18 minute read

Is Exness legal in south Africa? A Comprehensive Guide

from Exness trade

Understanding the Legality of Exness in South AfricaSouth Africa has a well-established financial regulatory framework that oversees the activities of forex brokers and other financial service providers. The Financial Sector Conduct Authority (FSCA), formerly known as the Financial Services Board (FSB), is the primary regulatory body responsible for regulating the financial services industry in the country.

Understanding the Legality of Exness in South Africa

South Africa has a well-established financial regulatory framework that oversees the activities of forex brokers and other financial service providers. The Financial Sector Conduct Authority (FSCA), formerly known as the Financial Services Board (FSB), is the primary regulatory body responsible for regulating the financial services industry in the country.

Start Exness Trade : Open Exness Account and Start Trade

The Role of the FSCA in Regulating Forex Brokers

The FSCA is responsible for ensuring that forex brokers operating in South Africa are fully compliant with the relevant laws and regulations. This includes monitoring the activities of these brokers, investigating any complaints or concerns, and taking enforcement action against those found to be engaging in unethical or illegal practices.

The FSCA's mandate is to protect consumers and promote the stability and integrity of the financial system in South Africa.

The regulator requires all forex brokers operating in the country to be licensed and registered with the FSCA, and to adhere to strict regulatory requirements.

These requirements cover areas such as client money protection, disclosure of fees and charges, and the prevention of market abuse and manipulation.

The Importance of Regulatory Oversight in the Forex Market

The forex market is a highly complex and fast-paced environment, and it is essential that traders in South Africa have access to legitimate and reliable forex brokers. Regulatory oversight plays a crucial role in ensuring that the market operates in a fair and transparent manner, and that traders are protected from fraud and other forms of financial misconduct.

Unregulated forex brokers may engage in practices such as price manipulation, excessive leverage, and the mishandling of client funds, which can have devastating consequences for traders.

By choosing to trade with a regulated forex broker like Exness, South African traders can have greater confidence in the safety and security of their investments.

Is Exness Regulated by South African Authorities?

Exness is a global forex broker that has a presence in a number of countries around the world, including South Africa. As with any forex broker operating in the country, it is important to understand whether Exness is regulated by the relevant South African authorities.

Exness' Regulation and Licensing in South Africa

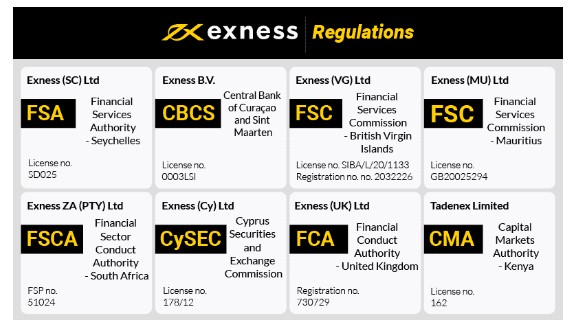

Exness is not directly licensed or regulated by the FSCA in South Africa. However, the broker is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a reputable and well-respected financial regulator in Europe.

CySEC is a member of the European Securities and Markets Authority (ESMA), and its regulatory framework is broadly aligned with the standards and requirements set by ESMA for the forex and CFD trading industry.

Exness' CySEC license allows the broker to offer its services to traders in South Africa, as well as in other countries around the world, under the principle of "passporting" – a regulatory mechanism that enables financial service providers licensed in one EU member state to operate in other member states.

Start Exness Trade : Open Exness Account and Start Trade

Compliance with South African Regulations

Although Exness is not directly licensed by the FSCA, the broker is required to comply with the relevant laws and regulations in South Africa, including the FAIS Act, the Financial Markets Act, and the Exchange Control Regulations.

Exness has taken steps to ensure that its operations in South Africa are fully compliant with these regulations, including the implementation of appropriate client money protection measures, the provision of clear and transparent disclosures, and the facilitation of forex transactions in a manner that is consistent with the Exchange Control Regulations.

South African traders who choose to trade with Exness can have confidence that the broker is operating in a manner that is compliant with the relevant laws and regulations in the country.

Oversight and Enforcement by South African Authorities

While Exness is not directly regulated by the FSCA, the regulator does have the authority to monitor the activities of the broker and to take enforcement action if it is found to be engaging in any unlawful or unethical practices.

The FSCA has the power to investigate complaints and concerns raised by South African traders, and to impose sanctions on Exness if it is found to be in breach of the relevant laws and regulations.

Traders who have concerns about the legality or compliance of Exness' operations in South Africa can contact the FSCA to file a complaint or to seek further information.

Legal Considerations for Trading with Exness in South Africa

When it comes to trading with Exness in South Africa, there are a number of important Exness legal considerations that traders should be aware of.

