There’s a theory that we no longer live in a society that takes anything seriously. But I’m just starting to think the savagery of the social media environment has sapped our sense of humor to the point where it’s almost impossible to maintain the perspective required to know when something is so far out of bounds as to be just… silly.

To illustrate this point, I bring you the latest swell of excitement around the David Bar. I’m writing this a few days after the company announced it was selling frozen boiled cod as part of a marketing campaign to make the point that their main product is a much more appealing and only slightly less nutritionally efficient on-the-go protein source than a block of frozen whitefish.

By Jeffrey Klineman

There’s only one problem - the campaign may have been too good. Now they’ve gotta sell the fish. I kid. They were always planning to sell the fish. To prove a point, But folks are taking this stuff really seriously. Like the listeners who still believe the Martians are coming after they heard a replay of The War of the Worlds broadcast, many internet folks are still out there saluting the brilliance of the cod strategy as a serious line expansion.

Here’s the LinkedIn reaction of a guy who’s an actual CMO. Note the sentence structure, which imparts an almost poetic meter to the hysteria:

“David Bar gets it.

They started as a protein bar brand.

Today they announced they’re selling frozen cod. Wild-caught. Zero sugar. 23g of protein.

Feels random — until you realize they’ve always been selling one thing: High-quality protein.

That’s the brand.

And once you know what you’re really selling, expansion becomes obvious.”

No, dude. David Bar gets it in the sense that they’re making the point that their bars are a great protein source. The branded cod is about as likely to be a long-term play as Liquid Death’s SKUs featuring Tony Hawk’s blood.

Blame it on the heat. After all, it’s the silly summer CPG season, when all of the products have already gone into the sets and most of the action is happening online.

It’s going on in beverage, of course, as well. You’ve got Pepsi rolling out their second attempt to compete against Poppi via a prebiotic cola, only this time, they’ve got the ultimate advantage: they own both brands!

Meanwhile, our friends at Coke found an even more ominous threat, the possibility that the President of the United States of America wanted to troll them on social media.

As you’ve probably heard by now, President Trump threw his weight behind a call for Coke to re-launch their flagship product with cane sugar, a move that quizzically played chicken not just with the beverage giant but also with his own tariff policies, as the U.S. imports most of its cane sugar, and also provides massive subsidies to corn growers, who provide the “C” in HFCS. Also, it’s not lost on me, or anyone within earshot of me, that the product he’s demanded Coke make is actually known as Mexican Coke,

and I’d gladly pay 5X per bottle for that to be the name of that particular line extension.

Cue: the National Guard descending on 1 CocaCola Plaza, attempting to send Mexico fellow traveler James Quincey back to Great Britain.

It’s so hard to understand what Trump is trying to accomplish here. Sure, his secretary of Health and Human Services, Robert F. Kennedy, Jr., dislikes HFCS, but he dislikes real sugar only a little less than that, and nutritionists don’t see a lot of value in the change.

Still, it’s the silly season, when massive companies are throwing (unbleached!) bread and circuses at the administration. It’s clear that in the back of their minds there’s a Kid Rock-shaped shibboleth, waiting to hit their own products with a scatter gun, and rather than face some kind of Bud Light-sized disruption, the cheapest option they’ve got is to concede a little bit of ground.

So you’ve got companies that have been gradually moving away from certain food dyes forswearing them en masse, giving RFK a chance to crow, while also keeping him off their backs about the really major supply chain changes that would have to take place for the food system to match what medical and nutritional experts – not activists, but scientists –would recommend.

Fortunately, RFK’s belief in science seems to only go as far as its willingness to agree with him for a sound bite; if there was some way for scientists to rename vaccines “magic ouch serum” do you think he’d resume access to them? What if we label the “pointy magic applicators” with “guaranteed mercury-free?”

It could work. After all, being mercury-free seems to be one of the chief attributes of the latest David product. That David Bar really gets it.

As we slog through the serious dog days of summer (get it?), I thought it’s a good time to assess how the beverage marketplace is holding up: after all, we’re at the mid-point of the year and the high season for hydration. Yesterday, I spent a day out in the field with a brand doing store checks. It’s always a fun thing to do. I so enjoy their enthusiasm and glee when their product is in the array of brands on the shelves. Yes, they always want a more prominent placement, but overall they’re grateful that it’s displayed at all.

Being in the field gave me the incentive to check into dozens of brands to see how their years are evolving, so I hit the phones, trying to understand their thoughts on the business atmosphere. Overall, they reported, it’s been strong, but growth was slower than they wanted. Sadly, it’s been hard to expand. Profit margins are a common thread in our conversations. Those with more than four SKUs are disappointed

that the full line isn’t taken. Still, as a small brand, it’s hard to find the clout to merit more. It’s imperative to be realistic in your expectations. But being forced to scale back brings on grave unease. We all know the statistics of beverage failure rates. I hear that fear.

The talk of investors and acquisitions is a major topic: so many brands are under-financed and in need of capital. I hear jealousy and wonder how some companies are able to raise money. I’m always asked what the formula is that enables comparable brands to secure the cash they need? I cannot answer this query with any real certainty. Which brands will the big wallets deem investment worthy? It’s a crapshoot. There are so many brands in need of money that deserve that infusion of cash.

I wish only success to those bold enough to launch beverages. Hang in there, and I’ll be looking for you on the shelf.

www.bevnet.com/magazine

Barry J. Nathanson Publisher bnathanson@bevnet.com

Jeffrey Klineman Editor-in-Chief jklineman@bevnet.com

Martín Caballero Managing Editor mcaballero@bevnet.com

Monica Watrous Managing Editor, Nosh mwatrous@bevnet.com

Justin Kendall Editor, Brewbound jkendall@bevnet.com

Adrianne DeLuca Assistant Managing Editor, Newsletters adeluca@bevnet.com

Lukas Southard Senior Reporter lsouthard@bevnet.com

Brad Avery Senior Reporter bavery@bevnet.com

Zoe Licata Senior Reporter, Brewbound zlicata@bevnet.com

Shauna Golden Reporter sgolden@bevnet.com

Sales & Ad Operations

John McKenna Director of Sales jmckenna@bevnet.com

Adam Stern Senior Account Specialist astern@bevnet.com

John Fischer Senior Account Executive jfischer@bevnet.com

Lou Calamaras National Account Executive lcalamaras@bevnet.com

Jon Landis Business Development Manager jlandis@bevnet.com

Colin Sughrue Digital Campaign Coordinator csughrue@bevnet.com

Jen Miles Digital Ad Operations Coordinator jmiles@bevnet.com

Art & Production

Aaron Willette Design Manager

BevNET.com, Inc.

John Craven CEO / Founder / Editorial Director jcraven@bevnet.com

Headquarters 65 Chapel Street Newton, MA 02458 617-231-8800

Publisher’s Office 1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

Subscriptions

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

By Gerry Khermouch

Politically, it’s been treated as more than just local news: an upset victory in New York City’s Democratic mayoral primary by the relative political neophyte Zohran Mamdani has been covered nationally as potentially carrying useful lessons for a national Democratic Party that’s searching for ways to better connect with voters. Or, conversely, maybe it’s a way to send even more swing voters scurrying to the Republican camp, considering that he’s a Muslim socialist who wants to make the buses free and raise taxes on the rich and is inevitably being demonized by the far right as a communist terrorist.

Either way, in absorbing the post-mortems on how an underfunded three-term state assemblyman, just 33, could have demolished the lavishly backed Andrew Cuomo campaign, among other established rivals, in the city’s first ranked-choice primary, it occurred to me that they’re pointing to the same dynamics that bev nerds like us understand to explain the success of insurgent beverage brands.

It’s one of the enduring glories of this industry that brands lacking the experience, connections and resources of bigcompany rivals are able to succeed, and they’re mirrored in the mechanisms that Mamdami employs. So drawing the parallels strikes me as kind of interesting.

One such mechanism is visual storytelling, harnessed to an authentic story. The son of a lauded filmmaker (his mom is Mira Nair, who directed movies like Mississippi Masala), Mamdani seems to have a gift for visual media and has brilliantly harnessed social media to amplify his messaging, hitting viral pay dirt with posts of him taking the polarbear plunge into the frigid Atlantic, dressed in his suit no less, or walking the length of Manhattan chatting up the folks he met. “The more Mr. Mamdani posted, the more people posted about him, and soon, whether or not you were following the New York City mayoral race, there were Mamdani videos in your feed,” as The New York Times characterized the effort. (That does seem to be how social media works.) Those videos “explained his plans for a rent freeze

and free bus service and childcare in simple terms, propelling him swiftly from relative obscurity as a state lawmaker to a household name.” Tsk-tsking by rivals like incumbent mayor Eric Adams, who’s running on an independent line, seemed to miss the point. “Let’s be clear: They have a record of tweets,” Adams harrumphed, not deigning to mention his young rival by name. “I have a record on the streets.”

Then there’s the entertainment-driven effort to build a cult of personality where even outrageous, seemingly counterproductive, statements and stunts serve to dominate the discourse and generate waves of social media attention. Trump, of course, is a master of that, to the point where adherence to his personal brand trumps absurdities like his campaign promises to end inflation and the Ukraine war on day one of his new administration. As an incumbent elected state official Mamdani surely knows that decisions like free daycare won’t be his to unilaterally make as mayor. But niceties like that can be dealt with later; for now, the priority is to make his sympathies with working New Yorkers clear in as emphatic a way as possible.

