> Recent trends and developments in mine electrification in Canada

> ARTIFICIAL INTELLIGENCE: Growing fact or lingering fiction

> TIME TO GET SERIOUS OR BECOME “UNINVESTABLE”

– Harness 40 years of Liebherr’s electric-drive excavator expertise and experience unmatched design,manufacturing, and maintenance

– Choose from the largest range of electric mining excavators to find the perfect fit for any application

– Reduce maintenance costs and extend component service life with fewer component changeouts than a standard diesel excavator

– Achieve the flexibility to work anywhere with multiple supply voltages and frequencies available

– Optimize safety and improve machine mobility with the fully autonomous Liebherr cable reeler

– Ensure peace of mind for operations as all Liebherr electric excavators comply with IEC or CAS/UL standards

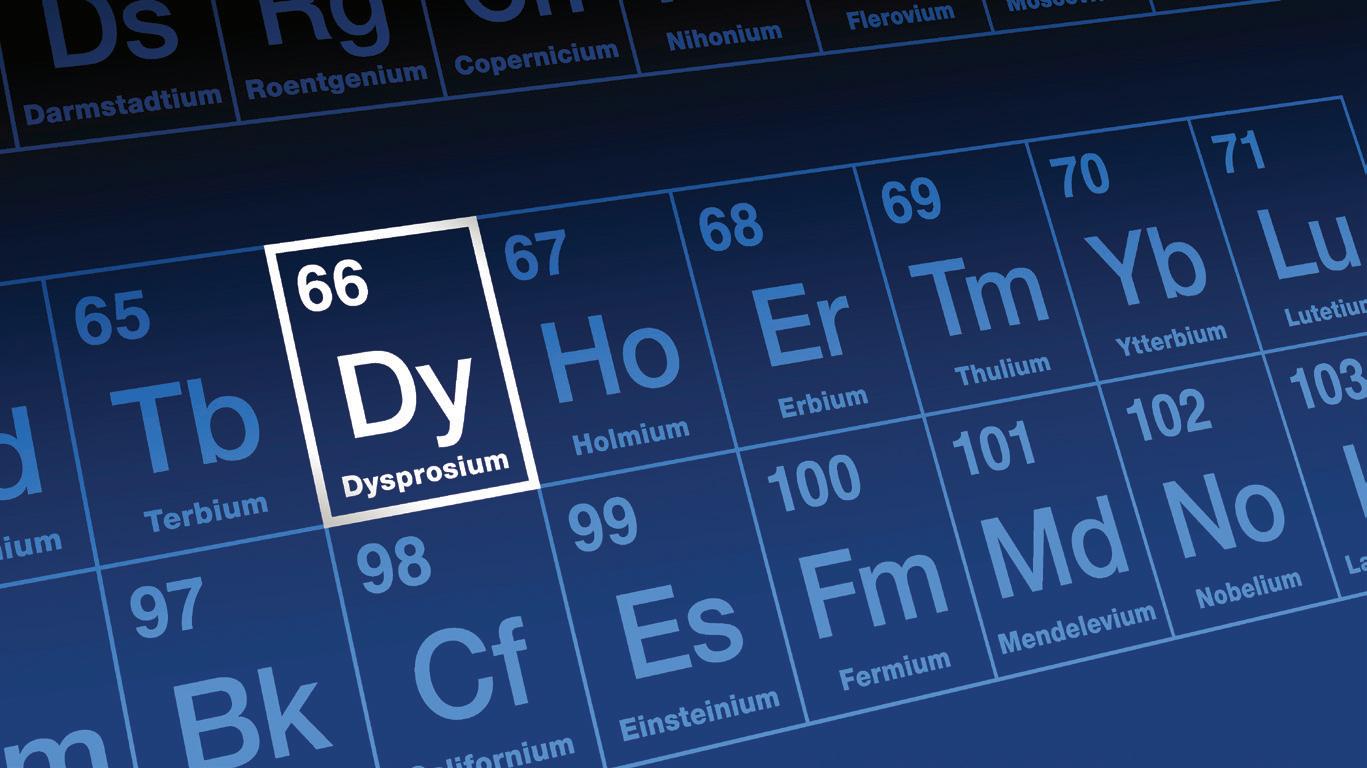

CRITICAL MINERALS

11 Critical minerals on the rise: What 2024 survey numbers reveal about British Columbia’s mineral exploration sector.

26 Unlocking lithium: Pairing technology and expertise to increase project value.

30 Outlook 2025: Reshaping the rare earth elements supply chain amid soaring demand and strategic risks.

32 Building an integrated critical minerals sector in Canada.

BATTERY ELECTRIC VEHICLES

18 Juiced for the Job: Round up of BEVs powering the future of mining.

MINE ELECTRIFICATION

23 Recent trends and developments in mine electrification in Canada.

40 Mine electrification in Canada: An industry in transition.

UNDERGROUND MINING

28 Pillar fortification with resin injection in the sub-level caving process.

TECHNOLOGY: ARTIFICIAL INTELLIGENCE

34 Artificial intelligence: Growing fact or lingering fiction.

TRAINING AND WORKFORCE

37 Finding the Canadian potash mining workforce to feed the world.

INTERNATIONAL DISPUTES

41 The billion-dollar standoff: Alamos Gold versus Türkiye.

4 EDITORIAL | Mining at risk: How tariffs could trigger an industry slowdown.

6 FAST NEWS | Updates from across the mining ecosystem.

10 LAW AND REGULATIONS | Time to get serious or become “uninvestable.”

13 MIN(E)D YOUR BUSINESS | Arbitration costs insurance: A natural fit for mining disputes?

15 LAW AND REGULATIONS | Straight talk on Canada’s new greenwashing laws.

17 INDEGINOUS AFFAIRS | Establishing the triangle of trust by creating a shared vision of prosperity.

39 IN MY MIN(E)D | How Canada can win the global resource race. 30

3740

eyond the immediate financial impact, tariffs are guaranteed to create economic uncertainty that discourages investment in the mining sector. Higher trade barriers often lead to market volatility, making it harder for companies to plan longterm projects or secure financing. Needless to say, the current Canadian regulatory and permitting process is already a tough nut to crack (see article on page 10 of this issue). Investors may hesitate to fund new mining developments if they anticipate reduced profitability owing to restricted trade. This uncertainty could also impact related industries, such as transportation and equipment manufacturing, which depend on a thriving mining sector. If prolonged, these effects could contribute to a broader economic downturn, slowing job creation, and weakening Canada’s position as a global mining leader.

Additionally, tariffs could trigger a slowdown in Canada’s mining industry by increasing costs and disrupting supply chains. Higher tariffs would drive up production costs for mining operations. This could make Canadian mines less competitive on the global market, forcing companies to scale back operations, delay new projects, or even reduce their workforce. On top of that, if countries impose retaliatory tariffs on Canadian minerals and metals, demand for these exports could decline, leading to revenue losses across the industry.

To combat the impact of tariffs, the mining industry in Canada must minimize costs, diversify markets, and strengthen resilience. For example, supply chain optimization, market diversification, and investing in domestic manufacturing or partnerships with local suppliers can also reduce reliance on costly imports.

Furthermore, mining firms can explore technological advancements, such as automation and energy-efficient equipment, to improve operational efficiency and offset rising costs. This reflects directly on the main feature of this issue, which is battery electric vehicles (BEVs), as switching to BEVs could help mining companies save money and reduce CO2 emissions.

Our annual BEV round up article on page 18 sheds light on several BEVs that are new to the market, with capabilities for the mining industry, as BEV demand and the selection of BEVs for the mining industry keep growing.

Clearly, assuming leadership across the BEV supply chain (including passenger BEVs) represents an enormous economic opportunity for Canada, creating good manufacturing jobs across the country. According to recent reports, experts are starting to agree that the federal government should ease or lift its 100% tariff, slapped on Chinese electric vehicles (EVs) last fall, to spur EV purchases and deliver a blow to Elon Musk’s Tesla, as part of Canada’s trade war with the U.S.

Moreover, rather than relying on a few major trading partners, Canadian miners can expand their export destinations to regions with favorable trade agreements. Strengthening relationships with emerging markets could help maintain demand for Canadian minerals and metals. Engaging with policymakers and industry associations to advocate for fair trade policies, exemptions, or tariff relief programs can also provide relief and create new revenue streams and reduce exposure to tariff-related fluctuations.

Critical minerals are essential for the manufacturing of BEVs and the global energy transition. In this issue, several articles cover topics related to critical minerals in Canada. On page 37, Scott Bahr discusses how we can find the Canadian potash mining workforce to feed the world. And on page 41, Gordon Feller explains the standoff between Alamos Gold and the government of Türkiye.

