1 2 3 5

4

p.02—04

Elements of the ecosystem come alive via accelerator programs and pitches

p.08—14

Celebrating 25 years of bringing business to APAC

p.18—20

Further opportunities to network, discover, and make an impression

p.22—28

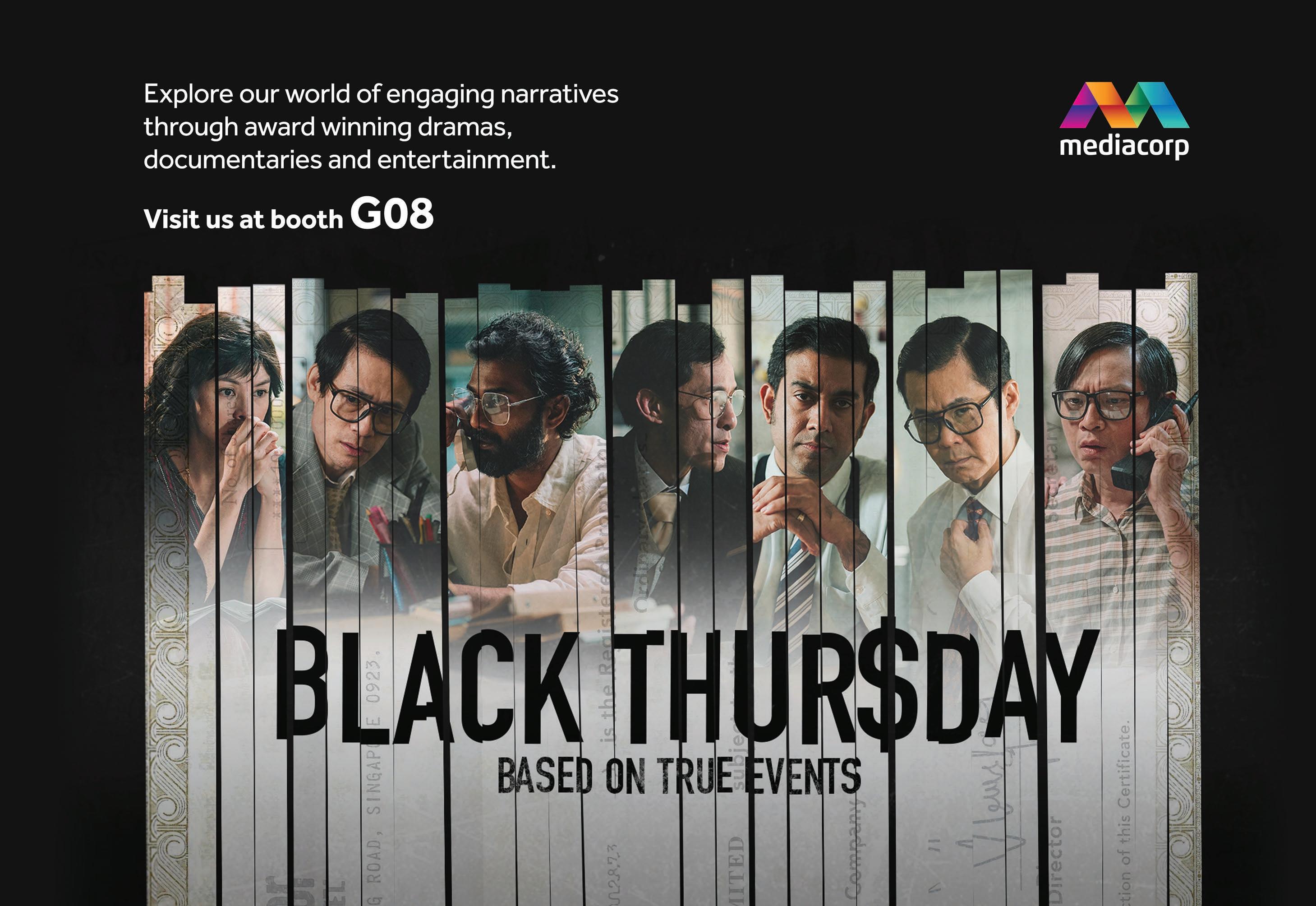

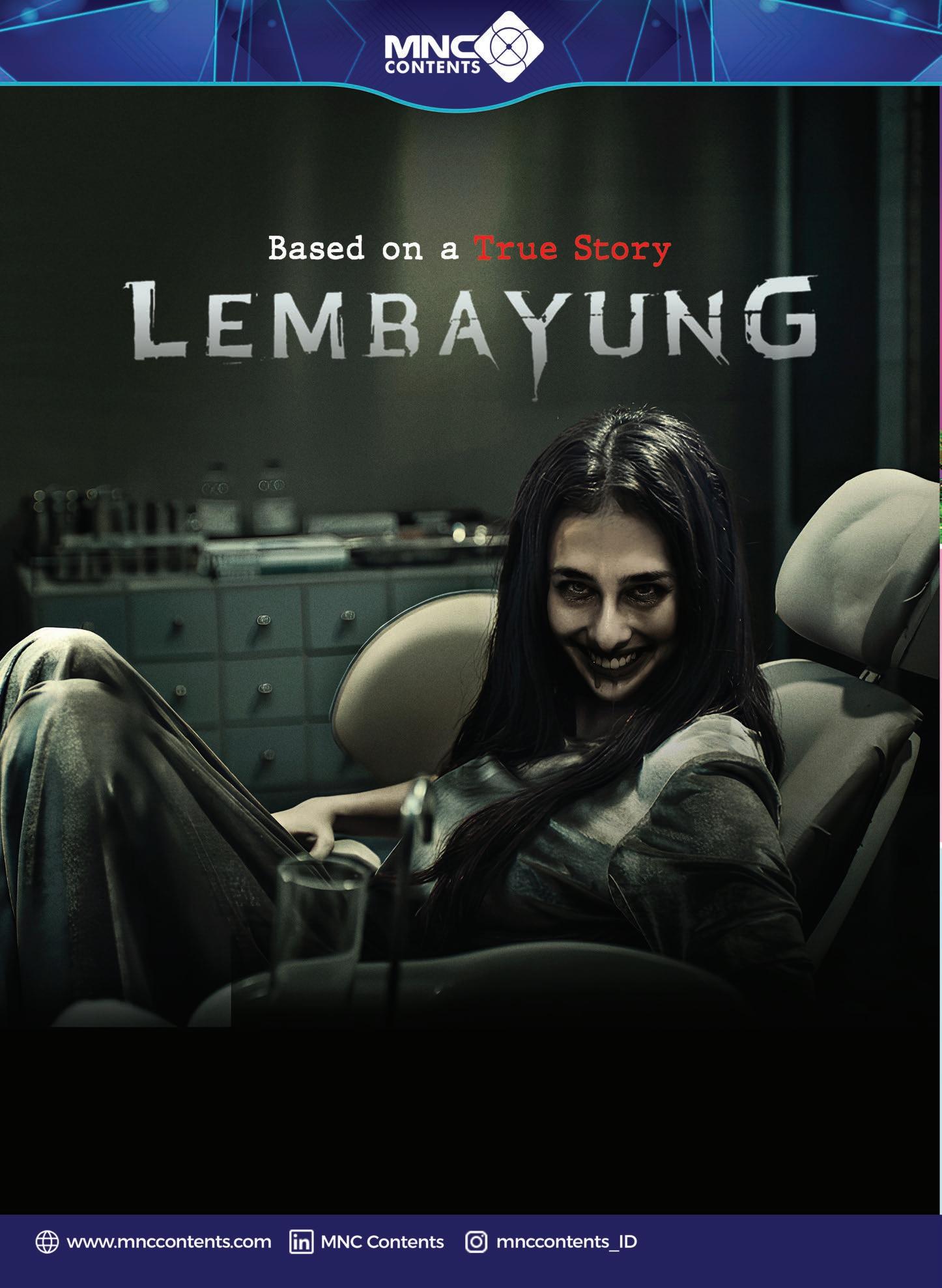

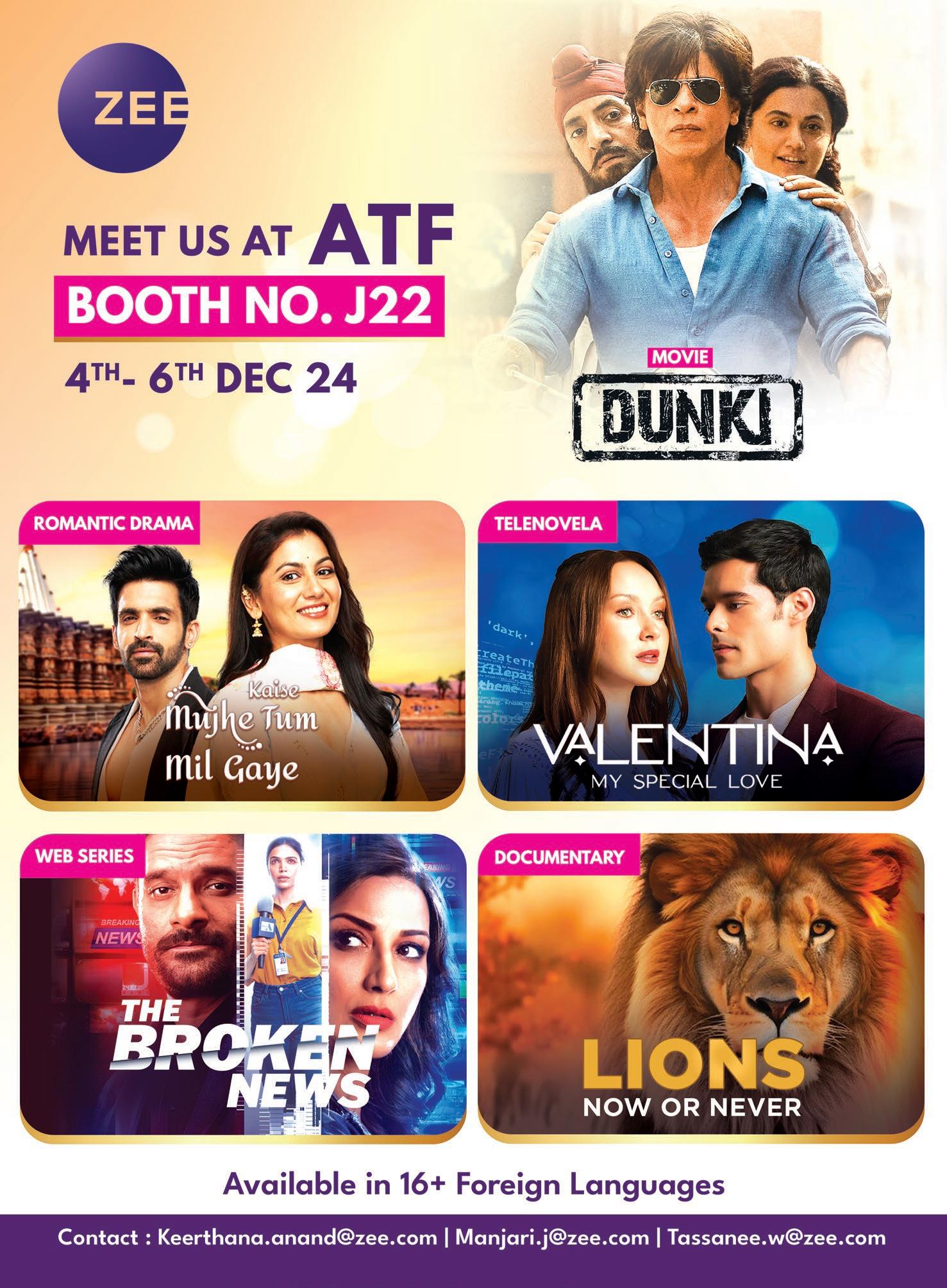

Exhibitors put on show their fresh & best content, while some offer fun gatherings over cocktails & hors d’oeuvres

p.30—40

Limelight on exhibitors on the market floor

6

p.44—67

The latest statistics and reports from top analysts— exclusive to ATF at time of printing

