Security Products and Technology News

GIS mapping technology, security-as-a-service and lockdown solutions are three hot technologies to keep your eye on in 2020

Toronto-based smart lock company gets ready to grow

Alfred International banks on its form factor and functionality to appeal to homeowners p. 6

CES 2020 show highlights

The annual conference showcased vendors looking to make the smart home even smarter p. 10

What today’s alarm dealer programs provide Marketing, tech support and back office functions are just some of the perks available p. 18

24/7 Monitoring 365 Days a Year The Latest IP Technology Dealers Corner Thousands of Independent Dealers Personalized Customer Service

• Wholesale Monitoring

• Interactive Services

• Video Monitoring

• Managed/Hosted Card Access

• Advanced Web Services

• Acqusition and Funding Program

Tech for 2020 and beyond

GIS map tools, lockdown solutions and security-as-aservice are trends to watch in this new decade.

By Will Mazgay

18 Options for alarm dealers

As the home security market gets more competitive, dealer programs may offer a necessary support mechanism. By

Neil Sutton

4 Editor’s Letter

6 Line Card

• Toronto-based Alfred enters smart lock market

• Genetec research: almost 70% of cameras lack up-to-date firmware

• 2020 vision at CES: photo highlights

11 CANASA Update

New opportunities and challenges By Patrick Straw

12 Camera Corner

Where PoE works (and where it doesn’t) By

Colin Bodbyl

13 Lessons Learned

How important is smart home in Canada? By Victor

Harding

20 Beam barricade

The Delta Scientific DSC7090 beam barricade will stop a 15,000 pound (6,800 kg) truck going 30 mph (50 kph) with negative 6.3 feet (1.9 m) of

includes improved

and new features.

MBy Neil Sutton

ost years, SP&T News has devoted its first issue of the year to a technology trends report.

This is an effective way of taking a snapshot of where the industry is now and forecasting where it is likely to be in the months and years ahead. The start of a new decade is also an ideal time to take stock.

In many ways, this year’s trends report builds on those that have preceded it, particularly in the case of lockdown solutions. In the 2019 report, SP&T focused on gunshot detection technology; this year it is lockdown, which can encompass not only gunshot detection but many more aspects of security, including mass notification and access control.

As a rule, complex integration for any type of security project requires many different systems to speak to one another and work in harmony. Lockdown solutions may be the truest expression of that philosophy. These systems, working together, can effect decisive and immediate action in the face of an imminent threat.

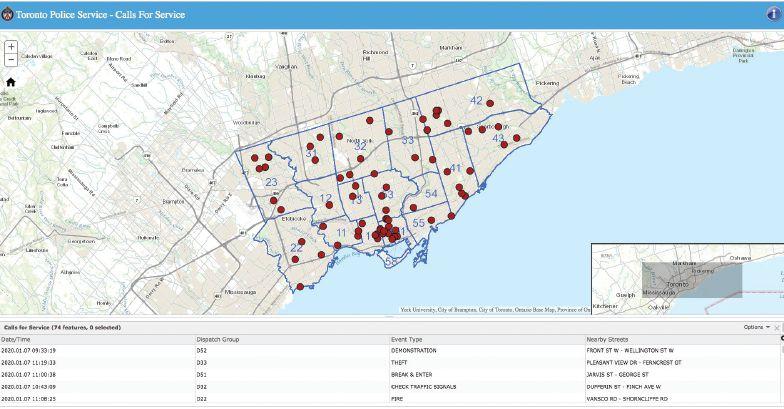

The second trend, GIS map-based systems, came to my attention when I was writing a feature article about Convergint Calgary’s Integrator of the Year award-winning project with the City of Calgary. The city deployed Live Earth, a geographic information system that can ingest multiple data points and display the results on an interactive map.

For a municipality like Calgary, these tools can cross reference weather, traffic, energy infrastructure, surveillance camera feeds — basically anything that can be assigned a value on a map. In the case of the Toronto

Police Service, as described in the article on p. 14, GIS data can be used to map crime trends and allocate resources.

The usefulness of these tools, particularly in any kind of smart city scenario, is abundantly clear. What isn’t always obvious is the best way to install and access them.

On-premise versus cloud (or as-a-service) is an issue that continues to be debated by security professionals, often leading to a hybrid approach.

Security-as-a-service, the last of the three trends we’re focusing on this issue, is one I expect to hear more about this year and into the future. A major discussion point around these models is typically, if my data is no longer on-premise, where is it and who has access to it? What this article explores is not only that question, but the economics that drive as-a-service: Is paying for a service on a monthly (or quarterly or annual) basis ultimately better than a capital expense up-front? In some ways, this mirrors what the alarm industry has been doing for decades — charging a monthly fee to homes and businesses to monitor their premises from an off-site location. But even alarm companies are being forced to re-evaluate their delivery models, as end users are looking for more flexibility in how they install and pay for alarm equipment and service.

As we move into a new decade, I think businesses and home owners will continue to challenge security providers with new expectations, and the industry’s best will rise to meet them.

@SecurityEd

Your Partner in Securing Canada Security Products & Technology News is published 8 times in 2020 by Annex Business Media. Its primary purpose is to serve as an information resource to installers, resellers and integrators working within the security and/or related industries. Editorial information is reported in a concise, accurate and unbiased manner on security products, systems and services, as well as on product areas related to the security industry.

Group Publisher, Paul Grossinger 416-510-5240 pgrossinger@annexbusinessmedia.com

Associate Publisher, Jason Hill 416-510-5117 jhill@annexbusinessmedia.com

Editor, Neil Sutton 416-510-6788 nsutton@annexbusinessmedia.com

Associate Editor, Will Mazgay wmazgay@annexbusinessmedia.com

Media Designer, Graham Jeffrey gjeffrey@annexbusinessmedia.com

Account Coordinator, Kim Rossiter 416-510-6794 krossiter@annexbusinessmedia.com

Circulation Manager, Shawn Arul sarul@annexbusinessmedia.com Tel: 416-510-5181

COO, Scott Jamieson sjamieson@annexbusinessmedia.com

EDITORIAL ADVISORY BOARD Anna de Jager, Lanvac Victor Harding, Harding Security Services Carl Jorgensen, Titan Products Group Antoinette Modica, Tech Systems of Canada Bob Moore, Axis Communications Roger Miller, Northeastern Protection Service Sam Shalaby, Feenics Inc.

111 Gordon Baker Rd, Suite 400, Toronto, ON M2H 3R1 T: 416-442-5600 F: 416-442-2230

PUBLICATION MAIL AGREEMENT #40065710 Printed in Canada ISSN 1482-3217

receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Officer privacy@annexbusinessmedia.com Tel: 800-668-2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission. ©2020 Annex Publishing & Printing Inc. All rights reserved.

Annex Publishing & Printing Inc. disclaims any warranty as to the accuracy, completeness or currency of the contents of this publication and disclaims all liability in respect of the results of any action taken or not taken in reliance upon information in this publication.

