Energy Drinks Learned to Win with Women

As much as I want to tell myself – and others, primarily at cocktail parties –that I’m an “ink-stained wretch”, in reality I spend an inordinate amount of time interviewing people and moderating panels on stage for our company’s events, BevNET Live, Nosh Live, and even, on occasion, Brewbound Live.

Prep for those events is pretty allconsuming, as we spend months trying to put together a lineup of founders and experts who are offering their time and experience for the benefit and education of others in their industry.

It’s a different kind of pitch than the ones founders and executives are used to giving to retailers, distributors, investors and the media. In those cases they’re trying to look their best, to show off hot new products and optimized supply chains. In one way or another, it’s all about making the sale by showing enough evidence that you’re worth the gamble.

Our audience is a different one, and it often makes speakers backtrack and analyze their process. It’s about the “how”: in the case of the sale, it’s how you prepare, how you build the case, how you close, how you react and come back when it doesn’t work out.

Of course we look at more than just sales and investment, but the basic idea, that exploration of the forces behind any transition point, are what we’re after.

The best interviews require research, and in the case of some founders, I’ve found that they supply their own best research materials in the form of memoirs, and I’ve really developed a weakness for the founder story format.

After all, where else can you find out that one of HINT founder Kara Goldin had stared down a rattlesnake in the Grand Canyon, except in Goldin’s Undaunted? Or that Daniel Lubetzky, the founder of KIND, once was nearly forced out of his bedroom – because he was using it as a temporary warehouse for an early spice company called Peaceworks, unless you’ve spent time parsing Do the KIND Thing? That Mark Rampolla used Led Zeppelin as his soundtrack when he boxed up cases of ZICO in his garage, as he describes in High Hanging Fruit?

As columnist Gerry Khermouch has pointed out repeatedly in the past, Mis-

By Jeffrey Klineman

sion in a Bottle, the ‘graphic memoir’ of Honest Tea co-founders Seth Goldman and Barry Nalebuff, is a particularly good look at the early startup experience.

Now, I’ve read a fair number of these over the years, mostly about food and beverage founders, occasionally straying – Phil Knight’s Shoe Dog, about the founding of Nike, is a particular favorite – and right now I’m deep in a couple that are among the most enjoyable of the type. Both lay bare not just the wins but the painful mistakes and near-misses that come with the startup life.

I picked up Greg Vetter’s Undressed - the story behind the rise and ultimate fall of salad dressing brand Tessamae’s - as a kind of blow-off-some-steam narrative to break up the much less breezy work of chewing through the dense J. Anthony Lukas doorstop Big Trouble. (That book is really incredible, by the way, offering up a pretty timely look at the way American corporate power attempted to control the narrative around government, justice, work, and journalism during the Gilded Age that our current President seems to worship so much – it even features a violation of Habeas Corpus that would make Kristi Noem blush, if she could figure out what it meant).

Anyway, Vetter is ruthless in his to-theinch mistakes, which he clearly made so that you won’t have to. Drums of olive oil are heaved into storage units when truck lift gates don’t match the ramp; investment bankers are recruited and go AWOL; working capital goes South - literally.

Chris Hunter’s Blackout Punch is similarly instructive and self-flagellating. Hunter, best known (he resignedly admits) as the co-founder and former CEO of Four Loko and currently the CEO at Koia, weaves a highly sympathetic story of personal and professional growth. A self-identified hustler, he’s also clearly a great salesman and student of the market, adapting the trends he sees in other parts of the business world as he builds up companies.

There are lessons on the sources and pace of innovation, ideas about why business partnerships soured, thoughts on professional coaching and a gradual understanding of what it means to be an entrepreneur in consumer products.

As someone who invented a 24 oz., 12% ACV energy drink, Hunter also supplies plenty of tales of booze and drugs to help the learning go down easy.

In each of these books, there are lessons in personal growth as well as professional; there’s a healthy understanding that luck plays a factor but it’s bolstered by preparation and hustle; and there’s ultimately a sense that good or bad, at least there’s a sense of how things happened, not just that they occurred. Entrepreneurs might sell their own stories as well as they sell their products, but we’re fortunate that they’re willing to share the lessons on the page, as well as on the stage.

By Barry Nathanson

Forty plus years of skiing, running and tennis have taken their toll on my 76-yearold legs (they took my brain years ago). Last week I finally had to face reality and start a process to recoup my mobility, enduring the first of two vascular surgeries to open the arteries down my legs (the next one’s in 6 weeks). The operation was a success thankfully. My immediate recovery process? Stay off my feet for 4 days.

The timing was great: I’m a sports junkie and this past weekend was a feast for us fanatics. Between the PGA Championship, New York’s “Subway Series” between the Mets and my Yankees, and the second rounds of both the NBA and NHL playoffs, I was overjoyed to have to stay immobile and watch the action. Jumping between the various contests was my toughest task. The remote was hot from all of the action.

Laid up, for sure, but still in 24/7 beverage mode, so as the games and weekend progressed, I was taken aback by the lack of beverage commercials. For my entire life, there have been brands on the TV screen. Between A-B, Coors, Corona, Heineken and Miller on the beer side, and the soft drink sellers like Coke, Pepsi, Dr Pepper, Sprite and more, I’ve always enjoyed seeing the creative work. Add to the

mix the sports drinks, energy drinks, flavored waters and seltzers, and you have the gamut of drinks vying for attention and viewership at these most synergistic sporting events. These were always the prime marketing opportunities that brands would jump at. This weekend, it was no longer the case. Aside from an occasional Propel commercial - actually not on the sports coverage channels - I couldn’t believe that the beverage industry seemed to have deserted the big ticket sporting events.

I hadn’t watched so much sports action all at once in quite a while, so I must admit I wasn’t aware of the decline in beverage advertising. It probably has been diminishing for a while. Yes, the world of marketing has changed as digital and online seem to fit today’s target consumers, who are sadly glued to their devices. I’m from the “old school” and still believe that there is life beyond their tiny screens (like on my bigger, remote-controlled screen). I hope that is the case. I loved the commercials that the marketers saw fit to link to the events with their messaging. I hope they’ll come back. Michelob Light for the Winners!

www.bevnet.com/magazine

Barry J. Nathanson Publisher bnathanson@bevnet.com

Jeffrey Klineman Editor-in-Chief jklineman@bevnet.com

Martín Caballero Managing Editor mcaballero@bevnet.com

Monica Watrous Managing Editor, Nosh mwatrous@bevnet.com

Justin Kendall Editor, Brewbound jkendall@bevnet.com

Adrianne DeLuca Assistant Managing Editor, Newsletters adeluca@bevnet.com

Lukas Southard Senior Reporter lsouthard@bevnet.com

Brad Avery Senior Reporter bavery@bevnet.com

Zoe Licata Senior Reporter, Brewbound zlicata@bevnet.com

Shauna Golden Reporter sgolden@bevnet.com

Sales & Ad Operations

John McKenna Director of Sales jmckenna@bevnet.com

Adam Stern Senior Account Specialist astern@bevnet.com

John Fischer Senior Account Executive jfischer@bevnet.com

Lou Calamaras National Account Executive lcalamaras@bevnet.com

Tom McCrory National Account Executive tmccrory@bevnet.com

Jon Landis Business Development Manager jlandis@bevnet.com

Colin Sughrue Digital Campaign Coordinator csughrue@bevnet.com

Jen Miles Digital Ad Operations Coordinator jmiles@bevnet.com

Art & Production

Aaron Willette Design Manager

Nathan Brescia Director of Photography

BevNET.com, Inc.

John F. (Jack) Craven Chairman

John Craven CEO / Founder / Editorial Director jcraven@bevnet.com

Headquarters 65 Chapel Street Newton, MA 02458 617-231-8800

Publisher’s Office

1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

Subscriptions

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

BPA Worldwide Member, June 2007

By Gerry Khermouch

As one who’s been active in advocating for safer streets around my home town, New York, I remembered being surprised a few years ago to hear about a new initiative that was being prioritized by the group I helped out, Transportation Alternatives: getting policymakers, the media and just people in general to stop using the word “accident” to describe cases where, say, a car rear-ends another car or sends a cyclist hurtling to the pavement. From now on, the idea was, everyone should start calling them “crashes.”

I was a bit skeptical. After all, we already had our hands full lobbying for policy changes like speed cameras near schools and protected bike lanes. Why distract everybody haggling over mere nomenclature?