Finally, our May 2025 issue will report on what is new in the world of analytics, robotics, autonomous mining, software, and the IoT, as the mining industry continues to digitize and automate. Editorial contributions can be sent directly to the Editor in Chief no later than April 10, 2025.

APRIL 2025

Vol. 146 – No . 2

69 Yonge St., Ste. 200, Toronto, ON M5E 1K3 Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief

Dr. Tamer Elbokl telbokl@canadianminingjournal.com

News Editor Joseph Quesnel jquesnel@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@northernminer.com

Manager of Product Distribution Allison Mein 416-510-6789 ext 3 amein@northernminergroup.com

Publisher & Sales

Robert Seagraves 416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada George Agelopoulos 416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published nine times a year by The Northern Miner Group. TNM is located at 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3. Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods: Phone: 1-888-502-3456 ext 3; E-mail: amein@northernminergroup.com

Mail to: Allison Mein, 69 Yonge St., Ste. 200, Toronto, ON M5E 1K3

We acknowledge the financial support of the Government of Canada.

Ottawa and Manitoba have hedged their bets on Northern Manitoba becoming a global hub for trade opportunities, especially in critical minerals, based on a historic investment from both governments recently. Between the two governments, the investment is close to $80 million over two years, with a total investment of $79.4 million.

The federal government is investing over $43 million over the two years in new transportation and training monies.

Federal Minister Terry Duguid made the announcement in Manitoba on February 4th. On the same day, the Manitoba government committed to a $36.4 million investment into the railway and port. The provincial monies will go towards restoring and replacing old infrastructure at the northern port. Churchill is only operational four months out of the year, but Arctic thawing may change this over time.

Minister Duguid – who is the minister responsible for Prairies Can – commented, “This is about keeping northern communities connected, strengthening Indigenous economic leadership, and positioning Manitoba as a key player in the global critical minerals market. Reliable, affordable rail service is essential for the North, and these investments will ensure it remains a lifeline for communities and businesses. At

the same time, we’re creating new opportunities in mining and mineral development—helping Indigenous communities build skills, secure good jobs, and drive economic growth. This is a long-term investment in Manitoba’s future and in Canada’s clean energy transition.”

This investment is in line with Ottawa’s net-zero climate policy goals that involve promoting mining that produces materials involved in accelerating electrification.

Defense Metals released the results of its independent pre-feasibility study concerning the on-going development of its Wicheeda rare earth element deposit in

British Columbia. The pre-feasibility study reveals the following about the project: Robust economics, the presence of a high-grade REE mineral deposit advantage, a high-grade mineral concentrate advantage, and a high-value saleable mixed rare earth carbonate product.

Guy de Selliers, executive chairman, stated: “The positive results of our pre-feasibility study confirm the strate-

gic importance of the Wicheeda Project at a time when North America and Europe are prioritizing economic resilience and supply chain security for critical minerals.”

De Selliers added, “With NdPr being essential to electric vehicles, renewable energy, and advanced defense technologies, the Wicheeda Project represents a unique opportunity to establish a reliable, Western-aligned supply of these vital materials, reducing reliance on foreign sources and importantly helping to secure economic security. Our Wicheeda rare earth project is one of the most advanced in either North America or Europe that is not yet in production, positioning it as a leading, near-term solution to meet the growing demands for Western-aligned supply chains.”

With more than 80 years of magnetic expertise behind them, Eriez Dry Vibrating Magnetic Filters (DVMF) dramatically reduces contamination in materials that require extremely high levels of purity.

Eriez. Always the Right Choice. The exceptionally high intensity magnetic field generated provides peak separation efficiency, reducing ferrous and weakly magnetic contamination to ppm or ppb levels.

FPX Nickel outlined plans for advancement of the Baptiste nickel project in 2025. Following the completion of the robust 2023 preliminary feasibility study, the company’s 2025 activities will build on strong progress made in 2024, prioritizing the advancement of further engineering studies, baseline environmental data collection, and continued positive engagement with First Nations and the provincial and federal governments in preparation for anticipated entry into the environmental assessment process in the second half of 2025.

Martin Turenne, FPX’s CEO, stated, “In 2025, FPX is focused on completing the key workstreams to initiate the EA process, which is the key critical path activity for the overall development of the Baptiste nickel project. We are committed to working in partnership with

the multiple First Nations communities connected to the project, including the proposed mine site and associated off-site infrastructure such as the powerline and access road. This collaborative approach has resulted in targeting a later entry into the EA process than originally planned, in recognition of the desire by the company, First Nations and the provincial and federal governments to align on the scope and design of the reg-

Power Metals announced the Ontario Ministry of Mines has issued an early exploration permit for the entire Case Lake project area in northeastern Ontario.

The government permit is effective immediately for a three-year period, paving the way for the company to initiate its highly anticipated winter drilling program. The program will include several newly identified cesium targets uncovered through late-2024 soil sampling, further solidifying Case Lake as a globally significant critical minerals asset.

Haydn Daxter, CEO of Power Metals commented: “This permit is a major milestone, enabling further expansion of the Case Lake project. We’re delighted to receive this support from the Ontario Ministry of Mines and regional stakeholders as we work to transform Case Lake into a world-class project set to meet the surging global demand for critical minerals. With winter drilling set to begin, we’re confident in unlocking even greater value for our shareholders.”

ulatory process in advance of initiating the EA.”

VRIFY Technology – a technology company combining advanced AI with deep industry expertise to transform how minerals are found – has secured CAD$12.5 million in series B funding. Led by New York–based venture capital firm LGVP, with continued support from series A funders RCF Innovation and Beedie Capital, this round brings VRIFY’s total funding to over CAD$30 million.

Industry sources say the investment will accelerate industry-wide adoption of DORA, the world’s leading AI-assisted mineral discovery platform. VRIFY has designed DORA as a sector-wide R&D tool, uniquely placing the platform directly into the hands of the geologists and geoscientists tasked with finding the minerals the world needs to feed supply chains, secure borders, and build energy solutions.

DORA was officially unveiled to the industry for the first time during the 2025 Prospectors and Developers Association of Canada Convention on Monday, March 3, 2025, at the Metro Toronto Convention Centre.

komatsu.com/padt

In the midst of crisis, we are being inundated with platitudes by governments across the country. This should worry everyone. While it will not be easy, this is the time for determined action by policy makers.

“When it comes to big capital projects, time is both money and risk”

I started pulling this thread following news of the recent visit to Canada by Mike Henry, CEO of BHP Mining, the largest mining company in the world. Mr. Henry, a Canadian transplant to Australia, expertly outlined the challenges facing the industry and cautioned that Canada might miss inbound investment if it does not start to move the dial on investment conditions and permitting time frames. He spoke with authority as one of the largest investors in Canada, with BHP having invested $20 billion to build out their potash resources. I thank him for the frank advice and propose to add some suggestions about how we can meet his challenge.

While Canada has listed and updated lists of critical minerals, this approach has not advanced a single project. Under new legislation and a federal-provincial agreement, proponents should be invited to request that their critical mineral project be designated a “project in the national interest.” In the first instance, projects could only be designated if an initial review concludes within 30 days of application that there are no factors identified which indicate that environmental approval should not be given on reasonable conditions. The regime must, from this point forward, focus only on how, and not if, a project will be permitted.

Once designated, a “project in the national interest” will be the subject for a meeting of the prime minister with the premier of the applicable province within 30 days. While they may devolve this power to any minister, any devolution must include the authority to enter into the required agreements to progress the project.

The ministerial meeting must promptly result in an agreed timeline and scope of review. The review will, absent special considerations, require a complete deferral of any federal environmental assessment to the provincial regime. The standards for review must only be scientific, with a focus exclu-

sively on environmental and human health. The perversions of environmental assessments to consider gender, identity, and other subjective matters must end. A firm timeline must be published with any extensions conditioned on prior approval of the proponent.

The federal government should appoint (in consultation with the impacted province) a community consultation arbitrator with full powers to make findings and orders in the national interest. The arbitrator will convene public meetings of effected parties for any “project in the national interest.” Our state of emergency is so great that there can no longer be private consultations and private agreements. Needless to say, non-resident intervenors can neither be permitted nor funded. The Crown’s arbitrator will convene and supervise consultations, order benefit sharing arrangements, and provide binding terms for community approval.

