Battery Energy Storage Systems (BESS)

Although death is inevitable, many people find it difficult to talk about. Uncomfortable as it may be, it is crucial to share your funeral wishes with your loved ones. This includes conversations on whether you’d prefer a grave burial, cremation or Aquamation (also known as alkaline hydrolysis or water-based cremation).

AVBOB launched Aquamation in South Africa in 2019 and, at present, it is only available at the AVBOB Maitland Funeral Parlour in Cape Town and the AVBOB Pretoria West branch in Gauteng.

Considering South Africa’s growing awareness of environmental issues, this offering comes at a good time, and AVBOB is investing heavily into it, going forward.”

The provision of a dignified send-off for loved ones has been part of AVBOB’s DNA for 107 years and it continues to lead the way in bringing this environmentally-friendly funeral service innovation to South Africa.

Mandate Molefi has long been recognised as one of South Africa’s foremost human resources and culture change consultancies. With globally respected thought leader in diversity, equity & inclusion, Nene Molefi, at the helm, the firm has spent more than two decades guiding clients through complex transitions.

How emotions rule every stage of the entrepreneurial process

It is time to remove the unconscious biases associated with being a ‘good businesswoman’

Exploring the real-world implications of AI for today’s workforce and the next

Turning sustainability into growth: A strategic roadmap for SMEs and mid-sized manufacturers Finance

Cryptocurrency and exchange control: The legal implications of the recent Standard Bank v SA Reserve Bank judgment on crypto asset service providers and fintechs

Inside South Africa’s masterplan for a renewable energy industry

South Africa’s new Critical Minerals and Metals Strategy 2025 marks a new frontier for sustainable growth

The African Energy Chamber demands OPEC reverse financing bans to unlock Africa’s oil and gas potential

How the African Development Bank is helping to spur Botswana’s automotive revolution

Agriculture

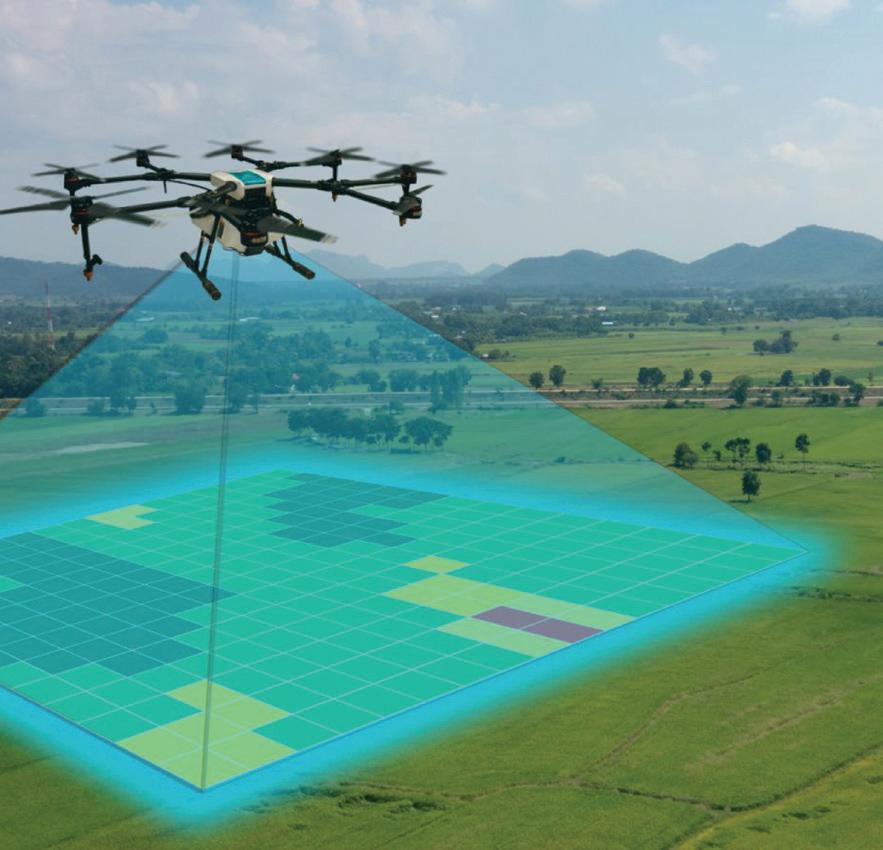

How aerial technology is transforming large-scale farming in southern Africa Infrastructure

Will South Africa’s R1-trillion infrastructure investment deliver real change?

South Africa’s 30% tariff shock: what it means, who gets hurt, and how we should respond

Construction

Why compliance is critical for the future of the South African construction industry

Water

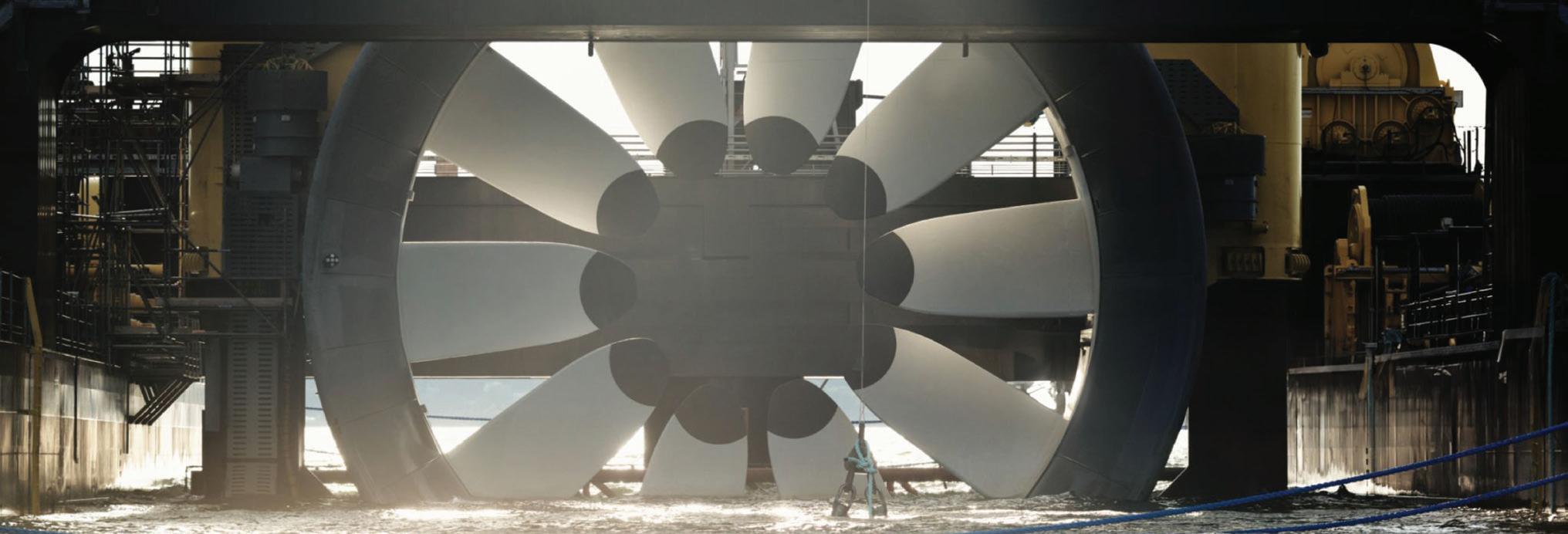

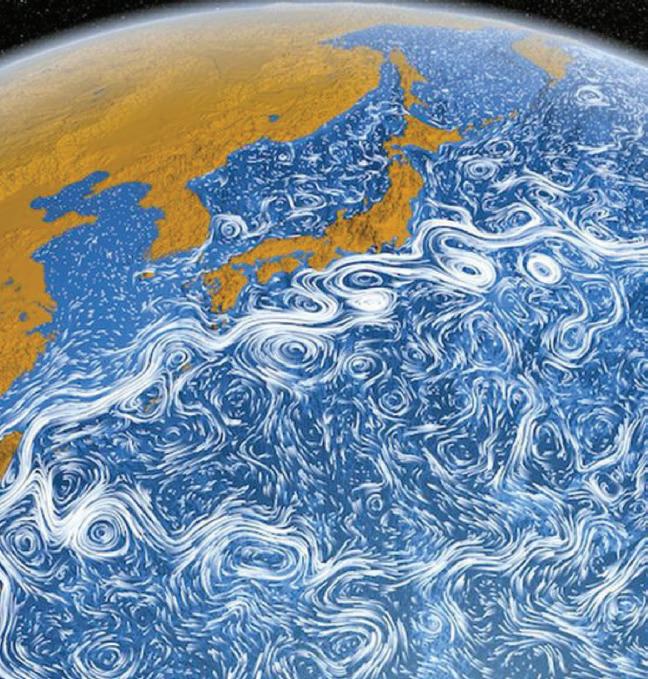

Ocean currents can generate electricity— and a study shows Africa’s seas have some of the strongest

Transport

South Africa needs an e-hailing ecosystem that values people as much as profit

While generative AI shows great promise in healthcare, from streamlining administrative tasks to accelerating medical research, it is far from a cure-all

Across the globe, artificial intelligence and machine learning are no longer futuristic concepts— they’re active agents of transformation. From finance to agriculture, mining to logistics, AI is rapidly reshaping the rules of competition, unlocking efficiencies, reducing costs and creating new value.

For African businesses, the message is clear: adapt now, or risk falling irreversibly behind. AI is already proving its worth in industries across southern Africa. In agriculture, machine learning is enabling predictive analytics that help farmers optimise yields and anticipate climate impacts. In finance, AI–driven algorithms are streamlining risk assessment and detecting fraud faster than any human could. In mining, AI–powered sensors are monitoring equipment in real time, reducing unplanned downtime and improving safety. Even in the public sector, governments are experimenting with AI to improve service delivery and citizen engagement.