project management

group project director

YEOW HUI LENG

senior project manager

JOYCE CHUA

assistant account director

PHUA MEENYI

assistant relationship manager

SAMANTHA LEE

relationship coordinator

BRIDGET TONG

project executive

JOCELYN PHNG

conference

executive producer

LULU MENDOZA

assistant conference producer

LERIS LEONG

editorial

editorial director

LULU MENDOZA

writers

MARCUS GOH

LIM JUN XI

MARK LEONG

DINESH PASRASURUM

KOON SI MINK

designer

SHELLEN TEH

photography

ARTGRAPHY traffic

TEO HUI HIANG

SOH CHUAN TING

marketing

marketing director

TEO HUI HIANG

marketing manager

CANDY CHEAH

digital assistant manager

AYE MIN THU

digital executive

LIEW BI LIANG

operations

operations director

KAREN LEONG

operations manager

CHUA LAI SOON

assistant operations manager

KAREN LIEW

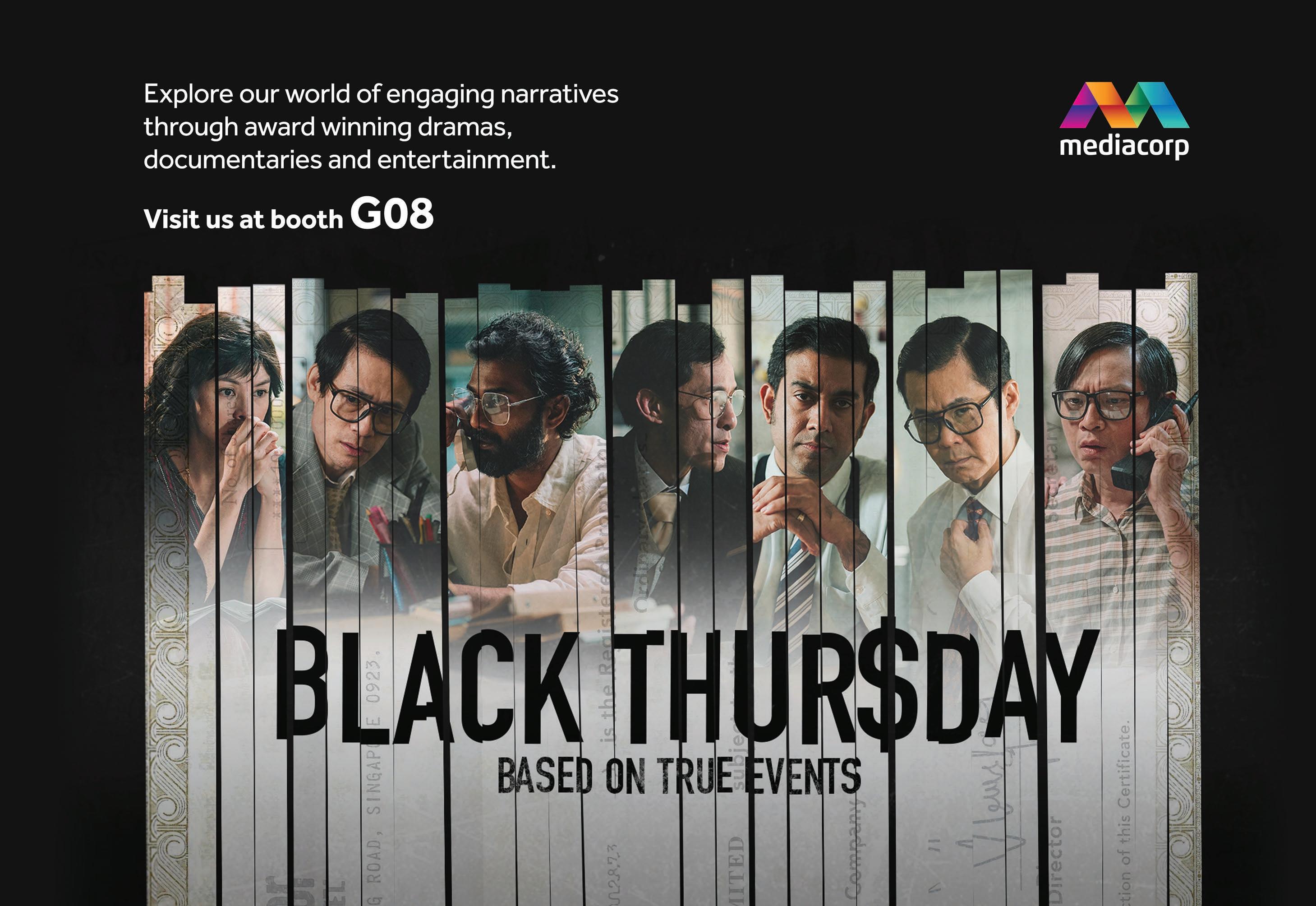

“This is the very first time we’re doing this pitch,” said Virginia Lim of the first ATF x Mediacorp Drama Concepts & Co-Production Pitch. The Chief Content Officer of Mediacorp was one of the three judges at the session.

Five finalists out of over a hundred entries were selected for this session. Each of the concepts was judged on four equally weighted criteria — concept and originality, storyline and structure, character development, and commercial and distribution potential.

From Singapore came a coming-of age comedy, Be Yourself Truly by Dennis Sim, while Thailand had Jiranun Piboonsawat’s Don’t Speak With Her, a true crime-inspired mystery drama. An important consideration was that the show “is relevant to the key market,” shared fellow judge Indra Suharjono, Co-Founder & Director, I.E. Entertainment.

So which were the three winning concepts that took home $10,000 each?

Singapore’s Cycle by Alan Sim, an action thriller about the secret world of bicycle couriers where the protagonist discovers that not all is as it seems, brought back the prize money. Drawn In by Paul Battle was South Korea’s winning entry — a fantasy drama about a shy student who discovers that she can turn her drawings into reality.

Steve Chicorel’s entry Detective Daji was one of the top three finalists. The supernatural crime drama from the United States revolves around the titular, demonpossessed detective. The third judge, Zainir Aminullah, Founder, Revolution Media, shared that “it is always about thinking about the potential questions that can come from the judges.”

Eight pitches out of 120 made it to the second annual ATF x TTB Animation Lab & Pitch and the quality of these finalists really showed. With four pitches each from Asia and Europe, the finalist pitches ranged from dark comedies to journeys of emotional growth – many with beautiful and electric art and animation.

While many were in 2D animation, some had unique styles like a live-action base enhanced with background animations and VX layers. The pitch mentors pointed out key qualities of each pitch, including emotionally compelling stories and characters, unusual and eye-catching animation choices, and relatable themes.

While every pitch here was a winner chosen from over a hundred submissions, the winner among winners was left to a vote of popularity from the audience. The winner of the vote was Mah Jong Pai, a dark comedy and horror 2D series written and directed by Yoshiya Ayugai from Malaysia with his partner CJ Lee. Mah Jong Pai tells the story of John, a young orphan who moves in with his uncle. Unbeknownst to John, his uncle practises dark magic and entangles John in a dangerous world where John unexpectedly bonds with his uncle and develops empathy for otherworldly creatures. Ayugai walked away with a cash prize of S$1000 as well.

As the global fascination with K-Content continues to soar, one has to ask: what’s next? The answer: five innovative concepts from the talented minds of accomplished Korean entertainment production houses.

O’PEN–CJ ENM presented two concepts. The first was horror thriller The Anatomy, which focuses on the regeneration of the human body. Crime drama Madame Tarot is based on the novel of the same name, authored by Lee Sua. The author also scripts the series, which examines the use of tarot reading for criminal profiling.

WEMAD’s comedy action drama Buddha Mafia has controversial characters like a mafia with abandonment issues, reminding us that it is important to have characters that resonate.

Combining elements of beloved classics would also provide the audience a fresh perspective on the familiar, said Daniel Son, Line Producer and Actor, Sarim New Cinema. His new comedy drama Seouler features ordinary Asians with the quirks of Friends and Seinfeld characters.

Repackaging old favourites can be refreshing as well. This was demonstrated in MBC’s latest unscripted format — AI K-Pop Star. It is the world’s first show to be directed by AI, announced Mini Hwang.

Ultimately, it is about authentic content that connects regardless of ages and experience.

“We’re trying to show the world that C-drama is the best drama.”

Wang Yilun, who stars in the upcoming costume drama, A Dream Within A Dream, had this to say to fans who turned up at Linmon Media’s content lineup.

The romantic comedy was one of the many costume dramas presented by Lu Yu, General Manager, Linmon Media International. He shared that localisation options were available for their content.

Audiences were over the moon with costume dramas Moonlit Reunion, a romantic fantasy drama, and In The Moonlight, a political drama. He also shared that the second instalment of the Journey franchise,

A Journey To Glow, would be a drama of self-discovery for five individuals. Linmon Media’s contemporary offerings include a new season of suspense drama Under The Skin 2 and The Unseen Sister, a cinematic thriller.

The content concluded with an MOU signing ceremony between Mediacorp and Linmon Media International.

“This allows us to work on more compelling stories across the shared cultures that we have,” said Virginia Lim, Chief Content Officer, Mediacorp.

Lu Yu, General Manager, Linmon Media International, echoed the sentiment. “I’m really excited to see more creative projects come from this collaboration.”

“The first three years of Duterte’s administration was a wave of terror brought about by the summary executions, vigilante murders, extrajudicial killings. Those murders were believed to be state sanctioned,” said Shugo Praico, writer and director of Drug War: A Conspiracy of Silence. The six-episode crime drama series by REIN Entertainment is based on the violence and death following President Duterte’s infamous war

on drugs early in his term, with a very deliberate focus on the biggest victims of the war – the underprivileged and the innocent.

Asked about the impetus for the series’ production, Lino Cayetano, Executive Producer at REIN Entertainment, shared that Philippines’ war on drugs was an event that deeply affected every person in the country and telling the story was important to them as Filipinos and human beings.

Making a special appearance, Ian Veneracion, who plays a priest in the series, echoed Lino’s sentiment, adding that the role was a way to navigate his guilt in being part of the ‘conspiracy of silence’. “It’s important to remind ourselves not to let this happen again,” pointed out Philip King, co-creator of the series. With such an emotionally charged and relatable theme, the series, on pre-sale with all rights available, is one to look out for.

Jeff Han, Vice President of Tencent Video, set the stage in a show of weTV’s phenomenal success on the global market. Since its establishment in 2011, WeTV has seen rapid growth from purely domestic operations to over 90% of the world’s countries. On the back of a projected 40% increase in the Southeast Asian OTT video market’s net worth over the next five years, WeTV has planned a Southeast Asian push centred around Thailand’s Boys’ Love genre.

Juan Xiang, Director of Tencent Video Overseas Business and Head of WeTV & Sanook, described Thailand as

having the highest potential in Southeast Asia for content production, especially since Thai content sells well in the lucrative Japanese and Korean markets.

WeTV’s heavy investment in Thai content shows in their upcoming slate of numerous Boys’ Love series, including Boys Lost, Love of Silom, and Love Destiny From Hell

Of particular note is CHUANG ASIA S2 The Boy Edition, a sequel to their highly successful idol survival reality series CHUANG ASIA. Set in nine countries and with over 60 participants known as ‘trainees’, the reality series will be one of WeTV’s higher value productions.

“US buyers are not interested in nonEnglish content anymore,” opined Christian Vesper, CEO, Global Drama and Film, Fremantle.

He explained that in the past, they were able to put together ambitious series outside the US, and they were pretty sure of finding co-financing in the US. But not anymore.

Christian shared his insights in a session moderated by Tony Gunnarsson, Senior Principal Analyst, TV, Video & Advertising, Omdia, which covered Fremantle’s contentproducing journey.

A grim observation about financing was that sometimes “there is hope from some of the buyers that the producers don’t need to make any money.”

When it comes to series, it’s not just about financing, but also storytelling. “Some of the series you see on bigger platforms are 10 episodes when it can be six episodes. I understand the

reasoning behind that, in terms of holding the audience, but it’s not good for storytelling,” explained Christian.

What about his perspective on Asia?

“What we need to understand better is that it is ridiculous to describe it as one unified market,” he said, demonstrating his understanding of the region.

Instead, there’s a more pertinent question on his mind.

“How do we approach a market this diverse?”

Bollywood is solidly entrenched in the world’s palate, but Indian series have lagged behind for the longest time – until now, that is. As the man behind content production at one of India’s biggest media companies, Tejkarran Singh Bajaj, SVP & Head of Originals at Jio Studios, is eminently qualified to talk about this incipient change.

While Indian films are abundant in the global market, Tejkarran said that Indian series that are relatable and fresh are not, implying that currently, Indian series are produced primarily for domestic consumption. Jio Studios, however, has recognised this gap in the global market and embraced the risk by making a big push to produce and distribute its own original series apart from the current meta.

“We have deep pockets, we are self-funded. We invest in stories that we believe need to be told and we retain the IP,” said Tejkarran, pointing out Jio’s privileged position that gives it the unique ability in the Indian market to dictate and deftly adjust their creative direction to fit the global market, while profiting immensely from their own original IP.

“We’ll probably be sitting here after a few years talking about the biggest Indian shows,” he added, displaying a strong confidence in the future of Indian series.

“We’re all thinking about the money all the time,” began moderator Justin Deimen. The Managing Partner, Goldfinch Asia addressed the elephant in the room as he opened the session about buyers and commissioners navigating the new terrains of content strategy.

An approach is to “think about brands, not as something that has to burden the scriptwriting process,” shared Kyle Ezra Goonting, SAVP, Head Development & Production, Astro Shaw. He also feels that “it is our responsibility to create an IP that is big enough to live outside of the film.”

