Special Features

Newsworthy business highlights for the year

Top SA businesswomen advocating for female empowerment

Africa Rising: Innovation and Investment in SADC

Progress in 2025, Outlook for 2026

Founder, Advocate Veerash Srikison

Special Features

Newsworthy business highlights for the year

Top SA businesswomen advocating for female empowerment

Africa Rising: Innovation and Investment in SADC

Progress in 2025, Outlook for 2026

Founder, Advocate Veerash Srikison

Transparency, dignity and respect in mediation

Real Time 24/7 online access to:

• Multi language.

• Quote effective Certification Cost Calculator.

• Application submission with REAL TIME status updates on certification progress.

• DATA captured once - is thereafter selected by means of a drop down menu for future applications.

• Globally consolidate, manage, maintain and retain your live record of all your Certified Imports & Exports with a Validated Certification history from Day 1.

www.connexafricatranscom.com www.ogefremsls.com

“What good is winning a case if relationships are destroyed, employees demoralised and communities fractured?” It was this question that prompted Advocate Veerash Srikison to leave the traditional legal track in 2010 and, in 2014, to establish Fair Practice™: a dispute resolution and mediation practice that merges law, psychology and negotiation strategy. For her, building a business that placed fairness at its core was not only professional but profoundly personal—a deliberate response to the injustices of the past.

In South Africa, the provision of water services has become a crucial lifeline amid rapid urbanisation, population growth and the relentless effects of climate change. The need for resilient infrastructure and adept management of water resources has never been more urgent. Rand Water has garnered a global reputation for delivering water of the highest quality, consistently meeting and surpassing national and international standards and building large water infrastructure projects.

“A defining part of Sony’s DNA has always been our ability to innovate while staying true to our core purpose: enriching lives through technology and creativity,” says Jobin Joejoe, managing director for Sony Middle East and Africa. Under his leadership, Sony has deepened its focus on Africa, with South Africa positioned as a strategic hub.

When Aymeric d’Ydewalle stepped into the role of CEO of Saint-Gobain Africa this year, he did so with a conviction that the continent’s construction future must be shaped from within. And under his leadership, Saint-Gobain Africa is deepening its commitment to local production, sustainability and skills development through its bold movement: Make It in Africa to Build Africa.

Newsworthy South African business highlights for the year

Top South African businesswomen across six industries, advocating for female empowerment, gender equality and mentorship

Southern Africa is fast emerging as one of the most dynamic regions in the global investment landscape, driven by a powerful convergence of innovation, entrepreneurship and cross-border cooperation. From energy transition projects to fintech breakthroughs, the Southern African Development Community (SADC) bloc is proving it can balance growth with sustainability and inclusion.

In 2025, regional economies weathered global volatility with surprising resilience, underpinned by diversification and digitalisation. Startups across sectors—from agri-tech in Zambia to renewable energy in Namibia—are attracting both local and foreign capital. Venture funding, though still modest compared to global hubs, is expanding steadily as investors recognise the region’s untapped potential and young, tech-savvy population.

Governments, too, are laying the groundwork for a more integrated and innovation-driven future. The implementation of African Continental Free Trade Area reforms is improving market access, while public-private partnerships are transforming transport corridors, energy grids and digital infrastructure. These developments are not only reducing operational costs but also connecting previously isolated economies to global supply chains. Looking ahead to 2026, the momentum is set to accelerate. Expect stronger investment inflows into green energy and critical minerals—particularly as global industries seek sustainable supply chains. Financial technology and e-commerce will continue to thrive, spurred by mobile-first consumers and supportive regulatory reforms. Meanwhile, regional innovation hubs—from Gaborone to Lusaka and Dar es Salaam—will nurture the next generation of African problem-solvers.

The SADC region’s rise is not without challenges— bureaucracy, policy inconsistency and power constraints persist. Yet, the direction is clear: A new era of smart, inclusive growth is unfolding, powered by innovation and strategic investment.

If the current trajectory holds, 2026 could well mark southern Africa’s firm step onto the global stage as a magnet for opportunity and progress.

ADDRESS: Boland Bank Building, 5th Floor, 18 Lower Burg Street, Cape Town, 8000 Tel: 021 418 3090 | Fax: 021 418 3064

Email: majdah@avengmedia.co.za

Website: www.abizq.co.za

BUSINESS QUARTERLY

PUBLISHER

MANAGING EDITOR

DESIGN

STAFF WRITER

PHOTOGRAPHIC SOURCES

PROJECT MANAGER

ADVERTISING SALES

Donovan Abrahams

Tania Griffin tania@avengmedia.co.za

Erin Esau

Matthew van Schalkwyk

iStockPhoto Courtesy Images

Lunga Ziwele

Lunga Ziwele

Viwe Ncapai

Ugo Iwunze

James Stone

Kim Jeneke

ACCOUNTS MANAGER ACCOUNTS

CLIENT LIAISON

IT & SOCIAL MEDIA

HR MANAGER

PRINTER

Benita Abrahams

Bianca Alfos

Majdah Rogers

Tharwuah Slemang

Colin Samuels

Novus Print

www.abizq.co.za, www.issuu.com

DIRECTORS

PUBLISHED BY DISTRIBUTION

Donovan Abrahams

Colin Samuels

Aveng Media

DISCLAIMER:

© 2025 African Business Quarterly magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of going to print.

1 .

The Storyteller’s Advantage by Christina Farr (R440)

Investor, startup adviser and former business journalist Christina Farr reveals the secrets of business leaders who inspire, entertain and empathise through the art of storytelling. She offers an inside look at the greatest storytelling CEOs, whose narrative abilities enable them to raise more capital, retain more talent and make their brands more memorable.

THE

2.

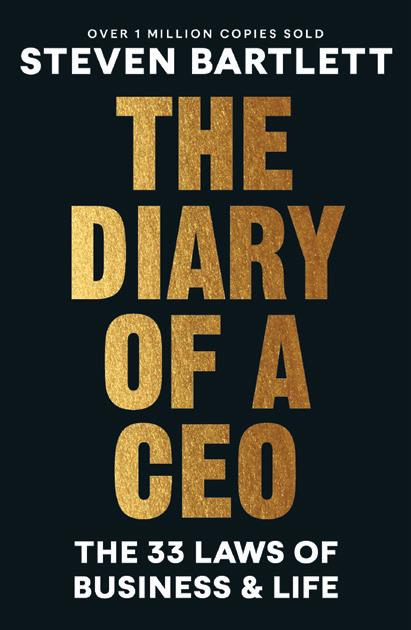

3.The Diary of a CEO by Steven Bartlett (R295)

At the very heart of all the success and failure the author has been exposed to—in his own entrepreneurial journey and through the thousands of interviews he has conducted on his podcast (the UK’s no.1)—are a set of principles that can stand the test of time, apply to any industry and be used by anyone who is search of building something great or becoming someone great. These are the fundamental laws that will ensure excellence.

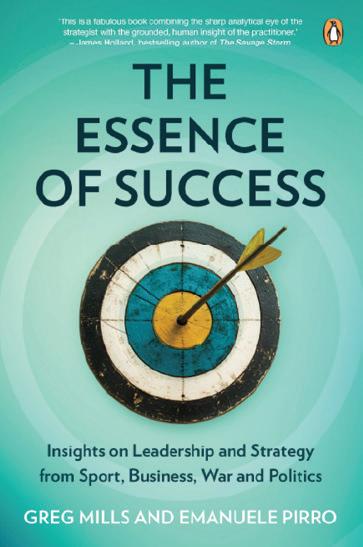

4.The Essence of Success by Greg Mills & Emanuele Pirro (R380)

This book finds common threads across different disciplines—sport, business, war and politics—and a consistent set of leadership attributes emerges. All these factors contribute to the achievement of success over different eras, in diverse settings, in public life as well as private business, in conflict and in the sporting arena. The book’s overall message is one of empowerment, whatever the level of your potential.

5.

Wicked Smart by Douglas Kruger (R300)

Feeding Unicorns by Jeni-Anne Campbell (R280)

Written in the margins of motherhood, meetings and midnight brainstorms, Feeding Unicorns is part manual, part manifesto, and all heart. It’s for leaders who care deeply—sometimes too deeply—and want to do things differently. From managing small teams or scaling a startup, Campbell (founder of The Good Businesswoman) offers practical tools, honest stories and a new kind of leadership playbook built on empathy, clarity and care.

