Planning For The Year Ahead And Beyond

Reflecting On 2024 And Preparing For 2025

SEI Parent Company Seeks To Boost Shareholder Value

Serving Our Communities In More Ways Than One

Understanding Your Interest & Open Account On Your Financials

Understanding The Value Of Insurance

Small Change, Big Impact

Tropical Beer Hug is the 3rd largest craft high ABV single by dollars at 7-Eleven, +64.3% vs. YA and sells 1.2 units per store per day.

Space Dust is the 6th largest craft high ABV single by dollars at 7-Eleven, +170.7% vs. YA and sell 1.5 units per store per day.

Beer Hug 19.2 oz. ROS increases +23% when the existing SKU is paired with an additional Beer Hug 19.2 oz. SKU.

Tropical Beer Hug: SLIN# 100003

Big Juicy Beer Hug: SLIN # 109465 Space Dust: SLIN# 105197

Source: Circana 7-Eleven Total Enterprise

SPARKLING GRAPE SLUSH

6 Month EXCLUSIVE 1/1-6/24

The new CELSIUS® Grape Slush 16oz. Essentials formulated for Fitness Enthusiasts looking to elevate their performance. A burst of juicy grape goodness that hits you like a rush of excitement, setting the stage for an epic flavor journey. It’s not just about quenching your thirst; it’s about indulging in a taste sensation that’s as bold, vibrant and refreshing.

SUPPORT

• First Case Free Fill

• FOD: 12/30/2024

• P1 : 1/8-3/4/2025

• P1 Promo: 2/$4.50 Mix & Match (12oz & 16oz. ESSENTIALS)

• P1 FBO Custom POS/in-Store Signage & displays/Shippers

• GULP Media – In-Store Radio & Display ads

• Social Media & influencer Support

• Targeted Digital Media Campaign

FMBS are growing 18% in convenience 1

Highly Incremental!

$3 off purchase of 2 Shorties scan program in AZ, CO, IL, NV & WI and $3 off 2 vendor rebate in OH from 1/8/25-3/4/25

FOD 1/6/25: AZ, CO, FL, IL, OH, NV, WI

FOD 2/24/25: CA, CT, IN, ME, MI, NM, WV

Member News

7-Eleven On

‘Retailers To Watch’ List

7-Eleven is a retailer to watch in 2025 due to its significant expansion of private label products and advancements in digital technology, reported Store Brands. According to the article, 7-Eleven has significantly expanded its private label product assortment throughout 2024, launching new items in categories such as water, sports drinks, juices, teas, and snacks. The retailer now offers over 900 store brand items across 50 categories, fo-

“7-Eleven is a retailer to watch in 2025 due to its significant expansion of private label products and advancements in digital technology.”

cusing on sourcing quality ingredients to create differentiated products. Notable collaborations, like the one with Miracle Seltzer for a sparkling water line, demonstrate 7-Eleven’s commitment to innovation.

In addition to product expansion, 7-Eleven has embraced technology to enhance the customer experience.

The company has heavily invested in its mobile app, integrating features such as mobile ordering, delivery services, and the 7NOW delivery app, which offers on-demand delivery of snacks, beverages, and essentials. The app’s loyalty program, 7REWARDS, drives customer retention by offering personalized discounts and promotions. With the rise of convenience-driven shopping behaviors, 7-Eleven’s digital ecosystem positions it as a leader in the quick-service retail space, ensuring it remains a retailer to watch in 2025.

Seven & i To Spin Off Noncore Stores

Seven & i Holdings is considering selling some of its noncore specialty store businesses as part of a strategy to divest shares in its subsidiary, York Holdings Co., reported Kyodo News This move, proposed by potential buyers, will focus on the supermarket operations centered around Ito-Yokado. The plan includes spinning off businesses in lifestyle goods and children’s apparel, such as Loft and

continued on page 12

The National Coalition Office

The strength of an independent trade association lies in its ability to promote, protect and advance the best interests of its members, something no single member or advisory group can achieve. The independent trade association can create a better understanding between its members and those with whom it deals. National Coalition offices are located in Ceres, California.

3645 Mitchell Road Suite B Ceres, CA 95307 855-444-7711

nationaloffice@ncasef.com

NATIONAL COALITION OF ASSOCIATIONS OF 7-ELEVEN FRANCHISEES

NATIONAL OFFICERS & STAFF

Sukhi Sandhu NATIONAL CHAIRMAN 855-444-7711 • sukhi.sandhu@ncasef.com

Nick Bhullar EXECUTIVE VICE CHAIR 626-255-8555 • bhullar711@yahoo.com

Teeto Shirajee VICE CHAIR 954-242-8595 • teeto.shirajee@yahoo.com

Michelle Niccoli INTERIM VICE CHAIR 719-661-1048 • nicco711@yahoo.com

Khalid Asad INTERIM VICE CHAIR 913-488-3014 • Khalid.asad@aol.com

Rajneesh Singh TREASURER 214-208-6116 • rjn_singh@yahoo.com

Shawn Howard OFFICE & VENDOR RELATIONS MANAGER 855-444-7711 • shawnh@ncasef.com

Eric H. Karp, Esq. GENERAL COUNSEL 617-512-9004 • ekarp@wfrllp.com

John Riggio MEETING/TRADE SHOW COORDINATOR 262-394-5518 • johnr@jrplanners.com

John Santiago MANAGING EDITOR 267-994-4144 • avantimag@ncasef.com

April J. Key GRAPHIC DESIGNER lirpayek@gmail.com

The Voice of 7-Eleven Franchisees 2024 ISSUE 6

Put Your Best Fruit Forward!

Source: NIQ Homescan Panel Data, Brand Shifting - TOTAL U.S., 52 W/E 08/26/2023 vs. 08/27/2022

Member News

continued from page 10

Akachan Honpo Co., while retaining the supermarket operations. The first round of bidding for York Holdings’ shares has attracted interest from major entities like Sumitomo Corp. and Fortress Investment Group LLC. Seven & i plans to sell a majority stake in York Holdings by February 2026, turning it into an equity-method affiliate, and is seeking a buyer who can enhance the real estate value of stores in prime locations while focusing on food product operations.

Couche-Tard Earnings Fall Short

Alimentation Couche-Tard report-

ed net earnings of $708.8 million for its second quarter of fiscal 2025, translating to $0.75 per diluted share, a drop from $819.2 million or $0.85 per diluted share in the same quarter last year. Adjusted net earnings fell to $705.0 million, marking a 9.8 percent decline in adjusted diluted earnings per share to $0.74. The company’s total merchandise and service revenues rose by 6.6 percent to $4.4 billion, though samestore merchandise revenues dipped across all regions, with declines of 1.6 percent in the U.S., 1.5 percent in Europe, and 2.3 percent in Canada. These declines were attributed to

constrained discretionary spending and a shrinking cigarette industry. Gross margins also faced pressure, particularly in the U.S., where merchandise margins dropped by 1.0 percent to 33.8 percent, impacted by increased promotional offers. Meanwhile, fuel sales reflected mixed results; same-store volumes fell 2.2 percent in the U.S. due to weak demand and disruptions from two hurricanes, while small gains were seen in Europe and Canada.

Despite challenges, Couche-Tard continued its expansion strategy, entering agreements to acquire 290 company-operated convenience and

continued on next page

fuel sites in the U.S. The company’s road transportation fuel gross margins showed regional variations, with U.S. margins decreasing by 3.46¢ per gallon to 46.10¢, while European margins rose slightly. Canadian margins, however, dipped marginally by CA 0.28¢ per liter. Couche-Tard cited difficult economic conditions for low-income consumers, depreciation related to business acquisitions, and financial expenses as key factors impacting its results. On the positive side, acquisitions and share repurchase programs contributed favorably to performance.

Member News

Seven & i Plans Management Buyout

Seven & i Holdings is planning a ¥9 trillion ($60 billion) management buyout, which includes an initial public offering of its North American 7-Eleven business, reported Bloomberg. This move would ease financing concerns by raising over ¥1 trillion in cash to pay down part of the ¥6 trillion in loans from major Japanese banks. The buyout proposal, led by the founding Ito family and Itochu Corp., seeks to counter a rival ¥7.1 trillion offer by Alimentation Couche-Tard Inc. The IPO is seen as

Reasons

we’re proud to serve you:

the optimal way to quickly pay down loans, offering reassurance to lenders. The plan also involves splitting Seven & i into three entities: domestic supermarkets and retail business, 7-Eleven convenience stores in Japan, and North American 7-Eleven shops along with Speedway and Sunoco gasoline stations.

