Convenience store value sales saw a positive trend in the first quarter of 2024, with 23 out of 32 countries reporting year-over-year growth, according to the NACS/ NIQ Q1 2024 Global Convenience Store Industry Report. This growth was most notable in Latin America, the Asia-Pacific region, and Europe, where eight countries experienced double- or tripledigit increases in value sales— an improvement from the seven countries that saw such growth in the previous quarter. Additionally, twelve countries showed improved growth compared to the prior quarter, with most of these markets building on the solid gains from Q4 2023. However, some countries did see a slight decline in growth rates compared to the previous quarter.

In the United States, convenience store dollar sales declined by 2.1 percent in Q1 2024, while the remaining market saw a modest

increase of 1.8 percent. Excluding tobacco products, the decline in convenience store sales was less severe at 0.5 percent. Inflation continued to impact convenience stores more than other markets, with average unit prices rising by 3.6 percent, and even more significantly by 4.5 percent when excluding tobacco.

Liquor (+15.8 percent), wine (+7.6 percent), and ice (+3.5 percent) were among the top growth categories in the U.S., continuing their strong performance from Q4 2023, while health and beauty care (+2.8 percent) and other dairy deli products (+1.9 percent) emerged as new growth leaders, replacing salty snacks and packaged beverages.

Convenience stores are intensifying their efforts to compete with quick-service restaurants (QSRs) by rolling continued on page 12

The strength of an independent trade association lies in its ability to promote, protect and advance the best interests of its members, something no single member or advisory group can achieve. The independent trade association can create a better understanding between its members and those with whom it deals. National Coalition offices are located in Ceres, California.

3645 Mitchell Road Suite B Ceres, CA 95307 855-444-7711 nationaloffice@ncasef.com

NATIONAL COALITION OF ASSOCIATIONS OF 7-ELEVEN FRANCHISEES

NATIONAL OFFICERS & STAFF

Sukhi Sandhu NATIONAL CHAIRMAN 855-444-7711 • sukhi.sandhu@ncasef.com

Nick Bhullar EXECUTIVE VICE CHAIR 626-255-8555 • bhullar711@yahoo.com

Teeto Shirajee VICE CHAIR 954-242-8595 • teeto.shirajee@yahoo.com

Michelle Niccoli INTERIM VICE CHAIR 719-661-1048 • nicco711@yahoo.com

Khalid Asad INTERIM VICE CHAIR 913-488-3014 • Khalid.asad@aol.com

Rajneesh Singh TREASURER 214-208-6116 • rjn_singh@yahoo.com

Shawn Howard OFFICE & VENDOR RELATIONS ADMINISTRATOR 855-444-7711 • shawnh@ncasef.com

Eric H. Karp, Esq. GENERAL COUNSEL 617-512-9004 • ekarp@wfrllp.com

John Riggio MEETING/TRADE SHOW COORDINATOR 262-394-5518 • johnr@jrplanners.com

John Santiago MANAGING EDITOR 267-994-4144 • avantimag@ncasef.com

April J. Key GRAPHIC DESIGNER lirpayek@gmail.com

The Voice of 7-Eleven Franchisees 2024 ISSUE 3

©2024 National Coalition of Associations of 7-Eleven Franchisees

Avanti Magazine is the registered trademark of The National Coalition of Associations of 7-Eleven Franchisees.

O er up an oversized taste of deliciousness—in the sweetest way possible.

Made with crispy, pu ed-rice cereal and made with marshmallow goodness, Rice Krispies

supersized taste of nostalgia whenever and wherever it’s needed.

Rice Krispies Treats

8/28/24-

Stock up now! Featuring 2 for $3 in-store promo 8/28/2410/29/24. Contact your Kellanova sales representative for more information today!

38000-59099 RKT Original 2.2oz

38000-26448 RKT Rainbow 2.1oz

38000-59095 RKT Double Chocolatey Chunk 3.0oz 38000-28073 RKT Homestyle 1.6oz

continued from page 10

out value-driven foodservice promotions, reported C-Store Dive. This summer, major QSRs like McDonald’s, Starbucks, and Taco Bell have launched low-priced meal deals to attract more customers, with McDonald’s $5 Meal Deal significantly boosting its traffic. However, c-stores have also seen a notable increase in customer visits due to their own value offerings. In the second quarter of 2024, 7-Eleven, Casey’s General Stores, QuikTrip, and Wawa experienced traffic growth of 7 percent or more year over year, outperforming QSRs like McDonald’s and Starbucks, which

saw much smaller increases. This shift towards c-stores is attributed to consumers seeking better value options amid rising living costs and economic pressures, as noted by industry experts.

Despite these gains, c-stores must remain vigilant as QSRs encroach on traditional c-store territory, particularly in the snacking market. Experts like David Portalatin from Circana suggest that c-stores need to continue offering strategic meal deals and creative value promotions to maintain their edge. As food retail prices decline and QSRs continue to innovate with their value offerings,

c-stores face the challenge of sustaining traffic and dollar sales growth. The key for c-stores will be to focus on providing affordable meal and snack bundles, targeting consumers who are increasingly consuming smaller, more frequent meals throughout the day. By adapting to these trends, c-stores can

“C-stores are intensifying their efforts to compete with QSRs by rolling out value-driven foodservice promotions.”

continued on next page

solidify their position in the ongoing value battle with QSRs.

7-Eleven has secured the top spot on CSP’s 2024 “Top 202” list, solidifying its position as the largest convenience store chain in the United States with 13,000 locations. The list, compiled through extensive research and industry collaboration, highlights 7-Eleven’s dominance in the convenience store sector, followed by Alimentation CoucheTard (Circle K) at #2 with 7,146 stores and Casey’s General Stores

continued from previous page

at #3 with 2,639 stores. The CSP report indicates that while 7-Eleven maintains a strong lead, other chains are also expanding aggressively through new store openings and acquisitions. This annual ranking serves as a benchmark for industry performance and provides valuable insights into market trends and growth strategies.

7-Eleven is once again #1 on the Convenience Store News 2024 Top

Reasons we’re proud to serve you:

100 list, maintaining its position as the largest convenience store chain in the U.S. Alimentation CoucheTard’s Circle K follows in second place and Casey’s General Stores rounds out the top three. The list also reveals notable changes among other major players. EG America experienced a decline, shedding 124 stores to hold 1,572 locations, while GPM Investments saw growth, increasing its count by 126 stores to 1,517. Regional dynamics played a significant role, with 7-Eleven consolidating in most regions but expanding in the Southeast and South Central areas.

continued on page 33

www.aondigital.com/en-us/7eleven Optimized our entire service team to continue serving you better. Introduced location-based policies for seamless service everywhere you go and grow. Launched our digital wallet to continue serving you better with the latest technology. Stores wont be cancelled due to losses We have additional Loss prevention, Employee retention and compliance tools MARKED 20 YEARS AS YOUR OFFICIAL WORKERS’ COMP INSURANCE AND EPLI BROKER!

us for any insurance questions: (847) 629-4711

BY SUKHI SANDHU, NCASEF CHAIRMAN

Our 48th Annual NCASEF Convention and Trade Show in Orlando was a powerful reminder of what we can achieve when we unite in purpose. Under the theme “Soaring to New Heights Together,” we gathered franchisees, vendors, and SEI executives in one place, focused on moving our 7-Eleven brand and stores forward. The energy and unity we shared were inspiring, and I want to extend my deepest thanks to everyone who made it possible.

every aspect of this event a success. The trust and mutual respect we’ve developed over the years are what make our partnership so valuable. Thank you all for being such vital members of our 7-Eleven family and for your ongoing support.

“The energy and unity we shared were inspiring, and I want to extend my deepest thanks to everyone who made it possible.”

“But the convention wasn’t all business. We took time to celebrate, and those moments were just as important.”

To our franchisees—you are the backbone of this organization. Walking through the convention, I saw firsthand the passion and dedication you bring to your businesses. Whether you were diving into seminars, exploring new products on the trade show floor, or reconnecting with fellow franchisees, your enthusiasm was undeniable. The challenges we’ve faced over the past year have been immense, yet you’ve shown time and time again that you’re ready to adapt, innovate, and push forward. Your resilience helps keep our brand strong, and for that, I’m deeply grateful. Our vendors—your role in this convention was critical. The trade show was alive with innovation, and the products, services, and deals you showcased are exactly what our stores need to stay competitive and help grow our sales and store margins. A special thanks to those vendors who went above and beyond by sponsoring our convention—your support helped make

My sincerest gratitude to the SEI executives who took the time to participate in this year’s convention. Your involvement in the seminars and the booths you set up at the trade show with private brand products and to engage directly with franchisees will make a significant impact on stores’ GP margins. It’s one thing to talk about partnership, but it’s another to show up and engage. Your willingness to listen, answer questions, and provide insights was appreciated by everyone in attendance. This kind of open communication is exactly what we need to navigate the challenges ahead and keep our brand thriving.

