By Jeffrey Klineman

Why did Mitch McConnell do it? Some say it was the bourbon companies, others a misunderstanding of the ramifications of the original bill. Maybe he did it because he was sick of Rand Paul. At this point, any explanation for the decision by the senior senator from Kentucky to torpedo the same industry he helped launch back in 2018 is moot.

The big question is, what comes next? Will all parties – the spirits companies, the cannabis lobby, the beer distributors, the manufacturers and the anti-drug warriors, those interest groups competing to influence the sale of hemp-based THC products – be able to find a path forward in the year they’ve got left before Nov. 12, 2026, when the industry fades away like Brigadoon?

Is there a Hemp Farmer’s Almanac? Is there a photo of Mitch McConnell in there? If social media is to be believed, among the farmers in his home state, he’s gone from Johnny Appleseed to Johnny Dangerously, from folk hero to public enemy #1.

So, here’s the problem with tarring McConnell, though – any one who has a sense of what should be vs. the cold reality of what is would never have relied so heavily on something that Sen. Slippery McTurtle helped foster. But they couldn’t help themselves: once would-be cannabis entrepreneurs realized McConnell had opened a loophole for hemp-based THC drinks in the original 2018 Farm Bill, the checkered flag had been waved, and the racers didn’t really care who got run over.

it out or bury it.

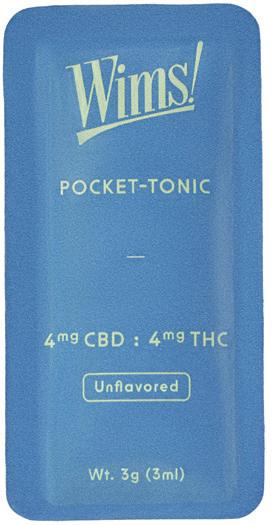

That’s why I’m still of two minds about the explosive growth of hemp-based D9 THC cannabevs that we’ve seen under the Farm Bill, and wonder, even if there’s a regulatory solution that can be found for the hemp lobby, whether that’s the right - or fair - thing to do.

Here’s my thinking: We keep hearing that the Delta-9 THC molecule is the same regardless of the source, whether it’s homegrown outdoor sativa or industrial-grade hemp, and at base, like many, I’m all for legalizing that molecule.

But I would argue that the rush to get hemp-based D9 products out onto the market has, in many ways, sold out the people who have spent years doing the hard work on behalf of that molecule. Not only did that rush create a lot of inferior products, it did so while turning a blind eye toward the rest of the cannabis industry. That has created infighting in the pro-legalization community at a time when the usual interests – booze manufacturers – either want to buy

Looking at the 30-year history of the dispensary movement in the U.S., you see a state-by-state campaign that evolved from medical usage to recreational, with careful attention and regulation freeing risk-takers to enter the business – even though the federal government won’t bless their actions. The divide between federal prohibition and state legalization leaves marijuana pioneers burdened by high security costs, a paucity of banking options, incredibly high tax rates and risk-driven interest rates, along with no federal bankruptcy protection. The hard work to establish legalization has also led to a variety of corrective social and criminal justice measures, including the expungement from criminal records of many small offenses that were unequally enforced against minority communities. The growth of legalization movements has brought recreational use to 24 states, and medical use to 40. Decriminalization and rescheduling of marijuana was being actively discussed by both U.S. presidential candidates in 2024 – one of the few areas of semi-agreement between the two campaigns. They blazed the trail, and it hasn’t been easy. Simultaneously, though, under the federal legislation that allowed for hemp beverages to grow, a lot of brands –particularly the ones that have looked to beverages as the untapped growth engine for mainstream cannabis use –decided that they couldn’t wait any longer. Like so many craft brewing operations using Kentucky hemp instead of Oregon hops, dozens of brands have either started up with hemp-based drinkables, switched to them from a marijuana-based extraction, or come up with a split formula program that places hemp drinks where they are allowed, and marijuana derived THC beverages in dispensaries.

It’s understandable: that 2018 Farm Bill – the .3 percent by weight loophole – created a federally legal, DTC-friendly spigot for all manner of hemp-based THC products, one unburdened by the same tax and regulation hurdles that marijuana businesses face, and a much deeper bench of retail targets, from liquor stores to gas stations, bars to breweries, Target stores to community co-op grocers. Instead of dispensaries – with their security guards, multiple ID checks, and video cameras – some of the states where hemp beverages initially popped up didn’t even have age requirements on the books around the purchase of intoxicating products.

With so little oversight, is it any wonder that the hemp-

based brand economy grew so fast – but also that it resulted in a lot of products being rushed to market with low quality control, inconsistent effects, and little consumer education?

It’s salt in the wound of the marijuana folks, who have had to go about it the hard way, sure – and they’ve reacted pretty quickly, pushing states with established dispensary channels like California, Massachusetts, and Colorado to force hemp companies to work under the same regulations as the rest of the cannabis businesses.

Equally risky, the hemp businesses poked the bear. States that have been very unfriendly to cannabis businesses like Texas, Tennessee, Kentucky and more have been some of the most fertile areas for the sale of intoxicating hemp products. Beyond that, those brands have been brazen enough in their customer come-ons product-wise that they’ve made it pretty easy for kids to score candy-flavored edibles from gas station clerks who just don’t know better.

Not everyone’s a bad actor, of course, but it’s not exactly a great look for an industry that wants to be taken seriously to play dumb around the idea that THC-infused Nerds and Sour Patch Kids might be consumed by kids - intentionally or unintentionally - when they’re picked up at some Waco convenience store.

Texas used that as the reasoning for an attempted statewide ban, which revealed another fault line: the hemp beverage business has proven too valuable to local beer wholesalers, who are facing tough times as their main product has started to decline. Which brings us to the strange bedfellows part of the column: the split in the THC molecule has also had a trippy effect in the beer business, where wholesalers and craft brewers are relying on hemp drinks to replace lost sales, while big brewers and spirits companies are fighting to set rules for the entire industry, although it’s clear they’d be happy to kill off the business if they can’t marry it.

I am trying hard not to judge the cannabis-native brands who went along with the move into hemp, with its much deeper bench of retail targets, rather than stick with a dispensary channel that considers a low-dose beer analog a cute novelty next to much higher margin pre-rolls and 100-milligram brownies. Once the door was open, it was a matter of survival – even OG edibles brand Kiva has started down the hemp highway, after all. But at the same time, they must have known that the states they were growing up in weren’t going to stand for hemp intrusions when they had spent so much money, time, and civic energy permitting and erecting state-sanctioned marijuana industries.

So is the McConnell rule really a betrayal? It depends on how you look at it – but unless the hemp interests recognize they need to include their fellow THC travelers in whatever kind of long range structures they want to put in place at a federal level, unless they put what are likely to be millions in lobbying graft to work on a system that creates some kind of reasonable footing for the recreational cannabis sellers of the world, I, for one, have a tough time summoning warm feelings for them. The Farm Bill loophole shouldn’t be a noose for the dispensary business.

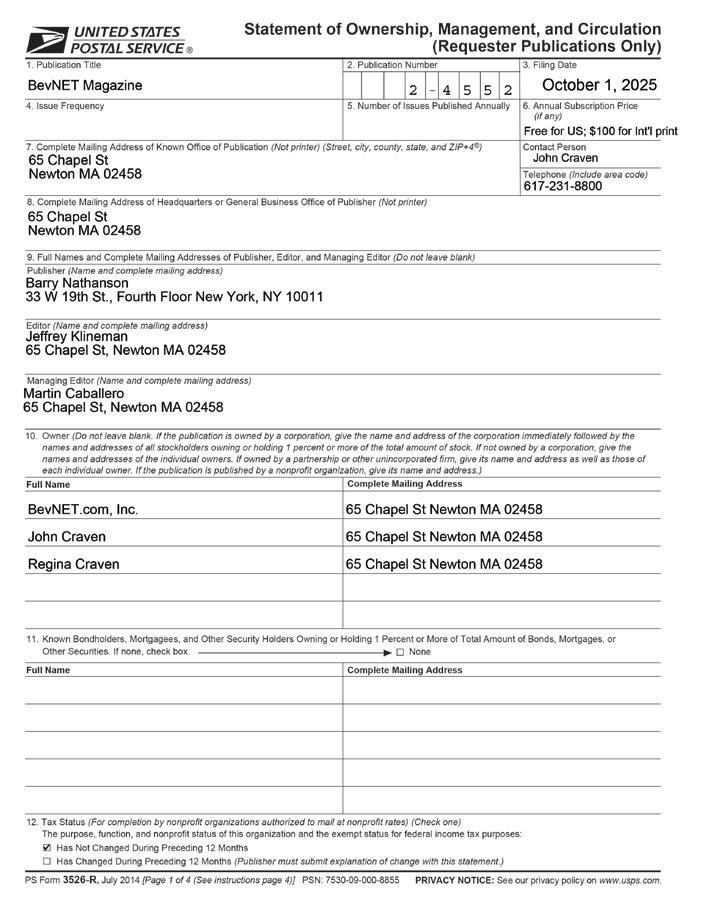

By Barry Nathanson

I’ve been around the beverage industry for a long, long time now. It is an industry that is ever evolving and reinventing itself. The route from launch to success in the marketplace has no set formula. It has seen newly-created categories and trends, packaging innovations, new and exciting product formulations, evolution in routes to market and to the consumer, and always incredible new marketing entreaties.

There is no limit to the difficulties in taking a beverage to market. Yet, with all the ways and steps to launch a brand, there is no aspect more crucial than raising capital.

The capability and speed to go from idea to actualization is almost always dictated by the funding available to the founder. We are all well aware of the high failure rate in the beverage industry. Money isn’t the only thing that can stave off failure, but without it there’s no chance of success.