As I came to realize, TA was on to something. Those destructive confrontations are almost never an accident. They are the result of bad decisions made by drivers of cars, ebikes, regular bikes and other vehicles. Calling them accidents is a way of implicitly absolving the perpetrators of responsibility, as if the carnage they create by running red lights and speeding is an act of God. To my surprise, the word change stuck. Though I still sometimes find myself slipping (accidentally!) into using “accident,” the words “crash” and “collision” have become the standard choices now for journalists, politicians and others in discussing these incidents

that take the lives of hundreds of New Yorkers a year and maim thousands more. While it’s impossible to gauge precisely how much of an effect this has had on changing the timbre of discussion around street-safety issues, I’m convinced it’s done much to cement the notion that these casualties are entirely preventable. That in turn has helped usher in beneficial laws, regulations and street redesigns.

So sometimes nomenclature can matter in framing things in a new way that opens minds and makes progress possible. Which brings me to “modern soda.” It’s been kind of remarkable how quickly the trade has embraced this term conjured up, apparently, by Walmart merchandisers looking for a catchy way to highlight the exciting, above-premium sparklers that have been showing up on the scene.

“Modern soda” is brilliant on several levels. For one, it creates a great catch-all not just for so-called gut pops like Olipop, Poppi and Culture Pop but for other sparklers that take the category in a new, nominally healthier direction, such as the stevia-sweetened Zevia brand that makes no claims to any functionality. (It also seems to exclude a prior generation of altsodas like Reed’s, Jones and Grown Up Soda that may have set some new directions but didn’t necessarily frame the category in a new light.) As for the gut pops themselves, it takes pressure off their leaning too heavily on prebiotic or

probiotic identities that may or may not stand up to real clinical scrutiny, an evolution those brands were likely to take on their own anyway.

Of course we see this in politics all the time. Trump does it in an infantile way with name-calling like “Sleepy Joe” and “Shifty Schiff” and “Crooked Hillary,” though I have to admit it seems effective, at least among his MAGA adorers. And it cuts the other way too. I’m seeing an increasing number of commentators now starting to refer to Trump’s tariffs not just as “tariffs” or “levies” but also as “taxes,” which of course is exactly what they are. Will that help tilt the debate in favor of pulling back this poorly thought-out policy (which, who knows, might be history by the time you read this)?

Unlike, say, “Gulf of America,” “modern soda” didn’t come out of nowhere: it’s entirely in sync with the directions several of the leading brands, like Olipop, Poppi and Zevia, have been taking in their marketing, positioning conventional CSDs as boring and out of touch. It’s a marked contrast from the more tempered – all right, timid – tack taken by earlier altsodas that were wary of poking the big bears, content to squirm into a defensible niche without taking the giants head-on. (Recall that most didn’t even venture their own ginger ale and cola styles for years out of a desire to stay in their own lanes.)

Taking a longer-term perspective, the advent of “modern soda” as a category simply follows in the path that iced teas, bottled waters and natural sodas took a few decades ago in describing themselves as “new-age beverages” to signal that they represented a decisive break with what had gone before and thereby were deserving of being merchandised in their own distinct store area. Among their innovations, new-age brands like Snapple included the first hotfill entries to reach scale, offering a more natural alternative to preservatives. Going back further, Pepsi-Cola once took a similar tack in contrasting itself to Coca-Cola by describing itself as “the choice of a new generation” in seeking to relegate the market leader to the dustbin of history. (That worked in getting Pepsi back in the game, though last I checked, Coca-Cola still seems to be around. I think I just saw some in aisle 4 at Duane Reade.)

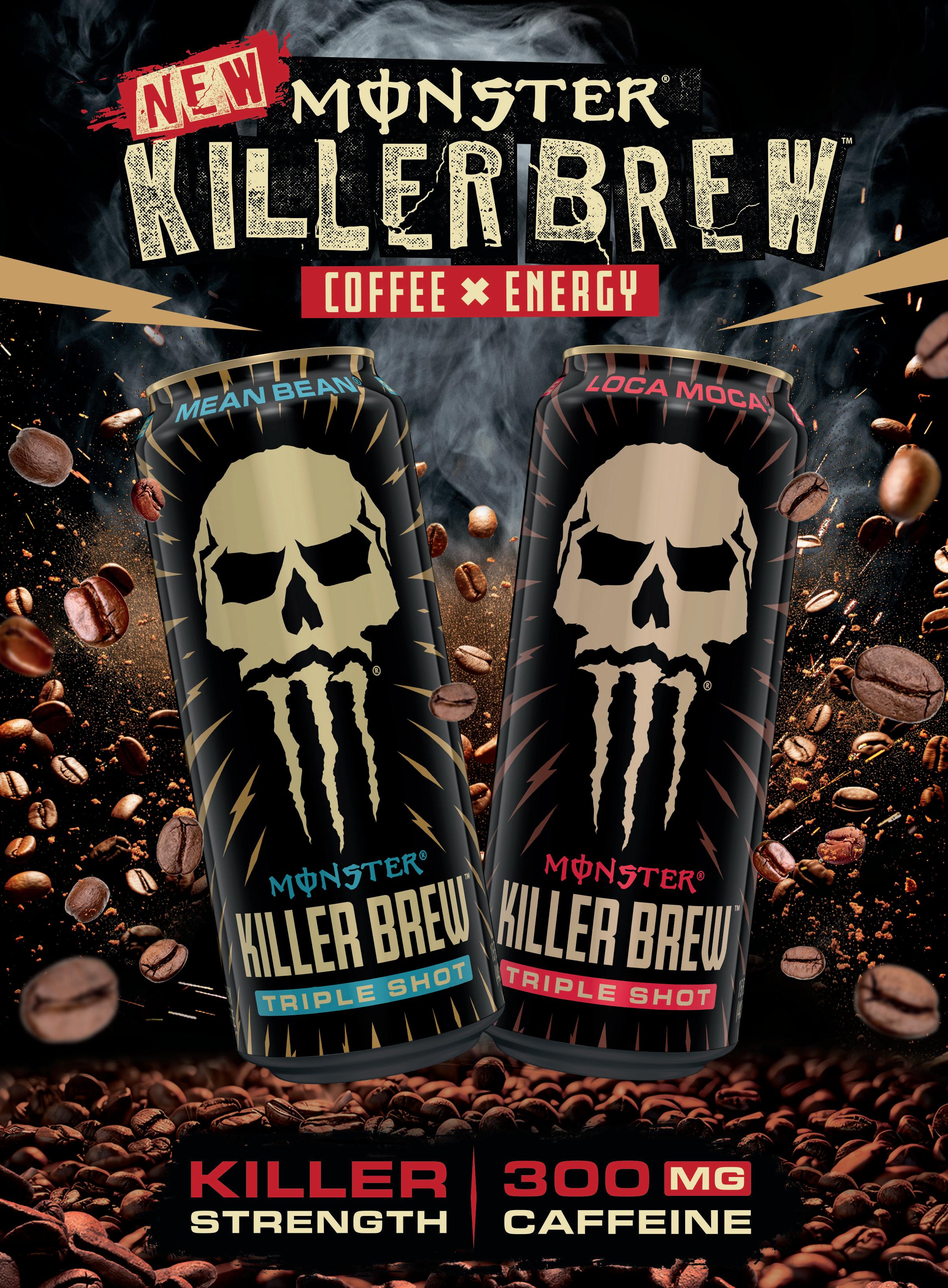

In fact, “modern soda” is so clean and crisp in making a break that it’s not surprising to see others trying to run with it for their categories. For instance, I recently heard the Celsius energy CEO describe his breed of sleek-can, zero-sugar, thermogenic energizers as “modern energy,” though it can be hard to put your finger on what the line is that divides challengers like Celsius and Alani from the leaders he’s implicitly challenging, Monster and Red Bull. Will we soon be hearing about “modern protein” and “modern iced tea” and, I don’t know, “modern water”? OK, I admit it, modern water sounds absurd. Still, I felt the same way years ago when water was suddenly being defined as “new age.” So, hey – why not?

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Yerba

After nearly 30 years in business, the mother of North American yerba mate brands is changing its name.

Guayakí announced in May a full rebrand under a new name: Yerba Madre. According to the company, the name –which means “Mother Herb” – is intended to be both easier for consumers to remember and more representative of its diverse set of suppliers and partners across South America.

“This rebrand is about coming back to our roots and recommitting to the mission that inspired the company decades ago,” said co-founder Alex Pryor in a press release. “Yerba mate is more than a beverage, it’s a tradition, empowering cultural and ecosystemic relationships. Yerba Madre honors the communities who have grown the yerba mate plant while ensuring the regeneration of the forest and its sacred value.”

Founded in 1996, Guayakí was originally named in tribute to the indigenous Aché people of Paraguay, who have traditionally consumed yerba mate and served as one of the first major suppliers of the plant for the California-based business.