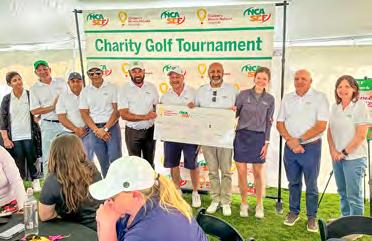

One of the most rewarding parts of the convention was coming together for a greater cause. Our Charity Golf Tournament at Hawk’s Landing Golf Club was a shining example of what we can achieve when we unite. Franchisees and vendors alike gathered on the green to enjoy a day of golf and support Children’s Miracle Network Hospitals. Through the tournament, the Charity Night Gala auctions, and local FOA donations, we raised $300,000 for this incredible organization. Presenting that check was a proud moment for all of us, knowing that our collective efforts will make a real difference in the lives of children and their families.

But the convention wasn’t all business. We took time to celebrate, and those moments were just as important. The Charity Night Gala was a night to remember. It was heartwarming to see so many of you come together to support CMN Hospitals. And then there was the Grand Banquet—a night of great food, even better company, and an unforgettable performance by Jasbir Jassi.

Before closing, I have to acknowledge the incredible work of the NCASEF Convention and Golf Committees, staff, and volunteers who made this event possible. Organizing a convention of this scale is no small task, and every detail was handled with care and dedication. Your hard work ensured that everything ran smoothly, and the success of this event is a direct result of your efforts. Thank you for your commitment and for making this convention one to remember.

“Together we have the power to shape the course of our businesses and our brand.”

As we move forward, I’m filled with optimism for what we can accomplish in the months ahead. Together we have the power to shape the course of our businesses and our brand.

SUKHI SANDHU CAN BE REACHED AT 855-444-7711 or sukhi.sandhu@ncasef.com

BY NICK BHULLAR, NCASEF EXECUTIVE VICE CHAIR

Driving foot traffic and building customer loyalty are important to the success of our stores, especially in today’s economic climate. We can achieve these goals by focusing on two key strategies: product innovation and diversification. By continuously updating our product mix and offering exclusive items, we can attract new customers and retain

become invaluable. By working closely with our suppliers, we can secure exclusive product lines that customers can’t find anywhere else, making our stores a destination for those looking for something different.

Responding to changing market demands is another crucial aspect of product innovation. For instance, with

“By continuously updating our product mix and offering exclusive items, we can attract new customers and retain existing ones, setting ourselves apart from the competition.”

existing ones, setting ourselves apart from the competition. But this isn’t a solo effort—it’s a collaborative push between SEI, franchisee leadership, and our valued vendors, all working together to bring fresh, exclusive products to our shelves that drive traffic and ultimately, improve the bottom line for everyone involved.

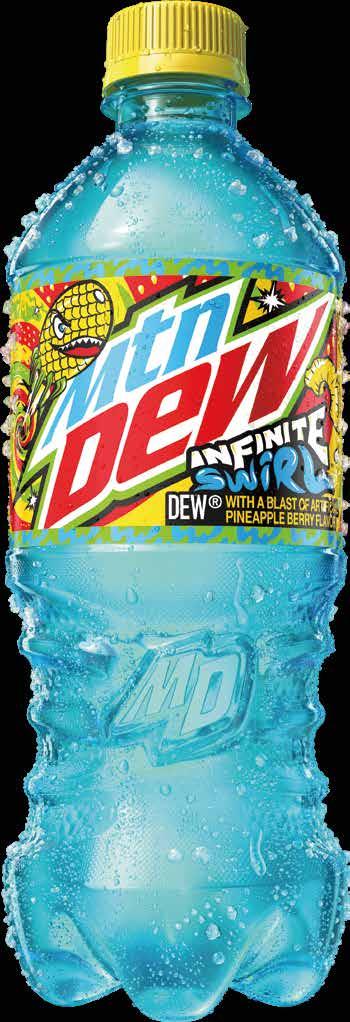

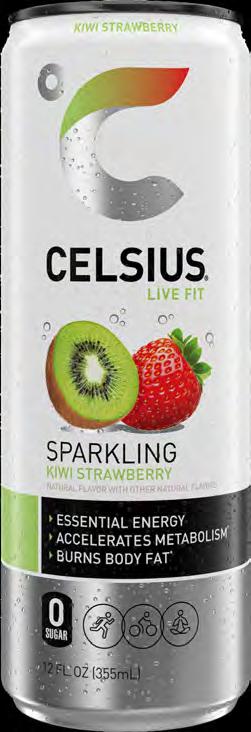

Product innovation lies at the heart of what makes our stores appealing. When customers know they can find something new and exciting at 7-Eleven, it gives them a compelling reason to visit our stores over others. This might involve introducing seasonal flavors that resonate with current trends, offering unique and fresh food options that cater to the evolving tastes of consumers, or bringing in trendy beverages that aren’t available at other convenience stores. The key is to stay ahead of the curve by keeping our product lineup fresh, diverse, and reflective of the latest consumer preferences. And here’s where our partnerships with vendors

the growing emphasis on health and wellness, offering products that cater to health-conscious customers is a necessity. Collaborating with vendors to bring in low-sugar, organic, or plant-based options can help us attract and retain this valuable consumer demographic.

Beyond tapping into broad market trends, it’s crucial to offer products that cater to the diverse tastes and cultural preferences of our customer base. This means introducing flavors and items that reflect the tastes of the local community, which can vary significantly depending on the region. By working closely with local vendors to bring in products that click with the local population, we create a shopping experience that feels personalized and relevant. This local focus helps drive foot traffic and creates a sense of loyalty among customers who appreciate the personal touch. Franchisees and vendors are on the same page here—working together to ensure that our stores offer a mix that’s

both unique and deeply connected to the communities we serve.

Diversification is another critical strategy for driving foot traffic. By expanding our product range, we appeal to a broader audience and meet a wider array of customer needs. Diversification can take many forms, from offering a broader selection of snacks and beverages to introducing entirely new product categories. This approach increases the chances of attracting different customer segments and encourages customers to visit our stores more frequently, knowing they can find a variety of products in one convenient location.

One effective way to implement diversification is through exclusive collaborations and special promotions. These unique offerings can create a buzz around our stores and draw in customers eager to try something new. Whether it’s a limited-edition product or a special partnership with a well-known brand, these initiatives can significantly boost foot traffic and generate excitement among customers. Plus, running promotions that offer great value, like discounts on bundled items or rewards for frequent purchases, can incentivize

“By working closely with local vendors to bring in products that click with the local population, we create a shopping experience that feels personalized and relevant.”

continued from page 17

customers to choose our stores over others. With SEI, franchisee leadership, and vendors all working together, we can ensure these promotions are as compelling and wide-reaching as possible, driving not just sales but also customer loyalty.

The 7Rewards app plays an important role in this strategy, serving as both a customer loyalty program and a powerful tool for driving repeat business. By offering exclusive deals and rewards to members, we encourage more frequent visits and increase customer spending. The success of our stores hinges on our ability to attract and retain customers

“Whether it’s a limited-edition product or a special partnership with a well-known brand, these initiatives can significantly boost foot traffic and generate excitement among customers.”

through innovative products and a diversified product range. By staying on top of market trends, embracing local flavors, and leveraging technology to enhance customer loyalty, we create a shopping experience that is both unique and compelling. With SEI, franchisee leadership, and vendors all pulling in the

same direction, we can build a business model that benefits all stakeholders, ensuring the long-term success and profitability of our stores.

NICK BHULLAR

CAN BE REACHED AT 626-255-8555 or bhullar711@yahoo.com

“None of us is as great as all of us together”

The best way to stay informed of the latest changes and challenges to our 7-Eleven system-and the convenience industry, in general-is to join your local Franchise Owner’s Association. FOAs help franchisees share ideas and concerns, and allow us to approach our franchisor and vendor partners with a unified voice. Becoming an FOA member also makes you a member of the National Coalition, which consists of all 41 FOAs nationwide.

To join your local organization, contact the FOA president closest to you, or follow the instructions below to fill out an online membership form. If you cannot find the FOA closest to you, contact nationaloffice@ncasef. com for more information. We welcome your participation!

1. Log in to 7Help using 7Hub (secured) in-store or using this link https:/7elevenna.servicenow.com/from any external device.

