Sometimes you need a fresh cup of get it done.

At McLane, we partner with retailers of all sizes to make sure they start every day fully stocked and ready to take on their bold business goals.

Learn more at mclaneco.com

By Sukhi Sandhu, NCASEF Chairman

By Sukhi Sandhu, NCASEF Chairman

By Joe Rossi, NCASEF Executive Vice Chair

By Eric Karp, Esq., General Counsel To NCASEF

By Joe Rossi, NCASEF Executive Vice Chair

By Eric Karp, Esq., General Counsel To NCASEF

By Teeto Shirajee, NCASEF Vice Chairman

By Teeto Shirajee, NCASEF Vice Chairman

By Ali Haider, Michigan FOA President, Board of Directors–SBAM

By Ali Haider, Michigan FOA President, Board of Directors–SBAM

Convenience retailers have witnessed a positive trend in sales for 2023, with two-thirds (66 percent) reporting an increase in sales during the first seven months as compared to the same period last year, reveals a new survey released by NACS. This data aligns with the metrics from the NACS’ CSX database, which showed in-store sales experiencing a 9.4 percent rise and inside transactions going up by 1.0 percent for the first half of 2023 compared to 2022. Furthermore, convenience store retailers are optimistic about the remainder of the year: onethird believe that convenience stores are best positioned for success, closely followed by online retailers at 32 percent, and dollar stores at 14 percent.

Conversely, when considering which channels might struggle in 2023, 39 percent of respondents believe restaurants are least positioned for success, followed by drug stores (25 percent) and grocery stores (12 percent). A key industry concern remains the labor shortage, with 44 percent of retailers listing it as their primary issue, especially given the current low unemployment rates. This concern surpasses others such as inflation, credit card fees, and government regulations.

On the community front, convenience

stores contribute significantly, donating over $1 billion annually to charitable causes. The top community issue that the industry should address, as per the survey, is the prevention of underage access to age-restricted products, wellness (nutrition), and human trafficking.

percent of convenience retailers reported an increase in sales during the first seven months of 2023 as compared to the same period last year.”

Achieving impressive growth in the retail sector, SEI has been recognized by the National Retail Federation (NRF) as one of the fastest-growing U.S. retailers, securing the No. 5 position on its 2023 Hot 25 Retailers list. Compiled by Kantar based on year-over-year domestic sales growth, 7-Eleven reported a 30.2 percent increase in U.S. retail sales from 2021 to 2022, translating to an increase of $6.99 billion in sales. This jump to the fifth slot is notable, given that 7-Eleven previously ranked 23rd on the 2022 list. While the

continued on page 12

NATIONAL COALITION OF ASSOCIATIONS OF 7-ELEVEN FRANCHISEES

NATIONAL OFFICERS & STAFF

Sukhi Sandhu

NATIONAL CHAIRMAN 855-444-7711 • sukhi.sandhu@ncasef.com

Joe Rossi

EXECUTIVE VICE CHAIRMAN 312-501-4337 • joer@ncasef.com

Rajneesh Singh

VICE CHAIRMAN 214-208-6116 • rjn_singh@yahoo.com

Teeto Shirajee VICE CHAIRMAN 954-242-8595 • teeto.shirajee@yahoo.com

Nick Bhullar

VICE CHAIRMAN 626-255-8555 • bhullar711@yahoo.com

Romy Singh TREASURER 757-506-5926 • romys@ncasef.com

Shawn Howard VENDOR RELATIONS ADMINISTRATOR 855-444-7711 • shawnh@ncasef.com

Eric H. Karp, Esq. GENERAL COUNSEL 617-423-7250 • ekarp@wkwrlaw.com

John Riggio MEETING/TRADE SHOW COORDINATOR 262-394-5518 • johnr@jrplanners.com

The strength of an independent trade association lies in its ability to promote, protect and advance the best interests of its members, something no single member or advisory group can achieve. The independent trade association can create a better understanding between its members and those with whom it deals. National Coalition offices are located in Ceres, California.

3645 Mitchell Road Suite B Ceres, CA 95307 855-444-7711

nationaloffice@ncasef.com

John Santiago MANAGING EDITOR 267-994-4144 • avantimag@ncasef.com

April J. Key GRAPHIC DESIGNER lirpayek@gmail.com

The Voice of 7-Eleven Franchisees 2023 ISSUE 4

©2023 National Coalition of Associations of 7-Eleven Franchisees

Avanti Magazine is the registered trademark of The National Coalition of Associations of 7-Eleven Franchisees.

“Sixty-six

The Greater Northwest FOA’s Annual Charity Golf Tournament, held at Harbor Pointe Golf Club on August 10, 2023, was a well-attended event featuring 18 foursome teams and drawing participants from various sectors of the 7-Eleven franchise ecosystem. Notably, SEI executives Becky Stockwell, Philip Shirk, and Tony Vaz joined in the action, alongside a large contingent of franchisees and vendors. The event aimed to embody the spirit of “Building the Brand Together,” with an underlying mission of charitable giving. Kira Haller from Seattle Children’s Hospital represented Children’s Miracle Network Hospitals, the beneficiary of the golf tournament.

FOA President Chander Shekhar led the crowd in voicing the event’s philanthropic mission: “Let’s open up our hearts and pockets for the children.” True to that rallying call, the charity golf tournament raised a total of $7,011— alongside an additional $500 from an auction—towards the Greater Northwest FOA’s commitment to serve CMN Hospitals. Beyond the financial contributions, the event was infused with a sense of community, featuring a wide array of raffle prizes and culminating in a sumptuous dinner for all attendees.

Credit for the event’s overwhelming success goes to the entire Greater Northwest FOA Board, who masterfully orchestrated the day’s proceedings. The charity golf tournament was met with unanimous applause, attesting to the event’s impact both as a charitable endeavor and as a catalyst for strengthening community bonds among franchisees, vendors, and corporate team members, alike.

continued from page 10

overall growth rate was generally lower on the 2023 list compared to the previous year, trends indicate a surge in food sales and growth driven by mergers and acquisitions.

Convenience Store News recently announced the selection of 36 individuals as part of its 2023 class of Future Leaders in Convenience (FLIC). Representing a wide range of roles from 29 distinct entities within the convenience store sector, these promising talents are being recognized for their significant positive impacts on their respective companies and the broader industry. From 7-Eleven Inc., three standout individuals are among the awardees:

Gretchen Akers (Category Manager, Beer West), Nathali Aucapina (Market Leader, Golden Gate Market), and Michael Silver (Payments Fraud Strategy Analyst Treasury). These leaders, all aged 35 or below, were chosen based on the commendable contributions they made between January 1, 2022, and April 30, 2023, as highlighted by nominations from their companies and peers.

The FLIC awards, currently in their sixth year, aim not only to spotlight but also foster the growth of the convenience store industry’s future leadership. These emerging frontrunners will receive their honors at the sixth-annual Future Leaders in Convenience Summit slated for November 16 in Pittsburgh, PA. This summit serves as a prelude to the Convenience Store News’ 2023 Hall of Fame gala dinner, where notable

figures will be inducted.

7-Eleven Inc., has once again secured the top position in the 2023 Convenience Store News Top 100 ranking, marking another successful year for the leading retailer. Despite relatively low activity in mergers and acquisitions within the convenience store industry, 7-Eleven has managed to maintain its dominance with a staggering 12,763 U.S. store locations, according to the annual report produced in partnership with TDLinx.

Preserving their top five ranks along with 7-Eleven, Alimentation Couche-Tard Inc. (5,716 c-stores), Casey’s General Stores

continued on next page

Inc. (2,489), EG America (1,681), and GPM Investments LLC (1,491) continue to play a pivotal role in the convenience store landscape. Despite the overall minimal change in the ranking, the industry has witnessed some significant moves in 2023, including BP’s $1.3-billion agreement to acquire TravelCenters of America Inc., and the acquisition of Kum & Go LC by MaverikAdventure’s First Stop. As the longestrunning census of the largest convenience store chains by store count, the Convenience Store News Top 100 offers key insights into the industry’s competitive landscape.