Weiser makes it easy to increase customer loyalty and position yourself as the core provider. If you already install security or home automation systems that are Zigbee or Z-Wave compatible, you’ll appreciate the easy installation and integration of Weiser Home Connect Locks.

Gain momentum in remote access and home automation as homeowners demand more from their primary solution providers.

Grow your business by building upon your existing services with Weiser.

Anew Canadian smart lock company aims to capitalize on what one of its founders describes as a severely under-served market with huge growth potential.

The smart home market overall is projected to grow at a CAGR (compound annual growth rate) of 16.5 per cent, reaching US$144 billion by 2025, according to Research and Markets. A sizeable portion of that could be smart locks, according to David Steele, head of partner development at Toronto-based Alfred International.

Smart lock adoption rates are still relatively tiny, says Steele, a veteran of the access control industry. But the potential is there — driven by smart phone adoption and the entrance of crucial players like Google and Amazon into the home automation market.

Alfred incorporated in 2018 and officially launched its first product in January 2019 at the Consumer Electronics Show (CES International) — a deadbolt smart lock. Steele, who designed the product specification along with partner Dan Cook, says the lock’s sleek look was the first consideration in order to differentiate it from

competitors. There’s a tendency for the industry to take existing locks that have served the market for decades and simply add smart components, like push-button keypads, he says. “We decided to focus on design and we really stuck with that all the way through.”

The deadbolt is available in two varieties: DB1, a consumer-focused product available online and through retailers like Best Buy, and

According to Montreal-based Genetec, the majority of security cameras lack the most up-to-date firmware, increasing the risk of a potential cyberattack.

Genetec, a supplier of video management software and other security products, conducted a study based on data from more than 40,000 cameras that are part of an opt-in product improvement program. According to the company’s research, 68.4 per cent of cameras are running firmware that is out of date. Firmware may help a device to access the latest and greatest features but they also help maintain the most current cybersecurity protections and measures, states the firm.

“Our primary research data points to the fact that more than half of the cameras with out-of-date firmware (53.9 per cent) contain known cybersecurity vulnerabilities. By extrapolating this to an average security network, nearly four out of every 10 cameras are vulnerable to a cyber-attack,” said Mathieu

Chevalier, lead security architect at Genetec, in a statement.

Genetec’s research also revealed that about one in four organizations (23 per cent) use the default passwords associated with cameras rather than updating them with unique ones. The company points out that most new cameras today prompt administrators to update passwords by default, but older models in the field may have never received this treatment.

“Unfortunately, our research shows that the ‘set it and forget it’ mentality remains prevalent, putting an entire organization’s security and people’s privacy at risk. All it takes is one camera with obsolete firmware or a default password to create a foothold for an attacker to compromise the whole network,” added Chevalier. “It is critical that organizations should be as proactive in the update of their physical security systems as they are in updating their IT networks.”

DB2, a professional grade model available from security distributors and installers as well as directly from the Alfred website. (DB2 is also available in a keyed version.)

The primary target for these products is the single-family dwelling, says Steele, and the basic version can be installed in about 10 minutes. The locks can be accessed via PIN and Bluetooth out of the box and are Zigbee and Z-Wave compatible for integration with a third-party smart hub. Both the DB1 and the DB2, can be assigned up to 20 PIN codes and an optional Wi-Fi bridge allows for connection to Amazon and Google devices.

The locks currently require a battery to operate (a wireless charging unit was introduced in January for a mid-year release). Battery life is approximately a year and a lock without power can be temporarily activated using a micro USB.

Using an app to operate the lock opens up other possibilities, states Steele, such as checking the lock status from a phone or remotely opening the door for a dog walker or maid service.

There is also the potential to use the lock with an Airbnb property by assigning temporary keys to visitors.

The product is multi-generational by design, says Steele. Younger users will be comfortable treating their locked door as another app on their phone, but they may also want to install a lock for aging parents, so they can double-check that their door is locked at night, or let in a home health-care worker.

A mortise version of the lock, ML2, designed for multi-family dwellings such as condominiums, was just launched at CES 2020, which opens up a much larger market for Alfred, says Steele. He says a condo can update its existing lock to the Alfred model at roughly half of what it would normally cost to install a brand new smart lock, giving developers and condo corporations an incentive to consider a building-wide upgrade. The mortise also includes a card reader, allowing for card or fob access to the units.

Alfred is currently a five-person operation and functions from its Toronto location, but there is growth potential on the horizon. The anticipated target market at launch was Canada, says Steele, but the U.S. came online almost simultaneously and quickly proved to be the faster adopter of the product. The company plans to open a U.S. logistics centre to aid its American distribution plans.

— Neil Sutton

Poland’s Port Praski manages cameras on dedicated network

Poland’s Port Praski occupies an area of 38 hectares and overlooks the Vistula River in Warsaw. Bosch Building Technologies was selected to provide this “city inside a city” an integrated solution that includes fire detection systems, video security and a site-wide building management platform.

Video surveillance is provided by a mix of Bosch’s bullet, dome and moving cameras, which monitor outdoor and underground areas, building entrances, garages and elevators. Centralized control of cameras, recording and storage is managed by the Bosch Video Management System that can scale to accommodate video, audio and data from thousands of cameras. Port Praski also required a solution that could provide privacy for its residents. As such, camera images are carried over a dedicated private IP network.

• Northeastern Protection Service announced Randy Milne has transitioned to become manager, special projects and training and Shirley Reid has been promoted to HR manager.

• Salto Systems has appointed Colin DePree as residential business leader. DePree oversees the

U.S. convenience chain utilizes analytics tool

U.S. convenience store chain Yesway is currently deploying March Networks’ Searchlight for Retail in 136 locations. Brandon Pohlman, Yesway safety and asset protection manager, said in a statement that the company selected the March Networks’ product for scalability, centralized management and exception-based reporting. Using the system, the store chain can search and sort transactions, matching them with video clips. The software can also integrate analytics data such as people counting, queue length and dwell time. Professional services firm Iverify handled the Yesway installation. The chain also installed March Networks 8000 Series Hybrid NVRs and SE2 Series IP Cameras. The solution is managed via March Networks Command Enterprise.

commercialization of the Danalock smart lock product line in North America.

• Genetec sales leader Alain Bissada, who is currently senior director for Canada, is taking on an expanded role which includes Mexico.

• Aiphone Corp. has promoted Brad Kamcheff to the position of marketing manager.

California housing for the homeless organization rolls out new cameras

Father Joe’s Villages, a non-profit organization that helps prevent homelessness in San Diego, Calif., has installed a security system including Hanwha Techwin cameras. Father Joe’s was established in 1950 in a small chapel and has since grown to include a campus and additional sites that provide housing services to those struggling with homelessness. The organization provides housing to more than 2,000 people a night and serves more than one million meals a year.