The proposed buyout reflects a unified effort by corporate Japan to keep one of its most famous companies from falling into foreign hands. Seven & i intends to retain a stake in the business after any potential listing. The company has already announced the separation of its domestic su-

Optimized our entire service team to continue serving you better. Introduced location-based policies for seamless service everywhere you go and grow. Launched our digital wallet to continue serving you better with the latest technology. Stores wont be cancelled due to losses We have additional Loss prevention, Employee retention and compliance tools MARKED 20 YEARS AS YOUR OFFICIAL WORKERS’ COMP INSURANCE AND EPLI BROKER!

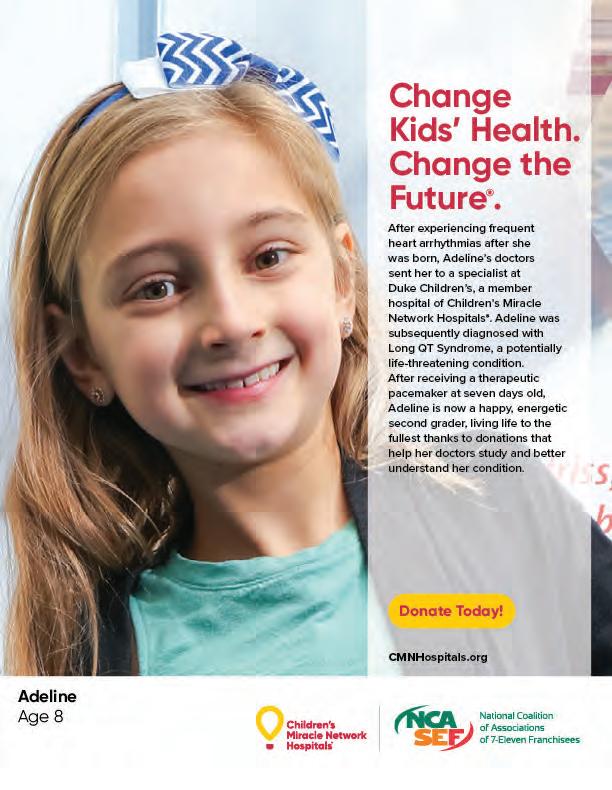

Small Change, Big Impact: How NCASEF Members Are Changing Kids’ Health To Change The Future

BY CHILDREN’S MIRACLE NETWORK HOSPITALS

Children’s hospitals are on the front lines of protecting the health of future generations. But they can’t do it alone. That’s where the amazing partnership between Children’s Miracle Network Hospitals (CMN Hospitals) and the National Coalition of Associations of 7-Eleven Franchisees (NCASEF) comes in! Together, members and affiliate vendors are an incredible team, committed to helping your local communities build a better tomorrow.

“Together, [NCASEF] members and affiliate vendors are an incredible team, committed to helping your local communities build a better tomorrow.”

Every penny donated through CMN Hospitals goes directly to helping local member hospitals provide lifesaving treatments and healthcare services. This gives kids the chance to grow up and do amazing things!

ZaLayaa’s Story

Meet ZaLayaa! Her early life was filled with medical mysteries. Doctors struggled to understand her rare conditions—she’s a “zebra,” a child with many invisible disabilities— making everyday life difficult. But at Gillette Children’s, with support from Children’s Miracle Network Hospitals, things changed. ZaLayaa discovered the joy of movement and play through adaptive sports and

accessible playgrounds. At Gillette, her truth, “See Me,” took on a new meaning. ZaLayaa is a champion, embracing a life full of possibilities and showing everyone that even with challenges, kids can still have fun and achieve great things.

And guess what? ZaLayaa wanted to share her gratitude with you!

Dear NCASEF Legends,

Sometimes life can be a challenging, unpredictable racetrack, especially for kids like me living with invisible disabilities and being a “Zebra.” Life is full of sharp turns, bumps, and roadblocks. Doctors call kids like me zebras because our conditions are super rare, and our diagnoses are tricky to figure out. We are unique, just like a zebra’s stripes—one of a kind!

As a Zebra, I face twists and challenges every day that aren’t always easy to navigate, but I keep going because I am a Champion! And when life bumps me off track, because of you, I don’t have to race alone—you’re like the ultimate pit crew helping me every step of the way!

All your fundraising is like the most amazing pit stop. It helps kids like me get the support needed to race through the hard spots. For me, it means having the care that keeps my wheels turning with therapies, better hospital stays, equipment, plus treatments, and lets me focus on the things I love. Like: golfing, gaming, drawing art, coding, plus dreaming about the future of

becoming a pediatric neurosurgeon someday (yep, I dream big!). For so many other kids, it means having the support they need to stay in the race, no matter how tricky the track gets. You’re not just franchisees—to me, you’re trailblazers, clearing paths and making sure kids like me never race alone. Thank you for being such an important part of my pit crew, making a large impact on my journey. With you by my side, I know no matter what, every finish line is just right around the bend!

With all my zebra-striped gratitude, ZaLayaa (And Family)

Small Change, Big Impact: How NCASEF Members Are Changing Kids’ Health To Change The Future

continued from page 15

NCASEF: Making A Difference

NCASEF members, communities, and vendors are all working together to raise money for CMN Hospitals. This helps fund important things like medical treatments, special equipment, and even comfy places for families to stay. It’s all about helping kids live healthy, happy lives and become the amazing inventors, artists, and leaders of tomorrow.

“It’s all about helping kids live healthy, happy lives and become the amazing inventors, artists, and leaders of tomorrow.”

Aloha from Kona!

Speaking of amazing things, the recent Q4 Affiliate meeting in Kona, Hawaii was a huge success! The

NCASEF Board, FOA Presidents and Vice Presidents, and Affiliate Vendors all gathered at the beautiful King Kamehameha’s Kone Beach Hotel.

Wednesday, it was announced that NCASEF had raised over a million dollars for CMN Hospitals! What an incredible achievement!

“On Wednesday, it was announced that NCASEF had raised over a million dollars for CMN Hospitals! What an incredible achievement!”

Tuesday before the meeting was all about golf! But amidst the friendly competition, a check for $11,711 was presented to CMN Hospitals. And that wasn’t all! Fairlife, a super generous partner, surprised everyone with an extra $10,000 donation.

The generosity continued with a silent auction filled with awesome items from Primo Brands. People were so eager to help that they raised over $6,000!

And the best news of all? On

Avanti Is Your Magazine

Avanti Magazine was created in 1981 by franchisees, for franchisees. It represents your voice within the 7-Eleven universe and requires your participation to remain relevant to the ideas, information, and knowledge floating about the franchisee community. You can contribute to the success of Avanti Magazine by submitting any of the following:

> Articles on any 7-Eleven topic that may be of interest to other franchisees.

> Your FOA events and Board meeting calendars.

> FOA event photos with a short description (who, what, where, when, and why).

> Store or community event photos with captions.

> Any combination of the above.

Please send your submissions to avantimag@ncasef.com.

As former National Coalition Chairman Bill Schuessler famously said, “None of us is as great as all of us together, so let’s stay tightly knit together.”

Looking Ahead

This is more than just about money; it’s about our future. Every dollar raised means essential research, equipment, and support for families facing tough times. It means more kids like ZaLayaa get the care they need to thrive.

NCASEF members are truly making a difference for children and families. Together, we can change kids’ health. Together, we can change the future.

Reflecting On 2024 And Preparing For 2025

BY SUKHI SANDHU, NCASEF CHAIRMAN

With 2024 now behind us, it’s safe to say last year felt like a rollercoaster ride for 7-Eleven franchisees. We’ve faced some big challenges, but also pulled off some impressive wins. Looking back, it’s clear that our resilience and unity got us through some tough times. Now as we gear up for 2025, I am confident we can tackle any issues that may come our way together as a team.

“Looking back, it’s clear that our resilience and unity got us through some tough times.”

Last year wasn’t easy. Growing sales was a major challenge, and rising operational costs ate into our profits. Stores on the east coast experienced logistical problems with the Regional Distribution Centers (RDCs), which made it harder to get products and placed extra pressure on franchisees to find solutions on their own. But despite this, east coast franchisees rose to the occasion, keeping shelves stocked and customers happy through sheer determination and creativity.

