18 minute read

How to Use Exness Trading Singals

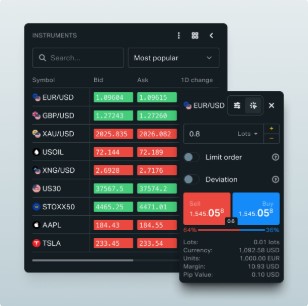

How to Use Exness Trading Singals:Exness offers a platform called MetaTrader 4 (MT4) and MetaTrader 5 (MT5) that allows you to access and utilize trading signals. Here's a basic guide on how to use them:

Introduction to Exness Trading Signals

Navigating the complex world of financial markets can be a daunting task, especially for novice traders. However, the rise of trading signals has revolutionized the way individuals approach the markets, providing a powerful tool to enhance their trading strategies and potentially improve their chances of success. In this comprehensive blog post, we will delve into the world of Exness Trading Signals, exploring step-by-step how to leverage this valuable resource to maximize your trading potential.

✅ Exness: Open An Account or Go to Website

Understanding the Concept of Trading Signals

Trading signals are essentially market insights or recommendations generated by experienced traders, analysts, or automated algorithms. These signals provide information on potential trading opportunities, including the direction, timing, and potential risk-reward ratios of a trade. By tapping into these signals, traders can gain valuable insights that can complement their own analysis and decision-making processes.

The Benefits of Using Exness Trading Signals

Exness, a leading global brokerage firm, offers a robust trading signals service that can provide several benefits to traders. These benefits include:

Access to Expertise: Exness' trading signals are generated by a team of experienced market analysts, providing traders with the opportunity to tap into a wealth of knowledge and experience.

Time-Saving: By utilizing Exness' trading signals, traders can save time on market research and analysis, allowing them to focus more on executing trades and managing their portfolios.

Enhanced Decision-Making: Trading signals can serve as a valuable supplement to a trader's own analysis, helping to improve their overall decision-making and potentially increase their chances of successful trades.

Diversification: Incorporating Exness' trading signals into a trading strategy can provide diversification, as traders can access a wider range of market insights and opportunities beyond their own analysis.

The Importance of Understanding Exness Trading Signals

Before diving into the step-by-step process of using Exness Trading Signals, it is crucial to understand the fundamentals of these signals. Traders should familiarize themselves with the different types of trading signals, the information they provide, and how to interpret them effectively within their trading strategies.

Setting Up Your Exness Account

To begin using Exness Trading Signals, you will need to set up an Exness account. This process is straightforward and can be completed in a few simple steps:

Creating an Exness Account

Visit the Exness website (www.exness.com) and click on the "Open an Account" button.

Follow the on-screen instructions to provide the required personal and contact information.

Choose the appropriate account type and currency for your trading needs.

Complete the account verification process by providing the necessary documentation.

Funding Your Exness Account

Once your account is created, you will need to fund it to start trading and accessing the Exness Trading Signals.

Exness offers a range of payment methods, including bank transfers, credit/debit cards, and e-wallets, to make the funding process convenient.

Familiarize yourself with the deposit and withdrawal policies to ensure a smooth funding experience.

Accessing the Exness Trading Signals

After your account is set up and funded, navigate to the "Signals" section of the Exness platform.

Explore the available trading signals, including their descriptions, historical performance, and recommended risk management parameters.

Ensure that you understand the specific details and requirements of each signal before incorporating them into your trading strategy.

Remember, setting up your Exness account is the foundation for effectively utilizing the Exness Trading Signals. Take the time to familiarize yourself with the platform and its features to maximize the benefits of this powerful trading tool.

Understanding Trading Signals Basics

To fully leverage Exness Trading Signals, it is essential to grasp the underlying concepts and principles that govern these signals. Let's explore the basics of trading signals in more detail.

Types of Trading Signals

Exness Trading Signals can be categorized into various types, each with its own characteristics and applications:

Market Entry Signals: These signals provide recommendations on when to enter a trade, based on factors such as market trends, technical indicators, or fundamental analysis.

