1

2

3

4

5 6 7 8 9

p.02

What’s Up Today! (Dec 4)

p.03

ATF 2025 Opening Ceremony

p.06 Conference— Analyst Exclusives, Content Showcases

p.16

ATF In-Development Club presents p.22 PARTAAY!

Corporate glamour with a side of sky

p.28 On the Market Floor

p.46

The Plethora of Profiles @ ATF 2025 Animation? Hallelujah!

p.58

The Plethora of Profiles @ ATF 2025 Scripted & Unscripted

p.62

The Plethora of Profiles @ ATF 2025 AI Content Creation

the official magazine for while it lasts! OUT DEC 3! Day 1

Pick up your limited copy of the Show Daily for amazing reads and exclusive stats and information each day.

Analyst Exclusive Anime in APAC: Identifying Audience and Market Gap Motohiko Ara, Analyst, Ampere Analysis 9:30 AM 12:00 PM 1:30 PM

Analyst Exclusive Trending Asia, Winning Formats

Clare Thompson, Non-Executive Director, K7 Media

Trang Nguyen, Research Lead (APAC, MEA), K7 Media

Analyst Exclusive From East to Everywhere: What Kids Want from Local & Global IPs

Ed Ludlow, Senior Analyst, Ampere Analysis

ATF In-Development Club presents ATF x TTB Animation Pitch 2025

We Have Money, We Want to Fund Your Movie

• Erik Gordon, Partner & VP, FilmHedge

Cinematic Legacy: The Value of Passion Today

• Shamin Yusof, Film Producer, Skop Productions Sdn Bhd

• Justin Deimen, Managing Partner, Goldfinch International

• Damiano Malchiodi, Channels & Contents Managing Director, Canal+ Myanmar & Canal+ International

K-Content in the Age Of AI: The Next Chapter & Global @ Main Stage

K-Content: Potential Beyond Business @ Connect+

Coupang Play Originals Made in Korea, Shared with the World @ Connect+ 10:00 AM 10:00 AM 11:00 AM 2:00 PM 3:00 PM 3:00 PM

• Timothy Oh, General Manager, Southeast Asia, COL 4:00 PM 5:00 PM 5:30 PM 6:00 PM @ Main Stage @ Connect+

Huace Group Content Showcase 2026 Grand Reveal @ Main Stage

Content Thailand Entertaining the World @ Main Stage

From Micro to Macro Micro Dramas’ Deep Dive And Showcase @ Main Stage

• Yeo Kok Siew, GM, Sony Music Taiwan (Moderator)

A Masterclass Exclusive Microdrama 101

• Enoch Chen, Chief Technology Officer, COL

Kanpai Hour @ The Japan Pavilion L5 | B12 4:00 PM 4:00

Happy Hour with Taiwan L5 | D18 Singapore Hour @ SG Pavilion L5 | F06—H06

Minister Tan Kiat How made a brief stop to meet industry leaders before his address at the Opening Ceremony of the Asia TV Forum & Market. During this exchange, he acknowledged ongoing collaborations and listened to leaders’ perspectives on emerging challenges. The conversation set a positive tone for the event, as he proceeded to the stage, ready to deliver his address and outline the government’s vision for the industry’s continued growth.

“ATF is where ideas, talent, and opportunities come together,” said Tan Kiat How, Senior Minister of State, Ministry of Digital Development and Information, Singapore at the opening ceremony of ATF 2025.

The Senior Minister of State graced the opening of this year’s ATF alongside Brian Thomas, President, APAC Hub, RX.

Minister Tan described large changes sweeping across the media industry and recognised the anxiety many felt. However, he noted the fresh possibilities these changes could bring and believed in the ability of local creatives to rally and adapt.

The Singapore government has invested S$200 million in the Talent Accelerator Programme (TAP) to help creatives put Singapore-made content onto the world stage.

2025 is shaping up to be one of the strongest years yet for Asia-driven co-productions. Glance’s latest data shows fiction firmly in the lead, rising 82% year-on-year and accounting for 68% of Asia-linked co-productions on streaming platforms between 2020 and 2025. Global performers like 3 Body Problem and Our Tokyo Story continue to demonstrate how far Asian IP can travel when matched with the right distribution partners.

In terms of genre behaviour, fiction leads the pack at 51% of all Asia coproductions, while entertainment formats (long considered trickier to export), are slowly gaining traction. Factual remains a major player at 38%, with nature, wildlife, love and romance collectively driving 46% of co-produced fiction titles.

The second key insight highlights Asia’s thematic evolution: nature and wildlife previously dominated, but love- and thriller-led genres are now driving demand. Titles like Marry My

Husband, The Head, and Heart Attack exemplify this appetite for emotionally charged or high-stakes storytelling.

The third insight focuses on geography: China, the UK and Japan remain the biggest engines of co-production activity, while South Korea continues to make headway into global partnerships. Southeast Asia is also stepping up, contributing 18% of Asia’s 2025 coproductions, including the ChinaSingapore drama Contenders

Looking ahead, upcoming titles such as Tokyo Crush, Blood & Sweat, When Socrates Met Confucius, and Synchro point to an Asia-driven co-production landscape that’s growing bolder, broader and more globally aligned.

APAC’s scripted landscape is undergoing a recalibration, with commissioning activity dropping significantly in 2025, shared Ed Ludlow, Senior Analyst of Ampere Analysis. This echoes global patterns even though the region was “in some ways insulated” from U.S.-driven disruptions. As Ed noted, macroeconomic pressures, rising production costs and the post-writers’ strike hangover have hit

When it comes to who is commissioning, data shows that global streamers are the ones pulling back most sharply, while domestic services remain relatively stable. Production costs continue to climb, especially in markets like South Korea, forcing platforms to become

more cautious with greenlights and selective about renewals.

“Thailand does seem to be an area where we are seeing continuous growth,” according to Ed. Government-led incentives, a boom in the romance genre plus cost-saving relocations have made Thailand increasingly attractive. The White Lotus is a prime example, with the move from Japan to Thailand resulting in “$4.4 million worth of savings.”

On genre demand, romance bloomed in scripted commissioning across APAC, buoyed by audiences craving escapism and “clippable content” that can cover ground on social media platforms. Crime and thrillers remain strong, aligning with Netflix’s viewing data.

Finally, APAC continues to excel in original IP, far outpacing the U.S. Ludlow summed it up simply, “Demand for local content is stronger than anywhere else.”

Martial vengeance, time travel, and tales of the modern woman – Shanghai pulled no punches in their showcase at this year’s ATF with twelve premium Chinese titles from six of China’s leading production companies.

Among the many high-quality productions, one that stood out was Mobius, a high-concept mystery drama about a detective who has the power to rewind any day five times to solve crimes, but faces grave danger when he encounters a criminal with a similar power..

Another standout was Blade of Vengeance, a series set in a world of martial arts that follows the lone survivor of a brutal massacre who infiltrates the imperial military

academy to train and seek vengeance. Two other titles in the genre of martial arts and fantasy include Melody of Love, a drama about spiritual manifestations of ancient Chinese musical instruments, and Fated Master and Disciple, a series about spiritual cultivation and saving the world.

The categories of modern stories and variety formats were not found lacking either. The Thirsty Thirty, a Thai adaptation of the Chinese IP Nothing But Thirty, and A Better Life are female-centric tales of personal development and ambitious women, while Singing With Legends is an excellent Chinese IP format that has seen highly successful adaptations in Spain and Vietnam.

KC Global Media Distribution’s showcase of four new Asian titles featured powerful and compelling narratives that could spark important conversations about modern society – an important quality in contemporary media.

Rein Entertainment led the showcase with Laya, a Filipino thriller drama series that follows a young woman struggling with accepting the death of her father. She aimlessly drifts in the world until she finds a kindred spirit in an ex-criminal who is haunted by his past. The series is directed by Sigrid Andrea P. Bernardo and stars Andrea Brillantes in the lead role.

Next up was mystery thriller series, Decalcomania –a Singapore-Thailand co-production by Mocha Chai Laboratories and The One Enterprise. The series revolves

around two women, a Bangkok nightclub owner and a Singaporean socialite, who mysteriously swap bodies after a car accident and need to find a way to resolve their predicament.

Following that was a rare Singapore-Japan coproduction, Lost and Found, by Mocha Chai Laboratories and NHK. The suspense drama tells an intriguing tale about the phenomenon of Johatsu, a Japanese that describes how some young Japanese people, unable to handle the pressures of modern life, choose to disappear from society.

Last to take the stage was Taiwanese comedy drama series, A Controversial Entertainer by Taiwanese studio Eric Ace. In this series, a handful of characters, each with differing circumstances, find themselves having to serve as male hosts in a host club and hilarity ensues.

ATF 2025 serves up the year’s freshest serving of Korean content, with offerings from five of Korea’s top production companies.

CJ ENM took the stage with Date My Friend, a dating format with a twist. Korean celebrities each bring a friend who is sequestered in a villa with seven others. With their celebrity sponsors playing cupid, each participant tries to find love as they endure hilarious matchmaking activities.

KBS Media’s selection was To My Beloved Thief, a gender-bender romance-comedy inspired by the classic story of Hong Gil-dong, a Korean Robin Hood figure. The female lead is a peasant who acts as Hong Gil-dong by night and is hunted down by a prince. When the two somehow switch souls, shenanigans ensue.

Meanwhile, Mr Romance brought Buy King, a mystery drama that follows the heir to a chaebol – a Korean family-owned conglomerate – who flees overseas for his safety after his mother dies. Years later, he returns to Korea to contend for his birthright and defeat his antagonist’s machinations.

SLL presented Just Makeup, a fresh competition format where 60 makeup artists turn makeup into storytelling with models as their canvas. The show blends artistry and performance into a bold, globally adaptable format.

Lastly, Something Special put forth Iron Squad, a gripping, high-intensity competition format that pits Korean special forces reservists against one another. In this series, eight teams of four fight to be the last squad standing in a grueling series of tests.

Linmon is Aiming High, and Mediacorp is Going Along for the Drama

Linmon Media opened its ATF showcase with General Manager Roy Lu recapping a standout 2025, with A Dream Within a Dream, Moonlit Reunion and The Thirsty Thirty collectively reached over 180 countries and 190+ distribution channels, demonstrating the cross-border pull of their productions.

That momentum continues with Linmon and Mediacorp officially formalising the co-production of Only Thirty-Five (35而已), sequel to the hit contemporary drama Nothing But Thirty. The original series amassed 5.5 billion views on Tencent Video and dominated the platform for 21 consecutive days, sparking adaptations in Thailand (The Thirsty Thirty) and now Singapore. Slated to begin production in 2026, the sequel

will be filmed across Singapore and China with a blended cast from both markets.

To promote In The Moonlight, premiering Q1 2026, actors Bao Shangen and Wang Hongyi joined the stage and had a spirited discussion about their on-screen chemistry and what Shang En, affectionately known as Bao Bao, has already eaten in Singapore (for those who are curious, Bah Kut Teh, Fried Porridge and Hainanese Chicken Rice.)

Linmon also showcased its upcoming slate, including the large-scale fantasy dramas The Infinite 10 Days and Huo Wang, plus romance-sci-fi title Love Between Lines, medical drama Xiao Cheng Liang Fang and The Heart 2, plus romance titles such as Sunshine Through the Rain and Light Through the Eternal Storm

In a tightly packed session hosted by the Development Research Center of China’s NRTA and YoyWow, industry leaders unpacked how AI, microdramas and platform optimisation are reshaping content creation and marketing across Asia.

Steve Wang, Co-founder of YoyWow Space and GM of YoyWow, opened with a short and sharp introduction.

All five keynote speakers, Jie Shi (VP, National Radio & TV Admin), Sirisak Koshpasharin (Vice Chairman, Motion Pictures and Contents Association of Thailand), Edmund Ooi (Cofounder, YoyWow), Cassie Liu (Director of BD, DramaWave&FreeReels), Castle Yen (Strategic Partnership Manager, Youtube) agreed on one thing: Micro drama is a growing market, and ASEAN is well-positioned to produce, deliver and benefit from this if they know to utilise the right AI tools for content creation.

Jie Shi unpacked the explosive trajectory of Chinese short dramas, noting how over 335 productions have gone overseas as at September 2025 and has gained 2.2 billion in cumulative in-app purchases. He pointed to the format’s rising global portability and the growing ease of cross-cultural collaboration, helped along by initiatives like the Singapore YoyWow Space.

SIRISAK

SPOTLIGHTED THAILAND’S EVOLUTION INTO THE “KINGDOM OF BL,” AS WELL AS THE COUNTRY’S EMBRACE OF WEBTOONS AND MICRODRAMAS.

“THAILAND IS NOT ONLY A CONSUMER OF MICRODRAMA;

IT CAN BECOME A PRODUCTION HUB FOR ASEAN,” SIRISAK

SAID.

In a panellist session after, consisting of Edmund (moderator), Xinmei Zhu (Director, National Radio & TV Admin), Crystal Wu (Co-founder, YoyWow), Ho Jia Jian (Cofounder/CEO, Viddsee), Ricky Ow (Founder, RJ Int’l) and Joanne Liew (Global head, Gushcloud) – the throughline was clear: AI, cross-border content strategy and unified marketing workflows are converging to redefine how APAC stories are created, distributed and monetised.

The iQIYI & G.H.Y Culture & Media

Extravaganza dinner unfolded as a dazzling affair, transforming the evening into a celebration of artistry, ambition, and cinematic allure. Held at MBS during ATF 2025, guests arrived to an atmosphere layered with elegance—drifting out into the night, they left with new connections, renewed excitement, and the unmistakable feeling of having experienced something special—an evening where glamour met creativity and the spotlight shone on possibility itself.

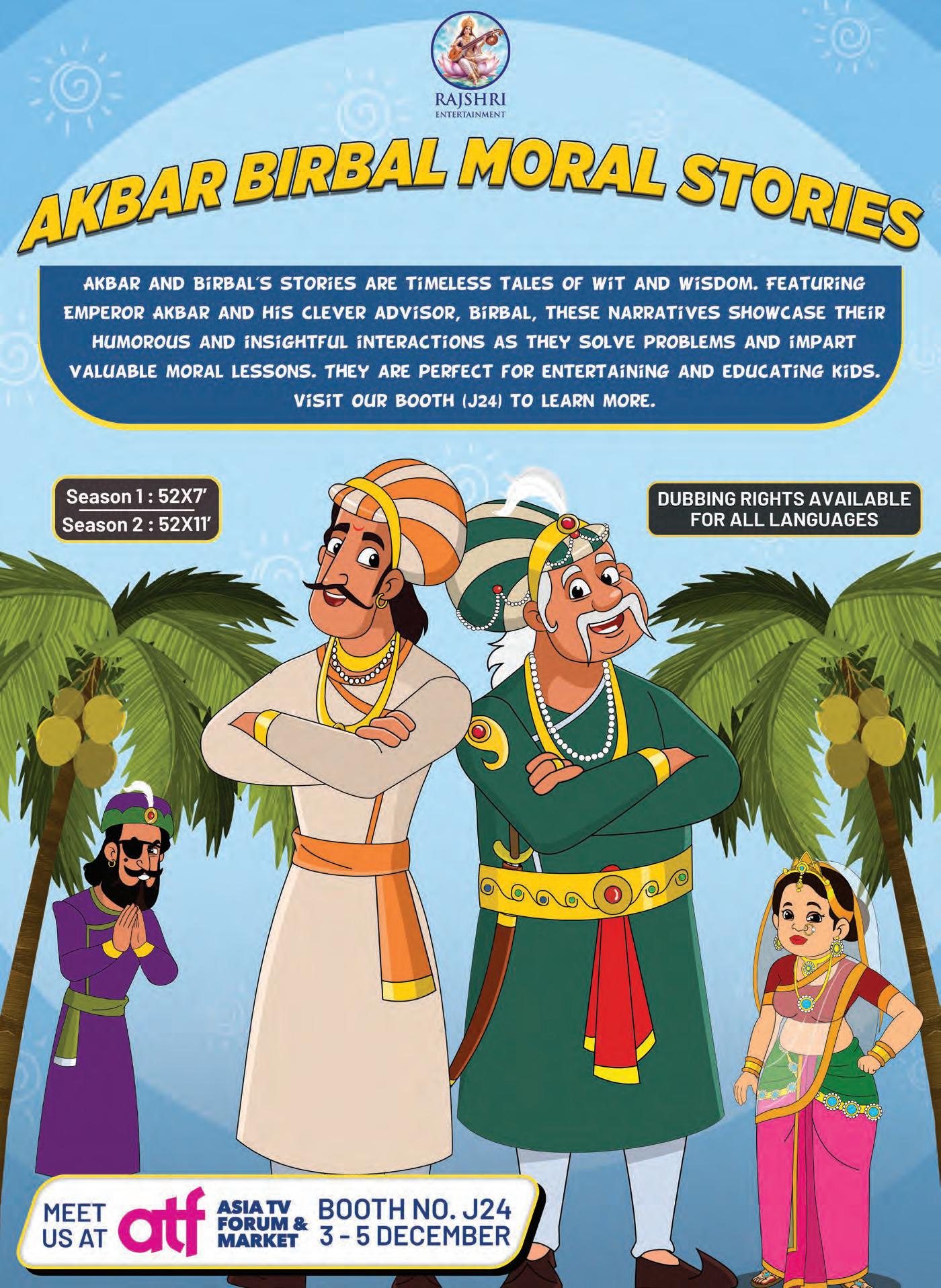

International buyers and industry professionals were introduced to a diverse line-up of programme ranging from family-friendly animation to sci-fi adult animation and gripping horror drama at the Buyer’s Lunch: Taiwan Spotlight today.

Organised by the Taiwan Creative Content Agency (TAICCA), the Buyer’s Lunch is one of the key activities at ATF 2025 to link Taiwanese content creators with global investors and partners. TAICAA is dedicated to drive crossborder collaborations, co-productions and distribution opportunities to elevate Taiwan’s visibility in the global media landscape.

This year, the Taiwan Pavilion showcased an impressive collection of 260 titles from 92 companies, including several award-winning series, representing Taiwan’s varied and creative content landscape.