Compliance with Exchange Control Regulations

As mentioned earlier, South African traders are required to comply with the Exchange Control Regulations when engaging in forex trading or other cross-border financial transactions. This means that they must obtain the necessary approvals and authorizations from the SARB before depositing or withdrawing funds from their Exness trading account.

Exness has implemented robust procedures to ensure that its clients in South Africa are complying with the Exchange Control Regulations, including requiring them to provide the necessary documentation and approvals.

Failure to comply with these regulations can result in significant penalties and legal consequences for South African traders.

Client Money Protection and Segregation

Another important legal consideration for South African traders is the protection and segregation of their client funds. Under the FAIS Act, forex brokers in South Africa are required to ensure that client funds are held in segregated accounts and are protected from being used for the broker's own business activities.

Exness has implemented appropriate client money protection measures to ensure that South African traders' funds are safeguarded and segregated from the broker's own funds.

This provides an additional layer of protection for traders, as it ensures that their funds are not at risk of being lost or misused in the event of the broker's insolvency or financial difficulties.

Dispute Resolution and Complaint Handling

In the event of a dispute or complaint with Exness, South African traders have several options for seeking redress.

Exness has an internal dispute resolution process that allows traders to submit complaints and have them investigated and resolved in a timely and fair manner.

If a trader is not satisfied with the outcome of the internal dispute resolution process, they may also have the option to escalate their complaint to the FSCA or to seek legal recourse through the South African court system.

Taxation and Regulatory Reporting Requirements

Finally, South African traders should be aware of the tax and regulatory reporting requirements that may apply to their forex trading activities with Exness.

Depending on their individual circumstances, South African traders may be required to report their forex trading profits and losses to the South African Revenue Service (SARS) and to comply with other regulatory reporting requirements.

Exness can provide guidance and support to its South African clients on these matters, but it is ultimately the trader's responsibility to ensure that they are meeting all of their tax and regulatory obligations.

Exness License and Compliance in South Africa

As discussed earlier, Exness is not directly licensed or regulated by the FSCA in South Africa. However, the broker is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a reputable and well-respected financial regulator in Europe.

Exness' CySEC License and Regulatory Oversight

Exness holds a CySEC license that allows the broker to offer its services to traders in South Africa, as well as in other countries around the world, under the principle of "passporting." This means that Exness' operations in South Africa are subject to the regulatory oversight and requirements of CySEC.

CySEC's regulatory framework is broadly aligned with the standards and requirements set by the European Securities and Markets Authority (ESMA) for the forex and CFD trading industry.

CySEC requires Exness to maintain adequate financial resources, implement robust risk management systems, and provide appropriate client disclosures and protections.

The regulator also conducts regular inspections and audits of Exness' operations to ensure that the broker is complying with its regulatory requirements.

Exness' Compliance with South African Regulations

While Exness is not directly licensed by the FSCA, the broker is required to comply with the relevant laws and regulations in South Africa, including the FAIS Act, the Financial Markets Act, and the Exchange Control Regulations.

Exness has implemented a range of measures to ensure that its operations in South Africa are fully compliant with these regulations, including the establishment of appropriate client money protection mechanisms, the provision of clear and transparent disclosures, and the facilitation of forex transactions in a manner that is consistent with the Exchange Control Regulations.

The broker also works closely with the FSCA to address any concerns or issues that may arise, and to ensure that its operations in South Africa are aligned with the regulator's requirements.

Exness' Commitment to Regulatory Compliance

Exness has a strong track record of regulatory compliance, not only in South Africa but also in its other markets around the world. The broker has a dedicated compliance team that is responsible for monitoring regulatory developments and ensuring that the company's operations are aligned with the relevant laws and regulations.

Exness has a reputation for being a transparent and trustworthy broker, with a commitment to providing its clients with a safe and secure trading environment.

The broker's compliance with regulatory requirements is a key part of its overall value proposition, and it helps to build trust and confidence among its South African client base.

Benefits of Trading Legally with Exness in South Africa

Trading with a regulated and compliant forex broker like Exness can offer a number of benefits for South African traders.

Client Funds Protection and Segregation

As mentioned earlier, Exness has implemented robust client money protection measures to ensure that South African traders' funds are safeguarded and segregated from the broker's own finances. This provides an added layer of security and peace of mind for traders.

In the event of the broker's insolvency or financial difficulties, South African traders can be confident that their funds will be protected and returned to them.

This level of client fund protection is a key requirement of the FAIS Act and other relevant regulations in South Africa, and it is an important consideration for traders when choosing a forex broker.

Transparency and Disclosure

Exness is committed to providing its South African clients with clear and transparent information about its services, fees, and trading conditions. This includes providing detailed disclosures about the risks associated with forex trading, as well as the broker's policies and procedures for handling client funds and complaints.

