ROADS AND INFRASTRUCTURE

BUILDING CANADA’S ECONOMY

EQUIPMENT: PAVING THE WAY

INFRASTRUCTURE REPORT: BUILDING BRIDGES

MACROFIBRES IN CONCRETE PAVING

EQUIPMENT: PAVING THE WAY

INFRASTRUCTURE REPORT: BUILDING BRIDGES

MACROFIBRES IN CONCRETE PAVING

I’ve often remarked that Canada is a construction economy. Sure, our system of production and consumption is a complicated structure with influences both internal and external, but in the little over a half-century that I’ve been on this earth, I simply cannot recall a time that I’ve not been impacted by construction, and that’s a good thing.

When times are good, we’re building. This is very often homes and supporting structures that enable population growth, but it’s also factories and warehouses for new and growing companies. When things are tighter, new schools, hospitals, highways and transit systems are rightfully viewed as stimulators of the economy, gaining political traction and budgetary inclusions.

Our most recent economic threat, a trade war with our largest trading partner, has once again put a spotlight on this vital segment – this time with advocacy towards infrastructure projects that will help diversify our trading partnerships and outreach to nations further abroad than our neighbours sharing our southern border.

And there’s no shortage of projects. With this being our annual Infrastructure Report edition (which happens to start on Page 29) Saul Chernos takes us on an exploration of some of the larger projects that will be keeping our industry busy for the coming year, and beyond.

www.on-sitemag.com

READER SERVICE

Print and digital subscription inquiries or changes, please contact Angelita Potal

Email: apotal@annexbusinessmedia.com

Tel: (416) 510-5113

Fax: (416) 510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

PUBLISHER | Peter Leonard (416) 510-6847 pleonard@on-sitemag.com

EDITOR | Adam Freill (416) 996-2391 afreill@on-sitemag.com

MEDIA DESIGNER | Lisa Zambri lzambri@annexbusinessmedia.com

ASSOCIATE PUBLISHER | David Skene (416) 510-6884 dskene@on-sitemag.com

ACCOUNT COORDINATOR | Kim Rossiter (416) 510-6794 krossiter@on-sitemag.com

AUDIENCE DEVELOPMENT MANAGER | Urszula Grzyb (416) 510-5180 ugrzyb@annexbusinessmedia.com

CEO | Scott Jamieson sjamieson@annexbusinessmedia.com

Established in 1957, On-Site is published by Annex Business Media 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1 Publications Mail Agreement No. 40065710

ISSN: 1910-118X (Print) ISSN 2371-8544 (Online)

Get the latest construction news! Follow us on @OnSiteMag

Many of the projects included in Saul’s article were in the works prior to the introduction of tariffs, but our webinar discussion with the Canadian Construction Association’s Louis-Philippe Champagne, Aneil Jaswal from Canada Infrastructure Bank, and Lisa Mitchell of the Canadian Council for Public-Private Partnerships (Page 38) touched on the need to build structures to enable the diversification of trading partnerships. The full webinar can be viewed on our YouTube channel. Perhaps some of the companies building these projects will even find themselves on our Top Contractors list. If you have not yet done so, please visit our website to fill out your annual survey so that your company can be a part of that report, which will be in our June edition. Until next time, stay safe and do good work.

Adam Freill / Editor afreill@on-sitemag.com

SUBSCRIPTION RATES Canada $50.49 CAD per year, United States $115.26 CAD per year, Other foreign $139.23 CAD, Single Copy Canada $13.50 CAD. On-Site is published 5 times per year except for occasional combined, expanded or premium issues, which count as two subscription issues. Occasionally, On-Site will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Business Media Privacy Officer privacy@annexbusinessmedia.com Tel: 800-668-2374

Content copyright ©2025 by Annex Business Media may not be reprinted without permission.

On-Site receives unsolicited materials (including letters to the editor, press releases, promotional items and images) from time to time. On-Site, its affiliates and assignees may use, reproduce, publish, re-publish, distribute, store and archive such unsolicited submissions in whole or in part in any form or medium whatsoever, without compensation of any sort.

DISCLAIMER This publication is for informational purposes only The content and “expert” advice presented are not intended as a substitute for informed professional engineering advice. You should not act on information contained in this publication without seeking specific advice from qualified engineering professionals.

MEMBER OF

A group of Canada’s leading general contractors have united to form the Canadian Construction Safety Council (CCSC), an organization whose mission is to elevate safety performance and establish innovative new industry benchmarks to protect construction workers nationwide.

The council’s founding members include Aecon, AtkinsRéalis, Bird Construction Inc., Dragados Canada

Inc., EllisDon Corporation, EBC, Graham Construction Inc., Kiewit Corporation, Ledcor Industries Inc., PCL Construction, Pennecon, and Pomerleau.

Among CCSC’s inaugural initiatives are the adoption of Type II safety helmets. These feature integrated chin straps and offer superior head protection compared to traditional hard hats. Additionally, the council is adopting a new fall protection

York University School of Continuing Studies has officially launched its post-graduate certificate in digital construction management. The program, offered through the Toronto-area school, is designed to equip students with the skills and expertise to thrive in a rapidly transforming construction industry.

It puts a focus on Artificial Intelligence (AI) and the software impacting the industrial, commercial, institutional, and high-rise residential construction sectors. The full-time program is set to begin in September 2025.

“Canada and Ontario’s population continue to grow at a significant rate. This puts demand on the construction industry to keep pace with new housing, social infrastructure and transit, all supported by increased need for talented construction management professionals to support this growth,” stated Marlon Bray, executive vice-president of Clark Construction Management and program advisory committee member at the school.

“The curriculum for this new program is designed to help students develop the necessary knowledge and skills to enter a

standard, requiring safety measures such as harnesses and guardrails at six feet, and is promoting the adoption of ANSI level 4 cut-resistant gloves.

By sharing best practices and insights, the council says it is aiming to build a safer and stronger construction industry across Canada with a goal to collaborate, educate and advocate for every worker’s safe return home every day.

constantly evolving construction management field which is enabled and powered by technology, data and software in an ever increasingly connected market.”

A unique highlight of the program is its construction practicum, where students choose one of three specialized streams:

construction estimation, construction project coordination or contract administration. Students will work on industry-inspired projects under the guidance of instructors who work full time in the construction field, ensuring their education is rooted in practical, real-world application.

A new power transmission line linking Nova Scotia and New Brunswick is a step closer to getting built thanks to $217 million in equity financing from the Canada Infrastructure Bank (CIB). The project, which aims to improve the reliability of interprovincial power grids and support the expansion of renewable energy production, is expected to create 587 jobs at its peak of construction and $105 million in GDP.

The CIB investment will help Nova Scotia construct the 160-kilometre, 345-kilovolt transmission line parallel to the existing connection from Onslow, N.S., to Salisbury, N.B. Additionally, CIB is working with Wskijinu’k Mtmo’taqnuow Agency Ltd. (WMA), the economic development partnership owned by the 13 Mi’kmaw First Nations in Nova Scotia, to complete a complementary equity loan. The loan will enable WMA to acquire an ownership stake in the project, using the CIB’s Indigenous Equity Initiative.

“The Wasoqonatl project is an important investment towards critical electricity infrastructure in Atlantic Canada,” stated Ehren Cory, CEO at CIB. “By deploying our first equity transaction, the CIB is advancing an impactful project which had faced affordability challenges while creating new jobs and economic opportunities.”

The project, to be named Wasoqonatl, will be owned by a limited partnership between Nova Scotia Power Inc. (NSPI) and the CIB, through a regulated utility corporation. Construction is expected to be completed in Fall 2028.

Overhead transmission lines will link Nova Scotia and New Brunswick through a second energy connection.

Plans for a tramway to augment public transportation between eastern portions of Montreal and Repentigny were recently announced by Quebec’s Deputy Premier and Minister of Transport and Sustainable Mobility, Geneviève Guilbault. The current proposal calls for a 38 km system with 31 stations spread over two branches, running from the Rivière-des-Prairies sector to the green metro line, as well as from Repentigny to the green metro line. The projected price has been reported to be north of $18 billion.