But while the technology is accelerating, adoption in many African markets remains uneven—often hampered by infrastructure gaps, digital skills shortages and regulatory uncertainty. These are serious hurdles, but they are not insurmountable.

To stay competitive, companies must start with mindset. AI isn’t just an IT upgrade—it’s a strategic enabler. Business leaders need to invest in talent and upskilling, rethink data strategies and forge partnerships with research institutions and tech startups. Governments and regulators, in turn, must create frameworks that encourage innovation while ensuring ethical and inclusive use of AI.

The Fourth Industrial Revolution is not coming—it’s already here. The businesses that thrive in this new era will be those that move early, learn fast and commit to using intelligent technologies not just to optimise processes but to reimagine possibilities.

Africa has the opportunity to leapfrog. But only if it chooses to lead—not follow—in the age of AI.

ADDRESS: Boland Bank Building, 5th Floor, 18 Lower Burg Street, Cape Town, 8000 Tel: 021 418 3090 | Fax: 021 418 3064

Email: majdah@avengmedia.co.za

Website: www.abizq.co.za

BUSINESS QUARTERLY

PUBLISHER

MANAGING EDITOR

DESIGN

STAFF WRITER

EDITORIAL SOURCES

Donovan Abrahams

Tania Griffin

tania@avengmedia.co.za

Erin Esau

Matthew van Schalkwyk

Jasvin Naidoo

Kerri Stewart

Jeni-Anne Campbell

Dean Wolson

African Development Bank

African Energy Chamber

Gaby Paton-Thomas

Tania Griffin

TheConversation.com

PHOTOGRAPHIC SOURCES

PROJECT MANAGER

ADVERTISING SALES

ACCOUNTS MANAGER

ACCOUNTS

CLIENT LIAISON

IT & SOCIAL MEDIA

HR MANAGER PRINTER

iStockPhoto Courtesy Images

Lunga Ziwele

Lunga Ziwele

Viwe Ncapai

Ugo Iwunze

James Stone

Marc Wesstls

Benita Abrahams

Bianca Alfos

Majdah Rogers

Tharwuah Slemang

Colin Samuels

Novus Print

www.abizq.co.za, www.issuu.com

DIRECTORS

PUBLISHED BY DISTRIBUTION

Donovan Abrahams

Colin Samuels

Aveng Media

DISCLAIMER:

© 2025 African Business Quarterly magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of going to print.

Rub shoulders and conduct business with the high-flyers in the African mining industry

Uganda International Oil & Gas Summit 2025

23 to 25 September

Kampala Serena Hotel, Uganda uiogs.com

Held under the patronage of the Ministry of Energy and Mineral Development, UIOGS has cemented its role as East Africa’s must-attend gathering for oil and gas leaders. Every year, it brings together senior government officials, global operators, investors, service providers and policymakers. Under the theme, “The Refinery: An East African Affair”, this year’s summit will explore how downstream development and crossborder co-operation are shaping a new era of regional prosperity.

African Energy Week

29 September to 3 October

Cape Town International Convention Centre, South Africa aecweek.com

African Energy Week (AEW) is the African Energy Chamber’s annual event, uniting African energy leaders, global investors and executives from across the public and private sector for four days of intense dialogue on the future of the African energy industry. AEW promotes the role the continent plays in global energy matters, centred around African-led dialogue and decision-making.

African Mining Week 1 to 3 October

Cape Town International Convention Centre, South Africa african-miningweek.com

African Mining Week is the ultimate platform to explore the continent’s rich mining opportunities. With Africa home to the world’s largest reserves of key minerals like lithium, cobalt and copper, as well as gold, diamonds and iron ore, the event provides insights into untapped resources, new projects and emerging markets that are driving global innovation and industrial growth.

The Joburg Indaba 8 & 9 October

Inanda Club, Sandton, Johannesburg, South Africa

www.joburgindaba.com

Critical and constructive conversations are one of the standout features of the Joburg Indaba, serving the industry with robust discussions that get to the crux of the key issues. The event will once again bring together an outstanding panel of speakers including CEOs and senior representatives from all major mining houses, local and international investors, government, parastatals, experts from legal and advisory firms, and representatives from communities and organised labour.

Sustainability & ESG Africa Conference & Expo 15 & 16 October

Sandton Convention Centre, Johannesburg, South Africa esgafricaconference.com

This highly anticipated event provides an unparalleled platform for industry pioneers and experts to come together and tackle the common challenges associated with embedding sustainability and ESG practices within organisations. The conference’s core theme, “Adapt. Innovate. Succeed—Driving Sustainability in Changing Times”, underscores the essential role that leaders play in ensuring their organisations align with ESG principles and integrate them into their overall strategy.

9th International PGM Conference 27 & 28 October

Sun City, Rustenburg, South Africa

www.saimm.co.za

The Platinum Conference Series continues to address the opportunities and challenges facing the global platinum group metals (PGM) industry. As the sector faces increasing demand— from technological innovation and decarbonisation to cost management

and market volatility—the 9th edition offers a critical platform for addressing these challenges head-on. Attendees can expect high-quality technical papers and presentations, robust networking opportunities and strategic insights that help shape the future of the industry.

2025 MineSafe Conference and Industry Awards 19 to 21 November

Emperors Palace, Johannesburg, South Africa

www.saimm.co.za

A key event dedicated to enhancing safety, health and environmental practices within the mining and metallurgical industry. This conference will serve as a vital platform for knowledge-sharing and idea exchange among key stakeholders including mining companies, the Department of Mineral & Petroleum Resources, the Minerals Council South Africa, labour unions, and health and safety practitioners at all levels in the minerals industry.

MSGBC Oil, Gas & Power 2025 9 & 10 December

Centre International de Conférences Abdou Diouf, Dakar, Senegal msgbcoilgasandpower.com

A hot spot for global energy investment, the MSGBC region is home to promising upstream acreage, integrated infrastructure projects and future-oriented development plans. MSGBC Oil, Gas & Power has emerged as the leading platform for industry leaders, innovators and policymakers across the MSGBC basin. With momentum from previous successes, MSGBC 2025 promises to be the most transformative edition yet, providing unparalleled opportunities for investors, project developers, international operators and service providers.

1 .

The Sweaty Startup by Nick Huber (R430)

Huber, founder of several million-dollar businesses, offers readers the simplest, easiest and lowest risk path to reclaiming entrepreneurship, generating value and forging a new path to get ahead on their own terms—by returning to the most foundational business tactics. The book is filled to the brim with practical insights, inspiring real-life stories and actionable advice.

2.

3.

Optimal by Daniel Goleman & Cary Cherniss (R295)

Emotional intelligence is now embedded in our public discourse. Beginning with a dissection of what makes for individual success, Goleman and Cherniss set out how high performance can be cultivated at every level, scaling up the concept to top team performance and outstanding organisations. Building on attributes such as self-awareness, a sense of meaning and emotional balance, high concentration and ‘flow’ states, they demonstrate it is in our optimal moments that our mental clarity shines.

4.

The Wealth Ladder by Nick Maggiulli (R440)

If you’ve been spinning your wheels trying to get ahead financially, working more hours or chasing the latest financial trends, but still find yourself stuck, the problem may not be your work ethic or even bad luck—the real issue is likely your approach. Because the difference between those who build wealth and those who don’t isn’t just about hard work; it’s about following the right strategies and focusing time and energy where it matters most. This book breaks down wealth into levels, each requiring a different strategy.

5.

Survive the AI Apocalypse by Bronwyn Williams & Sharon Pearce (R340)

AI is everywhere. The world we live in is changing daily, and it is no exaggeration to say everything you thought you knew is undergoing apocalyptic levels of change. In order to survive in this hyper-competitive, globalised and automated world, we need to change our mindsets and our skill sets to become fit for the ‘post-AI, apocalyptic’ world that is here to stay. This means embracing progress and turning AI and technology into an asset with which we can co-exist, while continuing to create new possibilities far into the future.

The Brain at Rest by Dr Joseph Jebelli (R440) Want to know how to solve tough problems, be more creative and protect your health, all with zero effort? This is the surprising science of the brain at rest. When we let our brains rest and our minds wander, something magical happens: The brain’s ‘default network’ switches on, and suddenly we’re able to think in completely new ways. Dr Joseph Jebelli reveals how neuroscience is solving the mystery of the brain at rest, with profound implications for intelligence, creativity and even life expectancy.

Mandate Molefi has long been recognised as one of South Africa’s foremost human resources and culture change consultancies. Founded on the belief that organisations thrive when they embrace inclusivity, equity and sustainability, the firm has spent more than two decades guiding clients through complex transitions.

At its helm is CEO Nene Molefi, a globally respected thought leader in diversity, equity and inclusion (DEI), whose influence extends far beyond the African continent.

From the outset, Mandate Molefi has positioned itself at the cutting edge of transformation work. Its multidisciplinary team is known for blending deep expertise with practical interventions that resonate across industries, organisations and cultural contexts. Whether facilitating large-scale dialogue sessions, aligning executive teams or embedding systemic change, the firm has built a reputation for producing meaningful, measurable results.

Harnessing cultural intelligence to transform systems

At the core of Mandate Molefi’s philosophy is whole system culture change: a holistic journey of renewal engaging every level of an organisation. This view is grounded on a strong foundation of cultural intelligence (CQ): the capability to relate to, work effectively with, and adapt across cultures, identities and diverse contexts.

For Molefi, culture change cannot be treated as a once-off project or compliance exercise.

