The market hunter

GOOD TO GO.

Vision | To be globally recognized as a superior provider of aviation maintenance by being a forward-looking employer. Notre Vision | Être reconnu mondialement comme un fournisseur supérieur de maintenance aéronautique en étant un employeur tourné vers l’avenir.

27 ATAC Report Regional aviation threatened UPFRONT BACK

6 Leading Edge Canadian airports turn to tariffs for growth

8 On the Fly WestJet expansion, BCIT gas turbine, Leonardo AW09 engine

12 Alternative Approach Long live the Queen of the Skies

13 Drone Report Preparing strategies for air taxi commuters

FEATURES

28 Marketplace

30 On final Airspace incursions of surveillance balloons and internationa law A

14 SPONSORED CONTENT: CITIZEN TIME

The grace and advanced function of modern mechanical and quartz timepieces BY

PHIL LIGHTSTONE

16 THE MARKET HUNTER

Boutique carrier Porter Airlines’ loveable raccoon mascot enters the mainline BY DAVID

CARR

20 FACING THE LUXURY TAX

Technical challenges remain for buyers, but mostly for aircraft vendors, lessors and importers BY STEVEN SITCOFF 22 RETHINKING

CANADA’S AIR TRAVEL SYSTEM

After months of chaos and disruption, has the Canadian commercial aviation industry learned its lesson BY JOHN

GRADEK

COVER PHOTO:

Porter Airlines and Embraer executives in Brazil celebrate the delivery of the first two E195-E2 jets destined for North America, which will see Porter provide a new strategy for economy class travel.

READER SERVICE

Print and digital subscription inquires or changes, please contact Serina Dingeldein, Audience Development Manager Tel: (416) 510-5124 Fax: (416) 510-6875 sdingeldein@annexbusinessmedia.com Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

EDITOR

Jon Robinson jrobinson@annexbusinessmedia.com 647-448-6188

FLIGHT DECK

David Carr, Kuan-Wei Chen, John Gradek, Scott Henderson, Phil Lightstone, Carroll McCormick, Steven Sitcoff NATIONAL ACCOUNT MANAGER Mena Miu mmiu@annexbusinessmedia.com • 416-510-6749

ACCOUNT CO-ORDINATOR Barb Vowles bvowles@annexbusinessmedia.com • 416-510-5103

MEDIA DESIGNER Curtis Martin

GROUP PUBLISHER AND VICE PRESIDENT OF SALES Martin McAnulty mmcanulty@annexbusinessmedia.com

PRESIDENT/COO Scott Jamieson sjamieson@annexbusinessmedia.com

WINGS MAGAZINE

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5 Tel: 519-428-3471 Fax: 519-429-3094 Toll Free: 1-888-599-2228

Printed in Canada ISSN 0701-1369

PUBLICATION MAIL AGREEMENT #40065710

Published six times per year (Jan/Feb, Mar/Ap, May/Jun, Jul/Aug, Sep/Oct, Nov/Dec) by Annex Business Media

SUBSCRIPTION RATES

Canada – 1 Year $ 34.50 (plus GST - #867172652RT0001)

USA – 1yr -$ 78.50 CDN (USD $60.50)

International – 1yr - $90.50 CDN (USD $69.50) Occasionally, Wings magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office privacy@annexbusinessmedia.com • Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission.

©2023 Annex Business Media All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

Annex Business Media brands focused on Canadian aviation and aerospace include Wings, Helicopters and UAV Canada, as well as the Careers in Aviation Expo and Directory, Aerial Firefighting Guide and the MRO Directory. Annex is the publishing partner of Canadian Owners and Pilots Association, providing essential news and market content through COPA Flight, COPAnational.org and Canadianplanetrade.ca.

By Jon Robinson |

Disrupting a virtuous circle

Canadian airports are turning toward higher tariffs to fund growth

The credit rating agency DBRS Morningstar on March 6 released an analysis titled Rising Aeronautical Fees and the Unsubsidized Nature of Canadian Airports emphasizing, that in the absence of predictable government subsidies or other funding sources, tariff increases appear to be a necessary move for Canadian airports. The global credit ratings business continues to explain tariffs are probably the only option left for Canadian airports to improve cash flows and reignite future growth.

The report notes that these potential further increases in aeronautical fees could gradually erode Canadian airports' relative competitiveness against U.S. peers. DBRS also feels the pricing power of major Canadian airports will remain largely protected by what the global rating business describes as their “monopolistic status” and “resilient demand” for access. DBRS explains that while airports in both Canada and U.S. operate under some forms of cost-recovery mandates, U.S. airports have had the benefit of substantial federal contributions during the Coronavirus pandemic.

DBRS notes many Canadian airports increased tariffs and fees during the pandemic, including Toronto Pearson which boosted an improvement fee by $5 to $30 for departing passengers and by $4 to $6 for connecting passengers in early 2021. Pearson then further increased these fees by $5 and $1, respectively, on January 1, 2023; in addition to increasing aeronautical tariffs by three per cent in 2021, three per cent in 2022, and four per cent in 2023.

Canadian airports have been under elevated pressure to raise fees, according to DBRS, based on the combined effect of the increased leverage during the pandemic and

Transport Minister Omar Alghabra in mid-2021, outlines two initiatives totalling $12 million to support Ottawa International, including its light rail transit project.

the unsubsidized and not-for-profit nature of the Canadian airport business model. The ratings agency notes this pressure will persist under the model until an airport is able to grow/rebuild traffic and match the designed capacity of facilities, which were developed with borrowed money. DBRS also notes the non-profit nature of Canadian airports means a large portion of capital expenditures must be financed through external funding sources.

DBRS points to data from the Canadian Airports Council showing domestic airports collectively added $3.2 billion in debt during the pandemic, not to meet any growing demand but mostly to protect liquidity and

TOP DATA BURSTS… in this issue

1. Air Canada started 747 flights in spring 1971. P. 12. 2. It is estimated over $1 billion in transactions have been cancelled because of the Luxury Tax. P.20. 3. CTA has a backlog of more than 36,000 passenger rights appeals. P. 22 4. EPS MobileMic electric fuel bowser in about 20 minutes can charge an e-DA40 . P.24. 5. About 1,000 rounds in 1998 wer used in a failed effort to down a Canadian weather balloon. P. 30

existing operations because of the lack of revenues. Prior to the pandemic, Canadian airports had generally followed a volume-maximization strategy, explains DBRS, because they are not for profit and also because increasing tariffs was not always necessary.

Keeping aeronautical rates low has been important to retain and attract airlines, explains DBRS, with some Canadian airports previously freezing aeronautical rates for years and/or set out fixed-fee programs to encourage airlines to add more routes and put more passengers through their facilities.

Before the pandemic, DBRS points to how the airport sector was relatively stable, with passenger volumes growing at a steady pace, showing resilience against economic downturns as capacity forecasting and project planning were relatively straightforward. Under this scenario, management focused on expanding facilities just in time to meet future demand. But DBRS notes the pandemic disrupted this “virtuous circle”.

This caused long-term erosion to the debt-per-enplaned-passenger ratio, explains DBRS, that will likely reduce the capacity of airports to take on additional debt. DBRS states many Canadian airports cancelled or reduced their capital projects, which will need to be restarted. As a result, DBRS states tariff increases seem to be a necessary move for Canadian airports to improve cash flows and reignite growth.| W

PHOTO: ALEX TÉTREAULT

ON THE FLY

THE LEAD

WESTJET ANNOUNCES LARGEST NETWORK EXPANSION FROM EDMONTON IN AIRLINE’S HISTORY

WestJet in mid-February outlined plans for increased transborder connectivity from Edmonton International Airport, with new non-stop service to Minneapolis and Seattle, as part of its 2023 summer schedule. In addition, WestJet explains its 2023 summer schedule from Edmonton will revitalize the city’s domestic connectivity from coast-to-coast with the airline unveiling new routes from Edmonton to London, Moncton, Charlottetown and the resumption of nonstop flights to Ottawa, Montreal, Nanaimo and Penticton.

WestJet notes its renewed commitment to the city of Edmonton will see the airline’s service increase by almost 50 per cent this summer when compared to 2022. The airline explains the route

expansion also underpins its strategic ambitions to grow its presence across Western Canada and further strengthens Canada’s east to west connectivity. “Since our first day of operation in February 1996 to reaffirming our commitment to the city and region almost exactly 27 years later, Edmonton is an integral part of WestJet’s beginnings and our future,” said Alexis von Hoensbroech, Chief Executive Officer, WestJet Group.

