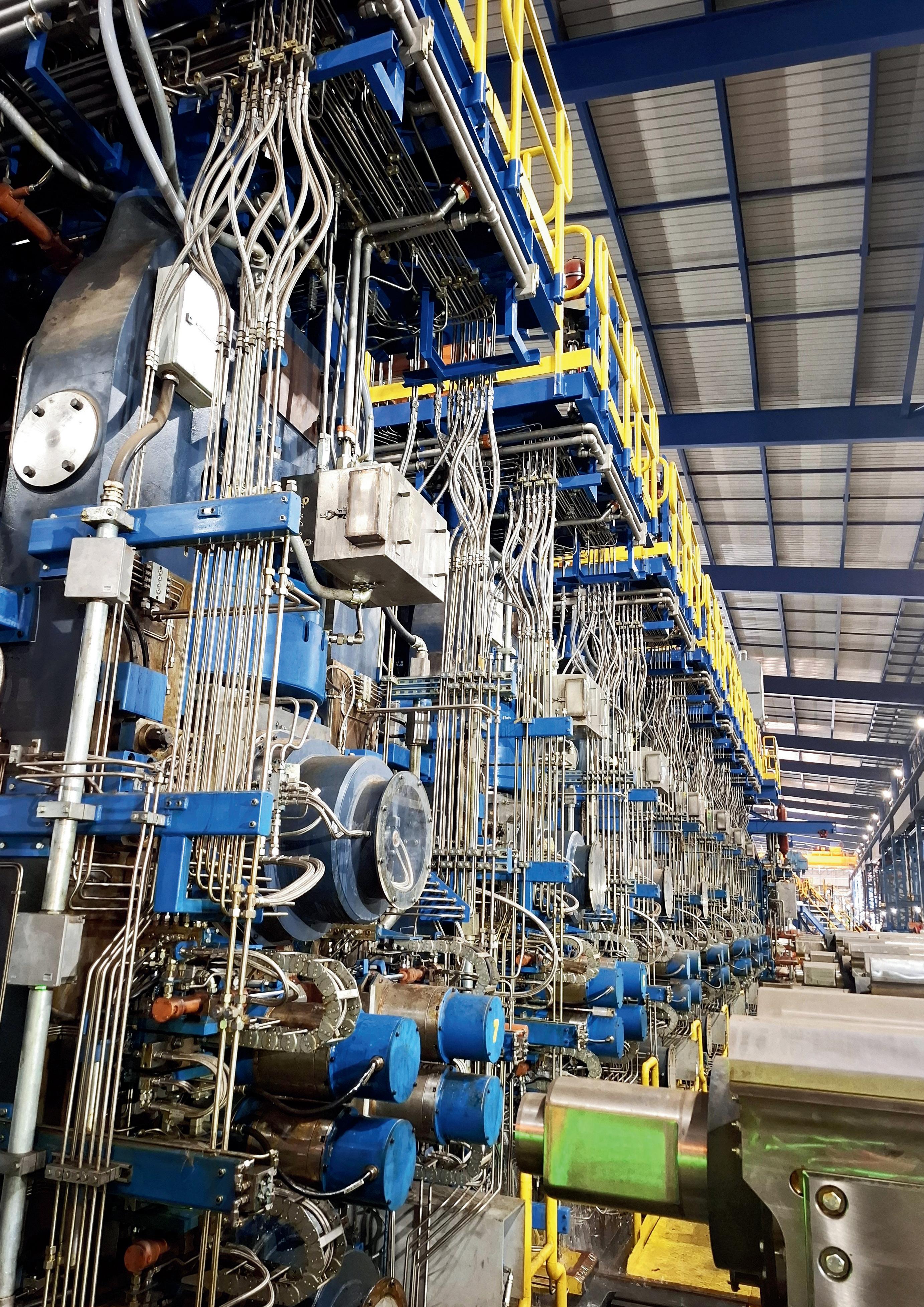

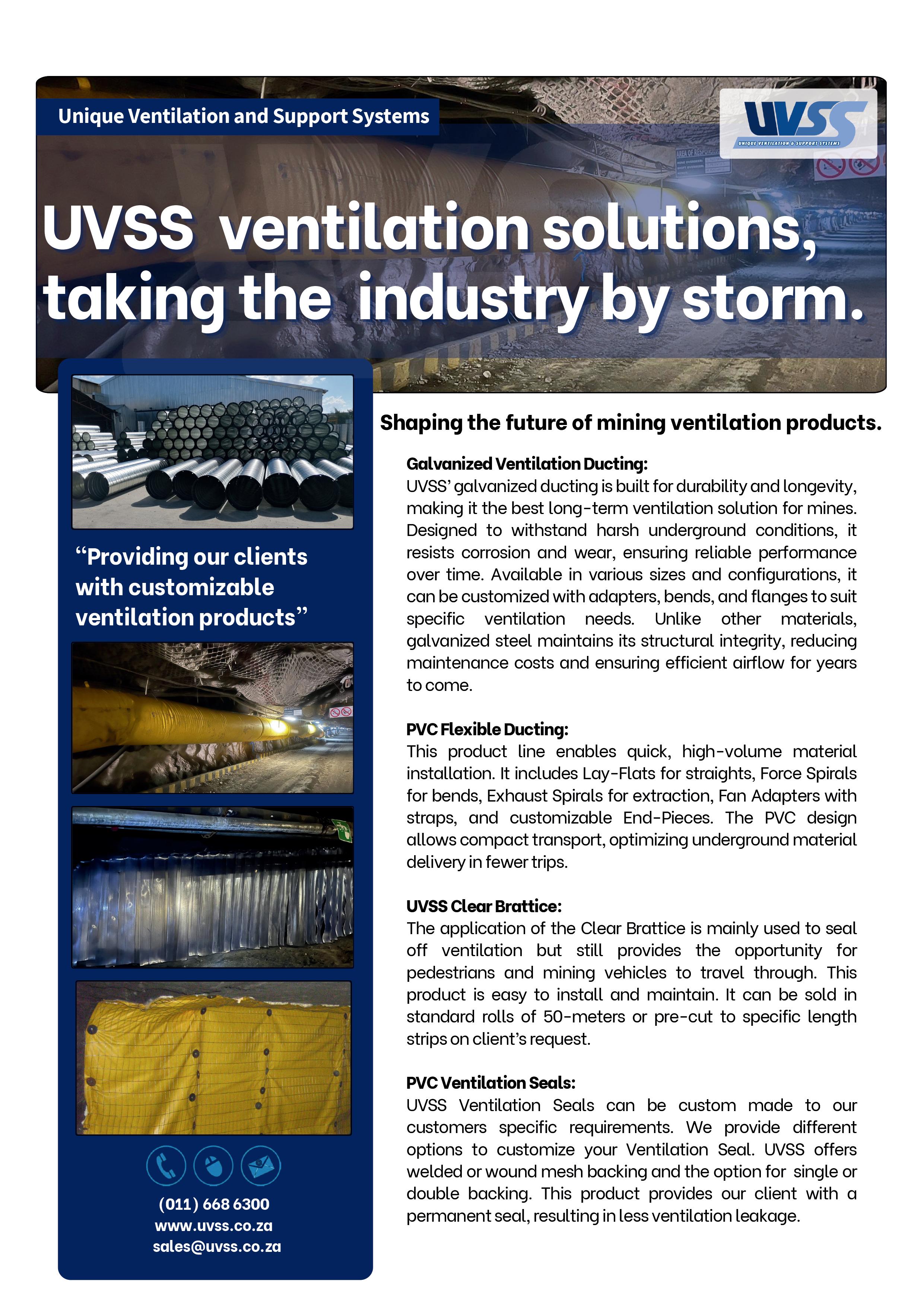

ET-X Projects is a Contractor with value added capabilities in SMPP and EC&I construction, engineering through partners, repair and refurbishment, maintenance, civils and associated interface and project management.

The Company specialises in projects in the Mining, Power, Port, Water, Oil & Gas, Infrastructure, FMCG and Industrial sectors.

ET-X Projects has evolved from the retained construction expertise of ELB Construction and the Intellectual Property of ELB Engineering Services into the dynamic business of today.

Cell: +27 76 283 1682

ET-X Projects (Pty) Ltd (ET-X) combines the history of ELB Construction with a new vibrant energy and together with the retained knowledge of its key executives, provides a platform to deliver successful projects. We have adapted to meet the demands of the ever-changing market whilst being guided by strong leadership with ethics and integrity. These principles continue to form the core of our business today as we progress and mentor tomorrow’s leaders. Over the years we have amassed the experience, skills, knowledge and partnerships needed to construct any size project.

We are a level 1 B-BBEE contributor, have a level 9ME CIDB grading and are accredited in ISO3834, ISO9001 and ISO45001 Quality Safety and Welding certifications. Our knowledgeable, specialised project execution and support teams enable us to be a reliable contractor with value added capabilities. Our fleet of self-owned plant and equipment allows us to act swiftly and manage costs appropriately.

We believe that establishing relationships with trustworthy partners guarantees the successful outcome of any project as it will overcome typical construction complexities and constraints. We have a “Can Do” attitude towards our client’s needs and expectations and are known for our ability to adapt to any challenges that are presented and manage it all with our One Stop Solution approach.

We have a dynamic approach and are committed to a sustainable Health, Safety and Environmental culture within our business and continuously drive “Safety Campaigns and Awareness”. Our employees are the backbone of our business, and we cherish the trust and responsibility we assign to all our ambassadors. We believe in doing the right thing, even when no one is watching.

Cell: +27 82 090 4592

Recent projects that we have successfully completed and are proud of include:

• Refurbishment of Electrostatic Precipitators including repairs on platework, mechanical equipment, hot and cold commissioning.

• Erection and installation of stainless-steel tanks with onsite welding and hydrostatic leak testing.

• Erection and commissioning of a complete Zinc Concentrator plant. This led to the design and installation of an additional filter press and Zinc cleaner expansion module.

• Erection and commissioning of a 27km single flight overland conveyor, 2 surface bunkers including all ancillary conveyors.

• Construction of coal feed, course ash and overland conveyors and installation of the emergency stacking and reclaim machines and its relevant conveyors.

expertise include the erection / construction / installation / maintenance of:

• Dense Medium Separation Plants;

• Bulk Material Train Load Out Stations;

• Coal and Dust Handling Plant systems at various Power Stations;

• Leach Vats.