The rollout of RIS 2.0 was a big step forward in terms of modernization, but it didn’t come without its hiccups. The transition caused disruptions, and both stores and customers felt the effects, like when network outages affected credit and debit card processing. Post-COVID, it seemed like some vendors and even corporate teams had gotten too comfortable relying on automated tools like guided replenishment and electronic ordering. These systems have their perks, but they’re not perfect—and when things go wrong, they can cause real

headaches. Issues like outdated minimums and unchecked electronic orders created inefficiencies that franchisees had to fix, often on the fly.

Labor issues were another tough spot. Finding and keeping good workers has been harder than ever. The labor pool has changed, with many workers less willing to take on the demands of retail jobs. Turnover went up, training costs climbed, and all of it added to the stress of running a store. And let’s not forget retail theft—it hit record levels last year, adding yet another layer of frustration and driving up insurance costs for everyone as smash and grab claims skyrocketed.

The economic environment didn’t do us any favors, either. High interest rates made borrowing more expensive, impacting some franchisees who have to rely on SEI to help finance their inventory. Inflation pushed operational

I will explain below), placing additional financial pressure on franchisees.

But even with all these challenges, we had some big wins in 2024. Our collaboration with SEI improved in key areas. For example, we formed committees comprised of franchisee subject matter experts to tackle logistics issues and IT concerns with SEI. We also joined with SEI to introduce a franchisee-owned captive insurance program to help franchisees get the coverage they need while managing costs. Additionally, just as the auto GGPS reduction policy was set to end on December 31, your NCASEF and FOA leadership teamed with SEI to develop a new “earned” GGPS reduction model with the potential for the same or greater support as the previous program. These achievements show how much we can accomplish when all stakeholders work together and stay focused on common goals.

“But even with all these challenges, we had some big wins in 2024.”

costs even higher and affected consumer spending habits. For many franchisees, this meant finding ways to cut costs and run stores as efficiently as possible while still delivering great customer experience and value. It wasn’t easy, but franchisees proved they could adapt and find creative solutions to keep things moving.

To make things tougher, the Franchisee Operating Credit program—the $200 monthly support many franchisees relied on—ended last year for those who signed the 2019 Agreement. The 7Now subsidy also ended, as did the auto GGPS of 100 and 150 basis points (but we worked out a solution for that, which

In California, franchisees took a proactive approach to tackling retail theft by joining forces with SEI, other business operators, lawmakers, and law enforcement agencies to push for legislative changes. Our efforts culminated in the passage of Prop 36 during the November elections, a measure aimed

“These achievements show how much we can accomplish when all stakeholders work together and stay focused on common goals.”

at strengthening penalties for repeat offenders and providing better support for theft prevention. 7-Eleven franchisees and FOAs from across the country also pitched in financially to help make this new law a reality, which is a significant step forward in addressing the growing issue of retail crime and could become a model for other states.

A huge highlight this year was hitting the $1 million mark in fundraising for Children’s Miracle Network Hospitals. Events like our convention’s Charity Golf Tournament and Charity Night Gala, as well as the golf tournaments held during our Board meetings and those organized by FOAs, were instrumental in our fundraising efforts. This milestone reflects our generosity, our commitment, and that we believe in giving back to our local communities, and it’s something we can all be proud of.

Our annual convention and trade show was another high point. Franchisees and vendors showed up in record numbers to network, exchange ideas, and find new sales opportunities. The energy and enthusiasm at this event were inspiring, reminding us why unity and collaboration are at the heart of what makes our brand strong.

Looking ahead to 2025, we know it won’t be a walk in the park. Inflation is still affecting consumer spending and we’ll still be dealing with rising audit inventory variances, insurance premiums, and labor costs. So, how do we tackle these challenges?

First, we’ve got to make store operations easier and less stressful for employees. Simplifying processes and reducing workloads will make 7-Eleven a more attractive place to work, helping us hold onto good employees and save on training costs.

Next, managing insurance premiums will take a group effort. Franchisees need to join our captive insurance program and learn how to keep the number

of claims low. Education and training will be key here, helping everyone understand how claims are incurred and how to prevent them.

We also must get more involved in legislative affairs at the local, state and federal levels so we can influence bills affecting our businesses. This is essential, as retail theft continues to rise and as more municipalities across the country look to pass new measures that could negatively impact our operations and bottom lines.

We also need to address audit inventory variances, one of our biggest expenses. This means improving how we handle things like waste tracking, inventory control, and cycle counts. In addition, we need to manage the quality and dollar amount of our inventory more efficiently without running out of products. If we can tighten up these processes, we’ll see real savings and a healthier bottom line.

wFood service will be a major focus next year. It’s a category with a lot of potential, but it also comes with challenges. Simplifying processes and improving inventory quality will help us make the most of this opportunity, as will keeping our stores clean and providing exceptional customer service. We also need to work with SEI to ensure we have a top-notch maintenance program so the equipment is always functioning properly.

Plus, we need to keep pushing to bring in new products and categories to stay competitive and keep customers excited. This includes working with our vendor partners to get better cost of goods. Another priority in 2025 will be to grow our private brand items without cannibalizing the national brand items that consumers look for in our stores and are loyal to.

We also need to keep pushing for better technology and infrastructure. Improvements to SEI’s IT systems could make a big difference in day-to-day op-

“At the end of the day, our success in 2025 will come down to teamwork.”

erations, and investing in store remodels and new equipment will help us stay competitive. It’s up to us to advocate for these changes and show SEI how they can benefit everyone involved.

Finally—and I direct this not only to franchisees, but also to our SEI colleagues and our vendor partners—we are, all of us, overworked. Therefore, it is essential that we keep a close eye on our health and well-being so we can keep driving the brand and our businesses forward, and keep morale up for everyone.

I have several ideas I would like to see implemented through NCASEF that I believe would help us achieve some of our goals this year. These include hiring lobbyists to help introduce and influence bills that will benefit our businesses, hiring a PR firm to promote our successes and communicate our messages to trade publications and in social media, hiring asset protection consultants to show us how to prevent or minimize theft in our stores, and hiring insurance consultants who can educate us on how to minimize claims.

At the end of the day, our success in 2025 will come down to teamwork. By sticking together, sharing ideas, and supporting one another, we can tackle anything that comes our way. The principles of the “three-legged stool” are more relevant than ever: franchisees, SEI, and vendors all have a role to play in making the brand successful.

SUKHI SANDHU CAN BE REACHED AT 855-444-7711 or sukhi.sandhu@ncasef.com

SEI Parent Company Seeks To Boost Shareholder Value

BY ERIC H. KARP, ESQ., GENERAL COUNSEL TO NCASEF

In an article published in C-Store Five on December 16, 2024, the reporter opined that 7-Eleven has experienced significant financial setbacks in 2024 as it faced mounting economic challenges brought on by inflation, not to mention a potential management buyout and initial public offering. According to this article, 7-Eleven CEO Joe DePinto stated in April of 2024 his expectation that inflation would continue to tighten consumer pockets. In October of last year, as SEI revealed plans to close 444 convenience stores in North America due to underperformance, it also announced that it would sell $750 million worth of property via sale and leasebacks.

These statements are wholly consistent with publicly filed documents by SEI’s parent indicating that in 2024 they would have a non-recurring gain of some $520 million from the sale and leaseback transactions, and a one-time loss of $365 million due to the closure of unprofitable stores. The parent company also predicted that SEI operating income for 2024 would be down 33.7 percent from the prior year and that EBITDA would be down 15.4 percent. More importantly for franchisees, they also predicted that same store sales would be down 3 percent on the year.

That news is not surprising given that YOY same store sales have been negative from September 2023 through October 2024. In November 2024, same store sales were essentially flat, reported as up 0.1 percent. But these numbers also show that same store

sales have been outpaced by inflation for 22 months in a row.

The company also announced plans to open 600 large food-focused locations in North America by the end of 2027, with approximately 115 of those locations operating by the end of 2024. This may be good news for shareholders, but it’s not clear that it will have any impact on store level sales or profitability for franchisees.

“As the parent company has stated, one of the reasons the stores in question have been underperforming is because the cost of living, measured by inflation, has created downward pressure on sales.”