Placer.ai’s Q2 2023 Quarterly Index reveals an ongoing trend of increased foot traffic in

discount and dollar stores, with these outlets enjoying steady visits throughout the quarter, reported StoreBrands.com. Specifically, year-over-year (YoY) weekly foot traffic rose by 3.7 percent to 9.7 percent from mid-May onwards. Leading the pack were Dollar Tree and Dollar General, with visit shares of 39.4 percent and 32.9 percent, respectively. While Dollar General remains the largest in terms of store count, Dollar Tree and its Family Dollar subsidiary experienced YoY visit increases of 10.5 percent and 5.1 percent.

On the other hand, grocery stores showed modest gains, mostly outpacing their previous year’s foot traffic by the end of Q2. Notably, Trader Joe’s, WinCo Foods, and Aldi witnessed the most significant quarterly YoY visit increments, whereas Meijer and Kroger registered decreased footfalls. Superstores, encompassing club retailers, exhibited signs

at discount and dollar stores rose by 3.7 percent to 9.7 percent from mid-May

of recovery after a slower quarter. Though Walmart remained dominant in this category, accounting for about 60 percent of visits, it— alongside Target and BJ’s Wholesale Club— experienced reduced YoY visits during Q2. Conversely, Costco observed a 0.7 percent rise in YoY visits.

In July 2023, U.S. retail sales revenue,

continued from previous page continued on page 53

“Year-over-year weekly foot traffic

onwards.”

(FOD: 10/16)

(FOD: 10/16)

The NCASEF 47th Annual Convention and Trade Show at Caesars Palace Las Vegas was nothing short of spectacular, capturing the spirit of the event’s theme: “Building The Brand Together.” The convention was a melting pot of innovation and community, attended by 7-Eleven franchisees and their families from across the nation, alongside sponsoring and exhibiting vendors, and SEI executives. Over four action-packed days, attendees were treated to business-building seminars, fun activities, and a stellar two-day trade show featuring the hottest products and deals our valued vendor community has to offer.

The convention also offered a perfect blend of enjoyment and philanthropy, with a charity golf tournament at the TPC Las Vegas Golf Course to benefit Children’s Miracle Network Hospitals. Additional leisure activities included tickets to the High Roller Observation Wheel, providing attendees with a unique view of Las Vegas from above.

The evenings were equally memorable, with special events like the Charity Night Gala benefitting CMN Hospitals and the Grand Banquet on the final night. The Grand Banquet was particularly dazzling, featuring an awards ceremony to recognize standout franchisees and vendors, topped off by an electrifying performance by renowned Indian recording artist Mika Singh.

As you flip through this photo spread, relive the magic and camaraderie that embody the essence of the NCASEF Convention and Trade Show!

PepsiCo, Inc.

Anheuser-Busch

McLane Company Inc.

MONSTER Energy Company

Altria Group Distribution Company

Coca-Cola

PREMIUM

Celsius

Hostess Brands

Kellogg’s

BeatBox Beverages

Bon Appetit

Congo Brands

Constellation Brands

Molson Coors

Vixxo Corporation

BIC USA

Hershey Company

Ghost Energy

Glanbia Performance Nutrition

Mondelez International

Red Bull North America

Ferrara Candy

In Motion Design

Mark Anthony Brands

Perfetti Van Melle

Acosta Sales & Mktg

Advantage Solutions

Atkinson-Crawford Sales Co.

Aon Risk Services

Barbot Insurance Services

Bimbo Bakeries

BlueTriton Brands

Cintas Corporation

Ecolab

Firestone Walker Brewing Co.

Heineken USA

InComm

Mars Wrigley

Mini Melts Ice Cream

Morinaga America

RJ Reynolds Tobacco Co.

SRP Companies

Swedish Match North America

Swisher International

T-Mobile

Wonderful Pistachios & Almonds/Fiji

Water

TOURNAMENT

Bon Appetit

Reyes Coca-Cola Bottling

DIAMOND

Monster Energy Company

Fairlife

RUBY

Congo Brands

Constellation Brands

Geloso Beverage Group

Molson Coors

Perfetti Van Melle

SRP Companies

SAPPHIRE

BeatBox Beverages

Core-Mark

PepsiCo & Bud Light – Grand Banquet Entertainment

Monster Energy – Charity Night Gala

Celsius – High Roller Ferris Wheel Reception

22nd Century Group

7 Stars Trading

Acosta Sales & Mktg

Advantage Solutions

Altria Group Distribution Company

Anheuser-Busch

Aon Risk Services

Ape Beverages

Atkinson-Crawford Sales Co.

Barbot Insurance Services

Bayside Wireless

BeatBox Beverages

Benestar Brands

BIC USA

Big Ideas Marketing

Bimbo Bakeries

BlueTriton Brands

Bon Appetit

Boston Beer Company

Bridgford Foods

Bring It Home

Brownie Baker

Bubbies Ice Cream

CAB Enterprises – Electrolit

Campbell Soup Co.

Celsius

Century Snacks

Cintas Corporation

Coca-Cola

Congo Brands

Constellation Brands

Core-Mark

CROSSMARK Convenience

Danone North America

DermaCare BioSciences

Ecolab

EHP Labs

Ferrara Candy

FIFCO USA

Firestone Walker Brewing Co.

Geloso Beverage Group

Ghost Energy

Glanbia Performance Nutrition

Happy Dad Hard Seltzer

Heineken USA

Hershey Company

Hostess Brands

In Motion Design InComm

ITG Brands

Johnsonville Sausage

JUUL Labs

Kellogg’s

Keurig Dr Pepper

Kretek International

Lewer Agency

Lindt & Sprungli

Mark Anthony Brands

Mars Wrigley

McKee Foods

McLane Company Inc.

MegaMex Foods/Hormel-Don Miguel

Mini Melts Ice Cream

MIT 45

Molson Coors

Mondelez International

MONSTER Energy Company

Morinaga America

National Raisin Company

Nepa Wholesale

Paradox

Payality Powered by Payroll People

PepsiCo, Inc.

Perfetti Van Melle

Procter & Gamble

Promark

Red Bull North America

Remedy Organics

Republic Amusements

Republic Brands

RJ Reynolds Tobacco Co.

Ryse

Shankman & Associates

Sigma

Sonam Water

SRP Companies

Starco Brands

Stratus Group

Swedish Match North America

Sweetwood Smokehouse

Swisher International

T-Mobile

Talking Rain

Tehuacan Mineral Water

The Patch Brand

Turning Point Brands

Ultimate Sales & Services

Vixxo Corporation

Whatcha Burnin

Wonderful Pistachios & Almonds/Fiji Water

Zappo - Chance Branding

What a whirlwind four days we had at the NCASEF 47th Annual Convention and Trade Show held at Caesars Palace in Las Vegas. The theme of the event was “Building the Brand Together,” and I believe we certainly lived up to it. The convention was packed with franchisees from all across the country, and the venue was filled with positive energy. We were also graced with the presence of SEI executives, whose participation added valuable insights to our discussions. Last, but by no means least, our exhibiting and sponsoring vendors dazzled with their amazing trade show offerings and unwavering support.

of collaboration and innovation. The seminars were meticulously planned to deliver insights, tools, and strategies to strengthen our businesses. The objective of these sessions was simple—inform our franchisees and equip them with the best resources to prosper.

There was also plenty of room for relaxation and networking. The charity golf tournament at the TPC Las Vegas Golf Course benefitting Children Miracle Network Hospitals and the High Roller Observation Wheel were not just entertaining, they also served as poignant reminders of the power of community.

The awards ceremony at the Grand Banquet shined a spotlight on franchisees and vendors who’ve made remarkable contributions to our community. And the mesmerizing performance by renowned Indian recording artist Mika Singh added a special charm to the night that will be etched in our memories for years to come. It was truly the perfect ending to a stellar event.

The importance of unity in strengthening the 7-Eleven brand can’t be overstated. From franchisees to vendors and SEI representatives, each stakeholder plays a significant role in driving us forward. We gathered from various corners of the country, each with unique experiences, challenges, and perspectives, but with a common goal: To grow and evolve, both as individual business entities and as an integral part of the broader 7-Eleven network.