WestJet notes these new Edmontonbased investments mark the single largest expansion of its network serving Edmonton in history. With five new additions and the restart of four destinations to Edmonton’s network, WestJet will serve 21 domestic and four transborder destinations from Alberta’s capital this summer.

COMMERCIAL

AIR INDIA REVEALS ORDERS FOR 470 BOEING, AIRBUS JETS

The Tata Group-owned Air India has announced its commitment to order 250 Airbus and up to 290 Boeing aircraft to boost its domestic and international operations. The commitment includes 140 A320neo and 70 A321neo single-aisle aircraft, as well as 34 A350-1000 and six A350-900 widebody jets that will mark a new era for the country as the all-new, long-range aircraft celebrates its debut in

the Indian market. Airbus deliveries are set to commence with the first A350-900 arriving by late-2023. The A350 widebody aircraft provides carriers with a 300- to 410-seat asset.

The Boeing commitment includes 190 737 MAX, 20 787 Dreamliner and 10 777X airplanes. Boeing describes its flagship 777-9 as the world's largest and most efficient twin-engine jet, which the aircraft maker says will become the largest airplane in Air India's fleet, enabling it to fly passengers non-stop and in enhanced comfort to almost any long-haul destination. The 737-10, the largest airplane in the 737 MAX family, offers seating for 188 to 230 passengers, depending on configuration with a range of 3,100 nautical miles. The 737-8, offer seating for 162 to 210 passengers and with a range of 3,500 nautical miles. The agreement between Boeing and Air India includes options for 50 additional 737 MAXs and 20 787-9s. When finalized, this will be the largest Boeing order in South Asia and after a nearly 90-year partnership with the carrier.

Air India’s journey took off in 1932, when Bharat Ratna J.R.D Tata formed an airline, which was nationalized in 1953. The Tata Group, founded by Jamsetji Tata in 1868, took back control of Air India on January 27, 2022. The Tata Group is comprised of 30 companies.

WestJet continues its Western expansion with new new summer 2023 routes planned of Edmonton, including non-stop service to Minneapolis and Seattle. (Image: Boeing, WestJet)

Tata Group-owned Air India commits to 250 Airbus aircraft. (Image: Airbus)

LYNX AIR BEGINS US BOUND FLIGHTS

Lynx Air on January 27 launched its inaugural flight to the United States, departing from Toronto Pearson International Airport and arriving at the new Terminal C at Orlando International Airport. Lynx plans to operate four direct flights per week between Toronto and Orlando, flying a new Boeing 737 aircraft.

“Lynx Air took to the Canadian skies for the very first time just over nine months ago, and we are excited to be already expanding across the border into the USA,” said Merren McArthur, CEO of Lynx. Lynx explains its U.S. network will expand over the next few weeks, with the planned launch of services out of Calgary to Phoenix, Los Angeles, and Las Vegas. In total, Lynx plans to operate more than 5,000 seats to and from the U.S.

more than $9.3 million in funding, specifically from the Aerospace Regional Recovery Initiative, to launch a training program for gas turbine maintenance, repair and overhaul. This investment is expected to create 160 new jobs, according to the government, and generate an additional $360 million in revenue in British Columbia by 2027. BCIT also received more than $5.2 million in funding to create a National Biomanufacturing Training Centre. The Province of BC is also contributing $2 million. This facility will provide training, professional development and talent for biotech companies in BC and across Western Canada. This investment is expected to see more than 700 people trained every year once the centre is operational and produce highly trained personnel for indemand jobs.

HELICOPTERS

BELL 505 FIRST SINGLE ENGINE HELICOPTER TO FLY WITH ALL SAF

British Columbia Institute of Technology is receiving more than $14.5 million in funding to support aerospace and life sciences training through the Pacific Economic Development Agency of Canada (PacifiCan), which is overseen by Harjit Sajjan, Minister of International Development and Minister for the Government of Canada.

To address the aviation industry’s need for skilled workers, British Columbia Institute of Technology (BCIT) is receiving

A Bell 505 completed that helicopter model’s first flight fueled solely by 100 per cent Sustainable Aviation Fuel, which Bell Textron describes as the first ever single-engine helicopter to fly with 100 per cent SAF. To achieve this flight, Bell collaborated with Safran Helicopter Engines, manufacturer of the Arrius 2R engine on the Bell 505; GKN Aerospace, the fuel system component supplier; Neste, the SAF supplier; and Virent, a Marathon Petroleum subsidiary that manufactures renewable fuels and chemicals. Safran Helicopter Engines and GKN Aerospace conducted testing on the engine and fuel system components.

Neste and Virent collaborated to blend, test, and deliver the SAF for this project as a 100 per cent drop-in fuel. Bell Textron explains that SAF, made from used cooking oil or other bio-based feedstocks, typically must be blended with petroleum products because it doesn’t include a component called aromatics, which is required to meet today’s aviation fuel specifications. Virent manufactures an aromatics component made from renewable plant sugars, which was added to Neste’s SAF, eliminating the need to blend SAF with petroleum fuel. The SAF supplied for this test flight by Neste and Virent is, therefore, a “100% drop-in” replacement for petroleum-based aviation fuel, explains Bell, requiring no engine modifications.

LEONARDO, SAFRAN PARTNER FOR AW09 PROPULSION

Leonardo and Safran Helicopter Engines have joined forces to enhance the capabilities of the next generation AW09 single-engine helicopter. Leonardo’s AW09 production aircraft will feature the 1,000 shp class of power Arriel 2K engine, the newest generation of the Arriel family. Leonardo and Safran have a longstanding partnership spanning from propulsion systems for light twins up to super medium class helicopters, in addition to this new commitment in the single-engine commercial market.

The new propulsion system is already installed on the latest AW09 prototype, PS4 (Pre Series 4), which is about to start flight test activities at Kopter’s facility in Mollis. PS4 includes all developments implemented and tested on P3, the previous prototype, allowing to reach the AW09 final configuration. PS5, the next and final prototype is planned.

Merren McArthur, CEO of Lynx Air, is joined by Greater Toronto Airports Authority VP of Stakeholder Relations and Communications, Karen Mazurkewich, to celebrate the airline’s first flight to the United States. (Photo: CNW Group, Lynx Air).

Bell Textron worked closely with engine maker Safran for the five-seat Bell 505 flight with 100 per cent Sustainable Aviation Fuel. (Photo: Bell Textron)

BCIT is receiving more than $9.3 million in funding, specifically from the Aerospace Regional Recovery Initiative. (Photo: BCIT)

ELECTRIC PROPULSION

JOBY BEGINS FINAL ASSEMBLY OF FIRST COMPANY CONFORMING EVTOL AIRCRAFT

Joby Aviation began the final assembly of what it describes as the world’s first company-conforming electric, vertical take-off and landing (eVTOL) aircraft. The aircraft, which is the first to be produced at Joby’s pilot manufacturing facility in Marina, California, has been manufactured in accordance with a released design and built according to a complete implementation of a quality management system, qualifying it as a company-conforming aircraft. The company describes this milestone as an important step on the path to achieving the Federal Aviation Administration (FAA) type certification required to begin commercial passenger operations. Having built the major aerostructures of the aircraft, including the wing, tail

and fuselage, Joby explains it is now in the process of mating the structures together and installing the wiring, electronics, actuation, and propulsion systems on its pilot production line. Joby expects the aircraft to begin flight testing in the first half of 2023. Joby’s Quality Management System includes tracking and documentation of every part on the aircraft, configuration management of engineering drawings, environmental conditions

FLY WITH CONFIDENCE.

during fabrication, and actions taken by manufacturing technicians. The system is reviewed regularly by the FAA as part of the company’s preparation to receive a production certificate following the type certification of its eVTOL aircraft. Concurrently with low-rate aircraft production in Marina, Joby states it is evaluating proposals from a number of U.S. states to support the construction of a Phase 1 production facility.