Another is navigating the hidden channels that the big guys don’t reach and may not even know about. While Cuomo spent millions running attack ads but little time doing “retail” politics in the streets and meeting halls, Mamdani attached himself to the city’s halal carts and bodegas to pop up in ways that resonated as far more authentic. While in these urban interstices, he seemed to genuinely listen to what people had to say about what was troubling them about the city.

It all amounts to a kind of asymmetric warfare where the challenger brands turn the advantages of the giants against them. Those of us with a longer perspective will recall that, going back to the earliest days of so-called “new age” beverages, new brands with little in the way of commercial armor have been able to turn the tables on the beverage giants. After all, Snapple was created by a pair of New York window washers and their friend who operated a health food store,

who harnessed such then-insurgent media as The Howard Stern Show to get the word out. In their early days, some of the general-market coconut water brands worked channels like yoga studios that were terra incognita to the big beverage players, even as FitAid incubated in cross fit boxes. (I will also argue that the independent DSD channel, as frustrating and inconsistent as it can be, is another such semihidden channel.) As brands like Red Bull and more recently Liquid Death and Poppi have shown, you can get pretty far riding our new entertainment economy where the medium really is the message rather than brand pitches that focus on product attributes and promotional pricing. And while bigger brands may think they’re listening to their consumers, they rarely are able to pivot as quickly in response to what they hear.

As for forging a cult of personality, nobody did it better than Jack Owoc in building Bang Energy, posing on social media in gangsta-like bling and calling out by name his business rivals at brands like Monster (who would end up having the last laugh when they acquired the brand out of bankruptcy). It may not be a coincidence that Owoc was a major contributor to Trump. And like Trump, when things seemed to be unraveling, he rarely betrayed any chinks in his selfconfidence. Only the outcome proved to be different.

There does seem to be one key difference. I found the right’s lurid attacks on Mamdani to be very disappointing: after all, his stances would seem to provide plenty of fodder for conservatives without their having to make up stuff. By contrast, it’s heartening that those kinds of false accusations don’t actually seem to have a corollary in beverages, where the strategics may use their market clout to blunt the inroads of challenger brands but generally don’t trash-talk them or whisper conspiracy theories behind their backs. (There are occasional exceptions, as when Anheuser-Busch in the 1990s orchestrated a Dateline report to try to derail Sam Adams and the craft beer movement by highlighting how the “microbrewed” beer actually was produced within immense Stroh tanks.)

Finally, a last word about those social signifiers that loom so large in defining who is a genuine New Yorker. Years ago, Mayor David Dinkins surely lost some votes when he showed up at the Guinness tent at the massive Caribbean Day parade and helped himself to the brand’s pallid lager extension. While some of the other candidates try to avoid such purity tests, Mamdani happily wades in to take his chances. Take the time he was strolling in lower Manhattan with an influencer who had adopted the theme “How New York is Zohran?” “Just a little if-you’re-a-real-New-Yorker test,” she warned him. “AriZona or Snapple?” “It’s got to be AriZona,” he replied, choosing the family-run Long Island bodega staple over the now-corporate brand based in Frisco, Texas. Hey! Maybe I’ll vote for this guy after all.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Keurig Dr Pepper (KDP) acquired drink mix manufacturer Dyla Brands, which produces Stur and a growing portfolio of co-branded liquid and powder mixes, the company announced during Q2 earnings call in July.

Financial terms of the deal were not disclosed.

KDP was previously a minority stakeholder in Dyla and held a seat on the company’s board of directors. Beginning around 2020, the company began licensing a number of its portfolio brands to Dyla to create drink mixes, including products like Hawaiian Punch, Crush Orange Soda, 7-Up, A&W Root Beer, Snapple and C4 Energy.

The acquisition provides KDP with 100% ownership of the business.

The deal, however, does not include the Happy Viking protein powder brand developed in partnership with Venus Williams, which will be spun out and continue as an independent business.

Speaking to BevNET, Dyla founder and CEO Neel Premkumar said that the company will continue to operate independently for the foreseeable future with all staff expected to remain in their current roles, but KDP’s ownership will provide an even bigger opportunity to expand the business in retail.

“We’ve just kind of consistently been growing every year, and it got to a meaningful size for them,” Premkumar said. “The category itself is on fire – the water treatment category is now about $4 billion and we do over 1.5 billion servings a year.”

According to Circana, U.S. retail dollar sales of Stur brand drink mixes were up 4.3% to about $16.6 million in MULO and c-store for the 52-week period ending April 20, 2025. However, that’s only a fraction of Dyla’s total business, which also includes online sales with a constant stream of

LTO launches, and a growing slate of licensed products with non-KDP aligned brands as well.

Premkumar said that in recent months, Dyla has been producing mixes for brands like Sparkling Ice, Dole and Ocean Spray.

Dyla also recently took over production of Liquid Death’s powdered Death Dust line. Launched last year, Death Dust suffered initially from a poor manufacturing run with lessthan-desired quality. Now, Dyla has created a “restaged version” rolling out in July, Premkumar said. The updated line includes 1,000 mg of electrolytes, reduced sugar, “boosted flavor” and a reduced price point.

Under KDP ownership, Premkumar said, the conglomerate is now looking at how it can work to scale Dyla’s distribution, particularly with its ability to secure more off-shelf placements, noting that “there are some channels and even the existing retail relationships that we already have, strong ones, where they’ve got levels above, deeper connections.”

As well, Dyla will be “looking at more and more of their trademarks,” he said.

For those who wondered whether President Donald J. Trump’s announcement in July of a full-sugar formula meant that Coke had experienced some kind of full MAHA conversion, this news pointed more towards a new denomination.

Coke CEO James Quincey told analysts on the company’s second quarter earnings call on July 23 that the company would be launching what amounted to a full-sugar line extension, rather than a complete formula change, as some believed Trump had indicated.

“As part of its ongoing innovation agenda, this fall in the United States, the company plans to launch an offering made with U.S. cane sugar to expand its Trademark Coca-Cola product range,” Coke noted in its current 8-K filing with the SEC. “This addition is designed to complement the company’s strong core portfolio and offer more choices across occasions and preferences.”

Many U.S. consumers already have access to cane sugar versions of Coca-Cola through “Mexican Coke,” a version imported from Mexico.

Robert F. Kennedy Jr., Trump’s Health and Human Services secretary, has campaigned against the widely-used CSD sweetener high fructose corn syrup; he has also campaigned against sugar consumption overall. Coca-Cola responded by defending its use of corn syrup, citing it as “safe” and as being metabolized by the body in the same manner as table sugar.

Health-Ade’s investors are selling the company to Generous Brands, a portfolio company of private equity firm Butterfly Equity, for approximately $500 million.

“With its purpose-led brand and products that are positioned at the intersection of delicious taste and modern health trends, Health-Ade fits perfectly into our platform and growth strategy, said Generous Brands CEO Steve Cornell in a statement. “This exciting addition to the Generous Brands portfolio will accelerate our mission of inspiring more people to thrive through the power of vibrant nutrition.”

The kombucha brand, founded by husband-and-wife team Justin and Daina Trout and Vanessa Dew, has long been the major alternative to category leader GT’s.

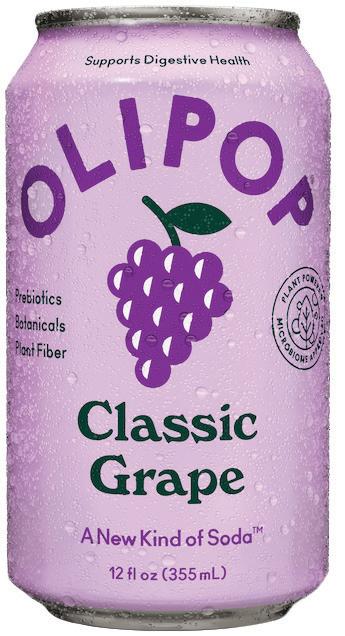

Health-Ade sold $182 million in kombucha over the past 52-week period ending June 15 – up 8% from the previous 52week period, according to data from retail information group Circana, good for a 24% share of the refrigerated kombucha category. GT’s was at close to $340 million in the same category. Both brands have other products; Health-Ade’s SunSip is intended to compete with prebiotic “Modern Soda” brands like Poppi, Olipop, and Culture Pop.

Generous Brands, a platform that includes Bolthouse and Evolution Fresh juices, as well as manufacturing for açaí brand Sambazon, has been pushing to acquire Health-Ade for more than a year. Health-Ade has long been rumored to be on the market, with CEO Chris Lansing brought in at the end of 2022 to accelerate growth and make it a more appealing sales target.

“This announcement marks a natural evolution in HealthAde’s journey and an exciting milestone for the premium refrigerated beverage category,” Lansing said in a statement. “Health-Ade and Generous Brands are aligned in their unwavering commitment to delivering exceptional taste while prioritizing clean, nutritious ingredients. We are excited and confident that Generous Brands is the right platform to unlock Health-Ade’s full potential and introduce even more people to the power of gut-healthy beverages. We are grateful to our founders who helped pioneer this category, and to First Bev and Manna Tree for their support and partnership to help us grow to where we are today.”

