If there’s one scheduled feature that causes our team to draw bendy straws, it’s our annual look at the state of kid’s drinks. It’s just a confusing category; it’s not like kids are physically incapable of drinking most things, or that, booze and THC aside, there are actual federal laws on the books that make them unable to purchase most of them. (Even energy drinks, the caffeinated subject of much Congressional and pediatric finger-wagging, aren’t subject to any kind of legal restrictions at the federal or state level, although some municipalities and retail chains have put bans on sales to children under 18. But that’s the vast minority.)

So for the most part, that means that if it’s in the hands of a kid, even if it isn’t prescriptively a “kid’s drink,” it’s nevertheless that kid’s drink.

Until there’s any kind of legal segmentation, then, the defining quality of these products as being for kids lies with the marketer - who at least defines it as part of their market building - or with that ultimate decision maker, the purchaser.

On the marketing side, there seem to be a couple of tried-andtrue variations.

One of them we’ll call the “Happy Meal” school of thought: make sure the product comes with or is inside of a toy or a licensing deal. Brands like superhero-topped collectibles Good2Grow and Sesame Street licensee Apple and Eve have spent years hanging around those neighborhoods, building enviable businesses under the aegis of those even stronger media properties. More than a decade ago, Good2Grow even pulled off the neat trick of making its products appear much healthier, pulling out some sugar and changing a lot of its branding away from what thenCMO Carl Sweat called “liquid candy.”

We’ll call the next “Stuffing the Lunchbox.” Last year, I wrote a story for this magazine about the seeming unconquerability of the Capri-Sun pouch, and while it was enjoyable to get to explore the way that the brand has maintained its position, we’re talking about a brand that is decades old. The only brand like Capri-Sun that has made significant gains in recent years is Honest Kids –itself largely pouch-bound – and which is, let’s face it, a knockoff with a better ingredient deck. If it someday catches Capri-Sun, it won’t be because it did anything worse than fail to adapt its recipe quickly enough to changing times; as it is, the run has been outstanding.

There’s also the “Kids are Adults Too!” approach, which our intrepid Brad Avery writes about in our kids beverage feature this month (Brad’s straw was the bendiest). Here we see brands taking the kinds of functions and features and dropping them into kid-size concentrations of ingredients or else marketing them with a bit of a kid-focused attitude. We’re seeing that in everything from NO CAP! Soda Pop to Koia Kids protein shakes, and they’re the descendants of Nestlé Quik and Yoo-hoo. Sometimes these are pitched towards parents (that’s the functional side) and sometimes it’s toward the kids (that’s the fun side).

For a long time, the idea that a finicky kid would actually drink something that an adult gave them allowed the growth of the “Lesser Evil” school of marketing to parents. That has evolved a bit – while it might once have been the realm of the full-sugar

By Jeffrey Klineman

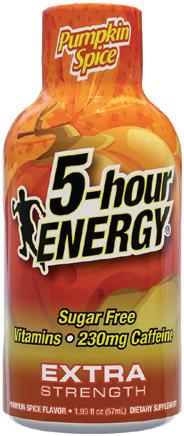

orange juice, or the fortified Sunny D, now it’s more of a “free from” situation. These can lead to something of a straddle for adults, who might be more inclined to throw a LaCroix or Talking Rain or even a Vitaminwater into the lunchbox for a hit of flavor. Move forward in age and things start to change. The outer edges of the range can bring in anything from a Frappuccino to a Diet Coke as kids start to enjoy the wonders of caffeine. Could a Red Bull be far behind?

These are all fairly legitimate brand strategies from where I sit, but here’s where things get complicated. As those who have kids know, it’s just often hard to determine the ultimate consumer: some households will let the kids drive the decision, while in others the adult controls the shopping cart. As kids age up, they may become more active in the decision, but the age target of a beverage – much like cereal, snacks, and Hostess Cupcakes – lies more in what’s allowed than what’s defined.

I’m an empty-nester as of August, so I think a lot about my kids, and I remember they were at various ages. The problem is that those ages are temporary. Like clothes, habits and ways of eating are outgrown. Milk turns into Sunny D; water to Gatorade; OJ to AriZona. Depending on social habits, economic situation, and so many other factors, it’s tough to build a drink that hits the age just right and doesn’t pander. So beware the idea, entrepreneurs, that you’ve invented the perfect solution.

That 12-year-old might slug chocolate milk now, but when she hits middle school, will she go searching for a Celsius? Your business plan might depend on it.

By Barry Nathanson

Sure, there are industry awards, but then there are MY awards. Over my 34 years as a beverage magazine publisher, I’ve used my columns to invoke the names of many of the industry luminaries I’ve had the pleasure to meet and work with. Early on in my career, the likes of Don Keough from Coke, Roger Enrico from Pepsi, Peter Coors from Coors, Augie Busch from A-B, Tru Knowles from Dr Pepper, Jack Stahl from Coke, Kim Jefferies from Perrier and countless other leaders were part of the galaxy I orbited. They were fascinating people, generous with their time and their knowledge. I was appreciative that they supported my efforts and utilized my magazine. There was no better group of people to emulate in terms of their success, passion and willingness to impart their expertise. I learned from these masters. Call them the originals, the ones who were there when they built the Hall, much like Ty Cobb, Babe Ruth, Christy Mathewson, Walter Johnson and Honus Wagner were the first ones inducted in the Baseball Hall of Fame (no truth to the rumor that I was actually present at their induction ceremony!)

Then came the next generation of beverage marketers. “New Age” brands changed the landscape. I remember when Michael Bellas from Beverage Marketing Corp. coined the term, and a terrific array of exciting products became all the rage. The consumer embraced

these brands and a whole new roster of entrepreneurs became my new “best friends.” My list of those Hall of Famers encompasses the likes of the Snapple Three, as well as the incomparable duo of Don Vultaggio and John Ferilito from Arizona, and John Bello from Sobe. From the corporate ranks, Mike Weinstein steered multiple brands, as did Jack Belsito. Then came Jim Koch from Sam Adams, John Carson from RC Cola, Rodney Sachs and Hilton Schlosberg from Monster, Darius Bikoff and Mike Repole from Vitaminwater, Lance Collins from Fuze: many of these folks are still going, even though there are newer founders who I’ve inducted: the coconut boys, Mike Kirban from Vita Coco and Mark Rampolla from Zico are on my list. I always have a special place in my heart for Seth Goldman, from Honest tea and now Just ice Tea. He was generous to every aspiring brand founder and still gives them good counsel.

Now I’m looking for the next group of beverage marketers who will get the nod and join my personal Hall of Fame. Times change and circumstances evolve, but the core of a person’s soul and demeanor will always be my touchstone (although a propensity to buy ads doesn’t hurt!). I will always be indebted to those named in my column for their wisdom and their friendship. I hope to add new members soon – just give me a call and we’ll talk about your candidacy. After all, you only have one voter to impress.

Barry J. Nathanson Publisher bnathanson@bevnet.com

Jeffrey Klineman Editor-in-Chief jklineman@bevnet.com

Martín Caballero Managing Editor mcaballero@bevnet.com

Monica Watrous Managing Editor, Nosh mwatrous@bevnet.com

Justin Kendall Editor, Brewbound jkendall@bevnet.com

Adrianne DeLuca Assistant Managing Editor, Newsletters adeluca@bevnet.com

Lukas Southard Senior Reporter lsouthard@bevnet.com

Brad Avery Senior Reporter bavery@bevnet.com

Zoe Licata Senior Reporter, Brewbound zlicata@bevnet.com

Shauna Golden Reporter sgolden@bevnet.com

Sales & Ad Operations

John McKenna Director of Sales jmckenna@bevnet.com

Adam Stern Senior Account Specialist astern@bevnet.com

John Fischer Senior Account Executive jfischer@bevnet.com

Lou Calamaras National Account Executive lcalamaras@bevnet.com

Jon Landis Business Development Manager jlandis@bevnet.com

Colin Sughrue Digital Campaign Coordinator csughrue@bevnet.com

Art & Production

Aaron Willette Design Manager

BevNET.com, Inc.

John Craven CEO / Founder / Editorial Director jcraven@bevnet.com

Headquarters 65 Chapel Street Newton, MA 02458 617-231-8800

Publisher’s Office

1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

Subscriptions

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com www.bevnet.com/magazine

By Gerry Khermouch

Some of us sitting high up in the peanut gallery have a tendency to give the benefit of the doubt to the strategics’ strategic strategizing even when the stratagems don’t entirely make sense to us. After all, those companies’ ranks are stacked with hundreds of MBAs. Thousands, maybe! They have access to reams of mysterious information, consumer and otherwise, that we get no glimpse of. They’re guided by directors who’re titans of their chosen business sectors. So who are we to quibble when new directions are unveiled that seem to be a bit beyond our comprehension? Surely they were exceedingly well thought out?

