the association’s Aboriginal Affairs Committee, which he also founded.

In November 2018, PDAC awarded Bubar with a Distinguished Service Award for his work on Indigenous relations. Bubar’s involvement with PDAC was an area where he offered much inspiration, remembers Simon Moores, CEO of Benchmark Mineral Intelligence. ‘Classy yet authoritative’ His approach showed he was a “master at making his point but making it with respect,” Moores said, remarking that Bubar showed others how to behave “in a classy yet authoritative way” in a world that is becoming more short-tempered and chaotic.

“As a result, Don was one of the key architects that built the critical minerals narrative we see now in Canada and within PDAC and the wider commodity world,” he said.

Bubar, who died after the rapid onset of neurodegenerative illness is survived by his wife of 38 years, Marcia Mazurski; his two children Andrew (Ingrid Ng) of Guelph, Ont., and Peter Bubar currently residing in Toronto; one sister, Carol Bubar (Richard Brown), of Red Deer, Alta., and two grandchildren Maria and Charles.

Friends and colleagues are welcome to attend a celebration of life for Bubar at PJ O’Brien Irish Pub & Restaurant, in Toronto on Oct. 5 from at 3 p.m. Donations in Bubar’s memory can be made to Mining Matters or the Canadian Museum of Nature. TNM

“YOU CAN’T BUILD TECH DEVICES WITHOUT MINING. IN FACT, YOU CAN’T BUILD, EAT OR DRINK ANYTHING WITHOUT INVESTMENT IN THE COMMODITY SECTOR.”

JAMES COOPER, ANALYST FATTAIL

INVESTMENT RESEARCHA dry cargo ship is loaded with Ukrainian grain at a Black Sea port. ADOBESTOCK/GLEBZTER

Granite Creek Copper (TSXV: GCX; US-OTC: GCXXF)

wants to attract a major company to consolidate a Yukon area into a local copper giant.

Granite’s Carmacks project, the past-producing Minto mine and some First Nations property could form a 30-year operation able to produce 2 billion lb. copper, according to Granite president and CEO Timothy Johnson. The area is about 280 km by highway south of Dawson City. Carmacks on its own carries a $220 million estimated capital cost.

“My goal is to attract a larger player to buy Minto out of bankruptcy, consolidate it with us and have us as a developer to de-risk it,” Johnson said in an interview in July in Dawson. “No major wants to come in and deal with the mess that’s there, but they will look for a joint-venture partner who has the exploration expertise in the district to turn us into a world-class asset.”

Granite Creek is part of the same companies group as Metallic Minerals (TSXV: MMG; US-OTC: MMNGF), which is advancing a resource update on the La Plata copper-silver-gold and platinum group elements project in Colorado with the backing of Newcrest (TSX: NCM; ASX: NCM). Metallic is also developing a placer gold project on Australia Creek in the Klondike with reality TV star Parker Schnabel.

The group also holds Stillwater Critical Minerals (TSXV: PGE; US-OTC: PGEZF), which is developing the Stillwater West nickel-copper-platinum group elements project in Montana. Glencore (LSE: GLEN) bought 10% of Stillwater in June.

Minto mess

The Minto mine stopped operations and its most recent owner, Minto Metals, ceased trading on the TSX Venture Exchange in May. Minto, a subsidiary of Pembridge Resources, bought the operation from Capstone Copper (TSX: CS) in 2019.

A court in British Columbia appointed PricewaterhouseCoopers as receiver and manager of Minto’s $76 million in assets and $70 million in debts. Japan’s Sumitomo Metal Mining started bankruptcy proceedings against Minto to get back $39 million of copper concentrate, still on the site, it owns as part of an offtake agreement, Johnson said. Minto directors resigned to avoid bankruptcy proceedings, he said, adding that the mine failed because of high costs from running its mill at less than capacity. It also

had issues handling and treating high volumes of water at the site this spring.

Carmacks holds 36.2 million measured and indicated tonnes grading 1.1% copper equivalent for a total of 651 million lb. copper, and an additional 38 million lb. inferred copper at a 0.3% cutoff grade, according to a preliminary economic assessment (PEA) released in January. Minto holds about 500 million lb. copper and the mill vital to the consolidation plan, while the wider area, including the First Nations land, could hold more, Johnson said.

However, the First Nations concept is in its infancy, there are no concrete offers from majors about the consolidation plan, and it’s unclear how long it will take to sort out the Minto mine bankruptcy. Carmacks is on a road that would need upgrading about 40 km south of Minto, 60 km from the highway and about 12 km from power lines, the CEO said. Minto is on the Yukon leg of the Alaska Highway about 280 km south of Dawson City.

The Carmacks project is starting to drill 1,800 metres this month on two geophysical targets with the same signature as the known mineralized orebody to expand the proposed nine-year mine life, Johnson said.

The project, with an after-tax net present value of $330 million at a 5% discount rate with 38% internal rate of return in the PEA, was spun out of Western Copper and Gold (TSX: WRN; NYSE-AM: WRN) and merged with Granite Creek in

Effective October 2023, The Northern Miner will be switching to a monthly publication schedule.

If you have any questions or concerns, please contact our customer support team at: support@northernminer.com

2020. The project had been taken to a feasibility study in 2007, but was denied approval because First Nations’ groups opposed the proposed heap-leach operation, Johnson said.