Matīss Kaža, Producer at Trickster Pictures, brought Flow, the animated film that won both a Golden Globe and an Oscar, to the world stage on an astoundingly small production budget –US$4 million. For context, Inside Out 2, its rival for the 2025 Oscar Award, had fifty times the budget.

But to Matīss, the small budget wasn’t a handicap – it was a strength. “In situations where you’re financially constrained, you have to figure out creative solutions,” he said. Unable to afford the anthropomorphic animals common to big budget animations, he had to find alternatives – from story treatment to direction – to help his animal characters express themselves. Each of these contributed to Flow’s unique identity, letting it punch above its weight.

Matīss even cautioned against indiscriminately chasing after a bigger budget. “At first glance, you never see the fine print,” he said, pointing out that one could lose out on key aspects like creative integrity. His ideal team was a small one – described as a “family environment where everybody could have a certain input on the project” – that could not exist in a large-scale production.

“The biggest risk in media and entertainment is not AI. I think it’s something much simpler but more dangerous – failing to protect the trust of your audience,” shared Scott McCarthy, VP of Global Brand Protection at DreamWorks Animation. At his talk titled Brand Consistency: The Hidden Driver of Global Monetization, he described how brand integrity – which spans dubbing, voice casting, translation, and cultural nuance – is not just a creative issue, but also concerns long-term monetisation.

He shared the story of Spirit Riding Free, a spin-off of the 2002 film Spirit: Stallion of the Cimarron, highlighting his points with short clips. When Netflix sought to license the show, McCarthy found previous dubs were poorly executed, with no quality control or oversight, which almost led to the deal falling through. By re-dubbing the series with greater quality control, DreamWorks was able to preserve the franchise’s integrity, unlocking new revenue streams from streaming, consumer products, promotions, and licensing.

McCarthy also emphasised that protecting brand consistency is a shared responsibility: not just content creators, but buyers and sellers also play a role in maintaining consumer trust. He outlined four key questions to safeguard brand consistency: Does a glossary of terms exist? Is there an established cast? Are the same director, translator, and creative team being used? Can we speak to the creators? Following these steps ensures translations, voices, and creative decisions remain consistent across all markets and platforms.

However, a small budget is no guarantee of success. “Just working under the constraints of a small budget doesn’t guarantee that you’re going to create the next masterpiece or even a good film,” Matīss warned, “You have to be very smart about how you use those constraints.”

At Reshaping Global Storytelling and IP, industry leaders discussed how innovation is affecting global IP, and how it has changed the way stories are created and consumed. Singapore’s Nickson Fong, Academy Award–winning director and producer, highlighted the “30% rule” he implemented at his company Egg Story Creative Production: actors cannot be replaced by AI. “We will spend the majority of our work creating digital assets and shooting the film virtually, but there is no replacement for real human performance, no matter how good the AI is.”

Matty Lin, Global Business Solutions, Bytedance | TikTok, agreed, describing a “three-legged stool” of brands, creators, and AI. He views TikTok as a tool that is democratizing content creation, empowering individuals to become their own creative directors, while stressing that TikTok does so while maintaining guardrails and AI transparency to protect users.

Shilpa Bisaria, VP of Global Corporate Strategy & Head of Emerging Tech Accelerator, Warner Bros. Discovery noted that micro-dramas have ‘exploded’ in popularity, growing beyond TikTok and Instagram to populate their own platforms such as DramaBox. “It’s really a new area we want to experiment with.” She added that

Actor Alicia Hannah-Kim (Cobra Kai) reflected on the universal popularity of shows like KPop Demon Hunters, noting that its cultural specificity drives global resonance, reiterating that “local creators need access to finance and structures that don’t punish cultural specificity”.

The session Pieces of the Production Puzzle—A CoProduction Program: Discover Türkiye positioned the country as a top-tier, production-ready destination for international filmmakers. Moderated by M. Selçuk Yavuzkanat, Deputy Director General of Cinema at Türkiye’s Ministry of Culture and Tourism, it showcased Türkiye’s desirability as a global filming hub.

Alex Sutherland, Founder of AZ Celtic Films, highlighted the country’s rare ability to offer four seasons simultaneously, allowing productions to shoot year-round while remaining cost-effective. He pointed to a professional and experienced local crew base, noting that recent productions such as The Night Manager relied predominantly on Turkish crews, requiring minimal foreign personnel. Accessibility is another major advantage, with Türkiye supported by Turkish Airlines’ extensive global network, as well as strong rail and highway infrastructure.

Sutherland outlined the country’s comprehensive incentive framework, which includes up to a 30% cash rebate when working with a qualified Turkish co-producer or production service provider, alongside VAT refunds on eligible expenses. The application process has been streamlined, with evaluations handled by a commission.

Türkiye’s production credentials are already well proven, with major films such as Argo and Skyfall shot on location, and successful co-productions like Klondike underscoring its ability to support both large-scale and prestige projects.

Following the Fireside Chat session, co-producers, decision makers, financiers and other participants gathered for a cocktail reception that offered a relaxed yet effective environment to build long-term business relationships, paving the way for potential future partnerships.

Co-production meetings at ATF’s In-Development Lounge gathered a dynamic mix of producers, financiers, broadcasters and creative partners from around the world, creating a concentrated environment for genuine international collaboration. The sessions allowed companies to introduce fresh concepts, explore cross-border opportunities and align creatively and commercially on projects with global potential.

A broad slate of content was discussed, including high-end drama, feature films, factual entertainment, animation and digitalfirst formats—demonstrating the region’s growing demand for diverse, globally resonant storytelling. These meetings offered creators the chance to find compatible partners, pursue financing pathways and build longterm strategic alliances.

As Asia’s influence as a content hub continues to expand, ATF’s co-production platform continues to play a crucial role in advancing ambitious ventures that balance international perspectives with strong local identity. Many participants concluded the meetings with valuable leads, strengthened networks and a clearer sense of direction for moving their projects into the next phase of development.

The ATF x EST N8 Horror Pitch 2025, in its second edition, continued to offer real opportunities for horror feature producers and projects globally with a strong Asian element.

Finalists from Indonesia, Malaysia, Taiwan, and the Philippines gave each other a tough fight, giving their best shot to frighten the judges to a win. The judges remained focused with several technical questions pertaining to target audience and budgets and were impressed with the overall commitment to keeping the texture of local culture in the storytelling.

Finally, the story of being haunted by a malignant spirit after his father’s mysterious death, which unravels a sinister evil, took the judges’ attention.

Keeping a four-decade-old IP alive across two millennia is no mean feat, and that’s exactly what Peyo Company has achieved. Julia Lee, Audiovisual Licensing Manager for APAC, Western Europe, and the Nordics at Peyo Company, shared how the studio has taken great pains to succeed on three fronts: maintaining high quality visuals with advancing production technology, updating storytelling with modern themes and values, and keeping the core DNA that makes The Smurfs timeless.

The heart of Peyo Company’s business has always been animation, Julia pointed out, and emphasises building on Peyo’s existing creative universe through innovative new projects such as The Smurfs Adventures, Cursedland – Tales of Johan and Peewit, and Benny Breakiron, thus ensuring the late

Wallace Chang, Vice General Manager of the Content Distribution Business Group, Asia at Muse Communication, shared how the company has continued to expand its footprint and strengthen Japan’s anime presence across the region. Wallace explained that Muse, with more than 30 years of experience in the Asian market, has established new subsidiaries in Kuala Lumpur and Jakarta in 2025, with offices planned for Bangkok, Ho Chi Minh City, and Mumbai by 2026.

This expansion reflects the company’s goal of connecting local audiences with Japanese anime through long-term partnerships and integrated regional operations.

In 2025, Muse maintained its strong slate of top-performing titles, including Demon Slayer, Dan Da Dan, One Punch Man, and SPY×FAMILY. While traditional shonen titles remain the backbone of its success, Wallace observed growing demand for supernatural comedy and emotionally resonant narratives. Among these, he said, Dan Da Dan and Frieren: Beyond Journey’s End were exemplary in showing how diverse genres are attracting new audiences across Asia.

creator’s legacy lives on through new storytelling.

Julia explained that as the international rightsholder of Peyo’s creations, the company operates worldwide, with The Smurfs available in over 40 languages, making the ability to adapt to global trends exceedingly important. Since their debut in the 1980s, the blue icons have remained a multi-generational favourite, sustained by new releases and seasons that keep the franchise fresh for both children and families.

As digital viewing grows, Peyo Company has embraced new platforms, expanding into FAST channels, YouTube, and social media, while continuing to serve traditional broadcasters—a strategy that has kept the brand thriving across generations and formats.

To stand out amid a flood of seasonal releases, Muse emphasises a focus on enhancing visibility and fan engagement through a multi-platform approach by maximising IP value across distribution, merchandising, and theatrical releases. This is evident in their frequent partnerships with cinemas and consumer brands to turn

each launch into a complete entertainment experience.

On the ATF market floor, Wallace expressed interest in meeting partners beyond streaming—particularly in IP licensing, exhibitions, and media promotion— to build a more connected and sustainable anime ecosystem across Asia.