So, who are the investors? Banks, institutional funds, rich friends and friends of friends and friends of rich uncles. But over the last few years I’ve seen another, exciting source of funding, one that brings high visibility and excitement, join the beverage fray: celebrities, including athletes, entertainers, and those people who are “famous for being famous.”

I find it refreshing and exciting to see this trend. As a rule, they are guided by “they know what they don’t know” which is a good thing. They can leave the day-to-day of beverage marketing to the pros, yet are often involved in a way that has no real downside. If they bring visibility to the brands, so much the better. They give the financial backing to keep the companies alive, and add the sparkle that all you beverage entrepreneurs deserve, as I will always think of you as stars in your own right.

Barry J. Nathanson Publisher bnathanson@bevnet.com

Jeffrey Klineman Editor-in-Chief jklineman@bevnet.com

Martín Caballero Managing Editor mcaballero@bevnet.com

Monica Watrous Managing Editor, Nosh mwatrous@bevnet.com

Justin Kendall Editor, Brewbound jkendall@bevnet.com

Adrianne DeLuca Assistant Managing Editor, Newsletters adeluca@bevnet.com

Lukas Southard Senior Reporter lsouthard@bevnet.com

Brad Avery Senior Reporter bavery@bevnet.com

Zoe Licata Senior Reporter, Brewbound zlicata@bevnet.com

Shauna Golden Reporter sgolden@bevnet.com

Sales & Ad Operations

John McKenna Director of Sales jmckenna@bevnet.com

Adam Stern Senior Account Specialist astern@bevnet.com

John Fischer Senior Account Executive jfischer@bevnet.com

Lou Calamaras National Account Executive lcalamaras@bevnet.com

Jon Landis Business Development Manager jlandis@bevnet.com

Colin Sughrue Digital Campaign Coordinator csughrue@bevnet.com

Art & Production

Aaron Willette Design Manager

BevNET.com, Inc.

John Craven CEO / Founder / Editorial Director jcraven@bevnet.com

Headquarters 65 Chapel Street Newton, MA 02458 617-231-8800

Publisher’s Office

1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

Subscriptions

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com www.bevnet.com/magazine

By Gerry Khermouch

Here in New York, off the coast of Lower Manhattan, the feds sold us a longtime Coast Guard base called Governors Island that had become surplus to requirements for about a dollar. It’s a glorious spot, just minutes away by ferry but semi-barren across its 150 acres, in the most charming way for our hyperdeveloped city. It boasts panoramic harbor views, a waterside oyster-and-beer bar, a sprawling outdoor taco emporium, a jerk chicken truck and a Threes Brewing beer garden. There’s glamping, to raise dough from the city’s high rollers, and festivals like early editions of Governors Ball and lately Porch Stomp, with acoustic bands playing all over the Admiral’s Row stretch of officers’ Victorian houses from back in the day.

On my many visits there, I’ve been fascinated by its playground dichotomy. There’s a state-of-the-art, ergonomically fine-tuned Hammock Grove Play Area that features all the latest in rope climbing structures. Your own neighborhood’s probably got one too. Then there’s The Yard “adventure playground,” which is their name for what’s basically a junkyard. It’s “stewarded by trained playworkers,” according to the island’s website, which suggests the site as an appropriate spot “for young people ages 5 to 19.” (Really, 19? Is this a veiled invitation to pot consumption?) There’s also a family play area there for kids under 5. It’s totally renegade, the kind of playground you’d expect Keith Richards to design.

Can you guess which of the two is more popular than the other? On my visits, it’s never been a contest: The Yard, of course. What does this have to do with beverages? To me, it captures a fundamental paradox in innovation: you can produce a new product that checks all the boxes of the prevailing trends, but that can be a demerit as much as it’s an advantage. God bless that

mysterious consumer who isn’t satisfied with products that just deliver a comprehensive matrix of benefits but wants something more, even if it’s something she can’t define in a focus group. Caffeine (energy), protein, gut health or just plain refreshment? Sugar or no sugar? Plastic or cans? Product developers can make their choices as to which mixture of these elements will deliver the targeted consumer, but there’s a certain je ne sais quoi that’s also an integral element of successful beverage launches. That may be a reason the strategics, awash in consumer “insights” and minute retail sales data, so often fail to hit the mark. They carefully design the entries to check all the right boxes, but in a soulless way that consumers can see right through. The marketing mechanics are totally transparent. It’s kind of like comparing a strait-laced achiever with a motorcycle outlaw: the achiever likely is a better choice to marry, but life sure will be more exciting with the other guy.

And when I say strategics, even the more agile among them can struggle with this. Take Monster Beverage. Feeling it needed a play in the natural/female space, a few years ago it designed a new brand called True North that had an exemplary ingredient list and was nakedly clear about the aspirational buttons it intended to push, right down to the compass rose on the front panel. It didn’t get far. More recently Monster’s getting ready to go out with a new Alani challenger called FLRT. Though the details aren’t out as of this writing, I worry that it comes across as the kind of condescending chick drink that a roomful of (mostly male) marketers would assemble trying to score with that demo. By the same token, when Pepsi’s Mountain Dew brand appropriates the dirty soda trend with a packaged Cream Soda extension, does that actually fight the dirty

soda dynamic by locking it within a permanent recipe? Isn’t the glory of dirty soda that consumers improvise the most unlikely flavor combos to see what works? By contrast, attend the New Beverage Showdown at BevNet Live, and many of the entries will exude an unpolished freshness that gives them an inherent appeal, even if further refinements will be needed along the way, as the judges are only too happy to point out.

I realize this is not a startlingly acute psychological insight. There are plenty of references to this phenomenon in other realms: the notion of swing in jazz, duende in Spanish poetry. Hard to explain but you know when it’s there. And there’s a key problem with this analysis too: it’s hard to take out what the lesson is if you’re a marketer at a sizable CPG. Intentionally make one element a bit off-key, the way oriental rug makers include a “Persian flaw” in recognition that, unlike God, they’re not perfect?

Since I’m roaming pretty far afield, I’ll filch another lesson from urban planning. Theorists like Kevin Lynch have noted how the ever-compelling charm of New York’s Greenwich Village stems from the way its tangle of narrow streets is kept from being unpleasantly disorienting by being bounded by major avenues, with distant skyscrapers also helping to orient pedestrians. In product development, you want the equivalent of those winding streets to intrigue the shopper, but you also need to bound the concept with branding and positioning that’s clear about what the beverage is trying to do.

I find this lesson continually reinforced to me in my daily life.

In Riverside Park, there’s an area that drew kids who were practicing this emerging French pastime called parkour. It’s a slowmotion discipline where you find ways to traverse a series of urban obstacles like bollards and benches and railings through balance, agility and strength. From my perch at a nearby beer bar, I’ve had ample opportunity to observe this nascent sport while recognizing, even three beers in, that it’s not one I need to be participating in. Concrete is hard.

Funny thing happened. In an effort to enforce decorum while not stunting these kids’ enthusiasm, the Parks Department decided to design a parkour-specific site not far away where the kids could strut their stuff, just like the city tries to shunt skateboarders from the courthouse steps to local skateparks. At first, I didn’t realize that’s what the padded Tinkertoy-like space was. It just seemed to be an oddball setup where exercise enthusiasts contorted themselves on the unusual geometry or tots climbed it, like in The Yard on Governors Island. Then I noticed the sign carrying detailed depictions of the parkour maneuvers required to navigate the space. You won’t be surprised to hear that I’ve never seen the space used by any actual parkour kids. They’ve moved on to other locales or activities. Just as with CPGs, by the time Parks reacted to the trend, it already had a foot out the door.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Keurig Dr Pepper (KDP) announced $7 billion in new investment and offered nervous investors a confident appraisal of its much-scruitinized plan to separate its coffee and refreshment beverage businesses, while acknowledging and addressing market concerns.

Since it was revealed via its $18 billion acquisition of

JDE Peet’s in August, KDP’s forthcoming breakup has sparked a stock decline while drawing questions over the two new companies’ financial structure, leadership and future timeline. Speaking at NASDAQ headquarters in New York City in October, KDP’s executive team, headed by board chair Bob Gamgort took turns addressing an audience of investors and analysts before hosting a Q&A session.

“We heard your feedback, we certainly noted the market reaction, and that made it really clear to us that we needed a day like today to better explain the strategy and thought process behind it,” Gamgort said.

Per KDP execs, cutting its coffee business loose via the Peet’s acquisition isn’t a rejection of the core strategic philosophy, but rather a voluntary strategic choice to improve the overall company.

Gamgort noted the initial combination, dating back to 2018, intended to “take two sub-scale beverage companies who were solely focused on North America… to create a beverage challenger at scale.”

Since then, explained CEO Tim Cofer, the refreshment beverage segment has strengthened considerably, but coffee has not, particularly “relative to our global competitors that can leverage broader advantages in technology and sourcing” that “can participate across the entire global category.”

The two companies could still function under one roof, Gamgort claimed, but the “global opportunity” in coffee “requires a very different management mindset.” JDE Peet’s represented one of the few potentially acquirable coffee companies with the kind of global reach KDP was searching for: it’s already large and profitable, bringing in $11 billion in net sales and nearly $2 billion in adjusted EBITDA. It also sports a robust portfolio of regional brands across Europe and in Brazil, including names that over-index with younger consumers.

“This is a good business,” said Cofer. “Its got iconic brands. Its got significant capabilities. Yet it’s also true that it’s a business with significant value creation poten-

tial that has yet to be fully realized.”

As the revamped Keurig business gets underway, strategy will center around four pillars: driving household penetration, growing premium coffee, scaling cold coffee solutions and the future of Keurig’s at-home brewer systems. In terms of innovation, the company is planning to launch its first owned premium brand, the Keurig Coffee Collective, which will boast “distinctively delicious blends” in “elevated packaging,” along with 30% more coffee per K-Cup. There’s also high hopes for the Keurig Alta brewer, powered by new aluminumfree, plastic-free round pods.