Both First Beverage and Manna Tree Partners, Health Ade’s primary investors, will maintain stakes in the company as shareholders in Generous Brands, according to a statement from the company.

With the acquisition, the Generous Brands portfolio will have nearly $1 billion in retail sales, the company said.

Barstool Sports boss Dave Portnoy is taking a starring role in the launch of PHX, a new 12 oz. canned line that aims to marry hydration and energy drinks.

The brand, pronounced “phoenix,” is the first product launch from Florida-based startup One 11 Brands, a new venture headed by former AB InBev senior VP Daniel Blake. The new line aims to marry hydration, immunity and energy, combining 200mg caffeine, 100% daily value of eight vitamins, and 700mg of electrolytes from a blend of sodium, potassium, magnesium and calcium.

PHX launched in July in New York, Massachusetts and Ohio, and is available in Peach, Lemon Lime, Watermelon Lime, Blueberry Lemonade, Wild Berry and Orange.

Portnoy, best known for his “One Bite” pizza reviews, and the Barstool media network have dabbled in beverages previously, through both official partnerships and organic support. Portnoy notably helped to personally promote and popularize High Noon vodka seltzers, including the release of a themed variety pack and a charity initiative. Meanwhile, Barstool has previously signed media sponsorship deals with brands like Phusion Projects, Proper Wild, Owen’s Craft Mixers and Revitalyte.

In this case, Portnoy has joined as a marketing partner and does not have a financial stake in PHX or One 11. Details were scant but PHX says he’s set to “play an instrumental role in the brand’s growth and boost awareness and visibility,” presumably through his 5.6 million followers on Instagram.

“People count on me to be straight with them, so I only get behind products I really believe in,” said Portnoy in a statement. “PHX is legit. It keeps you going when you’re grinding it out and tastes better than the competition. Daniel and his team have nailed it with something different here. I’m all in.”

PHX marks Blake’s first effort as an independent entrepreneur, having spent 10 years in AB’s marketing department working on both import and mainstream domestic beer brands. He departed in 2023 to launch One 11

Brands as an incubator for functional beverages, though the concept of PHX was developed internally after Blake’s market research led him to home in on functionality and branding.

Within the energy category, Blake said he identified hydration, ‘clean’ caffeine and immunity as three in-demand functional benefits consumers were demanding. And on the shelf, he sees white space for a “co-ed” brand that threads the needle between female-skewing and malecentric competitors. The logo and brand name are meant to reflect “overcoming challenges” of all types, and that theme will be incorporated into “a lot of the storytelling we’ll be doing as we launch,” with college athletes being one point of initial focus.

“I felt there was an opportunity for a brand to really be kind of squarely in the co-ed space, maybe skewing slightly more masculine, but that offered this compelling, functional proposition with a clear point of view and a role that it could play in consumers’ lives,” Blake said.

PHX is launching through a handful of DSD wholesalers, starting with Heidelberg Distributing in Ohio, Manhattan Beer in New York, and Quality Beverage in Massachusetts. Beer distributors from the Anheuser-Busch and Miller Coors networks have been key partners in building next-gen energy brands like Bang, Celsius, Ghost and others into major players, but have also suffered when those brands exited their portfolios.

“For most of these wholesalers, they have the experience and the knowledge on how to grow energy drink brands, but they don’t have the brands in their portfolio today to kind of support that knowledge. We believe Phoenix is going to come in and fill that void in their portfolios,” Blake said.

Blake hopes this is just the beginning for One 11 Brands. While PHX is the immediate focus, the group is also exploring product concepts in categories like modern soda and adult non-alcoholic drinks.

“Our goal is to build a full portfolio of non-alc functional beverage brands in the future,” he said.

Just months after spending almost $2 billion to enter the gut-health soda category through its acquisition of poppi, PepsiCo announced it was launching its own prebiotic carbonated soft drink with Pepsi Prebiotic Cola, a new two-SKU line featuring three grams of prebiotic fiber per 12 oz. can that is set to launch on Black Friday in November.

Launching in Original Cola and Cherry Vanilla flavors, Pepsi Prebiotic contains 5 grams of cane sugar, 30 calories and no artificial sweeteners. The product will debut online during the Black Friday and Cyber Monday shopping holidays before kicking off a national retail launch in early 2026. It will be sold in single cans and 8-packs.

“From the iconic blue can, to the consumer-preferred Pepsi Zero Sugar, our portfolio has always adapted to the needs and flavor preferences of the consumer,” said Ram Krishnan, CEO, PepsiCo Beverages U.S. “Pepsi Prebiotic Cola represents the next leap forward in giving consumers choice, optionality and functional ingredients in their cola experience, without sacrificing the iconic Pepsi taste we’re known for delivering. We can’t wait for the world to try the taste of Pepsi Prebiotic Cola for themselves!”

The announcement represents Pepsi’s latest attempt to modernize its flagship soda roster which, other than logo and design changes, has been relatively unchanged since the introduction of Pepsi Zero Sugar in 2007. In late 2024, Pepsi teased the launch of a product called Soulboost Soda, featuring prebiotics from soluble corn fiber and sweetened with both juice and stevia. That innovation never reached the market, though.

With poppi, Pepsi acquired a mature category-leading brand (alongside Olipop) with strong awareness, distribution and momentum. Launching its own prebiotic soda may allow for greater pricing flexibility and marketing strategies, and capitalize on the strong performance of trademark Pepsi cola, as highlighted in the company’s most recent earnings report.

Pepsi’s chief rival Coca-Cola launched its own prebiotic soda under the Simply banner earlier this year.

Mexican food brand Tia Lupita announced on July 21 it had been acquired by Vilore Foods, the San Antonio, Texas-based distributor and commercial subsidiary of heritage food brands including La Costeña, Jumex and Totis. Founder Héctor Saldivar and the rest of the Tia Lupita team will stay on board to continue leading the brand, per terms of the deal.

“I’m thrilled that Tia Lupita Foods is joining the Vilore Foods family,” said Saldivar, in a press release. “Vilore Foods understands the cultural roots that drive our brand and has the reach and experience to take our products to even more shelves and kitchens across the country.”

The deal will expand market access for Tia Lupita products – which includes grainfree cactus tortilla chips, hot sauce and Mexican chili crunch – further across the U.S. and bring the brand into the Mexican market, Saldivar said in a LinkedIn post.

For Vilore – which operates a variety of packaged food brands including Jumex and Kern’s juice-based beverages, Pronto sweetened condensed milks, Congelli gelatin and flan mixes and milk modifier Choco Milk – the addition of Tia Lupita marks its official entry into the natural food space.

“This acquisition signifies Vilore Foods’ powerhouse expertise in distributing and championing Hispanic food brands in the U.S. market,” said Edgar Vargas, director of growth and brand development for Vilore Foods, in a release. “As more U.S. households seek trusted and authentic culturally connected products, we’ve kept an eye on the growth and potential of Tia Lupita Foods and believe this partnership will take the brand to the next level.”

Vilore already owns and operates two brands with similar product portfolios to Tia Lupita: Totis, which makes chicharones, cheese puffs and chips, as well as La Costena which sells salsas, sauces, and condiments. The addition of Tia Lupita brings a healthfocused alternative to Vilore’s lineup that encompasses gluten-free, non-GMO and no-preservative products.

As evidenced by PepsiCo’s recent $1.2 billion acquisition of better-for-you, Mexican-American food brand Siete, consumer demand is growing for grainfree, clean label alternatives in the Hispanic food category. Premium tortilla chip and salsa brand Xochitl was also acquired last year, joining the growing portfolio of PE firm Forward Consumer

Partners, while SOMOS Foods has raised over $3 million in the less than five years since its inception.

Founded in 2018, California-based Tia Lupita has steadily gained momentum in the market. expanding to over 5,000 doors nationwide spanning natural, conventional and mass channel retailers. The company has raised about $4.5 million to-date, last closing a $2.6 million seed roundin 2023 with all funding coming from Mexican investment institutions including lead investors Santatera Capital and GBM Ventures.

That same year, the brand also appeared on “Shark Tank,” securing a $500,000 line of credit at 12.5% interest from Kevin O’Leary (aka Mr. Wonderful), who took a 5% nondilutible equity stake in the business.

“Congratulations to Hector and the team at Tia Lupita on being acquired by Vilore Foods,” said O’Leary, in the press release. “From day one, I believed in your mission to bring healthier, authentic Mexican flavors to the table, and you delivered. You built a brand that resonates with modern consumers while honoring tradition. This acquisition by Vilore Foods is a perfect match and a powerful validation of everything you’ve worked for.”

Within a few months of its late-April launch, Khloé Kardashian’s snack brand Khloud Protein Popcorn has expanded into more than 2,500 retail doors nationwide, including Target and Sprouts Farmers Market stores.

Additional distribution was planned for Wegmans, Raley’s, ShopRite and CIBO Express in July. The products also are available online on Thrive Market, GoPuff and the brand’s direct-to-consumer website.

Early traction has outpaced projections, said Jessica Lungariello, chief commercial officer, in an emailed interview with Nosh.

“Many Target stores sold out within days, and Khloud outperformed other salty snacks by over 150%,” Lungariello said. “As we expand into new retail doors, it’s clear Khloud is resonating with consumers and that more and more shoppers are craving snacks that are both functional and delicious.”