Our four-day event was a melting pot

The last two evenings of the convention were reserved for moments of celebration and gratitude. The Charity Night Gala and the Grand Banquet were elegantly executed, honoring our unified spirit. The Charity Night Gala in support of CMN Hospitals was an awe-inspiring testament to what we can achieve when we come together for a cause greater than ourselves. Not only did we enjoy silent and live auctions filled with incredible items, but the highlight of the night was the presentation of a $200,000 check to the organization. This charitable act shows that our 7-Eleven community doesn’t just talk about making a difference, we actively participate in bringing about positive change. It was an event that embodied the true essence of unity, and it makes me proud to be a part of this remarkable coalition.

A pivotal part of our convention was the two-day trade show, where our valued vendors showcased a variety of products and special deals designed to improve our retail offerings and ultimately enhance the customer experience. I want to extend my heartfelt thanks to all vendors who exhibited, as well as those who went above and beyond by sponsoring the convention. Your involvement in our national and local events isn’t just beneficial—it’s essential to our collective prosperity.

To all the franchisees who attended,

SUKHI SANDHU, NCASEF CHAIRMAN

“A pivotal part of our convention was the two-day trade show, where our valued vendors showcased a variety of products and special deals designed to improve our retail offerings and ultimately enhance the customer experience.”

“This charitable act shows that our 7-Eleven community doesn’t just talk about making a difference, we actively participate in bringing about positive change.”

“From franchisees to vendors and SEI representatives, each stakeholder plays a significant role in driving us forward.”

continued from page 21

your active participation added immense value to our convention. The exchange of ideas, the genuine feedback, and the profound commitment to the brand are what make these gatherings worthwhile. Lastly, I want to thank the SEI executives who attended. Your presence underscored the importance of a collaborative relationship between franchisees and the corporate team.

It’s through unity that we’ll continue to build a brand that’s not just profitable, but also impactful and enduring. Each one of us is a building block in the powerhouse that is 7-Eleven. When we come together, whether it’s for a grand event like this convention or in our dayto-day interactions, we fortify our brand.

Let’s carry the message of “Building the Brand Together” into every business decision we make, every customer we

serve, and every challenge we overcome. Once again, thank you all for contributing to the overwhelming success of the 47th Annual NCASEF Convention and Trade Show. Here’s to an exciting year ahead, building our brand together, united in purpose and vision.

The best way to stay informed of the latest changes and challenges to our 7-Eleven system-and the convenience industry, in general-is to join your local Franchise Owner’s Association. FOAs help franchisees share ideas and concerns, and allow us to approach our franchisor and vendor partners with a unified voice. Becoming an FOA member also makes you a member of the National Coalition, which consists of all 41 FOAs nationwide.

To join your local organization, contact the FOA president closest to you, or follow the instructions below to fill out an online membership form. If you cannot find the FOA closest to you, contact nationaloffice@ncasef. com for more information.

We welcome your participation!

1. Log in to 7Help using 7Hub (secured) in-store or using this link https:/7elevenna.servicenow.com/from any external device.

2. In the search bar type “FOA.”

3. Select the popup suggestion “FOA/ PAC:FRANCHISE OWNERS ASSOCIATION.”

4. Type “NONE” in the “Current FOA” box if you are joining an FOA for the first time or you are not a member of any other FOA.

5. Type in the full name of the FOA that you wish to join (No abbreviation) in the “Future FOA” box.

6. Type in the amount of monthly dues as instructed per local FOA.

7. Type “Please enroll (store number) as a member of (name of the local) FOA.”

8. Repeat Step 7.

9. Press the green submit icon.

“Let’s carry the message of ‘Building the Brand Together’ into every business decision we make, every customer we serve, and every challenge we overcome.”

“None of us is as great as all of us together”

BY JOE ROSSI, NCASEF

BY JOE ROSSI, NCASEF

Now that we’ve made it past the 100 Days of Summer, it seems apt to step back and assess not just our individual accomplishments but also our collective gains as part of the 7-Eleven franchisee community. We’ve weathered many storms together, including the impact of COVID-19 that disrupted the business environment on an unprecedented scale. While we are getting back to some sense of normalcy, there are still challenges we need to address collectively, such as labor issues and crime. Despite these hurdles, one thing remains clear: now is the time to reconnect with our franchisee community.

aren’t just opportunities to take a break from your daily grind—they’re crucial venues to share knowledge, solve common problems, and develop strategies for collective success. Even when it feels like there are not enough hours in the day, making time for FOA meetings and events is essential. The value derived from discussing issues with fellow franchisees—often leading to actionable insights—can’t be overstated.

locality. The larger the gathering, the broader the cross-section of experience and the richer the potential learning.

The past couple of years have been so centered on survival that many of us have inadvertently neglected the community aspect of being a 7-Eleven franchisee. But it’s important to remember that we didn’t get to where we are by isolating ourselves. We built our businesses by getting involved in our stores’ communities, by participating in events that brought people into our stores, and by supporting our fellow franchisees. The power of community isn’t just a feelgood concept, it’s a business imperative. Our local FOA meetings, for example, are not mere social gatherings—they are occasions for mutual learning and growth.

Think about the last time you attended a local FOA meeting or event. These

Soon, most local FOAs will host holiday parties. Make it a point to attend. These events offer a unique setting to understand your fellow franchisees as individuals, which can strengthen your professional relationships. After all, business isn’t always just about numbers, it’s also about people. And speaking of numbers, sharing knowledge with other franchisees at the annual NCASEF convention and trade show can also be invaluable. Many franchisees have reported implementing strategies learned at these events that have led to measurable improvements in their store performances.

Mark your calendar now for future franchisee community events, whether they are local FOA meetings, the NCASEF convention, or NCASEF Board meetings. Pre-planning ensures that you’ll make the time to be present and engaged. You might be surprised at how much you can learn from a national meeting, even if it’s not in your immediate

The fundamental truth is, we improve through interaction. Some of the most innovative ideas come from casual conversations where someone shares a tactic they’ve been quietly employing at their store. Such insights can be gamechanging, bringing about increased revenue or operational efficiencies. Lastly, don’t underestimate the value of subgroups within our larger franchisee community. If you find that your specific subgroup of a handful of 7-Eleven owners—be it regional or issue-focused—is not doing enough, take the initiative to organize activities. An informal lunch with a focused discussion topic can spark ideas that benefit everyone involved.

In a time when it’s easy to get lost in the day-to-day operations of our individual stores, let’s not forget the immense value that lies in franchisee community engagement. Let’s not forget to give back. As we head into the year-end and look forward to 2024, my message to each of you is this: reconnect, engage, and contribute to our franchisee community. It’s good for business and our brand.

“The power of community isn’t just a feel-good concept, it’s a business imperative.”

“Despite these hurdles, one thing remains clear: now is the time to reconnect with our franchisee community.”

EXECUTIVE VICE CHAIR

“The value derived from discussing issues with fellow franchisees—often leading to actionable insights—can’t be overstated.”

In the last issue of Avanti, we explored the turnover rates of franchised stores, which includes terminations of franchise agreements, non-renewals, repurchases by the franchisor, and abandonments of stores by franchisees. That examination did not include transfers in the calculation of turnover rates. In an excellent companion article in this issue, my colleague, Thomas Ayres, walks through the process of surrendering a franchised store.

default and staying in compliance with the franchise agreement and its operating standards.) Nevertheless, when such a sale is concluded, it is treated as a transfer rather than as a termination.

The number of transfers in the 7-Eleven system has been trending upward. Over the last five complete years, which included the introduction of the so-called 2018 Franchise Agreement and the COVID-19 pandemic, there were

an interest in the furniture, fixtures or equipment, these may not be sold without SEI consent.

Under the Franchise Agreement the person or entity to whom the franchisee sells or proposes to sell his or her location is called a “transferee”—in common parlance, the buyer.

That said, here is a checklist of the eight steps that SEI may require in the event of an assignment:

Transfers are sales of franchised locations from one franchisee to another franchisee. These transactions can be the result of distress or bad news, such as the death or incapacity of a franchisee, or good news in that a franchisee has reached the stage where he or she wants to retire or engage in other activities. Transfers sometimes occur when 7-Eleven gives a franchisee who has received a termination notice time to attempt to sell the location rather than having it terminated. (Termination notices can often be avoided by curing a

a total of 1,170 transfers in the United States. In the previous 5 years, from 2013 to 2017, there were 612 transfers, or approximately one-half of the number from 2018 to 2022.