It requires systemic intervention, sustained commitment, and the integration of shared values into leadership practices.

“I help organisations navigate the complexities of different cultures, diversities and nuances between people, between countries and

regions,” she explains.

The firm’s model is built on what Molefi calls the Head, Heart and Hands of transformation. The Head represents the preparation and strategic alignment necessary to anchor change. The Heart speaks to the emotional intelligence, empathy and awareness leaders must cultivate. The Hands are about action— practical plans, behaviours and the dismantling of systemic

barriers. This three-pronged approach ensures transformation is not only conceptual but also lived and embedded in daily operations.

“Organisations don’t change because leaders make big speeches,” Molefi explains. “They change because people feel included, seen and supported—and because systems shift to enable that change.”

Mandate Molefi’s six core offerings reflect its comprehensive vision of organisational development. These include:

1. Whole system culture change – embedding inclusion and transformation across all aspects of the organisation to unlock and enhance the performance of everyone.

2. Diversity, Equity and Inclusion—focusing on psychological safety, antiracism, neurodiversity, gender equity, LGBTQI, disability competence and belonging.

3. Leadership Development—with a particular emphasis on empowering women leaders.

4. Strategy and Team Alignment—ensuring organisations are not only strategically focused but also united in vision and culture.

5. Assessments and Organisational Surveys—360-degree tools and companywide diagnostics to identify gaps and measure impact.

6. Coaching and High-Performance Team Development—fostering

collaboration, resolving conflict and elevating performance. The consultancy’s strength lies in contextualisation. Each intervention is designed with cultural, socio-economic and political nuances in mind. A leadership programme in Johannesburg may not look the same as one in Nairobi or London—and Molefi is acutely aware of these differences.

When asked what has shifted most dramatically in the world of human resources and leadership, Molefi is unequivocal: the definition of leadership itself.

“Years ago, leaders who studied MBAs were taught that you can’t wear your heart on your sleeve, that you had to be tough, stoic and unemotional,” she says.

“Leadership today is no longer just about strategy and profits. It requires empathy, vulnerability and the ability to connect the heart with high performance. Far from being opposites, empathy and results reinforce one another. Leaders with

a high adaptability quotient (AQ) and agility are best positioned to turn disruption into opportunity and to unlock peak performance across their team.”

Her point resonates with global trends, where emotional intelligence and inclusivity are increasingly seen as core leadership competencies. Molefi adds that, in an age of artificial intelligence and technological disruption, the distinctly human qualities of empathy and humility will

Nene Molefi’s pioneering South African consultancy has been shaping inclusive leadership, culture change and diversity worldwide for two decades

only grow more vital. “To enable people to deliver, you must embrace their strengths and meet them with compassion. AI can do many things, but it cannot replace the human ability to care.”

As one of South Africa’s most prominent DEI consultants, Molefi has had a front-row seat to corporate progress in this field. Her assessment is nuanced.

“Corporates differ widely,” she notes. “Some sectors, like financial services, are showing encouraging progress. But others, such as mining, remain inconsistent. Even within a single organisation, you’ll find that some departments are more advanced than others, and often it comes down to leadership. Diversity and inclusion succeed when leaders are aware of how integral these are to their core business and prioritise them—it’s as simple as that.”

This leadership-driven reality, she says, underscores the need for accountability. Policies and strategies alone cannot deliver change. The lived experience of employees depends on the values and behaviours of those at the helm.

Molefi is more than a consultant— she is also an accomplished author, associate lecturer and sought-after keynote speaker.

Her book, A Journey of Diversity and Inclusion in South Africa, blends personal narrative with professional insight, offering a uniquely South African lens on issues often dominated by Global North perspectives. She also co-authored Global Diversity and Inclusion Benchmarks, an international reference guide used by practitioners worldwide.

“I’ve often said, those of us who live here must document our own stories,” she reflects. “Too often, outsiders come for a short time, write about South Africa and leave. But our voices matter. My story does not represent all

black women, or all South Africans— but it is my lived experience, and it resonates with many.”

For Molefi, sharing stories is not only about representation but also about empowerment. “We need to step into our own magnificence. Own our narratives. Share guidelines that can help others. That is how transformation begins.”

Despite her achievements, Molefi remains grounded in curiosity and humility. She describes herself as a lifelong learner, constantly reading, studying new case studies and engaging with global communities of practice.

“I still believe in that old saying that great leaders read a lot,” she laughs. “Even after 20 years, I keep learning. I look for new approaches, new case studies, especially from the Global South. What are we doing here that the Global North can learn from? Learning goes both ways. Without passion for continual growth, even the best qualifications won’t keep you relevant.” She is the author of a publication titled DEI in the Global South, which showcases case studies of pioneering leadership and success stories.

This hunger for learning not only fuels her personal growth but also enriches the firm’s offerings, ensuring clients receive insight informed by both global best practice and local relevance.

Asked what advice she would give to 21st-century leaders, Molefi does not hesitate: “listen more when you notice yourself trivialising someone’s lived experience; pause, learn and choose curiosity instead.”.

“If leaders would invest in genuine ‘listening sessions’—coming down to the level of employees, creating psychological safety, showing they are truly interested in what people are saying—workplaces would be transformed,” she insists.

She warns against “intellectual arrogance” , advocating instead for intellectual humility. “Even if you’re a CEO or an executive director, you must recognise your rank, power and privilege. Words carry weight. Use them to build, not to destroy.”

This philosophy echoes throughout her work: Leaders must be conscious of the influence they wield. Toxicity at the top spreads quickly, but so too does empathy, openness and humility. For Molefi, leadership is about enabling people to become their best selves, not about reinforcing hierarchy.

As the world of work undergoes rapid change—spurred by technological shifts, generational transitions and global crises—the role of culture and inclusivity has never been more pressing. Mandate Molefi’s work demonstrates that transformation is possible when organisations invest not only in systems but also in people.

Under Nene Molefi’s leadership, the firm has become a beacon for what inclusive, sustainable workplaces can look like. Her vision is clear: a future where organisations are not only highperforming but also humane; where leaders embrace vulnerability alongside strategy; and where diversity and inclusion are not buzzwords but lived realities.

“We often underestimate the power we carry as leaders,” Molefi reflects. “True leadership is not one-dimensional. It is the ability to hold people to the highest standards while leading with humility, empathy and courage. When accountability and respect walk hand in hand, we create workplaces where people don’t just feel safe—they excel. That is the legacy I strive to build.”

Matthew van Schalkwyk

For further information, visit mandatemolefi.co.za

How

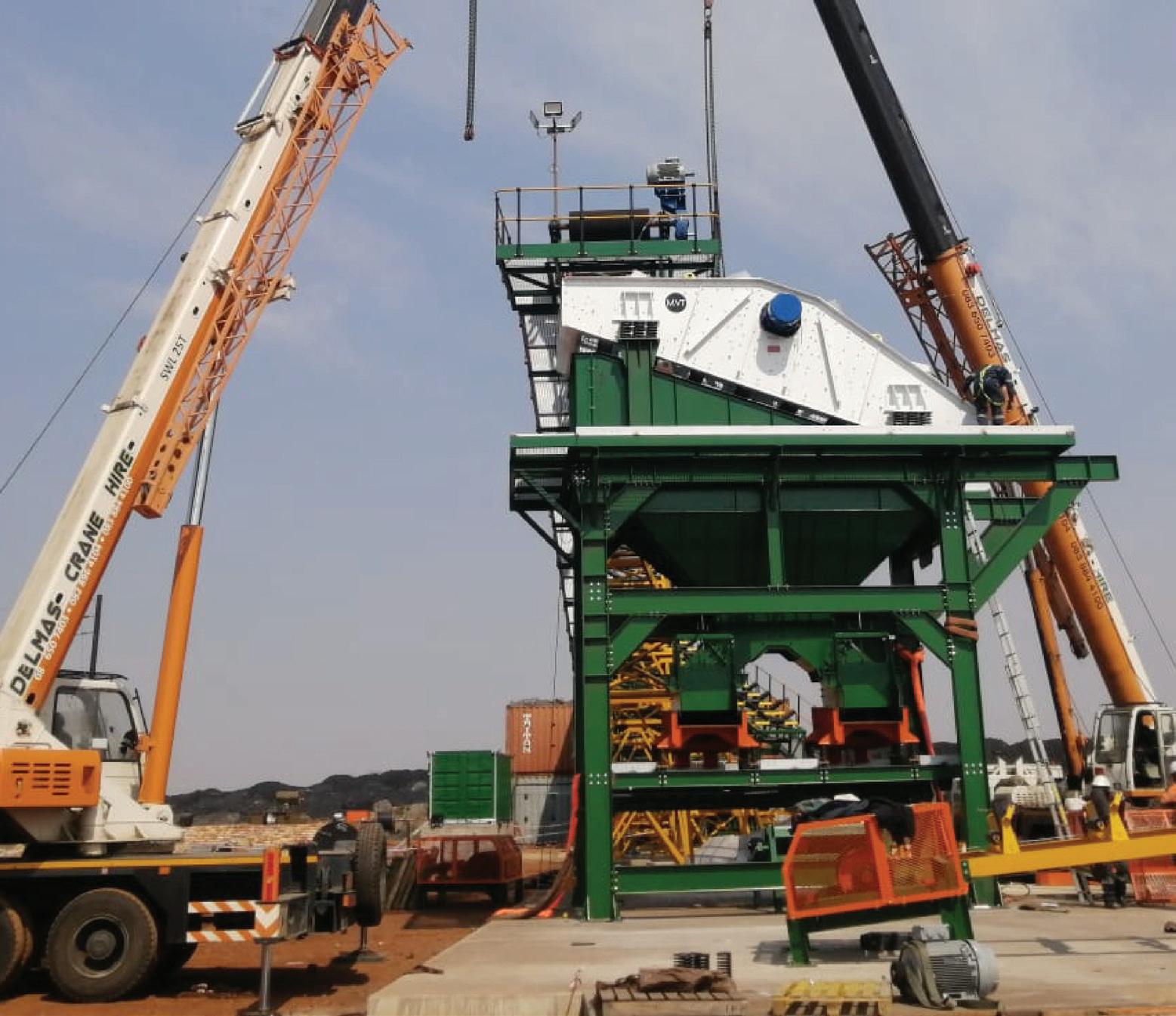

WiIn an industry often defined by tradition, Westcliff Mining has built a reputation for combining deep expertise with forward-thinking innovation. With over two decades of operational excellence and a team boasting more than 150 years of combined experience, the company has become a global leader in mineral processing and mining solutions.

