13 minute read

How to Use Exness in India

How to Use Exness in India is a comprehensive guide that covers everything you need to know about utilizing Exness, a leading online trading platform, in the Indian market. This article will walk you through the process of getting started with Exness, creating an account, verifying your identity, funding your account, navigating the trading platform, understanding leverage and margins, exploring trading instruments, withdrawing funds, and accessing customer support.

Getting Started with Exness in India

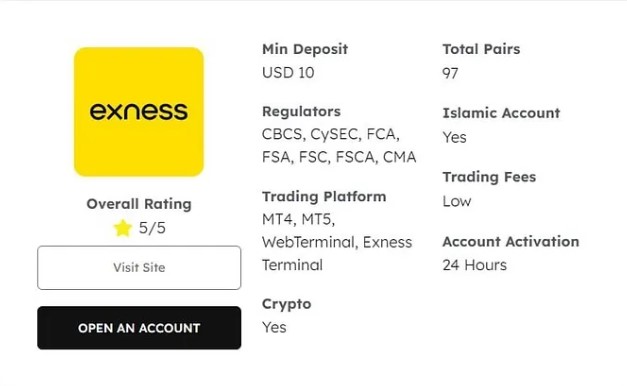

Before delving into the details of using Exness in India, it's important to understand the platform and its features. Exness is a reputable and regulated online trading broker that offers a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies. The platform is known for its competitive spreads, fast execution, and robust trading tools, making it a popular choice among traders in India and around the world.

✅ Exness: Open An Account or Go to Website

Understanding the Exness Trading Platform

The Exness trading platform is designed to be user-friendly and intuitive, catering to traders of all skill levels. The platform offers a variety of features and tools to help traders make informed decisions, such as real-time market data, advanced charting tools, and customizable trading strategies. Additionally, Exness provides access to a wide range of assets, allowing traders to diversify their portfolios and explore different trading opportunities.

Analyzing the Regulatory Framework for Exness in India

Exness is a globally recognized broker that is regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC). In India, Exness operates in compliance with the relevant rules and regulations set forth by the Reserve Bank of India (RBI) and other financial regulatory bodies. This ensures that Indian traders can engage with Exness with confidence, knowing that their funds and personal information are protected.

Exploring the Benefits of Trading with Exness in India

One of the primary advantages of using Exness in India is the platform's competitive spreads and low trading costs. Exness is known for its transparency in pricing, which can be particularly beneficial for traders looking to maximize their profits. Additionally, the platform offers a range of account types and trading tools, catering to the diverse needs and preferences of Indian traders.

Creating an Exness Account in India

To begin your trading journey with Exness in India, you'll need to create an account on the platform. The process of creating an Exness account in India is straightforward and can be completed entirely online.

✅ Exness: Open An Account or Go to Website

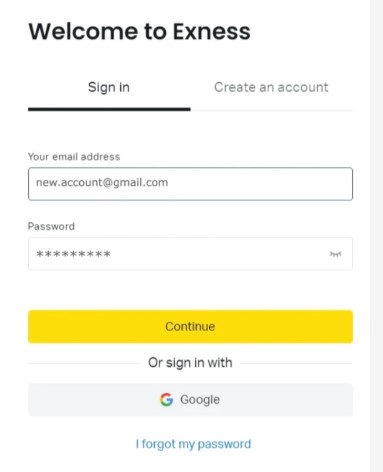

Navigating the Exness Registration Process

The registration process on the Exness website is designed to be user-friendly and intuitive. You'll be prompted to provide personal information, such as your name, date of birth, and contact details, as well as your trading experience and financial background. It's important to ensure that you provide accurate and up-to-date information to facilitate a smooth account creation and verification process.

Selecting the Appropriate Exness Account Type

Exness offers a range of account types to cater to the diverse needs of traders in India. These include Standard accounts, ECN accounts, and Islamic accounts, each with its own set of features and trading conditions. Take the time to carefully evaluate your trading goals, risk tolerance, and preferred trading style to determine the most suitable account type for your needs.