Candice Wen, International Distribution at Shanghai Youhug Media Co., Ltd., shared that the company has set its sights on the emerging markets of Russia and Mongolia. While Youhug’s traditional strongholds have been Southeast Asia, North America, Japan, and Korea, Candice explained that the company’s recent shift towards Russia and Mongolia are part of a strategy that reflects both rising international interest in Chinese storytelling and Youhug’s ambition to position its catalogue on a truly global scale.

Genre-wise, Candice noted that historical and fantasy dramas continue to dominate performance, particularly across Southeast Asia, where audiences remain captivated by large-scale period storytelling. However, she observed a clear shift in international trends, with growing demand for modern urban romance and suspense titles. This diversification, she said, has been driven by platforms seeking varied

content that speak to younger, globally connected audiences.

When asked about key success factors beyond pricing, Candice’s response was unequivocal: “Content is king.” She emphasised that strong storytelling naturally generates wordof-mouth promotion, as passionate viewers became advocates for the titles they love.

With more than 12 years of distribution experience, Youhug has also maintained a stable and transparent licensing framework. While its core terms and territories remain consistent, the company’s deep industry expertise ensures clarity and trust from the outset. By combining quality-driven production with strategic international expansion, Youhug continues to strengthen Chinese content’s position on the world stage.

IX Media is stepping up its cross-border drive with a focus on Southeast Asia, East Asia, Eastern Europe, and North America, as it looks to position Chinese IP in what it sees as high-value global markets.

“The Asian markets provide a strong cultural affinity, facilitating natural audience engagement. In contrast, Eastern Europe and North America serve as strategic frontiers for premium content,” said Jade Xu, General Manager and Founder of IX Media.

While costume dramas remain the company’s best-selling genre, Jade notes a rising appetite for contemporary stories. “Genres like modern urban tales, which explore female empowerment and youth romance, are gaining significant traction,” she said. The shift is driven by new content formats—from traditional series to micro-dramas—enabling IX Media to fine-tune its storytelling for different platforms and audiences worldwide.

Jade highlights the growing importance of cultural resonance and trust-based partnerships. “Streaming demand has surged, raising expectations for both quality and accessibility, and digital platforms have made cross-border collaboration faster, but also more reliant on trust,” she said. To meet these challenges, IX Media has strengthened its copyright governance, reinforced production standards, and expanded its digital infrastructure to enable smarter, data-driven content matching.

Trends come and go, but appeal that spans generations will always be relevant, according to Grace Chan, Senior Director of Content Distribution & Business Development, APAC at Mattel Studios. “Some of them are now young parents and are passing on the fandom to their kids,” she pointed out, referring to fans of the 80-yearThomas & Friends franchise that is beloved across key Asian markets such as China, Japan, Australia, Indonesia, and Singapore.

As expected, Mattel Studios continues to lead in the kids’ animated content genre, building its fanbase from young and driving consistent engagement with well-established franchises such as Barbie, Hot Wheels, Thomas & Friends, Monster High, and Pingu However, the company has also expanded its slate to include premium

Julia Nikolaeva, General Manager of Animotion Media Group, discussed how the company had strengthened its international presence while evolving its content strategy to meet new audience demands. While MENA remains Animotion’s home market— with strong partnerships across MBC, Majid, Spacetoon, and Yango, as well as an Arabic YouTube channel achieving 26 million views in just one year—the company has also deepened its engagement with China through titles such as The Fixies, Tina & Tony, and Babyriki. At the same time, Julia says Animotion has begun exploring opportunities in Southeast Asia, including partnerships, to bring thirdparty IPs to the Middle East.

According to Julia, edutainment centred on preschool audiences continues to be the company’s strongest genre. However, Julia noted that rising demand from the 6+ demographic has inspired new projects such as Finnick and Shooting Stars, enabling the company to expand into family co-viewing while maintaining its educational roots.

Beyond pricing, Animotion’s strategy focuses on forming meaningful partnerships built on quality, synergy, and long-term sustainability. Julia emphasised the importance of choosing partners carefully by making

scripted and unscripted programming, reflecting a strategy to spark fandom and cultural impact across multiple formats and platforms and across generations. With the Asia Pacific team marking its 10th year attending ATF, Grace believes that the event is a key platform for connecting with both existing and new partners across the region.

Mattel has also reinvigorated its extensive animation library, bringing classic titles like Bob the Builder, Polly Pocket, and Barbie movies back to the global stage. This strengthened library will enable the company to build new opportunities with partners and deepen audience touchpoints across generations, thus elevating Mattel Studios’ content, empowering families to rediscover the wonder of childhood together.

On the market floor at ATF 2025, Julia expressed enthusiasm for meeting co-producers, funding partners, and international collaborators. The company’s spotlight project, Shooting Stars—an animated series blending action, friendship, and sports—illustrates

For Bilibili, global ambitions extend beyond distribution deals—they centre on building cultural bridges through storytelling. “Our goal is not merely to export content but to foster a culture resonance,” says Shiqi Zhang (CK), APAC Lead of Licensing & Distribution. Central to that ambition is a focus on script development, production quality, and a “direct-to-fan ecosystem”.

Europe, Japan, North America, South Korea, and Southeast Asia are key markets for the company as they show a strong appetite for quality Chinese animation. Series such as A Mortal’s Journey and Tales of Herding Gods have topped charts in Southeast Asia, while Link Click and To Be Hero X have earned acclaim on global platforms like Crunchyroll and Japan’s Fuji TV.

Shiqi explained that building a “directto-fan ecosystem” spans physical and digital touchpoints, and opportunities

to co-create fan experiences with international partners. “This involves expanding our IP merchandising into international retail channels and participating in major global fan events. Engaging directly with fans at these events and through social media is crucial for building a dedicated community,” she said.

The company has introduced its IPs through local partnerships and merchandise availability in stores like Animate across Taiwan, Japan, Korea, and Thailand. In Japan, it has grown its presence with a dedicated channel on Fuji TV.

Ultimately, the challenge and opportunity lie in balancing cultural specificity with universal appeal. “By focusing on ‘culture resonance’ rather than one-way ‘culture output’, we can connect with audiences on a human level,” she noted.

Brian Nolan, Sales & Acquisitions Manager at Scholastic Entertainment | 9 Story Media Group, is a great believer in 9 Story’s symbiotic relationship with Scholastic Entertainment. He explains that their collaboration has “opened up endless opportunities for TV adaptations of popular Scholastic book IPs”, citing Dragon Girls, based on the bestselling series by Maddy Mara, as one project to watch.

Post-COVID, Brian observes that tighter budgets have reshaped commissioning trends, pushing buyers toward trusted brands. 9 Story’s strategy reflects this shift, leaning on IP-based properties with builtin recognition such as Clifford and Open Season. The company’s newest shows—including Do Not Watch This Show, Paris & Pups, and Dee & Friends in Oz—follow the same formula: tapping into existing awareness while delivering fresh, premium storytelling for global audiences.

While 9 Story’s catalogue spans genres and age groups, Brian says educational preschool programming continues to be the company’s strongest performer. Series such as Dylan’s Playtime Adventures have secured major international sales, while Daniel Tiger’s Neighbourhood, now in its eighth season, remains a regional favourite.

Brian also points out the group’s sharp focus on expanding the company’s footprint across Asia, with a keen interest in pan-regional and local buyers of kids’ and family content.

This year, NH Studioz has set its sights on Southeast Asia and the Middle East, regions where both Hindi and Tamil cinema already enjoy strong organic viewership. Narendra Hirawat, Founder of NH Studioz, said that with the studio’s recent acquisition of a major Tamil library, these markets are “even more strategic for us”, noting that the combination of timeless titles and newer releases place the company in a strong position to deepen audience engagement and form longer-term partnerships.

He explained that the action and drama genres remain NH Studioz’s strongest global performers, with action gaining further traction as some regions increasingly accept AI-assisted dubbing. Horror has also surged, becoming one of the company’s fastest-growing genres due to its ability to resonate across cultures.

Beyond pricing, Narendra emphasised consistency, clarity, and continuity as the core principles guiding NH Studioz’s partnerships. He highlighted the company’s focus on refreshed catalogues, verified rights, and reliable delivery, saying that “reliability is not just a value—it is a product in itself”.

Piracy, he acknowledged, has continued to undermine legitimate commercial value, but it has also strengthened demand for established distributors who could guarantee clean materials and secure rights. With global interest in Indian cinema rising rapidly—and new dubbing technologies lowering linguistic barriers—Narendra believes that the coming years offer significant opportunity for further expansion.

FANY Studio continues to sharpen its global strategy by developing formats and scripted projects built on concepts that travel easily across borders. “Our content is designed for

a global audience, and we consistently pursue development with a global perspective,” said Mari Kawamura, Head of Global Business at FANY Studio.

That approach is already bearing fruit. Several of the company’s unscripted formats have been successfully localised in Europe this year, underscoring the adaptability of its entertainment-driven concepts. “We continue to focus on concepts that are easily adaptable and widely appealing to the global market,” Mari explained. “For scripted projects, particularly the drama series currently in production, we develop ideas around themes that resonate with and attract fans across the world.”

