Introducing the world’s most advanced spray height controller. The performance that has been satisfying customers for years is now available through Ag Leader’s InSight TM panel. is now available.

• Increased efficiency in use of chemicals is achieved by maintaining proper spray nozzle height above the ground/crop,resulting in optimum coverage and reduced drift.

• Faster application speeds are made possible by UC5TM ultrasonic control.The sensors constantly measure the distance to the target allowing the UC5TM system to make responsive height adjustments.

• Non-contact height control.All control is achieved through the rugged,moisture-resistant ultrasonic sensors mounted on each boom section.

• Boom height is controlled by a choice of sensing either the soil surface or the top of the crop.The ultrasonic signal is “smart” enough to distinguish the ground from standing crop or field residue.

• More Flexibility.The ultrasonic sensors do not depend on light conditions to monitor changes in terrain, spraying is possible day or night in any light condition.

* Please contact your local sales rep for details

Our January edition of Top Crop Manager takes its usual look into the soybean sector, along with other issues like pests and diseases and fertility and nutrients.

Field editor Dr. Heather Hager explores soybeans in Atlantic Canada in just one of our stories geared specifically to enhancing crop management practices.

The future certainly looks bright, thanks to a young researcher who exhibits extraordinary curiosity, plus a quick assessment of buyers’ demands for Canadian quality IP soybeans.

Reference information of this calibre is hard to find, so many growers choose to keep Top Crop Manager issues on file. If you have not kept issues for your library, you can find our stories, and more, on our interactive web site.

Photo by Ralph Pearce

December 2008, Vol. 34, No. 14

EDITOR

Ralph Pearce • 519.280.0086 rpearce@annexweb.com

FIELD EDITOR

Heather Hager • 519.428.3471 ext. 261 hhager@annexweb.com

WESTERN SALES MANAGER

Kevin Yaworsky • 403.304.9822 kyaworsky@annexweb.com

CONTRIBUTORS

Blair Andrews

Treena Hein

ASSOCIATE PUBLISHER

Kelly Dundas • 519.280.5534 kdundas@annexweb.com

SALES ASSISTANT

Barbara Comer • 519.429.5176 bcomer@annexweb.com

PRODUCTION ARTIST

Gerry Wiebe gwiebe@annexweb.com

VP PUBLISHING

Diane Kleer dkleer@annexweb.com

PRESIDENT

Michael Fredericks mfredericks@annexweb.com

PUBLICATION MAIL AGREEMENT #40065710

RETURN UNDELIVERABLE CANADIAN

ADDRESSES TO CIRCULATION DEPT.

P.O. Box 530, Simcoe, ON N3Y 4N5

email: mweiler@annexweb.com

Printed in Canada ISSN 1717-452X

CIRCULATION

e-mail: mweiler@annexweb.com

Tel.: 866.790.6070 ext. 211 Fax: 877.624.1940

Mail: P.O. Box 530, Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES

Top Crop Manager West - 7 issuesFebruary, March, Early April, Mid April, July, November and December - 1 Year - $50.00 Cdn.

Top Crop Manager East - 7 issues - January, February, March, April, August, October and November - 1 Year - $50.00 Cdn.

Specialty Edition - Potatoe in CanadaFebruary - 1 Year - $9.00 Cdn.

All of the above - 15 issues - $80.00 Cdn.

Thank goodness for photography! If we did not have such means to capture these literal “snapshots in time,” we might lose the significance of things around us. Photos are limited in their capability to tell the whole story: a photo of a team celebrating a goal does not indicate a final score, or that a star player was injured during that game. Yet a single frame can easily translate into a harbinger of things to come.

The cover photo for this edition is a perfect example of that. One morning a couple of years ago, I happened upon a field of soybeans just days away from harvest, and I reasoned I should get some photos. In this business, a photo opportunity can be short-lived; a perfect stand of wheat in the morning can be straw later that afternoon.

So I parked my vehicle and began filling frames. It was not until I was looking at the developed cells a few weeks later that I realized that this particular cover shot was one of those rare instances where everything had come together perfectly, as if by some unseen guiding hand. There were so many positives in that one frame, and I had just happened along, as if something in Nature had jumped up and said, “Look at me!”.

I have never been accused of being overly optimistic, yet I regard this photo with a certain eager anticipation of the future. The clouds that day were clearing steadily from the previous night’s rain, giving way to blue skies, with the sun about to break through from the east. Looking down the rows into the distance gave the photo a deeper perspective, as if to offer a longing and hopeful look, not just of the field itself, but almost to the industry as a whole. Most of all, the spacing between plots formed a kind of triangle, angling off towards the horizon. When I looked

at the photo for the first time, that serendipitous shape reminded me of “delta” the scientific symbol that signifies change.

No matter the season, no matter the numbers that mark the years on the calendar, the pace of change in this industry continues its race forward. Change in economics, in commodity prices, in technology and practices, change in consumer demands and awareness, and in food safety procedures; all are occurring whether we choose to acknowledge them, or opt out and ignore them. It is up to the individual to look for a silver lining on a cloudy day, just as it is to see opportunity when others see adversity.

As a New Year brings the promise of a new beginning, Top Crop Manager resolves to continue as we have in the past: learning, formulating and sharing. Once again, our writers have done a remarkable job covering a variety of story topics, many of which focus specifically on the soybean sector: from news of IP markets to the latest on pests and diseases.

The start to 2009 may very well be a little bumpy, yet it is only a snapshot in time: it is not the whole story, and agriculture’s future looks bright enough to weather whatever may . . . develop. ■

Our corn hybrids are reaching new heights.

At Hyland we’re building leading corn hybrids that rise above the competition – on farm and in Ontario trials. And we take it up another notch by stacking a full-range of technology traits to give you hybrids that take corn performance to new heights on your farm. And our plans don’t stop there. We’re a local, independent company committed to agriculture. From developing leading varieties across a range of crops to creating market opportunities and helping ensure farmers are recognized for their contributions, Hyland is building with you. Visit hylandseeds.com or contact your Hyland seeds representative at 1-800-265-7403.

Since the discovery of soybean cyst nematode (SCN) in Ontario in the late 1980s, SCN-resistant varieties of soybean have become available to minimize devastating yield losses. Now, there are reports that this resistance might be breaking down. The change in field resistance, however, is difficult to determine.

Several factors contribute to the appearance of reduced resistance to SCN in specific fields. Resistant soybean varieties do not have complete immunity against SCN; this variable resistance may give the appearance of resistance breakdown where it has not occurred. On the other hand, both the limited genetic diversity of plant resistance sources and crop management practices can contribute to real changes in SCN populations, affecting resistance.

Each SCN-resistant soybean variety available today was developed using one of several breeding lines, or sources of resistance. “Plant introduction (PI) 88788 is the source of resistance for probably more than 90 percent of the SCN-resistant soybean varieties in the Midwestern United States and Canada,” explains Dr. Greg Tylka, nematologist at Iowa State University. “This is because it is the least difficult of the sources of resistance to use and still maintain high yields.” In the 2007 Ontario Soybean Variety Trials (www.gosoy.ca), only one of the 26 SCN-resistant varieties for which these third-party performance data are available had a non-PI 88788 source of resistance. This lack of genetic diversity contributes to concerns about the breakdown of PI 88788 resistance.

The seed industry has been working for years to introduce other sources of resistance into good-yielding varieties of soybean. “It has been really hard to break that genetic linkage between resistance and low yield,” says Don McClure, soybean breeder with Syngenta Seeds

Canada. “It takes a lot of screening of progeny and many breeding generations to get up to decent yield levels.” McClure notes that several seed companies are close to releasing new varieties with non-PI 88788 resistance that are suitable for Ontario growing conditions.

The actual resistance itself is something of a misnomer because no one SCN-resistant variety has complete immunity against all SCN field populations. Albert Tenuta, plant pathologist with the Ontario Ministry of Agriculture, Food, and Rural Affairs, compares it to a soybean variety that has resistance to specific pathotypes or races of the Phytophthora fungus. “You can challenge that soybean variety with those Phytophthora pathotypes and you won’t get infection. The only way to get infection is if you get a new pathotype that bypasses that variety’s resistance.”

With SCN, however, a variety that is classified as resistant can have up to 10 percent of the number of cysts found on roots of a susceptible check variety such as Lee 74. A moderately resistant variety can have 10 to 30 percent levels of cysts.