Wicked Smart, The Diary of a CEO, The Essence of Success, and The Storyteller’s Advantage published by Penguin Random House SA. Feeding Unicorns published by Good Business Press.

Here is a condensation of the best brilliant breakthroughs across a range of spheres, in one easy guide. Whether you are chasing personal goals, leading teams, persuading others or are merely interested in clever ways of living the human experience, you will pick up dozens of ingenious accelerators within these pages.

In many ways, the origins of Fair Practice™ lie not in a boardroom or courtroom, but in the personal history of its founder, Advocate Veerash Srikison. Growing up as a South African Indian woman under apartheid meant fairness was never a given. Opportunities were rationed, voices were silenced and dignity was often stripped away.

“Fairness was not just a legal concept,” she recalls, “it was a human need.”

Even after 1994, when democracy promised freedom, the residue of unfairness lingered in workplaces, schools and communities. This experience left an indelible mark on Srikison. She began to see that even

in courtrooms—where outcomes were deemed ‘fair’ in legal terms— people often walked away bitter, broken and disillusioned.

“What good is winning a case if relationships are destroyed, employees demoralised and communities fractured?” she asks.

It was this question that prompted her to leave the traditional legal track in 2010 and, in 2014, to establish Fair Practice™: a dispute resolution and mediation practice that merges law, psychology and negotiation strategy. For her, building a business that placed fairness at its core was not only professional but profoundly personal—a deliberate response to the injustices of the past.

“FAIR PRACTICE MEANS EVERY VOICE IS HEARD, ESPECIALLY THOSE SILENCED BY POWER IMBALANCES. IT MEANS TRANSPARENCY, DIGNITY AND RESPECT AT EVERY STAGE.”

How Advocate Veerash Srikison and her firm Fair Practice™ are transforming dispute resolution in South Africa

Building fairness into practice Fair Practice™ is intentional. It is not a marketing catchphrase, but a philosophy—a commitment to restoring trust, dignity and balance in every sphere of society.

“Fairness,” says Srikison, “is seen in the eyes of the beholder. For one person, it may mean equality; for another, recognition; for another, dignity. Our role is to create a process that honours different perceptions of fairness while holding to the principles of justice.”

This approach has allowed Fair Practice™ to develop a portfolio of services that go far beyond what most legal firms traditionally offer. The practice operates across multiple spheres:

• grievances, executive disputes and high-stakes negotiations,

Corporate and Workplace Mediation – handling human resources grievances, executive disputes and high-stakes negotiations, often preventing costly litigation.

Family and Community Mediation – helping families and communities navigate inheritance disputes, neighbourhood conflicts and relationship breakdowns.

navigate

Educational Programmes – accredited mediation and negotiation skills training that equips professionals to resolve conflict and collaborate; introducing peer mediation in schools, teaching children to resolve disputes constructively.

children to resolve disputes constructively.

• Conflict Resolution Wellness –

Conflict Resolution Wellness – integrating counselling, trauma support and stress management into mediation services.

Each service is designed not merely to end disputes but to foster healing and restoration.

“Watching a 12-year-old say, ‘This is how I feel, and this is what I need’, is profoundly moving,” says Srikison. “It plants the seed of fairness early.”

While Fair Practice™ is often described as an ‘alternative dispute resolution’ practice, Srikison challenges the term. Mediation, she argues, is not an alternative or secondary process—it is integral to justice itself.

She points to Section 34 of the South African Constitution, which affirms that everyone has the right to resolve disputes—not only in court but also in other independent and impartial forums. For Srikison, this section validates mediation as a constitutional expression of access to justice.

“Our role is to create ancillary dispute resolution forums,” she explains, “spaces that sit alongside courts, offering impartiality, independence and humanity. Mediation is not a soft option. It is fairness in action.”

What sets Fair Practice™ apart from other legal firms is this orientation. Where traditional law often frames disputes in terms of winners and losers, Fair Practice™ focuses on people, fairness and sustainable solutions.

For Srikison, fairness is not just about outcomes—it is about the process. “Fair practice means every voice is heard, especially those silenced by power imbalances. It means transparency, dignity and respect at every stage.”

She recalls mediations where parties walked away not with everything they initially demanded but with something more valuable: a sense of being heard and understood. One participant told her, “I came demanding what I wanted, but I got what I needed— and I felt heard. I can live with this outcome.”

That, for Srikison, is the essence of fair practice. It is not perfection but balance. Not about winners and losers, but about trust restored.

Shifts in the world of mediation and HR

The last decade has seen dramatic changes in dispute resolution, and Fair Practice™ has been at the forefront of adapting to them.

Technology has revolutionised the process. Today, cross-border disputes can be mediated online, with participants from multiple countries meeting in a virtual room. But virtual mediation also demands new skills: reading body language through a screen and building trust digitally.

Regulation and compliance have grown more complex, especially for African businesses operating under tightening labour laws and governance standards. For companies, mishandling disputes is not only a legal risk—it undermines trust among stakeholders and investors.

Most importantly, workplace culture itself has shifted. Employees now demand more than salaries; they expect fairness, inclusion and well-being. This is particularly true in Africa, where histories of inequality continue to shape perceptions of justice.

At Fair Practice™, these shifts are navigated by bridging compliance with compassion. In one hybridworkplace dispute, the firm did not simply draft policies. It convened dialogue circles, trained managers and provided wellness support— ensuring not just compliance but a workforce that felt included and respected.

Has corporate South Africa embraced fair practice? Srikison believes progress has been made, but too many organisations still default to litigation or rigid HR procedures. While these may resolve issues on paper, they often escalate hostility and damage relationships.

Her advice to leaders is clear: “See conflict not as a threat but as a resource. Every dispute in your organisation is a symptom, every

dispute is information—it’s telling you something about your culture.”

She recalls a corporate client paralysed by piled-up grievances. Management blamed “difficult employees” . The real issue? Managers had never been trained in communication or conflict management. Once mediation skills were integrated into leadership training, grievances dropped and trust began to rebuild.

In today’s world, Srikison argues, fairness is not a luxury—it is a strategic necessity. Investors, employees and customers demand it. Businesses that embed fairness into their DNA will thrive.

The role of wellness in dispute resolution

Conflict takes a toll not only on companies but also on individuals. Stress, anxiety and even physical illness are common side effects of workplace disputes. Recognising this, Fair Practice™ created a Conflict Resolution Wellness division, which integrates counselling, trauma support and stress management.

“Resolution without wellness is incomplete,” says Srikison. She recalls mediating between two executives whose conflict had traumatised their teams. By including wellness sessions, not just for the leaders but for employees, the resolution was able to heal the entire team.

This holistic model—where legal, psychological and wellness elements work together—is part of what makes Fair Practice™ unique.

Psychology at the core

Psychological insight is central to Fair Practice’s approach. Most conflicts, Srikison explains, are not about money or contracts, but about deeper needs: respect, belonging, recognition.

In one mediation, a manager’s aggression was revealed to stem not from hostility but from fear— fear of becoming irrelevant in a changing organisation. By surfacing this underlying concern,

resolution became possible.

Fair Practice’s mediators are trained to listen beyond words: reading silence, tone and body language, and equipping clients with questioning techniques to uncover deeper concerns. “Many mediators are trained in procedure,” says Srikison. “We are trained in people. And that makes all the difference.”

A global perspective, a local commitment

Srikison’s reputation as a mediator extends well beyond South Africa. Her international work has confirmed that conflict is universal: People everywhere share the same needs for respect, recognition and fairness.

Yet, cultural fluency is critical. In one cross-border dispute, a breakdown arose not over contracts but over cultural expectations: one party valued relationshipbuilding, the other speed. Once these assumptions were addressed, the dispute was quickly resolved and trust built for a long-term partnership.

These experiences have deepened Srikison’s adaptability, but also reinforced her belief that global best practices must always be tailored to South Africa’s unique history and context. Here, disputes often carry the weight of apartheid’s legacy. A one-sizefits-all model imported from abroad cannot work.