Justina Wojtowicz, EVP Acquisitions, Co-Productions & Sales, Rive Gauche, an Aftershock Company revealed that in the US, a financing approach was “buying ad space.” She explained that it is “when the brand is integrated into the actual series or documentary. On top of that, they get free ad space when the series goes out.”

Mediacorp made their biggest pivot in this climate during COVID. Angeline Poh, Chief Customer & Corporate

Development Officer explained “that was when we pioneered a way to do performance marketing,” where advertisers would pay based on campaign performance.

“Because of that, we’ve seen our customer retention grow by three times,” she said, ”and that accounts for 40% of our total revenue.”

“We have gone from just selling media inventory to becoming solutioning partners with our brand partners,” Angeline said.

Cyril Le Jeune shared the challenges in his market. The CEO, CANAL+ Myanmar, explained that “our main challenge first of all is piracy,” citing that 55% of the viewership for a recent live event came from pirated sources.

“I spend four hours a week fighting against piracy.”

The atmosphere was bustling with anticipation as Taiwanese talents took to the stage to discuss the next big Taiwan drama: The World Between Us II at a session moderated by Janine Stein, Editorial Director of ContentAsia.

Casting is crucial for a large-scale production to create box office magic, especially for a drama that focuses on human emotions.

While actors like Vic Chou are able to evoke invigorating emotions by tapping on personal experience and perspectives, others like actress Hsieh Hsin-Ying could empathise with the audience’s experience as a fan of the drama’s first season.

Younger audiences are drawn to the allure of stories about ordinary people embroiled in recent societal

events, a sentiment that artiste Hsueh Shih-Ling shared. The production team agreed that their common goal was to provide an immersive experience.

“2019 saw a resurgence of interest in Taiwanese drama and revived the local cinematic landscape. Government funding poured in to support the artistic ambitions, and content expanded in quality and quantity”, revealed Jayde Lin, CEO, Damou Entertainment.

Today, films and drama series cover a wider spectrum of topics and subjects.

EST N8 believes its uniqueness lies in being the only company in the US with a comprehensive focus on Asian content, spanning sales, production, finance, and distribution.

“This specialization appeals to a dedicated and growing segment of the audience that appreciates diverse and unique storytelling,” said Tenten Wei, Head of Studios at EST Media Holdings, Inc.

Apart from the Asian obsession, EST N8 further focuses on the very lucrative horror genre. “Horror films have a universal appeal that transcends language barriers and captivates audiences globally,” noted Sophie Shi, Head of Acquisition & Production at EST N8. “We’ve observed the enthusiasm for this genre through curated lists by horror fans on platforms like Letterboxd, showcasing the widespread appreciation for Asian horror.”

EST N8 ran their first horror pitch at ATF 2024, looking to evaluate great new scripts with a global perspective, then further developing it to align with audience expectations and market trends, to ultimately package and finance the film, ensuring effective distribution.

There is much anticipation for rapid growth for EST N8 in 2025. Their focus will be on partnering with the best production companies across Asia to bring compelling stories to a broader audience. This includes financing and producing projects that resonate with global audiences.

Buyers were presented with a rich selection of content as 22 Japanese production and broadcasting companies showcased a wide variety of programmes. The line-up included anime, manga, culinary shows, travelogues, manga adaptations, thrillers, heart-warming comedies, romantic suspense dramas, and game shows.

Among the showcased content were several long-running series, highlighting their enduring appeal.; while some other productions have already gained international success with adaptations in China, South Korea, Thailand, the Philippines, and Malaysia. This highlights the global popularity of Japanese content.

The showcase not only underscored Japan’s dedication to creating highquality, engaging programs that resonate with audiences worldwide, but also provided opportunities for collaboration. Many Japanese companies expressed interest in co-production ventures with global partners.

Spain is not only known for its rich cultural heritage, stunning architecture, and breathtaking natural landscapes, but also for producing captivating content. Notable among its film and television offerings is Courtois, The Return of the Number One, a documentary series from Onza Distribution, chronicling the recovery of Real Madrid’s goalkeeper from injury.

For fans of horror, Tales from the Void, produced by Mediapro Studio, delves into the dark corners of the human psyche. Additionally, Detective Romi, an investigative drama from Mediterraneo, features a deaf private detective solving complex mysteries. On the romantic front, Movistar Plus+ recently released The New Years, a series exploring the evolving relationship of a couple over a decade, across 10 episodes. Finally, Ena, a historical period drama from RTVE, stands as Spain’s biggest royal drama to date, offering a glimpse into the country’s royal history. Spain continues to be a hub for diverse and compelling storytelling.

With the explosive success of CJ ENM’s K-Dance IP, Street Woman Fighter 2, K-dance is proving a viable contender for the top spot occupied by K-Pop, a Korean entertainment phenomenon that has been dominant for the longest time. “K-Dance deserves to become as mainstream as K-Pop,” declared Jung Nam Choi, creator of the K-Dance show.

The genesis of the programme lies in the recognition of the skills, commitment, and talent demanded of backup dancers –undeniably on a par with K-Pop idols. The K-dance series also found massive success in the Vietnamese market with over 200 million views, according to Seungyen Lee, a sales executive at CJ ENM.

Music and live concerts were also produced under the Street Woman Fighter 2 IP – Smoke, a track by Dynamicduo and Lee Young Ji, even achieved top rankings on several music charts, including Billboard 2023.

Rich conversations and a delightful array of cocktails set the tone for a vibrant networking session hosted by THACCA.

M.R. Chalermchatri Yukol, President of the Film and Series Subcommittee of the National Soft Power Strategy Committee, graced the event with a delegation of Thai officials led by Natiya Suchinda, the Deputy Director-General of the Department of International Trade Promotion.

“The Thai government is actively promoting Thai content, with upcoming policies aimed at boosting the international presence of Thai films and dramas, including increased production rebates,” announced Chalermchatri.

He noted the Prime Minister’s recent discussions with major American film studios to foster co-productions and global talent collaborations.

Two showcased productions included the family comedy Baby Hero, a partnership between Hollywood Thailand and Singapore’s Hong Pictures, and Hidden Gem, a food documentary series set to air on platforms like Discovery Asia, Asian Food Network, and Netflix Thailand, with Hidden Gem Taiwan on the horizon.

Content Lab Thailand also presented twelve diverse projects, hoping to attract international collaborations in support of exceptional content.

cast from at least eight countries. The natural progression after that, said Jung Nam, is a “battle amongst the masterminds of dance –the choreographers”.

Studio76 is rewriting the playbook for Taiwanese content, blending cultural authenticity with bold global aspirations. “The content industry has shown remarkable resilience and growth in 2024,” says Dennis Yang, CEO of Studio76 Original Productions. “There’s an increasing demand for culturally rich Asian content, particularly in the FAST channel sector.”

Leading the charge is Studio76’s FAST channel, 886TV, which has been instrumental in showcasing Taiwan’s creative industry. “For 2025, we plan to expand 886TV into more territories and strengthen our position in the Asian market,” Yang explains. This expansion will be paired with original productions and co-productions aimed at delivering content that resonates across cultures

while maintaining its uniquely Taiwanese perspective.

While Love Punch—their hit drama series—has been a standout performer, Studio76’s ambitions go beyond individual successes. At ATF 2024, the company seeks to connect with FAST channel operators, OTT platforms, and broadcasters, focusing on partnerships that create mutual value. “Selling is not our only goal. We’re building long-term collaborations to expand the reach of Asian content globally,” says Yang.

With a clear focus on innovation and cross-cultural appeal, Studio76 is poised to take Taiwanese storytelling to audiences worldwide.

“Strong genre titles that resonate with audiences” has been the model of success for Vision Films, Inc. “And making smart deals that benefit our strategic partners,” shared Scott Kamins, Executive Director, International Sales & Strategic Partnerships.

In addition to the two strategies that they employed in 2024, Scott also revealed their best-performing genres for the year – action, thriller, romantic comedies, and family.

Their upcoming releases for 2025 include Dinogator (starring Michael Madsen from Kill Bill) and Altered Reality (starring Tobin Bell from Saw, Lance Henriksen from Aliens, and Ed Asher from Up).

Scott looks forward to reconnecting with existing clients and meeting new ones at ATF this year.

BEC World continues to lead Thailand’s entertainment industry with dramas that blend cultural authenticity and universal appeal. “2024 has been a year of evolution for us,” says Tracy Ann Maleenont, Assistant to Group COO & Executive Director. “It’s crucial that we keep evolving and exploring new opportunities.”

FANY Studio has quickly risen as a standout in entertainment formats since launching just last year. “We are very much keen to explore new partnerships and collaboration opportunities at ATF,” shares Mari Kawamura, Head of Global Business. “We have been highly focused on creating various contents this past year, and now we are ready to introduce them to buyers around the world.”

The studio’s innovative formats have already gained global traction. Fremantle acquired the comedy format FREEZE, which won the Best Comedy Format Award at MIPCOM (Marché International des Programmes de Communication). “We are extremely honoured with this collaboration and achievement,” Kawamura notes.

Meanwhile, comedy quiz show The 100 Choices went to Sony Pictures Entertainment, and reality dating show REA(L)OVE captivated Turkey’s Global Agency.

At the heart of their success is the globally beloved Love Destiny (บุพเพสันนิวาส), a drama that intricately weaves Thai history and culture into a captivating romantic tale. Its sequel, Love Destiny 2 (พรหมลิขิต), has further cemented the franchise’s popularity, making it a top seller across international markets.

Adding to their diverse portfolio, BEC launched their first GL (Girl Love) drama, The Secret of Us (ใจซ่อนรัก), a heartfelt story that has resonated with audiences across Asia on TV and digital platforms. This venture reflects the company’s adaptability to emerging trends while maintaining their storytelling roots.

BEC’s focus on incorporating Thai soft power—highlighting local cuisine, scenic destinations, and cultural heritage—has proven to be a winning formula. As they look to 2025, the company is poised to expand into the Indian subcontinent and Latin America, with plans to foster co-productions and licensing partnerships.

With its unique blend of cultural richness and innovative storytelling, BEC World is ensuring that Thai dramas continue to resonate with audiences, and it seems set to be so, with romance at its heart.

For 2025, FANY Studio plans to create original unscripted formats and produce the Japanese remake of the Korean hit Stove League. “We are thrilled to continue building on our successes with new partners,”

Kawamura says, hinting at short dramas in their line-up next year.

With momentum on their side, FANY Studio sure is shaping up to lead the next wave of entertainment trends.

To One Life Studios, the region’s evolving content consumption habits presented unique opportunities to create and curate high-quality crime thrillers and family oriented narratives for the global taste; the rapidly changing global demands encouraged experimentation with innovative formats like digital-first content and interactive experiences to engage all platforms, according to Shashank Singh, Senior Manager of Syndication and Content Alliance.

Shashank noticed a growing appreciation for content that blends traditional storytelling with modern interactive formats. He cited their bestseller, Porus, which was wellreceived for its powerful storytelling and universal themes. The historical

drama series is set for relicensing after a successful distribution in the South Asia market, and subsequently new territories in Asia.

The company’s most received request further highlighted a demand for premium drama series in the fiction and nonfiction genres that appeal globally and localise easily while keeping its allure.

One Life Studios would be expanding its global footprint for content enhancement and IP development: Shashank talked about plans for new international collaborations and partnerships with tech companies and distributors, which is vital for the company to stay ahead of the curve for 2025.

It’s a mix bag of circumstances for Taka Tagami, International Sales for TV Asahi Corporation, as he balances a tough market for traditional program sales against the gale of diversified demands across territories, with increased needs for programs by ever-emergent platforms, such as FAST and new players in the OTT space. He hopes to target the latter profiles at ATF, seeing how the annual market continuously brings in new digital buyers from across the globe.

For Taka, it is also the valuable chance to meet buyers from Southeast Asian countries who are difficult to meet at other markets.

“As we have newly produced animation series, we would like to meet kids’ animation buyers,” Taka indicated, noting that for 2024, he has already had great success with his kids’ animation sales in India.

From Taka’s best performing genre in kids’ animation and anime, he hopes to “expand the business”, not only in the content licensing space, but also in merchandising arena.

Taka also hopes to replicate the successes he’s had in kids’ animation and anime with other genres he looks after in drama and formats. “To achieve this, we are exploring other approaches, as well as seeking partners and investors,” Taka concluded, highlighting the vision to go beyond licensing, and into developing, co-developing, or co-producing content from scratch, in addition to considering other business schemes.

“You’re not just competing with other films,” said Rodney Uhler, Director of Acquisitions and Development at GKIDS, “There’s streaming at home, video games, all sorts of things that people wanna use their time and attention on.”

Apparently, a distributor’s job is not as simple as it appears. Rodney explains that reading the landscape for film and show is a critical part of the job, since the situation is constantly shifting and a single model cannot account for every situation. Rodney advised prospective filmmakers to consider

what distribution channels would work best for their project or niche –some “have an audience built in” that would enable the project to get to those who would most respond to it.