This variability in resistance has a lot to do with the genetic nature of the resistance. SCN resistance is linked

by Heather Hager, PhD

to multiple genes, but “varieties are coming out without the full complement of genes conferring resistance,” says McClure. Because of this, a grower should be aware of the level of resistance of the specific variety being used in any given year. Depending on the field, as well as seasonal and genetic factors, a moderately resistant variety may show more severe SCN symptoms than a highly resistant variety.

However, the possibility of resistance breakdown is of concern and can occur because of factors that change the SCN population. For example, a grower might find a PI 88788 source that works well and then continue to plant it year after year in the same field. This causes the nematode population in that field to become adapted to that variety to some degree. “The worst thing the grower can do is to keep planting the same SCN-resistant variety time after time after time,” says Tenuta. “That will promote a quicker shift to new populations of the nematode, which may overcome that source of resistance faster.”

Tylka has conducted field experiments in which varieties with the PI 88788 source of resistance are grown yearly at nine or 10 locations throughout Iowa. Even though some varieties are showing increasing levels of SCN, perhaps indicating some resistance breakdown, soybean yields are still quite good. “It’s not a good sign that the nematode is building up numbers on PI 88788 resistance, but I don’t think we’re on the verge of a collapse either. We’re still seeing very good yields, even though SCN reproduction is above 10 percent. I still get 55 and 60 bushel per acre yields from good PI 88788 resistance varieties,” says Tylka.

In Ontario, Tom Welacky, research scientist with Agriculture and Agri-Food Canada, is involved with the yearly field trials that examine the agronomic performance of SCN-resistant varieties

in SCN-infested fields for Table 7 of the Ontario Soybean Variety Trials. Welacky says that the resistant varieties still have better performance than susceptible varieties in those fields based on yields and other agronomic measurements.

Welacky is also in the third year of an Ontario-wide survey to monitor changes in population numbers and races of SCN. So far, he has tested 135 of 424 samples to see how well the nematodes reproduce on the original PI 88788. He is finding that although about one-quarter of the samples tested have greater than 10 percent reproduction on PI 88788, most of these fall between 10 and 30 percent reproduction. But he notes, “PI 88788 resistance is still more than adequate for taking care of the problem in Ontario fields as the SCN populations are now.” Also, the yields still seem to be as good as those of the average resistant variety. “In other words,” says Welacky, “We’re not getting an agronomic indication of serious breakdown in resistance, even though there are some populations that do reproduce over 10 percent on the PI 88788 varieties.”

However, Welacky has found that some fields have unusually high populations of SCN (Figure 1), which he cautions could indicate resistance problems. Further tests on these samples are pending. Even if resistance breakdown is not severe in these populations, such high levels are not good news. “Even if you have a resistant variety, if you start getting over 10,000 eggs per 100 grams of soil, SCN can start to overcome the resistance because the population size is overwhelming.”

Integrate management options

There are a number of aspects that the grower should consider in his or her strategy to maintain yields, keep nematode populations low, and reduce the probability of decreased resistance. Detection is key. “It is important for growers to first know that they have SCN in the field,” says Tenuta. “Every grower in Ontario, whether in southwestern Ontario or Ottawa, should be scouting for SCN.”

Growers should also keep track of their soybean yields over the years. Yield

For further information on soybean cyst nematode see www.soybeancyst.info and www.planthealth.info/scn_basics.htm.

decreases that are unrelated to weather or other obvious factors can appear long before other signs of SCN. In addition, changes in yield could indicate an increase or shift in SCN field populations to ones that reproduce well on that particular resistant soybean variety.

All three SCN experts recommend that once SCN has been confirmed, growers should rotate resistant soybean varieties to keep nematode populations from adapting to one particular variety. The best practice is to rotate varieties with different sources of resistance, for example, PI 88788 and another source. “It’s extremely difficult for the nematode population to build up on two different sources of resistance,” says Tylka. However, this practice is often difficult to follow because of the lack of availability of other sources of resistance. Despite this problem, McClure says that the seed industry is not yet hearing a big push from farmers to have alternate sources of resistance.

If growers cannot rotate sources of resistance, says Tenuta, they should at least rotate SCN-resistant varieties that have the PI 88788 source of resistance. He also recommends the increased use of crop rotation to reduce SCN population numbers. “Our highest SCN populations have been in fields that had heavy use of soybean in the rotation,” says

Tenuta, citing a corn/soybean rotation. “Any time you introduce a new crop in the rotation to extend the years between the soybean crops, that definitely has a positive effect.”

Ultimately, changes in the nematode population have a lot to do with how the grower manages SCN. If a grower ignores the problem and continues to grow a susceptible variety, SCN population numbers can quickly become extremely high. “Then it’ll be a tough battle to reduce that population to workable levels where it won’t be damaging to soybeans,” says Welacky.

Welacky emphasises that consistent monitoring is important. Growers should monitor their fields every two to three years to check SCN population levels. However, he thinks that the overall population decreases he has detected in the SCN population survey may indicate that growers are doing a good job of using resistant varieties and nonhost crops.

“All soybean growers in Ontario should be thinking about SCN and have a management plan in place because it is our number one disease problem and continues to be,” states Tenuta. As for other Canadian soybean growers, Tenuta says that so far, SCN has only been detected in Ontario, not the rest of Canada, but it is likely only a matter of time before it moves to other areas. ■

Managing information, not the tools, is the key.

Several practical advancements in precision agriculture are renewing farmers’ interest in the technology, particularly as a way to reduce their production costs. While precision ag equipment appears to be coming of age, the system has yet to live up to the early expectations of revolutionizing agriculture.

The precision farming concept is generally described as having the ability to apply just the right amount of fertilizers and pesticides in the right places in the field at the right time. The precision is achieved by using equipment tied to Global Position System (GPS) satellites. GPS-related tools include yield monitors, light bars and auto-guidance systems. The early selling points of the system were increased efficiency, higher yields and improved environmental stewardship. In recent years, the list has grown to include fuel and labour cost savings and, for some, meeting food safety requirements.

A quick history

In the mid-1990s, some of the earliest adoption of precision ag equipment involved yield monitors that were fitted with GPS receivers, giving farmers the ability to record the location of yields and to make yield maps, and grid soil sampling, which showed how nutrients varied across their fields. They could take this information, analyze it and then make management decisions to improve the production of the lower performing areas of their fields. Dr. Bruce Erickson, director of cropping systems management at Purdue University, says there was an initial phase of excitement over precision ag as farmers and agricultural equipment dealers embraced yield mapping and variable rate technology in nutrient applications. The excitement for some, however, turned to disap-

by Blair Andrews

pointment, and the interest “levelled off,” says Erickson. “The disappointment in the yield maps and the variable rate technology is that it was often difficult to relate cause and effect, and these might be very different in different fields or in different years. Also, there was a level of discomfort for many farmers in the computer technology. Somehow, the yield monitor information or grid sampling data had to come out in map form for it to be utilized.”

Erickson says the farmer would then have to analyze the data to determine possible causes and effects, sometimes very easily in the case of a broken tile or an obvious management mistake, but more often it was much more complicated. “And all of those things still haven’t turned a profit for the farmer until it drives a decision. You can collect all the information you want, but if you don’t make a decision to change something, that information is not

Above: Auto-steer systems have obvious benefits to spring planting, eliminating overlaps and skips while making it easier for growers to work at night.

Left: Precision farming is as much a benefit to spray applications, as it is for tillage and planting.

valuable.” Erickson explains that this part of precision ag was informationintensive, which was quite complex and time consuming for many farmers.

“Farmers are busy people; most are managing multiple enterprises and dealing with landowners, employees, and family responsibilities, they may have off-farm commitments such as serving on boards. Most don’t have time to spend hours in front of a computer,” says Erickson. In many cases farmers depended on their crop advisers or input suppliers.