At the centre of this growth is director Ivan Marè, whose vision has positioned Westcliff as one of South Africa’s most respected names in the field.

Founded as a mining contractor, Westcliff Mining evolved by learning to think like a miner while refining plant manufacturing expertise. Today, the company is recognised internationally for its advanced dense medium separation (DMS) washplants and a portfolio of smart solutions that serve the entire mining cycle. From extraction to mineral separation, Westcliff ensures that efficiency,

quality and sustainability are built into every process.

Innovation rooted in experience “Westcliff Mining started out as a mining contractor, and through this experience we have learnt to think like a miner with a unique understanding of the mineral process,” explains Marè. This means the company has forged developmental advances in the field of mining by sticking to the basics, but ensuring their decades of geological expertise add to effective mineral exploration. Westcliff produces a high level of service throughout the entire life cycle: from extraction to the finer practice of mineral separation and smart mining solutions.

This foundation has been critical in shaping the company’s plant designs, which are known for their cost-effectiveness, energy efficiency and minimal staffing requirements.

Having worked in more than 23 African countries across a range of commodities—from diamonds and gold to iron ore, lithium and coal—the team has gained a depth of insight that few competitors can match.

Its flagship offering, DMS washplants, remains at the core of Westcliff’s business. These systems separate valuable minerals with precision while maintaining eco-friendly processes. “DMS technology is the most consistent and cost-effective density recovery

method of all the different density recovery methods,” adds Marè. Complementary solutions include gravity concentration plants, CIP (carbon-in-pulp) and CIL (carbon-in-leach) techniques, as well as specialised systems for diamond processing and subsurface mineral evaluations. Collectively, these services ensure clients can maximise recovery while minimising environmental impact.

Balancing four pillars of success Westcliff Mining operates on four guiding principles: price, time, quality and environment. Marè emphasises that sustainability is not an afterthought but a cornerstone of the business.

“We have designed and developed strategies to make our plants flexible enough to accommodate more environmentally friendly power sources. We are constantly looking

for new and better ways to help save the environment. A good steward leaves a good inheritance for his or her children,” he says.

This philosophy translates into practical outcomes. By using smaller tank farms for precious metal recovery, Westcliff reduces both operational costs and environmental footprints. Its plants are designed to adapt to renewable energy inputs, positioning the company as a forward-looking partner for mines navigating stricter environmental, social & governance requirements.

While its reputation is firmly established in South Africa, Westcliff Mining is steadily expanding its footprint across the continent. The company is currently constructing 500tph and 350tph coal DMS washplants domestically, alongside designing a 250tph manganese DMS plant in West Africa. These projects underscore the company’s ability to handle large-scale operations while maintaining flexibility and precision.

Westcliff’s expertise has also made it a trusted supplier of specialist mining equipment including tanks, spirals, screens and cutting-edge mineral processing technologies. This ability to offer both services and equipment ensures clients receive a holistic, integrated approach.

Despite its technological edge, Westcliff Mining remains a people-driven business. Its team of specialists represents decades of hands-on experience, allowing the company to deliver tailor-made solutions for complex mining environments. From geological assessment to final recovery, the company combines precision engineering with the craftsmanship of seasoned professionals. The company’s strength lies

“WESTCLIFF MINING STARTED OUT AS A MINING CONTRACTOR, AND THROUGH THIS EXPERIENCE WE HAVE LEARNT TO THINK LIKE A MINER WITH A UNIQUE UNDERSTANDING OF THE MINERAL PROCESS.”

not just in technology but in its adaptability. Mining is an industry fraught with challenges—volatile markets, changing regulations, environmental scrutiny—yet Westcliff continues to thrive by staying ahead of the curve. By marrying proven methods like DMS with modern innovations, the company ensures its clients receive solutions that are both reliable and sustainable.

As global mining enters a new era defined by sustainability and efficiency, Westcliff Mining is well positioned to remain a frontrunner. With an eye on renewable energy integration, eco-friendly mineral

recovery processes, and continued investment in smart technologies, the company exemplifies the kind of leadership Africa needs in its resource sectors.

From its South African roots to its growing continental and global presence, Westcliff Mining has proven that success in mining today requires more than extracting resources; it requires vision, responsibility and innovation. Under the stewardship of Ivan Marè and his team, the company is not only delivering smart mining solutions but also shaping a more sustainable future for the industry.

Matthew van Schalkwyk For more information, visit wcmg.co.za.

HOW EMOTIONS RULE EVERY STAGE OF THE ENTREPRENEURIAL PROCESS

Governments often see entrepreneurs as the engines of innovation, job creation and economic growth. In South Africa, there are between 2.4 and 3.5 million small, medium & micro enterprises, which have created and sustained more than 30 000 jobs (tinyurl. com/3rf3t6mz).

However, entrepreneurship is not just a strategic or financial undertaking. It is primarily an emotional journey. From the spark of an idea to the triumphs and failures of running a business, emotions constantly shape how entrepreneurs think, decide, act and relate to others.

Recent research I led (tinyurl. com/3c3hbzhz) draws on 276 studies to show that emotions do not just accompany entrepreneurship—they drive it. Far from being distractions, emotions (like passion, fear, anxiety and compassion) and emotional intelligence can make or break a venture.

Here are four ways emotions shape the entrepreneurial journey:

1. The double edge of passion

Ask any entrepreneur what keeps them going through long hours, tight budgets and personal sacrifice, and you will probably hear the word “passion”. Passion is one of the most studied emotions in entrepreneurship— for good reason. It fuels creativity, motivates persistence and can inspire others.

Investors are more likely to back passionate founders, and employees feel more engaged when their leaders show authentic enthusiasm. Passionate storytelling resonates with customers.

Most of the benefits linked to passion emerge when entrepreneurs choose to pursue ventures that align with their identity and values. This aspect of the emotion is called ‘harmonious passion’, and it leads to greater well-being, better work-life balance and sustained motivation.

But passion also has a darker side, called ‘obsessive passion’. This is a type of emotional experience driven by internal pressures (selfworth, for example) or external expectations (status or validation).

Entrepreneurs with high levels of obsessive passion often become workaholics, suffer burnout and cannot walk away from their enterprises. This is even the case when their ventures are experiencing sustained failures. Passion can be a superpower. But like any power, it needs to be wielded with care.

2. Fear and anxiety: Not always the enemy

Starting a business is inherently risky. Founders often deal with uncertain markets, fluctuating cash flow and high personal stakes. Unsurprisingly, fear and anxiety are common companions

EMOTIONS CONSTANTLY SHAPE HOW ENTREPRENEURS THINK, DECIDE, ACT AND RELATE TO OTHERS

in this journey.

These emotions are often framed negatively, but our research shows they serve vital functions. Fear can make entrepreneurs more vigilant and help them anticipate challenges. Anxiety can enhance performance under pressure, such as during investor pitches or public launches. These can act like emotional smoke alarms, warning entrepreneurs about potential problems before they spiral.

However, problems arise when these emotions become overwhelming. Chronic fear of failure can prevent entrepreneurs from taking calculated risks. It can lead to perfectionism, decision paralysis or the premature abandonment of promising ideas. The key is not to suppress fear or anxiety, but to manage these emotions. Practices like journalling, peer mentorship and mindfulness training are valuable tools. They can help entrepreneurs reflect and use fear and anxiety constructively rather than letting it control them.

3. Compassion as fuel for social enterprise

Entrepreneurship is not always about chasing profits. Many founders launch ventures to address urgent social issues: from poverty and inequality to environmental degradation. These social entrepreneurs are often driven not just by vision but also by compassion.

Our review found that compassion is a defining emotional characteristic of social entrepreneurs. It motivates them to act when others turn away. It helps

them connect with communities, earn trust and stay resilient in the face of adversity. Their emotional connection to a mission creates a deep sense of purpose that can carry them through setbacks that may paralyse other entrepreneurs.

This emotional resilience is often overlooked in traditional entrepreneurship education, which tends to emphasise strategy and metrics. But for many missiondriven founders, compassion is the emotional backbone of the business.

4. Emotional intelligence as a business strategy

Emotions do not just shape how entrepreneurs feel; they affect how others respond to them. Our research points to emotional intelligence—the ability to recognise, understand and regulate emotions—as a critical skill for entrepreneurs.

Founders who demonstrate high emotional intelligence motivate teams better, manage conflict and build trust with stakeholders. They are more likely to retain talent, adapt under pressure and sustain long-term ventures. Investors, too, respond to emotional cues. A confident and passionate pitch can be more persuasive than a technically perfect but emotionally flat one.

However, there is a fine line. Too much emotional expression can backfire. Investors may question the founder’s judgement, and teams may interpret it as instability.