At the same time, she insists South Africa has lessons for the world: The Truth and Reconciliation process, though imperfect, demonstrated the power of dialogue even after profound injustice.

the mediation room

What does this philosophy look like in practice? Srikison shares the story of two business partners whose relationship had broken down so completely that litigation seemed inevitable.

By meeting them separately at first, she uncovered not just

anger but fear: one feared financial collapse, the other feared loss of identity. By reframing their conflict in terms of needs rather than accusations, and by reminding them of their shared vision for the business, mediation transformed the situation.

They reached a new arrangement that preserved their partnership and healed their relationship— an outcome no court could have achieved.

This is the “magic” of mediation, Srikison says: the quiet shifts, the safety of confidentiality, the moment when antagonists become collaborators. “Litigation could only have given them a winner and a loser,” she reflects. “Mediation gave them a future together.”

The way forward for mediation in Africa

Looking ahead, Srikison believes the future of dispute resolution in Africa lies in mainstreaming mediation—not as an ‘alternative’ but as a constitutional and cultural right.

In many African communities, courts are inaccessible or overburdened. Mediation provides affordable, accessible solutions rooted in Africa’s own traditions of dialogue and consensus. Historically, disputes were often resolved under trees, in circles, through storytelling. Modern mediation is, in many ways, a continuation of this heritage.

But for mediation to fulfil its promise, it must be embedded into schools, workplaces and communities. At Fair Practice™, this philosophy underpins both client work and community initiatives. By equipping young people with skills of dialogue and fairness, and supporting adults with dignified processes, the firm is nurturing a culture where fairness is not an exception but a standard.

Fairness as a strategic advantage Fair Practice™ is more than a law

firm; it is a movement to redefine fairness in South African business and society. Under Advocate Veerash Srikison’s leadership, it is proving that dispute resolution, when approached holistically— with law, psychology and wellness integrated—can do more than settle disputes. It can restore dignity, rebuild trust and transform conflict into opportunity.

As Africa steps further into the global economy, companies that embrace fairness will not only retain talent and foster innovation but also reflect the continent’s spirit of resilience and ubuntu. In this sense, Fair Practice™ is not just offering a service. It is pointing to the future of leadership: one where fairness is not an aspiration but a daily practice.

“Every mediation we conduct is proof that resolution is never enough unless it restores humanity. That is the culture we are shaping for Africa’s business future,” Srikison concludes.

1

See conflict as information, not disruption

Every dispute reveals something about an organisation’s culture: whether employees feel excluded, managers lack skills, or communication is breaking down. Instead of fearing conflict, use it as a diagnostic tool to improve systems and relationships.

2

Balance compliance with compassion

African businesses face increasing regulatory pressures, but box-ticking is not enough. Policies must be paired with dialogue, inclusion and wellness support. When employees feel heard and respected, compliance becomes a culture rather than a checklist.

3

Invest in fairness as a strategic asset

Fairness is no longer a ‘soft’ value. Investors evaluate it, younger employees demand it and customers reward it. Embedding fairness into dispute resolution, leadership and workplace culture is a competitive advantage that retains talent and drives innovation.

4

Recognise the role of psychology

Most disputes are about more than contracts or policies. They are about respect, recognition and belonging. Leaders who acknowledge underlying fears and needs can resolve conflicts more sustainably and build stronger trust within their organisations.

5

Draw on Africa’s traditions of dialogue

Mediation resonates deeply with Africa’s cultural heritage of consensus-building and ubuntu. By embedding fairness into schools, workplaces and communities, leaders can build resilient organisations that reflect African values while remaining globally competitive.

WHERE TRADITIONAL LAW OFTEN FRAMES DISPUTES IN TERMS OF WINNERS AND LOSERS, FAIR PRACTICE™ FOCUSES ON PEOPLE, FAIRNESS AND SUSTAINABLE SOLUTIONS.

Rand Water is ensuring clean water—the foundation of life, health and economic growth—reaches every household, business and institution

n early August 2025, President Cyril Ramaphosa officiated at the launch of Station 5A at Rand Water’s Zuikerbosch Water Purification Plant in Vereeniging, Gauteng. The Zuikerbosch plant is the biggest state-of-the-art water purification plant in Africa and one of Rand Water’s key water supply infrastructures.

Valued at R4.8 billion, the project has delivered many socio-economic benefits since its inception in 2019, and construction is still ongoing.

It forms an essential part of Rand Water’s long-term infrastructure strategy, purposefully developed to accommodate and anticipate the steady increase in customer demand—ensuring a dependable and uninterrupted water supply for millions of people.

At the ceremony, President Ramaphosa said: “Let the waters that flow through this facility be a testament to our commitment to provide clean and safe water to all our people.” Rand Water

group CEO Sipho Mosai says these words capture the essence of Rand Water’s mission and the significance of this new phase of the Zuikerbosch Station 5A plant.

“This project stands as a proud symbol of our shared determination to secure South Africa’s water future. It represents not only an engineering achievement but also a commitment to service delivery, resilience and equity. Every litre purified here reflects the collective effort of government, engineers, scientists and communities

“RAND WATER’S OPERATIONAL ACTIVITIES IMPACT THE ENVIRONMENT, PEOPLE AND BROADER SOCIETY.”

working together to ensure clean water—the foundation of life, health and economic growth—reaches every household, business and institution in our region,” Mosai adds.

“At Rand Water, we remain steadfast in advancing sustainable water management and innovation. We are investing in modern infrastructure, strengthening partnerships and building the skills required to meet future challenges. This facility is more than a plant; it is a promise—a promise that we will continue to honour the trust placed in us to deliver life-giving water, now and for generations to come.”

In South Africa, the provision of water services has become a crucial lifeline amid rapid urbanisation, population growth and the relentless effects of climate change. As cities swell and the demand for clean water surges, the need for resilient infrastructure and adept management of water resources has never been more urgent.

“It is vital that society as a whole acknowledges that despite great effort, severe water challenges persist—posing a threat not only to humankind but to all species in the environment,” says Mosai. “We recognise that scaling water access is not just about building more pipes; it’s about re-imaging how things are done, financed and how outcomes are measured.”

He says Rand Water has garnered a global reputation for delivering water of the highest quality, consistently meeting and surpassing national and international standards and building large water infrastructure projects. “Immense effort has been made to ensure the maintenance of a strong financial profile amid the economic challenges and tough operating environment making liquidity and financial

risk management fundamental cornerstones toward Rand Water’s financial sustainability.”

Rand Water’s commitment to constructive engagement with its stakeholders is driven by five corporate values: innovation, excellence, caring, spirit of partnership, and integrity, he shares. “These values guide our behaviour and are meticulously applied when engaging all stakeholders. Our stakeholder interaction is also guided by the best business practice principles of inclusivity, materiality and responsiveness. Our reputation rests on the value we deliver to our stakeholders and the way we manage our contributions to, and the impact we have on, the water sector and with South Africa’s economic development agenda at large.”

Community engagement and corporate social responsibility are key elements of that. Rand Water has spearheaded initiatives that go beyond water supply and tackling broader socioeconomic challenges, aligning the organisation’s goals with national development priorities.

“Rand Water’s operational activities impact the environment, people and broader society,” says Mosai. “We, therefore, have a responsibility to reduce our negative impacts, increase our positive impacts and create sustainable benefits for our internal and external stakeholders.”

The United Nations’ Sustainable Development Goals (SDGs) aim to eradicate poverty, safeguard the environment and promote peace and prosperity by 2030. “As the provider of bulk potable water and sanitation services, Rand Water directly supports Goal 6, which aims to ensure available and sustainable management of water and sanitation for all, while other SDGs are indirectly supported through our core activities,” explains Mosai.

In line with SDG Goal 6, Rand Water provides a reliable supply of water with no unplanned interruptions to bulk supply exceeding 24 hours. It has achieved

99.70% on the water quality Composite Indicator; and continues to implement infrastructure projects to ensure transportation of safe drinking water.