But according to CEO Ben Mand, since then, the business has grown its supplier partnerships to over 255 farmers across South America, including Argentina and Brazil in addition to Paraguay. After visiting with a number of those partners, Mand said the company felt the brand name should be reflective of the cross-cultural nature of the business as it stands today.

“They’re very proud to work with us, yet they were not reflected by the name,” Mand said of Yerba Madre’s international suppliers. “In all senses of how we brand this company, we’re trying to be as inclusive and positive as we possibly can.”

As for American consumers, Mand noted that native English speakers have often struggled with the proper way to pronounce Guayakí, with even longtime loyal customers instead employing nicknames like “The Yellow Can” or, more simply, “Yerba.”

“I find there’s always a hesitation, a pause, and then almost a bit of a stuttering when people try to say the name Guayakí,” Mand added.

Last year, the company sought to subtly drop the Guayakí name, creating a canned line of drinks that simply said “Yerba Mate” in the brand’s signature trade dress, with only a small call out to the parent company name on the label. Mand said that most consumers didn’t even notice the difference – a testament to the strength of the company’s design versus the name.

The first product relaunching under the Yerba Madre name will be the brand’s traditional air dried loose leaf tea, but Mand said that the brand’s 15.5 oz. RTD line is set to follow soon afterwards and will likely have a casual transition in the marketplace as the older Guayakí-branded cans sell out and are replaced by the new, visually similar, designs.

Despite any difficulties with the old name, the brand has long been the leader in the U.S. for ready-to-drink yerba mate beverages, often presenting in the market as an organic hybrid of tea and energy drinks, and has been experiencing sustained double-digit growth in recent months.

Mand assumed the CEO position in spring 2024, coming to the business from coconut water brand Harmless Harvest (another organic beverage maker with an intricate international supply chain). Since then, he has set about reorganizing the company to improve efficiency and drive growth.

Mand said Yerba Madre has reorganized its innovation team while also working to scale its marketing and sales operations, emphasizing more event and in-store activations and working to develop new products that can appeal to both existing and first-time consumers.

While the company was reticent to discuss recent reported investment, Tractor Beverage Company still has a lot to say.

The organic, non-GMO drink maker, which has established a foothold in fountain service at QSRs like Chipotle and Potbelly through its partnership with Keurig Dr Pepper (KDP), pulled in $15 million in March, according to a quarterly investment report from The Bank of Montreal (BMO).

Chief brand officer Duke Stump and chief revenue officer Brian Barbara declined to comment on the BMO report. A representative from Tractor confirmed that the company is “in the midst of a small raise” and that the figure cited by BMO is “generally in the right ballpark.”

“Here’s what I will say: We’re always desirous of capital if we feel like we need capital for the right reasons,” said Barbara. “And so being in conversations with likeminded investors is also a key piece for us. Then it becomes a function of strategically where we want to invest and what makes the most sense.”

The brand is eager to talk about its “grow strong” strategy, however, as efforts to transcend beyond its roots in foodservice converge with a new guerilla-style nationwide marketing campaign emphasizing Tractor’s connections to independent farmers and regenerative agriculture.

That mission is reflected in Tractor’s Mad Farmer Tour, a seven-month road trip across the U.S. which this week pulled its retrofitted Airstream trailer into the National Restaurant Association (NRA) show at McCormick Place in Chicago in May. The trailer was essentially Tractor’s de facto booth on the show floor, dispensing cold drinks (and cocktails) while acting as a physical space for “immersive brand storytelling.” The broad theme of promoting stronger engagement with parties across the food system aligns with the Farmhand Foundation, an organization promoting and supporting the transition to sustainable and organic farming that was headed by former Tractor chief brand officer Justin Herber (he’s since departed), alongside brand co-founders Griffin Barkley and Justin Schneir.

During a prior tour stop in Chicago, Tractor awarded a pair of $5,000 community grants to two local community leaders who have revitalized vacant lots into garden spaces growing food, part of a $20,000 investment in South and West Side Chicago gardens. That kind of high-touch, message-first activation — the brand’s quarterly online literary magazine Tractor Beam, launched last November, is another — is critical to building traction with consumers outside of the soda fountain, said the brand’s leaders.

“I like to say that this brand needs to be out in the wild,” said Stump. “It’s our ability to connect so that people understand the essence and the DNA of this thing called Tractor. It goes beyond just the beverage.”

Innovation is coming in the second half of this year, when the brand hopes its deliberate, exploratory approach will pay dividends. At last year’s NRA show May, Tractor introduced four RTDs — Lemonade, Strawberry Dragonfruit and Farmer’s Punch, plus a new flavor, Mango Peach — aimed exclusively at foodservice, part of an effort to make the consumer experience “multi-dimensional.” Speaking this month, Stump called the RTDs a “beta exploration that has allowed us to really learn a lot,” the results of which will be seen towards the end of 2025. It’s unclear as to what role KDP may play in RTDs.

Mixers, also introduced at NRA last year, will be less of a focus moving forward, Stump added, but underscore Tractor’s versatility in providing beverage solutions for its customers.

On a personal level, Barbara and Stump are part of Tractor’s corporate evolution; Stump, a seasoned veteran of consumer brands including Nike and Lululemon, arrived last March to succeed Herber, while Barbara, who joined this March, brings experience from Califia Farms and ConAgra.

Yet company leadership has integrated its core mission to improve agriculture and support farmers directly into its corporate development, as Stump can attest. Rather than a planned sales meeting in New Orleans, CEO Kevin Sherman last year organized a “farm camp” in Ojai, California, where employees planted crops, worked the land and reconnected with the brand’s “soil and soul” mantra.

“It feels like every day there’s a new beverage company popping up,” said Stump. “And I think for us, it’s [important] not to get intoxicated with the noise around us, but to be really clear and true on who we are and just lean into that.”

Working to go from TikTok and DTC to IRL brick-and-mortar, better-for-you energy drink brand Gorgie announced in May that it has closed a $24.5 million funding round led by Notable Capital.

According to the company, the new capital brings Gorgie’s lifetime funding to $37 million since its launch in 2023. Existing investor Notable Capital is joined in the round by Coefficient Capital and board members Jason Cohen and Yossi Nasseralso. With a focus on female consumers, Gorgie’s core line of functional energy drinks are made with 150 mg of caffeine from green tea, B vitamins, L-Theanine and biotin in each 12 oz. can.

Initially launched online with an aggressive influencer and social marketing strategy, Gorgie has been building out its DSD distribution network since last year and has landed in major distributors like New York’s Big Geyser, as well as wholesalers UNFI and KeHE. The brand is available in retailers such as Kroger, Albertsons, Sprouts, Erewhon, H-E-B and Whole Foods.

Last year, founder and CEO Michelle Cordeiro Grant told BevNET that Gorgie’s Amazon business was “bringing in about ‘five figures a month’ with little to no effort and attention,’” suggesting the brand was ready to make the extension into retail.

In a press release, the company said that it achieved 5x growth last year with customer reorders coming every eight days on average.

Alongside the new funding, the company said it will add 1,900 Target stores nationwide this summer, which the financing will support.

Culture Pop raised over $15 million in April, money which will go towards boosting marketing and expanding distribution, according to founder Tom First.

The latest raise, detailed in a SEC Form D, represents a “planned add-on” investment for the Boston-based soda company from existing investors, First told BevNET. Although there is still an additional $12 million left open, the new funding “is it for now.”

“There’s a potential for a bit more money to come down the road from similar investors under certain terms,” he added.

Culture Pop raised $21 million last February, adding Enlightened Hospitality Investments and a private investment by Howard Schultz to the cap table.

“We’re growing a lot,” said First. “We’ve experienced almost 100% growth every single year and we expect to do that again this year.”

Along with preparing to launch its ninth flavor, Grape, Culture Pop has added several new retail partners in the last year. The brand recently went nationwide in Target, adding on to its footprint in H-E-B, Albertsons and Walmart, among others.

“This is what disruption looks like,” Cordeiro Grant said in the release. “We built GORGIE to change the way people think about energy—something functional, yes, but also joyful, healthy, and community-powered. Our rapid growth proves the demand for a brand that brings together performance and wellness without compromise and puts community at the forefront.”

Cordeiro Grant told Fortune that Gorgie has marketed itself like a fashion brand to create a stronger emotional connection with consumers – which, as a former Victoria’s Secret executive, is in her area of expertise.

The funding comes at a time where the energy drink category has greatly expanded its reach with women via brands like Celsius and Alani Nu, while legacy players like Monster have sought to soften their hyper-masculine portfolio with lines like Reign Storm. Following its $1.8 billion acquisition by Celsius earlier this year, Alani Nu reported that it had surpassed $1 billion in annual retail sales for the 52-weeks ending April 13.

