Serving Installers, Dealers and Integrators Across Canada

Motorola Solutions recently announced its intent to purchase Vancouver-based Avigilon in an allcash transaction valued at approximately US$1 billion.

According to the terms of the agreement, Motorola will acquire all of Avigilon’s outstanding shares for $27 per share. The $1B enterprise value of the transaction includes Avigilon’s net debt.

“This acquisition will bring Avigilon’s advanced video surveillance and analytics platform to the rapidly evolving public safety workflow, while also expanding our portfolio with new products and technologies for commercial customers,” said Greg Brown, chairman and CEO, Motorola Solutions, in a statement.

A joint statement from both companies announcing the deal pointed to the role of cameras in

public safety as well as surveillance and analytics enabling public-private partnerships between communities and law enforcement. Motorola explained that its customers will be able to purchase security and surveillance solutions “as part of Motorola Solutions’ portfolio of critical communications technology for commercial markets.”

“We’re very pleased to be joining Motorola Solutions, as their vision and strategy aligns fully with our own,” added Alexander Fernandes, Avigilon’s founder, chief executive officer and chairman of the board. “This combination will bring new opportunities to Avigilon, allowing us to accelerate our innovation and provide even more value to our customers.”

Fernandes will retire as chairman and CEO upon completion of the acquisition.

“I think it’s a great deal for Avigilon,” said Bill McQuade, president of Toronto-based security consulting firm Final Image, in an email to SP&T News. “The valuation makes sense based on their current revenue.”

In a research note, IHS Markit analyst Jon Cropley said that “Motorola’s focus on public safety projects is likely to have

Fire Monitoring of Canada Inc (FMC)., based in St. Catherines, Ont., recently announced it has acquired systems integrator Bulldog Fire & Security in order to ramp up its existing security business and pursue new opportunities. Financial terms of the deal were not dis closed.

Chad Asselstine, FMC’s vice-president of business development, said that while FMC is primarily a fire monitoring alarm company, it has added more and more security based services over the past 10 years. He estimated that its business was split 60/40

between fire and security prior to the Bulldog acquisition.

“As our clientele grew and as we grew as a company, we acquired the knowledge base to be able to offer a full solution. We’ve always wanted to expand upon that,” said Asselstine.

Bulldog represented an opportunity to achieve some of that growth.

“As we worked our way through the process (of acquisition) we saw a lot of synergies ... in terms of the work that they do, their business ethics and their values as an organization,” added Kevin Allison, general

Kevin Allison, FMC

manager at FMC.

According to Ron Landry, Bulldog’s chief operations officer, Bulldog had “encountered our ‘ceiling of complexity,’” reaching the limits of its growth under its current structure. By merging with FMC, that growth potential has expanded, he said.

“We’ve grown to a point that we don’t have the expertise to grow it any further. With this merger/acquisition, FMC has the tools in place that allow Bulldog to continue to grow into different fields, different areas,” said Landry.

Bulldog, based in KitchenerWaterloo, Ont., offers a full suite of security services including monitoring via third-party providers. Now part of FMC, Landry said Bulldog’s customers will be able to take advantage of FMC’s ULC-listed monitoring facilities.

been a major motivation for the acquisition. City surveillance is an important element of public safety. Professional video surveillance equipment revenue has been growing faster in the city surveillance sector than in the rest of the market in recent years.”

According to IHS Markit forecasts, the city surveillance sector is growing at a compound annual growth rate (CAGR) of 11.1 per cent to 2021 compared to the overall market at 6.8 per cent CAGR. IHS also estimates that the command and control technologies and services market was worth almost US$5 billion in 2017, with Motorola holding approximately seven per cent, making it the largest supplier.

The acquisition is expected to close in the second quarter of 2018, subject to customary closing conditions.

Bulldog also recently expanded its offerings to include networking services such as structured cabling, fibre and wireless access, which present clear synergies with IP-based security hardware.

FMC offers monitoring coast-to-coast and has offices in Toronto, Napanee, London and other locations across Ontario. Bulldog’s customer base stretches across south-western Ontario. The acquisition will provide a base for further expansion, said Asselstine, who expects to see growth outside the province as well.

Asselstine added that FMC will maintain Bulldog as a division within the company and intends to keep its existing name and branding. Bulldog was recognized as Integrator of the Year by SP&T News in 2009 for a customer project with Sleeman Breweries.

Harding Security Services acted as advisor to the owners of Bulldog on the acquisition deal. Principal Victor Harding is a regular columnist in SP&T News

— Neil Sutton

ICT, a New Zealand-based company that makes access control, intrusion detection and intercom products, recently opened a new Canadian office in Toronto.

ICT has historically sold in Canada through a reseller and will continue to maintain those business relationships.

ICT is represented in Canada by Pat Alvaro, director of sales, and is quickly adding other staff. Hayden Burr, the company’s founder and CEO and a native New Zealander, also has a Canadian connection.

Burr lived in Canada for a period during the 1990s and moved back home after about a decade. He established his current company, ICT, in 2003, producing electrical products. With its manufacturing operations headquartered in New Zealand, the company immediately began exporting products to Canada before selling anything domestically. The company narrowed its focus on security products, developing its current line-up of card readers (and access cards), intrusion, intercoms and IP reporting tools. In addition to Auckland, New Zealand, ICT also has locations in Melbourne, Australia; Denver, Colo.; London, U.K.; and now Toronto. All of its products are still manufactured in New Zealand.

For Burr, who was in Toronto to attend the new office launch, integration and reporting is key, particularly

to leverage the value of access control data. “There was a term that was coined probably about eight years ago: Data is the new oil,” says Burr. “An access control system is really data about employee movements. If you’ve got that information, what can you do with it? Things like leveraging inter-departmental transactions in large organizations. You can calculate that using that information.”

Burr says his company goes to market by developing relationships with local integrators. Mass distribution “is not right for our type of product. We need to have that direct touch and feel with the integrator — that gets us closer to the end user.

“The integrators that we deal with, they are our partners. Ensuring that we’ve got good partnerships and maintaining good relationships with them is our No. 1 [priority]. No. 2 is backing them up and ensuring that they are trained well.”

Burr identifies high-rise residential, large retailers, commercial and finance (both branch level and corporate offices) as the company’s target markets. The company has an estimated 4,000 systems installed in Canada and is also working on increasing its brand recognition here. Establishing a Canadian office is a major step in that direction, says Burr. “Right now, for us, we have to have that presence.”

— Neil Sutton

According to a recent report authored by IHS Markit analyst Jim Dearing, the U.S. education sector’s spend on security equipment and services was US$2.7 billion (in revenue).

Due to the fact that most schools have already adopted surveillance and access control technology, the market is projected to grow at just one per cent annually to $2.8 billion by 2021. Despite

limited growth projections, security vendors are looking to newer technologies to improve adoption rates.

Facial recognition technology: adoption of this would allow for more proactive use of surveillance technology, particularly to recognize unfamiliar individuals in the building. The downside is affordable facial recognition systems may be unable to cope with the number

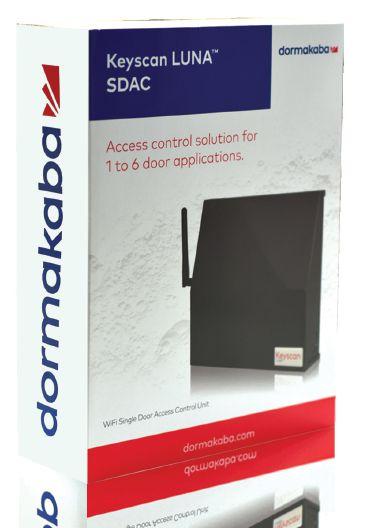

Access control solutions provider dormakaba announced its Oracode keyless access system now integrates with more than 30 vacation rental property management systems (PMS).