Joby expects its aircraft to start commercial passenger service in 2025, transporting a pilot and four passengers at speeds of up to 200 mph. (Photo: Joby Aviation)

MILITARY

BOEING TO END SUPER HORNET PRODUCTION

Boeing expects to complete new-build production of the F/A-18 Super Hornet fighter aircraft in late 2025 following delivery of the final U.S. Navy fighters. Production could be extended to 2027 if the Super Hornet is selected by an international customer. The F/A-18 Super Hornet was at one point a leading contender for Canada’s Future Fighter competition, which in January 2023 came to an end when Ottawa confirmed the planned purchase of a fleet of F-35s to replace the Royal Canadian Air Force’s aging CF-18s. The first F-35 is scheduled to be delivered to the Canadian military in 2026 with another 72 to be ordered in subsequent years, bringing the total size of the fighter-jet fleet to 88 aircraft. Boeing explains, that to meet demand for defense products and services, it plans

to continue hiring year-over-year for the next five at its St. Louis site where the F/A-18 Super Hornet is built. Boeing states the F/A-18 production decision allows it to redirect resources to future military aircraft programs and to support work on the next generation of advanced

crewed and uncrewed aircraft. Boeing plans to build three new facilities in St. Louis. These facilities, as well as the new Advanced Composite Fabrication Center in Arizona, and the new MQ-25 production facility at MidAmerica, represent more than a $1 billion investment. | W

Boeing will continue to deliver new Block III Super Hornets to the United States Navy through 2025, with a range of goals to build on its military footprint in the St. Loius region.(Photo: Boeing)

By David Carr | columnist

Long live the Queen

The airplane that transformed commercial aviation and global air travel

Boeing’s magnificent 747 jumbo jet has always been a majestic beast. But the Queen’s entry into service was far from smooth. It has been characterized as the glorious summer. A few days in June 1969 at France’s Le Bourget Airport when development versions of the AngloFrench supersonic Concorde and Boeing 747-100 shared a stage for the first time at the Paris Air Show. It was a time when the future was bright and all was possible. Neil Armstrong would step foot on the moon a few weeks later.

The 747 entered airline service with Pan American World Airways (Pan Am) in January 1970 and would revolutionize international air travel. But this was far from clear that summer in Paris, despite the massive crowds gathering on the rain swept tarmac waiting to get a glimpse inside the world’s largest passenger jet. The 747 was seen then as a lumbering stop gap between the dawn of the jet age and the arrival of supersonic air travel. Not necessarily via the groundbreaking Concorde that was already considered too small and expensive, but by the 250 to 300 passenger Boeing 2707, travelling at three times the speed of sound, or 1,500 kilometres an hour faster than Concorde.

As international airlines bulked up on sleek SSTs, more 747s were redeployed as flying cargo ships. The jumbo’s distinct hump and upper-deck cockpit was designed to support front door loading of large freight. The dream of supersonic transport soon flamed out. Unlike the 747, where Boeing literally bet the company (or “sold the family jewels” as William Allen, the chief executive said at the time), the 2707 was a government contract that was cancelled in 1971 when money dried up.

Exactly 1,574 ships after the first 747 was delivered to Pan Am, Boeing handed over the final 747-8 to cargo airline Atlas Air on January 31, 2023. (The last passenger version, the 747-8 Intercontinental was delivered to Korean Air Lines in July 2017.) Attending the ceremony were remaining members of The Incredibles, the first employees to design and build the airplane. The Atlas livery included a tribute to Joe Sutter, aeronautical engineer and father of

By the time Air Canada retired its 400 series in 2003, four domestic airlines had flown 32 747s.

the 747, who passed away in 2016.

Air Canada, an early customer, brought the 747 to this country in spring 1971. Like Paris in ’69, crowds flocked to the Air Canada maintenance hangar in Montréal to see a piece of aviation future before the airplane was placed on the Montréal-Toronto-Vancouver route in April. CP Air and Wardair would add 747-100s to their fleets in 1973. By the time Air Canada retired the last of its larger series 400 aircraft in 2003, 32 747s of various models had been flown by four Canadian airlines, including Nationair, a short-lived, Mirabel-based airline.

Early 747s were plagued with engine reliability and performance issues; and for some airlines, especially U.S. domestic giants such as American, Delta and United, it was too much airplane for the market and would be replaced with smaller McDonnell Douglas DC10 and Lockheed L1011 wide-bodied trijets. Launch customer Pan Am’s rush to market itself as the 747 airline, resulted in it taking delivery of too many airplanes upfront, making filling the seats

a tougher sell. Still, the die was cast. The 747 was popular with the public, making flying more accessible and offering unprecedented space and comfort. By the time the 747-400 arrived on the scene in 1989 with a stretched upper deck, lower operating costs and ability to carry more passengers over longer distances, the Queen of the Skies had hit her stride. A total of 724 of 747s sold would be 400 series jets.

The Boeing 747 had an unparalleled run, but she is now deep into the twilight. Covid accelerated the permanent grounding of what was left of its shrinking passenger fleet. Today, the 747 accounts for approximately two per cent of all passenger aircraft, including the 747-8 Intercontinental, an unnecessary response to the Airbus A380, flown by Lufthansa, Korean Air and Air China. Even the jumbo’s use as a freighter has dwindled from 71 per cent in 1990 to 21 per cent today, according to intelligence firm CAPA. Boeing continues to work on two V25-B aircraft, heavy modified versions of twin undelivered 747-8 passenger jets, for the U.S. Air Force as replacements for Air Force One, ensuring the 747 will be transporting important freight for decades to come. Long live the Queen. | W

PHOTO:

By Scott Henderson |

Commuting by electric air

Steps closer to the arrival of air taxis has companies focusing on strategy

The rich and powerful have had access to private flight helicopter services for decades, but flying electric or hybrid electric air taxis for mass transportation will change the game for consumers and suppliers. Several companies are now on the verge of establishing an entirely new sector of aviation and the reward could be lucrative. Brand Essence, a worldwide market research firm, stated in its Global Electric Air Taxi Market report (published Nov. 2022) that the market was “valued US$386 million in 2021 and is expected to reach US$2.3 billion by 2028.”

That is a compounded annual growth rate of 29 per cent over the next six years. The research firm defines Electric Air Taxi as a commercial aircraft for short flights. In an industry that loves acronyms, electric air taxis use the moniker Electrical Vertical Take-off and Landing (eVTOL) systems, among several others. The first electricpowered aircraft, the tethered PKZ-1, debuted in 1917 but the combined advances in batteries, motors and controllers seen in the drone industry have now made electric powered aircraft a viable alternative to fossil fuel systems. Air taxi test flights of all shapes and ranges are now taking place around the world.

In February of this year, Blade Air Mobility and Beta Technologies, completed the first successful test flight of what they term a piloted Electric Vertical Aircraft (EVA) in the greater New York City area. It was a significant milestone in the companies' partnership to provide safe, quiet and sustainable air transportation to commuters.

Important to note, this was a piloted test flight. The emerging industry also includes Unmanned Aerial Vehicles (UAVs). Three days after this test flight Chinese company EHang claimed Japan’s first passenger-carrying autonomous eVTOL flight. Its EH216 aircraft flew with two passengers and no pilot along the coastline in Oita, under the approval of the Ministry of Land, Infrastructure, Transport and Tourism of Japan.

On the day, Mayor of Oita, Sato Kiichiro, said, “I hope that today’s passenger-carrying flight test will accelerate autonomous aerial vehicles to take a further step toward

It completed a manned air taxi flight in Italy a few months ago utilizing new vertiport infrastructure at Rome Fiumicino Leonardo da Vinci Airport. Marco Troncone, CEO of Aeroporti di Roma stated, “The opening of the first vertiport in Italy and the first crewed eVTOL flight represent a remarkable step towards the activation of the first AAM [advanced air mobility] routes between Fiumicino airport and Rome’s city centre.”

Troncone says passengers could transfer from an intercontinental flight at FCO airport and take an electric air taxi to the city centre in minutes providing tourists with a groundbreaking transportation service.

Volocopter aims to launch commercial air taxi flights by 2024 in Paris and Rome.

practical use cases, so that this industry full of opportunities could be in full swing."

Since 2017, when Germany company Volocopter conducted the world’s first autonomous air taxi flight in Dubai, the race to launch the first commercial air taxi service has been on. New rules proposed by the U.S. Federal Aviation Administration (FAA) for eVTOL aircraft should allow for commercial air taxi operations. At a news conference in November 2022, acting FAA Administrator Billy Nolen told reporters that the agency does not expect the first eVTOL to begin commercial operations until late 2024 or more likely early 2025.

In the United Kingdom, the world’s first airport for flying taxis opened in the city of Coventry. Dubbed as a vertiport, the facility opened in April last year and will also service drone delivery systems. There have been no air taxi test flights there as eVTOL vehicles have yet to receive government approval. Industry insiders in the UK hope the aircraft could be permitted for use by 2024.