Those gains have been part of the brand’s transition to a direct-store delivery (DSD) model. First acknowledged that its deal with Big Geyser in New York has been “unbelievably” successful tapping into the market’s complex grocery and independent c-store channels.

The brand is in upwards of 18,000 stores (including independent channels), First estimated, and has seen nearly 100% sales growth year-over-year since it was founded in 2020.

Along with adding more sales support, Culture Pop expects to use its new funding on an expanded marketing push. This year the brand invested in its first television advertising campaign and has put dollars into building awareness with ads and activations in metro areas.

The raise underscores the attention investors are paying to next-generation soft drinks as a category. The news of PepsiCo’s $1.95 billion deal to acquire Poppi in March came on the heels of competitor Olipop raising $50 million on a $1.85 billion valuation in February. Total CPG investment grew 83% quarter-over-quarter in Q1 2025, despite being down yearover-year, according to tracking from FABID.

“We have significantly lower awareness than poppi and Olipop, but we’re going to close that gap,” First said.

Ghost has made recognizable candy brand collaborations a cornerstone of its successful business strategy, but its recent acquisition by Keurig Dr Pepper (KDP) has ruptured its relationship with Mondelez, from which it has licensed some of its most popular flavors.

In a trademark infringement suit filed in April, two Mondelez subsidiaries in Illinois are demanding Ghost stop marketing products featuring Sour Patch Kids, Chips Ahoy!, Swedish Fish, Oreo and other well-known trademarks, arguing that the energy drink brand violated a 2018 licensing agreement when it moved to KDP and transferred the licensing rights without required written approval.

The issue stems from the initial 2018 agreement between Ghost and Mondelez that granted the former rights to use certain trademarks in its sports nutrition mixes, protein powders and ready-to-drink products. In that contract, Ghost agreed to not assign any rights without written approval; no such approval was requested at any point, the suit claims, from when the KDP deal was announced in October 2024 to its closing on December 31, 2024.

At some point in January, per court documents, the CEO of Ghost contacted an employee at Mondelez asking the person to “maybe just send a couple sentence memo on letterhead” acknowledging the KDP partnership and “gives us at a minimum 26 [sic] at current terms so so we know Target isn’t going to launch and then disco within a few months?”

Shortly after Ghost’s $990 million sale to KDP was finalized, Mondelez claims it informed Ghost that the licensing agreement would end within three months of the transaction closing. KDP responded by attempting to amend the contract to allow for Ghost’s continued use of the trademarks in exchange for an upfront payment and revised terms, but negotiations did not produce a deal.

When Mondelez set April 17 as the end date for the licensing agreement, Ghost countered with a letter asking, for the first time, for approval of the transfer of rights to KDP. It also stated its intent to continue using the trademarks through April 30 and to continue selling products with those marks for a further 90 days. That sparked more failed contract amendment negotiations, and on April 21 Mondelez affirmed that the deal was over and Ghost was in violation.

“Defendants’ use of the MDLZ Marks is likely to mislead, deceive, and confuse the purchasing public,” read the complaint. “It is likely that consumers will mistakenly believe that Defendants are connected, associated or in some way affiliated with Plaintiffs, when in fact no such connection or affiliation exists, especially because the MDLZ Licensing Agreement expired on April 17, 2025.”

Ghost produces products using licensed IP from Perfetti Van Melle (Bubblicious, Airheads) and Impact Confections (Warheads).

King Juice (KJ Holding Corp.), the parent company of Calypso Lemonades, expanded its beverage portfolio this spring with the acquisition of plantbased hydration brand Mela Water, producers of a premium watermelon water in cans.

Calypso CEO David Klavsons noted in a press release announcing the acquisition in April that his brand’s national DSD network “coupled with our commercial and supply chain capabilities” will accelerate Mela’s growth.

“We are thrilled to welcome Mela to the beverage platform we have built behind Calypso. Mela is a great brand with strong consumer appeal that is delivering outstanding growth,” said Klavsons. “Mela’s exceptional taste, unique flavors, tropical vibe, and functional hydration make it a strong complement to our Calypso brand.”

With over $137 million in sales (52week period ended March 21, 2025) per Circana data, the Calypso brand, available in full-sugar and Light varieties in 16 oz. glass bottles, has emerged as a successfully incubated offshoot of Milwaukee-based copacker King Juice, owned by PE firm Mason Wells. This is its first acquisition.

“We are excited to join the Calypso platform as we enter the next phase of our growth,” said Mela CEO and founder Dominic Purpura, who is staying on with the brand. “Our team has done a fantastic job building the brand over the last several years gaining significant distribution with leading retailers while sustaining strong unit velocities. It’s now the perfect time to join the Calypso platform and leverage their infrastructure to scale the brand nationally and internationally.”

Launched by Purpura in 2022, Miami-based Mela has found traction for its four-SKU line of shelf-stable watermelon waters in 11.5 oz. cans in over 10,000 stores through distributors like Rainforest Distribution on the East Coast and Stone Distributing, Los Angeles Distributing, Shoreline and Seacoast Distributing in California. Con-

venience has been a focus as of late, via partnerships with 7-Eleven and QuikTrip.

In an interview last year, Purpura likened his company’s strategy to how Calypso had gone deep into independent convenience stores to make the brand recognizable to consumers “everywhere.”

Speaking with BevNET, Klavsons noted Mela’s growth “follows what we’ve learned about Calypso” thanks to its “ubiquitous” appeal across retail channels. The two brands share an “island vibe,” too.

“We see this as an ability to leverage the infrastructure and the network, both DSD and supply chain infrastructure, that we have built over the last five or six years with Calypso,” said Klavsons. “It’s a perfect opportunity for us to bring in a brand where we know we can accelerate growth.”

Mela’s watermelon water grew sales over 87% to more than $6.6 million in the 52-week period ended March 21, 2025, according to data from Circana, representing total MULO w/ C-Store (Grocery, Drug, Mass Market, Military, Convenience and Select Club, Dollar, Beauty & Online Retailers).

With Calypso profitable and still growing, Klavsons said the brand is well-positioned to make further buys.

“We’re developing a platform that we’re able to leverage now with acquisition,” he said.

It’s a bottled water scandal that bubbles right to the top.

A French Senate investigation found in May that Nestlé colluded with French government officials to cover up that it had filtered its Perrier brand of sparkling water in clear violation of French and European Union standards for the term “natural mineral water.”

The report claims that Nestlé Waters had begun lobbying French officials in 2021 to allow it to continue calling Perrier “natural” while treating the water.

According to The New York Times, members of President Emmanuel Macron’s office were alleged to be fully aware that “Nestlé had been cheating for years.”

In France and the E.U., the term “mineral water” is defined as being untreated from the source and filtering the water while still using the phrase on bottles is strictly illegal.

The investigation also draws attention to a couple of pressing issues: Nestle’s plans to sell its bottled water portfolio, as well as the long-term viability of natural water sources for beverage brands.

The report comes after Perrier fell under heightened scrutiny last Spring, when water in one of its wells showed signs of contamination. Around the same time, a 2023 report shared with media showed signs of banned pesticides in some of Perrier’s water sources.

Although Nestlé destroyed at least two million bottles of Perrier for safety concerns after the contamination came to light, the company was still the subject of a French government probe following word that it had been filtering Perrier water for sale.

Nestlé paid 2 million euros (about $2.25 million) to settle the dispute in September.

While this scandal may on its face sound like a mundane dispute over labeling regulations, French senator Alexandre Ouizille told the Times it speaks to a serious issue of “regulatory capture and state-industry collusion” and one watchdog group said that Nestlé has acted as if it’s “above the law.”

Nestlé has not admitted wrongdoing but in a statement said the issue highlights “common challenges” for bottled water and that food safety is “a primary goal.”

These latest findings arrived just weeks after Nestlé reportedly hired financial advisory firm Rothschild to help with a planned divestment of its water division as the Swiss conglomerate has said it intends to focus its attention on its biggest brands, with the division valued as high as $5.6 billion, according to Reuters.

In November, Nestlé said it intended to spin out its water business – which includes Perrier and San Pellegrino – into a standalone unit and that it sought to trim costs by $2.8 billion by 2027.

It was only four years ago, in 2021, that Nestlé acquired premium alkaline water brand Essentia in a deal rumored to be around $700 million.

That deal went down within weeks of Nestlé selling its Nestlé Waters North America portfolio to the group that would become BlueTriton Brands for $4.3 billion.

While it’s not been a stated reason for seeking a sale, divesting the last of its water brands would certainly alleviate the headache of managing bottled water brands in an era where contamination appears likely to be an ongoing issue.