Once in a while, I start to question whether I’m being a bit naïve about that. After all, those business geniuses are driven by the same emotions, prejudices and FOMO as the rest of us. As consumer products specialists, they’re by definition obligated to chase the latest fads, whether those prove sustainable or not. Further, internal politics surely can trump cogent analysis when some of these decisions are being made. Some might be driven by the simple need to impress naïve investors with a sense that something dynamic is unfolding.

One of these “once in a whiles” has occurred just in recent weeks when strategies I’d presumed I was simply too obtuse to understand have been repudiated. One was Coca-Cola’s decision five years ago to bet $5 billion on making the foundation of its struggling US coffee business the addition of a humdrum UK chain called Costa that nobody here had ever heard of. So enthusiastic was it about this new direction that it unwound a nascent alliance it had forged with its innovation-adept partner on Java Monster, Monster Beverage, to play in coffee via such entries as Café Monster. A few years in, though, there’s no chain of Costa cafes on this side of the pond and Coke’s Costa-branded

RTDs haven’t gotten anywhere. True, the Costa brand has been at the heart of an inventive series of foodservice offerings, but one can question how much value the Costa name itself lends to the effort compared with an invented name. Now the company has indicated it will look elsewhere for its coffee platform and there have been reports it’s shopping the chain, at the likely cost of a steep writedown.

Then there’s the move seven years ago by hot-coffee giant Keurig Green Mountain to acquire the cold-beverage giant Dr Pepper Snapple Group and merge the two entities via a deal that its architect, Bob Gamgort, said looked beyond outdated notions of “traditional manufacturer-defined segments” in favor of consumer need states, which the merged companies would dominate. At the time, some analysts and investors questioned whether there really were synergies to be harvested from the combination but Gamgort conjured the heady scenario of an ecomm-adept company that was perfectly positioned to shake up a stodgy liquid refreshment realm. Those who didn’t see the deal’s logic needed to question whether they were in step with the new times, he implied. That said, credit Gamgort with having proved an adept operator of the former DPS, willing to make investments in its bottling system that his predecessors weren’t and pursuing a partner-brand strategy that is the envy of the industry. Things haven’t gone as well on the Keurig coffee side but some of the reasons for that have been outside his control.

Those synergies, though? By now it’s clear to everybody that there really weren’t any, and the company now is moving to break up that purportedly breakthrough combination after fortifying the coffee side with the planned acquisition of JDE Peet’s. I’ve found it amusing how the company has conveniently for-

gotten about all the hype that preceded the merger and is now describing the move to undo it as visionary, too. Shareholders clearly haven’t been buying that, with shares slumping 20% since Gamgort’s successor as CEO, Tim Cofer, made the announcement. Now the glib Gamgort has called a special investor day at which he will put his personal spin on the transactions to get investors in line. It should be noted that his breakup plan is among a slew of such moves as CPG giants like Kraft Heinz realize that the scale that comes from putting together a legion of legacy brands only gets you so far, with most growth still being grabbed by the long tail of disruptor brands. In fairness, unlike many of those, Gamgort has actually kept the LRB side of the company briskly growing. So it’s not clear that doing the deal and then undoing it will cost the company much traction.

Then there’s the case of PepsiCo, a floundering giant where there’s lots that can be questioned. Take its decision to pay $4 billion to acquire its fading partner brand Rockstar Energy in order to clear the path for an alliance with Bang Energy purveyor Jack Owoc, who was famous throughout the beverage business for not playing nicely with others. That “alliance” duly proved to be the disaster that many had predicted though Pepsi recovered nicely by pivoting to Celsius as a new partner. Credit it further with the self-awareness to lately make Celsius the steward of its entire energy portfolio, including Alani and Rockstar, in the way Coca-Cola has successfully done with its partner Monster.

Still, Pepsi’s sluggish performance has lately drawn the activist investor Elliott Management, whose critique includes zeroing in on a possible strategic misstep of omission rather than commis-

sion: PepsiCo’s disinclination to refranchise its bottling system in the way its rival Coca-Cola did, a move that seemed to coincide with a marked divergence in the two companies’ fortunes. What does Pepsi say to justify maintaining a unitary distribution system? Unlike his predecessor Indra Nooyi, CEO Ramon Laguarta hasn’t even felt a need to publicly offer a rationale for maintaining the system beyond the general avowal that he likes it that way. The move by Elliott seems to ensure that there at least will be a discussion again of the pros and cons of the two approaches. Of course, Pepsi’s weak performance since it acquired its bottlers has devalued the franchise rights, a situation that some have suggested provocatively might be remedied by a pickup of KDP’s LRB arm once that’s spun off next year.

How much do any of these strategic reversals really matter? Maybe not much in the big scheme of things. Certainly, they don’t seem to put the managers who made the decisions under much pressure. In beverages it’s hard to find many examples of where a poor strategic decision actually cost a CEO the job. Maybe Campbell Soup’s CEO following her disastrous acquisition of Bolthouse Farms? More commonly, CEOs are eased out not for any particular decision but just for their company’s continued sluggish performance. In that context, the incentives seem to align with making bold moves, even if they ultimately don’t pan out.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

The thriving partnership between Celsius and PepsiCo is entering a new phase.

The two companies announced an expansion of their long-term strategic alliance in August that positions Celsius Holdings as PepsiCo’s “strategic energy lead in the U.S.,” placing the Celsius, Alani Nu and Rockstar Energy brands under its management, with PepsiCo distributing the full portfolio in the U.S. and Canada.

sumer and creates greater value for all our stakeholders.”

PepsiCo is also deepening its stake in Celsius Holdings to 11% through $585 million in newly issued convertible 5% preferred stock. The company will nominate an additional director to Celsius Holdings’ board of directors.

The deal builds upon Pepsi’s initial $550 million investment (8.5% ownership stake) in August 2022 as part of its distribution agreement.

“Stepping into the role of PepsiCo’s strategic energy drink captain in the U.S. is expected to be a pivotal milestone in our journey to shape the future of modern energy and grow our brands within a leading beverage distribution system,” said John Fieldly, Chairman and CEO of Celsius Holdings, in a prepared statement. “With a proven functional beverage portfolio and a stronger long-term partnership with PepsiCo, we believe that Celsius Holdings is well-positioned to deliver greater innovation, sharper execution and sustained brand growth. Together, we will reach more people, in more places, more often, with a total energy portfolio that offers options for every con-

As PepsiCo’s energy leader in the U.S., Celsius Holdings will drive a unified strategy across the energy portfolio through “seamless planogram design, SKU prioritization and promotional execution.”

“This agreement marks the next step in PepsiCo reshaping its brand portfolio to position us for long-term growth,” said Ram Krishnan, CEO PepsiCo Beverages U.S. “Energy is an important growth category, and we believe this move with our partner Celsius creates a stronger multi-brand energy portfolio that is better positioned to serve different consumer cohorts. This transaction creates an aligned incentive structure for both parties to bring their individual expertise to better compete in the energy category.”

The announcement confirms the future of Alani Nu distribution, one of the most pressing questions since Celsius bought the brand for $1.8 billion in February. Alani’s massive success — sales hit $301 million (+129%) in Q2, with share up 3.2 points from the same period last year — has come mainly on the back of independent beer DSDs, many of which

have been predicting it would eventually leave their portfolios. In a survey of beer distributors earlier this summer, 64% said they expected to lose the brand sometime in the near future. That cycle — growing in DSD before shifting to a major strategic — has been a major theme of the recent energy drink boom, driving consolidation at the top of the market. Outside of Red Bull, Coca-Cola (Monster, which also owns Bang), Keurig Dr Pepper (Ghost, C4, Bloom, Black Rifle) and now PepsiCo are collectively aligned with the energy category’s top ten brands.

The exchange is evocative of Coke’s alignment-seeking deal with Monster in 2015, in which Monster gained control of Coke’s energy brands like Full Throttle and NOS — the latter generating over $500 million in the 52-weeks ended July 3, 2025 — in exchange for the natural beverage portfolio it had grown as the original Hansen’s Beverage Co. But whereas previous strategic exits have opened up opportunities for smaller brands to fill the gaps on distributor’s trucks, the conditions now may be different as beer conglomerates seek to have their say. Molson Coors took full control of the much-hyped ZOA brand last November, while Anheuser Busch is currently in the midst of introducing Phorm Energy, its joint venture with UFC boss Dana White and supplement maker 1st Phorm. The brand announced it’s heading to 7-Eleven stores earlier in August.

Canadian drinks company Flow Beverage Corp., maker of Flow Water, entered a support agreement in early September with its foreclosing creditors to transfer ownership of the business and its assets. Under the plan, Flow’s old business will be “wounddown” while maintaining co-packing operations.