Some community support will require government to be at the table to provide funding for critical infrastructure. For remote projects this will include transportation which helps the project and the community. This support must also include financing to install, develop, or expand community facilities, such as water treatment infrastructure which we have somehow not completed after a promise made and violated over the last nine years.

The cost of doing nothing should be seen in the caution that BHP gave in Queensland, Australia, that state policy had rendered the jurisdiction “uninvestable.” Most investors will not bother making this kind of fuss, they will just quietly move on to more fertile ground. The price of failure will be counted in the continued diminution of our currency, declining productivity, lost opportunities for our children, and deterioration in private and public facilities (such as the much-lauded healthcare system). Is it a coincidence that everything seems broken at a time when the desirability of Canada as a place to do business is in question?

My prescription may not be the definitive answer, but we need to start and go fast. We seem to be having fun thumping our chests and cancelling our trips to the U.S., but it is far more important that we get to work.

Sander Grieve is a partner at Bennett Jones LLP in Toronto. He practises public market finance and M & A, focusing on global mining exploration, development, and extraction.

Disclaimer: The opinions expressed in this article are solely those of the author and do not necessarily reflect the views or positions of the Canadian Mining Journal.

Amid simmering geopolitical tensions, looming federal elections, and ongoing free trade and tariff negotiations, Canada’s mining sector and critical minerals supply have been thrust into the crosshairs of the global stage as government foreign policies have quickly shifted toward domestic industrial and economic autonomy.

In this uncertain global context, the latest numbers from the British Columbia Mineral and Coal Exploration Survey reveal mineral exploration in the Pacific province experienced its first year-over-year decline in exploration budgets in nearly a decade. As the stage is set for significant changes to the sector in the coming weeks and months, the survey highlights three significant takeaways including expenditure dips, momentum for critical minerals, and shifting tides in the distribution of B.C.’s exploration shares per mineral.

One of the most significant findings from the report is the sharp decline in exploration expenditures, which fell from $643 million in 2023 to $552 million in 2024 — a staggering 14% decrease. This downturn is particularly striking given the backdrop of high commodity prices for essential minerals like

gold and copper. Currently, 130 exploration firms are engaged in 283 active projects across the province, with notable concentrations in regions such as the northwest (Smithers) and the southwest (Vancouver).

For instance, the northwest region, particularly around Smithers, accounted for 32% of the total exploration spending in 2024, despite a 22% decline in expenditures compared to the previous year. This shift indicates a potential loss of interest in flagship projects as they transition from exploration to operational phases. The decline in investment is also evident in the overall drilling activity, which fell by 15% from 2023, with total metres drilled dropping to 631,726.

Several factors contribute to this reduced spending. As flagship projects mature, funding shifts from exploration to infrastructure needs. Additionally, junior mining companies are grappling with external financial pressures, particularly rising global interest rates, which hinder their ability to secure capital. Notably, investments in precious metals have diminished significantly, with a 24% decrease for gold and a 28% decrease for copper.

Despite the challenges in traditional exploration, there is a silver lining: a notable increase in investment in critical minerals. Expenditures in this area climbed from $24 million in 2023 to $49 million in 2024, reflecting a growing recognition of the importance of these resources for a sustainable economy. This increase is largely supported by the federal Critical Mineral Exploration Tax Credit introduced in 2022.

For example, the metallurgical coal sector saw a noteworthy 47% rise in exploration spending, increasing from $26 million in 2023 to $38 million in 2024. This resurgence can be attributed to recent acquisition activity and a fresh injection of capital into exploration projects. The southeast region, particularly around Cranbrook, has emerged as a focal point for this investment, showcasing the potential for growth in this sector. Emerging policies, such as the Critical Mineral Exploration Tax Credit, are designed to incentivize investment in this sector.

However, Saskatchewan’s competitive advantage through the Targeted Mineral Exploration Incentive is noteworthy and may attract further investment away from B.C.

Shifting sands: The new focus in exploration activities

The report also highlights a significant shift in exploration activities, particularly concerning the types of minerals being

targeted. While gold exploration investments have plummeted, silver exploration surged by 72%, and zinc saw a remarkable 209% increase. Nickel exploration also rose by 50%, indicating a growing interest in resources critical for electric vehicles and renewable energy support.

Moreover, the landscape for junior exploration companies is changing, with a 22% drop in expenditures in 2024, despite favourable market conditions for mineral producers. This trend suggests a transfer of market share towards larger entities, reshaping investment dynamics in the sector. For instance, mineral producers accounted for $228 million in exploration spending in 2024, matching last year’s expenditure, with 78% of this spend directed toward later-stage projects.

The 2024 British Columbia Mineral and Coal Exploration Survey paints a portrait of a pivotal moment for the province’s mineral exploration sector. While immediate challenges persist, particularly for precious metals, proactive policies and a growing emphasis on critical minerals signal a potentially positive trajectory. Stakeholders must remain adaptable to navigate the evolving market conditions effectively.

Iain Thompson is the mining and metals consulting leader at EY Canada, based in Vancouver.

Mining companies face a unique set of risks when it comes to arbitration and litigation, especially when dealing with foreign markets and navigating shifting political landscapes. Mining operations, particularly in resource-rich countries, are often exposed to “resource nationalism,” where governments may take actions that affect the profitability and operational stability of mining ventures. Political instability, shifting regulatory environments, and disputes with host governments can all lead to significant legal and financial risks. In such a context, arbitration becomes a critical tool for resolving disputes. However, it also comes with its own set of challenges — most notably, the high costs and uncertainties associated with financing such claims. But what happens when resolution efforts fail, correspondence goes unanswered, and deadlines pass?

The financial implications of pursuing arbitration are significant, and the approach to financing will vary depending on the size, liquidity, and risk appetite of the mining company involved. Large, cash-rich companies may be able to comfortably finance arbitration costs, which can range from several million to tens of millions of dollars. However, even large enterprises may encounter challenges when the costs exceed their planned budgets or when the dispute threatens a key asset in their portfolio. On the other hand, smaller companies may face a “bet the farm” scenario, where the outcome of the dispute could determine their financial survival. In such cases, the company may lack the liquidity to self-finance the arbitration and must explore alternative funding options.

For companies unable or unwilling to bear the costs of arbitration on their own, they may look to third-party funding to cash flow their legal budget. In this model, a third-party investor provides the capital needed to pursue the dispute in exchange for a share of any eventual damages award. While this option removes the financial burden from the claimant, it does come at a cost — funders typically expect a significant return on their capital, which can make this option unattractive for some companies.

For companies that are financially capable of financing their own legal budget but nonetheless wish to mitigate their capital risk, arbitration insurance provides an appealing alternative.

Arbitration insurance products can cover the costs associated with arbitration, including legal fees, expert costs, and tribunal expenses. If the arbitration is unsuccessful, the insurer will reimburse the claimant for the costs incurred. This removes the outcome risk — if the claimant loses, they do not bear the financial burden. Crucially, the cost of arbitration insurance is generally significantly lower than third-party funding, making it an attractive option for companies that can self-finance but want to mitigate the risk of an adverse outcome.

Arbitration cost insurance is often structured in a way that the premium is paid in instalments, with the full amount due only if, and when, the claimant successfully recovers damages. While not widely publicized, many litigation funders use this form of insurance to mitigate the risks associated with their investments.

Award preservation insurance is another useful tool, especially for companies that already hold an arbitration award but face the risk of an appeal or annulment. This insurance protects the claimant from the financial impact of an adverse decision in the appeal process, ensuring that the value of the award is preserved.

Arbitration cost insurance products are not mutually exclusive and can be combined with third-party funding or other financial tools to create a hybrid structure.

• Financial risk mitigation: For mining companies that have the financial resources to self-finance their arbitration or litigation but want to mitigate the risk of a poor outcome, arbitration insurance is a valuable tool. It offers a cost-effective alternative to third-party funding, while also removing the financial risk of an adverse award.

• Insurance options for arbitration: Insurance products like own-side cost insurance, award preservation insurance, and adverse costs insurance can all play a role in managing the financial risks associated with arbitration.

• Be mindful of a knowledge gap by practitioners: Unfortunately, arbitration insurance products have not always been on the radar of many arbitration lawyers, with advice often being limited to either private funded versus third-party financing options. This awareness gap can lead to missed opportunities, particularly for larger enterprises who might benefit from a more nuanced, tailored approach to managing arbitration costs and risks.

• Hybrid financing solutions: A combination of third-party funding and arbitration insurance can provide a balanced approach, giving companies the flexibility to manage both costs and risks in a way that suits their financial situation.