The European Aviation Safety Agency has eVTOL guidelines that will allow air taxis soon. Volocopter aims to launch commercial flights in Paris and Rome in 2024.

At this year’s World Government Summit in Dubai, Ruler Mohammed bin Rashid Al Maktoum tweeted about Dubai’s initiative to have flying taxis by 2026. In a follow up interview on local radio, Ahmed Bahrozyan, from Dubai’s Roads and Transport Authority, said it was still early days but estimated the cost of a flying taxi “will be in the range of a limousine service in Dubai, possibly somewhat higher.”

Volocopter is one of many companies competing in the race to deploy air taxis and costs will be very important. Robert Riedal, co-leader of McKinsey and Company’s Centre for Future Mobility quoted from video transcripts, says, "Nobody wants to build another toy for the rich. There’s a very limited market for that. Many companies are likely to fail, due to the technical challenge, the task of winning public confidence and reducing costs to make flying taxis more widely affordable.”

Riedal expects air taxi travel to be used initially by wealthy or business passengers in select cities until after 2030. He says a sign of a rich future ahead is that the FAA is including eVTOLs in new regulations, as U.S. drone regulation usually occurs when exemptions to existing rules are sought.

Costs aside, an additional push for air taxi service is coming from aviation industry efforts to produce quick and emissionfree flights. Air taxis will counter traffic congestion, provide transportation over waterways, and contribute to a more sustainable future. | W

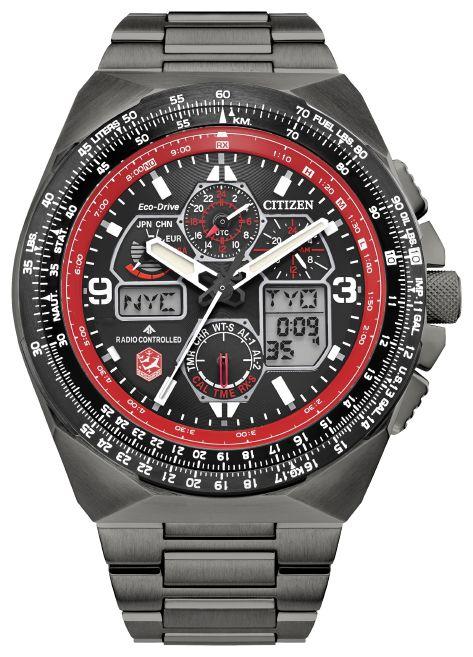

CITIZEN AVIATION WATCHES

The grace and function of modern mechanical and quartz timepieces

By Phil Lightstone

The past decade has seen the adoption of Smart Watches, which deliver many practical capabilities when paired with apps, Wi-Fi and cellular connectivity.

Garmin’s D2 Mach 1 and Apple’s Watch Ultra are downsized microcomputers packed with limitless capabilities. But there’s something romantic about a mechanical or quartz aviator watch. The size, weight, accuracy, materials, and design can transport you back to the golden age of flying. My first Aviator Watch was a Citizen Wingman (WR 100), which incorporated a tiny E6B flight computer into the bezel of watch. It was a great fashion statement subtly messaging friends and acquaintances, “Hey, I’m a pilot”.

Time is a critical aspect of every flight. Time, distance, and fuel remaining are essential components of every flight. A great aviation watch should have the following capabilities: Accurate time keeping; local and UTC time zones; sunlight readable dials and legibility of the dial in a multitude of conditions; and vibration and shock proof. The watch should be built to withstand the rigours of altitude, magnetic fields and extreme temperatures. All the while, the aesthetics, fit and finish of the timepiece should align to your expectations and needs. Let’s not forget comfort. The weight of the watch becomes another factor when selecting a watch. What’s on your wrist is an expression of your personality and budget.

Marvels of engineering

Aviation watches may be considered in three categories: Prestigious, budget and tech. Before the

advent of Smart Watches, companies like Citizen and Alpina, created fine timepieces. Citizen’s approach delivers a high-quality timepiece at an affordable price, essentially a timepiece for every citizen of the world. Citizen began manufacturing watches for pilots and aviation enthusiasts in the 1990s. Citizen’s subsidiary, Alpina, has been developing aviator watches since 1920. The Startimer collection stays faithful to the spirit of its predecessors and presents clean and legible dials enhanced by traditional oversized crowns and start at $1,595 (all quoted pricing is in Canadian funds and does not include taxes or shipping).

Founded in 1930, Citizen manufacturers revolutionary timepieces including a Super Titanium material which is five times harder and 40 per cent lighter than stainless steel. Ever innovating, its watches are powered by light (Eco-Drive), time and calendar synchronized using radio technology (Atomic Timekeeping) and its newest watch movements, receiving satellite GPS timekeeping (Satellite Wave). Eco-Drive was launched in 1976 and converts natural or artificial light into energy to power the watch, storing the surplus in a power cell. On a full charge, an Eco-Drive watch runs for months. Gone are the days of replacing a watch battery every few years.

Atomic Timekeeping keeps my Citizen Promaster Skyhawk A-T in perfect synchronization ensuring that the accuracy of timekeeping is maintained without me thinking about it. Using radio transmissions, this technology automatically updates the time and date of your watch based on a time signal from an atomic clock with

Citizen manufacturers revolutionary timepieces including a Super Titanium material which is five times harder and 40 per cent lighter than stainless steel.

The Citizen Promaster Snowbirds Skyhawk A-T features a grey ion plated stainless steel case, black dial and red accents encased in a genuine sapphire crystal, as well as atomic time clock synchronization for superior accuracy.

a margin of error of one second every 100,000 years. Time signals are received from transmitters and atomic clocks in four different regions: Europe, the United States, China and Japan. Reception can be affected by radio frequency noise, local topography, buildings and the weather. With a receiver chip, the watch wakes up at 1:00, 2:00 and 3:00 am and listens for a signal. A binary code containing the time, date, day of week and time zone from GMT is received. To help the process, its best to keep your watch on a credenza as opposed to buried in a cabinet.

Citizen watches equipped with Satellite Wave GPS receive position and time signals from orbiting GPS satellites, keeping the watch updated to the correct date and time, with updates in less than three seconds. Using this data, the timepiece determines which time zone you are in, setting your watch to the correct time for where you are at that moment. As with aviation GPS avionics, your watch requires a clear view of the sky.

Citizen’s Skyhawk and Navihawk models utilize a quartz movement and are available in a variety of materials, including stainless steel, titanium and super titanium. The success of quartz movements is based upon their accuracy and manufacturing process. The Promaster Skyhawk A-T edition features a super titanium case and bracelet five times harder and 40 per cent lighter than stainless steel. The Skyhawk A-T Blue Angels watch is available with either a bracelet, an indigo blue Italian leather strap with yellow contrast stitching or navy blue leather strap. With licensing agreements with the Snowbirds, Blue Angels and Red Arrows, an owner can feel like they are part of the team.

The Promaster Air collection has 28 different models with prices ranging from $550 to $1,195. With models like Air, Navihawk, Skyhawk and a variety of bands, you are sure to find a timepiece that suites your needs and personality. Citizen’s new Skyhawk A-T (JY8084-089H) takes the design back to its original Skyhawk released in the early 1990s.

Citizen has 36 new watches for 2023. Checkout its Super Titanium HAKUTO-R, created in collaboration with the Japanese lunar exploration program and iSpace. Citizen has provided Super Titanium parts for the legs of the project’s lunar lander. This limited-edition timepiece depicts the unique lunar surface patterns with newly developed recrystallized Titanium. The striking design combines recrystallized titanium with Duratect DLC (Citizen’s proprietary technology to harden the surfaces of watch parts) and features an all-black dial, case, and bracelet, taking inspiration from the mystery and infinite darkness of outer space. Advanced features also include GPS timekeeping, world time in 27 cities (40 time zones), a chronograph, dual time zones, a universal coordinated time display, a perpetual calendar, as well as daylight savings time, power reserve, and light level indicators. Priced at $4,500, it’s an exceptionally elegant timepiece. Citizen watches can be purchased from any

authorized Citizen dealer as well as on citizenwatch.com. All Citizen watches have a five-year warranty and a service and repair facility located in Markham, ON.