NFS Leasing Canada Inc. and RI Flow LLC have agreed to take control of the bottled water brand and beverage co-packing business following a default on debt repayments last month. The deal is pending court approval by the Ontario Superior Court of Justice.

The lenders have agreed to provide an undisclosed sum of bridge financing to Flow in order to maintain operations during the restructuring transaction.

According to the announcement in September, the support agreement comes after “an exhaustive strategic review conducted under the supervision of a special committee of independent directors, which considered all alternatives” to address Flow’s liquidity.

As part of the agreement, NFS Leasing Canada and RI Flow will jointly control Flow Beverage, likely through a new entity tentatively named “NewCo.”

The deal does not cancel out other debts incurred by Flow to other firms and businesses.

However, the end result appears to be to shut down Flow following the completion of the transaction. The release notes that Flow “and its subsidiaries and their remaining assets and liabilities will be wound-down under the supervision of the receiver and the Court pursuant to proceedings commenced under the Bankruptcy and Insolvency Act [of Canada].”

Paul Dowdall, CFO and a member of the interim CEO group running Flow, said in September that “the brand will continue (as it is an asset) but entities will be wound down after completion of the foreclosure.”

In a full statement, Dowdall noted that while the foreclosure process “limits what we can share today,” he highlighted that “the process is designed to restore stability and position the business for continuity.”

“During this brief period, our top priority is maintaining continuity for our existing co-packing and retail customers,” he added. “We are coordinating closely to minimize disruptions to the extent permitted by the process and will share updates as soon as possible once it concludes. Following completion of the foreclosure, we expect to emerge with strengthened sponsorship and liquidity and to evaluate capacity investments aimed at better serving current partners. Any consideration of additional co-packing opportunities would be incremental and capacitydependent, and not at the expense of existing relationships.”

Flow first announced it received a $2 million senior secured business purpose loan from NFS in May 2025, with a binding term sheet for an additional loan of up to $4 million. At the same time, Flow reported it entered an agreement with RI Flow for a secured convertible loan of up to $6 million.

A final tranche of $2 million loaned from RI Flow was announced on August 8. By August 25, the company said it was facing foreclosure from both lenders and that CEO Nicholas Reichenbach was being replaced in the chief executive role by an interim group of executives and directors.

Celsius Holdings, which was recently tapped by PepsiCo to be the company’s “strategic energy lead,” has appointed seasoned marketing executive Rishi Daing as CMO, effective September 8.

Most recently, Daing served as EVP of the Mark Anthony Group, where he spearheaded the launch of hydration beverage brand Más+ by Messi alongside global soccer star Lionel Messi. At Celsius Holdings, he will oversee marketing strategy across the company’s brand portfolio, aligning brand development, go-to-market execution and digital platforms.

“Rishi is a transformational leader with a proven track record of building and scaling iconic brands,” said Eric Hanson, president and COO of Celsius Holdings, in a statement. “As we continue to drive growth within our total energy portfolio – including Celsius, Alani Nu and Rockstar Energy – his expertise in innovation, data-driven marketing and international

expansion will be instrumental in unlocking new growth opportunities.”

In conjunction with Daing’s appointment, Celsius Holdings has established a marketing leadership team that includes Kyle Watson as chief brand officer and JoBeth Fink as chief creative officer. Watson had led marketing at the Boca Raton, Florida-based company since 2019, while Fink joined the company in 2025 through the Alani Nu acquisition.

In a press release, Celsius Holdings CEO John Fieldly said the appointments of Daing, Watson and Fink “reflect our commitment to building a world-class marketing organization capable of scaling our brands from big brands into mega brands.”

The better-for-you energy drink maker has seen explosive growth in recent months, in part fueled by its $1.8 billion acquisition of Alani Nu. In Q2, overall revenue jumped 84% year-over-

year ($739.3 million), while net income climbed 25% to $99.9 million.

Comparatively, the energy drink category as a whole experienced 16.3% dollar sales growth in the two-week period ending August 9, according to an analysis of NielsenIQ data by Goldman Sachs Equity Research. Category leader Monster Energy underperformed, with sales increasing just 9.3%.

Celsius Holdings has benefited from its flourishing partnership with PepsiCo, which recently deepened its stake to 11% through $585 million in newly issued convertible 5% preferred stock. The conglomerate plans to nominate an additional director to Celsius Holdings’ board of directors.

“Stepping into the role of PepsiCo’s strategic energy drink captain in the U.S. is expected to be a pivotal milestone in our journey to shape the future of modern energy and grow our brands within a leading beverage distribution system,” said Fieldly in a prepared statement.

Nutrabolt has taken a majority stake in Bloom Nutrition, positioning the parent company as a major platform across wellness CPG categories, including energy drinks and powdered supplements.

The Texas-based company, best known for its C4 brand of energy drinks and pre-workout supplements, led a $90 million investment round in Bloom in January 2024 for a 20% stake. That served as the springboard for the successful launch of Bloom’s first RTD, Sparkling Energy, in 2024, with a second line, prebiotic soda Bloom Pop, added this summer. Both products are distributed through Nutrabolt’s partnership with Keurig Dr Pepper (KDP).

Nutrabolt did not confirm its ownership in Bloom, but verified its total investment as over $200 million, which would bring its stake to over 50%.

“Since our first introduction to Bloom, I’ve been continually impressed by the brand’s evolution, its visionary founders, and their explosive growth,” said Doss Cunningham, Chairman and CEO of Nutrabolt, in a prepared statement.

“With the breakout success of Bloom Pop and a recordbreaking year for Bloom Sparkling Energy, the brand’s momentum presents a powerful step-change growth opportunity for Nutrabolt,” he said. “I’m confident Bloom is on track to become one of the fastest-growing and most talked-about beverage brands in the years ahead.”

Amidst a wave of digital-native wellness supplements that have emerged over the past decade, female-focused Bloom has found staying power thanks in part to its active social media following and organic support from TikTok creators. Its products are sold in Walmart, Target, GNC, Whole Foods and other retailers.

Bloom’s co-founders -- president Mari Llewellyn and CEO Greg LaVecchia -- will remain in their current roles.

“We’re incredibly proud of the momentum we’ve built and the community we’ve cultivated,” said LaVecchia. “Nutrabolt has been a valuable partner – fully aligned in our mission and a genuine champion of our brand. With this expanded partnership, we’re excited to enter our next phase of growth and create something truly meaningful together.”

With the combination of C4 and Bloom, Nutrabolt’s portfolio covers a broad range of product categories, audiences and use occasions.

That’s particularly relevant for coveted female consumers, an audience with which Bloom has created strong affinity, both through its branding aesthetic and products tied to skin health and beauty. The online momentum from those niche functional areas has carried over through its move into the mainstream with RTDs: in less than a year on the market, Bloom Sparkling Energy has generated over $95 million in sales – well clear of its closest competitor, Zoa –according to NielsenIQ data through July 3, 2025.

That experience helped Bloom forge relationships with top-class manufacturers and create a go-to-market playbook that it replicated for the introduction of Bloom Pop this year, LaVecchia told BevNET in July.

The move comes amidst category consolidation; the current landscape recalls Renaissance Italy, with a handful of

ultra-wealthy families spreading their patronage amongst a select group of high performers.

Celsius, the third-place brand behind Red Bull and Coca-Cola-affiliated Monster, acquired Alani Nu -- another fitness-focused supplement brand that broke through to mainstream consumers with its RTD energy drink -- for $1.8 billion in February.

Its parent company, Celsius Holdings, now acts as the ‘strategic lead’ for distributor PepsiCo, managing Celsius, Alani Nu and Rockstar, representing a nearly 20% share of the U.S. energy drink market. Global beer conglomerates Molson Coors (Zoa) and Anheuser-Busch InBev (Phorm Energy) have also dived in.

What does this mean for Nutrabolt’s relationship with its backer? KDP took a 30% stake in the nutrition company as part of its $863 million strategic pact in 2022; Nutrabolt’s value has increased significantly since then, meaning any potential bid for full control by KDP would well surpass the $990 million it paid to acquire Ghost in October 2024.

“I’d be watching for KDP to correct the C4 Energy ownership/incentive misalignment that was caused by their GHOST acquisition,” independent consultant Joshua Schall told us back in February in reaction to Celsius’ acquisition of Alani Nu.

Indeed, KDP’s aggressive expansion across categories in recent years may create some traffic issues; in energy drinks alone, the company distributes products by C4, Ghost, Bloom and Black Rifle. With each of those individual brands eager to expand their respective platform, it’s unclear how product innovation will be paced or where it will be funnelled; Ghost, for example, is set to reveal its first protein bar in September.

Kendall Jenner’s 818 Tequila has landed additional investment and named a new CEO.

In August, the tequila brand’s parent company, Calabasas Beverage Company (CBC), announced that it had received a strategic investment from the Pérez family, owners of Grupo Solave, the company in Jalisco, Mexico that produces 818 Tequila, according to an announcement today. Terms of the deal were not disclosed.