Our Aftermarket Services and Spare Parts Division provides a comprehensive spare parts and maintenance service facility. This relates to all equipment pertaining to bulk materials handling, industrial projects, minerals processing plants and other relevant industries, including the legacy equipment supplied in the past by ELB Engineering Services. Contact or email info@et-x.co.za +27 11 772 1548 www.et-xprojects.co.za

What began in a modest garage in 2005 has evolved into one of South Africa’s most dynamic and influential black-owned business conglomerates.

Celebrating 20 years of resilience, transformation and purpose-driven growth, the SSC Group—under the visionary leadership of founder and CEO Fred Arendse—stands today as a testament to the power of inclusive capitalism, integrity and grit.

12 TEAM MESSAGE

Junior miners: Reviving South Africa’s mining future

14 EVENTS

Conferences and meetings for the African mining industry

For us it’s no problem.

From large stones to the smallest grains: Bulk solids come in all types, shapes and sizes, but choosing the right measurement technology is surprisingly easy. With our level and pressure sensors, you can effortlessly keep an eye on all your important process values – and still have time to crack the really hard rocks. Everything is possible. With VEGA.

28 IN FOCUS

Natural resources and local enthusiasm will uplift tribal economies

34 NEW DEVELOPMENTS

Seriti Resources’ newly opened Naudesbank Colliery aims to drive economic growth and strengthen South Africa’s coal mining sector

40 ECONOMY

Green infrastructure and jobs: South Africa’s plan for a brighter economic future

46 INTERNATIONAL NEWS

What’s so special about Ukraine’s minerals? A geologist explains

52 REGULATORY

Local content development in Africa’s energy sector: Challenges, opportunities and best practices

58 ESG

A giant freshwater aquifer in southern Africa is under threat from mining. Two groundwater scientists explain the environmental dangers

64 CLEAN ENERGY

Green hydrogen is a clean fuel, but South Africa is not ready to produce it. Energy experts explain why

Energy Leaders

Global Reach. Local Precision.

Leadership Assessment

Measuring Leadership with a Sustainability Lens

Executive Development

Optimising Organisational Performance

Employer Branding Strategies

With Global Industry-Specific Insights

Executive Search

Securing High-Impact Leaders for Long-term Success

70 RENEWABLE ENERGY

The future of Africa’s energy sector: Balancing fossil fuels and renewables

76 CRITICAL MINERALS

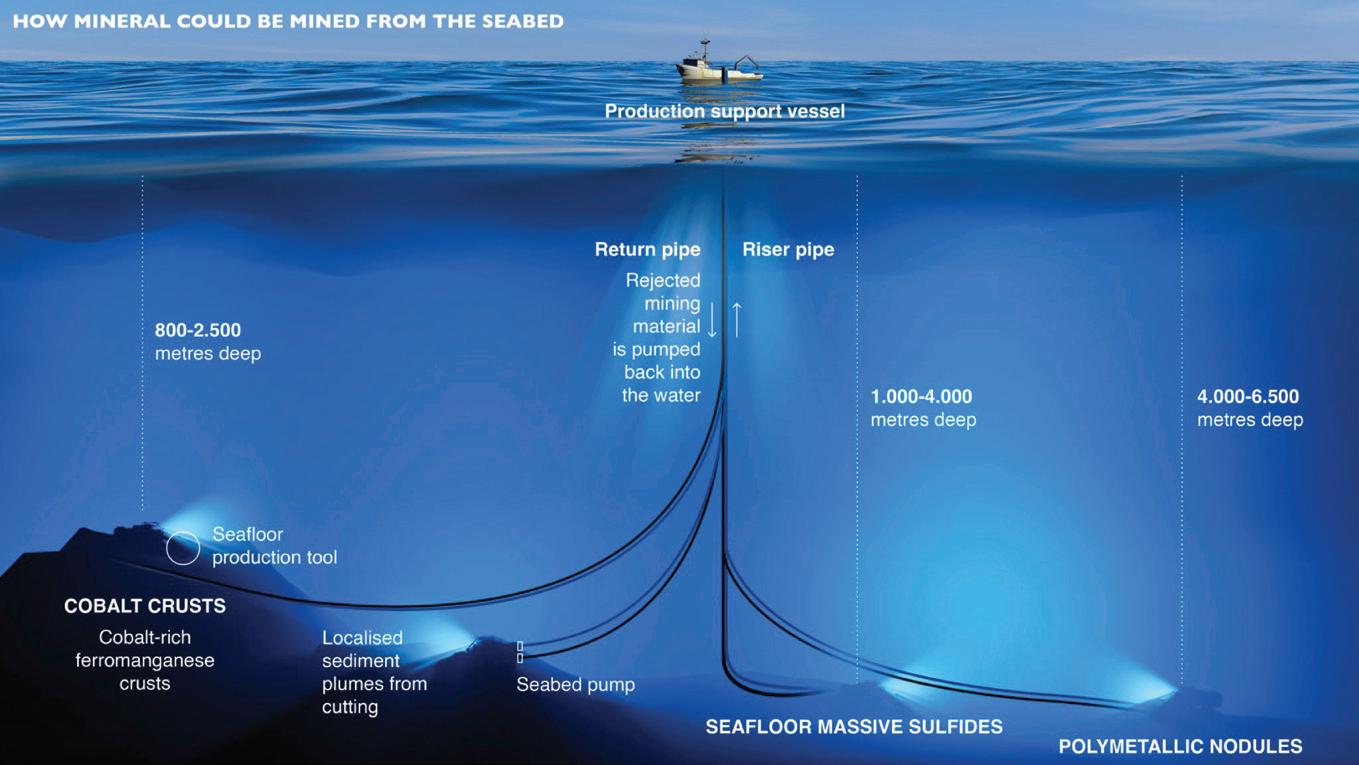

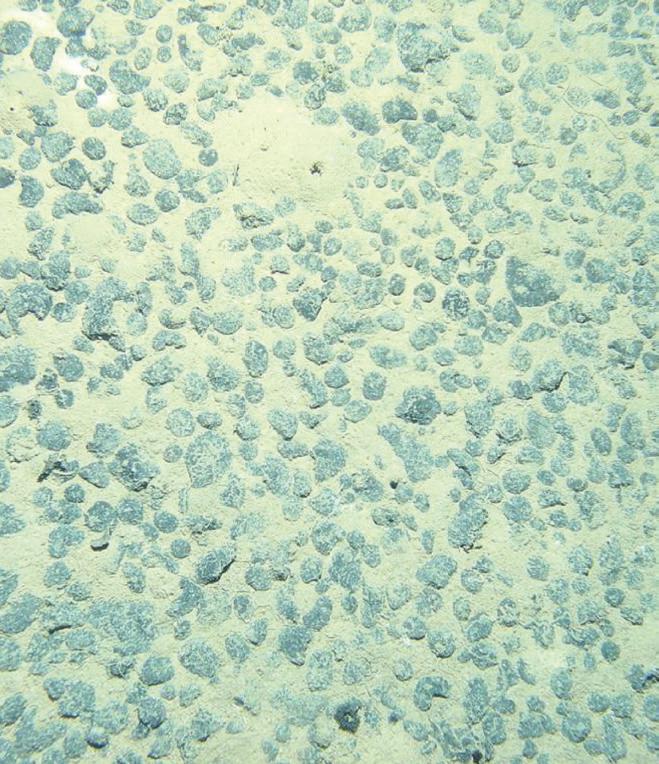

Why deep seabed mining is bad for biodiversity and terrible for the economy

84 OIL

South Africa’s new National Petroleum Company signals a shift in African energy governance

90 GAS

The GECF’s 9th edition of the Global Gas Outlook 2050 explores key trends and developments in Africa’s natural gas market

96 TECHNOLOGY

Mining must become more responsible and sustainable—where hi-tech solutions fit in

102 WOMEN

A holistic approach to personal protective equipment is needed to close the mining gender gap

106 SOCIAL DEVELOPMENT

Green energy doesn’t benefit everyone: Ubuntu ideas can help include more people

112 GOOD READS

The latest books to help you succeed in business

Today, as South Africa’s mining sector grapples with ageing infrastructure, declining ore grades and global shifts toward sustainable practices, the future may very well rest in the hands of the junior miners: the smaller, agile companies that are redefining what’s possible in this storied sector.

These firms operate under constraints that would cripple larger corporations: tighter capital, limited access to infrastructure and regulatory hurdles that often seem insurmountable. And yet, they persist.

South Africa’s policy environment, however, has not always been conducive to the growth of junior miners. Uncertain regulations, delays in the issuance of prospecting rights and limited access to exploration financing have stifled growth and deterred investment.

If the country’s serious about reviving its mining sector, it must place junior miners at the centre of that strategy. Streamlining the permitting process, creating dedicated financing vehicles—such as state-backed exploration funds—and improving geological data transparency are all critical steps. Encouraging partnerships between juniors and majors could also accelerate project development while spreading risk.

Additionally, junior miners can play a pivotal role in the country’s transition to a green economy. Critical minerals like lithium and rare earths—all essential for renewable energy technologies—are being targeted by juniors willing to explore beyond the conventional.

In many ways, junior miners represent the entrepreneurial spirit and resilience South Africa needs to inject back into its mining industry. By supporting their growth, the country can not only revive its mining future but also ensure it’s more inclusive, sustainable and aligned with the needs of a rapidly changing world.

The question, then, isn’t whether junior miners matter— they clearly do. The real question is whether South Africa will give them the space and support to thrive.

That’s why events such as the Junior Indaba are so essential. It’s here where junior miners can discuss the challenges of, and opportunities for, junior mining and exploration in South Africa and elsewhere in Africa.

