MODERN.CLEAN.SAFE

Wood biomass heating technology

from Viessmann

Viessmann offers state-of-the-art wood biomass heating solutions for both residential and commercial applications.

Innovative combustion technology ensures high efficiency. This leads to lower fuel consumption and emissions.

Numerous automatic functions ensure comfortable, reliable, and consistently efficient system operation.

Wood biomass heating systems from 37.4 to 4265 MBH

Over 80 biomass system installations across Canada

Residential & commercial applications

Wood-fired biomass heating systems for residential and commercial applications (outputs from 37.4 - 4265 MBH)

CANADIAN BIOMASS

The Grimsby Energy anaerobic digester keeps compost out of landfills in Ontario.

14 How to stop a pellet plant explosion

Lessons from Pacific BioEnergy in Prince George, B.C.

16 Green operations

The Town of Riverview in Moncton, N.B. opts for a biomass-fuelled operations centre.

18 Pellets in Japan

FutureMetrics’ William Strauss writes about how policies will drive demand for industrial wood pellets.

22 Coal no more

Coverage from WPAC’s 2017 convention in the nation’s capital.

24 Pellet power

An update on Ontario’s biomass generating stations from WPAC’s Gordon Murray.

“… Any oxygen entering would have been disastrous. It was a tremendously risky proposition.”

Read the full story on page 14

Grimsby Energy’s anaerobic digester in southern Ontario is helping keep compost out of the landfill. The new digester began producing biogas on July 15, and on Aug. 10 the facility officially began producing electricity for the Ontario power grid. Read the story on page 10.

IHot button issue

n a matter of days a frightening situation at Pacific BioEnergy turned into a remarkable one with important lessons learned for pellet producers.

This past August at the Prince George, B.C., facility a silo holding 3,500 tonnes of wood pellets began smouldering. The situation was critical. Up to this point efforts to put out fires in pellet silos have been unsuccessful in North America.

But cooler heads prevailed and a co-ordinated effort between the plant’s staff, first responders and FutureMetrics’ John Swaan over the next few days ended in the best possible result – the smouldering was extinguished and the silo was safely emptied. It’s a first in North America, says Swaan, who founded Pacific BioEnergy Corporation in 1994.

pellets from a silo when material fell on him. In June another silo on that site collapsed from a smouldering issue that sparked in April.

Fire incidents at pellet plants in North America and Europe, though uncommon, prompted a research report from Swedish Civil Contingencies Agency’s Henry Persson. The report, titled Silo fires: fire extinguishing and preventive and preparatory measures, was central to Pacific BioEnergy’s strategy. It’s a great example of research leading to action.

Central to the firefighting effort was the injection of nitrogen gas to limit the presence of oxygen in the silo. In a smouldering situation, oxygen is the recipe for an explosion.

Canadian Biomass’ Tamar Atik spoke with Swaan and Pacific BioEnergy’s CEO Don Steele. Read her article about the lessons learned from the successful fire suppression on page 14.

“. . . we’re beginning now to refit and add to our knowledge of our product and how to handle it,” Steele said. “And I think the whole industry is going to learn something from it too.”

As an industry we need to adopt these types of safety lessons – fast. Just a week prior to writing this editorial, an employee was killed at a pellet storage facility in Texas. According to local media, the employee was operating a skidsteer removing

The Wood Pellet Association of Canada is taking safety to the next level with its safety committee, chaired by Pinnacle Renewable Energy’s Scott Bax. That committee organized a well-attended event in Prince George a few months back, and regularly hosts workshops.

At WPAC’s AGM and conference this year safety was the subject of three presentations, including the keynote.

“Take the time and energy to address the culture you want to see,” Bax told attendees. “It’s not about making clever decisions or bigger deals, it’s about engaging people.”

Read our coverage from the AGM and conference on page 22.

Whether you’re in the business of wood pellets or other biomass production, safety is the top priority. Determine if you have the most up-to-date safety research and information, and make sure implementation is a focus of day-to-day operations.

Volume 17 No. 6

Editor - Maria Church (226) 931-1396 mchurch@annexweb.com

Associate Editor - Tamar Atik (437) 990-1107 tatik@annexweb.com

Contributors - Gord Murray, Andrew Snook, William Strauss and Jeff Passmore

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexweb.com

Account Coordinator Stephanie DeFields Ph: (519) 429-5196 sdefields@annexweb.com

National Sales Manager Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexweb.com

Quebec Sales Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

Western Sales Manager Tim Shaddick - tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Curtis Martin

Circulation Manager Carol Nixon – cnixon@annexweb.com 450-458-0461

COO Ted Markle – tmarkle@annexweb.com

President/CEO Mike Fredericks

Canadian Biomass is published six times a year: February, April, June, August, October, and December. Published and printed by Annex Business Media.