Grupo Solave has been growing agaves for four generations in Jalisco and is now the largest family-owned agave grower in Mexico, according to a press release. The company will now become a part-owner of 818 Tequila. Brands such as Astral Tequila, Don Gato and ready-to-drink (RTD) cocktail Onda are also made at Grupo Solave’s distillery.

Hecho Tequila Soda, a RTD brand that appears to be off the market, also received a strategic investment from Grupo Solave and signed a bulk tequila supply agreement in 2022.

Grupo Solave is a subsidiary of OLEOMEX, a Mexican company with business ventures in edible oils, margarine and agave products, among others.

CBC (also the parent company of Kylie Jenner’s Sprinter) used the occasion to reveal the appointment of a new CEO. Larry Goodrich, former chairman of CBC. The Southern Glazer’s veteran previously served as CEO of 818 Tequila during the brand’s formative years and early expansion.

Meanwhile, previous CBC CEO Michael Novy stepped into the CEO role for the top moonshine and flavored whiskey maker, Ole Smoky, which also owns Tanteo Tequila. He served as president and COO of CBC from the company’s start in 2021 until July 2024, when he moved up to CEO.

818 Tequila’s leadership change comes on the heels of a portfolio expansion this month: 818 Minis – 50 mL bottles of its Reposado and Blanco expressions. The mini line is another trend-savvy release from the reality TV star-turned-entrepreneur, including a past collaboration with influencer Emma Chamberlain on an espresso martini kit. Clearly aiming to tap into the need for portable, low-commitment spirit offerings, the minis also fit squarely into collectable, customizable trinket trends led by Gen Z.

On social media, the brand has positioned the minis as accessories, encouraging consumers to clip the bottles to purses and phone cases. Limited edition bundles debuted earlier this month on Gopuff featuring collectible custom 818 Minis Bag Charms that hold one 818 Mini. The line will later roll out nationwide at liquor stores such as Total Wine & More and BevMo in September.

Mini formats and RTDs have fared better in recent years than larger format sales in many spirit categories. Tequila, vodka, cordials, and whiskey are leading growth within the minis segment, according to NIQ.

818 Tequila sales are up 17% year-over-year in the four weeks ending May 17, 2025, according to NIQ.

Hold on to your coffee cups. Keurig Dr Pepper (KDP) is solidifying its position as one of the world’s largest coffee companies in announcing an $18 billion deal to acquire JDE Peet’s, expected to close in early 2026.

The transaction will divide KDP into two independent public companies, one exclusively for the coffee business (“Global Coffee Co.”) and another focused on beverage refreshment (“Beverage Co.”). KDP CEO Tim Cofer will lead Beverage Co. from Frisco, Tex., while KDP CFO and president Sudhanshu Priyadarshi will be Global Coffee Co.’s chief executive, from Amsterdam, Netherlands.

Following the split, the coffee division is expected to generate $16 billion in annual net sales, while Beverage Co. forecasts approximately $11 billion.

The consolidation of KDP’s coffee business will expand its current portfolio to more international markets in over 100 countries. Upon separation, the coffee division will be diversified geographically with about 40% share in both North America and Europe, respectively, and 20% throughout the rest of the world.

“You can think about it as one plus one equals three,” said Cofer during a conference call. “What we do at Keurig and our innovation capabilities with machines and brewers, and how we can bring that knowledge and technology to places like Sensio and Tassimo. On the other side, JDE Peet’s has a greater global scale and gives us access to expanding big ideas, some of which are in our pipeline. I think together, it really will be an unparalleled portfolio that’s stronger and more resilient.”

Despite the elevated price of green coffee and the impact of tariffs on Brazilian coffee exports, Cofer expressed optimism for going deeper in the set. Net sales were down 0.2% to $0.9 billion, in Q2 earnings call in August. International sales also trailed 1.8% to around $0.6 billion.

“I’m on record: We like the coffee category. Why? It’s huge, it’s ubiquitous, it’s a $400 billion TAM, and it’s a resilient grower,” Cofer said in response to a question about selling KDP’s coffee business over acquiring JDE Peet’s. “Here in this country, we’re seeing [coffee] begin to turn around. We would be selling a business that’s just beginning to turn around at a low multiple.”

In July’s Q2 report, Cofer explained that there was “sequential improvement” trends for KDP’s U.S. Coffee segment as “incremental pricing” has helped offset inflation and “volume remained resilient.” The company had announced that additional pricing actions would take effect during Q3.

In an analysis, Jefferies’ analysts reported that the acquisition is a “good deal” and “recent pressure on (the) coffee biz is irrelevant, this is about growing within a $400b category - a category that is innovating and thus fragmenting in formats and channels. A globally diversified operation makes sense.”

The acquisition will allow KDP’s beverage division to focus on its direct-store delivery network across the U.S. and Mexico. KDP’s portfolio of soda, juice, energy and other nonalcoholic beverages will benefit from “multiple paths to win,” Cofer said.

Along with its distribution deal with C4 Energy and high-growth drink and supplement brand Bloom, KDP has made a series of acquisitions in the last year to solidify and diversify its reach in beverage. In July, KDP acquired drink mix manufacturer Dyla Brands –producer of Stur– and energy drink and sports nutrition business GHOST in November.

“We have a proven buy-build partner model, and that means we don’t take a one-sizefits-alll approach,” he said. “We stay agile and flexible in looking at where are the growth spaces, where are the opportunities to add positions, what’s best for that partner and how can we do it in a highly capital-efficient way.”

PepsiCo is facing pressure from an activist investor to make a broad series of strategic changes, including restructuring its beverage division to welcome franchise bottlers back into the fold.

Elliott Investment Management, which holds a $4 billion stake in PepsiCo, sent a letter to Pepsi’s board of directors in September outlining a five-point plan to address “poor operational results, sharp stock-price underperformance and a meaningfully discounted valuation.” If enacted, the firm said, the changes could send Pepsi shares up at least 50% and restore organic growth revenue to mid-single-digits.

“PepsiCo finds itself at a critical inflection point. The Company has an opportunity – and an obligation – to improve financial performance and regain its position as an industry leader,” read the letter, signed by Elliott partner Marc Steinberg and managing partner Jesse Cohn.

The letter criticizes Pepsi Beverages North America (PBNA) for lagging behind chief rivals CocaCola and Keurig Dr Pepper (KDP) by continuing to “underinvest” in its core CSDs; there’s also several billions in impairment on the books from its purchase of Rockstar and Sodastream. Dr Pepper notably surpassed Pepsi as the second most-popular soda by market share in 2023, and despite big-ticket category acquisitions like Poppi, analysts cited in Elliott’s presentation are skeptical PBNA has a path to hit its longterm target for mid-teen operating margins (currently 11%).

Specifically, innovation under new acquired or launched brands has “fallen short” despite high SKU proliferation: according to Elliott’s presentation, PBNA has approximately 70% more SKUs than

Coca-Cola but is generating roughly 15% less retail sales.

Pepsi’s latest release, Pepsi Prebiotic, is set to launch online this fall.

In response, Elliott is pushing for Pepsi to explore potentially shifting back into a franchise bottling system as a means to “allow each business to focus on its core competencies.” The soda giant transitioned to a network of corporate-owned bottlers, buying Pepsi Bottling Group and Pepsi Americas in 2009, as a means to tighten control over operations, but the result has been “weaker price-pack management, slower regional innovation and poorer instore execution,” according to the presentation. The lack of checks and balances from a third-party partner has contributed to PBNA losing “focus and discipline.”

That should be complemented by a review of brand and SKU portfolios with an eye towards “reducing operational complexity,” while also divesting non-core and underperforming assets to help boost profit margins and freeing up capital for redeployment elsewhere.

Pepsi upped its stake in energy drink brand Celsius last week to 11% (+$585 million); as part of the deal, Celsius Holdings will manage the business for Alani Nu and Rockstar Energy and its namesake brand, with Pepsi distributing the full portfolio in the U.S. and Canada.

PepsiCo Foods North America (PFNA) should also be recalibrated, Elliott argued. The company’s aggressive investment strategy (criticized as “well beyond the needs of the current environment”) has failed to generate the anticipated growth and subsequently compressed margins. Yet the answer isn’t necessarily to spend less, but more strategically. Cutting operational costs and spending will free up capital for reinvestment in core brands and bolt-on acquisitions, said Elliott, noting it’s a model that already once helped PFNA jump-start growth in the early 2010s.

As for which brands should be on the chopping block, Elliott’s presentation notes that although its acquisition brought Gatorade into the fold, Quaker’s portfolio has “few, if any, synergies” with Frito Lay’s salty snacks, an area where PFNA has “true competitive advantage.”