Welcome to the future.

mining news

PUBLISHER: Donovan Abrahams

MANAGING EDITOR: Tania Griffin

DESIGN: Erin Esau

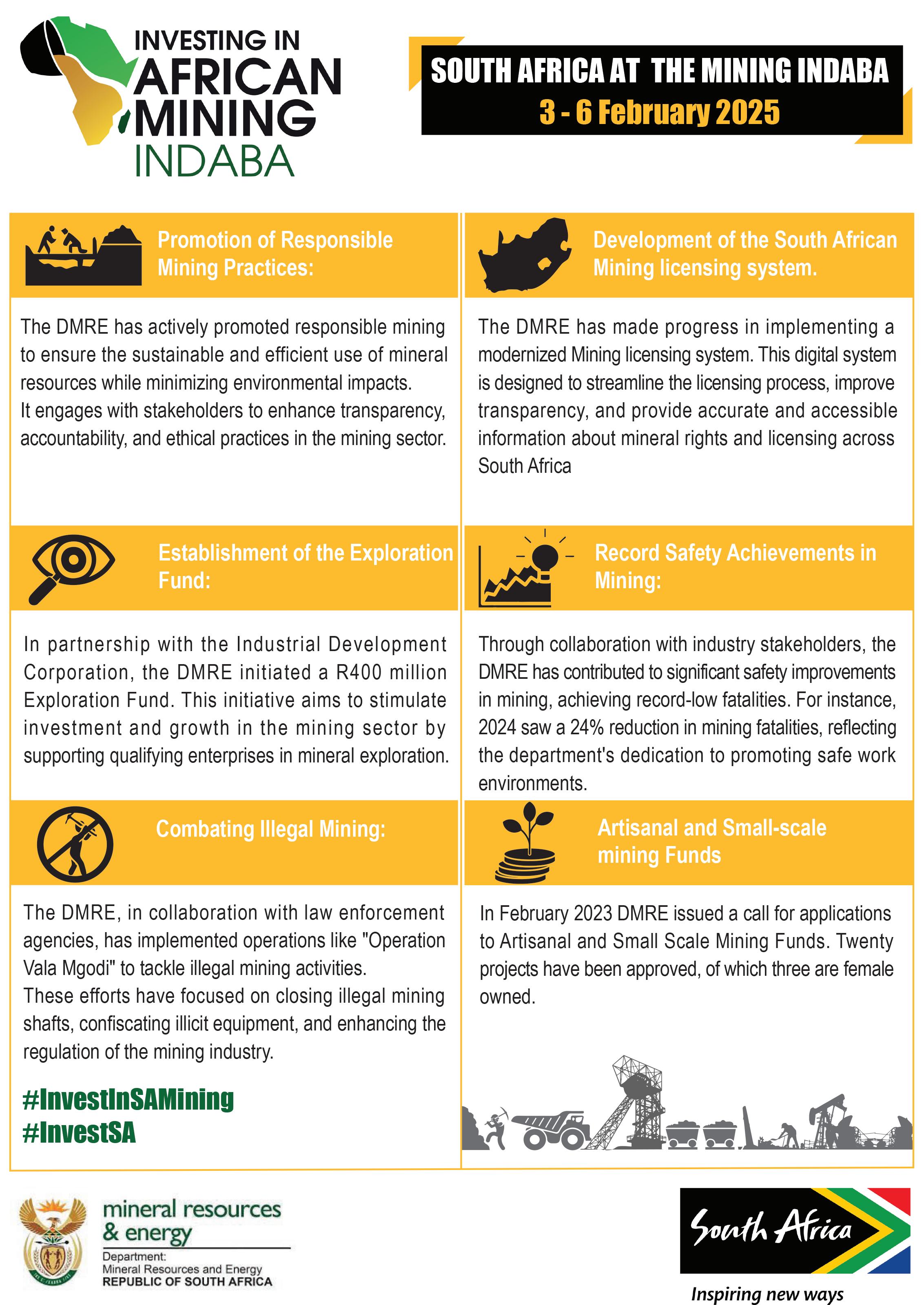

EDITORIAL SOURCES: TheConversation.com, GECF, Kgosi Pilane, Teboho Makhabane, DMRE, SANPC, African Energy Week, Sisi Safety Wear

IMAGES: iStockPhoto, WIkimedia Commons

PROJECT MANAGER: Viwe Ncapai

ADVERTISING EXECUTIVES: Viwe Ncapai, Lunga Ziwele, Andre Evans

ONLINE CO-ORDINATOR: Tharwuah Slemang

IT & SOCIAL MEDIA: Tharwuah Slemang

CLIENT LIAISON: Majdah Rogers

ACCOUNTS: Benita Abrahams, Bianca Alfos

HUMAN RESOURCES MANAGER: Colin Samuels

PRINTER: Novus Print

DISTRIBUTION: www.africanminingnews.co.za, www.issuu.com

DIRECTORS: Donovan Abrahams, Colin Samuels

PUBLISHED BY: Aveng Media

Boland Bank Building, 5th Floor 18 Lower Burg Street Cape Town, 8000

Tel: 021 418 3090

Fax: 021 418 3064

Email: reception@avengmedia.co.za

Website: www.avengmedia.co.za

DISCLAIMER:

© 2025 African Mining News magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of print.

Rub shoulders and conduct business with the high-flyers in the African mining industry

Mining in Motion 2 to 4 June

Kempinski Hotel, Gold Coast City, Ghana mininginmotionsummit.com

As a premier platform for discussions on responsible mining, sustainability and the formalisation of artisanal and small-scale mining (ASM) across Africa, this summit will welcome key mining nations in Africa and global industry leaders. Under the theme, “Sustainable Mining & Local Growth—Leveraging Resources for Global Impact”, it aims to promote responsible and innovative ASM practices, policy reforms and international collaboration in Ghana.

DRC Mining Week 11 to 13 June

Pullman Lubumbashi

Grand Karavia Hotel, DRC wearevuka.com/mining/drc-mining-week From cutting-edge machinery to game-changing digital tools, this is where the future of mining comes alive. DRC Mining Week is a pivotal conference and exhibition focused on Africa’s mining transition, where industry leaders and innovators come together to explore trends, technologies and strategies shaping the future of the industry. The 2025 conference, crafted by leading figures and industry experts, will deliver exceptional insights and create invaluable opportunities for all attendees to collaborate and shape the future of mining.

2025 London Indaba 24 & 25 June

InterContinental Park Lane, London www.londonindaba.com

This year’s London Indaba will bring together senior level representatives from multiple stakeholders including governments, mining houses, financial and investment institutions, legal and advisory experts to discuss the centrality of Africa in the race for the minerals and metals of the future. It will explore the critical role African countries must

play in providing many of the minerals and metals the world needs for the future, and the all-important question of where investment will come from and what international stakeholders and investors are looking for when investing in and partnering with African mining companies and jurisdictions.

25 & 26 June

Glenburn Lodge & Spa, Muldersdrift, Johannesburg, South Africa

www.saimm.co.za

The mining industry, along with the mining value chain, is seeking to take advantage of digital opportunities in the quest for competitiveness, sustainability and zero harm. Mining businesses in Africa, as globally, are on this journey purposefully or by default. This event adds to purpose by being a showcase and learning experience. Learn about global best practices and network with global leaders in mining and other businesses.

2 to 4 July

Avani Pemba Beach Hotel, Cabo Delgado, Mozambique mozambique-ei.com

The Mozambique Energy & Industry Summit, known globally as MEIS, is held at the heart of Mozambique’s significant natural gas discoveries, particularly in the Rovuma Basin. These gas reserves are among the largest in the world, positioning Mozambique as a key player in global energy markets. Attending MEIS in Mozambique’s energy nucleus has provided attendees direct opportunity to learn firsthand about the region’s energy future, major projects and the potential for further exploration and development.

MINEXPO KENYA 2025

16 to 18 July

Kenyatta International Convention Centre, Nairobi, Kenya www.expogr.com/kenyaminexpo

MINEXPO KENYA is the only international mining exhibition in the region that presents the widest range of the latest technology in the mining and processing of the minerals industry. The event presents the latest technology and machinery in mineral extraction, earthmoving, safety equipment and much more. The exhibition provides a common platform for both local and international exhibitors, professionals, buyers and delegates who share a common outlook in the industry.

Afrirock 2025

21 to 25 July

Sun City, Rustenburg, South Africa www.saimm.co.za

Rock engineering design plays a crucial role in advancing mining operations across the continent. The conference will spotlight cutting-edge technologies such as modern geotechnical data collection techniques, 3D visualisation software for geotechnical analysis, computer modelling, mechanisation and more. Technical visits will provide attendees with firsthand practical knowledge of South African mines.

Mining Expo & Conference Namibia 2025

5 to 7 August

Windhoek Showgrounds, Namibia miningexponamibia.com

This event, organised by the Chamber of Mines Namibia, will showcase the latest advancements, technologies and innovations in the country’s mining industry—bringing together professionals, exhibitors and stakeholders from around the globe. There will be three days of business-to-business networking, marketing of products and services, and additional platforms such as the Suppliers’ Platform and the conference.

SSC GROUP: 20 YEARS OF GROWING TOGETHER

In the complex and often unyielding terrain of the African mining industry, few stories resonate as deeply as that of SSC Group. What began in a modest garage in 2005 has evolved into one of South Africa’s most dynamic and influential black-owned business conglomerates.

Celebrating 20 years of resilience, transformation and purpose-driven growth, the SSC Group—under the visionary leadership of founder and CEO Fred Arendse—stands today as a testament to the power of inclusive capitalism, integrity and grit.

Humble beginnings: Building from the ground up Arendse’s journey is both remarkable and deeply symbolic of the entrepreneurial spirit that defines post-apartheid South Africa. With no external

investors and only his Anglo Platinum pension payout as capital, he transformed a personal leap of faith into a corporation that now spans multiple sectors, all rooted in servicing and innovating within the mining value chain.

The full name Siyakhula Sonke Empowerment Corporation, derived from the Zulu phrase “together we grow”, reflects both the ethos and operational model of the group. From day one, SSC was a mission, more so than a business. With nothing more than a home office and a vision, Arendse set out to create a black-owned enterprise that was more than just profitable—it had to be purposeful. As Arendse puts it, “It was my vision of establishing a diversified company owned by black shareholders, communities and the workers. I am proud to say that this vision has been the reality of our operations.”

Today, SSC is proudly 100% blackowned, with a majority black-women ownership and a Level 1 BBBEE contributor rating. More than a compliance checkbox, transformation is at the heart of its DNA: a living principle that has guided every business decision for two decades.

development; and renewable energy strategies.

By creating a service model that encompasses everything from technical mining solutions to community engagement, SSC has positioned itself as more than just a contractor; it is a full-service partner and strategic asset to the industry

Industry leadership through expertise and advocacy

The SSC Group’s rise to prominence has not just been about service delivery; it has been about reshaping the mining narrative in South Africa. SSC’s in-house and partner experts bring together over 761 years of combined experience in mining and corporate strategy. This depth of knowledge has enabled the group to not only deliver tangible business results but to do so ethically and inclusively.

The SSC Group operates as a holistic ecosystem, consisting of direct subsidiaries, strategic investments and associate companies. This structural design allows it to deliver an impressive range of services tailored for the mining sector.