The products are seasoned with a proprietary powdery substance called “Khloud Dust,” which contains a blend of milk proteins. Flavors include Olive Oil & Sea Salt, Sweet & Salty Kettle Corn and White Cheddar flavors. A serving delivers 7

grams of protein. A 5 oz. bag retails for $4.99 at Target.com.

Lungariello said the team plans to support new retail launches with a “mix of founder engagement, on-the-ground sizzle, smart digital marketing, and strong in-store execution.”

She added, “It’s not just about getting Khloud on shelves; it’s about building real buzz around our product and showcasing the value proposition that has proven to be incredibly compelling to today’s snack consumer.”

Longer term, the startup’s go-to-market strategy centers on “meeting consumers where they are, especially in moments when delicious, functional snacks are hardest to find,” Lungariello said, pointing to opportunities beyond traditional retail channels.

Ahead of its debut, Los Angeles-based Khloud raised $12.5 million in equity funding, per a filing with the U.S. Securities and Commission (SEC) in June. Investors include Serena Ventures, K5 Global, William Morris Endeavor and Shrug Capital, according to a TechCrunch report. Springdale Ventures also participated in the funding round.

Bryan Baum, a serial tech entrepreneur and co-founder of K5 Global, is listed as CEO of Khloud on the SEC filing.

Tempeh snack maker Mamame Whole Foods has raised $2 million in a funding round led by Granite Asia, a multi-asset investment platform headquartered in Singapore.

The family-owned and operated startup has translated a centuries-old superfood into a modern on-the-go snack that entered the U.S. market last fall. The brand’s line of tempeh chips is made with black-eyed peas, coconut oil, tapioca flour and a beneficial fungus that ferments the beans. Varieties include Original, Sea Salt, Hot Chili, Rosemary, Cheese and Barbecue.

The patented recipe is free from soy and seed oils, and a serving delivers more protein and fiber (3 grams of protein and 3 grams of fiber per 28g serving) than leading conventional potato chips (2 grams of protein and 1 gram of fiber), according to the company.

Mamame Tempeh Chips are available in multiple international markets including the United Kingdom, Germany, Lithuania, Singapore, Korea, Portugal and Hungary. The company’s retail partners in North America include Erewhon, Mother’s Market, Bristol Farms and Metropolitan Market, in addition to corporate offices including Meta. The brand also was available at Sprouts Farmers Market nationwide for a quarterly rotation in the innovation set earlier this year.

In its raw block form, tempeh is a regional staple with limited mainstream adoption, says founder Liz Kang, a former media sales executive who launched the business two years ago with her mother, Alvina Chun.

“By putting tempeh through a production line that can transform this raw ingredient into a protein-packed chip, we’re able to reach a massively incremental customer base,” Kang said in a statement. “We see tempeh as a commercial cousin to acai, akin to the raw acai berry-to-blended-smoothie-bowl pipeline.”

The new funding enables the company to quadruple its production capacity as it expands to meet burgeoning private label demand, adding a 60,000 sq. ft. facility to its existing manufacturing operations in Indonesia, near some of its raw ingredient suppliers.

A key focus area for Granite Asia is food systems and sustainability; the firm previously backed plant milk maker Oatside. Jenny Lee, senior managing partner, described Mamame Whole Foods as a “category-defining brand” that brings together “authentic storytelling, nutritional innovation, and a clear understanding of today’s consumer.”

Still, low consumer awareness in the U.S. remains a major hurdle for the mother-daughter duo.

“Tempeh is the national food of Indonesia. It’s been around for centuries, and academics say that it has a longer history than that of tofu,” Kang told Nosh, adding that, while tofu is widely familiar in the U.S., tempeh is not.

She continued, “These are whole fermented beans that carry all of the protein claims, the fiber claims, and even the probiotic properties of tempeh in this snack form. We really like to break it down for people and see their reaction. But nothing beats their reaction until they’ve put it in their mouth.”

Hummus maker Little Sesame closed a $8.5 million Series A funding round led by InvestEco Capital with participation from Watchfire Ventures, Santatera Capital, Beliade Consumer Partners, and other prominent individual industry investors.

The company will use the capital to expand manufacturing capabilities, with plans to open a 23,000 sq. ft. production facility by the end of the year. The new site, which includes a test kitchen and an in-house high-pressure processing operation, will significantly increase the brand’s production capacity.

“When we opened up our first factory in 2022, we were producing 1,000 lbs of hummus per week. Today, that number is 80,000 lbs per week, and by the end of the year, we expect to be producing upwards of 100,000 lbs of hummus a week,” Nick Wiseman, CEO and cofounder, told Nosh via email.

The increased capacity is expected to support the company’s mission to scale partnerships with regenerative chickpea farmers and transition 10,000 acres to regenerative management by 2027.

“From day one, we’ve sourced our organic American-grown chickpeas from Casey Bailey, a pioneer in regenerative agriculture in Montana; as our business needs have grown, we’ve since expanded to other farmers in the area, but all of them farm regeneratively, meaning the way they farm actually improves soil health and the environment over time. It’s not just about better hummus, but a

better food system,” Wiseman said. Additionally, Little Sesame will invest in new product development, including an expansion of its Hummus for Kids line, which debuted last year in lunchbox-ready on-the-go cups.

“Given the initial success and interest we saw, we plan to expand the kids’ line and also are exploring other extensions into healthy snacking,” Wiseman said. “Seasonal flavors have also become a big part of how we keep things fresh and exciting at Little Sesame. After the success of Golden Garlic and Green Goddess this spring, we brought back our fan-favorite Mexican Street Corn for summer. We’re now working on our biggest brand collab yet for the next seasonal flavor, dropping by the end of this year and look forward to sharing more soon.”

The Washington, D.C.-based startup has scaled its retail footprint to nearly 3,000 stores nationwide, including Sprouts Farmers Market, Whole Foods Market, Wegmans, Foxtrot, Erewhon and more. Last year alone, the company added more than 1,000 new retail doors while also securing partnerships with online grocers Misfits Market and Imperfect Foods.

Beyond retail, Little Sesame is building a presence in the foodservice market, Wiseman said, citing limited-time offerings at Call

Your Mother, Blackseed Bagels and Birdcall, as well as a partnership with Sweetgreen as the primary supplier for its hummus crunch salad.

The latest funding will also support new additions to the team, Wiseman said. In January, the company tapped Oatly North America executive Drew Martin as its new chief commercial officer.

“We’re excited to be adding talented new people up and down our organization; we’re people-powered, and this capital allows us to build a deeper team that can help us deliver the highest quality product, disrupt the category and scale into a household brand,” Wiseman said.

Hummus and refrigerated dips have become an increasingly competitive category. Little Sesame has contributed 46% of category growth at Whole Foods Market in the past year and stands out as an organic, Clean Label Project certified offering that relies only on squeezed lemon juice as its preservative, Wiseman said.

“Consumers consistently say we’re the best-tasting store-bought hummus available,” he added. “Our fine dining restaurant roots have informed our approach to manufacturing and quality even as we grow.”

He continued, “As we like to say, we’re founded and made by chefs. Our hummus is freshly spun in small batches at our own facility just outside D.C., giving us full control over quality and eliminating the need for co-packers.”

California-based Lexington Bakes has raised $1 million in a funding round led by VC firm Rainfall Ventures. The new cash will support the business as it scales up with a new co-packing partner, pipeline of retail launches and growing team that has been strategically built via agencies, contractors and fractional help.

“What I’m most excited about is being able to say yes to more opportunities,” founder, CEO and chef Lex Evan told Nosh. “What I’m most stressed about is saying yes to more opportunities, but that’s the trajectory.”

Aligning with Rainfall has provided the brand with strategic support as well, Evan said. He said that one of his investors has become “acting CMO” and meets with him on a monthly basis to pressure test ideas and marketing approaches as he works to build Lexington Bakes as a content or media company that “just happens to have products… I feel like that’s the future of any brand – so much of marketing has become social media.”

times and talked about the vision for the brand. Ultimately, he [said], ‘we love the brand, but we’re investing in you.”

The luxury baked goods brand marks Rainfall’s second packaged food investment, Evan said; the firm previously allocated cash to fellow Los Angeles-based brand The Real Cereal Company, however, it has also made a handful of investments in food tech companies including alt-protein business Simulate, parent company of NUGGS.

“Tom [Binder], who’s the founder of Real Cereal, introduced me to Ron [Rofe], the [general partner] of Rainfall, when I announced I was fundraising a couple of months ago,” Evan explained. “They happen to be [based] in West Hollywood, which is where I live. So we got coffee a couple

Evan worked as a brand designer and strategist at Johnson & Johnson for 10 years prior to jumping full-time into the bakery business. He emphasized that he has “studied people for 20 years,” and those learnings stuck out to Rofe as he assessed Evan’s approach to building his business, including his strategy toward hiring.

“A million dollars seems like a lot, but in the world of CPG, it’s not,” Evan said. “[Rainfall said] ‘We know that you can do so much more with that than a lot of other founders because you don’t have to go out and hire someone for every function.’”

Now with a check in hand, Evan has onboarded a part-time designer to help handle some of his own workload, in addition to two agencies – one to manage email marketing and 203 Media, a guerilla-style marketing agency that will produce on-the-street interviews for the brand’s social media

pages. Lexington Bakes’ first hire, however, was a community marketing manager.