Projet structurant de l’est (PSE) is the first project that will be within the mandate of Mobilité Infra Québec (MIQ), a new provincial agency for complex transportation infrastructure projects that has yet to be set up. Until the agency is fully operational, the Autorité régionale de transport métropolitain (ARTM) will be responsible for launching the first stages of the tramway project, which the province says will be carried out in a collaborative manner. MIQ will take over as soon as it takes office.

A selection of data reflecting trends in the Canadian

Construction investment in Canada’s non-residential sector was on the rise for a sixth consecutive month, according to the latest figures from Statistics Canada, pacing overall investment in building construction to a 1.8 per cent rise. The January figures came in at $22.1 billion, a $393.7 million gain over December’s results. Those gains included a 2.3 per cent increase in the residential sector, which hit $15.4 billion, and a rise of 0.8 per cent in the non-residential sector, which landed at $6.7 billion. Year over year, investment in building construction grew 5.7 per cent in January.

Much of the recent growth on the non-residential side came from the institutional and industrial components, which both reached record highs in January. The institutional component rose $38.8 million to $2 billion, while investment in the industrial component increased $22.5 million to $1.5 billion. The commercial component bucked the trend, decreasing $9.5 million to $3.3 billion, following five consecutive monthly increases. Compared to January of 2024, the industrial segment was up 7.6 per cent, the institutional segment gained 13.4 per cent, and the commercial segment was up 1.4 per cent.

Employment in Canada’s construction sector dipped in February as the sector had 5,000 fewer workers, on a seasonally adjusted basis, compared to Statistics Canada’s January Labour Force Survey. Despite the dip, year-over-year employment was up significantly, with more than 40,000 more workers in the sector than were working in February of last year, an increase of 2.5 per cent. Overall, Canada’s employment picture was relatively flat in February as the employment rate held steady at 61.1 per cent, the unemployment rate stayed at 6.6 per cent, and net job gains were limited to 1,100 positions.

Total Employment in Canada

20,995,300 Unemployment Rate 6.6%

Construction Employment

1,646,400

January saw year-over-year growth in the value of building permits tempered by a dip in the monthly figures, reports Statistics Canada. Canadian municipalities issued $12.8 billion in permits for the month, down $425.8 million, or 3.2 per cent from December, but significantly more than the $10.95 billion reported in January of 2024. Ontario experienced the heaviest hit, dropping $771.1 million. Residential construction intentions were down by $312.7 million, coming in at $8.8 billion in January as the multi-family component declined by $424.2 million. Losses in Ontario’s multi-family component were partially offset by gains in New Brunswick and Quebec. Across Canada, 23,500 multi-family dwellings and 4,900 single-family dwellings were authorized in January, down 3.7 per cent from the previous month, but up 37.4 per cent on a year-over-year basis.

The value of non-residential building permits decreased by $113 million in January, falling to $4 billion, a fourth consecutive monthly decrease. The industrial component drove the decline with a monthly dip of $285 million, followed by the institutional component, which was off by $87.4 million. The commercial component found a path to growth, however, adding $259.4 million above the December figures to mitigate the decline in the non-residential sector.

Manufacturers bringing high-tech touches to paving and roadbuilding equipment.

BY NATE HENDLEY

Electrification, autonomy, automation and high-tech performanceenhancing solutions continue to make inroads in the world of paving and roadbuilding equipment.

Even electric equipment is being increasingly accepted, thanks to such benefits as zero emissions, minimal maintenance, low-noise and reduced vibration. That said, paving and roadbuilding OEMs usually opt to electrify smaller equipment first, due to limitations on battery-size, cycle times and charging infrastructure.

“The heavy road construction arena doesn’t necessarily lend itself well to the current electrification initiatives. Often, these projects don’t have easy access to an electric grid, and moving a milling machine, paver or roller fleet to a charging station daily would impose some significant hurdles,” says John Gravatt, product marketing manager of digital products at BOMAG Americas.

Electrification “is probably not ready for prime time with the larger machines right now,” echoes Justin Zupanc, compaction product manager at Volvo Construction Equipment (CE).

However, this situation could change with improved battery technology and more charging stations, say experts.

Volvo CE and BOMAG have both produced conceptual autonomous machines – a compactor and roller, respectively. Given the ongoing skilled labour shortage in

the construction sector, autonomous equipment offers obvious advantages.

“There’s a struggle in the market for contractors to either retain operators that they have or find new operators. When we start talking about autonomy, this addresses a very real concern for them,” states Zupanc.

Technical limitations, however, make it highly unlikely that completely autonomous equipment will replace existing roadbuilding and paving fleets any time soon. Developing autonomous pavers would be especially complicated.

“On a paver, there are many things the machine interacts with, including trucks and transfer vehicles or the crew itself. I think that will be a hard piece of equipment to become truly autonomous,” says Brodie Hutchins, vice-president/head of sales for Vögele products, at Wirtgen America.

While human operators are still required for the time being, equipment functions are being increasingly automated.

“There are some pretty advanced grade and slope systems that are coming on board,” notes Hutchins. “Also, more and more use of 3D paving, where you load the

jobsite parameters and the information you want into the paver.”

On top of enhancing productivity and efficiency, automation might also help pave over labour gaps, so to speak. Automatic and semi-automatic features flatten learning curves for new machine operators, allowing contractors to get up to speed faster.

In other tech developments, telematics is becoming a standard feature in paving/ roadbuilding equipment, while Artificial Intelligence (AI) offers new opportunities. Within a few years, pavers might start using AI to parse real-time data gleaned from cameras, sensors, GPS systems and LiDAR to “optimize the particular task of the machine,” suggests Gravatt.

Vögele and Hamm, two brands within the global Wirtgen Group, are electrifying portions of their respective fleets.

Back at bauma 2022 in Munich, Germany, Vögele introduced its MINI 500 and MINI 502 pavers, and their battery-electric counterparts, the MINI 500e and MINI 502e. Designed for doing repairs and laying asphalt on small roads

and parking lots, the MINI 500e and MINI 502e offer similar performance to diesel machines while producing zero operating emissions and less noise.

Meanwhile, “our Super 1300 model is being developed for battery power. That’s a paver,” says Hutchins.

While specs for this embryonic electric paver aren’t available, the diesel Super 1300 paver measures 194.8 inches (4,950 mm) long, when fitted with an AB 340 extending screed, and offers a basic width of 70.8 inches (1,800 mm) to 133.8 inches (3,400 mm).

As for conventional wares, Vögele displayed the Super 700i Mini, Super 1703-3i and the Super 2000-3i at CONEXPO 2023 in Las Vegas. All three of these diesel pavers are intended for use in North America.

The four-cylinder Super 700i paver can handle basic paving widths ranging from 47 inches (1,193.8 mm) to 87 inches (2,209.8 mm) when using an AB 220 extending screed. The four-cylinder Super 1703-3i can pave widths from 96 inches (2,438.4 mm) to 186 inches (4,724.4 mm) with a VF 500 front-mounted screed. At six cylinders, the Super 2000-3i has a basic paving width of 118 inches (2,997.2 mm), ranging up to 236 inches (5,994.4 mm) when using an AB 600 extending screed.

Designed for smaller paving jobs and repair work, the compact Super 700i Mini can be fitted with telematics and an ErgoBasic operating system. This system contains a user-friendly paver console with status indicators, paving function controls and backlighting for clear visibility in

darkness. The system also includes a screed operator console.

The Super 1703-3i is intended for commercial and municipal applications while the Super 2000-3i excels at largescale commercial and highway work. Both machines are fitted with an ErgoPlus 3 operating system (an advanced version of ErgoBasic), a RoadScan asphalt temperature measurement system, and Automatic Grade and Slope Control features.