Drawbacks led to frustration

Dale Cowan, general manager of the Agri-Food Laboratories in Guelph, has seen the frustrations associated with precision ag. Cowan, whose company is in the business of analyzing soil, manure and water results, believes the management concept behind precision ag has been lost since it was first

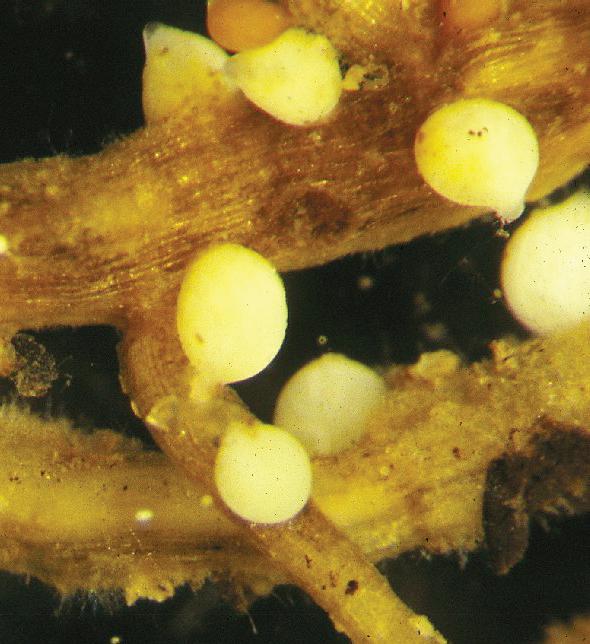

Leading soybean inoculant manufacturers, such as Becker Underwood, often advise growers to inoculate their seed every year because the quality and nodulating performance of improved rhizobia surpass that of native strains already in the soil.

Dave Hume believes there is definite merit in this advice. Several years ago the professor emeritus in the Department of Plant Agriculture at the University of Guelph oversaw a field study that compared the performance of original rhizobia to the performance of current improved rhizobia.

In this study a graduate student collected nodules from soybean roots from numerous farms in Essex and Kent counties. He then developed inoculants from these rhizobia, which would have been established in southwestern Ontario soils around 1940. In side-byside field comparisons, soybeans treated with commercial inoculant featuring improved rhizobia yielded an average of 7 percent more than soybeans treated with the older rhizobia.

“We didn’t delve deeply into the biochemistry behind the yield difference, but it seems that improved rhizobia are more efficient and provide more nitrogen fixation per gram of nodule than older native rhizobia strains,” Hume explains.

Hume goes on to say that, based on his trials, Ontario soybean growers can reasonably expect a yield response of at least 1 to 1.5 additional bushels per acre from the use of inoculants. One of the reasons for the yield advantage, Hume speculates, is getting better strains to form the first and most important nodules in the field.

“Since I started working with inoculants about 35 years ago, there have been essentially four phases in the continuing evolution of these products,” he says. “In the first phase, inoculants were non-sterile, powdered peat products. In the second phase the

industry moved to sterile peat formulations. This increased rhizobia numbers from 100 million per gram to 1 billion per gram, which is a ten-fold increase in active rhibozia on the seed. The third phase has been a move to liquid products, which has provided even higher numbers of active rhizobia. The fourth and most recent evolution is the stacked inoculants we’ve seen from Becker Underwood.”

HiStick® N/T represents the new category of BioStacked™ soybean inoculants with Nodulating Trigger® Technology. Available in potent liquid and sterile peat formulas, HiStick N/T features both Bradyrhizobium japonicum bacteria and a patented Bacillus subtilis strain (MB1600). The Bradyrhizobium japonicum bacteria colonize the root system to enhance nitrogen fixation. The Bacillus subtilis acts as a Nodulating Trigger, which results in greater nodule biomass, faster canopy closure, and ultimately higher yields.

In 16 field trials, Hume found that BioStacked HiStick N/T delivered an additional 1.5 bushels per acre compared to previous, non-stacked HiStick formulas.

At current market prices for soybeans, the decision to use an inoculant has never been better, Hume asserts.

“On average, inoculation is going to give you an extra bushel or two per acre,” he says. “In the crop-consulting firm I work with, we’re advising growers to use inoculants next year... and we’re quite firm in that recommendation.”

introduced. “It’s all about getting the information; it’s not about getting the toys,” says Cowan. “It’s the information you gather, and keeping it in an organized manner so that you can find some opportunities to improve management and make knowledgebased business decisions. That has been the hard part.”

The biggest problem, according to Cowan, is the amount of time it takes for most people to maintain an effective database. “There are very few people that have an organized on-farm database, or even agri-business for that matter, that has been fully scrubbed every year to make sure it is accurate, contains the right information and is consistent. So when you do a normalized yield over five years and look at yield patterns, or the tile, or variety responses over the years, you can do that.”

Moreover, frustration sets in because Cowan says most people are not in the position to make the analysis that would help them reap the cost-saving benefits of the technology. “There are an awful lot of guys who have 30 computer cards stacked up with 10 years of field data on it, and they haven’t processed a single file yet,” says Cowan. “GPS technology is great, but this whole idea of precision ag was to be a management concept and we’re not just there.”

Despite the early disappointment, precision ag is now enjoying a resurgence in interest thanks to the GPS navigation systems. Erickson says the economic benefits of the technology, including auto-guidance on tractors, are more straightforward. Growers can use auto-guidance or light bars to reduce overlaps, which translates into savings on fertilizers, pesticides, fuel and time. “And maybe you could go a little faster, and maybe you could spray at night, whereas you couldn’t before. Those are easy economics,” says Erickson.

The economics, along with the simplicity of the newer precision agriculture equipment, appear to be resonating with farmers. “I have enquiries, daily,” says Jamie McGrail of McGrail Farm Equipment Ltd.,in Chatham-Kent, Ont. McGrail, who

has been involved with precision ag equipment through John Deere since 2002, says interest has been growing every year.

McGrail says farmers in all sectors, from cash crop to high-value vegetable producers in her area are utilizing the AutoTrac™ technology. AutoTrac accurately steers the vehicle, allowing the operators to cover more area because they are reducing the overlap in the fields. “I see the hands-free driving from tillage to planting. Farmers are also using the technology on their sprayers because of the continuous spray applications that happen throughout the season. And your fatigue at the end of the day is much less.”

The future and food safety applications Echoing Erickson’s comments about working at night, McGrail says the technology can allow people to work during times of low visibility, which could help them take advantage of more ideal conditions. “The window of opportunity to spray may come at odd hours, such as late at night or during the early morning hours for the simple fact that the wind seems to die down during those times.”

McGrail adds that guidance systems offer potential benefits that go beyond pesticide or fertilizer applications. Noting that the vegetable crop industry is quite labour-intensive, and often farmers have to rely heavily on

off-shore labour, she says auto-steering and automatic controls could allow individuals with less experience to operate the equipment.

The growing issue of food safety, while not as obvious as the other applications of precision agriculture, is another area where the technology could make a difference for farmers. “In food safety, you need to document everything you do, and in these systems you do that. What you are spraying, the date, when you were in; when you were out, all of these factors are getting to be more important,” says McGrail.

As more farmers consider precision ag as a way to improve the various aspects their operations, Cowan hopes producers will again become interested in the information-based systems. “There needs to be a dedication to the fact that it is a management system, and to hone your management skills around the idea of this technology.”

Despite the early struggles with the databases, Cowan says the original concept of using GPS to micro-manage fields is paying off for those who took the time to do tasks like detailed soil sampling and to understand the response of their fields to fertilizer and other inputs. “If you look at the price of fertilizer, right now it’s $300 an acre, where it used to be $100. You’re going to be well rewarded for this management time and investment in learning about this technology.” ■

A new category of soybean inoculants offers Canadian growers more than just improved nitrogen fixation. In fact, Becker Underwood’s BioStacked HiStick® N/T soybean inoculants with Nodulating Trigger® Technology are designed to create a healthier, stronger root environment that gets soybean plants off to a faster start that pays off in higher yields at harvest time.

“Conventional soybean inoculants only enhance nitrogen fixation,” says Piran Cargeeg, Becker Underwood Technical Development Manager. “But our new BioStacked HiStick N/T inoculants combine multiple beneficial biological organisms that not only boost nitrogen fixation, but also provide a more robust root system with greater nodule biomass. And healthier roots are key to accessing the critical moisture and nutrients soybean plants need to deliver top yields.”

BioStacked HiStick N/T inoculants contain Bradyrhizobium japonicum, a symbiotic bacterium that colonizes the soybean root system (nodules) to enhance nitrogen fixation. In addition, BioStacked inoculants also include a unique micro-organism Bacillus subtilis that acts as a Nodulating Trigger, resulting in greater nodule biomass, faster canopy closure, and ultimately higher yields.