Comedy and quiz formats continue to show domestic and international success. Yet Mari emphasises that the studio’s focus lies in human connection and shared experience.

“We see that laughter, curiosity, and emotion are universal languages,” she said.

For Mari, the key to expanding that reach lies in collaboration. “To build mutually beneficial partnership is most important,” she noted.

“Whenever we actively approach the global market, having the right partners is essential. We believe that partnerships play a crucial role at every stage—during content development, production, and distribution.”

“We’ve evolved from traditional linear offerings to a more diversified, crossplatform portfolio that reflects Asia’s sophisticated viewing habits,” said Alexandre Bac, Managing Director APAC at Canal+ Distribution. This comes off the back of the company’s recent momentum in APAC, which Alexandre attributed to a clear focus on markets where audiences actively seek premium, differentiated programming. He explained that Southeast Asia, Japan, Korea, and India have become priority regions precisely because viewers there value content that feels distinct from both local output and mainstream global fare.

For the company, music and lifestyle programming remain consistent performers, but Alexandre stressed that the company’s edge comes from its varied mix of globally recognised brands and niche genres such as telenovelas, travel, culture, and factual storytelling. Over the years, Canal+

Distribution has shifted from a largely linear catalogue to an offering built for cross-platform consumption, aligning with the more sophisticated viewing habits shaping the region.

Success now depends on differentiation, brand strength, and distribution flexibility, according to Alexandre, who highlighted how ready-to-market channels — across linear, OTT, and FAST — helped partners stand out in increasingly crowded environments.

The post-COVID landscape, he added, has pushed audiences more firmly towards digital viewing and opened new space for specialised, adfree and ad-supported experiences. Canal+ Distribution has responded by expanding its thematic and FAST channel portfolio, giving partners both reach and stronger monetisation opportunities as the region’s content ecosystem continues to evolve.

While it is monitoring emerging opportunities in the Americas, Europe, and the Middle East, Juan Xiang, Director of the Overseas Business Department at Tencent Video, said that the company’s recent international strategy centres firmly on Asia. He explained that Chinese content remained Tencent Video’s strongest asset, and the goal was to broaden its global footprint in a way that preserves cultural identity while appealing to diverse audiences.

Costume dramas continue to be the platform’s best-selling genre, a trend Juan Xiang said has remained consistent for years due to the form’s distinct artistic style and cultural depth. However, he noted a growing appetite for urban and suspense series, which offers international viewers more insight into contemporary Chinese society. This shift reflects a broader diversification in overseas demand.

Beyond pricing, Juan emphasised that audience acquisition has become a decisive factor in commissioning and distribution. With user numbers in many markets reaching maturity, the focus has shifted to content that is capable of attracting new viewers through variety, innovation, and a stronger sense of relevance.

He observed that in a crowded global market, success depends on delivering stories that both represent Chinese culture and meet the expectations of increasingly selective international audiences.

According to Roy Lu, General Manager of Linmon International, the Asian buying landscape has shifted sharply in recent years. Pan-regional streamers have overtaken traditional broadcasters as the dominant commissioners, while the number of intermediaries has dropped. As a result, Linmon has been engaging more directly with platforms operating across multiple Asian markets, reflecting the region’s accelerating consolidation and cross-border commissioning trends.

He added that the company’s global ambitions were anchored by a strong focus on Southeast Asia, Japan, South Korea, Hong Kong, and Taiwan. These territories remain the mainstream markets for Chinese-language content, he said, making them the company’s core strategic priority during ATF.

Meanwhile, urban romantic dramas and costume titles have continued to be Linmon’s most reliable performers—a trend that has held steady for years. Yet, Roy noted a clear expansion in demand. Thai series, locally themed productions, short-form dramas, and Chinese suspense and urban realist titles have all gained traction, reflecting broader diversification in viewer preferences and buying strategies across the region.

Roy emphasised that factors beyond pricing have also become decisive when presenting new projects. Production quality, visual craft, and the careful selection of distinctive IP—often rooted in regionally recognised books—are playing an increasingly central role in differentiating titles. The cultural impact of these IPs, whether literary or adapted, remain a key influence on buyer interest.

The children-focused animation landscape is now favouring edgier young-adult animation, according to Hendra Wardi, Managing Director and Chief Paranormal Investigator at Bawah Tanah Sdn Bhd. Naturally, the company’s expansion strategy centres firmly on this trend in Southeast Asia, where their young-adult animated series, Kisah Bawah Tanah aligns naturally with local humour, folklore, and lived experience. Hendra explained that cultural familiarity remains a powerful catalyst for cross-border circulation, particularly as young-adult animation gains traction across the region.

He noted that the strongest performance now comes from youngadult animation blending horror, comedy, and social commentary. Audiences, he said, have matured and have been increasingly drawn to contemporary stories that speak directly to Southeast Asian sensibilities.

For Hendra, cultural authenticity, relatable humour, and defined character arcs are far more important than pricing alone. He highlighted the growing importance of localisation quality and compatibility with multiple

platforms, especially as the company explores extensions into social formats, live events, merchandise, and branded collaborations.

Buyer behaviour across Asia, he observed, has also grown more data-driven and niche-oriented. Decision-makers prioritised IPs with

strong identity, visible community engagement, and the potential to travel regionally. Demand for youngadult animation has risen sharply, with buyers preferring titles that demonstrate cultural distinctiveness and social traction before entering licensing or commissioning stages.

A drama about an infamous Singaporean midwife who learns that her presumeddead daughter is trapped in a hidden world of ritual exploitation, forcing her to confront past betrayals to save her.

L—R) Steve Wang, General Manager, Yoywow Co., Ltd; Chow Waithong, Founder, August Pictures Pte Ltd (Back, L—R) Lin Sumin, Director of Media Organization Management Division, Shanghai Municipal Administration of Culture and Tourism (Shanghai Municipal Administration of Radio and Television); Yip Je Choong, Senior Vice President, Commercial Asia Pacific, RX; Feng Shengyong, Director-General, The TV Drama Department, National Radio and TV Administration, PRC; Li Zhuang, Deputy Director-General, External Promotion Bureau, The State Council Information Office of China; Qin Wen, Counsellor at the Chinese Embassy in Singapore

The leading cast of Strange Tales of Tang Dynasty (唐朝诡事 录), Yang Zhigang (杨志刚) and Yang Xuwen (杨旭文), were interviewed at the iQIYI booth (C03) on the ATF market floor, about their roles in the highly popular series based on a book of the same title. Spanning three seasons, the show is set in the Tang dynasty and follows an experienced local official and a young Imperial Guard general from Chang’an who join forces to solve mysterious cases that haunt the city. While protecting the citizens, they encounter corruption and face moral dilemmas that challenge their sense of justice.

The MoU inked facilitates the distribution of the romance series Shine on Me, adapted from a popular web novel to a broader audience.

The signed MoU reflects a shared commitment to harness ATF— Asia’s leading platform for entertainment content and coproduction—to amplify the global reach of Chinese content.

An animated series about the world’s first AI school bus that transform into different vehicles to keep children safe and solve challenges.

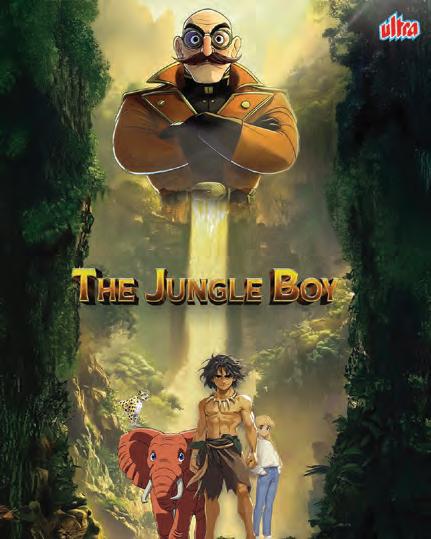

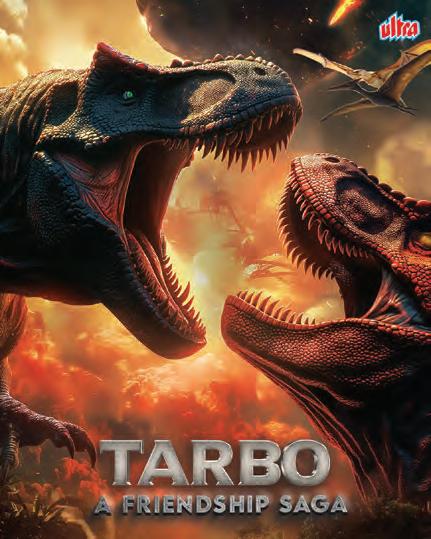

Ultra is showcasing its three OTT platforms at ATF 2025—Ultra Play for Hindi films, Ultra Gaane for music videos, and Ultra Jhakaas for Marathi content. The company will pitch these apps to global OTT and connected TV partners to expand access to its catalogue, which also debuts new animation titles Tarbo and The Jungle Boy, plus three micro-drama series. Rajat Agrawal, COO, Ultra Media & Entertainment Group spoke about the company’s film preservation and postproduction services, and that they are seeking international sales and copro opportunities and preparing to launch FAST channels and new YouTube content hubs.