Market Exit Signals: These signals indicate the optimal time to close a trade, either to lock in profits or mitigate potential losses.

Stop-Loss and Take-Profit Signals: These signals suggest appropriate levels for setting stop-loss orders and take-profit orders to manage risk and optimize potential returns.

Trend-Following Signals: These signals are designed to identify and capitalize on prevailing market trends, either in the direction of the trend or in anticipation of trend reversals.

Countertrend Signals: These signals aim to identify and exploit potential market reversals, capturing opportunities in the opposite direction of the current trend.

Understanding Signal Attributes

Each Exness Trading Signal will typically include a range of attributes that provide valuable information to traders. These attributes may include:

Signal Type: The specific type of signal, such as market entry, market exit, or stop-loss/take-profit.

Asset and Market: The financial instrument and market (e.g., EUR/USD, gold, S&P 500) to which the signal applies.

Entry/Exit Price: The recommended price levels for entering or exiting a trade.

Stop-Loss and Take-Profit Levels: The suggested stop-loss and take-profit levels to manage risk and potential returns.

Expiration Time: The time frame within which the signal is valid and should be acted upon.

Signal Strength: An indication of the signal's confidence or reliability, often expressed as a percentage or rating.

Understanding these signal attributes will enable you to make informed decisions and effectively incorporate Exness Trading Signals into your trading strategy.

Identifying Reliable Trading Signals

Not all trading signals are created equal, and it is essential to differentiate between reliable and unreliable signals to ensure the success of your trading endeavors. Let's explore the key factors to consider when identifying reliable Exness Trading Signals.

Evaluating Signal Providers

The first step in identifying reliable Exness Trading Signals is to assess the credibility and track record of the signal providers. Look for the following characteristics:

Reputation and Expertise: Seek out signal providers with a proven track record of successful trades and a reputation for providing consistent, high-quality signals.

Transparency: Reputable signal providers should be transparent about their methodology, historical performance, and any potential conflicts of interest.

Regulatory Compliance: Ensure that the signal provider is operating within the regulatory framework and adheres to industry best practices.

Analyzing Signal Performance

Once you have identified potential signal providers, it is crucial to evaluate the performance of their trading signals. Consider the following factors:

Historical Accuracy: Review the provider's track record of signal accuracy and the percentage of successful trades.

Risk-Reward Ratio: Assess the typical risk-reward ratios associated with the signals, as this can indicate the potential for profitable trading.

Consistency: Look for signal providers that maintain a consistent level of performance over time, rather than sporadic or erratic results.

Diversifying Your Signal Sources

To further enhance the reliability of your trading signals, it is advisable to diversify your signal sources. By accessing trading signals from multiple reputable providers, you can:

Reduce Reliance on a Single Source: Diversification helps mitigate the risk of relying on a single provider, whose signals may be subject to inconsistencies or potential biases.

Increase Validation: Comparing signals from different providers can help validate the reliability of the recommendations and identify common trends or patterns.

Enhance Decision-Making: Combining insights from various signal providers can lead to more informed and well-rounded trading decisions.

Remember, the key to identifying reliable Exness Trading Signals is to conduct thorough research, evaluate the providers' credentials and performance, and diversify your signal sources to improve the overall quality and consistency of the trading recommendations you receive.

How to Access Exness Trading Signals

Accessing and leveraging Exness Trading Signals is a straightforward process that can be accomplished through the Exness platform. Let's dive into the steps to access and utilize these valuable trading insights.

Navigating the Exness Platform

Log in to Your Exness Account: Begin by logging into your Exness account, either through the web-based platform or the Exness mobile app.

Locate the Signals Section: Within the Exness platform, navigate to the "Signals" section, which is typically located within the main menu or trading tools.

Explore the Signal Offerings: In the Signals section, you will find a comprehensive list of available trading signals, along with their respective details and performance metrics.