In conclusion, as arbitration becomes an increasingly important tool for resolving mining disputes, companies in the sector should explore the full range of financing options available. Arbitration insurance can present a compelling and cost-effective way to mitigate risk, offering an attractive middle ground between self-financing and third-party funding. While not a one-size-fits-all solution, when used strategically, arbitration insurance can help mining companies navigate the complex financial landscape of international disputes.

Robert Warner is the director of TheJudge Global, part of the Thomas Miller Group of companies.

Greenwashing regulations are sprouting up faster than organic kale. From the E.U.’s Green Claims Directive to Australia’s Green Claims Code, to the U.K.’s Financial Conduct Authority’s anti-greenwashing rules, many jurisdictions are cracking down on false or misleading environmental claims. On June 20, 2024, Bill C-59 became law and amended Canada’s Competition Act to introduce our own anti-greenwashing provisions, which aim to enhance the accountability of businesses making environmental and social claims. Additionally, in December 2024, the Competition Bureau released proposed guidelines to clarify their enforcement approach.

For mining companies headquartered or operating in Canada, these changes demand immediate attention this reporting season to avoid possibly substantial penalties and reputational damage. The Mining Association of Canada (MAC) has expressed concerns about the provisions’ vagueness and potential impact on the industry’s ability to secure investments. Nevertheless, these regulations are now in force, making compliance essential for mining companies publishing sustainability reports.

Many sustainability teams are deep in their annual reporting processes right now. It is key to remember that these recent Competition Act amendments apply to all businesses operating in or headquartered in Canada, regardless of your size. The provisions are already enforceable now, and from June 2025, private parties will also be able to take action to directly challenge companies on greenwashing. So, if your in-scope mining company is reporting on sustainability or environmental, social, and governance (ESG), here are our top practical recommendations.

Make

All environmental claims must be supported by “adequate and proper testing.” For mining operations, this means having solid evidence backing up any sustainability assertions. If you claim that a particular operational adjustment has reduced carbon emissions, or that you rehabilitate land more effectively than others, ensure you have credible data on hand demonstrating these outcomes.

Adopt internationally recognized methodologies

When making claims about your mining operations’ sustainability practices, use methodologies recognized internationally. Standards like the GHG Protocol, ISO 14064 for greenhouse gas (GHG) accounting, or Science Based Targets initiative (SBTi) provide credible frameworks. If your methods are not widely accepted, you risk being challenged on your claims.

By Elizabeth Freele and Rachel Dekker

While Canadian government program approvals may be helpful, they must be supplemented with internationally recognized methodologies. Relying only on Canadian standards or permits is insufficient for substantiating environmental claims under the new provisions. Though compliance with Canadian legislation is mandatory, the credibility of environmental claims requires alignment with globally recognized standards and methodologies to withstand potential scrutiny.

Conduct proper due diligence to ensure your company’s methods demonstrate that you took reasonable steps to prevent inadvertent deceptive marketing practices, particularly when making claims about sustainability practices. Implement a structured compliance program with clear policies, training, and monitoring mechanisms relating to any environmental claims. Third-party verification from reputable organizations also serves as particularly valuable evidence of due diligence.

Maintain thorough records of all data and evidence supporting your sustainability and environmental performance claims. Documentation should include monitoring data, testing results, methodologies used, and any third-party verifications. Although you are not required to disclose this information publicly, having it ready can help mitigate risks if questions arise about your claims.

Mining companies are often implementing innovative technologies to improve sustainability performance these days. Be particularly cautious when making claims about the impact of these innovations. If you are implementing new water treatment technologies or low-emission equipment that claim to be more environmentally friendly, have data ready to prove their effectiveness.

Be careful when repurposing information from regulatory filings for marketing materials or sustainability reports. While the Competition Bureau is not primarily focused on “representations made for a different purpose, such as to investors and shareholders in the context of securities filings,” the same information therein becomes subject to scrutiny when used for promotional purposes. So, if you extract environmental claims from your regulatory filings and use them in

public-facing promotional materials, they become subject to the Bureau’s enforcement of deceptive marketing provisions.

Do not stop disclosing

Your company may be tempted to reduce its disclosures to manage greenwashing risk, but sustainability disclosures, public policies, and commitments are an important part of building trust, social license, and demonstrating responsible performance to a broad range of stakeholders. So, do not stop disclosing, but ensure that the information your company makes public stands up to scrutiny.

When developing a sustainability report, it is crucial for your claims to be specific and evidence based. Dispense with the vague statements that have been all too common in this industry. Instead of describing your company as “environmentally responsible” or “sustainable,” provide concrete metrics such as “we reduced freshwater consumption by X% through water recycling systems that processed Y million litres in 2024.” Focus on showcasing actual accomplishments rather than aspirations too. Consider third-party verification of potentially contentious claims about topics like GHG emissions, water impacts, or biodiversity outcomes. And for forward-looking statements, develop concrete plans with interim targets, ensuring implementation steps are underway before publicizing. Finally, do not forget to have multiple people,

including your risk and audit committee and third-party experts review your reports for accuracy and compliance.

While the Competition Bureau will not retroactively enforce the new greenwashing provisions, mining companies must ensure future sustainability reports align with these regulations. Though still in early implementation, these rules apply to operations of all sizes across the Canadian mining sector.

The consequences of non-compliance are severe: fines up to $10 million ($15 million for repeat offenders) or 3% of global annual revenue, whichever is greater. Starting June 2025, private parties can initiate actions based on their interpretations of the Act, potentially exposing your company to additional litigation risk, in a context of rapidly growing ESG litigation risk.

Our industry has long faced intense scrutiny over our environmental and social impacts. Beyond financial penalties and legal compliance issues, the reputational damage from greenwashing allegations can significantly impact your social license to operate, stakeholder trust, and investor confidence.

Elizabeth Freele and Rachel Dekker are managing partners of the mining sustainability consultancy: Sympact and founders of online learning platform: the Responsible Mining Academy. While this guidance is offered in good faith, it does not constitute legal advice. Companies should consult legal counsel for specific compliance questions.

Historically, Indigenous communities have either been ignored or considered a final box to check when it comes to mining. These voices have been absent from strategic conversations around mineral development, but this is changing out of necessity. More than half of the key mineral projects currently proposed are on or near the lands of Indigenous Peoples in the U.S. and around the world. Thus far, interactions with First Nations have fallen squarely in the bucket of “consultation,” using town halls and the like. We must move from consultation to participation and ownership. This includes royalty streams, which can then be used as a financial multiplier to attract ongoing investment, or equity. Making this shift requires dialogue before either the company or the government has a plan, so that First Nations are involved at the outset and can have an honest dialogue about trade-offs and incentives, helping to establish a triangle of trust.

A key first step to establishing that triangle of trust between companies, the government, and First Nations and catalyzing prosperity beyond the life of the mine is creating a shared vision of prosperity with all stakeholders and owners. Outlining clear roles for government, mining companies, downstream companies, and Indigenous communities is key, along with ensuring representation across all the stakeholder and owner groups. Radical transparency from everyone involved and legal frameworks that protect the interests of the entire group are important steps.

As companies take on the responsibility of creating shared value, it has a massive opportunity to grow prosperity both through and beyond the life of the mine for resource-endowed communities. Mining provides multiple value streams and can have an investment multiplier effect. Job creation, supply chain development, and in-country sourcing of goods and services is a temporary boon to local economies during the life of the mine. But social and economic development beyond the life of the mine — investing in infrastructure development such as power, water, and transportation. — brings longer-term benefits to communities. Setting up structures to encourage and enable investment into the region and building up education and healthcare systems are two examples.

There are several examples of successful equity-sharing partnerships with Indigenous communities we can look to as models. In 2022, Hydro One implemented an Equity Partnership Model that offered First Nations a 50% equity stake in new, future large-scale capital transmission line projects with a value over $100 million. To date, Hydro One and nine First Nations partners have agreements that provide the opportunity to invest in the Waasigan Transmission Line, which is under development in northwest Ontario. In an incredibly unique and effective approach, in New Zealand, the Māori own 100% of the Mōkai geothermal energy field and sold a 25% stake to Mercury Energy to fund the expansion and development of the power station as part of a public-private partnership. Tools like

Aotearoa New Zealand’s resource management legislation, where the Māori is involved in any resource management decisions, are critical to making sure Māori have the most powerful voice in the development of their resources.

Another example of a successful partnership to enable equitably shared prosperity beyond the life of the mine is the South Africa Impact Catalyst, a cross-sectoral, multi-partner development initiative between Anglo American, the South African Council of Scientific and Industrial Research (CSIR), Exxaro, Zutari, and World Vision South Africa, who all share a vision of creating enhanced social impact in the mining communities in Limpopo and out to other provinces. Its early success led to the inclusion of two other regions. Core to its success was aligning on a shared definition of collective impact that began with a common agenda, established shared measurement, fostered mutually reinforcing activities and communication.