Mycelium-based alternative protein producer The Better Meat Co. (BMC), announced it closed an oversubscribed $31 million round of Series A funding co-led by Future Ventures and Resilience Reserve with participation from Hickman’s Family Farms’ CEO Glenn Hickman, Epic Ventures, Sigma Ventures, and other existing and new investors.

The new cash will enable the Sacramento, Calif.-based company to scale its patented mycoprotein fermentation process to commercial levels that will also allow it to compete with U.S. commodity ground beef. The company said it plans to sell its ingredient at prices lower than the animal-based commodity within 2026. Those projections were made possible by achieving what is known as “continuous fermentation,” which the company claims is the “holy grail in our sector” and enabled it to cut production costs by more than 30%.

While others in the space have struggled to build consumer-facing brands around their alternative protein inputs, BMC continues to take an industry-centric approach, reemphasizing its

alignment with U.S. meat companies alongside the funding announcement. According to the company, it has five signed letters of intent for future orders “from some of the biggest meat companies on the planet.”

BMC also claims its Rhiza input is the only mycoprotein considered “safe and suitable” for inclusion in animal meat, per the U.S. Department of Agriculture; the company has also secured regulatory approval from the U.S. Food and Drug Administration. The company has also recently secured a handful of new patents and international regulatory approvals.

“We’ve invented and patented our tech, received regulatory approval, scaled to a demonstration plant, and proven demand exists for Rhiza mycoprotein. It’s now time to fully commercialize and introduce our new crop that will help the protein industry cut costs and improve nutritionals, all with a much lighter footprint,” said CEO Paul Shapiro, in a press release. “I’m so proud of our team that’s led us to this critical milestone.”

The new capital will scale production capacity at its West Sacramento, Calif., facility approximately ten-fold, the company claims; currently, BMC operates a 9,000-liter demonstration-scale fermentation facility at that site. Glenn Hickman of

Hickman’s Family Farms and Future Ventures co-founder Steve Jurvetson will also join the company’s board of directors.

“The world needs better ways to make protein, and The Better Meat Co. has invented one of the most efficient – and delicious – ways to do it,” Jurvetson said in the press release.

The news comes at a tumultuous time for the alternative protein sector. Earlier this year, BMC competitor Meati, which it was once wrapped into a legal battle with over allegedly stolen trade secrets, lost its primary source of funding after failing to meet a revenue target and was on the verge of shuttering before it sold for $4 million in May; the company had raised nearly $450 million in total funding.

Elsewhere, rumors have swirled about the future of Beyond (f.k.a. Beyond Meat) after the company reported yet another quarter of sales declines, laid off 6% of its workforce and onboarded John Boken, managing director in the Turnaround and Restructuring Services practice at AlixPartners, to lead its transformation efforts.

All the while, blended meat products, once seen as lacking a target audience and product-market fit in comparison to pure plant-based proteins, have gained momentum in foodservice under the term “balanced protein.”

Frozen french fry brand Jesse & Ben’s House Cut secured a “sevenfigure” investment round to support its expanded retail footprint.

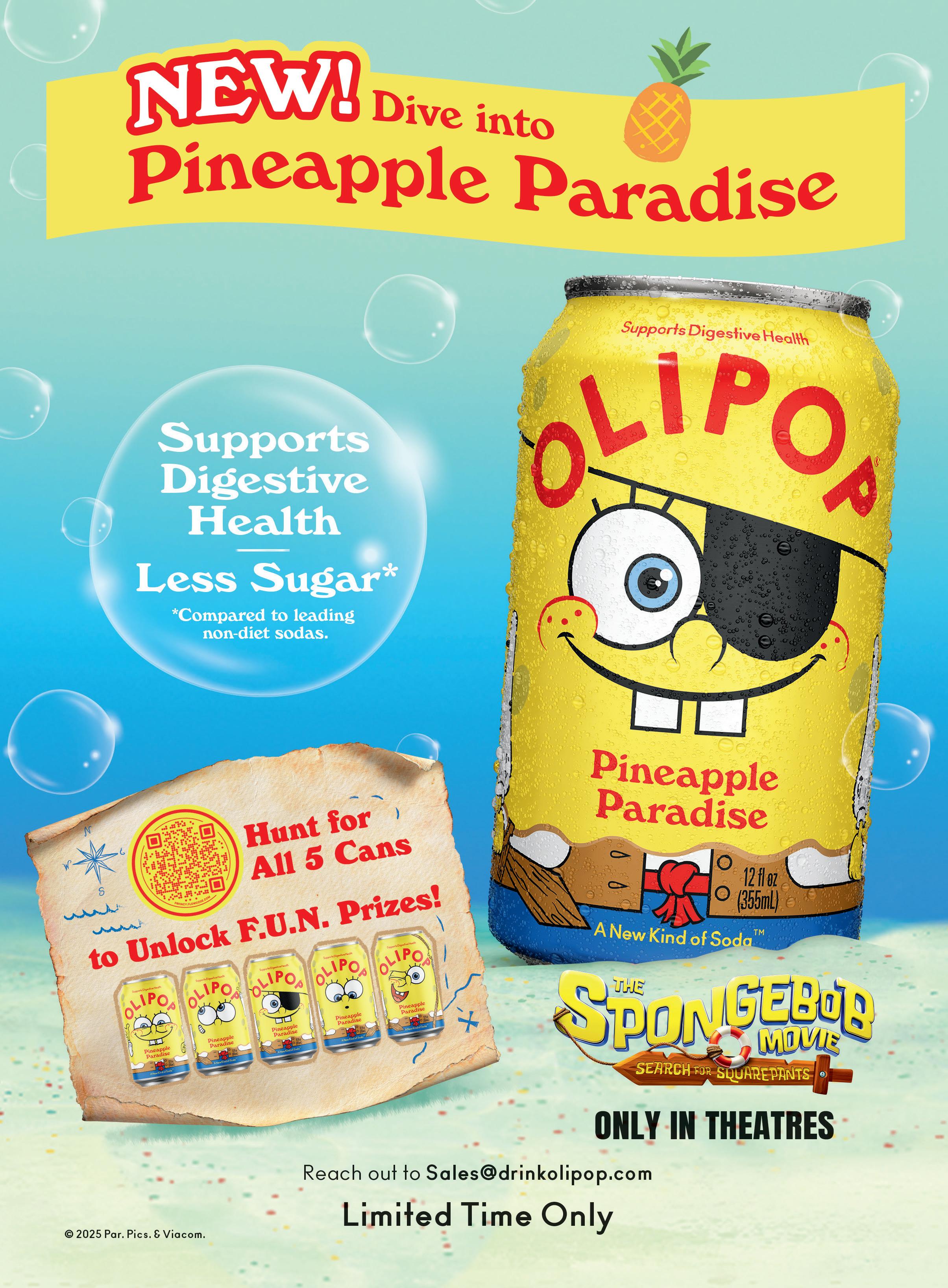

The undisclosed, oversubscribed seed round is the first institutional funding for the Washington D.C.-based brand. The “party round,” as co-founder and CEO Jesse Konig called it, brought in a diverse pool of strategic partners like Willow Growth Partners, BrandProject, Midnight Venture Partners, Supernatural Ventures, Siddhi Capital, grt sht ventures, Olipop investor Carter Comstock, Orgain founder Andrew Abraham, and content maker couple Lauryn and Michael Bosstick.

“No one’s coming in with $10,000 or $25,000 checks; they’re all generally wanting to have some skin in the game,” Konig added.

Jesse & Ben’s self-manufactures its beef tallow and avocado oil fried potatoes. The funding round needed to come together quickly to support inventory growth for the two national placements – Sprouts Farmers Market and Whole Foods Market – secured in December and January.

“It was a bit of an overwhelming process,” Konig told Nosh. “We had to get our ducks in a row very quickly. We went out to start our fundraising process in February and had it all wrapped up in May, including the due diligence and all the other ridiculous parts of the process that usually take a long time.”

A little over a year since its launch, Jesse & Ben’s will now be in over 1,500 retail doors, including Sprouts, Whole Foods and

Fresh Thyme. The brand is also now available on Thrive Market, which allows Jesse & Ben’s to reach consumers where a retail partner is unavailable.

College friends and entrepreneurial partners Konig and Ben Johnson didn’t initially intend to disrupt “Big Potato’s” hold on the frozen fries category, but has found there is a hungry consumer base for seed oil- and additive-free options. The brand currently makes three SKUs – Classic Sea Salt, Rosemary Garlic and Tallow & Sea Salt – available in 14 oz. bags.

As part of its retail expansion, the brand is investing in its sourcing, manufacturing and inventory as it opens up 20 new distribution centers.

The brand has found a “groundswell” of interest, particularly in organic social media posts, which has fueled its growth so far, Konig said.

“The interest stems from people seeking simpler foods where they can read the back of the bag and understand every ingredient. There’s certainly some die-hard people who are just trying to get access to a fun nostalgia food, like a french fry, that meets their needs without using things like ultraprocessed seed oils.”