Rand Water’s SDG contribution also includes Goal 5 (Gender Equality), with 43% of its employees and 76% of its managers being female; Goal 8 (Decent Work and Economic Growth), with 3 027 job created through the Rand Water Foundation and other infrastructure projects; Goal 12 (Responsible Consumption and Production), through its Project

1600 programme to improve water use efficiency; and Goal 13 (Climate Action), through ongoing improvements in its energy efficiency and reduction of its carbon footprint.

The Water Wise (waterwise.co.za) campaign, a sub-brand of Rand Water, is committed to educating and influencing stakeholders on the value of water and the importance of its conservation. Water Wise is also responsible for educating stakeholders on efficient water use, conservation and water demand management.

Rand Water’s Water Wise education team offers an education service to organisations at external venues to assist them with a variety of Water Wise programmes. These include educator workshops, interactive presentations, roadshows and puppet shows.

Water Wise uses interactive methodologies to promote the reduction of wasteful water use, the prevention of water pollution and the protection of water sources—aiming to create a sustainable future for all.

Mosai says Rand Water is not resting on its laurels despite its accomplishments.

“The toughest tests lie ahead with climate strain, municipal weak financial systems and non-payment of bulk water utilities.

Hard work and innovation in Rand Water’s value chain need to be used as a motivation by municipalities to reticulate the water they receive from Rand Water to taps for the benefit of communities.

“Again, to quote President Ramaphosa: ‘Water is not just a basic human need. It is the lifeblood of any thriving society. Water sustains life, supports industry, empowers agriculture and fuels innovation... Water is an enabler of economic growth.’

“The legacy we are building at Rand Water is one of resilience, innovation and inclusive water provision.”

For further information, visit www.randwater.co.za.

Established in 1903, Rand Water is Africa’s largest bulk water utility and one of the largest globally. Headquartered in Gauteng, it operates under the Water Services Act (No. 108 of 1997) and is listed as a Schedule 3B National Government Business Enterprise in terms of the Public Finance Management Act.

Owned by the South African government through the Department of Water and Sanitation, Rand Water plays a pivotal role in supplying bulk potable water to more than 18 million people across Gauteng, Mpumalanga, Free State and North West, covering an area exceeding 18 000 square kilometres.

The utility sources water from the Vaal River System, treating it at its Vereeniging and Zuikerbosch purification plants before distributing it via an extensive network of over 3 500km of large-diameter pipelines and 60 reservoirs. Its customer base includes 17 municipalities, 27 mines and nearly 1 000 industries and direct consumers.

Rand Water’s vision is “to be a provider of sustainable, universally competitive water and sanitation solutions for Africa”. Guided by strategic goals focused on energy security, financial sustainability and growth, it continues to invest heavily in infrastructure, with R34 billion allocated to capital projects over the next five years.

Recognised globally for its water quality and operational excellence, Rand Water remains a cornerstone of South Africa’s socio-economic development and regional water security.

Sipho Mosai is a seasoned leader in South Africa’s water sector and has served as Group Chief Executive of Rand Water since 2019. His appointment followed a decade as the organisation’s Chief Operations Officer, where he played a pivotal role in ensuring the consistent and sustainable delivery of bulk water to millions across the country. A scientist by training, Mosai has seamlessly transitioned into a visionary strategist, combining technical expertise with strong business acumen to guide one of Africa’s largest water utilities toward innovation and growth.

With more than 20 years of executive management and technical experience, Mosai’s career spans an impressive range of disciplines — including bulk and distribution water operations, infrastructure planning, system maintenance and refurbishment, project management, and strategic asset management. His leadership has been instrumental in driving Rand Water’s long-term infrastructure development and sectoral transformation, ensuring the organisation remains a cornerstone of national water security and socioeconomic progress.

Beyond his executive role, Mosai has contributed extensively to governance and leadership in various institutions. He has served as a non-executive and board member of several organisations, including the Construction Industry Development Board (CIDB), where he chaired the Human Resources Sub-committee and later the Audit and Risk Committee. He currently serves on the boards of the Rand Water Foundation and Rand Water Services. Widely respected for his integrity, strategic insight, and commitment to public service, Sipho Mosai continues to shape the future of South Africa’s water landscape through visionary leadership and unwavering dedication.

How Sony’s leadership in the Middle East and Africa is empowering African creators, deepening its regional presence and amplifying the continent’s rhythm through technology and storytelling

In after nearly two decades with Sony, Jobin Joejoe has witnessed the brand’s transformation across continents and product categories: a journey defined by innovation, adaptability and a deep respect for creativity. Now, as managing director for Sony Middle East and Africa, he brings that same visionary approach to one of the world’s most dynamic growth markets.

“A defining part of Sony’s DNA has always been our ability to innovate while staying true to our core purpose: enriching lives through technology and creativity,” he says. It is a legacy that stretches back to the company’s founding, when Masaru Ibuka predicted the central role artificial intelligence would one day play in electronics—a vision that continues

to guide Sony’s evolution. Under Joejoe’s leadership, Sony has deepened its focus on Africa, with South Africa positioned as a strategic hub. “South African consumers are early adopters and trendsetters across the panAfrican region,” he explains. The company’s success in the region is being driven by demand in audio and content creation, reflected in the rollout of flagship products like the Alpha 9 III mirrorless camera, the ULT Power Sound Series, and the 1000X noise-cancelling headphones.

Beyond products, Sony is investing in Africa’s creative ecosystem. Initiatives such as the Sony Creators Convention, Alpha Festival and the Sony Innovation Fund: Africa are designed to empower local talent and stimulate growth in entertainment sectors including music, film and gaming.

Joejoe recently oversaw the launch of Sony World (sonyworld.co.za), a dedicated online platform offering South Africans direct access to Sony’s full product portfolio: from televisions and home cinema systems to PlayStation. “This marks a major step in getting closer to our customers,” he says. “It allows for early access to global launches and a more personalised shopping experience.”

Looking ahead, he sees Africa’s youthful, tech-savvy population as a wellspring of innovation. “We want to help the next generation tell their stories,” he says.

Through partnerships with institutions like Open Window and initiatives like Alpha Femme, Sony is helping equip young and female creators with world-class tools. “By empowering diverse voices and enabling access to cutting-edge technology,” Joejoe concludes, “we’re building an ecosystem where creativity thrives.”

As Sony prepares to launch its new ULT Power Sound Series in South Africa, Koji Sekiguchi, Head of

Marketing for Sony Middle East and Africa, is confident the range will resonate with the continent’s passion for rhythm and celebration.

“The ULT Power Sound Series delivers massive bass and ultimate vibes—it’s about feeling the music, not just hearing it,” he says.

The launch event, set for 19 November in Johannesburg, will bring together media, influencers and consumers for an exclusive hands-on experience. “It’s a celebration of sound, energy and creativity,” Sekiguchi notes.

The entire range will also be available on Sony World, reinforcing Sony’s omnichannel presence and making it easier for consumers across South Africa to connect directly with the brand.

Sekiguchi explains that the ULT Power Sound Series was designed with Africa’s lifestyle and music culture in mind. “With genres like amapiano, bacardi, lekompo and hip hop dominating the scene, our goal was to create audio products that capture the heartbeat of these sounds,” he says.

The lineup’s standout feature—the ULT button— instantly boosts bass and sound pressure, perfect for outdoor gatherings or vibrant social settings. Durability and practicality were also key design considerations.

“We’ve incorporated IPX water- and dust resistance, long battery life, USB charging and multi-device connectivity to suit environments where power or connectivity can be inconsistent,” Sekiguchi explains.

Among the models, the ULT Field 3 and ULT Field 5 are expected to be particularly popular for their portability and robust design— ideal for beach days, braais and road trips. Meanwhile, the ULT Tower 10 will anchor home entertainment setups with lighting effects and deep, room-filling sound.

Sony is also tapping into South Africa’s thriving creative scene through local artist collaborations and influencer partnerships. “We’re engaging musicians and creators who truly understand the pulse of the audience,” Sekiguchi says. “These co-creative campaigns help showcase how our products amplify their artistry and connect with fans.”

For Sekiguchi, the ULT launch represents more than a product release—it is a cultural connection. “Music is a universal language, and in Africa it’s part of everyday life,” he reflects. “With the ULT Power Sound Series, we’re celebrating that energy: bringing people together through sound that moves them.”

