G4S establishes Secure Integration banner LINE CARD

G4S Canada has invested in its integration business, hiring new technicians and service coordinators, purchasing trucks and establishing a new centre of operations in the Toronto area.

The integration business is henceforth known as G4S Secure Integration.

Prior to this new investment, G4S Canada outsourced its integration work to Toronto-based RYCOM. Upon conclusion of that partnership, which was established in 2013, the company opted to reboot the business under a new banner in an effort to get closer to its customer base.

“It was a huge investment on behalf of G4S into the business. It’s a mandate that G4S has around the

world that we control that customer relationship because it’s so critical,” says Katie McLeod, G4S Canada’s national director, communications and sales. She adds that the new branding around G4S Canada’s integration business also brings it in line with the company’s other integration divisions globally.

G4S Canada has re-established its integration business in-house to the largest extent possible. It will continue to service clients through subcontractor arrangements where necessary, “but we’re trying not to use subcontractors,” says McLeod. “That’s why we’ve invested as much as we have.”

McLeod adds that the company will try to leverage its existing strength

G4S Canada’s investment in its rebranded integration business includes a fleet of new vehicles, as well as new service personnel and a Toronto-based facility. Expansion across Ontario, and possibly outside the province, will continue as the business grows.

in the guarding market, letting its customers know that it can offer a broader suite of security-based services. The company’s initial focus will be in Ontario, but it will look at expanding into other provinces over time — as well as through aforementioned subcontractor agreements. Territorial expansion through acquisition is also

Dormakaba reorganizes following acquisition trail

Dormakaba has taken the road that all large commercial organizations must take in the event of series of mergers and acquisitions and realigned itself in order to capitalize on market opportunities.

Dorma and Kaba, two separate, European access control companies announced their merger in April 2015. Prior to that, both Kaba and Dorma made significant, but separate acquisitions in the Canadian market: Kaba’s purchase of electronic access firm Keyscan in 2014 and Dorma’s purchase of door hardware company Rutherford Controls International. (Dorma also acquired Dor-Tech Ltd., an independent automatic door distributor located in Burlington, Ont.)

Data (EAD) division in North America. EAD includes the Keyscan and RCI product brands, as well as electronic locksets from Kaba.

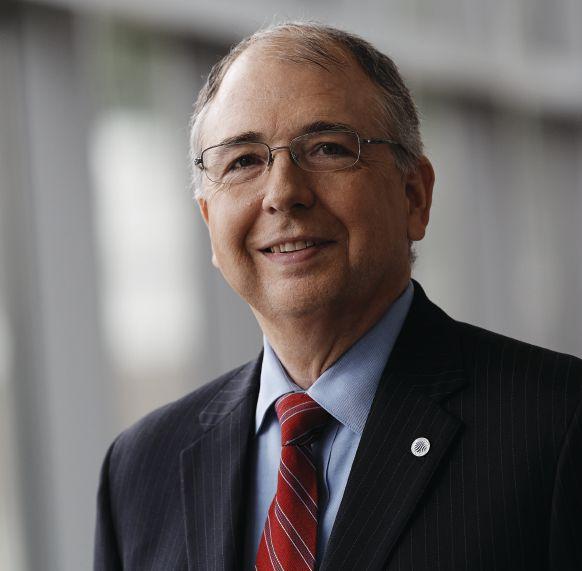

Steve Dentinger, Dormakaba

The reorganization has required that staff get up to speed on multiple product sets, according to Dentinger. Retraining and cross-training occurred in summer 2016 to allow sales personnel to become familiar with all the products within their group, creating greater opportunities for customer interactions and potential sales.

Bringing all of its brands into alignment is a process the now collective entity of Dormakaba has undertaken on a global scale, creating new divisions in the process.

Steve Dentinger, formerly Keyscan director of sales and marketing, is now vice-president of Dormakaba’s Electronic, Access and

a possibility, adds McLeod. Other guard companies have followed a similar model. Securitas, for example, announced late last year its acquisition of Diebold’s integration business. Similarly, Paladin Security recently announced a merger with Action BMS (see story on p.8).

—

Neil Sutton

The vice-presidents of each product cluster (there are eight in total) have been made aware of the potential for cross-selling, says Dentinger. “Access control, strikes, maglocks, door openers and closers, revolving doors: We’ve truly become that end-to-end one-stop shop for the door.”

“We’ve become that end-to-end one-stop shop.”

“The last thing I wanted was one of our sales agents to go out and not be aware of our entire solution,” says Dentinger. By having broader expertise in the market, Dormakaba enables better end-toend or solutions selling opportunities, he adds. Dormakaba’s portfolio also extends beyond its EAD portfolio into door hardware, glass and more.

— Steve Dentinger, Dormakaba

The company’s most recent acquisition is the Mesker Openings Group, a Huntsville, Ala., door company founded in 1864. That company’s products will also be rolled into the group adding doors and door hardware that fill what Dentinger says “was a component that we were missing. The Mesker acquisition fills that gap.” Dentinger says that Dormakaba has reorganized to follow the same basic business architecture across all of its global operations, but product mixes may vary according to regional strength. The company will continue to leverage its Keyscan and RCI brands, which have significant heritage in Canada. “Both are very strong brands and we want to use them throughout North America,” he says.

— Neil Sutton

Hébert and Shalaby team up at Feenics

Industry veteran Denis Hébert has joined Ottawabased Feenics, maker of Cloud-based access control systems, as the company’s president.

Hébert, who also took an equity stake in the company, was previously CEO of HID Global and executive vice-president at ASSA ABLOY. He is also currently chairman of the board at the Security Industry Association.

began speaking several months later to discuss the possibilities of working together. “I approached Denis and said, ‘Let me show you what we’re doing right now,’” says Shalaby.

Hébert says he immediately saw the possibilities, with a Cloud-based model as the next logical stage of evolution for access control. “I believe that what Feenics is doing is something that represents where the future of access control is going to be,” says Hébert. “Software as a service became a step change for the IT industry — I think it’s going to be one for the security industry in general … It has shown to be one on the video side, but I think access control is primed for that change as well.”

Paladin merges with Action BMS

Paladin Security Systems has merged with Action BMS — the latter now operating as a subsidiary of Paladin.

along and everyone seeing the greater good out of the merger,” says Reid.

Feenics was founded by Sam Shalaby after he sold his integration business, Future Security Controls (FSC), to Convergint Technologies in 2013. It was during his years at FSC that Shalaby formed a business relationship with Hébert.

“Sam and I had a vendor/ client relationship when I was at HID,” explains Hébert. “We worked on a number of different of projects that we were fortunate enough to help him with. He was a tremendous customer of ours in the Canadian marketplace.”