Organic skyr yogurt brand Painterland Sisters closed a seven-figure seed round led by The Angel Group, its partner fund Supernatural Ventures, and Spacestation Investments. The round also included participation from Scoop Ventures and independent angel investors, including Olympic medalists and lifestyle entrepreneurs.

Painterland Sisters is the fastest-growing dairy brand in the natural expanded channel in terms of dollar growth, per SPINS data.

The Pennsylvania-based brand was founded three years ago by sisters Hayley and Stephanie Painter in an effort to preserve, showcase and utilize their family’s organic regenerative dairy farm. Their ultimate goal is to connect consumers with the source of their food: American farmers.

Available in a variety of flavors, including Strawberry Fields, Meadow Berry and Blueberry Lemon, its lactosefree products contain up to 21 grams of protein per cup with gut-friendly probiotics. Additionally, the yogurt is made from pasture-raised dairy and is non-GMO and free from antibiotics, hormones and synthetic chemicals.

In August, Painterland Sisters landed on Whole Foods Market shelves nationwide, bringing its total door count to over 5,000, including Giant, Fresh Thyme and Costco, among others. As it continues to expand its distribution footprint, the brand will use the fresh funding to support operations and innovation.

The brand previously raised $1.2 million through a Wefunder campaign in February 2024 that included over 700 investors.

Opportunity in the yogurt category is plentiful. As of 2024, North America is the third leading region for both dairy and non-dairy yogurt sales value, according to market researcher Innova Market Insights. Vitamin/mineral fortified, lactose-free and organic claims are among the top positionings in the segment.

The space has seen various M&A activity over the past year, with Lakeview Farms and its recently-acquired noosa brand merging to form Novus Foods, as well as General Mills selling its North American yogurt business to French dairy companies Lactalis and Sodiaal in cash deals valued at an aggregated $2.1 billion.

Mooski Secures $1.5 Million to Scale Chilled Oat Bar Production Amid Triple-digit Growth

Chilled oat bar brand Mooski landed a $1.5 million Series A investment round from an angel investor who previously participated in the brand’s seed round. The investor has extensive experience in the refrigerated bar category, which founder and CEO Robert Broome called “extremely advantageous” for the brand.

Having established product-market fit, Mooski will use the fresh funds to accelerate scaling efforts from a sales, operations and marketing standpoint. The company is currently experiencing its second consecutive year of triple-digit growth, and the capital infusion will help cover expenses associated with that boom, including trade spend and slotting fees.

Mooski will also deploy the capital to fund larger, more frequent production runs necessary to meet demand. Most importantly, said Broome, the brand will invest in marketing efforts to generate greater awareness alongside its recent distribution gains.

“We have a unique and larger-than-life mascot, Alpy, that gives our brand an added layer of character and depth that transcends product. Our goal with these funds is to leverage Alpy in a bigger way and across more marketing touchpoints – social, experiential, partnerships, etc. – to drive awareness and intrigue about Mooski,” Broome told Nosh via email.

Broome – who previously held marketing and innovation roles at Clio and RXBAR – founded Mooski in 2022 on a mission to clean up the granola bar category by focusing on a short, clean ingredient deck and low-sugar, low-calorie positioning. Available in three flavors – Chocolate Peanut Butter, Cookie Dough and Peanut Butter Banana – the bars are a portable spin on muesli that feature 5 grams of protein per serving.

The startup has expanded its brick-and-mortar retail footprint to nearly 1,000 stores across the country since launch. This year, Mooski introduced its products into New Seasons, Woodman’s and Baron’s Market and broke into national retailers for the first time, including launches at Albertsons’ Pavilions division and Kroger, Mariano’s and Roundy’s stores.

The distribution push has, in part, been fueled by a shift in the brand’s manufacturing strategy. In 2023, Mooski pivoted from self-producing in San Diego to working with a comanufacturer in the Midwest.

“Our switch to a co-man was exactly what we needed to scale the brand. Not [just] because it increased our capacity tremendously – but it also improved our margins and allowed us to focus on other areas of the business at a time when our self-manufacturing was consuming a lot of time, energy and resources,” said Broome.

Mooski has also established a strong presence in the online grocery channel through partnerships with Hungry-

root, Misfits Market and Thrive Market. As a perishable brand, the channel allows Mooski to get its products into consumers’ hands without having to manage its own cold chain direct-to-consumer (DTC) operation. According to Broome, the brand’s online grocery partners have the scale to get its products to customers at the right price and at a margin that is, on average, higher than retail.

“These partnerships also allow us to acquire new customers in areas where we don’t yet have retail distribution. Building this national consumer base will only help our retail efforts when we do expand into more places,” said Broome, adding that while the majority of Mooski’s revenue is still retail-based, online grocery is a “healthy and growing” chunk of its business.

The U.S. snack bar market (spanning snack, nutrition and performance bars) is forecasted to reach $9.6 billion by 2029, according to a recent report from Mintel. Bars are not yet the top snacking choice, but the category excels in its perception as a better-for-you option, effectively addressing consumer health needs.

Significant opportunity lies in the refrigerated subcategory, with upstart bars like MUSH and Mid-day Squares also seeking to capture consumer demand for convenient, versatile snack options with an emphasis on unique flavors, textures and formats.

Looking ahead, Mooski will spend the back half of the year focused on strategically entering new doors, as “not every channel or retail banner will be the best fit for our product,” said Broome. The brand has identified a list of specific retailers in which it believes its chilled bars will resonate with consumers, and will strictly be pursuing these accounts.

From an R&D standpoint, Broome said Mooski’s goals are two-fold: “One, continue to make our current product better, as we firmly believe that a consistently excellent product will sell itself. Two, launch new innovations that will both expand our shelf presence and open us up to new occasions.”

Plant-based poultry producer Daring Foods was acquired by Australian alt-protein company v2food, with backing by Ajinomoto Co, Inc. Financial terms of the transaction were not disclosed.

Jeff Gendelman, CEO of Daring Foods, told Nosh the partnership will leverage the scale and frozen food expertise of Ajinomoto and the proprietary protein technology of v2food, bringing the brand into new protein formats and meal occasions across retail and foodservice channels.

Since its inception, Daring Foods has used high-moisture extrusion technology to make plant-based takes on chicken formulated with a short list of simple ingredients including soy, vegetable oil and natural flavors and spices.

Joining forces with v2food unlocks a range of solutions for developing and manufacturing a broader platform of plant-based products beyond its current assortment of frozen breaded and unbreaded pieces and wings, as well as a line of single-serve vegetarian meals.

“We want to own clean plant protein,” Gendelman said. “That’s our focus.”

Ajinomoto operates a billion-dollar frozen foods business in the U.S. –with brands including Ling Ling, Jose Ole and Tai Pei – and offers significant advantages in distribution and retail execution, Gendelman said.

According to Gendelman, Daring Foods’ products are sold in “north of 16,000 to 17,000” retail doors nationwide, having gained distribution over the past few years. He said the company has achieved a 24% compound annual growth rate since 2021 and boasts a high repeat rate among top plantbased meat alternative brands.

“We’re very proud of that growth in a space that’s been contracting,” he said.

Though many Americans have tried plant-based meat and expressed interest in the category, a minority of consumers purchase these products regularly, according to the Good Food Institute (GFI). Taste and price expectations play a large role in adoption, but benefits around health and nutrition are also important in motivating consumers to switch.

Beyond Meat’s recent struggles have illuminated many of the barriers to growth for plant-based foods, including price and a negative narrative surrounding the health impacts of highly processed meat alternatives.

“This space should have been built much more thoughtfully, paying more attention to the fact that the consumer was looking for healthy products, too,” Gendelman said. “A lot of businesses invested too heavily in the supply curve before the demand curve came to fruition.”

Daring Foods has raised $113.8 million in total funding since its founding seven years ago, according to Crunchbase, which included a $65 million Series C round led by Founders Fund alongside existing investor D1 Capital Group. Its

backers include celebrities and professional athletes such as Drake, Naomi Osaka, Cam Newton and Steve Aoki.

Gendelman told Nosh he will remain in his role leading the business to help “turbocharge growth” and that the brand will “feel and look the same as it did the day before the close.” He assumed leadership of the Los Angeles-based company after its founder and former CEO Ross Mackay stepped down to launch the hydration brand Cadence.

“We will continue to operate here in the U.S. not as an independent brand but one that can execute on its own objectives,” he said, adding, “The team has done an amazing job to continue to roll into this next chapter holding hands.”

Like countless other CPG brands – including giants like Hershey and Mondelēz International – SkinnyDipped has been forced to navigate surging cocoa prices over the past few years. However, by pinpointing efficiencies throughout its supply chain, the company has maintained pricing amidst the commodity crisis.