Groups like the First Nations Major Projects Coalition are coming together to champion Indigenous values and ownership in major mining projects in Canadian territories. The Nations Royalty Corporation is the world’s first mining royalty company that is majority-owned by Indigenous People. The Greenstone Gold Mines partnership, a partnership between Greenstone Gold Mines, Kenogamisis Investments Corporation, and Minodahmun Development LP, ensures First Nations involvement in the Greenstone region’s resource development project.

Recently, the Ontario government is investing $13 million through the Ontario Junior Exploration Program (OJEP) to help 84 junior mining companies finance early exploration projects. These projects have the potential to lead to promising discoveries of valuable mineral deposits and lead to future mines, which would boost economic growth and job creation for northern and Indigenous communities. The Canadian federal government recently unveiled the details of a loan guarantee program that could boost equity ownership for First Nations whose territories contain lucrative reserves of metals. The country’s Critical Minerals Indigenous Engagement Strategy aims to acknowledge, affirm, and implement the rights, interests, and circumstances of First Nations, Métis Nation, and Inuit. Similarly, the International Council on Mining and Metals’ (ICMM) guide for Indigenous engagement reinforces ICMM members’ commitment to respect the rights of Indigenous Peoples and set out equitable terms for impacts.

Rather than treating Indigenous communities as stakeholders that should be compensated, resulting in short-lived benefits, these efforts support a shift to viewing them as partners to share in the long-term development of their lands and sustained prosperity.

Peter Bryant is a managing director and board chair of Clareo and the co-founder and chair of the Development Partner Institute. Lana Eagle is an Aboriginal relations strategist and director of the Prospectors and Developers Association of Canada.

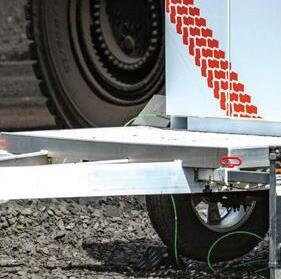

This article sheds some light on how battery electric vehicles (BEVs) are transforming the mining industry by offering a cleaner, more efficient alternative to traditional diesel-powered equipment. These electric machines reduce greenhouse gas (GHG) emissions, improve underground air quality, and lower ventilation costs, making them particularly beneficial for underground mining operations. Here, we showcase how the recent advancements in BEVs are becoming more viable, offering longer running times, and faster charging solutions tailored to the demanding conditions of mining sites. Additionally, BEVs help mining companies meet sustainability goals and regulatory requirements while reducing operational costs associated with fuel and maintenance. As the mining industry shifts towards electrification, BEVs are playing a key role in shaping the future of mining.

Say hello to the latest addition to Liebherr’s electric excavator portfolio: The R 9600 E!

This electric excavator has the same exceptional productivity as its diesel counterpart — the R 9600 — with the same class-leading bucket capacity but with some additional bonuses that only electric excavators can offer. Thanks to the R 9600 E’s electric motors, the machine emits no GHG emissions on site, which significantly reduces customers’ carbon footprints. The electric motors also make for quieter operations, benefiting the operator in the cab and everyone else in and around the mine site! And, with the electric motor’s service life equal to that of the R 9600 E itself, maintenance costs are also decreased!

The MacLean fleet solution “BEVolution” continues

With the delivery of MacLean BEV fleets to Agnico Eagle’s Odyssey mine, Torex’s Media Luna project, and Glencore Onaping Depth project, MacLean will soon surpass the milestone of more than 100 battery electric units commissioned, with well over 500,000 hours of operating time accumulated since the launch of the company’s Fleet Electrification Program in 2015. Leveraging the lessons learned and benefiting from the depth of total cost of ownership (TCO) data that has been collected over the years, MacLean is there to help current and future customers achieve their own purpose-designed BEVolution.

Epiroc’s Scooptram ST18 SG arriving on Canadian soil

Epiroc’s Scooptram ST18 SG, the battery-powered loader built for demanding underground applications, is making its debut on Canadian soil in 2025 with two rigs set to arrive to customer sites in early June. The machine is ideal for larger mining operations, such as block caving or stoping and is automation-ready, adding another layer of worker safety to underground operations. With one of the highest battery capacities on the market of 540 KwH nominal, the Scooptram ST18 SG can handle more than 1,300 tonnes on a single battery charge — keeping productivity at a high level throughout each shift.

Cat 793 XE Early Learner battery electric trucks begin testing and validation at global customer sites

The next generation of Caterpillar’s battery electric mining trucks are now at select customer sites for testing and validation. Caterpillar built and tested seven Cat 793 XE Early Learner battery electric trucks at its Tucson Proving Ground facility in Green Valley, Arizona. It is the second development phase of the company’s Early Learner program following the successful demonstration of the battery electric 793 prototype in 2022. Caterpillar will continue testing and validating some of the Early Learner trucks at its proving ground facility. The Early Learner program was launched to accelerate the development and validation of Cat battery electric large mining trucks with support from key mining customers and Cat dealers and will be critical to validate the enhanced design elements of the 793 XE.

The Toro LH518iB is Sandvik’s next-generation battery-electric loader, designed to enhance productivity and safety in underground mining operations. With an 18-tonne payload capacity, it fits into 4.5 x 4.5-metre tunnels, offering high acceleration and fast ramp speeds owing to its advanced electric driveline. The loader features Sandvik’s patented AutoSwap and AutoConnect systems, enabling efficient, operator-assisted battery swaps with-

out the need for large-scale equipment. Fully battery-powered, it produces zero underground exhaust emissions and significantly less heat than traditional diesel engines, supporting mining operations in reducing their CO2 emissions. Additionally, the Toro LH518iB is optimized for integration with Sandvik’s AutoMine automation system, further boosting operational efficiency. Learn more by visiting: https://www.rocktechnology.sandvik/

The first L440B LHDs are now reaching customers, marking a major milestone for Aramine’s battery-powered solutions. With a 4.6-tonne capacity, this groundbreaking loader eliminates the need for costly charging infrastructure, thanks to its integrated charger and ultra-fast battery swap system. Designed for extreme underground conditions, its LFP-based “energy module’ ensures safety, durability, and efficiency. Building on the success of the L140B, Aramine is expanding its battery-powered range, with a new mining truck coming soon. To meet the rising demand, a new factory is under construction. L440B order books are already full through 2026.

The KT300e delivers full vehicle performance Kovatera’s purpose-built BEV, is designed from the ground up using advanced technology and proven components — never adapted or converted — ensuring superior durability and performance. Its heavy-duty 13,000-Ib frame, high-capacity braking resistor, and dedicated cooling system allow it to thrive in demanding underground conditions. The KT300e delivers full

vehicle performance even at a high state of charge (SOC), with no speed limitations or runaways, maximizing battery efficiency and productivity. With zero emissions, reduced noise, and minimal heat, it outperforms in all categories while setting new standards for sustainable mining solutions. Explore more at www.kovatera.com.

Rokion is proud to introduce the R710, the latest in their line of battery powered utility equipment. Manufactured in Canada, the R710 is available with multiple custom front-end options, including a roof bolter and 10,000-Ib forklift configuration. If you are looking for a zero-emission alternative to your internal combustion equipment, then the R710 is the product for you.

Like all Rokion equipment, the R710 is powered by lithium iron-phosphate battery modules, offering exceptional safety and performance in the harsh underground environment. The R710’s robust, articulating frame and independent drive modules ensure superior handling and operation across uneven terrain.

Power your way with the adaptable 930E Power Agnostic Series from Komatsu

When it is time to transition to more sustainable power, Komatsu’s 930E Power Agnostic Series makes it simple. Its power-agnostic design offers the potential to integrate a wide range of current and future energy sources, giving you control over emissions and operational efficiency. Choose the power solution that fits your needs to help manage your carbon footprint while minimizing downtime and maximizing productivity. If you are ready to take the next step toward a more sustainable, cost-effective mining operation, learn how the 930E Power Agnostic Series can help.

In 2021, 27 members of the International Council on Mining and Metals (ICMM) committed to reaching net-zero Scope 1 and Scope 2 emissions by 2050 or sooner. This commitment set the global mining industry on a path to mine electrification. ICMM’s net-zero emissions goal is an ambitious goal, but observers say it is possible to attain emissions reductions of 85% or more in the mining sector.