Hébert left HID Global in May 2015 after 12 years serving as its CEO. He and Shalaby

It would be almost a year before the two would formalize the process and bring Hébert on board in an official capacity, but they see the arrangement as both complementary and mutually beneficial — Shalaby with his longstanding experience in security integration combined with Hébert’s high-level managerial skills and expertise on the product and manufacturing side. Rather than move to Feenics headquarters in Ottawa, Hébert says he will continue to reside in Texas, helping to steer the company’s U.S. market plans from there.

Hébert has worked for some of the largest organizations operating in the security market — and while he may be working on a comparatively smaller scale at Feenics, he says the customer approach is almost identical. “The bottom line is whether or not you are able to build customer relationships and enough trust in the marketplace that people are willing to buy from you,” he says. “I don’t think that’s any different whether you’re big or you’re small.”

— Neil Sutton

The merger closed in early December, providing Paladin access to a company that comprises a security integration business, as well as capabilities in data and electrical, a ULC-listed central station in Victoria, B.C., and approximately 200 employees.

In B.C., the company serves Vancouver Island, Lower Mainland and Kelowna. It also has operations in Calgary, Regina and Saskatoon. Willy Disley, founder and now former CEO of Action BMS, has retired from the business post-sale.

The merger will bolster Paladin’s growing integration business, says Paladin Security Systems president Ted Reid, providing some additional resources in B.C. where the company is based, as well as increasing its presence in other parts of Western Canada.

Paladin is already familiar with Action BMS, having come across the company numerous times in the past as a key competitor in western markets. The companies have some common customer interests, but Reid says those clients will benefit by having services come from a single provider as the entities come together.

“Our biggest competitor is now friendly and we’ve got to work together. One of the biggest things we’re working on is the integration [of the two companies]. The initial signs are that everyone’s getting

“They have some great people on the business development side and some great project management and field office support,” he adds. “Our director of integrated systems Guy Calb is going to work with their team on operations. It’s coming together really well. Where they’re strong, we probably needed some bench strength. And with what we can bring to the table, it’s going to help the organization grow a lot quicker.”

New to Paladin is the data networking and electrical expertise that comes with Action BMS. Reid says those components will help flesh out Paladin’s total offering, allowing the company to offer more of a full-service suite to clients with diverse requirements.

“It just allows us to get jobs done. We can plan for the larger, more complex jobs a lot better by having the Action entity there and bring different areas of a project together,” he says.

The company’s new depth and size will help it expand geographically, as well, says Reid. “Obviously we’re going to have to break into some new geographic markets where we haven’t really penetrated at all. The Ontario market in particular is an area where we’re going to be looking to try to grow,” he says.

“It’s going to be an interesting phase for the next two to three years. We’re going to be aggressive and growing.”

— Neil Sutton

Paladin’s merger with Action BMS will give the company the resources it needs to continue to grow its integration practice, says president Ted Reid.

Denis Hébert

Sam Shalaby

JCI/Tyco could open new doors in smart buildings

The merger of Tyco with Johnson Controls (JCI) may be one of the biggest security deals on record in recent years, but the joint company’s true value may lie in what it can do for building automation.

“Products are becoming more commoditized, so the focus then is on services.”

— Katie Brink, The Freedonia Group

The deal, which was announced on Jan. 25, will see the companies come together with JCI shareholders taking a 56 per cent stake. The Johnson Controls name will be retained for the combined entity and it will relocate its headquarters to Cork, Ireland, (currently the home of Tyco). As a result, it stands to save an estimated US$150 million annually in corporate taxes. (Johnson Controls will maintain its Milwaukee location as its North American headquarters.)

In a statement jointly issued by both companies, Alex Molinaroli, chairman and chief executive officer, Johnson Controls, says, “The proposed combination of Johnson Controls and Tyco represents the next phase of our transformation to become a leading global multi-in-

dustrial company. With its worldclass fire and security businesses, Tyco aligns with and enhances the Johnson Controls buildings platform and further positions all of our businesses for global growth.”

“We feel this is a win-win,” Johnson Controls spokesperson Fraser Engerman told SP&T News. “This is a great combination of two world-class companies that are coming together to deliver increased growth, revenue as well as opportunities for shareholders.

“We’re systems and controls and HVAC,” he adds. “Obviously (Tyco’s) strength is in fire and security systems. It’s a great fit because there’s a lot of potential integration there.”

According to Katie Brink, analyst with The Freedonia Group, Johnson Controls should be able to capitalize on Tyco’s deep expertise and portfolio of security products, potentially taking building automation to the next level.

“What I think we might be seeing going forward is more interaction between wider range of systems and leveraging information from HVAC for security, or between any of the systems that this large company is going to offer.”

Brink adds that the recent rise of useful analytics tools, particularly on the video side, could help this synergy take place. A “smart building,” for example, would be able to accurately count its number of occupants and any given time and know whether

or not a person is present in a room. This data may be useful not only for security purposes but for lighting and climate control.

“I think we’re going to see a lot more connecting these systems that have, up till now been more independent,” says Brink.

IHS analyst Blake Kozak agrees that the merger could potentially have a dramatic impact on what building automation systems may be capable of in the near future, with Johnson Controls taking advantage of Tyco’s product set in fire, video surveillance, access control and intrusion.

“It’s always been a trend — with building automation, everyone wants to integrate all these different systems, but when you actually drill down and find out what percentage of your projects actually have this type of integration, it’s not very much,” says Kozak. “It’s a very, very small proportion of the overall projects for a given year. So this could definitely have an impact on that.”

The merger is scheduled to close in fiscal 2016, subject to conditions and approvals. It’s too early to say how the deal will ultimately

affect how the company will operate in certain geographies like Canada, says Engerman. “We’re just not ready to speculate on what this will mean to specific locations. We’re both global companies; we operate globally, so we really see this as an opportunity to increase our market share opportunities worldwide.”

While mega-deals are becoming more common in the security industry, in some cases between direct competitors, this one between Tyco and Johnson Controls does present some clear opportunities, says Brink, particular on the services end.

“The products themselves are becoming more commoditized,” says Brink, “so the focus then is on the services that you can provide [such as] outsourcing the management of your access control system — that type of thing.” Where products are experiencing higher value is when they are tied to an analytics solution, she adds, which also requires a high level of service and maintenance to ensure that the systems are communicating properly and set up correctly in the first place.

— Neil Sutton

Alex Molinaroli, Johnson Controls

INTEGRATOR PERSPECTIVE

IBy Richard McMullen

Putting the pieces together

With continual and rapid change in security, there will always be more puzzles to solve, more solutions to discover

s your organization ready for the changes to come?

The electronic security industry has deep roots and an impressive history to be proud of. From humble beginnings to being entrenched in society, we continue to evolve as technology advances and change help propel our industry forward. Change is inevitable and should be embraced and managed.

“Change has been part of our landscape for as long as I can recall.”

The status quo, while appearing more comfortable, may not be so sustainable. I was recently reminded that there have been many changes in our industry, most notably some of the acquisitions and mergers we have observed in the Canadian market. I would argue that this type of change is not a new phenomenon.