It’s important to note that agricultural soils play host to a wide array of micro-organisms... some can be harmful while others can be beneficial and contribute to enhanced plant growth. Bacillus subtilis is an example of one such beneficial organism, or Plant Growth Promoting Rhizobacterium (PGPR). The patented Bacillus subtilis strain (MB1600) that is formulated into Becker Underwood’s BioStacked HiStick N/T colonizes the root zone of the host soybean plant and forms a protective sheath, or bio-film, that completely covers the root system. As the Bacillus subtilis grows, it produces phytohormones that can enhance plant growth and vigor as well as reduce time to canopy closure.

Another PGPR benefit Bacillus subtilis has demonstrated is enhanced nitrogen fixation through the promotion of extensive nodule formation. This leads to increased nodule biomass in soybeans, as a result of this Nodulating Trigger technology formulated into the BioStacked category of inoculants from Becker Underwood.

In addition to its plant growth-promoting qualities Bacillus subtilis also exhibits a unique biological fungicidal activity* In fact, the MB1600 strain is an EPA-registered biofungicide in the United States. The same protective sheath that contributes to improved plant growth and vigor occupies competitive space on the soybean plant’s roots. This helps inhibit harmful organisms from accessing points of infection that can lead to disease development or other harmful stress.

According to Cargeeg the new category of BioStacked inoculants from Becker Underwood is truly unique.

“There’s really nothing else like HiStick N/T in the Canadian soybean market,” he notes. “No other inoculant stacks multiple beneficial biological organisms that work synergistically with the soybean root system to deliver enhanced performance through the growing season. Becker Underwood BioStacked inoculants are an innovative technology that helps foster a healthier environment beneath the soil’s surface. And a healthier, well-developed root system is vital for strong vegetative growth that provides better, more consistent stands that ultimately result in higher yields.”

When it comes to climate change and the development of Canadian standards for greenhouse gas emission reductions, regulated industries may be looking to farmers for a source of carbon credits to use in the carbon offset system. In fact, this is already happening in Alberta. There, farmers are earning carbon credits by sequestering carbon in the soil.

“Carbon in the soil is a pretty dynamic item,” says University of Guelph professor emeritus Dr. Bev Kay. “It comes into the soil from the atmosphere as the plants fix carbon by photosynthesis and create organic matter. Organic matter goes into the soil, microorganisms decompose the organic matter and convert it to carbon dioxide, and the carbon dioxide goes back into the atmosphere.” Kay likens this process to a bank account: it is the rates of deposit and withdrawal that determine the final amount of carbon in the soil.

Changes in land management can change the equilibrium level of soil carbon. For example, the conversion of forest or prairie to agriculture generally results in an overall loss of soil carbon to the atmosphere. “When we started tilling the land, we introduced air into the soil and exposed it to the sun so it warmed up, so the carbon was being removed faster than it was being replaced,” explains Edgar Hammermeister, past president of the Saskatchewan Soil Conservation Association. “Now we’re into the tougher organic matter, so the rate of reduction has declined greatly.”

Different land uses such as fallow, annual crops or perennial crops have different equilibrium levels of soil carbon associated with them. The idea of carbon sequestration then, is to adopt a management practice that maximizes the amount of carbon in the soil, reasons University of Guelph professor Dr. Bill Deen, who studies cropping and tillage practices. Management practices and

by Heather Hager, PhD

Adding a cover crop like clover actually does more to increase carbon sequestration than altering tillage practices, and boosts yields in subsequent crops.

climate interact to produce differences in the amount of carbon that can be sequestered in different regions.

Cross-Canada differences in potential carbon sequestration

Long-term research indicates that although measurable increases in soil carbon are occurring with the adoption of no-till practices in western Canada, there is a much smaller effect in eastern Canada. “In western Canada, the adoption of no till was associated with two results: increased water conservation and reduced fallow use,” explains Deen. “By improving water conservation and decreasing fallow use, they were able to increase biomass production per unit area through increased yields and by adding crops in place of fallow ground. This resulted in increased biomass being returned to the soil.” And more biomass means more carbon.

In contrast, the adoption of no-till practices in eastern Canada has had less of an effect on the amount of biomass than in western Canada. Historically, the use of summer fallow has been less prevalent in eastern Canada, eliminating the potential for a large decrease in fallow use and a corresponding increase in biomass. Also, Deen has found no evidence of yield improvements in long-term no-till experiments near Woodstock, Ontario. He says that this lack of improvement might indicate that

the amount of biomass being returned to the soil has not increased much over that under conventional tillage.

In addition to greater moisture conservation and decreased summer fallow with the adoption of no till in the dry climate of western Canada, Dr. Brian McConkey, research scientist with Agriculture and Agri-Food Canada in Swift Current, Saskatchewan, cites differences in the primary tillage methods as a factor affecting the different potential for carbon sequestration between eastern and western Canada. “The nature of tillage is completely different,” says McConkey. “In eastern Canada you have more use of the moldboard plow, so you get soil inversion. In western Canada, there is usually no inverting tillage, and they only till 7 to 10 cm deep (2.75 to 4.0 inches).”

Kay also notes the effect of tillage method. He explains that with the moldboard plow, the soil is inverted up to 30 cm (12 inches) in depth, distributing organic matter throughout this depth. In going from conventional moldboard tilling to no till, more carbon accumulates near the soil surface, but the carbon that was previously mixed deep in the soil slowly decreases because it is only replaced by the death of deep plant roots and some transport by soil organisms. The balance is that the distribution of carbon through the soil layer has changed, but there has been little increase

When Watford, Ontario, grower Jeff Shea puts pencil to paper he sees HiStick N/T soybean inoculants as a sound risk management tool that offers the potential to turn a tidy profit year in and year out.

Shea used Becker Underwood’s BioStacked™ HiStick® N/T soybean inoculants with Nodulating Trigger® Technology on all 500 of his soybean acres in 2008, and enjoyed a strong enterprise-wide yield of 50 bushels per acre.

“HiStick N/T costs us $4 to $6 per acre. To me this is cheap insurance for not only protecting, but maximizing our yields,” Shea says. “At today’s soybean prices, you only need a halfbushel yield response to cover the cost of the inoculant. All the data I’ve seen indicates you can expect an average yield increase of around 2 bushels per acre. That’s a pretty solid return for a pretty small investment.

“To me, everyone has their own individual recipe for profitable soybean production,” Shea adds. “You can’t view inoculants as some kind of silver bullet, but I believe HiStick N/T is an important part of my recipe for maximizing yields and profits across my soybean acres.”

Horst Bohner is the soybean specialist for the Ontario Ministry of Agriculture, Food and Rural Affairs (OMAFRA). Results of OMAFRA field trials through the years have illustrated to Bohner inoculants are a sound management practice for many producers.

“The conventional wisdom used to be that inoculants were absolutely essential on fields that were new to soybeans, but that you didn’t need them after rhizobia levels had built up in the soil,” Bohner points out. “In recent years we’ve seen that there is a 1- to 1.5-bushel advantage in using inoculants even in fields with a history of soybeans. Is this a huge difference? No, but for many producers it

is a response that can put more profit into their soybean operation. I’m a firm believer that there’s enough value in inoculants that growers should at least consider trying them on their farms.”

According to Bohner, products like HiStick N/T are representative of a significant advancement in inoculant technology compared to 25 to 30 years ago.

“I think there are improvements in the strains of rhizobia in today’s inoculants, and there’s no doubt they’re delivering more live, beneficial bacteria to each seed,” he notes.

HiStick N/T represents a new category of BioStacked soybean inoculants with Nodulating Trigger Technology. Available in potent liquid and sterile peat formulas, HiStick N/T features both Bradyrhizobium japonicum bacteria and a patented Bacillus subtilis strain (MB1600). The Bradyrhizobium japonicum bacteria colonize the root system to enhance nitrogen fixation. The Bacillus subtilis acts as a Nodulating Trigger that results in greater nodule biomass, faster canopy closure, and ultimately higher yields.

Shea says Becker Underwood’s commitment to continuous innovation was a key factor in his decision to use HiStick N/T on all his soybean acres in 2008.