Service and repair

Whether you own a $600 Citizen watch or $3,000 Alpina timepiece, routine maintenance is critical to maintaining your investment. Timepieces require periodic servicing, which involves not only cleaning and polishing the exterior of the watch and bracelet, but also lubricating the watch movement (mechanical watches). The watch will be calibrated to ensure its accuracy as part of the service. Seals are replaced to ensure that waterproof or water resistance is maintained.

Dive watches tend to be guaranteed to be waterproof to a specific distance under water, during its warranty period. Water resistance tends to be a best effort guarantee and most manufacturers will honour their warranty. During a service, the gaskets will be changed to ensure that water resistance/proof capabilities are maintained, a great investment in protecting your watch during swimming or showering.

Different manufacturers have different views for when a timepiece should be serviced, but three to five years tends to be common for mechanical watches. Over time, the oils will tend to dry out, but if the timepiece is keeping accurate time, just keep wearing your watch. The movements are marvels of mechanical engineering, however, and should be serviced at least once every 10 years.

Citizen aviation watches can be found at pilot shops (like Aviation World and Threshold Aviation), jewellery stores and online. As with any purchase, a bit of homework can help you pick that right timepiece which becomes part of your persona. To avoid purchasing a counterfeit watch, consider acquiring your new watch directly from Citizen or one of its authorized retailers. As Citizen says, “Better Starts Now”.

The grey ion plated stainless-steel bracelet of the Promaster Snowbirds Skyhawk A-T fastens with a fold over clasp with hidden push buttons, with The Snowbirds' insignia replicated on the case back.

Evoking the dark side of the moon, this limited-edition men’s watch celebrates Citizen's partnership with HAKUTO-R, a Japanese lunar exploration project with plans to launch an expedition to the moon.

The Citizen Promaster Blue Angels Air Skyhawk timepiece features a 1/100 second chronograph, perpetual calendar, dual time, two alarms, 99-minute countdown timer, digital backlight display, Universal Coordinated Time (UTC) display, and power reserve indicator.

The Citizen Promaster Snowbirds Skyhawk A-T timepiece comes in a unique Snowbirds themed box.

CANADA’S NEW MARKET HUNTER

BOUTIQUE CARRIER PORTER AIRLINES’ LOVEABLE RACCOON MASCOT ENTERS THE MAINLINE

BY DAVID CARR

Michael Deluce does not sound like a guy satisfied with merely growing Porter Airline’s share of the pie. A shopworn sound bite to explain a strategy of low fares and bare bones service to build new market segments. Deluce, chief executive of Toronto-based Porter Airlines wants to take a bite out of Air Canada and WestJet’s market share by reimaging the tired economy cabin, where

90 per cent of the market sits. Much in the same way Deluce’s father, Robert, did in 2006 when he launched Porter Airlines from Toronto’s Billy Bishop City Centre Airport (YTZ) with a fleet of De Havilland (formerly Bombardier) Dash 8-400 turboprop aircraft.

Seventeen years after Porter’s inaugural flight, the airline has broken out of its downtown Toronto niche big time, taking its loveable Mr. Porter raccoon mascot

national. (Toronto of course being the urban raccoon capital of the world.)

In February 2023, Porter launched jet service to seven destinations, including Vancouver, Edmonton and Halifax from Pearson International Airport (YYZ), Canada's busiest transportation hub, with a sparkling new fleet of next generation Embraer E195-E2 aircraft. With 25 E195s expected by year’s end, Porter has a lot of seats to fill and an ambitious list of potential North American destinations to fill them.

“When Porter started flying, we set out to redefine what was expected from regional air travel,” Michael Deluce says during a media presentation of the E-195’s service debut. “With the expansion of our fleet, we are setting out to redefine air travel again. This time by elevating economy air travel across Canada and North America.”

Porter has opted to go nose-to-nose against Canada’s two mainline carriers on some of the country’s most competitive markets at a time when post-covid skies are in a state of flux. WestJet has, for the most part, retreated to its western corner. Slashing services to Atlantic Canada and cutting it’s presence on the Toronto – Montreal route by approximately 80 per cent.

At the same time, independent ultralow-cost carriers (ULCCs) have been adding aircraft and destinations, including the arrival of on again/off again Canada Jetlines, which switched its base from Vancouver to Toronto and began flying under the Jetlines banner last December. The recent arrivals of Flair Airlines and Lynx Air, not to mention WestJet’s Swoop operation, add even more options for Canadian travellers.

The competition is welcome, but some air Analysts question whether Canada can support more than two main airlines and a limited number of ULCC seats spread over several carriers. Porter enters the mix with a positive brand, scale and a unique value proposition in the economy sector that distinguishes Pearson’s latest tenant from mainline and ULCC carriers.

“For over two decades the entire industry has chipped away at the economy experience,” Deluce says. “Either by focusing all energies on their elite passengers or, at the other end of the spectrum, taking everything away and providing the lowest fare but charging for everything. We are embracing the economy traveller.”

This Porter market hunter plan includes elimination of the middle seat, with four abreast seating on both the E2 and Dash8 aircraft, and free Wi-Fi on the E2. The only Canadian airline to do so. Porter has chosen to configure the 146-seat capable E195-E2 in a 132-seat all-economy configuration, with a variety of seat pitches on offer

Michael Deluce, president and CEO of Porter Airlines, and Bob Deluce, founder of Porter Airlines, in Brazil to receive Porter Airlines’ first two E195-E2 jets.

for passengers: 36, 34, and 30 inches All passengers receive inflight snacks and Porter’s signature complimentary beer and wine service.

The airline has not given up on ancillary revenue entirely. The single all-economy cabin is broken into three categories. PorterReserve, offers an all-inclusive package that includes greater legroom (comparable with business class seating), meals on longer flights and an expanded bar menu for a nominal fare upgrade. A rebranded PorterClassic offers regular and stretched seat options (eight emergency exit row seats over the wing and a further 12 seats further up the cabin). A menu of PorterReserve amenities, including meals and cocktails are available at an added cost.

At the same time, a larger fleet (Porter will have taken delivery of approximately 18 E195’s by the summer) and multiple frequencies across a range of routes makes it less likely that Air Canada and WestJet will be able to aggressively beat back the competition by engaging in targeted price wars.

The profit hunter

The Brazilian-built E-195-E2 is not Porter Airlines first shot at expanding into jets. In 2013, Robert Deluce placed a letter of in tent for 30 Bombardier C Series aircraft, with the Montreal based program later becoming the A220 series of aircraft under Airbus ownership). But Porter’s breakthrough order for the then struggling C Series in its home market was conditional on lifting a jet ban at Toronto’s YTZ waterfront airport and extending the main runway by 150 metres on each side. Neither of these milestones happened and the C Series order was cancelled.

“It’s fast becoming the most successful branding program in B2B marketing.”

Introduced in 2020, the Profit Hunter campaign has had a hitech refresh, with E195-E2 display aircraft painted in tech versions of the lion and shark over the entire aircraft and not just the nose cone. For Porter, the switch from Airbus to Embraer was less law of the jungle and more law of economics. “The E2 is the best narrowbody aircraft available,” Deluce says. “It is highly fuel efficient and the quietest aircraft in the market with many passenger-friendly features.”

Meijer describes the E195-E2 as the most sustainable singleaisle aircraft, at 65 per cent quieter and up to 25 per cent cleaner than the company's previous-generation aircraft. “It has the lowest fuel consumption per seat and per trip among 120 to 150 seat aircraft, and is the quietest single-aisle jet flying today,” he says.

The Airbus A220 family has been outselling the E2 at a rate of almost three to one. North American operators Air Canada, Delta, Breeze and JetBlue have a fleet of over 100 A220s, while Embraer had been shut out of the market entirely. Until now.

Hungry for its first North American customer, Embraer has given Porter an attractive entry-into-market package with several bells and whistles, including heavily discounted jet pricing and early delivery slots. Partnership perks the airline was unlikely to receive from Airbus. At the 2022 Farnborough Air Show, Deluce raised the stakes with an order for a further 20 E195s, which can be converted to the smaller E190-E2.

Nose to nose

Arrival of Porter’s first jets could not have been better timed. Coming as it did as WestJet scales back its eastern-Canada presence and frustration with established airlines is at an all-time high following a chaotic Christmas travel period. There may be an appetite for something

In 2021, with Porter still grounded under the Covid-19 pandemic, Michael Deluce took the industry by surprise with a new deal for 30 Embraer jets, representing the next generation family of jets which Air Canada had brought to the Canadian market in 2005 (in addition to the E190, Air Canada was the launch customer for the Embraer E175).

Dubbed as the Profit Hunter in an award-winning marketing campaign by Zurich based Gravity Group, display aircraft featuring stunning nose liveries of predators, such as a snow leopard, shark and hawk, have thrilled audiences at aircraft trade shows around the world.

“The Profit Hunter branding has been an incredible global success with customers, journalists, employees and the wider industry. The iconic branding of predators on the front of the aircraft has attracted a huge following and even customers have adopted the idea for aircraft in operation,” said Arjan Meijer, chief executive of Embraer Commercial Aviation in an analysis of the campaign.

Porter’s first two E195-E2s will anchor a fleet set to reinvigorate economy.

new, especially with perks being returned to the neglected economy cabin. That does not leave its main competitors powerless. Both Air Canada and WestJet returned complimentary bar service to flights within the Toronto, Montreal, Ottawa triangle to compete with Porter. Air Canada also has a large marketing advantage over competitors with

for passengers to cash in points.

“Other airline programs typically don’t provide full earning power at lower fares,” says Kevin Jackson, executive vice president and chief commercial officer for Porter. “We value the loyalty of all our passengers. That’s why our members earn 100 per cent of their points on all Porter

Reach your Aviation Goals

cards have weakened the impact of loyalty cards anchoring travel decisions. VIPorter remains a pure play points for service card.

“We do not intend to compete with Aeroplan,” says Jackson. “It has always been the case that a carrier with an international network attracts certain types of travellers. Our focus is on economy passengers within North America who want a better experience and better value than they can get anywhere else. This is a group that is more likely to be less loyal to one carrier.”

The aircraft interior has always been a canvass for airlines to deliver a statement. Porter has “ultimized” the space of the E195 to deliver an economy travel experience distinct from other Canadian and U.S. airlines.

Still, legroom past the PorterReserve seats is comparable to what is available on an Air Canada A220, although elimination of the dreaded middle seat, complimentary Wi-Fi and other amenities greatly boost the overall passenger experience.

Demand for the PorterReserve product could present an early headache for the airline. The premium fare is limited to the first four rows onboard the E2 and first six seats on the Dash-8. Management may have to consider dampening demand by reserve or adding more premium seats, although the latter would disrupt the economics of the

Groundschool

For now, Porter operates zero point-to-point routes outside of its YYZ and YTZ hubs. That will soon change. Less than 10 years after selling its purpose-built passenger terminal at the island airport to Nieuport Aviation for an undisclosed sum, Porter is back in the terminal building business. This summer the airline will break ground on a nine-gate passenger terminal at Montréal’s Saint Hubert

Porter and YHU are building the new terminal, beginning in this year, to be capable of serving more than four million passengers annually. It will result in more than 500 permanent jobs, including full-time positions within terminal and airline operations, and the establishment of a new pilot and flight

Back in November 2022, Porter Aviation outlined plans with the Ottawa International Airport Authority to invest over $65 million in the future of Ottawa International Airport (YOW), including two aircraft hangars, over approximately 14,000 square metres (150,000 square feet), to maintain its growing fleet featuring the new Embraer E195-E2 and existing De Havilland Dash 8-400 aircraft. Phase one of the build is scheduled for

Largely an FBO airport with limited passenger service to points in Quebec, YHU already provides quicker access to downtown Montréal than neighbouring Trudeau International Airport (YUL), whose own rail link to downtown is delayed until at least 2025. Porter has already identified 10 potential jet routes out of YHU, including Vancouver and St. John’s, and will connect the airport with its YYZ and YTZ hubs in addition to serving YUL. Point-to-point destinations out of Ottawa and Atlantic Canada are also in the cards. But for now, replicating its YTZ success at YHU remains the prize.

“We have proven this concept at Billy Bishop,” says Deluce. “It is now one of the world’s best urban airports.”

When the 21,000-square-metre (225,000 square feet) terminal opens in late 2024, Porter will share the space with Pascan Aviation, the airport’s only scheduled passenger airline with a current focus on regional Québec flights. A codeshare between Porter and Pascan is expected.

Billy Bishop experience Porter founder Robert Deluce envisioned A220 jets being integrated into the airline’s Dash-8 operation at YTZ, but politics got in the way. Market conditions that made YTZ a convenient urban airport pre-covid still remain, and Michael Deluce has already confirmed Porter’s intention to continue to fly out of the popular waterfront facility.

Despite a legal dispute the airline is locked in with terminal owner Nieuport Aviation over slots that went unused during the pandemic. Porter accounted for approximately 85 per cent of passenger traffic at YTZ, and had already signalled it would be cancelling unprofitable slots prior to Covid-19 hitting, dropping the number of slots used below the alleged level agreed to when the terminal was sold to Nieuport in 2015. An Ontario court awarded Nieuport $130 million in damages last October, but the issue remains unresolved.

A larger issue could be the future of Canada’s ninth busiest airport (pre-covid) as a tripartite governance agreement between the City of Toronto, PortsToronto (the airport’s operator) and the federal government is set to expire in 2033.

PortsToronto has already fired an opening salvo, releasing a public opinion survey that says 87 per cent of Torontonians believe it makes sense for the city to have a downtown airport. With just under 25 per cent of those surveyed living along the waterfront in proximately to YTZ. The airport made the news in the latter part of 2022, with federal Conservative leader Pierre Poilievre promising to open the facility to jets, and an environmental candidate in the last mayoralty election quickly backtracking on a promise

to green over the airport. Suggesting that the ideological tug over YTZ’s future has already been won. But will it be a future with jets?

In July 2022, an E195-E2, painted in Embraer’s black and gold TechLion profit hunter livery, and carrying 39 per cent sustainable fuel, made its debut at London City Airport (LCY) in the United Kingdom, demonstrating the aircraft’s steep approach capability.

The A220 has been operating out of LCY since 2016. Last fall, the British capital’s urban airport launched a public consultation to extend opening hours only for quieter

airplanes such as the A220 and E2s.

In 2015, the Canadian federal government prematurely put the brakes on lifting the ban on jets at YTZ while its two partners in the tripartite agreement were considering the idea. The transport minister rushed his decision out in a tweet.

Allowing jets at YTZ as part of a renegotiated tripartite agreement will be controversial, and for its part, Porter remains uncommitted. “Jet operations at YTZ are not on our radar,” Deluce said. “But we remain open to this possible change and quieter, modern aircraft being reconsidered.” | W

Call Levaero Aviation, your nearest Authorized Pilatus PC-24 Sales Centre for further information on +1 905 6722000.

FACING THE AIRCRAFT LUXURY TAX

TECHNICAL CHALLENGES REMAIN FOR BUYERS, BUT MOSTLY FOR VENDORS, LESSORS AND IMPORTERS

BY STEVEN SITCOFF

Canada’s Federal Select Luxury Items Tax Act – commonly referred to as the Luxury Tax – took effect on September 1, 2022. This law generally applies a tax of up to 10 per cent of the value of certain passenger aircraft and automobiles having a value of over $100,000, and boats having a value of over $250,000, upon the sale, importation and lease of such vehicles, unless a specific exemption applies under the law.

In August 2022, I was asked by a reporter from a major news outlet whether Canadian businesses were ready for the tax: How could they be when the Canada Revenue Agency (CRA) was, at that point, still issuing forms and guidance documents for a tax that they knew was coming for more than a year.

To date, the Luxury Tax remains poorly understood notwithstanding that it is expected to have a broad impact on key industries. This can be attributed in large part to a lack of clear and timely guidance from the federal Department of Finance and the CRA.

The Luxury Tax was first introduced in the April 2021 budget announcement, purportedly as a tax on wealthy purchasers of luxury vehicles as a means of offsetting government spending on Covid-related measures. However, it became apparent upon the release of draft legislation nearly a year later that the Luxury Tax generally does not apply to buyers or lessees of these vehicles. Rather, legal liability for the Luxury Tax generally rests with registered vendors, lessors and importers. As such, the terms

of the commercial transaction between the registered vendor or lessor and their client will be critical to ensure the vendor’s ability to recoup its Luxury Tax cost will be adequately disclosed and provided for.

Moreover, the Luxury Tax generally applies to passenger aircraft having no more than 39 seats, sold under an agreement entered into on or after January 1, 2022, and manufactured after 2018, except for a pre-owned aircraft that meets the following criteria: (i) it is registered with

the possession of a “user” before September 2022. So, an unsold demonstrator aircraft that was held by a manufacturer or dealer would not meet the foregoing exception unless the aircraft was manufactured before 2019 (otherwise, an alternate exemption might still apply). Given that newer aircraft would generally be expected to be more fuel efficient and to have more safety features than older aircraft, it is unclear from a policy perspective why the government chose to favour preowned aircraft in this manner.

a government before September 2022 otherwise than solely for a purpose incidental to its manufacture, offering for sale or transportation, and (ii) it was in

Finally, any thought of registering an aircraft outside of Canada with the intent of avoiding the Luxury Tax would be ill-advised. First, irrespective of where an aircraft is registered, it might still be considered to be imported for purposes of the Luxury Tax; and the mere use of an aircraft in Canada by an owner might also be sufficient to trigger the tax. Second, the Luxury Tax was designed with a series of stringent anti-avoidance measures, and it imposes potentially high penalties for offences.

Legal liability for the Luxury Tax generally rests with the registered vendor, lessor or importer of an aircraft.

In May 2022, the Parliamentary Budget Office produced a report which estimated that the Luxury Tax would result in lost aircraft sales of $30 million per year. This estimate was surprisingly low since it amounts to less than the typical purchase price of a single mid-size jet. By contrast, my own informal survey of aircraft manufacturers put the retail value of already cancelled transactions attributable to the Luxury Tax at more than $1 billion.

It is not often that a major labour union opposes a tax supposedly targeting wealthy consumers. In this instance, however, two major labour unions representing the aviation industry in Canada, Unifor and the International Association of Machinists and Aerospace Workers, issued clear statements opposing the Luxury Tax and voicing concerns as to the adverse impact it would have on aviation and Canadian economy.

In that light, the final Luxury Tax legislation, which passed into law in late June 2022, included a provision that was intended to delay its implementation until sometime after September 1, 2022. The latter was based on a motion passed by the House of Commons’ Standing Committee on Finance in late May 2022 so as to allow for further time to study the impact that the tax would have on the aviation industry. Notwithstanding the foregoing, the government announced on July 14, 2022, that the tax would nonetheless apply to aircraft transactions as of September 1, 2022.

Six primary technical issues were brought to the attention of the federal Department of Finance during a consultation period, but, when the Luxury Tax was passed into law, these issues were not remedied in the final legislation. These concerns include:

(1) The business use exception is overly restrictive and would, in many cases, be inapplicable to genuine commercial uses of aircraft. The Luxury Tax generally does not apply in respect of the sale of a “qualifying subject aircraft”, which includes certain aircraft which, at the time of sale and for the year that follows, are expected to be used 90 per cent or more of the time for “qualifying flights”. Qualifying flights for this purpose would include an air ambulance service, aerial firefighting, air flight training, or where certain commercial use criteria are met. With regard to the latter commercial use criteria, the following concerns should be noted:

(a) The imposition of a 90 per cent threshold for this purpose is relatively harsh compared to the “primary use” standard (50 per cent), which generally applies to other tests for the commercial use of assets under the Income Tax Act and the Excise Tax Act.

(b) The definition of a “qualifying flight” includes one that is “conducted in the

course of a business of an owner” of the aircraft and which is carried on with a reasonable expectation of profit. However, the term “owner” is not defined for this purpose and it is thus unclear whether that term refers to the immediate legal owner or to an indirect or beneficial owner. This could be a critical oversight in Luxury Tax legislation, since business use aircraft are typically held in a distinct entity for risk management purposes. As a consequence, this exception might arguably only apply where the aircraft-owning entity is itself engaged in a qualifying business activity.

(c) The definition of a “qualifying flight” for purposes of the 90 per cent threshold excludes one that is operated for the “leisure” or “other enjoyment” of an owner or their guest. As such, a particular flight might be disqualified as a qualifying flight due to the underlying purpose of the passenger’s flight, even if that passenger pays fair value for that flight.

(d) Charter service providers fulfill an important need in the Canadian market for alternative means of private air travel, especially given that much of the country is underserved by commercial airlines. However, for purposes of the Luxury Tax, a charter flight is a qualifying flight if it is (i) sold by the seat, and (ii) all or substantially all of the passengers on the flight are individuals that deal at arm’s length with the operator and with all owners of the aircraft. This is inconsistent with how the charter industry operates, since charters are typically sold by the flight and not be the seat.

(2) Unfair timing concerns and related audit risk. Whether an aircraft would constitute a qualifying subject aircraft, and thus be exempt from the Luxury Tax, on the basis that it is anticipated to meet the required level of use for qualifying flights, is determined prospectively. However, whether that criteria will actually be met could only be determined in hindsight. It is thus expected that this disconnect will result in a significant increase in CRA audit activity to monitor ongoing compliance. Moreover, a “change of use” could unexpectedly trigger the Luxury Tax in respect of an aircraft that ceases to be a qualifying subject aircraft. Unfortunately, there is no corresponding provision which would provide for a refund of Luxury Tax paid upon the sale of an aircraft where, as a result of a later change of use, an aircraft that is initially non-qualifying subsequently becomes a qualifying subject aircraft.

(3) Absence of legal recourse against purchasers. Legal liability for the Luxury Tax rests with the registered vendor, lessor or importer of an aircraft. Moreover, the registered vendor or lessor will bear the risk that such amount may not be recoverable

from their client because there is no legal means of recourse provided for under the Luxury Tax legislation. This is especially burdensome given that the registered vendor will be jointly liable for the Luxury Tax plus a penalty of 50 per cent if it knows, or ought to have known, that a purchaser’s claim of being exempt from the Luxury Tax is false. Given the potentially high cost of the latter, registered vendors under the Luxury Tax regime would be well-advised to take steps to evidence proper due diligence in this regard.

(4) Challenges for importers of aircraft. In order for the importation of an aircraft to be exempt from the Luxury Tax, the importer would first need to obtain a special import certificate from the CRA. The imposition of an application mechanism in order for importations to be exempt in this manner is impractical and, noting the significant delays typically involved in obtaining other tax clearance certificates from the CRA as well as the time pressures on aircraft transactions in the current market, concerns over processing delays could put importers in the position of having to forego the certificate process and absorb the Luxury Tax or otherwise jeopardize the transaction.

(5) Challenges for lessors of aircraft. The Luxury Tax generally becomes payable by a lessor upon providing a right to use an aircraft under a lease (unless the transaction is otherwise exempt). This upfront imposition of tax creates particular challenges for the cash flow of lessors, in terms of timing (i.e., will the lessor seek to recover its Luxury Tax cost upfront, or will it do so as part of the lease payments, in which case it is financing that cost until it is fully recovered), and in terms of the amount (since the Luxury Tax that will be due is based on the full value of the aircraft, as opposed to the value of the lease contract.

(6) Challenges for sales of fractional interests in aircraft. It will generally be difficult for fractional aircraft sales to be exempt from the Luxury Tax because these arrangements are not properly contemplated nor accommodated in the legislation.

The Luxury Tax is complex, onerous and poorly understood by the aviation industry. Vendors, lessors and importers of aircraft in Canada should fully acquaint themselves with applicable registration, reporting, compliance and other obligations under the Luxury Tax to avoid potentially harsh penalties. It is crucial that registered vendors and lessors properly disclose in commercial agreements with clients that any Luxury Tax cost will be charged as part of the transaction. | W

Steven Sitcoff is a tax and aviation attorney with national law firm McMillan LLP.

RETHINKING CANADA’S AIR TRAVEL SYSTEM

AFTER MONTHS OF CHAOS AND DISRUPTION, HAS THE CANADIAN COMMERCIAL AVIATION INDUSTRY LEARNED ITS LESSON

BY JOHN GRADEK

Canadian air travellers were finally able breathe a sigh of relief as the chaos at airlines and airports appears to be over. But how long will this relief last?

As this article went to press, Spring Break and the corresponding surge in holiday travel were just around the corner. In late February, Toronto Pearson outlined plans to cap the number of flights into and out of Canada’s largest air hub during peak travel periods in 2023. Christopher Reynolds of The Canadian Press reported the GTAA planned to “flatten out” daily crests with a “hard limit” on how many commercial

planes arrive at and depart from Pearson at any given hour during March break and the summer season, “thereby spreading demand out over the course of each day.”

Will Canadian commercial aviation indeed prove to have learned its lesson from the last eight months of delays, cancellations, mishandled baggage and miscommunication? And if it hasn’t, how can Canadians better prepare themselves for potential disruptions in the future?