2. In the search bar type “FOA.”

3. Select the popup suggestion “FOA/ PAC:FRANCHISE OWNERS ASSOCIATION.”

4. Type “NONE” in the “Current FOA” box if you are joining an FOA for the first time or you are not a member of any other FOA.

5. Type in the full name of the FOA that you wish to join (No abbreviation) in the “Future FOA” box.

6. Type in the amount of monthly dues as instructed per local FOA.

7. Type “Please enroll (store number) as a member of (name of the local) FOA.”

8. Repeat Step 7.

9. Press the green submit icon.

BY ERIC H. KARP, ESQ., GENERAL COUNSEL TO NCASEF

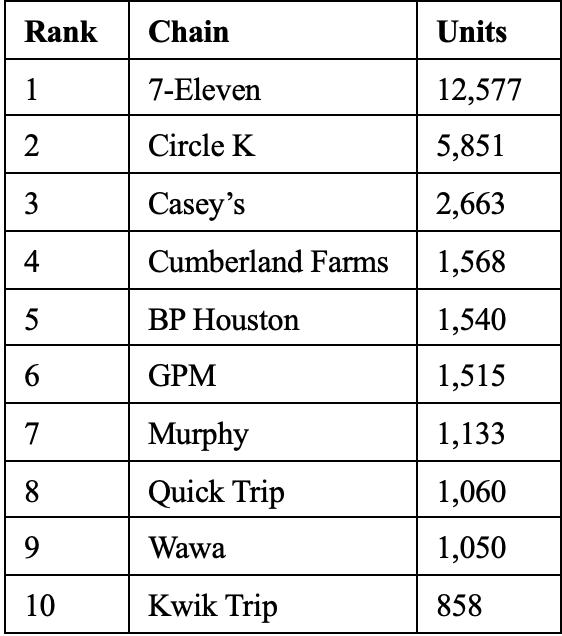

Since my last column, in which I reflected on the numerous changes to the 7-Eleven system over the past decade, Convenience Store News published its latest report on the Top 100 chains. The title of the report is “TOP 100-Slow Motion,” reflecting the fact that the ranking of the top chains had changed little from the previous year. Here is a summary of some of the data gleaned from that report:

Note that 7-Eleven retains its #1 ranking, reflecting its overall 8.5 percent U.S. market share, with 42 percent of the units in the top 10 and 60 percent of the units in the top three.

I also looked back at the same ranking for the year 2016, prior to 7-Eleven’s acquisition of the Sunoco chain in 2018 and the Speedway (Marathon Oil) chain in 2021—then ranked #7 and #8, respectively. Also in the Top Ten in 2016 were Shell, Chevron and Exxon, ranked #3, #4 and #6, respectively. These five chains, all linked to major oil companies, were replaced in the

“Note that 7-Eleven retains its #1 ranking, reflecting its overall 8.5 percent U.S. market share.”

Top 10 in 2023 by chains which have experienced significant growth, most especially Casey’s which was ranked #9 in 2016 and #3 in 2023. On the other hand, the 1st and 2nd rankings in 2016 were 7-Eleven and Circle K, and that remained so seven years later.

While many of the top chains have engaged in growth through consolidation, individual store ownership continues to grow faster than the chains. The percentage of convenience stores operated by chains has fallen by more than 2 percent since 2019. So, the U.S. market, which at the end of last year included more than 152,000 convenience stores, continues to be fragmented and over time has gradually become more so. For example, in 2017, the top ten chains amounted to a little more than 26 percent of the convenience store market, but in 2023 they were just under 20 percent of the market.

The signals thus seem clear that more consolidation is in the future, not just for the convenience store industry in general, but also for the 7-Eleven system in particular. There are two separate and

“While many of the top chains have engaged in growth through consolidation, individual store ownership continues to grow faster than the chains.”

distinct sources and reasons for this conclusion:

1. Convenience Store News also recently published its “Industry Report 2024 - A Trying Year.” The report contains a mountain of data which all boils down to what every 7-Eleven franchisee knows about financial results for 2023. As an industry, sales were down 4.7 percent and transaction counts were down 3 percent. But wages were on average up 6.6 percent and total expenses up by 11.3 percent. Inflation was 5.7 percent, down slightly from the year before. And it’s no secret that through April 2024, same store sales in this system have been down for many months in a row. These numbers provide added impetus to merger and acquisition activity within the industry. The smaller operators find it difficult to operate and compete in this environment, and the larger operations have deeper pockets and access to capital

2. The Seven & I Strategic Committee published a report this past spring telling investors that its areas of focus going forward includes an assertive approach to mergers and acquisitions in the U.S. market. Having already spent more than $24 billion to acquire two chains comprising more than 4,800 locations, the parent company of 7-Eleven has made clear that it intends to continue to grow through acquisitions in the United States. This means that some of the chains on the top ten list are among the likely targets for acquisition.

NUTRITION BAR CATEGORY at 7-Eleven is DELIVERING STRONG GROWTH MOMENTUM, +9% so far this year (through 4/21/24, Circana C-shopper)

continued from page 21

“The parent company of 7-Eleven has made clear that it intends to continue to grow through acquisitions in the United States.”

While we certainly have no inside information, it bears noting that Casey’s, designated by Convenience Store News as one of the “convenience store chains to watch going forward”, is led by CEO Darren Rebelez, who was employed by 7-Eleven from 2007 to 2014, occupying the title of Chief Operating Officer when he departed. But Casey’s is not the only potential target as 7-Eleven has acquired firms larger than those ranked #4 thought #10 in the Top Ten.

Two dedicated San Diego FOA franchisees— Vijay Booter and Najib Azzam—went all out to celebrate 7-Eleven Day on Jully 11 in their stores, creating a festive atmosphere for customers. As part of 7-Eleven’s 97th birthday, both franchisees offered free small Slurpee drinks, joining thousands of other stores across the country in this annual tradition. The day was particularly special as it

There is no question that the acquisition of the Sunoco and Speedway chains have altered the profile and culture of this system in material ways. My previous column was built around the theme that the only thing that is constant is change. That has proved true, whether you look to history or to the future.

ERIC

H.

KARP

CAN BE REACHED AT 617-512-9004 or ekarp@wfrllp.com

included a partnership with Children’s Miracle Network Hospitals, featuring a limited-edition Slurpee cup designed by a National Champion to raise awareness for kids’ health. Vijay Booter and Najib Azzam saw an enthusiastic turnout, with customers enjoying their free Slurpees and taking advantage of exclusive $1 deals on popular items like pizza and snacks.

Born at just 27 weeks, Ella was diagnosed with periventricular leukomalacia (PVL), a softening of brain tissue due to a brain bleed. After spending the first four months of her life in the neonatal intensive care unit (NICU), she was eventually referred to a specialist for children with cerebral palsy at St. Louis Children’s (a local member of Children’s Miracle Network Hospitals®), where she underwent surgery to allow her to walk independently. While recovering Ella was able to enjoy services at the hospital that helped her still feel like a kid, like visits from the therapy dog and time in the playroom.

BY CHILDREN’S MIRACLE NETWORK HOSPITALS

The 48th Annual NCASEF Convention and Trade Show showcased the incredible partnership between Children’s Miracle Network Hospitals® (CMN Hospitals) and the National Coalition of Associations of 7-Eleven Franchisees (NCASEF).

“Tour attendees witnessed firsthand the impact of NCASEF’s support, observing state-of-the-art rehabilitation gyms, specialized emergency department equipment, and inspiring play spaces.”

state-of-the-art rehabilitation gyms, specialized emergency department equipment, and inspiring play spaces. These vital resources, made possible by unrestricted funds raised by NCASEF, empower member hospitals like Orlando Health Hospital for Children to provide

While in Orlando, NCASEF and FOA leaders toured Orlando Health Arnold Palmer Hospital for Children, a leading pediatric facility supported by CMN Hospitals funds. The 156-bed member hospital specializes in critical pediatric care, including cardiology, oncology, and orthopedics.

Tour attendees witnessed firsthand the impact of NCASEF’s support, observing

exceptional care for children.

Arizona Tea joined the tour, sharing their products with member children’s hospital staff and spreading joy, not only with staff, but also for their friends and family. Their generous contributions to the member hospitals’ vibrant atmosphere were greatly appreciated.

Plays Yellow at Hawk’s Landing

A beautiful, sunny day at Hawk’s Landing golf course provided the perfect backdrop for a successful Play Yellow golf tournament. Vendor affiliates and franchisees united to support CMN Hospitals. Golfers, volunteers, and spectators wore yellow ribbons in solidarity.

Golfers enthusiastically participated in on-course fundraising activities, including mulligans, hole-in-one entries, and Play Yellow golf balls. Local patient Champion Myles inspired attendees with his story and infectious energy, teeing off the event with a memorable send-off. His putting skills and playful spirit delighted golfers throughout the day.