In 1983, the small independent alarm company that I worked for (Golden Triangle Alarms) was acquired by Honeywell-Amplitrol. Three years later, Honeywell-Amplitrol acquired another Ottawa based alarm company, and founding CANASA member, Universal Alarms Limited.

This trend continued throughout the 1980’s, 1990’s and beyond. In 2000, ADT Security Services Canada Inc. acquired the Canadian business operations of Honeywell Protection Services Division. ADT recently acquired Montreal-based Reliance-Protectron. There are of course dozens of other examples across our industry: Kaba acquires Keyscan; Anixter acquires Tri-Ed Distribution and the list goes on.

Change has been part of our landscape for as long as I can recall. I predict that there will be more changes to come.

Our industry may be in a constant cycle of change. What can we do to manage the impact of these changes? How can we embrace change and adapt as organizations and team members? Adaptability is certainly a quality that will help in this endeavour. Perhaps as important, having a positive attitude can help one effectively navigate the changes ahead. Focusing on the opportunities that develop from change will position you and your organization for success. Taking advantage of these opportunities will also have positive impact.

Growth is also a product of change. Managing growth, especially in uncertain times, can be a challenge. Developing an intimate understanding of the situation cou-

pled with planning are crucial.

Effective implementation of a tactical plan can help mitigate risks and help you reach your desired outcome. Knowing when to hire, when to re-organize and deploy resources is a vital element to success. Due diligence and having a clear understanding of the situation will also impact success.

Integrators seem to be well positioned for the changes to come. We are a segment of the security industry that focuses on implementing change with a variety of technologies. Enhancing security with video surveillance, access control and intercoms are just a few examples.

Many facilities have maintained security checkpoints with security staff to validate and control access. These checkpoints have often been enhanced with turnstiles and access control systems to help manage

secure and convenient access. The resulting deployment of technology has also had an impact of security staffing requirements.

Video analytics continue to play a role in the changes to security staffing requirements. The installation process and deployment of technology has also seen tremendous change. Image quality, wireless technologies and the adoption IP technology are a few examples.

Our security solutions will continue to evolve and adapt to meet the needs of our clients. I am confident that future generations of security professionals will look back with pride at our time in this vital industry.

Richard McMullen (@Richard_FCi) is partner, security solutions, FCi (www.fci. ca), and national president of CANASA (www.canasa.org).

By Neil Sutton

WThe value of integration

hile I was down in Orlando recently for the annual ASIS International conference, I had an engaging discussion with Bill Maginas, president of Tyco Integrated Fire and Security.

Maginas, who is new to the organization, told me matter-of-factly that some customers aren’t necessarily ready for (or even interested in) integration. Admittedly, this isn’t something you hear a lot from integrators, but I appreciated his candour, and more to the point, he’s right.

Maginas joined Tyco a few short months ago after a 17-year stint with Honeywell. He comes to Tyco when it is undergoing significant change now that its merger with new parent Johnson Controls has been finalized — at least in the sense that the deal has closed. Bringing two organizations of that size together is no easy task.

With JCI and Tyco essentially under the same roof, synergies become immediately apparent — JCI with its expertise in building systems, Tyco with its legacy in fire and security. What if you can tie all those systems together? Is the customer always going to jump in with both feet?

Probably not.

The real issue, Maginas said, is you have to show the value of integration. It’s not that customers reject the idea of integration. Demonstrate to the customer that you can save them money and then you’ve got their attention — whether its on energy bills, insurance costs, or ideally both. Those customers who may not have been interested in integration at the beginning of the conversation will be the ones asking the questions by the end of it.

I actually have no doubt that JCI and Tyco will be quite successful when they address the market with truly integrated solutions. Tying building systems together is not a new idea, but companies with that kind of critical mass might help push the envelope on what’s possible.

It’s always appropriate to talk about integration in SP&T News, but especially so in this issue where we celebrate the accomplishments of Houle Electric. The company was named Integrator of the Year for 2016 by our panel of judges based on a project they completed for client the Port of Vancouver. When judges delib-

erate, they often talk about “true integration.” It’s almost become a mantra. It’s the ability to arrive at a solution that meets the customer’s needs in a way that harnesses technology to its fullest capacity. It’s not an easy thing to do and often requires some ingenuity and flexibility on the job site in order to overcome potential obstacles. Ultimately, it’s about satisfying the customer and solving their problems and we congratulate Houle’s team for all their hard work.

Both Houle Electric and Tyco IFS are sizeable providers with huge resources, but you don’t have to be a large integrator to prove the value of integration.

At all levels, from building automation to home automation, there has to be a reason to install new technology. Explain to the customer why a security solution will make their life easier, and present it at a fair and reasonable price and they’re much more likely to listen to what you have to say.

The Evolution of Biometrics: Tracking the history of a technology that knows you better than you do

Selling security to the retailer: How brick and mortars can make the most of their surveillance investments using analytics tools and an omni-channel strategy

Dealing with “noise pollution”: Video analytics tools improving, but environmental factors impede accuracy

Eye on the future

echnology development can be an arduous pro cess, often characterized by fits and starts. Eureka moments can help spur progress in the right direction, even though we may not hear about them until months or even years later. What works once or twice in a lab or development centre must be replicated, tested, proven and generally investigated before a technology is allowed to get out of the research phase and make its way along the continuum from prototype all the way up to final product (with considerable input from sales

and marketing, of course).

The security industry, rarely accused of being a fast innovator, may see new (or newish) technologies gestate for years or decades before their potential can be reached.

Simplex introduces smart card and biometrics: The NT3400 integrates video badging, on-screen CCTV control, fire alarm monitoring and dynamic graphical maps. Simplex can apply both contactless Mifare and contact technology smart readers, and the biometric technologies offered include retinal recognition systems, fingerprint identity verification and hand geometry recognition.

Biometrics, for example, is a technology that has enormous implications for security.

In an era where credentials can be so easily misappropriated, captured, or hacked, perhaps we need biology-based (as opposed to a physical credential or alpha-numeric password) security tools now more than ever.

Almost 10 years ago (April, 2007 edition), SP&T News ran an article

called “Biometrics gets face time” which characterized the degree to which biometrics was already making some serious headway, particularly in the world of cross-border travel. It also indicated the need to collect multiple biometrics (e.g. fingerprint and iris) so one could act as a back up for the other. Information capture (particularly fingerprint) has improved in the last decade, but the advice is still sound. Additional stories in SP&T would describe use-cases for banking, telehealth (e.g. monitored health care) and more. A 2014 article called “Eye Catching” described the increasing use of biometrics for the mobile world, allowing an individual to encrypt data using a biometric identifier.

Biometrics is a technology that is likely to continuously improve.

