Companies continue to wrestle with ongoing labour shortage challenges.

14 Q&A: Cutting the cap

What will be the impact of changes to Canada’s temporary foreign worker program?

16 A protective shell

Lafarge Canada’s Coldwater Quarry doing its part to preserve endangered turtle species.

18 Gaining traction

Mike Aurilio provides an overview of how other countries handle high RAP content mixtures.

20 Advancing pavement design

Members of CTAA workshop discuss the importance of pioneering cold recycling for sustainable pavement.

24 What to expect in 2025

We asked industry association leaders to look into their crystal ball and tell us what they see for the industry in 2025.

26 Plenty to see

Companies provide a sneak peek at what visitors can see at this year's World of Asphalt/AGG1.

JANUARY/FEBRUARY 2025

VOLUME 38, ISSUE 1

Reader

Since the election of United States president Donald Trump, I have spent quite a few hours thinking about Canada, her people and what it means to be Canadian.

Unfortunately, I’m no further ahead now than I was when I first started thinking on this.

I know what we’re not -- American.

We are less bombastic than our southern cousins. We are also far more concerned with how the world perceives us. We believe the international order should be based on fairness, diplomacy and co-operation. We hate to offend, which results in the classic Canadian politeness Americans too often mistake as weakness. We prefer compromise over fighting.

This awkward relationship with the United States has always defined us.

Former prime minister Pierre Trudeau was right when he stated, “living next to you is in some ways like sleeping next to an elephant.”

Well, the elephant is now awake.

The rise of President Trump, and his threats toward our sovereignty, has made clear we are well past time in having a conversation about how we can be more than a thin ribbon of communities stretching across a near 9,000-kilometre border with the world’s only superpower.

While attending the Alberta Sand and Gravel Conference in Edmonton last month, I had a wonderful conversation with my Uber driver about this country.

He emigrated from Italy to Canada nearly two decades ago, first living on the east coast before eventually making his way west to Alberta. In our 30-minute drive from the airport to the hotel, we covered quite a few topics. Housing, the weather, transportation, technology and Canada.

He is a proud Canadian and had many thoughts on this country. Something he mentioned stuck with me. He said the thing he loves about this nation is that people from all over the world can move here, start a new life, and be free of the disputes and resentments of their homeland. Canada offers a clean slate to new Canadians.

I don’t know how true that is. I want to believe it. People are complicated and trying to define an entire population with broad strokes is rife with problems. But I like that optimistic perspective.

In many ways, Canada is more of an idea than anything else. Yes, Canada has borders and institutions and a unique history, but the reality of our geography results in a tenuous connection. Canada’s white whale has always been how to link our three coasts. We have tried railroads and highways, airwaves and airplanes. We have used language and culture and sport. It’s not easy. Even today, provinces are often more aligned with the American states directly to their south than they are with each other.

That needs to change. We need to grow up.

We are going to have some difficult years ahead. But these challenges also provide us with an opportunity to chart a new course. Perhaps it’s now time to make true the 1904 pronouncement of former prime minister Sir Wilfred Laurier: “For the next 100 years, Canada shall be the star towards which all men who love progress and freedom shall come.”

I’d love to hear your thoughts on what it means to be Canadian. Reach out anytime, mlacey@annexbusinessmedia.com

Associate

Astec’s commitment to its customers extends beyond making the sale.

From the beginning, our service team has provided construction services for the equipment we build. Astec construction and relocation services for asphalt plants include plant and equipment installs, plant tear-downs and moves, silo repairs, and industrial piping and tank farm installs.

Efficient planning minimizes downtime, local regulations and permits also play a key role. Astec has an extensive history and experience with permitting and regulations. Safety, efficiency, and compliance are paramount throughout the process. Scan QR

An organization dedicated to gender diversity and inclusivity in the asphalt industry is rolling into Canada.

The Canadian branch of Women of Asphalt (WofA) launched in August and has ambitious plans to expand its presence across the country through network events and education sessions.

partnered with Ashley Batson, Audrey Copeland, Natasha Ozybko, and Tracie Schlich. The organization's focus was on recruiting, educating and promoting women in the asphalt community. Since then, the WofA continued to grow and this August expanded into Canada.

WofA was founded in the United States in 2017 when national director of the Asphalt Pavement Alliance, Amy Miller,

The Canadian branch’s board members are: Ania Anthony, Roxana Balba, Leslie Dibling, Rielle Haichert, Selena Lavorato, Shantel Lipp, Veronique Szabo and Corinne Urquhart.

At the Ontario Asphalt Pavement Council’s 2024 Asphalt Seminar, which took place Nov. 27 in Mississauga, Ont., WofA Canada communication director Leslie Dibling and WofA Canada mentorship liaison Selena Lavorato spoke about their plans to address the ongoing challenges women face in the asphalt industry. Dibling explained the gender pay gap and underrepresentation in management positions are some of the issues women still experience in the industry. Joining WofA Canada is free and the organization encourages women in the asphalt industry to join so they can connect with their peers.

Superior Industries Inc., a U.S.-based manufacturer and global supplier of bulk material processing and handling systems, has hired Devon McKinney as product manager for portable plants. McKinney brings a wealth of experience to the role, having spent 15 years at Fab-Tec Inc., a portable plant manufacturer for aggregate processing based in the U.S. During his tenure at Fab-Tec, McKinney excelled in various roles, recently serving as a sales representative. In this capacity, he collaborated closely with equipment dealers, engineering teams and production crews to deliver exceptional service and customized solutions to dealers and producers.

His manufacturing expertise also spans roles in welding, fabrication and assembly, as well as managing parts sales and production schedules.

Superior has also appointed Matt Voigt to director of product management.

A coalition of Ontario civil infrastructure leaders, builders, suppliers and engineers have launched a campaign to urge government leaders to adopt policy changes to increase sustainability in the construction of public infrastructure projects. A government mandate to include just 20 per cent of recycled crushed aggregates (RCA) for critical construction projects like roads, subdivisions, highways, bridges and tunnels can save local governments more than $260 million while reducing greenhouse gas emissions equivalent to removing 15 million cars from the road annually. According to the coalition, RCA is made from reclaimed concrete and asphalt that would otherwise end up in landfills. By adding it to upcoming infrastructure projects, RCA offers economic advantages for municipalities struggling to address a growing state of good repair backlog and the infrastructure investments needed to keep up with population growth.

RCA already has a proven track record in Ontario, including in Ontario's 400-series highways. The coalition behind the public awareness video promoting the benefits of RCA is comprised of nine leading industry associations representing a diverse range of stakeholders in the construction and infrastructure sector. Together, these organizations are committed to promoting sustainable construction practices and encouraging the long-term sustainability of Ontario’s infrastructure.

Heidelberg Materials North America’s subsidiary, SEFA, joins the Heidelberg Materials brand.

The company acquired SEFA, a technology leader in converting coal ash for recycled use in concrete, in May 2023. While the SEFA name will continue to be associated with beneficiation technologies and solutions, the company now carries the Heidelberg Materials brand.

“The rebranding of our SEFA business to Heidelberg Materials aligns perfectly with our vision to build a more sustainable, circular and resilient future,” said Chris Ward, president and CEO of Heidelberg Materials North America.

SEFA has designed and operated beneficiation facilities for more than 25 years. At multiple facilities operated by SEFA, coal ash is excavated from ponds and processed into environmentally sustainable material. SEFA’s core business of processing and marketing fly ash for recycled, beneficial use in concrete complements Heidelberg Materials’ broad portfolio.

The World Cement Association (WCA) published a white paper authored by CEO Ian Riley analyzing the long-term outlook for global cement and clinker demand.

The report challenges prevailing forecasts, projecting a significant decline in demand for cement by 2050 and offers insights for industry stakeholders navigating the low-carbon future. Long-Term Forecast for Cement and Clinker Demand, the white paper highlights pivotal changes driven by decarbonization, technological advancements, and market dynamics. key findings include:

Global cement demand is likely to decline to 3 billion tonnes per annum (tpa) by 2050, far below existing forecasts. Clinker demand, the main source of CO2 emissions in cement production, is expected to decrease more, reaching 1.5 billion tpa by 2050. The need for Carbon Capture and Storage (CCS) will be reduced, impacting investment and policy priorities. The white paper also examines disruptive factors such as alternative materials, supply chain optimization and clinker-free technologies. By outlining three potential scenarios, it helps to provide a roadmap for stakeholders to adapt to varying degrees of change and seize opportunities for innovation.

Lafarge Canada, a provider of sustainable building materials and a member of the Holcim Group, has been selected as the subcontractor for the paving of the Vancouver International Airport (YVR) North Runway Modernization Program. This initiative, estimated at $133 million, will upgrade the runway and improve drainage and electrical systems to ensure the longevity and resilience of this piece of airport infrastructure. Working with Kiewit, Lafarge will provide durable, high-performance asphalt solutions that meet airport runway construction needs, including resistance to heavy aircraft loads and diverse

weather conditions.

The North Runway Program involves a full asphalt overlay of the runway and connecting taxiways, with construction

North American manufacturers and converters from the paper, nonwovens and textile industries and their suppliers can now contact Emtec Electronic GmbH directly.

The German manufacturer of testing solutions has been indirectly active in North America for many years. The company will expand its market in North America to answer all inquiries and requests. Sales representative Eric Haagen has taken responsibility for the North American market and is the first point of contact for all questions and suggestions.

Emtec originated in the pulp and paper industry and has been developing, producing and distributing testing solutions since 1995. Since 2015, the company found success in the nonwoven and textile industry.

scheduled to begin in the spring of 2025. Construction is planned during nightly runway closures to minimize flight schedules and disruptions.

A key milestone in this project is Lafarge’s use of Environmental Product Declarations (EPDs) for all asphalt mixes; the first time Lafarge has implemented this in Canada.

To further reduce the project’s carbon footprint, Lafarge will incorporate 10,000 tonnes of asphalt containing 30 per cent recycled content for the runway shoulders, alongside energy-efficient production techniques and advanced asphalt formulations.

Lippmann welcomes Tyalta Industries as its newest dealer. Tyalta will represent Lippmann’s full line of crushing and screening equipment, delivering solutions to the aggregate industry in Canada.

With a focus on building relationships and positive experiences, Tyalta is poised to support Lippmann customers with equipment, technical expertise and service. Founded in 1995 with a dedication to providing quality machinery to customers, Tyalta has built a solid track record in the aggregate equipment industry. With this partnership, Canadian customers can expect access to Lippmann’s equipment and technical expertise. From equipment sales and rentals to a full inventory of instock parts, Tyalta is well-equipped to support Lippmann customers.

CDE and Granite introduce major wash plant that efficiently manages water in water-scarce Utah

In a state where there are scarce water resources, an engineering company designs an aggregate wash plant that efficiently manages water. CDE, a design and engineering of sand and aggregate wet processing solutions for waste recycling and natural minerals processing has commissioned a 550 tons per hour plant in Utah for Granite,

a construction and construction materials company in the United States. Granite and CDE first met in 2023 through partner Goodfellow Corporation to bring the sustainable plant to life. According to CDE, its investment in the new wet processing facility results from Granite’s goal to increase its aggregate

supply to meet the rising demand in the Wasatch Front region. The project became top priority in late 2023, with Granite needing it to be completed by May 2024. “They needed a process that was fairly noninvasive,” says Ryan O’Loan, CDE’s business development manager.

The plant showcased its technology on Oct. 23, 2024, for an industry open house. O’Loan explains CDE’s solution is not necessarily new, “But it wasn’t something they’d seen in that part of the Western United States.”

BY

> In Canada, the aggregate and roadbuilding sectors are experiencing a significant labour shortage, yet the need for more roads, highways and bridges persists.

With the lack of available labour, the roadbuilding industry is unable to get projects done efficiently. However, this is not a problem specific to roadbuilding, as the construction industry as a whole is experiencing a major labour shortage. According to Statistics Canada, there are large vacancies in the skilled trades at a whopping 49.5 per cent. With fewer qualified applicants to fill the necessary roles, there is significant pressure on the industry to catch up.

“It's a tough balancing act between finding people to help fill gaps, with the infrastructure needs that come with such rapid growth,” says Rob Fragoso, executive director of Alberta Sand and Gravel Association (ASGA). “All that infrastructure relies on sand and gravel, and heavy construction, which relies on labour, and

that’s the problem.”

A CANCEA report commissioned by the Ontario Road Builders’ Association (ORBA) found that traffic gridlock in the Greater Toronto and Hamilton Area negatively impacts the region by $44.7 billion per year due to lost economic productivity.

Walid Abou-Hamde, CEO of ORBA, is urging the Ontario government to take immediate action and provide funding to get projects done faster.

The Canadian Construction Association (CCA) and ASGA are also asking the federal government for more support amid the labour shortages. “Currently, there are 39,000 open positions,” says Rodrigue Gilbert, CCA president. “Meaning today, right now, 39,000 workers are needed to fill vacancies.”

Although provincial governments are investing more into trade programs, career fairs and co-op placements, there are factors mitigating the labour shortage that aren’t being addressed. Roadbuilding jobs are primarily seasonal, explains Fragoso. “Many people prefer work that is permanent rather than seasonal, and work that is done indoors.”

Another challenge Fragoso suspects is the generational attitude towards the

industry. “This shouldn’t be construed negatively,” he explains. “Younger workers tend to value flexible work arrangements and higher wages, and there's nothing wrong with that. However, many of the jobs in the sector can't offer the flexibility they might want, and while the jobs do pay well, some want more, and that's not always possible given budget constraints.”

Often construction companies will turn to temporary foreign workers (TFW) to counteract the overwhelming workload and lack of candidates.

“This is a Canada-wide issue. This is a G7 issue. The birth rate is in a decline and only way to sustain our workforce is through immigration,” says Steven Crombie, senior director of public affairs at ORBA. "One of our messages to the federal government is, 'we do need more newcomers to Canada but we need to balance across the newcomers' so they are able to work in-demand industries."

The Labour Market Impact Assessment (LMIA) is a document that allows Canadian employers to hire TFW. It is mandatory for a TFW to have an approved LMIA to work. The issue is, roadbuilding is not considered an ‘in-demand’ industry, such as HVAC or carpentry. According to Crombie, ORBA is lobbying the federal government to adjust the immigration system so that road building is considered

an in-demand industry. Similarly, previous experience is required for a TFW to work in a specific sector. “There is nothing to demonstrate on a permanent resident application that you have worked on a road crew somewhere else in the world,” says Crombie. He explains that most trades in roadbuilding have voluntary certification, so it is difficult to demonstrate on an immigration application that the applicant has the requisite skills for the industry.

Crombie believes the province of Ontario has done a good job promoting the trades as career paths, especially to students, but, it has not led to an increase of new workers in the industry itself.

“Roadbuilding trades are considered among less visible trades,” he says, adding that historically there has been more exposure for HVAC technicians, electricians and other trades. “We would like to see that amended to recognize those skills.”

Fragoso echoes Crombie's sentiment, “A greater emphasis on academic streams leading to more people entering labour roles would be worth considering.”

Similarly to Ontario, Alberta does support the skilled trades through funding but it is not enough. “A meaningful solution would be for governments to boost programs that either assist with labour costs or provide tax benefits to companies as a partial offset for seasonal staff.”

Both Crombie and Fragoso believe that it is up to the provincial governments to prioritize labour shortages but recognize it’s not always possible due to budgets and other funding concerns.

In contrast, Gilbert believes all levels of the government need to find solutions that specifically address the construction industry. “The point system doesn’t help us attract foreign work,” he explains. Gilbert believes more policies need to be established for construction labour shortages besides the Federal Skilled Worker program. “The program is not well designed.” Gilbert shares that the CCA has implemented its own campaign “Talent Fits Here” to address the labour shortage and encourage the youth and underrepresented groups to work in the trades. “We are working on changing the perception of the trades as not a good career path,” says Gilbert. “But this cannot all be done by us, it needs to be done locally, provincially and nationally.”

For the time being, aggregate abd roadbuilding companies are left to their own devices to address the labour gap. Like the CCA, ORBA and ASGA offer scholarships and programs to encourage younger generations to get involved in the trades. Gilbert feels there may be an unintentional stigma around the skilled trades, specifically from parents, that discourages youth from getting involved.

Michael Auchincloss, associate dean at the School of Applied Technology Humber, has seen a large spike in engagement from the youth over the last few years. “At the winter and fall intake, I had never seen numbers like that before,” he says. “So, the interest is there.”

However, keeping them interested may be the challenge, explains Auchincloss. Due to roadbuilding being a bit more of a niche sector, he suggests companies in the industry create pathways from secondary schools or even elementary schools, where students can receive hands-on experience working in the industry.

“Create interactive experiences, where they can ask questions,” Auchincloss says. “The younger generation has a different way of thinking, a different mindset. They ask very clever questions.”

Although it may be difficult for the roadbuilding and aggregate sectors to showcase to students exactly what they do, there are still opportunities to make connections at job fairs, open houses and apprenticeship expos.

‘One of our messages to the federal government is we do need more newcomers to Canada but need a balance across the economy, so newcomers are able to work in the in-demand industries.’

- Steven Crombie, senior director of public affairs, Ontario Road Builders’ Association

“It is also important to let students know their skills are transferable,” says Auchincloss, who explains many students enrolled in one trade end up switching out for another. “Have students understand the skills of the trade [roadbuilding] so they may migrate into that industry.”

Auchincloss echoes Crombie’s sentiment that the industry must continue to market itself to the younger generations. The future of road building depends on Canadian youth, especially with the lack of foreign trade workers filling the gap.

of

it

BY MACENZIE REBELO

> In May of 2024, Alex Caruana, national manager of Canadian aggregates at Polydeck; Dean Glenn vice-president of Assinck Limited; and Brendan O’Neil, technical sales at Powerscreen of Canada Ltd., joined the Ontario Stone, Sand and Gravel Association (OSSGA) on its Technical Trip to the U.K.. The group toured multiple plants, dredging sites and quarries throughout the country.

The findings of the Technical Trip were presented at OSSGA’s 2025 Operations, Health and Safety Seminar in Toronto, Ont., on Jan. 23. Caruana, Glenn and O’Neil explained there are more similarities than differences between the U.K. and Canada. However, a few key distinctions make the U.K. stand out.

“The U.K. has a high population density spread across a much smaller area. Everything is more compact,” says Caruana. “Their trucks max out at 15 tons, whereas ours are around the 30 to 40 mark.” Caruana explains the aggregate market is a big deal for the economy in the U.K. and that people generally have a more accepting attitude towards quarries in their communities.

“There are bigger quarries with smaller equipment. And there was more willingness to go deep into the quarries,” he says.

At the stationary sites, the U.K. doesn’t hold back the size of its fixed plants. However, the setup is different.

“What I found remarkable is the use of synthetics. They crush high wear rock, but they have these big screens. With the lowest open area modules…It struck me odd that one would size the machines large and bottleneck them so tightly.”

Compared to the North American marketplace, where equipment is sized closely to what one requires, says Caruana.

In Ontario, dredging operations are at a smaller capacity compared to Europe and the U.K., explains Glenn.

“Here, we have a standard hoisting mechanism designed for shallow lakes. But in the U.K., it's a ship. They’re going out to sea with a pumping mechanism on board.”

According to Glenn, the ship pumping system essentially sucks up everything on the seafloor. “They have to be very aware of salt water. They have state-of-the-art water treatment facilities to process the material, which we don't have here.”

The U.K. and Europe have advanced recycling practices on site, says O’Neil. In the U.K., there are dumping/ tipping fees, which is an incentive to stop landfill con-

struction and encourage material reuse.

“Washing different areas of remediating soils has been an ongoing business there [U.K.] for about 20 years,” says O’Neil.

“The next lesson is turning excess soil to clean sand and aggregate.”

In Ontario, there is a market for clean sand and aggregate, he explains.

“I think it is going to be one of the biggest changes in the aggregate industry over the next year.” In the Greater Toronto Area, the volume of excess soil is moving annually, he says.

“I think it’s inevitable that these types of plants are going to be built and directed around the major smelters in Ontario.”

And like Canada, the U.K.’S industry is facing a labour shortage and is struggling to attract workers.

“The feedback has been, ‘it's the same over there,’” says Glenn.

BY MACENZIE rebelo

> During major labour shortages impacting the construction industry nationwide, the Canadian government has cut the number of temporary foreign workers (TFW) by 10 per cent. This means there will be a signficant decrease in TFW authorized to work in Canada. According to the government of Canada, employers will be allowed to hire up to 10 per cent of their total workforce through the TFW program. This maximum employment percentage will be applied to the low-wage stream. Effective September 2024, the cap of TFW went from 30 per cent to 20 per cent.

“The changes we are making today will prioritize Canadian workers and ensure Canadians can trust the program is meeting the needs of our economy,” explained Randy Boissonnault, Minister of Employment, Workforce Development and Official Languages.

Mike Andrighetti general manager of Ethier Sand and Gravel Ltd., uses the TFW and has found the program incredibly helpful. “We’ve been able to use TFW on a seasonal basis and year-round. It has been great.” Andrighetti feels the changes to the TFW program will have a large impact on the construction industry.

Employment, labour relations law and business immigration lawyer Dave McKechnie shares Andrighetti's sentiment. Together, the two explain the significance of the TFW changes and what they could mean for construction.

Andrighetti: We have about 860,000 temporary foreign workers in Canada and roughly five per cent of those are in the construction industry, so approximately 43,000. But in regards to aggregate and road building, I would estimate between 10,000 to 15,000 are currently employed in the industry.

McKechnie: The number of TFW has substantially increased. Additionally, 2024 saw more LMIAs approved compared to last by a good margin. That being said, there's also a substantial number of TFW because of the number of postgraduate work permits that are currently circulating in Canada.

McKechnie: The Immigration, Refugees and Citizenship Canada (IRCC) claims the change was mainly due to employer fraud and misconduct. I believe we're seeing several changes in immigration across Canada because of the influx of students who have become TFW. A big change was made in September, in the metropolitan area unemployment rate. If you’re located in a metropolitan area with a six per cent or higher unemployment rate, you cannot receive a LMIA. There are some exceptions of course, like seasonal work. Before, a construction company was allowed 30 per cent of its workforce to be TFW low-wage stream with a two-year permit. Today, it has been reduced to 20 per cent for the construction workforce in the low-wage stream with a one-year permit.

HOW WILL THIS IMPACT CONSTRUCTION COMPANIES CURRENTLY INVOLVED WITH THE PROGRAM?

McKechnie: In Ontario through the Ontario Immigrant Nominee Program, they are focusing a lot on skilled trades. This means we are always going to have space made in our immigration processes for skilled trade (carpenters, electricians, plumbers). So, this biggest impact will be on unskilled labour across Canada. Andrighetti: There won’t be a lot of impact on current LMIAs, they shouldn’t

be withdrawn. Instead, the impact of the 20 per cent cap is going to be a challenge, especially for employers. Current foreign workers are going to be included in that 20 per cent. This means if a company currently has 30 per cent capacity, they will have to drop significantly. It is going to hurt a construction company's business. In particular, our business relies heavily on the low-wage skilled labour workforce. Fortunately, it won't impact Ethier Sand and Gravel too much but I could see it impacting other aggregate companies.

McKechnie: Yes, a lot of changes are going to keep happening over the next two years. Employers must be intentional about recruitment strategies, especially if they rely on foreign workers.

Andrighetti: Yes. There seems to be a disconnect between the government and companies building the roads. If the idea is to boost the economy with infrastructure projects, we don’t have the labour support to do that.

BY MIKE lacey

> Lafarge Canada is doing its part to help sustain an endangered turtle.

Blanding’s Turtles are a medium-sized turtle easily identified by their bright yellow throat and chin, as well as their domed shell, which resembles an army helmet, according to the Ontario government.

In Canada, the turtles live throughout southern, central and eastern Ontario, as well as Nova Scotia. They are protected under Ontario’s Endangered Species Act.

At Lafarge Canada’s Coldwater Quarry in Severn Township, Ont., the company has put in place a formal mitigation plan to protect the species.

“The Lafarge staff at the Coldwater Quarry has been very diligent, ever since the Endangered Species Act came into effect in 2007, to keep an eye out for any turtles on site, to educate local staff yearly on how to identify and what to do if one is sighted, to put signage up to advise any visitors of their presence and to put in place measures to mitigate any harm to the species,” explains Mal Wensierski, senior land manager with Lafarge Canada (East) – West GTA.

When the operation is planning a new stripping campaign in areas it knows have the potential to be a turtle habitat, Wensierski says the team works with external consultant WSP to develop a plan that ensures no turtles are harmed or harassed during site preparation.

“First, a desktop analysis is conducted to determine which

portions of the site might have viable turtle habitat. Then this is ground-truthed with surveys. In some cases, the areas need dewatering to allow our biologists to have proper access to safely capture the turtles so that they can be quickly transported to a new relocation site,” Wensierski explains.

During turtle relocation, she says consultants follow best management practices to minimize stress on the turtles. Those include:

• Cleaning boots before entering the habitat so as not to spread pathogens.

• Cleaning hands with soap that will not impact amphibians that breathe through their skin.

• Catch the turtles by hand instead of with a hoop net. That will minimize the amount of time they are handling turtles and, therefore, decreasing their stress.

• Putting each turtle in its own container for transport and driving them to their new site within 30 minutes to one hour of being caught.

The turtles from the Coldwater Quarry turtles are relocated to a wetland less than two kilometres east of the quarry, which feeds into a large wetland complex that connects to Matchedash Bay. This provincially-significant wetland was chosen in consultation with the Ontario government because of its proximity and its high-quality habitat.

The most recent relocation efforts in 2024 took place in the fall to align with the turtle's biology, Wensierski explains.

“Essentially we want to ensure that they get moved before they hunker down for hibernation so that they have the appropriate fat reserves in place to properly prepare for hibernation at the relocated site,” she says. “Having such a good quality relocation site so close by means that not only can we reduce the amount of time the turtles are contained (reducing stress), but also dramatically increase the likelihood that they will adapt to their new environments instead of trying to find their way back to their old haunts.”

This work doesn’t come without an impact. The relocation efforts require advanced planning.

“Since the turtles can only be caught and relocated in the summer and early fall months, we need to ensure that we appropriately plan for our consultants

to be on site during the correct periods, and that all the ecological work happens before any stripping can take place,” she explains. “Stripping then needs to take place in the late fall and winter months, prior to when the turtles come out of hibernation. Our consultants also need a lot of lead-time to appropriately consult with MECP and acquire permits to allow them to move the turtles. Since we have been doing this for several years now, we know we can access a release relocation that has been vetted and works well for the turtles.”

She explains that this work is vital since most turtles don't start to lay eggs until they are in their twenties. As a result, any adult deaths can impact the species population. Wensierski states that Lafarge Canada’s efforts at its Coldwater Quarry demonstrate how industry can support conservation. Through careful planning and collaboration, the company protects endangered Blanding’s Turtles while meeting operational needs. This commitment to sustainability highlights the role businesses can play in preserving biodiversity for future generations.

Look no further than ME Elecmetal, the leader in solutions for crusher operators. We excel at tackling customer challenges while maximizing benefits. Our top priorities include safety, durability, and ease-of-use. Additionally, we offer a full line of Crusher Safety Tooling products designed to help you get the job done safer, faster, and smarter! Explore our solutions today and experience the ME Elecmetal difference.

• Through-hardened alloy steel concaves • Primary mantles

Crushers • Fixed & moving jaws

Spider caps

Arm shields

Rim liners

Secondary wear parts Jaw Crushers

Cheek plates

Cone Crushers www.me-elecmetal.com

Bowl liners

Mantles

Secondary wear parts

BY

> As producing more sustainable pavements becomes a necessity, the use of recycled materials must gain traction.

Efforts must be taken by all industry partners to ensure the successful use of recycled materials such as reclaimed asphalt pavements (RAP). Hot Mix Asphalt including more than 25 per cent RAP are typically considered as high RAP mixtures. Research and production of high RAP mixtures has successfully proven that these pavements will work under different climatic and traffic conditions. Engineering the mixture properly ensures that it is possible. To do so, we must understand the materials used, the way RAP impacts the mixture behaviour, the location of the mixture in the pavement structure and ensure proper quality control procedures are in place.

To understand the role RAP plays in impacting pavement performance, we must first consider the general behaviour of asphalt mixtures. Asphalt cement and mixtures are viscoelastic materials in nature. This means that under certain temperatures and loading conditions the material will exhibit either vicious-dominated

or elastic-dominated behaviour. Therefore, balancing these contradicting properties is necessary for ensuring the pavement will resist rutting and handle the expected level of strain induced by traffic. Often, there is a misconception that higher stiffness means more brittle, which results in overlooking valuable opportunities to improve the durability of our pavements. If properly designed, increasing the stiffness of a pavement structure can potentially reduce fatigue cracking through reducing the tensile strain in asphalt concrete layer. However, introducing a stiff material with a brittle behaviour can cause an issue. Asphalt mixtures with higher stiffness and yet maintaining the required resilience under loading can be effectively designed nowadays.

Binder-related mix properties can be used to control how the material responds to loading. Increasing the asphalt cement content or using a softer binder both promote a more “viscous-like” behaviour that can help with low temperature properties while SBS polymer modification adds a “rubbery” behaviour which can make the pavement more strain tolerant. Looking at the way a material functions in the pavement structure, it can be realized that a material that is too soft may experience larger strains and become more prone to fatigue cracking.

In other words, on the plus side a stiffer material can resist deflection and reduce the level of maximum strain that the material experiences in the pavement where an equivalent softer material will have the opposite behaviour. This larger strain level can accelerate cracking and premature failure of the material.

This brings us back to RAP. Properties of RAP will vary depending on the source and age of the material, but one major characteristic is hardening due to oxidation. Pavement materials will oxidize at different rates. The nominal maximum aggregate size, binder source, presence of additives and permeability introduced by construction issues can impact the rate of oxidation. RAP is a hardened material and introducing this into new mixtures must be accommodated properly to ensure performance is maintained. Generally, introducing RAP will increase the relative stiffness of the mix, which, when designed for, can improve the pavement performance. One of the biggest issues is ensuring that the mix does not react poorly under repeated traffic loading. Increasing stiffness alone without considering the impact on

the material response to loading can prove to be detrimental to performance. Jurisdictions that have been successful in increasing their RAP usage have focused on three key areas: redesigning the mixtures, characterizing the materials and processing the RAP stockpiles. These ideas are interrelated and although there are many examples of how to produce high RAP mixtures successfully, it is important to note that it is necessary to experiment with these ideas to ensure that they work at the local level. The most important factor is to validate that the performance in the field and adjust as necessary. For example, including fractionation requirements in a quality control plan will improve consistency, but the chosen particle size will also influence the diffusion rate of aged binder. How much aged binder is contributed to the overall mixture will influence how the RAP impacts the mixture properties and may impact the other mixture parameters. Large, multisource stockpiles may need to be treated differently than smaller, more uniform stockpiles.

The Ontario Asphalt Expert Task Group put together a literature review on international experiences with high RAP mixtures and there is a great deal of detail that is applicable to not only high RAP mixtures, but moderate RAP usage as well. One of the jurisdictions highlighted in that document was Sweden, which successfully uses anywhere from 10 to 50 per cent RAP depending on the pavement traffic and location. Sweden does some interesting things that help promote consistency in their mixtures. They limit stockpiles to single sources of RAP and analyze the gradation, asphalt cement content, asphalt cement stiffness and perform petrographic analysis of the aggregates. By characterizing the RAP properties, they can effectively compensate for the change in properties. Understanding the RAP binder stiffness and particle size gives mixture designers a better understanding of how the RAP binder will blend with the virgin binder. In addition to this, it is important to Swedish authorities that the mixture containing RAP has similar properties to the virgin mixtures they produce. Modulus (stiffness) is measured, and the mixtures are subjected to dynamic creep testing as well as indirect tensile strength testing. The modulus is important for ensuring that the pavement meets their structural

design requirements. Swedish authorities expect the mixture to reach a minimum stiffness of 5500 MPa at 10°C for heavy traffic. Their biggest concern is over softening the mixture with virgin asphalt cement and making the mixture too soft.

Another great example which is a little closer to home comes from Georgia. They generally had cracking issues with their pavements and took many steps to address this including reducing the number of gyrations (SuperPave mixtures), finer gradations and using mixture performance testing for specialty mixtures. These measures to increase asphalt cement content helped, but additional RAP specific requirements are also used. Georgia DOT is required to approve each stockpile before use and limits the amount of RAP being used based on the asphalt cement content and percent passing the #200 sieve of the RAP. To further ensure sufficient binder is in the mixture, Georgia employs the Corrected Optimum Asphalt Content methodology. This essentially assumes not all the binder in the RAP is available and requires additional virgin asphalt cement to be used to compensate for the unavailable binder.

The Ontario Asphalt Expert Task Group covers many other jurisdictions from similar climates to completely different climates, high traffic and low traffic environments. The engineering principles will generally remain valid regardless of traffic and climate, but it is important to determine specifics for local conditions. Georgia employs a 60:40 Corrected Optimum asphalt Content, but will a different ratio be required for more highly aged RAP binders? Questions like these are important to answer, but the data collected by so many different Departments of Transportation and researchers prove that high RAP mixtures are possible and perform very well when engineered properly. The full webinar is available here: https://vimeo. com/1014810357?share=copy

Mike Aurilio is the Terminal Manager for Yellowline Asphalt Products Ltd. Aurilio would like to thank his co-authors/friends Amma Agbedor, Yashar Almandary, Doubra Ambaiowei and Pejoohan Tavassoti for their help putting this literature review together.

> With growing populations, constrained budgets, and rising traffic demands, the need for resilient and sustainable road infrastructure has become a critical priority.

Advanced pavement design and construction approaches are increasingly essential to meet these challenges and ensure long-term durability. Adopting innovative approaches is essential to optimize our designs and meet these evolving demands. Techniques such as in-situ and ex-situ cold recycling with bituminous materials have proven highly effective, improving environmental performance and cost savings. However, despite nearly four decades of successful asphalt cold recycling in Canada, much of the pavement design remains empirical and under-optimized, falling short of meeting emerging demands.

The Canadian Technical Asphalt Association (CTAA) Workshop, held on Nov. 10, 2024, in Edmonton, Alta., provided a critical platform for industry leaders to tackle these challenges. The workshop focused on advancing sustainable pavement design and construction practices through cold recycling methods, improving and optimizing material/pavement performance by refining empirical approaches and incorporating mechanistic-empirical methodologies.

Enhancing pavement longevity through cold recycling methods involves restoring the structural integrity of existing layers and improving material performance by reprocessing damaged pavement with new binders and additives. The recycled layers exhibit increased load-bearing capacity, which enhances resistance to traffic-induced stresses. One of the primary benefits of this process is its ability to mitigate reflective cracking from the underlying layer, thereby protecting the upper layer. A key consideration for using this

technology is its potential to create resilient pavements that are less sensitive to moisture damage, temperature variations, and freezethaw cycles compared to conventional pavements. This enhanced durability extends the service life of the pavement, delaying the need for full-depth reconstruction, reducing material consumption, and lowering greenhouse gas emissions associated with traditional rehabilitation methods.

Although project-dependent, cold recycling techniques can provide substantial environmental and economic advantages over conventional pavement rehabilitation methods. This method allows for 100 per cent reuse of existing pavement materials, which aligns with the circular economy, promoting the continuous reuse of materials within the construction cycle rather than relying on new resources. Consequently, these processes can achieve a 40 to 55 per cent reduction in CO2 emissions and energy consumption is also lowered by 40 to 60 per cent, as the need for material heating is minimized. In addition, this approach can reduce overall project costs by 20 to 30 per cent through savings on materials, fuel, and transport while potentially accelerating project completion and reducing traffic disruption.

In-situ (Cold In-place Recycling, CIR), ex-situ (Cold Central Plant Recycling, CCPR), and Full-Depth Reclamation (FDR) are widely used cold recycling methods in pavement rehabilitation. CIR is particularly effective when pavement distress is limited to the asphalt layer. It involves milling the upper asphalt layers (typically 75 mm to 125 mm), then mixing the reclaimed asphalt pavement (RAP) with a bituminous stabilizing agent, such as asphalt emulsion (1.2 per cent to 1.6 per cent) or foamed asphalt (1 per cent to 1.5 per cent), at ambient temperature. The mixture is then placed back on the road to create a new layer without heating. Similarly, CCPR is conducted at a central cold plant where RAP, binder(s), and corrective aggregates (if necessary) are mixed. The recycled material is then transported to the job site and paved using conventional asphalt paving equipment. CCPR is particularly suitable for construction or reconstruction projects when RAP is available off-site.

FDR is a rehabilitation technique where the full thickness of the asphalt pavement and a portion of the underlying layer are pulverized and mixed to create a new base layer. Additives in the FDR process include

cementitious materials such as hydrated lime, cement, or fly ash; bituminous materials like asphalt emulsion and foamed asphalt; or chemical stabilizers. The most common additives in Canada are foamed asphalt, often combined with active fillers like cement to ensure proper binder distribution and improve moisture resistance. However, the quantity of these active fillers should be limited to a maximum of one per cent to avoid altering the material's behaviour from flexible to brittle.

There is no global consensus on designing bituminous cold recycled material (B-CRM) mixtures. B-CRMs possess unique properties that differ significantly from traditional pavement materials, including granular, cementitious, and bituminous-based materials. Granular materials, composed of unbound aggregates like gravel or sand, exhibit stressdependent behaviour, with their mechanical properties influenced by the level of applied stress. Cementitious materials, such as cement-stabilized layers, are characterized by rigid behaviour, providing high stiffness, but tend to crack under heavy loads or temperature changes. Bituminous mixtures,

which are viscoelastic, display both elastic and viscous behaviour, allowing them to flex and recover under loads, with performance affected by temperature and load duration, becoming more flexible at high temperatures and more brittle at low temperatures. Bituminous CRMs behave differently based on the type and quantity of added bituminous binder, active fillers, and the properties of RAP.

One of the key differences between BCRMs and traditional pavement materials is their ability to improve and strengthen over time. Initially, B-CRMs behave like granular material with high cohesion, but as they consolidate, their mechanical properties evolve. Over time, B-CRMs may transition from a stress-dependent, granular-like material to a more asphalt-like material. The evolution of B-CRM occurs in two distinct phases. During the first phase, the material consolidates and stiffness increases. Following the curing phase, the CRM enters the stiffness reduction phase, where the material’s stiffness gradually decreases potentially due to fatigue and long-term degradation. While these two phases are widely recognized, there is still limited research on fully understanding and optimizing the evolving mechanical behaviour of CRMs for

improved structural design and long-term performance in pavement rehabilitation projects. This gap in highlights the need for further exploration of CRM properties and their impact on pavement sustainability.

There are three main approaches for pavement design:

• Empirical approaches, such as the method described in the AASHTO Guide for Design of Pavement Structures (1993), are based on an empirical prediction of loss of serviceability. The empirical approach relies on historical data and observed performance, using past road tests under specific conditions like traffic and climate to guide decisions.

• Rational approaches, as described in the SETRA-LCPC French Technical Guide: Design Manual for Pavement Structures and the Southern African Bitumen Association (SABITA) guidelines: A Guideline for the Design and Construction of Bitumen Emulsion and Foamed Bitumen Stabilised Materials. The rational

approach applies engineering principles to analyze how materials respond to stress and strain, focusing on material mechanical properties such as stiffness and fatigue to predict the pavement damages.

• Mechanistic-empirical approaches, like the method outlined in the AASHTO Mechanistic-Empirical Pavement Design Guide, predict functionality loss based on environmental and loading damages. This approach combines both methods, using mechanistic models to calculate pavement responses and refining them with real-world data. It offers high accuracy but requires more detailed inputs, making it more complex than the other methods.

Pavement design for B-CRM lacks universal guidelines, as practices vary globally depending on regional climate, traffic, and available materials. In Canada, the most commonly used method for B-CRM pavement design is the AASHTO 1993 empirical method. Although not specifically developed for cold recycled pavements, AASHTO 1993 has been adapted to include them within its empirical framework. In this approach, B-CRMs are treated as a structural layer,

with the layer coefficient selected based on provincial guidelines, often without a direct link to the material properties. A key limitation of this method is the use of a static structural coefficient for B-CRMs, which fails to account for their evolving mechanical properties, potentially leading to less accurate long-term performance predictions. As a result, this often leads to conservative designs with reduced cost and environmental savings, which can ultimately cause the method to be rejected during the Life Cycle Cost Analysis phase of rehabilitation projects.

This article was authored by Dr. Leila Hashemian, Associate Professor at the University of Alberta; Jean-Martin Croteau, Technical Director; and Arash Ghahremani, Senior Technical Manager at Colas Canada Inc. The authors participated in the CTAA Workshop, joining more than 100 experts in the field of pavement engineering to explore the latest advancements in cold recycling methods.

The workshop focused on refining empirical practices and integrating mechanistic-empirical design approaches to enhance material behaviour modelling. Discussions highlighted the importance of accounting for material evolution and stiffness changes over time.

•

•

•

BY MIKE lacey

Rock To Road asked industry association leaders to look into their crystal ball and tell us what they see ahead

> Now that 2024 is firmly in the rearview mirror, everyone’s attention can turn to 2025.

Rock To Road magazine spoke to representatives from various Canadian industry associations about their outlook for 2025. (Editor’s Note: These interviews were conducted before US President Donald Trump took office.)

Derek Holmes, executive director of British Columbia Stone, Sand and Gravel Association, says his membership has reported moderate to strong demand for aggregate through 2024 due to capital projects and housing starts.

2025 should be interesting, he explains, as many of the large infrastructure projects in north B.C. are complete.

“Land use planning initiatives throughout the province and Mineral Tenure Act reform, key NDP natural resource priorities prior to the election, will certainly re-surface with their new mandate, creating a lot of uncertainty going forward,” he says. “Every one of our members reports long permitting timelines to be problematic to their business planning and we know that stifles investment.”

Holmes is hopeful B.C. Premier David Eby’s new ministry of mining and critical minerals (formerly ministry of energy, mines and low carbon innovation) will allow the minister to focus on reducing permit wait times.

“In our upcoming meetings with government, the association will be pushing hard for risk-based decision making for simple projects that are low impact which, in theory, should allow more government resources to focus on the complex ones and see an overall decrease in permit wait times,” he says.

The big unknown is the potential impact of tariffs from the United States. He says approximately 10 per cent of the 55 million tonnes of aggregate produced in B.C. is shipped to the United States.

The main challenges facing the industry in Alberta in 2025 are not new -- regulatory matters and labour.

“These challenges persist but are on a spectrum,” explains Rob Fragoso, executive director of Alberta Sand and Gravel Association. “One of the greatest opportunities for the industry in Alberta is to amplify our voice with allied industries, like heavy construction, road builders, concrete, asphalt, et cetera. We have friends in all of these industries who face similar challenges.”

Fragoso notes a priority of ASGA in 2025 will be neogtiating the Community Aggregate Payment Levy.

Steven Crombie, senior director of public affairs with the Ontario Road Building Association (ORBA), states that although Ontario Ministry of Transportation’s 10-year capital plan is in a healthy place, ORBA is questioning why projects that have had funding committed to them are being pushed one or two years out.

“While money is committed, projects are not being carried out in year budgeted for,” he says. “It’s causing trepidation in market.”

They are looking at getting clarification from the ministry on that. In the case of Ontario’s major municipalities, Crombie says there is quite a few projects scheduled but municipalities are delaying that work as a way to balance their books at year-end.

Ontario Stone, Sand and Gravel Association (OSSGA) executive director Michael McSweeney says the tension between the growing demand for aggregate and regulatory delays that prevent companies from bringing that aggregate to market in a

quicker fashion will continue in 2025.

“With significant investments in housing, transit and climate-resilient infrastructure announced by the provincial government, the demand for high-quality, close-to-market aggregate will be higher than it’s ever been,” he says.

However, in the first couple of years, funding for those projects go toward design and engineering costs.

“So, we are not seeing the volumes that we need to keep our companies fully occupied and hence a forecast that shows a reduction to tonnages for the past year and into next year,” he says.

Another challenge facing the industry, he explains, is the lengthy and costly licensing process for new pits and quarries.

“Where once you could get a permit in three to five years, it is now taking between seven and 12 years to get a permit,” he says. “What other kind of business would invest in design and planning for new or quarry expansion where a seven- to 12year lead time is required and even then, getting a permit is not guaranteed.”

In 2025, OSSGA plans to work with stakeholders ranging from indigenous communities to environmental and municipal

groups to ensure they understand how much aggregate is required to satisfy the demand of both government and private sector infrastructure.

Nova Scotia and New Brunswick Grant Feltmate, executive director with Nova Scotia Road Builders Association, notes that with a new government in place in Nova Scotia, the industry is carefully watching how policies unfold.

“The significant increase in population growth and the resulting infrastructure needs – housing, roads, waterworks, et cetera should lead to good levels of demand for our services for some time to come,” he says. “On the challenge side, finding sufficient workforce will still be difficult.”

There are no signs the labour shortage will improve in 2025, states Tom McGinn, executive director with the New Brunswick Road Builders and Heavy Construction Association. A focus of his association this year is trying to help government understand these issues and how they can work better together. The greatest opportunity for the industry this year is embracing new technology to create more efficient and productive operations.

With a history dating back to 1946, and now over 75,000 HAZEMAG impactors operating worldwide, HAZEMAG is a world-leading supplier for impact crushers and raw material processing systems. HAZEMAG offers industry-leading solutions through a range of products, and a level of partnership and support that remains second to none. We call it “Partnership Unlimited – The HAZEMAG Way”

BY MIKE LACEY

The 2025 World of Asphalt and AGG1 Aggregates Academy and Expo takes place March 25 to 27 in St. Louis, Missouri.

The event will feature more than 430 exhibitors and 120 education sessions at America’s Centre Convention Complex.

Here is a preview at what companies will have on display at their booths.

ADM Booth: 1846

See an ADM EX 8845 Asphalt Plant on display at this year’s show. The EX 8845 features an 88-inch drum diameter and 45-foot drum length. The ADM EX Series asphalt plants are designed to meet high-capacity production needs. These counterflow plants can produce up to 425 TPH and handle up to 50 per cent RAP.

HAVER & BOEKER NIAGARA Booth: 1344

Learn more about the Niagara F-Class Portable Plant at Haver & Boeker Niagara’s booth.

The portable plant is suited for

screening applications that require consistent performance, load independence and minimal vibration transmission into the chassis.

The plant features a double eccentric shaft assembly that maintains constant g-force during startup, shutdown and extreme operating conditions including overloading and surging. Its custom-built chassis holds the vibrating screen and periphery equipment, such as crushers or conveyors, to customize the plant for each operation. The hydraulic system

allows setup in less than 30 minutes, positioning the screen at an optimal 20-degree angle. The vibrating screen can be lowered in less than five minutes for easy screen media change-outs.

Inclined, circular motion technology uses gravity to help move material down the screen deck, reducing pegging as well as energy and horsepower requirements. On a 20-degree incline, at 70 to 75 feet per minute travel rate, the inclined vibrating screen delivers up to 25 per cent more capacity than a linear-stroke

horizontal machine, which experiences diminished capacity at 45 to 50 feet per minute due to a greater bed depth.

This year’s event will feature the world premiere of the W 210 XF. Wirtgen has added the W 210 XF to its portfolio of large milling machines. The new model combines high-performance and efficiency with compact dimensions. Offering milling widths between 2.0 m and 2.5 m and a maximum milling depth of 330 mm, it is suited for tasks ranging from surface layer rehabilitation and complete pavement removal to fine milling work with maximum efficiency in a wide range of project scenarios. The main areas in which the W 210 XF is deployed are where high milling performance and relatively compact dimensions are required, such as highways and airports.

Also on display at the Wirtgen/John Deere booth will be Vögele’s SUPER 1703-3i wheeled Universal Class paver, the SUPER 2000-3i Highway Class tracked paver, and, as a representative model from the Mini Class, the SUPER 700-3i. The highlight at the show is the smallest Vögele paver, the MINI 500. With a base pave width of only 0.90 m and working widths from 0.25 m to 1.8 m it is the ideal choice for paving between railroad or streetcar tracks, capping narrow trenches, or the construction of footpaths and cycleways.

With automated compaction with Smart Compact Pro, roller manufacturer Hamm provides a solution it states will not only play a significant role in assuring a longer service life of roads and highways but will also reduce the contractor’s operating costs. This year’s World of Asphalt will see the launch of Smart Compact Basic and Smart Compact Pro on the North American market.

With the HD+ 120i VIO-2 HF, the Wirtgen Group is also showing a tandem roller with 3-point articulation steering designed especially for use in North America. It is fitted with two maintenancefree VIO drums offering a choice of working with static compaction, vibration, or oscillation. Also appearing is the HX 70i tandem roller, the HP 100i pneumatic-tire roller for chipseal-applications, and the HD 12e VV, which due to its fully-electric drive system, enables emission-free compaction and low operating noise.

Visitors from the asphalt recycling sector can have a closer look at the MOBIREX MR 100i NEO mobile impact crusher. It is the only machine in this performance class to offer fully automatic crusher gap adjustment and zero-point determination.

Booth: 523

Luff Industries’ North American Standard Roller (NAS) will be on display at its booth. The NAS Roller was developed to allow its customers to standardize on one, high quality roller, to decrease operating and maintenance costs and increase efficiency. Each roller is manufactured to Luff’s highquality standards but can fit into a variety

of different manufacturer frames. The NAS Roller is currently available in five-inch CEMA C Steel Trough Rolls, for 24-inch to 48-inch belt widths, for 12 different idler manufacturers. Customers can now purchase one roller, the NAS Roller, for all their conveyors, regardless of the original manufacturer.

Booth: 1809

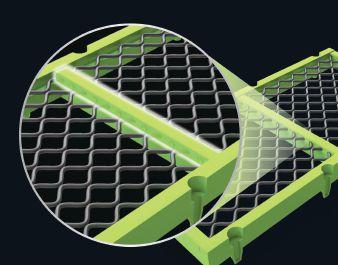

MAJOR will highlight its advanced polyurethane (PU) strip variant for the FLEX-MAT Modular series at this year’s World of Asphalt/AGG1 Academy. The PU strip increases the screen media’s durability, extending its lifespan and effectiveness in wet and corrosive environments. They are available for the FLEX-MAT Modular D, S and T Series. The new variant is not intended to completely replace the standard polyurethane.

Booth: 4001

McLanahan will have experts on hand to provide information on its complete line of equipment, which includes everything from crushing and screening to washing, classifying and tailings management. Sales staff will be able to answer questions about how McLanahan can provide a solution for your applications.

Booth: 1022

Polydeck will host a Happy Hour at its booth March 26 from 3:30 to 5 p.m.

for all attendees. While there, you will also have a chance to look at Polydeck’s different screening media that will be on display. That includes:

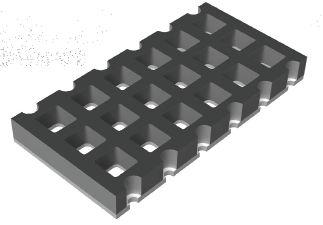

This modular welded wire panels are made with heavy duty steel and come in a wide range of opening sizes, wire diameters and fastening options.

These modular rubber panels with a 3/8-inch steel backing offer up to 30 per cent more material wear life. The panels offer multiple fastening options, and are ideal for high impact/heavily loaded applications and combatting margin separation due to material ingress.

Made from customer-used injection molded polyurethane panels, this product is still in the concept and development stage.

SUPERIOR INDUSTRIES

Booth: 1532

This durable machine delivers industry-leading performance in primary, secondary, and tertiary crushing applications. It processes up to 990 tons per hour with precision, making it suited for producers seeking consistent, high-quality output. Its design includes interchangeable wear parts and advanced technology, reducing maintenance and maximizing uptime.

Booth: 4713

Volvo Construction Equipment will debut its new 50-ton A50 articulated hauler at this year’s World of Asphalt/ AGG1. The hauler is a new size class machine in Volvo CE’s ADT lineup. The company’s six existing ADT haulers have also undergone updates as part of

the company’s redesigned lineup. These upgrades include improved fuel efficiency and a redesigned cab to improve operator comfort. Volvo CE states the upgrades will enhance safety and make maintenance simpler.

In addition to the A50 articulated hauler, Volvo’s booth will feature several compactors, including double drum and pneumatic asphalt rollers, soil compactors and a battery-electric model.

The latest wheel loaders and tech solutions will also be on display..

> FEB. 25-27, 2025 Ontario Stone, Sand and Gravel Association Conference and AGM Ottawa, Ont. www.ossga.com

> MARCH 3, 2025 Women In Construction 2025 Virtual Event Register at www.womenin-construction.ca/ virtual-events/womenin-construction-2025/

> MAR.25-27, 2025 World of Asphalt

St. Louis, Missouri www.worldofasphalt.com

> MAR. 30-APR. 2, 2025 Good Roads Conference Toronto, Ont. goodroads.ca/conference/

> APRIL 2–3, 2025 BC Stone, Sand and Gravel Association Conference, AGM and Trade Show Kelowna, BC gravelbc.ca

For aggregate owners and operators, navigating the complex landscape of federal, provincial and municipal ecological regulations is daunting. However, municipalities, planners and ecologists can help identify which policies and regulations may apply to a particular site.

Key regulations include:

• Protection of fish habitats

• Protection species at risk

• Protection or potential compensation of wetlands.

In many cases, the rehabilitation plan will typically call for the creation or enhancement of wildlife habitats. Throughout the various stages of extraction operations, practical solutions can be implemented to ensure compliance with these policies and regulations.

While understanding which requirements apply to different components and stages of a project approval can be complex and sometimes frustrating, it is essential for fulfilling project due diligence and regulatory compliance.

Some jurisdictions require the protection of wetlands, while others may allow for removal with compensation. When wetlands must be protected, the exclusion of these areas will be a factor in determining the limits of extraction and operation. Avoiding these areas as required by planning authorities can help expedite project approvals and be seamlessly incorporated into the site plan.

For projects where wetland removals are permitted, compensation is typically required to meet the municipal policies and regulations. Preplanning for the final rehabilitation plan during the operation’s lifecycle can aid in preparing for wetland restoration. For instance, the phasing of extraction operation and potential stockpiling of restoration materials (i.e., topsoil, stumps or woody debris), will allow for efficient progression of rehabilitation.

While restoring some wetlands can be complex, many wetlands can be successfully re-established by pre-planning hydrologic conditions. For an above groundwater operation, micro-grading of the quarry or pit floor to localize surface water collection in areas that do not inhibit operations can set the stage

for wetland conditions. Co-ordinating the approved wetland removal works with the wetland creation activities can further enhance the restoration success. For example, transferring the wetland soils from the removal location to the wetland creation site. These soils will contain plant seed banks and roots that will support wetland plant development and save costs associated with separate seeding and planting.

These practical strategies empower aggregate owners and operators to lead the restoration works and fulfill the project requirements by using their site resources and expertise to avoid third party costs while achieving policy and regulatory compliance and environmental goals.

Natural feature restoration and habitat enhancement are often required conditions of the project site plan approvals. Taking advantage of on-site materials and construction equipment capabilities can make these rehabilitation tasks more efficient and cost effective. Habitat enhancements can also be implemented through simple, practical approaches. For example, as part of a wetland restoration project, wildlife habitat can be created for amphibians, reptiles and birds through the provision of standing water and micro-habitat features. Over excavation to establish a depression in the wetland restoration area will allow for the ponding of water for frogs and salamanders, while adding logs within the pond will provide areas for turtles to bask and thermal regulate in the sun. Scattered sand patches can support nesting, and nest boxes can attract swallows and songbirds.

While the level of ecological policies and regulations can be extensive, with thoughtful preplanning solutions, aggregate owners and operators can navigate them successfully, balancing regulatory compliance with smooth operation.

Dirk Janas is the Technical Director for Terrestrial Ecology with SLR Consulting and has a broad range of project experience both in the private and public sectors. He has worked in the aggregate industry for over 20 years providing technical support in dealing with the ecological components of the project permitting and approval process.

Effi cient when & where yo u need it – the MOBIREX MR 100i NEO mobile impact crusher! With its compact dimensions and low transport w eight, this machine is amazingly fl exible, fast and versatile. The MR 100i NE O se ts an all-new benchmark in the compact class – with highlight features such as automatic crush er gap adjustment or Lock & Turn Quick Access for tool-free, safe crusher opening in 30 seconds. Choose between two drive versions: the electric E-DRIVE or direct D-DRIVE. The MO BIREX MR 1 00i NEO: ready, set, crush!

www.wirtgen-group.com/mr-100i-neo-kleemann