Once completed, the deal will see coffee net sales more than triple to $16 billion annually, making it the second largest coffee company on the planet and the top coffee buyer worldwide.

The acquisition plan is also targeting 500 million Euros in savings through 2032, with around half being reinvested in the business. There will also be plant closures, two of which have been confirmed thus far.

Speaking during the Q&A session, an exec said that a recent visit to JDE Peet’s headquarters in the Netherlands helped “improve confidence in our synergies, both on a revenue basis in terms of the growth opportunities,” particularly brewer system innovation, cost structure and economics.

The company has established a Transformation Management Office — led by a newly appointed Chief Transformation and Supply Chain Officer, Roger Johnson — to guide teams on both sides of the business with the aim of closing the deal in mid-2026 and being “ready to separate” by the end of that year. He’ll be tasked with establishing optimal operating models, executing integration, and driving cost synergy capture.

That includes maintenance of capital for each company upon going independent, itself a point of concern for some investors when the deal was first revealed, execs acknowledged on the call. In response, KDP is making a $4 billion investment in a newly created coffee manufacturing joint venture co-led by Apollo and KKR, of which it will retain a controlling interest and operational control. KDP is also investing $3 billion in convertible stock in the Beverage Co., also co-led by Apollo and KKR.

Both companies are projected to generate cash, with Beverage coming in at $6 billion over the next three years,

and Coffee set to produce more than $5 billion. The exact dividend at each company will be determined closer to separation.

With those transactions, management will nominate Brian Driscoll, chairman of Acosta Group, for election to its Board of Directors at its next annual meeting.

The separation process will be “milestone-based,” and while there is a time frame in mind, the deal will also depend on certain factors including synergies, balance sheet readiness, favorable market conditions and the appointment of an independent board of directors and “experienced leadership team” for each standalone company, with recruitment being led by a third-party firm.

It’s a subtle but pointed shift from the August announcement, which stated the separation would be complete by the end of 2026.

The leadership piece is of special note in coffee: on the call, KDP confirmed that CFO Sudhanshu Priyadarshi will not be stepping in to lead the Global Coffee Co. as CEO, as previously announced. Instead, KDP’s board is running an internal and external search for the role. Cofer, meanwhile, is still on track to be the Beverage Co.’s next CEO.

Once separated from the coffee business, KDP’s Beverage division is expected to benefit from a singular focus, said Eric Gorli, President of US Refreshment Beverages.

“There is definitely a different culture for a fast-moving, soft drink-centric, DSD-centric organization versus warehouse model. I think the amplification of that and just how we go about creating the company’s culture coupled with the management team’s focus will probably be the biggest underpinnings. That said, we’ve got a playbook that’s working, and you know, I would expect to see more of the same.”

The company also left the door open for “future optionality” as it matures independently.

“As you continue to advance a scaled brand portfolio, with many different categories of participation to strengthen that DSD muscle, there could be options down the road that present themselves around ownership in different levers of the business: brands, distribution, etc.,” said Gorli. “So we’ll take a step at a time, but I do think an option like that longer term is enhanced.”

The company has been aggressive in revamping its DSD system over the last six years, during which it made 30 acquisitions. Portfolio expansion has been motivated in part by generating additional scale for DSD operations, according to Cofer. The company is also plotting growth around liquid beverage enhancers and powders through its acquisition of Dyla Brands earlier this year.

“We do have a consistent and proven track record of creating value in beverages,” said Cofer. “We create vibrant businesses through a playbook that works, we have deep insights that underpin our conviction in this deal, and we have a clear plan to deliver on its promise.

At the same time, we’re listening and we are adjusting as and when needed, and this leadership team has the confidence, it has the experience to successfully carry out this transaction, but we also have the wisdom. We have the willingness to stay flexible in our approach.”

It takes more than luck to raise over $65 million in two years.

In November, Lucky Energy landed $25 million in a Series B round led by Paine Schwartz Partners, with former leaders from Suja Juice, James Brennan and Bob DeBorde, joining Lucky’s board. The round included follow-on investment from existing investors as well as new backers North Fifth Services, LLC, Sequel, and Joyance Partners, among others.

William Ford, CEO of global PE firm General Atlantic, and Florida Panthers owner and Virtu Financial founder Vincent J. Viola also contributed to the round.

“The idea was that we wanted to build the team with power and authority, the best we could get in the business,” Lucky Energy founder and CEO Richard Laver told BevNET.

The new capital comes after Lucky closed a $14.2 million Series A1 round in March and brings its funding total to $63 million. Already, the energy drink maker is planning a follow-on Series B1 in early 2026, driven by the “$50 million demand” for this new fundraising opportunity, the company reported.

Along with former Red Bull North America CEO Dan Ginsberg, Brennan and DeBorde bring veteran brand-building experience and the ability to “execute, build onto additional rounds and move companies to profitability,” Laver said.

Lucky is targeting the third quarter of 2027 to hit profitability.

In just two years, Lucky has moved quickly to fill a void in independent distributor portfolios as emerging brands like C4 and GHOST have moved into strategic distribution, Laver said. “There was an opening in DSD for a differentiated product that has fewer ingredients and storytelling that resonated with consumers.”

Now available in over 15,000 retail locations, including Albertsons, Circle K and QuikTrip, Lucky is preparing to go

national with Walmart, Sheetz and Cumberland Farms in December.

“From day one, almost everything about this business was engineered,” Laver said, referencing the company’s ability to raise multiple eight-figure investment rounds in short succession. “The only thing that was not engineered was I thought retailers would come on quicker than they did.”

After an April 2024 rebrand, Lucky has seen an uptick in consumer and retailer demand as the brand’s identity has shifted to emphasize Laver’s personal story of survival and resilience. Laver reported that 40% of Lucky’s consumers are women. The brand is leaning into social media discussions around jitter-free “energy soda,” while also looking to the future with new flavor and format innovation to broaden its appeal among more demographics.

The brand is preparing to launch a “low-weight, energy product” that is expected to disrupt the category further, Laver said

Monster Beverage Corp. continued to gain ground in Q3, and plans to use that momentum to release a slate of new innovation – including female-oriented brand FLRT – early next year.

Net sales were up 16.8% in the quarter to $2.2 billion, with Monster Energy enoying a 17.7% sales spike. Year-to-date net sales rose 8.5% to $6.16 billion.

Monster CEO Hilton Schlosberg used the occasion in November to tee up next year’s new releases, headlined by a late Q1 launch for FLRT in select channels. Complementing Monster’s Reign Storm line, FLRT is positioned as a zero-sugar, female-focused brand debuting in four flavors: Strawberry Fling, Guava Lava, Berry Tempting and Sunset Squeeze.

“Innovation remains central to our long-term growth strategy,” said Monster CEO Hilton Schlosberg in a statement. “We are excited about our 2025 fall new product offerings and our robust slate of planned new product offerings for 2026, including the upcoming launch of FLRT, our female-focused brand, late in the first quarter, which we plan to initially debut in four flavors.”

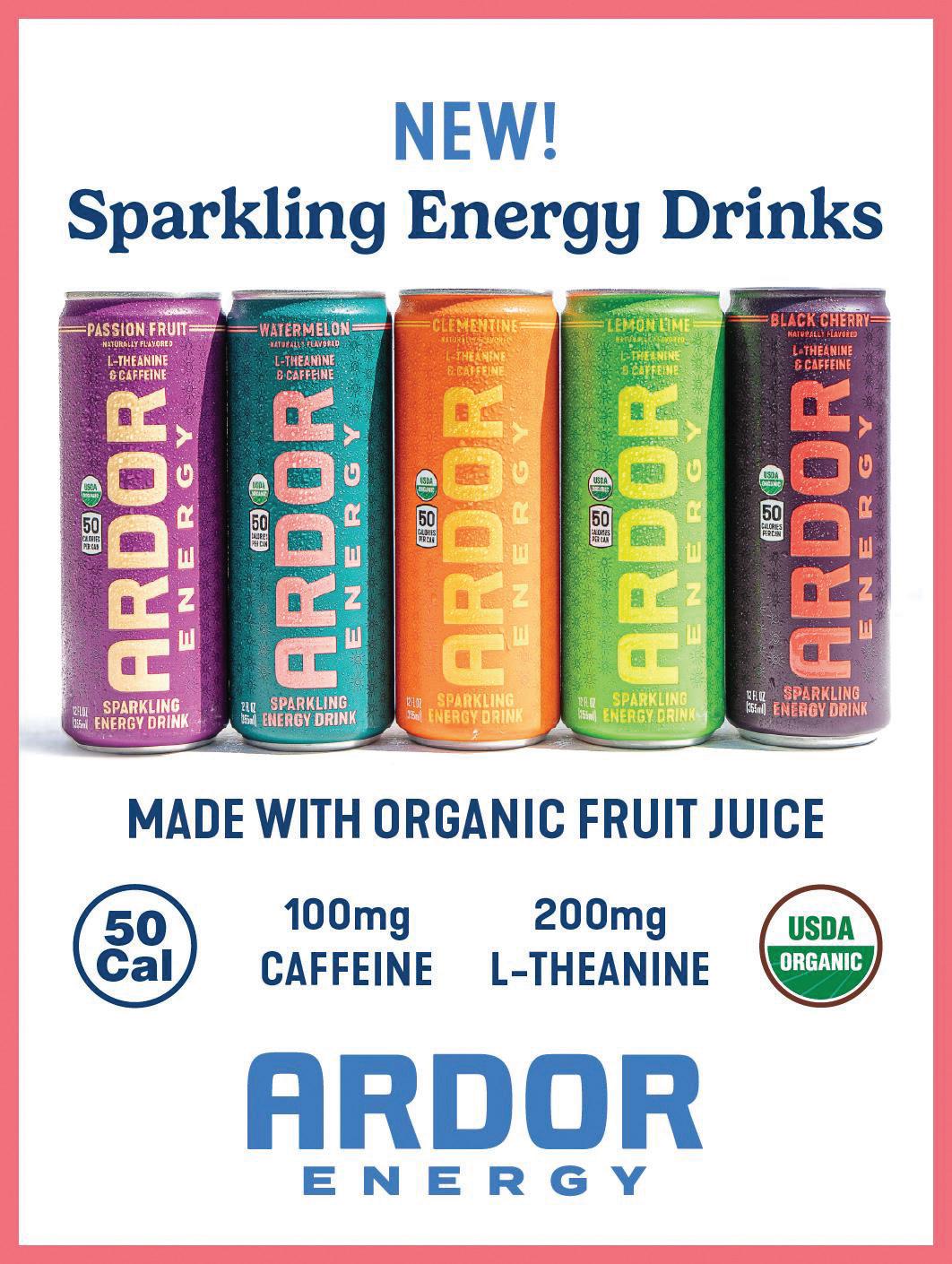

Female-centric energy drinks have been a rising trend over the last three years, highlighted by significant growth for brands like Celsius-owned Alani Nu, Gorgie and Bloom.