The most effective entrepreneurs are not the ones who suppress their emotions, but those who

deploy them strategically. In a world where startups rise and fall on relationships, emotional intelligence is not a soft skill—it is a core business strategy.

Entrepreneurship is an emotional endeavour. The highs are exhilarating, but the lows can be crushing. While grit and skill matter, our review shows that founders’ emotional agility often determines whether they thrive or burn out.

Innovation should be celebrated, and it is vital to recognise and support entrepreneurs’ emotional experiences. That means building programmes that teach emotional management, creating networks that offer psychological safety, and reframing failure not as weakness but as part of the emotional terrain of entrepreneurship.

Florencio Portocarrero Assistant Professor: Management London School of Economics and Political Science

IT IS TIME TO REMOVE THE UNCONSCIOUS BIASES ASSOCIATED WITH BEING A ‘GOOD BUSINESSWOMAN’

Iconsider myself a good businesswoman, but defining what that means to other people isn’t always easy.

Out of curiosity, I turned to Google and was surprised to see the glaring and unsettling differences between its definition of a good businessman and a good businesswoman: confident, strategic, decisive, assertive, visionary, good business smarts, financial acumen.

Definitely powerful traits, but these were all attributed to businessmen.

Search ‘good businesswoman’ and the words change dramatically: hard-working, willingness to learn, understanding, humility. Suddenly, the powerful descriptors had vanished, replaced by softer traits, often associated with caretaking roles rather than leadership.

It’s fascinating and frustrating to see these unconscious biases play out so plainly in something as simple as a Google search. The great news is that as a good businesswoman who is heading up a successful business, I have seen first-hand how softer traits aren’t negatives; empathy, nurturing and understanding can be superpowers

in business.

The problem isn’t the traits themselves; it’s the boxes this narrative locks us into when it comes to business. Why can’t a good businessman be empathetic, and a good businesswoman be assertive?

There’s a societal perception that success and leadership belong to those who are assertive, loud, the first to speak, and even sometimes indifferent to others. In reality, just because someone may be quieter, more thoughtful or even more introverted, it doesn’t mean they bring less value to the table. In fact, they often bring more measured, thoughtful and inclusive perspectives. Success isn’t exclusive to the loudest or most assertive; real leadership includes empathy, humility and genuine care for others.

I truly believe we can change the perception around what a good businesswoman is. It starts with our choosing consciously to recognise, celebrate and reward the quieter strengths of empathy, vulnerability and thoughtfulness as much as we do assertiveness. Integrity should never be confused with weakness; true strength lies in balancing both.

Being a good businesswoman means facing challenges head-on and knowing exactly why it matters every time:

• Customers are far more loyal, coming back over and over, not just for your products but for your principles.

• Your team thrives in a space where values align and their voices are heard.

• Your resilience is stronger because, by making the ethical decision every time, those around you intrinsically know your heart, your intentions, your business acumen and your priorities; in turn, they’ll trust your decisions.

The question is: how do we put this into practice?

A good businesswoman makes the choice—because it’s a daily decision—to keep their word, prioritise ethical decisions over personal gain, pay people appropriately, charge people conscientiously and fairly, and provide high-quality services and products consistently.

BEING A GOOD BUSINESS WOMAN MEANS FACING CHALLENGES HEAD-ON AND KNOWING EXACTLY WHY IT MATTERS EVERY TIME

My advice for being a good businesswoman

Moments of human connection and accountability mean everything: Speak to the people behind the emails. Remind them they’re dealing with real people who deserve respect—and, in return, they, too, will be respected.

Ethical behaviour is not transactional: Your values should never shift because of how someone responds to them. Ethical leadership, the kind that’s sustained and respected, comes from consistent, authentic actions—whether or not anyone is watching.

Doing good business isn’t about universal popularity: It’s about alignment with those who respect and uphold the same principles

you do. If ethics and values aren’t respected in a situation, that’s precisely the situation a good businesswoman wouldn’t be involved in. In the short term, standing firm may feel like a disadvantage. But long term? It’s how you build genuine respect, lasting partnerships and a business you can be truly proud of.

Let go of the idea that ‘good guys finish last’: Good guys stay in the race for longer, take sips of water from supporters at crucial touch points along the way, stop for chats and learnings, and enjoy the process. They push themselves beyond their limits to consistently finish strong.

Of course, this isn’t always easy. When I’m asked about challenges I’ve faced as a good

businesswoman, my first thought is: ‘How much time do you have?’ because the challenges are endless, varied and very real—but I would choose the same path every single time. Why? Because integrity isn’t negotiable.

This shift has the power to rewrite the rules of success. We need to give up the idea of doing whatever it takes to be the best and that, somehow, good is not good enough.

Being consistently good is a commitment: to ourselves, to the work, to the people around us. And yes, it can be harder to accomplish, but we can do hard things—especially when they are this important.

Jeni-Anne Campbell Speaker, Coach and Social Entrepreneur Founder: JAW Advertising

EXPLORING THE REAL-WORLD IMPLICATIONS OF AI FOR TODAY’S WORKFORCE AND THE NEXT

In the face of rapid technological advancements, artificial intelligence (AI) and automation are transforming industries and redefining the workforce. While these changes present challenges, they also offer opportunities for professionals to adapt and thrive.

Central to this adaptation is the cultivation of human-centric skills and strategic business education, which together can ensure longterm career resilience in an AI–augmented world.

The threat is real, but so is the opportunity AI’s influence extends across various sectors, reshaping job roles and skill requirements. For instance, the rise of AI in marketing has led to the emergence of hybrid positions that blend technical expertise with creative strategy. Similarly, in finance, AI tools assist in data analysis, but human judgment remains crucial for interpreting results and making strategic decisions.

This trend underscores the importance of combining technological proficiency with human insight. By learning how AI integrates into your specific industry and leveraging it for improvement, you not only enhance the field but also strengthen your own technological skills.

While AI can handle a wide range of tasks, it still requires the human touch for qualities that cannot be replicated, such as empathy, creativity, ethical judgement, leadership and the ability to genuinely listen and understand the concerns that individuals have with a certain situation. Those who can achieve the correct balance between technical literacy and human intuition will thus have a competitive advantage in the workplace.

Business schools can prepare students not only for the specifics of their industries but also for the dynamic challenges provided by AI, giving them the capabilities they need to adapt, lead and prosper in a technology-driven society.

Human-centric skills on the rise

Although AI is advancing in automation of routine and technical jobs, there remains a domain where it will consistently underperform: skills that are centred around human interaction. These abilities are valued by employers and will remain essential as we progress deeper into an AI–driven future.

Skills such as critical thinking and problem-solving are needed to analyse situations, identify challenges and think outside the box—something only a human can do. In situations involving decision-making, individuals can

rely on a broad range of personal experiences, cultural backgrounds and moral issues.

Equally important are humancentred skills such as emotional intelligence and adaptability, qualities that remain well beyond the reach of AI. Humans need to feel empathy and understand in certain situations they are facing; only a human can understand and manage those emotions while adapting to the situation and environment in which they are positioned.

Being creative and coming up with original plans is something only human intuition can aid, where new ideas are formed and there is a personal touch added to ideas being created. These skills need leadership, another downfall

of AI—it cannot be accountable for leading teams.

Business education provides individuals with the mindset and abilities to excel in volatile, uncertain, complex and ambiguous settings, cultivating the resilience needed to thrive in a constantly

evolving professional environment.

Business education as a career Now, as AI is becoming integral to business operations, traditional educational models may fall short in preparing professionals for future challenges. Schools and universities need to start becoming more aware of how AI can help students and encourage its use in the right way rather than banning it from being used during assessments. Individuals have implemented robotics for the longest time in South Africa, but that needs to evolve further now.

As research shows, current courses frequently cover subjects such as digital transformation, AI ethics and innovation management. These fields of study give students a more profound insight into the ways technology interacts with business processes, ethics and social dynamics.

Reports suggest that professionals are increasingly adding AI skills to their portfolios, with people now more than twice as likely to acquire AI skills than in 2018. This trend highlights the growing recognition of AI’s importance and the need for education systems to adapt accordingly.

Investing in business education—such as postgraduate diplomas, MBAs or specialised courses—equips individuals with a blend of technical knowledge

and soft skills. This combination enhances employability and positions professionals to lead in sectors where AI and human expertise intersect.

Contemporary business schools provide programmes that focus on interdisciplinary approaches, teamwork and adaptability: capabilities crucial for thriving in the digital economy. Through cultivating a diverse skill set, business education equips students for various roles, from management to entrepreneurship, making sure they stay adaptable and employable regardless of changes in the job market.

As AI continues to redefine how we work and live, professionals must view it not just as a disruptor but as a collaborator. The ability to co-create with AI, using it to enhance decision-making, improve productivity and uncover new solutions is quickly becoming a critical skill. Those who take the initiative to explore AI’s potential in their roles will not only remain relevant but will likely become innovators within their fields.

Institutions and employers must play an active role in supporting this transition. By laying the foundation for cultures of experimentation, continuous learning and ethical AI integration, organisations can empower their people to thrive amid change. This will mean not just surviving

the AI wave but surfing it with confidence, creativity and purpose. Something that individuals need to consider is how they need to adapt their profession to AI and include it so that they are evolving. They feel defeated because they believe AI can replace them, but rather openly embrace the change and grow as individuals. They can do this by attending workshops, webinars and even enhancing their skills in areas where AI cannot replace humans.

The interplay between AI and human skills is reshaping the employment landscape, creating a demand for professionals who can blend technological proficiency with human-centric competencies. Strategic business education serves as a building block for developing this unique skill set, ensuring career resilience in the face of automation.

As AI continues to evolve, professionals who invest in continuous learning and adapt their skill sets accordingly will be well-positioned to lead and innovate in an increasingly automated world.