Industry-wide transformations such as transitioning from using diesel fuel to electricity for large haul trucks and equipment take time, capital, and resources. However, recent advances in battery technology, charging technology, and the cost of electric mining equipment and large haul trucks becoming more cost competitive, as well as government tax incentives, are helping the mining industry make this transition.

Here is what the Mining Association of Canada (MAC), the Ontario Mining Association (OMA), and ABB Ltd. are doing to help Canadian mining companies navigate this evolutionary transformation.

The Mining Association of Canada (MAC) MAC has been the national voice of the Canadian mining industry since 1935. It supports its member mining companies in transitioning to mine electrification through several initiatives.

Many mines in Canada are located in rural and remote areas with limited access to reliable electricity infrastructure (the grid), especially from clean energy sources. “The cost and complexity of extending grid connections or installing off-grid solutions, such as renewable energy systems, can be significant

barriers to electrification,” said Photinie Koutsavlis, vice president, economic affairs and climate change, at MAC.

While advancements in battery electric vehicles (BEVs) and other electrification technologies are promising, challenges remain in adapting these technologies to the demanding environments of mines. Koutsavlis said, “Ensuring reliable performance in extreme conditions, such as underground operations or harsh climates, requires further development and innovation. Current electrification technologies, like battery-powered heavy equipment, face limitations in battery life, energy density, and performance reliability, making it a key hurdle to meet the rigorous demands of mining operations.”

Electrifying a mine requires significant upfront investment in new equipment, infrastructure, and energy systems. “The high capital costs, including those for electric vehicles, charging infrastructure, and energy management systems, can be a deterrent — particularly for small and medium-sized operators or in jurisdictions with limited financial incentives or support for low-carbon transitions. Additionally, the need to retrofit existing operations adds to the financial barriers faced by many mining companies,” said Koutsavlis.

MAC advocated support in the adoption of electric vehicles and equipment in mining operations, and in 2020, the federal government announced its commitment to allow mining companies to write-off the full cost of clean energy equipment. This will help de-risk purchases of electric heavy haul trucks and equipment and accelerate the adoption of BEVs at more mines.

Mine electrification decreases reliance on diesel-powered

equipment, significantly reducing greenhouse gas (GHG) emissions. “A decrease in reliance on diesel-powered equipment aligns with MAC’s commitment to climate change mitigation, regulatory compliance, and advancing the sustainability goals outlined in our Towards Sustainable Mining (TSM) initiative. It supports mining companies in transitioning to low-carbon operations and achieving net-zero targets,” said Koutsavlis.

Electrification eliminates harmful diesel emissions, such as particulate matter and other pollutants, leading to cleaner air and improved health for workers in underground mining environments. Koutsavlis added, “This creates a safer workplace, reduces health risks, and lowers the need for extensive ventilation systems, which are costly to maintain.”

Electric equipment offers lower operating costs over its lifecycle, including reduced fuel consumption, maintenance requirements, and energy expenses. “Electrification enhances

Delivering fit-for-purpose solutions across the entire project life cycle

We are a world leader, boasting decades of experience delivering fit-for-purpose solutions across the minerals and mining industry.

No matter your commodity, we are positioned to serve as your trusted advisors on the ground reducing your supply chain risk. We invest in the latest equipment, continual training and ensure industry requirements are met at the global, regional, and local level.

energy efficiency and enables better integration of renewable energy sources, further reducing operational costs and enhancing sustainability,” said Koutsavlis.

MAC actively supports its member mining companies’ transition to mine electrification through several initiatives such as developing and promoting best practices, advocacy and policy engagement, collaboration and knowledge sharing, and securing funding opportunities.

“Our TSM initiative includes frameworks and guidance for sustainable energy use and GHG emissions management. These tools help member companies integrate electrification as part of broader decarbonization strategies,” Koutsavlis explained.

Through its TSM program, MAC supports its member companies in advancing electrification by the following:

• Encouraging mining operators to identify and implement strategies to reduce GHGs, including electrification of fleets and renewable energy integration.

• Providing tools to optimize energy use and reduce reliance on fossil fuels, supporting electrification initiatives.

• Fostering collaboration, sharing best practices, and adopting cutting-edge technologies like BEVs and renewable energy-powered equipment.

• Advocating for government policies and incentives that support mine electrification, such as investments in clean energy infrastructure, funding for innovative technologies, and tax incentives for purchasing electric mining equipment.

• Participating in consultations on climate

and energy policies to ensure the mining industry’s needs are represented.

Since 1920, the Ontario Mining Association has advocated for industry advancement and opportunities. OMA works with governments and communities to help Ontario’s mining industry become the cornerstone of the country’s rich resource economy.

Mine electrification is a challenge for many mines in Ontario owing to grid and distribution infrastructure constraints. “In northern Ontario and remote areas, access to the electrical grid can be unreliable and, in some cases, not an option as it simply does not exist. Providing access to reliable power through Ontario’s electricity grid is vital for mining companies to electrify,” said Priya Tandon, president of the OMA.

Retrofitting mines in a move toward electrification is a costly undertaking and for many mining companies it is not a feasible expense. Tandon explained, “Transitioning from diesel to electric equipment requires high upfront costs and the upgrading of many systems and infrastructure. This large initial investment is especially a barrier for small and new mines.”

Redesigning a mine to adopt electrification can be unfeasible especially for legacy mines that have been engineered prior to the boom of electrification. “New mine designs that factor in BEVs and the supporting infrastructure have an easier path to electrify,” said Tandon.

Mine electrification leads to an overall reduction in GHGs. “By facilitating remote mines’ access to Ontario’s clean electricity, we can decrease their reliance on fossil fuels for operations, thereby minimizing their environmental footprint further,” added Tandon.

Transitioning from diesel to electric-powered vehicles impacts employees and local communities directly by enhancing the air quality in the workplace and the

region. Additionally, the quieter operation of electric equipment, such as drills and vehicles, minimizes noise pollution and helps reduce the risk of hearing injuries. Tandon said, “For Ontario mines, this translates into better working conditions for drivers and people working near the equipment.”

Although the upfront capital investment is high, in the longterm, mines that have BEVs on-site see a reduction in their ventilation and cooling costs. “Eliminating the need to transport diesel and lower maintenance costs for electric equipment result in ongoing savings,” Tandon explained.

According to Tandon, to enhance the electrification of Ontario’s mining sector, OMA continues to strengthen its partnership with the Independent Electricity Systems Operator to help shape new buildouts of transmission and distribution systems that can ultimately support Ontario mines in their electrification efforts. OMA is also advocating for the expansion of the province’s clean electricity grid to offer mines a sustainable alternative to fossil fuels.

As interest in mine electrification continues to grow among the members of OMA, we are facilitating information sharing and showcasing member success stories through our committees. Despite the challenges associated with mine electrification, mining companies have made strides in electrifying various facets of their operations.

Some notable examples include Agnico Eagle pioneering the use of electric scoops at its Macassa mine; Newmont introducing 38 pieces of electric equipment at its Borden mine; and Glencore designing its Onaping Depth project as an all-electric operation.

ABB is a global technology company that has inspired innovation in the mining industry for more than 130 years. Through its portfolio of industrial electrification, automation, and digitalization solutions, ABB helps mining companies plan and develop sustainable, resource-efficient mines as well as supports the transition of existing mines to all-electric, decarbonized operations.

Recent research reveals that as the mining industry moves toward mine decarbonization, many mining companies are changing out their hydrocarbon-fueled heavy-haul trucks and equipment for hybrid and BEVs. This fleet will require optimized megawatt charging, and the mine site must have access to a reli-

CREDIT: ABB

able electricity source or an electrical grid system.

ABB’s “Ability Mine Optimize” portfolio brings electrification, automation, and digital technology together. The digital connection of all of ABB’s solutions means that they can be monitored and controlled 24/7 to optimize mine’s operations and energy usage safely in real time.

ABB’s “eMine” is a holistic approach to mine decarbonization that can help with energy transition from fossil fuel to alternative sources of power including electricity. The company develops integrated and tailored systems specific to mine’s operational needs by optimizing the overall mine design, integrating stable and efficient systems to provide the right technology, to maximize safety, productivity, and energy efficiency.

ABB’s grid to wheel solutions for fleet decarbonization solutions include its stationary charging system “eMine Fast Charge” and its dynamic energy transfer system “eMine Trolley”.

ABB’s “Ability eMine Fast Charge” is an integrated electrical, automation, and digital charging solution with an automated connection interface. The “eMine Fast Charge” charging stations are engineered to interface with all vehicles, as ABB is vehicle type and OEM agnostic, which supports an inter-operable approach that can charge all BEVs.