Other releases on the calendar include Monster Energy Ul-

tra Punk Punch in March, and Full Throttle Red Apple and NOS Grand Prix Guava in April.

The brand’s presence continued to grow internationally in Q3: net sales to customers outside the U.S. increased 23.3% in the quarter to $937.1 million, up from $760 million in the same period last year.

Schlosberg cited internal consumer research in Western Europe that indicated 25% of Monster consumers over the last 12 months are new to the category, with rising coffee prices sparking a shift in caffeine preferences.

Monster’s Alcohol Brands segment – comprising various craft beers, flavored malt beverages and hard seltzers – suffered a 17% drop to $33 million for the quarter, down from $39.8 million for the same period last year. However more innovation is on the way, including the first subline for The Beast, a spirit-based RTD and two new beer brands.

The impact of tariffs was mixed: while fees on imported flavors and concentrates had a “modest impact,” tariffs had a “significant” influence on Midwest premium for aluminum cans.

The company confirmed it is increasing prices, but declined to specify how much. That comes after a 5% increase last year.

Recess Drinks closed a $30 million series B round led by CAVU and other repeat investors in late October.

Kyle Thomas, who joined C4 in 2021 and has led the growth of its sales team in beverage as Chief Commercial Officer, will be joining Witte as Recess’ co-CEO and President.

Witte cited Thomas’ leadership and development of platform brands, a long-time argument the founder has made around Recess, as one of the main reasons for the hire. Thomas has helped build both Nutrabolt – which went from a fitness supplement company to a leader in the energy drink space with C4 – and sparkling beverage maker Topo Chico at Coca-Cola Co. into brands with successful extensions into a variety of formats and categories.

Similarly, Recess has expanded in both the mocktail space and “mood” functionality, as well as its earlier hemp-based, CBD and adaptogen drinks. It’s now in about 15,000 stores, according to the company, with 95% of sales in its mocktail and mood varieties, according to Witte.

“I’ve been looking at Recess as a platform for about 7 years,” said Recess CEO and founder Ben Witte. ”Early trouble that the brand faced when it went to market as a CBD brand – the overall category faced massive setbacks in the face of regulatory inconsistencies – “turned out to be the best possible thing that could have happened to us” as it led to development of the Mood and mocktail varieties, he said.

Now, Thomas will be in position to lead a brand with recent Mocktails approvals in Albertson’s and Target as a national brand, as well as some Trader Joe’s stores. Mood has also received strong consideration in many of those accounts.

“Recess is at the forefront of what I believe will become one of the next major beverage spaces — functional relaxation beverages and alcohol alternatives” Thomas said. “I am incredibly excited to partner with Ben to help fulfill the incredible potential that the Recess brand and business has.”

Witte stressed that the next six months will let the brand build “infrastructure” in sales and marketing to grow much more quickly; current velocities have been supported in retail with very little marketing or trade spend – just 9% to date, he said.

“I’ve always taken a long term view here,” he added. “This is working, it’s a big idea, there’s a lot more places we can extend into from a channel view.”

To bolster the team, several other new sales hires have come on board, including DSD specialist Ryan McAulay as SVP of field sales and distribution, a role similar to the one he held at Liquid Death.

The investment is CAVU’s first beverage placement since Poppi, Witte noted. Other existing investors taking part in the round include Midnight Ventures, Rocana, Torch Capital and Doehler Ventures, as well as Atlantic Records CEO Craig Kallman, KAS Venture Partners and Vanquish.

The CAVU team lauded Witte for building a “counterweight” to “the $25 billion-plus energy drink market in the U.S. built on stimulation.”

“Recess isn’t about powering through the day — it’s about being more mindful within it,” said Jared Jacobs, a partner at CAVU. “We’re thrilled to partner with Ben and the team to help scale Recess from category pioneer to the definitive household name in modern relaxation.”

One of North America’s largest private label food and beverage manufacturers is set to become a private company.

TreeHouse Foods will be acquired by an independently managed investment subsidiary of Investindustrial VIII in an all cash transaction for a total enterprise value of $2.9 billion, the companies announced Nov. 10.

Investindustrial VIII is part of a European group of investment, holding and advisory companies with €17 billion of raised fund capital.

Under terms of the deal, Illinois-based TreeHouse Foods shareholders will receive $22.50 per share in cash for each share of common stock owned at closing, representing a 38% premium to the company’s closing share price on Sept. 26, 2025, the last full trading day prior to market speculation around a transaction.

The transaction has been unanimously approved by the TreeHouse Foods board of directors and is expected to close in the first quarter of next year, subject to the satisfaction of regulatory approvals and other customary closing conditions.

JANA Partners, which owns 10% of TreeHouse Foods common stock, entered into an agreement to vote in favor of the deal at a special meeting of shareholders.

Once the sale is completed, TreeHouse Foods common stock will no longer be listed on the New York Stock Exchange.

TreeHouse Foods produces crackers, non-dairy creamer, pickles, refrigerated dough, broths and stocks, hot cereal, pretzels, in-store bakery items, griddle, cookies, cheese and pudding, powdered beverages and other blends, coffee, tea, and unique candy products. It has a total of more than 85 manufacturing facilities and employs a workforce of more than 16,000. The company will operate independently within Investindustrial’s portfolio.

“We are confident in the long-term growth opportunities in private brands and the categories where TreeHouse Foods

operates, as well as the company’s ability to build on its strong foundation of leadership. We look forward to working closely with the TreeHouse Foods leadership team and employees to drive its long-term success,” said Andrea C. Bonomi, chairman of the Industrial Advisory Board of Investindustrial, in a statement.

Steve Oakland, chairman, chief executive and president of TreeHouse Foods, added, “TreeHouse Foods has been executing a strategy to become a focused snacking and beverage private brand leader with depth in categories, attractive long-term prospects and an agile operating model. Our agreement with Investindustrial, a leading European investor with a strong track record in food manufacturing and related sectors, will provide shareholders with immediate cash value, at a substantial premium.”

Goldman Sachs & Co. LLC serves as financial advisor to TreeHouse Foods, and Jones Day is serving as legal counsel.

Lazard, RBC Capital Markets and Deutsche Bank act as financial advisors to Investindustrial. RBC Capital Markets, Deutsche Bank and KKR Capital Markets provided Investindustrial with financing support for the transaction. Skadden, Arps, Slate, Meagher & Flom LLP served as legal advisor to Investindustrial on the acquisition, with Paul, Weiss, Rifkind, Wharton & Garrison LLP serving as financing legal counsel.

In 2022, Investindustrial acquired TreeHouse Foods’ Meal Preparation business for $950 million.

In its third-quarter financial report, TreeHouse Foods posted net sales of $840.3 million, up 0.1% from $840.3 million in the prior-year period, and net loss of $265.8 million, which compared with a net loss of $3.4 million the year before. The result was attributed to the negative impact of planned margin management actions and broader macroeconomic consumption trends that was partly offset by supply chain savings initiatives, the Harris Tea acquisition and cost reduction activities.

Jelly snack brand Oddball raised a $2 million seed round led by Springdale Ventures, as it expands its retail footprint and prepares for innovation.

The plant-based jelly brand will use the funding to support its launch into nearly 180 Whole Foods Stores in three regions (Northeast, Southern California, and Southwest).

Springdale Ventures, an earlystage investment firm founded by Genevieve Gilbreath and Dan Graham, has invested previously in insurgent food brands like Goodles, Feastables and FitJoy. Oddball is part of the firm’s Fund II, which includes Khloud Protein Popcorn, Bloxsnacks and The Absorption Company, among others.

Oddball is currently sold in about 500 locations and online. The zerosugar, fruit jelly snack is available in four varieties: Grape, Pink Grapefruit, Double Berry and Mango. The snack

comes in 2.75 oz. cups and are sold in retail for $3.59 per two-pack.

Launched at the beginning of the year, Oddball has been a passion project for founder and CEO Sophia Cheng since 2022. Cheng, who previously served as strategy director at Estée Lauder, sought to connect to her roots growing up in Singapore and Hong Kong where jelly snacks were a common childhood treat. Her goal was to create a better-for-you version of Jell-O using plant-based ingredient agar, instead of animal-derived gelatin.

The brand is expecting to double its retail footprint as it heads into 2026 with its Whole Foods partnership. Piggybacking off its success in Sprouts Farmers Market, Oddball is putting resources to its retail expansion.