The newest integration partners include Comtrol, CUBILIS and TurnKey.

Oracode’s keyless access control coupled with property management, site monitoring, and energy management systems improves guest satisfaction, and reduces operating expenses, according to the company.

Oracode partners include PMS solutions, HomeAway, Streamline, Barefoot Technologies, BeHome247 and more.

“dormakaba’s Oracode team continuously works with its vacation rental management customers to develop partnerships that improve efficiency and reduce operating expenses,” said Logan Stewart, senior product manager, vacation rentals with dormakaba, in a company statement.

“Oracode’s most recent integration with respected third-party system providers adds flexibility and boosts bookings.”

of faces in any given school.

Logical/physical security integration: integrating access control with, for example, the student directory would make it easier to remove access rights for former staff and students (left or graduated). Access to sensitive data may make this type of integration difficult.

High security classroom doors: Better doors would create a more effective barrier between students

dormakaba says it offers an open API for PMSes to access Oracode Live software and customize the integration to leverage their unique functionalities.

dormakaba Oracode offers vacation and short-term rental properties a keyless access system using a time and date specific code through a web-based interface. Oracode eliminates keys and cards as well as time-consuming management, says dormakaba.

Oracode’s network of integration options enables managers and owners to provide enterprise smart home control. It streamlines property access by providing and tracking keyless guest entry codes within partner PMS software for easily regulated, accountable access. Additionally, dormakaba’s Smart Controller allows operators to communicate remotely with their unit’s Oracode locks. With the Smart Controller, property management companies can evolve to a connected home using occupancy parameters to automatically control energy usage without staff intervention.

and potential attackers. Costs may be prohibitive, however, and fire regulations may dictate that some entrances and exits remain accessible in the event of an emergency. Metal detectors or x-ray machines: Weapons detection would be greatly improved, but managing such machines (as well as staffing them) would be difficult given the typical number of entrances in schools.

Anixter technology forum highlights growing role for surveillance, access and analytics in property and facilities

Anixter’s Converged Technology Forum, held recently in Toronto, focused on the increasing sophistication of smart buildings, as well as the tools and methodologies that are helping that transformation to take place.

Andy Jimenez, Anixter’s vice-president of technology, highlighted the important role that surveillance technology can play in smart buildings, in large part due to the relatively recent (and rapid) improvement in analytics capabilities.

Today’s surveillance cameras fit into three broad categories, he elaborated:

• General surveillance (where high quality images may not be required);

• Identification purposes; and

• Software forensics

phone than their card, he suggested, plus phones may also contain their own biometric component for an extra level of authentication.

In terms of how these two mainstream security technologies can affect smart buildings, simply put, they are huge sources of data. Cameras are “a perfect sensor,” said Jimenez. “There’s really no shortage of data points that you can extract. It’s really what you do with it… It’s how you harvest and use it and do something actionable with it.”

Andy Jimenez, Anixter

A growing sub-category is analytics, which can be split into simple applications like people-counting, and complex ones, like licence plate recognition (LPR) and facial recognition.

There are still misperceptions about what this technology can do, said Jimenez, “but it is evolving; it is getting more accurate. It’s certainly trending towards [high] sophistication.”

Access control is also in the midst of an evolution. “It’s going to be tremendously important,” he said.

Access can be broken into three components: something you know (like a PIN); something you have (a key or card) and something you are (a biometric component). In high security environments, such as data centres, all three levels of authentication may be required, he said.

He also postulated that the keycard, currently in heavy use for access control, may soon be supplanted by the smartphone as a credential. People are far less likely to lose their

Many of today’s cameras can do a “second job” in addition to their security roles, he added. Peoplecounting is an effective tool for a variety of purposes, including determining room occupancy. Access control data can serve a similar purpose, helping to generate what Jimenez called environmental analytics. Overhead costs like temperature and lighting can be more effectively managed using this data, saving money and contributing significantly to a business’s bottom line.

Jimenez also pointed to forthcoming changes in networking protocols and the profound impact they will have on building automation. Power over Ethernet (PoE) is moving towards a new standard that will deliver up to 70 watts of power to PoE enabled devices, which will facilitate the migration of commercial lighting and building management systems onto the network.

Twisted pair cable has traditionally been limited to a maximum physical reach of 100m, falling short of some of the applications required for commercial requirements, noted Jimenez.

An IEEE task force is working on a new standard — IEEE 802.3cg — that will support a data rate of 10Mb/second and 13 watts of power on a single twisted-pair cable rather than the traditional 4-pair category rated cable that is currently

deployed. The standard will also enable an installed single-pair cable to reach a distance up to 1km, a significant improvement over 100m. (A series of videos hosted by Jimenez on Anixter’s YouTube channel also details this transformation and others in the building automation space.)

A second session at Anixter’s Converged Technology Forum focused more on the cultural aspect of today’s workspaces and how environmental controls can help make people more comfortable. “If they’re not comfortable and they’re not productive… that’s a problem,” said Andy Schonberger, consultant, Intelligent Buildings, who co-hosted the session with Deb Noller, CEO, Switch Automation.

The answer to many of the problems that plague buildings — too hot or too cold, elevators not working, bathrooms not clean — is to be proactive about them, said Noller, and address them “before a human even notices.”

Traditionally, that can be difficult, particularly for large infrastructures. Airports, for example, typically comprise multiple terminals that may have been built

in different eras with different systems.

Improved collaboration between stakeholders, particularly IT and operations, is helping to take care of some of these issues, added Schonberger. Today’s buildings are “cyber-buildings” with most systems running over IP networks. As such, digital security is at a premium in order to protect a building’s infrastructure.

On a more fundamental level, the way people work today is evolving. Work from home programs, popular in recent years as a means to offer job flexibility and potentially save on real estate, are losing favour, said Noller.

CEOs are discovering that by isolating workers, they are preventing them from working collaboratively. More often, today’s offices provide employees smaller work spaces but larger collaboration rooms to foster creativity and spontaneity.

Businesses must be open to new ideas to address technical and cultural challenges, added Schonberger, again mentioning Jimenez’s example of using cameras as a sensor to collect useful data that can make buildings more efficient.

— Neil Sutton

With recreational cannabis set to become legal on Oct. 17 this year, the question of safety and security in cannabis producing facilities has taken centre stage.

In fact, ULC Standards recently announced the proposed first edition of CAN/ULC-S4400, Standard for Safety of Buildings and Facilities Utilized for the Cultivation, Production and Processing of Cannabis.

The standard is intended to:

• Provide minimum requirements for the protection of buildings and facilities used to cultivate, process and produce cannabis and cannabis-related products “to minimize dangers resulting from the effects of fire”;

• Provide minimum requirements regarding “cover devices, equipment and systems utilized for cannabis cultivation, processing and production”; and

• “Provide minimum requirements for the security of buildings and facilities from intrusion and infiltration, as well as considerations for secure access and safe egress.”

In an email to SP&T News, Theresa Espejo, project manager for the ULC Technical Committee S4400, explained the proposed standard has come “at the behest of local regulators concerned about security in a new and emerging industry.”

