17 minute read

How to complete verification on Exness in India 2025

How to complete verification on Exness in india? is a critical step for Indian traders looking to open an account with the global forex and CFD broker Exness. Verifying your identity and address is a crucial part of the onboarding process, ensuring compliance with KYC (Know Your Customer) regulations and anti-money laundering (AML) policies. This guide will provide a comprehensive overview of the Exness verification process in India, including the required documents, common issues, and tips for a smooth experience.

Step-by-Step Guide to Complete Verification on Exness in India

Before we dive into the details, it's important to understand that the Exness verification process is designed to protect both the broker and its clients. By verifying your identity and address, Exness can ensure that your trading account is secure and that your funds are safe.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Understanding the Exness Verification Requirements

The first step in the Exness verification process is to gather the required documents. For Indian clients, the typical documents needed include:

Valid government-issued photo ID (such as a passport, Aadhaar card, or PAN card)

Proof of address (such as a utility bill, bank statement, or rent agreement)

Proof of income (such as a salary slip or tax return)

It's important to ensure that all the documents are clear, legible, and up-to-date. Exness may also request additional documents depending on your specific situation or if they have any concerns about the information provided.

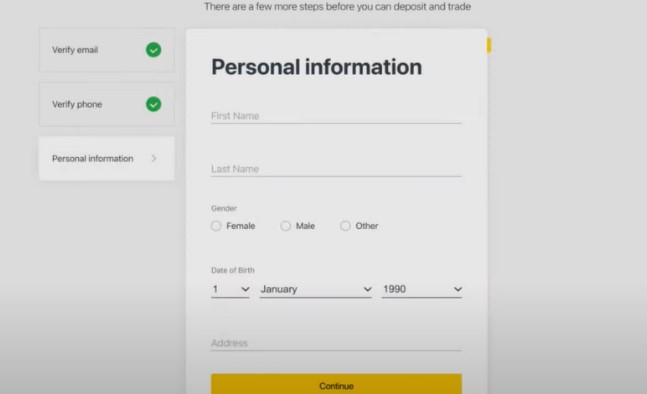

Submitting Your Verification Documents

Once you have all the required documents, you can begin the verification process by logging into your Exness account and navigating to the "Verification" section. Here, you'll be able to upload your documents securely and submit them for review.

It's important to note that you should only upload documents that are directly related to the verification process. Avoid including any sensitive information that is not necessary, such as bank account details or personal identification numbers.

Tracking the Status of Your Verification

After submitting your documents, you'll be able to track the status of your verification through your Exness account. Exness typically aims to review and approve verification submissions within 1-2 business days, but the process may take longer during peak periods or if there are any issues with the documents provided.

If Exness requires any additional information or if there are any issues with the documents you've submitted, they will notify you through your Exness account or via email. It's important to respond to these requests promptly to avoid delays in the verification process.

Completing the Verification Process

Once your documents have been reviewed and approved, your Exness account will be fully verified, and you'll be able to start trading. It's important to note that Exness may periodically request additional verification documents or updates to your existing documents to ensure compliance with their policies.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

By following this step-by-step guide, you can ensure a smooth and successful verification process on Exness in India. Remember to always provide accurate and up-to-date information, and to respond promptly to any requests from Exness to ensure a seamless trading experience.

Documents Required for Exness Verification in India

Verifying your identity and address is a crucial step in the Exness onboarding process for Indian clients. To complete the verification, you'll need to provide several key documents. In this section, we'll take a closer look at the required documents and what to expect during the verification process.

Valid Government-Issued Photo ID

The first document you'll need to provide is a valid government-issued photo ID. In India, the most commonly accepted IDs for Exness verification include:

Passport

Aadhaar card

PAN (Permanent Account Number) card

Ensure that the photo ID you provide is clear, legible, and up-to-date. If the ID has an expiration date, make sure it is still valid at the time of submitting your verification documents.

Proof of Residential Address

In addition to your photo ID, you'll also need to provide proof of your residential address. Acceptable documents for this purpose include:

Utility bills (electricity, water, or gas)

Bank statements

Rent agreement or lease contract

Government-issued documents (such as a voter ID card or driving license)

The proof of address document should be dated within the last three months and clearly display your name and current residential address.

