7 minute read

How to open account in Exness in India

How to Open account in Exness in India: Embarking on your investment journey with Exness in India promises an exciting opportunity to explore and participate in the global financial markets. This comprehensive guide will walk you through the step-by-step process of opening an Exness trading account in India, equipping you with the knowledge and confidence to navigate this exciting venture.

1. Navigating the Exness Website: Your First Step

The initial step in your Exness account opening journey begins with accessing the official Exness website . This platform serves as your primary source of information and guidance throughout the process. It's crucial to ensure that you are on the legitimate Exness website to avoid any potential risks associated with fraudulent or imposter sites.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

The Account Registration Process: Step-by-Step

With a solid understanding of the Exness platform and your trading objectives, the next step is to initiate the account registration process. This phase involves providing personal information, verifying your identity, and selecting the appropriate account type.

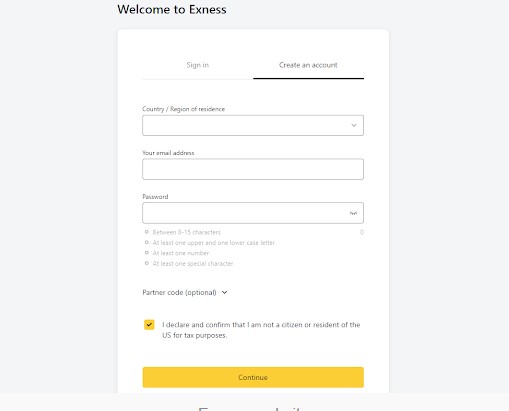

Completing the Online Registration Form

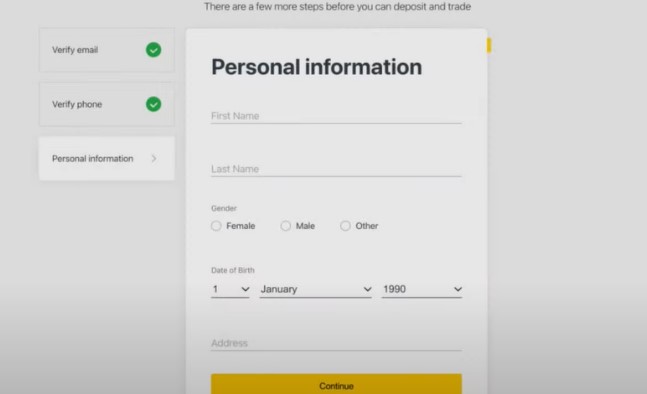

The first step in the account registration process is to fill out the online registration form on the Exness website. This form will require you to provide various personal details, such as your name, date of birth, contact information, and residential address. Ensure that you input accurate and up-to-date information to facilitate a seamless account activation.

📌📌📌 Open Exness An Account ✅

Choosing a Secure Password

Establishing a secure password is a crucial aspect of the registration process. Your password should be complex, unique, and not easily guessable. This will help protect your trading account from unauthorized access and minimize the risk of potential security breaches.

Verifying Your Identity

In compliance with regulatory requirements, Exness will request that you provide documents to verify your identity. This typically involves submitting a valid government-issued ID, such as a passport or national ID card, along with a utility bill or bank statement to confirm your residential address.

📌📌📌 Open Exness An Account ✅

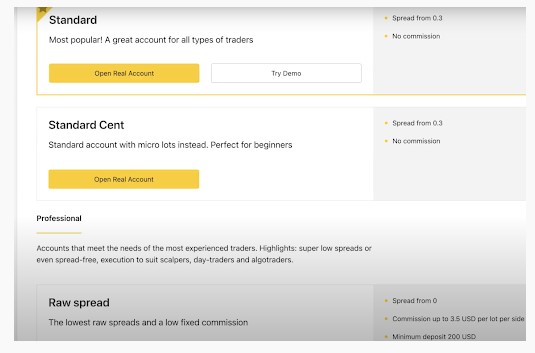

Selecting Your Preferred Account Type

Exness offers a range of trading account options to cater to the diverse needs of its clients. After completing the initial registration, you'll be prompted to choose the account type that best suits your trading preferences and experience level. This decision can be further refined based on factors like your initial deposit, leverage requirements, and the financial instruments you wish to trade.

Funding Your Exness Trading Account: Seamless and Secure

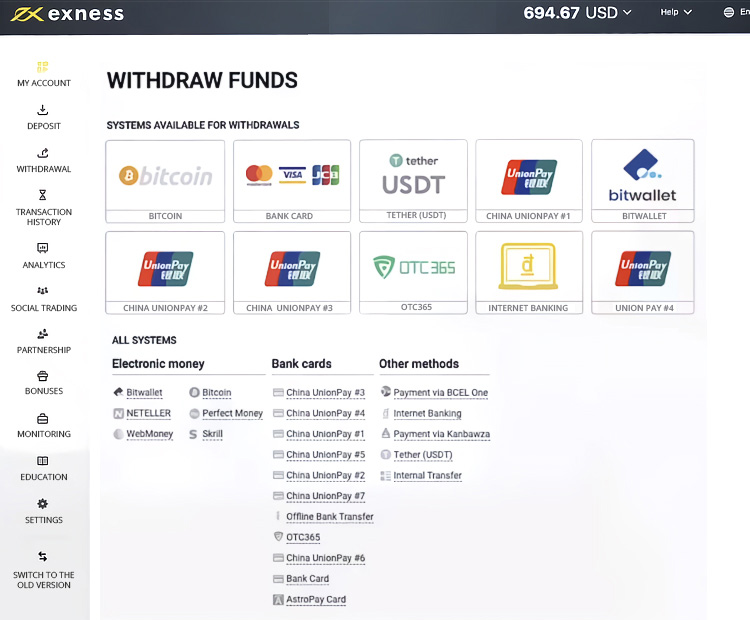

With your Exness trading account successfully registered, the next step is to fund your account, enabling you to initiate your trading activities. Exness provides a variety of convenient payment methods to ensure a smooth and secure deposit process.