Instead, Granite Creek is opting for a flotation system that would generate around 40% recovery

from oxide ore in the first couple of years, then 94% recovery from the sulphide. The deposit is split equally in oxide and sulphide ore, but Granite Creek is looking at processes to boost the oxide recovery to more than 60%.

“We proposed a simplified flow sheet where we would float every-

thing oxide and sulphide knowing that we would get poor recovery from the oxide, but we see the potential here is in the sulphide anyways,” Johnson said. “As your tailings are coming out of the mill, they go into a second vessel for leaching, and then that gets pumped back into the system.” TNM

PearTree is a Canadian Securities Dealer and Investment Fund Manager advancing over (CAD) $500 million annually for resource exploration and mine development in a uniquely Canadian structure which results in as much as $2.00 of capital deployed for every $1.00 invested by global institutions and family offices.

Watch our video in English, Français, Deutsch and Español on our website

YUKON | Junior wants to spur creation of district player peartreecanada.com Expanding

That’s made Snowline an investor darling since it started drilling Rogue two years ago. The company again generated buzz at a mining conference in Dawson City, Yukon, in July.

“Obviously it’s exciting and it’s good to see recognition about what’s coming together out at Valley,” CEO Scott Berdahl said in an interview at the conference. “More generally, we’re really happy about this discovery for what it is in terms of good grades, good geometry, good continuity of grade, potentially a very low strip ratio, strongest grades right near surface, good metallurgy.

“Basically, it ticks every box we want to see.”

Snowline may drill as much as 12,000 metres at Valley this year, part of an 18,000-metre program encompassing the Rogue, Einarson, Ursa and Cynthia projects, said Berdahl, whose father, Ron, began prospecting the area in the 1980s. The CEO declined to say when the company would aim to publish a resource estimate for Rogue, but gave a few clues.

“One nice thing about this deposit is the continuity of the system makes it very easy to understand,” he said. “This is a system that we can come to a resource with low tens of thousands of metres of drilling as opposed to hundreds of thousands or even millions of metres of drilling you see in some other large systems.”

However, Agentis has already generated its own models with two open pits, one estimated to contain 3.6 million oz. gold from ore grading 1.9 grams per tonne, and the other 9.4 million oz. from ore grading 1.3 grams. Based on the model, Analyst Gray forecasts an after-tax

net present value of US$1.8 billion at a 5% discount rate with a 40% internal rate of return.

Majors’ interest Berdahl, who has degrees in geology, earth sciences and engineering, science writing and an MBA, said B2Gold’s 9.9% investment is good for its stamp of approval, but won’t necessarily dominate Snowline’s trajectory.

“We’re really not ready to tie ourselves to any one master just yet,” he said. “We’re not mine builders but we are cognizant of value creation. There’s a sweet spot we would get to where our cost of capital in terms of dilution to develop a project really doesn’t add a whole lot, yet somebody with a better cost of capital could pay a premium and acquire the assets and still do very well for that kind of a transaction.”

The remoteness of the site, where Rogue, Einarson, Ursa and Cynthia are in a cluster 223 km from the nearest town of Mayo, is the chief topic raised by potential investors, Berdahl said.

Yet a winter trail for heavy machinery servicing a silver mine is about 30 km away. The territorial government has visited and is committed to area road upgrades, he said. It’s part of a general takeaway in investor sentiment from the conference that strong grades tended to overcome lack of services.

“At Valley we found what is the kind of deposit that we needed to find out there that can handily overcome those kinds of obstacles,” he said.

“If Valley is a sort of proof-ofconcept like that, and if additional discoveries can be made, whether on our project or on other projects, then there’s a lot of runway here as the industry and the broader investment world wakes up to the potential existence of a regionalscale bootcamp out here.” TNM

“WE CONSIDER IT A BREAKTHROUGH TO SEE MORE THAN 2 GRAMS GOLD PER TONNE MINERALIZATION OVER A BROAD INTERVAL TO MORE THAN 450 METRES VERTICAL DEPTH.”

MICHAEL GRAY, MINING ANALYST, AGENTIS CAPITAL

BY COLIN MCCLELLAND

BY COLIN MCCLELLAND

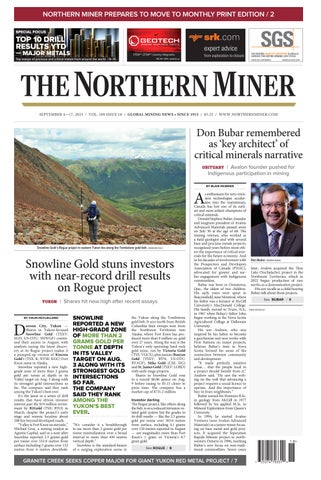

Building on our popular weekly TNM Drill Down feature ranking the best gold assays of the week, The Northern Miner has compiled the top 10 drill results for major metals year to date. Here, we present the best gold assays for the year to Aug. 1, 2023. Drill holes are ranked by gold grade x width, as identified by data provider Mining Intelligence. (www.miningintelligence.com)

Projects in Australia and Canada racked up the richest gold drill results reported so far this year. The land Down Under controlled two of the top three and the Great White North scooped six spots in the best 10 while outlier Serbia took second place.

Great Boulder at Mulga Bill

Great Boulder Resources (ASX: GBR) notched the best result in our table with a whopping 589.4 grams gold per tonne over 6 metres from 114 metres down drill hole 23MBRC006A for a grade x width value of 3,536.64. It was reported on March 27.