“There is a severe deficiency in code requirements, standards, regulations, by-laws, or even codified best practices specifically addressing the unique challenges facing this emerging industry,” she elaborated.

The proposed standard focuses solely on the safety of buildings and facilities used to cultivate, produce and process cannabis because “this is an identified priority concern of regulators and government stakeholders,” Espejo explained.

“Safety, egress, building codes … don’t always combine well with a heavy security environment. It can be a real challenge to balance both interests. “

— Jeff Hannah,JH &Associates

eliminate the black market. Hence it is crucial for all facilities storing, handling or processing cannabis to have a robust security system and be protected from intrusion and infiltration.”

“The standard aims to set the bar to an ideal, practical and attainable security set of requirements among all players,” she added.

To develop a consensus-based standard that can be applied nationally, ULC recently formed the ULC Technical Committee S4400. The committee is composed of 34 voting members and six associate, non-voting members, said Espejo.

Its members represent a mix of seven interest categories: AHJs (authorities having jurisdiction)/regulators, producers, supply chain, commercial/ industrial users, general interest, standards and testing, and government. They will help develop technical requirements, address comments in their respective fields of expertise, attend meetings and vote on ballots.

According to Espejo, Health Canada has said, “Mitigating the inversion and diversion of cannabis products is a primary goal to reduce and

security companies that are already aggressively marketing to that business sector,” Straw said. Consequently, he applied to be part of the committee. Three other CANASA members are also on the committee, he shared.

Straw believes it’s very appropriate that ULC develop a standard on security and safety in cannabis cultivation and processing, given the close relationship between electronic security and fire.

“To me, they’re [ULC] the perfect entity to come up with a national standard for protecting these facilities,” he elaborated.

Jeff Hannah, owner and principal of JH & Associates, a security consultancy with expertise in the Access to Cannabis for Medical Purposes Regulation (ACMPR), agrees. Although he is not on the committee, he is “definitely in favour.”

CANASA is one of those members. According to Patrick Straw, CANASA’s executive director, they became involved after inviting Al Cavers, engineering manager of ULC, to sit on their national board.

He asked Cavers how CANASA could become more involved with ULC. This standard seemed to be a good fit, as it’s “pretty close to the security industry and there’s a lot of

“The standard aims to set the bar to an ideal, practical and attainable security set of requirements among all players.”

—Theresa Espejo,ULC

“There’s a lot of safety and egress [components] they’re going to develop, which, to be honest, I think is needed,” he elaborated. “Safety, egress, building codes … don’t always combine well with a heavy security environment. It can be a real challenge to balance both interests. So to get some clarification and a defensible standard that balances all those interests with the regulatory influence taken into account would be a great thing to have.”

These types of cultivation and production facilities haven’t existed en masse before, so “that’s a great reason to have some good, solid, well-thought out standards to lean on when you’re designing these to be safe and secure,” he concluded.

ULC aims to complete the standard by Q2 of 2019, Espejo said.

Once complete, “it will be incumbent on the security companies that are working in that space to conform to whatever regulations come out of it,” Straw added.

— Ellen Cools

Identity management is one of the most important aspects of security. By knowing who all the actors are in a given space, a security department can immediately establish a baseline.

Identity management is also at the crossroads of security systems and technology, from access control to database management to biometrics to visitor management and CCTV to more specific applications like licence plate recognition. Knowing who you’re dealing with is half the battle.

But creating this visibility isn’t always easy. Back in 2012, SP&T News featured an article entitled “Why haven’t physical and logical access control merged yet?” written by Bill Spence, vice-presi-

dent of transactions for Lumidigm (which was acquired by access giant HID Global in 2014). At the time of writing, Spence posited that biometrics might hold the key to better integration between the physical and logical. “There is no meaningful access without first establishing the ‘who’ in transactions,” he wrote. Cards, fobs, even phones, cannot guarantee identity — merely that the holder has a key for access. Biometric verification, however, can help make the ‘who’ more of a certitude.

Identity, of course, is not only a matter of concern for the security or HR department, but for the identity holder themselves. Through technology, identity management can help provide that

person more options, or at least a more seamless transition across all of life’s roles.

Two years ago, in the Jan/Feb 2016 issue, Rob Martens, futurist for Allegion, took part in a Q&A. When asked to speculate on the identity outlook for the next five or so years, he said, “I fully expect for a couple of things to happen. One is the level of expectation of identity management at work and home is absolutely going to merge. This concept of knowing who I am when I arrive and what I want is going to be in effect.” The most compelling aspect of that is “hoteling” in the workplace. “We believe that will be on steroids,” added Martens. “When you come into the building, depending on what your prefer-

Toronto airport deploys ID management, access control: Since initiating the use of SAFE for its identity management and access control security systems, the airport has already realized reductions in credential processing time, along with related cost savings.

Why haven’t physical and logical access control converged?

Biometrics may be the key to linking up technology and answering the most important security question: “Who?”

Banking on biometrics: Brazil, India and South Africa are deploying biometric solutions at ATMs in an effort to ensure customers’ banking security. Should Canadian banks be making the same investments?

Advice for Installers: “An identity management system will help align a business’s security operations with its business operations.” (Jody Ross, Vice President, Global Sales and Business Development, AMAG Technology). 2009

ences are, you’ll have the ability to be assigned a workspace, have everything that is expected of you available, ready and accessible based off of that workstation.... The level of integration is going to increase exponentially.”

The push for better access management is expected to increase spending in the market substantially over the next five years. According to a 2018 IHS Markit report, global revenue is projected to increase from US$5.4 billion in 2016 to US$9.6 billion in 2021. Among those drivers: the availability of hybrid solutions (on-prem and Cloud); the constant battle with hackers creating a more urgent need for better ID management; and blockchain.

BBy Colin Bodbyl

Why facial recognition is superior to fingerprint alternatives and offers greater versatility

iometrics is the technical analysis of a person’s unique physical features.

“In many cases only an image of the person is needed to enroll them.”

The longest standing use of biometrics in the security industry is fingerprint recognition. This technology is commonly used as a form of access control to validate users without forcing them to carry an RFID badge or memorize a PIN number. While successful by many measures, biometric technology has never gained the kind of traction one would expect from such a futuristic technology. Recently, a different biometrics technology has been getting a lot of attention as facial recognition promises to overcome the challenges inherent to fingerprint recognition. Like fingerprint recognition, facial recognition is marketed as a credential validation tool for access control. It promises to overcome many of the challenges faced by fingerprint recognition.

The most common complaint about fingerprint recognition is hygiene. Studies have shown that touching a fingerprint reader is no less hygienic than touching a door knob. Somehow that has not been enough to change people’s minds about the cleanliness of these readers. Facial recognition easily solves this problem as no contact is required for it to operate; a person simply looks into a camera and the door unlocks, removing hygiene concerns completely.

Another challenge with fingerprint readers is their application in cold climates. Many parts of the world face sub-zero temperatures.

In these cases users may be wearing gloves or just have their hands buried in their pockets in places where every second exposed to the cold is unpleasant. In these applications, it doesn’t take long for users to resent the technology that forces them to chill their hand daily while waiting for the reader to analyze their fingerprint. Again, facial recognition does not have this issue.

User enrollment is another big challenge. Unlike RFID cards or even physical keys, where they can simply be handed to users, fingerprint recognition requires every user to enroll their finger in the system by scanning it several times while an administrator logs it in the software. Facial recognition is less invasive where in many cases only an image of the person is needed to enroll them.