According to Rodney, while these methods might not have the highest revenue, they’re perfect tools to help the film reach people in the most democratic way – especially in an industry where resources are trending towards concentration, leaving smaller projects with fewer options for reach.

Today, Oceanus Media Global and Curtin University signed a Memorandum of Understanding (MoU) to collaborate on creating a curriculum for virtual production and to strengthen coproduction capabilities in support of industry developments.

Several successful partnerships were also announced, including crossborder co-productions. These include Wheel Lady, a collaboration between Singapore’s JUO Studios and Refinery Media with South Korea’s MIRU Pictures, Inc; Triple Funky, an animation/ action production by Singapore’s Agogo Animation and South Korea’s Pixtrend Inc.; Losmen Melati 2, a horror drama co-produced by Indonesia/ Singapore’s Infinite Studios and Taiwan’s CATCHPLAY; and Baby Hero, a Singapore-Thailand action/comedy film produced by Hong Pictures and Hollywood (Thailand) Co., Ltd.

At the Japan Pavilion, the networking session was all about making genuine, casual connections that matter. Industry professionals, buyers, and partners mingled effortlessly, exchanging ideas over drinks and fostering collaborations in a relaxed, friendly environment.

Japan’s rich and varied content, from anime and manga to culinary shows and documentaries, sparked conversations that highlighted the depth and creativity of its entertainment scene. The atmosphere was perfect for meaningful interactions, where new opportunities were discovered, and partnerships began to take shape. Japan’s diverse and innovative offerings continue to captivate audiences globally, making these connections the first step in a promising future of collaboration.

Taiwan’s diverse and high-quality content stood out, making its programmes a favourite among buyers. The networking session at the Taiwan Pavilion was filled with energy as buyers, and partners connected, sparking interest in Taiwan’s creative offerings and solidifying its role as a global entertainment leader.

Handshakes, lively conversations, and a few bevvies set the stage for open dialogue and collaboration. Cheers to fostering meaningful connections and building successful partnerships that drive the entertainment industry forward!

For Akshat Singhal, Director of Enter10 Television Private Limited, the strategic changes their business is going through has pushed them into looking at collaborative approaches within the content space, as the market is transitioning to multi device and multiscreens.

“The entire management team is focused and committed to a strong global relationship network, so that Indian content can entertain audiences across the world,” explained Akshat, who is currently keen on meeting TV channels and telco platforms from Indonesia, Singapore, Vietnam, Malaysia, Cambodia and Thailand.

“In building strategic partnerships with buyers globally, we’d like to bring high quality Indian content to multiple partners in Asia and across the world,” Akshat continued.

“WE

WOULD ALSO BE LOOKING AT THE HINDI MOVIE SPACE, AS WE SCALE UP OUR PARTNERSHIPS FOR DANGAL PLAY (THEIR OTT APP) WITH B2B PARTNERS WORLDWIDE.”

“TV shows like Mann Sundar, Nath, Mann Ati Sundar, and Sindoor Ki Keemat have been the best so far, as they have performed better than the top shows of big broadcasters in India. They are also offered across Asia,” concluded Akshat.

The understanding that producers must know what the audience is looking for, in order to align themselves with preferences—knowing who the series is aimed at—is very important when defining one’s products.

Javier González Núñez, the Commercial Director of RTVE also noted that in addition to this, practicing specialization can also be a benefit, as it helps buyers find the genres they want more easily.

“If they know their preferences, and they know where to ask, it makes it easier for all,” opined Javier.

RTVE thus has its area of specialization, focused on fiction, especially long running series, thrillers or period historical, as Javier believes “it is the most required content, together with entertainment programs.”

“LONG-RUNNING SERIES ARE ONE OF RTVE’S BENCHMARKS OVER THE YEARS, AND WE EXPECT THEM TO BE ONE OF THE MOST DEMANDED IN THE FUTURE,”

“Long-running series are one of

Guo Jingyu, Executive Chairman and Group CEO of G.H.Y Culture & Media, reflected on the significant shifts in China’s media landscape over 2024, particularly the integration of media with cultural tourism. Guo noted that

CONSUMERS’ RISING INTEREST

EXPLORE CHINESE

He added that this trend also sparked global interest in Chinese microdramas, transforming media consumption patterns worldwide.

Over the past year, G.H.Y leveraged these trends to consolidate its resources, advancing its IP serialisation strategy. Notably, Strange Tales of Tang Dynasty led to sequels and spin-offs across short dramas, musicals, mystery games, and AR/VR experiences, even driving tourism to Chinese cities featured in the series, such as Xi’an and Dunhuang, merging cultural tourism with media content.

At ATF 2024, G.H.Y will showcase its IP-focused content, including Strange Tales of Tang Dynasty – Chang’An Contenders Nanyang Transport Volunteers

This underscores the company’s commitment to expanding its IP

library and linking its content with cultural tourism.

Though Guo celebrated the commercial achievements, he emphasised that his true measure of success lay in the connections made at ATF, valuing the platform for fostering collaboration and cultural exchange. Additionally, he expressed his hope that ATF would continue to promote Chinese media on a global scale, helping bridge cultural divides.

G.H.Y and iQIYI will also be hosting a joint dinner at ATF 2024 to announce exciting new projects, enhancing their collaborative momentum.

In a market often dictated by genre trends, Mediterráneo has carved its niche by prioritising quality storytelling over formulas. “Creating internationally acclaimed stories isn’t formulaic,” says Rocio Cachero, International Sales Manager.

“THE KEY LIES IN ORIGINALITY— WHETHER THROUGH BOLD, STANDARDBREAKING PLOTS OR RELATABLE NARRATIVES, THE STORY ITSELF IS ALWAYS THE MOST DECISIVE ELEMENT.”

This approach is evident in their upcoming slate. La Favorita 1922, a period drama blending friendship, intrigue, and resilience, promises to capture hearts with its rich narrative and thematic depth. Produced by Mediterráneo in collaboration with Bambú Producciones, the series has already generated significant interest across Latin America and Europe. Similarly, Detective Romi, a procedural drama debuting in 2025, challenges conventions with its hearing-impaired protagonist, offering a fresh perspective to the genre.

Beyond drama, Mediterráneo’s catalogue spans a range of genres, including true crime (The Marquess), docuseries (The Wine Wizard), and adventure (Mountain Rescue Academy), ensuring there’s “new content for all tastes.”

Guo Jingyu Executive Chairman and Group CEO

Culture & Media

Celebrating its 5th anniversary, Mediterráneo continues to expand its global footprint by delivering standout content. “Success hinges on storytelling, consistency, and strategic planning,” Cachero explains. With their blend of creativity and innovation, the company remains a trusted partner for buyers worldwide.

Pelin Koray, Senior Sales, Acquisition and Strategy Manager at Turkey’s Inter Medya,

SHARED THAT OVER THE PAST YEAR, INTER MEDYA HAS SEEN SIGNIFICANT GROWTH IN THE POPULARITY OF TURKISH CONTENT IN ASIA.

Pelin revealed new licensing deals in Korea, Taiwan, and Japan, with standout achievements like the adaptation of Ruhun Duymaz (Love Undercover) in South Korea—a first for Turkish content in the region. Inter Medya’s movie portfolio also expanded with feature films DENGELER and SAYARA, attracting buyers in India, Japan, and Korea.

Not resting on their laurels, Pelin underscored Inter Medya’s focus on longterm relationships, offering comprehensive operational support and a diverse content mix.

Beyond distribution, the company has entered co-financed production partnerships, further solidifying its position in Asia’s media landscape.

To this end, Pelin believes that their attendance at ATF plays a strategic role as she emphasised the abundant opportunity to deepen client relationships and engage new partners across Asia. According to Pelin, the inperson format is effective because the various face-to-face meetings enable stronger, more dynamic connections than virtual interactions. The event’s high attendance and organisation also facilitate her company’s outreach into territories less accessible through other content markets.

At ATF, Inter Medya will be showcasing an enriched content library, including the dialogue-based mini-series Like There Is No Tomorrow and a new slasher film, SAYARA Their latest ventures also introduced unscripted formats like Crossover, a genreblending singing competition, and two longrunning dramas, Valley of Hearts and Karadut, produced by Turkey’s renowned Tims&B.

Fiona Railane, International Sales Manager at Mediawan Rights, shared the company’s genre-driven strategy at ATF 2024. Fiona highlighted that genre selection plays a crucial role in Mediawan’s content sales strategy. By targeting specific clients with genre-appropriate series, Mediawan tailors its offerings to match market demand, leveraging deep industry insights to predict trends and maximise sales opportunities.

WHILE GENRE POPULARITY INFLUENCES MEDIAWAN’S

CATALOGUE, FIONA NOTED THE IMPORTANCE OF FOCUSING ON STORY QUALVITY AND ORIGINALITY OVER BLINDLY FOLLOWING TRENDS.

Fiona Railane International Sales Manager Mediawan Rights

“Some genres, like crime, consistently perform well across markets,” she said, adding that Mediawan aims to anticipate trends rather than react to them.

At ATF, Mediawan Rights showcased highprofile titles including The Count of Monte Cristo (8x52’), a new English-language series starring Jeremy Irons and Sam Claflin, based on the classic novel by Alexandre Dumas. With pre-sales already secured in many regions, The Count of Monte Cristo remains available in key Asian markets. Another highlight was Tom & Lola (12x52’), a light-crime procedural that has achieved record viewership and is set for significant success in Asia.

Fiona also outlined Mediawan’s dedication to expanding scripted format adaptations in Asia, with titles like Philharmonia, recently adapted in Korea as Maestra: Strings of Truth, serving as a model for future partnerships. Mediawan’s strategic shift towards premium, globally recognisable IPs and its focus on local adaptations reflect its commitment to creating content that resonates with international audiences. The company looks forward to fostering new collaborations across Asia, helping bring culturally resonant storytelling to diverse markets.

Disalada Disayanon, Director of Content Development at Thailand’s Kantana Group, is hitting ATF 2024 with a strategy that blends cultural authenticity and global appeal. Disalada explained that Kantana’s approach to success in international markets centres on stories rooted in Thai culture but rich with universal themes.

This year, Kantana’s strategy has yielded notable results, particularly with Master of the House, Thailand’s first Netflix Original Series. Reaching the top of Netflix’s NonEnglish TV chart worldwide and entering the top 10 in 63 countries,

DISALADA HIGHLIGHTED THE IMPORTANCE OF SELECTING PROJECTS LIKE THIS, WHICH REPRESENT UNIQUE THAI STORIES WHILE OFFERING UNIVERSAL APPEAL, DRIVING AUDIENCE ENGAGEMENT BOTH LOCALLY AND INTERNATIONALLY.

Reflecting on 2024, Yasemin Keskin, Sales Manager for MENA, APAC, and Global Inflight Entertainment Distribution at Kanal D International, noted several key successes, including the sale of Price of Passion and New Life to Thailand, as well as For My Son to Bangladesh. Vietnam also acquired Farewell Letter and Ruthless City, while a new Mongolian partnership secured a deal for Farewell Letter, A Father’s Promise, New Life, and Let’s Fall in Love, marking impressive regional expansion.

Yasemin highlighted that

KANAL D’S SUCCESS

LIES IN ITS ABILITY TO BLEND HIGH PRODUCTION VALUES WITH UNIVERSAL THEMES LIKE LOVE AND FAMILY.

This focus on quality storytelling has helped the company connect deeply with Asian audiences.

She emphasised that ATF was invaluable for showcasing Kanal D’s latest titles to the Asia-Pacific market, helping to strengthen brand visibility and cultivate collaborative partnerships. At ATF 2024, Kanal D will feature its latest titles, A Mother’s Tale, The Family Burden, and Secret of Pearls, the latter a Turkish ratings hit that had strong sales internationally. Kanal D will also promote popular titles from the previous year, including Farewell Letter and Daylight, capitalising on the strong demand for romantic comedies and dramas in Asia.

With a diverse catalogue, including finished products and adaptable formats, Kanal D aims to continue innovating in the region. As the largest media organisation in Türkiye, Kanal D sees expanding its reach in Asia as a key priority, leveraging its stories’ adaptability to capture and engage diverse audiences.

Kantana will be presenting two series. Reverse 4 You, a romantic fantasy currently on Channel 3 Thailand and Netflix Global. It features a culturally distinct plot—a young woman using time-reversal to save her sister’s life—that resonates with audiences through its mix of fantasy and Thai storytelling. Tomb Watcher, an upcoming horror thriller, reflects Kantana’s commitment to high-quality adaptations of its iconic IP, offering familiar narratives with a fresh perspective for new audiences.

Kantana also recently launched a cuttingedge virtual production studio in Bangkok, one of Southeast Asia’s largest. This facility supports Kantana’s strategic push to produce high-end visuals for international markets, enabling seamless collaboration with global OTT platforms. Disalada emphasised that partnerships and innovation are central to Kantana’s expansion strategy, and ATF is an ideal setting to engage new collaborators and secure distribution for content primed for international success.