“I really believe it pays to invest in the newest technologies when growing soybeans, whether it’s genetics, seed treatments or inoculants,” Shea. “I value the investment Becker Underwood makes in inoculant research and development, and I think the results can be seen in my yields from this year.”

overall, so there is little increase in carbon sequestration. However, Kay is quick to note that no-till practices can provide other benefits such as better water infiltration and water-holding capacity and decreased erosion.

Despite the lower potential for no-till systems to sequester carbon in eastern Canada than in western Canada, both Deen and Kay point to the potential for crop rotation practices to sequester carbon. Deen has performed long-term experiments at Elora, Ontario, to examine the effects of tillage and rotations on soil carbon. “Our data clearly demonstrate that if you want to alter soil carbon, the best way to do it is not by altering your tillage system, but by altering your rotation,” says Deen. In western Canada, no-till practices have altered the rotation by getting rid of summer fallow.

In eastern Canada, Deen recommends a shift to a more diverse rotation that includes high-biomass crops, perennials and legumes, as well as crops that increase the biomass of subsequent crops. As an example, he compares a corn/soybean/ wheat rotation with a corn/soybean/ wheat/red clover rotation. His data show that not only does the latter rotation have more biomass because of the red clover, but also, red clover increases the yields of the next corn and soybean crops, and may have a positive effect on the subsequent wheat yield, which also adds to the biomass.

Interestingly, Deen found that the highest soil carbon levels occurred in a perennial alfalfa plot from which biomass was harvested every year, likely because alfalfa is a perennial legume that produces a lot of belowground biomass in the form of roots. Thus, for both tillage and rotation, the effect on carbon sequestration ultimately depends on how much biomass is left behind in the field. It is also important to remember that there is an upper threshold to the amount of carbon the soil can hold and thus to carbon sequestration.

In March 2008, the Government of Canada published greenhouse gas

emissions reductions targets for specific industries that are to be regulated, including combustion-based electricity generation, oil and gas, pulp and paper, iron and steel, smelting and refining, and cement, lime, potash, chemical and fertilizer industries. These industries must meet emission reductions by 2010 via specific mechanisms; one option is the carbon offset system. Nonregulated industries such as agriculture that voluntarily reduce their emissions below business-as-usual practices can obtain carbon offsets, or credits, which can be sold to regulated industries through a carbon market.

So how can Canadian farmers who switch to improved management practices obtain carbon credits? “Currently, there is only one mandatory offset system in the country that is operational, and that’s in Alberta,” says Don McCabe, vice president of both the Soil Conservation Council of Canada and the Ontario Federation of Agriculture. The first deadline for industry compliance in Alberta was July 2007.

According to Karen Gorecki, policy analyst at Climate Change Central, three of seven projects that received carbon offsets in Alberta’s first compliance period were for reduced-tillage practices. Each of these projects was registered by an aggregator who bought offsets from individual farmers and sold them to industries, much like a grain elevator buys and sells grain. Gorecki estimates that roughly 1100 farmers participated. These reduced-tillage projects were calculated to account for the removal of 587,692 tonnes of carbon dioxide equivalent, which was 37 percent of the total registered tonnage for 2007 compliance. It is estimated that companies paid $6 to 13 per tonne and farmers received $4 to 9 per tonne, with aggregators taking 35 to 40 percent of the cut. This margin is expected to narrow as the market matures.

The amount of carbon dioxide equivalent that is sequestered by the adoption of reduced- and no-till is calculated following Alberta’s Quantification Protocol for Tillage System Management. Regional coefficients for broad soil-type and climate zones are used to calculate the carbon offsets associated with reduced and no-till. This protocol can be applied

regardless of the historical management practice, which means that a farmer who has been using reduced tillage for years does not have to convert to conventional till and then back to reduced till to benefit from carbon offsets.

A national offset system, administered by Environment Canada, is currently under development. Selected external offsets protocols such as Alberta’s tillage protocol are currently under review to meet ISO standards. Protocols are developed by organizations outside the federal government, and each protocol describes the methods required to quantify the greenhouse gas reductions achieved by that specific project type, e.g., reduced tillage.

The Industry Provincial Offsets Group (IPOG), a collection of industry and provincial government stakeholders, is one of these protocol developers. “IPOG is working very diligently right now to get protocols to Environment Canada,” says McCabe, who is involved with IPOG through the Soil Conservation Council of Canada. “We have to get the rules down as quickly as possible so we can get the knowledge out to farmers who want to participate.” After all, industries have to meet the first deadline for emissions reductions in 2010.

In Ontario, the provincial government is currently evaluating a draft protocol for tillage system management that draws on Alberta’s protocol, but is revised for Ontario’s different carbon sequestration conditions. To this end, as many as 40 farmers who have been practicing reduced or no till for several years are participating in a pilot project with the Ontario Ministry of Agriculture, Food, and Rural Affairs (OMAFRA) and Ministry of the Environment. The project is measuring the changes in tillage practices from which greenhouse gas reductions could be calculated, says Elizabeth McClung of OMAFRA. The project should wrap up in early 2009.

Tillage practices are just one of the ways that farmers may benefit from carbon credits. Other protocols may include livestock feeding, manure management and nutrient management. Whether crop rotation practices will have their own protocol for carbon credits remains to be seen. ■

Glyphosate is a great tool for soybeans. But it doesn’t get some of the really tough weeds, and it doesn’t provide residual control.

That’s where Guardian comes in. Guardian goes beyond glyphosate to deliver one-pass, broad-spectrum residual control – including tough weeds like dandelion, yellow nutsedge and annual sow thistle. And it guards against weed shifts as well.

For burn-down in all soybeans or in-crop use in GT beans, unleash the power of Guardian on your soybean weed problems this year.

Crop residues have worth –on and off the field.

In deciding whether or not to remove crop residues, particularly corn stalks, farmers need to consider the big picture, says Joel Bagg, forage specialist with the Ontario Ministry of Agriculture, Food and Rural Affairs. “There is always more interest in crop residues when forage is scarce,” he says. “It comes down to what’s available, but farmers need to remember that residues aren’t free.”

The first thing livestock farmers turn to for extra feed, says Bagg, is corn silage. Corn stalks are also an option, but rather than baling them, farmers can avoid these costs and allow the cattle to graze. “The limitation on that, however, is that these corn fields are not generally fenced, but you could use temporary fencing or inexpensive fencing,” says Bagg. However, he adds a cautionary note, “Everyone’s always looking for feed, but if you can’t recover your phosphorus (P) and potassium (K) and organic matter in terms having to add extra fertilizer, you’re better to leave residues in the field.”

Dr. Jim Camberato, associate professor in the Agronomy Department at Purdue University in West Lafayette Indiana, agrees. “The amount and value of P and K in stover clearly should be considered a cost of stover baling. Other essential plant nutrients, such as nitrogen, calcium, magnesium, sulfur and the micronutrients are also taken away when stover is harvested and should be figured into the nutrient cost of stover baling, especially in low nutrient soils and with long-term stover removal.”

Camberato says corn stover contains about 3.6 lb P2O5 and 20 lb K2O on a per ton basis (based on stover concentrations of 0.18 percent P2O5 and 0.99 percent K2O). The 2.5 tons per acre removed from a field producing 150 bushels per acre contains about nine pounds of P2O5 and 50 pounds of K2O. He calculates the current value of these nutrients, using a price of $0.75 US per pound of P2O5 or K2O to be about $44 US per acre or $18 US per ton of stover.

Camberato’s colleague Dr. Tony Vyn says the greatest nutritional values of crop residue, especially with corn, are right after harvest. Soluble sugars will be reduced in precipitation as well as K, with K being one of the nutrients lost the fastest. “In terms of total nutrient return to the soil,” says Vyn, “harvesting later is best.”

A look beyond feed to fuel

Nutrient value aside, crop residues are also important to leave on the field in terms of their capacity to reduce soil erosion and replenish soil organic matter. “Corn stover removal eventually will lead to reduced soil quality through a reduction in soil organic matter,” says Camberato. “Compaction during stover removal is another factor that may reduce soil quality and should be minimized.”

Vyn says the amount of residue needed for soil quality and

by Treena Hein

A value assessment has to be done when considering how much stover can be fed, and what needs to remain behind for the sake of soil health.

erosion control depends on the soil quality that already exists, and how susceptible the field is to erosion. There are currently investigations occurring in the states of Indiana, Iowa and Illinois into the impact of removing 50 and 100 per cent of residue, but Vyn says there are no conclusive findings yet. However, he believes it is safe to say “Fifty per cent removal of stover would give adequate erosion protection in no till or strip till, but you are removing a food source for soil microbes. Vyn adds “I have much less concern about farmers taking residue from the fields of a cow-calf operation because they’re returning nutrients to the soil via manure. In a cash crop situation, the concerns are more serious.”