By trading with a transparent and compliant broker like Exness, South African traders can make more informed decisions about their trading activities and have a better understanding of the risks and potential rewards involved.

Transparency and disclosure are also important requirements of the FAIS Act and other relevant regulations in South Africa, and they help to build trust and confidence between traders and their broker.

Regulatory Oversight and Enforcement

While Exness is not directly regulated by the FSCA, the broker's compliance with CySEC regulations and its commitment to meeting the requirements of South African authorities means that its operations in the country are subject to a certain level of regulatory oversight and enforcement.

In the event of any concerns or complaints about Exness' activities in South Africa, the FSCA has the authority to investigate and take appropriate enforcement action.

This regulatory oversight provides an additional layer of protection for South African traders, and helps to ensure that they are dealing with a legitimate and compliant forex broker.

Reputation and Credibility

Exness' reputation as a regulated and compliant forex broker is an important consideration for South African traders. The broker's track record of regulatory compliance and its commitment to providing a safe and secure trading environment can help to build trust and confidence among its clients.

By choosing to trade with a reputable and credible broker like Exness, South African traders can have peace of mind knowing that they are dealing with a legitimate and trustworthy provider.

This can be particularly important in the highly competitive and sometimes opaque world of forex trading, where traders need to be able to trust their broker to act in their best interests.

User Experiences: Is Exness Safe for South African Traders?

When it comes to evaluating the safety and reliability of Exness for South African traders, it is important to consider the experiences of the broker's existing clients in the country.

Positive User Feedback and Reviews

Overall, the feedback and reviews from South African traders who have used Exness have been largely positive. Many traders have reported a positive trading experience, with reliable platform performance, prompt customer support, and efficient withdrawal and deposit processes.

South African traders have praised Exness' transparency and compliance with local regulations, which has helped to build trust and confidence in the broker.

Several traders have also highlighted the broker's robust client money protection measures as a key factor in their decision to trade with Exness.

Addressing Concerns and Complaints

While the majority of user feedback about Exness in South Africa has been positive, there have been some isolated instances of concerns or complaints raised by traders.

These concerns have typically been related to issues such as withdrawal delays, platform outages, or perceived discrepancies in the broker's pricing and execution.

Exness has demonstrated a commitment to addressing such concerns in a timely and transparent manner, working closely with clients to resolve any issues and maintain a high level of customer satisfaction.

Regulatory Oversight and Enforcement Actions

As mentioned earlier, while Exness is not directly regulated by the FSCA, the broker's operations in South Africa are subject to a certain level of regulatory oversight and enforcement by the regulator.

The FSCA has the authority to investigate any concerns or complaints about Exness' activities in the country, and to take appropriate enforcement action if the broker is found to be in breach of the relevant laws and regulations.

This regulatory oversight provides an additional layer of protection for South African traders, and helps to ensure that Exness is operating in a manner that is consistent with the country's legal and regulatory requirements.

Overall, the user experiences and feedback from South African traders suggest that Exness can be considered a safe and reliable forex broker for those looking to engage in legal and compliant trading activities in the country.

Steps to Verify the Legality of Exness in South Africa

For South African traders who are considering trading with Exness, it is important to take the necessary steps to verify the legality and compliance of the broker's operations in the country.

Checking Exness' Regulatory Status

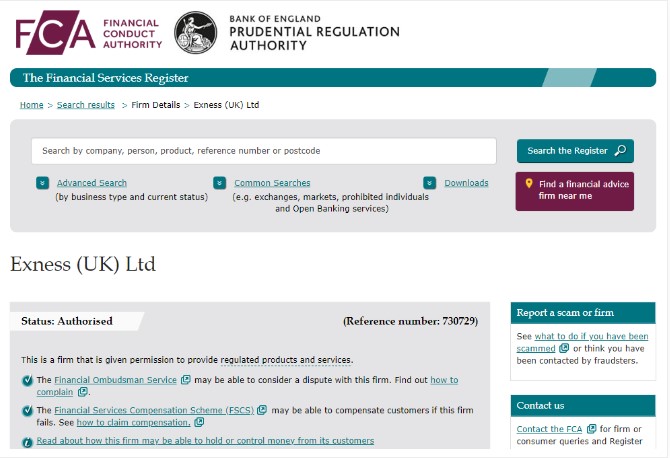

The first step in verifying the legality of Exness in South Africa is to check the broker's regulatory status and licensing. As mentioned earlier, Exness is not directly licensed by the FSCA, but it is licensed and regulated by CySEC in Cyprus.

Traders can check Exness' CySEC license and regulatory status on the CySEC website, as well as on the broker's own website.

It is also important to ensure that Exness is complying with the relevant laws and regulations in South Africa, including the FAIS Act, the Financial Markets Act, and the Exchange Control Regulations.