SEI Senior Vice President Randy Quinn was quoted as saying that everything in the article was accurate, except that the 440 closures were not because of inflation weary customers, but because they were negative EBITDA and should have been closed years ago. Some have seen this and characterized it as daylight between Mr. DePinto and Mr. Quinn, but the facts suggest otherwise.

The parent company’s public reports for the first half of 2024 indicated that the reasons for lackluster same store sales included the high cost of living, depleted savings, higher debt, more living from paycheck to paycheck, and evolving consumer expectations for such things as the quality of food, faster and easier fueling, digital

innovation, and larger and newer stores. The parent company also indicated that their oft-repeated 4-point strategy involved growing proprietary products, accelerating digital and delivery, improved efficiency and cost reductions, and growing and enhancing the store retail network. In the end they are both right. As the parent company has stated, one of the reasons the stores in question have been underperforming is because the cost of living, measured by inflation, has created downward pressure on sales.

In fact, the closure of 440 stores is not really news. According to our SEI franchise disclosure documents, nearly 1,600 company stores were closed in the U.S. from 2015 through 2023. And during the period 2016 through 2023 the turnover in franchise stores averaged 6.75 percent per year.

From my perspective, the issue of store closures and the reasons for them are grounded in the need of the parent company to unlock what it perceives to be unrealized shareholder value as a way of fending off the unsolicited bid from the parent company of Circle K and to protect management from displacement. But franchisees need not be distracted by these concerns, because the much more important issues of franchised store level financial performance, economics and value need to be urgently addressed by whoever controls and manages these companies.

ERIC H. KARP CAN BE REACHED AT 617-512-9004 or ekarp@wfrllp.com

Pop-Tarts® Frosted Strawberry, 3.3 oz

Pop-Tarts® Frosted Brown Sugar Cinnamon, 3.3 oz

Pop-Tarts® Frosted S'mores, 3.3 oz

Pop-Tarts® Frosted Blueberry, 3.3 oz

Pop-Tarts® Apple Jacks, 3.3 oz

Pop-Tarts® Frosted Strawberry Milkshake, 3.3 oz

Serving Our Communities In More Ways Than One

BY TEETO SHIRAJEE, NCASEF VICE CHAIR

Community service is a cornerstone of what makes us human. As president of the South Florida FOA, I am deeply honored by the proclamation issued recently by the Palm Beach County Board of Commissioners recognizing the tremendous efforts of our local 7-Eleven franchisees. This proclamation serves as a celebration and a call to action, reminding us of the transformative impact of small business ownership and community engagement. Palm Beach County’s acknowledgment highlights our role as community leaders. From inventing the convenience store concept to being the first to offer 24-hour service and “coffee to go,” 7-Eleven has long been a pioneer in meeting customer needs. But as the proclamation notes, our role extends beyond convenience. With 65 stores in Palm Beach County, we have generated thousands of jobs and contributed millions of dollars in sales taxes that strengthen our local economy. The South Florida FOA has always believed that community service goes hand in hand with business success. The proclamation mentions our collaboration with Habitat for Humanity, which has resulted in the construction of seven homes for deserving families. This partnership exemplifies how we as franchisees can use our resources and platforms to build stronger communities. Our commitment to supporting the community has also been evident during times of crisis. During Hurricanes Irma and Ian, South Florida franchisees donated thousands of cases of water to those in need, demonstrating our compassion when it mattered most. Moreover, we’ve made it a tradition to offer free coffee to first responders—a

small gesture of appreciation for the enormous sacrifices they make to keep our communities safe. These acts of service embody the spirit of 7-Eleven: going above and beyond to meet the needs of others.

In 2023, South Florida franchisees raised over $12,000 to support children in need of medical care at local

Children’s Miracle

Network Hospitals. This effort reflects a shared belief that investing in the wellbeing of our youngest residents is an investment in the future of Palm Beach County. Every dollar raised, every cup of coffee served, and every case of water donated is a testament to the power of our collective action and the profound difference it can make.

This level of service is only possible because of the incredible dedication of our franchisees and their employees. Operating 24 hours a day is no small feat, but it is this commitment that has earned the trust and loyalty of our customers. The relationships we build through these efforts are what turn customers into neighbors and neighbors

into family. I see this proclamation a reflection of the values that define the South Florida FOA. It reminds us that excellence is not just about running successful businesses, but about using our platform to uplift those around us. We are inspired to continue providing the best service to our customers and our communities. This recognition fuels our passion for finding new ways to serve, whether it’s through supporting local charities, helping our neighbors in times of need, or simply providing a warm, welcoming place for customers at any hour of the day. As franchisees, we are proud of what we have accomplished, but the work doesn’t stop here. This proclamation is a reminder that we must continue to lead by example, setting a high standard for community service and customer care. It is also an invitation for others—businesses, individuals, and organizations alike—to join us in building a stronger, more connected Palm Beach County.

As the proclamation so eloquently concludes, “Oh Thank Heaven for 7-Eleven.” But more importantly, thank heaven for the communities that support us, the employees who stand with us, and the customers who inspire us. Together, we can continue to make a difference, one cup of coffee, one donation, and one act of service at a time. Let this proclamation serve as a beacon of what we can achieve when we come together, united by a shared commitment to excellence and compassion.

TEETO SHIRAJEE

CAN BE REACHED AT 954-242-8595 or teeto.shirajee@yahoo.com

Understanding Your Interest & Open Account On Your Financials

BY TODD UMSTOTT, UMSTOTT INC. DBA 7-ELEVEN, PORTFOLIO FRANCHISEE—PA, MD & WV

In today’s tough economy, people are spending less because of higher prices and slower wage growth. Stuff like groceries and fuel are still necessities, but even in these areas shoppers are being careful with their money, choosing where to spend and what to buy more wisely. This shift has forced retailers to fiercely compete for consumer loyalty, offering discounts, loyalty rewards, and promotions in a bid to maintain sales. For 7-Eleven franchisees, this means it’s no longer business as usual—every financial decision carries greater weight, as profit margins tighten under economic pressure.

“For 7-Eleven franchisees, this means it’s no longer business as usual—every financial decision carries greater weight, as profit margins tighten under economic pressure.”

That’s why keeping a close eye on your store’s finances is so important right now. A key part of this is managing your Open Account with 7-Eleven. This account works like a line of credit at your financial institution or bank, and changes based on things like inventory, cash in the store, and your store’s equity. By managing these factors well, you can lower costs and maybe even earn money on negative balances (see below, as there are limitations).

Taking control of your Open Account can help you save money and keep your store financially stable during these lean times.

“The calculation of your line of credit or Open Account stops on the last day of each accounting period and interest is charged based on that number.”

As I find myself routinely explaining the subject matter of this article, I thought it time to put it out there on paper for everyone and to also try to simplify the explanation of the subject.

To begin, you will find your current end-of-month balance on the first page of your 48A at the bottom. It will be titled ***Open Account*** TO/(FROM) SEI. The calculation of your line of credit or Open Account stops on the last day of each accounting period and interest is charged based on that number. The interest charged is reset every March based on the thencurrent prime rate. Presently, the rate for all positive amounts on your open account is 10.5%, which is prime plus 2% on last reset

period. The rate for all negative amounts is currently 6.5% or prime minus 2% with one caveat—it is only paid on the first 10 thousand dollars of negative amounts.

I have heard in the past that the interest charge seems high and with that I say go into any financial institution and ask what their current rates are on an unsecured line of credit. Normal rates are prime plus 2%, as well as there is no such thing as having a negative amount on your line of credit at your financial institution that they pay you on.

The next question I get then is how does this number fluctuate? The main contributors to your open account calculation are your inventory, your total safe and registers, and your store’s equity balance.

To simplify this, how about some examples. Let’s say at the end of the month you have a cost of inventory valuation of $100,000, a total safe

continued on page 29

Understanding Your Interest & Open Account On Your Financials

“The main contributors to your open account calculation are your inventory, your total safe and registers, and your store’s equity balance.”

and register fund of $5,000 and an equity balance of $25,000. You will be paying interest on $80,000 at 10.5%.

Next example: let’s say at the end of the month you now have the same $100,000 cost of inventory valuation and the same $5,000 in total safe and registers, but your equity in your store is $75,000. You will be paying interest on $30,000 at 10.5%

Now let’s go the other way—let’s say at the end of the month you have the same $100,000 cost of

inventory valuation and the same $5,000 in total safe and registers, but your equity is $125,000. Now you have a negative balance of $20,000.