There is also research occurring at Iowa State University, says Vyn, into harvesting the top half of the corn stalks at the same time as the grain is threshed. “This is an interesting approach as it is all harvested at once, saving energy,” says Vyn. “In addition, the top half is least likely to have soil splashed on it.”

This is important, Vyn says, because some American electricity generation plants are considering the use of crop residue biomass to generate electricity by burning it along with coal, and soil is an undesirable addition. “The plants are being mandated to derive 8-15 percent of total generation from renewable sources,” says Vyn. “It varies by state as to when that mandate becomes law. They are also looking at wind, solar and hydro-electric possibilities.”

In Ontario, “The Ontario Power Authority estimates that an additional 450 MW of energy could be produced by biomass projects in the province by 2027, five times the current and committed capacity,” as stated on the Ontario government’s website. Baled corn stalks could be used, says Bagg, in cellulosic ethanol production in the future, “if there is a breakthrough and it’s worth the cost of harvest and transportation. There are a lot of economic unknowns with that.” ■

New markets and better prices may encourage growers to plant soybean.

Until recently, areas of Canada outside of southwestern Ontario have been at a disadvantage for soybean production because of their cooler climate and a dearth of soybean varieties suitable for low heat units. However, good-yielding varieties have become available in the last 10 years, and particularly in the last five years, says Mike Price, field crops specialist with the New Brunswick Department of Agriculture and Aquaculture. If soybean prices remain strong, as they have been since late 2006, soybean could catch on as a valuable cash crop in Atlantic Canada.

Agricultural census data from Statistics Canada indicate that between 1996 and 2006, the acreage of soybean in Prince Edward Island and Nova Scotia approximately doubled, and that in New Brunswick it increased by about one-third. “We don’t grow a lot of soybeans in New Brunswick,” says Price. Since 2006, New Brunswick’s soybean acreage has remained at about 2000 acres.

Soybean is not grown in Newfoundland.

In Nova Scotia, the acreage has increased to between 4000 and 5000 acres, says AgraPoint agronomist Jack van Roestel. By contrast, soybean acreage on Prince Edward Island has increased from a base level of about 7000 acres between 2000 and 2005 to about 18,000 acres in 2008, one-third of which is food-grade production, says Will Proctor, crop innovation officer with the PEI Department of Agriculture. These differences in acreage are related to market opportunities and challenges associated with adding or switching to a new crop.

Since about 1976, soybean has been

by Heather Hager, PhD

produced on hog or dairy farms and used for livestock feed. According to van Roestel, 80 percent of soybean in Nova Scotia is still grown and used on the farm for dairy production. The soybean is only sent off the farm for roasting, except on the largest dairy operations, which often have their own roasting facilities. However, the acreage grown as a cash crop has increased. “I’d say up until a couple of years ago, less than five percent of our acreage was for cash crop. Now it’s in the 20 percent range.” That 20 percent is grown on vegetable or beef farms as a cash crop and sold for use as livestock feed.

Until recently, the situation was similar on PEI. Soybean was mostly produced on hog farms for feed, and only a few farms grew it for sale as a cash crop. Two events transpired to change this, however.

“At the end of 2007, a local hog plant was closed, so hog farmers were faced with shipping animals to Quebec or Nova Scotia for processing,” explains Proctor. Because of the additional trucking costs, many producers chose not to continue with hog production. Many of these producers had the necessary equipment and skills to grow soybean, so they increased their acreage to move into cash crop farming.

Prince Edward Island farmer Robert MacDonald, along with his brothers Albert and Murray, originally produced potatoes and beef as their main output. “The challenge for us has been to try to find a crop that pays the bills in rotation years two and three between potatoes,” says MacDonald. A few years prior to the hog plant closure, MacDonald met Ontario-based David Hendrick of Hendrick Seeds, who supplies nongenetically modified soybean to specific buyers for the tofu market in Japan. In 2004, the MacDonalds grew 200 acres of soybean and sent it to Hendrick in Ontario to be conditioned there and sold to Hendrick’s Japanese buyers. “There was more money to be made growing identity preserved (IP) soybeans for David’s program than there was growing them for the livestock market,” says MacDonald. “The problem is, the extra that we were getting for growing for the program was taken away from us by transportation costs.” But there were no conditioning facilities located east of Montreal.

So, after several years of market analysis involving trials with PEI growers and a product marketing arrangement with Hendrick, MacDonald, now president of Atlantic Soy Corp.,

This season Canadian farmers will have a new partner in their efforts to control their toughest pests: Valent Canada Crop and Professional Products.

Valent Canada enters the market with the first of a series of new products and chemistries to help farmers manage the tough weed, insect and disease pressures facing Canadian crops.

“Canadian farmers play a major role in the global agricultural economy and need the best products possible to help maintain an edge in marketability worldwide,” said Eric Tamichi, national business manager for Valent Canada. “Valent Canada is committed to providing Canadian farmers some of the most proven products and chemistries currently in use in agriculture around the world.”

Tamichi said the new Canadian company will work in tandem with its sister company, Valent U.S.A. Corporation, and parent company, Sumitomo Chemical Co. Limited, to introduce a pipeline of products that have proven success against pests in U.S., Mexico, Latin America and other markets around the world.

“Our company network has a culture very focused on research, innovation and providing our customers the products they need to improve their operations,” Tamichi said. “In addition to introducing existing products from other markets, we will work to develop new products, tankmixes and formulations that help address specific needs important to Canadian farmers.”

New herbicide, new chemistry to fight tough weeds

One of the key products the company will be launching in 2009 is a new herbicide for use on both Roundup Ready and Glyphosate Tolerant soybeans as well as non-GMO and Identity Preserved beans. The soon-to-beregistered pre-emergence herbicide contains flumioxazin, a long-lasting residual compound proven to control even the toughest broadleaf weeds while suppressing annual grasses.

In various research trials, the herbicide showed as much as six weeks control on lamb’s quarters, Canada fleabane, three seeded mercury and velvetleaf and as much as eight weeks control on Eastern black nightshade and pigweed. Regina Rieckenberg,

sales and marketing manager with Valent Canada, said this extended length of control across a broad spectrum of weeds will give farmers greater peace of mind throughout the season.

“This herbicide will deliver long-lasting, consistent control across a variety of weeds,” Rieckenberg said. “We believe when it is registered in 2009 it will become that go-to product for soybean farmers who need assurance their toughest weeds will be controlled at those critical points in the season.”

The new herbicide should be applied as a preplant or early pre-emergence herbicide, from 30 days prior to planting up to three days after planting (before the soybeans emerge).

In burndown situations, it can be used as a foundation herbicide partner with glyphosate in Roundup Ready® or glyphosate tolerant soybeans. In research, flumioxazin has been shown to increase the speed and consistency of the glyphosate burndown and to give about six weeks of residual control. It also will be a good fit for growers of non-GMO or IP beans where it will be part of a complete herbicide program. Flumioxazin will add excellent control of eastern black nightshade as well as many other weeds, including those resistant to group 2 chemistry.

Additionally, the product will have no rotational restrictions, meaning no carryover issues into other crops.

Keeping resistance management top-of-mind

Rieckenberg said one of the primary reasons Valent is expanding to the Canadian market is the company’s interest in providing sound resistance management solutions to farmers around the world.

“University researchers have confirmed resistance to Group 2 and triazine herbicides among some of our toughest and most prevalent weeds, including, pigweed, lamb’s quarter and Eastern black nightshade,” Rieckenberg said. “Valent U.S.A. has an excellent herbicide with a long record of fighting resistant weeds in U.S. fields. The residual herbicide we will introduce has that same chemistry that will bring an entirely new mode of action to Canadian farmers. This new herbicide will not only

effectively control those tough weeds, but will give farmers a good rotational tool to help manage future resistance issues.”

Untreated Check Valent’s Herbicide*

In University of Guelph trials, Valent’s soon-to-be-approved pre-emergence product continued to show excellent control of tough weeds in late June, nearly a month after application. The new chemistry herbicide maintained control of Group 2-resistant pigweed and triazine-resistant lamb’s quarters in minimal till, IP soybean plots— results that were either comparable or better to older herbicides.