The definition of a “transfer” and the requirements for transfers are summarized in Item 17 of the Franchise Disclosure Document (“FDD”) and in sections 25(b) and 25 (c) of the 2018 form of the Franchise Agreement.

As a threshold matter, a “transfer” includes not only a sale or assignment of the Franchise Agreement and your interest in the franchised location, but also a transfer of any of the shares of stock in a corporation that may hold the Franchise Agreement, and also any transfer of the membership interests in a limited liability company. In addition, because the franchisee does not own

• Release of Claims by Transferee. The transferee or buyer is required to execute a document that releases SEI from any liability for amounts paid by the transferee or any representations you may make to the transferee regarding the business. While SEI takes an active role in approving both the transferee and the transaction, it insulates itself from any liability to you or the buyer.

• List of Available Stores. In a provision unique to the 7-Eleven system, SEI reserves the right to provide the

“The transferee or buyer is required to execute a document that releases SEI from any liability for amounts paid by the transferee or any representations you may make to the transferee regarding the business.”

“Transfers sometimes occur when 7-Eleven gives a franchisee who has received a termination notice time to attempt to sell the location rather than having it terminated.”

continued from page 27

proposed transferee with a list of all 7-Eleven stores available to purchase in the general area where your store is located. This provision obviously helps the transferee in a variety of ways, but it is not particularly favorable to the franchisee seeking a sale.

• Release of Claims. In order to finalize the transaction, the franchisee must enter into (a) a mutual agreement with SEI to terminate the existing Franchise Agreement, (b) an indemnity in favor of SEI for any claims made by the transferee relating to the transaction, and (c) a general release by you in favor of SEI, which has the effect of wiping out and forever forgiving any claims you may have against your franchisor.

• Franchise Agreement in Effect. In order to be eligible to participate in a sale of your store, no termination of your Franchise Agreement can be pending, and you must be not in Material Breach of the Franchise Agreement. Material Breach is a defined term under Exhibit E to the Franchise Agreement, which in turn refers to 12 separate and distinct events listed in section 26(a) and 16 events listed in section 26(b) of the Franchise Agreement.

• Complete Required Training. SEI is required to approve or disapprove your proposed transferee for training within 60 days after it receives all information regarding the proposed transaction that it may reasonably require. The reasonably required information is not specified in the Franchise Agreement. Training must be successfully completed based on criteria and standards specified by SEI.

• Sign Then-Current Form of Franchise Agreement. The transferee must sign the then-current form of Franchise Agreement which may be materially different (and possibly less favorable to your buyer) than your Franchise Agreement at the time of sale. The transferee must also comply with all then-current financial terms, including those relating to the Down Payment, the 7-Eleven Charge, Franchise Fee, and other matters. These capitalized terms are also defined in Exhibit E to the Franchise Agreement.

• Meet All Qualifications. The transferee must, in the sole opinion of SEI, meet all qualifications to become a franchisee including those general qualifications set forth in the then-current 7-Eleven Operations Manual. According to the 2023 FDD, the Operations Manual

contains 1,009 pages. Provisions regarding the Operations Manual can be found in Section 4 of the 2018 form of Franchise Agreement.

• Comply with SEI Right of First Refusal. SEI has a right of first refusal, meaning that it has an opportunity to match any offer you may receive from anyone else to purchase your franchised business. You must notify SEI of any such offer you receive and provide whatever information and documentation regarding that offer that it may require. Once that information is submitted, SEI has 15 days to exercise its right of first refusal, in which event it must close the purchase within 60 days thereafter. It is important to note that such rights of first refusal are more or less standard in franchise agreements in the United States.

One way to measure the health of a franchise system is the extent to which franchisees are able to successfully navigate the many requirements for approval of the sale of their business, as well as their ability to harvest the goodwill value that they have created through their investment and hard work. We hope that this information is helpful to every franchisee in the system, especially those who are currently contemplating the possibility of a transfer.

“SEI has a right of first refusal, meaning that it has an opportunity to match any offer you may receive from anyone else to purchase your franchised business.”

“In order to be eligible to participate in a sale of your store, no termination of your Franchise Agreement can be pending, and you must be not in Material Breach of the Franchise Agreement.”

The retail industry is no stranger to challenges, from evolving consumer behaviors to increasing competition from e-commerce giants. However, there is an often-overlooked crisis within retail businesses that deserves attention: the high employee turnover rate. This unaddressed crisis is not only detrimental to the profitability and overall success of retail companies, but also poses a significant risk to the industry’s future.

Employee turnover has become a common issue plaguing retail businesses across the globe. The cycle often starts with employees feeling undervalued, overworked, and under-compensated. This leads to low job satisfaction, reduced motivation, and ultimately, high turnover rates. As a result, retail companies find themselves in a constant cycle of recruiting and training new employees, which is both time-consuming and costly.

1. Low Wages and Lack of Incentives: Retail employees are frequently paid minimal hourly wages, making it difficult for them to make ends meet. With low pay, limited career growth prospects, and inadequate benefits, employees find it tempting to seek better-paying opportunities elsewhere.

2. High Workload and Stress: Retail jobs are often demanding, requiring employees to handle numerous responsibilities simultaneously and face demanding customers. The constant pressure and stress affect employee motivation, leading to burnout and an increased desire to leave the job.

3. Inadequate Training and Development

Opportunities: Retail businesses often prioritize cost-cutting measures, including inadequate training programs for employees. This results in a lack of skill development, leaving employees feeling undervalued and unprepared for their roles, prompting them to search for better opportunities.

4. Limited Career Advancement: Many retail employees perceive a lack of growth potential within their organizations. This absence of clear career paths can discourage individuals from staying longterm, as they feel there is limited room for advancement.

1. Increased Costs: Employee turnover can be financially burdensome for retail businesses. Costs associated with recruiting, hiring, onboarding, and training new employees rack up quickly, negatively impacting the bottom line.

2. Decreased Customer Experience: Frequent turnover means a constant influx of new employees who lack familiarity with products and services, leading to lower customer satisfaction levels. A decline in customer experience can result in decreased sales and brand loyalty.

3. Poor Employee Morale and Productivity: A constant cycle of hiring and training new employees can act as a demotivator for remaining staff. When colleagues continuously leave, it creates an atmosphere of uncertainty and instability, leading to decreased productivity and employee dissatisfaction.

Solutions and Best Practices

1. Competitive Compensation and Benefits: Retail businesses must offer competitive

wages and benefits packages to attract and retain talented individuals. Implementing performance-based incentives and recognition programs can incentivize productivity and loyalty.

2. Ongoing Training and Development: Consistent investment in employee training and development can enhance their skills, job satisfaction, and loyalty. Offering opportunities for skill-building and career advancement within the organization promotes a sense of commitment.

3. Flexible Scheduling: Retail businesses can provide flexible scheduling options to accommodate the needs of their employees. This can improve work-life balance and, in turn, reduce turnover rates.

4. Employee Engagement and Support: Encouraging open communication, soliciting employee feedback, and providing support systems can contribute to a positive work environment. Regularly recognizing employee efforts and achievements fosters a sense of belonging and boosts morale.

The employee turnover crisis in the retail industry is a pressing issue that cannot be ignored. By addressing the root causes and implementing strategies to improve employee satisfaction and retention, retail businesses can break the cycle of high turnover rates. Taking proactive measures to invest in their employees will not only lead to a more stable and motivated workforce, but also enhance the overall success and profitability of the retail industry as a whole.

Franchisees should review the following reports on a daily, weekly, and monthly basis in order to analyze how your store is performing and to identify opportunities for improvement. All the reports mentioned below can be accessed on 7-Report.

This report provides information on your Daily Purchases, Beginning and Ending Inventory Level of DMR date, Audit Adjustments, Past Invoices, Price Overrides, Markups and Markdowns, Write Offs, Daily Inventory Sales, and very importantly— MTD GP% of purchases during the month.

•

This report provides information on Price Overrides, Markups/Markdowns, Retail Adjustments and Retail Adjustment Amounts associated with the Sales Transactions of items within a business day. Please note: The POR report is a summary of Inventoried Items Transactions ONLY.

• NIS—Non-Inventoried Sales

This report provides Sales Transactions of Proprietary Beverages, SBT, and Commission Items.