These include: contract mining and shaft sinking; specialist underground support and backfilling systems; mine rehabilitation and mining dump reclamation; exploration drilling and mineral evaluation; manufacturing HR outsourcing, stakeholder engagement and transformation consulting; health and safety advisory; digital marketing; chemical cleaning solutions; SMME

But SSC’s impact extends beyond commercial metrics. As a founding member of the Junior Mining Council (JMC), the group has championed the interests of emerging miners. The JMC serves as an essential voice for junior mining companies—often overlooked yet critical to the industry’s long-term health. Through advocacy and support, it promotes ethical practice, innovation and inclusivity, embodying values that mirror

“I want junior miners to have access to opportunities for growth. The JMC is actioning emerging miners to capitalise on mines and companies under care and maintenance.”

— Fred Arendse, Founding President of the JMC

Over two decades, SSC has notched up a series of milestone achievements that highlight its capacity to influence both industry and society:

• COVID-19 response: During the pandemic, SSC stood out by avoiding retrenchments and safeguarding the welfare of its people while continuing operations—a feat few in the industry managed.

• Post-Marikana stability: SSC played a role in stabilising the mining sector in the wake of the Marikana tragedy, offering innovative approaches to worker relations and equitable value sharing.

• Employee share ownership plans (ESOPs): The group has designed model ESOPs for various mining clients, setting new benchmarks for shared value in the sector.

• Ongoing growth: The drilling and manufacturing divisions have expanded steadily, contributing meaningfully to the local economy and mining supply chain.

Each success underscores the group’s strategic agility and its unwavering commitment to stakeholder inclusivity, resilience and empowerment.

For Arendse, being ‘Proudly South African’ is more than a marketing slogan, it is a commitment: a com-mitment to diversity, inclusion and building a better future rooted in the lessons of the past.

As a proud black South African businessman, he sees his company’s achievements as a tribute to those who fought for equality. His work honours the legacy of icons like Nelson Mandela by ensuring mining— one of South Africa’s most historically exploitative industries—becomes a force for justice, empowerment and regeneration.

Arendse’s leadership style is deeply personal and anchored in faith. He attributes all his success—personal and professional—to God, supported un-waveringly by his wife and children. “Without God, none of this would have been possible,” he says.

This humility and spiritual grounding have shaped a corporate culture where ethics, compassion and longterm thinking are not just buzzwords but everyday practice.

The group’s value system has manifested most visibly through the SSC Foundation for Peace and Prosperity. The foundation channels financial and material resources toward a variety of causes, particularly education. From bursaries and scholarships

for underprivileged youth to infrastructure support for schools, SSC’s social investments are helping lay the groundwork for a more equitable South Africa.

Looking ahead: The next chapter in the SSC story

The vision for SSC Group’s next 20 years is no less ambitious than the first. With plans to move from being a service provider to a mine owner and operator, it is targeting strategic acquisitions.

A recent bid for the Beisa Mine signals this pivot towards the diversification of the group’s portfolio and direct mineral investment.

SSC’s existing stake in Beisa, through Neo Metals Pty Ltd, also marks its entry into the uranium ura-nium and gold space—diversifying the portfolio in both product and risk.

This strategy is not just about verti-cal integration or shareholder return. It is about deepening the group’s footprint in South Africa’s economy while ensuring communities, employ-ees and partners benefit from shared ownership.

As SSC Group celebrates its 20th anniversary, Arendse is clear about the legacy he wants to leave behind.

“I want to be remembered for integrity in leadership: making decisions that balanced economic success with social impact and environmental responsibility,” he says.

His vision is of a company that endures beyond his lifetime: a company defined not just by what it extracts from the earth but by what it gives back to it. It is a vision anchored in integrity, driven by people and sustained by innovation.

That legacy is already taking shape. SSC is no longer just a company; it is a blueprint for what ethical, inclusive business can look like in South Africa. From a garage office to boardrooms that shape national mining policy, the journey of SSC is both inspiring and instructive.

In an industry often criticised for its exploitative history, SSC offers a counter-narrative: one where mining becomes a lever for national development, dignity and empowerment. It is mining, not as extraction but as elevation—a source, not just of minerals but of hope.

As SSC Group charts its future, it carries with it a powerful message for Africa’s business community: that you can build big while staying rooted in values; that you can lead boldly without losing your humanity; and that when we say “together we grow”, we mean it.

SSC Group has positioned itself as more than just a contracting company; it is a full-service and strategic partner to the industry

As the African mining, energy, construction and environmental industries evolve amid increasing regulatory scrutiny and global sustainability imperatives, legal expertise tailored to these sectors has never been more critical.

NSDV Law, a firm with deep roots in African business, is at the forefront of helping companies navigate this changing landscape—ensuring not just compliance but leadership in ESG (environmental, social and governance) priorities and sustainable business practices.

From advising on mergers and acquisitions (M&As) in a climate of renewed international interest in Africa’s resources, to supporting clients with responsible environmental and operational strategies, NSDV Law plays a pivotal role in shaping what responsible business looks like on the continent today.

NSDV Law plays a pivotal role in shaping what responsible business looks like on the continent today

South Africa remains one of the most highly regulated jurisdictions in the world, particularly in sectors such as energy, construction, mining and environmental. This regulatory intensity has increased in recent years, with the implementation of legislation such as the Climate Change Act, 2024 and key amendments to the National Environmental Management Act, 1998.

These developments demand a strategic legal approach, and NSDV Law ensures its clients not only meet the minimum requirements but also understand the broader implications for their operations and long-term sustainability.

In construction, compliance is not just about ticking legal boxes—it is a matter of life and death. The tragic building collapse in George, Western Cape highlighted how breaches of occupational health and safety regulations, substandard material use and failed inspections can lead to catastrophic consequences.

NSDV Law emphasises strict compliance in such sectors and advises clients on how to build resilient frameworks that uphold the highest standards of safety and accountability.

Africa’s mining sector is currently experiencing a surge in mergers and acquisitions: a ‘neo-scramble’ for resources, spurred by the global demand for gold and critical minerals essential to defence, aerospace and the green economy. International powers including the European Union, United States, United Kingdom and China are significantly increasing their in-

NSDV Law emphasises strict compliance and advises clients on how to build resilient frameworks that uphold the highest standards of safety and accountability.

vestments in African mining and associated infrastructure in a bid to secure mineral supply chains.

NSDV Law provides critical legal and strategic advice to companies engaging in this fast-paced M&A environment. This includes due diligence, regulatory compliance, risk mitigation and stakeholder alignment—key ingredients for successful transactions.

An example is the recent investment by First Quantum Minerals in Prospect Resources to advance Zambia’s Mumbezhi Copper Project, illustrating how major miners are leveraging proximity and strategic alignment in their expansion efforts.

Notably, new players are entering the mining sector: not traditional mining companies but businesses seeking to secure long-term supplies of critical materials essential to their own industries. NSDV Law helps these companies navigate unfamiliar regulatory terrain, ensuring their investments are sound, sustainable and legally protected.

Today’s investors are increasingly ESG-conscious, looking to back businesses that demonstrate a clear commitment to environmental stewardship, social responsibility and robust governance. In sectors like mining, energy and construction—where operations significantly impact communities and ecosystems—this commitment is both a responsibility and a competitive advantage.

NSDV Law understands this dual imperative. The firm supports clients in embedding ESG into core business strategy—moving beyond compliance to best practice. Whether it is advising

on efficient water use in mining operations, developing renewable energy solutions to mitigate loadshedding, or guiding companies through stakeholder engagement processes, NSDV Law ensures ESG is integrated into every aspect of the business.

Access to sustainable energy is a particularly pressing issue in African mining. Inconsistent power supply can halt production, derail timelines and erode investor confidence. NSDV Law works with clients to identify and implement alternative energy strategies such as solar power, which not only guarantee energy security but also reduce environmental impact.

Water use, too, is a major concern— especially in regions prone to drought or water scarcity. Mines must manage their water use efficiently to ensure both operational continuity and community well-being. NSDV Law’s guidance helps clients strike this balance, ensuring legal compliance and longterm sustainability.

For NSDV Law, responsible business is about more than simply meeting the legal minimum. It means ‘going beyond compliance’ to align with international standards and demonstrate a commitment to doing good— both for business and society.

One area where this approach is especially important is tailings management. Improper handling of mining waste can have devastating environmental and social consequences. NSDV Law helps clients align with the Global Industry Standard on Tailings Management, ensuring their practices reflect not only regulatory requirements but global best practices.

The firm’s broader philosophy of responsible business includes offering strategic counsel to align business goals with societal needs. Whether

that is through advising on community development initiatives, supporting local employment strategies or implementing inclusive governance structures, NSDV Law empowers its clients to build trust and foster longterm value.

NSDV Law does not simply provide legal advice; it serves as a strategic partner to companies building Africa’s future. The firm’s deep knowledge of the continent’s regulatory environments, cultural landscapes and economic dynamics enables it to deliver solutions that are both legally sound and commercially strategic.

In a region where legal complexity and opportunity go hand in hand, NSDV Law ensures its clients are equipped to navigate risks, seize opportunities and lead with integrity. Whether it is advising on a cross-border acquisition, implementing a climate-resilient energy strategy or strengthening ESG governance, NSDV’s support is grounded in a holistic, forward-looking approach.

As Africa continues to attract global investment and drive innovation in resource-based industries, the need for robust, responsive and responsible legal guidance has never been greater. NSDV Law is meeting this moment with expertise, insight and a commitment to helping its clients not only comply—but thrive.

Natural resources and local enthusiasm will uplift tribal economies

We must and will take a proactive role in mining ventures, from equity stakes to operational partnerships.

For the Bakgatla tribe, anchored on the Platinum Belt of the North West Province, the question is not whether prosperity is possible—it is how we seize it with both hands. And this is not just empty rhetoric, either: South Africa is host to 88% of the world’s platinum market share, and much of that is to be found in the Platinum Belt.

Armed with that powerful statistic, our tribe stands at the intersection of opportunity and ambition, with the potential to redefine what it means to be a rural economic powerhouse.

Mining has long been the backbone of the South African economy, but for too long, the potential benefits of this industry—and other, downstream industries—have eluded tribal communities upon which these activities take place.

The Bakgatla, however, are poised and ready to change that narrative.

We must and will take a proactive role in mining ventures, from equity stakes to operational partnerships. In so doing, we can ensure the profits do not just trickle down, but flow directly and regularly into active community development. This means that, among other initiatives, we must establish community trusts that manage revenue transparently, and create clear and ring-fenced allocations for infrastructure, education, healthcare and entrepreneurial support.