The reverse-circulation hole pierced the Mulga Bill prospect near Meekatharra, Western Australia, located 750 km northeast of Perth. It was part of a 13-hole firstphase program of 3,400 metres to test targets in the Central and HGV zones.

In August, the company reported air core drill hole 23SWAC152 at Mulga Bill North cut 4.2 grams gold from 119 metres depth, including 1 metre at 19.1 grams. The Mulga Bill and Ironbark deposits, part of the company’s Side Well project, hold 6.2 million inferred tonnes grading 2.6 grams for contained metal of 518,000 oz., the company said in February.

“With near-resource extensional and infill targets at Mulga Bill and Ironbark as well as a series of untested new targets along the eastern stratigraphy, Great Boulder is aiming to reach the million-ounce resource target within the next two years,” the company said.

Dundee Precious at Čoka Rakita

Dundee Precious Metals (TSX: DPM) scored second on the table with hole RADDMET001 at the Čoka Rakita exploration prospect in eastern Serbia. It cut 40 metres grading 63.5 grams from 517 metres depth for a grade x width value of 2,538.4, the company said on Jan. 16.

Toronto-based Dundee says it has diamond drilled 40,000 metres this year on Čoka Rakita and plans

30,000 additional metres to produce an initial resource estimate by December. The site lies 3 km southeast of the Bigar Hill sediment-hosted deposit and forms part of the Timok magmatic complex in eastern Serbia. The company has other projects in Bulgaria, Ecuador and Namibia.

M3 Mining at Edjudina

In third place, M3 Mining (ASX: M3M) cut 10 metres grading 241.2 grams from 27 metres deep in hole EDJAC164 at its Edjudina project in Western Australia for a grade x width value of 2,412, the company said on July 9.

M3 has completed 6,638 metres of air core drilling at the El Capitan prospect at Edjudina, which is accessible by road about 750 km east of Perth. More assays were due in August. TNM

Trusted. Independent. Committed.

Our fit-for-purpose solutions encompass the skills of qualified geologists, geostaticians, analytical chemists, mineralogists, metallurgists, process engineers and mining engineers brought together to provide accurate and timely mineral and process evaluation services across the entire mining life cycle.

Building on our popular weekly TNM Drill Down feature ranking the best gold assays of the week, The Northern Miner has compiled the top 10 drill results for major metals year to date. Today, we present the best silver assays for the year to Aug. 1, 2023. Drill holes are ranked by silver grade x width, as identified by data provider Mining Intelligence.

Gogold Resources at Los Ricos Gogold Resources (TSX: GGD) reported on Jan. 23 that drill hole LRGAG-22-118 at the Los Ricos South project in Jalisco state, Mexico, cut 55 metres grading 2,152.7 grams silver per tonne from 95.6 metres depth for a grade x width value of 118,398.5.

“We’ve drilled an additional 100 holes in the Main zone at Los Ricos South since our initial July 2020 mineral resource estimate and we believe they are proving to be quite impactful on our upcoming updated resource and preliminary economic assessment,” Brad Langille, president and CEO, said on Aug. 2 in a release. “Our team is diligently working to complete the studies expected to be released before the end of summer.”

The Halifax-based company’s Los Ricos South project posted an initial resource estimate in 2020 of 10 million measured and indicated tonnes grading 199 grams silver equivalent per tonne for 63.7 million oz. silver. It also holds 3.3 million inferred tonnes grading 190 grams silver equivalent for 19.9 million ounces.

The Los Ricos North project holds 22.3 million indicated tonnes grading 122 grams silver equivalent for 87.8 million oz. silver equivalent and 20.5 million inferred tonnes grading 111 grams for 73.2 million oz. silver equivalent, according to a 2021 resource estimate.

Gogold operates the Parral Tailings mine in Chihuahua state that generated second-quarter revenue of US$8.5 million on the sale of 360,011 silver equivalent. The mine produced 375,112 silver equivalent oz. consisting of 203,894 oz. silver, 1,512 oz. gold and 135 tonnes copper during the quarter.

Kuya Silver at Silver Kings

Kuya Silver (CSE: KUYA) reported the second-best hole in April at the Silver Kings advanced exploration project in northern Ontario. The Toronto-based company cut 16,883 grams silver per tonne over 3 metres from 235.2 metres down hole 23-SK08 for a grade x width value of 51,187.52.

In July, Kuya said it was starting 6,000 metres of drilling to expand the Campbell-Crawford target on the property, located near the town of Cobalt, 500 km northwest of Ottawa.

“We would also expect to test other targets that we have built up recently,” exploration vice-president David Lewis said in a release. “The initial Angus Vein discovery was made by exploratory drill testing of historically overlooked areas, and we have several other similar targets in this world-class mining district.”

Aya Gold & Silver at Zgounder

Aya Gold & Silver (TSX: AYA) provided the outlier on the list. In May, drilling at its Zgounder mine in Morocco returned 1,611 grams silver per tonne over 27 metres for a grade x width value of 43,497 from 22 metres deep in hole ZG-RC-232260-70.