Following an RFP process, Father Joe’s Villages upgraded its existing system with Hanwha cameras managed by Wisenet WAVE VMS. Father Joe’s currently operates more than 400 cameras across its facilities which can be viewed from the organization’s control centre.

• Arecont Vision Costar has named Geoff Stoliker as regional sales manager for Northern California and the Pacific Northwest Region.

• Vunetrix, a provider of security system health and performance monitoring, has announced the promotion of Cristine Wick to director of sales, West.

February 27, 2020 Mission 500 Hockey Classic Toronto, Ont. www.sptnews.ca/hockeyclassic

March 18-20, 2020 ISC West Las Vegas, Nev. www.iscwest.com

March 31, 2020 ADI Expo Toronto, Ont. www.adiglobaldistribution.ca

March 31 – April 2, 2020 Canadian Technical Security Conference Cornwall, Ont. www.ctsc-canada.com

April 22, 2020

Security Canada East Laval, Que. www.securitycanada.com

May 5, 2020 ADI Expo Calgary, Alta. www.adiglobaldistribution.ca

May 6, 2020

Security Canada Alberta Edmonton, Alta. www.securitycanada.com

May 27, 2020

Security Canada Ottawa Ottawa, Ont. www.securitycanada.com

June 9, 2020 Buildings IoT Forum Vaughan, Ont. www.biotforum.ca

June 9-12, 2020 Electronic Security Expo Nashville, Tenn. www.esxweb.com

June 17, 2020

Security Canada West Richmond, B.C. www.securitycanada.com

September 16, 2020

Security Canada Atlantic Moncton, N.B. www.securitycanada.com

September 21-23, 2020 Global Security Exchange Atlanta, Ga. www.gsx.org

ISC West is the largest converged security industry trade show in the U.S. At ISC West, you will have the opportunity to network and connect with over 30,000 security and public safety professionals that convene at the show to experience and explore the newest technologies and solutions from Access Control, Video Surveillance, Emergency Response, Public Safety to IT/IoT Security, Smart Home Solutions, Drones & Robotics and more! The combination of networking opportunities, special events, award ceremonies and the leading-edge SIA Education@ISC makes ISC West the security industry’s most comprehensive security event in the U.S.

Discover the industry’s latest products, technologies & solutions

Network with 30,000+ Physical, IoT and IT Security Professionals Direct access to 1,000 leading exhibitors & brands 85+ SIA Education@ISC Sessions

The 2020 Consumer Electronics Show was held Jan. 7-10 in Las Vegas, Nev., at several venues on the city’s iconic strip. The event, which featured more than 4,400 exhibits and hosted about 170,000 attendees this year, is a showcase for cutting-edge consumer electronics from the largest multinationals to the smallest tech startups. This year, the latest smart home innovations were on display, as were consumer and enterprise-focused offerings from security providers.

By Patrick Straw

Anew decade has arrived and CANASA continues to expand its role and programs.

We are continuing our education initiatives through the online Alarm Technician Course (ATC) which is now being upgraded due to evolving industry requirements. This program provides course study on a number of relevant topics for today’s technicians including false alarm management, notification/communication and networking.

regional councils, to meet with employers to ensure programs provide graduates entering the workforce with the knowledge necessary to be effective employees.

Secondly, CANASA has initiated ongoing discussions with a number of colleges across the country to develop on-campus and online education. These opportunities are designed to provide students with courses that can give them the practical knowledge they need to hit the ground running. Watch for upcoming announcements on the first college program, expected to be available by the fall of 2020.

CANASA will also continue, through our

CANASA has also expanded on the highly successful scholarship program which has now been increased to 14 possible recipients.

CANASA, through its national board of directors, is developing a number of minimum standards designed to be a membership requirement. These include:

• Background checks for any employee who deals directly with consumers and has access to confidential information;

• Mandatory liability insurance for those companies who deal directly with the public;

• Compliance with provincial health and safety regulations and;

• Compliance with the Personal Information

Protection and Electronic Documents Act (PIPEDA).

2020 will see regional councils focusing on providing their area members with informative and thought-provoking presentations through knowledge experts. In 2019, CANASA members enjoyed a wide array of workshops and seminars, all designed to increase their knowledge base and assist in their understanding of key issues facing the industry and their businesses.

We expect 2020 to build on this knowledge base as the regional councils prepare their plans for their respective jurisdictions. CANASA members will be the first to learn of these important events plus receive attractive pricing discounts to attend. Watch for more about these events at www.canasa.org and our bi-monthly newsletter CANASA Update.

Patrick Straw is the executive director of CANASA (www.canasa.org).

Security Canada Trade Shows are held in six powerhouse markets at the forefront of the Canadian security industry. Spanning key cities from east to west, these markets are home to thriving businesses and leading professionals that want to remain ahead of the curve - - and they do it by attending Security Canada Trade Shows. Exhibit at one or all six of these trade shows to meet them face-to-face.

Laval, Quebec April 22, 2020

Ottawa, Ontario May 27, 2020

PBy Colin Bodbyl

Power over Ethernet has become the norm for surveillance cameras, but it still has a few limitations

ower over Ethernet (PoE) has become the predominate method for powering IP cameras.

The technology has played a key role in the rapid adoption of IP cameras by reducing cabling requirements and simplifying installation. While it may be the perfect power solution for most applications, there are times where PoE is not the right choice.

“There was a time when IP cameras needed separate power.”

If you are not familiar with the technology, PoE is a method for powering IP devices using the same network cable that transmits data. PoE is used to power IP phones, wireless access points, and, of course, IP cameras. It has become so popular as a method for powering IP cameras that it is almost unheard of to find a commercial IP camera that does not support PoE.

PoE uses spare strands in a standard eight strand network cable to deliver power between 44 and 57 volts DC. How many watts of power are available depends on the PoE switch or injectors power output rating. The typical output is 15.4 watts which is plenty of power for a stationary IP camera, though PTZ cameras often require more power. For devices where 15.4 watts is not enough, PoE+ can provide up to 25.5 watts and other versions of PoE (including proprietary ones) can provide up to 100 watts and even support different voltages.

The most obvious benefit of using PoE is the reduction in cabling costs as integrators do not need to install separate cables for data and power. PoE also reduces other hardware requirements by eliminating the need for independent power supplies or large power banks to support each camera. Another benefit of PoE is the ability to regulate power to specific devices from remote locations. For example, certain network switches allow automatic or manual cycling of individual PoE ports. This gives users the ability to reboot cameras remotely, which often solves minor problems like a camera that has locked up.

There are cases where PoE is not the right choice — 44 to 57 volts DC is a high range for DC voltage and can be difficult to achieve

when batteries are involved. If a battery backup is required for a camera or group of cameras, the most power-efficient method is to run the cameras on 12 or 24 volts and use a battery backup that matches that voltage. Some users will default to a UPS, which is acceptable but very inefficient, and will cost significantly more to match the runtime of a 12 or 24 volt system.