7-Eleven will now PAY YOU 6.5% interest, but only on the first $10,000.

With the examples above I want to point out that I have heard comments like, “I always draw my store down to minimum net worth each month.” Well, that is fine if first you need the money for personal obligations or you are making more than 10.5% on the money you drew out. If you are making more than 10.5% on your cash, please email me and tell me where you are putting your cash.

Your equity offsets your open account, so you also do not want to have your store sitting there with too much cash in it, either. I have seen statements where stores have excessive negative amounts posting in their open account, and what I mean by excessive is basically anything over $10,000 as at that time you are making a big fat zero on those dollars above $10,000. Heck, even pulling anything above that amount out and putting it into a money market account would get you more than zero. See my example above.

I have been asked, “Where do I see how much I am paying?” The answer is on or about the fourth page of your 48A under “General &

Admin Expense” Acct 00991 titled “Interest Expense.” Just like all other expenses, if the number is positive then it’s a credit to your store. If it has brackets around the number, it is a debit (charge) to your store.

You are in control of your “line of credit” and what it may or may not cost you. Just know that by leaving cash in your equity that you’re ultimately making currently 10.5% on it up to the point where it offsets your “open account” (LOC).

How do you work on getting that expense in line? This is a two-part anwer, with both parts being equally important. First, if your situation allows, let your equity grow in your location to the point it offsets your open account. Second, look at your inventory and your inventory turns— do you have the right level? Too much and you are chipping away at your profit from it because it costs money to sit on inventory via interest. Too little and you begin shooting yourself in the foot with sales and gross profit, so managing your inventory best for your store is the quickest and largest way to benefit. Lastly, don’t keep unnecessary cash in your total safe and register calculation, as not only is this calculated into your open account at the end of the month, but it is also a liability to you.

As always if anyone wants to reach out directly, please do not hesitate.

Understanding The Value Of Insurance

BY JOHN WALES, AON PROGRAM MANAGER

One of the things I enjoy about my position at Aon is the opportunity to meet many of you at the local FOA trade shows. I enjoy hearing your stories and answering your questions, which often highlight your unique challenges as franchisees.

“After we reviewed the policy, the ‘best deal out there’ suddenly didn’t seem like such a deal.”

Earlier in 2024, I was approached by a franchisee with a liability policy he was eager to share. He described it as the “best deal out there” and was confident that “nobody” would be able to beat the price.

As I reviewed the actual policy, I noticed several key details that raised concerns. This policy was a general liability policy with a $10,000 deductible, a 70 percent coinsurance clause, and a range of other insurance-related restrictions that greatly limited his coverage. For instance, this policy excluded most types of claims other than a slipand-fall incident and required the $10,000 deductible to be met before any payments would be made. In addition to that, any potential settlements would be reduced by 30 percent due to the coinsurance provision on the policy.

While the policy was inexpensive, it became clear that the franchisee didn’t fully understand what he was paying for. After we reviewed

the policy, the “best deal out there” suddenly didn’t seem like such a deal.

This experience raises an important question: As business owners, are we prioritizing price without considering the overall value? Are we ensuring that what we pay for truly meets our needs?

Having the wrong insurance policy is like trying to dig a hole with a screwdriver—it’s simply the wrong tool for the job.

“Having the wrong insurance policy is like trying to dig a hole with a screwdriver—it’s simply the wrong tool for the job.”

In business, having the right tool for the job can be the difference between success and failure. This can be especially true in insurance, where cutting corners to save costs can lead to unexpected gaps in coverage. During tough economic times, it’s natural to look for ways to reduce expenses, but it’s essential to understand the risks of cutting the wrong costs.

“This can be especially true in insurance, where cutting corners to save costs can lead to unexpected gaps in coverage.”

An example can be seen in workers’ compensation coverage,

“Taking the time to review your coverage can help ensure that you’re equipped with the right tools to help protect your business and your livelihood.”

where many states allow company officers to exclude themselves from coverage to lower premiums. While this can help reduce the upfront costs, it can also reduce the overall value of the policy. If an excluded owner is injured while working in their store, their injuries wouldn’t be covered by the workers’ compensation policy. We’ve seen situations where owners who opted out are now paying far more than they saved in insurance costs. Insurance, because of its complexity, is normally not our favorite topic of discussion, but it’s a critical one. Taking the time to review your coverage can help ensure that you’re equipped with the right tools to help protect your business and your livelihood. If you have questions about your policy or want to learn more, visit us at the next FOA trade show. We’re happy to discuss your options and provide resources to help you make more informed decisions. Plus, don’t forget to stop by our booth to grab a free safety whistle for your store! I look forward to talking with you!

NCASEF’s 4th Quarter Affiliate Member & Board Meetings Summary

NCASEF held its 4th Quarter Affiliate Member and Board of Directors meetings from November 13-15, 2024, at the picturesque King Kamehameha’s Kona Beach Hotel in Kona, Hawaii. The event was marked by productive discussions, valuable insights, and collaborative engagements. A charity golf tournament benefiting the Children’s Miracle Network Hospitals preceded the meetings on November 12, held at the scenic Mauna Lani Golf Course, adding a philanthropic touch to the event.

Chairman Sukhi Sandhu and Executive Vice Chair Nick Bhullar opened the Affiliate Member Meeting with a warm welcome, expressing gratitude to all franchisees and vendors who participated in the charity golf tournament and sponsored various activities throughout the meetings. Kate Burgess from Children’s Miracle Network Hospitals provided an inspiring overview of the organization’s efforts, highlighting the impressive fundraising achievements by NCASEF, its FOA members, and vendor partners, which have raised

over $1 million since 2022. She also announced a silent auction featuring autographed Major League Baseball items to be held during the tabletop trade show, and encouraged FOA leaders to invite local children’s hospital representatives to their meetings and events.

The attendees then participated in breakout workshops, divided into four groups: Vault, Center of the Store, Packaged Foods/DSD, and Service Providers. Each group tackled specific challenges and brainstormed solutions: Group One discussed issues

continued on next page

like insufficient vault space in older stores, with potential solutions such as standalone coolers provided by vendors. The conversation also covered private label product space, point-of-purchase displays, and dollar-days promotions. Group Two explored how FOAs could work with vendors to market new products and get them into the 7-Eleven system, as well as delivery processes and data utilization to measure product success. Group Three addressed the communication of new items to FOA members, pre-book options, and maximizing participation in FOA trade shows. Group Four discussed maintenance service provider issues, offerings from Aon and T-Mobile, and Eco Labs’ instructional videos on cleaning store equipment.

The session concluded with a presentation from 7-Eleven, Inc. guests, including Randy Quinn (Senior VP of Franchise Operations), Bruce Maples (Senior Director of Franchisee Relations and Engagement), and Jim Bayci (Manager of Franchise Support). Randy Quinn provided an overview of the current operating environment, highlighting challenges affecting customers and sales, such as high living costs, consumer debt, and the impact of flavor bans on cigarette sales. He outlined SEI’s strategies to address these issues, including winning breakfast, owning snacking, and promoting private brands. He also spoke about the Golden Pass delivery service and efforts to improve energy drink sales. The session ended with a Q&A segment.

On November 14, the NCASEF Board of Directors convened to discuss internal governance, vendor relations, and strategic priorities. Chairman Sukhi Sandhu encouraged open dialogue, stressing that the Board meetings are the perfect platform to address concerns directly with SEI leadership. Vendor presentations from Anheuser-Busch, Coca-Cola, and Body Armor were featured, along with open discussions on labor issues, retail theft, and 7Rewards discounts. Open discussions among Board members covered pressing issues like labor shortages, retail theft, and rising operational costs.

7-Eleven, Inc. guests returned for further discussions, with Randy Quinn emphasizing the importance of promoting CMN Hospitals’ fundraising campaign and providing updates on operations, merchandising, and SEI’s financial investments in stores. Topics addressed during the Q&A included 7Now delivery costs, retail crime, rising labor costs, and product shortages.

Committee reports included a recap of the 2024 NCASEF convention, in-house maintenance issues, and processes related to the upcoming vice chair elections. Vendor presentations from PepsiCo, T-Mobile, Campbell Snacks, Hain Celestial, and Poppi provided additional insights.

The final day of the meetings began with a treasury report by Treasurer Raj Singh, which was unanimously approved. The Government Affairs/Tobacco Committee discussed national legislation affecting

continued from previous page franchisees, upcoming labor rules, and the potential impact of the Trump administration on businesses. Vendor presentations from Vita Coco and Beatbox followed.