Subscribing to Exness Trading Signals

Review Signal Descriptions: Carefully review the descriptions of each trading signal, including the asset, market conditions, entry and exit criteria, and risk management parameters.

Evaluate Signal Performance: Assess the historical performance of the trading signals, analyzing their accuracy, risk-reward ratios, and consistency over time.

Select Signals to Subscribe To: Based on your analysis and trading preferences, choose the Exness Trading Signals that align with your investment objectives and risk tolerance.

Subscribe to the Selected Signals: Once you have made your selections, follow the on-screen instructions to subscribe to the desired trading signals.

Integrating Signals into Your Trading Workflow

Monitor Signal Updates: Keep a close eye on the Exness Trading Signals you have subscribed to, as they will be regularly updated with new recommendations and market insights.

Evaluate Signal Validity: Before executing a trade based on an Exness Trading Signal, carefully review the signal's attributes and assess its validity within your own trading framework.

Implement Signal-Based Trades: If the signal aligns with your trading strategy and risk management protocols, execute the trade according to the recommended parameters.

Track and Analyze Signal Performance: Continuously monitor the performance of the Exness Trading Signals you are using, adjusting your strategy as needed to optimize your trading results.

By following these steps, you can seamlessly access and integrate Exness Trading Signals into your overall trading approach, leveraging the expertise and insights of the Exness team to enhance your decision-making and potentially improve your trading outcomes.

Interpreting Trading Signals Effectively

Effectively interpreting and utilizing Exness Trading Signals is crucial for maximizing their benefits within your trading strategy. Let's explore the key considerations and best practices for interpreting these signals with precision and accuracy.

Understanding Signal Attributes

Revisiting the various attributes of Exness Trading Signals is essential for proper interpretation. Carefully analyze each signal's details, including the asset, market conditions, entry and exit criteria, stop-loss and take-profit levels, and expiration time.

Evaluating Signal Strength and Confidence

Pay close attention to the signal strength or confidence level provided by Exness. This metric can serve as a valuable indicator of the signal's reliability and the likelihood of a successful trade outcome.

Aligning Signals with Your Trading Approach

Ensure that the Exness Trading Signals you choose to follow align with your overall trading strategy, risk tolerance, and investment objectives. This alignment will help you make informed decisions and seamlessly integrate the signals into your trading workflow.

Considering Market Conditions and Trends

Analyze the broader market conditions and prevailing trends to contextualize the Exness Trading Signals. This holistic understanding can provide valuable insights into the potential validity and timing of the signal recommendations.

Incorporating Supplementary Analysis

While Exness Trading Signals can be a powerful tool, it is essential to supplement them with your own market research, technical analysis, and fundamental analysis. This approach can help you validate the signal recommendations and make more informed trading decisions.

Tracking Signal Performance and Adjusting Accordingly

Continuously monitor the performance of the Exness Trading Signals you are using, evaluating their accuracy, consistency, and alignment with your trading objectives. Be prepared to adjust your signal selection or trading strategy based on the observed performance.

By mastering the art of interpreting Exness Trading Signals, you can unlock their full potential and make more informed and profitable trading decisions. Remember, effective interpretation requires a combination of understanding signal attributes, evaluating confidence levels, and aligning the signals with your overall trading approach.

Implementing Trading Signals in Your Strategy

Incorporating Exness Trading Signals into your trading strategy is a critical step in leveraging the full benefits of this powerful tool. Let's explore the key considerations and best practices for seamlessly integrating trading signals into your trading approach.

Aligning Signals with Your Trading Style

Carefully assess the compatibility of Exness Trading Signals with your preferred trading style, whether you are a swing trader, day trader, or long-term investor. Ensure that the signal recommendations fit within the time frames and risk parameters of your trading approach.

Defining Signal-Based Trading Rules

Establish clear and consistent rules for utilizing Exness Trading Signals within your trading strategy. These rules should address factors such as:

Signal Validation: Determine the specific criteria you will use to validate the reliability and relevance of a trading signal before executing a trade.