All3Media International’s new culinary series Beyond Bali: The World’s Most Exotic Islands has been acquired by Warner Bros. Discovery in APAC for the AFN channel, covering Southeast Asia, Taiwan and Hong Kong. The eight-episode series follows chef Lara Lee as she travels across Indonesia, exploring her heritage through local flavours, traditions and community stories. The deal adds to Warner Bros. Discovery’s recent acquisitions from All3Media International and forms part of the distributor’s wider ATF slate, which also includes major natural history and documentary titles.

Mediacorp signed five MOUs at ATF 2025 with leading media and entertainment companies across Japan, Thailand, and Taiwan, marking a significant expansion of its regional collaborations and copro partnerships across Asia. These include A+E Global Media Japan, One 31 Company Limited, Gala Pictures International, Sanlih Television and TVBS.

“There is growing demand for environmental education and emotional animation in Southeast Asia,” said SeungNam Baek, CEO of Access Korea. SeungNam’s conviction is clear in Access Korea’s heavy promotion of its new animated series Gangchi Island, featuring an endearing sea lion protagonist set against the backdrop of a beautiful island.

He explained that Gangchi Island was designed to combine humour and heart while raising awareness about environmental protection and biodiversity. Inspired by the extinct Dokdo sea lion, the series brings Korea’s natural beauty to life through engaging characters and family-friendly adventures.

“OUR GOAL WAS TO BLEND ENTERTAINMENT WITH EDUCATION WHILE STAYING ROOTED IN OUR CULTURAL AND ENVIRONMENTAL HERITAGE,” HE SAID.

Notably, SeungNam observed that Access Korea’s read on the Southeast Asian market has been reflected at ATF in recent years – creators participating in the ATF x TTB Animation Lab, and international buyers showing a rising interest in animations themed around sustainability and local culture, making SeungNam more

SeungNam Baek CEO Access Korea

Kinjal Mehta, Senior Director of Distribution of APAC at Moonbug Entertainment, credits their success in Asia to touching the hearts of families through linear and digital platforms, while fueling sustainable growth through long-term partnerships.

The cherry on top of this cake, said Kinjal, is the opportunity for collaborations that blend local icons with Moonbug’s beloved characters — one such partnership with Sanrio put Hello Kitty and JJ from CoComelon on the same screen.

On the side of long-term partnerships, Kinjal noted that buyers across Asia had become more flexible and strategic in recent years. Traditional constraints around windowing and exclusivity had eased, with buyers now seeking a higher volume of proven hits alongside culturally resonant content. This trend had made projects like Blippi’s Singapore Adventures particularly meaningful, proving that when global IP met local culture, audiences responded with enthusiasm.

KINJAL ALSO OBSERVED A SHIFT TOWARD DATA-DRIVEN CONFIDENCE IN COMMISSIONING DECISIONS.

Buyers were increasingly open to new content if it already had a strong digital following. With many Moonbug shows starting life on YouTube, this organic fan base provided reassurance that titles would perform well across broadcast and streaming platforms.

Looking ahead, Kinjal acknowledged that maintaining quality amid rapid growth remained the biggest challenge. However, through co-productions, local collaborations, and shared creative solutions,

Moonbug has continued to deliver trusted, high-quality entertainment that connected deeply with families worldwide.

Collaboration, creative deal-making, and shared value creation are the way forward, according to Edmund Chan, Group Managing Director of Animasia Studio Sdn Bhd. This focus on finding new avenues for mutual benefit, he believes, is critical in an industry with shrinking content license fees and bloated production costs.

Over the past three years, Edmund observed significant shifts in buying patterns across Asia. New buyers had emerged with fresh content needs, reflecting changing viewer behaviours and platform strategies. He noted that these evolving dynamics transformed relationships with traditional partners. Previously, different buyers were satisfied with their own set of distribution rights, but were now pushing largely for combined Linear and Digital Rights packages. This shift meant a shrinking profit margin.

INCLUDING BRAND INTEGRATIONS AND SPONSORSHIPS

— strategies that not only compensated for shrinking budgets but also deepened audience engagement.

Thankfully established Asian buyers had become more receptive to innovative approaches, particularly branded content, which helped offset high production costs and reduced licensing fees.

Asia is becoming a contender in the global animation industry, producing content that rivals Western output in quality, creativity and scale.

BREAKING INTO THIS LANDSCAPE DEMANDS MORE THAN JUST COMPELLING IPS;

it requires adaptability, authenticity and long-term relationships.

“Entering the Asian market is challenging, as it is now home to the world’s most high-quality productions,” said Lucille Janvier, Sales and Acquisitions Manager at MIAM! distribution. “The dominance of globally renowned IPs, combined with local content, makes standing out more difficult than ever.”

To stay competitive, projects should have cross-platform appeal and educational potential, Lucille opined. “One of our key strengths is the development of an innovative real-time CGI pipeline, allowing us to produce not only animated series, but also a wide range of additional content around our IPs, including films, video games, and educational series,” she said.

The company has established deep roots across Asia, particularly in China, where its first in-house animated series Edmond and Lucy was acquired by the streaming platform Youku over a decade ago. A more recent collaboration is with Bilibili for a line-up of animated

documentaries.

Having reflected on buyer

By maintaining its reputation for reliability while embracing new monetisation models, Animasia demonstrated the flexibility and partnership-driven mindset essential for thriving in Asia’s fastchanging media landscape.

Storytelling alone is no longer enough. As buyers across Asia become more globally connected and brand-savvy, demand has shifted from one-off titles to IPs that could thrive across streaming, licensing, and live experiences.

“In recent years, animation acquisitions have evolved beyond screen-based rights to encompass broader brand and lifestyle opportunities,” said Hyemin Gemma Joo, Chief Business Officer at The Pinkfong Company.

“BUYERS INCREASINGLY LOOK FOR IPS THAT CAN LIVE ACROSS MULTIPLE PLATFORMS–STREAMING, CONSUMER PRODUCTS, AND LIVE EXPERIENCES–WHILE PLACING GREATER VALUE ON LOCAL RELEVANCE AND LONG-TERM FRANCHISE POTENTIAL.”

The company is focussed on creating globally resonant IPs that connect entertainment and education in formats optimised for digital natives, while also building opportunities for brand optimisation.

Asia’s animation market is increasingly valuing content format, quality and story over scale, according to Kwon Yi Gyu, Director of m29 Inc. Where acquisitions were once transactional, today’s platforms increasingly act as co-developers through early investment, shaping the creative direction, and evaluating IPs through the lens of long-term franchise potential.

“With OTT expansion, platform-driven acquisitions have increased, with local culture, fandom potential, and IP scalability emerging as key evaluation criteria,” said Kwon Yi.

“BUYERS ARE EVOLVING FROM MERE IMPORTERS TO PLANNING AND INVESTMENT PARTNERS LEADING TO A MORE DIVERSIFIED COLLABORATION STRUCTURE.”

He observed a growing interest in short-form and modular content suited to multiple screens, which reflected a shift from passive acquisitions to long-term co-production and licensing partners.

According to Kwon Yi, these evolving roles had opened the door to a new generation of hybrid partnerships that combined creative storytelling with business strategy. “Beyond traditional sales, international funding, licensing and platform collaboration have grown rapidly. Localisation strategies, multi-screen formats and OTT-exclusive content continue to inspire new creative and commercial directions across the region,” he added,

developing properties with strong IP growth potential. The company’s non-verbal exemplifies this approach,

localisation across multiple through its universal learning

Kwon Yi Gyu Director m29 Inc.

“Even amidst familiarity, there is always something new to be found,” said Jin Lim, COO of WHYJ Contents, reflecting on over a decade of participation at ATF. This year, the company has deepened its footprint in China, Taiwan, and Hong Kong through a mix of character IP pop-up stores, offline activations, and mobile games launched before and after broadcast.

Indonesia, Singapore and Thailand also remain key Asian markets for the company. Following last year’s success, WHYJ revived its proprietary IP pop-up store at Takashimaya Department Store in Singapore to coincide with this year’s ATF. The store serves as both retail space and business showcase.

Market dynamics have also shifted.

“WHILE THE FIRST RUN USED TO BE CRITICAL, WE NOW PERCEIVE A PREFERENCE FOR C ONTENT THAT ALREADY HAS ESTABLISHED RECOGNITION AND AWARENESS,”

Jin said. “This was likely because building awareness required significant investment, so platforms are increasingly looking to benefit from the existing popularity of a title.”

Even as acquisitions tighten, Jin remains confident in the fundamentals. “Content remains essential to everyone,” he said, “[and] I believe that high-quality animation will continue to command a good value.”

Mediawan Kids and Family has been steadily growing its partnerships across Asia, with focus on a few key markets. “South Korea, China and Australia are actually key partners for our flagship series Miraculous: Tales of Ladybug and Cat Noir,” said Hugo Brochard, International Sales Manager at Mediawan Kids and Family. Southeast Asia has also played an increasingly important role in extending the reach of the company’s content, with new collaborations across Malaysia, Singapore, and then Pakistan as well.