“Hole ZG-RC-23-2260-70, which is the fifth-highest drill intercept on a grade-thickness basis, particularly demonstrates the continuity of the deposit,” said company President and CEO Benoit La Salle. “Further, preliminary results from the

The Montreal-based company said in July it was expanding drilling this year at Zgounder and Boumadine, both in the kingdom’s northeast. It is also expanding the Zgounder mine itself, which increased output by 15% in the second quarter to 526,703 oz. silver compared with the same period last year.

Zgounder Regional program, although anomalous, confirm the potential for the discovery of satellite deposits for the Zgounder mine.”

Zgounder hosts total measured and indicated resources of 9.7 million tonnes grading 306 grams silver per tonne for 96 million oz., and inferred resources of 542,000 tonnes at 367 grams silver for 6.3 million oz., according to a January 2022 resource estimate. TNM

PANUCO SILVER-GOLD PROJECT

Actively Advancing a District-Scale

A standout silver discovery: one of the highest-grade, silver primary discoveries in the world

Aggressive, low-cost explorer

Significant re-rate potenial

Positioned to execute

Experienced management & board

Eight of the top 10 copper assays for the year to Aug. 1, 2023, come from countries in South America, including Argentina, Chile, Colombia, and Ecuador. The only assays from North America come from Quebec and Arizona. Drill holes are ranked by copper grade x width, as identified by data provider Mining Intelligence.

Filo Corp at Filo del Sol Filo Corp’s (TSX: FIL) pre feasibility-stage Filo del Sol project in San Juan, Argentina, produced the highest width x grade value among copper explorers so far this year. On Jan. 10, the Vancouver-headquartered company reported that hole FSDH071 cut 1,028 metres grading 0.78% copper for a width x grade value of 801.84 at Filo del Sol.

This included a segment of 172 metres with an exception ally high concentration of 2.14% copper equivalent from 408 me tres and another segment of 237.5 metres with 1.49% copper equivalent from 776 metres. The drilling ended at a depth of 1,320 metres due to equipment limitations, with the final 20 metres averaging 0.46% copper equivalent.

The company reported the result alongside hole FSDH070A, with both holes drilled in the Aurora zone and FSDH070A being about 410 metres away, further demonstrating the project’s exploration potential.

Filo del Sol hosts indicated resources of 432.6 million tonnes grading 0.33% copper for 3.2 billion pounds. The inferred resource stands at 211.6 million tonnes grading 0.27% copper for 1.3 billion lb. of metal.

Nine rigs are active on the project, and winter activity focused on Aurora infill and the Aurora-Bonita gap drilling.

Atex Resources at Valeriano

Atex Resources (TSXV: ATX) produced the second-best copper assay this year to date. The company reported on March 30 that hole ATXD-11B cut 1,342.5 metres grading 0.46% copper for a width x grade value of 617.55 at the advanced exploration-stage Valeriano project in Chile. Results from ATXD-11B confirm a new highgrade porphyry trend called the Western Trend. The company interprets the results as expanding the mineralized corridor over 300 metres west of the Central HighGrade Trend and is open along strike for further extension.

Atex CEO Raymond Jannas said at the time the results from ATXD-11B were a “step change” in demonstrating the growing scale potential at Valeriano.

Most recently, the company reported on July 13 it had completed holes ATXD-24 and ATXD-22B, the last two holes, from its third phase of drilling.

“Hole ATXD-24 is a very significant hole as it intersected Early Porphyry further west than anticipated demonstrating that the Central Trend is wider than anticipated in this area. We look forward to completing this hole in the fall and are especially excited to follow up and test the continuity of this wider

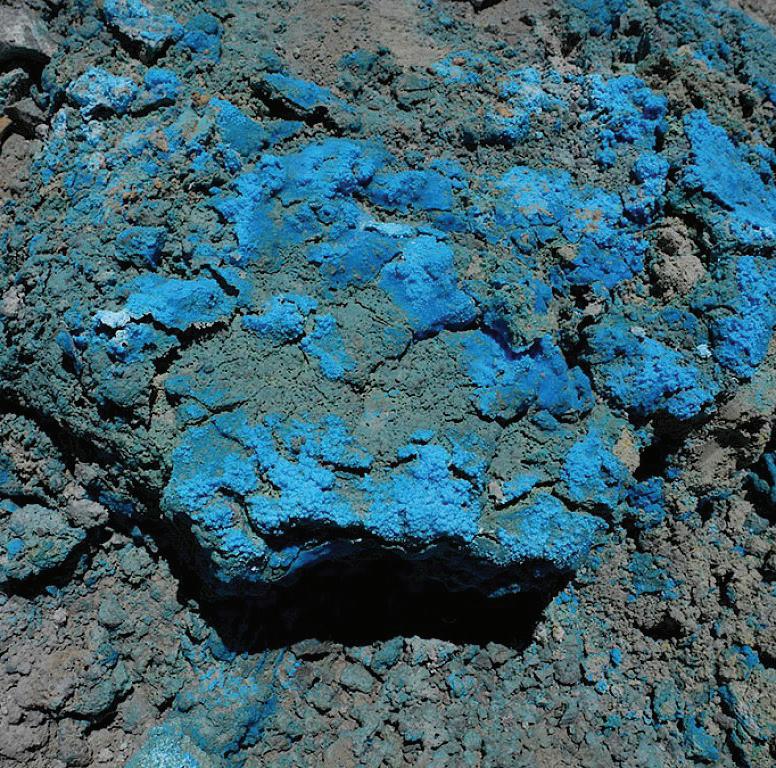

Our top 10 drill results for major metals year to date includes a look at the best assays delivered from hard rock lithium projects. Canada leads the rankings with the most projects in the top 10 (a total of six), with Africa (Democratic Republic of Congo, Mali and Namibia) delivering three of the top assays. Drill holes are ranked by lithium grade x width, as identified by data provider Mining Intelligence.

