7 minute read

Is Exness legal in Pakistan? New regulations update 2025

from Exness trade

Introduction

Forex trading has grown in popularity worldwide, including in Pakistan, where traders are increasingly seeking opportunities in the global currency markets. With the rise of online brokers, platforms like Exness have become widely used by traders in Pakistan. However, before engaging with any forex broker, one of the first questions that comes to mind is: Is Exness legal in Pakistan?

This article provides a detailed analysis of the legal framework for forex trading in Pakistan, the regulations that govern brokers, and whether Exness complies with those regulations. We will also explore the potential risks and benefits for Pakistani traders using Exness, as well as the tax and legal implications.

Overview of Exness and Its Global Reach

Exness is an online forex and CFD broker that was established in 2008. Over the years, it has built a strong reputation in the trading community, offering a wide range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. Exness is known for its low spreads, high leverage options, and user-friendly platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

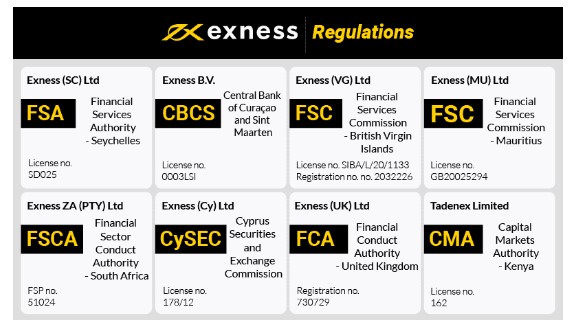

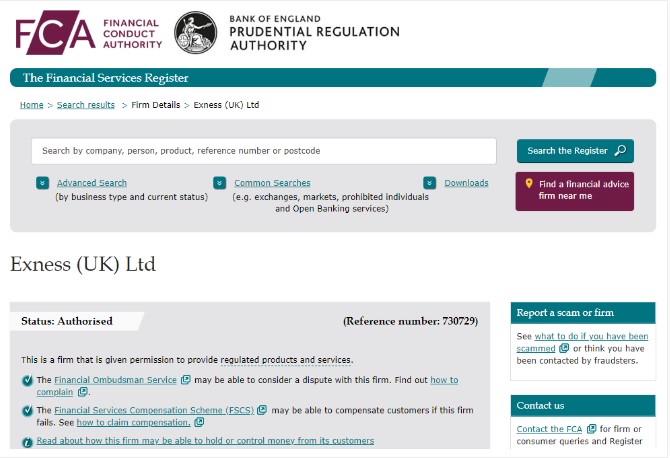

Exness broker is regulated by several financial authorities worldwide, including the FCA (Financial Conduct Authority) in the UK, CySEC (Cyprus Securities and Exchange Commission), and the FSCA (Financial Sector Conduct Authority) in South Africa. While Exness is regulated in multiple jurisdictions, it is not licensed by the Securities and Exchange Commission of Pakistan (SECP) or the State Bank of Pakistan (SBP).

Start Exness Trade : Open Exness Account and Start Trade

Forex Trading Regulations in Pakistan

In order to understand whether Exness is legal for Pakistani traders, we need to examine the regulatory framework for forex trading in Pakistan. The two main authorities that regulate financial markets in the country are:

1. The Securities and Exchange Commission of Pakistan (SECP)

The SECP is the regulatory body responsible for overseeing capital markets, including securities, commodities, and forex trading in Pakistan. The SECP’s primary role is to regulate local brokers offering financial services within the country and ensure they comply with the Securities Act, 2015 and the Companies Ordinance, 1984.

However, SECP does not directly regulate offshore forex brokers like Exness. This means that while the SECP governs the operations of local brokers in Pakistan, it does not have authority over foreign brokers offering trading services to Pakistani residents.

2. The State Bank of Pakistan (SBP)

The SBP, as the central bank of Pakistan, plays a crucial role in regulating the foreign exchange market under the Foreign Exchange Regulation Act (FERA), 1947. The SBP ensures that any foreign currency transactions, including forex trading, comply with the rules set forth in the law.

According to the SBP, forex trading with local brokers is legal, but trading with offshore brokers is subject to the individual’s discretion. Since Exness operates outside of Pakistan, it is not directly regulated by the SBP, but the platform can still offer services to Pakistani traders, as long as they do not violate the country's foreign exchange regulations.