Human beings are physically complex, so it is a challenge for machines to effectively match (and map) that complexity. The same is true of other technologies like analytics. A 2012 article, “The fall and rise of analytics,” pointed out the number of false starts and false promises that technology has made. However, it has reached a level of sophistication now where it is proving its worth. In a way, it is mirroring the development of biometrics. We are allowing machines to identify us and think for us in the name of improved security.

Dorma and Kaba are now dormakaba

The merger of Dorma and Kaba has formed an industry leader and trusted source for security and access controls – Smart access begins at dormakaba.

Dorma and Kaba are a natural fit. Having complementary product portfolios we have expanded our service and product offering to transcend the asset protection category with a wide-range of diversified and technologically advanced systems.

With an emphasis on innovation and sustainability, our product suite comprises architectural hardware, interior glass fittings, entrance door systems, physical access systems, workforce management, lodging access systems and electronic locks, safe locks, keys, cylinders, mechanical and electronic access controls.

The quest to develop innovative yet practical products is what differentiates dormakaba.

Our new technologies incorporate mobile access with online or wireless control management systems – merging security with convenience.

Our integrated end-to-end access solutions are designed for a multitude of specialized multihousing, lodging, healthcare, financial, retail, transportation, government, sports and entertainment applications with a single goal in mind – protect people and property.

For our customers, service and support is critical in meeting today’s most challenging security demands. In addition to preparing architectural hardware specifications and schedules, we provide comprehensive technical support including installation, replacement or repair.

We will continue to innovate systems that define security and convenience.

Together with first class service, on-going training and after-market sales support, our mission is to add value for our customers and esteem to our brands.

Revolving doors and entrance systems

Safe Locks

Architectural hardware

Time and attendance

Keyscan networked access control systems

Mobile access solutions

E-Plex wireless and electronic locks

Physical access systems

Multihousing access systems

RCI electronic access controls

Smart access means confidence

Alleviate customer trepidation by focusing on the facts and value proposition

THE TOP 5 FEARS OF CLOUD COMPUTING

By Brian Matthews

The stage is set. Cloud computing continues to rise in deployments, with users citing economic advantages, speed, agility, flexibility, elasticity and ongoing innovation.

We’re entering the realm of “everything as a service” and that includes physical security provided by Cloud-hosted security management systems (SMS). Systems integrators who can successfully adopt and offer Cloud-hosted security and access control solutions will find themselves well-positioned for the future — with the ability to deliver a wide range of managed and remote services to vertical market customers — while boosting the overall value of their company in the process with sustainable recurring monthly revenue (RMR).

Research by Gartner predicts a substantial shift in information technology spending from traditional hardware and software to Cloud computing over the next five years, with that transfer set to total $1 trillion, according to the firm’s July

“The challenge lies in understanding the technology and what it can do, then conveying those benefits to the customer.”

2016 findings.

The Cloud has been used for nearly a decade or more in banking and financial processes but one of the biggest objections still hindering full adoption may be an ongoing concern of data security and integrity. As such, there’s a necessary education process for both systems integrators and the end user customer to understand why Cloud-hosting is inherently safe, being “purpose built” for physical security communications and data exchange.

What fears are most commonly voiced

by customers and prospects when it comes to Cloud-hosted SMS? Do you know how to address objections by potential clients? Here are the top five fears you may hear from prospects and the information you need to know to dispel lingering doubts.

1.

The Cloud’s data may be easily compromised

Nothing is further than the truth. In fact, the Cloud is actually safer than non-hosted environments and its software programs have been specifically engineered for safe data transmissions for the physical security environment. Using the Cloud for access control and physical security management actually equates to heightened cyber and threat protection as opposed to traditional legacy, on-premises server systems.

With Cloud-hosted systems, a multi-layered design brings together data security and data access with added safeguards. A security management system designed from the ground up as a

Cloud-based product begins first and foremost with software security. Hosted systems can follow what Microsoft refers to as SD3+C: Secure by Design, Secure by Default and Secure in Deployment in Communications. In addition, encryption further protects the transmission of data between the client and the Cloud-based server using modern Secure Sockets Layer (SSL) and is something by default that most Cloud-based solutions provide. SSL is a standard security technology for establishing an encrypted link between a server and a client. SSL encryption, 2048 bit, secures the data connection as opposed to easily hacked Open SSL protocols.

In addition, the most secure Cloud-hosted access control systems also utilize IP Client. Systems with IP Client use outbound ports at the user’s site instead of inbound ports, which greatly reduces the risk of security breaches and data compromise. With IP Client, the IT staff does not have to enable any inbound network ports or set up port forwarding. This helps keep the network secure and lowers the management workload on IT.

Finally, some hardware providers enable Transport Layer Security (TLS) encryption which allows the server and client to authenticate each other and to negotiate an encryption algorithm and cryptographic keys before data is exchanged. In Cloud hosting, manufacturers auto-negotiate the TLS encryption with the controller boards as they initiate contact with the server.

2. Passwords make Cloud-hosting vulnerable

That’s definitely true — when it comes to non-hosted solutions. Passwords can be guessed, recycled or written down and all these factors could compromise the security of an access control system. However, secure, Cloud-hosted solutions don’t use default user names and passwords. Instead each hosted system is issued a unique password and can also provide additional security with two-factor authentication which can be attached to the log-in credentials of any user for an added layer of security. With two-factor authentication user accounts are linked with a second source of verification, i.e. Google authenticator, which generates a code based on a timer or counter. Users must provide this code upon entering their user name and password, which means a perpetrator would need three things in order to access the system: user name, password and access to open the device which generates the two-factor authentication code.

3. Management of Cloud software takes an IT tech

Quite the contrary: once it’s set up, no additional work has to be done. A SaaS access control solution can automatically eliminate the threat of the user losing data due to negligence or being too busy to regularly backup the database. An SMS hosted in the Cloud provides regular, automatic upgrades, daily database backups and full re-

dundancy, eliminating the risk of having all data stored on site.

A reliable product will also provide multi-layered redundancy, meaning that multiple “write” transactions are provided. If the primary database goes down that data would exist at another location and brought back online. A second layer would be point-in-time recovery. This allows the user to restore or recover data or a particular setting from a time in the past, including history reports and recent access control transactions. If the user accidentally deletes records it only takes a quick tech support call to revert the system back to a time point before the error happened.

4. Cloud hosted systems don’t readily scale and can’t integrate legacy components

The Cloud actually provides greater flexibility and scalability of applications, and that equates to better business agility. These solutions offer a more convenient route for both small-to-medium businesses as well as enterprise customers who don’t have to go through the complexity of designing and deploying an on-premises server system. With off-site hosting, there are no servers or appliances necessary at the customer site. This saves time and money and allows customers to future proof themselves from obsolete technology. In addition, Cloud-based SMS systems offer nearly infinite scalability, from smaller systems to large national/enterprise accounts. Cloud-hosted access control is in most cases a platform that can grow to an infinite number of access points, limited only by the controller’s hardware specifications. Finally, with legacy equipment and Cloud-hosted solutions, the user isn’t forced into a total rip and replace. Cloud-hosted access control systems are most often hardware agnostic and can be configured for communication with many legacy devices already on site.