“We are building a community to market this brand, and that’s what it is,” he said about his thinking behind the role. “It’s not just influencers. It’s not just creators. We can invite our fans to be a part of this, too. [The community marketing manager] is someone to manage all of those marketing efforts under one umbrella.”

But one key function will remain in house: social media. Evan said he “hired and fired an agency within a week” after having extensive conversations about his idea and vision for content, but was quickly delivered lackluster results.

“I’ve realized that I need to just own that myself and hire people to execute my ideas,” he said. “I have endless lists of skits and series ideas to do, which leads me to the YouTube show that I’m starting to develop…. ultimately I want that YouTube show to go to Netflix in a couple years…. no one else is thinking about the brand funnel to Netflix, [but] I’m building that pipeline.”

Evan said in the meantime, social media marketing efforts are primarily rooted in engaging between 25 to 50 influencers or creators around a specific goal each month. For Pride month in June, it gifted its Cocoa Crunch Bar collaboration with So Gay to 50 influencers and collectively reached a potential audience of 50 million people, he said; “It was a really powerful group.”

As the brand geared up for a rollout to Chicago-area Mariano’s stores, Evan had another activation with local creators already underway, aimed at creating content that will build awareness for the brand as it rolls out

in the region.

Those efforts will put Lexington Bakes in a strong position as it continues to test, learn and expand its reach. The brand is currently sold in 100 stores but has its eye on reaching 1,000 doors over the next 12 months.

Retail growth will be supported by a distribution deal with KeHE, and the company is now active in two of its distribution centers in addition to working with two regional distributors in California.

In order to meet the demand of those retail partnerships, Lexington Bakes has onboarded with its first co-packing partner and is expecting to complete a final scale trial run for its brownie and cookie products in the coming weeks. By September, Evan expects the manufacturer will be producing about half of the company’s SKUs.

For Evan, who has primarily selfmanufactured his products since launching the brand over three years

ago, the manufacturing shift gave the business a significant boost as it scales up to meet current market demands. Evan said he is considering also hiring a part-time individual to manage operations at the co-manufacturing plant once the partnership is completely up and running.

In the meantime, however, he is still workshopping how to produce the brand’s highest-volume, “hero” platform: its recently launched Chilled Oat Bars. The product’s browned butter ingredient presents a safety issue for most large-scale production facilities, he said, leading him to consider a variety of possible solutions, including tweaking the ingredients.

“[We’re] working on more flavors and expanding that,” he said. “We officially have an indulgent platform and a nutritious [platform]. Eventually we’ll have granola bars, or oat and seed bars, which will bump up the protein – the oat bars are doing phenomenally

in retail.”

The 2-SKU line held the No. 1 and No. 2 best-selling fresh snack products on Good Eggs for two months, he said, beating out competitors such as Yes Bar, Mid-Day Squares and Go Macro. Evan credits those “insane velocities” to a “really strong launch promo” and emphasized that over the next eight months he is focused on running “micro tests” to continue evaluating pricing and discounting strategies in order to replicate those results with every retail roll out.

“I’ve learned so much in the last couple of years that when I launched the oat bars, I just knew how to tweak the formulas to be more aligned with what consumers are looking for,” Evan said. “I knew more about the pricing strategy – it’s almost like I was able to relaunch the business with so much more learning, but now I can tweak that learning and apply it to the brownies and the cookies for the future.” For

Barrel One Collective is getting a new leader, a little more than six months after the founding of the New England-centric parent company of 15 brands, including Harpoon and Smuttynose.

Nathaniel Davis will take the reins as CEO from Harpoon founder Dan Kenary, who will transition to the role of president after an eight-week sabbatical. Davis joined Mass. Bay Brewing in April 2023 as chief operations and strategy officer and was named president of the Boston-based craft roll up in August 2023.

to five years, like, ‘OK, this is out there, I’ve got to set this up and do it right for the company.’ And so I met Nathaniel, and it clicked very quickly to me.

“Culturally, talent-wise, industry experience, he’s the full package in every which way, which is outstanding,” he continued.

Kenary, whose 65th birthday is approaching this summer, started Harpoon in 1986 and stepped into the CEO role in 2014 when co-founder Rich Doyle departed. He steered the company through acquisitions, the COVID-19 pandemic and the merger that created Barrel One in late 2024 – all amidst the backdrop of a challenging craft beer industry that has

“It became very clear to me very quickly this was the person that I hope to be my successor,” Kenary said of Davis. “I’ve taken that very, very seriously, the last three Boston Beer has renewed its Samuel Adams sponsorship deal with the Boston Red Sox for another decade.

The new deal extends the 8-year pact between the two brands first struck in 2018 for Samuel Adams to become “the official beer of the Boston Red Sox.”

Through the sponsorship, Samuel Adams took over the right field sponsor sign in historic Fenway Park that had featured Anheuser-Busch’s Budweiser brand for nine years and transformed the right field roof deck into the “Sam Deck.” The company said “more than 275,000 fans have raised a pint of Sam Adams” on the Sam Deck, while the “Sammy’s On Third” branded bard has sold around 50,000 Sam Adams beers last season.

Boston Beer expanded its Fenway presence again in 2022 with the debut of the Truly Terrace above the right field bleachers.

Angry Orchard, Truly Hard Seltzer and Twisted Tea will also be featured in Fenway in the new agreement.

grown more tumultuous in recent years.

Acknowledging that “there certainly are times when founders can’t get out of the way and are a problem with the new CEO establishing themselves and becoming the focal point of the company,” Kenary went on sabbatical July 16. The time away includes a cross-country road trip with his wife.

“He’s already running a lot of the company,” Kenary said of Davis. “So I think it’s going to be pretty damn seamless, but this is just to ensure that it takes place, because I’m a big personality, and so I think I’ve just got to get out of here for a stretch, so that Nathaniel feels very comfortable that he’s clearly the guy in charge.”

While it was shifting its leadership around, Barrel One Collective was also adding another New England craft brewery to its growing roster.

The Boston-headquartered platform struck a deal to acquire Worcester’s-based Greater Good Imperial Brewing, the only dedicated high-ABV craft producer in the country.

“Greater Good has carved out a distinct space in the craft world with its unapologetically big, flavorful beers and cult following in Central Mass.,” Kenary said. “Their team’s focus on quality, authenticity, innovation and community perfectly aligns with our company values and shared ambition of pushing the boundaries of what craft beer can be.”

All beers in Greater Good’s portfolio are 8% ABV or higher, which gives Barrel One a toehold in the increasingly important high-ABV segment. Coupled with the brewery’s “tremendous wholesaler overlap” with Barrel One’s network, the deal was a slam dunk, Kenary said.

All 178 Ohio Eagle Distributing employees are expected to be laid off once the company’s sale to Redwood Holdings closes on September 8, Ohio Eagle president Devyn Dugger wrote in a July 7 Worker Adjustment and Retraining Notification (WARN) Act notice to the state.

Dugger wrote that “all separations will be perament; future employment opportunities, if any, will be communicated by the buyer.”

The layoffs cover Ohio Eagle’s facilities in West Chester and Lima. Ohio Eagle

employed 124 workers in West Chester and 54 in Lima, including union members of Teamsters Local 1199 and International Brethren of Teamsters Local 908, respectively.

With the sale, Redwood picks up 7 million cases, Beer Marketer’s Insights first reported earlier this week. Ohio Eagle served 18 counties in western Ohio, distributing Anheuser-Busch, Constellation Brands and Yuengling products, as well as local craft beer.

Redwood, the private investment firm for

billionaire Jim Davis, will add to its already vast Ohio Anheuser-Busch InBev footprint, which it began building in 2021 with the purchase of Heidelberg Distributing Company. The price tag for Heidelberg, which also covered parts of Kentucky, was reportedly around $1 billion.

Craft brewers continue to find strength in numbers.

Hendler Family Brewing (HFB) and Sloop Brewing have forged a strategic partnership in which the Framingham, Massachusetts-based brewery platform will take over production, sales and marketing for the Hopewell Junction, New York-based craft brewery’s portfolio, including flagship Juice Bomb IPA (6.5% ABV).

“There’s been a lot of talk over the last couple of years about the pressures facing craft beer,” HFB co-founder and CEO Sam Hendler told Brewbound. “Brewers need to either get large or be smaller and nimble, and I think this transaction essentially does both.”

HFB has grown larger through two high-profile acquisitions in 2024, adding fellow Massachusetts craft breweries Wormtown and Night Shift to its Jack’s Abby Craft Lagers portfolio. The company also operates a contract brewing arm in Jack’s Beverage Company. Combined, the platform’s output reached 86,000 barrels (+1% year-over-year [YoY]) and ranked 38th among BA-defined craft breweries by volume last year.

Under HFB’s arrangement with Sloop, no equity will change hands. Sloop will maintain ownership and control of its taproom and production facility, which will focus on innovation. No jobs will be lost as a result of the partnership, the leaders confirmed.

“We’ve been long admirers of Sloop,” Hendler said. “Obviously, as we’re trying to build up the contract brewing side of our business – and Sloop has had a need for additional volumes beyond their capacity in New York for years now – we’ve been in some level of conversations with Sloop about brewing beer here.”

Sloop reached the 25,000-barrel ceiling of its brewery’s capacity years ago, and needed a new partner after an alternating proprietorship with Smuttynose Brewing, now part of the Barrel One Collective, wound down, Sloop co-founder Adam Watson told Brewbound.