See more:

How to trade in exness in india

how to open account in Exness in india

Proof of Income

Exness may also request documentation to verify your source of income. This can include:

Salary slips or payroll statements

Tax returns (such as your ITR-V or Form 16)

Bank statements showing regular deposits

Proof of business ownership or self-employment income

Providing evidence of your income helps Exness ensure that your trading activity is aligned with your financial situation and that there are no concerns about the origin of your funds.

Additional Documents (If Required)

Depending on your specific situation or if Exness has any concerns about the information you've provided, they may request additional documents. This could include:

Proof of funding (such as bank statements or transfer receipts)

Proof of relationship (if you're trading on behalf of someone else)

Explanation of source of wealth or funds

It's important to respond to these requests promptly and provide the required documents to avoid delays in the verification process.

By gathering all the necessary documents upfront, you can ensure a smooth and efficient verification process with Exness in India. Remember to double-check that all the information is accurate and up-to-date before submitting your documents.

Common Issues During Exness Verification in India and Solutions

While the Exness verification process in India is generally straightforward, there can be some common issues that clients may encounter. In this section, we'll explore some of these challenges and provide practical solutions to help you navigate the verification process successfully.

Blurry or Unclear Documents

One of the most common issues during the Exness verification process is submitting documents that are blurry, unclear, or difficult to read. This can happen due to poor image quality, improper scanning, or even outdated documents.

To solve this problem, make sure to use high-quality images or scans when uploading your documents. Ensure that the text is legible, the colors are accurate, and there are no shadows or glare. If necessary, you can try re-scanning or re-photographing the documents to improve the quality.

Expired or Outdated Documents

Another common issue is submitting documents that are expired or outdated. Exness requires that all verification documents be current and valid at the time of submission.

If you find that one of your documents is expired, you'll need to obtain a new, up-to-date version before resubmitting your verification. This may involve requesting a new utility bill, bank statement, or government-issued ID.

Inconsistent Information

Exness will carefully review the information provided in your verification documents to ensure that it is consistent across all the documents. If they notice any discrepancies, such as a different name or address on different documents, they may request additional information or clarification.

To avoid this issue, double-check that all the information in your verification documents is accurate and consistent. Ensure that your name, address, and other personal details are the same across all the documents you submit.

Difficulty Obtaining Specific Documents

In some cases, clients may face challenges in obtaining the specific documents required by Exness, such as a recent utility bill or bank statement.

If you're having trouble obtaining a particular document, reach out to Exness customer support for guidance. They may be able to suggest alternative documents that can be used for verification or provide instructions on how to obtain the required documents.

By understanding and addressing these common issues, you can increase the chances of a successful and timely verification process with Exness in India. Remember to be proactive, responsive, and transparent throughout the verification process to ensure a smooth experience.

Understanding the Exness Verification Process in India

The Exness verification process in India is designed to ensure the security and integrity of your trading account. By verifying your identity and address, Exness can comply with regulatory requirements and protect both you and the platform from potential fraud or money laundering activities.

The Verification Workflow

The Exness verification process typically follows these steps:

Document Submission: You'll need to upload the required documents, such as your government-issued ID, proof of address, and proof of income, through the Exness platform.

Document Review: The Exness compliance team will review the documents you've submitted to ensure they meet the necessary requirements.

Additional Information Request: If Exness requires any additional information or clarification, they will contact you through your registered email or the Exness platform.

Verification Approval: Once your documents have been reviewed and approved, your Exness account will be fully verified and you'll be able to start trading.

Compliance and Regulatory Requirements

The Exness verification process is in place to comply with various regulatory requirements, including:

Know Your Customer (KYC): Exness must verify the identity of their clients to prevent financial crimes such as money laundering and terrorist financing.

Anti-Money Laundering (AML): By verifying the source of your funds, Exness can ensure that your trading activity is not associated with any illegal or suspicious financial activities.

Financial Regulations: Exness must adhere to the regulations set forth by the relevant financial authorities in the countries where they operate, including India.