Hoosen Essof Head Deepti Govind Intern

Employability

Unit Regent Business School

TURNING SUSTAINABILITY INTO GROWTH: A STRATEGIC ROADMAP FOR SMES AND MID-SIZED MANUFACTURERS

AAs the climate crisis accelerates and the global economy undergoes structural transformation, a growing consensus has emerged: Sustainability is not just an environmental responsibility—it is a critical business opportunity.

The recently published World Economic Forum (WEF) white paper, “Sustainability Meets Growth: A Roadmap for SMEs and Mid-Sized Manufacturers” (June 2025), offers a compelling guide for smaller manufacturers on how to turn environmental sustainability into a competitive edge.

Developed in collaboration with Schneider Electric and based on global consultations and surveys with 60 manufacturing small & medium enterprises (SMEs) and mid-sized companies, the white paper lays out an actionable fivestage roadmap, backed by realworld examples and bolstered by recommendations for financial, policy and technical support.

For SMEs in southern Africa— many of which face constrained access to capital, skills and infrastructure—this presents a practical framework for sustainable and scalable industrial development.

Why SMEs matter in the sustainability transition

SMEs and mid-sized manufacturers account for roughly 90% of global businesses and 70% of employment. Countries that are part of the Organization for Economic Co-operation and Development are responsible for nearly 40% of industrial pollution. Yet, these businesses remain largely overlooked in sustainability discourse, with most policy frameworks and investment strategies tailored toward large multinationals.

For countries across southern Africa, where industrial sectors are populated by a diverse array of small manufacturers—from textile and agro-processing firms to light engineering and automotive suppliers—the stakes are particularly high. Without deliberate inclusion, these firms risk being left behind in the transition to low-carbon economies.

The WEF report identifies a dual opportunity: Sustainability can drive cost savings, improve operational efficiency and open up new market opportunities, all while aligning companies with global climate targets.

Reframing sustainability as a business enabler

Rather than treating environmental sustainability as a compliance burden, the white paper urges SMEs to see it as a growth driver.

The benefits of sustainable practices are tangible and measurable:

Operational cost savings

By embedding efficiencyenhancing technologies, companies can reduce energy and material use. The Jiangsu plant of China’s Yunzhibao Foodstuff, for example, reduced production costs by 5% and boosted operational efficiency by 10% through automated, sensordriven process optimisation.

Improved talent attraction

Sustainability initiatives enhance employer branding. In the United

States, craft beer producer Vivant Brewery + Spirits (www. breweryvivant.com) integrates sustainability training into its onboarding process—a strategy that strengthens recruitment and builds culture.

New revenue streams

United Kingdom–based Ananas Anam (www.ananas-anam.com) transforms pineapple leaf waste into a leather substitute used in global fashion houses. This example demonstrates how circular economy thinking can unlock value from previously discarded resources.

The five-stage sustainability roadmap

To guide SMEs through the transition, the WEF proposes a five-stage roadmap:

1. Build the foundations

Begin with a self-assessment to understand current environmental impacts. Appoint a ‘sustainability lead’—often from within existing operations—and set measurable, achievable goals based on priority impact areas like energy or water use.

2. Identify and implement quick wins Prioritise initiatives that deliver strong return on investment with low complexity. These early wins build momentum, demonstrate value and create buy-in among internal stakeholders.

3. Measure, report and improve

Introduce monitoring systems (e.g. digital dashboards tracking emissions, waste and energy usage). Adopt tools like the SME Climate Hub’s carbon calculators (smeclimatehub.org/startmeasuring) to align efforts with global Scope 1, 2 and 3 reporting standards.

4. Embed sustainability in long-term planning

Move from isolated projects to integrated strategy. Redesign

procurement and production with eco-efficiency in mind, explore local sourcing to reduce transport emissions, and future-proof business models against climate and regulatory risks.

5. Drive cultural change and communicate achievements

Instil a sustainability mindset at all levels of the organisation. Link environmental outcomes to performance metrics, celebrate milestones and use achievements to engage customers, attract investors and inspire talent.

Barriers to adoption: What’s holding SMEs back?

The white paper’s global survey revealed three common barriers faced by SMEs:

• Competing priorities: Over half of respondents (53%) cited business expansion or cost-cutting as taking precedence over sustainability initiatives. Yet, the paper argues that sustainability can enable these very goals.

• Policy uncertainty: 47% of respondents felt unclear or unsupported by current regulatory frameworks, which often lack coherence or are not tailored to SME realities.

• Funding and technical capacity: 42% of SMEs struggle to secure funding or lack internal expertise to implement projects. While capital is crucial, the report stresses that knowledge gaps and weak implementation support are equally significant.

Enabling the transition: The role of support ecosystems

The WEF outlines five support mechanisms that public and private stakeholders must strengthen to accelerate sustainable transformation among SMEs:

1. Finance

Targeted grants, tax incentives and matched funding based on efficiency savings can lower upfront costs. For instance, Oregon’s energy efficiency programme offers commercial incentives aligned with performance outcomes. In Kenya, loan application support helped a tea co-operative access bank funding it would otherwise have missed.

2. Knowledge and training

Resources like the Green Industry Platform’s I-GO tool (igosolution.org) and the SME Climate Hub’s training modules provide easy-to-use templates, project ideas and emissions calculators. Upskilling staff in environmental accounting and energy management is critical.

3. Networks

Peer-to-peer collaboration and corporate–SME

partnerships help foster learning and accelerate implementation. Initiatives like Schneider Electric’s Zero Carbon Project (tinyurl.com/2s36f645) have helped over 1 000 suppliers begin tracking and reducing emissions.

4. Policy alignment

Policymakers should issue clear, SME–friendly guidance on sustainability compliance and incentives. China’s green SME policy includes tax breaks, green loans and subsidies for digital solutions—an approach other regions could adapt.

5. Implementation support

Regional integrators and technical experts are needed to translate sustainability theory into operational execution. Local partnerships ensure solutions are context-appropriate and financially viable.

What this means for southern Africa

Southern Africa’s industrial future depends heavily on the adaptability and innovation of its SME sector. With growing global demand for low-carbon products, circular design and sustainable supply chains, the region’s manufacturers can compete—but only if they are equipped to meet these evolving expectations.

The WEF roadmap offers a strategic lens for policymakers, business associations and corporates across the region to think beyond ‘greenwashing’ and begin building capacity for sustainable, inclusive industrialisation. The success of this agenda will depend on deliberate investment in skills, funding mechanisms and regionally tailored implementation support.

From compliance to competitiveness

The message from the WEF’s white paper is clear: Sustainability should no longer be viewed as a luxury, a distraction or a regulatory checkbox. It is a cornerstone of business strategy, a driver of innovation and resilience, and an investment in future competitiveness.

By following a structured, practical roadmap and mobilising the right support, southern African SMEs and mid-sized manufacturers can not only reduce their environmental impact—they can grow stronger because of it.

The time to act is now. Not only because the climate demands it, but because the market is already rewarding those who do.

Access the full white paper at tinyurl.com/2daeac52.

CRYPTOCURRENCY AND EXCHANGE CONTROL: THE LEGAL IMPLICATIONS OF THE RECENT STANDARD BANK V SA RESERVE BANK JUDGMENT ON CRYPTO ASSET SERVICE PROVIDERS AND FINTECHS

In a groundbreaking decision handed down on 15 May this year in Standard Bank of South Africa v South African Reserve Bank and Others (tinyurl. com/45yd8w65), the Gauteng High Court ruled that cryptocurrencies do not fall within the ambit of South Africa’s Exchange Control Regulations (Excon Regulations).

Though currently suspended pending an appeal, the judgment represents a watershed moment for crypto asset service providers (CASPs), fintech innovators, financial institutions and regulators alike.

The court’s finding, being that cryptocurrencies are not “money” or “capital” for purposes of exchange control, unlocks temporary regulatory breathing room for crypto players. Yet, it also lays bare a regulatory vacuum that is unlikely to remain open for long.

Background: The collision of crypto and traditional finance

The dispute originated from the South African Reserve Bank (SARB) investigation into Leo Cash and Carry (Pty) Ltd, a wholesale trading company that used funds from South African bank accounts to purchase bitcoin on local exchanges, transferring the crypto to foreign exchanges. SARB, acting through its Financial Surveillance Department, declared over R26 million in funds held

with Standard Bank and Nedbank as forfeited to the state, citing alleged contraventions of Excon Regulations 3(1)(c) and 10(1)(c).

These provisions prohibit, respectively: payments to nonresidents without Treasury approval; and the export of capital without permission.

Standard Bank challenged the forfeiture of R16.4 million it held in a pledged money market account, arguing the Excon Regulations did not apply to crypto. The High Court agreed, at least in part.

Key legal findings: Cryptocurrency is not currency or capital

The court’s decision turned on several interpretative and constitutional principles:

Restrictive interpretation of criminalising legislation

Drawing on Oilwell (Pty) Ltd v Protec International Ltd [2011] (tinyurl.com/yc387uky) , the court emphasised that Excon Regulations, which carry punitive consequences, must be interpreted narrowly. Cryptocurrency, being novel and unregulated, could not be forced into legacy definitions of “currency” or “capital” without legislative amendment.

Cryptocurrency is not money or legal tender Bitcoin and similar assets, the

court held, are not “currency” as contemplated by Regulation 3(1)(c) and cannot be deemed “capital” under Regulation 10(1) (c). These assets are decentralised, not backed by a central authority, and function outside the statesanctioned financial ecosystem.