Summer airline chaos

In early 2022, Canadian air carriers celebrated when Covid-19 restrictions were

lifted. Air Canada and WestJet announced significant increases in their summer 2022 operations, touting a relaunch of services to regain traffic and revenue lost during 2020 and 2021 from service interruptions.

Canadian air travellers welcomed these services back, anxious to shed the yoke of Covid-19 travel restrictions and return to the wanderlust of seeing the world in person.

As summer 2022 flights filled with travellers, faint alarm bells were heard about the aviation infrastructure’s ability to accommodate operations amid the influx. These alarm bells grew louder when passengers were subjected to long wait times, both at departure and arrival.

Flight delays and cancellations quickly became the norm at major Canadian airports. Toronto Pearson International and Montreal-Trudeau International Airport led the world in flight disruptions during the peak summer months.

There was no shortage of finger-pointing when it came to laying blame for the cause of the summer chaos. Transport Minister Omar Alghabra stated in August 2022: “In May, all agencies, companies and airports had a massive labour shortage compared with the surge in demand that occurred then. We acted quickly. We were preparing for it, but the surge ended up being beyond what was expected.”

It’s clear the federal government and airlines misjudged the ability of airport infrastructure to handle the sheer volume of returning air travellers. The minister may have stated the surge was unexpected, but it appears as though airlines knew about passenger volumes but didn’t listen to workers.

Holiday airline chaos

Fast forward to December 2022. While Mother Nature received the lion’s share of blame for disrupting air services during the winter months, it is once again evident that neither airports nor airlines were adequately prepared.

While staffing levels were touted to have reached pre-pandemic levels, a lack of winter conditions experience and poor operations planning appear to be major contributing factors to the chaos.

Disruption has also been the hallmark of the United States’ last six months, from summer delays to the Federal Aviation Administration’s system failure to Southwest Airlines’ computer system meltdown.

Perhaps the current state of commercial aviation can best be summarized by Scott Kirby, CEO of United Airlines. When asked about his views of the airline industry in 2023, he said: “The system simply can’t handle the volume today, much less the anticipated growth. There are a number

Greater Toronto Airports Authority, operator of Toronto Pearson International Airport, in November 2022 reopened Runway 06L/24R, the airport’s second-busiest runway, after an eight-month rehabilitation, helping to ease flight congestion. Still, in late February 2023, GTAA announced it would cap the number of flights into and out of Canada’s largest air hub during peak periods over the year.

WestJet in July 2022 proactively announced reductions over the upcoming holiday season to better meet customer expectations for air travel services.

of airlines who cannot fly their schedules. The customers are paying the price.”

The U.S. Secretary of Transportation has been the focus of media attention for his pronouncements on the need for airlines and airports to increase their customer service levels and ensure flight schedules are realistic and operable.

What to expect in the future

What might Canadian air travellers expect over the next few months? Some air

The minister of transport has promised a review of the air passenger protection regulations to address enforcement and efficiency. Canada should take inspiration from the European Union’s approach to mishandling compensation, where the onus is on air carriers to defend their rationale for not paying compensation.

Canadians have great expectations for the actions about to be taken by the minister of transport and the Canadian government. Patience with the air travel system

has worn thin and changes are most definitely needed. I, for one, am looking forward to a solution that quells Canadians’ anxiety on air travel. | W

This article was originally published by The Conversation. John Gradek is a Faculty Lecturer and Academic Program Coordinator of Supply Chain Management, Logistics and Operations Management, as well as the Integrated Aviation Management Program, at McGill University.

AIRPORT MIGRATION TO ELECTRIC AIRCRAFT INFRASTRUCTURE

VISIONS FOR SUPPLYING THE ENERGY AND CONNECTING IT TO AIRCRAFT

BY PHIL LIGHTSTONE

The automotive industry has paved the way for the transformation of fossil fuel powered vehicles to electric vehicles both from a power technology perspective but also the deployment of charging infrastructure on a national level. Overtime, the evolution of rechargeable battery technology will improve range, power, capacity and weight. Aviation is beginning to reap the benefits from the research and development (R&D) activities of the automotive industry with companies like Pipistrel, Diamond, MagniX and others delivering e-aircraft and eVTOLs. As an example, Canada’s Harbour Air has been successful in applying electric technologies

to a De Havilland Beaver aircraft to support its short haul routes in Western Canada.

Unique to the aviation industry, most recreational operators do not store their aircraft at home, where it would be much easier to implement charging infrastructure. However, airports are completely different than residential real estate. I fly out of the Toronto Buttonville Municipal Airport, which was founded in 1953. Located in the north end of the Greater Toronto Area (GTA), access to the hydro grid is not a challenge, but the costs to bring energy to an aircraft tiedown requires a well thought out plan and capital investment.

The delivery of electricity to facilitate aircraft battery

charging should be considered from an end-to-end perspective. Beginning with the manufacturing of copious amounts of clean electricity and ending with the connectivity of the aircraft. Unlike Wi-Fi and cellular technologies, there are a lot of wires required to get electricity to the batteries of an aircraft.

The challenge is the last mile of electric cabling, transformers and other hardware (and cooling) to the airport property and the aircraft. With commercial operators relying on the delivery of electricity to support their revenue generating flights, one questions the requirement to create a redundant electricity connectivity platform. While many airports utilize diesel generators to backup their electricity needs, these generators (and fuel tank capacities) were not designed for the increased demand which many electric aircraft would require. While electric power disruptions are

infrequent, they do happen, as does brownouts during periods of peak demand. Historically, many provinces, states and municipalities cope with the daily balancing of electricity supply and demand through importing or exporting electricity to neighbouring states/provinces. One of the biggest challenges in the electricity manufacturing ecosystem is storage. Essentially, without massive battery farms, we are confined to a real-time consumption model.

Herein lies one of the challenges in managing the North American power grid. We might well remember the activities of an electric company’s employee, who dropped a wrench in a substation, shorting out the substation. This event demonstrated not only the interconnectivity of the grid but also its fragility.

Bringing redundant electricity providers to an airport is an exercise in economics, political will, and major long term

Beta Technologies has developed an electric aircraft charging network, powered by its Charge Cube, and aims to have 150 units online by 2025.

construction projects. One might argue that at full e-aircraft/eVTOL deployment, an airport might be considered in the same light as the Data Centre industry. Both require: Redundant power providers; could use 3 to 10 MWh on a daily basis (depending upon the number of servers contained at the data centre); demand is growing over time (e.g. the move to the Cloud by providers like Amazon, Microsoft, Apple and others); typically requires an investment of $10 million per MW; requires operational staff to manage the environment; is hardware intensive; and is capital intensive.

We might agree that the first e-aircraft use case to deliver certified aircraft at scale would be targeted to flight training units. Diamond’s first production aircraft, the e-DA40, was expected to start flight testing Q2 2022 with certification expected in 2023. But those dates have been pushed out. Its first all-electric aircraft is powered by an ENGINeUS 100 electric motor manufactured by Safran Electrical & Power. The 130 kW or 175 SHP engine is air cooled with certification expected in 2023. The e-DA40’s charging system is provided by Electric Power Systems. The aircraft is expected to have a 90-minute range, perfect for flight schools, regional air taxis and General Aviation pilots. While the final battery system capacity has yet to be finalized, rumours have the size at roughly 40 kWh. Diamond’s initial research indicates an operational savings of 40 per cent over conventional fossil fuel aircraft.

Airport electrical infrastructure upgrades in the short term are the Achilles Heel of the electric aircraft revolution. Diamond Aircraft, collaborating with Electric Power Systems, has created a Mobile Micro Grid and a quick recharging truck. Like a fuel bowser, the MobileMic can be driven up to a Diamond e-DA40 and plugged in. The e-DA40 will be fully recharged in roughly 20 minutes. Perfect for airports which do not have the capital to dig up the ramps to install the electrical infrastructure to hangers or tie downs. The MobileMic can be recharged in the evenings during lower off-peak electricity costs or during the day using solar panels or hydrogen-based systems. Airports have lots of hanger roof real estate and lots of open areas, perfect for solar panel farms or hydrogen micro grids.

Electric Power Systems (EPS) was founded in 2016 with the goal of designing, manufacturing and capitalizing the delivery of electric solutions focused on aerospace and the military. It develops energy storage systems, DC fast-charging stations, and electric propulsion products for aerospace, defense, Aautomotive, marine, and industrial traction industries. It