Solar powered systems are also a poor choice for PoE. Solar systems rely on battery banks that are charged by the panels during the day and drawn on by the surveillance system as needed.

No different than other battery backups, most solar solutions also run on 12 or 24 volts

DC. Converting that power up to 57 volts DC requires additional parts that reduce power efficiency and create new points of failure.

Aside from its limitations in specific use cases, PoE is a safe, simple and cost-effective technology. It was introduced so early on in the evolution of the IP camera that most users take it for granted, but there was a time when IP cameras needed separate power supplies to function. Thankfully, that is no longer the case and while it is not always the right choice, today PoE is by far the preferred choice.

Colin Bodbyl is the chief technology officer of Stealth Monitoring (www.stealthmonitoring.com).

By Victor Harding

An informal poll of Canadian security providers suggests this market has yet to make a significant impact

If you were a keen reader of various American security magazines, you would think that the major issues affecting the industry were DIY, smart home integration and video monitoring.

I think, to some extent, the U.S. security market is either ahead of or different from the Canadian market. Having spoken with some of the players in the Canadian market, I found that these issues don’t seem to be as important up here.

Regarding DIY, although there is every reason to believe that Canadians are going online to buy Amazon Ring and Google Nest products, or going into a Best Buy store to pick up security-related equipment, to my knowledge there are very few established security companies in Canada selling DIY systems like there are in the U.S.

The dealers I talked to don’t see DIY as a threat and are not doing anything about it. Yes, DIY security equipment is undoubtedly being sold in Canada, but it does not appear to be a threat to professionally-installed systems. One very experienced Canadian industry player said he felt that the model for DIY still has to be worked out and it is not clear that any model is truly sustainable.

What about smart home penetration? How important are those systems today in Canada? As a point of definition, I don’t think installing an interactive panel that allows the customer to turn the system on and off from his home makes for

“To my knowledge, there are very few established security companies in Canada selling DIY systems.”

a “Smart Home” installation. I consider a “Smart Home” one where the panel is set up to control the door locks, the lights, the thermostat and/ or the cameras. In the U.S., there may well be a very significant percentage of new smart home installations. But my small sampling of key dealers and players in the Canadian industry suggests that, for whatever reason, they are not nearly as prevalent in Canada. Perhaps the one exception to this is cameras. More and more customers are asking for cameras inside and outside their home.

Finally, as far as video monitoring is concerned, the view of my informal panel is the service does have some traction in Canada but is by no means hot. Some dealers are using a little bit of video verification, but according to the monitoring station personnel I talked to, none of them are doing much of it. It appears to be more of a niche business done by a few video monitoring specialists.

So if DIY and smart home are not currently big issues in the security industry Canada today, what are? One issue I want to draw people’s at-

tention to is the increasing influence of the telcos like Telus, Rogers and Bell in the residential security market in Canada. Unlike in the U.S., I think they are slowly taking over all but the very high end of the residential security market. With their size, these companies can market in a way none of the rest of the industry can. They can afford to offer what we would consider low prices on installing security equipment, as long it helps them attract customers they can sell their other services to, such as internet, cable and cellular. Also, there is a good chance that Telus buying ADT’s Canadian assets could propel Rogers and Bell to be more aggressive with their security offering than they have been so far.

All the players I talked to, for one reason or another — maybe it’s not because of the telcos — have almost given up on the low and medium end of the residential security market and are far more focused on the commercial market and maybe a few high-end homes. One dealer told me that residential customers are now calling the telcos first to get a quote on a security system. Another told me the residential market is gone for the normal, everyday alarm dealer. If I was an alarm dealer today with residential monitored accounts, I would be very apprehensive about just how long I would be able to hold on to those accounts.

Victor Harding is the principal of Harding Security Services (victor@hardingsecurity.ca).

The security industry is poised to take advantage of advances made in the previous decade and push them even further as we enter the 2020s. We can expect to see security manufacturers, installers and end users continue to explore the limits of what’s possible in this new decade. Security, by definition, implies a strong emphasis on caution and measured steps. That may be why cloud-based and security-as-a-service (SaaS) options have a little way to go before they can be embraced more whole-heartedly. But it seems that some of those hurdles have been cleared and the discussion about solutions that are not strictly

“on-premise” is taking place.

SaaS is one of three major focal points for SP&T News’ annual technology trends round-up. The other two areas this year are GIS mapbased systems and lockdown solutions. GIS systems speak directly to the importance of timely and precise information in security. Lockdown may comprise a variety of options, including access control and mass notification, all working together to maximize site security in the event of a potential disaster. Regardless of the platform, response time is critical in security and immediate action may protect lives.

Whether it’s tracking down criminals, measuring crime hotspots, or helping public and private organizations manage risk, location software provides important insights

By Will Mazgay

Geographic information systems (GIS), software platforms that collect, manage and analyze geospatial data, are increasingly being used as tools by law enforcement and security organizations.

Ian Williams is the head of analytics and innovation at the Toronto Police Service and course instructor at Ryerson University, where he teaches GIS and analytics. He says for public safety organizations, the goal is to take the information presented by these systems and analyze it so that patterns can be identified and actions can be taken. An example of this is resource allocation: “If there’s a higher prevalence of robberies in certain parts of the city, we would strategically deploy around that.” Williams continues, “If there’s something occurring, where’s my closest unit, or units, and what’s going to happen if we assign multiple units? Is that going to impact service availability elsewhere?”

Jeff Hughes is the district manager, defence and security, for Esri Canada, part of a global GIS software giant. He says GIS data can help prioritize security workflow and responses. “Data can

be geofenced to provide the ability to assign or reassign work, based on location.… We know that we need to visit 50 locations; let’s prioritize based on spatial information, which locations we’re going to secure or inspect first.”

Williams says GIS are valuable tools for searches, like manhunts or for missing persons.

“We can co-ordinate that search area from a command centre, we can deploy resources while they’re on the ground and completing search grids. They can actually check off ‘I’ve been to all the houses in this search grid, that’s detailed, audited, logged,’ so in real-time the operations centre can coordinate which spaces still need to be searched.”

In addition to GIS being used as public safety tools, public and private organizations can turn to GIS to protect their assets. Hughes says, “Many organizations gravitate towards a location intelligence approach. For risk management, certainly, municipalities are very interested from a public works perspective; large utilities are very interested in understanding their networks and their assets for not only their immediate risk but long term asset valuation.” He continues, “Increasingly we’re also seeing commercial applications, specifi-

cally in insurance for doing risk assessment.”

Hughes says that regardless of the application or industry, “it’s understanding your assets, whether those are physical assets, mobile assets or personnel. Having situational awareness of those dynamic assets and static assets really helps not only in tactical security situations but also in strategic and risk analysis or risk assessment of your operations.”

