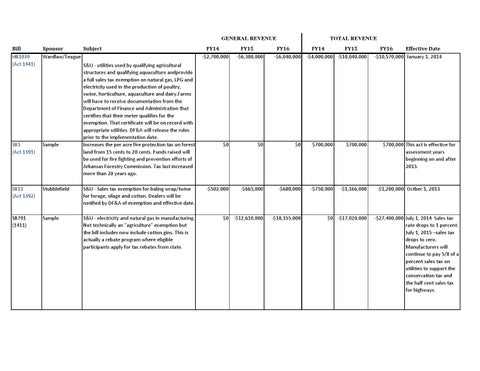

GENERAL REVENUE Bill Sponsor Subject HB1039 Wardlaw/Teague (Act 1441) S&U ‐ utilities used by qualifying agricultural structures and qualifying aquaculture andprovide a full sales tax exemption on natural gas, LPG and electricity used in the production of poultry, swine, horticulture, aquaculture and dairy.Farms will have to receive documentation from the Department of Finance and Administration that certifies that their meter qualifies for the exemption. That certificate will be on record with appropriate utilities. DF&A will release the rules prior to the implementation date. SB5 Sample Increases the per acre fire protection tax on forest (Act 1391) land from 15 cents to 20 cents. Funds raised will be used for fire fighting and prevention efforts of Arkansas Forestry Commission. Tax last increased more than 20 years ago. SB11 Stubblefield (Act 1392)

S&U ‐ Sales tax exemption for baling wrap/twine for forage, silage and cotton. Dealers will be notified by DF&A of exemption and effective date.

SB791 Sample (1411)

S&U ‐ electricity and natural gas in manufacturing. Not technically an "agriculture" exemption but the bill includes now include cotton gins. This is actually a rebate program where eligible participants apply for tax rebates from state.

TOTAL REVENUE

FY14 ‐$2,700,000

FY15 ‐$6,300,000

FY16 ‐$6,040,000

FY14 FY15 ‐$4,000,000 ‐$10,040,000

$0

$0

$0

$700,000

$700,000

‐$502,000

‐$665,000

‐$680,000

‐$750,000

‐$1,166,000

$0 ‐$12,610,000

‐$18,355,000

$0 ‐$17,020,000

FY16 Effective Date ‐$10,570,000 January 1, 2014

$700,000 This act is effective for assessment years beginning on and after 2013.

‐$1,200,000 Octber 1, 2013

‐$27,400,000 July 1, 2014 Sales tax rate drops to 1 percent. July 1, 2015 –sales tax drops to zero. Manufacturers will continue to pay 5/8 of a percent sales tax on utilities to support the conservation tax and the half cent sales tax for highways.