“We’re not in the same era of 2019 to 2021,” Cheng said in a statement.

“Meta ads aren’t as efficient as they once were, and shoppers are returning to stores. For our category, discovery happens in the aisle.”

In addition to bringing Oddball to new markets and retailers, the brand is planning innovation with its new funding.

Oddball is taking a familiar approach to reworking nostalgic childhood snacks for a modern, health-conscious consumers, similar to Goodpop and JonnyPops in the popsicle set and Flings, Glonuts and Legendary Foods taking on toaster pastries and donuts.

“Oddball is designed for families and kids who snack often, but want something fun, clean, and made from real fruit. As parents look for betterfor-you options, we’re seeing that momentum reflected on shelves — and retailers like Whole Foods are catching on fast,” Cheng said.

With its U.S. expansion in motion, Canadian confections manufacturer Mid-Day Squares is planning to triple the output capacity of its Montreal production facility over the next year.

According to co-founder and co-CEO Nick Saltarelli, Mid-Day Squares received a debt deal investment from the Canadian federal government and the provincial government of Quebec to help finance a facility expansion, which could bring the plant from around $75 million in product output to upwards of $300 million in output.

The brand is nationally distributed in the U.S. to Target, Costco, Walmart, Albertsons and others, and demand has been rapidly rising as the company sets a goal of achieving $100 million in revenue over the next 2 1/2 years. However, Saltarelli said the business has been “teetering on our execution plan in the U.S.” due to its limited production capacity.

“We’ve just been balancing what partnerships do we take on at the right time so that we don’t put ourselves in a cash crunch position and that we grow methodically,” Saltarelli said. “And now is go time.”

Mid-Day Squares’ facility currently employs 52 people, and Saltarelli said the expansion should create about 10 new jobs once complete.

The expansion will be finalized and online within the next 12 months, he added.

“We’ve tailored all of the demand backwards from those drop points, so we still have demand that we can put in the current production facility, and so that will get us through the next 12 months,” he said. “And then that new capacity unlocks for us, so that we can continue to launch a lot of these major retailers that are yet to come.”

The expansion is getting underway as Mid-Day Squares prepares to launch its first non-chocolate innovation in January, with an official announcement likely to come in the next two to three weeks.

Saltarelli declined to say what the new product will be, but noted it is in the confections category and has a “super nostalgic platform.”

The need to find a non-chocolate line extension came about as the rising price of cocoa – rising roughly fourfold over the last two years, Saltarelli said – has weighed on the company’s bottom line.

“It opened our eyes that we have an over-reliance on a commodity like cocoa,” he said. “We kind of locked ourselves in a room with the team for almost three months going back and forth on how we take this tailwind and turn it into a massive headwind.

“So this is a huge moment for the brand, because we are moving beyond chocolate and really focusing on the Mid-Day platform.”

Nut butter and confection company Justin’s will soon return to private ownership, a move that incoming CEO Peter Burns –who previously served as CEO from 2014 to 2016 – believes will “unlock the true potential of the brand.”

Private equity firm Forward Consumer Partners purchased a 51% stake in Justin’s from Hormel, with the CPG giant retaining the remaining 49%. Forward declined to disclose the financial terms of the transaction.

Founded in 2004 by entrepreneur Justin Gold, Justin’s was purchased by Hormel in 2016 for approximately $286 million to grow its portfolio of protein-rich products. Under Hormel’s ownership, the brand expanded its offerings to include a full range of almond and peanut butters, as well as new varieties of peanut butter cups and almond butter cups.

“Hormel has elevated the brand since we sold it in 2016, launching extensions and confections. Essentially, [this transaction with Forward] is about unlocking the true potential of the brand and giving it focus and priority,” Burns told Nosh. “If we can do that in association with our partnership with Hormel, that’ll be great. There are a lot of things we can learn and leverage from our relationship.”

“Justin’s is a beautiful brand with a remarkably strong latent brand equity. It was a very small brand within a much bigger portfolio at Hormel, and so over the course of the roughly 10 years that Hormel owned it, resources inevitably were diverted to other parts of that portfolio and Justin’s didn’t get the focus it can and will under private ownership,” echoed Brandon Staub, partner at Forward Consumer Partners.

Once the transaction closes (expected in December), the biggest near-term priority is “executing a flawless carve-out from Hormel,” according to Staub. Justin’s is currently “entirely intertwined” within the broader Hormel infrastructure, including IT systems, financial reporting and supply chains.

“We’ve surrounded ourselves with excellent third-party service providers who are going to be our arms and legs, helping us execute [the carveout] alongside the [Forward] management team,” said Staub. “It’s going to be hard work and take some time. We have set relatively tempered expectations together

with the management team as to the financial performance and step change we’ll see in 2026.”

Burns shared a similar sentiment, stating, “The first thing that we have to do is stand up Justin’s as an independent company. Getting the knowledge transfer, getting our hands on the brand and building our own infrastructure will take time. Once we have our feet on the ground, that’s the point when we start to build the innovation platform.”

Part of that knowledge transfer will come from another resource from Justin’s early days, or more aptly put, the source: Justin Gold.

Gold will be returning to the brand while also continuing to serve as chief innovation officer at Rudi’s (where he’s an investor), which, incidentally, recently launched a collaboration with Justin’s on its line of frozen “PB&J Sandos.”

“This gives me a chance to work with both sides of the organizations to make sure that we’re maximizing the potential for those products,” Gold said. “I can’t think of this ever really happening before. It feels really good for me because it doesn’t feel like I’m splitting myself in two; it feels like these things are unified.”

Though the process is complex, the Forward team is confident that Justin’s will become a fully independent and “truly standalone” business in the next 6 to 12 months, at which point there will no longer be linkages with Hormel across any functional areas. Additionally, Justin’s is opening up a new headquarters in Boulder, Colo.

During this transition period, one of the biggest priorities for the Justin’s team is to emphasize quality and ensure there is no customer interruption,

according to Burns.

“The first thing we need to do is fix the business and this requires a lot of discipline and focus,” Gold said.

Gold will consult on how to fix “quality and distribution concerns” and recapture lost ACV, while also looking ahead to update the brand and innovate its portfolio.

“There are some places that Rudi’s can win, that Justin’s really doesn’t have a strength in and there are places where Justin’s can win where Rudi’s doesn’t have a strength,” he said. “It’s a really fun opportunity for me to go find things that can work at Rudi’s or work at Justin’s or work together.”

Once the “pick and shovel work” of the carve-out is complete and the brand establishes a solid foundation, Justin’s will double down on marketing, innovation, and consumer awareness.

During the nine years that Justin’s was under Hormel’s ownership, the food and beverage landscape – and the world itself –underwent significant changes, per Burns. He pointed to Amazon’s purchase of Whole Foods, the rise of the club channel and the influence of content creators on Instagram and TikTok.

“The first time around, Justin’s didn’t have a club presence, a c-store presence, or an international presence. You think about that today and go, ‘Those are areas of green field. How do we get to them?’ That’ll be our focus as we stand up Justin’s,” said Burns.

The potential for product innovation with the brand is “limitless,” according to both Staub and Burns. That includes extensions in the nut butter and confection categories, as well as a potential expansion into “snackfections.”

“We’re thinking about how we want to bring this brand to life in the public’s eye and what the optimal portfolio mix is between peanut butter, almond butter, confection and snackfections,” said Staub. “Justin will have great insight as to what should work based on his deep experience of having built the brand, and Peter is a fantastic leader who is strategic and very strong operationally.”

He continued, “This is an archetypal Forward investment. We see tremendous opportunity for Justin’s. We’re going to get this to a stand-alone and then you’re going to see Justin’s out in the world in a way that you haven’t before.”

Amid murky times for THC beverages, Ohio’s largest craft brewery, Rhinegeist, is wading into the intoxicating hemp beverage category with Fuzzy Bones.

Fuzzy Bones is a line of non-alcoholic sparkling beverages made with real juice and infused with hempderived delta-9 THC.

The line will begin with three flavors – Blood Orange + Tangerine; Lemon Blueberry; and Blackberry Hibiscus – each 5 mg of THC and sold in 12 oz. slim can 4-packs. Each offering also contains 10 mg of either cannabinol (CBG) or cannabidiol (CBN), depending on the flavor.

“As the largest craft brewer in the state of Ohio, we recognize that there is some legitimacy, credibility and weight that we can offer by acknowledging that we want to participate in this category,” Rhinegeist CEO Adam Bankovich told Brewbound. “We’re also very appreciative of all the efforts that are ongoing to create regulation, which we are fully supportive of.”

Fuzzy Bones is the product of two years of research and study. Packaging bears the Rhinegeist name and “skull drop” logo, trading on the brand equity that the craft brewery has built over the last 12 years.

THC-infused beverages present a “meaningful” opportunity for Rhinegeist’s overall business, Bankovich said.

“This is something we believe is going to be a very real, very materially contributing component of our business going forward,” he said. “Everything that we’ve read, everything we’ve studied, everything the industry is talking about, acknowledges that this product category is one that will be here to stay.

“This does solve a true need state and a different occasion for consumers,” he continued, adding that from “Cali sober” drinkers, to those looking to moderate consumption, THC beverages are becoming a “true every day presence in people’s lives.”

Fuzzy Bones is now available in Rhinegeist’s Cincinnati taproom for onsite consumption and togo sales to 21+ consumers at an $18.99 price point, which will also be the suggested retail price in retailers, Bankovich said.

The brand will soon be available for direct-to-consumer shipping in states where legally permitted, with a $22.99 (plus shipping) price point per 4-pack. Rhinegeist is also exploring subscribe-and-save and bundling options, Bankovich added.