The wealth that slumbers beneath our feet is not just a resource—it is a responsibility. The key lies in strategically and profitably leveraging our natural resources to fund projects that enrich and sustain our people.

Imagine, if you will, communities no longer shackled by dependency but thriving through self-sufficiency. Imagine the ripple effects of economic activities spreading from our villages to the provincial and even national economy. This is not some academic and unattainable utopia, however. It is entirely possible—with the right strategies, unwavering commitment and ethical and competent governance.

In our zeal to exploit our region’s mineral bounty, we must, of course,

not throw out the proverbial baby with the bathwater. We must ensure, for example, mining operations are carried out with a constant eye for environmental impact: on human settlements as well as on water and arable land, and the aesthetic appeal of our land.

The ripple effect of our newfound prosperity would be thunderous: Mining profits that are carefully invested in modern schools would produce educated youth who could return as doctors, engineers and business leaders. In short, we would have a prosperous, positively inclined and forward-looking community. Better roads and utilities (in short, an aesthetic ‘facelift’) would attract investors who would be eager to establish their businesses in a region that wears its potential proudly on its sleeve.

This cyclical growth would transform not just the tribe but the entire North West Province.

Don’t get me wrong, however. I do not believe any country or community can put all its eggs in one basket. Diversification, after all, is the cornerstone of economic resilience.

The Bakgatla territory is a jewel not only for its minerals but also for its breathtaking landscapes, rich cul-

tural heritage and biodiversity. In recent years, the Bakgatla tribe has uncovered the benefits to be found in ecotourism, cultural heritage sites and adventure tourism. These initiatives can create jobs, promote local crafts and generate sustainable revenue streams. By developing lodges, cultural centres and guided tours, we can attract both domestic and international tourists who are eager to experience our authentic South African heritage.

Agriculture is another vital pillar of our local economy. The fertile lands of our region can support both subsistence and commercial farming and— by investing in modern agricultural techniques, irrigation systems and value-added processing facilities—we can turn our agricultural sector into a robust contributor to food security and economic growth.

All these growth initiatives must be firmly rooted in the bedrock of education, both at school level and beyond. We must invest in vocational training, entrepreneurship programmes and scholarships that equip our people with the skills needed in mining, tourism, agriculture and beyond. After all, empowered individuals create empowered communities.

So, how do we attain all these lofty ideals?

It begins with visionary leadership and community involvement. The tribe must establish clear governance structures that promote transparency, accountability and inclusive decision-making. We must also forge partnerships with private investors, government agencies and development organisations that are able to provide the expertise, funding and networks required to kickstart and maintain projects.

Importantly, capacity-building within the community ensures we have the skills to manage and sustain these initiatives. Again: education, education, education.

By leveraging our resources strategically, the Bakgatla tribe can become a beacon of what is possible when rural communities take charge of their destinies. We can crush that stereotype of rural areas being stunted com-

Our contribution to the North West provincial economy will be undeniable, and our impact on the national stage will be profound.

I must assure you that my words are not just a fanciful dream—they are a call to action. The time is ripe for us to escalate from dreaming to doing; to transform our mindsets, landscapes, economies and futures. The sky is not the limit; it’s merely our starting point.

We must ensure mining operations are carried out with a constant eye for environmental impact

Seriti’s newly opened Naudesbank

Colliery aims to drive economic growth and strengthen South Africa’s coal mining sector

On 14 March this year, Seriti Resources official opened its new Naudesbank Colliery: a strategic new mining development that underscores the company’s commitment to economic growth, job creation and responsible mining in South Africa.

The Naudesbank Colliery is strategically located in Carolina, within the Chief Albert Luthuli Local Municipality in the Mpumalanga Province—a region rich in coal resources—and is poised to make a significant contribution to the country’s coal sector and the local economy.

As a long-life, export-orientated mining project, Naudesbank Colliery is set to generate around 300 direct jobs, with additional indirect and downstream employment opportunities in the surrounding communities, contributing to the region’s economic development and social upliftment. The company has actively engaged with local communities throughout the project’s development phase and will continue to prioritise community partnerships and initiatives to ensure meaningful shared value.

The Naudesbank Colliery “not only promises to enhance the local economic activity but reinforce our assertion that mining is a sunrise industry that is ready to bolster South Africa’s economy for years to come,” said Minister of Mineral and Petroleum Resources Gwede Mantashe at the official opening.

“The study on the state of mining in South Africa further confirms the South African mining industry is not a sunset industry, but an industry that

is diversifying from the gold era to an industry with a diverse range of mineral resources including, but not limited to, coal, PGMs [platinum group metals], manganese, chrome and rare earth minerals.

“The study shows that coal will continue to play an important role, as it makes up the largest share of baseload energy generated in developing and developed nations such as South Africa, China, India and Japan. Despite the fact that South Africa has proven reserves of coal that are equivalent to 173 times its annual consumption, the study further shows that at the current production rate, the operational collieries in South Africa should have more than 50 years of coal supply left.”

He continued, “In 2023 alone, the coal mining sector increased its production from 230 million tonnes in 2022 to 232 million tonnes and thereby positioned South Africa in the top 10 of coal-producing nations and the fifth largest coal exporter in the world.”

“By investing in the coal mining, and opening this mine, [Seriti is] practically demonstrating that ‘king coal’ is back, and that coal will continue to play a significant role not only in energy generation but in cement production, steel making and the production of synthetic petroleumbased fuels.”

The minister noted that although the country’s gross domestic product expanded by 0.6% in the fourth quarter of 2024, Statistics South Africa had reported that mining activity was down on weaker production levels for

Our investment in Naudesbank bears testament to our firm belief in the future of responsible mining and its role in driving economic progress and shared value.

manganese ore, iron ore, gold, chromium ore, nickel and copper. Coal and PGMs were positive; however, this was not enough to prevent the South African mining industry from going under, hence the -0.2% contribution to GDP.

In addition, in 2024 the South African mining industry employed 484 837 mineworkers, marking a significant decrease of 0.9% from the previous year.

“Changing this reality for the better will require all social partners— government, business, labour and communities—to put shoulder to the wheel and make it possible to do business in South Africa, including opening new mines and thereby create the much-needed employment opportunities.

“It is within this context that we are particularly pleased with the new sizeable investments that cut across the South African mining value chain,” Mantashe stated.

Seriti has invested over R500 million in the development of the Naudesbank Colliery, including infra-

structure projects that will not only support mining activities but also deliver benefits to local communities. The mine is expected to contribute significantly to South Africa’s mining sector and play a key role in the country’s economic growth.

The Naudesbank Colliery holds two separate mining rights, covering Portion 9 and Main Mine. Portion 9 is fully permitted, with opencast mining already underway. Seriti has secured all necessary land for the development of the entire mine complex.

“The opening of Naudesbank Colliery is a milestone for Seriti, Mpumalanga and the country at large,” said Mike Teke, group CEO of Seriti Resources.

“Coal remains a vital component of South Africa’s energy mix and export economy, and this project strengthens our ability to supply high-quality coal while at the same time creating jobs and contributing to the local economy.

“Our investment in Naudesbank bears testament to our firm belief in

the future of responsible mining and its role in driving economic progress and shared value.”

Minister Mantashe commented that another encouraging fact about this project, and the coal sector in general, is that it is predominantly black-owned, which augurs well for the mining industry’s transformation agenda.

“We are encouraged by the increased participation of historically disadvantaged individuals in the industry, in particular black people in general, women and youth. The study on the state of mining in South Africa shows that by 2022, the South African coal mining sector employed nearly 91 835 mineworkers, of which 15 140 (20%) were female. We need to see more women and the youth participating in the industry, as they are the hardest hit by the scourge of unemployment, poverty and inequality.”

Another key element of the transformation agenda, said Mantashe, is increased investments in the social

and economic welfare of the communities in which mines are operating, as well as the labour-sending areas.

“It is encouraging that mining companies are beginning to implement impactful projects such as clinics, schools and road infrastructure in our communities as part of their Social and Labour Plans (SLPs). We cannot overemphasise the fact that SLPs are not a replacement for the Municipal Infrastructure Development Plan but a social licence for mining companies to co-exist with their communities.”

In closing, he stated: “Let me congratulate Seriti for officially opening this mine—and urge you to open more mines!”

It is poised to make a significant contribution to the country’s coal sector and the local economy

Green infrastructure and jobs: South Africa’s plan for a brighter economic future

In the face of South Africa’s high unemployment rate—hovering around 34%—and the growing urgency to combat climate change, the country finds itself at a crossroads.

The solution may lie in an often overlooked but increasingly vital sector: green jobs. As global focus shifts toward environmental sustainability and resilience to climate change, South Africa has a unique opportunity to capitalise on green industries, creating millions of jobs that not only address pressing environmental challenges but also stimulate economic growth.

Green jobs encompass a broad range of employment opportunities linked to sustainability and environmental responsibility. These include positions in renewable energy (solar, wind and hydroelectric power), green infrastructure development (energy-efficient buildings, sustainable urban planning), waste-to-energy technologies, water conservation and biodiversity protection.

Each of these sectors not only helps mitigate the country’s carbon footprint but also creates long-term job prospects in areas where unemployment is critically high.

For instance, South Africa’s ambitious renewable energy goals have already started to create employment.

Green jobs encompass a broad range of employment opportunities linked to sustainability and environmental responsibility.

According to the Renewable Energy Independent Power Producer Procurement Programme, South Africa has already created thousands of direct and indirect jobs in the renewable energy sector: from project managers and engineers to electricians, maintenance crews and administrative staff.

Projects like the development of large-scale wind and solar farms in rural provinces are not only helping to meet the country’s energy needs but are providing jobs in communities that traditionally rely on coal mining and other fossil fuel industries. The renewable energy sector also offers opportunities for local suppliers and small businesses, further multiplying the economic impact.

Similarly, green infrastructure projects are poised to become a signif-

icant job creator. These projects focus on building sustainable cities, improving energy efficiency in buildings and constructing green spaces.

With a growing focus on urbanisation and sustainable living, there is substantial demand for experts in green building, eco-friendly construction materials and energy-efficient technologies. This is particularly relevant as cities like Johannesburg and Cape Town are working toward implementing sustainable solutions that align with international climate goals.

Waste-to-energy and water conservation: A game-changer

Waste-to-energy (WtE) projects are another area where South Africa has the potential to see substantial growth in green jobs. With waste management

The Afr ican mining sector operates in the most demanding conditions; from the iron-hard rock for mations in the Nor ther n Cape to the mineral-r ich, ar id belts of Namibia, robust, adaptable, and high-perfor ming equipment is essential.