Position Sizing: Establish guidelines for determining the appropriate position size based on the signal's attributes and your risk management plan.

Entry and Exit Criteria: Outline the specific entry and exit points based on the signal recommendations, including any adjustments you may make to the suggested levels.

Risk Management: Incorporate the signal-provided stop-loss and take-profit levels into your overall risk management strategy, while also considering additional risk mitigation techniques.

Backtesting and Optimizing Your Strategy

Before implementing Exness Trading Signals in live trading, it is crucial to backtest your trading strategy to evaluate its historical performance and identify areas for improvement. This process can help you:

Assess Signal Effectiveness: Analyze the historical performance of the Exness Trading Signals you plan to use and their impact on your overall trading results.

Refine Your Approach: Make necessary adjustments to your trading rules, position sizing, and risk management protocols to optimize the integration of Exness Trading Signals.

Boost Confidence: Successful backtesting can instill greater confidence in your ability to effectively incorporate Exness Trading Signals into your live trading.

Monitoring and Adjusting Your Signal-Based Strategy

Implement a robust monitoring and adjustment process to ensure the ongoing effectiveness of your signal-based trading strategy. This may include:

Continuous Performance Evaluation: Regularly review the performance of your Exness Trading Signal-based trades, analyzing their accuracy, profitability, and alignment with your trading objectives.

Adaptability to Market Changes: Be prepared to adapt your signal-based strategy as market conditions evolve, adjusting your rules and parameters to maintain optimal performance.

Diversification and Rotation: Consider diversifying your Exness Trading Signal sources or rotating between different signal providers to enhance the overall resilience of your trading approach.

By carefully integrating Exness Trading Signals into your trading strategy, you can leverage the expertise and insights of the Exness team to potentially improve your trading outcomes and achieve your financial goals.

Risk Management When Using Trading Signals

Utilizing Exness Trading Signals without a robust risk management framework can expose traders to significant financial and psychological risks. In this section, we will explore the essential principles and best practices for managing risk when incorporating Exness Trading Signals into your trading strategy.

Defining Your Risk Tolerance

Before implementing Exness Trading Signals, it is crucial to clearly define your personal risk tolerance. This involves assessing your financial resources, investment objectives, and emotional capacity to withstand potential losses. Aligning your risk tolerance with the signal recommendations is essential for preserving your trading capital and maintaining a sustainable trading approach.

Implementing Stop-Loss and Take-Profit Orders

One of the most effective ways to manage risk when using Exness Trading Signals is to diligently implement stop-loss and take-profit orders. These orders, as suggested by the signal providers, help you:

Limit Potential Losses: Stop-loss orders automatically close a trade when the market moves against your position, preventing further losses.

Lock in Profits: Take-profit orders automatically close a trade when the market moves in your favor, allowing you to capture your gains.

Maintain Discipline: The use of stop-loss and take-profit orders can help you adhere to your trading plan and avoid the temptation to hold on to losing trades or prematurely exit profitable ones.

Diversifying Your Signal Sources

As discussed earlier, diversifying your Exness Trading Signal sources can help mitigate the risks associated with relying on a single provider. By accessing signals from multiple reputable sources, you can:

Reduce Concentration Risk: Avoid over-exposure to a single signal provider, which could potentially lead to increased risk if that provider's signals underperform.

Enhance Validation: Comparing and cross-checking signals from different providers can help you identify more reliable trading opportunities.

Improve Resilience: A diversified signal-based strategy can better withstand market volatility and shifts in trading conditions.

Proper Position Sizing and Risk Allocation

Responsible positionsizing is a critical aspect of risk management when utilizing Exness Trading Signals. It involves determining the appropriate amount of capital to allocate to each trade based on your overall trading capital and risk tolerance.