5.

End users will balk at the price tag

Cloud-hosted solutions actually offer a lower total cost of ownership over the life of the solution. Most users don’t consider the true cost of

an on-premises system which includes servers, racks, power and cooling costs, labour hours by the IT staff, operating system updates, firewall configurations, necessary VMware, etc. All these little nuances add up big.

In addition, with offsite Cloud hosting customers don’t need a dedicated IT person to administer programs and configure operating systems, databases and applications. These expenses and ongoing maintenance are alleviated as they are handled by data centres in the Cloud. Users also have access to all software functionality housed in the Cloud and can select the portions they want to manage, such as badge creation and decommissioning of access control permissions. They have choices: the option of having the systems integrator manage the solution, or, administer the system themselves with their choice of connected device, including desktop, laptop, tablet or smartphone. Integrators get the bonus of managed services, which allows them to perform maintenance and service remotely, which equals lower costs for users as opposed to paying for a service call or onsite visit. And, as a tiered solution, customers can expand without costly jumps from entry level to enterprise solutions.

Finally, users will be attracted to the possibility of being able to budget effectively with Cloud-hosted services, which move physical security from a large initial capital outlay or capital expense to an operating expense which can be planned and budgeted for easily.

Today’s systems integration is all about delivering service. And there’s no better way to deliver service in a highly flexible and scalable environment than Cloud-hosting. Cloud hosting for physical security and access control management is a sophisticated, yet user-friendly solution that provides tangible benefits to both systems integrators and end users. The challenge lies in understanding the technology and what it can do and conveying benefits to the customer.

Brian Matthews is director of sales at Feenics (www. feenics.com), an Ottawa-based security company offering Cloud-based software and services.

Managed Services with the Cloud

Not only is the customer future-ready with Cloud hosted SMS, but the integrator gets a big boost with the ability to offer a wide range of managed services, which equal RMR.

Some RMR possibilities include:

• remote testing and maintenance;

• system resets;

• scheduling;

• lockdown;

• SMS alarm and alert notifications;

• and management of databases and approved users.

Because the Cloud is “always on” and “always accessible,” systems integrators can easily manage their customers’ sites from any location with an Internet connection. Systems integrators are in a great position to take advantage of Cloud hosting, once they learn its nuances, embrace the concept and are armed with facts to effectively dispel any objections by the prospect or customer.

— Brian Matthews

Rip and replace or retain and maintain? The replacement cycle for security equipment can vary from years to decades depending on the capital investment and new options in the market

By Linda Johnson

T or Keep it can it

wenty years ago, obsolescence was not a major issue in the security industry. Technologies changed little from one year to the next, and end users did not expect to replace equipment for a long time. Today, the replacement cycle for many kinds of equipment is rapidly getting shorter. Still, end users will always look for ways to extend the life of their systems.

John L. Moss, CEO at Framingham, Mass.based S2 Security, sees the life cycle of security equipment as dividing into three categories. Hardware can have a lifetime of about 25 years, he says, while access control and other administrative systems manufactured during the last 30 years have a lifetime in the 10-to-15-year range. During that time, an end user may replace the computer but won’t replace the software or the field panels that operate the electric locks.

Finally, he says, video equipment has a lifes pan similar to IT equipment: thus, a video re corder has a three-to-five-year life, while cam eras have the same or slightly longer lifespans.

Moss does not believe the trend to falling prices has, in itself, shortened the lifespan of cameras. Lower prices are not driving the consumption as much as the increase in their technological capability. “The fact that the price is

“Most large companies will keep their equipment until it’s been fully depreciated.”

— John Moss, S2 Security

coming down on cameras makes them more accessible and means there are more video systems being sold,” he says. “But if you own cameras,

place them because new ones are available that have significant technology enhancements over what you own and the cost also happens to be less.”

Moreover, in most corporations, he adds, there’s a minimum length of time that equipment will be kept because their acquisition is a capital purchase.

“The equipment is on the books for five to seven years. So, if you decide, after four years, you want to replace your cameras, you have to take all the depreciation you haven’t taken yet, and all the expense you haven’t absorbed yet has to be absorbed at the time you replace it. So most large companies will keep their equipment until it’s been fully depreciated.”

Although the replacement cycle for intrusion systems is about 10 years, says Peter Redfern, commercial sales leader for Mississauga, Ont.-based Tyco Integrated Fire and Security, systems are commonly installed for much longer than that.

Access control systems are more in the six-to-eight-year range, although customers are not usually faced with a forklift replacement.

“Depending on what platform a client uses, and if it’s an enterprise platform from a reputable manufacturer that’s been around a long time, you can typically upgrade your existing system rather than have a rip-andreplace situation.”

In video, Redfern says, we see the most compression of life cycle, which is due to changing quality and declining prices. He puts the lifespan of most camera systems today at five to seven years. “People are finding it’s cheaper to upgrade to newer technology, and you get better quality cameras for the same price or lower than trying to replace them. They get obsolete really quickly, depending of course on what the client needs.”

Even with the shorter lifespan, he adds, some customers may want to upgrade a little sooner to take advantage of new technology.

“They may be really active in using the systems and want to take advantage of new technology. Or maybe they want to use one camera to cover a larger space and zoom in with a pan-tiltzoom technology, use video analytics or such.”

Andrew Elvish, VP of product management at Montreal-based Genetec, says the replacement timeline for some access control systems can be quite long — up to 20 to 25 years — because they don’t tend to wear out. The result of that longevity in access control, however, is a reduced ability to bring in new features to the systems.

“In effect, they can become frozen in time, especially if they’re proprietary access control systems. In the access control world, there are ‘forklift upgrades,’ which is an unfortunate thing to have to endure as a company. But if a proprietary access control company stops developing their system, for instance, it effectively becomes obsolete, and you either live with obsolete material or you rip it out and replace it,” he says.

“So, on the access control side, you’re looking at long timelines — but [it’s] riskier because of the proprietary nature of some of the traditional access control manufacturers.”

Jim Dearing, market analyst for security and building technologies at IHS, says one trend

that will distort the replacement cycle, at least in the short term, is the impending sunset of the 2G network in the U.S. Control panels will have to be either replaced or upgraded before the shutdown, at the end of this year, or face being rendered unable to communicate with monitoring stations if they do not possess 3G or 4G capability or a PSTN backup.

“Many of the new platforms coming out have the ability to interface with, or be a direct upgrade from, the previous generation.”

— Peter Redfern,Tyco Integrated Fire and Security

“Manufacturers and dealers are working at getting the panels that are currently installed upgraded to the 3G network. Many have begun developing campaigns to capitalize on this expected surge in demand, and they’re coming up with new ways to educate their subscribers that they need to upgrade their panels.”