Founded in 2011, Sloop’s output reached 25,300 barrels in 2019, according to data from the Brewers Association (BA), necessitating off-site production. In 2024, the brewery’s volume dipped 17% YoY, to 26,359 barrels, down from 31,854 barrels in 2023.

“We were looking for a partner,” Watson said. “I don’t love contract brewing. I think it adds another layer to the three-tier system, and eats up margin and is not necessary. We were talking to Sam and his team forever about contract brewing, and it just fit with them for a number of reasons.

“We’re like-minded people – Sam, his brothers and his team. We align,” he continued. “They’re good people. They’re normal people. They’re not crazy business people – they’re just down-to-earth, regular guys. So that went a long way.

“Also, the fact that our distribution partners, our wholesalers are so aligned makes it very easy. So it really just fit. And once we found a structure that worked, just everything fell into place.”

Hand Family Companies’ (HFC) Sunset Distribution subsidiary is adding another piece to its growing craft footprint in California with the acquisition of Scout Distribution in Los Angeles.

The deal follows Sunset’s late March acquisition of Stone Distributing and Classic Beverage in Southern California.

HFC president and CEO J.R. Hand told Brewbound that the transaction will add around 1.1 million cases to Sunset’s business, around $35 million in revenue and around 5,000 SoCal retail accounts. He added that Scout’s portfolio will add “continuity” to Sunset’s book due to several of the brands in Scout’s portfolio being part of the Classic purchase. Additionally, Sunset and Scout already share a warehouse, easing integration. Scout’s Arizona branch, as well as its joint venture in Idaho with Columbia Distributing, were not part of the transaction.

The tally of layoffs has come in as Republic National Distributing Company (RNDC) winds down operations in California.

RNDC gave notice to 1,756 employees on July 1 to coincide with the company’s withdrawal from the Golden State on September 1. The distributor filed a notification under the Worker Adjustment and Retraining Notification (WARN) Act, which mandates that employers with 100 or more employees must provide at least 60 days’ notice to affected workers before a plant closure or mass layoff.

The layoffs will impact eight locations: 640 in Tustin, 238 in San Bernardino, 226 in Pleasanton, 176 in Los Angeles, 156 in Morgan Hill, 136 in West Sacramento, 104 in Hayward and 80 in San Diego. Eliminated roles range from sales, human resources, business analysis to warehouse drivers, and include union-represented jobs, according to paperwork filed by RNDC.

The withdrawal followed a supplier exodus from RNDC, whose former CEO, Nick Mehall, departed the company in February after Brown-Forman and Tito’s Handmade Vodka, the country’s top-selling spirit brand, announced their departures in California. Brown-Forman later announced a national departure.

Tilray Brands beverage division president Ty Gilmore is departing from the company, in one of several leadership changes, the craft beverage and cannabis firm announced in June.

Tilray chief growth officer Prinz Pinakatt is taking over the beverage division, effective immediately, chief corporate affairs officer Berrin Noorta shared in an email to Brewbound.

Pinakatt joined Tilray as CMO in February 2024 and was promoted to chief growth officer in November.

In addition to Pinakatt’s promotion, Tilray announced that Breckenridge Distillery chief operating officer Ken Bohnet and distillery founder Bryan Nolt will lead Tilray’s spirits business going forward. They will work with Pinakatt “to leverage synergies across our beverage business,” Noorta wrote.

In yet another move, Tilray shared that Tilray Wellness president Jared Simon (no relation to CEO Irwin Simon) will now lead its hemp-derived THC beverage business.

Tilray installed Gilmore as president of its North American beverage division in December 2022. A month before his arrival, the company acquired Montauk Brewing for $35 million.

Gilmore’s appointment also came nine months before the first of two major acquisitions, with Tilray picking up eight craft brands from Anheuser-Busch InBev (A-B) – Shock Top, Breckenridge Brewery, 10 Barrel, Blue Point, Redhook, Widmer Brothers, Square Mile Cider and HiBall Energy – in a deal valued at around $85 million in cash.

Tilray struck again a year later with the $23 million acquisition of Hop Valley Brewing, Revolver Brewing, Terrapin Beer Co. and Atwater Brewery from Molson Coors.

Shortly before the wrestler died in July, the parent company of Hulk Hogan-founded Real American Beer was sued by a licensing firm that alleges the concept for the lager brand was swiped by its former executives.

Carma Holdco, a Chicago- and Las Vegas-based branding house, filed the lawsuit in U.S. District Court for the Northern District of Illinois on July 8 against its former president and board chairman Chad Bronstein; former chief legal and licensing officer Nicole Cosby; Real American Beer (RAHM Inc.); and 25 unnamed “Does.” Bloomberg first reported news of the lawsuit.

Carma alleges Bronstein and Cosby breached their executive agreements by taking confidential information gained from their employment to start the Real American Beer brand with former pro wrestler Hogan (Terry Bollea). Carma fired Bronstein and Cosby “for cause” around November 17, 2023, per the lawsuit.

Carma is seeking “at least $10 million” in damages, as well as attorneys’ fees and costs at a jury trial. Additionally, the firm is after restitution of $348,000 from Bronstein and $231,333.33 from Cosby.

Garage Beer – an “internet darling” turned mainstream lager brand, with the backing of football celebs Jason and Travis Kelce – is on pace to ship around 4 million case equivalents (around 300,000 barrels of beer) by the end of 2025.

The brand is trending up “400% or 500%, depending on whether you’re looking at consumption or shipments,” owner Andy Sauer shared with Brewbound.

If the trends hold, Garage Beer would rank just outside of the Brewers Association’s top 10 craft breweries by volume.

The rapid growth follows falling just short of 1 million CEs in 2024 and production of 120,000 CEs in 2023.

“We grew about 10x from ’23 to ’24 and didn’t change our team really at all,” Sauer explained. “It was very much a tight-knit crew, six people that were just having fun, building a brand.”

Garage Beer’s ranks have since grown to 25. Still a lean team, made possible through co-packing primarily at City Brewing in Memphis and supplemented by Founders Brewing in Grand Rap-

ids, Michigan. Sauer said new hires have come on to help “guide and mature the organization” through its rapid expansion, while staying lean and maintaining the company’s culture.

“We want to still be crazy and fun and entertaining on the internet, but we want to start to permeate more and more people outside that,” VP of marketing Corey Smale told Brewbound.

As of early 2025, Garage Beer is now available in all 50 states, primarily through the Molson Coors distributor network. In 2024, Garage Beer was in just six states. Even as new markets have come online, the company is maintaining growth by “digging deeper” in its core Northeastern Midwest markets.

“It’s fun to see those legacy markets growing rapidly as we enter the summer,” Sauer said. “Our oldest market, in Ohio, is up 135% for the month. [Pennsylvania] and other really big markets are up similar growth numbers. So we’re still growing like crazy in our most-established, mature markets, while pressing further.”

The expansion has coincided with placements in about 80% of Walmart’s footprint, which Sauer called “incredibly transformative” for the business.

“As an entrepreneur, you are always excited, but also have some trepidation to lean in bigger with bigger customers,” Sauer said of Walmart. “They’ve been wildly supportive, and we’ve seen great pull through there.”

Jack McAuliffe, who is credited with helping start the modern craft beer movement by co-founding New Albion Brewing in 1976, died at age 80 at his home in Arkansas on July 15, his daughter Renee DeLuca shared.

“Jack’s place among United States craft brewers as a change maker and inspiration will be a part of the beer world for generations,” DeLuca wrote.

Like many other early craft pioneers, McAuliffe first encountered fuller-flavored beers while abroad. In McAuliffe’s case, he was stationed in Scotland during his time in the U.S. Navy.

McAuliffe and co-founders Suzy Stern and Jane Zimmerman then cobbled together a brewhouse and bottling equipment from scrap materials and brewed an English-style ale, porter and stout, a nod to Albion’s etymology as an ancient name for the island of Great Britain.

In its six years in operation, New Albion inspired Sierra Nevada founder Ken Grossman, who ran a homebrew shop in Northern California at the time of his visit to New Albion, according to a profile on CraftBeer.com.

University of California – Davis brewing professor Michael Lewis added visits and tastings at New Albion to his curriculum because it introduced students to the idea of smaller-scale brewing, CraftBeer.com reported.

The uniqueness of its small size contributed to New Albion’s demise. The brewery struggled to secure funding, in part because the craft brewing industry did not exist at the time and lenders didn’t understand the business model, having only macrobreweries as a comparative model.

“They just didn’t understand what I was doing, they couldn’t comprehend the idea of a small brewery,” McAuliffe told CraftBeer. com. “It was like I arrived from Mars and I was speaking Martian.”

When New Albion opened, it and San Francisco’s Anchor Brewing were likely the only two microbreweries in the country, according to historical data from the Brewers Association. By the time New Albion closed in 1982, the number of craft breweries quintupled to 10.

Homebrewers and craft beer enthusiasts alike can thank McAuliffe for his early contributions to the industry, American Homebrewers Association executive director Julia Herz said in a statement to Brewbound.

“If you’re into beer, then Jack McAuliffe’s small but mighty California brewery, which literally only survived six years, fueled everyone’s love of beer,” she said. “The influence of Jack and his surviving daughter, Renee DeLuca, looms large. Without Jack, I’m not sure this whole ‘craft beer thing’ would have taken off, and he used homebrewing as a means to get started. He will be very missed.”