Protecting Your Account and Funds

The Exness verification process is not just about compliance – it also plays a crucial role in protecting your trading account and funds. By verifying your identity and address, Exness can:

Prevent unauthorized access to your account

Ensure the safety and security of your funds

Mitigate the risk of fraudulent activities

Provide a secure trading environment for all their clients

Ultimately, the Exness verification process is a necessary step to ensure the integrity and trustworthiness of the platform, which benefits both Exness and its clients.

Maintaining Compliance over Time

It's important to note that the Exness verification process doesn't end after your initial account setup. Exness may periodically request updates to your verification documents to ensure that the information they have on file is current and accurate.

By staying proactive and responsive to any verification requests from Exness, you can maintain a compliant and secure trading experience on the platform. This can help you avoid any disruptions or issues with your account in the long run.

Tips for a Smooth Verification Experience on Exness in India

Navigating the Exness verification process in India can be a straightforward experience if you're prepared and know what to expect. In this section, we'll share some valuable tips to help you have a smooth and hassle-free verification journey.

Gather All Required Documents Upfront

One of the most important tips for a smooth Exness verification is to gather all the required documents upfront. This includes your government-issued ID, proof of address, and proof of income. By having these documents ready, you can streamline the submission process and avoid delays.

Ensure Document Quality and Accuracy

When submitting your verification documents, make sure they are of high quality and accurate. Double-check that the information on the documents matches what you've provided in your Exness account, and that the documents are clear, legible, and up-to-date.

Respond Promptly to Requests for Additional Information

If Exness requests any additional information or clarification during the verification process, be sure to respond promptly. Delays in providing the requested documents or information can slow down the verification process and potentially lead to issues with your account.

Stay Organized and Keep Records

Throughout the Exness verification process, it's a good idea to stay organized and keep records of your interactions with the Exness team. This can include keeping track of the documents you've submitted, any communication you've had, and the status of your verification.

Utilize Exness Customer Support

If you have any questions or encounter any issues during the Exness verification process, don't hesitate to reach out to the Exness customer support team. They can provide guidance, clarification, and help you resolve any problems that may arise.

Be Patient and Persistent

The Exness verification process, while straightforward, may take some time to complete. Be patient and persistent throughout the process, and avoid getting frustrated if there are any delays or additional requests. By staying calm and responsive, you'll increase your chances of a successful and timely verification.

By following these tips, you can ensure a smooth and efficient verification experience on Exness in India. Remember, the key is to be proactive, organized, and responsive throughout the process.

How Long Does Exness Verification Take in India?

The time it takes to complete the Exness verification process in India can vary depending on several factors. In this section, we'll explore the typical timeline and what can impact the duration of the verification process.

Average Verification Timeline

Exness typically aims to review and approve verification submissions within 1-2 business days. However, this timeline can be influenced by various factors, such as the volume of verification requests, the complexity of the information provided, and any additional requests for information.

Factors Affecting Verification Time

Some of the key factors that can impact the duration of the Exness verification process in India include:

Document Completeness: If the initial documents you submit are complete and of high quality, the verification process is likely to be faster. Incomplete or unclear documents may result in additional requests and delays.

Verification Volume: During peak periods or high-volume times, Exness may experience a higher number of verification requests, which can slow down the review process.

Additional Information Requests: If Exness requires any additional information or clarification from you, the verification timeline may be extended until you provide the requested details.

Regulatory Changes: Modifications to KYC or AML regulations in India can sometimes necessitate changes to the Exness verification process, which may impact the timeline.

Monitoring the Verification Status

You can track the status of your Exness verification through your account dashboard or by contacting the Exness customer support team. Once your documents have been reviewed and approved, your account will be fully verified, and you'll be able to start trading.

It's important to note that the Exness verification process is an ongoing one, and you may be required to provide updated documents periodically to maintain compliance. By staying proactive and responsive, you can ensure a smooth and efficient verification experience throughout your trading journey with Exness in India.

Exness Account Verification: A Comprehensive Overview for Indian Users

Exness is a prominent global forex and CFD broker that has made a significant presence in the Indian market. As an Indian trader, understanding the Exness account verification process is crucial to ensure a seamless onboarding experience and secure trading. In this comprehensive overview, we'll dive deep into the various aspects of the Exness verification process for Indian users.