Key Restrictions on Forex Trading in Pakistan

Although Pakistan allows forex trading, there are certain restrictions that traders need to be aware of:

Indian and Pakistani Markets: Local regulations prohibit trading on domestic exchanges for foreign currency pairs. Hence, Pakistani traders are only allowed to trade forex through international brokers, as long as they follow the SBP’s guidelines on foreign currency exchange.

Leverage Restrictions: In Pakistan, the SBP imposes limits on leverage, with retail traders allowed limited leverage. Offshore brokers like Exness often offer higher leverage, which might attract Pakistani traders seeking more significant trading opportunities. However, this comes with increased risk, which traders must manage carefully.

Is Exness Legal for Pakistani Traders?

So, the key question remains: Is Exness legal in Pakistan?

While Exness is not regulated by the SECP or the SBP, it is still legal for Pakistani residents to use the platform for trading. Exness is considered an offshore broker, and offshore brokers can legally offer their services to traders in Pakistan, as long as the traders comply with local financial and taxation laws.

Here’s why Exness remains an attractive option for Pakistani traders:

1. Exness’ Global Regulation:

Exness is regulated by financial authorities in several respected jurisdictions, including:

The FCA in the UK,

CySEC in Cyprus,

FSCA in South Africa.

These regulations provide transparency and ensure that Exness adheres to global standards of financial conduct, including capital requirements, reporting standards, and investor protection. While these regulations do not apply directly to Pakistan, they ensure that Exness operates safely and securely, making it a reliable choice for traders.

2. Trading with High Leverage:

Exness offers high leverage options, which are appealing to many traders, especially those in Pakistan who may not have the same access to high leverage through local brokers. Exness provides leverage up to 1:2000 on certain accounts, which allows traders to take larger positions with a smaller initial investment.

However, high leverage also increases the risk of substantial losses, which is why it’s essential for traders to understand and manage the risks associated with leveraged trading.

3. Transparency and Security:

Exness takes various measures to ensure that traders' funds are safe. These include:

Segregated accounts: Exness keeps clients’ funds in separate accounts from company funds, ensuring that traders’ money is protected even if the company faces financial difficulties.

Negative balance protection: Exness offers protection against losing more than the balance in your trading account, which can prevent traders from owing money if the market moves against them unexpectedly.

4. Taxation and Reporting:

Forex trading is subject to taxation in Pakistan. Traders need to be aware that any profits made from forex trading, including trading with Exness, are considered taxable income under Pakistan’s Income Tax Ordinance, 2001. Traders must report their earnings and pay taxes on their profits as required by the Federal Board of Revenue (FBR).

While the FBR has not specifically addressed offshore forex trading, it is the responsibility of traders to ensure they comply with tax regulations and declare their income from forex trading.

Risks and Considerations When Trading with Exness in Pakistan

While Exness is a legal and regulated broker, there are some potential risks and considerations for Pakistani traders:

1. Lack of Local Regulation:

Since Exness is not directly regulated by Pakistani authorities, traders do not have the same legal protections they would have when dealing with a locally regulated broker. In the event of a dispute or issue with the broker, resolving the matter may be more complicated, as Pakistani authorities do not have jurisdiction over Exness.

2. High Leverage Risks:

Exness offers high leverage, which can lead to significant profits, but it also increases the risk of large losses. Pakistani traders should be cautious when using high leverage, especially beginners who may not fully understand the risks associated with leveraged trading.

3. Exchange Rate Risks:

When trading with offshore brokers, Pakistani traders should be aware of currency exchange rate fluctuations. While Exness operates internationally, the value of the Pakistani Rupee (PKR) can affect trading results, especially when converting profits or withdrawing funds to Pakistani bank accounts.

4. Tax Obligations:

As mentioned earlier, forex trading profits are subject to taxation in Pakistan. Traders must ensure they comply with local tax laws and report their earnings to avoid legal issues in the future.

Conclusion

In conclusion, Exness is legal in Pakistan, and traders can use its platform to trade forex and other instruments. While Exness is not regulated by Pakistan’s financial authorities, it is regulated in other jurisdictions by reputable agencies such as the FCA, CySEC, and FSCA. This ensures that Exness operates under strict financial standards and offers a secure trading environment.

However, Pakistani traders should be aware of the potential risks, including the lack of local regulation, high leverage risks, and tax obligations. By understanding these factors and complying with local tax laws, traders can safely use Exness to engage in forex trading.

If you decide to trade with Exness, it’s crucial to educate yourself about the platform, risk management strategies, and the legal requirements for trading in Pakistan. Always make informed decisions and approach trading with caution to maximize your chances of success.

See more: