Bliss Industries has the experience combined with 21st century technologies for your size-reduction or pelleting needs. Call today!

Bliss Industries, LLC is a leading manufacturer of pelleting, cooling and size reduction equipment.

Founded in 1981, Bliss Industries maintains a reputation of manufacturing the most efficient, reliable and well-built equipment in the industry.

Developed from a design concept proven worldwide, the range of Pioneer Pellet Mills continues to expand. Overall reliability, maximum efficiency, ease of operation and maintenance combine to provide lower operating costs to each owner. With the ability to provide a wide range of die sizes, die speeds and drive power, Bliss can more than meet your requirements for high quality at a reasonable cost.

Proudly Manufactured in the USA

Bliss Industries, LLC P.O. Box 910 • Ponca City, Oklahoma U.S.A. 74602

Phone (580) 765-7787 • Fax (580) 762-0111

Internet: http://www.bliss-industries.com

E-mail: sales@bliss-industries.com Impacting Industries Worldwide.

Four industr y leaders share their insights in honour of Canadian Biomass’ 10th anniversary. Hear from chair of Renewable Industries Canada and chief executive officer of IGPC Ethanol Jim Grey, senior vice-president of government affairs and communications for Enerkem Marie-Hélène Labrie, president and chief executive officer of Ecostrat Jordan Solomon, and John Swaan, the original founder of PFI Pellet Flame and co-founder of FutureMetrics.

Pinnacle finds new oppor tunities in Alberta. This is the first time the 29-year-old company has expanded its production outside of British Columbia.

Canadian Biomass’ annual Pellet Gear Buyers Guide rounds up suppliers of pellet production equipment available for the Canadian industr y.

ost Canadian magazine launches fail within a few issues. Canada is simply a small market to attempt to carve out a successful media niche. When it happens, success is a delicate mix of timing, intuition, a keen understanding of the market, and good content. Oh yeah, and luck.

In the case of Canadian Biomass, that luck came in the form of a long-time competitor of our forestry magazine Canadian Forest Industries — Rob Stanhope, the publisher of Logging & Sawmilling Journal Rob and I were attending World Bioenergy in Sweden in June of 2008, and there were many Canadians in attendance and lots of buzz around the industry. We may all have been a little desperate after a couple of years of the U.S. housing market collapse, and so saw a possible saviour in all things bioenergy.

zines lose money for years before they establish readership and a client base. We’ve made money ever since, although in some years not a lot. But people are working, the industry is getting reported on, and we continue to promote the benefits of the biomass sector.

We soon added a website and enewsletters, then social media, and began partnering with the Wood Pellet Association of Canada on all things marketing, including their annual event. We do webinars and the Pellet Mill Map. In fact, more people now know us for all of these things than the actual magazine, and that’s just fine.

Having a beer with Rob just before heading back to Canada, Rob asked a question that I had been asking myself through the whole conference — “What was I going to do about all of this bioenergy buzz?” I told him I didn’t know, that we’d probably not do much more than we were doing already in the pages of Canadian Forest Industries And that was true at the time.

And then I woke up during my flight home with a start. If Rob was asking me my plans, he was likely planning something himself. I was damned if he was going to be first out of the gate in this emerging market, so I sketched out the first issue on a pad of paper during the rest of the flight, assembled a launch team the next day, and the first issue of Canadian Biomass rolled off the press less than two months later.

We made $455 profit on that first issue, no small feat for issue No. 1. Some maga-

We’ve seen a few competitors come and go along the way. The CANBIO association tried their hand at a magazine for a few years, but it vanished, followed soon after by the association itself. Our colleagues south of the border, BBI International, tried a Canadian media brand, but it was short lived. Each discovered how hard it is to run a magazine around a constantly emerging industry.

The biomass “market explosion” I guaranteed in the first issue has yet to happen, as current editor Maria Church so kindly reminds me in her retrospective on page 10. But the industry survives, some parts thrive, and continues to grow. Almost 60 issues later, we’re still here covering it.

I never did ask Rob if he was considering launching a biomass magazine back then. Either way, thanks for the inspiration, Rob. Next round’s on me.

•

Scott Jamieson, Founding Editor

Volume 18 No. 5

Editor - Maria Church (226) 931-1396 mchurch@annexbusinessmedia.com

Associate Editor - Tamar Atik (416) 510-5211 tatik@annexbusinessmedia.com

Contributors - Lesley Allan, Jim Grey, Marie-Hélène Labrie, Gordon Murray, Jordan Solomon, and John Swaan.

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexbusinessmedia.com

Account Coordinator - Stephanie DeFields Ph: (519) 429-5196 sdefields@annexbusinessmedia.com

National Sales Manager - Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexbusinessmedia.com

Quebec Sales - Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexbusinessmedia.com

Western Sales Manager - Tim Shaddick tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Curtis Martin

Circulation Manager – Jay Doshi jdoshi@annexbusinessmedia.com Ph: (416) 442-5600 ext. 5124

President/CEO Mike Fredericks

Canadian Biomass is published six times a year: February, April, June, August, October, and December. Published and printed by Annex Business Media.

Publication Mail Agreement # 40065710 Printed in Canada ISSN 2290-3097

Subscription Rates: Canada - 1 Yr $56.00; 2 Yr $100.00 Single Copy - $9.00 (Canadian prices do not include applicable taxes)

– 1 Yr $91.60 US; Foreign – 1 Yr $104.00 US

CIRCULATION mchana@annexbusinessmedia.com Tel: (416) 510-5109 Fax: (416) 510-6875 or (416) 442-2191 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2018 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication. www.canadianbiomassmagazine.ca

Celebrating 100 years in the business, Viessmann has been providing homeowners with industry-leading heating solutions for generations.

The Vitoligno 300-C wood pellet-fired boiler is a modern, compact and fully-automatic heating solution for residential and light commercial applications.

High efficiency up to 85%

Environmentally-friendly, carbon neutral heating

Easy conversion from automatic to manual fuel feed

Easy to obtain, locally and sustainably sourced wood fuel

WINNER of the 2015 German Design Award

Quebec-based Airex Energy has received approval from the Canadian Food Inspection Agency for the sale and use of its BiocharFX product in Canada.

BiocharFX is a 100 per cent natural and organic soil amendment. Its high carbon content promotes plant growth and yields by improving soil aeration and drainage, nutrient retention, as well as soil moisture availability.

When mixed with soil, compost or peat moss, BiocharFX can be used with all types of plants and crops, and

for a wide range of applications such as flower beds, home gardening, landscaping, organic agriculture and commercial horticulture.

Biochar can also be used for waste water filtration as well as the reduction of metals for environmental soil remediation.

“Airex Energy is the largest biochar producer in Canada. Our plant located in Bécancour, Que., has an annual capacity of more than 5,000 metric tonnes produced from sawdust and barks from fir, spruce and maple species,” said Sylvain Bertrand, CEO of

Airex Energy. “Our BiocharFX product can be delivered in big bags by trucks, rail or even by sea to customers anywhere in Canada.”

Airex Energy’s industri-

al-scale demonstration plant opened in February last year. The facility cost around $10 million in public and private investments for its design, construction, and start-up.

Toronto and Enbridge have announced plans to build the city’s first renewable natural gas (RNG) facility at the Dufferin Organics Processing Facility. The facility will produce biofuel by capturing and processing the biomethane released by the city’s organic waste.

The facility is expected to produce more than five million cubic metres of RNG, which would be enough to fuel 132 garbage trucks – 90 per cent of the city’s fleet – or heat more than 2,000 homes. The RNG will be injected into the city’s

natural gas distribution system.

Mayor John Tory said the project represents a path to low-carbon fuel for Toronto and will play an important role in helping them reach their goal of reducing greenhouse gas emissions by 80 per cent by 2050. “The city remains committed to its climate change action goals and to creating a more sustainable Toronto. By working with Enbridge we are able to move positive projects like this forward to the benefit of our residents and the environment,” Tory said in a news release.

The Ontario Power Generation (OPG) has announced the closure of the 100 per cent wood pellet-fuelled Thunder Bay Generating station.

The closure stems from significant corrosion damage found to the boiler at in late May this year, the OPG said in a news release. Because of the high capital repair costs, high operational costs and limited time remaining on the Independent Electricity System Operator (IESO) contract for Thunder Bay Generating Station, OPG and IESO determined that shutting down the station now is in the best

Cynthia Hansen, executive vice-president of utilities and power operations for Enbridge, commended Mayor Tory and the city for their vision and commitment to renewable energy.

“We all agree that we must have cleaner or lower carbon energy options to heat our homes and move our vehicles. While traditional natural gas is the cleanest-burning conventional fuel, RNG is the first step in ‘greening’ the natural gas system,” she said.

The project is expected to be completed next year.

interests of electricity customers.

Repairs to the Thunder Bay Generating Station would take approximately six months, leaving only one year remaining for the IESO contract. Because of a lack of demand, Thunder Bay Generating Station is rarely used for electricity generation. Based on historical annual average operational days, it is expected that the repaired boiler would only be used for 2.5 days.

The OPG said the decision will save Ontario electricity customers $40 million and avoid $5 million in costs to OPG.

The federal government is challenging Canadians to develop sustainable and affordable bio-jet fuel that reduces the aviation sector’s carbon foot print.

Minister of Natural Resources Amarjeet Sohi announced the Sky’s the Limit Challenge at the Alberta Aviation Museum in Edmonton in August.

“This unique challenge facilitates collaborations to support a game-changing transformation of the aviation industry. A Canadian-made sustainable aviation fuel will grow our clean economy and create good, middle-class jobs for Canadian workers,” Sohj said in a news release. The competition is divided into two segments.

• The Green Aviation Fuels Innovation Competition: provides $2 million to four teams who develop

B.C.-based pellet producer Pinnacle Renewable Holdings is heading to the southern U.S. with the acquisition of an Alabama industrial wood pellet plant.

Pinnacle announced in early September it has entered into a definitive agreement to acquire a 70 per-cent interest in an operating industrial wood pellet production facility located in Aliceville, currently owned by The Westervelt Company. Westervelt will retain a 30 per cent ownership.

The facility has an annual production capacity of about 270,000 metric tonnes, 210,000 of which is committed under a long-term off-take contract with a major European utility. Pinnacle plans to sell the remaining volume through its contracted backlog of long-term, take-or-pay off-take contracts.

Pinnacle CEO Robert McCurdy said in a news release the acquisition is launching point for Pinnacle’s future growth in the U.S. Southeast, a key fibre basket.

“Through this transaction, we are also pleased to form a partnership with Westervelt, a leading forestry and land resource company in the region. We look forward to working with Westervelt to optimize the production capacity and operating efficiencies at the Aliceville Facility, and to jointly explore other potential future growth opportunities in Alabama and Mississippi,” McCurdy said.

“Our mutual dedication to safety, environmental responsibility, quality and our people provides a strong foundation for our partnership,” said Westervelt president and CEO Brian Luoma. “Where Pinnacle brings decades of pellet industry experience, we bring generations of land stewardship and management, our core business competencies. This was a natural partnership because of our shared values, and because this joint venture takes advantage of synergies between the two companies.”

Several large local sawmills will be supplying residuals to the Aliceville plant, including Westervelt’s sawmill in Moundville, Ala.

the most innovative solutions. The funding will support an 18-month competition to produce the most economical and environmentally sustainable aviation fuel. The winner will receive a $5-million grand prize.

• The Cross-Canada Flight Competition: first participant to fuel a Canadian commercial flight using a minimum 10 per cent blend of made-in-Canada bio-jet fuel. Winner will receive $1 million.

According to the news release, the federal government plans to purchase bio-jet fuel for its federal aviation fleets once it is commercially available at a competitive price. The Department of National Defence and Transport Canada have signalled their early support.

Jeff Passmore is the conference chair for Scaling Up Bio, held annually in Ottawa.

Scaling Up Bio, Ottawa’s annual conference on strategies to scale up the industrial bioeconomy in Canada, is returning to the capital Nov. 5-7 with a new format that allows more time for Q&A and discussion.

Conference chair Jeff Passmore has arranged plenary sessions that give speakers just three minutes to share their message, leaving plenty of time for a healthy panel and audience dialogue.

“One of the comments we’ve had in the past is to increase time for discussion and Q&A. Three minutes really forces a person to focus their message. Each panel should then have at least 20 minutes left over for Q&A,” Passmore says.

Over three days, 50 Canadian and international speakers will cover the bioenergy, biofuel, bioproducts and biochemical sectors. The conference will not only hear from commercial producers, but also large industrial customers.

“In the past we’ve had technology providers discussing the pathways, and we have at least 10 of those coming, but we also have customers coming – companies like Shell, SkyNRG out of the Netherlands, and the steel industry. These are companies looking for ways to reduce their greenhouse gas footprint,” Passmore says.

Keynote speakers will include Christopher Regan, chair of Canada’s Ecofiscal Commission, who will discuss the use of carbon tax to drive substitution, as well as David Golden, senior vice-president for chemical producer Eastman. Green Party of Canada leader Elizabeth May is also back by popular demand.

Julie Gelfand, commissioner of the environment and sustainable development for the Office of the Auditor General of Canada, will also be presenting a keynote.

Find a list of speakers and a working agenda at www.scalingupconference.ca. Register before Oct. 5 to receive the early-bird rate of $575.

By Gord Murray, WPAC executive director

appy 10th birthday to Canadian Biomass magazine (CBM)!

After having published its first issue in August 2008, CBM has emerged as the go-to source for biomass news and opinion in Canada. I began in my role with the Wood Pellet Association of Canada at about the same time as CBM was established. It did not take long for our two organizations to develop what has become an enduring, mutually beneficial partnership.

Scott Jamieson — CBM’s creator and first editor — convinced me to contribute my first column in the March-April 2009 edition. Since then, I have written a column in every edition and have frequently contributed feature articles to the magazine. Scott has maintained control over CBM, but has since moved up the ranks in Annex Business Media, CBM’s owner, where he is now a group publisher.

WPAC is a tiny organization so we rely heavily on our relationship with CBM/Annex. Here are a few of the ways they help WPAC:

• Website: CBM/Annex hosts and manages WPAC’s website.

• E-news: We rely on CBM’s e-news to keep WPAC members up to date on current issues in the biomass world. Whenever I have important news to share, CBM distributes it through the weekly e-news, which is also shown automatically on WPAC’s website.

• Annual conference: Scott and I had breakfast at the Chateau Laurier Hotel in Quebec City one morning after a WPAC member meeting in November 2012. It was then we decided that WPAC and CBM/Annex would partner in producing an annual national wood pellet conference. We have now held conferences in Vancouver (2013 and 2014); Halifax (2015); Harrison Hot Springs (2016); Ottawa (2017); and are back in Vancouver in September 2018. We attract delegates from all over the world to our annual conference.

• Other events: Upon the success of our annual conference, WPAC and CBM/Annex have collaborated on three annual safety conferences, several training workshops, combustible dust webinars, a co-firing conference in Edmonton, a wood pellet forum in New Brunswick, and many other events.

• Marketing and promotion: Annex helps WPAC with graphic design services, brochures, social media, and other marketing materials.

Besides my warm personal relationship with Scott, WPAC

would like to recognize other key CBM/Annex personnel including: Tara Jacobs, our super-organized conference manager who does so much to make our events a great success; Ross Anderson, who in addition to serving as a member of WPAC’s board, handles all the sponsorships and exhibitors; and Maria Church and Tamar Atik, the two editors of CBM who keep all the news up to date and look after WPAC’s website.

It is interesting to look back on our industry and how it has changed since 2008.

• Global wood pellet production increased almost threefold, from 11 million tonnes in 2008 to 31 million tonnes in 2018. In the same period, Canadian production increased from 0.7 million tonnes to 2.9 million tonnes.

• Drax Power has emerged as the world’s largest biomass power station and consumer of wood pellets. Yet the

company did not begin wood pellet co-firing until 2009. It completed its first boiler conversion to 100 per cent biomass in 2013 and its fourth boiler in 2018.

• South Korea did not begin using industrial wood pellets until 2012 and has now emerged as the largest wood pellet consumer in Asia, followed closely by Japan, which is also growing rapidly.

• Italy has emerged as the largest and fastest growing premium wood pellet market in Europe, currently about two million tonnes per year.

• I attended the inaugural meeting of the European Pellet Council in 2010, at which time we decided to introduce the wood pellet quality scheme known as ENplus. WPAC has remained the only non-European full voting member of the European Pellet Council. ENplus has grown to cover 70 per cent of the premium pellet market in Europe.

• In 2008 there were no interna tional wood pellet standards. Since then, the ISO Technical Committee 238 has established the ISO 17225 quality standards and have developed many relat ed physical and chemical test ing standards. Recently the ISO 17225 standards were adopted by the Canadian Standards Asso ciation.

• Ontario Power Generation con verted two coal boilers to wood pellets and continues to operate the Atikokan boiler to this day.

• The company Rentech, which was so prominent in Ontario, has come and gone.

• In 2010, Green Circle operated the world’s largest wood pellet plant at 500,000 tonnes annual capacity. Since then, Green Circle was purchased by Enviva. Today, plants with 500,000 tonnes ca pacity are commonplace.

• Pacific BioEnergy completely re built its plant in Prince George, more than doubling capacity. The plant is now a leader in us

ing forest harvesting residues as feedstock.

• In 2008, Pinnacle Renewable Energy was still owned by the Swaan family. Since then the company has multiplied its number of production facilities, was purchased by ONCAP, then underwent an IPO to become a publicly traded company, and expanded into Alberta and Alabama.

• Shaw Resources and Groupe Savoie began exporting wood pellets through the Port of Belledune to Europe. Shaw’s Rene Landry and Belledune’s Jenna MacDonald have both served on WPAC’s board for many years, with Rene having served the past three years as president

• The Sustainable Biomass Program has emerged as the dominant European sustainability certification program for wood pellets. All Canadian exporters to Europe have either been certified

or are in the process of becoming certified.

• Until 2014, WPAC had minimal involvement in managing safety. In 2014, members asked WPAC to establish a safety committee. Since then, safety has become one of WPAC’s primary focus areas. The wood pellet industry has completely turned around its reputation favourably in the eyes of regulators.

All of these changes to our industry have been chronicled in the pages of CBM and in the weekly e-news. After many years of effort by all wood pellet industry participants, we are now in a situation where demand for our product is strong; prices are fair; foreign exchange rates are favourable; we having some success in convincing our critics regarding our sustainability credentials and the greenhouse gas benefits of wood pellets; and our industry’s future looks bright. We are looking forward to continuing our strong partnership with CBM/Annex for many years to come. •

By Maria Church

en years is barely a blip in the histories of industries such as forestry, mining or oil and gas, but for the young biomass industry in Canada, a lot has happened in 10 years.

It was just 10 years ago that this magazine launched with its first editor (now publisher) Scott Jamieson remarking in his inaugural editorial: “Biomass, bioenergy, biorefining — you name it and people want to know about it in Canada’s forestry sector and related government departments. With the industry in tough times and energy costs soaring, it makes sense. … We’re on the verge of a biomass explosion on this continent — mark my words.”

Explosion may not be an apt description for the industry’s growth over 10 years (and I’ve been told it’s a faux pas term in the pellet world), but biomass has certainly experienced significant milestones in spite of challenges that producers and users continue to face.

Looking back at 10 years of comments by Canadian Biomass editors can give us insight into how companies faced these challenges, and what we can learn from them now.

I doubt you’ll find any of the magazine’s 60 issues escapes discussion about the sustainability of the biomass industry; that includes concerns about harvesting levels, profits and demand. Whether

Canadian Biomass magazine launches as a supplement to Canadian Forest Industries and Canadian Wood Products magazines. The premier issue in August covers the 2008 World Bioenergy in Sweden where Canada made up the largest foreign delegation.

A livestock feed mill in eastern Quebec becomes the first in the province, and possibly all of Canada, to use biomass as energy for processing. Mill managers say the new biomass system saves them at least 80 per cent of energy costs in propane and completely eliminates the use of fuel oil.

The B.C. government estimates that mountain pine beetle has killed 620 million cubic metres of lodgepole pine from the late 1990s to 2008. With the province flush with bioenergy, companies are ready to dive in to the supply, but challenges still exist around transportation costs and ground disturbance.

it’s a consumer’s decision to purchase a biomass alternative, or a producer’s decision to peruse a new biomass product, sustainability is truly the name of the game.

In 2008 the traditional forest products sector voiced concerns that the demand for biomass could threaten access to affordable fibre. Jamieson noted in the November/December editorial that those fears are without base in Canada where the bioenergy sector cannot outbid traditional players for fibre and still be competitive with other energy sources. “Biomass will be a part of a strong forest products sector for some time to come,” he stated. This continues to be the case in Canada. Most forestry biomass producers are integrally tied to lumber producers, with a few exceptions. Even those exceptions rely on agreements with nearby lumber mills for sawdust and shavings.

But with advances in technology, such as the Dieffenbacher ClassiCleaner installation by Pacific BioEnergy in Prince George, B.C., detailed in the May/June 2018 issue, pellet producers can increase their access to forest residuals typically too contaminated to process. In the future we may see more independent producers setting up shop.

For the pellet industry it’s vital to demonstrate sustainability to customers. “Just as ethanol producers have been accused of driving up food prices, wood pellet producers are under suspicion for using

A study commissioned by the Wood Pellet Association of Canada, Natural Resources Canada, and the BC Bioenergy Network examines how torrefaction could be incorporated into a pellet facility to improve the product and reduce shipping costs. Canadian Biomass updates on black pellet projects in development.

The University of Northern British Columbia seeks to embody its slogan as “Canada’s greenest university” with its new $15-million wood gasification system from Vancouver-based Nexterra Systems. The system saves the university the equivalent of around 63,000 gigajoules of fossil fuels.

Canada’s first full-scale commercial plant for the production of cellulosic ethanol from waste begins its construction phase in Edmonton. Enerkem’s $131-million project includes a feedstock prep facility, a commercial plant and the Advanced Energy Research Facility.

too much wood,” Amy Silverwood wrote in the March/April 2014 editorial. She urged pellet producers to consider standardization to prove they offer high-quality product that is sourced from sustainably managed forests. As she predicted, building on established forest industry quality and sustainability standards helped drive the industry forward over the coming years.

Other forestry biomass producers, such as biochar and biofuels, are also carving out a piece of the forest products’ pie, albeit more slowly. Over the years some projects have came and gone, but as Jamieson pointed out in the January/February 2010 editorial, new biomass projects need to consider all the variables — fibre supply, public policy, fuel costs, etc. — before confidently heading to a banker for funding. More than eight years later, projects that took that advice are humming along.

It’s impossible to discuss the biomass markets with blanket statements. Each subset within the biomass industry is at a different stage when it comes to market development. Bioenergy is by far the most established market both in Canada and worldwide. Biofuel from corn and wheat ethanol, too, is a fixture in the North American landscape.

The markets for bio-products and forestry biofuels, like the technology by which they are produced, are developing slowly.

If the forestry biofuels sector could sell potential, companies would be rich. But finding a market for the bio-derived fuel hinges on good timing — not too early and not too late, but just as it takes off, as Heather Hager pointed out in her September/ October 2009 editorial. At the time, no forestry cellulosic ethanol producers were at a commercial scale. Hager predicted as soon as 2010 or 2011 for the first commercial scale plant.

To this day there is no commercial producer, however Ontario’s Enzyn Technologies is building the Cote Nord Project in Port Cartier, Que., along with Arbec Forest Products, that will produce

The Atikokan Generating Station - the final holdout of Ontario’s coal-fired power stations - converts from coal to wood pellets, reviving the sleepy northern Ontario town of Atikokan. Two local pellet plants are under construction by Rentech and Resolute Forest Products to supply the required 90,000 tonnes per year.

GreenField Specialty Alcohols invests $40M in its Chatham, Ont., plant, the bulk of which goes to the construction of a second cogeneration facility that will take the plant off the Ontario power grid. The investment will both increase GreenField’s industrial alcohol output, and also go towards the introduction of new technology.

10 million gallons per year of biocrude from forestry residuals. The project is expected to be operational by the end of the year. Canfor and Licella are also building a biocrude refinery that will produce 500,000 barrels a year from Canfor’s Prince George, B.C., pulp mill.

Two notable cellulosic ethanol producers have found commercial success from other sources. Ontario’s Iogen Corporation’s technology is used in a commercial scale plant in Brazil to produce ethanol from sugarcane, and Enerkem in Alberta produces ethanol and biomethanol from municipal waste.

Wood pellet producers experienced perhaps the most significant growth in market demand over the past 10 years. In spite of Hager’s warning in the September/October 2010 editorial of upcoming competition for the EU market from U.S. pellet producers such as Enviva, pellet exports surged less than three years later. “As more facilities convert to co-firing as a way of reaching government targets, Canadian wood pellet producers will continue to smile and ask, ‘How much do you need?’” John Tenpenny wrote in the March/April 2013 editorial.

Taking advantage of sustained demand in Europe, the B.C. pellet industry expanded significantly in 2014-15. Andrew Macklin stated in the March/April 2015 editorial that more than five new pellet projects were added to Canadian Biomass’ annual pellet map, adding much needed capacity for the export market.

Ontario Power Generation’s second pellet conversion in Thunder Bay (the first in Atikokan was in 2014) fired up in late 2015 causing a domestic market demand spike. The conversion cost just $5 million, Macklin noted in his November/December 2015 editorial, which set a strong example for other provinces still firing coal. In July 2018, OPG announced the Thunder Bay station was permanently shut down due to boiler corrosion damage. It’s a sad blow to industrial pellet market in Canada, however, hope remains that other coal-firing provinces will consider a conversion to pellets.

Pinnacle Renewable Energy, Canada’s largest wood pellet producer, partners with Vernon, B.C.-based lumber producer Tolko Industries to build a full-scale pellet plant adjacent to Tolko’s Lavington sawmill. The new plant is the first use of two new technologies to improve emissions from pellet production.

The recently inaugurated Toundra Greenhouse in SaintFélicien, Que., is one of the most-productive greenhouses in the country, powered by heat and CO2 piped in from Resolute Forest Products’ nearby pulp mill. The $38-million project involves stateof-the-art technology to grow 360 cucumbers per square metre.

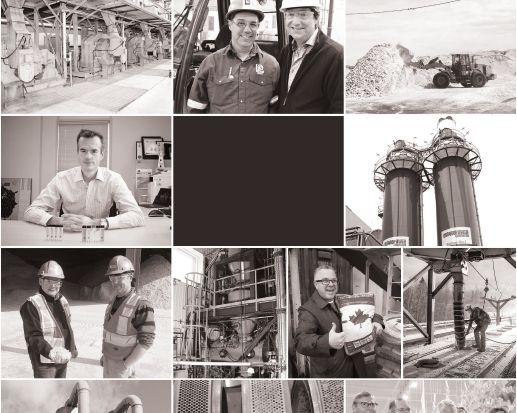

Canadian Biomass magazine, the country’s premiere information source providing comprehensive coverage of the emerging Canadian biomass, bioenergy and bio-products markets, celebrates 10 years of print.

Every year, millions of tons of industrial waste are turned into millions of dollars of reusable materials. CPM and Di Più Systems help make that happen.

We’ve joined forces to bring you the world’s best mechanical and hydraulic briquetting technology.

Together, we’re taking the fossil out of fuel.

The biomass industry has weathered many broadsides to its reputation from environmentalists, unfriendly industry associations and negative news stories. Every few issues Canadian Biomass editors remind readers to counter the spread of misinformation as it happens.

Hager’s November/December 2009 editorial chided the biomass industry’s lack of public education. “It’s time to brush up this image of biomass if it is to remain a viable renewable energy option,” she states. Less than a year later, in mid-2010, Hagar reports in the July/August editorial that at least seven U.S. biomass power plants were scrapped due to public opposition of “dirty plants”. Education and communication continue to be stumbling blocks, she said.

Environmentalists’ PR campaigns rely on language that lead readers to specific conclusions, Jamieson explained in his November/December 2011 editorial. They espouse an all-or-nothing world view that doesn’t exist. Biomass is not a silver bullet, he said, but, once combined with other alternative energy sources, is on track to a better energy mix.