General Counsel Eric Karp addressed suggestions for changes to the NCASEF officer election process, which were explained by an Election Committee member. The election for Vice Chair positions commenced, resulting in the election of Khalid Asad, Michelle Niccoli, and Teeto Shirajee for the next three-year term.

The meeting concluded with updates from General Counsel Eric Karp on SEI’s financials, and the announcement of dates and venues for the 2025 Board and Affiliate Member meetings. Chairman Sukhi Sandhu made closing remarks, discussing the Graduated Gross Profit Split (GGPS) and congratulating the newly elected vice chairs.

Throughout the four-day event, the NCASEF Board and Affiliate Members engaged in meaningful discussions, setting the stage for continued progress and success in 2025.

Heartfelt Thanks For Your Generous Participation

We extend our deepest gratitude to all the vendors and franchisees who participated in the charity golf event on November 12, 2024, at the breathtaking Mauna Lani Golf Course in Kona, Hawaii, just prior to the NCASEF fourth quarter meetings. Your presence and enthusiasm made the event an outstanding success, turning a day

of golf into a significant contribution to the Children’s Miracle Network Hospitals. It’s because of your dedication and support that we could make a meaningful difference in the lives of countless children and their families.

Your generosity and commitment to this cause did not go unnoticed. The camaraderie and spirit shown

throughout the event exemplified the best of our community, highlighting the incredible impact we can have when we come together. We are proud to have partners like you who share our passion for making a positive change. Thank you for your unwavering support and for being an integral part of this memorable and impactful event.

Kudos To Our Outstanding Vendors

A huge thank you to all the vendors who joined us for the Tabletop Trade Show after the Fourth Quarter Affiliate Member meeting on November 13 at the King Kamehameha’s Kona Beach Hotel in Kona, Hawaii. We appreciate you bringing your top-selling products to showcase and offering great trade show-only deals—our franchisees are always eager to place orders on the spot for those hot new items. We are grateful for your support and participation, which played a big role in the success of the overall event.

Member News

permarkets and retail business, with plans to bring in strategic partners and eventually list the domestic retail business.

Dollar Stores Are Struggling

Dollar General and Dollar Tree are facing significant challenges despite their reputation as go-to destinations for budget-conscious shoppers, reported CNBC. Both retailers have cut their sales forecasts due to weaker-than-expected sales, with shares plunging over 40 percent in 2024. The economic strain on low-income households, who are their primary customers, has been exacerbated by inflation, leading to reduced discretionary spending. Additionally, company-specific issues such as messy

stores, worker safety concerns, and limited e-commerce capabilities have further hurt their performance. Leadership changes, including the departure of Dollar General’s CEO Jeff Owens and Dollar Tree’s CEO Rick Dreiling, have added to the instability. Dollar Tree is also considering selling its Family Dollar brand, which has struggled more than its namesake stores.

The competitive landscape has intensified, with legacy retailers like Walmart making significant investments in e-commerce to attract middle- and upper-income shoppers. This shift has drawn customers away from dollar stores, which have not kept pace with digital offerings. Both Dollar General and Dollar Tree have faced backlash for poor store conditions and have paid millions in fines

Chocolate & Candy Sales To Grow This Winter

According to a recent survey by the National Confectioners Association (NCA), 95 percent of Americans are ready to celebrate the winter holidays with chocolate and candy. In 2023, confectionery sales during the winter holidays reached nearly $7 billion and are expected to grow by up to 3 percent in 2024. The winter holidays, along with Valentine’s Day, Easter, and Halloween, account for 64 percent of annual sales in the $48 billion confectionery industry. continued from page 13

HRI Development recently opened the Lebec Travel Center in Southern California, which is set to become one of the largest EV charging facilities in the state with 112 Tesla Supercharger DC fast chargers by the end of 2025, and already offering 40 stalls. The travel center combines traditional and electric refueling options with a flagship 7-Eleven store, expanded food offerings, an EV lounge, and amenities designed to enhance the travel experience for all. • Walmart recently opened its 400th fuel station in Palm Springs, California, and plans to expand its fuel station network over the next five years. The retailer its

strategy is to enhance customer experience by offering everyday low prices at the pump and additional savings for Walmart+ members. • Albertsons recently called off its $25 billion merger with Kroger after a federal judge blocked the deal, citing concerns that it would eliminate competition and potentially raise prices for consumers, reported CNN Business. Albertsons is also suing Kroger for breach of contract, alleging that Kroger failed to secure regulatory approval for the merger, while Kroger claims the lawsuit is baseless and without merit. • Whole Foods is expanding its small-format Daily Shop stores in urban areas,

for safety violations. The pandemic worsened these issues, with staffing shortages leading to cluttered aisles and out-of-stock items.

continued on page 45

starting with a successful location in Manhattan that has exceeded sales projections, reported The Wall Street Journal. The stores, about a quarter the size of regular Whole Foods, cater to “fill-in” shoppers who make frequent trips for a few items. • Grocery stores are increasingly resembling quick-service restaurants by offering fresh-prepared meals, made-to-order sandwiches, and other convenience-focused options to meet consumer demands for quick, high-quality, and healthier meal choices, reported Supermarket News. This trend is driven by the blurring lines between gro-

Election Excitement At DelVal FOA Board Meeting

On December 18, 2024, the Delaware Valley FOA gathered at the charming Masal Café and Restaurant in Philadelphia for their final meeting of the year. The evening featured vendor presentations from Feel Free, Coca-Cola, PepsiCo, and Mini Melts, adding an informative and engaging touch to the proceedings. A key highlight of the night was the election for the vice president position. The meeting was a perfect blend of insightful presentations and pivotal decision-making, setting a positive tone for the year ahead.

Strawberry Lemonade Green Tea

12 oz. single

Mango Passion Fruit Green Tea 12 oz. single

Blueberry Pomegranate Black Tea

12 oz. single

Member News

continued from page 42

The survey also revealed that more than half of Americans share chocolate and candy as part of their holiday gifting, with foil-wrapped chocolates, small boxes of chocolate, and candy canes being the top choices for stocking stuffers.

C-Stores Innovate Foodservice Offerings

In 2024, convenience stores across the U.S. significantly enhanced their foodservice programs, introducing new restaurant concepts and expanding their menus to attract more customers, reported C-Store Dive. 7-Eleven, for instance, has added numerous permanent and limited-time items to its menus and rolled out a new, larger, food-focused store design, with plans to open hundreds of these stores in the coming years. Other retailers like Circle K, EG Amer-

continued from page 42

cery stores, convenience stores, and QSRs, with all sectors leveraging technology and innovative strategies to capture a larger market share. • Black Friday 2024 saw U.S. e-commerce sales surpass $10 billion for the first time, with a 10.2 percent year-over-year growth, according to Adobe Analytics data. This increase was driven by significant mobile device usage, which accounted for over half of the sales. Globally, Black Friday online sales reached $74.4 billion, with

ica, and GPM Investments have embraced value meals, making them a popular trend in 2024. New QSR-

“In 2024, convenience stores across the U.S. significantly enhanced their foodservice programs to attract more customers.”

style concepts have been introduced by various c-stores, such as Onvo’s Food on the Fly, Schmitz Sunoco’s Gastro High Octane Eats, and Rebel Convenience Stores’ Hatch Chicken Co., which is expected to expand to 20 locations next year. Furthermore, c-stores have formed new partnerships with unique eateries, such as Gas N Wash’s collaboration with Mickey’s Greek-style restaurants and Love’s Travel Stops’ expansion

of its agreement with Naf Naf Middle Eastern Grill.