Tempo Equipment and Attachments is a leading manufacturer of custom-designed, high-quality, and durable attachments with decades of exper ience. Operating across var ious sectors, including mining, it has built a strong reputation for deliver ing innovative solutions to combat the continent's most challenging mining conditions. Manufactured in our state-of-the-ar t, 82,000-square-metre European Tempo facility, utilising a combination of global exper tise and advanced technology to create wor ld-class equipment that withstands the test of time

Ever y Tempo product is built on four foundational pr inciples: Innovation, High Quality, Customisation and Durability.

Tempo Equipment and Attachments are built to withstand abrasive conditions, remote locations, and heavy-duty wor kloads. Ever y unit maintains unwaver ing perfor mance, whether breaking through hard rock or operating under extreme temperatures. Each attachment undergoes str ict quality control and is backed up by advanced computer ised engineer ing and controlled manufactur ing processes.

Innovation is at the centre of Tempo Equipment and Attachments Its dedicated Research and Development Depar tment continues to push boundar ies, placing durability, technology, and customer satisfaction at the forefront of product design.

CTC Plant Company is an exclusive Tempo Equipment and Attachments agent, deliver ing super ior engineer ing solutions to mining operations across the Souther n Afr ican region. Through this strategic par tnership, Tempo equips clients with high-perfor mance attachments, including hydraulic hammers and vibrating r ippers, that redefine productivity and safety standards across Afr ica’s mining sector

Tempo understands that no two sites or clients are the same With decades of exper ience in custom-designed equipment manufactur ing, the team specialises in tailored solutions that meet specific project needs Whether facing a unique challenge or seeking improved perfor mance, Tempo delivers the r ight tool for ever y task.

Tempo provides dedicated suppor t at ever y stage, from the initial consultation to after-sales assistance; customers are guided by exper ts who br ing decades of exper ience in mining and ear thmoving equipment Tempo is committed to long-ter m par tnerships to ensure clients not only get the best-fit attachments but also the suppor t needed to maximise uptime and retur ns on investments in the field.

becoming a critical issue in many urban centres, converting waste into usable energy could provide a dual benefit: reducing landfill use and generating electricity.

Companies investing in WtE technology are likely to need skilled workers for plant operations, maintenance, and research and development.

Water conservation is equally pressing, particularly in a country where water scarcity is becoming more pronounced due to climate change. Initiatives that focus on improving water use efficiency, wastewater treatment and the development of new water technologies are essential for the longterm sustainability of the economy.

conservation:

South Africa’s rich biodiversity, which supports tourism and agriculture, is another sector primed for job creation. Biodiversity conservation is increasingly seen as both an economic and environmental necessity.

Protecting ecosystems, managing wildlife reserves and promoting sustainable agriculture practices offer employment opportunities in rural areas, where alternative livelihoods are often scarce.

rates at historically high levels, the urgency for job creation has never been more critical. By supporting industries that are aligned with South Africa’s environmental goals, we can position ourselves as a leader in green innovation while addressing its social and economic challenges.

Sanlam Investments (www.sanlaminvestments.com) is committed to investing in the future. It has funds dedicated to the infrastructure required to preserve our precious natural resources and uncap their limitless potential, to the betterment of our country and people for generations to come.

Teboho Makhabane Head: ESG and Impact Sanlam Investments

Additionally, carbon offset projects that promote forest regeneration and sustainable land management can generate further employment while contributing to global climate goals.

A paradigm shift for South Africa’s workforce

By prioritising green industries, South Africa has the power to ignite a new wave of job creation that not only contributes to economic growth but also strengthens the nation’s resilience to climate change. With unemployment

South Africa›s ambitious renewable energy goals have already started to create employment

The US and Ukraine have signed an ‘economic partnership’ centred on Ukraine’s wealth of critical minerals—but extracting them isn’t so simple

The United States and Ukraine have a new “economic partnership” (tinyurl. com/ynntem73) centred on Ukraine’s mineral wealth as Ukraine continues to fight off Russia’s invasion, officials from both countries announced on 30 April this year.

After a rocky start to negotiations, US Treasury Secretary Scott Bessent said the two countries had signed an agreement “to work collaboratively and invest together to ensure that our mutual assets, talents and capabilities can accelerate Ukraine’s economic re-

Here’s what we know:

Ukraine’s minerals fuel industries and militaries Ukraine’s mineral resources are concentrated in two geologic provinces (tinyurl.com/4pdzwnk5). The larger of these, known as the Ukrainian Shield, is a wide belt running through the centre of the country, from the northwest to the southeast. It consists of very old, metamorphic and granitic rocks. A multibillion-year history of fault movement and volcanic activity created a diversity of minerals concentrated in local sites and across some larger regions.

A second province, close to Ukraine’s border with Russia in the east, includes a rift basin known as the Dnipro-Donets Depression. It is filled with sedimentary rocks containing coal, oil and natural gas.

Before Ukraine’s independence in 1991, both areas supplied the Soviet Union with materials for its industrialisation and military. A massive industrial area centred on steelmaking grew in the southeast, where iron, manganese and coal are especially plentiful.

By the 2000s, Ukraine was a significant producer and exporter of these and other minerals (tinyurl.com/ bddjbdwr). It also mines uranium, used for nuclear power (tinyurl.com/ mwbxyhfh).

In addition, Soviet and Ukrainian geoscientists identified deposits of lithium and rare earth metals that remain undeveloped. However, technical reports suggest

covery.” He described the agreement and establishment of the US–Ukraine Reconstruction Investment Fund as an “economic partnership.”

The fund, to be financed with 50% of the royalties and fees from new licences for critical materials, oil and gas extraction (tinyurl. com/325a932v), creates a strategic alignment between the two countries as the war continues. It includes provisions for US access to minerals, and states that US military equipment sent to Ukraine in the future could count as US contributions to the fund.

There is no doubt that Ukraine has an abundance of critical minerals, or that these resources will be essential to its postwar reconstruction. But what exactly do those resources include, and how abundant and accessible are they?

The war has severely limited access to data about Ukraine’s natural resources.

However, as a geoscientist with experience in resource evaluation, I have been reading technical reports, many of them behind paywalls, to understand what’s at stake.

assessments of these and some other critical minerals are based on outdated geologic data, that a significant number of mines are inactive due to the war, and that many employ older, inefficient technology.

This suggests critical mineral production could be increased by peacetime foreign investment, and that these minerals could provide even greater value than they do today to whomever controls them.

Critical minerals are defined as resources that are essential to economic or national security and subject to supply risks. They include minerals used in military equipment, computers, batteries and many other products.

A list of 50 critical minerals (tinyurl. com/46hc2495), created by the US Geological Survey, shows that more than a dozen relied upon by the US are abundant in Ukraine. A majority of those are in the Ukrainian Shield, and roughly 20% of Ukraine’s total possible reserves are in areas currently occupied by Russia’s military forces.

Critical minerals Ukraine currently mines

Critical mineral production could be increased by peacetime foreign investment

Three critical minerals especially abundant in Ukraine are manganese, titanium and graphite. Between 80% and 100% of US demand for each of these currently comes from foreign imports (tinyurl.com/fzk9mdar).

Manganese is an essential element in steelmaking and batteries. Ukraine is estimated to have the largest total reserves in the world at 2.4 billion tonnes.

However, the deposits are of fairly low grade—only about 11% to 35% of the rock mined is manganese. So it tends to require a lot of material and expensive processing, adding to the total cost.

This is also true for graphite, used in battery electrodes and a variety of industrial applications. Graphite occurs in ore bodies located in the south-central and northwestern portion of the Ukrainian Shield. At least six deposits have been identified there, with an estimated total of 343 million tonnes of ore—18.6 million tonnes of actual graphite.

It is the largest source in Europe and the fifth largest globally (tinyurl. com/kc54fys5).

Titanium, a key metal for aerospace, ship and missile technology, is present in as many as 28 locations in Ukraine, both in hard rock and sand or gravel deposits. The size of the total reserve is confidential, but estimates are commonly in the hundreds of millions of tonnes (tinyurl.com/ mvbspshp).

A number of other critical minerals that are used in semiconductor and battery technologies are less plentiful in Ukraine, but also valuable. Zinc occurs in deposits with other metals such as lead, gold, silver and copper. Gallium and germanium are byprod-

ucts of other ores—zinc for gallium, lignite coal for germanium. Nickel and cobalt can be found in ultramafic rock, with nickel more abundant.

No figures for Ukraine’s reserves of these elements were available in early 2025, with the exception of zinc, whose reserves have been estimated at around 6.1 million tonnes—putting Ukraine among the top 10 nations for zinc.

Critical minerals that are not being mined—yet Geologists have identified potentially significant volumes in Ukraine of three other types of critical minerals important for energy, military and other uses: lithium, rare earth metals and scandium. None of these had been mined there as of early 2025, though a lithium deposit had been licensed for commercial extraction (ukrlithium.com/project).

The largest potential lithium reserves exist at three sites in the south-central and southeastern Ukrainian Shield, where the grade of ore is considered moderate to good. How much lithium these reserves hold remains confidential, but technical reports suggest it is in the order of 160 million tonnes of ore and 1.6 million to 3 million tonnes of lithium oxide. If most of this could be recovered in a profitable way, it would place Ukraine among the top five nations for lithium.

Smaller volumes of tantalum and niobium, also used in steel alloys and technology, have also been identified in these reserves. Most of Ukraine’s lithium occurs as petalite which, unlike the other main lithium mineral spodumene, requires more expensive processing.

Rare earth elements in Ukraine are known to exist in several sites (tinyurl.com/bdh3wrth) of volcanic origin and in association with uranium in the south-central portion of the Ukrainian Shield. These have not been developed, though sampling has indicated commercial potential in some sites, while other sites appear less viable.

Rare earth elements in high demand for superior magnets and electronics—neodymium, praseodymium, terbium and dysprosium—are all present in varying amounts in these areas. Other critical minerals are associated with these deposits, especially zirconium, tantalum and niobium, in undetermined but potentially significant amounts.

Finally, scandium, used in aluminum alloys for aerospace components, has been identified as a byproduct of processing titanium ores.

Ukraine’s scandium does not appear to have been studied in enough detail to evaluate its commercial potential. However, world production, about 30 to 40 tonnes per year, is forecast to grow rapidly.