Another driver in the replacement cycle, Dearing says, is people moving homes. When someone moves into a home that already has an intrusion alarm panel, it’s fairly common for the monitoring company to offer them a new or better panel at a lower price.

“Companies like ADT, for example, usually offer heavy discounts on the initial installation of a residential security offering in exchange for RMR revenues. The replacement rate is boosted as a result. This also comes into play when a customer switches to a new monitoring provider,” he says.

Dearing says some of the ways customers avoid upgrading are:

• keeping an alarm sign despite no longer possessing an actively monitored alarm;

• moving from single-family to multi-family housing; and

• setting up a DIY home security system or opting for an MSO (multi-system operator) security offering.

However long customers may want to extend equipment life, they are sometimes compelled to accept the end has come. One cause of equipment demise is failure rate, Moss says. When cameras fail beyond their warranty period, they must be replaced. One factor affecting the failure rate of cameras is the presence of motorized components.

“A camera with PTZ controls, for example, will not last as long as a fixed camera,” he says. “The newer cameras with high megapixel ratings often come without the motorized controls

because you can use digital controls to zoom into and pan around an image. I suspect those cameras will last even longer.

Equipment lifespan is also influenced by environmental conditions, Elvish of Genetec says. The longevity of sensors, for example, whether they’re camera sensors, door sensors or heat/cooling sensors, will be affected in varying degrees depending on where they’re located. Outdoor cameras, like automated licence plate recognition cameras, tend not to last as long as indoor cameras.

“Indoor cameras can last quite a long time. That’s why we see legacy analogue equipment still being viable and people saying, ‘We still have these analogue cameras. We bought them 10 years ago, 12 years ago, and they’re working just fine. Why would we replace them until we really need to?’”

One strategy customers use to avoid full upgrading is hybrid appliances, Moss says. During the move from digital video recorders to network video recorders, manufacturers built hybrid recorders, which accepted analogue cameras alongside IP cameras. While hybrid recorders were popular a few years ago, he adds, not many people buy them today.

Sometimes, he says, people buy the security software only, thus replacing their own computing platforms. Alternatively, they may be able to keep the system and just replace the hardware by taking advantage of obsolescence programs offered by some companies.

“When systems begin to become obsolete, we offer a lower-cost upgrade. So manufacturers will offer a program that makes it cost effective to do replacements, and people don’t have to face the forklift upgrade,” he says.

Redfern says equipment lifespan is often extended because most major manufacturers, especially of enterprise-level systems, are making products that are backward compatible.

“Many of the new platforms coming out have the ability to interface with, or be a direct upgrade from, the previous generation. Companies are cognizant that, when people make a substantial investment in an access control system, for example, they don’t want to be ripping it out and replacing it every six, eight or 10 years. The backward compatibility is very important, to the large clients in particular.”

Overall, Dearing says, replacement cycles are getting shorter. But then, security companies are offering so much more in equipment and features than they did 20 years ago.

“And, now that they’re using things like LCD screens on smart home panels, the life cycle is obviously much shorter. It’s like your television,” he says.

“Five years ago, what did your television look like? Completely different. It’s all helping to speed up the replacement cycle.”

Linda Johnson is a freelance writer based in Toronto.

Security begins at the entrance

Best practices, at doors and throughout a building, can help prevent catastrophic events at our schools and facilities

By Bruce Czerwinski

In fall 2014, a man entered a Hamilton elementary school playground via one of three unlocked gates. As nearly 30 kindergarten students played, the man flung one child over his shoulder and walked off campus. Fortunately, a woman parked across the street saw what was happening and opened her car door to confront the abductor. The man dropped the child and fled. The four-year-old was unharmed but shaken, as were parents of 250 other students.

A few weeks later, a man wandered undetected onto an Ottawa elementary school campus and

offered candy to a young student. Fortunately, the student declined and the man walked away, never having been confronted by school personnel. A witness used her mobile phone to take a picture of the intruder and shared it with police.

While both of these situations ended well, smart security planning may have prevented them from ever occurring. Schools aren’t the only facilities that can suffer from lax access control. For example, office buildings face the return of a disgruntled former employee looking to gain revenge on a supervisor. Medical centres treating an injured gang member may encounter rival gangs seeking to continue fights begun in the street.

Creating roadblocks at facility entrances that rely on layers of security can stop potential

criminals before they have a chance to reach potential targets — both people and property. And those layers can become part of security plans that are easily repeatable across various types of buildings, architecture and locations.

Since many organizations count on their security providers to offer solutions, it is imperative for integrators and dealers to become aware of current and proven best practices. Here’s a look at solutions that are working today across Canada.

Assessing the risks

The first step in the design of any new or retrofit security plan should be an all-hazards risk assessment. This assessment will highlight an organization’s security strengths as well as pinpoint weaknesses. It will also help the organization to spend its money more wisely to create the specific solutions required to secure entrances.

An assessment will include the surrounding neighbourhood and traffic patterns, perime ter landscaping, parking lots, lighting, outbuildings, fencing and gates and current security equipment, including communications systems. It will give special emphasis to potential entry points such as doors, windows — even the rooftop.

Protecting the entry

The process of protecting the entry begins by defining an entry to serve as the main entrance for visitors and those which will serve employees, ven dors and delivery people. Best practic es call for a single visitor entry.

The process of protecting any en try begins with a sturdy electronic lock with a pick guard. And locks are good only when used. So an end user should be encouraged to keep doors locked at all times except in those operations where main entries are kept open to allow a free flow of customers during business hours. But nearly all organizations have doors that should remain locked unless in use.

When visitors require access, a video intercom can serve as the doorbell. These units, usually mounted just outside the entry, typically include a colour camera (some with PTZ), call button and microphone and speaker for voice communication.

Visitors push the call button to connect with a base station often placed on a receptionist’s desk or in a security office. The base unit provides a view of the visitor and allows for a twoway conversation. An employee can safely make the determination to allow access from the other side of a locked door. A push of a button on the station remotely unlocks the door. If there are any doubts about the visitor, the door stays locked and a security officer or first responder can be summoned.

Entry vestibules are now considered a best practice for many campuses and office buildings. It adds an extra wall and door to create one more barrier between visitors and the interior facility and people.

While still in the vestibule, visitors are asked to present a government-issued photo ID that is swiped through a visitor management system. That checks the visitor’s information against national and provincial criminal databases and the RCMP sex offender registry. Each organization can add its own data to check for non-custodial parents, disgruntled former employees and others. Approved visitors receive a temporary photo ID badge to be worn on the premises. Then the final vestibule door is opened.

The process of requesting and receiving permission to enter and completing the badging process doesn’t take much more than a minute for most visitors. And the extra layers of security provide a much higher level of safety for those in the facility.

But most buildings have multiple entries.