Retail Crime & Losses Increase

mobile devices contributing to 69 percent of these sales. • PepsiCo recently acquired the remaining 50 percent interest in Sabra Dipping Company LLC and PepsiCo-Strauss Fresh Dips & Spreads International, becoming the sole owner of both companies. The company said the acquisition will accelerate its innovation in the fresh dips and spreads market, meeting growing consumer demand and expanding PepsiCo’s Positive Choice portfolio. • Dollar General is testing same-day

Shoplifting incidents have soared by 93 percent since 2019, with retailers reporting a corresponding 90 percent increase in losses, according to the National Retail Federation’s (NRF) latest study, “The Impact of Retail Theft & Violence 2024.” Conducted in partnership with the Loss Prevention Research Council and Sensormatic Solutions, the study examines the evolving challenges in combating retail theft and violence. Retailers surveyed experienced an average of 177 shoplifting incidents daily in 2023, with

delivery in 75 locations to stay competitive as it loses market share to Walmart, reported Fast Company The service, called DG Delivery, is available through the Dollar General app and online. The retailer hopes to attract customers by offering convenience and value without additional fees. • Circle K recently signed lease agreements for three new distribution centers in Minnesota, Ohio, and Missouri, as part of its plan to optimize its merchandise supply

Member News

continued from page 45

some sectors reporting over 1,000 daily incidents. Adding to the complexity, 73 percent of respondents noted increased aggression among shoplifters compared to last year, and 91 percent saw a stark rise in violent behavior compared to pre-pandemic levels. In response, 71 percent of retailers have increased their budgets for employee training to address workplace violence, reflecting a growing commitment to safety amid an alarming escalation in retail crime.

Organized retail crime (ORC) is another pressing issue, with 76 percent of respondents indicating heightened concern over coordinated theft. Retailers capable of tracking such incidents reported a 57 percent rise in ORC-related thefts from 2022 to 2023. Multi-person theft involving two or more individuals is also on the rise, presenting additional challenges. To counter these trends, industry leaders emphasize collaboration between retailers, technology providers, and law enforcement. The NRF continues to push for federal legislation, such as the Combating Organized Retail Crime Act, to improve coordination among law enforcement agencies.

Global C-Stores Market To Grow

The global convenience stores market is expected to grow by $930 billion from 2024 to 2028, driven by rising demand for convenient food products and a shift towards private-label brands, according to a new

Technavio report. Key market players—including Alimentation Couche Tard, Caseys General Stores, EG Group, Kwik Trip, Royal Farms, and Sheetz—are capitalizing on this trend by expanding their product lines and leveraging AI to enhance efficiency and customer experience. Despite the anticipated growth, the convenience store market faces challenges from the increasing popularity of e-commerce and changing consumer buying behavior. As more consumers turn to online shopping for its convenience and flexibility, traditional convenience stores must adapt by incorporating digital transformation strategies such as home delivery, online goods, and time-saving options like self-checkout systems and mobile apps. The report further reveals that convenience stores are evolving to meet the needs of urban populations with fast-paced lifestyles, offering a wide range of products such as groceries, household goods, snacks, and fresh food.

Online Grocery Shopping Hits Record

Online grocery shopping reached a new high in November 2024 with 77.8 million households placing

orders, surpassing the previous record set during the early days of the COVID-19 pandemic in April 2020, reported Supermarket News This surge, driven by a 15 percent year-over-year increase in monthly active users, resulted in $9.6 billion in sales, a 17.8 percent rise from the same period last year. The three main fulfillment methods—delivery, pickup, and ship-to-home—all saw significant growth, with delivery and pickup each generating $3.9 billion in sales, up 22 percent and 8 percent respectively, while ship-to-home sales rose by 30 percent to $1.7 billion. The increase in delivery sales was particularly notable, fueled by deep-discounted offers on membership and subscription programs that began in mid-2024.

Supermarkets experienced a significant boost in their monthly active user base due to widespread discounts on membership and subscription programs offered by both national and regional grocers throughout November. Despite a 4.5 percent year-overyear decline in average order volume among younger shoppers, the pickup method still saw a 9 percent increase in its user base. Mass merchandise stores maintained their position as the largest share of monthly active users, with a less than 1 percent year-over-year expansion. The satisfaction rate for online grocery sales reached 65.2 percent, the highest in four years, indicating a positive consumer response to the enhanced online shopping experience. To sustain long-term growth, grocers are fo-

AMERICA’S #1 NICOTINE POUCH

“Online grocery shopping reached a new high in November 2024 with 77.8 million households placing orders.”

cusing on creating personalized and seamless online shopping experiences, including tailored product recommendations and easy-to-use rewards programs.

Job Openings Rise Despite Slowed Hiring

U.S. job openings in October rebounded to 7.7 million, up 5 percent from September’s 3 1/2 year low, indicating that businesses are still actively seeking workers despite a slowdown in hiring, reported the Associated Press. This increase in job postings, particularly in professional and business services, restaurants, hotels, and IT industries, suggests potential job gains in the coming months. However, the overall figure remains significantly lower than the 8.7 million job postings from a year ago. The number of people quitting their jobs also rose in October, reflecting confidence in the job market, while layoffs dropped to 1.6 million, the lowest in over two decades. Despite these positive signs, the unemployment rate

Member News

continued from page 47

remains at a low 4.1 percent, with job growth slowing sharply in October due to hurricanes and a strike at Boeing.

What Shoppers Want In 2025

The Acosta Group shared its top five predictions for what shoppers will want in 2025, focusing on how people’s priorities are changing. Shoppers are looking for brands that offer more than just cheap prices— they want products and stores that feel authentic and match their personal values. Colin Stewart, the group’s Executive Vice President of Business Intelligence, said customers now define value in new ways, depending on their generation. Gen Z prefers affordable prices with no extra hassle, Millennials want high quality at reasonable costs, and Boomers look for exciting products that impress them. To keep up, big brands are being advised to offer better deals and create unique products to stand out.

mean companies will need to stay flexible and keep up with what customers want to succeed in 2025.

Store Closings Surged In 2024

The report also predicts that premium products will become even more popular. Shoppers are willing to spend a little extra for gourmet or special items, which means restaurants and food stores will focus on offering more creative and indulgent experiences. Even with some economic challenges, customers like the idea of treating themselves to small luxuries. Other trends include more convenient shopping through social media, a push for healthier living options, and turning in-store visits into exciting experiences. These changes

The number of U.S. store closings in 2024 increased by 69 percent compared to the previous year, with major retailers like Family Dollar, CVS, and Big Lots leading the way, reported KTVH News. According to data from Coresight, there have been 7,308 confirmed or planned store closings in 2024, nearly 3,000 more than in 2023. Family Dollar has closed the most stores, with 718 locations shutting down, followed by CVS with 586 closures and Big Lots with 580. The closures are largely due to high inflation and interest rates, which have led to reduced consumer spending on non-essential items. Big Lots, in particular, has faced significant restructuring and bankruptcy, citing these economic pressures as key factors in their struggles.

Despite the increase in store closings, some brands expanded their presence in 2024. Dollar General opened 754 new locations, Dollar Tree added 541 stores, and 7-Eleven opened 295 new locations. In some cases, store closings have involved brands changing ownership, such as DK convenience stores being rebranded as OXXO stores, a popular chain in Latin America. Retailers are adapting to economic challenges and

Sparkling Celebrations At Joe Saraceno FOA Holiday Bash

The Joe Saraceno FOA 2024 holiday party was a festive event held on December 6 at Swad of India in Upland, California. The gathering saw a remarkable turnout, with members from various FOAs such as the San Diego FOA, the FOA of Southern California, the Las Vegas FOA, and the FOA of Greater Los Angele. Special guests included SEI local management, as well as Kathy York and Annette Durham. Vendor partner guests like Monster, Coca-Cola, Constellation Brands, and Anheuser-Busch graced the occasion, along with Greg Totten, the Chief Executive Officer of the California District Attorneys Association.

The evening was filled with delightful entertainment, featuring performances by singer Yash Wadali and a special singing act by FOA member Priya Kumar. The celebration provided an excellent opportunity for networking, socializing, and celebrating the holiday spirit together. The ambiance, coupled with the lively performances, created a memorable experience for all attendees, making it a night to remember.

San Diego FOA Elects Officers

At their most recent Board meeting, the San Diego FOA proudly conducted their annual elections to determine the leadership for the upcoming year. The results brought forth a dedicated and dynamic team committed to guiding the organization’s vision and mission. Bic Sidhu was elected President, bringing his wealth of experience and passion for service to the helm. Succeeding him, Sukhminder Dhillon was voted

in as the 1st Vice President, followed by Raj Hundal as the 2nd Vice President, both of whom are known for their strong leadership and innovative ideas. Bobby Brar, with his extensive financial expertise, will serve as the Chief Financial Officer. Meanwhile, Sukhjit Kaur will assume the crucial role of Recording Secretary, meticulously documenting the Board’s decisions and maintaining the organization’s records. Congratulations to the newly elected officers. Their collaborative efforts and strategic vision promise to drive the San Diego FOA to new heights in 2025 and beyond.