Completing the Exness Account Opening Procedure

After providing the necessary information during the registration process, you'll need to complete the account opening procedure by submitting the required documents for identity and address verification. This is a crucial step to ensure the security of your Exness account and compliance with regulatory requirements.

Familiarizing Yourself with the Exness Trading Platform

Once your Exness account is created and verified, you'll have access to the trading platform. Take some time to explore the platform's features, customization options, and trading tools to familiarize yourself with the user interface and identify the functionalities that best suit your trading approach.

Verifying Your Exness Account in India

After creating your Exness account, the next step is to verify your identity and address to comply with regulatory requirements. This process is designed to protect you and ensure the integrity of the Exness platform.

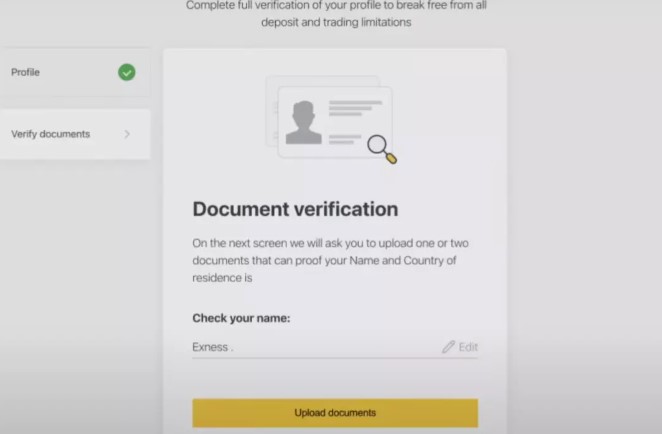

Understanding the Exness Account Verification Process

The Exness account verification process involves submitting a valid government-issued ID, such as a passport or national ID card, along with a proof of address document, such as a utility bill or bank statement. This information is used to verify your identity and ensure that your account is associated with a legitimate individual.

Gathering the Required Documents for Exness Verification

Before initiating the verification process, make sure you have the necessary documents ready. The specific requirements may vary, so it's recommended to refer to the Exness website or customer support for the most up-to-date information on the required documents.

Submitting the Verification Documents to Exness

Once you have the required documents, you can proceed to submit them through the Exness platform. This is typically done by uploading the documents through the account verification section or by sending them directly to the Exness customer support team.

Monitoring the Exness Account Verification Status

After submitting the verification documents, you'll need to wait for Exness to review and approve your account. The verification process may take some time, so it's important to be patient and responsive to any additional requests for information or documentation from Exness.

Funding Your Exness Account in India

To begin trading on the Exness platform, you'll need to fund your account. Exness offers a variety of deposit methods to cater to the preferences and needs of Indian traders.

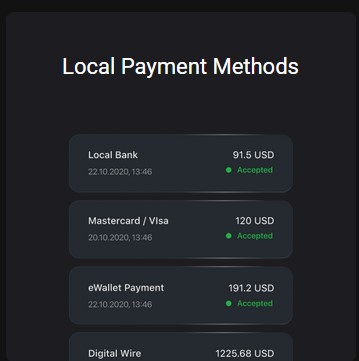

Exploring the Deposit Options Available on Exness

Exness supports a range of deposit methods, including bank transfers, credit/debit card payments, and electronic wallets. Each deposit option has its own set of benefits, fees, and processing times, so it's important to carefully review and select the one that best suits your needs.

Initiating the Deposit Process on Exness

The process of depositing funds into your Exness account is straightforward. You'll need to navigate to the deposit section of the platform, select your preferred payment method, and follow the on-screen instructions to complete the transaction.

Understanding Exness Deposit Fees and Processing Times

It's important to be aware of any fees associated with your chosen deposit method, as well as the processing time for the funds to appear in your Exness account. This information can be found on the Exness website or by contacting their customer support team.