IT IS NO SECRET THAT THE GENRE OF DOCS AND FACTUAL ALWAYS APPEALS TO A WIDE RANGE OF AUDIENCES,

and this is what ARTE Distribution is arming itself with as it returns to ATF after a two-year hiatus.

“We will be attending the event with plenty of new surprising, breathtaking, thrilling titles that have already piqued the interest of our partners!” said Alexandra Marguerite, Sales Manager at ARTE Distribution.

One of their highlights is Ramesses II, Secrets of a Pharaoh, a beautiful documentary series that uses state-of-the-art technology and

Alexandra Marguerite Sales Manager ARTE Distribution

UNIPIXEL is making bold strides in global content, positioning financial literacy as a cornerstone of its mission. “Economics and finance are the most universal and powerful themes in the global market,” says CEO Yoonhee Park. “We believe our character IP offers the perfect blend of educational value and entertainment, meeting the rising demand for financial education.”

In 2024, the company focused on expanding its character IP internationally, participating in major exhibitions to gather market feedback and tailor its offerings to global audiences. This strategy laid the foundation for their next big leap: animation production. By adopting cutting-edge animation technology, UNIPIXEL is not only broadening the applications of its IP but also ensuring its content appeals to audiences across cultures and age groups. Their flagship IP merges universal themes with engaging storytelling, making complex financial concepts accessible and entertaining. As they prepare for 2025, the company’s focus shifts to producing high-quality animation while cultivating a strong viewer base through social media engagement.

gives voice to leading experts on ancient Egypt, taking viewers back in time to meet one of the most important and intriguing leaders of the time.

“Our catalogue will also hold Homo Plasticus, a one-off documentary that uses science popularisation in order to explain a very complex phenomenon scientists have been witnessing for some time now: plastic invading our bodies!” underlined Alexandra. “These two very different titles show that we value innovative content but most of all, content that is for everyone!”

Coupled with a refreshing point-of-view that success, according to Alexandra, “resides in the quality of the content we offer to our partners”—meaning bringing the best, most groundbreaking programs possible, with titles that give new perspective—ARTE Distribution has every reason to be excited about coming back to ATF with a catalogue full of exciting new titles.

“OUR VISION IS TO ENHANCE GLOBAL FINANCIAL LITERACY THROUGH ENJOYABLE AND ENGAGING ECONOMIC CONTENT,” PARK EMPHASISES.

With a firm commitment to innovation and education, UNIPIXEL is crafting a unique niche in the content world, proving that learning and entertainment can go hand in hand.

Yoonhee Park CEO UNIPIXEL

FRENCH SALES COMPANY, CINÉTÉVÉ SALES IS BOLSTERING ITS GLOBAL PRESENCE WITH A STRATEGIC FOCUS ON FORMING INTERNATIONAL COPRODUCTION ALLIANCES,

especially with European partners in Spain and Switzerland, while also exploring distribution opportunities with third-party production companies.

Over the year, the company has expanded its line-up with the acquisition of several programs from third party production companies. Its

diverse line-up is reflected in its slate presented at ATF, ranging from an investigative series DNA Business, a Gene Gold Rush, to the six-part science and wildlife program Of Trees & Forests, and the arts and cultural documentary, The War of the Worlds amongst others.

“Digital sales have been significantly increasing in the past year and we are currently working with various platforms and aggregators to give our content the best possible exposure,” said Éléonore Picq, Sales Executive & Acquisition Assistant of Cinétévé Sales.

Looking ahead to 2025, Cinétévé Sales will debut a two-part documentary, The NehruGandhi Dynasty, an Indian Story, alongside a confidential current affairs project about Iraq.

Kris Akkarach, Director of the Content Creation Bureau at Thai Public Broadcasting Service (Thai PBS), has high hopes for ATF 2024 as part of Thai PBS’ evolving strategy. According to Kris, ATF is the ideal platform to elevate Thai PBS as a leader in socially conscious, educational programming through meaningful discussions on content development and distribution. But to what end?

“WE ARE COMMITTED TO ENSURING THAT NO ONE IS LEFT BEHIND BY CREATING MEANINGFUL, ACCESSIBLE CONTENT FOR EVERYONE, AMPLIFYING UNHEARD VOICES AND PROVIDING REPRESENTATION WHERE IT’S MOST NEEDED,” SAID KRIS.

For them, partnerships with likeminded organisations were key, as these collaborations enhance Thai PBS’s public service mission by amplifying Thai culture in a globally appealing way.

In 2024, Thai PBS focused on a robust digital expansion strategy, recognising the shift towards online viewership. By offering content across traditional and digital platforms, Thai PBS aims to engage a broader audience. They also emphasised content that reflects Thai culture, such as historical drama Love Spice, the inspiring Bussaba and the Ordeal of Fire, and Mhom Ped Sawan, which explores themes of resilience and identity. This diverse selection aligns with Thai PBS goal to bridge cultural understanding and spark international interest in Thailand’s rich heritage.

Looking forward, Thai PBS is set to deepen its focus on cultural connectivity, mental health, and climate change awareness. Embracing strategic partnerships both locally and internationally, Kris shared that Thai PBS’ alignment with global trends and values reflects their dedication to becoming “The Most Trusted Media” while championing inclusive, accessible content.

In 20 + countries, lol ! Shh! They can’t laugh, but YOU can!

Gameshow Format

Adapting to current needs, sticking to a staple genre, and taking on meaningful and powerful partners, has made sure 30+ years boutique company, Brands and Rights 360 SL keep growth sustainable.

“Fortunately, as a company, we are experiencing sustainable growth year over year for the past six years,” said the Head of Business Development at Brands and Rights 360 SL, Antonio Fernández Alcaraz.

“ENTERING NEW MARKETS, QUICKLY ADAPTING TO INDUSTRY CHANGES, AND CONTINUOUSLY REFRESHING OUR CONTENT CATALOGUE HAVE BEEN KEY TO REACH SUCCESS.”

At ATF this year, Brands and Rights 360 SL is “confident to secure deals with the main local TV stations and VOD services in Asia, finding

new commercial leads and following up with our long-standing commercial partners in the region,” continued Antonio, who will be announcing their global scale rep deal with PBS Kids, as well as with the top media conglomerate in Brazil, Globo.

No doubt, for Antonio, 2025 will be, “Super work intensive, but very fruitful.”

Workpoint Entertainment continues to redefine Asian content with formats that seamlessly blend cultural depth, innovation, and adaptability to modern audiences.

“Our formats resonate globally because they pair universal appeal with distinct Thai charm,” says Wirata Laksanasopin, Senior Licensing Manager. This balance has made Workpoint Entertainment a powerhouse in the entertainment industry, offering fresh perspectives in game shows, singing competitions, and beyond.

At the forefront of their latest innovations is Voice of Queens, a survival-style singing competition featuring beauty queens. This groundbreaking format marries pageant themes with emotional storytelling and drama while engaging audiences on multiple levels.

Wirata Laksanasopin Senior Licensing Manager Thai Broadcasting Company Limited (Workpoint Group)

WITH LIVE E-COMMERCE ELEMENTS WOVEN INTO ITS FINALE, THE SHOW DEMONSTRATES WORKPOINT’S COMMITMENT TO INTEGRATING TRADITIONAL TELEVISION AND ONLINE STREAMING EXPERIENCES.

“It’s a format that reflects our ability to connect with both traditional audiences and digital-first viewers,” Laksanasopin notes. While innovation drives their new IPs, Workpoint Entertainment’s flagship programs, such as The Wall Duet, continue to captivate audiences with their unique mix of singing, games, and heartfelt moments. At ATF, the company aims to strengthen partnerships and explore regional adaptations that bring their creative storytelling to new markets.

By blending cutting-edge strategies with cultural authenticity, Workpoint Entertainment proves that content rooted in creativity and innovation can resonate across platforms and cultures alike.

A proud Turkish company that has gone global, Calinos Entertainment, commemorating its 25th anniversary this year, has much to celebrate beyond its 105-country reach across five continents. More recently, Akshit Sandhu, Manager—Format Acquisitions & Sales of Calinos Entertainment, noted that the company is “enhancing growth through co-productions with international partners and distributing local adaptations of our Turkish series, deepening our global reach.”

Their presence at ATF comes with the excitement of a “continued expansion into new territories, propelled by the rise of streaming platforms”, according to Akshit.

“THIS SHIFT HAS MADE TURKISH DRAMAS MORE ACCESSIBLE WORLDWIDE, WITH NEW AUDIENCES EMERGING IN COUNTRIES LIKE THAILAND, VIETNAM, AND THE PHILIPPINES,” AKSHIT CONTINUED.

“To further expand our reach, we’re open to co-productions in Asia, aiming to build partnerships that bring compelling Turkish content to even broader audiences across the region,” Akshit explained, mentioning that in addition to Canadian and Romanian dramas, Calinos Entertainment is also presenting six high-quality new dramas from Serbia in their global catalogue.

Akshit also highlighted the launched of their newest series, Hidden Garden, produced by TMC Film, starring Ebru Sahin and Murat Yildirim. Seeing how one of the long-lasting dramas in Turkish drama history, Forbidden Fruit from Calinos Entertainment continues to expand its fandom around the world in 2024, with it sold in more than 70 countries already, their aim of success is high.

Part of their success means being at ATF, for Akshit represents “invaluable opportunities to connect with Asia-Pacific buyers and producers, fostering relationships with key industry players and staying engaged with market trends.”

As the demand for culturally rich, versatile programming continues to grow, Spain’s Onza Distribution is making waves with its ability to deliver content that resonates globally. “Our portfolio’s versatility is what attracts buyers,” says Sales Manager Erika Gómez.

“WE FOCUS ON HIGHQUALITY PRODUCTIONS WITH AUTHENTIC STORYTELLING, OFFERING BROAD APPEAL YET PRESERVING SPECIFIC CULTURAL PERSPECTIVES.”

Erika Gómez Sales Manager Asia, Nordics, Benelux, MEA, IFE, Educational Onza Distribution

A prime example is Cacao, Onza’s latest telenovela, which has captivated audiences in 72 countries and achieved a 24% share on its most-watched episode. Set between Brazil and Portugal, the series combines luxurious settings with deep family secrets, embodying the hallmarks of Onza’s drama catalogue. “It defines pretty well what our drama slate is about,” Gómez adds.

In 2024, Onza has embraced co-production opportunities, such as the wildlife documentary Iberia & Savannah, created in close collaboration with Azor Producciones. With a diverse slate spanning drama, factual, and formats, the company hopes to strengthen its presence in the Asian market through partnerships and new launches, including the upcoming The Color of Love and Traffic Jam

Looking ahead, Onza’s strategy is clear: blend creative collaboration with global storytelling to maintain its upward trajectory. As Gómez summarises, “We’re bringing the best Western content to connect with audiences worldwide.”

The Mediapro Studio is rapidly solidifying its presence in Asia, thanks to a slate of diverse, high-quality productions that resonate with regional audiences. “This year has been significant for us, with three of our series premiering in Japan, which demonstrates the interest generated by our productions,” says Marta Ezpeleta, Director of Distribution, International Offices and Coproductions.

Recognised as a leader in global content production,

THE MEDIAPRO STUDIO HAS BUILT A REPUTATION FOR EXCELLENCE THROUGH ITS COMMITMENT TO HIGH PRODUCTION STANDARDS AND CREATIVE TALENT, BOTH IN FRONT OF AND BEHIND THE CAMERA.

This dedication to quality has made the studio a trusted name in the audiovisual industry.

Flagship titles like Express, a fast-paced thriller by Iván Escobar, and Cromosoma 21, a groundbreaking series featuring actors with Down syndrome, have captivated audiences across markets. Cromosoma 21 has already achieved success in Chile and on Netflix across Latin America, the United States, Spain, and Italy, while Las Bravas, an HBO Original set in the world of women’s football, continues to appeal globally.

At ATF, The Mediapro Studio is showcasing a rich catalogue of series and films, including Quiet, a gripping crime thriller set in Barcelona; Fusion, a Nordic noir; and Celeste, a drama thriller

about a tax inspector pursuing justice against a famous singer. Their film slate includes The 47, a Spanish box-office hit, and Transmitzvah, a Cannes Film Festival selection.

By tailoring content to reflect universal themes while meeting regional preferences, The Mediapro Studio reaffirms its commitment to crafting global stories that connect with audiences across the Asian markets, and beyond.

Marta Ezpeleta Director of Distribution, International Offices and Coproductions

The Mediapro Studio

Movistar Plus+ International is redefining the art of storytelling by blending a European cultural identity with universal themes that resonate across borders.