COME VISIT THE DREYERS BOOTH AT 7EE

Member News

Legislative Update

Texas Court Blocks CTA Nationwide

The U.S. District Court for the Eastern District of Texas recently issued a nationwide injunction against the Corporate Transparency Act (CTA), temporarily suspending its enforcement just weeks before the January 1, 2025 reporting deadline, reported NACS Daily. The CTA required certain U.S. and foreign entities to submit beneficial ownership information (BOI) reports to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). The plaintiffs in the case argued that the CTA represented an unconstitutional expansion of federal power, threatened privacy and associational interests, and violated individual rights. The court agreed, finding that the CTA exceeded Congress’s enumerated powers and granted a preliminary injunction pending the final resolution of the case. This decision means that, for now, small businesses are not required to comply

continued from page 49

changing consumer behaviors by focusing on more profitable locations and exploring new business strategies to stay competitive.

Grubhub Report Highlights Consumer Preferences

Grubhub’s 2024 Delivered Trend Report reveals that Americans fully embraced the concept of “doing

with the CTA’s reporting requirements, although they should continue preparing in case the injunction is lifted.

Supreme Court Upholds Graphic Cigarette Warning Labels

The U.S. Supreme Court recently declined to hear an appeal from tobacco companies, including R.J. Reynolds,

“THE U.S. SUPREME COURT RECENTLY DECLINED TO HEAR AN APPEAL FROM TOBACCO COMPANIES CHALLENGING A FEDERAL RULE THAT MANDATES GRAPHIC WARNING LABELS ON CIGARETTE PACKAGES.”

challenging a federal rule that mandates graphic warning labels on cigarette packages, reported Bloomberg Law These labels, which depict severe health consequences such as cancer and lung

disease, are designed to more effectively communicate the dangers of smoking compared to text warnings. The tobacco companies argued that the labels were provocative and misleading, infringing on their First Amendment rights. However, the court upheld the 5th U.S. Circuit Court of Appeals’ decision, which supported the FDA’s stance that the warnings are factual and necessary for public health. The FDA plans to enforce the new labels starting in December 2025, marking a significant step in tobacco regulation after years of legal battles.

FDA Proposes Nicotine Reduction In Cigarettes

The FDA recently submitted a proposal to the White House to drastically reduce nicotine levels in traditional cigarettes in order to make them less addictive and help smokers quit, reported The New York Times. The proposal, submitted to the Office of Management and Budget, is

continued on page 55

the most” with their delivery orders, reflecting a broader cultural shift towards maximalism. The report states that chicken was the most popular protein, featuring in nearly 40 percent of all restaurant orders and dominating grocery store orders. Cottage cheese also saw a resurgence, with over one ton delivered through Grubhub. Espresso orders spiked, particularly during the week of June 22nd, coinciding with a popular song’s rise

on the charts. The report also notes a 14 percent increase in pickle orders, with creative uses such as bread substitutes and soda flavoring. Convenience store deliveries surged, with hotdogs, bananas, and sodas being the most popular items. Corporate coffee orders increased by 53 percent due to return-to-office policies, and Mexican cuisine, especially birria, became the most popular international cuisine.

seen by health advocates as a milestone in tobacco regulatory policy, potentially saving countless lives by reducing smoking rates, they said. However, the timing of the proposal—coming in the final days of the Biden administration— raises questions about its future under the incoming administration of Presidentelect Donald Trump, who has received substantial campaign donations from the tobacco industry. The proposal has faced strong opposition from major cigarette companies like Reynolds American and Altria, who argue that such a reduction would effectively ban cigarettes, violating tobacco control laws. While the FDA has refined the plan, it remains unclear whether it will also affect nicotine levels in cigars, hookahs, or e-cigarettes.

Massachusetts Considers Phasing Out Nicotine Sales

Massachusetts lawmakers are set to introduce the Nicotine Free Generation Bill in 2025, a measure that will ban the sale of tobacco and nicotine products to individuals born after a specific date, reported Convenience Store News This legislation, proposed by State

Member News

continued from page 53

Legislative Update

Reps. Tommy Vitolo and Kate LipperGarabedian, along with State Sen. Jason Lewis, seeks to protect future generations from nicotine addiction while allowing current smokers to continue purchasing these products. The bill would replace the state’s existing Tobacco 21 rule and follows similar efforts in various Massachusetts municipalities, including Brookline, which implemented a generational tobacco ban in 2021.

“MASSACHUSETTS LAWMAKERS ARE SET TO INTRODUCE A MEASURE THAT WILL BAN THE SALE OF TOBACCO AND NICOTINE PRODUCTS TO INDIVIDUALS BORN AFTER A SPECIFIC DATE.”

Despite facing opposition and legal challenges, Brookline’s legislation was upheld by the Massachusetts State Supreme Court, inspiring other towns to adopt similar measures.

In response to these local bans, the New England Convenience Store and Energy Marketers Association launched the Citizens for Adult Choice campaign to educate lawmakers and raise public awareness about the implications of such bans. The campaign argues that these restrictions unfairly limit adult consumers’ ability to purchase legal products in their hometowns. Massachusetts previously made history by becoming the first state to ban the sale of flavored tobacco products statewide in 2019.

Supreme Court To Hear Challenge On California’s EV Mandate

The U.S. Supreme Court recently agreed

to consider the petition filed by NACS and its coalition partners challenging California’s Advanced Clean Cars I rule, reported NACS Daily. This rule mandates that 22 percent of new vehicles sold in California by model year 2025 must be “zero emission,” with the ultimate goal of reaching 100 percent zero-emission vehicles in the future. NACS argues that vehicle standards should be decided at the federal level to ensure nationwide interests in lower emissions and a strong economy are prioritized. The coalition contends that California’s waiver request, based on global climate change rather than state-specific air quality needs, is not legally justified. The Supreme Court’s decision to hear the case is a significant milestone, as it keeps the issue alive and raises questions about the legality of the EPA’s waiver for California5.

Previously, the DC Circuit Court of Appeals ruled against NACS, stating that automakers would likely follow similar practices regardless of the rule, leaving NACS without a legal complaint. The Supreme Court will now determine if this interpretation of the law is correct and whether the case can proceed to address the legality of the EPA’s waiver. NACS has presented evidence suggesting that favoring one technology over others could lead to worse environmental and economic outcomes. The case, Diamond Alternative Energy v. EPA, will be closely watched as it could have significant implications for the future of vehicle emission standards in the United States.

Member News

continued from page 63

7-Eleven Expands In Australia

Seven & i Holding, plans to expand its presence in Australia to 1,000 7-Eleven stores by 2030, leveraging successful strategies from its Japanese operations, reported Nikkei Asia. The new concept stores emphasize food and daily necessities, offering a wider selection of fresh bakery goods, frozen food, and everyday essentials compared to typical convenience stores. This approach has already shown positive results, with daily sales at remodeled stores increasing by 20 percent. Store managers now have the authority to select and review

products, allowing them to respond swiftly to local demand. The company also plans to use data on pedestrian and vehicle traffic to choose new store locations, replicating the successful model used in Japan.

The expansion comes after Seven & i’s takeover of 7-Eleven Australia, which had previously operated independently. The company plans to capture a larger share of Australia’s AU$6 billion convenience store market, targeting a 45 percent market share by 2030. To boost sales, 7-Eleven plans to introduce popular food items from Japan and share food recipes with

NCASEF BOARD Elects

Vice Chairs

During its fourth quarter meeting held November 13-15, 2024, in Kona, Hawaii, the NCASEF Board of Directors elected Khalid Asad, Michelle Niccoli, and Teeto Shirajee as Vice Chairs for the upcoming threeyear term. Khalid Asad and Michelle Niccoli, who had stepped into interim Vice Chair positions during the first quarter 2024 Board meeting, were affirmed in their roles, joining Teeto Shirajee in the leadership team.

its Australian unit. The company also intends to import food manufacturing equipment from Japan to support these offerings.

SEI Adds New Stores In Arizona

7-Eleven opened three new stores in Arizona in 2024, marking its first expansion in the state in 25 years, with plans for two additional locations in 2025, reported Store Brands. The new stores—located in Glendale, Surprise, and Goodyear—offer a variety of fresh food options, proprietary beverages, and services tailored to local preferences. The company