No legislative shortcut

The court rejected SARB’s attempt to stretch existing definitions, pointing out that when the government wanted to include intellectual property under “capital”, it had done so by formally amending the Regulations. The same path should apply to crypto.

Digital wallets do not equal bank accounts

Notably, the court observed that if crypto were equivalent to money, “then crypto wallets would be attached under Regulation 22B”. But crypto assets, being intangible and decentralised, elude traditional mechanisms of state seizure.

Immediate implications for crypto asset service providers

Regulatory pause, not immunity CASPs may temporarily enjoy relief from SARB scrutiny under Excon Regulations, but the landscape remains fraught with uncertainty. The appeal, and eventual legislative reform, may restore oversight in due course.

Eased compliance pressures

The judgment weakens SARB’s current tools for enforcing cross-border crypto transfer restrictions, creating breathing space for providers transacting internationally. However, it simultaneously raises reputational and operational risks for banks and financial institutions servicing crypto clients.

A renewed legislative imperative

The court highlighted a “regulatory vacuum”, echoing longstanding calls for bespoke digital asset legislation. The

2021 Intergovernmental Fintech Working Group

Crypto Assets Regulatory Position Paper (tinyurl. com/bdfkwmvu) and SARB’s own 2020 research foreshadowed this moment, and a swift regulatory amendment—akin to the post-Oilwell reforms—is likely on the horizon.

A double-edged sword: Risk and opportunity in the vacuum

While CASPs and fintechs may see this moment as an opening, the judgment creates new compliance and legal strategy challenges:

Capital flight concerns

Without clear restrictions, businesses may attempt to ‘round-trip’ capital using crypto, moving value offshore via local crypto purchases and reconverting it abroad. This risks undermining South Africa’s broader financial stability objectives.

Banking sector dilemma

Financial institutions must now navigate a compliance gap. While crypto transfers may fall outside exchange control, they remain subject to anti-money laundering (AML), counterterrorism financing and prudential risk management requirements under laws like the Financial Intelligence Centre Act (FICA) and Financial Advisory and Intermediary Services Act (FAIS).

Securitisation and insolvency risks

The court’s nuanced treatment of security rights and bank standing—in particular, its analysis of pledge, cession and the principle of commixtio (thelawdictionary.org/commixtio) —should prompt CASPs to revisit how they structure and collateralise crypto holdings in financing or insolvency contexts.

Regulatory recommendations: What crypto providers should do now Pending the appeal or an inevitable statutory overhaul, market participants should:

Maintain strong AML/FICA compliance

Excon relief does not absolve other legal duties. KYC, transaction monitoring and source-of-funds verifications remain essential.

Prepare for imminent legal reform

Providers should anticipate that crypto will soon be formally included in the Excon regime. Preemptive alignment with global best practices (e.g. FATF’s Travel Rule, tinyurl.com/n4hfm45f ) may mitigate transitional risk.

Reassess contractual and security arrangements

Lenders and fintechs should revisit their treatment of crypto in lending, pledge and liquidation scenarios, incorporating the court’s treatment of ownership

rights in digital assets.

Engage with regulators and industry bodies

The door is open for industry-led engagement to shape the next iteration of exchange control law. Participation in public comment processes will be key to avoiding overly broad or counterproductive regulatory approaches.

A defining moment in South African financial law

The Standard Bank v SARB judgment is more than a technical ruling: It is a legal and regulatory pivot point in South Africa’s digital asset journey. While the court has momentarily lifted the Excon curtain from cryptocurrencies, it has also made clear that a new act, crafted for a digital age, must follow swiftly. Until then, crypto asset service providers must walk a fine line: operating within the current relief, but preparing for a future in which digital assets will no longer be exempt from the rigours of capital control.

Kerri Stewart Attorney: Commercial Law SchoemanLaw Inc

LENDERS AND FINTECHS SHOULD REVISIT THEIR TREATMENT OF CRYPTO IN LENDING, PLEDGE AND LIQUIDATION SCENARIOS

THE MASTERPLAN ALSO AIMS TO ATTRACT AT LEAST R15 BILLION IN INVESTMENT BY 2030 AND TRAIN ‘GREEN WORKERS’ FOR EMPLOYMENT IN 25 000 DIRECT JOBS.

INSIDE SOUTH AFRICA’S MASTERPLAN FOR A RENEWABLE ENERGY INDUSTRY

About 85% of South Africa’s electricity is produced by burning coal (tinyurl.com/ yt8f5hjw). The country’s move to renewable energy means the coal industry will be phased out. To this end, the South African Cabinet approved the country’s first Renewable Energy Masterplan (tinyurl.com/2d29zk4j) in April this year, which sets out what is needed to establish new renewable energy industries.

Ricardo Amansure researches the move toward renewable energy and how communities can benefit from this. He explains what the masterplan aims to achieve, what problems it may face and how it can succeed.

What is the South African Renewable Energy Masterplan?

It is an industrial strategy that sets out how South Africa can set up a new manufacturing industry in renewable energy and battery storage value chains.

The masterplan was developed by the government, some sections of organised labour, a non-profit organisation advocating for renewable energy (GreenCape), and representatives of the renewable energy industries. It sets out a framework to produce renewable technologies locally. These include solar photovoltaic panels, wind turbines and batteries.

The masterplan has been drawn up so that it aligns with South Africa’s existing national target of adding 3–5 gigawatts of renewable energy capacity each year to 2030. This is a scale that can support the development of local manufacturing hubs. (One gigawatt can supply electricity to about 700 000 average homes.)

This steady supply will be enough to give businesses and investors the confidence to commit to long-term investments in local manufacturing hubs. These are zones where renewable systems and components are produced or assembled for domestic and export markets.

The state-owned electricity company Eskom has not directly guaranteed it will buy 3–5GW of renewable energy each year. But the government’s national electricity plan—the Integrated Resource Plan (tinyurl.com/5cx258sv) provides a strong indication of future demand.

The masterplan also aims to attract at least R15 billion in investment by 2030 and train ‘green workers’ for employment in 25 000 direct jobs. These roles range from factory work and logistics to engineering and construction. Many will be for youth and semi-skilled workers.

South Africa already has a Just Transition Framework (tinyurl. com/38yzh4xp) to ensure the shift to a low-carbon economy is fair, and does not leave workers, communities or regions behind. The masterplan is aligned with this. It aims to support blackowned companies and small-scale and community-based initiatives, especially in places affected by the looming loss of jobs in the coal industry.

However, it is not a response to the country’s frequent power cuts and will not decide how electricity is generated. Energy system plans like the Integrated Resource Plan and Energy Action Plan (tinyurl. com/2f4sy5r3) do this; they focus on power generation, securing a constant energy supply and expanding the electricity grid (tinyurl.com/4ztzmjxj).

Why should South Africa manufacture renewable energy systems?

In 2023 alone, the country spent over R17.5 billion on solar and battery imports (tinyurl. com/3wrka27n). This is unnecessary because South Africa sits on reserves of manganese, vanadium, platinum and other rare earth elements. These are the critical ingredients for manufacturing clean energy systems and storage, which could be made locally.

South Africa already produces

solar panels, steel towers for wind turbines, and electrical cabling. Some local firms also assemble inverters and balance-of-system technologies used in solar and battery systems. The potential to grow renewable energy industries is there.

How will South Africa set up these new industries?

Factories making solar, wind and battery storage components will be financed through private sector investment and government incentives and support. These include tax breaks, localisation requirements and support in special economic zones. As manufacturing demand increases, expansion is planned into offshore wind and next-generation (longer duration) batteries.

What are the challenges in reality?

South Africa has a history of ambitious strategies to localise production in energy and car manufacturing. These struggled to get off the ground; the plans were often undermined by delays and mismatched approaches by government departments (tinyurl. com/9sktev2k) . The masterplan could face similar obstacles if these governance and execution gaps are not addressed with urgency.

Another bottleneck is the electricity grid, which cannot accommodate new renewable energy connections. Eskom needs about US$21 billion to expand the grid (tinyurl.com/mr45s6cs) , which will take time. This is a problem because renewable energy manufacturers need certainty

Between now and 2030, the masterplan has these aims:

• To fast-track government procurement of renewable energy, ensuring reliable energy planning, and expand the electricity grid to handle new projects.

• To develop an industry producing key components like wind turbine towers, solar mounting structures and batteries.

• To promote inclusive development by supporting black-owned firms, small businesses and former coal communities. This is to make sure everyone gets their fair chance to take part in green economic opportunities.

• To grow local skills and innovation. Training and education institutes and the energy industry will partner to make renewable energy skills part of national curricula and workplace training pipelines. They will need the support of the government’s Higher Education Ministry.

now about future demand if they are to invest in new factories and training programmes.

South Africa also has a huge shortage of renewable energy technicians, electricians, installers and engineers.

What needs to be done for this plan to succeed?

A few urgent actions are required: The government must publish updated procurement rules with a clear and enforceable set of localisation targets. This will give local manufacturers confidence that they will have a market to which to sell renewable energy.

South Africa’s official electricity plan, which still emphasises the role for coal-fired power, must be realigned with the Renewable Energy Masterplan.

Eskom may need support from the government and development financiers to expand the grid at the pace needed.

Training institutions must modernise their courses and train more students to work in the solar, wind, battery storage and green hydrogen sectors.

The government must create incentives that make it easier for local and international investors to be part of the industry. Red tape— long waits for environmental approvals, land rezoning and licensing processes—must be cut. Simplifying and speeding up these procedures, while maintaining safety and environmental standards, would improve investor confidence.

Ricardo Amansure is a senior researcher in the Centre for Sustainability Transitions at Stellenbosch University.