The Importance of Exness Verification

Verifying your identity and address is a mandatory step when opening an Exness trading account in India. This process serves several vital purposes:

Compliance with Regulations: Exness must comply with strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations set by financial authorities in India and globally. The verification process helps Exness ensure that your trading activities are legitimate and in line with these regulations.

Account Security: By verifying your identity and address, Exness can protect your account from unauthorized access and potential fraudulent activities, safeguarding your trading funds and personal information.

Confidence and Trust: The Exness verification process helps build trust between the broker and its clients, ensuring a secure and reliable trading environment for all users.

Required Documents for Exness Verification in India

To complete the Exness verification process in India, you will need to provide the following documents:

Government-Issued Photo ID: This can be a passport, Aadhaar card, or PAN (Permanent Account Number) card.

Proof of Residential Address: Acceptable documents include utility bills, bank statements, rent agreements, or government-issued documents like a voter ID or driving license.

Proof of Income: This can be in the form of salary slips, tax returns, or bank statements showing regular deposits.

Ensure that all the documents you submit are clear, legible, and up-to-date to avoid any delays in the verification process.

The Exness Verification Workflow

The Exness verification process in India typically follows these steps:

Document Submission: You'll need to upload the required documents through the Exness platform.

Document Review: The Exness compliance team will review the documents you've submitted.

Additional Information Request: If Exness requires any further clarification or additional documents, they will contact you.

Verification Approval: Once your documents have been reviewed and approved, your Exness account will be fully verified, and you can start trading.

Throughout the process, you can track the status of your verification through your Exness account dashboard.

Maintaining Compliance over Time

It's important to note that the Exness verification process is an ongoing one.As an Exness user, you may be required to periodically update your documentation to maintain compliance with evolving regulations. This could include providing updated proof of identity or residence every few years, or whenever there are significant changes in your personal circumstances, such as moving to a new address or changing your legal name.

Failure to keep your documents updated could result in limited access to your trading account or even suspension. Therefore, it is essential to remain vigilant and proactive regarding your account status. Regularly reviewing the documents associated with your Exness account can help ensure that you are prepared for any requests for updates.

Frequently Asked Questions About Exness Verification in India

Navigating through the verification process can bring about a slew of questions and uncertainties, especially for new users. In this section, we will address some of the most frequently asked questions regarding the Exness verification process in India.

Why is Verification Necessary?

One of the most common questions revolves around the necessity of the verification process. As mentioned earlier, this process is primarily designed to comply with KYC and AML regulations. By confirming your identity, Exness ensures that all trading activities are legitimate and secure, protecting both the broker and its clients from potential fraud.

Additionally, the verification process helps to strengthen trust within the trading community. It reassures traders that their personal information is safeguarded and that they are engaging in a regulated environment.

What Happens if My Verification is Denied?

In some instances, your verification request may be denied due to incomplete or insufficient documentation. If this occurs, Exness will typically provide you with a clear explanation of the reasons behind the denial and may offer guidance on how to resolve the issues.

If your verification is denied, do not panic. Take the feedback into consideration, double-check the documents you submitted, and resubmit after making the necessary adjustments. Being thorough during your second attempt can greatly improve your chances of successful verification.

Can I Trade While Waiting for Verification?

This question often arises among traders eager to engage in the markets. Unfortunately, until your account is fully verified, trading capabilities may be restricted. Most brokers, including Exness, implement a "no trading" policy until verification is complete to prevent unauthorized transactions.

While waiting for verification, consider using this time to familiarize yourself with the trading platform, practice with demo accounts, or conduct market research. This way, you'll be well-prepared to dive into trading once your account is approved.

How Can I Expedite the Verification Process?

Traders looking to speed up their verification should focus on submitting high-quality documentation. Ensuring that all documents are clear, legible, and current can help eliminate unnecessary delays. Additionally, being prompt in responding to any requests for additional information will demonstrate your commitment to the process.

Maintaining open lines of communication with Exness customer support can also assist in clarifying any ambiguities or issues, allowing you to work towards a speedy approval.

Conclusion

Completing the verification process on Exness in India is a crucial step for any trader looking to engage in financial markets safely and securely. By understanding the requirements, the importance of documentation, and the common challenges encountered, you can navigate this process with confidence.

✳️ Read more:

how to use EXNESS trading app for beginners

Is Exness legal in Dubai, UAE?