In the lead up to the Red Bull Dance Your Way World Finals in Los Angeles this fall, the energy drink brand has released two limited edition cans featuring competitors Marlee Hightower (NBC’s World of Dance) and David “The Crown” Statler Jr. (So You Think You Can Dance?) in 8.4 oz. and 12 oz. cans for both original and sugar-free varieties. For more information, go to redbull.com.

Bubbles not your thing? Celsius hears you, and is responding with a pair of new summer entries to its Fizz-Free Flavors family: Pink Lemonade (available now at 7-Eleven) and Dragonfruit Lime (sold at Circle K). More details are available at celsius.com.

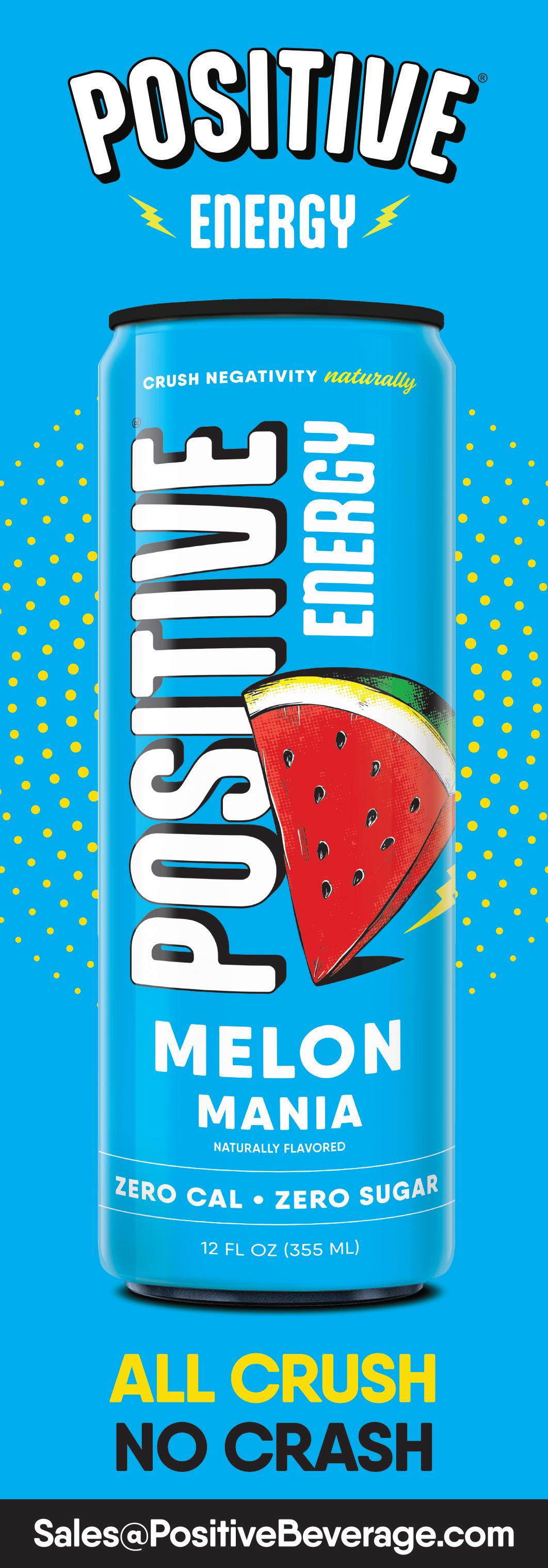

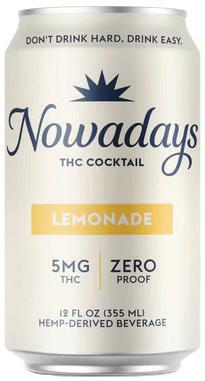

On the heels of its $24.5 million funding round, better-for-you energy drink brand Gorgie is releasing a Pink Lemonade flavor. Each 12 oz. can contains 150mg of green tea caffeine plus biotin, B Vitamins and L-theanine. Gorgie Pink Lemonade is exclusively available at 1,939 Target stores nationwide. For more details, visit getgorgie.com.

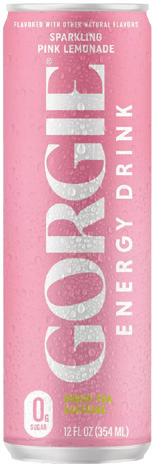

Naked Nutrition has made its first foray into the energy drink space with the debut of Naked Sparkling Energy. Available in three flavors at launch – Lemonade, Orange and Strawberry Lemonade – each 12 oz. can contains 200mg of caffeine from organic unroasted coffee beans and is sweetened with monk fruit and fermented cane sugar (Reb-M). Consumers can purchase Naked Sparkling Energy on the brand’s website for $35.99 per 12-pack. Learn more by visiting nakednutrition.com.

You can’t say they aren’t on-trend: for its summer release, New England-based grocery chain Stop & Shop is launching a Shirley Temple-inspired Soda as part of its store brand, available for just $1 per a 2-liter bottle while supplies last. More details are available at stopandshop.com.

Disney and Coca-Cola’s latest project is a global marketing campaign centered around Star Wars called “Refresh Your Galaxy,” which includes 27 limited-edition 12 oz. cans and bottles, split between Original and Zero Sugar, with designs featuring characters from Star Wars. For more information, set coordinates to starwars.com/news/coca-cola-star-wars.

Poppi’s recent innovations have taken their cues from classic soda flavors (cola, cream soda, root beer) but its latest release goes for a different kind of nostalgia. Punch Pop is a modern take on fruit punch and is set to launch in 12 oz. single cans and in 4-packs at retail and online. Design credit for those funky, eyecatching labels goes to artist Matthew Langille. Get more information at drinkpoppi.com.

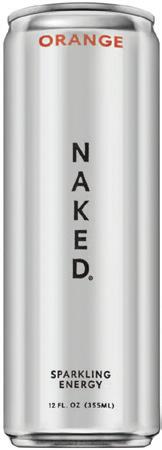

Following up on Cranberry and Cherry, THC cocktail maker Nowadays is releasing Lemonade (5mg THC) as its latest limited-run flavor, available in both 12 oz. cans ($34 per 6-pack) and a 750ml bottle ($68.99 each). To learn more, visit trynowadays.com.

For its second product innovation in four months, Atlanta-based Triple is dropping a 12 oz. THC-infused lemonade for its Triple High (10mg THC) lineup in three flavors: Original, Raspberry, and Half & Half (lemonade & iced tea). For more information, go to drinktriple.com.

Promising “effortless chill” in a can, Upstate Elevator Co.’s new Ruby Red Ranch Water combines 10mg hemp-derived THC with lion’s mane (22mg) for cognitive health and mental clarity, Cordyceps (88mg) for promoting natural energy and stamina, and Reishi (440mg) to help the body adapt to stress. Find it online and in Minnesota, Florida, Texas, Tennessee, New Jersey, Illinois and Ohio. For more information, visit upstateelevator.com.

Make your house a Waffle House with the famous Southern chain’s new ready-to-drink Classic Blend Cold Brew, if you can. The 11 oz. cans (“lightly sweetened with cream”) are available at nine Waffle House locations in the Atlanta area for $3.95 each, while supplies last. To learn more, visit wafflehouse.com.

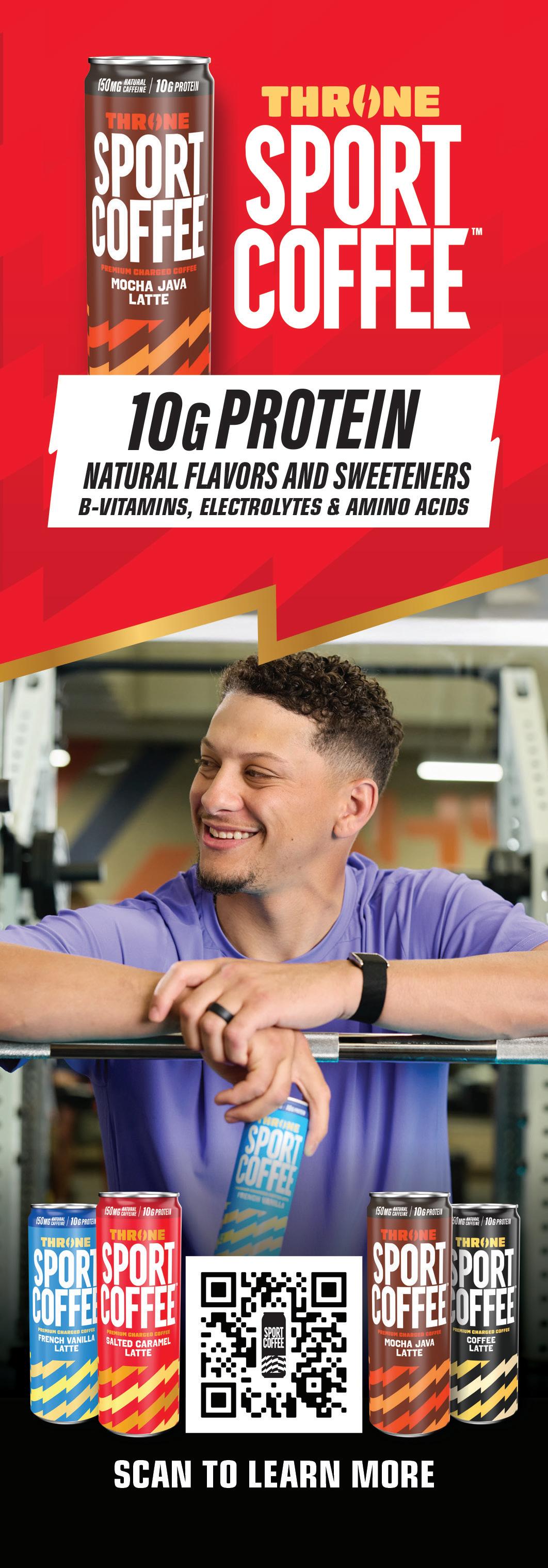

Throne Sport Coffee has undergone a makeover both inside and outside the can. Along with moving from “iced coffee” to “cold brew,” the brand flipped its color palette in favor of a white background, using subtle color cues to differentiate the flavors. Throne also retooled its flavor names making Salted Caramel into Sea Salt Caramel, Mocha Java to Mocha Cocoa and French Vanilla is now Vanilla Bean. For more details, visit sportcoffee.com.

