10 minute read

How to Withdraw Money from EXNESS to Capitec Bank: Step-by-Step Guide 2025

With the rise of online trading, many individuals have turned to platforms like EXNESS to manage their investments effectively. If you're among them and are looking for a comprehensive explanation on How to Withdraw Money from EXNESS to Capitec Bank: Step-by-Step Guide, you've come to the right place. This guide will walk you through every aspect of making withdrawals from EXNESS to your Capitec Bank account, ensuring a seamless process.

Understanding EXNESS Withdrawals

Before going into the specifics of withdrawing funds from EXNESS to Capitec Bank, it’s essential to understand how withdrawals work on the EXNESS platform.

Start Exness Trade : Open Exness Account and Start Trade

EXNESS offers various methods for withdrawing funds, each with its own set of rules and requirements. Knowing these can help you choose the method that works best for your situation.

The Importance of Withdrawal Methods

When it comes to online trading, withdrawal methods play an integral role in managing profits. Your choice of withdrawal method can influence both the speed of transactions and any associated fees.

EXNESS provides several options, including bank transfers, e-wallets, and credit cards. The right method for you depends on factors like convenience, cost, and processing time. By understanding all available options, you can decide which method will serve your financial goals best.

Security Measures in Place

One of the key aspects to consider while making withdrawals is security. EXNESS employs strict security protocols to ensure that your funds are safe throughout the entire transaction process.

Using two-factor authentication (2FA) and Secure Socket Layer (SSL) encryption, EXNESS guarantees that your personal information and financial data are protected. This makes it crucial to follow the necessary steps when initiating a withdrawal.

Currency Considerations

While EXNESS allows withdrawals in multiple currencies, it’s important to note what currency you’re using for trading and what is accepted by Capitec Bank.

Most commonly, withdrawals are made in USD or your local currency. Ensure that you're aware of the currency conversion fees that may apply if you're withdrawing in a different currency than what your Capitec account accepts.

Setting Up Your Capitec Bank Account for EXNESS Transfers

To successfully withdraw funds from EXNESS to your Capitec Bank account, you'll need to make sure your bank account is configured correctly.

This setup involves not only verifying your identity but also ensuring that all details are accurate and up to date.

➡️➡️➡️How to Use EXNESS On Tradingview

➡️➡️➡️How to Use EXNESS on MT4

➡️➡️➡️ How to Use EXNESS Trading app On Android

Opening a Capitec Bank Account

If you don’t have a Capitec account yet, the first step is to open one. Capitec Bank has a straightforward process that can be completed online or at a physical branch.

You’ll need to provide personal identification, proof of address, and any other required documents. Once your account is set up, make sure to familiarize yourself with how Capitec operates, especially regarding online banking.

Linking Your Trading Account to Your Capitec Bank Account

After your Capitec Bank account is active, you’ll need to link it to your EXNESS trading account. This ensures a smooth transfer of funds when you initiate a withdrawal.

In your EXNESS account settings, look for the section regarding bank accounts or payment methods. Here, you can add your Capitec Bank account details. Double-check that the information entered matches exactly as it appears with your bank to avoid any delays or rejections.

Start Exness Trade : Open Exness Account and Start Trade

Verifying Your Account Information

Once your bank account is linked, it's vital to verify that all the information provided is correct. Incorrect details can result in failed transactions or delays.

Take the time to confirm both your Capitec Bank and EXNESS account details, including your account number and personal identification numbers.

Step-by-Step Process to Withdraw from EXNESS

Now that you have your Capitec Bank account set up, let’s dive into the actual process of withdrawing funds from EXNESS.

The withdrawal procedure is designed to be user-friendly, but it helps to know each step beforehand to avoid any potential errors.

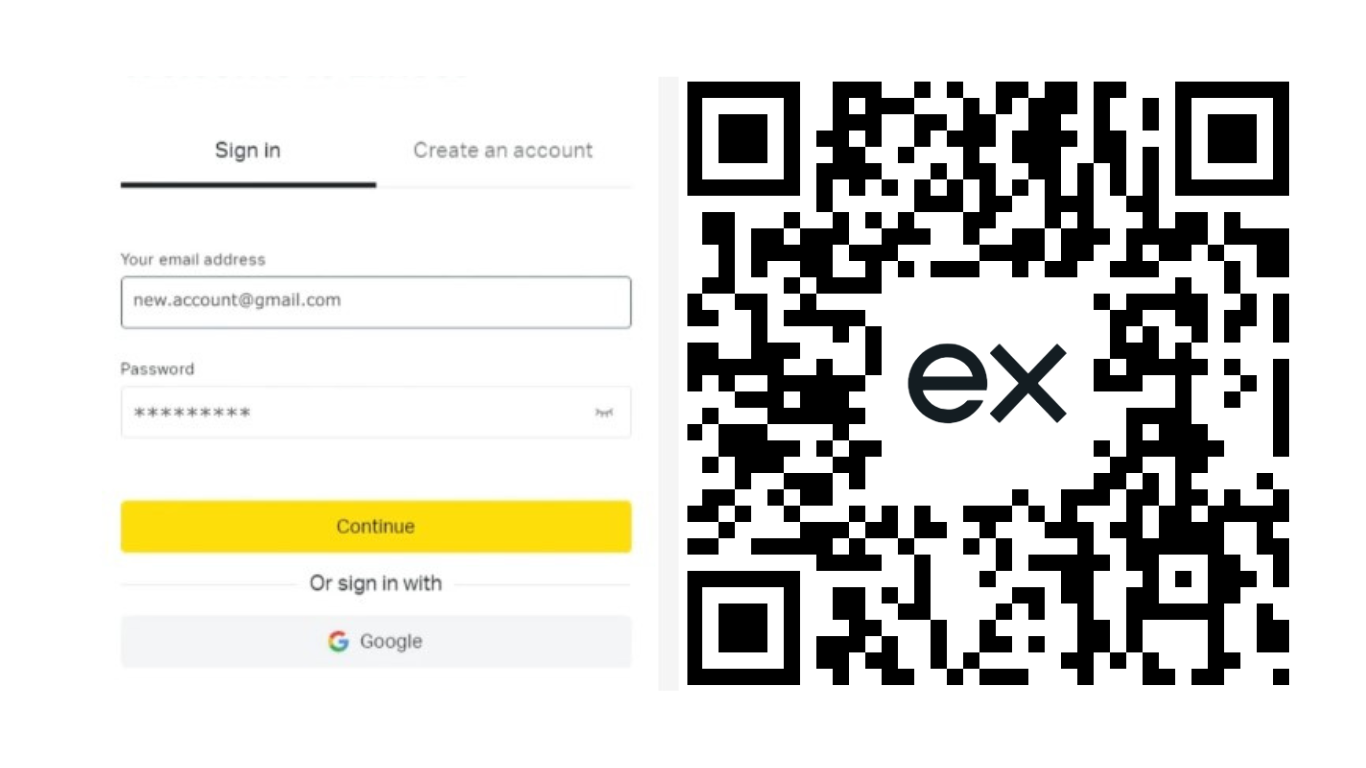

Logging Into Your EXNESS Account

First things first, log into your EXNESS account using your credentials. Make sure you're accessing the official website or app for security reasons.

Once logged in, navigate to the 'Withdraw' section. This area is typically found in your dashboard and will guide you through the necessary steps to initiate a withdrawal.

Choosing the Withdrawal Method

From the 'Withdraw' menu, you’ll see various options for withdrawing your funds. Select 'Bank Transfer' as your preferred method since you are withdrawing to your Capitec Bank account.

Each method will show specific processing times and potential fees associated with it, so read through this information carefully before making a selection.

Start Exness Trade : Open Exness Account and Start Trade

Entering the Withdrawal Amount

Input the amount you wish to withdraw from your EXNESS account. It's advisable to leave some funds in your trading account for future trades, so plan accordingly.

Be mindful of the minimum withdrawal amount requirements, as exceeding these limits could lead to complications.

Confirming the Transaction

After entering your desired withdrawal amount, review all the entered information. One last check is critical; any errors could delay the process.

Once you're confident everything is correct, click 'Confirm.' You should receive a confirmation message or email indicating that your withdrawal request has been initiated.

Required Documents for Withdrawal to Capitec Bank

When withdrawing money from EXNESS to your Capitec Bank account, certain documentation is often required to validate your identity and transaction.

Having these documents ready will streamline the withdrawal process and minimize any potential hurdles.

Identification Documents

Typically, you will need to present a form of identification, such as a government-issued ID or passport.

This requirement is part of EXNESS's commitment to regulatory compliance and helps prevent fraud. Be prepared to upload a copy during the withdrawal process if prompted.

Proof of Address

In addition to identification, you might also need to submit proof of your residential address.

Documents such as utility bills or bank statements that display your name and address are acceptable forms of proof. Make sure these documents are dated within the last three months for accuracy.

Bank Account Verification

Lastly, it may be necessary to verify your bank account details. This step confirms that the funds are being transferred to the correct account.

Keep your Capitec Bank account details handy, as you may be asked to confirm them during the withdrawal process.

Common Issues When Withdrawing Money

While withdrawing funds from EXNESS to Capitec Bank is generally straightforward, there can be issues that arise.

Understanding these common challenges can prepare you to handle them effectively and avoid unnecessary stress during the process.

Delays in Processing Time

One of the most frequently encountered issues is delays in processing time. Although EXNESS typically processes withdrawals quickly, external factors like banking hours and public holidays can cause delays.