The company is in active negotiations with distributors to carry Fuzzy Bones, including in states where Rhinegeist’s beer is not yet distributed, Bankovich said. Rhinegeist’s existing nine-state footprint includes Ohio, Indiana, Kentucky, Pennsylvania, Tennessee, Michigan, West Virginia, Wisconsin and Illinois.

“I don’t believe we’ve talked to any distributor yet who doesn’t acknowledge the impact this category is having and that it is a category that is likely here to stay,” Bankovich said.

Molson Coors CEO: Taking $3.6B Goodwill Impairment a Way to ‘Check Ourselves’

Molson Coors’ Q3 financial performance brought expected declines as the beer giant and others in the industry continue to tackle macroeconomic headwinds and soft beer trends.

But what brought some surprise to analysts in the company’s latest earnings release, was a nearly $3.65 billion non-cash goodwill impairment charge in the quarter. $77.5 million of that charge was “attributable to noncontrolling interests.”

On a call with investors and analysts following the release, Molson Coors CEO and president Rahul Goyal said the impairment charge was due to a “number of factors,” including the company’s 2025 performance and outlook, discount rates, risk premium and valuation multiples. In evaluating the company, he noted that Molson Coors needs to “check ourselves to make sure we’re thinking of the business in a prudent way,” and “the impairment is a function of that.”

“We can get this business back to top and bottom [line] growth,” he added. “We think we are very undervalued in the context of our market cap right now.”

Molson Coors has an $8.1 billion market capitalization.

Additionally, the company took a $273.9 million intangible impairment loss in the quarter, credited in part to its Staropramen and Blue Run Spirits brands. $75.3 million of that loss was credited to Blue Run, which Molson Coors acquired a majority stake in for $78 million ($65 million cash) in 2023.

Goyal’s leadership run has started off with a bang, including the restructuring and realignment of Molson Coors’ Americas business unit, the departure of chief commercial officer Michelle St. Jacques, and the elimination of 400 salaried positions in the Americas division – equivalent to about 9% of the division’s headcount.

“I want to assure you that we are moving with a sense of urgency and with a clear purpose,” Goyal said.

New Belgium to Test New RTDs, Add Bell’s Two Hearted Stubby Bottle, Take Oberon Light Year-Round

A pair of new ready-to-drink (RTD) offerings are coming from New Belgium in 2026, including Kirin’s top-selling canned cocktail and a vodka cocktail with a “subtle nod” to the Voodoo Ranger franchise.

As part of their incubator approach to test, learn and prove new launches, New Belgium will bring parent company Kirin’s Hyoketsu vodka soda to the U.S.

The 5.8% ABV vodka RTD inspired by the chuhai cocktail will be available in two flavors – Pineapple and Strawberry – beginning in March. Hawaii and Tampa, Florida, will be the first test markets.

In addition to Hyoketsu, New Belgium will launch Vandal Cocktails, a 10% ABV vodka-based RTD focused on the convenience channel.

Arizona, Nevada, New Mexico and Ohio will get Vandal first. The first flavors out of the gate include Blue Razz, Cherry Limeade and Citrus Charge. Each can includes two vodka shots.

“Lots of our convenience store chains are really excited about this one,” Dye Yonushonis said.

The package features a masked bandit-style doppelganger of the Voodoo Ranger.

New Belgium is taking the learnings from launching hard refresher brand LightStrike this year and applying them to Hyoketsu and Vandal. Among those lessons was that scale in RTD offerings doesn’t come overnight, Dye Yonushonis said.

“It’s either bought or built,” she continued, citing BeatBox, Carbliss and Surfside as successful examples that have “built region by region, channel by channel, step by step, adjusting along the way.”

Boston Beer’s transformation from a craft brewer to an adult beverage company, which began in earnest about a decade ago, is looking like an even better bet as traditional beer’s declines outpace those of the beyond beer segment.

Traditional beer has declined about 5.5% in 2025, founder, chairman and CEO Jim Koch said during a call with investors and analysts to discuss the company’s third quarter. By comparison, the category’s non-traditional segments – hard cider, hard seltzer, flavored malt beverages (FMB), and other ready-to-drink (RTD) offerings – appear to be down “maybe 1% or 2%,” he said.

“Think of us as having a bias towards growth,” Koch said. “That is how we look at the world. We believe that we should be growing our revenue. As a company, we are heavily weighted away from traditional beer towards what people call beyond beer. I like to call it a fourth category because it’s not just beyond beer, it’s beyond liquor, beyond wine.”

Koch’s optimism came after an expectedly tough quarter. Boston Beer’s shipments (sales to wholesalers) declined 13.7% and depletions (sales to retailers) declined 3%. Net revenue declined 11.2%, to $537.5 million.

Beyond beer offerings now account for 85% of the company’s volume, driven by its largest brands, Twisted Tea and Truly Hard Seltzer. For the first three quarters of 2025 (data ending October 5), both have declined in dollar sales and volume in Circanatracked multi-outlet grocery, mass retail and convenience stores (MULO+C):

Twisted Tea, dollars -5%, volume -6.9%; Truly, dollars -14.4%, volume -16.2%.

The losses of both Twisted Tea and Truly – the category’s No. 10 and No. 14 largest brand families, respectively – have outpaced their segments’ declines. FMBs, to which Twisted Tea belongs, have declined 3% in dollars and 5.3% in volume year-to-date (YTD) through October 5. Hard seltzer has declined 5.1% in dollars and 7.8% in volume.

Twisted Tea’s declines “surprised us,” Koch told the analysts. The company had expected 7% dollar sales growth in 2025. The twin problems plaguing Twisted Tea are a loss of shelf space to spirits-based RTDs, including vodka-based teas, and excessive prices, he said.

Included in the set of space-stealing vodka-based teas is Boston Beer’s Sun Cruiser, the hard tea and lemonade brand the company launched last year. The company estimates 20% of Twisted Tea’s losses can be attributed to this group, but any share that Sun

Cruiser has picked up “is revenue and gross margin accretive for us,” due to the brand’s higher price point, Koch said.

To combat softness in sales of Twisted Tea 12-packs, which the company said were priced higher than Constellation Brands’ Modelo Especial and Anheuser-Busch InBev’s Stella Artois at some retailers, Boston Beer is trialing 16 oz. can 4-packs priced at $10 and below in certain markets.

Twisted Tea Light (4% ABV) and Twisted Tea Extreme (8% ABV) have each gained shelf space. Boston Beer is adding an Extreme variety pack early next year, which may include Twisted Tea Extreme Long Island Iced Tea, which was unveiled earlier this month at the National Association of Convenience Stores (NACS) annual trade show, according to a Goldman Sachs report. The higher ABV line also includes Extreme Lemon and Extreme Blue Raz.

In its sophomore year, Sun Cruiser has become the fourth-largest spirits-based RTD brand, Koch said. After reaching national distribution in early 2025, the brand has gained large-scale chain placements and tripled its points of distribution. Sun Cruiser is the leading vodka-based tea and lemonade RTD in the on-premise, according to NIQ data cited by Koch.

To build Sun Cruiser’s momentum, Boston Beer is rolling out 19.2 oz. single-serve cans nationwide in early 2026 after a New England trial and sponsoring sports and music venues. The 19.2s will replace 24 oz. resealable cans.

“We believe Sun Cruiser will be the next iconic brand for our company and an important growth contributor for the beyond beer category,” Koch said. “We are focused on building the brand’s distribution, displays and retail promotion while investing in media and key sponsorships that keep the brand relevant throughout the four seasons of the year.”

Angry Orchard hard cider returned to growth in 2025, “driven by a higher level of focus across the organization, including increased investment and new sponsorships,” Koch said. YTD through October 5, dollar sales of flagship Angry Orchard Crisp have increased 3.1% and volume increased 2.1%, which accelerated to +7% and +6.5%, respectively, in the last 12 weeks (L12W).

The brand is gaining momentum going into Q4. In the oneweek period ending October 12, Angry Orchard recorded double-digit growth in dollar sales (+16.5%) and volume (+13.1%), according to Circana. A spooky-season boost could be attributed to Angry Orchard’s seasonal programming featuring Jason Voorhees, the fictional killer in the popular Friday the 13th movie franchise.

Boston Beer Company’s chief supply chain officer (CSCO) Phil Hodges has been promoted to chief operating officer, effective immediately.

Hodges’ new responsibilities include overseeing “day-to-day operations across all functions” and “continuing to improve execution and implementation [of] the company’s previously announced brand building and margin enhancement initiatives,” according to a release.

He will report directly to Koch, who retains his role as CEO – a position he took in August with former CEO Michael Spillane’s departure from the company. Koch’s primary focus will remain on “high-impact areas, includ-

ing the company’s innovation pipeline, wholesaler relations, brand investment strategy and talent and culture.”

Hodges has served as CSCO since May 2023, after a year of consulting for the company. His resume includes stints at Carlsberg, Kraft Foods and Mondelez.

The role of CSCO will be passed to Phil Savastano, who has been with the company since March 2024, leading operations for Samuel Adams’ Pennsylvania brewery.

New Belgium Brewing has big plans for Voodoo Ranger in 2026, from two new IPAs to partnerships with two of the biggest TV and video game releases of the year.

The goal is to bring new consumers into the Voodoo Ranger franchise through new products and partnerships that energize its core portfolio.

New Belgium’s big Voodoo Ranger bets for next year include:

• Sweet Ride, a 6.5% ABV IPA targeted to the grocery channel;

• And G-Force, an 11% ABV IPA in 19.2 oz. singleserve cans for convenience.

Both new items were revealed during New Belgium’s distributor meeting in September in Fort Collins, Colorado.

The expectations for Sweet Ride are big. New Belgium VP of marketing Dave Knospe predicted Sweet Ride will be “the biggest craft launch of the year.” Sweet Ride will roll out in the spring, first in the Voodoo Ranger Hoppy Pack to 30,000 points of distribution to drive consumer trial, as well as on draft. Individual 6-packs will follow.