THESE OFFERS FROM SONY WILL RUN FROM 1 NOVEMBER TO 31 DECEMBER 2025

WH-1000XM6 Wireless Noise Cancelling Headphones R8 999

WF-1000XM5 Wireless Noise Cancelling Earbuds R4 999

WH-1000XM5 Wireless Noise Cancelling Headphones R5 999

WH-CH720N Wireless Noise Cancelling Headphones R1 699

WF-C510 Truly Wireless Earbuds R899

WF-C710N Truly Wireless Noise Cancelling Earbuds R1 899

WH-CH520 Wireless Headphones R649

R3 299

HT-A9000

BRAVIA Theatre Bar 9

R17 999

HT-A8000

BRAVIA Theatre Bar 8

R14 999

BRAVIA Theatre Quad + SA-SW5

R47 999

BRAVIA Theatre Bar 9 + SA-SW5 + SA-RS5

R34 999

Bundle O er:

HT-A8000 BRAVIA Theatre Bar 8 +

SA-SW3 200W Additional Wireless

Subwoofer + RS3S Total 100W

Additional Wireless Rear Speakers

R25 499

Bundle O er:

HT-A9000 BRAVIA Theatre Bar 9 +

SA-SW5 300W Additional Wireless

Subwoofer + SA-RS5 Total 180W

Additional Wireless Rear Speakers with Built-in Battery

R34 999

ULT TOWER 9 AC

R12 999

ULT Field 5

Wireless Portable Speaker R4 999

Bundle O er:

SA-RS3S Total 100W Additional Wireless Rear Speakers + SW3 200W

Additional Wireless Subwoofer + HTA3000 360 Spatial Sound Mapping

Dolby Atmos® / DTS:X® 3.1ch Soundbar

R20 999

Bundle O er:

BRAVIA Theatre Quad + SASW5 300W Additional Wireless Subwoofer

R20 999

Saint-Gobain Africa CEO Aymeric d’Ydewalle champions the organisation’s commitment to ‘Make It in Africa to Build Africa’

When Aymeric d’Ydewalle stepped into the role of CEO of Saint-Gobain Africa this year, he did so with a conviction that the continent’s construction future must be shaped from within. For him, Africa is not an emerging market waiting to be developed—it is a powerhouse of capability, innovation and talent.

And under his leadership, Saint-Gobain Africa is deepening its commitment to local production, sustainability and skills development through its bold movement: Make It in Africa to Build Africa (MABA).

“MABA is our deep commitment to this continent,” says d’Ydewalle. “It is an extension of our group’s purpose—Making the World a Better Home—but tailored to Africa’s unique realities and opportunities.”

A 360-year legacy anchored in local futures

Saint-Gobain’s global heritage stretches back more than three centuries to its origins as France’s Royal Mirror-Glass Factory. Over the years, it has evolved into a worldwide leader in construction materials and sustainable solutions, operating in more than 70 countries.

But Africa, d’Ydewalle believes, has the potential to shape the next chapter of that long history. “I believe deeply in Africa’s true greatness,” he says.

For more information about Make It in Africa to Build Africa, visit www.saint-gobain-africa.com.

“My commitment is to ensure we drive this movement forward—and together, as an industry, we build confidence in African capability.”

MABA: A framework built on four pillars

The Make It in Africa to Build Africa movement is centred on four pillars: Local Production, Sustainability, People & Communities, and Customer Centricity. Each pillar is intended to translate into practical, long-term actions across the continent.

“By investing in local production, we reduce dependence on imports, strengthen supply chains and ensure the materials we create are designed for African conditions and needs,” d’Ydewalle explains. “Every product we make in Africa has a multiplier effect: It builds skills, transfers knowledge and encourages entrepreneurship.”

For d’Ydewalle, the human impact matters just as much as the industrial strategy. “At its heart, MABA is about real stories of real people, real products and real projects that demonstrate Africa has the talent, resources and capacity to build for itself.”

One of the most significant developments under the

Made around the corner.

current growth strategy is the construction of a new fibre-cement manufacturing facility in Brakpan, Gauteng, set to open in 2026.

“The Brakpan facility will be our first fibre-cement plant in SaintGobain’s sub-Saharan Africa region,” d’Ydewalle shares. “This expansion reinforces our long-term commitment to the region.”

The project will create more than 60 permanent jobs in its first phase, stimulate local supply chains and make high-quality, durable building materials more accessible to the market.

“By expanding our production capacity locally, we aim to reduce reliance on imports and empower local communities,” he notes. “This development reflects our belief in the long-term potential of South Africa and the broader African market.”

Shaping a climate-resilient built environment

As Africa’s cities grow, so too does the need for sustainable and climate-resilient construction solutions. For d’Ydewalle, this is a responsibility the company takes seriously.

“In the face of climate change, it is important to consider designing for climate-resilient cities,” he says. “Our products are designed for durability and improving indoor comfort and energy performance.”

He is equally focused on building resilience into supply chains themselves. “We’re reducing our reliance on virgin raw materials to

build climate-resilient supply chains. Disruptions due to climate change impact daily wage workers the most. As manufacturers, it is up to us to ensure no one is left behind.”

Saint-Gobain’s futuRE Range, which offers locally manufactured materials with third party–verified Environmental Product Declarations, is a key result of this sustainability journey.

“With these products, we’ve reduced embodied carbon, improved resource circularity and catered to better health and safety indoors and on job sites,” he adds.

Saint-Gobain Africa’s commitment extends beyond production. The company invests heavily in skills development through training programmes for applicators, installers and contractors across the continent.

“We transfer valuable skills and knowledge that help build strong local talent pools,” says d’Ydewalle. “Our free Contractor Care Programme goes a step further by helping contractors grow their expertise in building with light and sustainable construction materials.”

These initiatives are designed to uplift communities while ensuring a skilled workforce for the future of African construction.

Leadership grounded in listening and collaboration D’Ydewalle’s leadership

philosophy is unmistakably collaborative. He engages directly with architects, engineers, contractors and distributors across Africa to understand market needs firsthand.

“I make it a priority, alongside my teams, to stay closely connected with our clients and all stakeholders across the value chain,” he says. “It’s through these meaningful interactions that we gain a deeper understanding of local needs and strengthen partnerships.”

Having worked across advanced materials, global mergers and acquisitions, and highperformance product sectors, d’Ydewalle brings a broad technical and strategic perspective to his African mandate.

“I’ve had the privilege of working across a wide range of technical market sectors,” he notes. “But when I think about MABA, the construction sector stands out. It connects directly to people’s everyday lives: homes, schools, hospitals and workplaces.”

His focus now is clear: expanding local manufacturing capacity, deepening sustainability commitments and ensuring African innovation takes its rightful place in the global construction industry.

“Our goal is not only to build materials,” he says. “It is to build confidence, capability and sustainable economic growth across the continent.”

NEWSWORTHY SOUTH AFRICAN BUSINESS HIGHLIGHTS FOR THE YEAR

Insurtech company Naked raised US$38 million (around R700 million) in a Series B2 funding round, led by global impact investor, BlueOrchard. According to coverage, this was “the largest insurtech investment in Africa to date” . Naked uses artificial intelligence (AI) and automation for underwriting, risk selection, pricing and claims processing.

Pret A Manger debuted in South Africa, with its first store opening in Johannesburg’s Melrose Arch. (A second store was opened in May 2025 at The Zone in Rosebank.) This expansion, spearheaded by the Millat Group, introduces a brand renowned for its quality, sustainability and ethical food sourcing. The South African menu features a mix of global Pret classics and locally inspired items such as a Soutvleis (Corned Beef) Sandwich.

Microsoft South Africa announced it would invest R5.4 billion in cloud and AI infrastructure in the country by the end of 2027, and contribute to skills certification for 50 000 individuals in highdemand digital skills. This latest round will enable a wide range of organisations—from startups to large multinationals and government entities—to access the cloud and AI solutions to improve operational efficiency and productivity, optimise the delivery of services and drive innovation across the South African economy.

Medtech disruptor hearX (with Futuregrowth as its largest South African institutional investor) completed a strategic merger with United States hearing aid manufacturer Eargo to form LXE Hearing, and secured a $100-million investment from Patient Square Capital to scale globally. This marked the first major merger in the over-the-counter hearing aid space since the Food and Drug Administration introduced the regulatory category in 2022.