Thanks to the generous support of attendees, the tournament raised over $4,750 benefiting Orlando Health Arnold Palmer Hospital for Children.

continued on page 27

Dear NCASEF Members,

I want to express my deepest gratitude for your support and partnership with Children’s Miracle Network Hospitals. As the parent of JP, I have witnessed firsthand the incredible impact your dedication has on kids like him. JP has grown in unimaginable ways and your support continues to be instrumental in his journey.

Your commitment has not only made a difference, but it has also helped shaped the lives of many children.

Because of people like you, and his incredible team at the hospital, kids like JP are given the best chance to reach their full potential and achieve their dreams.

Thank you for all that you do to help families like ours and kids like my son JP. Your generosity and partnership are sincerely appreciated and loved.

Norma & Jorge JP’s Parents

Play Yellow, a collaborative effort between CMN Hospitals, Jack and Barbara Nicklaus, and the PGA TOUR, unites the golf community in support of children’s health. Inspired by the story of Jack Nicklaus’ friend—Craig Smith, who battled Ewing’s sarcoma—yellow, Craig’s favorite color, became a symbol of hope and healing. By participating in Play Yellow events, golfers directly contribute to the lifesaving work of member children’s hospitals nationwide. The program has raised millions of dollars funding critical care, research, and equipment for countless young patients.

The CMN Hospitals booth at the convention showcased the powerful impact of collective efforts in advancing pediatric healthcare. Engaging activities like digital caricatures and a map highlighting local member hospitals drew attendees in, fostering a deeper understanding of CMN Hospitals’ hope in transforming the lives of children and building a healthier future.

“We extend our heartfelt gratitude to NCASEF for their invaluable support!”

The high point of the event was the Charity Night, sponsored by Coca-Cola, Fairlife, Body Armor, and Monster Energy. Through inspiring presentations, awards, and competitive bidding, the evening culminated in a remarkable milestone: NCASEF members and affiliates collectively have raised over $1 million since the partnership’s inception in 2022.

These generous contributions will directly benefit member children’s hospitals across the U.S., funding vital equipment, research, and patient care. Congratulations to the 2023 award winners for helping make a difference through your contributions!

2023 Top Fundraising Franchisees (Store Fundraising)

• Nick Bhullar

• Cassandra Jones-Williams

• Naeem Khan

2023 Top Fundraising FOAs (Event Fundraising & Store Fundraising)

• Southern California FOA

• Texas FOA

• Rocky Mountain FOA

2023 Highest Fundraising Average FOAs (Combined Highest In-Store Fundraising Averages and FOA Giving Averages)

• Cal-Neva FOA

• Greater Oregon FOA

• Central Valley FOA

Annual Gala & Check Presentation

The week concluded on a high note with a glamorous gala where the NCASEF officers presented a $300,000 check to Children’s Miracle Network Hospitals. This significant donation will directly benefit the local member hospitals across the U.S., addressing critical needs such as uninsured patient care, groundbreaking research, medical education, and family support services. By investing in state-of-the-art equipment, facilities, and treatments, we empower member children’s hospitals to conquer the most complex health challenges.

We extend our heartfelt gratitude to NCASEF for their invaluable support! Together we can change kids’ health and the future—for all of us.

BY JOHN WALES, AON PROGRAM MANAGER

When I visit your stores or speak with you at local trade shows, I am often asked what can be done to lower insurance costs. Lowering your insurance costs involves minimizing the number and severity of losses in your stores, and sometimes a simple tool and a bit of education can make a big difference.

“At my specific location, the leading cause of Workers’ Comp claims and employee injuries came from my staff chasing after thieves and beer runners.”

For example: In the early 2000s, before I started working at Aon, I owned a convenience store in Southern California and, as a store owner, one of my biggest concerns was my employees’ safety and wellbeing. At my specific location, the leading cause of Workers’ Comp claims and employee injuries came from my staff chasing after thieves

and beer runners. My team members would run outside to chase after the thieves, not realizing that the thieves were rarely alone.

Unfortunately, this often resulted in a dangerous experience for my employees. I was determined to find a solution and spoke to many of my peers about how I could help reduce employee injuries and improve store safety and morale.

One of my friends suggested that I buy a whistle. This seemed like an odd solution, but I was willing to try it.

I trained my team members to blow the whistle instead of chasing after the thieves and beer runners, and while it did not reduce the frequency of beer runs, I found that my employees no longer chased the criminals outside the store. They simply blew the whistle instead.

After implementing the “Be Safe, Don’t Chase” program in my store, the frequency of these injuries

“After implementing the ‘Be Safe, Don’t Chase’ program in my store, the frequency of these injuries dropped.”

dropped. In the year following the program’s implementation, we only experienced one employee injury due to pursuing thieves, which was much lower than the seven from the prior year.

Not only did this program help reduce Workers’ Compensation costs by preventing injuries, but it also boosted my team’s morale. My staff felt safer working in my store, which made a big difference.

All it took was a simple whistle and a bit of education.

I’d love to share more about my story at your local FOA trade shows. Stop by and we’ll even provide you with free safety whistles for your stores!

BY MARSH

With the 100 Days of Summer now over, what’s the next big thing on your to-do list? Here’s a hint: insurance renewal.

Now is the time to make sure your store remains covered by the only insurance company created by 7-Eleven franchisees to exclusively protect 7-Eleven franchises— National Captive Insurance Solutions (NCIS).

But unlike summer, you won’t need 100 days to renew your insurance coverage. That’s because the NCIS renewal process is smooth and easy, consisting of only 3 short steps.

“Marsh has recently begun sending renewal quotes to all franchisees currently enrolled in NCIS.”

Marsh has recently begun sending renewal quotes to all franchisees currently enrolled in NCIS. Once you receive your quote, be sure to review it closely. You want to confirm that your store count, sales and inventory numbers, and liquor information is accurate, as those details impact your premium.

NCIS uses a common renewal date for Business Owner’s Policies, which means all participating franchisees will renew their coverage on the same date. So, whether you joined the captive

in December 2023 or May 2024, your renewal date this year will be October 1, 2024.

“So, whether you joined the captive in December 2023 or May 2024, your renewal date this year will be October 1, 2024.”

The best way to avoid a lapse in coverage is to renew your policy as soon as possible. Once you’ve reviewed the quote for accuracy, completing the renewal process is as simple as clicking a button to capture your signature through DocuSign.

And if you haven’t joined NCIS yet, your renewal date is the perfect time to do so! All 7-Eleven franchisees will receive a quote from NCIS for their stores based on their current expiration date. Simply review your quote, sign it, and return it to Marsh to move your coverage to an insurance company that understands— first-hand—how best to protect a 7-Eleven franchise.

Once you’ve reviewed your quote, then electronically signed it through DocuSign, the next, and final, step is the easiest. Relax! With your store covered for another year by NCIS, you can feel confident you made the right choice. Insurance offered through NCIS not only helps protect your store against a wide range of risks, it also satisfies your

franchise agreement.

And don’t forget, NCIS is a franchisee-owned captive insurance program. That means all participating franchisees work together by sharing business risks and losses. This approach helps NCIS negotiate more favorable premiums, which could save you money in the long run.

Marsh is here to help you with all your insurance needs—including Workers’ Compensation coverage, which will renew on January 1, 2025.

Marsh USA LLC, in CA DBA Marsh Risk and Insurance Services, CA Lic. 0437153. NCIS coverage is underwritten by AIG Specialty Insurance Company.

Marsh is the exclusive administrator of the 7-Eleven® Franchisee Insurance Program. We can help you protect your franchise with comprehensive business insurance and quality customer service. Contact the 7-Eleven Franchisee Insurance Program to learn more about how to obtain compliant coverage through this captive at https://affinity.marsh.com/7eleven/ or scan the QR code.

continued from page 13

SEI was recently honored by being named to the 2024 Yello Top 100 Internship Programs List, a recognition based on public voting and evaluation by industry experts. A standout feature of 7-Eleven’s internship program, as highlighted by Yello, is the “in-store experience” where interns get an exclusive behind-

This immersive opportunity allows interns to gain a deeper appreciation for the complexities of convenience retailing by stepping into the shoes of frontline employees and witnessing the intricate workings of the business.