As the Times noted, the Perrier scandal not only raises questions about government and corporate corruption, but also the impact climate change and pollution will have on the CPG business and our food systems. Climate scientist Peter Gleick told the Times that it is “becoming harder and harder to find waters safe from contamination.”

It’s unclear whether more natural water brands will transition to filtered water in the future, and for now “natural” is still a premium position for bottled waters.

But if more contamination cases hit the category down the line, brands could be left with little choice.

Conagra Brands is saying bye-bye to Chef Boyardee.

On May 1, the Chicago-based conglomerate announced the signing of a definitive agreement to divest the ready-to-eat pasta meals producer to Brynwood Partners-owned Hometown Food Company for $600 million in cash. The transaction is expected to close in the first quarter of the Conagra Brands’ fiscal 2026 and is subject to customary regulatory approvals.

The Chef will now be slung alongside Hometown’s other brands – including the likes of Pillsbury, Hungry Jack, Birch Benders and Arrowhead Mills. The transaction includes the brand’s Milton, Pa., manufacturing facility along with all assets and operations for its shelf-stable products.

Conagra, however, will retain control of Chef Boyardee’s frozen skillets business.

Conagra is focusing on high-fiber and high-protein offerings in its core categories as it tunes its assortment for current consumer demands, specifically around weight loss and GLP1 use. Per its third-quarter earnings report in early April, the company saw both net sales and organic net sales drop 6.3% and 5.2%, respectively. During the full run of fiscal year 2024, the Boyardee business contributed roughly $450 million in net sales.

Now, under Brynwood’s guidance the firm’s CEO Hendrik Hartong told The Wall Street Journal it would work to “reinvigorate” the century-old shelf-stable pasta producer and bring The Chef’s items to new areas of the store.

Conagra first bought Boyardee back in 2000 through a $2.9 billion buyout of International Home Foods, which also gave it Pam cooking spray, Gulden’s mustard and Bumble Bee seafood, the latter of which it divested just three years later.

Brynwood has been an active player in the consumer products space, acquiring more than 60 brands and currently operating five food and beverage companies: Carolina Beverage Group, West Madison Foods, Great Kitchens Food Company and Miracola Pizza Company. Earlier this year, the firm sold its Harvest Hill portfolio business – which included Sunny D, Juicy Juice and others – to Guatemalan conglomerate Castillo Hermanos for nearly $1.5 billion.

Chobani ‘Entering a New Dimension’ With $1.2 Billion New York

Chobani is investing $1.2 billion in a new dairy processing plant in Rome, N.Y., amidst accelerated growth.

Upon completion, the Rome facility will house up to 28 production lines to process approximately 12 million pounds of milk per day. Chobani currently purchases over a billion pounds of raw milk from New York State dairy farmers annually. Once the new facility reaches full capacity, the brand expects to purchase roughly six billion pounds per year.

Founded in 2005 by Turkish businessman Hamdi Ulukaya, Chobani got its start in Edmeston, N.Y., in a former Kraft factory. With the addition of the Rome plant, the company will operate three production plants across the U.S. and one in Australia.

“With our new plant and our original home in South Edmeston, we’re entering a new dimension, partnering with hard-working people across the heartland of New York to build an ecosystem of natural food production and nourish families throughout the country,” Ulukaya said in a press release.

Notably, the dairy industry is the largest single segment of the Empire State’s $8 billion agricultural industry. New York has nearly 3,000 dairy farms that produce 16.1 billion pounds of milk annually, making it the fifth-largest dairy state in the country.

Chobani’s new project is expected to generate more than 1,000 full-time jobs in Oneida County. To help facilitate Chobani’s investment and expansion in the Mohawk Valley, Empire State Development (ESD) has agreed to provide the company up to $73 million in performance-based Excelsior Jobs Program tax credits to support the creation of these jobs.

“Through this partnership with Chobani, we’re revitalizing upstate New York’s manufacturing sector one spoonful at a time. When I took office, I pledged to make New York the most worker-friendly and business-friendly state in the nation, and projects like this show our strategy is working,” said New York Governor Kathy Hochul in a statement.

The brand has experienced significant growth over the past few years, branching out from a yogurt business into a platform that also manufactures products like oat milk and creamers. Following its $900 million acquisition of La Colombe in 2023, the company began selling cold-pressed espresso and lattes on tap at cafés nationwide and ready-todrink beverages at retail.

Chobani is the third-largest refrigerated oat milk brand in the U.S., representing roughly 20% of the category with dollar sales over $118 million in the 52-week period ending December 29, according to data from Chicago-based research firm Circana.

Last year, the privately held company saw sales climb 17% to $2.96 billion, reported The New York Times, and the new plant is expected to help Chobani meet “soaring” product demand and create runway for new innovations.

Frozen plant-based Italian food producer Sunday Supper has appointed former Good Planet COO Spencer Oberg as CEO as it readies to launch a $2.5 million seed round supporting the expansion of its brick-and-mortar distribution footprint.

Additionally, the brand has named Chris Hays as CMO and Matt Williams as head of sales. Hays previously served as senior director of brand and content at Farm Sanctuary, while Williams held senior leadership positions at Tattooed Chef and Beecher’s.

“Spencer has this amazing business ethos and we’ve always had an incredible working relationship with a lot of trust. His extensive background in helping to build Good Planet made a lot of sense. It’s time to take [Sunday Supper] to the next level,” said Richard Klein, cofounder and chief brand and product officer at Sunday Supper.

Klein and Oberg first connected while Oberg was still at Good Planet, collaborating on Sunday Supper’s new Mozza Fritto appetizer, a vegan take on the mozzarella stick crafted with Good Planet’s plant-based cheese.

“When it was time for me to transition from my job over there, it seemed like a natural fit to come [to Sunday Supper] and apply the wonderful experience and expertise I had gained into building this product and brand that I’m in love with,” said Oberg. “I think the sky’s the limit.”

Founded in 2021 by Klein alongside marketing and brand communications professional Florian Radke, Sunday Supper began as a direct-to-consumer business selling plant-based Italian Sausage Lasagna on its website. Within the first two months of launch, Sunday Supper had sold nearly 3,000 lasagnas at $45, plus roughly $60 for shipping.

However, the high cost and lack of sustainability of shipping frozen food products across the country sparked a shift to brick-and-mortar retail in 2022. Sunday Supper’s first retail account was Fresh Market in the Southeast, and the brand has since grown to 600 doors nationwide, including Giant,

Fresh Direct and Central Market, among others.

The Los Angeles-based brand expects to reach 1,000 doors by year’s end with a focus on natural and specialty retailers.

“We want to be hyper-focused on those channels because that’s where the main consumer is for this type of gourmet, healthy, indulgent plantforward product,” said Oberg. “Making sure that we gain a lot of good traction there [is important] before spreading too thin in conventional and mass.”

While a number of plant-based brands lead with the fact they are plant-based, Sunday Supper has chosen to call out that its offerings are chef-crafted, making the plantbased attribute secondary. The brand partnered with award-winning Italian chef Celestino Drago to help create its final product, marking Drago’s first and only commercial food endeavor.

“We’ve seen with the consumer that [the products’] healthy, nutritious and indulgent quality attributes are resonating very well,” said Oberg. “The fact that it happens to be plant-based, vegan and dairy-free is a benefit that we see as a great way to help people eat healthier and do better for the planet without giving anything up.”

Since launch, Sunday Supper’s product portfolio has grown to seven SKUs, including the aforementioned Italian Sausage Lasagna and Mozza Fritto, Three Cheeses Lasagna, Italian Cheese Ravioli, Italian Mushroom Ravioli and Italian Baked Manicotti.

Its flagship lasagna, which contains five servings per box, is a premium product with a suggested retail price of $17.99. Sunday Supper is venturing into single-serve products to achieve greater household penetration.

“The idea of singles is to compete with brands that are solely focused on [single serves], as well as to increase trial and [drive] better margins,” said Klein.

Oberg added, “We had valuable feedback from some of the largest natural retailers suggesting [singles]

would be a very good strategic move on our part and something they’d be quite interested in.”

Available in four varieties – Italian Sausage Lasagna, Three Cheeses Lasagna, Eggplant Parmesan and Fusilli Alla Vodka – the single-serve products have a more accessible price of under $10.

Additionally, the brand is rolling out a collection of appetizers – dubbed the “Frittos” line – that includes products like zucchini fries and fried ravioli in addition to the mozzarella sticks. According to Oberg, the new products fit into two key categories on which buyers are currently focused: snacking and appetizers.