The final issue with fingerprint recognition is false negatives. A false negative is when a user who is in the system is rejected by the reader because of a misread. Manufacturers

will boast a 99 per cent or higher accuracy rate but that still means users are rejected several times per year. This may not sound like a huge issue, but the reality is that users (especially those expecting perfect performance) can quickly become frustrated by the false negatives. Facial recognition doesn’t solve this problem either. Similar to fingerprints, faces can present differently under different conditions, which can generate a false negative.

Facial recognition is without question superior to fingerprint recognition, but it cannot overcome every challenge related to biometric technology. That being said, even though facial recognition may have a limited future in access control, it has many other applications outside of access control where false negatives are not an issue. In particular, the technology is good in active monitoring situations where a guard or monitoring centre only wants to be alerted of unknown visitors and the occasional false negative is

expected. Similarly, the technology will be extremely effective as a data collection tool to recognize frequent visitors or loyal customers. It is these types of applications that will make facial recognition far more successful than fingerprint recognition.

Biometrics is an exciting technology that has existed for many years now. Limitations around cost and functionality have prevented wide spread adoption. Fingerprint recognition has led the way in mainstream applications but inherent limitations prevent it from growing faster. Facial recognition promises to overcome many of these hurdles and while it is not perfect, it has many applications beyond access control that will bolster its growth and ultimately see it surpass the popularity of biometrics products of the past.

Colin Bodbyl is the chief technology officer of Stealth Monitoring (www.stealthmonitoring.com).

SP&T News recently reached out to a variety of security systems manufacturers and developers and asked them for some helpful pointers that we can relay directly to our readership. Read on for advice on customer relationships, IoT, legacy systems, connected devices, project management and more.

Jacquelyn Davies, Vice President of Sales for Canada, Bosch Security Systems

In 2018, we’ll see an increased focus on solutions that go beyond security requirements to add value by addressing other needs of the user. As a result, systems that consist of silos of security technologies will no longer be acceptable to end users who will be looking for smart, connected systems. Integrators will need to identify how

security technologies can work together to improve overall system performance.

For example, video integration with the alarm panel can enable control panel events — such as an alarm triggered by a motion detector — to initiate camera actions, including sending video snapshots from cameras focused on the area to end users via email or text. Cameras equipped with video analytics can also activate points on the control panel, improving security and enabling the integrator to extend system capabilities beyond security. A camera triggered to alert on loitering or an object left behind can notify security personnel about a pallet blocking an emergency exit door or a car parked in a no-parking zone to prevent health and safety

risks. These capabilities add value for the user by providing a solution for health and safety pain points and helps them seek additional funding sources outside of the security budget.

Integrators who move out of the traditional security system comfort zone can use integrated solutions to solve issues that extend beyond security. With knowledge of the capabilities of integrated systems, the integrator can become a strategic advisor and trusted partner, helping them establish valuable, long-term relationships with customers.

Derek

Arcuri,

Product Marketing Manager, Genetec

Moving from a legacy access control system to an IP-based system can sometimes be seen as expensive and time consuming. Security directors can be hesitant, often asking questions such as: “Will I have to replace my entire system? How much will it cost to rewire and transition my cardholders and data-

bases? How much downtime are we looking at?” While these concerns are valid, it’s never been easier to migrate to IP access control. The first step to ensure a successful outcome is to treat the migration as a project and elect a project manager to ensure successful planning, execution and closure. This is worth the investment as it gives the customer the assurance that everything is under control and increases your success in terms of cost, scope, schedule and time. From there, it’s important to follow the following steps:

Planning: Understand how the current system is being used from card to reader (this includes analyzing wiring drawings, architecture, where the doors and openings are located, card technologies expectations).

Analysis: Evaluate which features and technologies are being used vs. what will be needed, what work arounds are required. Evaluate what changes are needed at every level of the architecture: cards, readers, locks, wiring, controllers, servers, database cleanup, software features, etc.

Design: Map out the desired system on paper, creating a block diagram for the system migration. Build a model system in your test lab before you commence implementation.

Implementation:There are varying implementation approaches but we recommend a phased approach where components of the current system are migrated over in phases. First, set up the new system, and migrate the smallest component first (e.g. the smallest building, the smallest floor). Get feedback from system operators. Then continue moving from floor to floor or building to building.

Controlling: Test the system in batches to ensure the customer is pleased with each floor or building. Once the entire system is migrated, perform an overview test and fine-tune if needed. If the customer wants to make changes during implementation, we recommend waiting until the migration is complete as this can complicate the project plan.

Fredrik

Nilsson,

VP, Americas, Axis Communications

The current megatrends in most technology markets are Internet of Things (IoT), cybersecurity and big data. To security professionals it means that there will be more IP connected devices on the network, which started with IP cameras and is now moving over to perimeter protection, intercom and audio. All of these devices generate a large amount of data that can be integrated and analyzed. Additionally, with increased connectivity, security professionals need to ensure that the devices and data are protected against vulnerabilities. To do so, they’ll need to be educated in those areas to become a trusted advisor (not just an installer) to end customers. To

“It’s important to have the technician spend some time prior to the installation to refamiliarize himself with the products involved. Time invested pays for itself quickly with less stressful and easier installations.”

— Ish Ishkanian, Milestone Systems

be successful in this realm, security professionals need to ensure they align with the right partners on their journey.

Roy Park, Director of Integration Solutions, ASSA ABLOY

Door Security Solutions Canada Integrators should seek to build collaborative relationships with both the end user they will provide solutions for, as well as the manufacturers they plan to purchase product from.

To maximize the value of your relationships with manufacturers, work closely with their sales teams and discuss your current, future and potential projects. New products and solutions are being developed by manufacturers every day, and if you stay in contact with your sales team, you’ll be able to present the latest innovations to your customers and find the best solutions for their needs. It is also beneficial to take advantage of manufacturer training and certification programs, to increase your value to your customers and ensure successful deployments

When it comes to end-user relationships, it is critical to approach every new or potential client by taking a collaborative approach to security. That starts by listening to exactly what the end user needs. From there, you can begin providing solutions that you have previously spoken to the manufacturer about. By being well versed in all the offerings from a manufacturer, you can provide additional solutions to end users that allow you to address openings or security needs deeper into the building, and deeper into the clients’ business operations.

By establishing a long-term relationship with both sides, the integrator also becomes a conduit for information between the manufacturers and the users of these systems. That means the needs of the end user are being shared with the engineers developing new solutions. As a result, manufacturers are able to develop solutions that specifically address enduser requirements.

Ish Ishkanian, Pre-sales Manager, U.S & Canada, Milestone Systems

For large and complex integrations, most dealers try to tackle the entire challenge as one whole implementation. Due to the complexity

of these projects, it then becomes exceedingly hard to diagnose issues. I recommend in these cases dividing the project into multiple stages and delivering on each as individual projects. This helps to simplify the design and helps in cutting the time required to diagnose a problem.

Having trained and certified technicians to execute these projects is also an essential part of ensuring success. Additionally, it’s important to have the technician spend some time prior to the installation to re-familiarize himself with the products involved. We sometimes see partners’ technicians who are certified on our software but have not touched the product for a few months and forgotten some important aspects of it. In my opinion, the time invested in reviewing the products for the project pays for itself quickly with less stressful and easier installations.