Research: Dr. Francois Tardif, University of Guelph Location: Woodstock, ON Soybeans planted May 29, herbicide applied May 29, photos June 20, 2008 (29 DAT)

* PENDING REGISTRATION

The flumioxazin compound used in Valent’s new herbicide has a long, proven history in the U.S. against such tough-tocontrol weeds as Eastern black nightshade— a significant issue across several American states. In those areas, the residual control helped deliver both in-season control and end-of-season profits.

“Some American farmers who used our residual product within their glyphosate program saw an average 10-bushel-per-acre increase in yield versus those farmers who used a glyphosate burndown alone,” Rieckenberg said. “If soybeans are at $10 US a bushel, farmers will receive and increased $100 US an acre—clearly an excellent value and return on investment.” **

increased $100 US

Tamichi said it is that kind of value he hopes to be able to provide Canadian farmers moving forward through Valent Canada.

“At Valent, our motto is ‘products that work, from people who care’,” Tamichi said. “Therefore we are very focused on deepening relationships with Canadian farmers, researchers and retailers to collaborate on their specific needs. And, most importantly, to providing those best-in-class products farmers need to keep their operations running smoothly and profitably.”

obtained financing to build a conditioning facility in Belle River, PEI. The facility began operating in March 2008. In the 2007 growing season, MacDonald contracted 18 growers to produce 2300 tonnes of IP soybean (one acre produces about one tonne of soybean on PEI). In 2008, MacDonald had 52 growers and 6400 acres contracted.

Still, MacDonald says that the Japanese customers would like more. “They’re very enthused about buying product out of PEI. They would like to buy all the soybeans we can get. They thought, ‘you’re growing 95,000 acres of potatoes, so you should be able to get 50,000 acres of soybean.’ But it’s a new crop to a lot of people, a new process, and everyone’s cautious about making big changes.” However, MacDonald says that this IP market currently garners premiums of $35 to $100 per tonne because of the specific varieties and care requested by the Japanese customers. He plans to supply 10,000 tonnes by 2010.

Other market possibilities

The Japanese market is not the only opportunity available. “We’ve got more feed market here in Nova Scotia,” says van Roestel. “We’re certainly nowhere close to fulfilling our feed market.” Much of the soybean that is needed for the dairy industry is brought in from Ontario and Quebec.

The organic feed market is small, but is also developing. Some roasting of organic nongenetically modified soybean is done by a small business in Freetown, PEI, says Proctor. In addition, facilities in Sussex, New Brunswick, and Lawrencetown, Annapolis county, Nova Scotia, were certified this year to process organic soybean for feed production. “PEI is getting established this year to sell organic milk, and the dairy farms need organic protein for feed,” states Proctor. The certification of these local facilities will benefit both organic soybean growers and organic milk and meat producers.

The market for organic food-grade soybean is smaller than that for organic feed. At least two local businesses make organic soybean products such as tofu, roasted soy nuts, and frozen soy dessert. And MacDonald plans to

Maritime growers can easily adapt management practices necessary for potato production to those demanded for IP soybean production.

have his facility certified to condition organic soybean next year. But Price has a different opinion about the potential for the organic market. “No, we’ll still need to use conventional technology to produce these crops,” he says. Price has some ideas for potential markets that have yet to be explored. “The market opportunities that we’re looking to develop would not be similar to those out west,” he says. Rather, opportunities may lie in markets where there is limited demand and perhaps qualifications that require segregation. Plus, he states, producers that have grown potatoes are familiar with intensive management, so they have a demonstrated ability “to do intensive or close monitoring-type management. So putting something in here that would be a specialty would be a good possibility.”

One of these specialty applications might involve the aquaculture industry, says Price. “We have a tremendous salmon aquaculture industry in the Bay of Fundy, and it consumes as much livestock feed as the terrestrial livestock do in the province. There is potential for that to evolve and command specialty products to brand the fish produced,” for example, by altering the fatty acid composition of the fish meat. Or soybean may simply provide an alternative plantbased source of protein for the fish diet, as for livestock.

The market for industrial soy products remains virtually untapped. Such products include soy-based plastics and foams, lubricants, solvents, inks and coatings, and adhesives. Some of these products can replace fossil fuel-based

products or industrial chemical ingredients such as urea formaldehyde that can be harmful to human health.

The main challenge to increasing soybean acres is simply the development of markets. “Our main market definitely is the livestock feed,” says Price. “What we’re struggling with is to develop alternative markets. We see alternative opportunities coming up, but we haven’t realized them yet like other areas because of our size.” New companies need to know that a supply is available before investing in local infrastructure.

A challenge for the grower is the investment in new equipment and production practices that is required to accommodate another crop. If the grower already grows grain and has a grain seeder, the investment is minimal says MacDonald. And compared to potatoes, which must be planted, fertilized, sprayed up to 12 times per year, harvested, and then packed, soybean takes much less management. For his particular market, MacDonald says, “When you get away from the genetically modified varieties, your cropping practices are different in that you can’t spray Roundup on the crop after it comes up. You very much have to be on top of weed management.”

Pests and diseases have not been serious challenges. Although aphids are present, Price says that they have not caused notable yield reductions. He says that white mould can be a problem in the humid climate of New Brunswick, but van Roestel says that it is a minor problem in Nova Scotia.

Van Roestel cites two other challenges: nodulation and climate. “I think we’re not getting adequate nodulation in some fields, and that’s either from not properly applying the inoculant or from cold, wet soil conditions in late May or early June.” In addition to wet springs, drought can be a problem in July and August, which may cause pods to abort.

No one can predict the future of soybean in Atlantic Canada. However, if soybean prices remain high, production increases, and markets are explored and developed, it could be a good crop for growers to add to their repertoire. ■

Highest quality liquid starter fertilizers

Quality, precision placement, seed safe

Low impurities

Low salt

True solution N-P-K

Orthophosphate (available phosphorus)

Highly soluble

ALPINE liquid starters have a neutral pH and are low in both salt index and impurities. These features of our liquid starters enable the product to be placed directly with the seed at planting time. Placement with the seed enables the available phosphorus to be taken up at the critical early stages of growth to maximize yield potential.

ALPINE liquid starters contain 80% -100% of their phosphates in the available orthophosphate form.

Orthophosphate is immediately available to the plant during the critical early stages of growth. Plants can only take up phosphorus in the orthophosphate form.

Higher levels reduce dehydration and chilling injuries, boosting germination and vigour.

The early stages of germination are a critical time for a soybean seed. A seed’s performance is strongly affected by its starting moisture content, before it is even planted. Seeds that are too dry at planting are more susceptible to chilling and dehydration injuries, which result in decreased germination, slower growth rates and generally lower seedling vigour.

However, how exactly seed moisture relates to field performance is a question that has not been closely studied, until now. From February 2007 to February 2008, Josh Segeren undertook research to determine this, and in May 2008, Segeren, a grade 11 student at John McGregor Secondary School in Chatham Ont., presented his results at the Intel International Science and Engineering Fair (IISEF), held in Atlanta. With more than 1500 of the world’s most promising young scientists in attendance, it is the largest competition of its kind.

Segeren says the research stemmed from his previous studies on the best time of day to plant soybean seeds. “After that research, I was left with several unanswered questions,” he says. “I realized that injuries during soil water absorption (imbibition) such as chilling and dehydration are significant and prevalent. Surprisingly, many of the current techniques used to counter these injuries are relatively expensive and cannot be practically integrated. Research into seed moisture levels as they relate to attaining maximum yields is certainly of interest in these times of high input costs.”

Experiment details

Josh tested seeds at eight, 10, 12 and 14 percent moisture under both lab and field conditions. “My results recommend that producers should aim for a soybean harvest moisture between 12 and 14

by Treena Hein

percent,” he says, “although subsequent drying to these percentages at a low heat setting with sufficient air circulation is also an option.”

He adds “Regulation of soybean seed moisture content at 12 to 14 percent during harvest and storage would be a low-cost and easily integrated solution to increase yield, and therefore ultimately the world food supply.” He states that this can be accomplished by ensuring that contract growers are aware of these findings and to be as strict as possible during harvest to meet these recommended levels. “Furthermore, these moisture contents could be maintained during storage through consistent and monitored temperature and humidity levels,” he notes.