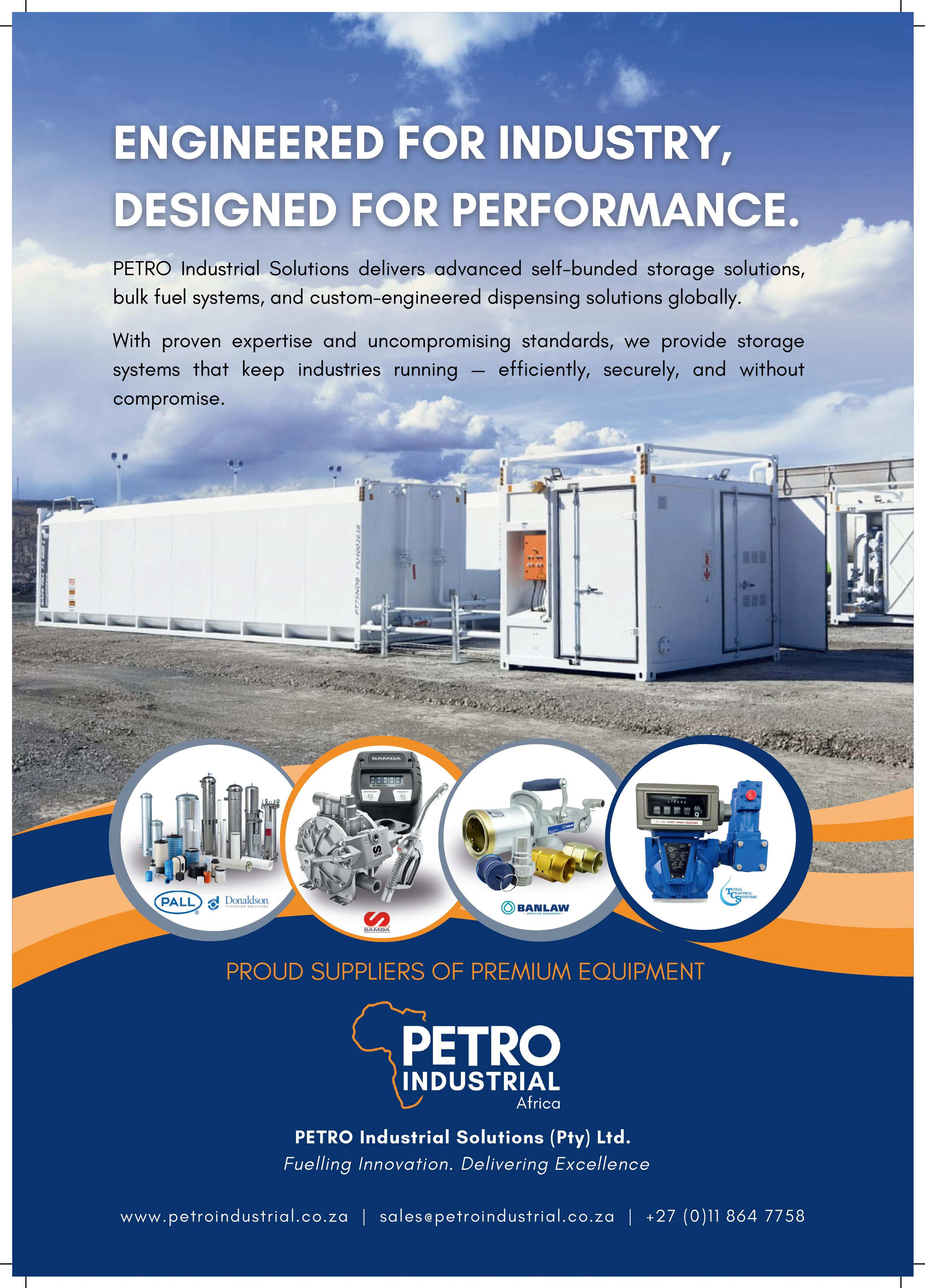

ZERO-EMISSION BATTERY ENERGY STORAGE SYSTEMS TO POWER AFRICA’S CLEAN ENERGY

Cummins Inc., a global leader in integrated power solutions, has launched its advanced battery energy storage systems (BESS) in Africa, reinforcing its commitment to sustainable innovation and energy resilience across the continent. This milestone launch simultaneously advances Cummins’ global “Destination Zero” strategy and tackles Africa’s toughest energy challenges: from grid instability to diesel reliance and soaring power costs.

Unlocking Africa’s renewable potential Africa holds over 60% of the world’s best solar resources and its untapped wind energy potential, positioning it as a natural leader in advancing global clean energy efforts. Yet, 600 million people in sub-Saharan Africa live without access to electricity, and many industries rely on costly, polluting

diesel generators.

Cummins’ BESS technology provides a zero-emission solution that stores energy from renewable sources like solar and wind, ensuring reliable power even during outages or low-generation periods. These systems support peak shaving, energy arbitrage and grid stabilisation—making them ideal for industrial, commercial and mission-critical applications.

“We’re excited to bring this product to Africa, where the need for reliable, clean power is urgent and growing,” says Kweku Fin Winful, executive director for Cummins Africa Middle East. “Our BESS solutions are designed to meet the continent’s unique challenges powered by worldclass innovation and local expertise.”

Zero emissions, maximum impact

Cummins BESS units produce zero emissions during operation,

supporting Africa’s climate goals and helping industries meet ESG (environmental, social & governance) targets. They also reduce fuel logistics and maintenance costs, offering a compelling return on investment.

“Our customers are looking for more than just backup power; they want smart, sustainable energy systems that match their evolving needs,” adds Winful. “With BESS, we’re delivering just that—backed by Cummins’ 100+ years of power generation expertise and unmatched service network.”

For more information visit: www.cummins.com / contact Cummins South Africa: +27 11 451 3400/1/2

Sylvester M Thwala

PowerGen Application Engineer: +27(0)82 524 4370

sylvester.thwala@cummins.com

SOUTH AFRICA’S NEW CRITICAL MINERALS AND METALS

STRATEGY 2025 MARKS A NEW FRONTIER FOR SUSTAINABLE GROWTH

South Africa is entering a transformative era in mineral resource governance with the adoption of its Critical Minerals and Metals Strategy 2025, a forward-looking framework designed to reposition the country as a global leader in the production, processing and beneficiation of strategic resources essential for the green economy and high-tech manufacturing.

As global economies shift toward renewable energy, electric mobility and digital transformation, the demand for critical minerals—such as lithium, cobalt, rare earth elements, platinum group metals (PGMs) and manganese—is accelerating rapidly. South Africa, with its vast geological endowment and mining legacy, is uniquely poised to capitalise on this surge.

But doing so requires more than extraction—it demands strategy.

Defining critical minerals and South Africa’s global position

According to the new strategy, critical minerals are defined as “minerals that are essential for the overall economic development, job creation, industrial advancement and contribution to national security.” These minerals are vital inputs for batteries, fuel cells, wind turbines, aerospace components, advanced manufacturing and digital technologies.

South Africa ranks among the top producers of several key critical minerals. The country holds 88% of global reserves of PGMs, 80% of manganese and 72% of chromite. It is also a significant producer of vanadium, titanium and rare earth elements (REEs).

Yet, despite this mineral wealth, much of South Africa’s production remains concentrated in upstream activities—mining and export of raw ore—while beneficiation and advanced processing are minimal.

This underutilisation of local resources prompted the Department of Mineral Resources & Energy to craft a comprehensive national strategy to enhance value addition, attract investment and build a globally competitive critical minerals value chain.

Strategy development: A multi-stage process

The Critical Minerals Strategy 2025 was developed through a multiphase process involving material flow analysis, value chain mapping and extensive stakeholder consultation.

Key milestones included:

• Developing a model to define criticality, based on supply risk, economic significance and industrial application.

• Performing commodity-specific analyses on 21 minerals including PGMs, lithium, cobalt, copper, vanadium and REEs.

• Drafting a national position paper on strategic resource diplomacy.

• Formulating an implementation plan, complete with performance indicators and investment pathways.

This approach ensures the strategy is not only rooted in geological data and market intelligence but also aligned with South Africa’s industrial policy, energy goals and regional integration ambitions.

Core pillars of the strategy

The strategy is structured around six strategic pillars, each designed to overcome bottlenecks and create enabling conditions for long-term success:

1. Geoscience and Exploration: prioritising exploration of high-demand minerals like lithium, graphite and copper, supported by the newly launched Junior Exploration Fund.

2. Value Addition and Localisation: reviving beneficiation capacity, especially in ferroalloys, vanadium redox batteries, green hydrogen and lithiumion technologies.

3. Research and Development: establishing innovation hubs focused on battery materials, hydrogen fuel cells, titanium applications and AI-driven mining methods.

4. Infrastructure and Energy Security: upgrading rail, port and energy infrastructure critical to mineral processing.

5. Financial Instruments: introducing incentives such as research & development tax credits, reduced royalties for beneficiation, and export incentives for value-added products.

6. Regulatory Harmonisation: streamlining licensing and creating a ‘one-stop shop’ for mining investment approvals.

Intended outcomes and strategic vision

Mineral Resources & Energy Minister Gwede Mantashe, in his foreword to the strategy, highlighted its importance in driving both domestic transformation and international relevance: “This strategy is not just a policy framework. It recognises that the future of our country is inextricably linked to how we develop and manage our mineral wealth. By strengthening our industrial base and increasing our capacity for value addition, we can unlock significant

employment opportunities, stimulate innovation and advance our economic growth priorities.”

The government envisions the creation of a selfsustaining industrial base that supports downstream industries, enhances South Africa’s trade resilience and establishes the country as a regional hub for green technologies such as battery manufacturing, hydrogen infrastructure and sustainable steel production.