John Voyatzis, Country Manager, Canada, Digital Watchdog

For 2018, we suggest that integrators review the relationship between themselves, the manufacturer and the distributor. It is a partnership that will yield the right solution for the application, the best prices available and reliable service before, during and after the sale. Taking the time to ask for opinions from others can often pay dividends. Integrators might find it attractive to search for deals on the Internet. An integrator may be in a rush and find it convenient to pick up what is available at the distributor. Sales circulars offer some of the available offers, but not all the offers available from a manufacturer. Manufacturers look at those published offers as conversation starters. Distribution personnel are able to listen to the integrator’s needs and provide options to consider. Engaging a manufacturer’s representative will reveal additional recommendations after considering the entire product line. Filing a project registration with the manufacturer provides assurance that the distributor is quoting the best price. Taking the

time to use others as sounding boards can 1. Make it easier to sell the end-user customer and 2. Simplify the installation. Sometimes we think that gathering input complicates the situation. For integrators, discovering their options reduces the complications in assembling the right system for the application.

Dwight Dumpert, Director of Product Management, FLIR Security

Thermal cameras with onboard analytics are the industry standard for 24-hour monitoring and intrusion detection. However, configuring these cameras for high performance requires expertise and skill. Here are three best practices:

When installing thermal cameras on the perimeter, place them where the field of view is parallel to the fence line and perpendicular to any intruder nearing or crossing the perimeter. The greatest probability of detection occurs when targets move horizontally from one side of a camera to the other so you need to ensure that the cameras can capture any approaching individual from head to toe.

Secondly, evaluate your end user’s most important alarm detection needs to determine the best lens and focal length. A greater lens focal length provides target magnification, ideal when target classification is required at farther distances. A lens with smaller focal length yields a larger field of view, appropriate for applications where wide area perimeter detection is needed. A good rule of thumb is to define the minimal criteria for scene width and select the largest available focal length to meet the width requisite.

Third, use a statistical evaluation to define detection ranges and calculate the maximum achievable distance for detection. Professional site planning software platforms, made available by leading security manufacturers, are great resources for this and should be utilized. For example, FLIR’s Raven Site Planning Tool allows you to simulate mounting height, rotation, range and image detection to ensure accurate placement and performance in real life conditions.

Lorne Terry, Sales Director, Hikvision Canada

Best practices for complex integrated system design starts with communication during the sales process. At the initial client meeting it is paramount to have a clear understanding of the customer’s situation, needs, wants and budget. This can be a lengthy process because customers’ needs and wishes aren’t always clear or realistic. During this

discovery process, integrators need to find out who the key stakeholders are. Stakeholders are often people outside of the security and facility managers, including influencers from accounting, HR, marketing and manufacturing.

Once you have a firm understanding of the customer’s expectations, you should start looking at the hardware and software that will be capable of meeting your customer’s needs. Typically, the glue that holds all of this together is head-end software, often the video management system or access control software. Choose wisely, as the head-end can quickly become the headache. Evaluate the software company’s list of integration partners and gain a clear understanding of how the integration works. Equally imperative is ascertaining how long partnerships have been in place; review successful case studies; and evaluate the support provided by all of the parties to ensure that the system will work and stay working for the long haul. Try to avoid having things customized or developed just for a particular project, as this may lead to missed deliverables and result in some serious cost overruns and an unhappy client. After all of that, remember to document the customer’s needs and wants and clearly define how you will deliver your integrated solution in your proposal.

Aaron Saks, Product and Technical Manager, Hanwha Techwin America

We’re helping integrators tackle complex integration challenges by working with VMS vendors and other third parties to integrate our direct API. While ONVIF is OK to ensure basic connections and capabilities, so much more is available when using a dynamic driver. There’s no need to write individual device drivers anymore. Using our API, any VMS can properly interrogate a camera or group of cameras, discover all available features, and configure them on the fly. Hanwha is ONVIF compliant, but like any standard, it’s not possible for it to keep up with rapidly evolving feature sets, particularly with the multiple analytics now available onthe-edge. Another key focus is the continued development of our Wisenet Device Manager software tool that allows an installer or integrator to make changes and deploy systems in bulk. Whether that’s changing framerates and bitrates, focusing cameras, turning motion detection on, or changing IP addresses and security parameters, being able to do these tasks quickly and easily is critical to our integrator partners’ and installers’ bottom-line.

Willem Ryan, Vice President, Global Marketing and Communications, Avigilon As the world becomes increasingly connected, the way users think about and interact with security systems will continue to evolve across all verticals

and applications. Cloudbased security systems are offering a new means for integrators to grow their business through a suite of managed services, while having a connected platform that can scale with them.

Cloud-based systems offer a new level of accessibility to integrators, enabling them to deploy, manage and service more sites with a new level of ease, using fewer resources. For instance, Avigilon’s Cloud platform will provide integrators the ability to remotely adjust camera and system settings, perform upgrades, and check the health of their customers’ sites, all from the Cloud, without needing to deploy a technician.The adoption of Cloud-based security systems not only increases an integrator’s ability to manage more sites remotely, but will also help to expand their revenue streams through subscriptions-based services.

Scott Lindley, General Manager, Farpointe Data

Dealers need to be aware that 95+ per cent of all adults 18-44 years old own smart phones. Plus, 69 per cent of the entire population already uses smart phones. Thus, practically anyone using an access control system already carries a smart phone. Another way to look at it is that every smart phone user, or almost everybody, could now easily download an access control credential. In fact, they could load multiple credentials to gain access to multiple access control systems — facilities, communications, data, cafeteria and transportation.

No longer will people need various physical credentials to move throughout a facility. Instead, a person’s iPhone or Android smart phone, which they carry with them wherever they go, will have the credentials they need to enter into any authorized access system. In fact, such a system can reach beyond the facility into their homes, their automobiles or at the gym.

Smart phone credentials will be sold in the same manner as traditional 125-kHz proximity or 13.56-MHz smart cards - from the existing OEM to the dealer to the end users. For the dealer, smart phone credentials will be more convenient, less expensive and more secure. They can be delivered in person or electronically. They are quicker to bill with nothing to inventory or to be stolen. And, for those few that don’t have smart phones, they can still use a smartcard. Soft, mobile, smart phonebased access control credentials are inevitable. Every dealer needs to get on board.

“Best practices for complex integrated system design starts with communication during the sales process. At the initial client meeting, it is paramount to have a clear understanding of the customer’s situation, needs, wants and budget.”

— LorneTerry, Hikvision

David Price, Marketing Manager, Camden Door Controls

Adding voice over IP (VoIP) to telephone entry systems doesn’t just reduce the telecommunications costs for building owners/manager, it also offers a revolution in call management that provides both building owners and building tenants with more security, and more convenience. For tech-savvy dealers and integrators, VoIP telephone entry systems offer a new way to provide more benefits to customers, differentiate their business against less sophisticated competitors and, most importantly, receive RMR revenue for the telecommunications service.

VoIP telecommunications combines the advantages and capabilities of voice telephone and

computer networking together. This not only allows a tenant to receive a visitor call by voice, text and/or video, on any land-line or cell phone, it also means:

• Visitor calls can be broadcast simultaneously to multiple phones at the same time.

• Visitor calls can be scheduled to be sent to one phone at one time of day and another phone at a different time.

• Visitor calls can be sequenced to multiple phones so that if one device or tenant does not pick up, the call is then sent to a 2nd or 3rd device or tenant.

• Visitor calls can be easily directed to a concierge desk, automatically, by time of day or only when the call is not picked up.