Publication Mail Agreement # 40065710

Printed in Canada ISSN 2290-3097

Subscription

- $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $60 US; Foreign – 1 Yr $77 US

CIRCULATION

Tel: (416) 442-5600 ext 3552 Fax: (416) 510-6875 (main) (416) 510-5133 blao@annexbizmedia.com 111 Gordon Baker Road, Suite 400 North York, ON M2H 3R1

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2017 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

www.canadianbiomassmagazine.ca

• Growth in the use of woody biomass in new applications

• Opportunities and challenges in the low carbon economy

• Governments’ role in promotion and regulation of the bioeconomy

• New products, new places: new technology and local deployment

BIOMASS update

EPA APPROVES ENERKEM TO SELL CELLULOSIC ETHANOL IN US

Enerkem Inc. has received approval from the United States Environmental Protection Agency (EPA) to sell cellulosic ethanol produced at its Edmonton facility under the U.S. Renewable Fuels Standard (RFS).

The facility is the first commercial-scale plant in the world to produce cellulosic ethanol made from non-recyclable, non-compostable mixed municipal solid waste, and the first to receive approval to sell in the United States.

The company began producing and selling

biomethanol in late 2016, and expanded production to include cellulosic ethanol with the installation of its methanol-to-ethanol conversion unit earlier this year.

“With this EPA approval, we are now able to sell one of the lowest-carbon transportation fuels into the world’s largest biofuels market,” president and chief executive officer of Enerkem Vincent Chornet said. “This provides further validation of Enerkem’s leading position in the global race to decarbonizing the transportation

fuel sector, which is a major source of greenhouse gas emissions.”

Earlier this year, Enerkem expanded its Edmonton biofuel facility to produce some 13 million gallons of cellulosic ethanol annually following the commissioning of its

ORIGIN MATERIALS TO BUILD OXIDATION PILOT PLANT IN ONTARIO

Origin Materials has announced that it will locate its oxidation pilot plant at the Western Sarnia-Lambton Research Park in Ontario for terephthalic acid (PTA) and furandicarboxylic acid (FDCA) production.

Origin recently purchased this asset from Eastman Chemical Company. This major applications development ($6 million) project is being supported by Bioindustrial Innovation Canada through its COMM SCI initiative with its partners; Lambton College and the Western Sarnia-Lambton Research Park. This project will include the relocation, commissioning and process validation of the pilot plant. BIC will provide advice, services and financial support for the removal of technical and market application barriers to commercialization of bio-based PTA and FDCA to enable commercial production of bio-based polyethylene terephthalate (PET) and polyethylene furanoate (PEF).

In a recent news release, Eastman Chemical Company, headquartered in Tennessee announced that, in addition to the sale of the pilot plant, Eastman and Origin Materials have entered into an agreement for Eastman to license its proprietary 2,5-Furandicarboxylic Acid and

FDCA derivatives production technology from renewable resources to Origin Materials. Terms of the deal were not disclosed.

Earlier this year, Bioindustrial Innovation Canada (BIC) announced a COMM SCI investment in Origin Materials, Sacramento, California, through BIC’s Sustainable Chemistry Alliance (SCA) investment fund, as part of an investment round that will see Origin construct its first commercial scale demonstration facility in Sarnia in late 2018.

“Locating this oxidation pilot plant in Sarnia is further recognition of the great innovation potential within the Sarnia-Lambton area. BIC is very excited to support Origin and their activities. There are many benefits to producing products and conducting applied research within a strong industrial biotechnology cluster,” Sandy Marshall, executive director of BIC said.

Dr. Mehdi Sheikhzadeh, executive dean of applied research and innovation at Lambton College stated: “This project is another very successful example of attracting international companies to our region that will utilize our strong collaborative effort in our community to expand the Sarnia-Lambton Bio Hybrid Chemistry Cluster.”

methanol-to-ethanol conversion unit. This pioneering facility has been financed by private sources and received funding support from Sustainable Development Technology Canada (SDTC), Alberta Innovates and Alberta Energy.

QUEBEC PYROLYSIS PLANT TO PRODUCE BIO-COAL PRODUCTS

Quebec-based pyrolysis plant Xylo-Carbone is receiving $1.5 million in funding from the Quebec Government to build a charcoal production plant that will produce bio-coal products.

The $6.6 million plant is being constructed in the town of Saint-Tite, Que.

The project is being re-engineered using the company’s new Maple Leaf Charcoal technology to produce vegetable charcoal (renewable forest biomass); a new type of furnace with improved mass efficiency and stability with respect to the carbonization process.

The project is expected to create approximately 20 jobs.