By calculating position sizes accurately, you can ensure that no single trade carries too much weight in your portfolio, thereby protecting your capital from significant drawdowns. This approach also allows for better emotional control, as smaller losses are easier to accept emotionally when they occur.

In addition, consider allocating risk across different trades instead of putting all your eggs in one basket. This diversification within your positions can provide a buffer against unforeseen market movements that may impact individual trades negatively.

Evaluating Trades for Emotional and Psychological Impact

While technical aspects of risk management are vital, it's equally important to consider the emotional and psychological factors associated with trading. Trading signals can lead to heightened emotions such as fear and greed, especially during volatile market conditions. It's essential to remain disciplined and stick to your established risk management rules.

Regularly reviewing past trades can help you identify patterns in your emotional responses and refine your approach accordingly. By maintaining a journal or log, documenting not only the outcomes but also your feelings and thoughts during trades, you can gain valuable insights into how emotions influence your decision-making process. This self-awareness can empower you to make more rational choices in the future.

By adhering to robust risk management principles when using Exness Trading Signals, you can navigate the complexities of the financial markets with greater confidence. Risk management is not merely about avoiding losses; it’s about creating sustainable trading practices that support long-term profitability.

Monitoring and Adjusting Your Trades

Once you've implemented Exness Trading Signals into your trading strategy, ongoing monitoring and adjustments are crucial to optimizing performance. The dynamic nature of financial markets requires traders to be vigilant in assessing their trades and adapting to changing conditions.

Continuous Performance Evaluation

Establish a habit of regularly evaluating the performance of your signal-based trades. This analysis should encompass metrics like win rates, risk-to-reward ratios, and overall profitability. By keeping track of these indicators, you can discern which signals yield positive outcomes and which ones fall short.

Moreover, the evaluation process should go beyond mere numbers. Reflect on the context surrounding each trade, including market conditions at the time of entry and exit. Did external news events affect the trade? Were there any delays in execution? Understanding these nuances can significantly enhance your future decision-making process.

Adapting to Market Changes

The financial landscape is perpetually evolving, influenced by various factors such as economic indicators, geopolitical events, and shifts in market sentiment. As a trader using Exness Trading Signals, being adaptable is paramount.

If certain signals consistently underperform due to changing market conditions, it might be time to reassess their relevance in your strategy. You may need to modify your interpretation of the signals or explore alternative approaches to align with current market dynamics.

Additionally, remaining open to new information and insights from the Exness team can provide fresh perspectives that can improve your trading results.

Diversification and Rotation Strategies

Implementing diversification and rotation strategies can further bolster your trading approach. By diversifying your signal sources—whether through different asset classes, timeframes, or trading styles—you can mitigate risks associated with specific market conditions. This approach can create a more balanced portfolio, reducing the likelihood of large drawdowns.

Rotation strategies involve shifting focus between various signal providers or types of signals based on their recent performance. For instance, if one provider has been particularly successful with forex pairs while another excels in commodities, consider rotating your attention accordingly to maximize potential returns.

By continuously monitoring your trades, adapting to changes in the market, and employing diversification and rotation strategies, you can enhance the overall effectiveness of your trading signals from Exness. This proactive stance will keep you well-positioned to capitalize on profitable opportunities while managing risk effectively.

Conclusion: Maximizing Profits with Exness Trading Signals

In conclusion, successfully leveraging Exness Trading Signals can elevate your trading experience to new heights. By understanding the fundamentals of trading signals, carefully integrating them into your trading strategy, and diligently applying risk management protocols, you can achieve consistent and sustainable profits.

🏅 Read more:

apakah Exness terdaftar di bappebti? Apakah Exness Legal di Indonesia?

apa itu Exness trader? apakah trading di Exness aman

Apakah Exness itu judi? Apakah Exness dilarang?

Broker forex indonesia Exness 2025? Exness terdaftar di bappebti?

Cara buat akun demo di Exness [Trading Exness Pemula di Indonesia]

Cara verifikasi akun Exness [Trading Exness Pemula di Indonesia]