“Early signs from the launch of the Mozza Fritto are proving this sentiment to be correct. [The product] has quickly become a top mover and is in high demand. It’s very early, but there are very exciting signals,” said Oberg.

Beyond retail, the brand is eyeing foodservice as a means of diversifying its revenue streams. According to Oberg, there is a “great market fit” in college and university grab-and-go sections, particularly with the new Frittos line.

To support its next stage of growth, Sunday Supper today launched a $2.5 million seed round. The two-tier round will consist primarily of funds and venture capital, with a smaller portion coming from a crowdfunding campaign.

According to Oberg, the decision to include a crowdfunding element is part of the brand’s “strong desire” to have its community share in its success. Once the seed round closes, the funds will be deployed to expand the team and grow the Sunday Supper’s distribution footprint.

“The vast majority will go into the growth aspect of making the product and getting it on shelves. We’re looking at a very significant growth year, [anticipating] 4x year-over-year growth,” said Oberg. “The future looks very bright.”

Cash is hard to come by, and the future is uncertain.Just look at the earnings reports of nearly every publicly traded CPG conglomerate lately.

As Ibraheem Basir, founder and CEO of A Dozen Cousins, began to strategize his business’ next stage of growth, there was one major capability on his mind, and the route to secure it was poised to provide much more support than someone simply cutting a check.

In May, A Dozen Cousins announced its acquisition by Verde Valle Foods, the U.S. subsidiary of Verde Valle, a ready-to-eat pouched bean and Mexican meal manufacturer producer of Mexican bean and meal brand Isadora. We sat down with German Rosales, Verde Valle Foods U.S. CEO, and Basir, now general manager, to learn what potential benefits both sides saw in a business combination.

Rosales said Verde Valle has admired Los Angeles-based A Dozen Cousins virtually since its founding, but a brief encounter with Basir at Natural Products Expo West in 2024 started a conversation about the potential to collaborate. According to Basir, he was not necessarily seeking an exit, but as he assessed his business’ runway, he recognized that it needed manufacturing capacity and support.

“We always try to think about capital as a tool – like what is the funding needed to get to the next stage in the business,” Basir explained. “Sometimes that has been traditional equity, at other times it’s been debt, at other times it’s been creative terms with suppliers. We take a pretty creative approach in terms of what we do to get to the next stage. This past year what became clear to me was, what we really need is support in terms of manufacturing and manpower.”

A Dozen Cousins received early support from the Chobani Food Incubator, and it has received investment from firms including Emil Capital Partners and RCV Frontline, as well as notable CPG execs including John Foraker and Gail Peterson. As the conversation with Verde Valle evolved, and as Basir got to know the team, he said the backing of a large, legacy company was an appealing proposition.

It helped that Basir was a fan of Verde Valle’s Isadora brand as well. He recounted that just weeks before meeting the team at Expo, A Dozen Cousins had conducted an in-house competitive tasting that included Isadora’s refried black beans as part of the panel.

“We tasted Isadora and I was like, ‘Man, these are really good,’” said Basir. “Honestly, they were better than ours, which I didn’t say at the time, but I don’t feel shy admitting now.”

It became clear to Basir that the synergies and capabilities Verde Valle could provide would unlock plenty of runway for years to come. As general manager, Basir will also retain control of the brand’s day-to-day operations within Verde Valle’s larger organization, and he will continue to lead the business and its growth with the entire A Dozen Cousins team now on board at Verde Valle, per terms of the deal.

“We obviously liked the brand a lot, but we were also very excited for the opportunity to have Ibraheem join the team,” said Rosales. “That was a big part of the rationale behind the acquisition and his new title, general manager, it tells you a lot about what you need to know in terms of his decision making ability going forward.”

Long term, A Dozen Cousins plans to leverage Verde Valle’s internal manufacturing network and R&D team, which Basir said was a “big value driver” in the deal. He said that as the brand has grown over the past two years, it has not been able to thoroughly meet market demands.

“As a startup, you’re constantly fighting for line time, making sure you have enough capital to build inventory, trying to turn things around really quickly from producer to retailer,” Basir said. “As a result we’ve never felt like we fully satisfied the market demand for our products… as an entrepreneur, you spend so many years and hours trying to build a brand and a product that people want, and then once you’ve created that demand, to not be able to fully fulfill it is really one of the most frustrating feelings in the world.”

That added capacity is what Basir claims he is “most excited about,” in addition to tapping the expertise of its R&D team. He believes that the ability to “jointly imagine” new products, while also having the resources and “ability to help bring it into the world” on hand will be a major unlock for the business.

Though A Dozen Cousins will accelerate its growth in the coming year, Basir said he will maintain the thoughtful approach he has always taken when entering new retailers and markets. The brand, which currently spans beans, sauces and pouched rice products, distributes to retailers nationwide including Whole Foods Market, Sprouts, Fresh Market, Publix, Meijer, Target, Walmart, Kroger, Thrive Market, Wegmans and more.

Verde Valle remains the category leader in pouched readyto-eat beans in Mexico, Rosales emphasized, and brought its Isadora brand to the U.S. nearly a decade ago. However, over the past year, the brand has found a new consumer base in non-Hispanic markets and is working to expand its presence across retail channels.

That’s where A Dozen Cousins comes in.

Rosales believes the brand’s strong natural retail relationships will be integral to Isadora’s growth and evolution. The two brands complement one another, he added, noting that Isadora is rooted in “authentic Mexican recipes” while A Dozen Cousins takes a unique approach to its formulations, blending flavors from Latin America, Creole and Caribbean cuisines.

“We don’t necessarily see our products competing with each other,” Rosales said. “More than half of our consumers are nonHispanic [per Nielsen data] so we’ve now seen the opportunity to cross over Isadora to mainstream consumers. We’ve seen success last year, and so we’re very excited to expand our client base as part of a partnership with A Dozen Cousins.”

Mary’s Gone Crackers, a manufacturer of organic glutenfree snacks founded in 2004, has been acquired by Rosseau Incorporated, a U.S.-based subsidiary of Canadian food conglomerate Dare Foods Limited.

Mary’s prior owner, legacy Japanese food business Kameda Seika Co., agreed to divest the brand in a debt equity swap, with a deal reached on April 29.

According to an April 30 filing by Kameda, Mary’s will convert a loan it received from Kameda into equity, in the amount of $60.7 million, through the debt equity swap process, which will be transferred to capital surplus. No shares will be issued.

Kameda had acquired Mary’s in 2012 as part of a strategic expansion into the U.S. market, with a goal of establishing a portfolio in the emerging better-for-you set.

However, the brand has recently “been facing challenging business conditions,” the company reported, including “soaring raw material prices” that have pushed Mary’s Gone Crackers to undergo reforms “such as improving production efficiency and launching new products.”

For its U.S. business, Kameda has opted to now focus on its TH Foods subsidiary, which it sees as an avenue to “invigorate the rice cracker products in the USA market, aiming to become

a ‘Rice Innovation Company’ that maximizes the potential of rice and creates new value and new markets around the world”.

A spokesman for Mary’s Gone Crackers declined to comment on the deal, noting only that the brand is adapting to the new ownership structure.

The deal comes as Mary’s has been working to revamp its brand and grow via innovation. The company introduced a new package design earlier this year and is moving to a smaller 4 oz. pack size that is intended to lower its SRP. The brand previously reported doubling its manufacturing capacity in early 2024 and in August it brought on tech industry veteran Roger Yoder as VP of marketing and business development.

In Canada, Dare manufactures several lines of crackers and cookie brands including Bear Paws, Breaktime and Normandie.

For the second time in two years, Hain Celestial is once again changing its leadership team and initiating a strategic portfolio review after reporting Q3 net sales dropped 11% year-over-year to $390 million, driven by declines across all key segments with the exception of meal preparation.

The company appointed Alison Lewis as interim president and CEO, replacing Wendy Davidson. Lewis has served as an independent director on the company’s board since September 2024 and was previously CMO at Johnson & Johnson in addition to spending over 11 years at Coca-Cola, leading the Odwalla business and later serving as SVP and CMO of North America.

Following Davidson’s appointment in 2022, Hain later implemented its Hain Reimagined transformation plan; however, analysts and shareholders were hesitant about the latest turnaround effort, which also leans heavily on past initiatives to streamline operations and simplify the portfolio. Ken Goldman of JP Morgan asked executive leadership during the Q&A portion of the call “what’s different this time… we’ve heard all of it before a few times.”

Lewis, acknowledging that it is her first day on the job, offered little specificity into the new transformation effort. She instead pointed to the understanding she has derived from past experiences on “what makes the machine tick,” including a digital-first strategy, great innovation, strong revenue growth management and superior P&L management against margin accretion, with an added emphasis on gross margin and EBITDA.