Monitoring the Progress of Your Exness Deposit

Once you've initiated the deposit process, you can monitor the status of the transaction through the Exness platform. This will allow you to ensure that the funds have been successfully credited to your account and that you're ready to begin trading.

Navigating the Exness Trading Platform

The Exness trading platform is designed to be user-friendly and intuitive, offering a range of features and tools to help traders make informed decisions and execute trades effectively.

Exploring the Exness Trading Platform Interface

The Exness trading platform interface is clean and organized, with various sections and tabs dedicated to different functionalities. This includes the market watch, chart analysis tools, order management, and account management sections, among others.

📥📥📥 Link Download MT4 👈👈👈

📥📥📥 Link Download MT5 👈👈👈

Utilizing the Exness Trading Tools and Features

Exness provides a variety of trading tools and features to enhance the trading experience. These may include advanced charting capabilities, customizable indicators, automated trading strategies, and risk management tools. Familiarize yourself with these features to optimize your trading performance.

Customizing the Exness Trading Platform to Your Preferences

The Exness platform allows for a high degree of customization, enabling you to tailor the interface, layout, and features to match your trading style and preferences. Take the time to explore the platform's settings and personalization options to create a workspace that is efficient and comfortable for you.

Accessing Market Data and Research on Exness

Exness offers a wealth of market data and research tools to help you make informed trading decisions. This may include real-time quotes, economic calendars, market analysis, and educational resources. Utilize these features to stay up-to-date with market trends and developments.

Understanding Leverage and Margins on Exness

Leverage and margins are essential concepts in the world of online trading, and Exness offers a range of options to cater to the needs of traders in India.

Defining Leverage and Margins on Exness

Leverage is the ability to control a large trading position with a relatively small amount of capital. Margins, on the other hand, refer to the initial deposit required to open a trade. Exness offers a variety of leverage ratios, depending on the asset class and account type.

Evaluating the Leverage Options Available on Exness

Exness provides a range of leverage options, typically ranging from 1:1 to 1:500, depending on the asset and account type. It's important to carefully consider your trading strategy, risk tolerance, and account balance when selecting the appropriate leverage ratio.

Managing Risks Associated with Leveraged Trading on Exness

Leveraged trading can amplify both profits and losses, so it's crucial to understand and manage the risks involved. Exness offers various risk management tools, such as stop-loss and take-profit orders, to help you control your exposure and protect your capital.

Understanding Margin Requirements and Maintenance on Exness

The margin requirements on Exness vary depending on the asset class and market conditions. It's essential to monitor your margin levels and maintain sufficient funds in your account to avoid margin calls and potential liquidation of your positions.

Exploring Trading Instruments on Exness

Exness offers a diverse range of trading instruments, allowing traders in India to diversify their portfolios and explore various market opportunities.

Overview of the Asset Classes Available on Exness

The Exness trading platform provides access to a wide range of asset classes, including:

Forex: Major, minor, and exotic currency pairs

Indices: Global stock market indices

Commodities: Precious metals, energy, and agricultural commodities

Cryptocurrencies: Bitcoin, Ethereum, and other digital currencies

Evaluating the Characteristics and Trading Conditions of Exness Instruments

Each asset class on Exness has its own unique characteristics, such as volatility, trading hours, and liquidity. It's important to understand these factors and how they may impact your trading strategy.

Analyzing the Spreads and Commissions Associated with Exness Instruments

Exness is known for its competitive spreads and low trading costs. However, the exact spreads and commissions may vary depending on the asset class, market conditions, and your account type.

Developing a Diversified Trading Portfolio on Exness

By exploring the wide range of trading instruments available on Exness, you can create a diversified portfolio that aligns with your investment goals and risk tolerance. This can help you manage your overall market exposure and potentially improve your long-term trading performance.

Withdrawing Funds from Exness in India

When you're ready to withdraw your trading profits or funds from your Exness account, the process is straightforward and secure.