This report provides a detailed breakdown of all the Promos/Discounts issued at the store, which helps to check the performance at the Promo level.

This report provides information on maintenance charges, amount withdrawn from the Draw Portal, and other businessrelated miscellaneous amounts that are paid on your behalf.

• ERI—Extended Retail Invoice

This report provides information on the Daily Invoices Detail for purchases that are reported on the DMR for DSD, and provides information on how their retail was calculated—i.e., Suggested Retail Price (SRP), Custom Retail Price (CRP) and Factored (FCTR).

• WDR—Wholesaler Detail Report

This daily report provides very vital and useful information on your purchases, and needs to be reviewed to ensure the accuracy of your Invoice. (Invoice Unit Cost and Retail, Selling Unit Retail Price, Invoice Quantity, Extended Cost and Retail)

• IMR—Inventory Management Report

Franchisees should review this report every week in order to understand the purchase trend over weekly overage. The IMR reveals information on the irregularity in ordering.

• AP9—Accounts Payable Summary

This report provides information on your maintenance charges and other miscellaneous amounts that 7-Eleven pays on your behalf. The AP9 is the summary report of the APD.

• 11A—Detailed General Ledger

This report provides all the charges that appeared on 48A—Franchise Financial Summary. Apart from the charge details, this report provides Net Activity of the month and beginning balance of all the charges, including your purchases during the month.

• 48A—Franchise Financial Summary

This report provides all the financial

information, including profit or loss, balance on Open Account, and Minimum Net Worth.

The above information is very basic, but is important as it helps you understand your store’s finances. Apart from above reports, franchisees should also review the following Daily/Weekly/Monthly reports in order to understand your store in detail.

DAILY REPORT

• RA1D—Daily Bank Activity

MONTHLY REPORT

• BRS—Final Billback/Scanback report to verify the accuracy of Billback amount in 48A.

• CCE—Monthly Credit Card Fees

Expanse Report to verify the accuracy of credit card fees in 48A.

• MAP—Product Margin Report

This is monthly report provides very useful information on the Current Period and Year-to-Date (PSA Category, Cost, Retail, % to the Retail, % to the Purchase Margin, % Purchase Margin Contribution, Ending Inventory, Non-Inventoried Sales, Inventoried Sales, Inventory Turn, Gasoline Sales, Transaction Count, Average Daily Transaction Count, and Average Sales).

All of the above-mentioned reports contain essential information that will help you better understand how your store is operating, and if there are any measures you can take to improve its performance.

You’ve fought the good fight, but you may still feel that the store isn’t worth the hassle, and no one seems to want to buy it. No franchisee wants to give up, but sometimes it makes good business sense. According to 7-Eleven’s Franchise Disclosure Document issued April 1, 2023, 347 stores ceased operations and 670 stores were reacquired by the franchisor in 2020, 2021, and 2022, so franchisees often voluntarily terminate their agreements. Here is a brief checklist of how to surrender your store in an orderly fashion:

First, you need to notify the franchisor in writing. Paragraph 27(b) of your franchise agreement states that if you want to avoid a $5,000 termination fee, you must give more than 30 days’ written notice. You can give written notice as short as 72 hours if you want, but be prepared for the $5,000 fee to be taken from your Open Account (more on that later). Do not expect an SMS or WhatsApp message sent to your Field Manager to do the trick: you should at least email your notice and ask for confirmation of receipt.

Second, you need to participate in the closeout procedure. If you just walk away, you may be charged for things that you could have addressed yourself and your Final Inventory amount may be less than you expected. Your store should be in the same condition you received it, except for normal wear and tear. 7-Eleven will charge your Open Account if it feels that any cleaning or maintenance needs to be done, so look around and make sure things are

in pretty good shape. Be present when the Final Inventory is taken so you can correct any entries you think are wrong. Take pictures or videos if it helps prove your case. Once the Cost Value of the Final Inventory is determined, it is very difficult to change it a month later.

Third, take all paper copies of business licenses in your name or other materials that are personal to you; otherwise, they will be thrown out. (You may need to transfer some licenses and permits to 7-Eleven.) Cancel any licenses and permits in your name so the government doesn’t charge you later. Relatedly, settle your accounts with any nonrecommended vendors and cancel any future services or deliveries. Contact the worker’s compensation company to cancel the policy and request a refund. If you have a paper version of the Operations Manual, give it back for a $100 credit. If you’ve downloaded the Operations Manual to your laptop or tablet and are not operating any other stores, then delete it.

Fourth, make sure 7-Eleven has your correct contact information and physical address so you promptly receive the initial settlement worksheet and money 30 days from the changeover day. You will not have access to the store’s ISP and data, so if your address changes, call Customer Service at 1-855-711-0711 to update it. You will receive the greater of $15,000 or 25 percent of your total assets. If you signed the franchise agreement in 2019 or after, you will receive the greater of $10,000 or 25 percent of your total assets. (If you’re in New Jersey, New York, Connecticut, or Illinois, you may receive the greater of $35,000 or 25 percent of your total assets due to bulk sales provisions.)

Fifth, be patient because the final summaries will come within 105 days after the last day of the month in which the changeover occurred, which means it could take more than four months. If you have a credit balance in your Open Account, then you receive payment in that amount. (A debit balance means that you have to pay that amount.) If you still dispute the amount, then do not deposit the check because that will be considered an acceptance and a release of claims.

If you have any questions about surrendering your store or anything else relating to your franchise agreement, you can reach me at tayres@wfrllp.com and 617.970.0063.

“Cancel any licenses and permits in your name so the government doesn’t charge you later. Relatedly, settle your accounts with any nonrecommended vendors and cancel any future services or deliveries.”

The Greater Oregon Franchise Owners Association (FOA) successfully hosted their annual golf tournament on July 17, 2023, at Pumpkin Ridge Golf Club in North Plains, Oregon. The event was attended by 192 golfers and raised a commendable $11,711 for the Children’s Miracle Network Hospitals (CMN Hospitals). Among the attendees of both events were NCASEF Chairman Sukhi Sandhu and Jawad Ursani, Secretary of the FOA of Southern California. Several key representatives from 7-Eleven, Inc. were also present, including Sembe Cole, Vice President of Western Franchise Operations; Becky Stockwell, Regional Director of Operations Western Zone;

and Market Leaders Jessica Weese and Jason Mollet, as well as most of the area leaders from Oregon.

Following the golf event, a trade show was organized at the same venue on July 18. The show featured 48 vendors, presenting an excellent networking and business opportunity for franchisees and suppliers.

Both the golf tournament and the trade show exemplified the collaborative spirit of franchisees, vendors, and SEI leadership, underlining the Greater Oregon FOA’s dedication to philanthropy and the growth of the 7-Eleven brand.

Great products and deals filled the showroom floor of Caesars Atlantic City Resort in New Jersey during the Delaware Valley FOA’s annual trade show, held on July 20, 2023. The event was an extravagant affair featuring 60 exhibiting vendors, big prize giveaways, and a special live performance by a celebrated singer from Pakistan. In terms of prizes, attendees had the chance to win a grand cash prize of $3,000, a bicycle, a 75-inch TV, two Xbox video game consoles, and an assortment of gift

cards totaling $5,000.

NCASEF Chairman Sukhi Sandhu was among the distinguished attendees, marking the event with his presence. Mr. Sandhu was joined by key figures from the SEI team, specifically from the Accounting and Franchising departments. Representatives from facility management company Vixxo were also in attendance. Adding to the success of the event were the presidents and vice presidents of other FOAs, including those from UFOLINY, Detroit FOA, and the

Alliance of 7-Eleven Franchisees, making the event a significant assembly of franchisee leaders.

This gathering not only provided a platform for vendors to showcase their products, but also allowed for networking opportunities among different arms of the 7-Eleven franchise universe. With its prize giveaways and a diverse range of attendees, the Delaware Valley FOA’s trade show has set a high bar for future events.

Lately, there’s been a lot of talk about raising the minimum wage—that’s the lowest pay someone can legally receive. Some folks say it’s a good thing because it helps workers earn more money. But for 7-Eleven franchisees, it’s not that simple. We’re going to look at why this can be a problem for us and what’s been happening in some states where the minimum wage went up.