One way to counter misinformation is to tell Canada’s unique biomass sustainability story. Jamieson stated in the May/June 2013 editorial that Canadian biomass producers should be promoting their certifications, integrated fibre supply and low carbon footprint. “The industry must be able to quantify and effectively communicate these key factors so that everyone along the supply chain understands the Canadian biomass advantage,” he wrote.

In early 2017 U.K. think tank Chatham House published a report questioning government decisions to treat biomass as carbon-neutral. Biomass experts were rightfully concerned about the impact of such a report and were quick to go on the offensive. Andrew Snook shared compelling evidence against the report in the March/April 2017 editorial, and wrote: “I never thought I would be using the term ‘alternative facts’ in an editorial. How times have changed.”

Times have indeed changed and biomass producers must be up to speed with the reality of “Twiplomacy”, or Twitter diplomacy. While the term is typically used to refer to the Donald-Trump effect on international diplomacy, it seems an appropriate way to describe the need to

tackle misinformation as is originates on non-traditional media sources.

Public support is dealt a crippling blow when safety is compromised at a biomass project. This is most keenly felt in the wood pellet industry.

In the May/June 2010 editorial, Hager noted that in one month three wood dustrelated fires were reported. Her advice at the time holds true today. “Best practices include: housekeeping standards to minimize dust build-up; functioning fire safety and prevention measures/systems; self-inspection programs and record keeping; preventive maintenance programs; third-party auditing and certification of fire/ explosion risk management systems; and industry-wide monitoring, evaluation and annual program revision,” she wrote.

Tennpenny reported in the September/ October 2012 editorial that new research from Staffan Melin with the Wood Pellet Association of Canada explains a dust management method specific to wood pellets that can eliminate much of the risk with minimal costs. “In pellet manufacturing plants, cleaning and monitoring dust levels hasn’t always received the attention it deserves,” he wrote.

A close call at Pacific BioEnergy in August 2017 was a keen reminder for pellet producers to keep up to date with the latest research in fire safety. Fire crews injected nitrogen gas into a smouldering pellet silo to successfully extinguish the fire. It was the first successful extinguishment at a pellet plant in Canada, and hopefully the beginning of a new trend of well-researched corrective measures by firefighters and pellet plant staff.

As these four themes continue to crop up in our pages, companies should pay attention to new solutions to and new ways to suceed.

Editors, unfortunately, aren’t fortunetellers, but we do have a unique insight into the industry courtesy of the job, which takes us to many conferences and gives us access to the inner workings of companies. So while I can’t predict the next 10 years of biomass growth in Canada, I expect the industry to flourish as companies grow older and wiser, firmly rooting in the economic landscape.

One success at a time we are telling the story of the rise of the Canadian bioeconomy.

JIM GREY Chair of Renewable Industries Canada and CEO of IGPC Ethanol Inc

The story of the Canadian biofuels sector over the last decade is remarkable. Our industry has existed in Canada for about 30 years, but it was the Federal Renewable Fuels Strategy in 2006 that sparked our growth into a billion-dollar industry providing home-grown, clean-burning fuels to Canadians.

Today, the contributions of the biofuels sector are focused primarily on achieving substantial reductions in greenhouse gas (GHG) emissions in the transportation sector. However, 10 years ago, biofuels were discussed primarily in the context of agriculture. From the beginning, the industry recognized its role within Canada’s circular economy, directly supporting the agricultural sector by providing a stable market, while continually creating environmentally sustainable economic growth in rural communities right across the country.

This confidence and commitment from the agricultural community has built an industry in Canada that generates $3.5 billion worth of annual economic activity and has created over 14,000 jobs. Ethanol production for 2016 was 1.7 billion litres, with an estimated sales value of $1.1 billion.

As we enter our second decade as an established industry the future looks bright. Today’s governments are developing a suite of policy mechanisms that will directly impact the renewable fuels sector for the next decade and beyond.

In December, the Canadian federal government announced the details of its national Clean Fuel Standard (CFS), which aims to eliminate 30 megatonnes of GHG emissions annually by 2030. This targeted reduction will begin with liquid fuels, creating a significant opportunity for biofuels.

The federal CFS also comes at a time when Canada’s provinces have been demonstrating impressive leadership on driving increased use of biofuels. Canada’s five most populous provinces — Ontario, Quebec, British Columbia, Alberta and Manitoba — have embraced or are in the midst of exploring progressive approaches to promoting enhanced use of clean fuels either through increasing biofuel mandates or new low carbon fuel policies. Ontario, Canada’s largest province, will increase ethanol content in gasoline from five to 10 per cent.

There is still work to be done, but with a combination of a solid foundation, strong domestic industry and ambitious GHG reduction targets being planned across the country, Canada’s biofuels industry can expect to continue delivering good news for years to come.

Original founder of PFI Pellet Flame, and co-founder of FutureMetrics

It has only been about 25 years since the Canadian pellet industry started. But its early days set the foundation for today’s global leadership.

The early to mid-1990s saw the establishment of B.C.’s early wood pellet producers. They started in response to the fledging demand for residential heating pellets in the Pacific Northwest; primarily in the Seattle region. These early entrepreneurs included the wood pellet pioneering companies that still exist today: PFI Pellet Flame (now known as Pacific BioEnergy Corporation), Pinnacle Pellet (Pinnacle Renewable Energy), and Princeton Co-Gen. Soon to follow was Armstrong Pellet.

In Eastern Canada, also during the 1990s, early producers like Energex, Lauzon and Shaw Resources established and began production to meet the Northeast U.S.’s developing residential heating market.

1996 saw the formalization of the first wood pellet association in Canada, organized by the original four wood pellet producers in B.C.: PFI Pellet Flame (I was the original association director), Pinnacle Pellet (Jim and Rob Swaan), Princeton Co-Gen (Doug*, Dean, and Gary Johnston), and Armstrong Pellets (Roger Mushaluk). The BC Wood Pellet Fuel Manufactures Association became the Wood Pellet Association of Canada (WPAC) in 2006. WPAC, under the leadership of executive director Gordon Murray, has become an influential institution and a champion of for the Canadian and global wood pellet industry.

It has been an amazing 20 plus years since the Canadian pellet industry’s early days. Canada’s wood pellet producers have become world leaders in production excellence, safety, and shipping standards. Canada continues to be globally respected for the sustainable management of its forest resources. In 2018 Canada’s wood pellet exports are expected to exceed 2.5 million tonnes; and significant growth in the industry is possible as market demand grows. Growth in the Canadian pellet industry is always bound by the constraint of maintaining perpetually renewing forest resources.

Industrial wood pellet markets will continue to grow. The world is still heavily reliant on coal, but the effects of climate change are becoming increasingly “in-your-face”. As the next decade unfolds, the use of sustainably produced pellet fuel to replace coal will spread beyond the current markets. Canada started the pellet export industry and Canada will continue to be a world leader in an industry that is an important part of the solution for a low-carbon future.

The next 25 years will be an exciting time for this industry and I am proud to have been one of the pioneers that set the stage.

JORDAN SOLOMON President and CEO of Ecostrat Inc.

Many people believe that the next 10 years will bring step changes in bio-technologies. I don’t disagree, but I believe that one of the most undervalued and important developments that will take place in the next 10 years will be the creation of de-risking and credit-enhancing mechanisms for bioeconomy projects.

These advances will be accretive and immediately transferable across the full spectrum of the bio-based industries; the benefits will impact advanced biofuels, bioenergy, bio-based heat and power, pellet production and bio-products among others.

When bio-projects choose to site in Canada, the Canadian economy enjoys a wide range of benefits. Recognizing this, in the past 10 years the federal government has taken meaningful steps towards its goal of promoting the bioeconomy in Canada. However, there have been few, if any, initiatives that address the vital issue of biomass supply chain risk in a way that allows capital to flow easier, faster and less expensively to the wide range of bioprojects. This is about to change.

The next 10 years will show a more nuanced approach by governments. One of the biggest barriers that is going to be eliminated in the next 10 years is inflated perceptions of biomass supply chain risk on the part of capital markets.

A key challenge to the rate of growth of the bio-industry is that risks associated with biomass supply chains are not well understood. At present there are no established protocols, standards, or recognized industry best practices that developers, investors, commercial lenders, insurance companies and rating agencies can utilize and rely upon to empirically demonstrate biomass supply chain risk. Debt and capital markets are independently using inconsistent approaches and evaluation criteria, leading to unreliable assessments of bio-project risks. Put simply they are confused about the quanta of risk. This results in significant project financing barriers for bio-projects and in millions of dollars of “financial-drag” on the projects that are eventually built.

A solution to this problem lies in creating an established set of recognized standards that creates a validated approach when attempting to price feedstock risk. The U.S. is already moving ahead. Two years ago the U.S. Department of Energy Bioenergy Technologies Office funded the development of new U.S. National Standards for Biomass Supply Chain Risk (BSCR). Development of the BSCR is being done by Idaho National Laboratory and Ecostrat.

In the next few years there will be independent body that will issue validated, industry-accepted certifications of the risk of biomass projects’ supply chains. Bio-projects will be able to empirically demonstrate the risk of feedstock supply chains to the capital markets though an accepted rating system. These ratings will assure the capital markets that the best available practices have been used and enable more accurate pricing of biomass supply chain risk.