“OUR GOAL IS TO ENSURE THAT OUR STORIES TRAVEL GLOBALLY WHILE RETAINING THEIR UNIQUE SPANISH ESSENCE,”

says Fabrizia Palazzo, Distribution Manager. With a robust 2024 slate of 11 TV series, the company is proving its adaptability in a competitive global market.

Key highlights include The New Years, a romantic drama tracing a couple’s love story across 10 New Year’s Eves in Madrid, and Second Death, a gripping investigative thriller set in the breathtaking landscapes of northern Spain. Titles like Marbella (journalistic drama based on a true story), Galgos (family business drama rooted in heritage), and The Other Side (horror series set in Barcelona) showcase Movistar Plus+ International’s versatility in storytelling.

With recognition at prestigious festivals such as Sundance, Venice, and Tokyo, the company’s original content continue to gain global traction. This approach has culminated in a strategic partnership with LG U+ in South Korea, a significant step towards expanding their Asian footprint. “Finding the right partner for each show ensures that our stories connect with diverse audiences,” Palazzo explains.

By aligning compelling narratives with global sensibilities, Movistar Plus+ International demonstrates that authentic storytelling transcends cultural boundaries, offering audiences worldwide a fresh perspective on European content.

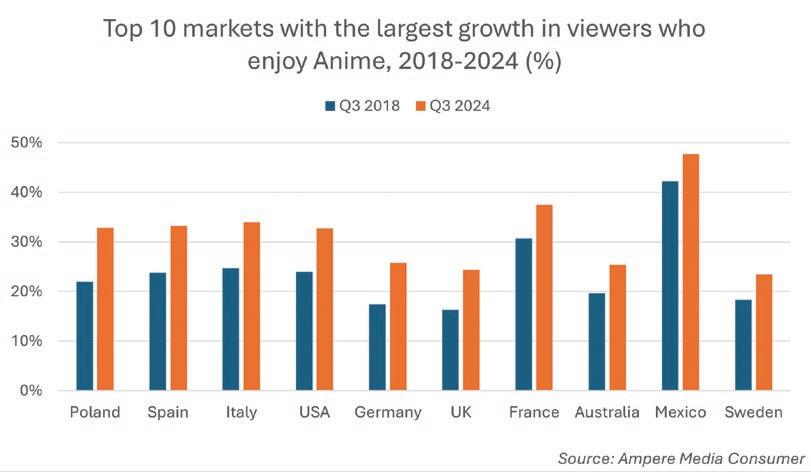

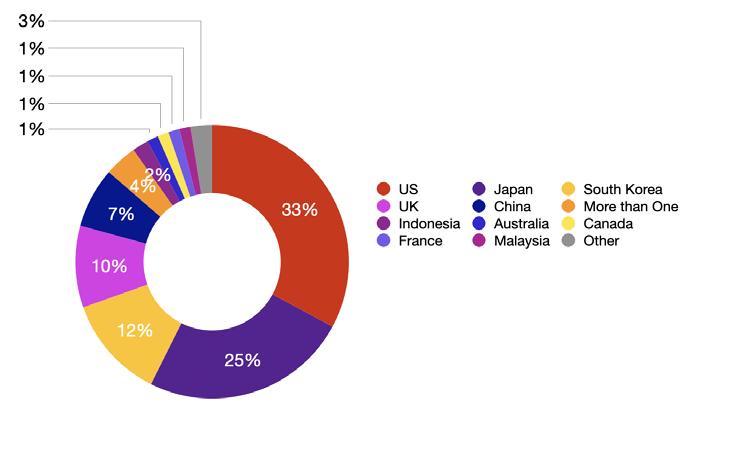

BY MOTOHIKO ARA, AMPERE ANALYSIS

Consumers in Europe are becoming big fans of Japanese Anime. Among the 30 countries where Ampere conducts bi-annual surveys, European markets have seen the largest growth in Anime enjoyment. Indeed, seven out of the top 10 markets with the largest growth in enjoying watching Anime are from Europe, specifically Poland, Spain, Italy, Germany, the UK, France, and Sweden. Across these markets, the share of all viewers who report that they enjoy watching Anime ranges from 23—37% in Q3 2024, up from 16—31% in Q3 2018.

While Anime is enjoyed almost equally by both males and females in Europe, the trend is notably higher among younger cohorts. This reflects that Anime has various sub-genres and characters, appealing to both male and female audiences, with its young protagonists and often upbeat plots engaging with young audiences’ attention particularly well.

Around half of 18—24-year-olds in Finland, France, Italy, and Spain, for example, now say they enjoy Anime, and within that, a substantial core of young Anime fans is emerging: 13% of 18—24-year-olds in France and Italy, for example, now describe Anime as their favourite genre.

Moreover, Anime fans in Europe spend more time in front of screens. Each Anime episode lasts around 20 to 25 minutes, yet with many series exceeding some hundred episodes, it is very easy for viewers to binge-watch several episodes. So, Anime content not only strengthens interactions with young

audiences but also increases the time viewers stay on the platform – something increasingly important in the context of the launch of adtiers on major streaming platforms.

Moreover, within the markets surveyed, European Anime fans spend 4 hours and 25 minutes on an average day watching TV and video services, about 20 minutes longer than an average European consumer. These European Anime fans spend more than an hour each on scheduled TV and subscription VoD platforms per day, though the viewing time on the former is declining while the latter has increased by about 35% over the past five years. As for the remaining two hours, they turn to free social video platforms such as YouTube (which has a lot of Anime episodes), on-demand content from pay TV providers

and broadcaster video-on-demand services (BVoDs), each of which account for around 30 to 40 minutes daily viewing.

The rising popularity of Anime content has been driven by the increasing accessibility and supply in Europe. First and foremost, global streaming giants Netflix and Amazon Prime Video have ramped up their Anime catalogues in the region, making Anime more accessible to their large existing user bases.

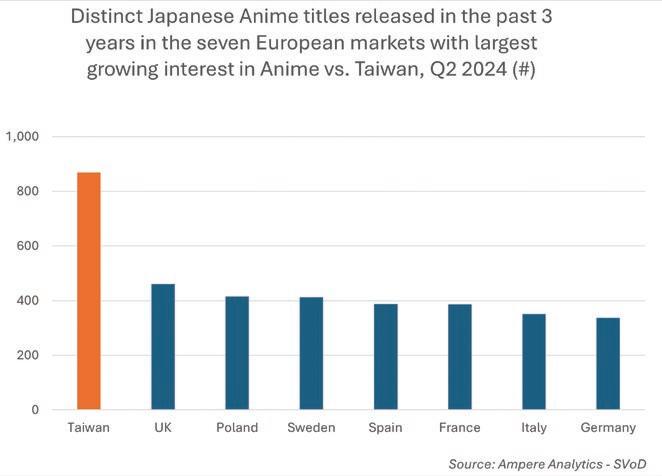

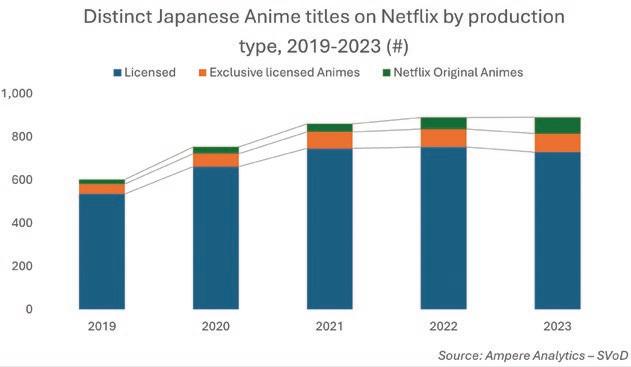

Previously, Anime was primarily provided by dedicated platforms such as Crunchyroll and Funimation, but the number of distinct Anime titles on Netflix grew from around 400 titles in 2019 to 500 in 2023, while for Amazon Prime Video those figures nearly doubled from 300 to 570. As a result, in the seven European markets that have seen the largest growth in Anime enjoyment, there are now around 2.8k distinct Anime titles available overall on SVoD services as of 2023, up 42% from 2019.

However, despite this growth in overall availability of titles, European markets still lag far behind APAC, a region with the largest catalogue of Anime, even excluding Japan, crucially in terms of the latest Anime titles. Only around 20% or 460 of all Anime titles available as of Q2 2024 in the seven European markets are new (in this case, titles released in the past three years), whereas 1.1k (or 27%) of

the 4,000 or so Anime titles available in APAC (excluding Japan) are new. Indeed, Taiwan alone, as the largest Anime carrier outside Japan, has twice as many new Anime titles as any single European market, at nearly 900 new titles.

In terms of sub-genres, Action & Adventure and Sci-Fi & Fantasy comprise around 60% of existing Anime titles in Europe as of Q2 2024, similar to other regions. These two sub-genres are evidently the most popular with 76% and 75% of Anime fans saying that they enjoy Action & Adventure and Sci-Fi & Fantasy respectively in Ampere’s consumer survey (Q3 2024).

Anime’s wider reach in Europe, thanks in part to Netflix and Amazon Prime Video, has been further bolstered by the merger of Funimation and Crunchyroll. After both were acquired by Sony in 2017 and 2021 respectively, Funimation’s content was gradually migrated

to Crunchyroll in 2022. Funimation eventually shut down in April 2024 with its subscribers automatically transitioned to Crunchyroll.

As a result, Crunchyroll now boasts by far the largest Anime catalogue among all SVoD services outside of Japan, making it the primary destination for Anime fans. More than 1.4k Anime titles were available on the platform across Europe as of Q2 2024, up from some 1.2k in 2021. This represents over 160% of Netflix and Amazon Prime Video’s Anime catalogues combined (deduplicating overlapping titles) as of Q2 2024.

Although much smaller in customer base than the two global streaming giants, Crunchyroll has been steadily increasing its presence in recent years thanks both to the Funimation merger and Anime fans’ strong loyalty. Its total subscriptions grew more than 400% over the past four years to reach 14.7m subscribers worldwide, among which around a quarter are from Europe (as of Q2 2024).

Given this, Crunchyroll has a strong comparative advantage, especially in Europe

where there are fewer competitors. Apart from Netflix and Amazon Prime Video, no other major streamers in Europe carry a distinct amount of Anime content, in contrast to North America or APAC where not only the global giants but also local platforms such as Hulu in the USA, Hami TV and FriDay in Taiwan, TVING in South Korea, and Bilibili in China carry hundreds of Anime titles. In Europe, therefore, Crunchyroll is the natural destination for an audience that has developed an interest in Anime through exposure to it on Netflix or Amazon Prime Video (which also offers Crunchyroll as an add-on Prime channel).

Another opportunity for Anime is Netflix, which has been investing heavily in both producing original Anime and exclusively licensing high-profile Anime titles. Netflix has partnered with renowned Anime studios in Japan such as Production I.G., Bones, and Anima, which resulted in almost quadrupling the number of Netflix Original Anime titles from 21 in 2019 to 76 in 2023. Netflix Exclusive Anime titles similarly doubled during the same period from 45 to 86.

This effort made Japan Netflix’s second largest country of production after the USA, ahead of the UK and South Korea. The prominence of Japanese content on the global giant’s platform, fuelled by an expanding Anime catalogue, can further grow the Anime fanbase not only in Europe but also globally. Over 2.1k distinct titles, or 9% of Netflix’s global catalogue, now originate from Japan, about half of which are Anime (as of August 2024).

Overall, local streamers in Europe looking to capitalise on the growing appeal of Anime can compete and differentiate themselves by licensing recent Anime titles which are still in short supply in Europe. With Japanese Anime producers also eager to export their new titles globally, amid the global expansion of Anime popularity in Europe, a further Anime boom in Europe is a distinct possibility.

BY CYRINE AMOR, RESEARCH MANAGER, AMPERE ANALYSIS

y-o-y drop in Scripted commissioning volumes stemming from the US.