Avalon at Separation Rapids

Topping the ranking is Avalon Advanced Materials (TSX: AVL) and its Separation Rapids project in northwestern Ontario.

On June 1, Avalon reported that hole SR23-93 returned 564.8 metres grading 1.51% lithium oxide (Li2O) from 1.3 metres depth for a width x grade value of 852.92.

Avalon’s 2022-2023 drilling program consisted of 4,179 metres across 13 holes, with SR23-93 drilled vertically to test the depth of the deposit.

“These drill results truly demonstrate what our team has always believed — the resource at Separation Rapids is potentially much larger than what is currently understood,” said Avalon COO Rickardo Welyhorsky.

Avalon updated the Separation Rapids resource in August, with measured and indicated resources coming to 10.1 million tonnes grading 1.35% Li2O, a 20% increase over the 2018 estimate. Inferred resources total 2.8 million tonnes at 1.38% Li2O, an increase of 57%.

The project, about 70 km north of Kenora, is a joint venture with Antwerp-based-SCR-Sibelco NV.

AVZ Minerals at Manono

The second-best lithium result comes from AVZ Minerals’ (ASX: AVZ) Manono project in southeastern Democratic Republic of Congo. On June 30, the Perth-headquartered company reported that hole MO22DD040 drilled 459.8 metres grading 1.48% Li2O from 100 metres depth for a width x grade value of 680.5.

The result is from a set of 53 holes of the extension drilling program at Roche Dure, which along with Carriere de l’Este, are the two major pegmatites at Manono.

“The current drilling information at Roche Dure now extends over 1.8 km… and to a nominal depth of about 300 metres below ground surface. This remarkable orebody remains open along strike in both directions as well as down dip,” said managing director Nigel Ferguson.

Roche Dure hosts proven and probable reserves of 93 million tonnes grading 1.58% Li2O for 1.5 million tonnes of Li2O, according to a 2019 estimate. In the measured

and indicated categories, the project hosts 269 million tonnes grading 1.65% Li2O and inferred resources of 131 million tonnes at 1.66% Li2O.

AVZ holds a 75% interest in Manono, with state-owned enterprise La Congolaise d’Exploitation Minière SA holding 25%.

The third-best lithium result comes from Patriot Battery Metals’ (TSXV: PMET; ASX: PMT) flagship Corvette project in the James Bay region of Quebec.

On Jan. 18, the explorer reported that hole CV22-083 drilled 157 metres grading 2.12% Li2O from 176.4 metres depth, for a width x grade value of 332.84. The intercept, at

Corvette’s main CV5 pegmatite, also returned 25 metres grading 5.04% Li2O.

“[The hole] has raised the bar ever higher with respect to the considerable potential at CV5 as we continue to delineate it, and by extension, the rest of the CV lithium district held by the company that has yet to be drill tested,” said vice-president of exploration Darren Smith.

This year also brought Patriot’s highly anticipated initial resource for CV5, released on July 30. It outlined a deposit hosting 109.2 million inferred tonnes grading 1.42% Li2O and 160 parts per million tantalum, for 1.6 million tonnes of contained Li2O, or 3.8 million tonnes of lithium carbonate equivalent, using a 0.4% lithium cut-off grade. TNM

COPPER from / 11 part of the Central Trend,” Jannas said in a release.

The company is compiling a resource update for Valeriano, due by September, which will underpin plans for the fourth drilling phase to start in October.

Aldebaran at Altar

This year’s third-best copper assay comes from Aldebaran Resources

(TSXV: ALDE) in Argentina. On May 31, the company reported that hole ALD-23-225B returned 1,056 metres grading 0.51% copper from 291 metres depth for a width x grade value of 538.66 at its preliminary economic assessment-stage Altar copper-gold project in San Juan province, Argentina. The company said then the hole was among the best drilled at the Altar project in terms of grade and length.

Hole 225B infills a 400-metre gap between previous drill holes 223 and 224, which also returned long runs of attractive grades, further confirming the continuity of the new Altar United mineralized zone. Significantly, the holes encountered higher-grade mineralization than the average copper-equivalent grade in the current resource, suggesting that the company might have found a “hot spot” within the more extensive

system, Alderaban said.

As of March 22, 2021, the Altar project held measured and indicated resources of 1.2 billion tonnes grading 0.43% copper for 11.4 billion lb. of metal. It has another 189.2 million inferred tonnes grading 0.42% copper for 1.8 billion lb. copper. On Aug. 14, the company announced it had earned a 60% interest in Altar from Sibanye-Stillwater (NYSE: SBSW; JSE: SSW). It

has also given Sibanye notice that it intends to proceed with the second option to gain 80% ownership by spending a further US$25 million over three years. Aldebaran had since 2018 spent US$38 million on the project.