It is clear that Ukraine is endowed with valuable resources. However, extracting them will require roads and railways for access, infrastructure such as electricity and mining and processing technology, investment, technical expertise, environmental considerations and, above all, cessation of military conflict.

Those are the true determinants of Ukraine’s mining future.

Munira Raji Research Fellow: Geology University of Plymouth

Local content development in Africa’s energy sector: Challenges, opportunities and best practices

As Africa’s energy sector expands, the need for productive local content policies has become critical for local job creation and value retention. Such policies catalyse growth of nationally owned companies while creating revenue-generating opportunities for local service firms by strengthening their contribution to the industry.

African Energy Week: Invest in African Energies (aecweek.com), taking place from 29 September to 3 October 2025 in Cape Town, will show how well-crafted local content policies have the potential to stimulate local participation, job creation and value retention while standing to improve international partnerships that facilitate the transfer of knowledge, skills and technology.

As Senegal and Mauritania prepare to solidify their position as a major hydrocarbons hub in West Africa—on the back of first liquefied natural gas at the Greater Tortue Ahmeyim (GTA) project in February (tinyurl.com/54rytaup)—the MSGBC region is well-positioned to leverage its extractive industries and enhance local content development.

Senegal’s Local Content Development Fund and National Local Content Monitoring Committee are set to bolster local capacity for training and support for small- and medium-sized enterprises (SMEs), with the objective of achieving a 50% local content ratio by 2030.

To enhance local content amid the start of production at the GTA project, Mauritanian authorities are currently crafting a new local content law. As a partner on the GTA project, upstream oil company Kosmos Energy launched the Mauritania Innovation Challenge (tinyurl.com/4vxhuvk4), which is designed to support entrepreneurs under the age of 40.

Notable beneficiaries from the programme include iMauritanie (imauritanie.com), which works to enhance public administration communication; Sekem (sekem.com), an expert in non-GMO vegetable production; Ayadi Amila, which crafts accessories from recycled materials; and FASEI, which leads local salt processing.

On the back of robust local content policies, mature petroleum producers like Nigeria have seen an increase in local participation within the oil & gas industry.

The Nigerian Oil and Gas Industry Content Development Act mandates the prioritisation of Nigerian products, services and employment. Central to this effort is the Nigerian Content Development and Monitoring Board (ncdmb.gov.ng), which oversees the act and fosters partnerships with industry and educational institutions, aiming to achieve a 70% local content target by 2027.

The National Upstream Local Content Policy showcases Namibia’s dedication to empowering local communities while maintaining a welcoming environment for foreign investment.

In a significant step for the industry, Namibia recently approved the National Upstream Local Content Policy (tinyurl.com/mshtkdmt). This is set to play a significant role in reducing the country’s dependence on foreign expertise by focusing on the development of local capacity. Aimed at strengthening economic sovereignty and empowering Namibians within the country’s hydrocarbons sector, the policy marks a turning point for the country as it sets its sights on achieving first oil production by 2029.

The National Upstream Local Content Policy showcases Namibia’s dedication to empowering local communities while maintaining a welcoming environment for foreign investment. The policy is designed to balance

the interests of local stakeholders with the needs of international oil companies: a model that other African nations can look to replicate as they expand their own oil and gas exploration and production strategies.

Meanwhile, last October, Angolan service company Associação de Empresas Autóctones para a Indústria de Angola launched an initiative to increase local capacity in the country’s oil & gas sector to 20%. The Action for 20% initiative (tinyurl. com/bddyktuj) serves as a strategy to direct foreign investment to focus on local content by integrating Angolan companies and developing human capital in the country.

With an estimated 98% deficit in terms of local companies operating in the country’s oil & gas sector, improved capacity building is expected to result in oil and

gas production stability while diminishing an over-reliance on the international community to retain production standards.

Ghana’s energy sector is also benefitting from robust local content initiatives driven by the country’s Petroleum Commission. Local content and local participation regulations mandate a minimum 10% equity for Ghanian companies in all projects and establish employment targets for nationals. Meanwhile, the Local Content Fund (petrocom.gov.gh/local-content) provides crucial financial support to enhance the competitiveness of local firms, while the Enterprise Development Center offers essential training, advisory services and market linkages to Ghanian SMEs in the sector.

Local content policies address unique challenges in the African energy sector, including a capital-intensive financing model, a lack of modern technologies and a reliance on highrisk investments over long periods.

Traditionally, the hydrocarbons sector in Africa tends to have a low level of local employment and a heavy reliance on imported goods and services. To counteract this, resolute local content policies ensure African businesses and workers are fully integrated across all levels of the value chain: from exploration and production to service delivery and technology provision.

These policies also provide the opportunity to showcase a stable and transparent regulatory environment in the countries where they are implemented. By ensuring local content requirements are clear and enforceable, such policies are set to attract responsible investment while fostering an atmosphere of trust and co-operation.

start

production at the GTA project, Mauritanian authorities are currently crafting a new local content law.

At Alpha Insure, we recognise that mining is more than just an industr y

– it is the driving force behind an extensive ecosystem of interconnected businesses From the transport and logistics companies that keep supply chains moving to the manufacturers and ser vice providers supporting mining operations, we understand the unique risks and challenges involved.

Our comprehensive insurance solutions are strategically designed to safeguard critical assets, ensure fleet continuity, and enhance operational resilience, providing peace of mind for the entire mining value chain.

Key Insurance Solutions for the Mining Sector Commercial Insurance

We understand the risks faced by businesses within the mining

◦ Tailored Coverage: Customised solutions for equipment suppliers, ser vice providers, and transporters

◦ Liability Protection: Coverage for public liability and employer ’s liability risks

◦ Property and Stock Insurance: Protection for warehouses,

◦ Business Interruption Insurance: Financial security during disruptions, such as natural disasters or supply chain breakdowns

Assets All Risk Insurance

◦ On-Site Protection: Cover against damage, theft, or loss of plant vehicles and machiner y in operation, storage, or transit.

◦ Specialised Equipment Insurance: Comprehensive cover for high-value equipment, such as excavators, loaders, and drilling rigs

◦ Damage Protection: Safeguarding assets against fire, explosion, floods, and other unforeseen events.

◦ Operational Continuity: Rapid claims handling and bespoke risk solutions to minimise downtime

Fleet Insurance

Fleet management in the mining sector demands resilience and

Motor Fleet Specified:

Designed for transporters and logistics companies with medium to large fleets:

◦ Detailed, itemised cover for individual vehicles

◦ Flexibility to adjust coverage as fleets grow or operations shift.

◦ Protection against road risks, theft, and accidental damage

Motor Fleet Unspecified:

A streamlined solution for fleets exceeding 300 vehicles:

◦ Blanket cover for all fleet vehicles, reducing administrative complexity

◦ S calable protection to accommodate operational changes

◦ Comprehensive cover for vehicles on the road or at mining sites

Take the Next Step

Empower your business with industr y-leading insurance solutions from Alpha Insure.

SCAN THE QR CODE

To leave your details and explore how we can protect your assets, mitigate risks, and ensure operational continuity.

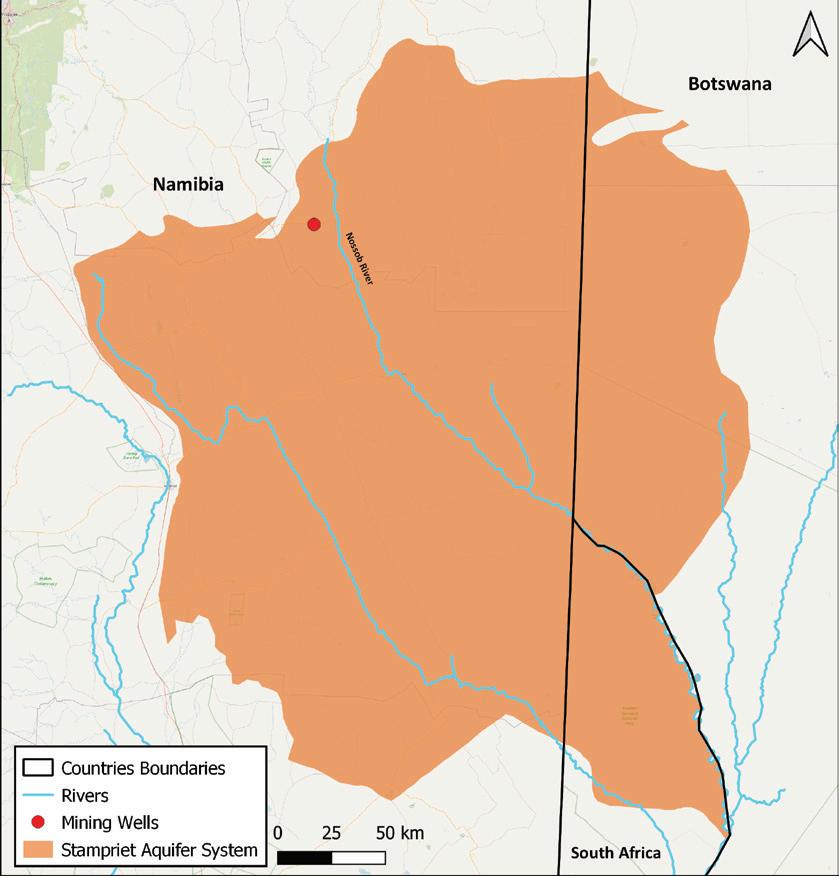

A giant freshwater aquifer in southern Africa is under threat from mining. Two groundwater scientists explain the environmental dangers

The combined extraction of oil and gas, uranium leach mining and rare earth heavy metal mining could contaminate the aquifer.

Ahuge underground water resource the size of Austria, the Stampriet Transboundary Aquifer System (tinyurl.com/2s3bc32d), stretches for 87 000km² across Namibia, South Africa and Botswana. It supplies 50 000 people in several towns with water pure enough to drink, and is their only source of water (www.saumanamibia.org).

But the Namibian government has awarded uranium prospecting licences to several mining companies across the aquifer system. Other mining companies already have the right to prospect for rare earth metals in the aquifer.

Surina Esterhuyse and Anton Lukas are groundwater scientists and mining specialists. They say if mining goes ahead, the groundwater may become contaminated by metals that can cause cancer, kidney damage, bone fragility, cardiovascular issues and respiratory problems.

What mining licences have been applied for?

At least seven uranium mining companies have applied to the Namibian government for uranium mining licences. So far, 35 uranium exploration licences have been issued by the Namibian government. These cover 3.3 million hectares of Namibian land and 29% of the 87 000km² area (tinyurl.com/5yrjpfyx). The exploration licences set out the ways the mining companies may explore for minerals, before they start mining.