Starting in the Hoppy Pack will put Sweet Ride in front of core Voodoo Ranger drinkers while also bringing new energy to the pack to help reverse trends after a tough 2025 due to lost distribution as Walmart eliminated rotator packs. Hoppy Pack is the No. 1 IPA variety pack in NIQ-tracked retailers.

“We’re pumped on this thing because we think this is going to solve a huge problem within the category, in multipacks, in everyday drinkability,” Knospe said.

Knospe described Sweet Ride as a “crushable,” “bright, crisp, lightly fruit-flavored IPA” with some “bitterness to round it out.” Those attributes fit what New Belgium’s research and the Harris Poll showed Generation Z drinkers are seeking: fruity, sweet and lighter profiles.

New Belgium also views the 5% to 8% ABV range of beer – which makes up 70% of craft’s volume – as ripe for disruption. Knospe pointed to a lack of breakthrough brands in that space over the last five years.

“Of the top 20 brands in everyday drinkability, none of them are new within the last five years,” he explained. “In the craft sense, usually the top brands are new brands. They pop up, they go through the sophomore slump, they get discontinued. They do it again. That’s the cycle. None of the top 20 in this entire space are considered even remotely new.

“This is what the category needs, innovation that is built to attract new drinkers into craft and get this category healthy once again, build something for today’s consumer, not the consumer of 2010,” Knospe said.

Meanwhile, G-Force is aimed at building on Voodoo Ranger’s dominance of craft singles in convenience and building on the 24% share of craft single dollars held by top brands Voodoo Ranger Imperial IPA and Juice Force.

Kiron Chakraborty, director of core brands Voodoo Ranger, described G-Force as a “supercharged juicy IPA” set to arrive in February.

“This isn’t just another SKU,” he said. “It is built to thrive

in convenience.”

G-Force is expected to build on the success of Imperial, Juice Force and Tropic Force.

New Belgium is hoping it has its next big things with Sweet Ride and G-Force in 2026, while also energizing its core offerings.

“We have to attract the next wave of drinkers through Sweet Ride, but we also have to do it with what we have in our portfolio today,” Knospe said.

Beyond Sweet Ride and G-Force, New Belgium is launching a partnership with Amazon’s Invincible, the animated superhero series voiced by Mark Hamill, Walton Goggins, Steven Yuen and Gillian Jacobs that has amassed 6.6 billion views and is big with 21- to 34-year-olds.

Invincible vs. Voodoo Ranger will be a limited-edition Blood Orange IPA in the Hoppy variety pack that will be available for summer – ahead of Invicible’s first video game release.

“We are committed to adding energy to our existing portfolio,” Knospe said of Hoppy Pack. “We’re going to feature Invincible and bring in a whole new wave of drinkers that may not have even considered a craft beer before.”

The gamer community factors heavily into Voodoo Ranger’s plans. Voodoo Ranger will go even bigger than ever before into gaming in 2026 with Borderland 4, which is running a $100 million ad campaign and is expected to be among the biggest video game releases of next year. The game will be cross-promoted on Voodoo Ranger IPA 6-packs.

“This younger generation, almost all of them consider themselves to be gamers,” Knospe said, noting that 70% of gamers average eight hours a week playing.

“It’s bigger than Hollywood now, and these people are loyal to the brands that sponsor their favorite games and their favorite streamers,” he added.

The founders of BeatBox are hoping 2026 will bring them their second hit brand aimed at a new generation of consumers.

BeatBox parent company Future Proof -- which was the subject of rumors of a sale to AB-InBev as of press time -- will launch Chillitas in February, a new-to-world, flavored malt beverage (FMB) outside of the company’s flagship party punch brand.

Chillitas will target second-generation Latino consumers, who make up 20% of the U.S. population and are expected to grow to 33% by 2030, BeatBox co-founder and chief marketing and experience officer Brad Schultz and SVP of global marketing Zech Francis told Brewbound.

What Chillitas is not is a chelada, Schultz and Francis stressed.

“We don’t have any tomato in it, which we think is a big competitive advantage for us,” Francis said. “We don’t have beer in it because, frankly, look at the macro trends with what’s happening in beer. There are a lot of consumers that feel like beer is not aligned with where they are as consumers.

“There is this Chelada shopper who doesn’t want the beer and tomato,” Schultz added. “They want something light.”

Schultz sees an opportunity to create a new product at the “magical intersection” of cheladas, FMBs and hard seltzers with an elevated ABV at 8.1%.

Available in four flavors – Chili Mango, Wild Paloma, Pica Piña and Sandia Loca – Chillitas will be sold in 19.2 oz. singleserve cans that feature “Spanglish” text (a mix of Spanish and English).

Although Chillitas will not trade on BeatBox’s brand equity, the reputation has carried over with retailers and distributors, leading to early adoption, Schultz said.

The new product will roll out in eight states – Arizona, California, Colorado, Illinois, Nevada, New Mexico, Oklahoma and Texas – with retailers such as Vallarta, Cardenas Markets, Superior Grocers, Circle K and HEB on board.

“We feel pretty confident within the first few months of launch, this will get into 30,000 to 40,000 accounts, pretty much immediately after launch,” Francis said.

In a fall 2026 Phase Two, Chillitas is expected to add 20 states.

Schultz and Francis also see an on-premise opportunity for Chillitas with Tajin chamoy rim dressings as a ritual similar to adding an orange slice to a Blue Moon or a lime to a Corona.

The idea for Chillitas has been marinating for years. As BeatBox leaned into being a leading flavored alcohol producer, the company zeroed in on Tajin, chamoy, sweet, salty, spicy flavors that extended beyond cheladas into traditional CPG products such as popcorn, chips and sorbets. However, the right opportunity didn’t fully emerge until around eight months ago.

A small team began working on what would become Chillitas, partnering with “The Drip Committee,” a group of around 25 Latino influencers who met monthly to help shape the liquid and branding while also offering weekly feedback by text.

“They have a voice, but right now, we’re just using the brain power to validate what we’re building,” Schultz said. “And come launch, they’re going to be launch partners.”

Red Bull’s 2025 Holiday Edition features a blend of Fuji apple and ginger flavors, available in full-sugar and sugar-free varieties. The autumn-themed drink can be found in 8.4 oz. and 12 oz. formats. For more information, visit redbull.com.

Anheuser-Busch and Dana White-backed Phorm Energy released a limited-time variety to honor Veterans Day, Honor. Educate. Unite. A portion of the proceeds for the cherry slush flavor will support the Folds of Honor nonprofit scholarship organization. For more information, visit phormenergy.com.

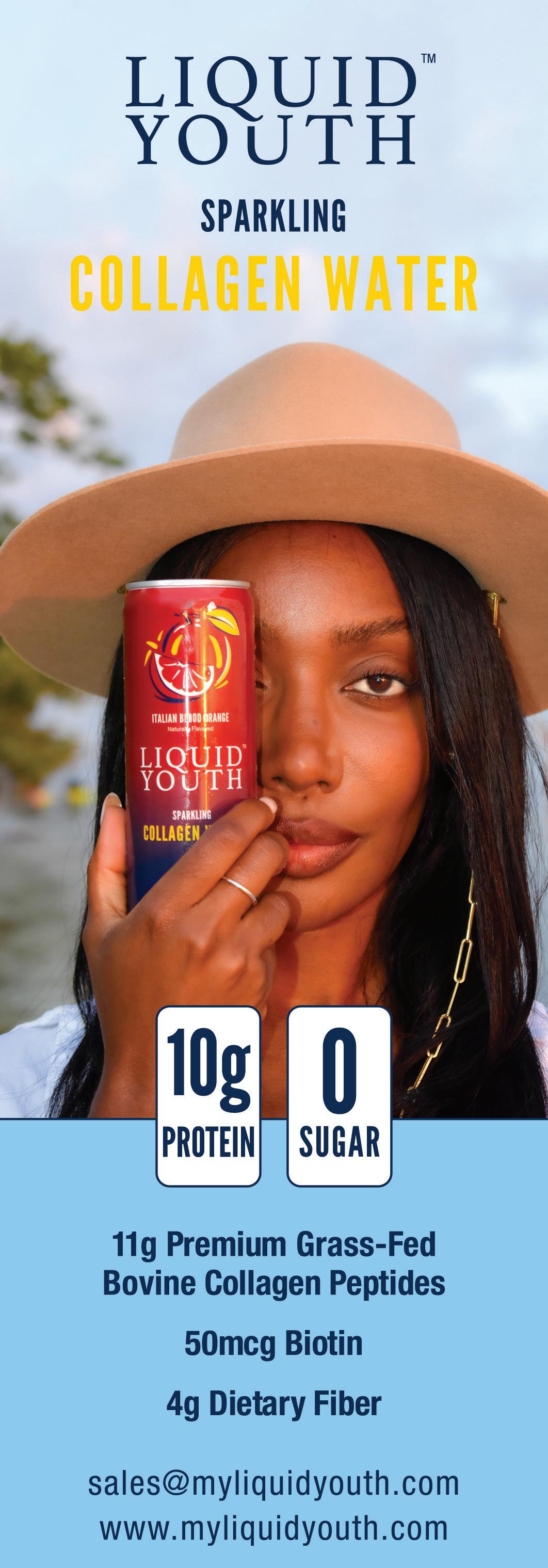

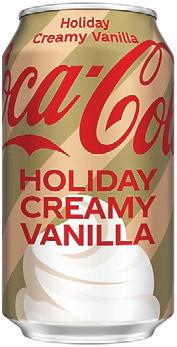

A year and a half since launching, energy drink maker Huxley has refreshed its packaging. The brand’s 3-SKU (Strawberry, Tangerine and Mango) juice-based energy drinks contain 100mg of electrolytes, 90mg of caffeine and 5 grams of sugar, as well as the benefits of l-theanine derived from cascara. The updated branding simplifies front-of-label callouts and adds color and transparency to flavor varieties. For more information, visit drinkhuxley.com.