Williams says that for security applications, a lot of tools, widgets and apps are being designed around GIS engines. “A lot of them have an interesting workflow integration. So you could use one of them to manage incidents, but you could also connect that into a planning module and they’re all technically distinct applications but they work together.” He continues, “So the data produced in one to track your incidents or requests for service, you can move that into a planning tool that helps you understand what those needs will be for tomorrow or next week or this time next year.”

When it comes to how these systems are delivered, Williams says that currently, on-premises installations are more popular, but there

is a move towards software-as-a-service (SaaS) models, and in some cases organizations are opting for a hybrid approach, especially municipalities. “Most municipalities that have GIS technology, they’re going to be on-prem.” But, “often what they’ll do is serve up content to the public or other users through web interfaces, a variety of application formats.” However, moving forward, “I’d expect a lot more of that to be software-as-a-service-based, the implementations being either completely cloud or hybrid... I think a lot of organizations will be hybrid for some time and then it will be organization-specific to determine if it’s pure cloud or not.”

Williams says that for the Toronto Police Service, “all of our public-facing content is cloud-based, and the applications are all SaaS from what the public has access to in that regard. But we have almost an identical (onprem) platform internally as well… So we’ll be hybrid for some time I would imagine.”

Hughes says software-as-a-service is “really accessible, it has a low bar of entry for lots of organizations, especially ones that traditionally haven’t invested in GIS.” He continues, “Software-as-a-service really opens up opportunities for municipalities and individual organizations, to not only get access to managing geospatial data in the cloud but also to collab-

orate amongst themselves or between private and public agencies.”

Hughes also explains that data like that obtained from sensors and alarms, “often necessitates the hybrid or fully online capability to move data around between devices and across networks.”

Whether organizations opt for on-premise, cloud or hybrid GIS platforms, what isn’t up for debate is that they are becoming increas-

ingly essential to public safety and risk management.

Williams says, “Our frontline people expect that there’s apps in their hand that are giving them access to all of this information, and equally at the senior levels of the organization, they expect those apps to be available to their people but also to themselves. It’s really crossing that tactical-strategic line…. It’s only going to grow from here.”

By Will Mazgay

Active shooter attacks have become a part of life in North America and around the world, and so has preparing for them with technologies to facilitate lockdown protocols.

Alex Goldstein, principal security consultant for GV Solutions & Consulting, says with the uptick in attacks over the last several years, the demand for lockdown technologies has risen. “We get a lot of calls to come down and assess facilities based on lockdown preparedness.”

Goldstein says there is demand from end users for lockdown solutions that integrate with existing building systems, as opposed to standalone technologies. “They’re (end users) integrating the rest of security into building automation systems. So people are not going to be OK with lockdown systems operating on their own.… People want to use what they have.”

Bruce Montgomery, business development, enterprise solutions, Honeywell, says integrating with existing systems is a priority for deploying a suite of lockdown technologies.

“If they don’t communicate with your principal system, then they’re not really worth the money,” he says.

There are several different elements required for an effective lockdown system, but firstly, the solution needs to be able to determine that there is an attacker in a building, which can be accomplished through gunshot detection — analytic tools which can pick up on the audio or energy signature of a gunshot.

Goldstein explains that getting gunshot detection right requires properly trained analytics that can recognize gunshots from benign

sounds like cars backfiring.

Honeywell uses a gunshot detection system provided by manufacturer EAGL Technology, which tracks the energy signature of a gunshot. Montgomery says Honeywell chose an energy-based system because “it’s significantly more stable. There’s a lot of gunshot detection out there that only uses audio, and we integrate to those too if you happen to have them, but we prefer to use the energy detection.”

Another popular tool for discerning if weapons are present in a building is an analytic attached to video surveillance. Goldstein says, “If the system can, in theory, recognize there is a weapon, based on physical characteristics or geometric patterns, then it might do that.” However, “if a person brings a broomstick and it looks like an AK (rifle), you’re kind of stuck dealing with false alarms and false announcements.”

Honeywell provides weapon detection through video surveillance analytics, but Montgomery notes the system does have some limitations. “It will detect specific guns, but there are other weapons to consider. We need to open it up to knives. But there’s so much opportunity for comparatives. A lot of things look like guns

— a drill for example.” But he is positive about the evolution of this technology. “Through deep learning analytics, we’ll eventually get there.”

Once an attacker has been discovered in a school or office, doors and access points need to be locked down.

Montgomery says Honeywell’s systems can either trigger lockdown manually, through a panic button, mobile app or web client, or automatically based on triggers set by gunshot detection technologies. He says locking down access points takes less than a second.

One major problem with physically locking down a building is denying access to police and other first responders. To this extent, Montgomery says Honeywell provides emergency services with special access cards to be kept by police. He explains that these cards have zero privileges until lockdown is initiated. “The school doesn’t have to give away the keys to the castle. You’re not having cards floating around that are going to make you vulnerable.”

However, Goldstein notes that human error can sometimes get in the way of this protocol running smoothly. “The problem with that, and we’ve seen it happen, is that when a fire or police department responds to a building, they sometimes don’t bring the key. Then they expect conditions on the inside to allow them to come in.” He says it is also possible to have an

administrator manage police access, but this isn’t always practical in an emergency.

While detecting threats and locking down buildings to impede an attacker’s progress are critical, Montgomery argues that notifying affected individuals is the most important part of a lockdown system.

He says, “Every building should have some technology to alert their employees, staff or students of threats or imminent dangers that are in progress.”

Honeywell’s mass notification, according to Montgomery, integrates into existing public announcement systems (both analogue and IP systems), and it can also integrate with analogue phones, utilize LED signs inside or outside of schools, or send out text messages. Like locking down, Honeywell’s mass notification can be activated manually or automatically, and law enforcement is notified immediately.

Montgomery explains further that the notifications are localized based on where the activity is taking place in the building. For example, if a shot is fired in the cafeteria, and then a few minutes later another shot is fired in a hallway, all of those details will be communicated, allowing teachers and students to have an idea of where the shooter is and potentially plan an escape.

Goldstein says mass notification, both as part of integrated solutions or as a standalone

system, has become increasingly popular in universities and large government buildings.

While lockdown technologies are growing in usage, Goldstein notes there is still some apprehension.

“Right now our clients are demanding policies and procedures. They are not demanding systems yet, because they still want to look at what the corporate policy is going to look like.”

He explains that budget is also an issue for a lot of firms. “They are saying, the remote chance of this happening may not warrant us purchasing and implementing all of this and then servicing and maintaining it and paying monthly subscriptions for it, so we’re just going to focus on training.”

While the price tag of lockdown systems is still a prevalent issue for schools and businesses, Montgomery notes that they are not as expensive as they used to be. “Right now the costs of (automatic lockdown capable) wireless locks are half of what they were four or five years ago.”

Goldstein says that, despite current concerns, the dangers faced by schools, offices and other institutions will push organizations to look more closely at making the investment in these technologies. “With more and more of what’s going on in the world, there will be an appetite for this, and property and operations will demand these solutions.”