7-Eleven, Inc. is the highestranked convenience store chain on the National Retail Federation’s

coming in at No. 20. Despite a slight drop from No. 19 last year, 7-Eleven achieved $27.88 billion in U.S. retail sales, marking a 6.9 percent growth rate. The NRF’s annual rankings, which evaluate the largest U.S. retailers by sales, shpwcase 7-Eleven’s significant market presence and its ability to sustain growth in a competitive industry. Other convenience store chains on the list include Alimentation CoucheTard Inc., ranked at No. 42 with $11.76 billion in sales, and Casey’s

to No. 83 with $5.14 billion in sales. The NRF’s list, compiled using a range of estimation techniques and focused on U.S. retail sales, does not include fuel sales when locations are primarily gas stations.

“7-Eleven, Inc. is the highestranked convenience store chain on the NRF Top 100 Retailers 2024 list.”

The 2024 Top Women in Convenience (TWIC) class, the largest ever, includes 107 female leaders, according to Convenience Store News. Among the distinguished winners from 7-Eleven, Inc. are Nikki Boyers, Vice President of Private Brands, who was named one of the five Women of the Year. Recognized as Senior-Level Leaders are Carina Duffy, Vice President of Strategic Sourcing; and Marissa Eddings, Senior Director of Brand, Advertising & Media, Digital & Content Marketing. Additionally, several 7-Eleven employees were honored as Rising Stars: Rachel Allen, Senior Director of Talent Acquisition; Kristy Gerardo, Market Leader for Northern California; and Cecilia Serrano, Senior Category Manager—Open Air Case. Tasha Smith, Senior Director of the Corporate Project Management Office, was acknowledged as a

continued from page 33

The winners were selected based on nominations from their companies and peers. Evaluations focused on their achievements over the past 12 months, highlighting innovative corporate initiatives, significant financial and strategic accomplishments, sharp problemsolving skills, outstanding performance, impactful mentorship and its benefits for mentees, charitable contributions, and any attributes that demonstrated exceptional dedication and went beyond their usual responsibilities.

Store brands reached unprecedented market shares in the first half of 2024, outperforming national brands significantly compared to the same period a year ago, according to Circana sales data released by the Private Label Manufacturers Association (PLMA). Store brands attained a unit market share of 22.9 percent and a dollar market share of 20.4 percent, reflecting a strong preference among consumers. Store brand dollar sales grew by 2.3 percent, outpacing the 1.1 percent increase for national brands.

The detailed analysis further reveals substantial growth in several product departments, with beauty products seeing a 10 percent rise in dollar sales, followed by liquor (8.8 percent) and general food (6.9 percent). Only the refrigerated

category saw a slight decline. PLMA projects that if this trend continues, store brand revenues could surpass a quarter trillion dollars by the end of the year, setting a new record for annual sales.

California’s recent law mandating a $20 per hour minimum wage for fast-food workers, which took effect in April 2024, has stirred significant reactions across the industry, reported Forbes. For many employees, this wage hike provides a crucial boost to their earnings, allowing them to cover essential expenses and even invest in their future.

However, the impact on franchise owners has been challenging. To manage the increased labor costs, many are reducing employee work hours and increasing menu prices. Additionally, the Hoover Institution noted that since the law’s implementation, California has seen a reduction of nearly 10,000 fastfood jobs, indicating that the higher wages are leading some businesses to streamline their operations.

“California’s new $20 per hour minimum wage for fast-food workers is having a negative impact on franchise owners.”

On June 12, the Delaware Valley FOA trade show at Harrah’s Resort in Atlantic City, New Jersey, brought together a vibrant mix of 55 exhibiting vendors and eager attendees. The event provided a unique opportunity for franchisees to explore new products and services while engaging directly with vendors. A key attraction was the raffle giveaway, where attendees earned entries by placing orders with vendors, creating a lively atmosphere of anticipation and excitement throughout the day. The raffle featured an array of cool prizes, including a 55-inch TV, Coca-Cola Igloo cooler, Xbox, and numerous gift cards. Adding to the thrill, three lucky Delaware Valley FOA members were randomly selected and each awarded $1,000, making the day even more memorable. Vendor engagement and exciting giveaways made this year’s trade show a standout event for all who attended.

continued from page 35

Convenience stores boast impressive loyalty retention rates, with the top half of loyalty transaction share seeing at least 80 percent of their members returning every month, reported C-Store Dive. According to the 2024 Loyalty Trend Report from Paytronix, this retention rate climbs to 85 percent for c-stores in the 90th percentile and above. In contrast, quick-service restaurants (QSRs) and full-service restaurants (FSRs) at the same percentile range retained only 62 percent and 58 percent of their members, respectively. However, c-stores lag behind in acquiring new loyalty members, with top-performing QSRs attracting 110 new members per location monthly, compared to 70 for FSRs and just 35 for c-stores. Building strong customer relationships is central to loyalty programs, and c-stores excel once members are onboarded. Even c-stores at the midpoint for loyalty transactions surpass the retention rates of most restaurant programs. This could become a strategic advantage as c-stores move to capture more traffic from restaurants, which have seen weaker results.

The fate of skill games in Virginia is still up in the air as lawmakers

continue to debate their legality and regulation, reported WRIC. These games, often found in convenience stores and bars, have been a contentious issue since their temporary legalization in 2020 to generate revenue during the COVID-19 pandemic. Supporters argue that skill games provide essential income for small businesses and contribute to the local economy. Meanwhile, opponents contend that they resemble illegal gambling and lack proper regulatory oversight, potentially leading to issues such as addiction and crime.

The ongoing debate has led to a series of legislative battles, with recent efforts to extend their legality facing significant opposition. The outcome of this debate could have significant implications for both the gaming industry and small businesses across Virginia that rely on the revenue generated by skill games, as well as for the broader regulatory landscape surrounding gambling in the state.

A recent survey by the Merchants Payments Coalition reveals that a significant majority of likely voters favor the Credit Card Competition Act (CCCA), with 55 percent supporting and only 7 percent opposing it (38 percent are unsure). The survey also shows that voters are more inclined to back Senate candidates who support the bill, with

42 percent expressing this preference. The CCCA addresses high credit card swipe fees, which are seen as a burden on small businesses and consumers. The survey also debunks claims that the CCCA would reduce credit card rewards, with many voters indicating they would still support the bill even with this consideration. The findings come amid increasing concerns over rising swipe fees, which reached a record $172 billion last year, significantly impacting consumer prices and merchant costs.

Circana’s latest research reveals the global snack market has surged to $214 billion, fueled by consumers’ growing appetite for flavorful and convenient snacks. The study also found that 46 percent of Americans consume three or more snacks daily, with 83 percent of these consumers prioritizing flavor above all. Furthermore, the research indicates that screen time activities, such as watching TV, significantly drive snacking occasions, presenting unique marketing opportunities for brands.

As 34 percent of consumers turn to social media to discover new snack foods and trends, snack brands have a prime opportunity to engage and form deeper connections with their target audiences. With 20.2 percent of eating occasions occurring while watching TV programs, it’s evident that screen time has become

intertwined with snacking routines. The study suggests that by aligning with relevant cultural moments and occasions, brands can capitalize on viral trends and ignite excitement among consumers, potentially driving increased engagement and sales.

“Forty-six percent of Americans consume three or more snacks daily.”

Casey’s General Stores recently announced a significant move to expand its presence by agreeing to acquire Fikes Wholesale, Inc., owner of CEFCO Convenience Stores, for $1.145 billion in an all-cash transaction. This acquisition will add 198 retail stores and a dealer network to Casey’s portfolio, enhancing their

Seven-Eleven Japan’s curry bread has been recognized by Guinness World Records as the most sold freshly made curry bread in 2023, with nearly 77 million pieces sold, reported The Japan Times. • A new survey by Vontier reveals that nearly 80 percent of summer roadtrippers are willing to drive out of their way to visit their pre-

continued from previous page

footprint, particularly in the southern United States. The deal includes 148 stores in Texas and 50 in Alabama, Florida, and Mississippi, along with a fuel terminal and a commissary to support the operations in Texas. This expansion is strategically significant for Casey’s, as it increases their total store count to nearly 2,900, thereby solidifying their presence in key markets and boosting their operational efficiency.

Alimentation Couche-Tard is undertaking an ambitious project to remodel 80 percent of its Circle K convenience stores across the U.S. and Canada, reported C-Store Dive The company has already completed remodels at approximately 1,000 locations, focusing on enhancing store layouts and shelving configurations. These changes are part of Couche-Tard’s “one-touch” remodel program, which makes

minor yet impactful adjustments without necessitating store closures. The remodels are designed to boost the Couche-Tard’s foodservice margins, and the company noted that food growth has already been positively impacted by these upgrades. Although the specific timeline for completing the project across more than 7,400 stores remains unspecified, Couche-Tard said it remains optimistic about the benefits of the program.