If you find that your withdrawal hasn’t arrived in your Capitec account on time, it’s advisable to wait a bit longer and then reach out to customer support if the issue persists.

Rejected Transactions

Sometimes, transactions may be rejected due to incorrect details or insufficient funds in your EXNESS account.

Always double-check your withdrawal details before submitting the request. If an issue arises, you’ll receive an email notification detailing why the transaction was declined, allowing you to rectify the problem.

Currency Conversion Issues

If you are withdrawing in a different currency than what your Capitec Bank account supports, you may experience additional charges related to currency conversion.

It's crucial to be aware of these details ahead of time to avoid unexpected fees. Always check with Capitec regarding their policies on foreign currency deposits.

Fees Associated with EXNESS Withdrawals

Understanding the fee structure associated with withdrawals is vital for effective financial management.

EXNESS has transparent fees, but being informed about them beforehand can save you unwanted surprises later on.

Transaction Fees

Depending on the withdrawal method you choose, EXNESS may levy transaction fees.

These fees can vary based on the payment processor and the total amount being withdrawn. If you opt for a bank transfer to your Capitec account, check the specific fee listed under that option.

Currency Conversion Fees

If you are withdrawing funds in a currency not supported by Capitec Bank, currency conversion fees may apply.

Be vigilant about checking the exchange rates and any possible additional fees that could reduce your final amount upon receipt.

Hidden Charges

While EXNESS aims to maintain transparency, sometimes hidden charges can surface, particularly when dealing with international transactions.

Always read the terms and conditions associated with your chosen withdrawal method to safeguard against unforeseen costs.

How Long Does It Take to Withdraw Funds?

The duration it takes for funds to appear in your Capitec Bank account can vary.

Start Exness Trade : Open Exness Account and Start Trade

Understanding these timelines will set realistic expectations and help you plan your finances better.

Standard Processing Times

EXNESS aims to process withdrawals swiftly, often within 1-3 business days.

However, this timeframe can fluctuate depending on the chosen withdrawal method. Bank transfers may take longer compared to e-wallet options, which tend to be faster.

Start Exness Trade : Open Exness Account and Start Trade

Variables Influencing Duration

Factors such as weekends, public holidays, and even internal bank processes can affect how long it takes for funds to appear in your Capitec account.

After initiating your withdrawal, keep an eye on both your EXNESS account and your Capitec Bank account for notifications.

What to Do If Funds Are Delayed

If there are undue delays, it’s best to contact EXNESS customer support for clarification.

They can provide insights into the status of your withdrawal and any potential hold-ups you might not be aware of.

Tips for a Smooth Withdrawal Process

Successful withdrawals require a blend of preparation and awareness.

Implementing the following tips can help facilitate a hassle-free experience when transferring funds from EXNESS to your Capitec Bank account.

Double-Check Everything

Whether it's your EXNESS login details, withdrawal amount, or banking information, always ensure accuracy.

Small errors can lead to significant delays or complications, so take that extra minute to verify each detail thoroughly.

Keep Documentation Handy

Maintaining organized records of your identification documents and banking information can expedite the process significantly.

Whenever you plan to make a withdrawal, have all necessary documentation readily accessible.

Stay Informed

Keep abreast of any changes to EXNESS policies or Capitec Bank requirements.

Regularly reviewing terms and conditions can help you stay prepared for any new regulations or fees associated with withdrawals.

Alternatives to Capitec Bank for EXNESS Withdrawals

If you encounter difficulties withdrawing to Capitec Bank or simply want to explore other options, EXNESS offers various alternative withdrawal methods.

Having these alternatives in mind can offer flexibility and convenience.

E-Wallets

Platforms like Skrill, Neteller, and PayPal are popular among traders for their quick transaction times.

These e-wallets can often process withdrawals within hours, providing immediate access to your funds. However, they may charge fees, so it's wise to review their terms beforehand.

Credit and Debit Cards

Another common withdrawal method is to use credit and debit cards, which can be a viable alternative.

Transactions via cards are typically processed quickly, though, similar to e-wallets, they may come with their own set of fees.

Cryptocurrency

For the tech-savvy trader, withdrawing funds in cryptocurrency presents another alternative.

Cryptocurrency transactions can bypass traditional banking systems, offering quick and often cheaper options. However, always ensure you understand the risks involved with digital currencies.

Start Exness Trade : Open Exness Account and Start Trade

Conclusion

Navigating the world of online trading comes with its unique challenges, especially regarding withdrawals.

By following this How to Withdraw Money from EXNESS to Capitec Bank: Step-by-Step Guide, you can equip yourself with the knowledge needed to effectively manage your funds.

See more:

How to create a strategy in EXNESS Social Trading?

Is EXNESS Social Trading legit?

How to become an EXNESS social trader?