In addition to being up to date on all the latest technologies that integrators offer, and knowl-

edgeable about the latest up and coming trends such as IoT and mobile solutions, the most important thing an integrator can do is understand their customer’s business as best they can. The industry is moving away from card management to identity management. Identity management allows an organization to manage the different identities that enter its buildings. Understanding whether or not an employee, contractor or visitor has entered, and providing specific access to specific areas for a predetermined amount of times provides data the end user can use to better operate his business. This data can be used to improve onboarding and offboarding processes, access request and approvals, re-certifications and to enforce audit and compliance requirements. When an integrator understands an end user’s business, he can look beyond security and see where the business can improve its operational processes. An identity management system will help align a business’s security operations with its business operations. The integrator will help his customer save money, meet audit and compliance requirements and mitigate risk. The end user, in turn, will look to his integrator as a subject matter expert and overall business partner.

Simplex pushbutton access control

Interior Glass Systems

RCI electric strikes, electromagnetic locks and switches

LUNA small business access control software

Electronic Access & Data

• Stand-alone & wireless access control

• Keyscan networked access control

• RCI electronic access control

Entrance Systems

• Revolving doors

• Automatic sliding doors

• Automatic swing doors

• Sensor barriers

• Turnstiles

Interior Glass Systems

• Glass partitions

• Horizontal sliding walls

• Manual sliding door systems

• Architectural pulls, handles & locksets

Keyscan mobile credentials

AURORA access control software

Saffire LX™ RFID electronic locks

E-Plex 7900 RFID electronic lock Door hardware

X-fac•tor; noun, informal; 1. a variable in a given situation that could have the most significant impact on the outcome.

2. a unique quality that makes someone or something exceptional.

At the core of our approach to providing our customers with integrated access control systems is a passion for developing solutions that perform seamlessly to incorporate the highest level of security, control and efficiency. We focus on all aspects of building access and safety to increase convenience, reduce risk and add value.

The measure of true value is performance. It is the dormakaba X-Factor – integrated solutions designed with one goal on mind –making access in life smart and secure.

dormakaba.us

The notion of safer cities through technology integration and data sharing is an enticing one, but there are twists and turns to navigate first

By Ellen Cools

The Government of Canada recently launched the Smart Cities Challenge, a pan-Canadian competition that “encourages communities to adopt a smart cities approach.”

A number of Canadian cities across the country are taking part. Evidently, more and more municipalities see the benefit of installing and integrating intelligent sensors to efficiently manage their cities.

This, in turn, means integrators and installers will reap some of the rewards. But in order to benefit, they should know what municipalities are looking for.

To do that, installers and integrators first need to understand what a smart city is, and, by extension, what a safe city is.

According to the participant summary of IHS Markit’s “Safe Cities Report - 2017,” a smart city project is “one that uses an inte-

grated ICT [Information and Communication Technologies] system to improve efficiency, manage complexity and enhance citizens’ quality of life through sustainable improvement in city operations.”

The smart city includes six components: “safe city,” mobility and transport, energy and sustainability, social infrastructure, physical infrastructure, and smart economy.

Additionally, the report says that while a smart city is not always a “safe city,” a safe city uses smart city concepts. A safe city is “a security concept that integrates critical security information from a range of sources onto a consolidated IT platform.”

Those sources include video surveillance cameras, sensors, biometric applications, access control systems, etc.

“You need to have [surveillance] automated, so you’re not stressing out your operators.”

— Alexander Richardson, IHS Markit

tracking down the perpetrators … but it doesn’t always work from a prevention perspective,” he explains.

Kabilan also believes the primary focus for most smart city installations is not surveillance, but “sensing.” For him, surveillance is the observation of a specific group, while sensing is directed at a process. “For example, if you think about sensors in traffic lights, what you’re trying to do is maybe gauge where the traffic is. By that, you may know what cars are around you, where all the traffic is, so you would have some information that might be useful from a surveillance aspect, but it’s more about the sensing aspect.”

“Sensors … can be used in conjunction with surveillance systems or camera systems to provide you with additional information on a situation,” he continues. “Combine that with the potential that AI (artificial intelligence) and big data offers, and maybe you could get real-time analysis of images.”

Evidently, analytics and big data will play an important role in smart city projects, particularly because of the sheer number of sensors and cameras required.

For example, “if you’re routing 15 or 20,000 surveillance cameras in a control room, there’s no way that a couple of operators … can sift through all of that data,” says Richardson. “It’s really important to have some kind of analytics program so that you can identify the anomalies.”

In creating this convergence, it’s important to understand the role of surveillance in smart and safe cities.

“Strong surveillance infrastructure is critical to the success of a safe city, as much of the analytics and operational procedures are driven by the surveillance inputs,” reports IHS Markit.

According to the study, video surveillance equipment and hardware, as well as peripheral services, currently make up approximately 50 per cent of the market.

“A lot of cities already have a good number of surveillance cameras, so it just makes sense to continue to use those in the future,” adds Alexander Richardson, senior research analyst, technology, media and telecom for IHS Markit, and author of the report.

“You can keep adding more cameras on that network and you can add things like analytics, and once you connect with sensors, access control, etc., it [becomes] a lot more efficient,” he continues.

For example, Atlanta, Ga., implemented an initiative called Operation Shield in 2015. The city put together a steering committee to integrate the police and transportation department’s surveillance systems into one command centre, utilizing the pre-existing cameras to make their operations more efficient.

However, Dr. Satyamoorthy Kabilan, director of national security and strategic foresight at the Conference Board of Canada, believes there are a number of misperceptions about how surveillance systems function and affect public safety.

“In most cases, they affect public safety retroactively, i.e., they give us a better chance of

Giovanni Gaccione, justice and public safety practice leader at Genetec, also finds that surveillance will have broader applications through analytics and AI. “Surveillance as a thought is going to be important, but not [only] from a public safety or a policing perspective,” he explains. “It’s going to be for a whole city benefit.”

For instance, cities can use it to monitor traffic and pedestrian flow.

This is especially the case because video analytics are more advanced, which in turn makes cameras more intelligent so “not only can they tell me if traffic is flowing…but with a simple analytic, [they] can say, ‘traffic should always be flowing in this direction,’” he explains.

If a vehicle is going in the wrong direction, for example, an alert can be raised automatically.

Lisa Brown, senior national director of municipal infrastructure and smart cities, North

America, for Johnson Controls has also seen how video analytics have helped city managers.

For example, a city she spoke to had a problem with illegal parking, particularly at city hall. But through licence plate recognition, city managers were able to determine who was parking illegally and who wasn’t.

For municipal managers, she adds, analytics and big data were daunting in the past. Their goal with analytics is to “be able to translate it into … real return on investment or some real tangible results for their citizens.”

The power of data analytics for governments, then, is to make more informed decisions regarding public safety, energy, public health, etc., she explains.

While Kabilan agrees analytics could potentially provide useful insights, he is still concerned about their effectiveness.

“A lot has been said about [video analytics], a lot has been touted by vendors, but as far as I see, the effectiveness has not been quite as good as many have hoped for,” he explains.

“I think really to make the most out of analytics, it’s not going to be video, it’s going to be…marrying all of those other sensing systems,” he continues.

To marry these systems, AI will play a “tremendous” role, especially as it becomes cheaper to install a variety of sensors through IoT.

But the challenge then becomes how to make sense of all the data.

“You need to have [the surveillance system] automated so that you’re not stressing out your operators,” says Richardson. “As you use the system more and more and as you tailor the analytics to each specific application, the system just becomes that much better — it becomes more intelligent.”