Mexican convenience store giant FEMSA is making a significant move into the U.S. market by acquiring 249 DK convenience stores— primarily located in Texas and New Mexico—for $385 million, reported news station CW 39 Houston. This acquisition marks FEMSA’s first major expansion into the U.S., where the stores will be rebranded under the OXXO name, a well-known brand in

ferred convenience stores, and almost 60 percent would pay a markup for products to avoid multiple stops. • Uber and Lyft have agreed to pay a combined $175 million to settle labor law violation claims in Massachusetts and will now provide drivers with a minimum wage of $32.50 per hour, along with benefits such as paid

sick leave and health care stipends, reported The Verge. • Walgreens plans to close a significant number of underperforming stores across the U.S. due to ongoing financial struggles and weak consumer spending, reported CNN Business. • The U.S. online grocery market finished June 2024 with $7.7 billion in

NCASEF’s 48th Annual Convention and Trade Show drew franchisees, their families, and valued vendors to the stunning Gaylord Resort and Convention Center in Kissimmee, Florida, from July 16-19, 2024. The event, set against the backdrop of Florida’s lush landscapes and just minutes away from the excitement of local attractions like Walt Disney World and Universal Studios, delivered a perfect blend of business, networking, and family fun. Franchisees from across the country gathered at the convention to engage in meaningful discussions, explore new business opportunities, and enjoy a much-needed break with their families. The event kicked off Tuesday evening with a warm welcome reception replete with food trucks and live DJ music that set the tone for the days to come. The reception was an ideal opportunity for franchisees and vendors to reconnect with old friends, meet new ones, and start conversations that would continue throughout the week.

The following day offered attendees a variety of activities tailored to suit different interests.

Franchisees and their families had the option to participate in several organized outings, such as an ultimate beach day at Cocoa Beach, a private airboat tour through Wild Florida, or a day filled with Las Vegas-style gambling aboard the Victory Casino Cruise. For those looking to spend a relaxing day on the greens, Hawk’s Landing Golf Club provided an elegant and energizing golf experience while supporting Children’s Miracle Network Hospitals.

On Thursday the convention transitioned into a more formal tone with the beginning of the seminars. The NCASEF officers hosted the State of the Coalition address, which was followed by a session with SEI executives. The highlight of the day, however, was the Trade Show, which featured a showroom full of booths from a wide array of vendors, each showcasing their latest products and services designed to enhance the profitability of 7-Eleven stores. Franchisees were treated to exclusive show deals and promotions that were available only to those in attendance.

The day concluded with the

Charity Night Gala, which combined entertainment with philanthropy. The gala featured both a live and silent auction benefitting Children’s Miracle Network Hospitals, and ended with a live performance by standup comedian Akaash Singh.

Friday began with a series of seminars that included a Legal Forum with NCASEF General Counsel Eric Karp, a Government Affairs Seminar, and a presentation by CMN Hospitals. Following the sessions, attendees had a final chance to visit the trade show floor, placing orders and taking advantage of the deals before the show wrapped up.

The convention culminated in the Grand Banquet, an elegant affair where honored franchisees and vendors received recognition awards for their contributions to the 7-Eleven community over the past year. The banquet was a fitting end to a week filled with learning, networking, and fun. The night was capped off with a special concert by renown Indian singer Jasbir Jassi, leaving everyone with memories that would last long after they returned home.

Anheuser-Busch

Coca-Cola/BodyArmor/fairlife

PepsiCo

GRAND

Celsius

McLane Company Inc.

Monster Energy Company

Altria

BeatBox Beverages

Congo Brands

Red Bull North America

Vixxo

Bon Appetit

Nepa Wholesale

Acosta

Constellation Brands

Ghost

Keurig Dr Pepper

Pabst Brewing Company

Molson Coors

ELITE

Hershey Company

Atkinson Crawford Sales

Bic USA

In Motion Design Inc.

ITG Brands

JM Smucker - Hostess Brands

Liquid Death

Mini Melts Ice Cream

Mondelez International

SRP - Strategic Retail Partners

Perfetti Van Melle

Geloso Beverages

Grupo Bimbo

Mark Anthony Brands

Advantage Solutions

BlueTriton Brands

Budderfly

Dippin’ Dots

Ecolab

Haribo

Juul Labs

Kellanova

Reynolds American

Swedish Match

Swisher InComm

Heineken USA

Republic Amusements

Welcome Reception Celsius

Charity Night Gala Monster/Coca-Cola/BodyArmor/fairlife

Grand Banquet

Anheuser-Busch PepsiCo

Tournament Sponsor

Coca-Cola/BodyArmor/fairlife

Molson Coors

Ruby Sponsors

Coca-Cola/BodyArmor/fairlife

Anheuser-Busch

BeatBox Beverages

Bon Appetit

Celsius

Congo Brands

Dippin’ Dots

Geloso Beverages

Monster Energy

Sapphire Sponsors

Accel Entertainment

Budderfly

Core-Mark

McLane Company

Mini Melts Ice Cream

Aaron Choate Consulting

Accel Entertainment

Acosta

Advantage Solutions

Altria

Anheuser-Busch

Aon Risk Services

Arizona Beverages USA

Astro Freeze

Atkinson Crawford Sales

Bazooka Candy Brands & Storck USA

BeatBox Beverages

Bic USA

Big Ideas

BlueTriton Brands

Bon Appetit

BSW Distribution LLC

Budderfly Celsius

CIB Security, Inc.

Coca-Cola/BodyArmor/ fairlife

Congo Brands

Constellation Brands

Core-Mark

Crossmark

Danone North America

Diageo

Dippin’ Dots

Drive USA

Ecolab

Evamor Products

FIJI Water/Wonderful Pistachios

Florigas Inc.

FÜM

Geloso Beverages

Ghost

Grupo Bimbo

Haribo

Heineken USA

Hershey Company

Hornell Brewing

InComm

In Motion Design Inc.

Inter-Continental Cigar Corp.

ITG Brands

JM Smucker - Hostess

Brands

Juul Labs

Kellanova

Kenny’s Candy

Keurig Dr Pepper

Kretek International

Liquid Death

Mark Anthony Brands

Marsh

McLane Company Inc.

Mini Melts Ice Cream

Molson Coors

Mondelez International

Monster Energy Company

Morinaga America

Nepa Wholesale

Pabst Brewing Company

Paradox

Payality

Pecan Nation

PepsiCo

Perfetti Van Melle

Red Bull North America

REDCON1

RhondaRita

Remedy Organics

Republic Amusements

Republic Brands

*Reynolds American

Shankman & Associates

SRP - Strategic Retail Partners

Stateside Vodka

Stratus Group

Streamline Group

Swedish Match

Swisher

T-Mobile

Ty Inc.

Ultimate Sales & Services

Vixxo

Whipped Fusion Corporation

Zolt, LLC

Franchisee leaders, vendor partners and SEI special guests gathered in Salt Lake City, Utah, for the 2nd Quarter NCASEF Affiliate Member and Board of Directors meetings from April 2426, 2024. Set against the backdrop of the Grand America Hotel, the meetings were preceded by a charity golf tournament on April 23 at the Bonneville Golf Course. Franchisees and vendors came together to make a significant impact, raising $15,711 for Children’s Miracle Network Hospitals (CMN Hospitals), which benefitted local Primary Children’s Hospital. Over the next two days, discussions ranged from operational challenges to strategic vendor partnerships, all aimed at navigating the current retail landscape and preparing for future

growth.

Chairman Sukhi Sandhu started the Affiliate Member meeting by reflecting on the previous day’s successful golf tournament, which had brought together franchisees and vendors in a spirit of philanthropy. The tone then shifted to the realities facing the franchise community. The Chairman didn’t sugarcoat the situation—sales this year had been disappointing, operational costs are rising, retail crime is becoming a more significant issue, and consumer spending is on the decline. The message was clear: these challenges require a collective effort from all stakeholders to overcome.

The conversation then turned to the charitable initiatives that have long been a hallmark of NCASEF’s activities. Kate Burgess of Children’s Miracle Network Hospitals expressed deep gratitude to NCASEF, its franchisees, and vendors for their unwavering support. The highlight of this session was a heartfelt presentation by speakers from Primary Children’s Hospital, including a mother who shared her personal story about the lifesaving care her child received from the hospital.

From there, the meeting delved into

operational topics through a series of breakout workshops designed to address specific franchisee and vendor concerns. The first group focused on issues related to the vault, including the financial impact of store displays and the broader economic impact of retail theft, which has now become the fourth-largest expense for franchisees. The second breakout group discussed challenges in the center of the store, particularly related to order accuracy and fill rates from suppliers like McLane and Core-Mark. This group also discussed issues with the FOD and the importance of maintaining high fill rates to ensure product availability.