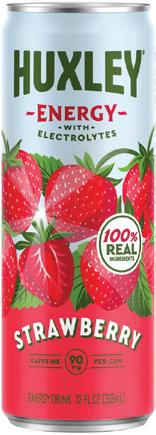

Lucky Energy is teaming up with influencer Brittany Cartwright for its latest flavor: Raw in Hail. The limited edition strawberry lemonade flavored energy drink contains 200 mg of caffeine per 12 oz. can along with maca, ginseng, beta-alanine, and taurine. The flavor is available direct-to-consumer at luckybevco.com for $28.99 per 12-pack.

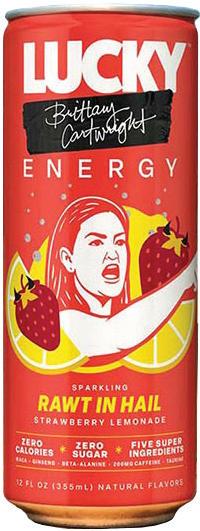

Coca-Cola is getting festive with its seasonal variety, Holiday Creamy Vanilla. Available in 12-packs of 12 oz. cans, and individual 20 oz. and 2-liter bottles, the LTO is part of Coke’s campaign to “Refresh Your Holidays.” For more information, visit coca-cola.com.

Amazon Prime’s hit show Fallout returns in December and Jones Soda Co. is partnering up again on its popular video game-inspired flavors. The 12-can Vault-Tec Supply Pack launched into Costco Northeast locations with four bottles each of the Sunset Sarsaparilla, Nuka-Cola Quantum and Nuka-Grape varieties, along with a magnetized bottle opener and three collectible bottle caps. For more information, visit jonessoda.com.

Soda brand Bear Maple is getting ready for Thanksgiving with a Cran-Raspberry flavor launch. CEO Brian Bethke said the 12 oz. beverage aims to be “crisp, refreshing [with] just the right balance of tart and sweet.” The flavor can be found on Amazon for $39 per 12-pack. For more information go to drinkbearmaple.com.

Actor and comedian Ben Stiller is jumping into the soda game with Stiller’s, a new brand of better-for-you craft sodas containing 30 calories and “No Fake Stuff” in each 12 oz. can. For more information, visit stillerssoda.com.

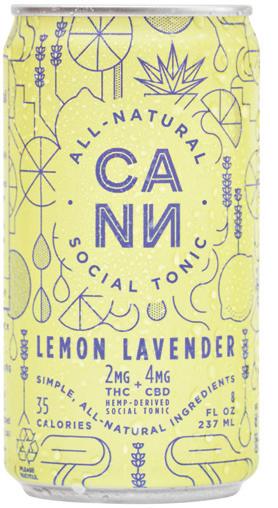

Intoxicating hemp brand Cann has added sage to its seasonal LTO cranberry variety. Cranberry Sage is available in the brand’s microdosed 2mg THC, 5mg Hi-Boy and 2mg Roadie packet formats. For more information, visit drinkcann.com.

Cannabis technology company Mfused has launched a cannabis-infused lemonade beverage Super Fog Burzt. The new dispensary channel product will launch in Washington state recreational cannabis retailers, with New York and Arizona following. The seven flavors (Baja Blazed, Blu Razz, Früt Punch, Lemon Loopz, Galactic Grape, Wild Watermelon and Swirly Temple) are 100mg THC per 12 oz. bottle with a 6ml dosing cap for “controlled consumption.” For more information, visit mfused.com.

Jones Soda has expanded its Mary Jones hemp-derived THC drinks with Zero Sugar options. The zero-calorie line comes in 12 oz. sleek cans and have 10mg of THC, available in Cola, Root Beer and Berry Lemonade. For more information, visit gomaryjones.com.

Adult non-alcoholic (ANA) cocktail brand Mockly unveiled its new can design and flavor names as it launches a new Citron Café Noir variety. The cold brew-based drink blends cocoa, fennel and lemon as an ANA espresso martini. Mockly is returning to its 8.4 oz. cans, reinforcing the brand’s identity as “cocktail adjacent” beverages. For more information, visit drinkmockly.com.

As the moderation movement mixes with wellness trends, brands like Mingle Mocktails are rising to meet the moment through innovation: in this case, it’s a new line called Mood. Available in two flavors, Berry Lemon Bliss and Serene Citrus Spritz, the 30-calorie drinks’ featured ingredients (lion’s mane, ashwagandha, and L-theanine) are designed to calm, support focus, and promote balance. There’s more info on this release at minglemocktails.com.

Adult non-alcoholic Italian Spritz brand Ghia’s latest flavor is Blood Orange, described as “a collision of our signature bitter apéritif and sun-ripened blood orange.” Available in 8.4 oz. cans, each drink is made with juice concentrates and botanical extracts. For more information visit drinkghia.com.

Rapper Future dropped a new release: Roué, a brand co-founded with Ohza founder Ryan Ayotte. The debut lineup includes two winebased RTDs, Ruby Passion and Lemon Lust (8% ABV, $14.99 per 4-pack), that blend natural fruit juice with a sleek glass bottle. For more information, visit drinkroue.com.

California’s Roseade USA is popping off with a new variety 6-pack (including Original, Pineapple, Strawberry Lemonade) and a massive retail rollout in California. A 750ml bottle of Original Roseade Spritzer is also hitting shelves. For more information, visit roseadeusa.com.

Subourbon Life continues its daytime bourbon cocktail lineup with two new flavors –Bourbon Piña Colada and Bourbon Espresso Martini – both 5% ABV. Made with six-year Kentucky bourbon and all-natural ingredients, the brand aims to make America’s signature spirit accessible for any occasion. Visit subourbonlife.com for more information.

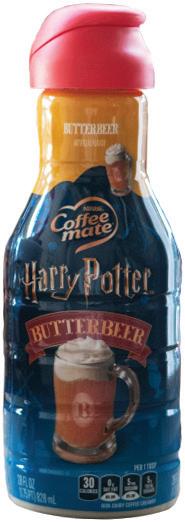

It won’t turn you into a wizard, but Coffee mate’s line of Harry Potter branded creamers are looking to cast a charm over your morning coffee. Taking inspiration from the children’s series’ creamy fictional beverage, the cobranded lineup includes Butterbeer and Butterbeer Zero Sugar flavored creamers, as well

as a Butterbeer cold foam – which to our nonmagical taste buds comes across as a blend of sweet butterscotch, cream and caramel. The creamers will roll out to retail in January at $4.49 per 28 oz. bottle and cold foam canisters will sell for $5.49 each. For more information visit goodnes.com/coffeemate.

Danone North America’s Too Good & Co. is introducing a line of Coffee Creamers available in Sweet Cream, Roasted Vanilla and seasonal Lavender varieties. Inspired by TikTok’s #HomeCafe and #CoffeeTok communities, the creamers aim to elevate the athome coffee occasion with premium ingredients and lower sugar; 25.4 oz. bottles will launch in retail this month at $5.99 each. Visit heytoogoodandco.com for more details.

MALK is getting into the holiday spirit with the return of its limited edition almond Holiday Nog. Made with just five ingredients –organic almonds, maple syrup and nutmeg extract as well as Himalayan pink salt and filtered water – the 28 oz. multiserve bottles are back in stock in Whole Foods stores. For more information visit malkorganics.com.

With GLP-1 being a major CPG trend, it’s no surprise to see new brands like Todo attempting to capture consumers’ attention. Available in four flavors, Todo offers a blend of 26 grams of protein with 6 grams of prebiotic fiber per 12 oz. can to support satiety and provide sustained energy. To learn more, visit drink-todo.com.

The expanding sparkling protein drink set has a new addition: Shaklee, which boasts 40 grams of “next-generation” grass-fed whey protein per 12 oz. can, with zero sugar and no artificial sweeteners or flavors. There’s more details at us.shaklee.com.

Koia is extending its Elite Protein line with Coffee and Cookies ‘N Creme flavors, launching this month in Target stores across the country. The Elite line launched earlier this year in Whole Foods and the new flavors contain 32 grams of plant-sourced protein, 4 grams of organic cane sugar, avocado oil and 6 grams of fiber. For more information, visit drinkkoia.com.

Looks like White Claw has found its level, and that level is about $2 billion. As the category slows (look at the -4.5 points of overall decline) the OG brand is sitting pretty. The erstwhile top challenger, Boston Beer’s Truly is skidding out, and the rest of the category has bit players in big systems (Topo Chico) with only one brand moving through the pack (Happy Dad). Still, hard seltzers have been an important catalyst, validating the notion that there is opportunity on beer shelves for everything from RTD cocktails to NAs of all stripes.

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 10-5-25

The future of soda and proliferation of protein were two of the hot topics at this year’s National Association of Convenience Stores (NACS) trade show in November, with major brands like Pepsi, Coca-Cola and Keurig Dr Pepper (KDP) showcasing category innovation.

“This NACS feels different,” Pepsi North America president Mike Del Pozzo told attendees at a pre-show reception in Chicago. In brief remarks, Del Pozzo backed the company’s boldness; this year’s embrace of innovation and “flexibility” is centered around long-term gains, or a “next chapter” for the company.

At the event, all eyes were on Pepsi Prebiotic Cola, the much-heralded innovation from Pepsi’s flagship line. Despite the functional positioning (3 grams of fiber) and the addition of stevia, the new drink still looks and tastes much like the original formula. The line is available in just two SKUs, Original and Cherry Vanilla.