“Our goal was to not raise prices, because we know that there has been a significant impact already on the end of the consumer in terms of inflation. Everyone sees it on that grocery bill,” said Griffith. “So we are doing everything we can as a brand to hold pricing for our consumer.”

SkinnyDipped will spend the back half of the year focused on expanding distribution for its coconut bites, which have already had “incredible reception,” according to Griffith, citing Amazon data and reactions from retailers. The company will also work to build out its presence in the c-store channel and foodservice, which is a “huge unlock.”

For about six months, Saffron Road was under construction.

The frozen meal maker introduced its “most ambitious brand refresh” in its 15-year history, according to founder and CEO Adnan Durrani, as it aims to align with today’s consumer trends, including the growing anti-seed oil sentiment and an insatiable appetite for protein.

Saffron Road’s renovated product line, which rolled out in August to retailers nationwide, features reformulated recipes – eliminating canola and soybean oils and adding, in some cases, twice as much chicken or lamb – and a bold new look that integrates artwork that reflects the brand’s global heritage. The Certified B Corp also is transitioning to plant-based and compostable fiber trays to strengthen its commitment to sustainability.

While the brand was built on introducing international flavors to the freezer aisle – with cuisines spanning Indian, Korean, Thai, Mexican, Moroccan and more – its core consumers are “modern millennials and aspirational baby boomers” who are seeking more nutritious, premium options in the set, Durrani told Nosh.

The latest changes were informed by a “very deep dive” using retail tracking data, panel studies and consumer surveys over the past year, he said. Transitioning away from seed oils has been in the works for more than five years, long before they were deemed unhealthful by the Make America Healthy Again (MAHA) movement, he added.

“Our research and the data reveals that the opportune time [to remove seed oils] was now,” he said. “Why? MAHA’s mandates align with Saffron Road’s of reducing harmful food additives, potentially aligning U.S. standards closer to Europe’s more stringent

regulations, and promoting fresh, minimally processed foods.”

Moreover, the rising adoption of weight loss medications marketed under names such as Ozempic, Wegovy and Mounjaro has fueled demand for products with higher protein density and portion control, he added.

“… with now as much as 10% of Americans on GLP-1 drugs, that is a very large cohort that cannot be ignored,” he said. Homing in on these attributes “maps very nicely with a material percentage of our core consumers as well as aligns with non-core modern millennials that we are also looking to bring into the Saffron Road brand.”

As a growing number of restaurant and retail brands ditch seed oils, the frozen food category has lagged behind, Durrani claimed. Saffron Road is the first Seed Oil Free Certified frozen entree in the market, he said.

To support the renovation, Saffron Road is launching a fullfunnel marketing campaign that includes television, paid search, digital video and influencer activation, Durrani said.

The company has also created a curated insiders club, dubbed Saffron Roadies, that already comprises more than 2,500 brand ambassadors and will engage consumers through targeted social campaigns and dietary apps like Yuka and Seed Oil Scout, he said.

“Today’s most influential marketing doesn’t always come from big ad budgets — it comes from real people sharing real enthusiasm who are authentically passionate,” Durrani said. “Saffron Roadies will be trusted voices within their communities, and by tapping into that network, we’re building authentic advocacy at scale.”

Amylu Foods secured an investment from TowerBrook Capital Partners and Prelude Growth Partners that will support continued retail expansion.

Dating back just over a century, Chicago-based Amylu Foods manufactures value-added chicken products including sausages, meatballs and burgers that are sold under the Amylu brand and private label. The company produces dozens of offerings featuring organic, antibiotic-free and nitrate-free claims. Earlier this year, the brand unveiled Frozen Breakfast Patties and an Organic Chicken Sausage line.

Last year, Amylu Foods acquired Klement’s Sausage Company, diversifying its portfolio into new categories, including snack sticks and summer sausages, while enhancing its production capacity.

The company said it plans to leverage its partnership with TowerBrook to further scale operations and expand across channels.

“At Amylu, our success has always been built on delivering great-tasting, cleaningredient products that our consumers genuinely love and trust. This partner-

ship with TowerBrook is the natural next step for our growth strategy, and we’re confident they’re the right partner to help us expand our business across the nation given their strong track record of scaling food businesses, particularly in the protein space,” said Steven Zoll, CEO of Amylu Foods, in a press release.

A Certified B Corporation, TowerBrook Capital Partners has $23 billion of assets under management and invests in businesses across multiple sectors in Europe and North America spanning consumer products and services, financial services, business services and healthcare.

“Amylu’s long-standing commitment to quality, innovation, and health-conscious convenience has earned it a strong reputation in the industry and outstanding commercial momentum,” said Michael Recht, managing director of TowerBrook, in the release. “We look forward to partnering with Steve and the Amylu team to continue to build upon the company’s legacy of delivering unique products to its loyal consumers.”

Sidley Austin served as legal counsel to

TowerBrook. J.P. Morgan and Winston & Strawn acted as financial advisor and legal counsel, respectively, to Amylu Foods. Prelude Growth Partners, a leading consumer-focused growth equity firm, this week announced the close of its third fund with $600 million in total commitments, bringing its total assets under management to $1.3 billion. The group supports “brands made for the new modern consumer” by providing category experience and value-added operational support. Its food and beverage investment portfolio includes Riverside Natural Foods (Made Good), Bachan’s, So Good So You, Banza and Fly By Jing.

21st Amendment Brewery is ceasing operations after 25 years, as founders Shaun O’Sullivan and Nico Freccia seek a buyer for the legacy craft beer brand.

The California craft brewery will wind down operations at its San Leandro production facility with a target date to cease operations during the first week of November, Freccia told Brewbound.

The company plans to maintain its taproom at the facility and 2nd Street San Francisco brewpub as long as possible, depending on staffing, before shuttering them, he added.

The news is a reversal of a plan announced by O’Sullivan on social media, which would have seen 21st Amendment’s founders step away from the daily operations and transition to board roles while a new CEO took over with the goal of building a platform.

“A week ago, we were moving in a different direction, and we were excited about a potential path forward with building a platform,” Freccia said. “But it just wasn’t tenable. So a pivot has been made.”

Those plans had been in the works since early July but changed “relatively suddenly,” Freccia explained. A financial lender that 21st Amendment was working with to grow the business ultimately decided against moving forward with the transition due to the industry’s mounting challenges and no “clear path forward.”

“We just thought it was going to be a really good, elegant and optimistic way forward for us and for the brand, with a good steward that was willing to invest, and they were really bullish on the brand too,” Freccia said. “They wanted to grow the brand. We were about to make some hires.

“The lenders aren’t necessarily craft beer people,” he continued. “They’re money people, and they can see the challenges ahead. At a certain point, I think somebody decided ‘We better step back before we get in too deep.’”

Without the lender’s support, 21st Amendment’s path forward

Anheuser-Busch

became untenable. Freccia said the business has not been profitable for a few years now, and its San Francisco location is operating at about 40% of pre-pandemic business, which Freccia described as “a little microcosm of the bigger world.”

“We built a big facility at a time when the industry was growing rapidly and we were growing 30%, 40%, 50% a year,” Freccia said. “And that growth came to a slowdown and then a standstill right after we opened.”

Freccia and O’Sullivan are still open to exploring a sale of the 21st Amendment brand.

“Our hope is that the brand will live on and there’ll be opportunities coming down the line,” he said.

Declining alcohol sales, moderation trends, tariffs and economic uncertainty added to mounting headwinds facing the business, Freccia said. The 2023 pivot to a co-packing model proved successful early on, but the industry’s increasing challenges this year led to struggles for those partners whose contract volume slowed.

Freccia and O’Sullivan founded 21st Amendment in 2000 as a brewpub within walking distance of Oracle Park, the San Francisco Giants’ home stadium. The company quickly established itself for being among the first craft brewers to can its beers, such as flagships Hell or High Watermelon and Brew Free! or Die IPA.

In 2018, 21st Amendment ranked as the 26th largest Brewers Association-defined craft brewery by volume, with 112,845 barrels of output. The company rode craft’s early 2010s growth wave, with double-digit growth from 2012 through 2015 (according to available BA data, which begins in 2012) when it reached a 100,000-barrel milestone (102,709 barrels).

21st Amendment remained above the 100,000-barrel threshold until the COVID-19 pandemic in 2020, but the company wasn’t able to recover, suffering double-digit volume declines every year since 2019. In 2024, the company produced 23,217 barrels of beer, a 28% YoY decline.

In a tectonic shift in the distribution landscape, Anheuser-Busch InBev (A-B) plans to sell its wholly owned distributor (WOD) in New York City to Southern Glazer’s Wine & Spirits (SGWS).