You might have heard about politicians who really want the minimum wage to go up. They say it’ll make things better for workers. But the thing is, they might not be thinking about what this means for people who own small businesses like 7-Eleven. There’s even a big court case in Michigan about this, that could potentially lead to a significant increase in the state minimum wage.

One of the most significant challenges with implementing minimum wage hikes is the pressure placed on small businesses like our 7-Eleven stores. Small businesses often operate on thin margins and may not have the capital or the revenue stream to absorb a sudden increase in labor costs. When the minimum wage rises quickly, small businesses may face two untenable options: cut staff or raise prices. Cutting staff can erode the quality of service or products, while raising prices can drive away cost-sensitive customers. Both scenarios risk the sustainability of small businesses, potentially resulting in closures that harm local economies and lead to job losses.

A rapid increase in the minimum wage can also contribute to inflation. When businesses raise their prices to offset higher labor costs, the cost of goods and services increase, affecting everyone. Furthermore, a sudden surge in income for minimum-wage workers can drive up the cost of rent and other living expenses in areas where they live. In essence, any benefit from higher wages may be negated by a proportionate increase in the cost of living.

7-Eleven franchisees have a special challenge. Most of the money we make goes towards paying our workers. If the minimum wage increases significantly, we might have less money left over to keep our stores running properly and make a profit. This could mean fewer job opportunities for people in the communities that our stores serve, and even some stores having to close down.

The whole minimum wage situation is like a tricky balancing act. It’s important to pay workers fairly, but it’s also important to make sure small businesses, like our 7-Eleven stores, can keep going strong. People need jobs, and stores play a big part in local communities. So, it’s like figuring out a puzzle where both workers and franchisees win.

Let’s look at a few places where the minimum wage has gone up a lot over the past five years:

Five Years Ago: Workers earned at least $9.25 per hour.

Now: Workers get at least $13.25 per hour. Increase: About 43.24 percent.

2. New York

Five Years Ago: Workers earned at least $9 per hour.

Now: Workers get at least $13.20 per hour. Increase: About 46.67 percent.

3. California

Five Years Ago: Workers earned at least $10 per hour.

Now: Workers get at least $15.00 per hour. Increase: 50 percent.

4. Washington

Five Years Ago: Workers earned at least $9.47 per hour.

Now: Workers get at least $14.49 per hour. Increase: About 52.96 percent.

5. Massachusetts

Five Years Ago: Workers earned at least $11 per hour.

Now: Workers get at least $14.25 per hour. Increase: About 29.55 percent

Being a 7-Eleven franchisee is rewarding, but it isn’t easy, especially when it comes to the minimum wage challenge. While it’s important to make sure workers are paid fairly, it’s also important to think about how raising wages quickly can affect our stores. We need to find a way where both workers and franchisees can be happy because a strong community needs both jobs and stores to thrive.

You’re a business operator. Tending to hundreds of customers’ needs a day, on top of the behind-thescenes management of your 7-Eleven location(s) isn’t easy. The last thing you want to have to worry about is if your night shift cashier is going to show up for work on a given day.

That’s where we come in. Paradox completely automates the hiring experience, from the initial contact through onboarding. We automatically handle all candidate screening and scheduling so you can focus on making sure customers keep coming back to your store.

Here are five reasons you need to transform your hiring process with Paradox.

Paradox actually helps your business save money. A McAlister Deli’s franchise organization improved their candidate flow by more than 42X, while simultaneously reducing their paid job advertising spend by 70 percent and their employee turnover by more than 60 percent. The result: An influx in top talent, staffed stores, and money in the franchise owner’s wallet.

So not only is our technology saving time and reducing headaches for hiring teams, it’s also impacting the bottom line of the business—and it’s doing it almost instantly.

Speed is key to attracting highdemand, frontline employees. A difficult application results in high candidate drop-off rates, making it impossible to hire quickly.

With Paradox, candidates can prequalify for a position in one minute and apply in two minutes via text. And because these processes are automated, they can happen 24/7, not just when your hiring managers are available. A candidate can reach out about open roles at 11:55 PM and be scheduled for an interview by midnight.

A leading retailer used Paradox to shorten their interview scheduling process from days to minutes, with an average schedule time under seven minutes. Hiring managers no longer wasted hours each day looking back and

customer).

4. It’ll Keep Your Hiring Compliant Paradox doesn’t stop working after a job offer is sent and accepted. To ensure a positive experience all the way to the first day on the job, we handle onboarding and employee verification processes as well.

Digital onboarding documents like Form I-9 and WOTC are automated and sent to candidates through text message, even sending reminders on deadlines to complete the forms. This ensures candidates don’t forget to complete all necessary documents, and understand what is expected of them for their first day.

Put yourself in the shoes of a candidate. You get excited about working at 7-Eleven, but then find out the application process is long and difficult. You end up disinterested and frustrated, and this may even discourage you from shopping at 7-Eleven in the future.

forth at their calendar, and candidates moved along in the process much quicker, creating less room for drop-off.

With Paradox, 7-Eleven candidates can apply in Spanish, English, or French. This ensures an immersive and personal experience for every candidate while helping them stay comfortable and confident through the hiring process. This also increases your volume of candidates without any extra work.

With demand for bilingual workers more than doubling in recent years, this flexibility is vital to creating seamless experiences for every candidate (and

With Paradox, applying for a job is as easy as sending a text. Candidates don’t even have to leave their messaging app—everything happens in the initial conversation. This creates a modern, sleek, and people-friendly experience that matches the 7-Eleven brand.

Companies that use Paradox end up getting overwhelming positive responses from candidates, often because they had never seen hiring this easy. Paradox makes your hiring process simple, fast, and fit for any customer. Best of all, you won’t have to worry about unfilled positions again.

“Paradox completely automates the hiring experience, from the initial contact through onboarding.”

What if you or one of your employees suffers a back or strain injury and is unable to work? Employee back, shoulder and knee injuries can occur in the store from lifting, pushing/pulling, reaching, and slip and falls. These injuries can occur from a single event but many times it’s an accumulation of small events and poor fitness over days and even years. Back injuries are one of the most costly injuries to businesses and are a common cause of worker’s compensation claims at 7-Eleven stores.

Now that the 100 days of summer have ended, it’s important to assess how you did in preventing strain injuries and look for improvement ideas in the future.

The cost of a back or shoulder injury can be significant because of medical bills, continuing therapy, lost time, and in serious cases the employee may need surgery or be unable to return to their regular duties. In general business, NCCI estimates that the average cost of a low back injury is $37,000.

• Changing a 5g. BIB— $42,237

• Repetitive stocking using the same arm—$6,920

• Employee throwing trash into the dumpster—$2,425

• Lifting a case of water in the cooler—$9,610

1. Improper technique while lifting or carrying.

2. Lifting too much.

3. Sudden motion or twisting.

4. Slip, trip, and fall.

5. Lack of fitness.

6. Poor posture when standing, bending, or reaching.

although 2022 saw an uptick. And, the costs tend to increase over time as claims costs develop over time.

Common Causes of Back or Strain Injuries in the Stores

• Lifting bag in a box (BIB).

• Moving cases of beer or soda.

• Handling full trash bags, especially with wet coffee grounds.

• Slip and fall while stocking or throwing trash.

At MSIG-insured franchise stores, 17 percent of all injuries involved strains and overexertion as the basic sources of claims. But, the severity or medical/lost time costs are 35 percent of the total. Here are the costs and count of strain claims since 2018.

It’s valuable to note that there is an improvement in the number of strains,

• Repetitive bending to the floor while stocking.

• Standing at the register on a hard floor without a mat.

• Pushing cases of milk inside the cooler.

• Overhead reaching while stocking the cooler or shelves.

Here are a few examples of franchisee store back or strain injury cases:

“Back injuries are one of the most costly injuries to businesses and are a common cause of worker’s compensation claims at 7-Eleven stores.”

The Texas FOA recently participated in the Northwest Independent School District’s Back to School Fair in Justin Texas for the third year in a row. The group handed out over 1,000 free Slurpees and Mini Melts to kids, parents, and other attendees. The Texas FOA thanks Market 1611 Market Leader Ken Kieweg and his team for supporting the event.

continued from page 47

• Most liquids weigh 8.3 pounds per gallon. Milk is 8.6 pounds.