Also at CONEXPO 2023, Hamm showed off its battery-powered, zero operating emission HD 10e and HD 12e tandem rollers. The HD 10e has an operating weight of 5,765 pounds (2,614.9 kg) and a drum width of 39.4 inches (1,000 mm) while the HD 12e weighs 6,073 pounds (2,754.6 kg) and has a 47.2 inch (1,198 mm) drum width. Both are powered by a 23.4 kWh lithium-ion battery.

BOMAG is riding the cutting-edge of roadbuilding and paving equipment, starting with an electric vibratory plate called the BP 18/45 e.

Displayed at the 2024 World of Asphalt

show in Nashville, Tenn., the BP 18/45 e represents BOMAG’s first foray into electric vibratory forward plates. This compact machine weighs 213.8 pounds (97 kg) and offers a working width of 17.7 inches (450 mm). With a push-button start and maintenance-free engine, the BP 18/45 e can be used for asphalt paving and construction applications in trenches, buildings, tunnels, and any other space where diesel exhaust fumes could pose a health hazard.

The BP 18/45 e “offers the same performance as an ICE [Internal Combustion Engine] equivalent, and in an equally robust package, but with even simpler operation,” states Gravatt.

BOMAG fitted one of its BW 213 PDH-5 single drum rollers, which are typically used for heavy soil compaction, with Trimble Advanced Operator Assist at last November’s Trimble Dimensions conference in Las Vegas. This Trimble solution “enables automated control of steering, travel speed, vibration frequency, starts/stops, and lane changing,” explains Gravatt.

BOMAG’s in-house paving solutions include Asphalt Manager, a blended proprietary vibration and automatic control system that “measures vibration feedback and automatically adjusts the amplitude of the vibration accordingly” on heavy tandem rollers, he explains.

Asphalt PRO is a data management and job planning solution while BOMAP is an Intelligent Compaction (IC) system available as a downloadable app for remote viewing. IC systems, “visually map out parameters like pass count, temperature, and even compaction measurement value [stiffness] and display them for the operator,” says Gravatt.

The company also offers an exclusive

ION Dust Shield designed to mitigate fine dust and smoke particles “generated in a typical cold milling process,” he continues.

Also of note, BOMAG introduced the Robomag 2 autonomous single drum roller to North American viewers at CONEXPO 2023. While this concept roller isn’t available commercially, the Robomag 2 “helps BOMAG understand technology needs and limitations on the path to full autonomy,” says Gravatt.

Volvo Construction Equipment (CE) exhibited its DD25 Electric, the manufacturer’s inaugural electric asphalt compactor, at CONEXPO 2023 and began shipping units last year. This machine features an operating weight of 6,140 pounds (2,785 kilos) and a width of 47 inches (1,200 mm) with wide drum.

The low-noise, zero-emission DD25 Electric is intended for smaller-scale compaction chores including street repair work and patching driveways and parking lots. The absence of exhaust fumes makes it ideal for duties in enclosed spaces, such as warehouses and parking garages.

The company reports the DD25 Electric can charge from zero to 100 per cent in an hour with an optional onboard DC fast charger and requires minimal maintenance. Being electric, there is no engine oil, nor air filters, that need changing.

With the DD25 Electric “you have a little bit more performance in general because of the way the electric motor technology works,” says Zupanc.

The DD25 Electric offers instant torque with no ramp up, making it helpful when trying to climb grades or working up a steel slope with both drums on for vibration, he explains.

Volvo’s plans for this year’s World of Asphalt Show (past press time) are to display a smaller electric double drum compactor with the working title, DD15 Electric, adds Zupanc.

Compact Assist offers temperature and pass mapping, data compilation and details about asphalt density and stiffness.

For heavy-duty applications on highways, airport runways, and the like, Volvo CE offers the DD140 and PTR240 asphalt compactors. The DD140 is 236 inches (5,595 mm) long, 92 inches (2,337 mm) wide and 125.2 inches (3,179 mm) high while the PTR240 is 198 inches (5,029.2 mm) long, 82 inches (2,082.8 mm) wide and 123.2 inches (3,129.28 mm) high. As a static machine, ballast can be added to the PTR240, increasing its weight to 52,910.9 pounds (24,000 kg), far beyond the 14,102 pounds (31,090 kg) operating weight of the DD140.

Volvo unveiled an experimental autonomous single drum asphalt compactor called the CX01 at The Utility Expo in Louisville, Ky., in 2021 and continues to conduct research and development into autonomy.

Volvo’s paving tech solutions include a multi-level intelligent compaction system called Compact Assist. In its advanced form,

Volvo roadbuilding and asphalt paving equipment can also be fitted with CareTrack telematics to collect data and monitor performance.

Caterpillar introduced an online cloudbased platform called VisionLink Productivity for its PM600 and PM800 series of cold planers and enhanced its PM300 cold planers in March of 2024.

VisionLink Productivity compiles, analyzes and summarizes jobsite and telematics information from every piece of equipment at a worksite and can be accessed remotely on a phone or laptop. Data includes “time spent waiting for trucks, cutting and travel at the jobsite, as well as distance cut, fuel burn, location and cycle mapping,” states a Caterpillar press release.

Caterpillar’s PM300 cold planers are well-suited for small to medium-sized jobs where maneuverability is a plus. Upgrades to the series include Cat CP.3B 343 horsepower (256 kW) engines for added power and torque, an improved conveyor system and a broader range of left-hand camera features to track the cutting edge on the sides of the machine.

Optional wide dispersion LED road and work lights are available for some Caterpillar PM300 cold planers as well.

Nate Hendley is a freelance writer and author and is a regular contributor to On-Site Magazine.

For the past 125 years, we’ve helped our customers lay the foundation of this country, and trucks like the International® HX® Series are a big reason why. Under its hood, you’ll find the International® S13 Integrated—the bedrock of the nation’s most ambitious projects. international.com

BY WILLIE CARROLL

Digital twin technology has become a game-changer for industries and companies tasked with monitoring, managing and maintaining physical assets. While the concept of digital twin technology has existed for years, rapid advancements in drone technology have made their creation more practical and impactful.

Digital twins are digital recreations of physical objects or systems, designed

to mirror their real-world counterparts by integrating diverse datasets. They act as a constantly evolving connection between the physical and digital worlds, with the ability to be updated in real time based on the data fed into them. Digital twins can represent the current state of an asset, its historical conditions, or even predictive future scenarios, making them indispensable for decision-making and strategic planning.

Beyond their 3D visualization capabil-

The foundation of a digital twin lies in comprehensive data collection. This can often involve capturing hundreds or even thousands of high-resolution images or capturing large quantities of information from other sensor inputs, which all depend on the size and complexity of the asset being inspected. Accurate and high-quality data is essential, and drones have emerged as a superior tool for this task. Their ability to reach difficult or hazardous areas safely and efficiently makes them invaluable in creating reliable digital twins. Drones have the ability with different payloads to collect diverse data types, including photographic images, point cloud data generated from LiDAR

A point cloud rendering of a municipal operation facility.

ities, digital twins integrate multiple data layers, including many different sensor inputs and data from a wide variety of repositories to provide a comprehensive understanding of an asset. By providing accurate and current information, digital twins enhance decision-making, reduce uncertainties and minimize the downtime that can be associated with conventional inspection methods, as those conventional

sensors and thermal imagery. The datasets collected from these sensors form the basis of essential components of a digital twin, such as point clouds, 3D meshes, 2D orthomosaics and digital terrain models (DTMs).

A point cloud dataset is a foundational element of digital twins, consisting of thousands or millions of spatial data points that collectively form a 3D representation of an asset. Each point is precisely geolocated, allowing for accurate measurements and analyses to occur if inspections of an asset is required.

Point clouds enable users to examine an object’s elevation, geometry and spatial positioning, serving as the building blocks of digital twins. In the sample image, the rendering allows for a semi-detailed view of the facility and for measurements to occur. There are noticeable “holes” within the point cloud, however. These are due to the limitations in how the data for this project was collected with a drone, which highlights how important thorough and high-quality data collection is to the generation of a point

methods may require an entire site shutdown to facilitate an inspection.

The adoption of digital twin technology offers transformative benefits, allowing users to comprehensively view and analyze assets without needing physical proximity. This capability can enhance operational efficiency and reduce logistical costs.

Through the use of remote preinspections, digital twins can help

pinpoint specific areas requiring closer examination. This targeted approach can be used to optimize resource allocation for on-site inspections.

As the asset information gathered is accessible to remote stakeholders, the technology also fosters and enhances collaboration. This can be particularly valuable in large-scale or geographically dispersed projects.

The technology also improves site safety. Since inspections can happen remotely, technicians can assess structures and facilities without being exposed to dangerous environments. This can be especially helpful when inspecting hazardous areas.

The use of digital twins can be critical during the planning phases of construction projects. For example, these digital models can be used by architects to demonstrate how structures will fit within a space.

Restoration projects, in particular, can benefit greatly from digital twins. Before on-site work begins, contractors and specialists can use the models to identify areas requiring detailed attention. This

cloud. Incomplete or inconsistent data can affect a digital twin’s creation.

A 3D mesh evolves from a point cloud by adding surfaces between points, typically forming triangular patterns. This process fills in gaps, creating a cohesive and detailed representation of the asset. As with point cloud data, the quality of data collection factors into the quality of the rendering, and its ability to be used for detailed inspections.

Orthomosaics are high-resolution, georeferenced 2D maps generated from aerial imagery. They resemble satellite maps but offer

pre-assessment process saves time and resources by enabling precise planning. Additionally, digital twins provide a visual record of the asset’s condition before restoration, serving as a reference point for achieving historical accuracy.

The integration of drones with digital twin technology is reshaping how industries approach asset management and visualization. By offering comprehensive, dynamic models of physical systems, these models enhance decision-making, reduce risks and improve collaboration.

Whether for construction planning, historical preservation, or operational efficiency, the ability to capture high-quality data through the use of advanced drone capabilities is allowing construction organizations to fully harness the potential of digital twins to revolutionize their workflows and project outcomes.

UAV Practice Leader at global engineering and technical consulting firm Rimkus, Willie Carroll, C.E.T., is a certified UAV/ drone pilot, UAV flight reviewer, professional GIS analyst, engineering technologist and photographer.

significantly finer detail and accuracy. An orthomosaic can provide decision-makers with detailed information about the current state of a facility to aid in strategic planning and operational decisions. A 2D orthomosaic can be quickly updated to reflect changes to an asset, ensuring that stakeholders have access to the most up-todate information.

Digital Terrain Models (DTMs) represent the ground’s surface, excluding features like vegetation or man-made structures. By mapping elevation changes, DTMs ensure that the virtual model reflects the physical terrain accurately, providing critical data for infrastructure planning and design.

Digital terrain model showing elevation changes.

The industry was on display at the world’s largest concrete construction and masonry tradeshow.

Moving from the classroom to the outdoor competition sites, this year’s show saw 27 masons from around the world competing to be “the world’s best bricklayer” in the Spec Mix Bricklayer 500 World Championship, while apprentices in the trade competed in their own Masonry Skills Challenge.

Ohio mason Cole Stamper, working with his brother Forest as his tender, laid 738 bricks in one hour win a new Chevrolet Silverado truck and other prizes as the Bricklayer 500 champion.

“We created this competition in 2003 to highlight the incredible skill and pride that bricklayers all over the world dedicate every day to the projects they build,” said Spec Mix vice-president, Brian Carney. “Now it’s the masonry industry’s most celebrated annual event.”

With almost 58,000 registered attendees, World of Concrete dove into its next decade of service to the concrete construction and masonry industries this past January at the Las Vegas Convention Center.

Over 1,500 companies exhibited this year, putting a spotlight on the latest heavy machinery, tools, products and services for material handling, concrete reinforcement, concrete masonry, cement production and decorative concrete for all types of building, repair, demolition and reconstruction.

Along with the exhibits, the event also had an educational side, with more than 180 learning sessions available on topics ranging from business and project management to concrete fundamentals.

“This event sets the standard for excellence in construction, both excelling in size, attendance and engagement as well as the ability to deliver highly relevant and tailored content to our various audience types,” explained Jackie James, vice-president of World of Concrete. “It provides actionable insights and tangible takeaways that attendees can take into the real world, empowering them to thrive in their roles and stay ahead as the knowledge gained at WOC is applied in the day-to-day work.”

In addition to being transformed into the competition battleground, the parking lots surrounding the convention centre were teaming with machinery and tool demonstrations, as well as the Western Star Trucks Get Tough Challenge, where commercial drivers could test drive vocational trucks on an outdoor obstacle course.

Tuesday night saw tool manufacturer DeWalt put the industry on display for all of Las Vegas to see with a coordinated Sphere and drone show in the skies above one of the city’s newest attractions. The exterior screens of the giant dome were lit up with images from the industry, all “revealed” by drones flying in the shape of a giant crane and other lifting equipment.

At its booth, the company immersed attendees in its lineup of concrete tools, encouraging active participation.

“Attendees really embraced the hands-on aspect of the event, whether it was taking a rammer for a drive or crushing through blocks of concrete with a demolition hammer,” explained Richard Cacchiotti, the company’s director of product development.

Inside the halls of the convention centre, even more booths were buzzing as attendees checked out product displays and new technologies, like a prototype rebar tying robot from Max USA.

“This year’s show really stood out, with strong attendance and exceptional engagement from the customers who drive our industry’s success,” stated Craig Olson, director of sales at Astec Industries.

Next year’s World of Concrete will return to the Las Vegas Convention Center from January 20 to 22, 2026, with education beginning on January 19.

Sensors and formwork technology are facilitating the use of low-carbon concrete.

BY DANIELA EHRENREICH

Concrete is a crucial construction material. It is essential for infrastructure, housing, and even renewable energy projects. Yet, its climate impact cannot be ignored. Concrete production is a major source of greenhouse gas emissions. The challenge is clear: How can we make concrete more climate friendly?

In 2023, the Cement Association of Canada joined with partners in the concrete sector to launch a roadmap and action plan to reduce the CO2 emissions of cement to net-zero by 2050. The cement and concrete industries were also the first to join Canada´s Net Zero Challenge.

These commitments represent an important step forward for everyone who aims to build more sustainably, but achieving these ambitious targets will require innovative approaches. Focus areas will need to include carbon capture, utilization and storage, as well as advocacy for smarter planning with performance-based codes and standards and higher material efficiency.

There are three primary approaches to reducing CO2 emissions in concrete production. The first focuses on optimizing the cement production process by using alter-

native fuels and improving energy efficiency. While this has already led to significant reductions, further progress is slowing. Emerging technologies such as CO2 capture and storage show promise but remain costly and face some technical hurdles.

The second approach involves advances in concrete technology. High-performance mixes with dense structures reduce material demand but are expensive and complex to produce. A more common solution is reducing clinker content in concrete mixes. This is a practice initially driven by cost savings rather than sustainability. Further reductions face regulatory constraints.

The third approach is developing novel binders that reduce or eliminate cement clinker by using supplementary cementitious materials. One example is using Portland-limestone cement (PLC) in place of traditional Portland cement. PLC contains a higher percentage of limestone, typically five to 15 per cent, which reduces the need for clinker, the most carbon-intensive component of cement. Using PLC is just the beginning. There are alternative materials like geopolymers or calcined clays that can replace traditional cement, or at least a certain amount of cement. While technically possible, these alternatives are currently limited to niche applications.

The cements that are in use today can´t be easily replaced by new clinker-reduced cements, because the components do not act in the same way. The required concrete compression strength cannot be reached as easily, especially with certain temperature conditions. Concrete compositions will need adjustment to ensure that each project’s technical requirements are met and that they can perform as expected in practical applications under real-world conditions.

Contractors and ready-mix concrete suppliers should be aware that using cement with lower clinker content may slow reaction time. This can delay the setting and hardening of the concrete, and the compressive and tensile strength of the concrete develops more slowly. These delays often result in prolonged pressure on the formwork.

In some cases, this slower process can cause the opening of element joints of the formwork if the fresh concrete pressure is increased due to different assumed setting behaviours, and the height and speed of concreting are not adjusted accordingly.

In addition, if the system is overloaded, the connecting parts may fail or collapse. Consequently, this slower strength development leads to changed stripping times. Cold or even cool ambient temperatures can

cause delayed development of the early age compressive strength in these new concrete mixes, especially between fall and spring.

When the strength development slows down and more time is needed to reach the required concrete compressive strength, it can cause major challenges and project delays. Previous wisdom such as “pour in the afternoon and remove the formwork the next morning” can no longer be assumed to apply. Results will depend on weather and environmental conditions. Ignoring these aspects can lead to significant safety risks.

On the other hand, we also know that in some cases slower curing times can actually increase the concrete quality and reduce the risk of cracks. However, concrete contractors are frequently under pressure from tight project timelines, so the requirements of quality and efficiency must be balanced.

New digital solutions and initiatives can accelerate the green turnaround on construction sites. Above all, they help to ensure that CO2-reduced concrete mixes can be used safely and productively on jobsites across Canada and around the world.

Reliable and timely information about the temperature and strength of the concrete is crucial for a smooth construction process,

especially with new concrete mixes. Sensorbased solutions provide data on temperature and strength development in real-time, which enables improved control of formwork and in-situ concrete work. Everything from stripping times and curing times to the earliest time for prestressing can be derived from these concrete pressure measurements.

Another exciting development is intelligent heated formwork. This enables the efficient and safe use of CO2-reduced concrete mixes, even in low temperatures. Since these concretes take longer to cure, the heated formwork provides a targeted “heat boost” to accelerate early strength development and reduce curing times.

Encouraging results from an Austrian research project using a heated formwork prototype showed that, in cold weather conditions, the prototype formwork ensured proper strength development, prevented structural damage, and enabled CO2-reduced concrete to be used reliably on-site.

In Norway, a significant stride has been made toward sustainable construction at Cissi Klein Upper Secondary School in Trondheim, where the construction team proved they could use innovative techniques

to reduce carbon impacts, even in harsh winter climates.

The project used CEM III low-carbon extreme concrete paired with heated formwork, reducing CO2 emissions by over 50 per cent compared to traditional concrete.

Despite Norway’s intense winter temperatures, which frequently plunge to -15°C, the project has shown that it is possible to pour low-carbon concrete in frigid conditions without compromising quality. Again, the heated formwork prototype proved its effectiveness.

As the construction industry moves toward more sustainable practices, embracing low-carbon concrete and advanced technology will be essential to achieving net-zero targets. The challenges of slower strength development, temperature sensitivity, and project timelines can be effectively managed with smart formwork solutions, real-time monitoring and innovative heating technologies.

Daniela Ehrenreich is a senior researcher in the research and design department at formwork and scaffolding producer Doka.

Despite having to navigate one of the largest snowstorms in recent record, the 7th Annual Canadian Concrete Expo (CCE) still managed to set records as it continued its growing trajectory. Held at the International Centre in Toronto on February 12 and 13, CCE 2025 smashed the one-day attendance record on the opening day only to be slowed on day two by the snowstorm. Overall attendance for the two-day event was 6,657 visitors. The show experienced a 35 per cent increase in visitors from outside Ontario.

The largest annual trade show exclusively focused on construction in Canada, this year’s event featured 343 national

and international exhibitors representing all sectors of the diverse and ever evolving concrete construction industry.

“CCE is becoming a must attend tradeshow for contractors and professionals operating in the Canadian construction industry,” stated CCE president Stuart Galloway. “The rapid growth of CCE in size, scope and visitor attendance each year indicates the need for knowledge and networking, plus the need to keep up with changing technology and equipment, in this era of modern construction.”

The show, which has significantly increased its footprint at the trade centre, featured two new areas that were well received by show visitors.

The indoor Equipment Demo Area provided show visitors the opportunity to test and operate the latest cordless concrete construction tools at the interactive job site demo areas, as well as to test and operate telehandlers, material handling and concrete pumping equipment.

“The equipment demo area was a complete success and demand in 2026 will likely see the number of participating companies and the size of the demo area double or triple in size,” suggested Galloway.

Elsewhere on the show floor, the Forming, Shoring and Scaffolding Pavilion brought together major manufacturers and distributors serving the Canadian market, attracting strong interest from builders, contractors and developers seeking changing technology, methods, efficiency in use, and cost to projects.

Sharing of knowledge played a key role at this year’s event, with almost 700 visitors registering for the educational sessions on offer, and hundreds more taking in product presentations on the main stage.

“The sessions and presentations at CCE provide a deeper understanding of advanced construction methods, sustainable materials and structural efficiency,” explained Galloway.

Planning for CCE 2026 is already underway, with the show president saying that he expects to see the show grow again in size and scope. The 2026 event will be hosted on February 11 and 12, once again at the International Centre.

BY GUSTAVO POLIDORO

The construction industry is constantly evolving, with new technologies and materials emerging to improve efficiency, reduce costs and enhance sustainability. One of the most transformative developments in recent years is the adoption of synthetic macrofibres in concrete pavements.

While fibre reinforcement has been used for centuries to reinforce mud bricks with straw, considerable advancements have since been made to fibre technology to better enhance mixing and finishing characteristics, as well as to impart improved mechanical properties to concrete. Nowadays, these advanced fibres are reshaping the way we approach modern concrete construction, providing a cost-effective, durable and sustainable alternative to traditional reinforcement.

Synthetic macrofibres are engineered, polymer-based materials, commonly made from polypropylene or polyethylene, that are designed to provide crack control and post-

crack load-bearing capacity to concrete.

Unlike traditional steel reinforcement, which is placed in specific locations, synthetic macrofibres are mixed into the concrete to form a three-dimensional network throughout the structure. This uniform distribution enhances the material’s ability to handle stress, improve durability, and enhance impact and fatigue resistance.

When the size and functionality of fibres are considered, they can be classified into “microfibres” and “macrofibres.”

Microfibres are usually applied for plastic shrinkage crack control, and typically they do not add any structural capacity to a concrete section. These fibres are relatively fine with a diameter in the range of 0.0004 to 0.004 inches and a typical length in the range of one-quarter to one inch.

Macrofibres are typically larger, ranging from three-quarters to two inches in length,

and are designed with unique surface textures or shapes to improve bonding with the concrete matrix. This design ensures that the fibres are anchored securely within the concrete, optimizing their ability to transfer loads and control cracking.

The versatility of synthetic macrofibres makes them suitable for a wide range of applications, including industrial flooring, pavements, precast elements, shotcrete and overlays.

Concrete is one of the most widely used construction materials globally, prized for its strength, versatility and durability. However, traditional reinforcement methods like steel rebar and welded wire fabric come with significant drawbacks, including high costs, labour-intensive installation and vulnerability to corrosion.

For certain applications, synthetic macrofibres offer a solution to these challenges, controlling the shrinkage and temperature cracks as well as providing post-crack load-bearing capacity in flexural and tensile concrete members.

The economic benefits of synthetic macrofibres can be compelling, with savings stemming from reduced material costs as well as the elimination of the labour-intensive process of tying rebar.

One of the key advantages of synthetic macrofibres is their ability to improve the performance and durability of concrete.

Synthetic macrofibres are non-corrosive, ensuring long-term durability even in harsh environments. This makes them particularly well-suited for applications like parking lots, bridge decks and highway pavements, where exposure to moisture and de-icing chemicals can accelerate the deterioration of concrete. Smaller crack widths limit the penetration of potentially harmful chemicals into concrete.

Synthetic macrofibres also enhance concrete’s resistance to common failure modes. Since concrete is strong in compression but relatively weak in tension, it needs a reinforcing mechanism to carry the tensile

or flexural stresses caused by loads, shrinkage and thermal stresses after cracking.

It should be noted that fibres at moderate dosage rates do not typically increase the flexural strength of concrete (at cracking), nor do steel rebar or wire mesh. The flexural strength, or the strength at which concrete cracks, is mainly a function of concrete mix design and curing. The main role of reinforcement of any kind is in the post-crack stage for crack control, providing load-bearing capacity to withstand ultimate forces and moments.

At elevated dosage rates, however, some fibre types can provide strain hardening and increase the ultimate flexural strength.

Field studies have shown that fibre-reinforced concrete (FRC) pavements experience fewer surface cracks and remain functional longer compared to traditional concrete pavements. This makes macrofibres a reliable choice for infrastructure projects requiring long service lives.

The successful application of synthetic macrofibres requires careful consideration of some technical factors. One of the most important aspects is the concrete mix design.

To achieve optimal performance, the concrete mix must be properly proportioned to accommodate the macrofibres without compromising workability or strength. This often involves the use of water-reducing admixtures to maintain the desired consistency and strength.

Pumpability is another key aspect to be considered. Best practices for adequate pumpability include ensuring the concrete

mix is not over-watered, using a working vibrator on the pump grate, and discharging the mix at an appropriate height to facilitate the passage of fibres through the grate.

Finishing operations also play a crucial role in the appearance of FRC. Timing is essential, as the cohesive nature of the mix can make it appear to set up more quickly.

Using a vibratory screed during initial finishing and maintaining clean equipment for broom or tine finishes can help achieve

the desired surface quality while minimizing the visibility of fibres.

Some fibre types in the industry, such as twisted fibres, do not have as much of a tendency to be pulled to the surface during finishing operations, making this fibre an ideal candidate over steel fibres or rigid synthetic fibres, whose stiffness can cause issues along joints when saw-cutting operations are underway.

The versatility of synthetic macrofibres has led to their adoption in a wide range of concrete paving applications. Parking lots, industrial floors and roadways are among the most common uses, where the fibres provide enhanced load-bearing capacity and resistance to wear and tear.

In the U.S., some state transportation agencies are increasingly incorporating FRC

Rip through the toughest of concrete with Ulti-Grit™, a series of powerhouse blades engineered to squeeze every ounce of performance from your flat saw. Go further with exceptional flat saw performance - from the first cut to the last. Contact your sales representative today to learn more about our road sawing solutions and how they can help drive your business forward.

www.husqvarnaconstruction.com

into bridge decks and overlays, leveraging its durability and cost-effectiveness for critical infrastructure projects.

A notable example was the rehabilitation of US 52 in Indiana. This project involved the application of a thin concrete overlay reinforced with macrofibres. The result was a durable, cost-effective solution that met the project’s performance requirements while streamlining construction processes.

Another high-profile project is SoFi Stadium in Inglewood, Calif. By using macrofibre-reinforced concrete for its topping slabs, the construction team was able to significantly reduce costs and accelerate the construction schedule.

The growing adoption of synthetic macrofibres in concrete pavements is a testament to their transformative potential within the construction industry. As more engineers, architects and contractors recognize the benefits of these advanced fibres, their use is expected to expand across a broader range of applications—from industrial flooring to bridge decks and roadways.

Research and development efforts are also driving innovation in fibre technology, with new products emerging to meet the specific needs of different projects. For example, self-fibrillating fibres are gaining popularity for their ease of finishing and reduced visibility on the concrete surface, making them an ideal choice for applications where aesthetics are a priority.

Synthetic macrofibres represent a significant advancement in concrete construction, offering a cost-effective, durable and sustainable alternative to traditional reinforcement methods. These fibres are paving the way for a more efficient and environmentally responsible future in infrastructure constructions.

As the industry continues to evolve, synthetic macrofibres will undoubtedly play a central role in shaping the built environment for years to come.

Gustavo Polidoro is a professional engineer and product manager of marketing and technology for fibre-reinforced concrete at Euclid Chemical.

GOMACO offers the full range of concrete slipform pavers, curb and gutter machines, trimmers, placer/spreaders, texture/ cure machines and bridge/canal finishing equipment. GOMACO equipment features our exclusive and proprietary G+® control system, created in-house by our software engineers from the wants and needs of contractors paving in the field. At the heart of GOMACO equipment is our passion for concrete and our commitment to our customers. We look forward to visiting with you about your upcoming paving projects and your concrete paving equipment needs. Our worldwide distributor network and our corporate team always stand ready to serve and assist you.

White Cap has released its Concrete Formwork Supplement Products, a resource for Canadian tradespeople in the construction industry that contains the most common products used on jobsites. The free guide serves as a reference for any jobsite, offering diverse options that meet different needs.

DeWalt Powershift is a cordless equipment system engineered to optimize the workflow of concrete and construction jobsites through electrification. The system meets the critical needs of concrete professionals – power, runtime and ergonomics – allowing users to transition away from gas-powered equipment, without compromising efficiency and performance. The line includes a vibrator, backpack vibrator, concrete power screed, rammer, plate compactor, core drill and stand, 554WH battery, and a 550W charger.

The S-940 Laser Screed Machine from Somero is available with a fully automated self-levelling screed head, raking/fine grade head and the option of a diesel engine. The machine has a foldable elevation beam that provides a narrower profile during transport and easy entry to jobsites, and its offset screed head provides minimal overlap per pass.

The latest generation of slipform machine from Power Curbers, the Power Curber 5704-D MAX, is a four-track version of its popular 5700 series. Designed to pour curb and gutter, sidewalk, barrier, ditches, paving, tunnels, agricultural and specialized applications, the machine features a compact size, simple design, easy operation, and high productivity, says the manufacturer. It is available with several conveyor options, including a 12 ft. (3.7m) auger, 20 ft. (6m) belt, and 28 ft. (8.5m) belt.

The construction industry continues to experience a pivotal transformation fuelled by ongoing government investment in infrastructure, growing demand for resources, and a push for sustainable building practices. However, these opportunities come with challenges, including shifts in manufacturing capacity and evolving environmental regulations that shape project planning and execution.

For more than 150 years, the Link-Belt brand has remained steadfast in its commitment to progress, delivering innovative solutions that enhance efficiency across construction operations. Today, we continue that tradition by integrating cutting-edge technologies into our excavators, empowering operators with unprecedented control, real-time insights, and reduced environmental impact.

At Link-Belt Excavators, our purpose extends beyond machinery. We are dedicated to strengthening our communities by fostering strong dealer partnerships, delivering reliable equipment, and cultivating a company culture that embraces progress and customer success. These values ensure we remain a trusted partner in the evolving construction landscape—now and for future generations.

We are proud to support On-Site Magazine’s 2025 Canadian Infrastructure Report and recognize the importance of collaboration in overcoming industry challenges. By working together, we can drive efficiency, support critical infrastructure development, and build a stronger future for Canada’s construction sector.

Chris Wise Director of Marketing & Distribution Development

Link-Belt Excavators

BY SAUL CHERNOS

With a trade war with the U.S. undermining economic certainty, there’s no better time to build bridges. These may be challenging times, but highway, rapid transit and other transportation activities are alive and kicking north of the border. The infrastructure sector is poised for another year of growth ahead, as new projects are flowing in as several major projects progress towards their completions.

One of the biggest projects in the country, the $6.4-billion Gordie Howe Interna-

tional Bridge between Detroit and Windsor, Ont., is slated for completion this September. As that looks to wind down, multiple projects are coming to the fore in Ontario. The re-election of the Conservatives to a majority provincial government in late February lends near-certainty to the path forward on the construction of Highway 413. That highway is charted to run 60 kilometres through suburbs north and west of Toronto. The federal government has withdrawn a planned federal environmental assessment, and preliminary planning and

design are underway. As such, early works are anticipated soon.

Also proceeding is the 16.3-kilometre Bradford Bypass, which will link Highways 400 and 404 north of Toronto. Some early preparatory works are completed on its western leg, and the central and eastern sections are likely to come to market this year.

In northwestern Ontario, work on the first phase of twinning Highway 17 is nearly finished, with 6.5 kilometres from the Manitoba border to Highway 673 widened from two to four lanes. Preliminary design

for phase two, an 8.5 kilometre stretch between Highway 673 to Rush Bay Road, is underway, and a third phase that will run 25 kilometres from Rush Bay Road to Highway 17A also lies ahead.

Multiple other projects are also waiting in the wings. The province issued a request for proposals last year for the Garden City Skyway on the Queen Elizabeth Way between St. Catharines and Niagara-onthe-Lake. Plans call for a new four-lane, 2.2-kilometre bridge across the Welland Canal and the rehabilitation and full deck replacement of the current bridge. Each span will have four lanes, with the new one carrying Toronto-bound traffic and the upgraded span being used for Niagara-bound vehicles.

Also coming up is twinning 68-kilometres of Highway 69 north of Parry Sound. With single lanes in each direction currently separated by a small culvert divider, plans call for one additional lane in each direction, separated by a full concrete safety barrier. The addition of a centre passing lane for the two-lane Highway 11 south of Sudbury is also being explored.

Rapid transit is equally active. The Ontario Line project is underway. That’s a downtown Toronto relief subway route expected to cost up to $19 billion, possibly opening by 2031. Also happening in Ontario’s capital city is tunnel boring for a 7.8-kilometre, three-station extension of the Scarborough Subway line. This started in 2023, with a possible 2030 launch. It has an estimated cost of $5.5 billion.

Not too far away, to the west of the city, is the $5.6-billion, 18-kilometre Hazel McCallion LRT. That project is underway between Port Credit and Brampton. Looking a little farther west, early works started last year on a 14-kilometre LRT line in Hamilton, with request for proposals for major works expected this year.

“This government is laser-focused on generating economic prosperity, and they believe the vehicle to achieve economic competitiveness is through expansion of rapid transit and relief of congestion through

expansion of our highway networks,” says Ontario Road Builders’ Association spokesperson Steven Crombie.

In Quebec, the government has started rebuilding the Île d’Orléans Bridge northeast of Quebec City. More than 12,000 vehicles cross daily, but the 90-year-old span doesn’t meet modern safety standards and lacks capacity for heavy trucks. The new cablestayed bridge will include two traffic lanes and space for cyclists and pedestrians. With a current estimated cost of $2.759 billion, completion is expected in 2028.

Construction also continues on the new $2.3-billion Île-aux-Tourtes Bridge, which will replace a troubled 1960s-era crossing that accommodates 87,000 vehicles daily between Montreal’s West Island and Vaudreuil-Dorion. Two new structures, one in each direction, will each include three lanes for motor vehicles, plus one each for cyclists, pedestrians and emergency vehicles. The province says it expects the new structures to open starting in late 2026.

Also in that province, repairs to the Louis-Hippolyte-La Fontaine bridge-tunnel underneath the Saint Lawrence River near Montreal will involve major structural work, modernization of operating equipment, and redevelopment of service corridors. The projected cost is $2.5 billion, with completion slated for 2027. On Route 136 in Montreal, meanwhile, major repairs to the Ville-Marie and Viger tunnels are pegged at just over $2 billion and should wind down by 2030.

Highway work is also ongoing. An $899-million extension of Highway 19 between Highways 440 and 640 in Laval is slated for completion in 2027, and Phase 3 of $883 million in upgrades to Route 185 between Saint-Antonin and Bas-Saint-Laurent near New Brunswick will likely end later this year.

Public transit projects are also active in Quebec. An extension of the Metro Blue Line in Montreal, awarded in 2023 and currently estimated at $7.6 billion, is expected to reach substantial completion by 2031. And one leg of a $6.9-billion expansion of the Réseau Express Metropolitain (REM) is slated for substantial completion later this year.

Xavier Turcotte-Savoie, with the Quebec Road Builders & Heavy Construction Association, is particularly enthused about TramCité, a proposed new tramway in Quebec City.

“We’ve been talking about it for something like 10 years, and it was finally

announced last summer,” he says. The Caisse de dépôt et placement du Québec is planning the line, but the project includes federal funding, and a looming election leaves some uncertainty.

Overall, Turcotte-Savoie considers the workload steady. An $11 billion provincial deficit might impact spending, but Premier François Legault has talked about investing in infrastructure to help boost the provincial economy in the face of tariffs.

The provincial government is also planning a new agency dedicated to major new projects for transportation infrastructure.

“It was adopted by the National Assembly last fall and they’re working on it right now,” Turcotte-Savoie says, anticipating a possible launch this year. “The concept of the agency is a good thing, but we want to make sure the money we put into new projects doesn’t come at the expense of repairs to infrastructure we already have.”

Last year, British Columbia put the $4.15-billion Fraser River Crossing in motion. Plans call for a 2,625-foot-long, eight-lane immersed tube to replace the current four-lane George Massey Tunnel carrying Highway 99 under the Fraser River between Richmond and Delta, south of Vancouver.

The new tunnel looks to meet modern seismic performance standards and offer three vehicle lanes and a dedicated transit lane in each direction, with a separated active transportation corridor for cyclists and pedestrians. Plans also include replacing Deas Slough Bridge between Deas Island and Delta. An environmental assessment, as well as design and early peripheral construction work, are underway, and proponents say they hope major construction can begin next year and conclude by 2030.

Work also continues on the Fraser Valley Highway 1 Corridor Improvement, with $5 billion projected to widen and improve the Fraser Valley section of the Trans-Canada and ease growing congestion. The planned widening spans 21 kilometres and would add an HOV lane to two existing lanes in each direction. It would also add a

bus-on-shoulder lane in each direction to improve rapid transit.

Kelly Scott, CEO of the B.C. Road Builders and Heavy Construction Association, says both projects are key, and the improvements stand to ease commuting times throughout the Fraser Valley south of Vancouver.

“Traffic can be very congested on this corridor. It is the key artery for the economy. This is a huge investment to open the corridor from Chilliwack to Surrey, ease the congestion, and keep the economy moving.”

In the north, a series of small, $30 to $50-million projects are underway as part of the Caribou Road Recovery Program, to address recent flood damage.

On the public transit front, shovels hit the ground late last year on early works for the 16-kilometre elevated Surrey-Langley SkyTrain extension, including pilings and foundation construction. The project has experienced a slight delay, with the initial planned opening moved from 2028 to late 2029 and the cost rising 50 per cent, from $4 billion to just shy of $6 billion.

Scott says he’s pleased construction is also underway on the Broadway SkyTrain line, which will run underground.

“These are both exceptionally large projects. Our members are busy relocating utilities and preparing the ground works for the overhead railway and stations for the Surrey-Langley extension.”

Also on tap are significant investments from Port Vancouver, BC Hydro, Vancouver International Airport, and Metro Vancouver.

With the completion of other major projects, including the Kicking Horse highway, the industry has the capacity for new work, says Scott. “The need to invest in an efficient, effective transportation system that moves our economy west to east has never been more important. These projects align nicely for the industry to continue investing in people, equipment, and local communities.”

In Alberta, the Yellowhead Trail Freeway Conversion in Edmonton is well underway. That is the largest roadworks program in northern Alberta and has a value of just over $1 billion. Extensive upgrades are also underway in Calgary along Deerfoot Trail, with new bridges, interchanges and other components.

“It’s an immense program,” says Alberta Roadbuilders & Heavy Construction Association CEO Ron Glen, who estimates the project’s current work program at roughly $800 million, with additional funding expected as the project carries on. “At the end of the day it will be more than the Yellowhead conversion program.”

Also underway is a $180-million twinning along a 45-kilometre stretch of Highway 3 in the south that passes through Medicine Hat and Lethbridge. “This was put out as a design-build two years ago and it’s now in full swing,” Glen says, adding that work could be completed by 2026.

A significant number of bridges, culverts

and other road-related infrastructure also require attention and, with roads important politically in rural areas, Glen says the recent provincial budget has stood pat on infrastructure spending, so he’s hopeful.

While roads thrive, early work on Calgary’s Green Line has come to a grinding halt. The 46-kilometre, 29-station LRT looked to become the largest public infrastructure project in Calgary’s history, but wrangling over routing, tunnels, development around stations, and escalating costs came to a head last year when city council voted to shorten the first phase due to cost overruns. The province responded by pulling its funding, and the city in turn decided to halt work, at least for now [and as of press time].

“It’s been a boondoggle,” Glen says, noting that initial plans to go underground failed to address complex geotechnical challenges, and routing should have instead been above-ground.

“They need to completely revisit the alignment, which is now happening,” he explains. “But they’re also going to have to revisit the governing structure and the procurement process. And it’s now going to be impacted by the global situation and the tariffs because there are American companies involved or who would like to be involved, and there’s American product that would be involved. So, the budget is now going to be under even further constraint.”

Glen says the current trading environment and uncertainty with the U.S. warrants dedicated attention to infrastructure.

“This is a potentially existential moment for this country,” he says. “Everything we do needs to improve the transportation of goods to market. We need to get our ports and pipelines built so we can get our products to the coasts and into other parts of Canada, because we can’t rely on the United States anymore.”

Saul Chernos is a freelance writer and author and is a regular contributor to On-Site Magazine.

Distributors

Other

BY ON-SITE STAFF

Canada has a significant need of investment in infrastructure, with particular focus on housing- and trade-enabling infrastructure. While there are projects underway, more are needed, and not just in or around the nation’s largest cities. Infrastructure expansion is needed in all regions of the country, and in all segments of the infrastructure sector.

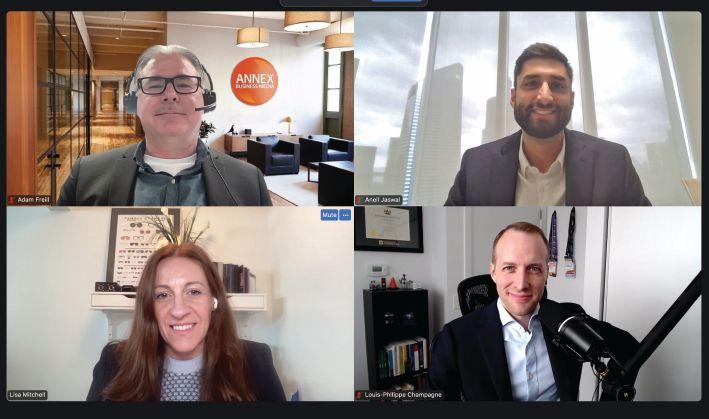

To foster the discussion about Canada’s infrastructure needs, On-Site Magazine welcomed representatives of key construction organizations to a webinar in March to explore current projects, upcoming projects, and the sector’s prospects going forward.

The panel, moderated by Adam Freill, editor of On-Site Magazine, and sponsored by LBX Company, included LouisPhilippe Champagne, vice-president of public affairs and industry practices at the Canadian Construction Association (CCA), Aneil Jaswal, director of portfolio strategy at Canada Infrastructure Bank, and

Lisa Mitchell, president and chief executive officer of the Canadian Council for Public-Private Partnerships.

“We are starting with an infrastructure gap in this country,” said Mitchell. “Not only are we trying to build new infrastructure to enable more housing starts in new communities, but the existing ones are already maybe a little bit behind the eight ball.”

The building of new projects, and the expansion of existing infrastructure components, will likely open opportunities for construction companies for the foreseeable future, said the panellists. Two of the key drivers for the sector will be housing and trade. While trade is in the spotlight due to the trade war, housing has been a core focus for the past several years.

“The price of a home is too high compared to the available incomes of Canadians.

What happened in the 20 years from 2005 to 2025 is the average income doubled, meanwhile the price of a home tripled. That discrepancy has made it more challenging for new owners to get into the market,” explained Champagne. “In order to bring that price down, the only real solution is to change the supply.”

That’s not an easy task, since annual Canadian home completions are typically between 200,000 and 250,000 units per year, peaking at barely more than 250,000, he explained.

“In order to increase the housing starts, a number of things need to happen. We need to have the workforce to build it. We need to have the procurement process be efficient, and we need infrastructure to support it,” he said. “You can’t just build a home in a field. You need streets to get there. You need sewers and water mains to get to the house. You need utilities, you need schools in that new neighbourhood, et cetera, et cetera.”

There is a real cost to building all of this housing-enabling infrastructure, however, and the expense of these backbone systems may not be recoverable for some time, which can make financing the projects difficult, explained Jaswal of CIB.

“A couple years ago, as the housing crisis was starting to really pick up, we took a deeper look at the needs around infrastructure and housing,” he said. “We spoke to municipalities… and we found that they have to make these big upfront investments for growth that really doesn’t materialize for many, many years.”

He pointed to building of a wastewater plant, since the capacity of the water

system is a critical component of the ability of a municipality to expand its residential development.

“That’s typically paid back through utility rates, but that takes 20, 30, sometimes more, years, and sometimes there’s risk for a city that’s putting a major capital outlay up front,” he stated. “We looked at that and thought, how can we help? We’ve developed a product – our new infrastructure for housing initiative – where we have a standardized product that municipalities can access for pretty low-cost financing that shares in the risk of that future development.”

Longer payback periods can make certain projects more difficult to finance traditionally but he explained that the structure of Canada Infrastructure Bank allows it to take a longer-term approach when investing in such projects.

Beyond housing, investment is also needed as Canada and its regions look for new options to export goods, both interprovincially and to the world.

“Canada, for a long time, for decades, has been in the top 10 of best trading nations in the world. That’s how the world sees us. That’s how we see ourselves. We have a significant amount of natural resources. We have a great manufacturing sector. We have been good partners, especially to the U.S., but also to Europe and more recently to Asia. Shockingly, though, in their latest report, we fell from the top 10 to place 32nd; right after Azerbaijan,” said Champagne. “The problem is that our capacity, in terms of trade infrastructure, is declining.”

He added that the trade war has

changed how Canadians view the trading relationship with the U.S., which is heating up discussions about trade-enabling infrastructure. “While they may remain an important trade partner in the future, especially following the Trump administration, we can’t just be dependent to a single trade partner. We need to diversify on both coasts,” he said.

“There have been a lot of people that I think have been thinking east-west for a number of years now, but I think the situation that we’re in has really prompted a broader view of the need for east-west trade and less on north-south,” added Mitchell.

“We want to buy Canadian. We want to turn away from U.S. suppliers in many industries, construction being one of them, and say, ‘We’ll buy more of our own goods made in Canada, our own wood, our own steel.’ But the fundamental problem is that many of these resources are regional in nature,” said Champagne. “How do we get that these goods from east to west to all the markets in Canada? You need significant road infrastructure, significant railroad, ports, airports, name it. This is where the investment is very much needed.”

“We’ve seen plenty of projects in the trade and transportation industry that have been using the P3 model: highways, roads, bridges. There are opportunities and other types of assets as well, ports and other things,” said Mitchell, who explained that integration across agencies needs to be part of the planning process. She looked to Nova Scotia for an example of how this can work.

“They’ve created an organization called the Joint Regional Transportation Agency.

Their board consists of the airport, the port, transit, the rail, everybody that is in that system and network space. And they’re doing an analysis of what the needs are in the region,” she said. “I think those are the types of things we need to see more of across the country, because things don’t operate in silos.”

Jaswal also brought up multi-jurisdictional planning and projects that would enable movement of goods. He pointed to the CANXPORT project in the Port of Prince Rupert in Northern B.C. “They had an issue where they had a lot of empty export containers. This is a problem at many ports in Canada where we’re sending off containers that are empty. So, there’s tons of export capacity in many ways, but how do you access it? We invested in a project that is called a transloading hub. Basically, it allows bulk goods to be containerized.”