But simply gathering the data and finding patterns is not enough, says Gaccione. The footage pushed from cameras has to be interpreted and used correctly.

“As one of our police departments always tells us, ‘You need to tell us what we don’t know,’” Gaccione says. “I think what’s going to be the most important tool of AI, is how can we, with all these different data sets, be able to pick out a trend or an anomaly that a city might not know?”

But Gaccione emphasizes that “the importance isn’t necessarily having a data set, it’s the ability to cross what information can the sanitation department’s data set [for example] help with public safety, or vice versa.”

For Richardson, sharing data is the ultimate goal of safe and smart city initiatives.

“You want to be able to disseminate information, so that especially when you have a large-scale incident, you can have all of the different agencies or stakeholders on the same page,” he shares.

“It would be very interesting to see that happen because it would certainly provide a lot of useful information and insight,” adds Kabilan. “The only thing I would say, of course, is that it

certainly comes at a cost. You have to be able to access the data securely, the provision also has to take into account privacy — who has access to that data and where it goes.”

Consequently, privacy and cybersecurity should be a top priority.

Gaccione says that this is the No. 1 priority for Genetec’s Justice Public Safety team. “It’s the first thing we think about whenever we speak to customers,” he says.

“With IoT, the largest issue is scale,” he continues. “Maybe in the past, for NYC, they have a thousand computers. If they start rolling out cameras and sensors and… IoT, that might go … to 50,000 or to 100,000 units that need to be maintained, monitored and secured.”

“A lot has been said about [video analytics], but as far as I see, the effectiveness has not been quite as good as many have hoped for.”

— Dr. Satyamoorthy Kabilan, Conference Board of Canada

Those devices need to be secure to make sure it’s “easy to keep those IoT devices up-to-date, and ... those IoT devices don’t turn against you and basically act as malicious devices on your network.”

Yet Kabilan says he hasn’t seen a lot of discussion about cybersecurity among municipal managers.

“Sometimes, what I’ve heard in discussions is, ‘Well, you know, it’s just a traffic light sensor, who’s going to want to hack that?’ But it’s an endpoint. It goes back into your system, and if you can hack 100,000 of those … you’ve now got a botnet,” he explains.

The increase in endpoints combined with the lack of concern for cybersecurity and privacy is “creating what could potentailly be a highly critical set of vulnerabilities,” he concludes.

Despite the potential vulnerabilities in smart city projects, it is undeniable that the industry is a growth market for installers and integrators.

“I think this market has been exploding,” says Gaccione.

Case in point, both Genetec and Johnson Controls have benefited from this growth.

“Genetec has been positioned and continues to position itself as a unification platform,” Gaccione says. “We see great benefit because it allows cities to not be locked into a specific technology.”

Likewise, Johnson Controls is “seeing significant growth in the market … because these projects are becoming more holistic,” says Brown.

For example, the company recently helped install a federated surveillance system in Philadelphia, connecting small businesses with universi-

ties, hospitals, police and fire.

“It was very, very interesting in terms of not just the security that it brought, but also the co-operation,” Brown says.

Integrators, she adds, will play a key role in the coming years “because they’re bringing more coalition partners together ... to really bring a bigger and broader offering for smart cities.”

“What I’ve been seeing out in the market is that companies are really aligning and approaching projects as teams, rather than just going it alone.”

Globally, the safe cities market reached total revenue of US$13.1 billion in 2015, reports IHS Markit. By 2020, it is predicted to reach US$20.06 billion.

The fastest growing markets are predicted to be Broadband Enhanced Node Bs (the broadband infrastructure which transmits the signal for connected devices) and PSIM (Physical Security Information Management) software, which integrates video surveillance feeds, sensors, access control systems, etc., explains Richardson.

Video surveillance equipment will account for 8.6 per cent of the compound annual growth rate (CAGR) between 2015 and 2020, while communication and incident management will account for 9.4 per cent, data management 15.7 per cent and analytics 7.0 per cent.

In fact, a new study by IHS Markit, “Video Surveillance & Security Report - Cities,” reveals that “the world market for security equipment in city surveillance has registered robust growth in the past few years, surpassing US$3 billion in 2017.”

Additionally, the global city surveillance market is predicted to grow at an average annual rate of 14.6 per cent from 2016 to 2021.

Evidently, installers and integrators will have plenty of opportunities as the smart and safe cities market evolves.

But Richardson warns there are challenges.

“There aren’t any absolute technology standards,” he explains. “There’s different video standards, there’s different communications standards and cities always have different generations of all these technologies made by different vendors, so it’s really tricky to get a system that can tie all of it together.”

Richardson says that while many PSIM software integrators claim their system can integrate sensors from different companies, that’s not always the case.

“A lot of times, I think there is a disconnect,” he adds. “The vendors will pitch this great system, but ultimately it’s not what their client needs.”

This might be because cities are often behind compared to the technology.

“From a technology side, I think we’re there as an industry,” says Gaccione. But cities have to do more to “wrap their head around … the technologies that are out there.”

Consequently, “discussion and interaction with the end user is a key thing,” concludes Richardson.

Is the Access Control as a Service market headed skyward? Adoption trends indicate it has a bright future

By Ellen Cools

The transition to cloud-based systems has been so pervasive that the question now might be, what doesn’t run on the cloud?

The answer? Access control. Or at least, on-premise access control is still the norm.

But the growth of Access Control as a Service (ACaaS) is changing this.

According to Jim Dearing, lead analyst for electronic access control research at IHS Markit, “Access Control as

a Service is a fast-moving market within the access control subspace.”

In 2013, the ACaaS market in the Americas was worth $150 million. Now, it’s worth $375 million, he says.

But what is driving this growth? And how can security professionals capitalize on this trend?

Another question must be answered first: how does ACaaS work?

“A cloud application like anything else”

There are three types of ACaaS, says Dearing: hosted, managed and hybrid.

“Hosted essentially means that the provider is providing the software platform and hosting the software for the person who’s buying the service,” he elaborates. “Whereas [with] managed … the end user is buying a fully-managed service from the provider.”

Typically, says Dearing, end users expect a managed service whereby the provider installs the equipment and monitors the service.

The third type of ACaaS, hybrid, involves a hosted solution and a managed aspect. For example, the end user may also subscribe to have their credentials managed.

Beyond the different ways ACaaS can be installed and operated, there are two sides to the technology, says Steve Van Till, president and CEO of Brivo.

“One side, of course, is user facing, and that includes the ability to administer either on a web browser, or now, on a mobile phone, and to get alerts, information, look at videos,” he explains.

“The other side of it is the device side, and on that side, you still have a control panel installed locally, inside the building, which people are now calling edge computing.”

The control panel functions as usual, Van Till says. “But the big difference is that it talks to the cloud.”

As with any cloud application, the data is remotely hosted. However, where the data is hosted varies.

“Typically, it can either be hosted on a public cloud space, like Amazon or Microsoft — large resources of cloud — or it can be a private cloud set up where only the end user has access,” Dearing explains.

Currently, he says, the market is split between private and public cloud, with public cloud becoming increasingly popular.

However, “there is also the issue of companies not really wanting the data to be stored on a server that may also be storing or hosting some other website.”

Additionally, “there are a number of limitations on storing identities,” such as privacy laws.

For example, with the recent adoption of the General Data Protection Regulation (GDPR)

“Once larger enterprise end users start using this type of service, obviously the market size will increase massively.”