Understanding the Exness Withdrawal Process

The Exness withdrawal process involves navigating to the withdrawal section of the platform, selecting your preferred withdrawal method, and providing the necessary information. Exness supports a variety of withdrawal options, including bank transfers, e-wallets, and debit/credit cards.

Reviewing the Exness Withdrawal Fees and Processing Times

It's important to be aware of any fees associated with your chosen withdrawal method, as well as the processing time for the funds to reach your desired destination. This information can be found on the Exness website or by contacting their customer support team.

Initiating and Monitoring the Exness Withdrawal Request

Once you've selected your withdrawal method and provided the necessary details, you can submit the request. Exness has a dedicated withdrawal processing team that will review and process your request, and you can monitor the status of your withdrawal through the platform.

Ensuring the Security of Your Exness Withdrawal

Exness prioritizes the security of its clients' funds and personal information. The withdrawal process is designed with multiple layers of verification and security measures to protect against unauthorized access or fraudulent activity.

Exness Customer Support Options for Indian Traders

Exness provides comprehensive customer support to ensure a smooth and enjoyable trading experience for its clients, including those in India.

Accessing the Exness Customer Support Channels

Traders in India can reach out to the Exness customer support team through various channels, such as email, live chat, or phone. The Exness website also features a detailed FAQ section and a knowledge base to help address common questions and concerns.

Understanding the Exness Customer Support Response Times

Exness is committed to providing timely and efficient customer support. The response times may vary depending on the method of communication and the complexity of the issue, but Exness strives to address all inquiries and concerns in a prompt manner.

Evaluating the Exness Customer Support Expertise and Professionalism

The Exness customer support team is composed of knowledgeable and experienced professionals who are dedicated to assisting traders with a wide range of issues, from technical support to account management and trading strategies.

Providing Feedback and Suggestions to Exness Customer Support

Exness values its clients' feedback and suggestions, as it helps the company to continuously improve its services and offerings. Traders in India are encouraged to share their experiences and insights with the Exness customer support team, contributing to the ongoing development and enhancement of the platform.

Tips for Successful Trading with Exness in India

To maximize your trading success with Exness in India, it's essential to consider the following tips and best practices.

Develop a Comprehensive Trading Strategy

Establish a well-researched and disciplined trading strategy that aligns with your investment goals, risk tolerance, and market conditions. Regularly review and refine your strategy to adapt to changing market dynamics.

Practice Effective Risk Management

Utilize Exness's risk management tools, such as stop-loss and take-profit orders, to protect your capital and minimize potential losses. Avoid over-leveraging and maintain a prudent approach to position sizing.

Stay Informed and Continuously Learn

Actively monitor market news, economic indicators, and industry developments to make informed trading decisions. Take advantage of Exness's educational resources and webinars to enhance your trading knowledge and skills.

Diversify Your Trading Portfolio

Explore the wide range of trading instruments available on Exness to build a diversified portfolio that can help you mitigate risk and capitalize on various market opportunities.

Maintain Patience and Discipline

Successful trading requires patience, discipline, and emotional control. Avoid impulsive decisions and stick to your well-crafted trading plan, even in the face of market volatility.

Conclusion

Using Exness in India can be a rewarding and fulfilling experience for traders looking to participate in the global financial markets. This comprehensive guide has provided you with the essential information and practical tips to navigate the Exness platform, from creating an account and verifying your identity to funding your account, trading effectively, and withdrawing your funds.

🏅 Read more:

apakah Exness terdaftar di bappebti? Apakah Exness Legal di Indonesia?

apa itu Exness trader? apakah trading di Exness aman

Apakah Exness itu judi? Apakah Exness dilarang?

Broker forex indonesia Exness 2025? Exness terdaftar di bappebti?

Cara buat akun demo di Exness [Trading Exness Pemula di Indonesia]

Cara verifikasi akun Exness [Trading Exness Pemula di Indonesia]