Exxaro Resources and Eskom signed a Memorandum of Understanding that focuses on collaboration on strategic initiatives, research and projects in the areas of Carbon Emissions Reduction, Air Quality and Just Transition. The agreement focuses on jointly measuring, managing and reducing Scope 1, 2 and 3 emissions, and potentially investing in innovative technologies to drive decarbonisation. It also emphasises transition initiatives such as skills development, job creation in green sectors, and stakeholder engagement to ensure climate resilience.

MAY

Zero Carbon Charge (CHARGE), South Africa’s first company to pioneer a national network of off-grid, solar-powered ultra-fast electric vehicle (EV) charging stations, secured a R100-million equity investment from the Development Bank of Southern Africa. The funding will enable the rollout of CHARGE’s ultra-fast charging stations every 150 kilometres along all national roads. Each site is fully off-grid, powered by solar energy and supported by battery storage.

MTN Group conducted an Africa-first smartphone satellite voice trial with American satellite company, Lynk Global. The trial showed that low-earth orbit satellite technology can help bring mobile services to areas that have been hard to reach in the past. MTN was also inducted into the inaugural Brand Africa Hall of Fame “in recognition of its transformational impact on African consumers and its role in shaping a positive African narrative”

Mzansi Energy Consortium entered into a landmark 12-year power purchase agreement with Palabora Mining Company. The Marula Green Power project will be South Africa’s first grid-forming renewable energy facility, combining 132MWp of solar PV with a 360MWh battery energy storage system, and a dedicated 132kV transmission line. Mzansi Energy is implementing the system in partnership with Huawei. The facility is expected to begin operations in early 2027.

South Africa’s fastest growing solar-as-a-service provider Wetility secured a R500-million structured capital partnership with Jaltech, a leading funder of solar energy projects. The transaction marked a milestone in Wetility’s mission to provide clean, reliable and costeffective solar energy to over one million homes and businesses across the country. The capital provided by Jaltech will be utilised to fund solar and battery systems.

Vodacom finalised a 30% stake (R14 billion) acquisition in Maziv, owner of fibre assets including Vumatel and Dark Fibre Africa. The deal, following years of regulatory review, positions Vodacom to expand its fibre network and strengthen South Africa’s digital infrastructure.

Pepkor gained Competition Commission approval to acquire five Retailability brands—Legit, Style, Boardmans, Swagga and Beaver Canoe—adding 462 stores across southern Africa. The R1.9 billion deal boosts Pepkor’s adult apparel presence and enhances its sourcing, logistics and e-commerce capacity.

Checkers (part of Shoprite Holdings) introduced South Africa’s first smart shopping trolley, enabling scan-and-bag shopping, live total tracking and on-trolley payment. The pilot supports the Shoprite Group’s drive toward a seamless, tech-enabled omnichannel retail experience.

Globeleq and African Rainbow Energy reached financial close on the 153MW/612MWh Red Sands battery energy storage project near Upington—the largest standalone BESS in Africa. The R5.4 billion project will create about 250 construction and 80 operational jobs.

South African Breweries celebrated 130 years, marking its contribution to local sourcing, sustainable farming and job creation. SAB supports over 250 000 livelihoods across agriculture, manufacturing, logistics and entrepreneurship.

Nedbank was named Sustainable Bank of the Year at the African Banker Awards for its leadership in sustainable finance. It also launched ReNEW, a programme funding youth-led circular economy businesses to create jobs and reduce climate impact.

Yoco was listed among CNBC and Statista’s Top 300 Fintech Companies worldwide—the only South African firm recognised—for its role in digital payments for small businesses.

LIV Golf announced Steyn City, Johannesburg, as host of the first LIV Golf South Africa in March 2026, a multi-year, multi-million-rand event to be played on its acclaimed Nicklaus Design championship course.

ADvTECH launched Emeris, a new private higher education brand uniting Varsity College, Vega School and MSA under one name. The move strengthens ADvTECH’s ability to meet evolving student and industry needs, supported by a R420-million state-of-the-art campus in Sandton, Johannesburg.

Sasol marked its 75th anniversary and a return to profit for the 2025 financial year, driven by cost controls and one-off gains. From its pioneering coal-to-liquid roots in Sasolburg, the company has grown into a lasting symbol of innovation and resilience.

MultiChoice Group became part of CANAL+ , after the international media and entertainment group secured ownership of about 94% (valued at around $3.2 billion) of the South African company. CANAL+ aims to strengthen its position as a leading media and entertainment player across Africa—a continent rich in diversity and opportunity.

Prosus, majority-owned by Naspers, completed its €4.1 billion tender offer for Just Eat Takeaway.com, gaining access to over 60 million customers and 362 000 restaurant partners . The acquisition will help strengthen Prosus’s position in global food delivery, combining scale and technical expertise to enhance customer experience and create value for partners and shareholders.

Harmony Gold celebrated 75 years of responsible and inclusive mining while finalising its $1.08 billion (R19 billion) acquisition of MAC Copper , owner of the high-grade CSA Copper Mine in Australia. The transaction— funded through cash and debt—expands Harmony’s international footprint and diversifies its mineral portfolio.

West Wits Mining achieved a major milestone by bringing its first underground ore to surface from the Qala Shallows gold project in the Witwatersrand Basin—South Africa’s first new underground gold mine in 15 years. The project is expected to create 1 000 direct jobs and introduce greener mining practices, including solar power and battery-operated machinery.

store’s product offering would be largely sourced from local suppliers, complemented by a curated selection of global brands. Walmart also announced it would launch a mobile app to allow South Africans to shop online from its first branded stores in the country

In a boost for youth entrepreneurship, the Youth Employment Service (YES) launched the Gamechangers Challenge , an initiative linking promising young entrepreneurs with corporate supply chains and offering R300 000–R2 million in funding to help scale their businesses.

Growthpoint Properties announced a strategic investment in developing the Cape Winelands Airport precinct, envisioned as a next-generation aviation, industrial and hospitality hub. Located on the site of the former Fisantekraal airfield, the project aims to bolster logistics, trade and tourism infrastructure in the Western Cape.

Massmart—owner of Game, Makro and Builders— revealed it would be opening its first Walmart store in South Africa in Clearwater Mall, Johannesburg. The

TymeBank announced a rebrand as it undergoes a series of changes—set to change its name to GoTyme in the first half of 2026. In addition, the bank would be partnering with Sanlam to create a co-branded super app that consolidates a variety of financial services (from digital banking and payments to airtime, data purchases, bill payments and credit) into a single, seamless digital platform.

SPAR Health took a major step forward with its acquisition of Aptekor Group, a leading Western Cape pharmaceutical wholesaler. The move strengthens the Pharmacy at SPAR network—now at 125 stores, with plans to grow to 250 nationwide in the next three years.

South Africa’s removal from the Financial Action Task Force (FATF) grey list marked a significant milestone, reflecting strong reforms to combat financial crime. The decision is expected to lower transaction costs, boost investor confidence and make doing business in South Africa easier, especially in the financial and investment sectors.

TOP SOUTH AFRICAN BUSINESSWOMEN ACROSS SIX INDUSTRIES, ADVOCATING FOR FEMALE EMPOWERMENT, GENDER EQUALITY AND MENTORSHIP

In South Africa’s energy sector—still largely male-dominated—Mahlanyane is proving what determination, skill and purpose-driven leadership can achieve. As Coal & Civil Maintenance line manager at Eskom Holdings SOC Ltd, she has risen through the ranks from apprentice technician at Hendrina Power Station to one of the utility’s respected technical leaders. Beyond her engineering responsibilities, Mahlanyane is a passionate advocate for gender equity and community empowerment. She is an active champion of Eskom’s Women Advancement Programme, which supports the professional growth of women across the organisation’s technical fields. Her advocacy extends beyond the power station gates. Mahlanyane spearheaded a sanitary towel donation drive for local schools—an initiative that has improved attendance and dignity for girls in underserved communities.

Featured among Africa’s 20 Under 40 Energy Women Rising Stars in 2025, Mahlanyane continues to inspire a new generation of women entering science and engineering. Her example demonstrates that leadership in energy is no longer defined by gender but by commitment, competence and communityminded purpose.