Security-as-a-service (SaaS) can provide end users and integrators with flexibility, both financial and technical

By Will Mazgay

As cloud and internet-based technologies slowly take over many aspects of our lives, there is a growing movement in the security technology market towards solutions being delivered through the cloud, and end-users paying for equipment, software and the expertise to manage it on a recurring basis.

For end users, security-as-a-service (or SaaS) can be attractive because paying for services and equipment in predictable increments can make life easier than the traditional method of paying for entire security systems or installations upfront.

Jon Cropley, principal analyst, video surveillance, for research firm IHS Markit, says, “For a lot of companies, that sort of meets their operational expenditure requirements more steadily. A lot of companies like paying for things that way because it’s a predictable and constant expense rather than a one-off capital expense.”

Nigel Waterton, chief revenue officer of Arcules, which offers cloud-connected video sur-

veillance and access control, agrees. “When you come down to an operational budget, and it’s incremental, every month, month-over-month, you can say, ‘You know what, this is a digestible amount of money that we can program for.’”

Waterton says predictability is also beneficial for Arcules’ integrator partners, who sell the solution. “Having the predictability of monthly recurring revenue allows you to create a more dedicated timeline for how you grow your business. If you are predicating your growth on

what you think you might get as opposed to what you know you will get, that’s a different proposition.”

In addition to providing financial reliability, SaaS also brings the promise of low maintenance and flexibility to end users.

Cropley says that cloud-connected services can be updated automatically by vendors, which takes the responsibility for patching and other issues out of the hands of end users.

Waterton expands on this: “Every week we are sending out or improving the software. We are doing a software fix, patch or otherwise in the background, unbeknownst to customers.… Our software is always running with the most current environment.”

Brad Konkle, director of integrated solutions for integrator Stanley Security, also believes SaaS benefits end users with low maintenance. “Once updates are released, they’re pushed out automatically, so you’re not having to schedule downtime or schedule or plan upgrades.”

Konkle says the ability to patch quickly and easily addresses cyber security concerns as well. “Cyber security vulnerabilities are generally patched or fixed automatically in the cloud, versus remediation on the on-prem solutions.” He continues, “A lot of our customers aren’t aware of the cyber security risks they have with the way their systems are set up on-premise.… These are systems that require maintenance and updating, and you’re going to need to update your firmware, you’re going to need to make sure you harden your systems, and if you don’t have the skillset to do that yourself, you might need to engage an expert or somebody who can provide security-as-a-service to you.”

Konkle says another benefit of SaaS is the ability for end users to customize their solution. “We can do the monitoring, we can do the access control, we can integrate that altogether through a set of single interfaces so that you can manage your entire security needs.”

In addition to giving end users the ability to bundle, Waterton says SaaS gives them the freedom to select only the solutions and offerings that they need and disregard those they don’t.

While the financial and technical flexibility of SaaS solutions is garnering the attention of end users and integrators, there are barriers to

“I think as people become more comfortable with the cloud... you’ll see that adoption.”

— Brad Konkle, Stanley Security

more rapid growth.

Cropley says that growth in this space has so far been gradual, noting that the overall costs of systems can sometimes be higher when compared to buying them outright, and there is still a lack of trust with having data stored in the cloud. Data residency laws also present a stumbling block, as some jurisdictions have very strict requirements for where data has to be stored.

Waterton also notes that “SaaS over the last several years has been slow to adopt” due to a lack of education and awareness of solutions. He says, for vendors, “our job is to educate and create stability on terms and conditions, service level agreements on what the technology can do, remove all of the myth or innuendo of what it can’t do, and remove the concern about security.”

Konkle agrees that awareness of the benefits

of SaaS is a barrier to adoption. “If a facilities group is in charge of physical security (as opposed to IT) it is a lot more education and a higher barrier to be overcome — it is a newer concept to the physical security industry.”

Despite these barriers, it looks like the arrows are generally pointed upward for SaaS business models. Waterton says, “We will get there. The market adoption will double and double over the coming months and years. The industry itself is a hundred billion dollar industry out there that we are going to draw down from. The adoption rate will come so much faster when everybody sees that one, it’s secure, two, it’s simple, and three, it can be budgeted against.”

Konkle says that as the cost of storage has come down, it has become more attractive for customers to put their data in the cloud, fueling SaaS growth. “You’re going to see more and more cloud adoption. Today you might manage your system in the cloud and it’s still sitting on-premise but I think in the future, we’re going to see more and more the actual data storage coming off the premises and into in the cloud. I think as people become more comfortable with the cloud, and the price point of storage comes down (further), you’ll see that adoption.”

Today’s dealer programs can help alarm companies with marketing, billing, tech support and potentially a lot more

By Neil Sutton

The home automation market has changed in recent years with the advent of new technology, new metrics, new players (many of them telco and consumer giants) and new customers.

To stay current with the market and ahead of the trends, alarm and security dealers may look to the support that a well-established alarm dealer program can provide.

The right mix of marketing and technical and financial support can help a dealer survive the tumult of the current market and hopefully thrive well into the future.

Smaller alarm companies run the risk of getting lost if they don’t have a proper support system, says Dina Abdelrazik, senior analyst

with Parks and Associates. The research firm conducts an annual dealer survey to take the pulse of the alarm industry.

“Dealer programs have really had to step up to provide dealers with the tools they need to differentiate themselves, as well as be able to compete well in the market,” says Abdelrazik.

Parks Associates’ survey looks at the U.S. market, but the trends it addresses can also apply to Canada, she says — the need for marketing and sales support to communicate the value of a modern security system is a universal one.

Monitoring models

Wes LaBrash, director of marketing and sales at Saskatchewan-based SecurTek Monitoring

Solutions, says the company has adapted to the changing needs of its dealers and customers over its two decades of business. When the company was first formed, it was driven 100 per cent by a dealer program. As SecurTek acquired new dealers, their accounts became SecurTek customers and they would receive service and support under the SecurTek umbrella.

But it became apparent that wholesale monitoring — selling monitoring services directly to independent dealers — was a necessary step in the company’s evolution, he says. As this trend continued, a hybrid approach emerged where “you could live in both worlds if you wanted to,” says LaBrash. Dealers could offer services to the public through SecurTek and represent

the company as an independent contractor, or else simply utilize SecurTek as a partner through a wholesale model. The hybrid program, which has been up and running for about a decade, has added some flexibility to the relationship between SecurTek and its dealers and opened up new options. “We’ve found a way to make that work,” says LaBrash.

A large provider like SecurTek can offer a range of support services, he adds. Under the wholesale program, the company can provide billing and customer support, while still allowing the alarm company to maintain their own logo on the invoice. For SecurTek dealers, there are a broad range of options available as well.

Industry pressures and an increasingly competitive environment have driven a lot of independents to seek out established dealer programs as a safe haven. Such programs can help mitigate the risk associated with customer churn, says LaBrash.