ABB’s “Ability eMine Trolley System” is an integrated electrical, automation, and digital mechanical energy transfer system (catenary or rail) plus mechanical, structural, and civil works (case by case, depending on location). The eMine Trolley System works in open pit and in underground mines.

Sachin A. Jari, general manager, mining North America, process industries, at ABB, said, “ABB is at the forefront of this transformation journey. Our solutions can reduce diesel consumption by up to 90%, thereby greatly reducing CO2 emissions; reduce a mine’s energy costs; provide improved productivity via higher speed-on-the-grade, as electrified trucks run at a higher speed than diesel-fueled trucks; reduce maintenance; and provide a return on investment in two to five years. We believe that no single company can realize this vision alone. We are working together with end-users and industry stakeholders to build the electric, connected, and autonomous mine of the future. The objective is to create sustainable progress for the mining industry, as well as the world beyond it. ABB’s Mining team has been engaging in fleet electrification with cases such as open pit mining in B.C. with Copper Mountain and underground mining in Ontario with Vale.”

Canadian mining companies can expect to experience myriad challenges in their journey of mine electrification. However, the benefits will result in reduced GHG emissions, increased energy efficiency, reduced capital expenditures, improved overall mine performance, and improved miners’ health and safety.

Diane L.M. Cook is a freelance mining writer.

By Victoria Martinez

The number of batteries used in energy storage is rising as the world adopts more advanced technologies, particularly green energy and electric vehicles (EVs), thus increasing the demand for critical minerals such as lithium.

Lithium extraction, like many resources, can be a complicated and expensive proposition for mining companies. Typically found in low concentrations, lithium deposits vary from rock to clays to brines with unique impurities from location to location. Lithium supply chains also require high degrees of purity.

“As companies look to optimize processes and plan ahead to ensure the marketability of lithium,” says Mike Crabtree, president and CEO of the Saskatchewan Research Council (SRC), “our experts can provide industry with essential expertise in every stage of testing and proving out technology and processes.”

With more than seven decades of experience in mining, SRC offers clients analytical testing, minerals process development, tailings management, and everything in between.

Lithium demand requires innovation

Today, about 80% of the worldwide demand for lithium goes to rechargeable battery manufacturing for EVs,

electronics, and electric grid storage.

Although lithium has been used in glass products, medicine, and lubricating greases for years, the need for batteries is driving demand for higher purity lithium than most of the market previously required.

“Lithium hydroxide for batteries needs 99.5% or greater lithium purity and more than anything, companies need to ensure that certain impurities do not exist or exist at very low concentrations,” says SRC’s chief operating officer, Ryan Hill. Higher purity requires more complex testing and design strategies, leading to exponentially higher costs.

Despite a large market need for high purity lithium, fluctuating prices have made process optimization one of the essential ways to ensure the profitability of lithium projects. This is where SRC’s specialized expertise in both technology development and pilot testing helps companies develop a viable process efficiently.

“Ensuring that companies have fully optimized their processes, that they have proven out the purity and the recovery, that is how they can really drive down the cost per tonne while ensuring or improving product quality,” says Hill.

Addressing the challenges that market dynamics bring through rigorous and specialized testing, validation, and

development is what SRC does best. As the second largest organization of its kind in Canada, the depth and breadth of its expertise means SRC is wellequipped to help lithium companies develop cost-effective processes that are not only innovative but are designed and tested for real-world situations.

“SRC looks to catalyze industry in unique ways that are specific for each those industries,” says Lucinda Wood, manager of SRC’s business development team. “We address these challenges differently depending on what the industry or our client needs.”

While SRC offers the mining industry a wide range of services for other critical minerals, such as rare earth elements, uranium, and potash, what sets it apart in lithium is how its experts have tackled some of the more complex problems faced by industry in lithium extraction, from hard rock processing to traditional and novel brine extraction and lithium-ion battery recycling.

“Where we really standout is when clients come to us with a process or technology that has challenges to implement or commercialize,” says Wood. Because SRC has a variety of technical expertise, from minerals processing to advanced manufacturing, these challenges can be addressed by a multi-disciplinary team.

“In our mineral processing group, we can see not only where optimization is required, but where the bottleneck problems in the industry exist and tailor our solutions to meet these,” says Wood.

SRC’s unique service offerings in lithium include a facility where continuous-operation pilot plants are run, with capabilities ranging from ore beneficiation and calcination to hydrometallurgical refining. This is one of the few facilities of this type in North America and Europe.

Unlike other smaller scale pilot plants in the lithium industry, SRC’s pilot plants are built so that processing runs are continuous and can be finely tuned for the final design of an industrial plant, which results in more accurate performance data.

The lithium pilot plants were developed

to meet client requests for testing, from rocks to final battery-grade products.

“At SRC, we have run pilots for decades, and since we are acknowledged by industry as experts within this space, we were approached by clients to build a hydrometallurgy refining pilot facility to test out their processes,” says Hill. The first test run in the facility demonstrated the ability to produce 99.9% pure lithium hydroxide from the client’s feedstock.

The hydrometallurgical refining pilot plant, as well as the lithium beneficiation plant, can process spodumene, petalite, and lepidolite to produce battery-grade final products.

Jack Zhang, SRC’s associate vice-president of strategic technologies, says, “The hydrometallurgical refining pilot plant is built to be re-configurable and customizable to respond to the unique challenges associated with different lithium deposits around the world.”

After the facility ran the initial tests, it was partially dismantled and rebuilt to accommodate automation upgrades and technique optimizations, then operated for a two-month run of continuous operation.

“These plants not only prove out technology and expertise within SRC, but also create a space for companies to ensure that product recoveries and qualities are marketable,” says Hill. This is essential to companies exploring new sources for lithium.

Proving out technology for lithium from brine extraction

Along with lithium mineral deposits, brines (continental, geothermal, and produced waters) are also an important source for the valuable metal, but conventional extraction methods are slow and expensive.

They depend on large-scale evaporation ponds to concentrate the lithium and lengthy separation processes to remove all the impurities.

Direct lithium extraction (DLE) technology would flip the lithium recovery model and extract lithium from brines directly. While there are various companies that have developed and piloted DLE technologies, there is not a commercially available technology at scale that is economically producing lithium.

operation,” says Wood. “Innovation for us is often attained in addressing implementation challenges using known technologies in new ways.”

Hill explains that DLE is still at a relatively early stage. “We have been working on a DLE technology that we believe alleviates a lot of the issues with successful commercialization,” he says. “We have been getting significantly more cycles out of this technology than what we have seen within the industry.”

SRC is also testing the process with different industrial brines to ensure the positive early results it has seen are robust enough for a variety of conditions.

Developing new sources through recycling

“It is expected by the mid-2030s that 30% of the world’s lithium is going to come from recycling,” says Hill. Although recycling plays an important role in the future for lithium, current recycling processes are energy intensive and produce significant secondary pollutants, such as waste residues, toxic solution discharges, and gaseous emissions. Industry needs efficient, sustainable battery recycling processes, and that is

why SRC is supporting industry through research into battery metal extraction from lithium-ion batteries. “The aim is for lithium and other battery metals such as nickel, copper, and manganese to be recovered at high purity through a green hydrometallurgical process using a highly selective process and reagents,” says Zhang.

Currently working at the bench scale, experts have developed a recycling process to extract essential metals from batteries, harnessing knowledge developed in hard-rock lithium extraction.

“The same individuals that have been involved in lithium extraction and processing from hard rock and rare earth elements have developed a process that significantly improves the recovery of lithium at a lower cost,” says Hill.

While the lithium industry faces numerous challenges, some more complex than others, SRC has the facilities, specialized expertise, and experience to help companies meet the world’s growing demand for this critical mineral, through developing, testing, and commercializing technologies and optimizing processes.