The third group focused on packaged foods and DSD, with an emphasis on integrating new vendors into the system. New vendors often struggle with understanding the processes for getting their products into stores, such as navigating NRIs and SSIs. Veteran vendors in the group provided guidance, and there was a suggestion to include an SSI instruction handout in welcome packets for new vendors. Additionally, vendors requested more timely data on product performance to help them decide whether to expand their product lines. The

continued on page 48

fourth group, consisting of service providers, discussed the challenges of communicating effectively with franchisees at the store level. They also explored the benefits of the Captive Insurance Program (NCIS).

As the Affiliate Member meeting continued, there was a strong focus on building and strengthening vendor partnerships. Representatives from SEI—Senior Vice President Dennis Phelps (Merchandising, Vault & Proprietary Beverages), Senior Director Bruce Maples (Franchisee Relations and Engagement), and Manager Jim Bayci (Franchise Support)—joined the discussion to share SEI’s strategic priorities and future plans. Phelps stressed SEI’s commitment to exclusive product offerings and collaborative marketing efforts, particularly as the company gears up for its centennial celebration in 2027. He highlighted the importance of working closely with vendors to introduce new products and keep stores well-stocked. The Affiliate Member meeting concluded with a tabletop trade show featuring 26 exhibiting vendors.

The Board of Directors meetings on April 25 picked up where the Affiliate Member meeting left off, with the inclusion of presentations from vendors like Anheuser-Busch, CocaCola, PepsiCo, and Vita Coco.

At the top of the day’s ageda was a discussion panel with SEI guests, which included Luke Scott (Vice President, Merchandise Strategy and

Support), Buddy Francisco (Vice President, Logistics), Sembe Cole (Vice President, Western Franchise Operations), Guyton Gagliard (Senior Director, Merchandise Accounting and Assistant Controller), Daniel Cisneros (Senior Director, Franchise Sales and Systems), Bruce Maples (Senior Director, Franchisee Relations and Engagement), and Jim Bayci (Manager, Franchise Support).

SEI’s Sembe Cole spoke about the ongoing challenges franchisees are facing, such as labor quality and supply chain issues, alongside SEI’s efforts to boost sales through various operational improvements and product innovations. Daniel Cisneros discussed plans to return eligible stores to 24/7 operations, addressing concerns about charges for stores that are closed for specific reasons. Luke Scott provided insights into SEI’s pricing strategies, while Buddy Francisco and Guyton Gagliard tackled logistics and pricing discrepancies, respectively. These presentations were followed by a detailed Q&A session where franchisees raised concerns about insurance issues, store closures, the AR Gap reemerging, RIS 2.0 issues, 7Now profitability, and pricing challenges, among other issues. The meeting then shifted to Committee Reports, which provided updates on various initiatives, including the successful charity golf event, which raised significant funds for CMN Hospitals. The Government Af-

fairs/Tobacco committee highlighted new federal overtime rules and their potential impact on franchisees, along with a recap of CFA Day in Washington, D.C. The Digital/IT/7Now Committee shared progress on IT transformation projects, including RIS 2.0 rollouts and enhancements to the 7BOSS system, while the Store Profitability Safety and Simplification Committee engaged in a long discussion on factors affecting store profitability. The Board also addressed additional items brought up by members, including issues with DMR charges, audit shortages, and equity breaches.

The second day of the Board meeting was streamlined to allow for more focused discussions, and included vendor presentations by Nepa Wholesale, ITG Brands, Keurig Dr Pepper, LiveView Technologies (LVT), and Mela Water. The Facility Maintenance Committee provided an update on the performance of IHM and non-IHM services, improvements to the IHM program, and enhancements made to Vixxo and CBRE operations based on committee input.

General Counsel Eric Karp then provided a comprehensive legal update and provided insight on SEI’s and its parent company’s latest financials based on publicly available data. He later discussed the escrow accounts from the resolved misclassification lawsuits in California and Massachusetts, offering Board members options on the funds’ future use.

The Vendor Relations/Merchandising Committee presented a report, and stressing the goal of elevating NCASEF through stronger vendor relations, proposing different levels of Affiliate Program membership, and encouraging FOA presidents to share member store lists to promote new products and deals.

In closing remarks, Executive Vice Chair Nick Bhullar provided a brief update on the 7Now meeting. Chairman Sukhi Sandhu provided updates on the credit card swipe fee settlement, self-checkout issues, and the necessity of store insurance, while urging members to attend the upcoming convention.

We extend our deepest gratitude to the vendors and franchisees who participated in and sponsored the Charity Golf Tournament at the Bonneville Golf Course in Salt Lake City, Utah, just before the NCASEF 2nd Quarter Affiliate Member and Board of Directors meetings. Your generous support was instrumental in the success of the event, helping

us raise vital funds that have been allocated to the local Primary Children’s Hospital through Children’s Miracle Network Hospitals. Your dedication and generosity ensured a fantastic day on the course and made a lasting difference in the lives of children in Salt Lake City. Thank you for your unwavering commitment to this important cause.

The 3rd Quarter NCASEF Board of Directors meeting, held on July 16, 2024, at the Gaylord Palms Resort in Orlando, Florida, was a prelude to the 48th Annual Convention and Trade Show. Chairman Sukhi Sandhu and Executive Vice Chair Nick Bhullar opened the meeting by welcoming the Board members and thanking the local Florida FOAs for their hospitality. The meeting was brief due to the convention schedule, but key updates were shared. After the Treasury Report was presented and approved, the Convention and Entertainment Committee reviewed the event schedule, highlighting the new initiatives being introduced this year.

Representatives from SEI were introduced by Bruce Maples, Senior Director of Franchisee Relations and Engagement. The SEI team was led by Randy Quinn, Senior Vice President of Franchise Operations, and included other key figures such as Jim Bayci (Manager of Franchise Support), Mark Buscher, (Zone Vice President), and

Cassie Maggiacomo (Regional Director of Operations for Florida).

Randy Quinn presented a comprehensive overview of the current retail environment, noting challenges like inflation, high interest rates, and declining consumer spending. Quinn acknowledged the struggles franchisees face, particularly with labor shortages and reduced income, but expressed optimism about future opportunities. He discussed strategies to increase sales, including high-margin promotions and the implementation of new 7Boss tools. The presentation led to a Q&A session where franchisees raised concerns about store operations, RDC issues, the franchise agreement, the impact of the swipe fee settlement on store income, and other issues.

General Counsel Eric Karp provided a legal update, beginning with an overview of the recent credit card swipe fee settlement. Karp explained the implications of the settlement for franchisees and addressed questions

from Board members during a Q&A session. He also discussed the status of escrow funds from the resolved misclassification lawsuits in California and Massachusetts, offering the Board options on how to handle these funds moving forward. Karp concluded his update by previewing the topics he planned to cover during his seminar at the convention.

The Board meeting continued with a discussion led by Chairman Sandhu on how a unified front is crucial for effectively addressing the challenges facing franchisees and ensuring that their concerns are heard and acted upon by SEI. Executive Vice Chair Bhullar then explained the structure and function of the Vice Chairs’ FOA sub-groups. He encouraged FOAs to reach out to their assigned Vice Chair if they have unresolved issues that cannot be addressed by the corresponding NCASEF committee. Bhullar assured the Board that any such issues would be escalated to SEI for resolution.

continued on next page

During the meeting, a Board member suggested that NCASEF officers hold town hall meetings with multiple FOAs and their membership to better understand the scale and nature of certain franchisee issues. This idea was well received, with many Board members agreeing that such meetings could provide valuable insights and help build stronger relationships between franchisees and NCASEF leadership.

In the final part of the meeting, Board members brought up several additional topics for discussion. These included ongoing issues with In-House Maintenance, strategies for improving margins on fresh foods, and concerns about RDC and CoreMark pricing. Other topics discussed were complications with non-taxable sales, challenges with 7Now alcohol delivery, and the quality of the count data. The meeting concluded with Chairman Sandhu thanking the Board members for their attendance and participation, both in the meeting and the upcoming convention.

The Keystone FOA hosted its second annual trade show on May 31 at Rivers Casino in Philadelphia, Pennsylvania, marking another successful event for the organization. With over 50 exhibitors and more than 100 franchisee attendees, the event reflected the dedication and hard work of the Keystone FOA Board members.

The presence of SEI’s Accounting, In-House Maintenance, and Franchising teams added further value, offering franchisees direct access to crucial support services. Special guests included Eastern Virginia FOA President Romy Singh, Suburban

Washington FOA President Arvinder Makkar, and Pennsylvania State Representatives Danilo Burgo, who elevated the event’s significance. Franchisees had the chance to win big, with raffles and cash giveaways totaling $20,000. Vendors expressed satisfaction with the return on investment they gained from the show, making it a win-win for all parties involved. The Keystone FOA’s trade show stood out thanks to its engaging vendor displays, plentiful networking opportunities, and generous cash prizes, leaving participants excited for next year’s event.