“They’re looking for creativity, flexibility and funding, and for marketing to still make that phone ring. Lead referrals, social media support, marketing support, co-operative funding. We’ve built mechanisms to

“[Dealers are] looking for creativity, flexibility and funding, and for marketing to still make that phone ring.”

— Wes LaBrash, SecurTek

offer that type of support.”

“Providing the correct language to sell is really big,” adds Abdelrazik. “When you’re moving into things like interactive services and smart home devices and having to have all these smart home devices work in the home with your security system, that becomes a huge challenge. How do you sell that? How do you upsell that? [Dealer] programs are really focusing on how to provide adequate training and marketing tools.”

LaBrash says SecurTek can provide its dealers with phone tech support to help installers when installing equipment on site and help end users who may still have questions after the install.

The technology is trending towards greater complexity, particularly with IP-based systems. “Now you’re wiring in doorbells and cameras and door locks, and you’re activating it on a third-party portal and you’ve got to train the customer on how to use it. What those dealers also need is somebody that can support the customer. If the customer has questions after the install and they want to phone somebody, they can phone us,” he says.

A major upside of today’s systems and security environment is the amount of useful data that is generated, says Patrick Soo, director of national sales, Canada, for Alarm.com.

“With interactive services, which is Alarm.com’s focus, we’re helping the dealers drive higher quality business,” he says. The technology can provide end users with more control and more insight into how their systems are working. Dealers get a clearer picture of what their customer base looks like.

According to Soo, Alarm.com is able to provide key data to dealers while still exceeding all Canadian privacy requirements.

“How many accounts are they adding, what does their attrition look like, what’s their service package, is it residential or commercial? They have a lot of resources at their fingertips through our dealer portal,” says Soo.

Residential vs. commercial

An unintended consequence of the Alarm.com platform and its reach is the degree to which it became adopted by small business, adds Soo. “What we found was, when we started off with a residential focus, a lot of our dealers were selling our solution into small and medium business and even medium enterprise. We realized we were really missing an opportunity.”

Soo says the commercial channel is now Alarm.com’s fastest growing market. “We’ve added access control to our platform. We’ve got commercial grade cameras and commercial grade streaming video recorders. We’re really excited about what we can do in the commercial space — helping dealers leverage that. Especially in light of what’s happening in the residential space. It’s becoming a lot more competitive.”

LaBrash says that SecurTek’s residential program continues to thrive — “We’re signing up new dealers pretty regularly” — but the commercial segment is growing more quickly.

“That’s where many dealers are focusing. I’d say our most successful dealers are investing more time and money into commercial, but they’re not walking away from residential.”

A relatively new wrinkle in the market is the appearance of do-it-yourself security products, often sold through big box retailers.

While this trend may have caused some initial consternation among the established alarm industry, or it has just been ignored altogether, some companies, both big and small, have figured out the upside of DIY.

Mike Chaudhary is the CEO of Toronto-based Alarm Guard Security Services, the largest of ADT’s Canadian dealers. (ADT Canada was acquired by Telus last year.)

Chaudhary has been an ADT dealer since 2003 and in 2016 started a sub-dealer program, providing support and services. “We teach them [dealers] from the get-go and work with them on a daily basis,” he says.

The outlook for professional monitoring firms looks good, he says, particularly for forward-looking companies who capitalize on opportunities to upsell clients.

There are a lot of legacy alarm panels still left in the field and smart dealers will be able “to fill that technology gap… At the end of the day, it’s a customer market. The customer is going to get a lot of benefits with this new technology,” he says.

Chaudhary has also established a business which caters purely to the DIY client, DIYProtection.ca. In Chaudhary’s view, the market for this remains an underserved one: retirees, cottagers and people who live in more remote areas. For the latter especially, it can be cost-prohibitive to send out a professional installer, “so it’s a big opportunity for us.”

Chaudhary tested out the business model for more than a year before launching the website in 2019. Customers can buy security systems that are pre-packed and pre-programmed. Everything can be shipped in one box and sent via an overnight courier. Once the user sets up the system in their home, they call in to activate it. Professional monitoring options are also available for those who desire a more complete offering.

“It’s working very well,” he says of the new business. “We’re seeing exponential growth, month by month.”

Parks Associates’ Abdelrazik says their research indicates solid growth in the smart home and DIY security market, with about 29 per cent of U.S. consumers adopting at least one smart home device. But the DIY model is still a disruptive one, says Abdelrazik, with many dealers wrestling with the question: “‘How am I going to sell a DIY system — something that’s self-installed. And how is that going to compete with what I’m currently offering?’ Dealers want to be in the home. They want to be installing the security system themselves.”

Some dealers are starting to make that transition. “It’s slowly growing,” she says. “They’re treading cautiously, trying to figure it out, but that is something that is emerging.”

The DSC7090 beam barricade will stop a 15,000 pound (6,800 kg) truck going 30 mph (50 kph) with negative 6.3 feet (1.9 m) of penetration. Raising in five seconds and lowering in two seconds yields a fast cycle rate of over 100 vehicles in and out per hour, making the new DSC7090 suitable for higher traffic and population locations. The dual beam design provides coverage of 12 to 24 feet (3.7 to 7.3 m) of roadway with a full 90 degree opening. The DSC7090 deploys touch screen controls and the same logic as used by government organizations. www.deltascientific.com

FiberPatrol FP400 is a zonebased intrusion detection system for fence applications. The FiberPatrol FP400 is an affordable fiber optic perimeter intrusion sensor, according to Senstar. Each processor provides up to four zones of detection and supports insensitive lead-in enabling electronics to be installed up to 12 miles (19 km) from the perimeter fence. It is suited for small sites with concerns over EMI, lightning, or conductive elements on the perimeter. www.senstar.com

Alula

The Slimline Touchpad, offers in-home interactive control for the Connect+ Hub and the BAT-Connect Communicator. The seven-inch touchpad enables real-time command of intrusion security, video cameras and automation devices. The touchpad can be mounted on tabletops or walls with a power supply that utilizes existing wiring in the home or business. The device features the same look and functionality of the Alula smartphone app. The touchpad controls every aspect of a modern security system.