• A 24-count of bottled beer weighs 35-40 pounds.

• A 5 g. bag in a box weighs 43 pounds.

• 10 pounds at arm’s length puts almost 100 pounds of force on your lower back.

1. Train your employees in safe lifting, and encourage stretching and fitness.

2. Most employees should not lift more than 25 pounds without help.

3. Are box weights within the employee’s lifting ability?

4. Bag in a box—keep full boxes off the floor. 5 g. boxes should be placed above the knees and below the shoulders.

• Plan the lift—where will the case or product go?

• Check the load—is it as heavy or light as expected?

• Know your limits—get help.

• Get a good grip.

• Bend your knees, not your waist.

• Hold the item close (fully extended arms can increase the load by 10 times).

• Move your feet—do not twist at the waist.

• Avoid lifting heavier items from below the knees or above the shoulders.

• Wear sturdy shoes with a cushioned insole.

5. BIBs should be replaced during shifts with 2 employees.

6. Stock room and cooler should have clear space to allow for proper lifting/handling methods and to reduce reaching.

7.Add cameras in the vault and backroom to document an injury (many “unidentified” injuries occur here).

8. Incoming deliveries should be placed where employees can easily grasp and carry.

9. Make sure stacks of beverages are stable.

10. Encourage milk and other caseloads are delivered only 4 high.

11. Keep crates stocked in the cooler 4 high or less.

12. Crates or case goods should be kept on the dollies in the cooler for easier movement.

13. Store dollies in a designated space or on a holder to prevent trips and falls.

14. A long-handled hook device should be used to limit reaching for lightweight items like cups.

15. Stocking lower shelves should be done using a small chair or stool, or a knee pad on the floor to minimize bending.

16. Use a sturdy step stool to reach high shelves.

17.Trash bags should be emptied frequently, especially if there are wet coffee grounds.

18. Dumpsters should have a fold-down side or opening so employees don’t have to toss trash bags over the top.

19. Keep floors clean and dry—a slip can result in a back strain.

20. A cushioned mat at the registers can improve back health and lessen fatigue.

If you need assistance with injury prevention resources, please contact your broker, agent, or me at the contact info below.

“At MSIG-insured franchise stores, 17 percent of all injuries involved strains and overexertion as the basic sources of claims.”Without space, it is difficult to lift these items properly. The upper and lower shelves are danger zones.

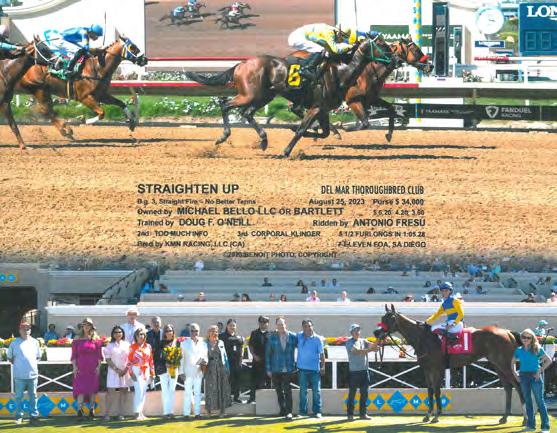

The San Diego FOA celebrated its 30th Annual Charity Golf Tournament on July 12, 2023, at the picturesque Rancho Bernardo Inn in San Diego. This year’s event was extra special as it marked three decades of community engagement and philanthropy, with the proceeds benefiting Rady Children’s Hospital San Diego. A total of 173 golfers attended the charity tournament—a perfect mixture of franchisees and valued vendors—and the celebratory atmosphere was capped off with a banquet dinner held in the Bernardo West. The tournament’s first-place

winners included Roy Sawaya, Eric Horan, Steve Menefee, and Gary Walia, while the Closest to the Pin accolade was awarded to NCASEF Vice Chairman Nick Bhullar.

The event drew significant participation from industry vendors, amplifying the spirit of collaboration. In addition to individual players and teams, Tee Sponsorships added an extra layer of support and were provided by Beam Suntory, Sahara Stock & Go Wholesale, Phaze International, and 21 ROCS. Special guests included NCASEF Chairman

Sukhi Sandhu and Executive Vice Chairman Nick Bhullar, as well as franchisees from various FOAs such as the Joe Saraceno FOA, the FOA of Greater Los Angeles, and the FOA of Southern California.

Beyond the competitive fun and networking, the heart of the event was its charitable mission. Attendees and sponsors alike contributed generously, underscoring the FOA’s long-standing adherence to social responsibility.

The San Diego FOA sends a special thanks to the event’s aforementioned Tee Sponsors and participating vendors:

• Alesmith

• Altria

• Anheuser Busch

• Ballast Point

• Bang Energy

• Blue Triton

• Body Armor

• Boston Beer

• C-4

• Coca-Cola

• Constellation Brands

• Fairlife

• Geloso Beverage

• Heineken USA

• John Lenore

• Mark Anthony Brands

• McLane

• Molson Coors

• Monster Energy

• Pepsi

• Red Bull

• Sigma

• SRP

• Stone Distributing

• Stratus Group

• Swisher

The NCASEF 47th Annual Convention & Tradeshow was an incredible showcase of the partnership between Children’s Miracle Network Hospitals (CMN Hospitals) and the National Coalition of Associations of 7-Eleven Franchisees.

Monday: TPC Las Vegas Golf Outing Benefiting Children’s Miracle Network Hospitals

The week kicked off with a successful golf outing. Over 140 golfers braved the Las Vegas heat to enjoy time at the beautiful TPC Las Vegas. Funds from the golf outing were encompassed in the check presented to CMN Hospitals during the Annual Gala on Wednesday, August 2.

Tuesday: Convention Opening & Annual Charity Night Sponsored by Monster Energy

The CMN Hospitals booth showcased how our collective efforts provide member hospitals with the critical funds they need to advance pediatric healthcare at large, ultimately improving individual patients’ health, protecting our children’s futures, and enhancing our communities.

Spencer Haywood, four-time NBA AllStar and Hall of Famer, stopped by the CMN Hospitals booth for a meet-andgreet. Fans of all ages stopped by for a picture, autograph, and basketball advice. Spencer Haywood is a proud supporter of Children’s Miracle Network Hospitals!

The Tuesday evening Annual Charity Night was sponsored by Monster Energy. The evening consisted of presentations, awards, and successful live and silent auctions. At the end of the event, individuals generously gave additional donations through a fundraising effort led by NCASEF Chairman Sukhi Sandhu. Together, we had the opportunity to

celebrate the incredible impact of the partnership between NCASEF and CMN Hospitals in 2022. A special thank you to our award winners for their continued effort and dedication to change kids’ health to change the future.

2022 Top Fundraising Franchisees

(Store Fundraising)

• Jeannine Christensen

• Donald Wills

• Harshil Patel

2022 Top Fundraising FOAs

(Event Fundraising & Store Fundraising)

• Eastern Virginia FOA

• Rocky Mountain FOA

• Central Florida FOA

Wednesday: Annual Gala & Check Presentation

The week culminated with a check for $200,000 being presented to Children’s Miracle Network Hospitals during the Annual Gala. The check funds will go to the local member hospital of each donor or FOA.

These funds are unrestricted and go to each hospital’s most urgent needs, whether that’s providing care to children without insurance, investing in research that discovers life-saving treatments and cures, training the next generation of doctors and nurses, or offering families comfort and peace of mind during the most trying moments of their lives.

Thank you, NCASEF! We couldn’t achieve our mission without you. Together we can change kids’ health and the future— for all of us.

When we positively change the health of even one child, we create a ripple effect felt in our neighborhoods for years to come. When we ensure our children can lead healthy, fulfilling lives, we foster the inventors, artists, leaders, and families of tomorrow.

Children’s hospitals are on the frontlines when it comes to protecting the health of future generations. But they can’t do it alone. We are committed to serving our neighbors to meet their everyday needs. So together, we can build a better tomorrow.

Children’s Miracle Network Hospitals is proud to be the National Coalition of Associations of 7-Eleven Franchisees’ charity of choice. With the support of NCASEF and local FOAs, CMN Hospitals raises critical funds for 170 children’s hospitals across the U.S. to help fulfill their most urgent needs. We make all this possible at the local level. When you donate through NCASEF or your local FOA, the donation goes to your local member hospital.