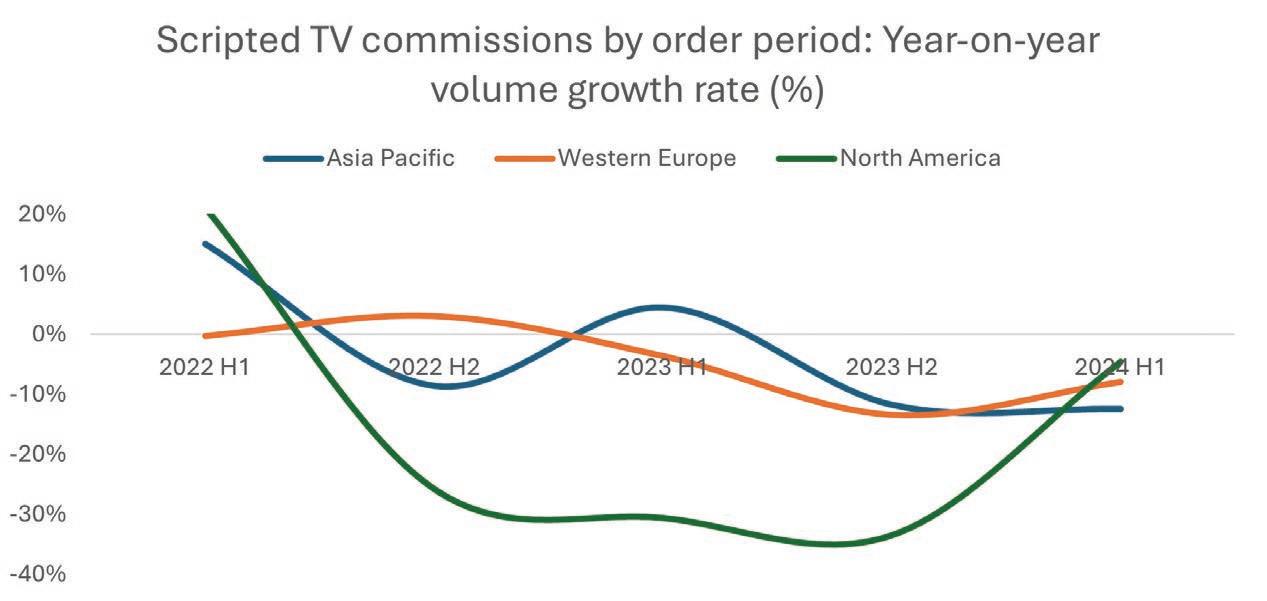

As we move into the final quarter of 2024, the recovery of the global TV production market from the end of “Peak TV” is less tangible than may have been hoped for. But an uptick in commissioning activity in the North American market points to what may be a cautious rebound.

Since the second half of 2022, the reappraisal of content investments and the pivot towards profitability by major US studio groups and streamers has led to significant cuts in commissioning rates. These have been further exacerbated by an ad market slump, production cost inflation, and the impact of the WGA and SAG-AFTRA strikes on Scripted US content orders. This perfect storm led to a decline in global commissioning volumes of 10% year-onyear in 2023, including a staggering 35%

However, the latest data from the North American market indicates a 5% uptick in volume order for the first 9 months of 2024 in total, including 7% y-o-y growth for Scripted. But globally, the overall growth rate in production orders continues to be negative in 2024 to date (H1 stood at -7% y-o-y), partly caused by the delayed impact of these factors across regions, as the most mature markets in Western Europe and APAC respectively started to feel the pinch – in particular in their Scripted TV production activity.

Western Europe, which had resisted the recessionary pressures for longer, saw a sharper decline in Scripted orders, with volumes down 13% in Q2 2024 compared to flat levels in the same period last year. The APAC region, though initially less affected, experienced a delayed impact, ending 2023 with a double-digit drop in Scripted orders and posting a 12% decline for H1 2024, following a 4% increase in the same period last year.

Reflecting this delayed downturn in some of the most mature APAC markets, TV production powerhouse Japan saw a reduction in commissioning volumes of 7% y-o-y in H1 2024, bringing total volume to just below H1 2022 levels, with 1,105 commissions across both Scripted and Unscripted content during the period. While Unscripted entertainment shows accounted for the majority of these orders, the decline rate was relatively consistent across both Scripted and Unscripted categories.

Scripted Anime titles bucked the overall trend, though, growing 20% y-o-y in H1 2024, driven particularly by Sci-Fi & Fantasy Anime commissions. This underscores the sustained popularity of Anime, which has become a key genre for younger audiences not only in the APAC region, but also in North America and, more recently, Western Europe.

The recessionary pressures were perhaps most evident in the South Korean market. It remains the largest pay TV market by revenue in the APAC region, with pay TV players leading in commissioning activity by volume. However, local production-cost inflation, coupled with a weak ad market (mirroring Western trends) led to the sharpest drop in TV orders across both Scripted and Unscripted for the second consecutive year. H1 2024 saw a 20% y-o-y decline, following a 5% drop in H1 2023. In contrast, public broadcasters and commercial FTA channels showed an upward trend in commissioning activity in 2024, following a slight dip in 2023.

Meanwhile, South Korea’s mature and highly competitive SVoD market continues to undergo a number of readjustments. Netflix leads among streamers in a market where 60% of households now subscribe to at least one SVoD service, but its dominance is a double-edged sword: While it has significantly amplified the wider appeal of K-Drama beyond its national and regional borders, and bolstered local production activity, it has also contributed to production- cost inflation and created more challenging conditions for local players, who must juggle competing linear, VoD and studio production demands— pressures reflected in the wave of mergers among local SVoD providers in recent years.

It is worth pausing to contextualise these SVoD trends in the APAC region. Since the second half of 2022, global streamers have significantly reduced the number of productions they commissioned overall, while continuing to expand their geographical footprint. Compared to H1 2022, their total commissions (including movies, new TV shows

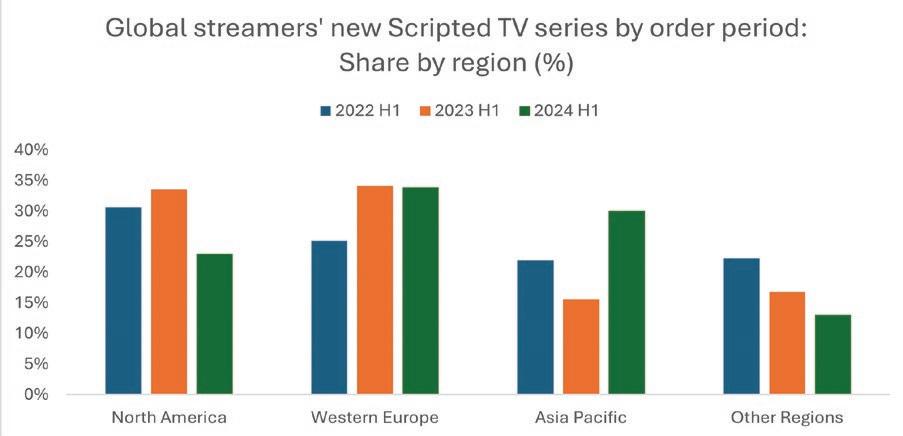

and renewal orders) were lower by 23% in H1 2024 overall, at 783 commissions. The bulk of these cuts stemmed from the North American region, while APAC benefited from a surge in commissioning volumes of 15% over these two years, reaching 137 commissions by global streamers in H1 2024. This translates into a gain in share for the region of over five percentage points in two years.

The resulting increased prominence of titles produced in the APAC region within global streamers’ Originals content strategy is particularly tangible in the Scripted sector. APAC Originals accounted for one quarter of all Scripted content ordered by global streamers in H1 2024 in total. Excluding season renewals, 30% of all their Scripted series stemmed from the APAC region during this period, ahead of North America’s share (with 15 more new TV series ordered in the APAC region than in North America).

Source: Ampere Commissioning

However, global streamer commissioning trends in the APAC region are split: While more mature markets mirror some of the patterns seen in Western markets, emerging markets continue to experience growth. And commissioning volumes across the APAC region have shifted notably by country.

South Korea’s mature SVoD market, for example, has seen commissioning activity from global streamers stagnate since early 2023, following a peak in 2022. Netflix, the market leader, has been scaling back its local production commitments, particularly in Scripted content, in this market.

Meanwhile India, the world’s fastest-growing content market by content spend, saw a record 55 global streamer commissions in H1 2024, driven primarily by Amazon Prime’s

Source:AmpereCommissioning

commissioning push. Amazon has significantly ramped up its investment in the Indian market in 2024, shifting a larger portion of its local spend from acquisition to original content production. In H1 2024, Amazon became the leading commissioner of original content among SVoD platforms in India, surpassing Disney+ Hotstar, while Netflix maintained a steady volume of orders.

Netflix’s growth in commissioning within newer APAC markets is also noteworthy, particularly in Thailand, which saw 10 new content orders in H1 2024 alone, but also in Indonesia and the Philippines. This push is part of Netflix’s strategy to expand its local subscriber base through regionally targeted productions that also resonate with its wider international subscriber base, one that is increasingly open to consuming content stemming from outside of their own regions in dubbed or subtitled form.

While this trend began in 2021 with global hits such as South Korean drama Squid Game, such successes are now starting to emerge from some of the less saturated SVoD markets in the APAC region where global streamers have recently ramped up production.

A recent example is Netflix’s Indonesian original thriller, The Shadow Strays, which has garnered significant international attention and appeared in Netflix’s top 10 titles across dozens of markets beyond the APAC region within a week of its release in mid-October 2024.

With subscriber additions hard to come by for global streamers in the mature markets of North America and Western Europe, their ongoing investment in content attractive to viewers in the APAC region looks set to continue.

BY ADAM WOODGATE, VP, RESEARCH SOLUTIONS, THE INSIGHTS FAMILY

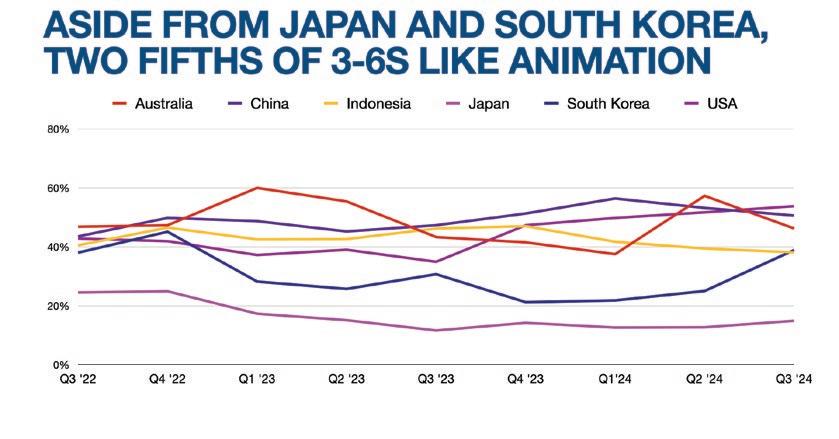

In the 1950s, Crusader Rabbit paved the way as the first animated children’s television show. Animation has evolved to become an integral part of early childhood entertainment and learning, and amongst 3—6-year-olds it’s as popular as ever.

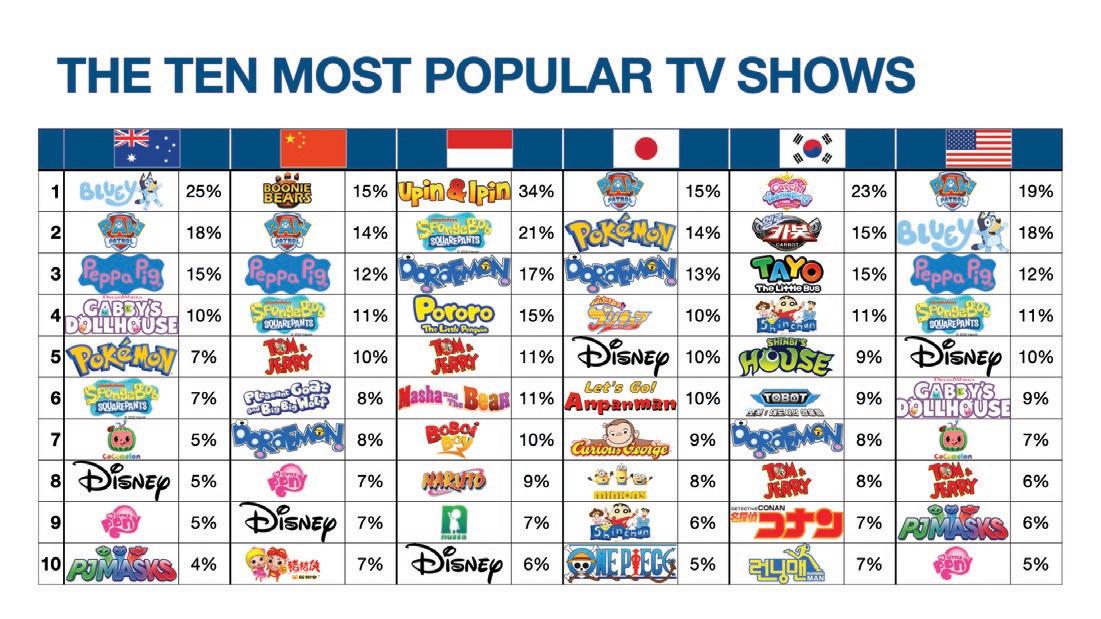

The Insights Family captures near real-time data on 3—18-year-olds in 22 countries. Analysis of the data for 3—6-year-olds in Australia, China, Indonesia, Japan, and South Korea along with the US reveals that aside from Japan and South Korea, around twofifths like animation. In Japan, two thirds of preschoolers are said to like Anime, which is a style of animation originating in the country. It’s worth noting that Anime is almost as popular in China as it is in Japan, according to data for Q3 ’24, (66% versus 70% respectively).

So, what is it about animation that resonates so deeply with this young age group?