Best practices call for them to be locked at all times except when in use. And video intercoms have proven very useful in that the same receptionist or security officer can make judgments on entry requests for access. The units are ideal for allowing entry into loading docks without having to dedicate manpower to locking and unlocking these doors. Even staff members who have forgotten their access card for the day can be let in through an employee entry.

The same lock-video intercom combination also works well on interior doors — those at rooms with high-value inventory or data, such as cash and record rooms.

The Ontario government has given its thumbs up to protecting school entries. During the 2005-06 school year, the Ontario Ministry of Education offered the province’s public elementary schools up to $3,100 to buy and install front door locks and video intercoms. Nearly 850 schools took advantage of the Safe Welcome program. The offer was expanded in 2012, adding schools from among 66 of Ontario’s 72 school boards. In total, more than 75 per cent of the province’s 4,000-plus public elementary schools received Safe Welcome funding.

There are at least two more security tools that are part of the best practices being employed for entry protection. Security screens, made of stainless steel mesh, protect glass entry doors and nearby windows. The December 2012 Sandy Hook gunman shot his way through a window to enter the school. Security screens are virtually impervious to gunshots, knives, clubs or rocks.

Also panic buttons and related emergency notification systems located throughout a facility allow those inside to quickly contact first responders if there is a security breach.

CPTED

The adoption of Crime Prevention Through Environmental Design (CPTED) principles also adds to overall facility security — especially at the entry — and often at very little cost. Many of the CPTED ideas will have been identified during the all-hazards risk assessment. For exam-

ple, making sure that trees and brushes have been cut back to not provide a hiding place for criminals and contraband. Overgrown landscaping can also block the entry views to first responders patrolling the area. Fencing and gates help to channel visitors to the proper entry. Inexpensive signage works in tandem with fencing to direct people from the parking lot to the main entrance. Signs can also provide information on the entry procedure, including use of the video intercom and visitor management system. Lighting discourages criminals and helps to identify visitors at the front door on dark winter afternoons. A well maintained front entrance sends a message that the organization is serious about maintaining security. That requires immediate removal of graffiti, repair of broken windows and replacement of burned out light bulbs.

Here are some other security layers that also help protect an entry. Basic cardkey/keypad systems are ideal for employee entries. They are relatively inexpensive and eliminate the time and cost of re-keying when traditional keys are lost or stolen. With wireless systems now available, they also can be added to protect entries to outbuildings and other entrances where cabling would be cost prohibitive or impossible. Also, systems hosted by a central station remove the cost, trouble and space required to maintain an onsite server.

Interior entries also need attention. All interior doors should be lockable from the inside. These locks represent one more layer between office occupants and gunmen and other criminals. A $10 peephole allows the occupant to see who’s requesting access without having to open the door.

It’s all about layers

Audio intercoms also play a role in the larger security plan. They can be used to simultaneously share messages with all offices should a security breech occur. They can also be integrated with video surveillance cameras protecting the perimeter.

If the budget permits, video cameras, placed inside and outside a facility provide valuable real-time and recorded images of emergencies.

By selecting one public entry and then hardening it with layers of security, it is possible to seriously deter criminals from entering a facility — from a school to a medical centre to an office building.

And these layers are among the most affordable available on the security market. They complement one another to synergistically heighten safety. They have also been proven effective and represent today’s best practice for securing the entry.

Bruce Czerwinski is the U.S. general sales manager for Aiphone (www.aiphone.com).

Product Previews dormakaba Electronic Access and Data (EAD)

RCI Electromagnetic Locks and Electric Strikes

RCI supplies a variety of electromagnetic locks to suit different applications, including Delayed Egress and Early Warning. Our family of electric strikes continues to grow, as we remain committed to bringing all that is required for each application.

RCI Power Supplies:

RCI’s filtered and regulated 10 Series power supplies provides safe and reliable power for your power distribution needs. They incorporate many life safety options required, such as fire panel interface, instant unlock upon power failure and remote override reset capabilities for authorized personnel.

The RCI 10 Series offers the perfect solution when flexible power distribution is required.

Dorma and Kaba are now dormakaba. With our extended portfolio we provide innovative solutions that include Electronic Access and Data (EAD) Keyscan networked access control systems, E-Plex stand-alone and wireless lock systems and RCI electronic access controls. Complete smart access solutions for your satisfaction.

RCI Readers and Credentials

RCI offers proximity readers that feature slim design, compact design and reader & keypad combo. Our passive proximity cards and fobs, sold in packs of 10, 25 & 50, complement this offering.

RCI Specialty Locking Solutions

RCI brings a wide range of specialty locking devices to the marketplace. We provide a variety of cabinet locks, electronic latches, compact electromechanical locks and intelligent electromechanical locks that offer monitoring capabilities.

Keyscan CA & EC Series Door and Elevator Floor Controllers

Keyscan’s line of feature-rich door and elevator floor access control units provides best- in-class access control solutions for all new installations or system upgrades. Our access control units can all be mixed and matched and networked to any LAN/WAN to satisfy all system design requirements.

E-Plex® Enterprise Wireless Access Control System

E-Plex wireless locks now integrate with Keyscan Aurora V1.0.14, offering two-way communication from E-Plex wireless locks to your Keyscan Aurora software using wireless gateways. It provides a flexible and scalable path to true hybrid access control. You can also use E-Plex locks as a simple stand-alone solution. Management of both online and as stand-alone locks is made simple. Fast data transfer and long battery life make E-Plex systems an efficient, low cost solution.

Keyscan Aurora Access Control Management Software

Keyscan Aurora provides a new level of efficiency and integration options regardless of your system size or complexity. Aurora features VMS integration with top manufacturers, wireless lock integration with E-Plex wireless and Allegion AD400 and NDE series, web interface and other multiple add-on modules for enhanced functionality.

Product Previews Access Control

Interlock controllers

Dortronics Systems

4700 Series Interlock Controllers incorporate a unique watchdog circuit that constantly monitors operation. Also featured are LED indicators for input-output connection status, and system busy or system idle confirmation. The 4700 Series includes suppression protection on all outputs to prevent inductive load locking devices from damaging the circuitry. Additional features include interlock violation alarm relay output; 4 DPDT relays (three powered and one dry contact for signaling); panic release and custom programmable propped door, panic release and door unlock timers. www.dortronics.com

Security shutter

Wayne Dalton

The Model 523 Security Shutter is suitable for areas with high pedestrian traffic. Beyond its trim design, the security shutter comes in four standard powder coat colours, 197 RAL powder coat colours and six wood grain finishes. This door comes preassembled, allowing easy installation for hospitals, offices, schools and other buildings. The Security Shutter comes with multiple lock and operations options, providing security and safety to compliment individual needs. In addition, the aluminum design comes with a compact bottom bar featuring slide locks and a vinyl seal. www.wayne-dalton.com