The company was last actively drilling with four rigs at the site but has shut down operations for the winter, with holes ready to re-enter during the next field season. TNM

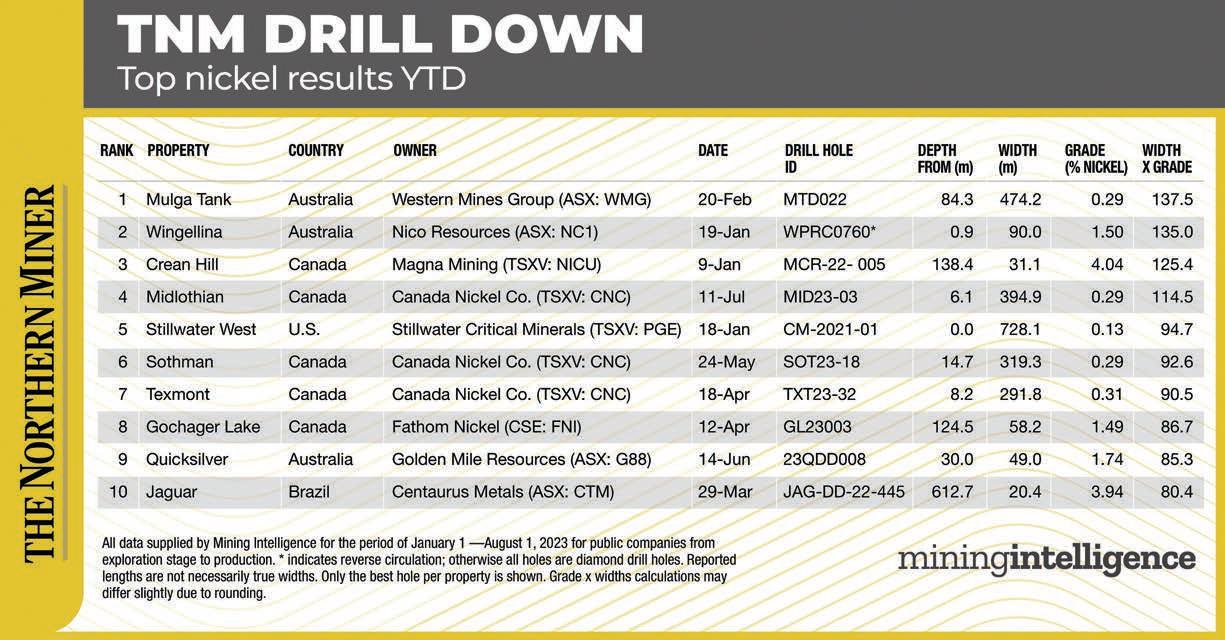

Eight out of the 10 best nickel assays for the year to Aug. 1, 2023 came out of projects in either Australia or Canada. Of the Canadian projects that made the ranking, three out of five were delivered by one company — Canada Nickel Co. (TSXV: CNC) at its projects in Ontario. See the table on page 14 for full results. Drill holes are ranked by nickel grade x width, with data provided by Mining Intelligence.

The best nickel drill assay reported in 2023 so far comes from Western Mines Group’s (ASX: WMG) Mulga Tank project in Western Australia. On Feb. 20, the company reported that hole MTD022 cut 474.2 metres grading 0.29% nickel from 84.3 metres depth for a width x grade value of 137.52. According to the company, the hole, along with MTD012, hint at the lateral extent of this system in drill holes approximately 500 metres apart. Western Mines is hoping to find potential broader, richer zones of this mineralization. The disseminated mineralization seen at depth may represent disseminated cloud sulphides, commonly found above layered formations of massive sulphide deposits. The company has noted several examples of high-tenor remobilized massive nickel sulphide veinlets along the western margin of the complex in holes MTD012, MT013 and MTD022 above the major W Conductor electromagnetic anomaly. A down-hole electromagnetic survey crew is being mobilized to test recent holes MTD022 and MTD023 and look for off-hole conductor anomalies that could signal massive or matrix sulphide mineralization.

The year’s second-best nickel intercept also comes out of Western Australia, where Nico Resources (ASX: NCI) on Jan. 19 reported that reverse-circulation hole WPRC0760 cut 90 metres grading 1.5% nickel from 0.9 metre depth for a width x grade value of 135 at

EIGHT OUT OF THE 10 BEST NICKEL ASSAYS FOR THE YEAR TO AUG. 1, 2023 CAME OUT OF PROJECTS IN EITHER AUSTRALIA OR CANADA. OF THE CANADIAN PROJECTS THAT MADE THE RANKING, THREE OF FIVE WERE DELIVERED BY ONE COMPANY.

CSE: FNI | OTCQB: FNICF | Frankfurt: 6Q5

the Wingellina nickel-cobalt project. The results come from a drilling program completed in October last year comprising 152 holes for 7,856 metres. The program was designed to follow up on work started in 2017 to infill 15 high-grade nickel-cobalt domains delineated from the resource model as potential high-grade starter pits.

lion tonnes and 127,800 tonnes of metal, respectively.

Nico completed a prefeasibility study for Wingellina in December 2022. Highlights include an after-tax net present value of A$3.3 billion and an internal rate of return of 18% at a capital cost of A$2.9 billion (US$1.95 billion).