Spindrift has always made fresh, real fruit its calling card, so it’s no surprise to see them dive into a very on-trend citrus flavor for its new limited summer release, Yuzu Mandarin. Created in partnership with culinary brand Momofuku, the flavor debuted this week as an online exclusive and at Momofuku Noodle Bar in New York City. To learn more, visit drinkspindrift.com.

Aren’t they adorable? Sparkling Ice hopes consumers will fall in love with its collaboration with produce brand Cuties on a limited time release of two new flavors (Mandarin and Orange Cream) in 7.5 oz. mini-cans. The drinks arrive in 10-packs at nationwide retailers starting next month. For more information, visit sparklingice.com.

With its typical flourish, Liquid Death has unveiled its latest limited edition sparkling water flavors, Deathberry Inferno (strawberry, lime, ghost pepper) and Piña Killada. Both offerings contain 10 calories and 2 grams of sugar per 12 oz. can. Consumers can find Deathberry Inferno at Walmart and Piña Killada at Target. Learn more by visiting liquiddeath.com.

Australian non-alc cocktail producer Naked Life is hitting the States with its U.S. launch. Available on its website and Amazon for $9.99 per 4-pack, the brand touts Margarita, Mojito, Classic G&T, Cosmo and Negroni Spritz flavors with zero alcohol, added sugar or artificial ingredients. For more information visit drinknakedlife.com.

The Pathfinder is offering up its zero-proof spirit in a 200 mL canned spritz format. Available exclusively through the brand’s website for $19.99 per 4-pack, The Pathfinder Spritz is “bubbly, botanical, and bursting with citrus zest” as well as “bold, bitter and anything but a basic spritz,” according to the company. For more information visit drinkthepathfinder.com.

Legacy liqueur producer Campari is embracing the NA trend with its new Crodino Spritz, a zeroproof RTD bitter soda made with aromatics of clove, cardamom, nutmeg, and coriander seeds, along with more than 10 other herbs and spices. It will be sold across California, Texas, Florida, Massachusetts, Illinois, Washington D.C. and Maryland at $14.99 per 4-pack of 175 ml glass bottles. For more information visit camparigroup. com/en/spiritheque/crodino.

C4 is launching its “most advanced pre-workout formula yet”: C4 Alpha Bomb. The new product contains 336mg of caffeine, featuring Deura9 (d9-caffeine), a first-to-market stimulant created by d9 Designs. Each serving also has 8 grams of the patented VELOX blend of L-Arginine and LCitrulline and 8 grams of CarnoSyn Beta-Alanine. C4 Alpha Bomb is available for $54.99. For more information, visit cellucor.com/pages/c4-energy.

Superfood powdered latte maker Laird has unveiled its latest innovation, Protein Instant Latte, capitalizing on rising consumer demand for highprotein products. Each serving contains 10 grams of plant-based protein from a blend of pea, hemp and pumpkin seeds and also features coconut, organic lion’s mane, cordyceps, maitake and chaga mushroom extracts. The new offering is available on the brand’s website for $19 per 6-serving bag. To learn more, go to lairdsuperfood.com.

Cure Hydration is leveling up its Energy collection with a fresh take on its Peach Tea, a plantbased powder now featuring 100mg of caffeine, L-theanine to support focus and the brand’s signature electrolyte blend for hydration. Launching on June 24 on Amazon and Cure’s website, the revamped product retails for $28.99 per 14 sticks. For more information, visit curehydration.com.

Good Boy Vodka is stepping up its Lemonade RTD collection with new flavors, including Pink Lemonade, Strawberry Lemonade, Tropical Lemonade, and Huckleberry Lemonade. Now available nationwide in a variety 8-pack, with the Pink Lemonade also available in a unique single-serve 19.2 oz. can. For more information, visit GoodBoyVodka.com

Lake Hour is venturing beyond spiked seltzers with the introduction of its Vodka Iced Tea line. Available in four varieties – Blackberry, Raspberry, Earl Grey and Green – the non-carbonated beverage is canned at 5% ABV and is crafted with real brewed tea and fruit juice. For more information, visit lakehour.com.

DIO introduced its newest canned cocktail: Blood Orange Cosmopolitan, boasting a vibrant blend of blood orange, cranberry, and lime. The new release is now available across accounts in New York, Michigan, Connecticut and New Jersey in singles and 4-packs ($28). For more information, visit drinkdio.com.

Hidden underneath the older terminology here is the term “protein drink” and it’s easily the fastest-growing category in beverage. Powered by GLP-1 medications, they are taking America’s obsession with weight loss and turning it into an obsession with protein, with many consumers trying to get in the range of 1 gram per lb. of body weight per day. All that protein is helpful for hefting all of the extra cases of Core Power, Fairlife, Premier, and Owyn that are getting thrown around. But look also to other categories where protein powered coffee, water, milk, and even CSDs are coming to the party.

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 6-15-25

BevNET hosted its annual summer conference this June in New York City with a program full of the industry’s smartest and most innovative minds. The two-day conference featured industry leaders and stakeholders offering lessons in retail growth strategies, insights in scaling and coaching budding beverage entrepreneurs on the best practices for investment during challenging economic times.

The event kicked off with VOSS Americas CEO Jack Belsito explaining how his decades of experience as an executive has shaped how he currently makes decisions. Belsito explained that in his first stint at VOSS to his time as CEO of Snapple and later Health-Ade, he has learned when it’s beneficial to diversify a brand’s portfolio and when it might “choke the winner.”

After a panel discussion about funding collectives, another seasoned beverage executive, Ben Mand, presented his approach to leadership. Mand, who took over the head job at Yerba Madre (formerly Guayaki) in March 2024, discussed why and how he approached changing the yerba mate drink’s name.

Mand spoke broadly about the challenges of refocusing a brand as an incoming executive and why it is important to find out “what you need to hear, not what you want to hear.” Over his time leading Harmless Harvest and mar-

keting roles at various CPG food brands, Mand has developed a strategic toolkit that he implements to reshape a business and prepare it for the next stage of growth.

Day one’s afternoon session included a panel of adult non-alcoholic (ANA) brand leaders — De Soi’s Scout Brisson, Little Saint’s Megan Klein and Jill Sites from Pathfinder — discussing their various approaches to building the increasingly popular category.

The group talked about how the target demographic for the ANA category is not concentrated solely on the Gen-Z consumers who are abstaining from alcohol. While that generation will continue to grow the category, millennials are one of the key groups changing their consumption

behaviors and looking for premiumpositioned alternatives to popular cocktails or alcoholic drinks.

Harnessing the enthusiasm behind the ANA category was represented on the panel in a variety of forms. While some brands like De Soi or Little Saints have used the wellness community and functional ingredients as a focal point for driving growth, Pathfinder has taken a more traditional beverage-alcohol approach, targeting on-premise locations. Sites, who is Pathfinder’s EVP of Sales, spoke about diversifying the message with partners to be an ANA option or a great mixer. This strategy expands the brand’s value proposition but also refrains from villainizing distribution partners’ portfolios.

“We were built as a brand that wanted to be with alcohol,” said Sites. “I don’t think that spirits are going away. I think they’re on a slight decline. But if you have a distribution network, it’s important that you try to help them.”

On the second day’s session, the slate of speakers and panelists tackled topics ranging from the relationship between convenience store chains and emerging beverage brands to scaling startups into category competitors. Veteran leaders Mel Landis, president of Olipop, and Polar Beverage CEO Ralph Crowley Jr.

addressed their respective philosophies of building incremental growth so independent brands can compete against larger strategics.

Yet, moving from being an insurgent phase to an acquisition target can be a balancing act. Nicholas Giannuzzi, founding partner at Humble Growth, said that “you have to be pretty big in the beverage industry right now for a strategic to have interest.”

Giannuzzi calculated a brand’s revenue to be upwards of $300 million, yet creating value is more than just

what shows up on a P&L statement. The key is to focus on core principles and filling “a white space that is evolutionarily different,” he said.

Chobani’s chief customer officer John Frost spoke later in the day about maintaining a “challenger mindset” as he moved from his long career at PepsiCo to the “30th largest CPG company in the country.”