“There are things that can be done differently and will be done differently as we move forward,” added Dawn Zier, chair of the board. Per, the company’s Q3 results today, there is plenty of room for improvement, particularly across its North American business.

Third quarter organic net sales declined 10% year-over-year across its North American business, contributing 80% of the “top line shortfall,” said CFO Lee Boyce on the call. Two-thirds of that decline stemmed from softness in its snack segment, Boyce added, which saw organic net sales decline of 13% yearover-year, primarily due to poor execution of Garden Veggie’s promotional strategy.

SKU rationalization, softness across its pouch business and smaller velocities across its Earth’s Best formula business contributed to a 6% organic net sales drop in Q3 year-over-year. Beverage segment organic net sales fell 7% year-over-year due to channel shifts in Europe for its non-dairy milk offerings and poor execution against its Celestial Seasonings business at the start of “hot tea season;” the brand pulled double digit velocities, but sales volume growth was offset by a temporary stocking issue at the beginning of the quarter.

The lower-than-expected results were also driven by a shortfall in pricing actions not keeping pace with the impact of trade, investment and cost inflation. Hain is preparing for the impact of tariffs by rebuilding inventory, reallocating resources and shifting some manufacturing and R&D activities but, overall, doesn’t expect impending tariffs to have a material impact.

“Most of our products are produced and sold in the same region, making us less subject to tariff impact on finished goods and cross border shipping,” Boyce said. “We have some exposure on raw materials that cannot be grown or sourced in the U.S.; however, based on what we know today, we do not expect any material cost impact in fiscal 2025 and we are actively working to mitigate any impact going forward.”

Meal preparation segment sales provided a small bright spot within Hain’s Q3 results, with organic net sales up 1% due to strength in its branded U.K. soup business and growth in U.S. yogurt.

As Hain works to improve its top line, Boyce outlined five key levers it will pull on: “simplifying our business and reducing overhead spending; accelerating renovation and innovation in our brand; implementing strategic revenue growth, management and pricing actions; driving operational productivity and working capital reduction; and finally, strengthening our digital capabilities.”

The company has already made advancements to shift and simplify distribution networks, as well as consolidating its corporate office footprint between Canada and the U.K., Boyce explained. Additionally, Hain has simplified its strategic partner network, reducing co-manufacturing partnerships by 23% and raw material and packaging vendor relationships by 13%. Further cost structure optimization efforts are expected to contribute $25 million in run rate cost savings by the second half of FY26, the company said.

“I’ve spent my career building and scaling consumer brands, and I believe Hain has many of the right ingredients to succeed… that being said we also need to be realistic about where we are today,” Lewis said. “Our third quarter results were disappointing and fell short of our expectations. We are not where we need to be, and we cannot afford to stand still. To that end, we are taking a hard look at our strategic plan to leverage what is working and address the areas in which we need to make changes.”

Rhinegeist is ghosting alcohol. The Cincinnati craft brewery will add its first non-alcoholic (NA) beer to its portfolio later this summer.

Ghost is an “affiliated brand” that plays on the “geist” name, meaning ghost or spirit, Rhinegeist CEO Adam Bankovich told Brewbound.

The NA beer is one of two big portfolio additions for Rhinegeist this year, with Cincy Light’s first line extension, Cincy Light Lime (4.2% ABV), rolling out now on draft.

Ghost Haze and Ghost Pils will launch in 12 oz. can 6-packs across Rhinegeist’s full nine-state footprint – Ohio, Pennsylvania, West Virginia, Kentucky, Tennessee, Indiana, Illinois, Michigan and Wisconsin – in mid-August.

Conversations about NA beer have been ongoing since Bankovich joined Rhinegeist in fall 2022. But the company didn’t have a pasteurizer or the space for one. NA beer production is a difficult endeavor to take on due to food safety concerns.

“We got comfortable with this idea that maybe we just don’t make our own non-alc,” Bankovich explained. “If we can’t make it and it’s of the same quality as all the beer and cider and everything that we make, that’s OK.

“We can still put our stamp on it if we have a partner that we trust,” he continued.

Enter Sustainable Beverage Technologies (SBT), its BrewVo technology and their partner facilities.

SBT has worked with other craft breweries to create NA beers, most notably Deschutes Brewery. Rhinegeist is SBT’s latest partner brand, with production of the Ghost line being

pulled forward due to initial sales forecasts exceeding expectations, Bankovich said.

With a mid-20s share of craft beer in the Cincinnati market, Rhinegeist expects to gain a significant piece of NA share in its home market.

“There’s no reason why we shouldn’t have some share of the non-alc beer market, where we have that much share of the craft beer market,” he said.

Rhinegeist is projecting “really modest” growth this year, with the company targeting around 1.6 million cases in 2025, following 7.5% growth in 2024, Bankovich said. Forecasting the impact of NA beer on the business this year is difficult due to scan data not capturing direct-to-consumer (DTC) ecommerce sales, Bankovich explained. However, DTC sales aren’t likely to be part of Rhinegeist’s strategy, he added.

“For now, it’s really modest expectations,” he said. “[NA is] a really tiny bit of our plan for this year, but it could absolutely grow into something meaningful.”

Before Ghost’s arrival, Rhinegeist is pushing out Cincy Light Lime on draft, which hit the Cincinnati market two weeks ago.

Rhinegeist’s previous plan was for a fall release ahead of resets, but positive feedback from consumers led the brewery to kick out Cincy Light Lime faster. Rhinegeist will follow draft with 16 oz. single-serve cans in June and 12-packs cans later in the month, Bankovich said.

“We’ve got some key retail partners that are really excited about [16 oz. singles], which is a new way for us to launch something to both capitalize on summer, but not get the full volume package out there just yet,” Bankovich explained.

Cincy Light Lime’s arrival comes nearly two years after the launch of Cincy Light in June 2023.

The U.S. beer industry generated $470.96 billion in economic output in 2024, holding 1.58% of the country’s gross domestic product (GDP), according to the biennial Beer Serves America study commissioned by the Beer Institute (BI) and the National Beer Wholesalers Association (NBWA).

Beer’s economic impact increased by around $61.76 billion compared to the last survey, which covered 2022, when goods and services reached $409.2 billion, with a similar GDP, according to the survey conducted by John Dunham & Associates (JDA), using data from Data Axle, industry sources and government publications.

The beer industry alone directly generated $179.96 billion in economic output, while suppliers contributed $146.33 billion and induced output amounted to $144.66 billion.

The total economic output of beer outstripped every alcohol category, BI chief economist Andrew Heritage shared during a call with members of the trade press.

The spirits industry generated $250 billion in economic activity and supported more than 1.7 million jobs in the U.S. last year, according to the Distilled Spirits Council of the United States. In 2022 (the most recent year in which data is available),

wine generated $276 billion in annual output and supported 1.84 million jobs. Beer dwarfed both categories’ economic output and employment.

“Americans not only love beer, but beer is an economic powerhouse,” Heritage said during the briefing.

Amid industry volume declines, the growth in economic output was driven by two years of inflation, price increases, premiumization, innovation and increased wages and employee benefits such as health insurance, NBWA chief economist and VP of analytics Lester Jones told Brewbound.

“The good news is that beer has kept pace and that demand for beer has been able to support the upward pressure on retail wages,” Heritage added.

In addition, for every $1 invested in the beer industry, $2.31 was generated within the U.S. economy, Heritage said, referring to the industry’s “multiplier effect.”

“Beer is connected to local economies in a way that really not very many industries are,” Heritage continued. “You’d be hard pressed to think of an industry that has a manufacturing plant the way that there’s a brewery in every single congressional district.”

Bev-alc industry members continue to tout concerns that Gen Z is drinking less, with many blaming the generation’s increased attention to health and wellness versus previous generations.

However, that narrative is “greatly overblown,” according to Rabobank senior beverage analyst Bourcard Nesin in a recent report from the financial services company.

Nesin turned the narrative on its head, noting that while bev-alc consumption is down for Gen Z consumers – both of legal drinking age (LDA) and underage – their habits could actually be a good thing for the bev-alc industry.

“In particular, we find that Gen Zers’ alcohol consumption will likely increase significantly as they age, such that by their mid-30s, their consumption will be much closer to that of previous generations,” Nesin wrote. “This is an ideal outcome for the alcohol industry, which can celebrate the declines in underage drinking and binge drinking, while still benefiting when Gen Zers reach their more mature and responsible prime spending years.”

of 13- to 27-year-olds, with the spending of generations made up entirely of LDA consumers. More importantly, less than half of Gen Z consumers “have established an independent household,” so the majority of the generation is not included in the data.