• Two highly prospective magmatic nickel projects in Saskatchewan

• Both projects host high-grade nickel-copper-cobalt + PGE mineralization

• Saskatchewan consistently ranked in top 5 jurisdictions in the world for exploration

CONTACT

More recently, on July 27, Nico said the 2022 drilling program confirmed Wingellina has enough higher-grade material to provide high-grade feed for the first decade of production. The company has started work on a resource update, building on the existing JORC-compliant resource of 182.6 million tonnes grading 0.92% nickel and 0.07% cobalt for 1.7 mil-

Ian Fraser, CEO & VP Exploration

1-403-650-9760 ifraser@fathomnickel.com

Doug Porter, President & CFO +1-403-870-4349 dporter@fathomnickel.com

fathomnickel.com

Magna Mining at Crean Hill Ranking third is Canada’s Magna Mining (TSXV: NICU), which on Jan. 5 reported strong drill intercepts from its Crean Hill brownfields prospect in Ontario’s Sudbury Basin. Hole MCR-22-005 returned 31.1 metres grading 4.04% nickel from 138.4 metres depth for a width x grade value of 125.44.

The company reported at the

time that hole MCR-22-005 also intersected two massive sulphide intervals: 5 metres grading 6.5% nickel, 1% copper, 0.5 gram platinum, palladium and gold (3E) per tonne, and 16.1 metres of 5.7% nickel, 0.7% copper and 0.8 gram 3E per tonne. The results were the second set of assays received from the 101 FW Zone, and they demonstrate the continuity of high-grade, massive sulphide mineralization within the footwall breccia zone.

More recently, Magna reported on Aug. 15 that some of the latest assay results confirm a shallow zone of massive sulphides near MCR-22005. This is one area that the company plans to include as part of the advanced exploration and test mining program in 2024. TNM

For more TNM Drill Down results, maps and more, check out:

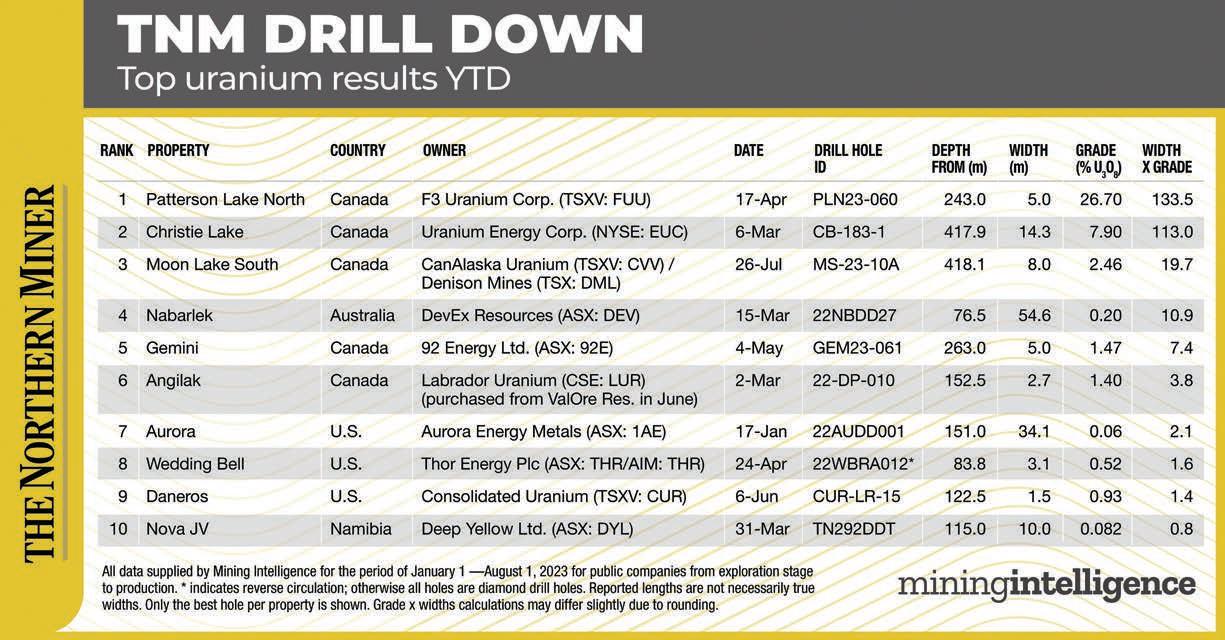

Our top 10 drill results for major metals year to date includes a look at the best uranium assays. Canada leads the rankings, delivering five of the top 10 results. While Saskatchewan accounts for four of those, the No. 6 spot goes to the Angilak project in Nunavut. Drill holes are ranked by uranium grade x width, as identified by Mining Intelligence.

F3 Uranium at PLN

The top three uranium oxide (U3O8) drill results of the year to Aug. 1 all come from Canada’s uranium hotspot, the Athabasca Basin, located in northern Saskatchewan.

Leading the list is F3 Uranium (TSXV: FUU) and its Patterson Lake North (PLN) advanced-exploration project in the basin’s southwest. On April 17, the company reported that drill hole PLN23-060 intersected 5 metres grading 26.7% U3O8 from a depth of 243 metres, for a width x grade value of 133.5.

The result was among 12 holes reported from F3’s winter 2023 drill program at PLN, eight of which returned high-grade results. Drilling defined the JR zone at PLN over a total strike length of 105 metres and it remains open to the south, at depth and up-dip towards the Athabasca unconformity.

“PLN23-060, cored 60 metres grid south from the discovery hole, intercepted truly impressive grades within the A1 main shear zone,” said F3 president Raymond Ashley. He added that the hole delivered a peak sample grade of 65.2% U3O8 over 0.5 metre at 244.5 metres depth.