“There are many reasons why a technology like DLE is not commercially available yet, such as the cost of ensuring the process conditions are optimal for its

By Anthony

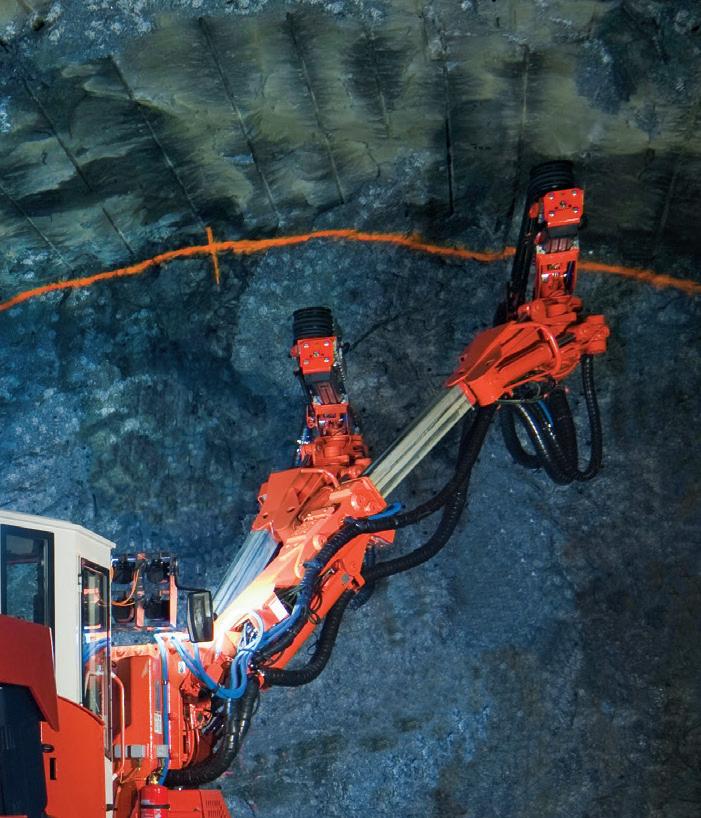

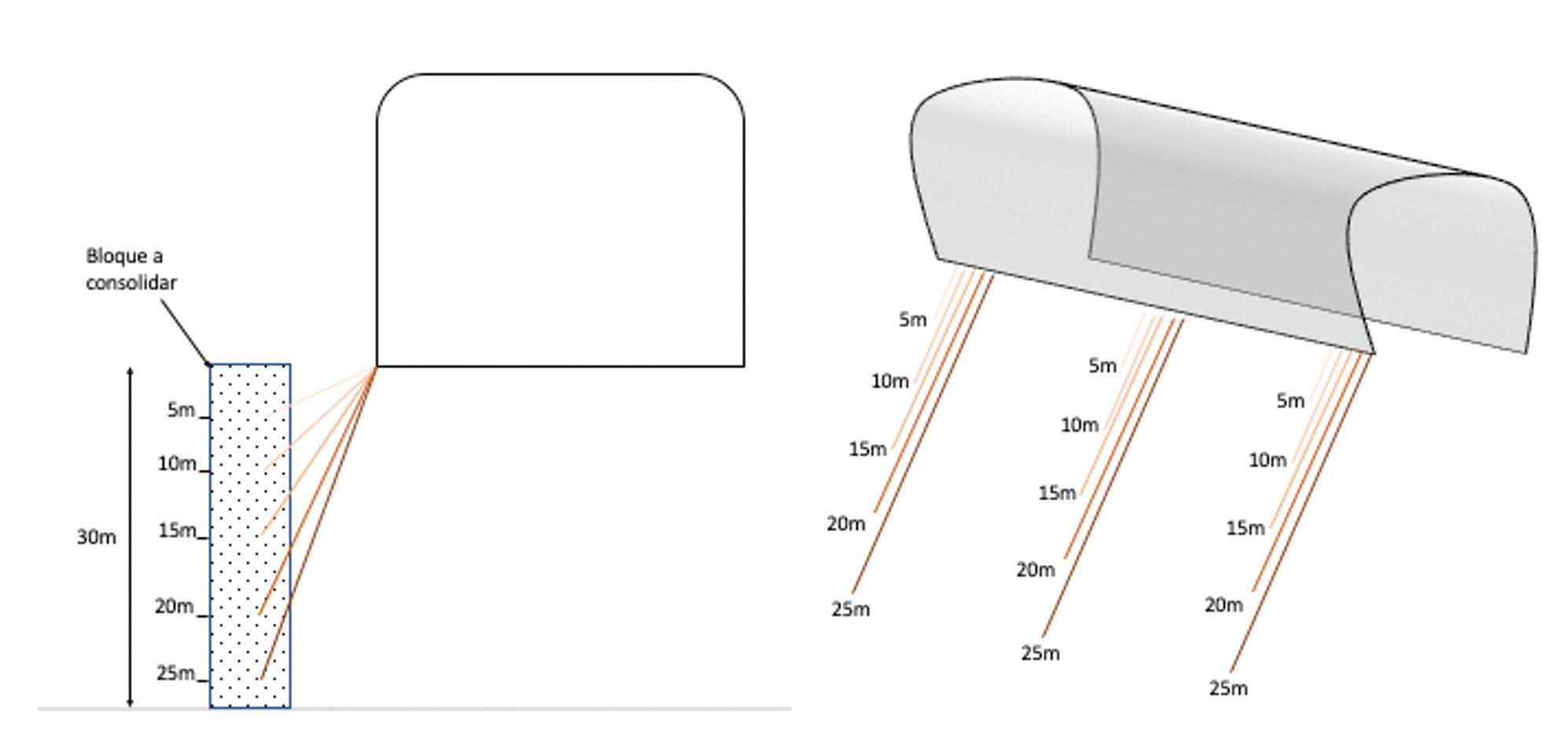

The use of pumpable resins in mining operations has become increasingly versatile owing to their ability to consolidate grounds and prevent accidents in unstable geological conditions. In this case study, we describe how resin was used for the fortification of a pillar that facilitated the sub-level caving of a mineral block located next to a collapsed area spanning over several levels.

The first option, which was discarded because of its lack of safety, consisted of mining the block over its entire length and width without any treatment. Although this option would allow the extraction of the entire block, it presented the risk of completely losing the block if the collapsed zone connected to the mining area during the sub-level caving. Given the presence of a massive collapsed zone, this risk was even higher. Another option was to leave a natural pillar between the collapsed zone and the mining area, which would significantly reduce the size of the block to be mined and result in the loss of valuable minerals. This was primarily because of the required thickness of the natural pillar, as the collapsed area extended over several levels. However, this option, although safer, offered reduced

benefits without sufficiently reducing the risk.

This option did not provide sufficient guarantees of success considering the risks involved with the natural pillar’s resistance, and the benefits would be limited.

Instead, Weber Mining proposed fortifying a pillar between the block to be mined and the collapsed area. This would create a consolidated barrier, enabling the safe extraction of the remaining block.

To achieve this, a drilling template was made from the upper gallery to the block to be mined, allowing the resin to cover the entire surface of the block. The drilling template consisted of injection lines, located five metres apart, with each line having five boreholes of various depths.

Given the changing ground, mixed between different types of rock, and the collapsed zone, this distribution is crucial to ensure the ground is homogenously injected. During the injection into each borehole, the resin migrates into the ground’s cracks. The injection stops once the pump’s pressure increases, indicating ground saturation. This methodology, with distribution throughout the block, allowed for consolidation and adaptation to the needs of the ground. Between one borehole and another, there was up to a 30% difference in consumption, owing to the presence of significant cracks in certain parts of the block. To achieve the above, it was also necessary to define the type of resin to use according to the type of ground, the void percentage, the distance over which it will be injected, the desired consolidation perimeter, and the injection equipment. With these parameters, we decided to use a resin with an expansion of three times its initial size and a curing time of four minutes.

Given the collapsed area and a high void percentage, the resin’s expansion allowed the area to be consolidated with a smaller amount of resin, which ultimately expedited the injection process and logistics, while still retaining excellent compression resistance. The reaction time of the resin, in conjunction with the injection equipment used, ensured that the resin was focused solely on the pillar’s area, and not beyond it. If the resin had migrated farther, it would have resulted in an unnecessary increase in cost and time.

CREDIT: WEBER MINING AND TUNNELING

Covering the area with strategically distributed injection points facilitated the precision of the consolidation work. As another parameter, we chose to start the injection with the deepest boreholes to begin saturating the ground from the bottom of the pillar and generate an ascending injection with the other boreholes. This ultimately created a lower limit from where the resin can migrate, helping the subsequent injection to stay localized on the pillar.

It is important to note that the compressibility of the resin and its adherence to the ground are crucial to ensure the block’s cohesion. During the sub-level caving process, the ground is under a lot of stress. The flexibility of the resin allows to maintain the ground’s cohesion during these times and prevent the pillar’s fortification from breaking.

Starting with a complex situation, where the most intuitive solution might have been for the mine to leave a natural mineral pillar between the collapsed terrain and the block to be mined, we were able to take all the available information, adapt our injection parameters, ensure the consolidation of a pillar with resin, and optimize the sublevel caving process.

Anthony Ferrenbach is the general manager at Weber Mining Mexico.