Hugo further noted that

ASIAN BUYERS HAVE BECOME MORE SELECTIVE OVER THE PAST THREE YEARS, INCREASINGLY FAVOURING LOCALLY PRODUCED ANIMATION AND SEEKING CO-PRODUCTION OPPORTUNITIES THAT ALIGN WITH REGIONAL SENSIBILITIES.

This approach, he explained, allows studios to navigate local content quotas and ensure cultural relevance. Established intellectual properties and well-developed licensing and merchandising strategies are now central to buyers’ acquisition decisions.

To meet these shifts, Mediawan Kids and Family has cast a wide net by focusing on high-quality animation across diverse genres and formats, ensuring its catalogue appeals to multiple age groups and markets. Hugo emphasised that the company’s adaptability–balancing premium storytelling with broad global resonance–has helped sustain longterm relationships in Asia.

Looking ahead, Hugo said the studio’s commitment to co-production and creative collaboration would continue to underpin its strategy in the region. Hugo highlighted the studio’s two newest animated series at ATF 2025, Karters and Witch Detective, and welcomes all parties interested in collaboration.

Hugo Brochard International Sales Manager Mediawan Kids and Family

One of the clearest shifts in Asia’s animation business has been the move toward acquiring IPs that can evolve into brands.

“BUYERS NOW PREFER STORIES THAT REFLECT LOCAL IDENTITY WITH GLOBAL APPEAL,”

said Hwa Jeong Lee, CEO of WeNobs Co., Ltd., noting rising demand in China and Southeast Asia for content centred on the environment, family, and emotional growth.

That demand aligns neatly with the company’s flagship title Hotel Penni, a 2D comic fantasy set in a microbe-only

Hwa Jeong Lee

CEO WeNobs Co., Ltd.

hotel hidden in Jeju’s Gotjawal Forest. The show’s balance of humour, science, and emotional storytelling give it cross-market potential while staying rooted in Korean themes of co-existence and empathy. Designed from inception as a scalable IP, it targets both OTT platforms and consumer licensing opportunities.

“The greatest challenge today lies in rising production costs and rapidly shifting global markets,” she noted. With margins tightening, the studio built an efficient production pipeline and adopted a localised creative strategy that cuts waste without sacrificing quality and authenticity.

As the company makes its debut at ATF, Hwa Jeong said the goal was clear: to connect with partners who see the future of animation not just as content, but as culture.

Hyung Lee, also known as Brendon Lee, Team Leader at Hotel Lotte Co., Ltd. Lotte World, shared how the company has sharpened its focus on Southeast Asia, particularly Indonesia and Vietnam, where the wider Lotte Group has already expanded its business presence. He noted that these markets hold strong potential for aligning the group’s broader success with new animation projects.

Reflecting on industry developments, Hyung observed that

ASIAN ANIMATION BUYERS HAVE BECOME MORE DIVERSE AND DISCERNING, WITH GROWING DEMAND FOR CONTENT THAT INCORPORATES LOCAL CULTURAL ELEMENTS SUCH AS K-POP INFLUENCES.

This evolution has encouraged Lotte World to adapt its creative direction and explore cross-cultural appeal. At the centre of the company’s animation slate is X, an adventure-driven educational series designed to teach children about ecosystems and the protection of endangered species.

Hyung also pointed out that OTT platforms have transformed animation acquisition patterns, pushing producers to adopt more digital-focused strategies. For Lotte World, this means developing globally targeted animations capable of reaching international audiences while staying rooted in meaningful storytelling.

Although 2025 marks Lotte World’s first participation at ATF, Hyung said the team viewed it as an opportunity to connect with partners, gather market feedback, and refine strategies through exposure to new trends.

Over the past three years, Jihye Michelle Kim, Head of Global Business Development at ACOMMZ Co., Ltd., has observed a dramatic shift in animation buying behaviour across Asia. As audiences diversify across digital and hybrid platforms, buyers are seeking IPs that are adaptable, emotionally engaging, and capable of multi-platform storytelling. This trend is encouraging producers to build strong IP ecosystems that extend beyond linear broadcast into gaming, toys, and

“THIS CHALLENGES STUDIOS TO DEMONSTRATE BRAND VALUE INDEPENDENTLY THROUGH DIGITAL TRACTION AND GLOBAL FANDOM,”

Asian buyers once known for snapping up European animation have become markedly more selective. “Activity has slowed down towards French production in animation , [there are] no more blind acquisition and fees are lower,” said Isabelle Aghina, Director of Acquisitions and Distribution at Moon-Keys International Content. With free-TV budgets shrinking and VOD platforms setting the pace, the buying landscape now demands stronger editorial focus and proven audience pull.

FOR ISABELLE, THE RECALIBRATION PLACED RENEWED EMPHASIS ON THE VALUE OF ESTABLISHED IPS THAT TRAVEL WELL ACROSS CULTURES.

Jihye shared, but noted that it was a welcome change for creative producers who sought to cultivate direct audiences and scale IP ecosystems beyond traditional distribution models.

Jihye also highlighted ATF as a pivotal market for sparking new collaborations and insights. It was at ATF that ACOMMZ first connected with August Media, a partnership that began as a creative exchange and evolved into a full co-production on Super Guardians Seasons 2 and 3. “ATF gave us the platform to turn creative dialogue into long-term collaboration,” Jihye said.

With Super Guardians earning nominations at the 2025 AACA and ATA, ACOMMZ has demonstrated its balance of narrative depth and commercial foresight. Jihye acknowledged the growing challenge of selective acquisitions, but welcomes how animation success has been re-defined in the modern media economy.

China and Southeast Asia remain key territories in a region where acquisition budgets have tightened, and audience recognition and brand trust have become the real markers of value. As Isabelle noted, “as long as our IPs talk to their kids’ audiences.”

The company’s animated series for young children, now two seasons in, continues to perform in Asia. The company hopes to achieve similar success with its new titles such as Melody & Momon Migali (from TF1), alongside the third season of Gus the Itsy Bitsy Knight

Isabelle Aghina Director of Acquisitions and Distribution Moon-Keys International Content

For Studio ACORN Inc, Southeast Asia has emerged as one of the most dynamic growth markets in global animation. The company is focused on Malaysia, Indonesia, Thailand and Vietnam, where kids’ content and new media sectors have shown remarkable growth. “The energy and creativity in these markets make them incredibly exciting to work with,” said Angela Lee, Producer and Head of Content Marketing.

That expansion coincides with a clear shift in audience demographics.

“ANIMATION IS NO LONGER SEEN AS JUST FOR YOUNG CHILDREN—IT’S NOW REACHING AND ENGAGING AUDIENCES ACROSS A MUCH WIDER AGE RANGE.

We’ve seen a noticeable shift toward the upper pre-school and older kids’ segments. More recently, there’s also been a growing number of projects aimed at teens and young adults,” she added. To meet this change, the company has pivoted to developing projects for both kids and young adults.

“The rise of OTT and FAST platforms has completely reshaped how we think about content creation and distribution,” Angela noted. With broadcasters and streamers more cautious in their spending,

Asia’s rapidly evolving animation landscape has steered K-Ani Inc.’s strategies towards Japan, according to Daniel Lee, Executive Vice President of K-Ani Inc. Daniel explained that while Korea remains K-Ani’s core market, Japan similarly serves as a creative hub and vital partner for co-productions and IP development. He stressed the impact of his long-standing relationships with Japanese studios and licensors that has enabled the creation of original, high-quality content with strong commercial potential across Asia and beyond.

Reflecting on his experience at ATF, Daniel noted that the event has always been instrumental in fostering cross-cultural collaborations. As a relatively new production company, K-Ani views ATF 2025 as a valuable opportunity to strengthen its visibility and build coproduction and distribution partnerships. Direct dialogue with regional buyers has also helped the team refine project concepts to appeal to broader international audiences.

According to Daniel, the biggest shift in recent years has been the diversification of animation platforms. With global OTTs, streamers, and mobile platforms all competing for animated content, studios have been forced to adapt their creative and production strategies to serve multiple viewing formats.

More adults across the region are turning to animated storytelling for its creative freedom and emotional depth. “In many Asian countries, more adults are starting to enjoy watching animation, and this trend continues to grow,” said Hur Sungwhe, CEO and Director of Storyfarm. He noted that streamer diversification and maturing audience segments have both contributed

Buyers are now scouting for stories with complexity and visual sophistication that appeal to wider age groups. “Kids’ animation is still strong, but the market is expanding. With new platforms and audiences, we see growing interest in non-traditional formats and animation made for older audiences,” Hur said.

This change is happening alongside broader shifts in viewing behaviour.

According to Jeon HongDeog, CEO of Magic Image Co., Ltd., Mongolia has become one of the most dynamic markets for Korean content, with audiences deeply engaged in Korean culture and buyers increasingly expanding their interest from content acquisition to merchandising and brand partnerships.

HONGDEOG ALSO NOTED THAT AI TECHNOLOGY HAS BECOME CENTRAL TO MAGIC IMAGE’S SALES STRATEGY OVER THE PAST FEW YEARS BY HELPING TO STREAMLINE CONTENT PROMOTION AND ACCELERATE DECISION-MAKING.

While Hur recognises that theatrical attendance had been heavily impacted by the pandemic, he remains optimistic about the longevity of cinemas.