— Jim Dearing, IHS Markit

in Europe, providers “had to ensure that they were compliant with that new regulation by creating means to delete data within certain time frames and create new software features that allowed end users to comply,” he explains.

Bernhard Mehl, CEO and co-founder of ACaaS provider Kisi, a New York-based company established in 2012, says, “In the end, even cloud software is hosted on a local server — it’s just a server that is hosted by Amazon, for example.”

Remote hosting ACaaS enables companies to remotely manage systems, he elaborates, making access control “infinitely scalable.”

On the infrastructure side, he adds, ACaaS is easier to manage and creates a more “seamless deployment” for end users.

This “seamless deployment,” is partly thanks to ACaaS’ integration potential.

Kisi’s clients “want to embed access control into their on and off-boarding workflows that they have on the IT side and security side,” Mehl explains. “That means you embed provisioning and deep provisioning of access rights into the normal onboarding workflow.”

“Imagine you’re a new employee at the company: you’re automatically getting file access, email access…why not door access?” he elaborates.

Businesses “have security standards for all other security critical applications,” he adds. “So why isn’t that standard already at the doors, too?”

Mehl believes ACaaS solves that problem, especially with mobile apps that allow two-factor authentication on doors.

Van Till agrees that ACaaS has a lot of potential. In fact, Brivo already has “a couple hundred integrations with our product alone,” he says.

“The most interesting sector is integration with other business systems, which means that access control is becoming a part of how other things are functioning, and that’s driving a lot of adoption,” he adds.

Given this, one might wonder about the typical customer base for ACaaS solutions.

The market is currently more focused on commercial than residential. In fact, Kisi and Brivo work solely for the commercial market.

Kisi’s clients include biotech labs, educational institutions and financial institutions, Mehl says. Across Canada, they include Cowork Penticton, Launch Coworking Space, York Entrepreneurship Development Institute and Sequence Bioinformatics.

They are “mostly companies on a corporate side, and if it’s enterprise [companies], it’s typically a smaller office that starts this transition,” Mehl says.

Small and medium businesses (SMB) are the biggest adopters of ACaaS, adds Dearing.

“But you also have a few smaller education,

health-care based [end users], smaller doctor’s offices, etc., and they’re also starting to opt for Access Control as a Service as a means to keep investments low,” he adds.

Additionally, property management firms are a big adopter of ACaaS, as they own large buildings and rent offices to smaller companies, and are often responsible for the entire building’s access control. ACaaS offers these companies a way to outsource management or that responsibility, Dearing says.

However, there are still some constraints to widespread ACaaS adoption.

“Traditionally, the Access Control as a Service business model was designed for smaller installations that perhaps either could not afford the initial capsule outlay of installing a fully-fledged traditional access control system, or did not want to spend money managing it themselves,” Dearing says.

Consequently, ACaaS is not typically used in larger enterprise security installations.

Dearing argues this is because “the leading providers of traditional access control have not really developed Access Control as a Service offerings.”

“Most of the Access Control as a Service companies are quite small … and they are mainly servicing smaller segments of the market because there’s a lack of demand from the enterprise segment,” he explains.

This is partly because ACaaS providers have traditionally charged clients per door.

“As you increase the number of doors over a thousand, it becomes very difficult to manage how you’re going to charge for that and how you’re going to create software that’s going to allow you to charge for that centrally,” he explains.

But while SMB makes up the majority of Brivo’s customers, the company also does a lot with enterprise systems, says Van Till.

However, Brivo is a unique case, he maintains. The company began offering ACaaS in 2001, about “10 years ahead of our time,” he argues.

This gave the company an early foothold with larger companies such as Tyco, ADT and Pro1, he says.

“So ironically, the biggest companies…were actually the earliest adopters of this technology,” he continues. “And they thought it was very useful for niche applications in particular, because the control panel that we developed had built-in cellular, which was very unusual for that day and commercial access control.

“It slowly grew and grew and grew and became a bigger part of their overall offering.”

According to Dearing, the ACaaS market in the

“Imagine you’re a new employee at the company: you’re automatically getting file access, email access…why not door access?”

— Bernhard Mehl, Kisi

Americas is forecasted to reach $685 million in 2022.

Globally, IHS Markit estimates that revenues will increase to $950 million by 2022, according to the report, “ACaaS and mobile access propelling each other to mainstream adoption.”

Van Till agrees with this prediction.

“If you’re looking at new purchases of access control, it’s probably somewhere around 10-20 per cent right now,” he says.

“But that number, I believe, is swinging…to the 50-60 per cent level, and it’s going to ultimately catch up with the cloud adoption statistics for enterprise application software and the world in general, which is currently running at 80-90 per cent.”

So what is driving this growth?

One of the main influences is the flexibility ACaaS offers, since companies can outsource the responsibility of access control, Dearing says.

Van Till agrees, adding that cloud provides the convenience end users are demanding as they become more comfortable with cloud.

“The convenience of cloud versus the convenience of on-premise is unmatched because the anytime, anywhere, mobile access [possibilities], with notifications, integrations with other systems — you simply can’t match with the old-client server model,” he explains.

However, both Mehl and Van Till argue consumerization has been the biggest driver.

“There’s this phenomenon called consumerization, which was first discussed in the context of the consumerization of IT,” Van Till explains. “We’re seeing the same thing happening in security now … increasingly the on-premise piece like sensors and so forth are IoT [Internet of Things] devices that are equally at home in a residential context and a commercial context.”

IoT has put “huge downward price pressure” on sensors and connected devices, he adds, which is making demand for ACaaS grow.

Dearing does not believe the Bring your Own Device trend is influencing the adoption of ACaaS — at least with regards to mobile access control.

“The market adoption of mobile credentials so far has been a little bit limited because there are a few issues still,” he explains.

The problem is that access control card readers are still popular and work well, he says. In contrast, with a mobile solution, users have to open the application, authenticate themselves

and then activate it, at which point they can use it to open a door.

“For that to continue to work, the application will need to be running in the background the whole time,” he says.

Consequently, if someone turns off their phone or their phone closes its background applications, then the process has to be repeated.

“A number of Access Control as a Service providers have not put the investment into developing a successful mobile application that allows their customers to deploy mobile access,” he argues. “But that is changing.”

“Once that happens, I feel like mobile access and Access Control as a Service will go hand in hand quite nicely.”

Given the potential ACaaS presents, how can industry players get ahead?

Dearing says offering flexible pricing options is key, as charging clients per door can become complicated.

But the most important thing is “to develop solutions catering to the larger enterprise end users,” he says.

“Because once larger enterprise end users start using this type of service, obviously the market size will increase massively. Once you’ve got large enterprises using this type of solution, you can also leverage all the data they are gathering and improve it.”

“Being more accepting and being able to market cloud-based solutions…better, is probably another thing they need to improve,” Dearing adds.

Van Till agrees, saying that first industry players must make the investment in the cloud, and then hire the best engineers possible.

Mehl argues security professionals should take their involvement with cloud even further before entering the ACaaS market.

“We’ve seen companies do everything from white-labelling a cloud-based connector, licensing some Bluetooth technology for their reader, licensing mobile credential technology, hiring an outside IT firm to build their new mobile app,” he explains. “But that will not solve the big problem of access control just not being in the cloud.”

“If I would have to give one [piece of] advice to other companies … it’s to become a cloud company first,” he continues. “Use cloud for your own business. Hire people that are familiar with the cloud, change your culture and organization to a cloud mindset, and then build products that follow this mindset.”