Each licence is different and is determined by the country issuing it. There is an ongoing battle between the Namibian Department of

Agriculture, Water and Land Reform (tinyurl.com/4ebakp4u) and the mining companies over the exploration licences (tinyurl.com/45vemar4).

The Minister, Carl-Hermann Schlettwein, said in June 2024 (tinyurl.com/yf6p6vpb) that his priority was to make sure the Stampriet Transboundary Aquifer System would not be polluted and would continue to supply clean water in future.

Petroleum

Petroleum exploration licences for shale gas, petroleum and natural gas cover 37% of the aquifer system. Four oil & gas companies have applied for petroleum exploration licences in Namibia and one in Botswana.

Licences to explore have been granted in Namibia for base and rare earth metals across 10% of the aquifer. These metals include tin, lithium, rubidium and tantalum (tinyurl.com/ cruf5bt7).

How could the aquifer be affected by mining?

The combined extraction of oil and gas, uranium leach mining and rare earth heavy metal mining could contaminate the aquifer. This has happened in the boreal zone in Canada (tinyurl.com/4sd8zccz), where 80%

of mining for ferrous metals, precious metals, base metals, oil and gas, and precious gems takes place. Research has found that mine effluents and acid mine drainage have seeped into water resources. The groundwater is also contaminated by heavy metals.

It is difficult to rehabilitate groundwater that is contaminated by different chemicals that have interacted with each other. It becomes nearly impossible to determine how much each mine contributed to the damage and what percentage of the cleanup each mine is responsible for.

Oil and gas: Groundwater pollutants from oil and gas extraction sites could contaminate aquifer systems with saline waters (tinyurl. com/49pszpc6). These pollutants may migrate from surface spillages into shallow aquifers. They can also migrate via leaking production wells to freshwater aquifers.

Base and rare metal mining: Heavy metal pollution is a known cause of groundwater contamination (tinyurl.com/57e9ewtu).

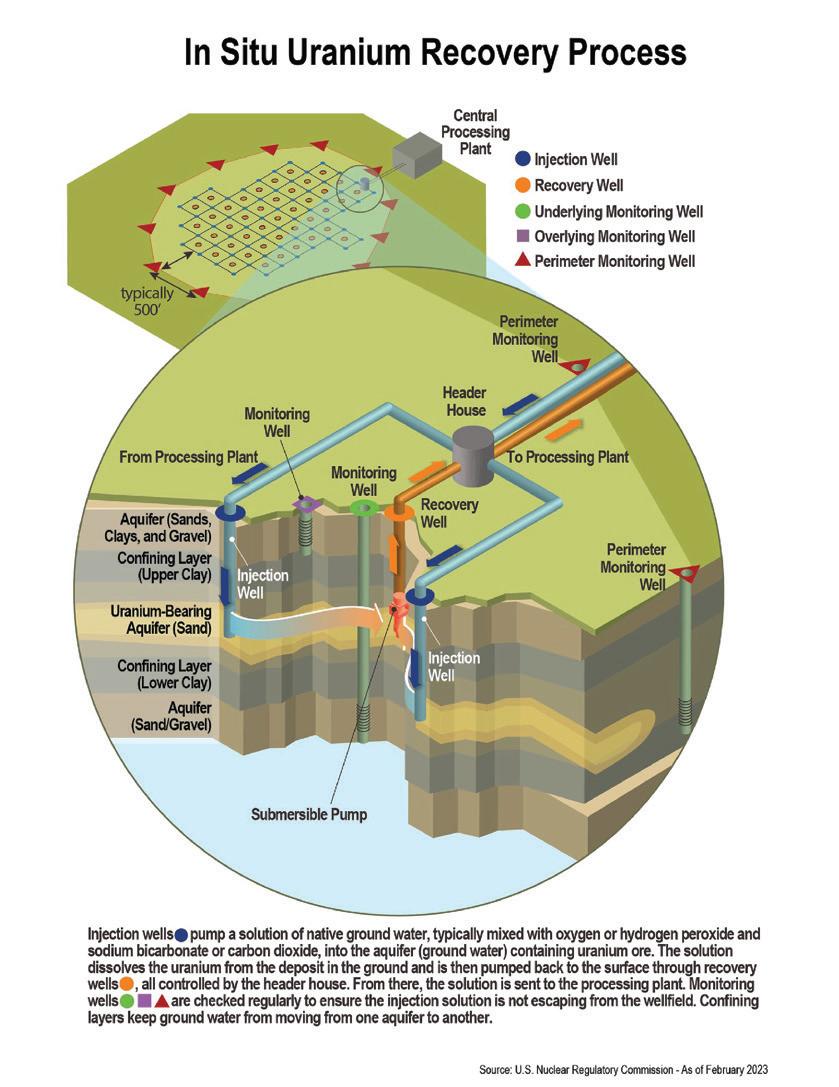

Uranium: In situ uranium leach mining (see diagram overleaf) could contaminate the aquifer system with radioactive leach fluids (tinyurl. com/2uaftrk4). This is because uranium mines drill thousands of boreholes over more than 1 000 hectares.

Sulphuric acid is typically inject-

ed into the aquifer rock that contains the uranium to dissolve it. The mine then pumps out the aquifer water and removes the uranium. The process repeats until economically viable amounts of uranium are exhausted.

At this point, the mine shuts down operations. The wastewater from the operations can be partially recycled at other active uranium well sites, or be injected into deep saline aquifers, or pumped back to an area of the mined aquifer (tinyurl.com/5c5hwr2h), which is what Uranium One proposes (tinyurl. com/4tjdh7dz).

This creates a risk for contaminated groundwater to be drawn to the outside of the mine area, where it can be pumped out by farmers or local communities.

Uranium One believes in “spontaneous neutralisation”: that the minerals in underground rock will neutralise the sulphuric acid (tinyurl. com/mr4xu5w7) and the company will not have to rehabilitate the aquifer. But this kind of natural rehabilitation has not yet been proven (tinyurl.com/56tdsdt5).

How could people in the area be affected by the mining?

With large-scale irrigation projects in Namibia extracting water from the Stampriet aquifer, groundwater can flow from mine areas toward freshwater zones in the aquifer system, potentially contaminating it.

There is no alternative water

source for farmers—and when farmers pump, they may draw out contaminated mine water for irrigation or livestock to drink from without realising it. The consequences to cattle could be inflammation, anaemia and damage to their DNA and organs (tinyurl. com/48senu74). The contaminated water could even unknowingly be consumed by the local communities.

Should mining be allowed?

We are not opposed to mining. Africa needs to profit from its wealth of mineral resources— but not to the detriment of African people in the long term (tinyurl. com/yc766fs2)

The mining planned in the Stampriet aquifer system has not properly considered the overall effect on people and the environment. This is because most environmental impact assessments only focus on the effect of extracting one resource (gold or coal or oil, for example).

Cumulative impact assessments (tinyurl.com/4j3fb2un) have not been conducted in the Stampriet aquifer system, and we believe they should have been.

The Namibian, South African and Botswana governments must co-operate to protect the aquifer system from contamination. Currently, the Stampriet aquifer groundwater is domestically protected in each of the three countries by exploration and mining permit conditions (tinyurl.com/tj3d8tzj). However, mining companies have not always obeyed these. Already, Namibia is facing a devastating drought. The country has needed to cull animals to reduce the load on the country’s water supplies. Mineral exploration places additional stress on the country’s water supplies (tinyurl. com/2u38e3hn)

The Southern African De-

velopment Community must develop legal instruments and a water security plan for this aquifer system. Neglecting the water security in an arid region for short-term gains is extremely concerning.

The governments must also ensure people are not misled into supporting mining when it is to their detriment.

Uranium mining and oil & gas extraction provide very limited job opportunities for local workers. They need specialised skills for operation and maintenance. Most jobs created are for trained technicians and engineers, and not local people.

Finally, the governments of Namibia, Botswana and South Africa must jointly monitor and manage important water resources. They should develop a regional baseline monitoring network to keep an eye on how the water quality is changing.

If the governments cannot co-operate to protect this shared water resource, water disputes and international litigation may happen.

Surina Esterhuyse is a senior lecturer at the Centre for Environmental Management, and Anton Lukas a groundwater modeller and postdoctoral researcher, both at the University of the Free State.

Green hydrogen is a clean fuel, but South Africa is not ready to produce it. Energy experts explain why

Every day, millions of engines and factories burn fossil fuels, releasing carbon dioxide: a greenhouse gas that traps heat in the Earth’s atmosphere and contributes to climate change. Now imagine a clean fuel that does not pollute and produces only water as waste.

That is the promise of green hydrogen, which is made by using solar and wind power to split water into hydrogen and oxygen.

Countries worldwide, including South Africa, see green hydrogen as a vital tool for tackling climate change. There are plans to use green hydrogen in South Africa for everything from producing fertiliser for farms to powering factories and heavy trucks (tinyurl.com/4ed2kcsd)

As governments worldwide push for green hydrogen as a clean energy solution, a critical reality is being overlooked: producing green hydrogen is only one piece of a complex puzzle. The success of green hydrogen projects depends on simultaneously developing infrastructure that will transport the green hydrogen to industry. It will also need industries to adopt new technology or convert existing equipment so that they can switch from using fossil fuels to using green hydrogen.

Producing 1kg of green hydrogen needs up to 30 litres freshwater. Desalination or water-recycling plants would be needed if green hydrogen hubs are set up in water-scarce areas. You would not construct a train station without first laying train tracks

and making sure trains are available to run on it.

Yet, South Africa aims to build seven gigawatts of hydrogen production capacity by 2030 (tinyurl. com/555vbej4)—enough to power up to seven million homes at once.

We are chemical engineers, with over five decades of combined experience in the petrochemical industry, who have researched the potential for green hydrogen commercialisation in South Africa. Drawing on our experience, our latest research (tinyurl.com/ mr2m76af) is about why ambitious energy projects succeed or fail.

We researched how to manage the risks of setting up a green hydrogen industry—from project execution through to market readiness—in a way that is fair to both developed and developing countries.

To develop our risk assessment framework, we analysed historical data from pioneer energy plants globally and examined some of the challenges experienced by megaprojects (those that cost more than R20 billion, or US$1 billion, to build). We compared different ways to use green hydrogen by measuring how much CO2 emissions are avoided for each tonne of hydrogen used. This helped us understand which applications are the most effective for cutting emissions.