“WE BELIEVE THAT GREAT STORIES MADE FOR THE BIG SCREEN CAN ATTRACT AUDIENCES AGAIN, AND WE ARE WORKING HARD TO CREATE SUCH STRONG TITLES,” HE SAID.

At events like ATF, Hur observed that the variety of projects and styles on display has sparked “new ideas and inspiration” for creators exploring this maturing audience space, signalling that Asian animation is not just evolving, but growing up.

This digital approach has allowed the company to remain agile amid industry shifts and maintain steady growth across international markets.

A cornerstone of the company’s portfolio is the educational series Aungdaung Fairy Tale Land, which has been distributed internationally for over a decade. HongDeog said the enduring success of this title demonstrates the long-term potential of educational animation, particularly in markets seeking family-friendly,

value-driven storytelling.

HongDeog acknowledged the challenges facing animation producers as audiences migrate from traditional broadcasters to streaming platforms. Unlike legacy television, streaming requires faster production cycles and greater risk-taking, but it also offers new opportunities for monetisation through advertising, fan engagement, and in-platform shopping. For Magic Image, the key to future success will lie in adapting quickly while maintaining quality and authenticity in its storytelling.

“THE MARKET USED TO BE SATURATED WITH BOYS’ ROBOT ANIMATIONS, BUT LATELY, WE’VE NOTICED MORE BUYERS SHOWING INTEREST IN GIRLS’ CONTENT,”

said Kyungmin Nah, Manager of Campfire Aniworks. This trend across Asia, according to Kyungmin, could have major implications for their strategy in their key markets of Indonesia and Taiwan, both with regard to the animation itself as well as merchandise sales.

Over the past three years, Romane Cot-Ogryzek, International Sales Manager at Millimages, observed that Asian buyers have diversified, with traditional broadcasters now sharing space with new digital players adopting innovative acquisition strategies. This evolution, she said, has reshaped how distributors like Millimages approach partnerships in the region.

Romane further highlighted the continued rise of anime and interactive 3D formats across Asia, which has brought new audience dynamics beyond Millimages’ traditional preschool base.

THE SHIFT TOWARDS DIGITAL CONSUMPTION, SHE SAID, REMAINS BOTH THE COMPANY’S GREATEST CHALLENGE AND ITS MOST IMPORTANT OPPORTUNITY FOR FUTURE GROWTH .

At the heart of the company’s portfolio is Molang, described by Romane as Millimages’ superstar—a universal, multi-channel brand that exemplified the studio’s ability to create content with global appeal. Besides an animated series, Molang has also spawned a wide variety of commercial merchandise.

In closing, Romane reflected on how the company has deepened its understanding of the Asian market through recent editions of ATF. She noted that the 2023 TTB Animation Pitch introduced exceptional regional projects and provided valuable insight into upcoming Asian animation trends.

“Our stories are not limited to Asia— they’re designed to appeal globally,” Kyungmin pointed out. Their content strategy emphasizes global appeal, with a focus on relatable emotions and relationships that are expressed in a way that is easy for children of all ages to understand.

Kyungmin also anticipated that a major hurdle that the company could face would be securing access to broadcasters. “Even when we have the right contacts, responses can be slow or limited,” Kyungmin lamented. However, to ford this river, Kyungmin and company have been looking to ATF this year to build stronger and more effective face-to-face connections—it will be their second time attending since 2022.

The animated film industry is ripe for the picking in Southeast Asia, according to Juraj Barabas, Managing Director of Luminescence Kft.

“THE MOST IMPORTANT TASK FOR US TODAY IS TO FIND NEW AVENUES AND TO CREATE NEW OPPORTUNITIES FOR ANIMATED FEATURE FILMS TO BE EXPLOITED IN THE SOUTHEAST ASIAN REGION, PARTICULARLY IN THE THEATRICAL SECTOR,”

he said, indicating the company’s intention for a strategic push in the sector.

Juraj also pointed out that the industry has responded well to this strategy, with higher interest in animated feature films from platforms and broadcasters in recent years, as well as remarkably warm reception to new ideas in animated feature films. On the side of the company’s main strategy, Juraj noted possible plans to respond to the recent interest in the industry for family-oriented live-action feature films.

Studio W.Baba has recalibrated its business for an era where, as CEO In-Chan Park put it, “anyone who can tell a story well can become a distributor”.

WITH AI-DRIVEN PRODUCTION TOOLS AND GLOBAL DIGITAL PLATFORMS BLURRING THE LINE BETWEEN CREATOR AND BROADCASTER, THE KOREAN STUDIO HAS BEEN EXPANDING ITS STORYTELLING APPROACH BEYOND TRADITIONAL PIPELINES TO MAXIMISE REACH AND EFFICIENCY.

That rethink has extended to how it approaches key territories: China provided scale, the United States delivered strong OTT and licensing opportunities, and Singapore is emerging as a hub for project financing and co-production. Together, they form the foundation of a more diversified business network.

“The number of [Asian] buyers has significantly decreased,” In-Chan observed. “They now seek strong IPs with scalable OSMU [One-Source Multi-Use] potential–properties that can evolve into animation, games, and merchandise.” Titles such as Dr. Robot Teo, blending STEM themes with educational storytelling, and B-Family, a comedic franchise growing through merchandise collaborations, reflect that push toward multi-platform IPs.

For In-Chan, balancing quality with scalability remains the key challenge. Unreal Engine 5 has helped streamline production, but localisation still defines success. In-Chan added that renewed

On the topic of new formats like micro-dramas, Juraj indicated investor confidence, boosted by Korean-inspired hits such as K-Pop: Demon Hunters reminder that strong IP, not just strong visuals, is the currency that endures.

that the company has no plans currently to foray into new territory, but would instead play to their strength of theatricallydriven feature films and consolidate their current efforts in the APAC region.

What was once a race for broadcast slots is now a sprint across streaming algorithms. “Adapting to new platforms and viewing behaviours requires constant innovation and flexibility,” said Hye Jin Moon, Sales & Acquisitions Manager at Superights.

“The rise of streaming platforms and the shift toward on-demand viewing have transformed how content is discovered and valued,” Hye Jin said. The challenge now lies in crafting content that cuts through recommendation algorithms while remaining adaptable to local tastes and languages.

Hye Jin explained that the market shifts have pushed the company to refine their production and distribution strategies, encouraging creative experimentation and stronger connections with audiences worldwide. She noted that the evolution of children’s media consumption has been both a challenge and an opportunity, demanding a constant rethink of what resonates and why.

Armed with a diverse animation slate, the company aims to meet buyers where their audiences already are, from preschool favourites like Go! Go! Cory Carson to global icons such as Miffy and Hello Kitty, as well as European classics including Lassie and Nate Is Late

French studio Hari continues to cement its position across Asia with globally recognised titles such as Grizzy & the Lemmings. The series maintains remarkable momentum, ranking among China’s top 10 international shows with over 1.3 billion views on Mango TV, and performing strongly on Tencent and iQIYI. On YouTube, it draws 1.8 billion views worldwide, led by audiences in India and Southeast Asia—a testament to its universal, non-verbal humour.

HARI’S ENDURING STRENGTH, SAID TOBY JONES, HEAD OF SALES AT HARI, LIES IN FEATURE-QUALITY ANIMATION PAIRED WITH

ACCESSIBLE, CHARACTER-DRIVEN STORIES.

As a creator-led studio, its focus on heart, humour, and highquality production enable its titles to transcend language barriers and resonate globally.

Toby explained that buyers across Asia have become more strategic, prioritising adaptable brands that could perform across both linear and digital platforms. He noted the opportunity to capitalise on a growing appetite for layered comedy and adventure-driven storytelling, with Mystery Lane gaining traction following its success in China.

Despite increasingly complex financing and fewer pan-regional deals, Toby remains optimistic. The demand for distinctive,

emotionally engaging IPs continues to grow, and HARI’s strategy—staying true to its creative DNA— ensures its stories keep connecting with audiences around the world.

Global tentpoles and long-running franchises remain strong draws for audiences across Asia, and this insight for recognisable talent and distinctive storytelling continue to inform increasingly selective buyers. According to Amreet Chahal, Director, Content Sales Asia, A+E Global Media Group, “Asian buyers have a lot of choice in the market, and are pulled towards compelling premium content,” she said.

Success lies in balancing marquee names with dependable franchises–a strategy built on variety as much as vision. “With all of the strong competition out there, we need to come to market with a sensational catalogue that ensures our partners will come to us again and again,” Amreet added, emphasising the company’s “depth and breadth” as its competitive edge.

The focus on premium quality is reflected in A+E’s slate, which spans genres and formats. Amreet highlighted a 20-part World War II documentary hosted by Tom Hanks alongside productions such as, Mysteries Unearthed with Danny Trejo, Hazardous History with Henry Winkler, and Secrets Declassified with David Duchovny–titles that combine star power with storytelling and historical depth.

Unscripted programming has also proven a crucial growth driver.

“THERE IS A BIGGER APPETITE FOR UNSCRIPTED CONTENT, BUT IT MUST BE HIGH-QUALITY AND RESONATE WITH VIEWERS,”