Ultimately, by enabling the capital markets to more accurately quantify and price supply chain risk, we can drive 150-350 basis points out of the current debt burden worn by bio-projects, accelerate existing bio-project development and give a huge boost to our bioeconomy.

Senior vice-president, government affairs and communications at Enerkem

Traditionally, Canada has been a leader in biomass via its traditional natural resources, but was not necessarily at the forefront of the bioeconomy. This is partly due to the country not having had a national policy framework to foster innovation and facilitate the transformation. The first major federal policy enabling a real shift toward the bioeconomy that comes to mind is the Renewable Fuels Standard in 2010, imposing a binding share of renewable energy in the transportation sector, as well as the creation of the cleantech funding agency Sustainable Development Technology Canada. At the same time, the U.S. was already well engaged in developing the bioeconomy and was putting in place national strategies, regulations and policies. A key driver of this movement was the release of the ‘1 billion tons study’ published by the U.S. Department of Energy and Department of Agriculture in 2005, which confirmed the nation’s capacity to produce a billion dry tons of biomass resources (composed of agricultural, forestry, waste, and algal materials) annually to produce enough biofuel, biopower, and bioproducts to displace 30 per cent of 2005 U.S. petroleum consumption without impacting other vital U.S. farm and forest products, such as food, feed, and fibre crops.

Until recently, most of the Canadian policies, programs and initiatives stimulating the development of a bioeconomy were led by provinces, regions and groups like the Forest Products Association of Canada. Regional bioeconomy clusters were developed, including, for example, in Sarnia, Ont., with its biobased chemistry cluster; in Quebec where several biomass and biofuels projects were being developed; and in B.C. with its forest bio-products cluster.

A major shift occurred in the last two to three years when the new federal government presented its vision to diversify the economy and address climate change where a clean environment and a strong economy go hand in hand. The objective is to build a clean growth economy in Canada. The bioeconomy is the means to achieve lower carbon growth where innovation is a key enabler. In these last few years, many federal policies and programs were developed and implemented. In the last budget alone, the federal government proposed to increase financing support by nearly $1.4 billion to help bolster and grow Canada’s clean technology firms.

Developing the bioeconomy requires that we change our attitude toward biomass production for food, bioenergy and other purposes and develop a more holistic approach as we evolve from single end-use approach to integrated production systems. Biorefineries producing biofuels, biochemicals and energy are a great example.

The Paris Agreement spurred the shift toward a bioeconomy globally by creating the commitment and building the momentum for the global transition to a low carbon economy. Over the next 10 years, the transition to a bioeconomy in Canada will enable the diversification of our exports and ensure sustainable prosperity. It will also play a role in achieving the UN Sustainable Development Goals. This will advance climate goals, sustainable energy, food security and better land use. We can all agree that such achievements will benefit not only Canada, but the world over.

Biorefinery

By Lesley Allan

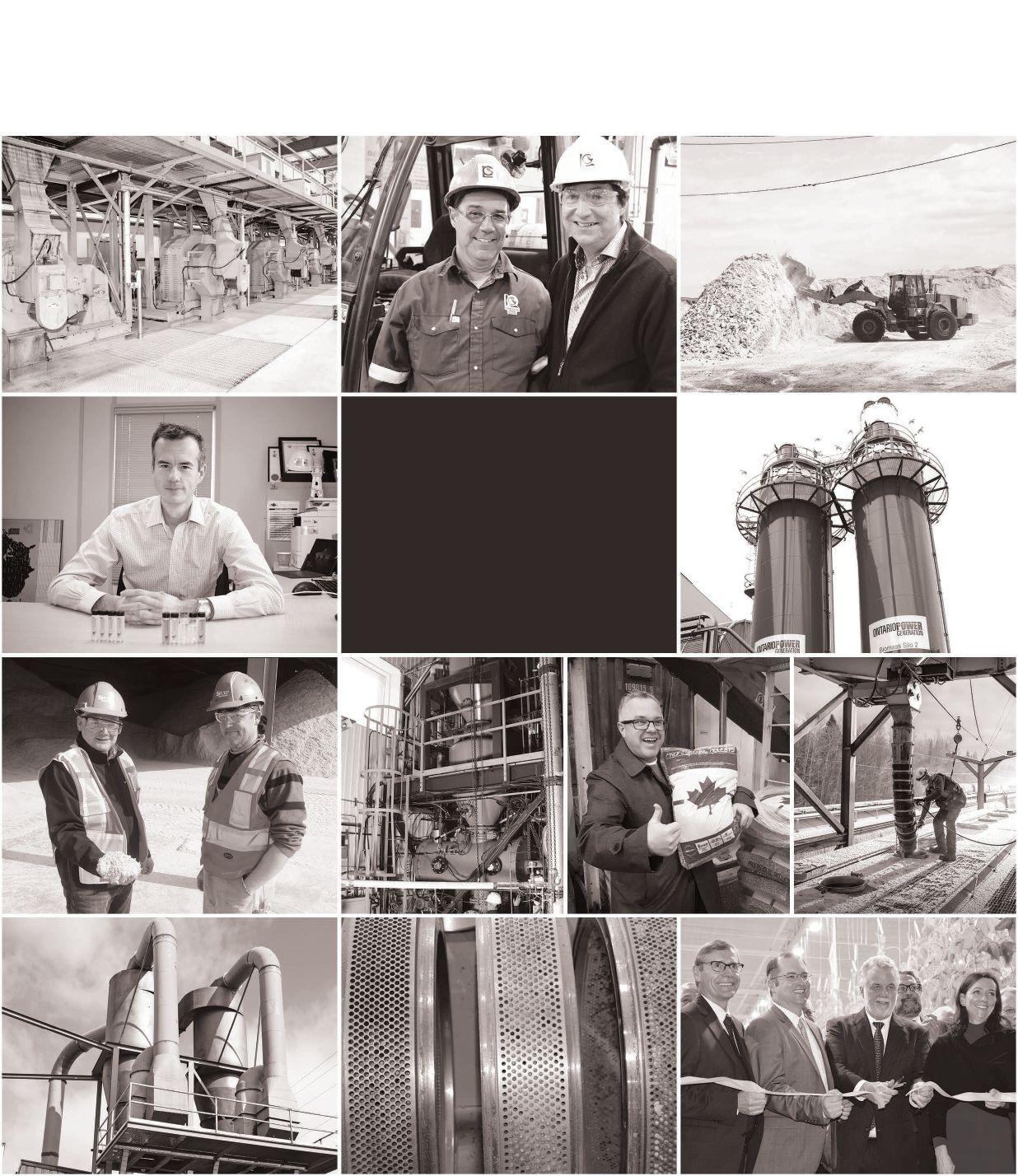

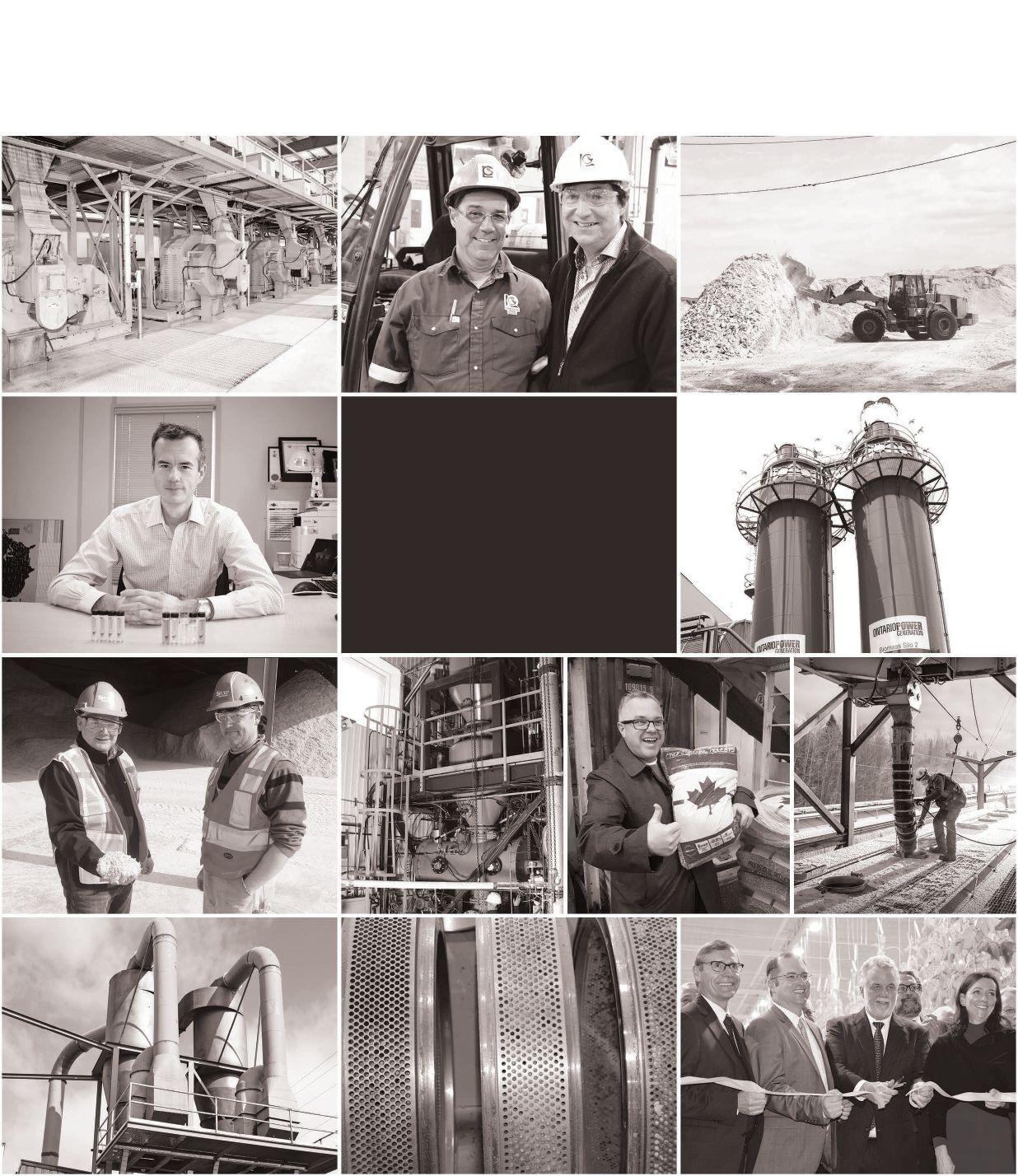

Spring 2018 saw a new milestone come to life for Pinnacle Renewable Energy Inc. as it opened a new facility in central Alberta, a first for the B.C.-based company that produces industrial wood pellets.

The facility, located roughly 100 kilometres west of Edmonton, sits near the community of Entwistle, a small hamlet in Parkland County at the Yellowhead Highway’s intersection with Highway 22/Highway 16A.

This is the first time the 29-year-old company has expanded its production outside of British Columbia, where it currently operates six production plants, has a seventh under construction (Smithers), and uses two shipping terminals, one of which is fully owned

and operated by Pinnacle (Westview in Prince Rupert).

According to Scott Bax, Pinnacle’s senior vice-president of operations, the new facility fits perfectly with the needs of the company and takes advantage of the province’s healthy forest industry.

“We saw a surplus of sawmill residuals in the province, and specifically in this area,” he explains of the decision to move into Alberta. “Where you see a surplus of residuals you often find stockpiles because sawmills don’t have a consistent home to get rid of them.

“So basically, we saw an opportunity,” adds Bax.

One of Pinnacle’s largest production facilities, the new plant is strategically located on a CN railway for the efficient

transportation of the product, as well as close to key fibre suppliers, such as Weyerhaeuser and West Fraser.

Although the plant initially started off utilizing only dry-shavings during the first quarter of 2018, by the time the facility reaches capacity it will also be making use of sawdust and hog to produce their six-millimetre white pellets.

The new facility, currently operating at roughly 50 per cent capacity, is expected to produce more than 180,000 metric tonnes this year.

Once at full capacity it will produce 400,000 metric tonnes, which the company expects to see by the second quarter of 2019.

A $92-million investment by Pinnacle, the new greenfield production facility features many of the same standard pieces of equipment found in other Pinnacle plants, such as the Grizzly Mill Hog by Brunette Machinery, 10 Andritz LM26 II pelletizing machines, four hammer mills by Bliss Industrial LLC, as well as rail bins for storage.

As with any new facility, Pinnacle made sure to take advantage of the opportunity to introduce new features to the Entwistle plant, some of which are predominant and striking for the 14,000 square-foot facility.

“One thing that really stands out is the storage silo, it’s by far the largest of all our plants,” Bax says. “I’d say significantly larger at 12,000 metric tonnes, our other biggest silo would be around 3,000.”

According to Bax, this new feature helps to alleviate the number of trips needed to deliver product to Pinnacle’s shipping port, something that’s important for the company as the distance between production and export grows as they develop further east.

“The concept here is that as opposed to regular CN service, where they’re taking 15 to 20 cars at a time, we can load an entire string of 90 to 100 cars and CN takes them all directly to Prince Rupert where they get unloaded and then immediately brought back,” he explains.

By doing this Bax says the company is able to save additional funds when it comes to shipping, something the company already works hard to do as train service

is mandatory at all of its facilities and is currently the only way they ship their product to port.

These cost-saving initiatives also brought about another big change for the facility as it reduced the number of dryers in operation and opted to go with a much larger unit.

“We only have a single dryer here,” Bax says of the system supplied by TSI. “We chose not to go with two smaller ones, like you would see in our other plants. We’ve had such great reliability out of our dryers so when we looked at the best way to allocate our capital resources we saw that our plants are rarely ever down because of dryer issues so we were confident that we could make that decision.”

The dryer system is also the first for Pinnacle to use a step grate furnace. Bax says every aspect of the facility’s construction was carefully planned to ensure it was

as cost effective and energy efficient as possible.

“We put a fair amount of time and energy into designing our plants,” Bax says, explaining that every design helps to make new facilities better, but can also help to find ways to improve those built previously. Nowhere is that more important than when it comes to safety, he says.

“One of the new things that we’ve done is include flameless vents to a number of our conveyors after the dryer. They’re made by a company called CV Technology and basically, should there ever be a deflagration, the vents prevent it from getting bigger and processes the energy until just some residual smoke comes out,” he explains.

“It’s great technology and something that we’re really proud of having as part of our process,” Bax says, adding that the company has already begun retrofitting all its other facilities with the new tech.

Dedicated to the safety of its facility and its staff, Pinnacle goes far beyond everyday safety practices and features to ensure their plants operate smoothly.

From preventative maintenance inspections every eight to 12 hours, to specialized training, regular shutdowns for maintenance, as well as open and honest dialogue between all levels of staff, Pinnacle built its Entwistle plant around Owning Safety — a program that not only educates but also creates a culture within the facility.

“We’ve had phenomenal buy-in from employees,” Bax says, explaining how the company has seen their safety initiative transform its workplace.

“We’ve had a significant reduction in our lost time, accident and medical instances rates, but I think in general we’ve improved

our retention,” he says. “So we’re losing fewer employees and our plants run better because there are fewer upset conditions. So it’s had a number of really phenomenal ripple effects that really goes to show that the term ‘safety pays’ is really true.”

With a full-time staff of 40 people, as well as up to 35 contractors that assist with maintenance, this same safety-to-success sentiment can be found on site at Entwistle and demonstrates how the program has really helped the company grow.

“If you define success by being safe then at the end of the day we can say ‘yes we are very successful’ and the rest will come,” says Marcus Ziesman, plant manager of the Entwistle facility. “If you establish that mindset and do it safely first it will automatically lead to performance improvements.

“That’s exactly what we’ve seen happen, a moderate up curve over the last month and a half, really just ramping up very nicely,” Ziesman says. “At the end of the day people understand their place, the risks, and the hazards, but also know the exact systems in

place and are trained and competent. That’s how we define success here.”

Introduced in 2015, Owning Safety was the answer to a question that many pellet plants had surrounding occupational hazards. The internally created program forced Pinnacle to pinpoint its deficiencies and make the necessary changes to improve their safety record, but also their day-to-day operations.

The benefit of this plan is perfectly demonstrated in 2018 alone with the company already seeing great success with its new production facility in Entwistle, as well as the redevelopment of a particleboard plant in Smithers, and initial public offering of its parent company, Pinnacle Renewable Holdings Inc., on the Toronto Stock Exchange.

One of the world’s top pellet manufacturers, Pinnacle Renewable Energy Inc. produces roughly 1.5 million metric tonnes of product a year and has multiple long-term take-or-pay contracts with utilities in the U.K., Europe and Asia.

In Canada, however, the company

Let CV Technology offer peace of mind to

currently only sells to domestic consumers, as the industrial market is nowhere near as strong as it is throughout Europe and Asia. According to Bax, who says the Entwistle plant was designed to allow for future expansion, the company hopes that some of that future growth will be due to an upswing in the Canadian market.

“We look forward to the day that a utility wants to reduce its carbon footprint, burn wood pellets and catch up with some of the other countries that are definitely more environmentally progressive,” he says. “The opportunities here would mean we don’t have to ship the product around the world to create that benefit that wood pellets can create from a power generation perspective.”

“We try to be vocal in the provinces of Alberta, B.C., and across Canada on seeing pellets as part of that sustainable energy solution for society’s needs,” Bax says.

Currently, it is estimated that Pinnacle’s product contributes more than one per cent of the total electricity produced in the U.K. •

Like all Kadant Carmanah chippers, the 96-inch Whole Log Chipper is designed to produce high quality chips with a focus on machine longevity and simplified maintenance. The shear pin protected anvil reduces operational costs by limiting damage caused by tramp metal and rock hits. The heavy-duty base is constructed from thick steel sections to minimize flexing under heavy load and permit close knife-to-anvil clearances.

Kadant Carmanah’s 96-inch Whole Log Chipper can easily be adapted to produce either standard pulp chips or micro-chips as small as 1/4 inch for use in the biomass/pellet industry.

www.kadant.com

The most productive portable drum chipper in the industry has become even better. The Morbark 50/48X Whole Tree Drum Chipper was updated to a similar design layout as Morbark’s other industry-leading industrial drum chippers with a sloped infeed, reverse-pivot top feed wheel, bottom feedwheel, externally adjustable anvil and Advantage 3 drum assembly that can come as 10-knives for fuel chip or 20-knives for micro-chip applications. Making it easier for customers to perform routine daily maintenance and increasing performance and production guided the new improvements, which include large work platforms, an enhanced hydraulic system and an enlarged top feedwheel.

www.morbark.com

Acrowood has long been known as a chipper manufacturer. From 42-inch diameter disc Rechippers to 175-inch diameter whole log chippers, Acrowood and our predecessors Black Clawson and Sumner Iron Works have supplied chippers and forest products equipment for over 100 years. Since the 1960’s, our slant disc chippers have seen wide spread acceptance and use in waste wood chipping applications. In recent years, there has been increasing utilization of smaller diameter stems. The Acrowood Slant Disc has also proven a great choice in for chipping these small diameter stems. Delivering high quality chips for both pulp mill and pellet mill. www.acrowood.com

The Andritz BioCrusher BSX is designed for high capacity crushing of bark and breakage from the log debarking process, including difficult-to-handle wood species like eucalyptus and acacia. These wood species, as well as the easier ones like pine, spruce, and birch are crushed into uniform, optimized particle sizes. The BioCrusher BSX spreads the material efficiently, thus utilizing its full width for the crushing action. This results in efficient plug-free operation, with more even wear and tear on the crusher knives, resulting in higher availability lower cost of maintenance. www.andritz.com

USNR’s Wastewood Chipper is a powerhouse that comes in four sizes and three configurations, handling logs from 11- to 22-inch diameters. Basic horizontal feeding needs no special installation layout, while gravity feeding handles high volumes. The J-spout design has a higher capacity typically fed by a vibrating conveyor. All models accommodate bottom, rear, and top discharge. The helical knives of USNR’s Norman Chipper slice uniform chips instead of scraping them from the stock, thus eliminating sawdust, slivers, and oversize split ends. Handles logs from 8.25- to 22-inch diameters.

www.usnr.com

The CBI Magnum Force 6800CT Horizontal Grinder has been engineered to surpass ever y horizontal grinder that came before it. Improving on the 6800BT’s revolutionary design, the 6800CT has a 15 per cent larger screening area, wrapping more than 190 degrees around the rotor, allowing production rates to surge beyond 200 tons an hour. Supported by a larger shaft and bearings and an optional 1,200-hp CAT C32, the engine powers the forged drum rotor through the toughest materials. The design of CBI’s offset helix rotor minimizes energy loss from each strike and distributes material evenly across the 24 hammers, requiring less power while out producing the competition. www.cbi-inc.com

Stringer Industries manufacturers its own line of waste wood chippers and waste-reduction hogs that are designed and built to improve a mill’s bottom line. The Stringer chippers are available in a 48-, 60-, and 70-inch disc. Not only do they have a maximized throat size to handle large slabs, but they also have a cutting action that utilizes the entire knife. The Stringer chipper comes standard with the following features: Easy-Change Clamping System that allows the knives to be changed by one employee; NCK Holders that eliminate the need for counter-knives; Helical Wear Plates that draw wood up the side of the spout. The Stringer hogs are built for dependability and ease of maintenance. The hammers are available with replaceable, carbide-welded tips. Sizes range from a 12-inch opening to a 54inch opening.

www.stringerind.com

W.H.O. Manufacturing Company designed and patented the first tub grinder in 1947. The company is celebrating its 71st year of producing these grinders for different markets over these many years. W.H.O. Mfg.CO.’s wood grinder units are the most efficient processors of waste wood in cost of cubic yards processed verses cost of operation. Over the years, W.H.O. Mfg.CO. has constantly improved its grinders with focus on increased production and durability with ease of maintenance. With over 70 years of experience, no other manufacturer has the knowledge in designing and producing tub grinders for processing waste wood. www.who-mfg.com

HogZilla Monster grinders are built extra-heavy duty in sizes ranging from midsized to massive and can be configured as stationary, fifth-wheel portable, track mounted, or with a mounted grapple. Twenty standard models with numerous options are available, providing the most durable, most reliable and efficient, diesel or electric powered, high capacity tub or horizontal grinder in the industry with proven production. HogZilla grinders are for waste reduction, recycling, land clearing, construction demolition or any other tough grinding application. From stumps and logs to railroad ties or tires, HogZilla can handle the toughest jobs and can provide the highest production rates.

www.hogzilla.com

The Brunette Whole-Log Micro-Chipper is a horizontal-feed chipper that can process up to a 24-inch diameter log and produce micro-chips consistent in thickness and size. A powered feedworks controls the feed of single logs, or multiple stems and branches. With a 40-inch wide throat it can process a variety of materials with ease. It features a hard surfaced anvil with a break-away support frame for protection from foreign materials. The rear access platform makes knife maintenance simple and safe. The chipper includes a common sub-frame for a single lift installation. Take control of your chip supply with the Brunette Whole-Log Micro-Chipper. www.brunettemc.com

productive industrial grinders available. At the cornerstone of the industry, our innovative, state-of-the-art grinders ensure to be the most cost effective and profitable for our customers. Diamond Z offers a broad range of tub, horizontal, and solid waste grinder models designed to suit any application. From composting to construction and demolition, land clearing to tire disposal, municipal solid waste to asphalt shingle grinding, nothing out grinds the Diamond Z. www.diamondz.com

As a pioneer in the wood grinding industry, Diamond Z has established a global reputation for manufacturing the highest quality, most durable, easy to service, and most

The Rotochopper B-66 is packed with exclusive features like the patented screen change system, optional KeyKnife chipper package and track and dolly system to make it a highly versatile horizontal grinder. Our patented screen change system

lets you change screens at ground level with no specialized equipment required. The KeyKnife chipper package makes it quick and easy to switch from grinding to chipping by swapping out the grinder tooth mounts with knife mounts. Our Track & Dolly system switches from road travel on tires to site navigation on tracks in minutes. The Rotochopper B-66 simplifies high-volume grinding with exclusive features designed to maximize uptime and end product control.

www.rotochopper.com

Vermeer Canada has 10 full-service locations providing equipment solutions geared towards the forestry industry that includes: horizontal and tub grinders, forestry mulcher, whole tree chippers, stump cutters, skid steers and more while also providing product support, parts and inshop and mobile service. Vermeer provides equipment solutions customers need to turn wood waste into a useful product. The

new Vermeer BC1500 Gas Brush Chipper is powered by a PSI 5.7L 89-HP gas engine. The chipper has an infeed 15 by 20 inches, dual horizontal rollers, Vermeer SmartFeed System, and an optional winch. www.vermeercanada.com

WSM’s Biomass

Super Shredder delivers reduced fibre costs, simplified fibre preparation, and reduced operating costs by processing of a wide range of incoming green feedstock for improved drying and sizing for pellet manufacturing. The massive Super Shredder supplies high capacity and high speed milling of green fibre at rates from 10 to 75 tons per hour (tph). Maintenance friendly features include modular and adjustable tooling with either rigid or swing hammers with replaceable inserts; large screen area with modular sizing screens to allow adjustment to product sizing; and heavy duty housing with interior wear liners and pivoting case access for long

life and ease of maintenance. www.westsalem.com

Converting the many kinds of waste products in sawmills into a saleable product can be a chip quality headache. The BRUKS Drum Chipper is the best solution, proven in thousands of installations, worldwide. From pulp chips to microchips, playground chips and more, the BRUKS Drum Chipper can be configured to produce the best possible product from most any feedstock. www.bruks-siwertell.com

and specification. Add a wide variety of available options such as belt, chain, vibrating in-feed and out-feed conveyors, metal, protection, product screening, and you’ve got the flexibility to customize the perfect wood grinding system.

www.wastewoodhogs.com

Powered by a Tier II or Tier IV Caterpillar

Rawlings delivers wood grinding equipment with a reputation for durability, performance and reliability. Since 1976 Rawlings Manufacturing Inc. has been manufacturing and installing custom wood grinding systems. The team designs each system specific to the customers operation

C27 1,050 hp engine, or an optional Tier II or Tier IV 1125 hp C32 engine, the 5700D Horizontal Grinder provides the highest power to weight ratio of any Peterson grinder. At 82,000 pounds, the 5700D is designed for operations requiring high production and frequent moves between jobs. With a feed opening of 60 x 40 inches combined with Peterson’s high lift feed roll, the 5700D can readily reduce a wide range of material including stumps. Peterson’s threestage grinding process with an up turning rotor and large grate area enables the 5700D to produce materials to exact specifications. www.petersoncorp.com

the

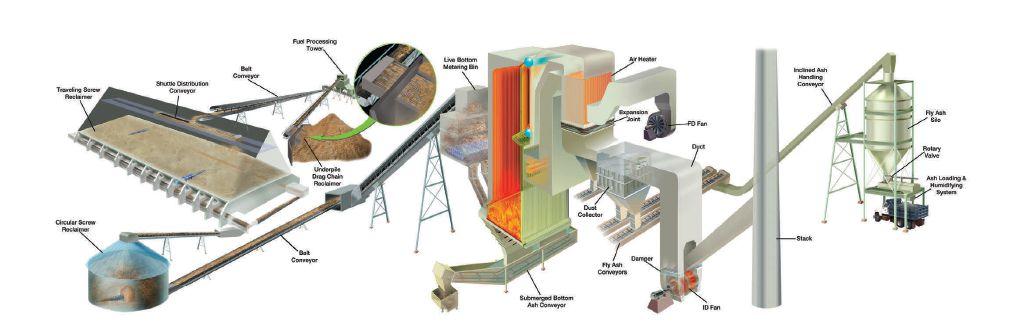

The following information has been compiled to provide readers interested in developing or updating a wood pellet manufacturing facility with a reference tool of the major manufacturers and service providers for this industry in Canada. From fibre to pellet, the listing is a comprehensive source for equipment involved in the

pelletizing process.

The Canadian Biomass Pellet Gear Buyers Guide is organized into two sections. The first section is an alphabetical listing of companies that provide the relevant products or services for each of the following categories: dryers, pneumatic conveying, hammermills, pellet mills, screens and coolers, fire/spark

detection and suppression technology, bagging and palletizing, dies and rolls, quality control equipment and services, building contractors and engineering firms, Canadian ports for pellet exports, truck dumpers and moisture analyzers. The second section is an alphabetical listing of all the companies, with contact information for each. •

Altentech

Amandus Kahl

Andritz

Anhydro Baker-Rullman

Bruks Siwertell

Büttner

Certified Labs

Dieffenbacher

Earth Care Products

Energy Unlimited

GEA CANADA

Jiansu Yongli

Kesco

Münch-Edelstahl

Muyang

Player Design

Saimatec Engineering

Siempelkamp

Silvana Import Trading

Solagen

Stela

Swiss Combi

Thompson

TSI

Uzelac - Duske

Drying Systems

Allied Blower

Amandus Kahl

Baum Pneumatics

Certified Labs

Clarke’s Industries

Concept-Air

Fox Venturi

Jeffrey Rader - Terra Source

Coperion K-Tron

Kesco

Koger Air Corporation

Rodrigue Métal

Silvana Import Trading

Walinga

HAMMERMILLS

Amandus Kahl

Andritz

Bliss Industries

Bruks Siwertell

Brunette Industries

Buskirk Engineering

Certified Labs

CPM Global Biomass Group

Dieffenbacher

Gemco Energy

Jeffrey Rader/ Pennsylvania Crusher

Kesco

La Meccanica

Münch-Edelstahl

Schutte-Buffalo Hammermill

Silvana Import Trading

West Salem

Amandus Kahl

Andritz

Astec

Bliss Industries

Buskirk Engineering

Certified Labs

CPM Global Biomass Group

Dieffenbacher

La Meccanica

Münch-Edelstahl

Pelleting Technology Nederland

Salmatec GmbH

Silvana Import Trading

SCREENS & COOLERS

Amandus Kahl

Andritz

Baum Pneumatics

Bliss Industries

BM&M Screening Solutions

Bruks Siwertell

Brunette Industries

Buskirk Engineering

Certified Labs

CPM Global Biomass Group

Dieffenbacher

Jeffrey Rader - Terra Source

Kesco

La Meccanica

Law-Marot

Münch-Edelstahl

Pelleting Technology Nederland

Silvana Import Trading

West Salem

FIRE/SPARK DETECTION & SUPPRESSION

Allied Blower

Amandus Kahl

Clarke’s Industries

Concept-Air

CV Technology

F.E. Moran

Fenwal-IEP Technologies

Fike

Firefly

Flamex

Grecon

Kesco

Rodrigue Métal

Silvana Import Trading

BAGGING & PALLETIZING

Amandus Kahl

Balcan

Bulldog Bag

Certified Labs

Creative Packaging Inc.

Hamer

Möllers North America Inc.

Polypro Solutions

Premier Tech

Primary Packaging

Rethceif Packaging

Silvana Import Trading

Trinity Packaging

DIES & ROLLS

Amandus Kahl

Certified Labs

CPM Global Biomass Group

Dorssers

La Meccanica

Münch-Edelstahl

Silvana Import Trading

QUALITY CONTROL EQUIPMENT & SERVICES

Amandus Kahl

Biomass Energy Lab

Domosystem

Electromatic Equipment

Grecon

Kesco

Münch-Edelstahl

Twin Ports Testing

Silvana Import Trading

ENGINEERING & CONSTRUCTION SERVICES

Andritz

Buskirk Engineering

DelTech

Dieffenbacher North America, Inc

Earth Care Products

Energy Unlimited

Kesco

Process and Storage Solutions

Solagen

Stolberg Engineering Ltd.

TS Manufacturing

PORTS

Belledune

Halifax

Montreal

Prince Rupert

TRUCK DUMPERS

Airoflex

American International TN, LLC.

BID Canada Ltd.

Bruks Siwertell

Phelps Industries

Wolf Material Handling Systems

MOISTURE ANALYZERS

MoistTech

TEWS of America Corp.

Doescher Microwave System GmbH

GreCon, Inc.

AIROFLEX EQUIPMENT www.airoflex.com 563-264-8066

ALLIED BLOWER www.alliedblower.com 604-930-7000

ALTENTECH BIOVERTIDRYERS www.altentech.com 604-568-9848

AMANDUS KAHL GMBH & CO. KG www.akahl.de 905-778-0073 (Sarj Equipment, Canada)

AMERICAN INTERNATIONAL TN, LLC. www.woodchiptipper.com 7316972423

ANDRITZ GROUP www.andritz.com 457-216-0300

ANHYDRO INC. (SPX FLOW TECHNOLOGY) www.spx.com/en anhydro/ 704-752-4400

ASTEC www.astecinc.com 423-867-4210

BAKER-RULLMAN

www.baker-rullman.com 920-261-8107

BALCAN www.balcan.com 1-877-422-5226

BAUM PNEUMATICS INC. www.baumpneumatics.com 604-945-4507

BID CANADA LTD. www.bidcanadaltd.com (506) 328-4381

BIOMASS ENERGY LAB www.biomassenergylab.com 218-461-2579

BLISS INDUSTRIES, LLC www.bliss-industries.com 580-765-7787

BM&M SCREENING SOLUTIONS www.bmandm.com 800-663-0323

BRUKS SIWERTELL

www.bruks-siwertell.com 770-849-0100

BRUNETTE INDUSTRIES LTD.

www.brunettemc.com 604-522-3977

BULLDOG BAG LTD.

www.bulldogbag.com 800-665-1944

BUSKIRK ENGINEERING www.buskirkeng.com 260-622-5550

BÜTTNER www.buettner-energy-dryer.com 704-522-0234

CERTIFIED LABS www.certifiedlabs.com 905-691-0492

CLARKE’S INDUSTRIES, INC. www.clarkes-ind.com 541-343-3395 CONCEPT-AIR www.concept-air.ca 866-644-0041

COPERION K-TRON www.coperion.com 785 8251611

CPM GLOBAL BIOMASS GROUP www.cpm.net 800-428-0846

CREATIVE PACKAGING INC. cp22243.tripod.com/baggingsystems 423-825-5311

CV TECHNOLOGY, INC. www.cvtechnology.com 561-694-9588

DELTECH www.deltech.ca 800-736-7733

DIEFFENBACHER NORTH AMERICA, INC www.dieffenbacher.de 519-979-6937

DOESCHER MICROWAVE SYSTEM GMBH www.moisturemeter.eu 510-420-1716

DOMOSYSTEM www.domosystem.fr +33(0)1 45 87 22 99

DORSSERS INC. www.dorssers.com 519-676-8113

EARTH CARE PRODUCTS, INC. www.ecpisystems.com 620-331-0090

ELECTROMATIC EQUIPMENT COMPANY INC. www.checkline.com 800-645-4330

ENERGY UNLIMITED INC. energyunlimitedinc.com 608-935-9119

F.E. MORAN SPECIAL HAZARD SYSTEMS

www.femoranshs.com 847-849-8720

FENWAL-IEP TECHNOLOGIES

www.ieptechnologies.com 855-793-8407

FIKE CORPORATION

www.fike.com 816-229-3405

FIREFLY AB www.firefly.se +46 (0)8 449 25 00

FLAMEX, INC.

www.sparkdetection.com 336-299-2933

FOX VENTURI

www.foxvalve.com 973-328-1011

GEA CANADA

www.gea.com 819-477-7444

GEMCO ENERGY

www.agicogroup.com 0086-372-5965148

GRECON, INC.

www.grecon-us.com 503-641-7731

HAMER LLC

www.hamerinc.com 763-231-0100

HANSENTEK

www.hansentek.com 905-607-5780

JEFFREY RADER – TERRA SOURCE www.terrasource.com 514-822-2660

KESCO, INC. www.kescosolutions.com 803-802-1718

KOGER AIR CORPORATION www.kogerair.com 800-368-2096

LA MECCANICA SRL DI REFFO www.lameccanica.it +39 049 941 9000

LAW-MAROT www.lawmarot.com 800-461-6276

MOISTTECH www.moisttech.com 941-351-7870

MÖLLERS NORTH AMERICA INC. www.mollersna.com 616-942-6504

MÜNCH-EDELSTAHL GMBH www.muench-edelstahl-gmbh.de 02103 58996

PELLETING TECHNOLOGY NETHERLANDS www.ptn.nl +31 (0)73 54 984 72

PHELPS INDUSTRIAL www.phelpsindustries.com 501-375-1141

PLAYER DESIGN, INC. www.playerdesign.net 207-764-6811

POLYPRO SOLUTIONS www.polyprosolutions.ca 514-730-2433

PORT METRO VANCOUVER www.portmetrovancouver.com 604-665-9000

PORT OF BELLEDUNE www.portofbelledune.ca 506-522-1200

PORT OF HALIFAX www.portofhalifax.ca 902-426-8222

PORT OF MONTREAL www.port-montreal.com 514-283-7011

PORT OF QUEBEC www.portquebec.ca 418-648-3640

PORT OF TROIS-RIVIÉRES www.porttr.com 819-78-2887

PORT SAGUENAY www.portsaguenay.ca 418-697-0250

PREMIER TECH CHRONOS www.ptchronos.com 418-868-8324

PRIMARY PACKAGING www.primarypackaging.com 800-774-2247

PRINCE RUPERT PORT AUTHORITY www.rupertport.com 250-627-8899

PROCESS AND STORAGE SOLUTIONS www.processandstorage.com 256-638-1838

RETHCEIF PACKAGING