Southwest Microwave

Gallagher

www.alula.com

Southwest Microwave has expanded its suite of intelligent microwave sensor technologies with the introduction of the IP-based INTREPID Model 336-POE Long Range Digital Microwave Link. This all-weather, Power over Ethernet (POE) sensor couples field-proven RF detection performance with secure network connectivity. The Model 336-POE has a range of 457 meters, operating at K-band frequency. The sensor employs advanced digital signal processing algorithms to optimize discrimination between intrusion attempts and environmental disturbances. www.southwestmicrowave.com

The MR6442X IP 4MP dome camera is suitable for outdoor installations in challenging lighting conditions, such as schools, parking lots and sports stadiums. The camera’s features include 2.8 to 12mm Varifocal-Auto Iris Lens, 30-meter IR night vision, and built-in Sense up+ low light technology. Advanced motion detection, object counting and tripwire detection allows the camera to detect when an object or person has breached an area such as the entrance to a building or parking lot. An IP67 waterproof rating qualifies MR6442X for outdoor perimeter protection. www.meritlilin.com

Boon Edam

Circlelock can integrate with any access control system and biometric scanning technologies can be mounted inside the portal on an optional, supportive post. A user can present one credential to enter the portal and then present their face, iris, fingerprint or hand to confirm their identity before the second door opens. The Circlelock utilizes near-infrared detection technology housed in the ceiling, called StereoVision 2, which scans the compartment to verify that a user is alone before allowing them to enter a secure facility.

www.boonedam.com

Gallagher’s Command Centre v8.20 software solution includes improved functionality and new features, such as streamlined car park management, mobile evacuation, enhanced site plan functionality, and improved locker management. Utilizing Gallagher T20 readers and the Gallagher Mobile Connect app, drivers are informed of which parking lot they’ve been allocated via the screen on the T20. With the Mobile Connect app, users don’t need to wind down their car window to enter or exit the lot, as there’s no need to badge a card at the reader. security.gallagher.com

AMAG Technology

Symmetry Con trol Room V4.5 is an open architecture command and control platform. It brings together multiple, disparate systems into a single, personalized user interface designed to improve response time and security management. V4.5 features a new video overlay to control and navigate the system directly from within a camera view. The new video overlay option allows for symbols or objects to be placed directly onto the foreground layer of a camera video stream. The operator is able to monitor, control and track directly from within the camera view while keeping focus on the object of interest. www.amag.com

Keith D’Sa, country manager,

By Neil Sutton

Keith D’Sa is the second country manager for Axis Communications in Canada and the first Canadian to hold the position. (Axis has operated an office here since 2010.) D’Sa first joined Axis in 2012 as national account manager and was soon promoted into a national sales manager role. He took over the top spot in Canada last year, replacing Bob Moore, who accepted a role in the U.S. as director of marketing. SP&T News recently spoke to D’Sa about what makes Axis’s company culture distinctive, the difficulties of hiring talent in today’s market and the ongoing importance of strong cybersecurity for surveillance products.

SP&T News: How much autonomy do you have as a country manager in Canada?

Keith D’Sa: The nice part about the way Axis is set up is they allow autonomy and nimbleness to be done in the field. In North America, we moved to a business area model. LATAM is basically Mexico and South America. We have six business areas in the States, and we have Canada, so in total eight that are roughly equal in size.

If I wanted to change how we go to market… I wouldn’t be able to make that change because that’s a direction that we have globally. We have a two-tiered model, so that’s something I would never change. But if I wanted to do my own specific marketing campaign in Canada, we have control over doing that. If I wanted to hire a person to focus on a specific segment of the market or product segment that we have, I have the autonomy to do that in Canada.

I can essentially control our own destiny for Axis in Canada, with some constraints that I have to follow with our global policies.

In all honesty, I haven’t seen

“I’d like our partners to be able to make their businesses grow.”

any of those policies to be detrimental to us, so I’m happy to follow them because they just make sense.

SP&T: Did you receive any words of advice from your predecessor Bob Moore?

KD: Bob was actually great. He helped me develop to get to the stage I’m at, so I owe Bob a lot. Bob’s advice was “Just be yourself.” I’ve been here seven years at Axis. It’s evolved over those seven years. A lot of it [is because of] Bob, but I had a major play in that as well and Bob doesn’t let me forget that. And Bob hasn’t gone anywhere — he still works at Axis. I see him once a month and talk to him regularly. He’s always there for advice and support.

SP&T: Are there any goals you’ve established for yourself or the organization?

KD: Obviously growth is a major goal. We’ve seen some significant growth over the last few years. I’d like our partners to be able to make their businesses grow in the same way that we’re growing. Being able to transfer some of that knowledge and our go-to-market strategy and what’s working for us onto our partners so they can grow their businesses. That’s something that I’d like to see in the short term as well as the long term.

I’d like to see career development within our staff here. One of my big things is that people develop in their careers — that they’re not just stuck in a role and not happy. I want long-term happy employees and I want to make sure there are advancement opportunities for them. I think that speaks to our industry as well. I’m probably not the only person to say this, but we struggle in our industry finding good talent and a lot of talent.

I have seven open [positions] right now and it’s becoming difficult to fill those just because there’s not a huge community of talent you can pull from. If you look at the States, they have the population to support it. Maybe they have more programs through universities and colleges that push people through the security channel. I don’t see that as much in Canada. A goal for me is to give back to the communities — maybe colleges and high schools — and really try to get people down the path of security. So when we do need to fill these positions, we have a talent pool we can pull from.

SP&T: Axis is often regarded as a forward-looking company.

KD: It’s a pleasure to work for a company that actually has that forward mentality. Some companies get focused on the bottom line — the bottom line and making sure the shareholders are happy. I’m not saying that Axis isn’t that way, but what they really focus on is making sure they’re doing the right thing. Are we developing the right product mix? Are we pushing the envelope of technology? That’s what Axis likes to do. Since 1996, when [Axis] first invented the IP camera, we’ve been doing that. I knew they were an innovative company and they were constantly pushing out innovative product. What I didn’t know about the company before joining it is the culture. We have a very tight-knit community. We have the same core values.

SP&T: Axis is known for its surveillance but it has branched out into other areas like access control and audio. KD: I look at us essentially as an IT manufacturer — a company that makes Internet of Things

(IoT) products. Devices that fit on the network, whether they are cameras, speakers, access control. That’s the tie-in — the network. I liken audio back to how video was in 2004/2005. It’s still very heavily analogue. Most of the integrators doing it are still doing it analogue because they’re comfortable with that. Yes, there’s still some advantages to analogue… back in 2005, there were definitely some advantages to analogue video. But we slowly saw the scales tip and things move towards IP. The advantages of IP bloomed from there. I think the same thing is going to happen with the audio world as well.

SP&T: Cybersecurity is also a major concern with network video today. KD: I think with everybody that manufactures an IP-based product in our market, you have your own responsibilities to ensure that you’re doing everything possible to make sure that it’s a secure and cybersecure product, especially when you’re selling it to enterprise business. That’s the last thing you need — a vulnerability in your product. Yes, they will happen from time to time. It’s just how you address it and deal with it long term.

I think Axis has a pretty good record of dealing with it. We’ve had our own vulnerabilities. We try to address it before it actually becomes an issue. Axis has a forward-thinking policy when it comes to cyber. We have a fully dedicated person — somebody who is responsible for cybersecurity education in Canada. We try to make it easier within Axis Device Manager. We’ve added cybersecurity protocols that make life easier for integrators. We try to make things easier to make sure our product is very secure.

We’ve even taken some steps where we’re forcing people to change the default password. We’re trying to do our part.