Nell has steadily carved out a role at the intersection of sustainable development and gender inclusion, bringing both purpose and pace to South Africa’s evolving energy economy landscape. As founder and executive director of Estahale Advisory, she advises investors and host communities on ESG, stakeholder engagement and the transition to low-carbon growth.

Her early career in renewable energy consultancy has helped shape her deep conviction that women’s empowerment is not simply a checkbox but a strategic lever in transforming high-impact industries. For example, she was selected as one of the “Next Generation Women Leaders” by McKinsey & Company in 2020, recognising her leadership potential and commitment to inclusive growth.

Nell has leaned into mentoring and capacity building, particularly in rural and underserved communities, aligning her advisory work with themes of skills development, gender equity and meaningful economic participation. Her participation in the “Energising Women to Advance the Energy Transition in the SADC region” mentoring programme further underscores her efforts to amplify women’s voices in a male-dominated sector.

Mbanga is making waves in South Africa’s energy transition—not just for her technical leadership but for her strong advocacy of women, youth and inclusion in the sector. At the age of 35, she holds the role of programme/ project manager at the South African National Energy Development Institute (SANEDI).

Crucially for gender equality and mentorship, Mbanga serves as vicechairperson of the South African Association for Females in Energy Efficiency (SAFEE). In that capacity, she drives awareness-raising, peer mentorship and network building for women in energy. She also publicly affirms that mentoring young talent is central to her work: through SANEDI’s internship programme and through commissioning young and female entrepreneurs in procurement processes.

In a sector where women remain under-represented, Mbanga’s dual focus on energy efficiency policy and inclusive leadership offers a template for change—proving that advancing the clean energy transition and advancing gender equity are not separate agendas, but complementary ones.

Hudson brings more than 18 years of experience in energy and finance to her role as head of Project Finance at Scatec South Africa, where she leads the structuring and execution of complex renewable energy deals across the region.

She uses her position not only to deliver commercial outcomes but also to champion inclusivity and mentorship. She has helped create informal ‘coffee sessions’ and a women’s forum where female professionals in renewable energy finance and project development share challenges, progress and strategies.

Hudson is particularly passionate about facilitating mentorship, networking and honest dialogue so that women feel empowered to claim technical finance roles. Her message to the next generation: “Trust your intuition, prepare your voice and remember that you bring multidimensional talent to the table.”

Her blend of technical finance mastery and advocacy for gender-balanced leadership is reshaping how renewable energy deals are financed in southern Africa—and who gets to sit in those rooms.

Mokoena

As executive vice-president for Human Resources and Corporate Affairs at Sasol, Mokoena has become one of South Africa’s most consistent voices for gender equality, inclusion and mentorship in the corporate sphere. She has spearheaded initiatives that place people and purpose at the centre of the company’s transformation journey. Through programmes such as Bridge to Work, Mokoena has helped equip women and youth with the critical skills needed to participate in the energy transition, while ensuring Sasol’s ‘just transition’ efforts translate into tangible community upliftment. She also mentors young professionals, many of whom have gone on to achieve senior roles in their own right—a testament to her commitment to nurturing talent.

In public dialogues and her own social platforms, Mokoena consistently challenges peers to foster workplaces where diversity, equity and belonging are lived values. “We must move from conversation to action,” she says, echoing her call for South African corporates to accelerate inclusion.

Mabhena-Olagunju, founder and CEO of DLO Energy Resources Group, stands among South Africa’s most influential business leaders driving both the energy transition and gender transformation in industry. For her, ownership is power—and ensuring women have a stake in renewable energy projects is essential to changing the narrative of who leads Africa’s green future. Through the DLO African Women in Leadership Summit and targeted mentorship initiatives, she has created spaces for women to connect, learn and access opportunities across STEM and infrastructure industries. The company also provides bursaries and training for female engineering students, helping build the next generation of energy professionals.

Mabhena-Olagunju speaks passionately about representation and inclusion, noting that women must “see themselves in spaces where they don’t normally see people who look like them.” Her advocacy blends purpose with performance— proving that transformation and excellence are not competing ideals but complementary drivers of sustainable progress.

Johnston, CEO of Edge Growth Ventures, is a leading voice in South Africa’s investment landscape—and a passionate advocate for gender equality and women’s economic empowerment. She has helped unlock growth for small and medium-sized enterprises (SMEs), while championing the visibility and advancement of women within the financial sector.

As chairperson of 100 Women in Finance South Africa, Johnston has been instrumental in expanding mentorship and networking opportunities for women across the investment value chain. Her leadership in this space has provided a platform for women professionals and entrepreneurs to connect, learn and thrive.

She continues to advocate for the removal of systemic barriers that hinder women entrepreneurs’ access to funding, insisting that gender equity in finance is not only a moral imperative but a strategic one.

Johnston exemplifies how finance can be a powerful lever for empowerment— transforming not just businesses but the broader narrative of women’s participation in South Africa’s economy.

Kekana, CEO of Royal Bafokeng Holdings (RBH), has become a defining figure in South Africa’s corporate transformation landscape—not only for her strategic acumen but also for her unwavering commitment to women’s empowerment and inclusive leadership.

Kekana has cultivated a corporate culture where representation and merit go hand in hand. Her focus on developing female talent and mentoring emerging leaders has created a pipeline of women prepared to take on senior roles across sectors traditionally dominated by men.

In 2024, she was honoured as the Fearless Thinker at the Gender Mainstreaming Awards, celebrating her leadership in embedding equality as a business imperative rather than a compliance exercise.

Beyond RBH, Kekana uses her platform to encourage women to lead with purpose, courage and conviction—reminding them that “our stories, our decisions and our presence shape the future of African business.”

Nicolette Mashile, better known to her audience as “The Financial Bunny”, has become a formidable voice in South Africa’s fi nancial literacy and empowerment movement. As founder of the Financial Fitness Bunnies agency and creator of the Financial Bunny brand, she charts a clear mission: make financial education accessible, engaging and relevant—especially for those who have historically been left out.

Mashile’s Financial Bunny School targets learners and young adults with tailored workshops and resources. She has also taken public-facing advocacy roles. She articulates the view that inclusive financial education is essential for social equality, especially for women who often face systemic barriers in wealth building.

Her reach is real: Recognitions include being featured among Brand South Africa’s 30 Voices of the Future, and her content agency winning accolades such as a Gold PRISM podcast award.

In essence, Mashile is far more than a content creator or influencer; she’s a social entrepreneur using storytelling, education and empowerment to shift the financial narrative for women, youth and underserved communities in South Africa.

Moosajee is a South African civil engineer turned serial social entrepreneur whose career is defined by building pathways for women and girls in STEM, technology and entrepreneurship across Africa. She co-founded WomEng (Women in Engineering) and served as CEO of the organisation, which develops female engineering talent in multiple countries.

She also co-founded WomHub: an innovation ecosystem and co-working/ incubator platform for female founders in STEM, technology, mining and manufacturing. She has helped reach more than 150 000 women and girls across 30+ countries.

Her most recent venture, CybHERfence (a spinoff of WomHub), addresses cybersecurity vulnerabilities affecting women entrepreneurs and innovators.

She also uses her voice on global platforms, serving on the World Economic Forum Global Future Council on Gender, Education the Future of Work, and as co-chair for B20 task forces on women empowerment.

In sum, Moosajee is not only transforming the gender dynamics of engineering and tech in southern Africa; she’s building the ladder, the network and the platform that enable more women to climb it.

Baratang Miya is a South African tech social entrepreneur dedicated to advancing women’s empowerment and digital inclusion in ICT and STEM. As founder and longtime CEO of GirlHype (Women Who Code), she has spent over two decades equipping young women from underrepresented communities with coding, web development and tech entrepreneurship skills.

Beyond training, Miya advocates for tackling structural barriers facing women in tech—access, representation, resources and confidence. Through mentorship, global partnerships with organisations like UN Women and the Mozilla Foundation, and community-led workshops, she has helped build a more inclusive tech ecosystem.

Her message is simple yet powerful: when women gain digital literacy, access and opportunity, they become creators of the digital future—not just consumers of it.