Your donations allow each hospital to be flexible to address the most urgent needs in your community, while also preparing

By improving medical equipment, facilities, and treatments, children’s hospitals are better equipped to address the most challenging health issues of our day.

and planning for tomorrow. With your support, we can change kids’ health to change the future.

“At the end of the event, individuals generously gave additional donations through a fundraising effort led by NCASEF Chairman Sukhi Sandhu.”

The Atlanta City Council in Georgia recently approved legislation that will require gas stations and convenience stores to install and maintain video surveillance systems to help stop shootings, robberies, and carjackings, reported Atlanta News First. • Dollar General has partnered with retail tech company AiFi to test cashierless checkout at one of its stores in North Carolina, reported Supermarket News. Similar to Amazon’s Just Walk Out technology, AiFi’s system uses cameras to monitor what items shoppers leave the store with and charge them accordingly. • A Walmart warehouse in Brooksville, Florida has shifted to automation to handle most products and is a prototype of the company’s larger plans to fully or partially automate its more than 100 warehouses across the United States, reported the Wall Street Journal. • Wawa recently launched its own pizza in over 900 locations across the Mid-Atlantic and Florida, with options available via in-store touchscreens or their app. The pizzas are made to order using fresh ingredients and baked in dedicated ovens, with a variety of toppings available. • Seven & I Holdings recently replaced the president of Sogo & Seibu in an apparent move to pave the way for a sale of the department store unit, reported The Japan Times. Seven & I hopes that the new president, Hiroto Taguchi, will help accelerate the talks to sell Sogo & Seibu. • Albertsons and Safeway recently launched Vine & Cellar, a digital platform delivering curated wines from regional and specialty vineyards to consumers across California, with offerings ranging from $10 to over $1,000 per bottle, reported Drug Store News. • The global contactless payments market is expected to be valued at $90.6 billion by 2032 from $22.4 billion in 2022, with a CAGR of 15.4 percent during the forecast period 2023 to 2032, according to a new report by Market.Us. North America is forecast to be the most lucrative market, with a share of 30 percent during the forecast period. •

including both discretionary general merchandise and consumer packaged goods (CPG), increased 2 percent compared to the same month last year, and unit sales declined 2 percent, according to Circana. Discretionary general merchandise spending declines continued with a 4 percent drop in dollar sales and 7 percent decrease in unit sales compared to July 2022. CPG spending remained elevated with 4 percent growth in food and beverage, and a 3 percent increase in non-edible revenue. However, the impact of elevated prices on demand are evident in CPG, with unit sales falling 1 percent and 3 percent respectively across edible and nonedible segments. Overall, discretionary general merchandise spending declines continued into the first week of August with another 5 percent year-over-year decline in sales revenue, and 8 percent drop in unit sales.

A new study conducted by global payments consulting firm CMSPI has revealed that the passage of the Credit Card Competition Act would have virtually no impact on credit card rewards, according to the Merchants Payments Coalition. The research estimates that credit card rewards would be reduced by less than one-tenth of 1 percent if the legislation becomes law. Furthermore, it found that six out of the 10 largest U.S. card issuers have a 30 percent profit on swipe fees, more than enough to offset reduced revenue and maintain current reward levels. The study highlighted historical precedents like Australia where credit card swipe fees were capped in 2003, resulting in minimal impacts on rewards. Comparatively, U.S. rewards per dollar would drop a minuscule 0.097 percent.

continued from page 13 continued on page 57

The card industry’s threats to eliminate or reduce rewards in other places that have reduced swipe fees were described as idle threats, as rewards continued to be offered after reforms.

Ampm recently launched its very first autonomous arena c-store called “Ampm ASAP Grab and Go” at San Francisco’s Chase Center, home to the NBA team Golden State Warriors, reported C-Store Dive. Incorporating AiFi and Verizon Business technology, this store offers a seamless shopping experience where customers can swipe their credit card upon entry, pick up their desired items, and simply walk out. This trend of frictionless technology in convenience stores is becoming increasingly prominent in arenas, combining both swift service and branded experiences for sports enthusiasts.

The Ampm ASAP Grab and Go store was first trialed during the 2022-23 NBA playoffs and has now been inaugurated for all Chase Center events. Positioned conveniently on the main concourse near portal 19, the store offers a variety of snacks and beverages, including beer, wine, and Ampm’s signature cookies. According to Ampm’s Vice President of Convenience, the store’s advanced selfcheckout technology ensures shorter wait times, an ideal feature for arenas where fans don’t want to miss pivotal moments of games or shows.

New York State recently introduced an additional one-dollar tax per pack of cigarettes, and the New York Association

continued on page 54

continued from page 53

of Convenience Stores (NYACS) has warned that this move might backfire, pushing consumers towards illicit cigarettes and causing legitimate retailers to lose significant business, reported WREN News. While understanding the state’s goal of reducing smoking, NYACS President Kent Sopris said that the tax might inadvertently promote the rise of illegal vendors who evade taxes and sell unauthorized vapes. He also emphasized that convenience stores, which derive nearly a third of their business from tobacco sales, will also miss out on associated sales of drinks and sandwiches. Sopris advocated for stricter tobacco law enforcement over increased taxation.

collaborative, with Kellogg employees worldwide contributing name suggestions and feedback, resulting in thousands of proposed names. Notably, many suggestions celebrated the company’s enduring legacy, as seen in the final chosen names.

Robomart, a Los Angeles-based startup, aims to redefine the shopping experience by introducing “store-hailing”—a concept where consumers can summon a mini, selfdriving store stocked with items right to their doorstep, reported Tech Crunch. Initially launched in 2018, the idea is to provide a more accurate and convenient shopping alternative to existing online grocery apps, which often misrepresent stock availability leading to order mistakes. The firm recently secured a $2 million seed round, bringing their total funding to $3.4 million.

Kellogg Company recently unveiled the names for the future companies it will create through its planned separation into two public companies focused on global snacking and North American cereal. The global snacking, plant-based foods, international cereal and noodles, and North American frozen breakfast sector will be branded as “Kellanova.” This entity is set to oversee a plethora of internationally recognized brands, such as Pringles, Cheez-It, and PopTarts.

The North American cereal division will operate under the name “WK Kellogg Co.” Representing a significant portion of the cereal market in the U.S., Canada, and the Caribbean, this division boasts iconic cereal brands like Frosted Flakes, Froot Loops, and Mini-Wheats. The company stated that the naming process was deeply

Additionally, Robomart has announced their new product, the Haven, which will join their existing Oasis model. While the Oasis model, launched in 2020, targets restaurants and has around 100 vehicles contracted (with Ben & Jerry’s as a notable customer), the Haven is set to cater to supermarkets and convenience stores, and plans to commence deliveries by 2025. Robomart’s Haven offers retailers the option of custom branding and can house approximately 300 SKUs.

After successfully transitioning from $1 to

$1.25 pricing last year, Dollar Tree is setting its sights on higher price points ranging from $2 to $5, primarily for food and beverage items, reported Winsight Grocery Business. The discount retailer announced its new strategy during its annual investor conference recently, noting that the previous price shift, coined BTD (Breaking the Dollar), has set the stage for further price increases. According to CEO Rick Dreiling, the move to multiple price points allows for a wider assortment of goods, including national brands and bigger pack sizes, as they aim to capture sales that their customers are

“Dollar Tree is setting its sights on higher price points ranging from $2 to $5, primarily for food and beverage items.”

currently making elsewhere.

Dollar Tree had initially begun testing its multi-price “Dollar Tree Plus” offerings in 2019, a program that expanded to 2,500 locations by the end of 2022, and is expected to reach 4,300 of the retailer’s over 8,000 stores by the end of 2023. While the initial product mix was skewed towards seasonal discretionary items, Dollar Tree is now focusing on capturing more of the grocery market share. As it introduces more prices, Dollar Tree also plans to maintain its opening price point as the core assortment and is considering reducing the price of 300 to 400 items back to $1.

Amid soaring grocery prices and lingering

continued on page 57

“NYACS said New York’s cigarette tax increase might backfire, causing legitimate retailers to lose significant business.”

continued from page 54