The vibrant colours, dynamic movements, and exaggerated expressions in animated series are tailor-made for young children’s developing brains. At this stage of growth,

The popularity of animated series inAustralia,China, Indonesia,Japan,South Korea andUnitedStates (Q3 2022 through toQ3 2024)

kids are naturally drawn to bright, bold visuals that stand out and stimulate their imagination. A cursory glance at the top 10 shows in each of the six countries reveals an almost full-house for animated series— in China, Indonesia, and Japan the top 10 are all animation.

Closer analysis reveals other insights, for example the top 10 in Australia and the US, excluding Disney, consists of only four

TheTop 10TV shows inAustralia,China, Indonesia, Japan,South Korea andUnitedStates (Q3 2024)

different genres – Animals, Fantasy, Slice of Life and Music. Whereas South Korea has the most contrast in genres – Animals, Quiz/Game Show, Action/Adventure, Fantasy, Scary/ Creepy, Sci-Fi, Thriller, and Slice of Life.

Japan accounts for the largest number of action/adventure shows in its top 10. In Australia, China and the US, series themed around animals account for four of the top 10 shows. Three shows in Australia, South Korea, and the US fall into the ‘fantasy’ genre.

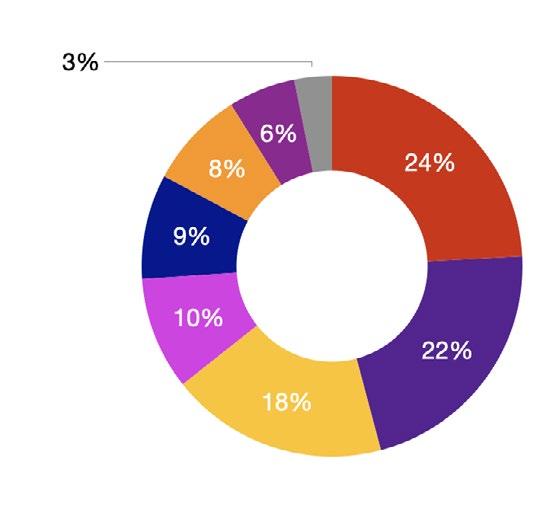

Core EntertainmentGenres aggregated acrossAustralia, China, Indonesia, Japan,South Korea andUnitedStates (Q3 2024)

Top three shows like Paw Patrol, Bluey and Peppa Pig use relatable scenarios that strongly resonate with preschool audiences, such as going out for the day as a family, learning that it’s good to share or being curious about things they see in the world around them. The familiarity of these experiences helps children connect with the stories, fostering a sense of comfort and belonging.

Further analysis of the most popular shows among 3—6-year-olds in the six countries

reveals almost a quarter feature comedy and over a fifth can be viewed as supporting a preschooler’s education and learning.

Whilst it’s clear that animation delivers a form of visual storytelling without the constraints of reality, animated series appear to readily travel across borders. Referring to the top 10 shows in each country, US productions account for six of the top 10 shows in Australia, four in China, three in Indonesia and three in Japan, but only one in South Korea.

In both Japan and South Korea, six of the top 10 shows are locally produced. It’s worth noting that all six shows originating in Japan are Anime, but the shows originating outside Japan are a mix of comedy and education. In the US, the six of the top 10 shows are comedy/humour. The same is true in Australia. In the US, six of the top 10 shows fall under the comedy/humour category, a trend mirrored in Australia. While Pokémon is the only anime show to make Australia’s top 10, no anime titles feature in the US top 10 (Pokémon ranks 16th).

Since the country of origin is less important from a 3—6-year-old’s perspective than say relatable characters, and imaginative storytelling more effective at driving audiences to an animation series, it feels like the time is right for producers from the Asia-Pacific region to pitch their wares to TV companies in other parts of the world and global streaming services.

BY ADAM WOODGATE, VP, RESEARCH SOLUTIONS, THE INSIGHTS FAMILY

While often stereotyped as a medium for children, animation manages to retain a multi-generational appeal, thanks to its ability to blend entertainment with social commentary and cultural relevance. The popular animated series are the ones that push narrative boundaries, exploring empirical questions and societal flaws, often with a darkly comedic twist.

In spring 2024, The Insight Family launched its NextGen survey, designed to capture the attitudes and behaviours of young adults initially in France, Germany, Italy, Spain, the UK and the United States. The plan is to expand into other territories in the coming year.

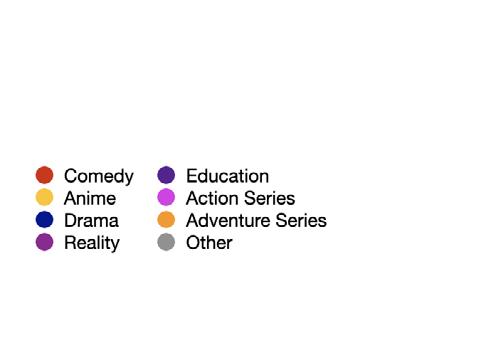

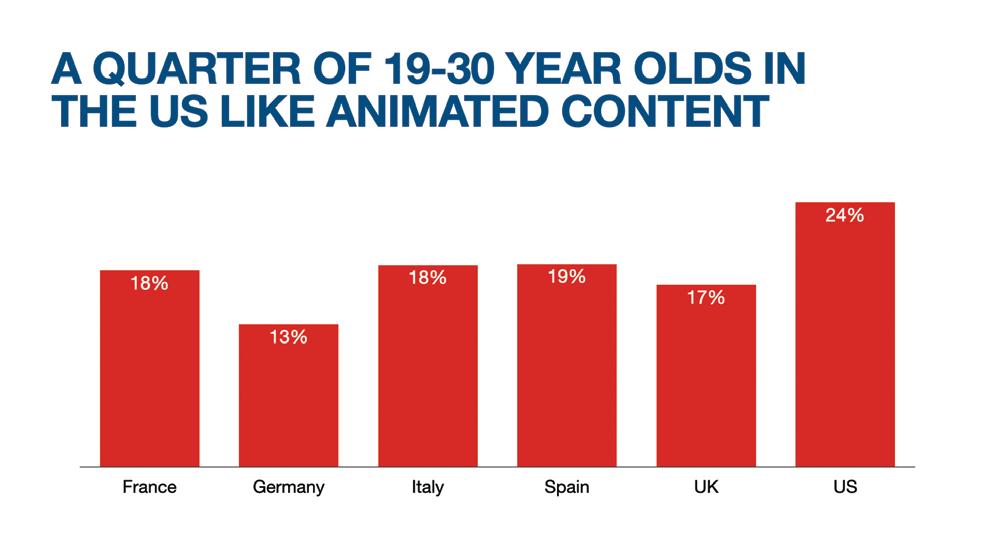

The popularity of animation among 19—30-year-olds in France,Germany, Italy,Spain, theUK and theUS (1August—31October 2024)

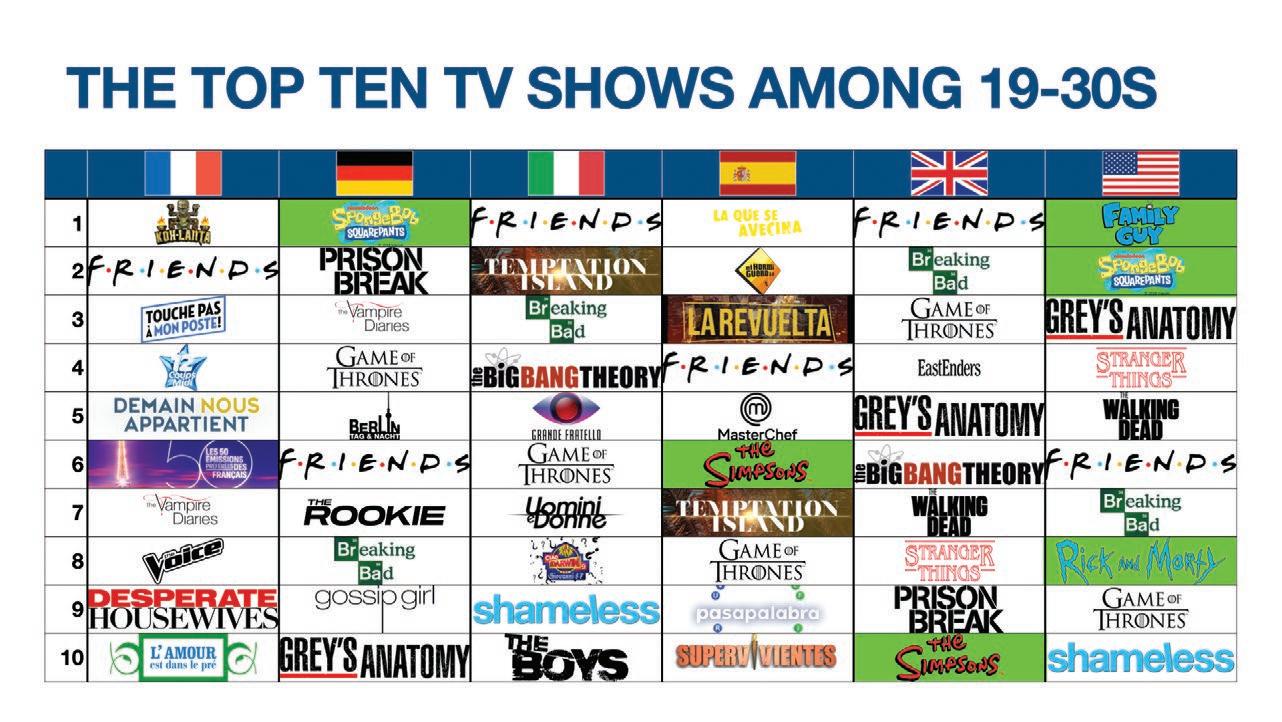

TheTopTenTVShows (AnimatedSeries Highlighted inGreen) among 19—30-year-olds in France, Germany, Italy,Spain, theUK and theUS (1August—31October 2024)

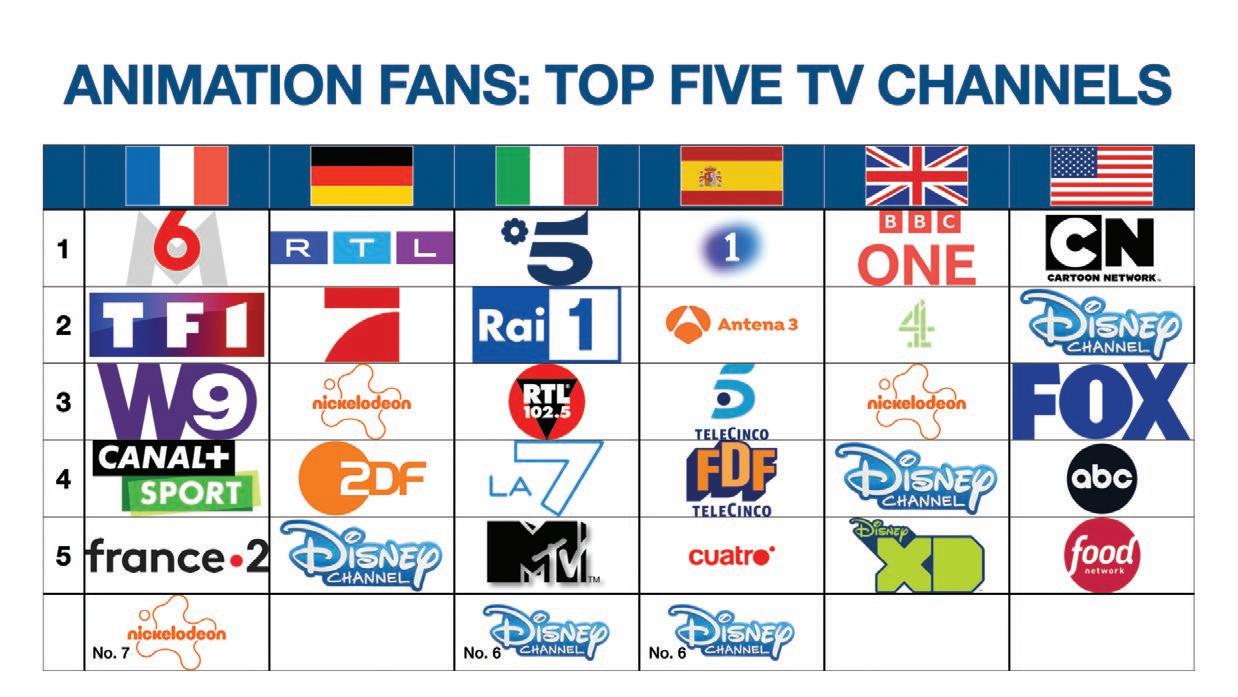

Fans ofAnimationTop FiveTVChannels among 19—30-year-olds in France,Germany, Italy,Spain, theUK and theUS (1August—31October 2024)

Among the countries analysed, animation achieves the highest score in the US (24%) and Spain (19%), with the lowest inclination towards the format in Germany (13%).