Charnley is a transformative force at the intersection of business leadership, social entrepreneurship and women’s empowerment in Africa. As CEO of Smile Communications (formerly Smile Telecoms) and a former president of the International Women’s Forum South Africa (IWFSA), she brings decades of experience in union advocacy, corporate restructuring and telecommunications innovation—all fuelled by a deep commitment to inclusion, mentorship and economic justice.

In her IWFSA role, Charnley has actively championed mentorship and leadership development for women. She has publicly emphasised issues such as gender pay parity, women’s economic empowerment and leadership pipelines for women of colour.

Among her many recognitions is the 2023 AWCA “Woman of Substance” Award, reflecting her continuous dedication to creating structural change for women in Africa.

Through her board roles, telecoms innovation and advocacy for gender equality, Charnley is creating pathways for women to lead, influence and thrive.

Naidoo is a dynamic force in South Africa’s entrepreneurship and innovation ecosystem, serving as CEO of YIEDI (Youth Innovation Entrepreneurship Design Institute) and founder of WomX Women in Business. She has made a point of championing women entrepreneurs and advancing gender equity through meaningful mentorship and market access initiatives.

Through WomX—established in 2023—she spearheaded a national platform dedicated to elevating women-led businesses by offering structured accelerators, free online learning (the Entrepreneurship Academy), and networking events (WomX Connect). Under her leadership, WomX has already brought together a network of more than 2 000 women entrepreneurs and supported dozens of women-owned businesses through its accelerator and mentorship programmes.

By linking YIEDI’s innovation and incubation capabilities with WomX’s gender-focused mission, she creates an ecosystem where women aren’t just supported—they’re scaled.

Naidoo’s work has touched everything from narrative shaping (via the Her Story, Her Success book featuring 100 women founders) to hands-on mentorship and business acceleration sessions.

Gqomo is an award-winning South African social entrepreneur and the founder of the Womandla Foundation, a non-profit organisation dedicated to mentoring, STEAM (science, technology, engineering, arts & mathematics) education, entrepreneurship and development for women and girls across Africa.

She established Womandla with the stated mission of educating, equipping and empowering women and girls through structured mentorship, entrepreneurial training and career development.

She was named among News24’s 100 Young Mandelas in 2023 for humanitarianism; a winner of the Mail & Guardian Power of Women 2022 in the “Guiding Woman” category for gender equality and sustainability; and a JCI South Africa TOYP Honouree (Outstanding Young Person) 2023 under Voluntary Leadership.

In an interview with Glamour South Africa, Gqomo spoke candidly about transformation, agency and leadership: “This is my duty, purpose and role as the director of a women’s organisation to promote it, live it and support other women in all endeavours.”

As managing director of redAcademy, Hawkey is redefining how young South Africans—particularly women—enter and thrive in the technology industry. With a clear focus on bridging the digital divide, she has built an organisation that transforms lives by creating pathways into sustainable, high-impact tech careers.

Hawkey’s mission goes beyond technical education. She is an outspoken advocate for women in technology, regularly highlighting the need to address systemic barriers that keep women under-represented in coding, data and engineering fields.

In interviews, she has spoken candidly about the gender imbalance in tech: “We need to shift the narrative from women being consumers of technology to becoming the creators of it.”

Her approach to empowerment is practical: equipping women with digital skills that translate directly into employability and leadership. By combining academic rigour, mentorship and real-world experience, she is ensuring inclusion becomes a measurable outcome, not a slogan.

In an industry historically dominated by men, Nkomo and Milanzi, cofounders of Tshepa Basadi Group, are proving that women can not only participate but lead with purpose and impact. Founded in 2018, Tshepa Basadi—meaning “Trust Women” in Setswana—is a 100% black femaleowned engineering, procurement and technical services company that has become a symbol of empowerment and excellence in South Africa’s mining and construction sectors.

Milanzi, a supply chain strategist by training, has been vocal about the power of procurement to drive gender equality. In her essay, “Women in Mining: Project Procurement as a Strategic Lever for Women Empowerment,” she argues that every procurement decision represents an opportunity to uplift women-owned enterprises and shape a more inclusive economy.

Nkomo, an experienced project management specialist, focuses on visibility and representation, ensuring women occupy spaces traditionally reserved for men.

Tshepa Basadi continues to model a future where women are not tokens of transformation but architects of industry.

As CEO of Kumba Iron Ore, Zikalala stands at the forefront of South Africa’s mining leadership—not only as a seasoned executive but as a passionate advocate for women’s empowerment and gender equality in one of the country’s most male-dominated sectors.

In 2023, she served as the campaign ambassador for the International Day of Women in Mining, amplifying global conversations about advancing women and youth in the mining sector. Under her influence, Kumba Iron Ore has continued to strengthen its diversity and inclusion agenda, investing in programmes that develop female talent and improve workplace equity.

As a member of the International Women’s Forum South Africa, she uses her platform to mentor emerging women leaders and advocate for structural inclusivity across industries.

By combining operational excellence with purpose-driven leadership, Zikalala has redefi ned what it means to lead in mining—proving that empowerment and performance can, and must, co-exist for sustainable growth.

Naidoo, CEO of The Particle Group and chairperson of Women in Mining South Africa (WiMSA), stands at the forefront of advancing gender equality, mentorship and structural inclusion in South Africa’s mining sector. Her dual leadership roles allow her to steer both business growth and transformation agendas simultaneously.

In her capacity with WiMSA, she has used her voice and influence to insist on meaningful change in a traditionally male-dominated industry.

Naidoo’s advocacy stretches beyond statements: She has spearheaded programmes under WiMSA that promote mentorship, STEM training, career path visibility for women and supplier diversity initiatives within mining service providers.

By blending executive leadership with an unwavering dedication to empowerment, Naidoo exemplifies a new generation of industry leaders who view diversity as both a moral imperative and a growth lever. Her efforts are helping open the shaft for women in mining—pulling them not just into roles but into leadership.

Maphefo Anno-Frempong serves as CEO of the Transport Education Training Authority (TETA) in South Africa, where she combines a deep background in skills development, enterprise empowerment and stakeholder engagement with a strong commitment to advancing women and youth in the transport sector.

Under her tenure, TETA has launched gender-responsive training programmes, increased women’s participation in transport-related skills development, and supported dedicated forums and mentorship platforms for women in transport.

Anno-Frempong has also driven strong partnerships for empowerment. For example, TETA partnered with the EmpowaWomen in Transport Summit and other networks to deliver workshops, masterclasses and networking opportunities for women in transport and logistics.

Maphefo Anno-Frempong is not only leading a major Sector Education & Training Authority but also championing an agenda of gender inclusion and mentorship—ensuring women are not only present in transport but positioned to lead and shape its future.

As founder and CEO of BBOpEx Solutions, Maitin stands out as one of South Africa’s most dynamic champions for transformation in logistics, transport and supply chain management. Her company is more than a consulting firm; it is a platform for developing people, empowering women and reshaping the face of an industry still marked by gender imbalance.

Her real passion lies in empowering women and youth. This commitment earned BBOpEx recognition as a finalist in the Accenture Gender Mainstreaming Awards in the “Investing in Young Women” category—a nod to the company’s ongoing mentorship and development programmes.

In partnership with the Chartered Institute of Logistics and Transport South Africa, Maitin has led initiatives that promote education, training and work-readiness opportunities, particularly for young women entering the logistics and freight sectors.

She continues to build bridges between operational excellence and inclusive growth—proving that advancing women in logistics is not just about equality but about unlocking South Africa’s full potential in the global supply chain.

With over two decades of experience in logistics and operations, Naicker— director at SAPICS and respected supply chain professional—is a leading advocate for women’s empowerment and professional development in the industry. She has dedicated her career to ensuring women have equal access to the skills, mentorship, and leadership pathways needed to excel in supply chain management.

As a board director of SAPICS, South Africa’s professional body for supply chain management, she shapes initiatives that elevate and empower individuals across the logistics and manufacturing sectors. She plays a key role in Women in Supply Chain programmes, mentorship forums, and capacitybuilding workshops, helping women acquire both technical and leadership competencies in a rapidly evolving global industry.