Once the transaction closes later this year, SGWS will launch Southern Glazer’s Beverage Company of New York, with a footprint covering Manhattan, Queens, Staten Island and the Bronx – all New York City boroughs except Brooklyn. In the NYC area, Southern Glazer’s will offer A-B’s full product lineup, ranging from beer brands Michelob Ultra, Busch Light, Bud Light and Budweiser to spirits-based RTD offerings

Cutwater Spirits and Nütrl Vodka Seltzer, as well as newly launched energy drink brand Phorm Energy.

A-B vet Devyn Dugger will lead operations as senior VP of Southern Glazer’s Beverage Company’s New York division. Dugger most recently served as president and equity agreement manager of Ohio Eagle Distribution, which was sold to Redwood Holdings earlier this summer. That deal is expected to close September 8.

All A-B Bronx employees are expected to be retained, with Southern Glazer’s operating out of the borough’s existing warehouse.

Dan Kleban, founder of Freeport-based Maine Beer Co., has entered the race to unseat longtime U.S. Senator Susan Collins. Kleban is the latest candidate to join a growing field of challengers in the state’s Democratic primary to take on Collins, a Republican, in 2026.

“I’m running for U.S. Senate because politicians in Washington, they’re making it harder to do what’s right for Maine,” Kleban said in a video on his campaign website. “Donald Trump is trampling on the values of Mainers and

tearing this country apart. And Susan Collins, she’s been in Washington for 30 years. She stopped looking out for us. She lied about protecting abortion rights, and she refuses to stand up to Donald Trump when it really matters. Enough is enough.”

In the video, Kleban traced Maine Beer’s entrepreneurial roots to the failed policies that created the Great Recession. At the time, he was an associate attorney at a Portland law firm and a hobbyist homebrewer with his brother.

Kleban was laid off in 2008, and channeled his frustration with the corporations whose actions led to a nationwide economic downturn into building a people-centric company with his brother.

“They collapsed our economy and walked away with no consequences,” Kleban said of the big banks. “Hard-working Mainers, they lost their homes, their pensions, and struggled to get by.

“I was angry at the big banks,” he continued. “I wanted to do something. So my brother and I, we set out to prove you could run a successful business by doing what’s right. We promised ourselves that anybody we hired would get a living wage, employee healthcare fully paid, profit sharing and a retirement plan.”

The brothers turned their homebrewing pastime into a career and opened Maine Beer’s first location on Industrial Way in Portland in 2009, with seed money from Kleban’s wife Beth, who cashed out her 401(k).

Other entrants in the Democratic primary to challenge Collins include Graham Platner, a harbor master, oyster farmer and military veteran who has secured the endorsement of Sen. Bernie Sanders (I-VT); and Jordan Hill, chief of staff to former U.S. Rep. Katie Porter (D-CA).

Sazerac and Coca Cola’s bev-alc subsidiary are embarking on a new partnership.

Fresca Mixed, a ready-to-drink (RTD) line launched by The Coca-Cola Company and Constellation Brands, as well as Minute Maid Spiked, are moving to Sazerac.

Coca-Cola’s “firewalled, wholly owned” bev-alc subsidiary Red Tree Beverages announced in September the transition to Sazerac, which will take over Fresca Mixed as well as a future malt version. The move was reported via a distributor update from Constellation Brands, which Beer Business Daily obtained.

Red Tree said the new partnership blends the subsidiary’s “proven expertise in brand building and marketing with Sazerac’s production excellence, established sales network, distribution management, and enduring brand stewardship.”

Sazerac has made waves in the RTD business after acquiring Southern Champion’s RTD portfolio, including orb-shaped RTD line BuzzBallz, in March 2024. The brand is one of the leading RTDs, particularly in the wine-based segment. Sazerac was among the first major spirit companies to shift its RTD distribution to beer distributors, now giving Red Tree’s beverages a robust distribution footprint.

In 2022, Constellation Brands entered a brand agreement with

Coca-Cola to manufacture, market, distribute and launch Fresca Mixed – a spirit-based RTD based on the citrusy soft drink. At the time, Fresca, a zero-calorie soda with citrus-inspired flavors, was the fastest growing soft drink trademark in Coca-Cola’s U.S. portfolio.

Fresca Mixed’s 5% ABV Vodka Spritz will live on under Sazerac, while a Tequila Paloma is being discontinued.

Sazerac will also acquire the Minute Maid Spiked portfolio. Red Tree Beverages debuted the line of multi-serve wine cocktails under the juice brand in spring 2024. The cocktails were produced by LeVecke Corporation, a California-based wine and spirits co-packer, and was distributed by Republic National Distributing Company (RNDC), along with a network of other wine and spirits wholesalers.

The Minute Maid line grew to include a Spiked Vodka Lemonade and Spiked Vodka Pink Lemonade RTD and boosted its number of wine-based flavors, earlier this year.

Minute Maid Spiked marked the first time Red Tree launched a hard product on its own, without collaborating with its other bev-alc partners Molson Coors (Topo Chico Hard Seltzer, Simply Spiked, Peace Hard Tea), Brown-Forman (Jack & Coke) and Constellation Brands. The brand was also Red Tree’s first foray into using wine as an alcohol base.

Garage Beer, the light beer brand that achieved national prominence when NFL stars Travis and Jason Kelce invested in it last year, has received “strategic growth investment” from Durational Capital Management.

This funding round, Garage Beer’s first, sets the company’s valuation at “roughly $200 million,” the Wall Street Journal reported. Durational is “a large shareholder” in the brand, but the size of its stake was not immediately clear. The Kelce brothers, who promote the beer on their popular podcast New Heights, will remain “existing owners and operators” in addition to CEO and co-owner Andy Sauer, according to a press release.

With the investment, Garage Beer’s board of directors gains two beer industry veterans: Bill Hackett, former Constellation Brands beer division president and chairman, who retired from the Mexican importer in 2019; and Rich Pascucci, former Pabst chief growth officer. MavenHill Capital chairman and managing partner Rhodes McKee will also join the board.

“Our vision is simple: to make a domestic light beer that resonates with everyone,” Sauer said in the release. “Over the past year, we have increased our volume over 400%, expanded nationally, and became the fastest growing and one of the most exciting beer brands in the U.S.

“Durational’s partnership is a strong endorsement of what we have achieved to date and our ambitions for the future,” he continued. “This investment gives us the resources to accelerate our growth and introduce Garage Beer to even more communities and consumers nationwide.”

Boston Beer Company is willing to fail fast with new fourth category products in order to find its next big brand, founder and CEO Jim Koch shared during the Barclays’ Global Consumer Staples Conference in September.

Koch admitted the company has had “a lot of failures,” joking that he hoped the audience had never heard of discontinued offerings Loma Vista, a tequila-based RTD launched in 2022, or General Admission, a 40% non-alcoholic beer and 60% fruit water released in 2024.

“If we do 10 of those and one becomes a 10-million-case, $250-million brand, I’m good with that,” Koch said. “We’re kind of built around regular failure as a company.”

Boston Beer is letting it ride with more fourth category bets, from Sin-

less, a zero carb, 100- calorie vodka cocktail line; to Just Hard Squeezed, a 4.2% ABV flavored malt beverage (FMB) made with real fruit juice and alcohol from cane sugar; to Social Pop, which Koch described as an alcoholic version of Poppi.

No other details of Social Pop were shared, and the company declined to offer additional information when asked by Brewbound.

Boston Beer’s new product philosophy comes from hitting big with Truly during the hard seltzer boom and now riding a growth wave with Sun Cruiser, a vodka-based iced tea. After a summer of triple-digit gains, the company is increasing its advertising investment in the latter brand.

Koch acknowledged that growth is expensive, as evidenced by the rush

to build Truly. Sun Cruiser‘s ad spend has paid off thus far, giving Boston Beer a “significant new brand,” which he described as “a holy shit thing.”

Asked about the lessons from building Truly that are now being applied to Sun Cruiser, Koch said Sun Cruiser is being built “from the bottom down.” Instead of national ads or programs, the company is zeroing in on the 30 major metros that make up the majority of the brand’s demand. Boston Beer is also focused on building Sun Cruiser in bars and restaurants, which is “more expensive but it builds a stronger brand,” he continued.

Additionally, Boston Beer is more hesitant to add SKUs, Koch said. Where Truly at its peak had seven different flavor families, Sun Cruiser has two (lemonade and tea).

City Brewing & Beverage has completed a transfer of control to a new ownership group made up of some of the multistate contract manufacturer’s existing lenders.

The move has been in the works for several months as City has attempted to fix its financial situation. Terms of the deal and names of the involved financial partners were not disclosed.

News of City’s money troubles arose in early 2024, when the company overhauled its capital structure to borrow $115 million. Later in the year, Bloomberg reported the company was in negotiations for an additional $50 million loan to help with restructuring efforts.

In January, S&P Global reported City had missed quarterly principal payments on loans due at the end of 2024.

City entered into a forbearance agreement with its lenders to temporarily pause payments, and received a $35 million bridge loan.