As a result, comparing spending across generations fails to “distinguish between shifts in behavior driven by life stage and shifts in behavior driven by generation,” Nesin wrote. Other life stage factors include many Gen Z consumers are working entry-level jobs or working to obtain college degrees, and “don’t have any money to spend on alcohol.”

Earlier this year, the U.S. Bureau of Labor Statistics (BLS) released annual bev-alc spending numbers by generation, shocking many industry members with the realization that Gen Z (those born between 1997 and 2012) spends more than 87% less than the next youngest generation, millennials.

Households led by Gen Z consumers collectively spent $3.6 billion on bevalc in 2023, compared to $25.5 billion by millennial-led households, $27.5 billion by Gen X households and $25.5 billion by baby boomers.

However, comparisons are misleading, according to Nesin. The data includes all Gen Z consumers, not just LDAs, comparing the bev-alc spending

“This was also true of millennials, Generation X and baby boomers when they were in their twenties,” Nesin wrote.

What provides a more accurate picture of Gen Z bev-alc spending versus older generations is to look at what percentage of consumers’ income is spent on bev-alc. When doing so, Gen Z doesn’t look that different compared to its counterparts.

As of 2025, Gen Z consumers spend about 0.72% of their after-tax income on bev-alc, in line with millennials (0.72%) and the national average (0.73%). Gen Z consumers spend less of their income on bev-alc versus baby boomers (0.83%), but spend more than Gen X (0.65%).

Where spending has declined is in comparing that percentage to generations when they were of a similar age, as “younger people used to spend a much higher share of their income on alcohol,” Nesin wrote.

Between 2012 and 2013, households led by people under age 30 spent 1.11% of their after-tax income on bev-alc, and 0.68% on non-alcoholic (NA) beverages, Nesin reported, citing BLS data. Between 2022 and 2024, the percentage spent on bev-alc declined to 0.74%, with 0.63% spent on NA beverages.

The decrease isn’t unique to Gen Z, but is steeper than previous generations. Between 2012 and 2013, households led by people over age 30 spent about 0.6% of their after-tax income on bev-alc, and 0.57% on NA beverages. Between 2022 and 2024, the amount spent on bev-alc fell to 0.61%, while spending on NA beverages increased to 0.64%.

What can be accurately compared among generations is underage drinking, which has declined significantly among Gen Z consumers.

In a 1991 survey by Monitoring the Future, 64.4% of high school seniors reported they “had been drunk at least once in their lifetime.” As of 2024, that percentage had fallen to 33%.

Gen Z’s concerns over the negative effects of bev-alc on their health has been

blamed by many for this decline, but that’s not necessarily the case, according to Nesin. The same survey asked respondents whether they perceived a “great harm” from consuming “five or more drinks once or twice each weekend.” Between 2008 and 2019, the percentage of respondents who said yes remained consistent, between 46% and 49%.

Note: In 2021, Monitoring the Future changed its methodology for this part of the survey, so data after is “not comparable,” Nesin noted. For transparency, the percentage of respondents who perceived a risk from 2021 to 2023 was between 34% and 39%.

A bigger influence on Gen Z’s habits is the introduction of cell phone culture, according to Nesin. Most of the decline in underage drinking happened after 2012, with the percentage of high school seniors reporting drinking falling from about 50% in 2012 to 35% a decade later.

2012 was also “about the time when the use of mobile devices became an ubiquitous part of teenage life,” Nesin wrote. The share of the population aged 12 and older who own a smartphone was around 31% in 2011, and increased to 44% in 2012, according to a 2022 report from Edison Research and RaboResearch. As of 2021, that number had increased to 88%.

With increased cell phone use comes numerous hits on bev-alc spending, including:

A decline in in-person social gatherings now that digital connection is more accessible, in turn affecting the number of occasions young people have to purchase and consume bev-alc.

The use of location tracking, as “every parent with teenage children can track their location 24 hours per day” thanks to their cell phone, adds more risk to underage gatherings with alcohol.

And the ease of access to cameras and social media, which increases the risk of an underage person being filmed consuming alcohol and the consequences of being caught, as school administrators – and college admissions teams – can see what young people are doing.

The true impact of cell phones on future bev-alc consumption by Gen Zers is unknown, Nesin noted.

“On one hand, the move away from in-person socialization toward social media seems like a permanent shift with consequences for young people’s well-being that go far beyond alcohol consumption,” he wrote. “If one assumes that this is the factor driving the declines in alcohol use, then future consumption seems unlikely to recover to historic norms as Gen Zers reach their prime spending years.

“However, if the main driver is universal parental surveillance and a loss of privacy making underage drinking a far riskier activity than it was in the past, then that is a condition or restriction that will disappear as Gen Z becomes more independent during later years of adulthood,” he continued. “Ultimately, these facts together suggest that as they age, Gen Z will probably drink less than previous generations, but that gap between Gen Z and other generations will shrink significantly over time.”

Craft brewers’ collective production declined 4% in 2024, to 23.1 million barrels of beer produced, according to the Brewers Association’s (BA) = annual craft brewing production report.

The trade group representing small and independent craft breweries described 2024’s numbers as “highlighting the new realities of a maturing market in a rapidly evolving environment.”

“In a mature market, not every year is going to be defined by substantial growth,” BA staff economist Matt Gacioch said in a press release. “While progress may not come in additional production volume, it can still come in honing operations, business practices, and world-class beer.”

Although craft’s volume declined, its market share by volume held steady year-over-year (YoY) at 13.3%, even as the overall U.S. beer market’s volume fell (-1.2%).

Craft made up nearly a quarter (24.7%) of total beer market retail dollar sales in 2024. Driven by price increases and onsite sales, the retail dollar value of craft increased 3% YoY, to around $28.9 billion.

The number of U.S. craft breweries in operation declined to 9,612 in 2024, which breaks out to:

• 1,934 microbreweries;

• 3,389 brewpubs;

• 3,695 taproom breweries;

• 266 regional craft breweries.

In 2024, 9,680 total breweries (craft and non-craft) operated in the U.S., a decrease from 9,747 in 2023.

The BA also adjusted its opening and closing numbers for 2024, with closures (501) outpacing openings (434) for the first time since 2005. The BA reported preliminary numbers in December, with 399 brewery closures and 335 openings.

The number of jobs in the craft brewing industry increased 3% versus 2023, to 197,112. The BA said the increase in jobs was due to a “shift toward hospitality-focused models such as taprooms and brewpubs, which create more jobs in local communities.”

The BA pointed to several headwinds facing craft brewers “rising ingredient costs, shifting consumer preferences, and increased competition in a saturated market. Tariffs on imported brewing equipment, steel kegs, aluminum cans, and key ingredients such as hops and malt only exacerbate these financial pressures.”

The organization added that those issues are exacerbated for small brewers operating on “tight profit margins,” leading them to “delay expansion plans, raise prices, or absorb losses.”

Ball Corp. chairman and CEO Daniel W. Fisher has once again called on major beer manufacturers to deploy “more aggressive pricing” strategies to “push volume,” suggesting those strategies have worked for energy drink companies and other non-alcoholic (NA) beverage producers.

“Non-alcoholic, in general, there’s been enough innovation in that segment, along with more constructive pricing to drive volume,” Fisher said during Ball’s 2025 Q1 earnings report, echoing similar sentiments made on earnings calls last year.

“You haven’t seen that on the beer side.”

Fisher explained that non-alcoholic beverage manufacturers have been innovating and chasing volume, with “moderate pricing in line with CPI [Consumer Price Index], maybe even take a little less than that and go back and get that growth.”

The expectation for beer producers is to moderate pricing during the peak summer selling season in order to move product, but thus far, beer is “a little behind” compared to NA producers.

“I don’t think anybody’s happy where mass beer is here through the first quarter,” Fisher said. “I’m not surprised that they’re going to have to use the affordability lens and push that.”

Nevertheless, Fisher expressed cautious optimism that beer producers will lower prices and increase their marketing efforts to drive volume and sales this summer.

Beer pricing was just one of the hot topics to come up during the call with Ball leadership, who also fielded several questions about tariffs, including the 25% Section 232 tariffs enacted by President Donald Trump on aluminum and steel imports in March.

Throughout the call, Ball execs referred to the company’s “defensive business model,” as well as its “global footprint” as advantages, despite volatility caused by tariffs and “geopolitical dynamics.”

Despite those headwinds, Fisher referred to the start of 2025 as “very constructive” and the tariffs as manageable thus far. The 232 tariffs have amounted to “three-quarters-of-a-cent to a-cent-a-can impact,” which Fisher called “really negligible in the grand scheme of economics.”