The inaugural Joe Saraceno FOA Golf Tournament— held on June 13 at Brookside Golf Club in Pasadena— was a sold-out success, attracting over 60 franchisee players, many of whom were first-time golfers supporting the event. The tournament also saw overwhelming backing from a diverse group of vendor partners, including industry giants. Their enthusiastic participation contributed to a day filled with fun under the sun, setting a strong foundation for what is sure to become a cherished annual event for the JSFOA.

The Joe Saraceno FOA thanks the following vendors for their unwavering support: Anheuser-Busch, Heineken, Hershey, Red Bull, Constellation Brands, BodyArmor, BeatBox, ZenWTR, Coca-Cola, Celsius, Mercado, Sapporo, Southern Glacier-Buzz Ballz, Lucky Energy Beverage, Pepsi, Proximo Spirits, Allied Distributing, Monster, McLane, Fairlife, Fiji Water, LA Distributing, Jeff and Tony’s, Sazerac, Barbot Insurance, Cold Star Ice, Stone Distributing, and Hostess.

continued from page 39

Latin America. The purchase also includes a small fuel transportation fleet. This strategic entry into the U.S. market is expected to allow OXXO to compete with established players like Circle K and Speedway, while bringing its unique brand and customer experience to American consumers.

FEMSA’s OXXO chain is already a dominant player in the convenience store sector in Mexico and parts of South America, operating over 30,000 stores globally. The company said their rebranding of DK stores to OXXO will introduce American customers to a new convenience

“Mexican c-store chain OXXO has moved into the U.S. market with its recent acquisition of 249 DK stores.”

store experience, and they plan to fine-tune and expand their offerings based on local market needs. The transition is expected to be completed in the second half of 2024, pending regulatory approvals, and is anticipated to set the stage for further expansion across the U.S.

A new report by Legion Technologies details the urgent need

for employers to raise retention rates and boost morale among their workforce by improving the employee experience. According to the findings, the hourly worker attrition crisis is ongoing, and retention will remain a daunting challenge in the year ahead, especially with younger generations: continuing the trend from last year, an astonishing 76 percent of hourly employees aged 18-24 plan to leave their jobs in the next 12 months—a drastic increase from those aged 3544 (56 percent), 45-54 (44 percent), and 55-64 (34 percent).

Greater flexibility, benefits, and rewards lure hourly workers to new job opportunities, making them key to retention and recruitment: when asked what incentives, besides pay, would drive hourly workers to take a new job, 57 percent said flexibility to pick up extra shifts and swap shifts, 56 percent said greater recognition and rewards, and 36 percent said the ability to be paid early. However, the ability to be paid early was much higher amongst younger generations, with 43 percent of employees aged 18-24 and 47 percent of employees aged 25-34 saying it would persuade them to take a new job.

A recent report from Numerator highlights the impressive growth of private label products in the grocery sector, revealing that every U.S. household purchased a store-brand

product in the past year, reported Progressive Grocer. Private label products now account for 23.7 percent of the grocery sector’s unit sales, marking it as one of the largest segments in this space. ALDI U.S. stands out with 80 percent of its units sold being private label items, while other major retailers like Costco, Sam’s Club, Walmart, and Kroger also have significant portions of their sales coming from private labels. Notably, Kroger’s Smart Way collection saw a remarkable 135 percent increase in sales volume, leading the pack in growth among specific retailer brands.

Walmart continues to be a dominant player in the private label market, with five of its brands—Great Value, Equate, Mainstays, Marketside, and Freshness Guaranteed—penetrating over 50 percent of U.S. households in the past year. This widespread adoption reflects changing consumer perceptions, with 58 percent of shoppers viewing private label brands as offering above-average value for their price and 29 percent considering them equal to name brands.

The Retail Industry Leaders Association (RILA) and the National District Attorneys Association (NDAA) have launched the 2024 Store Walk Initiative, a unique program aimed at addressing

SEI successfully raised more than $3 million for Children’s Miracle Network Hospitals during its recent 33rd Annual Miracle Tournament and Celebration Dinner. This event brought together nearly 1,000 supporters—including franchisees, vendors, and employees—to support member children’s hospitals across the U.S. Through a combination of the golf tournament and celebration dinner, the funds raised will assist in providing critical treatments, healthcare services, and financial assistance to families in need. The event also featured inspiring stories from 55 Champion Children representing local member hospitals. This effort is part of SEI’s long-term commitment to improving pediatric healthcare, having raised over $190 million for the cause since 1991.

7-Eleven is set to introduce popular Japanese snacks and meals such as ramen, rice balls, and milk tea to its U.S. stores, as part of a major revamp to attract more customers and diversify revenue sources, reported Salon. According to the article, SEI plans to shift its focus from declining tobacco and gas sales to food, following the successful, data-driven model of its Japanese counterparts. This move represents a significant change from the traditional U.S. offerings like hot dogs and Big Gulp drinks, positioning 7-Eleven as a more competitive player

in the convenience store market.

To support this initiative, SEI said it will upgrade its 17 nationwide commissary locations and collaborate with Warabeya, a supplier for SevenEleven Japan, ensuring the quality and variety of the new menu items. The company said it hopes to achieve onethird of its sales from food, aligning more closely with the Japanese model praised for its affordable and diverse food options.

SEI recently announced an ambitious expansion of its 7FLEET Diesel Network, which is designed to meet the specific needs of professional truck drivers across the United States. Initially launched in 2022 with 240 Speedway commercial diesel locations, the network has since grown to more than 375 sites across 7-Eleven, Speedway, and Stripes stores in 26 states. By 2025, SEI plans to increase this number to over 500 locations, further solidifying its presence in the commercial diesel market.

In addition to fuel services, the 7FLEET Diesel Network offers a customer experience that mirrors the convenience and quality associated with the 7-Eleven brand. Professional

drivers can benefit from loyalty programs, a variety of food options such as Laredo Taco Company and Raise the Roost Chicken & Biscuits, and essential truck merchandise. The network also ensures a consistent payment experience by accepting all major truck payments and providing competitive pricing.

The 7-Eleven Cares Foundation, supported by 7-Eleven, Inc., recently announced its official sponsorship of National Night Out (NNO), an annual event that promotes positive relationships between law enforcement and communities across the United States. This sponsorship highlights 7-Eleven’s ongoing commitment to building safer and more connected neighborhoods, aligning with its long-standing community outreach initiatives such as Operation Chill, which has been promoting positive interactions between police and youth for nearly three decades. As part of this new partnership, 7-Eleven, along with its brands Speedway and Stripes, will support NNO events in select markets to enhance neighborhood camaraderie and support local law enforcement efforts.

SEI recently expanded its private brand beverage lineup with the introduction of two new drinks: 7-Select Fusion Energy and 7-Select

continued from page 58

organized retail crime and habitual theft. This initiative, now in its second year, seeks to connect retailers with local prosecutors to facilitate a mutual understanding of shared challenges and develop collaborative strategies to reduce retail crime and recidivism. Lisa LaBruno, RILA’s Senior EVP of Retail Operations, emphasized the importance of a unified response to combat organized retail crime (ORC), stating that the Store Walk Initiative helps DA offices and retailers build stronger cases for successful prosecutions, ultimately aiding in the restoration of community vibrancy.

The inaugural Store Walk Initiative, launched last year, saw participation from over 100 district attorney offices across the U.S. in store walks with retail asset protection leaders and store management teams. This effort improved communication and strategic coordination around ORC cases, leading to successful prosecutions and crime deterrence.

“The 2024 Store Walk Initiative is aimed at addressing organized retail crime and habitual theft.”

A recent Givex survey found that 78 percent of Americans believe

higher menu prices have made dining out more difficult this year. The Givex 2024 Restaurant and Dining Trends Survey emphasizes the impact of inflation on dining habits. It revealed that 86 percent of respondents are motivated to dine out by promotions, 81 percent by coupons and discounts, and 65 percent by loyalty programs. As a result, consumers are seeking value-added services to manage costs.

Additionally, the survey noted a decline in dining out and food delivery, with 41 percent dining out less frequently and 45 percent reducing delivery orders, while 60 percent are cooking more at home. Furthermore, the survey indicates a growing acceptance of technology, with 52 percent of Americans comfortable with AI-driven product recommendation technology, and 63 percent of restaurant operators planning to implement AI or automation in their operations.