Integrated entry systems

Aiphone

Aiphone introduces a series of integrated HID multiCLASS SE readers for their IS, IX, and JP Series audio/ video entry systems. These dynamic, multiCLASS SE 13.56 MHz, contactless readers support a broad array of credential technologies and a variety of form factors. The embedded HID multiCLASS SE readers allow these video door stations to integrate with new or existing access control systems. Aiphone’s flagship IX Series allow users to improve staff efficiency by controlling security needs from either a central location or remote user. www.aiphone.com

SIP video station

Vingtor Stentofon

TCIV is an IP and SIP video station designed to withstand treacherous, noisy, and demanding environments. HD quality, broadcast level amplification audio with active noise reduction, echo cancellation, and HD video provide effectiveness in user comprehension and communication. The TCIV overcomes the problem of unintelligible communication and low resolution video by providing a dynamic HD quality solution that is flexible, expandable, and easily integrated. www.Vingtor-Stentofon.com

MRI locks

Olympus Lock

Smart card encryption

Farpointe Data

Farpointe Data has migrated to MIFARE DESFire EV1, the next generation of smart card technology by NXP Semicon ductors, in its line of Delta smart cards.

MIFARE DESFire EV1 uses 128 AES encryption, the same as used by the U.S. federal government. MIFARE DESFire EV1 is based on open global standards for both air interface and cryptographic methods. It is compliant to all 4 levels of ISO/IEC 14443A and uses optional ISO/IEC 7816-4 commands. Featuring an on-chip backup management system and mutual three pass authentication, a MIFARE DESFire EV1 card can hold up to 28 different applications and 32 files per application. www.farpointedata.com

This new MRI line of cabinet door and drawer locks is designed for use in Magnetic Resonance Imaging (MRI) areas. The new MRI locks are available on N Series (100M and 200M) and R Series (500M and 600M) keyways. Features include all non-magnetic materials, components and copper plated non-magnetic keys. The MRI locks are stocked in US26D satin chrome finish and can be ordered with stock keyed alike numbers, keyed different or custom keyed to the user’s specifications. www.olympus-lock.com

Access control panel

Sielox

Anti-terrorist barrier

Delta Scientific

The 1700 Controller has been designed with all logic built into its field-programmable processor allowing for fast design changes to accommodate new features and enables easy field updates. A built-in SD card stores a backup of all configuration data, allowing for instant recovery in the event of a failure. The entire access database can also be downloaded onto the SD card to facilitate access operation in the event of network failure. Among the enhancements are improved IP network performance and enhanced wireless lock solutions. www.sielox.com

The new HD2055 electromechanically controlled anti-terrorist barricade decisively stopped a 15,000 pound (6,803 kg) test vehicle traveling at 51 mph (82 kph) in a recent crash test conducted by an independent testing laboratory. The barricade features a shallow foundation with an environmentally-friendly electromechanical actuator which utilizes a sophisticated cam design that accelerates and de-accelerates the barrier road plate during raising and lowering. This reduces the lifting and closing force down to zero at the end of each stroke. www.deltascientific.com

Product Previews Access Control

Ruggedized controller Senstar

The UltraLink Rugged Controller is a ruggedized, embedded controller for unmanned sites that enables remote management of Senstar security sensors and provides local control of security functions. The UltraLink Rugged Controller connects to a site’s Senstar sensors and I/O devices and provides a standard Ethernet/IP-based interface for communication with the Security Management System (SMS) using the facility’s own WAN/ SCADA network.

www.senstar.com

Multi-functional keypad

Camden Door Controls

The CM-110SK is a single door, multifunctional stand-alone keypad, with a Wiegand output for interfacing to an access control system. This unit supports up to 2,000 users with a four-digit PIN. Extra features include lock output current short circuit protection, anti-tamper, and a backlit keypad. Housed in a vandal proof zinc alloy electroplated case, it’s suitable for mounting in both indoor and harsh outdoor environments. The electronics are fully potted so the unit is waterproof. www.camdencontrols.com

Nest-integrated touchscreen lock

Yale

Linus, an official Works with Nest product, is a key free touchscreen lock. It can lock and unlock doors from anywhere, create passcodes that provide different levels of access for family members and guests, and revoke access at any time – all from the Nest app. Homeowners can also receive alerts based on guest passcodes, set Linus to automatically lock after a specified number of seconds, and see a history of who has come and gone with timestamps. Linus is the only residential door lock that allows a homeowner to remotely check to see if the door is secured and locked.

Yale2you.com/LinusLock

Lockdown solution

STANLEY Security

BEST SHELTER is a lockdown solution designed specifically for educational K-12, business and health-care environments. The SHELTER fob by BEST allows for communication with the SHELTER wireless system to initiate a lockdown and third-party notification of an event. This multi-purpose fob permits lockdown of one door, hallway or entire building. When initiated from the fob, it is communicated to an attached BEST SHELTER 9KX Cylindrical Lockset (9KX). www.stanleysecuritysolutions.com

Second generation smart lock Kwikset

The Kevo 2nd Gen smart lock offers homeowners an in-app and interactive installation experience and eliminates user-initiated calibration. Kevo 2nd Gen features an all-metal interior with a dramatically reduced interior size, making the smart lock more durable than its predecessor. Kevo 2nd Gen also features the latest version of the Kwikset patented SmartKey security. The advanced SmartKey security provides strong resistance against forced entry techniques, passes the most stringent lock-picking standards (UL 437, par 11.6. & 11.7), and utilizes BumpGuard to prevent lock bumping. www.kwikset.com

Mini-dome cameras

Illustra

Illustra Pro 2 megapixel minidome cameras feature new UltraVision low light technology to capture high quality colour video in the extreme low light conditions. Illustra UltraVision technology allows the camera to effectively maintain colour video well below 1 lux. The minidomes also feature advanced on-board analytics, including motion detection, face detection, blur detection and tampering. To minimize bandwidth use and storage requirements, users can program up to five individual regions of interest.

www.illustracameras.com

Access control lock

Corbin Russwin

Access control platform

Nortek Security & Control

Linear ProControl is a commercial grade, secure front and back-end integrated security and access control platform with an exclusive dealership program and Remote Management Console. Linear ProControl with RMC encompasses an entire commercial security and access control management ecosystem. The turnkey solution’s integrated back-end opens up a variety of revenue streams through enhanced support and RMR services. Elevator control, anti-pass back, and an array of video, viewing and other features can be securely managed on or offsite through the RMC dashboard. www.nortekcontrol.com

The SE LP10 Integrated Wiegand Access Control Lock, combines ASSA ABLOY’s Integrated Wiegand technology with multiCLASS SE smart card technology from HID Global. The SE LP10 is an Integrated Wiegand lock that incorporates all standard access control components including the card reader, door position switch and request-to-exit monitoring sensors into a single device. An open architecture platform ensures compatibility with all popular access control systems.

www.corbinrusswin.com