Segeren also found that if seeds are dried below 10 percent moisture, their viability after planting is greatly inhibited. Soil moisture is absorbed very quickly, and as it proceeds the seed must make a transition from its dry, dormant state to a biologically active growing state. Overly dry seeds are slower at making this transition, which causes a cellular activity spike, wastefully burning up the seed’s energy reserves and damages the cell membrane. The overall result is lower

vigour embryos and poor germination rates.

Among others, Dr. Hugh Earl, an associate professor in the Department of Plant Agriculture at the University of Guelph, provided guidance and support to Segeren. Regarding the research findings and their significance, Earl says “The most surprising thing to me was the very large and statistically significant effect of initial seed moisture on final crop yield. That result shows that there is something important going on here, not just in a laboratory context, where we have been studying these things for decades, but in the field, where it matters.”

Earl adds, “What Josh has produced here is one of the best demonstrations I know of, to date, of the potential effects of soybean seed quality, in terms moisture content, on emergence, vigour, and ultimately yield of the crop under Ontario growing conditions. This is particularly important now when many growers are looking to cut back on seeding rates to increase profit margins. Anything that can increase emergence and vigour of those fewer seeds going into the ground enhances the bottom line.”

A great deal of the yield potential of your corn or soybeans is decided very early during the growing season. The best way to enhance yield is to keep your crops clean during this make-or-break period. We call this weed control window the POWER ZONE –the Critical Weed-Free Period (CWFP).

Take corn, for example. Corn’s CWFP extends from the 3-leaf to the 8-leaf stage of growth. A good deal of the crop’s yield potential is decided during this time. When you keep your crop clean, you maximize yields. The same principle holds true for soybeans. In soybeans, the Critical Weed-Free Period runs from the 1st to the 3rd trifoliate stage. You need effective weed control during this period to achieve maximum yields.

Some herbicides, such as glyphosate, only control weeds that have emerged and come directly in contact with the application. Or strictly pre-emergent herbicides that require lots of moisture for activation and may not work well in a lumpy soil, which could be a problem in 2009. For control throughout the CWFP and protection of your crops' yields, you need residual control.

For 2009, DuPont brings you POWER ZONE products for corn and soybeans – proven performance and flexible strategies to achieve residual weed control during the Critical Weed-Free Period.

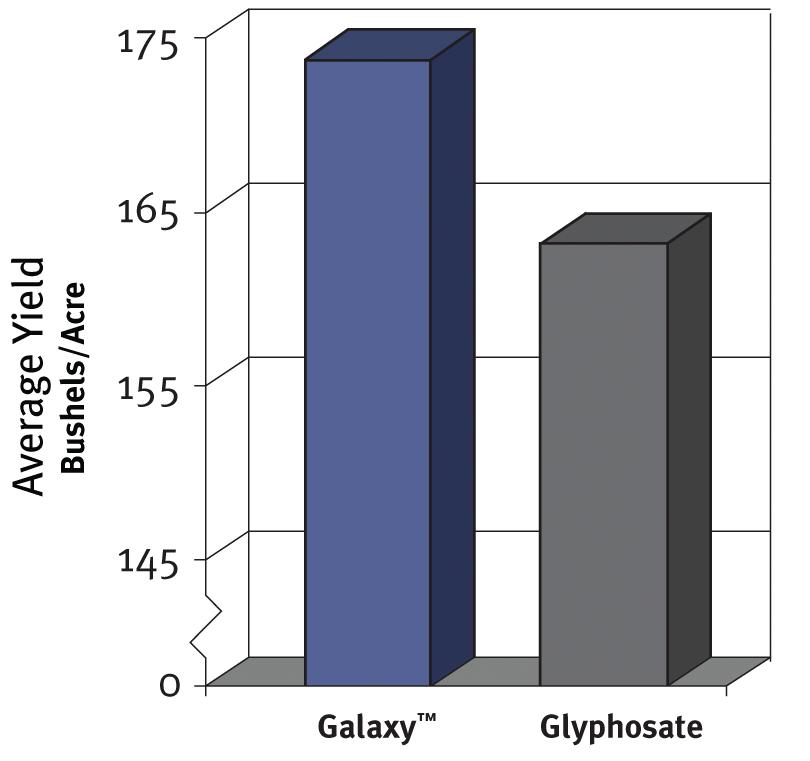

Let’s start with glyphosate-tolerant corn. DuPont™ Galaxy™ Herbicide goes beyond glyphosate to provide residual, onepass control that will help keep your crop clean during the critical period. Because you don’t have to wait until all the weeds are up, you can start spraying earlier, thus spreading out your workload. Galaxy™ also improves control of troublesome weeds such as fall panicum, green foxtail and redroot pigweed. Proof is in yield results – grower field trials showed an 11.1 bu/ac increase over glyphosate alone1

With two active ingredients from different herbicide groups (2 and 9), Galaxy™ helps protect against weed shifts and resistance. It can be applied from emergence to the 6-leaf stage on glyphosate-tolerant corn adapted to greater than 2500 CHU.

™

DuPont™ Guardian™ Herbicide can be applied two ways –both of which help keep your soybean crop clean during the Critical Weed-Free Period.

Used as a pre-plant burndown, before either conventional or glyphosate-tolerant soybeans, Guardian™ allows your crop to get established quickly, with less weed competition. Or, applied in-crop from the 1st trifoliate to the 3rd trifoliate in glyphosate-tolerant soybeans, Guardian™ allows you to focus on planting first and spraying later.

Either way, Guardian™ delivers one-pass contact and residual control, including control of tough weeds like dandelion, yellow nutsedge and annual sow thistle. It reduces the need for extra passes over the field, which saves you time and money. With two modes of action, Guardian™ is also an effective resistance- management tool for glyphosate-tolerant soybeans – as well as guarding against weed shifts.

Optimum™ GAT™: new control options on the way Guardian™ and Galaxy™ are compelling choices for today, but of course, our business is also about the future. The good news is technology, now being developed by DuPont, will allow more flexible use of glyphosate and ALS herbicides. Optimum™ GAT™ is a new herbicide resistance technology that combines a new glyphosate metabolic inactivation mechanism with an ALS enzyme that’s insensitive to all ALS herbicide types, including sulfonylurea herbicides.

What does this mean? In a nutshell, crops with the Optimum™ GAT™ trait carry resistance to glyphosate and ALS herbicides while keeping their natural resistance mechanisms, so herbicide mixes with other modes of action are also possible. This gives growers the power to use new herbicide technologies to control their toughest weed problems. Look for the first sales of Optimum™ GAT™ technology in the near future.

Reflections on the research

Overall, Segeren is pleased with his project’s performance. “I feel good about it being one of the 16 Canadian projects selected for Team Canada competing at the IISEF,” he says. “The rules were very strict, and each project had to pass multiple inspections regarding both safety and scientific legitimacy of the work. Research plans had to be submitted and reviewed before conducting experimentation, and after project reports were submitted, there were interviews.”

The most difficult aspect of the project, says Segeren, “was likely designing a procedure to simulate the different conditions for the first phase of experimentation, as well as overcoming the limitations of conducting the experiments entirely at home and at the field level.” He won fourth place, and an award of $500 in the Plant Sciences category.

The competition aspect aside, Segeren says “This project means a great deal to me, since I am able to see the results of my work within my community. This project has taken me many places and offered many exciting opportunities. Because of it, I have had the pleasure of meeting like-minded, ambitious people from all over the world, which has been a tremendous source of inspiration.” Segeren was struck by the energy, enthusiasm and intellect displayed by participants. “Everyone there was equally passionate about their work, with good reason,” he says. “I realized that I was likely amidst the future leaders of this planet.”

Segeren notes “I was very fortunate to have been referred to Dr. Earl, who played an extremely valuable and supportive role, and, in many ways, went above and beyond all expectations.” For other important guidance and support, Josh thanks his parents, farmers Gary and Michelle, Mary Ellen VanZelst, a seed lab manager with Pioneer Hi-Bred Limited in Chatham where Gary works as a production technician, and Phil Snider, science department head at his school.

Earl was glad to be involved: “I can’t even describe how incredibly heartening it is to me to see such a promising young scientist applying his considerable talents so enthusiastically to the field of agronomy.”