Exploring the Available Deposit Options

Exness supports a wide range of deposit options, including bank transfers, credit/debit cards, and e-wallets. Review the available payment methods and select the one that aligns best with your preferences and banking practices.

✳️ Read more:

Initiating the Deposit Process

Once you've chosen your preferred payment method, follow the on-screen instructions to complete the deposit process. This may involve providing additional details, such as your bank account information or e-wallet credentials, to facilitate the fund transfer.

📌📌📌 Open Exness An Account ✅

Ensuring Timely and Secure Transactions

Exness prioritizes the security and efficiency of all financial transactions. Your deposit will be processed promptly, and you can track the progress of the transfer through your Exness account dashboard. Maintain vigilance throughout the deposit process to safeguard your financial information.

Verifying the Successful Fund Transfer

After initiating the deposit, check your Exness account balance to ensure that the funds have been successfully credited. This will allow you to commence your trading activities with the necessary capital.

Exploring Exness Trading Platforms: Unlock Your Trading Potential

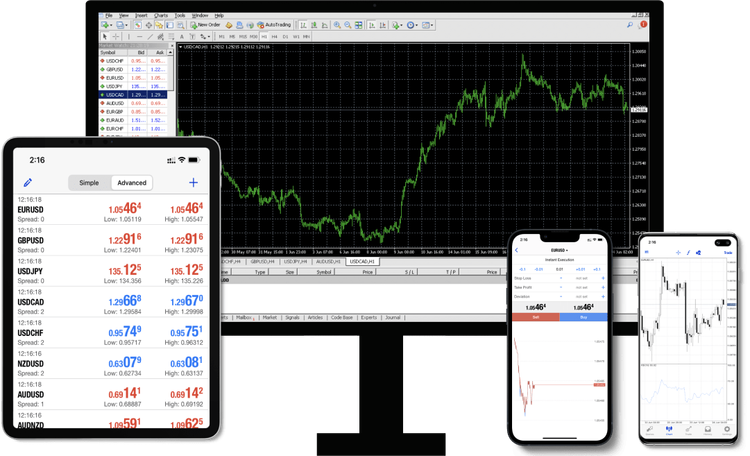

With your Exness trading account funded, you're now ready to explore the powerful trading platforms offered by the company. Exness provides a range of robust and user-friendly platforms to cater to the diverse needs of its global clientele.

Familiarizing Yourself with the MT4 Platform

The MetaTrader 4 (MT4) platform is one of the most widely recognized and utilized trading platforms in the global financial markets. Exness offers MT4 as a comprehensive solution, providing advanced charting tools, customizable indicators, and automated trading capabilities.

📥📥📥 Link Download MT4 👈👈👈

📥📥📥 Link Download MT5 👈👈👈

Discovering the Exness Proprietary Platform

In addition to MT4, Exness also offers its own proprietary trading platform, designed to deliver a seamless and intuitive trading experience. Explore the unique features and functionalities of the Exness platform, which may include specialized order types, advanced risk management tools, and integrated market analysis.

Accessing Mobile Trading

Recognizing the importance of on-the-go trading, Exness provides mobile trading applications for both iOS and Android devices. These apps allow you to monitor the markets, execute trades, and manage your account anytime, anywhere.

Leveraging Educational Resources

Exness places a strong emphasis on empowering its clients through comprehensive educational resources. Explore the company's library of webinars, video tutorials, and written guides to deepen your understanding of trading strategies, market analysis, and risk management.

Navigating the Exness Trading Experience: Strategies and Insights

With your Exness trading account set up and the trading platforms at your fingertips, it's time to embark on your investment journey. Developing a well-informed trading strategy and leveraging the insights provided by Exness will be crucial to your success.

Defining Your Trading Approach

Carefully consider your investment goals, risk tolerance, and market analysis capabilities to establish a trading approach that aligns with your personal preferences. This may involve exploring various trading styles, such as technical analysis, fundamental analysis, or a combination of both.

Leveraging Exness Market Analysis and Insights

Exness offers a wealth of market analysis and insights to support its clients' trading decisions. Engage with the company's research team, stay up-to-date with market news and trends, and utilize the provided trading signals and recommendations to inform your trading strategies.

Read more:

Implementing Effective Risk Management Practices

Responsible risk management is paramount in the world of financial trading. Familiarize yourself with the risk management tools and features offered by Exness, such as stop-loss orders, position sizing, and diversification strategies, to protect your trading capital and mitigate potential losses.

Continuous Learning and Improvement

The journey of becoming a successful trader is a continuous process of learning and adaptation. Actively engage with Exness' educational resources, participate in trading communities, and refine your strategies based on market conditions and your own trading experiences.

Conclusion: Unlocking Your Financial Potential with Exness in India

Opening an Exness trading account in India marks the beginning of an exhilarating venture into the global financial markets. By following the step-by-step guide outlined in this article, you've laid the foundation for a rewarding and empowering trading experience.

From navigating the Exness website and completing the account registration process to funding your trading account and exploring the powerful trading platforms, you've gained the essential knowledge and skills to embark on your investment journey.