JR, located between F3’s Minto and Broach properties was discovered by F3 in November 2022 with drill hole PLN22-035, and intersected off-scale radioactivity associated with massive uraninite mineralization within the A1 main shear zone. Results from the hole returned 6.97% U3O8 over 15 metres, including 5.5 metres of 18.6% U3O8. It is also located about 25 km northwest of Fission Uranium’s (TSX: FCU; US-OTC: FCUUF)

Triple R deposit and NexGen Energy’s (TSX: NXE; NYSE: NXE; ASX: NXG) Arrow deposit.

Uranium Energy at Christie Lake

The second best result comes from Uranium Energy’s (NYSE: UEC) Christie Lake project in the southeast of the basin, located 9 km northeast of Cameco’s (TSX: CCO; NYSE: CCJ) McArthur River mine. The advanced exploration project hosts the Paul Bay, Ken Pen, Ōrora, and Sakura deposits.

On March 6, UEC reported that hole CB-183-1 cut 14.3 metres grading 7.9% U3O8 from 417 metres depth, for a width x grade value of 112.97. The hole, which also intersected 3.8 metres of 26.16% U3O8, expanded the footprint of highgrade mineralization at Sakura northeast about 14 metres from hole CB-178-1.

“The continued success at the Sakura zone demonstrates the potential of the Yalowega Trend at Christie Lake to host high-grade uranium mineralization,” said Chris Hamel, vice-president exploration.

While the total size of Christie Lake’s deposits is still being defined, they host an inferred resource of 488,000 tonnes U3O8 grading 1.57% for 16.8 million lb. U3O8

UEC holds an 82.775% combined direct and indirect interest

in Christie Lake in a joint venture with JCU (Canada) Exploration, which itself is 50% owned by UEC’s subsidiary UEX Corp.

Denison and CanAlaska’s Moon Lake South

The third-best result comes from Moon Lake South, a 75%-25%JV between Denison Mines (TSX: DML) and CanAlaska Uranium (TSXV: CVV). On July 26, the partners reported that hole MS-23-10A intersected 8 metres grading 2.46% U3O8 from 418.1 metres depth for a width x grade value of 19.68.

The project is located just southwest of Denison’s Gryphon and Phoenix projects. The mineralization discovered in MS-23-10A is open in all directions and the 3,600metre winter drilling program confirmed mineralization in several zones over a strike length of 4 km.

“An increase in the high-grade mineralization by 78% over the expected grade based on down-hole radiometric equivalents is an exciting outcome for the Moon Lake South JV and CanAlaska share-

holders,” said CanAlaska CEO Cory Belyk. “These results clearly indicate this could be a very significant high-grade uranium discovery in the heart of the eastern Athabasca near all the critical infrastructure

of currently producing uranium mines and mills.”

Based on the winter program results, the JV opted to double exploration spending for 2023 for a summer drill program of four to eight

holes for a total of up to 4,400 metres, starting in mid-September. Drilling will focus on testing the northeast strike extension of the high-grade mineralization in MS23-10A. TNM

FE Battery Metals’ (CSE: FE)

shares shot up 53% in early trading on Aug. 21 after the company announced a channel sample value of 14.7 metres grading 1.15% lithium oxide (Li2O) from a new high-grade area at its Augustus project in northern Quebec.

The Vancouver-based company said in a release that its Outcrop #26 discovery on the eastern portion of the prospect would help inform its understanding of the geology, structure and trend of the main potential deposit area to develop more drill targets. The main Augustus pegmatite is a blind lithium deposit with very few surface exposures.

The sample also returned anomalous values of rare metals such as beryllium, cesium, niobium, rubidium and tantalum. One grab sample from Outcrop #26 returned values as high as 1.92% Li2O.

At Outcrop #900, also on the Augustus property and near Sayona Mining’s (ASX: SYA) North American Lithium Mine (NAL), FE cut 10 metres at 0.52% Li2O. This outcrop also returned lithium grab values in the range of 0.004% to 1.18% Li2O.

Another 19 grab samples from the Bella prospect, also near NAL, returned lithium values in the range of 0.005% to 1.26% Li2O with more values of interest from

other rare metals. This zone will be drilled during the current drilling program.

Elsewhere on the Augustus property, four grab samples collected from the Lac Fiedmont area returned low lithium values. Six grab samples collected from the Duval prospect returned high values of 0.004% to 2.15% Li2O, which averaged 1.14%. The company intends to expand its exploration on this higher lithium value area.

FE Battery has to date, drilled 68 diamond drill holes totalling over 15,000 metres on the property. It has intercepted several lithium pegmatite dykes of variable lengths, widths and lateral continuity.

Augustus consists of over 270 sq. km surrounding the Val-d’Or mining hub. The project was first drilled in the mid-1950s when pegmatite was outlined along an 850metre strike with an average width of 7.6 metres. Drilled to a depth of 207 metres, the mineralization remains open at depth.

As it works towards an initial resource at Augustus, FE Battery also holds two lithium projects in Ontario.

At press time, FE Battery shares traded at 44¢, down 12% from their Aug. 21 high of 50¢. The company has a market capitalization of $18.4 million, with its shares trading in a 52-week window of 34¢ and $1.38. TNM

[the] announcement,” he said.