Reviewing Exness' Client Protections and Disclosures

In addition to checking

Reviewing Exness' Client Protections and Disclosures

In addition to checking the regulatory status of Exness, it is essential for South African traders to review the broker's client protections and disclosures. This includes understanding how Exness handles client funds, provides risk disclosures, and processes complaints.

Traders should look for detailed information on Exness’ website regarding its policies for segregating client funds, which is a crucial aspect of safeguarding their investments. Segregation ensures that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of financial difficulties faced by the broker. Furthermore, reviewing the broker's risk disclosure documents allows traders to gain insights into the potential risks associated with forex trading, helping them make informed decisions before engaging in high-risk activities.

Understanding the complaint handling procedures is also vital. A trustworthy broker like Exness will have clear and accessible channels through which clients can raise concerns or seek resolution. Comprehensive disclosures not only comply with regulations but also foster transparency and build trust between the broker and its clients.

Engaging with the Trading Community

Another effective way to verify the legality of Exness in South Africa is to engage with the local trading community. Online forums, social media groups, and trading communities can provide valuable insights into the experiences of other traders dealing with Exness.

By participating in discussions or reading through posts, prospective traders can gauge the general sentiment towards Exness and better understand any common issues or praises shared by existing users. Having access to real-time feedback and experiences can be instrumental in determining whether Exness aligns with their trading needs and expectations.

Moreover, connecting with experienced traders who have navigated the regulatory landscape in South Africa can offer first-hand knowledge about legitimate brokers, including Exness. With their guidance, new traders can learn how to evaluate brokers effectively and what particular red flags to watch out for.

Utilizing Regulatory Resources

Lastly, South African traders should utilize available regulatory resources to check the legitimacy of Exness. The Financial Sector Conduct Authority (FSCA) provides valuable information regarding registered entities and their compliance with local laws.

Traders can visit the FSCA’s website to search for any warnings or enforcement actions taken against Exness, which would indicate possible issues with the broker's operations. Staying well-informed about regulatory updates and changes is vital for all traders; it helps maintain a secure trading environment and avoids unnecessary risks.

In conclusion, verifying the legality of Exness in South Africa requires a multifaceted approach, where traders must combine checking regulatory status, reviewing client protections, engaging with the community, and utilizing regulatory resources to develop a comprehensive understanding of the broker's standing.

Future Outlook for Exness in the South African Market

As the forex trading landscape continues to evolve, the future outlook for Exness in the South African market presents various opportunities and challenges that could shape its operations moving forward.

Opportunities for Growth

Exness stands to benefit from the growing interest in forex trading within South Africa. Factors such as increasing internet penetration, rising financial literacy, and the availability of advanced trading platforms contribute to a more significant number of individuals seeking to invest in foreign currency markets.

Furthermore, Exness’ commitment to providing educational resources and tools can enhance its appeal among novice traders eager to learn. By offering webinars, training materials, and demo accounts, the broker can attract more users and create a loyal client base.

The ongoing digital transformation in the financial services sector provides additional opportunities for Exness to innovate and improve its trading platform. Incorporating cutting-edge technology and enhancing user experiences can give the broker a competitive edge in attracting South African traders.

Navigating Regulatory Changes

However, alongside these opportunities, Exness must navigate the complexities of regulatory changes in South Africa. The FSCA has been actively working to enhance its regulatory framework, ensuring that forex brokers adhere to strict standards to protect traders. As such, Exness must remain diligent in complying with both local regulations and those established by its home jurisdiction.

Remaining proactive in adapting to these regulatory shifts will be essential for Exness to maintain its credibility and reputation in the South African market. Honoring compliance and fostering transparency can strengthen relationships with regulators and engender trust among traders—two factors that could significantly influence the broker's continued success.

Competing with Local and International Brokers

With an influx of both local and international brokers entering the South African market, competition is likely to intensify. Exness must position itself strategically to differentiate from other forex brokers actively targeting this demographic.

Offering unique features, superior customer support, competitive spreads, and tailored products can help Exness stand out amidst the competitive landscape. Additionally, engaging with the South African community through partnerships, sponsorships, or events can further enhance brand visibility and loyalty.

In summary, the future outlook for Exness in the South African market remains promising, provided it capitalizes on growth opportunities while navigating regulatory changes and competition. A strong commitment to compliance, innovation, and community engagement will be critical for the broker's sustained success in this dynamic environment.

Conclusion

In conclusion, understanding the legality of Exness in South Africa involves a careful examination of regulatory frameworks, compliance measures, user experiences, and future prospects. Despite not being directly regulated by South African authorities, Exness’ adherence to CySEC regulations and its commitment to transparency can provide a sense of security for local traders.

See more: