Williams Lake logger starts up salvage wood biomass operation

Williams Lake logger starts up salvage wood biomass operation

AT PETERSON WE NEVER STOP DEVELOPING THE ULTIMATE INDUSTRY LEADING EQUIPMENT.

For over 35 years, we’ve built our business around building the most productive mobile chipping and grinding machines in the industry. Day after day, we partner with our customers by giving them the best tools for the job and exceptional support when they need us.

Visit us at www.petersoncorp.com today and see why Peterson is the industry leader for disc and drum chippers, horizontal grinders, blower trucks, screens and stacking conveyors.

Get the right sized product, sort it out, and stack it higher with Peterson!

Let us know how we can help grow your business!

B.C. forest company Tsi Del Del Enterprises, in partnership with Borland Creek Logging, began a biomass operation last summer grinding up salvage wood from harvesting residuals and old burn areas.

FPInnovations and Resolute Forest Products’ new TMP-Bio plant in Thunder Bay, Ont., presents new industry opportunities for the wood products sector.

Tsay Keh Dene Nation in northern B.C. looks to salvage biomass to reduce the remote community’s reliance on fossil fuels for heat and power.

Canadian Biomass joined a group of just over 20 wood pellet stakeholders from North America and Europe on a tour of New Brunswick’s pellet producers, including one of Canada’s newest wood pellet facilities.

FutureMetrics’ William Strauss shares the annual global markets overview and forecast for both heating and industrial wood pellets.

Tsi Del Del Enterprises and Borland Creek Logging workers are grinding slash piles roadside and transporting the wood chips to nearby Atlantic Power and Pinnacle Renewable Energy’s Williams Lake, B.C., pellet plant. Photo by Mitch Cheek, Solos Productions. Read the story on page 10.

ith the start of a new year and a new decade – especially one that brings with it a number of puns about ‘2020 vision’ – it’s only natural that everyone is looking ahead and predicting how things will unfold in the coming years. In our industry, the new decade will likely see rapid expansion and new developments as Canada’s bioeconomy picks up speed.

In fact, a new milestone was reached less than one month into the new decade. On Jan. 16, Pinnacle Renewable Energy signed a 15-year charter agreement with NYK Bulk and Projects Carriers for a new Japanese-built ship that will transport up to 33,000 tonnes of pellets exclusively between Canada and Japan six times per year. This is a first for a Canadian pellet producer, and is “certainly different to how freight has been arranged in the past by any wood pellet company anywhere,” said Vaughan Bassett, Pinnacle’s senior vice-president of sales and logistics, on page 6.

downtime at more than 20 other mills.

However, there is a silver lining: as a result of the sawmill closures, more and more B.C. loggers are turning to chipping and grinding wood waste to supplement their operations. Tsi Del Del Enterprises Ltd., a joint venture between Tsideldel First Nation and Tolko Industries, is just one example. “We think that is the future for all of us: using all of the fibre in the stands, not just the saw logs but also the pulp logs and the biomass,” says Phil Theriault, general manager of Tsi Del Del Enterprises, on page 10.

Meanwhile, Canada’s East coast pellet producers are enjoying steadily growing business. Canadian Biomass editor Maria Church got an inside look at some of New Brunswick’s pellet plants, including the newly commissioned Grand River Pellets. Read more on page 20.

Volume 20 No. 1

Editor - Maria Church (226) 931-1396 mchurch@annexbusinessmedia.com

Associate Editor - Ellen Cools (416) 510-6766 ecools@annexbusinessmedia.com

Contributors - Adam Kveton, Gordon Murray, Harry “Dutch” Dresser, William Strauss, Jordan Solomon, Taylor Whitfield

Group Publisher - Todd Humber 416-510-5248 thumber@annexbusinessmedia.com

Account Coordinator - Stephanie DeFields Ph: (519) 429-5196 sdefields@annexbusinessmedia.com

National Sales Manager - Rebecca Lewis Ph: (519) 429-5196 rlewis@annexbusinessmedia.com

Quebec Sales - Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexbusinessmedia.com

Western Sales Manager - Tim Shaddick tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Alison Keba

Circulation Manager – Jay Doshi jdoshi@annexbusinessmedia.com Ph: (416) 442-5600 ext. 5124

COO Scott Jamieson

Canadian Biomass is published four times a year: Winter, Spring, Summer and Fall. Published and printed by Annex Business Media.

Publication Mail Agreement # 40065710

Printed in Canada ISSN 2290-3097

Subscription Rates: Canada - 1 Yr $57.00; 2 Yr $102.00 Single Copy - $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $121.50 CDN; Foreign – 1 Yr $138.00 CDN

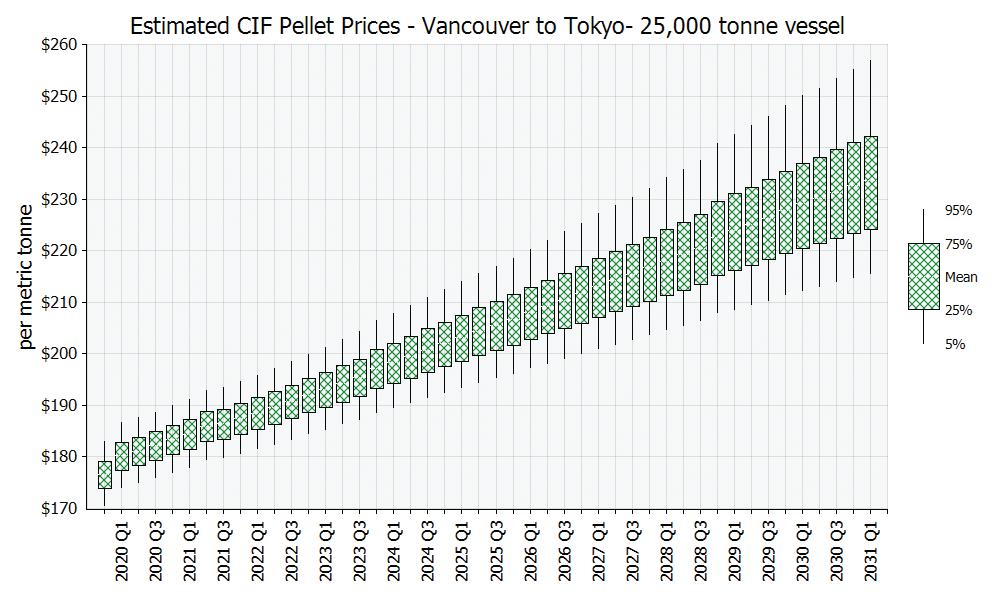

In his global market outlook for 2020, William Strauss, president of FutureMetrics, notes that the future of pellet prices will be heavily influenced by long-term contracts such as the one established between Pinnacle and the Japanese government. By the end of the decade, FutureMetrics expects the price for pellets to be between approximately $215 to $235 per tonne. Read more on page 24.

This is an encouraging sign as the industry looks ahead. But access to fibre in B.C. remains difficult, as the province’s forestry sector has experienced a downturn in the past year, resulting in the permanent closure of at least nine sawmills, as well as

As we move into a new decade, diversifying operations and producing bioproducts from wood residues will be critical. On page 14, FPInnovations’ Jean Hamel explains how the organization’s thermo-mechanical-pulp (TMP)-bio technology at Resolute’s Thunder Bay, Ont., pulp and paper mill, could open up new markets for the forest products sector. With all the new projects and developments already underway, I’m excited to see where the industry goes this year, and beyond into the 2020s. •

Ellen Cools, Associate Editor

CIRCULATION jdoshi@annexbusinessmedia.com Tel: (416) 510-5124 Fax: (416) 510-6875 or (416) 442-2191 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2020 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

www.canadianbiomassmagazine.ca

The worldwide wood pellet industry hit a new milestone on Jan. 16 as Pinnacle Renewable Energy Inc. signed a 15-year charter agreement with NYK Bulk and Projects Carriers to have a brand-new Japanese-built ship transport wood pellets exclusively between Canada and Japan.

“It’s certainly different to how freight has been arranged in the past by any wood pellet company anywhere,” said Vaughan Bassett, Pinnacle’s senior vice-president of sales and logistics.

The S1130 Handy class vessel of almost 40,000 deadweight tonnage (dubbed the M/V New Pinnacle) will transport between 32,500 and 33,000 metric tons of wood pellets six times per year from Canada to Japan.

Japanese Consul General

Takashi Hatori took part in the signing ceremony on Jan. 16, as the deal was made possible by a long-term commitment from the Japanese government to purchase pellets from Pinnacle.

“The Japanese government set an ambitious goal of increasing the biomass power generation to make it 2.3 times by the year 2030,” Hatori said. He added that Canada, and in particular B.C., is “the most reliable partner to source wood pellets.”

Unlike Contracts of Affreightment (COA) – which are typical in wood pellet exporting – where a shipping line agrees to carry a certain number of tons from one market to another, this long-term charter will see Pinnacle take on the costs of running the ship, said Bassett. However, that means the New Pinnacle can run exclusively between Canadian

and Japanese ports without needing to travel to other ports to source other cargo. The vessel is also built to take the maximum possible load into Japanese ports.

But Bassett did note that, in terms of securing enough supply for their contracts in Japan, “we could certainly build more pellet plants. And in order to do that, we would certainly like more access to more fibre.”

There is more fibre available

The Forest Enhancement Society of BC (FESBC) has allocated another $2,737,764 in grants for four projects that will support forestry contractors and increase the use of wood fibre that otherwise would have been burned. These projects will turn wood waste from slash piles into wood pellets and pulp products, and they will help achieve B.C.’s and Canada’s climate change targets. The grants are being allocated as follows:

• $408,320 to Skeena Bioenergy Ltd. to use material from slash piles to make wood pellets (about 22,000 cubic metres or 440 truckloads) in the Coast Mountains Natural Resource District.

• $1,080,000 to Taan Forest Products to use material from slash piles to make pulp for use in paper products (about 51,000 cubic metres or 1,020 truckloads) in the Haida Gwaii Natural Resource District.

• $880,000 to Skookumchuck Pulp Inc. to use material from slash piles to make pulp for use in paper products

in B.C., he said. “I’m thinking about things like forest residues, the stuff that’s left behind after harvesting, for example. If it’s within economic reach of our plants, we should be able to access it.”

Bassett said Pinnacle is in talks with the B.C. government to facilitate better access where it makes sense to do so.

Read the full article at canadianbiomassmagazine.ca -Adam Kveton

(about 110,000 cubic metres or 2,200 truckloads) in the Rocky Mountain Natural Resource District.

• $369,450 to RPP Holdings Inc. to use material from slash piles to make pulp for use in paper products (about 36,000 cubic metres or 720 truckloads) in the Quesnel Natural Resource District.

“Assisting the province to reduce greenhouse gases, add value to forest fibre and maintain jobs for workers and communities are some of our key objectives,” said Wayne Clogg, board chair, Forest Enhancement Society of BC.

“There are many society-funded projects throughout B.C. that are making a difference right now. The amount of biomass (woody debris) that will not be burned as slash – but instead used this winter season to fuel a greener economy – is expected to exceed 1.6 million cubic metres by March 2020. Funding has been committed to continue some of these projects to 2022 to further help forest workers and communities who are most in need.”

Resolute Forest Products will spend a total of $38 million to construct a commercial plant specializing in the production of cellulose filaments and to optimize its operations at the Kénogami paper mill in Quebec.

“Our investment in cellulose filaments represents an opportunity to enter into non-traditional growth markets,” said Yves Laflamme, president and chief executive officer, during a press conference on Jan. 15. “The cellulose filament and Kénogami mill optimization projects will create synergies within our network of operations in Saguenay–Lac-Saint-Jean.”

Cellulose filaments are derived from wood fibre that is mechanically processed without chemicals or enzymes. They are manufactured entirely from renewable sources, resulting in a low carbon footprint.

The filaments can be integrated into commercial and consumer products from many industries, including transportation, construction and energy, increasing the resistance and durability of those products. The extraction technology was developed by FPInnovations.

Resolute’s $27-million cellulose filament project will create eight jobs in the start-up phase slated for 2021, and a total of 23 jobs once the plant reaches its full production capacity of 21 metric tons per day.

The project will be funded in part by Quebec’s Department of Forests, Wildlife and Parks ($2.5 million), Investissement Québec ($4.2 million) and Natural Resources Canada ($4.9 million).

The founding members of the Integrated Biogas Alliance (IBA) including AB Energy (Italy), Eisenmann Corporation (USA), Encourage (Italy), Tietjen (Germany), and Greenlane Renewables (Canada) have joined forces on a non-exclusive basis to provide the global biogas industry with a unique, fully-integrated organic waste-to-renewable-energy platform solution.

This platform solution will lower the inherent risks facing developers, investors and EPC (engineering, procurement and construc -

tion) firms in developing biogas plants, lower project execution risks and improve their bankability.

“The market is definitely pulling us towards providing customers with a total solution where they can more easily optimize the full economic, agronomic and environmental value chain of products from the plant, driving stronger ROI, enabling more circular economy benefits while reducing project implementation and financing risk,” said Christopher Maloney, newly-elected president of IBA.

Wood raw-material costs were down for pulp manufacturers in most regions around the world in the third quarter of 2019 compared to both the previous quarter and Q3 2018, reports the Wood Resource Quarterly (WRQ).

Prices for softwood pulplogs and wood chips were down between one and 15 per cent quarter-over-quarter, depending on region, with the biggest price reductions occurring in Germany, France, Sweden and the U.S. Northwest.

The only region with higher prices in Q3 2019 was Western Canada, where pulplog prices increased by 10 per cent quarter-over-quarter.

The Softwood Fiber Price Index (SFPI) fell by 2.2 per cent quarter-over-quarter to $89.26/odmt in Q3 2019, the lowest level in two years, and slightly below its five-year average.

Of the major hardwood consuming regions in the world, pulp mills in Russia (+13 per cent), China (+eight per cent), U.S. South (+eight per cent), Germany (-10 per cent) and Indonesia (-eight per cent) have seen the biggest changes in wood fibre costs the past year.

- Wood Resources International

Manitoba Premier Brian Pallister announced at the end of January that the province will be implementing the “Made-in-Manitoba Climate and Green Plan,” which will increase the ethanol and biodiesel content for its transportation fuels.

These new clean fuel standards will reduce the province’s emissions by 400,000 tonnes in five years.

The province plans to increase the ethanol content requirement of gasoline from 8.5 per cent to 10 per cent, and the biodiesel content of diesel from two per cent to five per cent. In the next few months, industry, stakeholders and the public will be consulted with to determine any necessary regulation changes.

By Gordon Murray

very fall, the Wood Pellet Association of Canada (WPAC) holds an annual general meeting where we review the progress of the previous year and seek input into the business plan for the following year. During this year’s AGM, members approved these focus areas:

• Reinforcing the reputation of Canada’s wood pellet supply chain regarding high quality, sustainability and ethical business practices with markets in Europe and Asia

• Creating opportunities in Canada’s domestic wood pellet heating sector

• Participating in the development of the Sustainable Biomass Program to provide third-party certification of Canada’s wood pellet sustainability credentials

• Continuing to improve the wood pellet sector’s safety performance

• Continuing to support applied wood pellet research and development in cooperation with the University of British Columbia Biomass and Bioenergy Research Group.

Here are some highlights of what we have accomplished over the past few months, and a look at our upcoming activities:

In Europe, WPAC is a director of both the Bioenergy Europe trade association, which advocates on behalf of the European bioenergy sector, and the European Pellet Council, which is responsible for ENplus wood pellet quality certification. We have nearly completed the fourth revision of the ENplus quality program.

WPAC has also been active in Japan. We recently joined the British Columbia Forest Sector Mission to Japan where, to-

gether with our customer Sumitomo, we met with B.C.’s forestry minister Doug Donaldson and chief forester Diane Nicholls to discuss the need for improved fibre supply access for the pellet sector. In February, I will be participating in the annual IEA Clean Coal Biomass Co-Firing workshop in Kokura, Japan to give a presentation, “Demonstrating that electricity production from solid biomass is both low-carbon and sustainable.”

In May, we will, as usual, be sponsoring and helping to present the Biomass Pellet Trade and Power Conference in Tokyo. WPAC will provide speakers and host a reception for Japanese customers. We will also arrange meetings with Japanese energy industry regulators to discuss potential market access concerns and reinforce the sustainability of Canadian wood pellets.

WPAC has progressed on three fronts in pushing for more Canadian market support.

First, we have been advocating with Environment and Climate Change Canada for changes to the proposed Clean Fuel Standard Regulation to make fuel switching from heating oil to wood pellets eligible for carbon credit generation.

Second, we have progressed on our initiative to harmonize Canadian and European biomass boiler pressure standards. In February, we will be attending a meeting between the Government of Canada and the European Commission on reducing regulatory barriers under the Canada-Europe trade agreement where our issue has made it onto the agenda. We will also be present at a second meeting between the provinces, the Government of Canada,

and the European Union to discuss reducing regulatory barriers between Canadian provinces and the potential adoption of European boiler standards.

Finally, we have completed two market studies, one on Canadian market opportunities and a second, via social media, on Canadian consumer perceptions of wood pellet heating.

Sustainable Biomass Program (SBP) certification is required by all Canadian exporters selling to European power utilities. Since 2018, WPAC has been working on a regional risk assessment (RRA) for B.C. to help streamline the SBP certification approval process for wood pellet producers. The B.C. RRA is on target for completion by March 31, 2020. We have also begun work on RRA’s for New Brunswick and Nova Scotia, both of which we plan to complete by March 31, 2021. When those are complete, we will start work on a RRA for Alberta.

WPAC is continuing to advocate for Canadian interests by participating in SBP’s governance and participating in SBP’s recently announced standards review. We are represented on SBP’s board of directors, standards committee, stakeholder advisory committee and carbon working group.

We are also working on a management information system to track the chain of custody and other characteristics of commingled wood pellet deliveries, invento-

ry and vessel loading through the Fibreco and Westview terminals in B.C. This project has been in progress since 2018 and is nearing completion.

We are continuing to operate the WPAC Safety Committee, which includes members from across Canada. In January, we released our 2020 Work Plan, outlining our key focus areas for the year ahead.

WPAC, in co-operation with WorkSafeBC and media partner Canadian Biomass, held a Process Safety Workshop on Bow Tie Analysis in November. Bow tie analysis is a method of predicting all the potential causes of catastrophic incidents and implementing critical controls to prevent such catastrophes from occurring. Our next step is to support individual member companies with implementing bow ties.

This year will see multiple safety events – in April, again in co-operation with WorkSafeBC and Canadian Biomass, we will present a workshop on Human-Machine Interface best practices, designed mainly for plant operators. In June, our team will present the annual Wood Products Safety Summit.

WPAC is continuing to co-operate closely with the University of British Columbia’s Biomass and Bioenergy Research Group (BBRG). In 2019, BBRG, with help from WPAC, secured a four-year agreement

WPAC is governed by a seven-member board of directors, which meets quarterly. The 2020 board includes:

• President – Vaughan Bassett, Pinnacle Renewable Energy

• Vice-president – Rene Landry, Shaw Resources

Directors:

• John Stirling, Pacific BioEnergy

• Jonathan Levesque, Groupe Savoie

• Todd Humber, Annex Business Media

• Jose Pedrajas, Prodesa

• Andre Bedard, Quebec Wood Export Bureau WPAC’S GOVERNANCE

from Agriculture and Agrifoods Canada for nearly $1.8 million. This funding will enable us to keep our research team and laboratory facilities intact at UBC.

We are in the middle of several important research and development projects, including additional testing on wood pellet off-gassing in support of IMO shipping regulations. This is a second phase of a project that was first completed in 2016. As part of ISO Technical Committee 238, we are working to develop chemical and mechanical wood pellet testing standards for laboratories. Finally, we are developing a plan to implement centralized nitrogen storage for rapid deployment to pellet plants to support silo fire fighting.•

By Maria Church

For central B.C. logger Tsi Del Del Enterprises Ltd., harvesting is just one component of how they manage forest licenses belonging to the Tsideldel First Nation and other First Nations west of Williams Lake, B.C.

The 27-year-old company – a joint venture between Tsideldel (formerly called Alexis Creek First Nation) and Tolko Industries – is a fully integrated forestry company involved in forestry consulting, harvesting, log sales, silviculture, and, most recently, biomass harvesting in the bush.

“The company belongs to the community of Tsideldel,” says Phil Theriault, general manager of Tsi Del Del Enterprises. “We’re not a contractor logger, we own the wood and we’re doing all the forestry management. It’s a full loop from harvest planning to reforestation. We’re a full forest management company.”

Based in Williams Lake, B.C., Tsi Del Del Enterprises started up in the early ’90s as a way to keep resources within the First Nations’ traditional lands and to improve the economic and social conditions of the community. The band originally partnered

with Jacobson Brothers Forest Products Ltd., which was purchased by Riverside Forest Products and later by Tolko.

“After quite a few meetings we managed to form a joint venture company,” says Percy Guichon, business development manager for Tsi Del Del Enterprises. “We started with a buncher, a skidder, a loader and two or three trucks – under 10 employees, including the foreman and the book keeper.”

Today the company employs nearly 100 staff members and subcontractors, running around 40 machines in the bush. Depending on the year, they harvest between 340,000 and 400,000 cubic metres a year – about 40 to 45 loads a day.

The geography of the Tsilhqot’in region of B.C. presents challenges for loggers like Tsi Del Del Enterprises, mainly due to small piece sizes and low volume stands. Typical volume is less than 100 cubic metres per hectare. Around 90 per cent of the trees are lodgepole pine, common in the B.C. Interior, which range from 0.07 to 0.16 cubic metres per log.

“I would say at least 60 to 70 per cent of the volume is from

The new CBI Magnum Force 6800CT Horizontal Grinder is engineered to surpass every grinder that came before it. Once land clearing and wood waste professionals switch to CBI grinders for their ultimate production, performance, and durability, they never look back. No other grinder in its weight class meets the production rates or low cost of ownership like the CBI Magnum Force 6800CT.

We are excited to announce the opening of our new branch in Woodstock, Ontario. Due to market demand, we have expanded our grinding, shredding, screening, crushing and material handling equipment sales, rentals, services and parts, and are ready to serve you!

beetle kill from 20 years ago,” Theriault says. “We’re still harvesting it. Because it’s so dry, the root system doesn’t rot quickly so the trees are still standing and they’re still good, but it’s tailing off.”

It will be some time yet before second-growth harvesting can take place in the Tsilhqot’in. Pine logging began there in the ’80s, Guichon says, so there’s a while to go before the second growth pine matures.

The company owns several logging trucks and subcontracts the rest. Transportation costs are significant with the average haul between 10 and 12 hours.

There is a slew of equipment working for Tsi Del Del Enterprises and Borland Creek Logging’s biomass operation. Each company supplies several machines to get the job done.

Tsi Del Del:

• Peterson 4710B grinder

• CBI 6800 grinder

• John Deere 792 log loader

• John Deere 270 excavator

• 3 Western Star tractors with 53-foot live floor trailers

This summer the company added biomass harvesting to its portfolio. In partnership with Williams Lake Indian Band-owned Borland Creek Logging, Tsi Del Del Enterprises is grinding up salvage wood from harvesting residuals and old burn areas. The partnership will see both companies grinding roadside and transporting the wood chips to nearby Atlantic Power and Pinnacle Renewable Energy’s Williams Lake pellet plant.

Borland Creek Logging

• Link-Belt 3740 log loader

• John Deere 2154 log loader

• Cat D6 dozer

• Cat 320 excavator

• Western Star gravel truck

“We’re producing biomass and pulpwood instead of burning the slash piles,” Guichon says. “It creates some jobs there, reduces the carbon emissions and allows us into those low-volume stands.”

Theriault estimates that about 60 per cent of their gross harvest volume is saw logs and the rest is biomass, either pulp logs or tree tops and branches. “For us to log about 300,000 or 400,000 metres of saw logs in a year, you have to picture at least another 250,000 up to 400,000 metres of slash produced and left in the bush to be burned,” he says.

Theriault and several of Tsi Del Del Enterprises’ employees were involved in a biomass harvesting company called Pioneer Biomass that started up in 2008. Ledcor Group purchased the company three-and-a-half years later. Theriault says the knowledge acquired while running that company has been an asset for the new grinding venture.

“It’s an old pair of shoes for us because we’ve done it before. The operator that we had in 2008 is the same guy running the grinder for us now in 2019. These guys are experienced,” he says.

This time, rather than running a company that depends solely on fluctuating biomass markets, the grinding is just one component of their fully integrated forestry company, giving them the flexibility to take advantage of surges in the biomass market, such as we’re seeing now. With sawmills in B.C. struggling to remain open and running at full speed, secondary users like pellet mills and power plants are turning to alternative sources of wood fibre, including wood chips from harvesting residuals.

“It really is, in a way, a recession business,” Theriault says. “As opposed to starting up a grinding company as a standalone, for us, it’s just a couple more machines on the logging side. Our overhead is a lot lower this way and the supports like mechanical

and the low beds, we already have those in place.”

The joint venture is initially grinding logging debris in forest areas impacted by the 2017 wildfires that came dangerously close to the outskirts of Williams Lake. Tsi Del Del Enterprises is providing the grinding machines – a Peterson 4710B, purchased used, as well as a CBI 6800 grinder – and the Williams Lake Indian Band is providing harvesting equipment and access to their lands.

“If you go out to the site today, there’s the Tsi Del Del Enterprises grinding machine and there are Borland Creek Logging machines working side by side. We think that is the future for all of us: using all of the fibre in the stands, not just the saw logs but also the pulp logs and the biomass,” Theriault says.

When it comes to the economics of the grinding business, Theriault says it’s feasible for now within a certain radius of their operations, but it is a fine line affected by transportation costs and government support, or lack thereof.

The Forest Enhancement Society of B.C. has been a major supporter of biomass, and is willing to back sensible projects, Theriault says. “As long as the province of B.C. sees it as an efficient way of using the carbon tax money, I think we’re a winner, especially if you think about all the small northern towns that will lose jobs because of the downturn in forestry. These are the same people, and the same jobs. The skills are transferable,” he says. “This is how we can save the little towns like Quesnel, Williams Lake, 100 Mile House, Prince George, Williams Lake, you name it.”

Tsi Del Del Enterprises’ end goal is to take on all phases and all aspects of forest management, from initial harvest planning to silviculture and rehabilitation of burn areas to promote forest regrowth and sustainability of the local wildlife.

The diversification has so far brought stability to the logging company, which managed to stay active during the past summer when most loggers in the Interior took downtime as sawmills in the region announced closures or curtailments.

“The fact that Tsideldel First Nation has always been very proactive makes it so that it’s one of the first First Nations that’s going to reach the goal of touching every aspect of forestry as opposed to being a specialist of one phase. That diversification should bring stability to the company,” Theriault says.

“Our production has dropped a bit in the current downturn, about 20 to 25 loads, but Phil and his crew are trying to be innovative so that all employees are getting some kind of paycheque every two weeks,” Guichon says.

When all is said and done, the community-owned company’s mandate is to help create a stable future for the First Nation, and that means making long-term, sustainable decisions for its people and its forests. And that is what makes Tsi Del Del Enterprises the ideal forest steward. •

WHAT IS OPTIPELLET? OptiPellet is a one-day workshop focused on the current and future state-of-the-art in pellet production technology, including challenges and opportunities on the cutting edge of this side of the industry. It will offer a time effective and affordable learning and networking opportunity for those driving the future of pellet manufacturing in their operation.

OPTIPELLET IS FOR Pellet Mill managers and owners, process engineers, continual improvement managers, optimization staff, researchers, design consultants, government and other wood pellet industry stakeholders.

Exclusive attendance restricted to pellet industry professionals and sponsors only.

STRATEGIC PARTNER

OptiPellet is co-located with the 2020 WPAC AGM & Conference, and will be the only activity running on Sept. 21. Make the most of your time in Vancouver by registering for both events!

Rebecca Lewis I National Sales I 519-400-0332 I rlewis@annexbusinessmedia.com

Josée Crevier I Quebec Sales I 514-425-0025 I jcrevier@annexbusinessmedia.com

By Ellen Cools

In May 2019, FPInnovations and Resolute Forest Products commissioned a new thermomechanical-pulp (TMP)-bio plant in Thunder Bay, Ont. The plant, which can treat 100 metric tonnes of biomass annually, produces lignin and sugars that will be used to develop new bioproducts.

But where did the idea for a TMP-Bio plant initially come from and how does it work?

Over the past few years, FPInnovations had been working on processes to produce different materials and chemicals. One of these processes was the production of sugars from cellulose and lignin from trees, Jean Hamel, vice-president of industry at FPInnovations, tells Canadian Biomass

“One of the challenges of producing sugars is that you need to take the

biomass and physically separate the wood component to give you access to the enzymes so it can easily chew the cellulose and transform it into two types of sugars (C5 and C6 sugars), and then separate the sugars from the lignin,” he explains. “The cellulose and sugars are chemicals that represent about 90 per cent of the mass of the tree itself.

“We came up with a technology that we call the TMP-Bio process, which makes use of refiners to break and open the fibres, react the enzyme with the cellulose and then separate the sugars and lignin components, providing two streams of bio-sourced chemicals,” Hamel explains.

“A big part of the process is to make the reaction with the enzyme and

separate the products, and then clean up the two product streams to obtain the quality required for industrial and commercial applications,” he explains.

“What’s interesting is, if you look at how you make kraft pulp, what the kraft process does, it kind of dissolves the lignin around the cellulose, so the fibres remain intact,” he continues. “But in this process, we are doing the inverse – we are dissolving the cellulose and the lignin remains intact. The molecular structure of lignin we obtain from this process is closer to what you’d find in a tree than the kraft lignin. This is very interesting for the industry as both lignins have different properties, increasing the range of potential new product applications that the forest industry can produce.”

FPInnovations and Resolute Forest Products inaugurated the thermo-mechanical-pulp biorefinery in Thunder Bay, Ont., on May 27, 2019. Photo courtesy FPInnovations.

Initially, FPInnovations tested this process in a small-scale pilot plant in their facilities, using separate units to test different phases of the process. They used the results of these tests to design a larger scale plant as the process needs to be tested on an industrial scale and a continuous basis, Hamel says.

“What we had was all separated small-size units and not necessarily very practical to produce significant quantities to be tested by potential users. Also, it was not sufficient to provide us with good information about how a full-size plant would look and how much it would cost because we needed to test and optimize the operating parameters,” he explains.

In developing this technology, FPInnovations wanted to use pre-existing equipment or processes as much as possible.

In 2016, the organization began discussing the possibility of developing a TMP-Bio pilot plant with its members and partners, and started looking for a site. Eventually, they formed a three-year strategic research alliance with Resolute Forest Products. The partnership stipulates that FPInnovations is in charge of constructing and operating the plant, while Resolute hosts the plant at its Thunder Bay pulp and paper mill and supports the integration of the plant in their facilities.

Construction on the site began in September 2018. “It took about a year or two – eight months to build the plant, and then starting operations and commissioning,” Hamel says. “Now the plant produces sugars and lignin. We still have to do some fine-tuning, but we’re quite happy to have built the plant, as planned, on time and on budget, and we’re pretty happy with the outcome now.

“We have a lot of discussion and guidance working closely with Resolute to help us conduct the project, which consists of both the on-site process and product applications for the three-year duration of the project,” he elaborates.

Ten process units for the TMP-Bio process were installed in an area of Resolute’s pulp and paper mill that is no longer in use.

The project development, which ultimately cost $23 million, required co-

ordination from numerous supporting organizations. The federal government provided $5.8 million in funding to help accelerate the development of the plant, as well as production and commercialization of the green biochemicals derived from the TMP-Bio process. Other key players in the project’s development included the Ontario Centre for Research and Innovation in the BioEconomy (CRIBE), FedNor, the Northern Ontario Heritage Fund Corporation (NOHFC), the Thunder Bay Community Economic Development Commission and the Ontario Ministry of Natural Resources and Forestry. The Ministère de Forêts, de la Faune et des Parcs du Quebec and the Nova Scotia Innovation Hub also contributed to the research on potential applications of the process.

Once the plant was commissioned, FPInnovations and Resolute received an additional $2 million through Natural Resources Canada’s Clean Growth Program.

FPInnovations and Resolute are now approximately two years into the threeyear project, and have found the new TMP-Bio plant represents an important step towards opening up new markets for the forest products sector.

“For the last two years, we’ve been working on the applications of this process, and we have identified 15 potential applications,” Hamel says. “We have decided to go further, focusing on testing four or five of those potential applications.”

Those applications include using the two types of sugars produced from the process (C5 and C6 sugars) in the chemical supply chain to produce plastic chemicals.

“Right now, there’s a big demand around the world in terms of research and product development for making chemicals from these sugars instead of making them from oil-based products. So, there’s a new supply chain building and the chemists can use these chemicals and these sugars to make a different type of chemical, like succinic acid, and so on,” Hamel elaborates.

The lignin produced in the process can also be used in different applications, such as in resins. There is also the

potential to use both lignin and sugar in applications like creating animal feed additives.

Currently, a team of five researchers from FPInnovations work at the TMP-Bio plant full-time.

“This is not an industrial process; it is a demonstration plant that is operating, and not on a 24-hour cycle,” Hamel explains. “We start the plant for a few days and then we stop and we look at the results to do some modifications. That’s really what demonstration plants are for. It’s to test different operating parameters aimed at optimizing the plant for the next phase, which will be an industrial site.”

Testing the process and conducting experiments will allow FPInnovations to determine the best operating conditions, detect potential issues and make changes so the future full-size plant will have the best operations at the lowest cost. It also helps them evaluate potential risk; for example, the team wants to test reactor materials to see if there are any problems with corrosion.

“That’s why nearly all of the process development goes through that phase – so you can minimize your risk when you’re going full-size and commercial,” Hamel says.

The next phase for the plant will depend on which application is determined to be the most viable and the size of its market, as well as the strategy around product development.

As the process is commercialized, FPInnovations will play a supporting role. The organization’s job is to make technologies such as the TMP-Bio process as mature as possible and reduce risks, obtain more information about the capital and operating costs, and to understand markets and customers, Hamel explains.

The ultimate goal is to have one of the organization’s members construct and operate an industrial site and develop the new market.

Regardless of which company takes up the torch, it’s clear the TMPBio technology presents multiple opportunities in new markets, especially as countries around the world look to transition from fossil fuels to renewable resources and processes. •

By Maria Church

Tsay Keh Dene Nation has embarked on a bioheat project that aims to liberate its primary village located along the shores of the Williston Reservoir in northern B.C. from reliance on diesel generators. With support from Chu Cho Environmental – an environmental consulting company owned by Tsay Keh Dene Nation – the project aims to completely displace diesel consumption in the community.

The project will see sustainably harvested wood sourced from nearby forestry debris fuel a co-generation ORC biomass plant, creating an inexpensive heat and power source as well as permanent local jobs in the village of around 300 people.

The bioheat project is the second in Canada to be funded by Natural Resources Canada’s Clean Energy for Rural and Remote Communities (CERRC) program. The program’s goal is to reduce remote communities’ reliance on fossil fuels for heat and power. It would be the first system and project of its kind in B.C.

The project is just as much about community autonomy and selfdetermination as it is about practicality. Forestry biomass is plentiful in the Tsay Keh Dene territory, so much so that it is burned as waste, yet the village has been saddled with a fossil fuel for decades.

The community’s current four diesel generators run by provincial utility B.C. Hydro burn more than a million litres of diesel every year, shipped to the remote community via transport truck.

The Tsay Keh Dene Nation has a complicated history with B.C. Hydro, to say the least. In an op-ed that ran in the Vancouver Sun in 2016, former Tsay Keh Dene Chief Dennis Izony and UBC professor Hadi Dowlatabadi explained

the saga and decried the power imbalance between the small First Nation and the provincial utility.

More than 50 years ago the province built the massive W.A.C. Bennett hydroelectric dam near Hudson’s Hope in northern B.C. The dam flooded a forested valley in the traditional territory of the Tsay Keh Dene, removing the First Nation’s rights and title to that land.

In 2007, Tsay Keh Dene first proposed a bioheat project that would allow them to harvest and burn reservoir debris –logs that float to the surface in the dam reservoir. Project supporters at the time emphasised the same benefits touted today: energy independence, inexpensive and climate-friendly fuel, and local jobs. The proposal even won a $1-million award as part of B.C.’s Innovative Clean Energy competition.

BC Hydro blocked the project, instead forcing the community to build new, $3-million diesel generators funded by Indigenous and Northern Affairs Canada, Izony and Dowlatabadi state. In 2016,

when the op-ed was written, those 990kW capacity generators were already not meeting demand, causing blackouts during peak hours.

“Inadequate consultation and disrespect for First Nations was not excusable half a century ago; it should be criminal now,” the op-ed reads.

Today, after another decade of proven durability for bioheat technology, there are no more excuses left, says Chu Cho Environmental general manager Michael Tilson.

“Tsay Keh Dene’s project is about fundamentally shifting the energy landscape of a remote community that is currently reliant on diesel through intensive community driven effort that is focused on achieving the vision of a sustainable and prosperous future. A vision that is focused on preserving the natural environment and building capacity, pride, and resilience,” he says.

Tilson says the project is an early step in a long path towards self-determination, reconciliation and building Tsay Keh

Dene’s own unique version of prosperity.

“This project will be a powerful centrepiece for a remote community that will endure for decades. Tsay Keh Dene views the development of green infrastructure and clean energy projects as an opportunity to participate in the energy cycle of the natural environment,” he says.

In 2017 Tsay Keh Dene Nation leadership asked Chu Cho Environmental to reinvestigate the idea of installing a biomass system in the community and to begin taking concrete steps towards making it a reality.

Chu Cho Environmental partnered with Prince George-based Clean Energy Consulting to design an ideal system for the community. Tim Hoy, president of Clean Energy Consulting, said it was important the system they chose would suit the community’s needs.

“Particularly in First Nations communities, what ends up happening in the community is decided by a

bureaucrat in Ottawa. And it’s typically the lowest-cost, minimally viable project,” Hoy says. “As a result, the communities are constantly plagued with these assets that don’t operate properly, that weren’t necessarily commissioned or meet the spec, and they become a burden.”

In contrast, Clean Energy Consulting’s mission was to first determine the community’s capacity – including existing

infrastructure and skilled labour. They also defined what could realistically be achieved in terms of infrastructure upgrades and staff training.

A final piece of the puzzle was to factor in the community’s desire for growth and development. While the costs of operating diesel and biomass systems are roughly equivalent today, unlike a diesel system where fuel costs account for roughly 50 per cent, a biomass plant’s fuel costs are closer to 10 per cent and that money stays in the community, Hoy explains.

“The cost of energy, if you look at it over 20 years, ends up being quite flat and not that dependant on the amount of production,” he says. “If we make twice as much energy it only costs you a fraction more. So that really creates the capacity in a community for an energy system that, once it is built – and we’re calling it foundational infrastructure – now, if the nation wants to build a swimming pool or a rec centre or a pellet plant or sawmill, the costs of producing enough energy to operate those assets is negligible.”

A spinoff but essential benefit of a biomass plant is the creation of jobs in the community to both build the infrastructure and service the equipment, as well as permanent harvesting jobs to collect and process the reservoir log debris.

Currently, that debris – some 100,000 cubic metres of wood each year – is collected and burned in massive piles in order for BC Hydro to maintain navigable waters in the reservoir. Tilson says it’s a logical step for the Tsay Keh Dene to harvest that fuel for its power and heat.

“Tsay Keh Dene territory is vast, it’s full of immense forest reserves, it’s been

heavily harvested and all those residuals are burned every year. There are tens of thousands of cubic metres in any given month available for an energy system. It just makes sense to close the loop on an economy where you are wasting resources,” he says.

Once the community-needs picture was complete, the team landed on plans for a modern combined heat and power (CHP) biomass ORC (organic Rankine cycle) dualcombustor system, likely around 1.2 MW.

The dual combustors will be burning the biomass to create electricity and heat, while the ORC converts heated thermal oil into electricity.

“The ORC system is very reliable and needs very little maintenance. These systems have run for 10 years or more without being taken down or having anything done to them. And there are about 400 of them running in Europe,” Hoy says.

The combustors, which are relatively low tech, also allow for a more flexible

fuel specification when compared to, for example, a wood gasification system. This is important since Tsay Keh Dene will be sourcing fuel from low-quality reservoir debris as well as harvest residuals from local forest licensees.

“If you throw rocks in there, you don’t want to be doing that, but the system will tolerate it,” Hoy says.

Having two combustors allows the community to control the heat output, turning one off when it’s not needed during the summer months, or when it’s time for regular servicing.

The electricity produced from the biomass plant will then flow into a roughly 2 MWh battery system. The battery allows for system downtime, and also supplies extra energy to the system during peak demand when the biomass system can’t produce heat fast enough to meet needs. A 1.2-MW ORC system along with a battery will be enough energy to serve the 300-person village, as well as foreseeable growth for the next 10-15 years.

The primary selected vendors for the

project are CAW (Classen Apparatebau Wiesloch GmbH) for the thermal oil plant and Turboden for the ORC turbine generator.

With CERRC funding in hand and a solid system design from Clean Energy Consulting, the project team is working through final engineering requirements and commercial agreements. Construction is slated to begin in late 2020 or early 2021. The system is expected to be fully operational in 2022.

An ongoing challenge has been working with policy makers and the provincial utility to green light a change to a utility system that has been in place for decades.

As with any bureaucratic change, they know it will take time, Tilson says. “It’s a long-term transition to have a community running on a biomass system that is, in and of itself, sustainable,” he says.

But Tsay Keh Dene Nation has been waiting on this energy independence for arguably a half a century. It’s time. •

By Maria Church

Fall may be the most beautiful time to visit northern New Brunswick, as the Acadian forest’s unique blend of softwood and hardwood trees burst into spectacular shades of red, orange, and yellow.

For those in the business of trees, it’s perhaps the best time to appreciate the impressive diversity of New Brunswick’s forests, which cover more than 80 per cent of the province’s land mass. The timing couldn’t have been better for the Wood Pellet Association of Canada’s 2019 post-conference tour to explore New Brunswick’s pellet and sawmill operations. Representing Canadian Biomass, I joined a group of just over 20 wood pellet stakeholders from North America and Europe on a bus tour of the province’s northern wood operations over two days last September.

The tour brought us to the various operations of four companies in the New Brunswick pellet world – H.J. Crabbe & Sons, Groupe Savoie, Shaw Resources, and pellet newcomer Grand River Pellets – as well as a quick stop at the Port of Belledune where Eastern Canada’s pellet plants ship to international markets.

Our first stop of the trip was in the small town of Florenceville-Bristol, N.B. – home to H.J. Crabbe & Sons’ random dimension sawmill and two-year-old pellet plant.

The third-generation family-run company was established in 1946. Today, the company owns 16,000 hectares of freehold forest land and has a woodlands division looking after planning, harvesting and silviculture of its SFI- and PEFC-certified sustainable forests.

Residuals from the adjacent 30 mmbf sawmill directly feed the pellet plant, which is currently producing 16,000 tonnes of premium grade softwood pellets for the heating market. About 90 per cent of the pellets are sold bagged in one-tonne bags, with the remaining 10 per cent sold in bulk.

A Player Design burner fuelled by bark provides heat for the plant’s drum dryer. A newly-installed Kahl 10-tonne pellet mill – the largest Khal manufactures – is producing about eight tonnes of pellets an hour. The line finishes with a fully-auto-

Canada’s newest pellet facility, Grand River Pellets, in Saint Leonard, N.B., has a 100,000 tonne-per-year capacity of industrial and bagged wood pellets.

mated Premier Tech bagging, palletizing and wrapping system.

The team at the recently-commissioned Grand River Pellets in Saint Leonard, N.B., was our second host on Day 1 of the tour.

All fibre used for the 100,000 tonne-per-year pellet plant is secondary product from Northern New Brunswick and Maine forest products manufacturing facilities. The plant was ramping up production in the fall and staff expected it to meet its capacity by the end of 2019.

Three infeed bins feed the plant, allowing it to blend hardwood and softwood fibre. Martin Bokesch, technical leader at Grand River Pellets, said they are continuing to test the moisture content and durability of the pellets to find the right mixture of fibre, which determines pellet size and quality.

Five Promill pelletizers working at full capacity will allow the plant to produce about 15 tonnes an hour. The plant will be able to produce both industrial and bagged retail grade pellets. Grand River Pellets is certified under the Sustainable Biomass Program.

Day 2 began with a trip to Groupe Savoie’s headquarters in Saint-Quentin, N.B., where they operate a hardwood sawmill, pallet plant, component plant and pellet plant. A quick tour through the sawmill, pallet and component plants explains the pellet plant’s 90 per cent intake of hardwood fibre including hard and soft maple, white and yellow birch and aspen.

Groupe Savoie’s vice-president of sales and development, Jonathan Levesque, said the pellet plant purchases some softwood fibre, amounting to between 10 and 20 per cent of their total mix, due to challenges pelletizing pure hardwood.

Three infeed chambers separately contain the softwood, mixed hardwood and bark, the latter fuelling a Wellons burner providing heat to the triple pass MEC dryer. Dried fibre is then treated to a Schutte Buffalo hammer mill before heading to one of three Andritz pellet mills. After screening and cooling, pellets are bagged, placed on skids and wrapped via a Premier Tech bagging line.

Groupe Savoie’s hardwood pellet plant has been running for nine years producing both industrial pellets shipped abroad and residential pellets for the local heating market.

A quick stop at the company’s nearby head office gave us a snapshot of another company affiliated with Groupe Savoie: Bio-

mass Solutions Biomasse (BSB). Founded in 2011 by Groupe Savoie owner Jean Claude Savoie and Malcolm Fisher, owner of Compact Appliances in Sackville, N.B., BSB promotes biomass heating systems throughout Eastern Canada.

BSB distributes OkoFen, Herz, Binder and Mabre biomass boilers. The company was also the first in Canada to operate a bulk delivery pellet truck to supply their customers, including a local church, the Saint-Quentin town hall, Grand Falls General Hospital, and the Collège communautaire du Nouveau-Brunswick’s Shippagan campus.

Up next was Shaw Resources’ industrial pellet plant in Belledune, N.B. The plant produces 100,000 tonnes per year of industrial pellets for U.K. utility Drax, shipped out of the nearby Port of Belledune.

The plant’s fibre mix includes both hardwood and softwood, with bark fuelling the plant’s new indoor drum dryer from Player Design, installed in October 2018. Operations manager Robert Boyd says the new dryer will increase their drying capacity.

Four Andritz pellet mills produce about 16 tonnes per hour of pellets, which are cooled via a Milpro cooling system and screened before heading to one of three indoor storage silos. Pellet moisture content is continuously monitored via a MoistTech pellet moisture analyzer in addition to the regular operator testing process.

The 11-year-old pellet plant runs two shifts, 24/7, with 10 operators during the day and three at night. Watch a short video tour of Shaw Resources Belledune pellet plant on Canadian Biomass’ website, www.canadianbiomassmagazine.ca.

Capping off the tour was a stop in to meet the folks at the Port of Belledune, less than five minutes from Shaw Resources’ plant.

We got an inside look at the port’s wood pellet storage facilities, which includes a large dust collection system that is active during pellet handling.

Built in 1968, the port today handles 24 products. In 2018 they shipped 223,948 tonnes of biomass. •

WPAC is already in the process of planning for this year’s postconference tour in B.C. Space is limited on these tours and spots fill quickly on a first-come-first-served basis. Find upcoming news on the WPAC conference at www.canadianbiomassmagazine.ca.

By Harry “Dutch” Dresser

In September 2018, the Wood Pellet Association of Canada (WPAC) initiated a project with the goal of increasing domestic use of Canadian wood pellets in central heating plants. As conversations were held and research was done, a number of impediments to achieve that goal became clear. Chief among the reasons for the slow adoption of pellet-fired central heating practices?

The very limited availability of efficient, user-friendly boilers and furnaces in Canada to serve small to mid-size buildings – the buildings most likely to find pellet central heating advantageous.

There is no domestic manufacturer of these appliances, as there is no significant Canadian market. A few boiler models from a couple of Europe’s largest manufacturers are available in Canada. However, there are many sophisticated small- to mid-sized pellet-fired boilers and furnaces with various price points heating other parts of the world. Most of these appliances are manufactured in the EU. Importing and distributing this equipment in Canada is difficult and expensive, and the potential early market is small.

The manufacturing provision found in CSA B51 section 4.10.1.2 is the biggest single deterrent to importing and distributing this equipment. It stipulates, “Manufacturers in countries other than Canada that manufacture and export boilers and pressure vessels to Canada shall ensure that all boilers and pressure vessels are stamped with the appropriate ASME Code product certification mark and registered with the National Board.” CSA B51 is integral to the boiler regulations of all of Canada’s provinces and territories.

The vessels in many EU manufactured pellet-fired boilers are manufactured to the international standards of the European Union – P.E.D. standards (EN 3035, EN 12953) – not the ASME standards

most common to the U.S. and Canada. Redesigning and manufacturing pressure vessels to fully different design specifications is too expensive for EU companies that would otherwise enjoy supporting a new marketplace in Canada.

The chief boiler inspector and the ministers of one Canadian province have given this dilemma serious attention. Their story follows.

In the 1980s, several attempts were made to heat government buildings in Prince

Edward Island with wood chip boilers. To avoid the power engineering staffing requirements for such boilers in the province, these boilers were installed open to the air. But within a few years these boilers were shut down over operational and maintenance issues, some due to the corrosion inherent in systems that are open to the air.

In 2012, two companies approached the province wishing to supply heat with EU-built low-pressure biomass heating plants. The applicants promised to operate and maintain these heating plants and

to provide heat at prices noticeably lower than heat produced by burning heating oil. They further ensured that the biomass burned would be harvested sustainably. These boilers were installed and operated, but, as before, they were installed open to the air to avoid constraining regulations, including the manufacturing requirement found in CSA B51.

The chief boiler inspector in the province, Steven Townsend, knew that systems installed open to the air would be subject to problems associated with corrosion, and he knew the rules forced such installation for these boilers. With the permission and support of the provincial government, in April 2012, Townsend undertook an investigation into the construction of low-pressure boilers built to the European Pressure Equipment Directive (P.E.D.) standards.

Townsend’s research included three trips to Austria. During those trips, he visited boiler manufacturers’ facilities, operating biomass boiler installations and authorized testing laboratories. Townsend gained an understanding of the P.E.D. codes and standards, exposure to the level of third-party inspection offered by testing laboratories, and reviewed the quality control programs of specific manufacturing facilities.

Townsend visited low-pressure biomass heating plants in Austria that operated with guarded controls at pressures from 60-90 psi. He found the plants to be operated, monitored, and maintained well by factory-trained personnel.

Based on his research and European experience, including first-hand exposure to fabrication, testing, and operation of European low-pressure steel biomass boilers, Townsend determined that pressure vessels fabricated to P.E.D. standards provided an acceptable level of public safety. In his expert opinion, the boilers had a level of safety comparable to that provided by the ASME standards already in place.

Because time for research was limited, Townsend proposed boiler regulation amendments to the province that would permit the installation of welded steel hot water biomass boilers built to P.E.D. standards (EN 303-5 for boilers up to 300kW, EN 12953 for boilers greater than 300 kW output) restricting operating pressures to 30 psi while experience was gained with the systems.

In proposing regulatory changes for the province, Townsend considered four aspects of heating plants using European biomass heating equipment: operations and maintenance of the heating plant, the quality of the European supplied equipment, and the facilities’ safety.

To ensure safety as the province gained a better understanding of these European-manufactured biomass-heating plants, Townsend proposed amendments to the province’s boiler regulations to allow for the installation of European boilers built to P.E.D. standards. These amendments included a training program review, carbon monoxide detection, free standing buildings for larger systems, burn back protection, pressure rise on safety valve activation, and plant dust control. Another amendment for non-ASME manufactured boilers was a reduced maximum operating pressure, currently 30 psi. This is reportedly likely to increase to 60 psi soon. These proposals became law.

Today a schedule in the Prince Edward Island Boiler and Pressure Vessel Regulations makes it lawful to install European low-pressure steel hot water boilers fabricated and tested to P.E.D. standards (EN 303-5, EN 12953) and outlines the associated regulations. The regulations give the chief boiler inspector the right to confirm proper manufacture and suitable quality control systems.

In 2013, the safety of thermal storage tanks (buffer tanks) fabricated to P.E.D. standards were similarly considered for inclusion in systems with P.E.D. boilers and permitted for installation in systems not exceeding operating pressures of 30 psi.

As of September 2019, P.E.I. had 23 biomass heating plants operating in the province with six more scheduled to come on line in 2020. Three of these plants supply small district heating systems.

Townsend is frequently asked two questions: Is P.E.D. low-pressure biomass equipment safe? And, with the additional installation and operational regulation requirements outlined in the Power Engineering and Boiler Pressure Vessel Regulation, is an equivalent level of safety achieved? His answer to both is an emphatic yes.

More technical details about the nonASME schedule in the Prince Edward Island Boiler and Pressure Vessel Regulations can be found in a powerpoint presentation Townsend prepared for WPAC’s 2019 conference and AGM, at www.pellet.org/wpac-agm/presentations. It can also be found in the province’s boiler regulations at tinyurl.com/vyv3y2h. •

Harry “Dutch” Dresser is the project lead of WPAC’s Domestic Wood Pellet Heating Project.

By William Strauss

Global wood pellet markets have had significant growth in the past decade. Between 2012 and 2018, the global wood pellet market has experienced growth rates averaging 11.6 per cent annually, from about 19.5 million (metric) tonnes in 2012 to about 35.4 million tonnes in 2018. From 2017 to 2018 alone, wood pellet production increased by 13.3 per cent.

The heating pellet markets are distinct from the industrial wood pellet markets. However, the sectors influence each other. Within the heating pellet sector, there are two sub-sectors: the bag pellet markets (for pellet stoves) and the bulk pellet markets (for pellet fuelled central heating systems).

The demand for heating pellets is influenced by policy, weather, and the

price of other heating fuels.

Policy that supports the heating pellet markets is based on the fact that pellet-fuelled appliances lower carbon emissions, support local jobs in forestry and pellet production, and do not pollute with wood smoke.

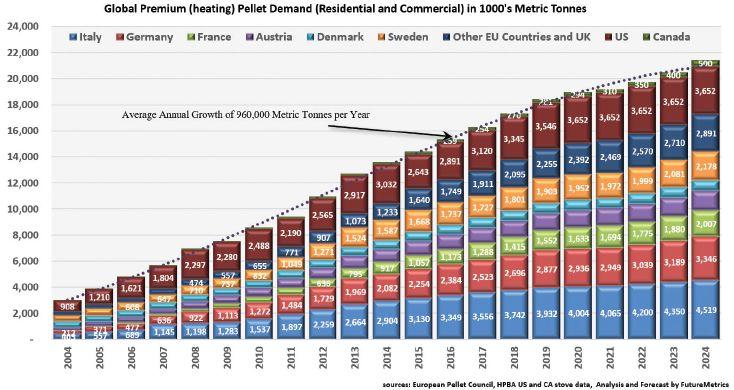

The heating pellet sector is substantial and is expected to grow significantly. Chart 1 shows the historic global demand and FutureMetrics’ forecast demand for heating pellets under current policy.

The first requirement for the development of a pellet heating sector is to have a sufficient annual demand for heat (heating degree days). Then, the economic benefits of pellet fuel versus alternative heating sources must be tangible. In some locations, pellet fuel is the lowest-cost alternative. However, in almost all locations, government support for the capital costs of new systems is a critical component of healthy growth.

In most jurisdictions, the industrial wood pellet market is driven by carbon emissions mitigation and renewable generation policies. Many countries have promulgated policies to support decarbonization and/ or the use of renewable energy for power generation; other countries are expected to follow. Those policies underpin the industrial wood pellet sector. Industrial wood pellets are a low-carbon, renewable fuel that easily substitutes for coal in large utility power stations.

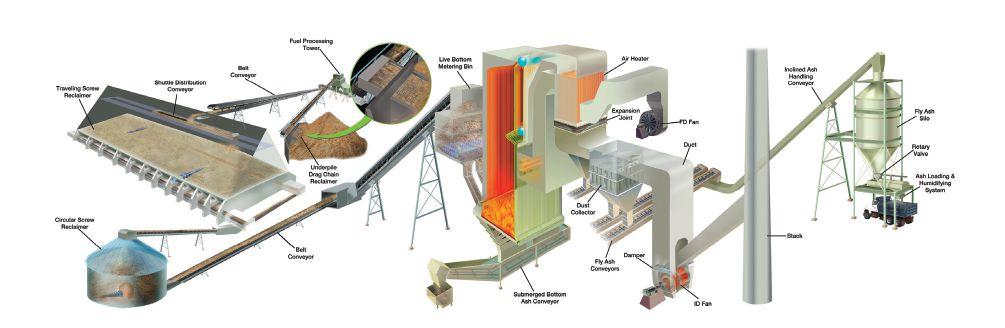

Pellets can be substituted for coal in two ways: a full conversion or co-firing. During a full conversion, an entire unit at a coal station is converted from burning coal to burning wood pellets. This requires modifications to pulverizers and potentially the burners feeding the boiler. Using any biomass-derived pulverized fuel in larger ratios also requires that the primary combustion air that carries the pulverized fuel to the burners be tempered to a lower temperature than is typical for 100 per cent coal. Building heat exchangers to carry the combustion air heat to the feedwater system, so as to not lower the power plant’s efficiency, is an unavoidable but relatively modest cost. Co-firing is the combustion of wood pellets along with coal in a coal power plant. It can be one of the most efficient ways to meet renewable energy and/or carbon mitigation targets. At lower co-firing ratios of wood pellets, minimal modifications to existing pulverized coal facilities are required. In fact, at lower blends (under approximately seven per cent) of wood pellets, almost no modification is required.

Recent advances in “advanced”

waterproof pellets made via steam exploded thermal treatment technology will significantly lower the required capital costs for modifications to the power station and will eliminate the need for dry fuel storage solutions. Using advanced pellets will allow higher co-firing ratios for lower cost than for traditional wood pellets.

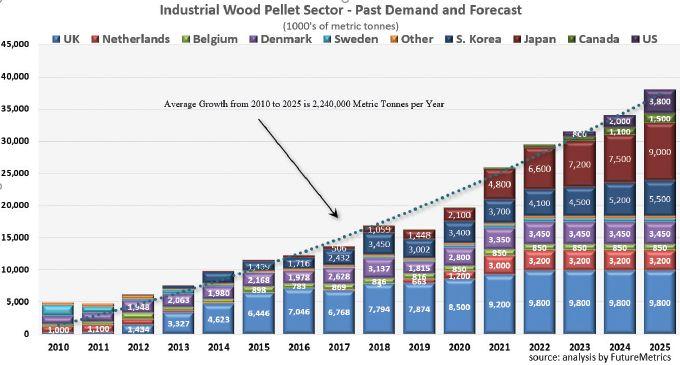

Chart 2 shows the historical demand and FutureMetrics’ demand forecast for the industrial wood pellet markets. The aggregate demand in 2019 is estimated to be about 16.2 million tonnes. That is the equivalent of a 55,000-tonne panamax vessel every day of the year. Note that this demand forecast is based on current policy. The drop fro 2018 to 2019 is due to lower demand in South Korea and Denmark. This is expected to recover and surpass those levels by the end of 2021.

As shown in Chart 2, future demand in the U.K. and EU is expected to plateau by 2021. However, major growth is expected in Japan and South Korea until 2024. From 2010 to 2025, the average annual increase in demand for industrial wood pellets is estimated at about 2.3

million tonnes per year.

This forecast, as noted above, is under current policy. Policies are likely to evolve as the impacts of climate change accelerate. FutureMetrics expects even the U.S. to have a policy for carbon emissions reduction by the mid-2020s.

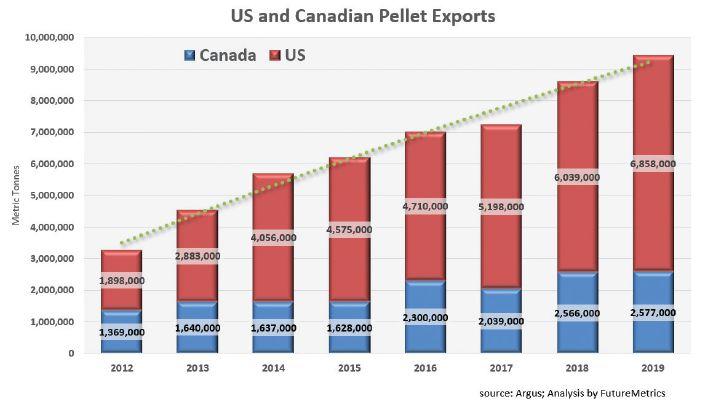

North America currently dominates the global supply of industrial wood pellets.

See Chart 3. The industrial wood pellet market began in Europe and, with the evolution of the Drax power stations’ conversion from coal to pellets, grew significantly in the U.K. The ability to source abundant and competitively priced wood fibre in western Canada via sawmill residuals enabled B.C. to lead the way.

The first trans-oceanic bulk shipment of wood pellets left Prince Rupert, B.C., in 1998, 22 years ago. FutureMetrics’ partner and operations expert, John

Every year, millions of tons of industrial waste are turned into millions of dollars of reusable materials.

CPM and Di Più Systems help make that happen.

We’ve joined forces to bring you the world’s best mechanical and hydraulic briquetting technology.

Together, we’re taking the fossil out of fuel.

Swaan, entered into the first off-take agreement for bulk pellet delivery from North America. Swaan produced pellets at what is now the Pacific BioEnergy pellet plant, which he founded in Prince George, B.C., and he loaded the ship, the Mandarin Moon, in Prince Rupert, B.C., on Feb. 9, 1998. That was the beginning of the transoceanic trade in wood pellets.

As demand grew, the U.S. southeast came into play. Fram Renewable Fuels (originally 130,000 tonnes per year (tpy)) was founded in 2007 in Georgia, and Green Circle (originally 550,000 tpy) started in 2008 in Florida.

Since those early days, North American supply has grown dramatically. As demand has materialized in Japan and South Korea, new pellet production capacity has followed in fibre-rich areas in southeast Asia. The Baltic states (Estonia, Latvia, and Lithuania) have also become major producers of wood pellets.

Vietnam production has also increased over the past five years.

FutureMetrics has estimated the historical delivered (CIF) price of wood pellets from international trade data. The value and quantity of imported pellets reflects the actual prices that buyers are paying for the fuel. Most pellets are traded under long-term contracts. Some pellets (probably less than 15 per cent of total trade) are traded on the spot market.

Argus reports the weekly spot price of pellets. However, the spot price is quite volatile compared to the overall prices paid for imported pellets because the spot price reflects short-term supply and demand imbalances. If the market is in a state of excess supply, prices fall. If the market in a state of excess demand, prices rise. Since the spot market is a small portion of overall pellet trade, supply and demand imbalances have amplified impacts on the spot market. Long-term off-take agreement prices are stable and change only due to the terms of the contract.

FutureMetrics’ estimates the CIF prices and market shares by major suppliers for the U.K., Japan, and South Korea. Note that monthly data is somewhat volatile in part due to how the data is gathered and the number of shipments per month for any given month. The trade weighted average price and the trend lines help to see through the volatility. Even with those issues, the estimated pellet prices are far less volatile on a three-month rolling average than the spot prices.

The price of pellets will be heavily influenced by long-term contracts for wood pellets. In fact, as noted above, the volatility of the spot market increases because the majority of the market is under long-term contract. Since such a large percentage of the market is already under long-term take-or-pay contracts, when the market is in periods of excess demand or excess supply, the majority of the market correction has to take place within the 10-20 per cent of the

total market that is traded on spot. In the long run, the contract price and spot price should converge around a market equilibrium price.

The intrinsic costs of producing and delivering pellets, including typical profit margins, will set the market prices for long-run supply contracts.

Many of the forecast model’s modules use oil prices as a significant source of cost uncertainty.

Harvesting and transporting wood to pellet mills, conversion to pellets, transport logistics by truck, rail, and ship, all contain a significant exposure to petroleum costs (such as diesel and bunker fuels). FutureMetrics utilizes the United States Energy Information Administration’s (EIA) forecast for oil prices (West Texas Intermediate or WTI).

Historical pellet ocean shipping freight rates provide insight into the expected long-term market clearing rates for typical-sized vessels from various pellet export terminals. FutureMetrics does not try to forecast the short- to medium-term drivers of shipping cost volatility.

The methodology of estimating expected future CIF prices involves developing independent forecasts for each of the main components of pellet costs: wood costs delivered to the pellet mill; pellet mill conversion costs (excluding wood costs); pellet producers’ expected margins (using EBITDA per tonne as the model input); inland transportation from the mill to the port, and port storage and loading costs; and shipping.

Expected EBITDA/tonne is based on historical data from the two publicly traded producers (Pinnacle and Enviva) and from FutureMetrics data based on due diligence analysis on existing pellet plants.

Based on a number of assumptions, the forecasted prices for the next 10 years are shown in Chart 4.

Find more charts and analysis in the online version of this article at www.canadianbiomassmagazine.ca. •

William Strauss, Ph.D., is the president of FutureMetrics. www.futuremetrics.com.

Edge Innovate is set to debut two new high-capacity waste shredders at CONEXPO 2020 in March: the VS420 and HS750. The Edge HS750 offers operators a high-capacity, horizontal, slow-speed shredder that combines impressive throughput, the ability to withstand difficult-to-shred materials and superior resistance to non-shreddables. A 42inch diameter compression top feed roll aids in the delivery of material to a 42-inch tip diameter solid steel downturn rotor which has been designed to absorb heavy impacts and deliver high throughput. Potential for rotor overload or material bridging is reduced via an intelligent material management system that ensures the efficient delivery of ma-

terial to the chamber. Meanwhile, the Edge VS420 is a high-capacity, high-torque twin shaft shredder that is ideal for the processing of a large array of materials including green waste, MSW, C&D waste, biomass and end-of-life tyres. www.edgeinnovate.com

In a move designed to bring unparalleled versatility to its line-up of dust suppression equipment, BossTek has introduced an optional Variable Frequency Drive (VFD) system that allows users to adjust air flow to suit a broader range of applications and working environments. Driven by customer input from a number of different industries, the new VFD system reduces the need to purchase or rent differ-

ent models to match the machines’ output to specific project requirements, delivering greater flexibility and reducing the total cost of equipment ownership. The VFD control will be available via a simple dial or remote control on three of the company’s DustBoss models: the DB-30, DB-45 and DB-60. All three use specialized nozzles and a ducted fan design to atomize the water flow into droplets 50-200 microns in size, which is the optimum for most dust control applications. Matching the droplets to the most common particle sizes delivers the greatest opportunity for them to collide and fall to the ground.

www.bosstek.com

A new conveyor belt cleaner has been designed with an innovative method of holding the urethane blade in place without the need to mill any slots for holding pins. The QC1+ Belt Cleaner from Martin Engineering can be cut to length to fit virtually any application, reducing the need for customers to stock multiple blade sizes to

accommodate different belt widths. Operators simply trim the blade to the desired size from the stock nine-foot length to match the material path, slide in the blade holders and lock them in position. The new blade can be retrofitted to virtually any Martin main frame and most competing designs.

The mainframes on the QC1+ are three-piece assemblies, with a square centre section and a torque tube sliding into each end. The tubes are formed from high-strength steel and engage in the corners of the square main frame. They transmit the torque from the tensioner through the tubes and into the main frame to maintain blade tension. www.martin-eng.com

Peterson Pacific has introduced the Peterson 1710D horizontal grinder to its product line.

The 1710D’s large feed opening measures 54 x 27 inches. When boosted by Peterson’s high-lift feed roll, the feed opening’s maximum lift of 41.5 inches can tackle the largest of feedstock, and allows excellent accessibility to the rotor for maintenance. The 1710D horizontal grinder is equipped with a

Caterpillar Tier IV C9.3B 455-hp engine, or an optional, export-only C9.3B Tier III, 415-hp engine. At 46,500 pounds, it is one of the lightest of Peterson’s grinder series and is easily transportable.

The 1710D also features Peterson’s patented Impact Release System, to protect the machine against ungrindable materials, a feature unique to Peterson horizontal grinders. It also features a quick-change multiple grate system, making it easy to customize grate configurations.