FPINNOVATIONS SECURES

LANDS AT TECHNOPARC DE MONTRÉAL

FPInnovations has purchased lands at the Technoparc de Montréal for its international biomaterials innovation centre.

The lands, totalling more than 360,000 square feet, are in the southern part of the Technoparc de Montréal, the Eco-campus Hubert Reeves section.

“I am pleased in regard to this first step toward building an integrated international biomaterials innovation centre under FPInnovations’ leadership. This is an opportunity for the greater Montreal area as well as for the Quebec and Canadian forest industry to lead the way in the field of biomaterials and clean technologies,” said Pierre Lapointe, president and CEO of FPInnovations. “The location chosen at the Technoparc will allow us to get closer to our current partners, to facilitate travel for our collaborators, and to allow our employees to work within an environment that promotes innovation and co-operation.”

Mario Monette, president and CEO of Technoparc Montréal,

WHITESAND FIRST NATION BIOMASS PROJECT GETS FUNDING BOOST

Whitesand First Nation in northwestern Ontario is one step closer to developing an industrial park to support new biomass and wood processing facilities thanks to federal and provincial investments.

The project received $2.81 million from the federal government and $949,539 from the government of Ontario.

The goal of the industrial development project is to attract new business and provide steady employment opportunities for community members as well as those in neighbouring communities.

Community-owned and operated Sagatay Cogeneration LP and Sagatay Wood Pellets LP will be the first tenants of the industrial park. Under Sagatay, Whitesand First Nation has negotiated a 20-year renewable agreement for electrical generation to ensure a guaranteed revenue stream and the sustainability of the industrial park project.

“Whitesand First Nation is proud to partner with the Governments of Canada and Ontario to make this game-changing, generational project a reality,” Chief and Council, Whitesand First Nation, said in a news release. “We have been pursuing this complex development for many, many years and we could not be happier to finally see it moving from development towards construction and implementation. The industrial park will be known as the Bio-Energy Centre and will provide a home for our biomass co-generation facility, wood pellet plant and wood merchandising yard. Whitesand First Nation will capitalize on the new low carbon economy to create meaningful employment, while respecting the environment and providing clean, renewable power.”

The funding complements previous federal support of $1.1 million provided by Natural Resources Canada under its Indigenous Forestry Initiative through the federal Strategic Partnerships Initiative.

said the transaction marks a kick-off in the development of the Eco-campus Hubert Reeves. “FPInnovations corresponds exactly to the type of resident companies looking for a workplace with a perfect symbiosis between humans and nature. We are convinced that the arrival of FPInnovations will attract a growing interest for companies wishing to settle in an environment where nature protection is a priority,” he said.

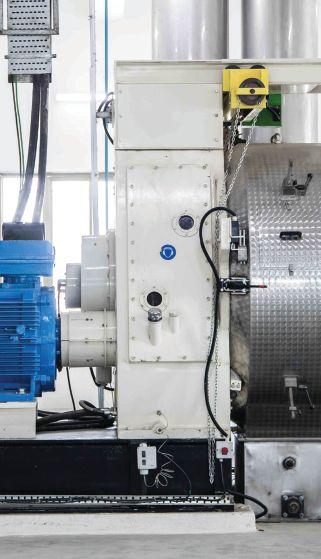

UBC receives new equipment for wood pellet research

The wood pellet research laboratory (BBRG) at the University of British Columbia is getting a boost of $250,000 from the Canada Foundation for Innovation (CFI).

The funding is part of a larger grant of $1.8 million to a larger group of UBC researchers to further support the development of the UBC’s biorefining research and innovation capacity. Founded in 1997, the CFI funds state-of-the-art research infrastructure (facilities and equipment) that Canadian researchers will use to conduct world-class research.

The one-time infrastructure grant will be used to acquire a new pilot scale pellet mill complete with hammer mill, conditioning chamber, pellet press, pellet cooling system, and screens for fine removal.

The new equipment will augment the already well-established facilities for investigations on pellet production, handling and storage. In addition to pilot scale continuous pellet system, a new precision single pellet press will enable the scientists to study the development of new formulations, design, and operating conditions to manufacture high quality pellets.

The single pellet press is capable of controlling temperature, moisture, particle size, and speed of compaction, and pressure.

In addition to the densification equipment, a pilot scale continuous heat treatment (pyrolysis) system is planned to test the commercial production of biochar and biocoal.

Source: Shahab Sokhansanj

Combatting climate change

IPellets can be part of N.B.’s move to a low-carbon economy

By Gord Murray, WPAC executive director

n December 2016, the government of New Brunswick released its Climate Action Plan (CAP), Transitioning to a Low-carbon Economy . The plan lists more than 100 action items to combat climate change including expanding energy efficiency and clean energy programs across all sectors and all fuels; phasing out coal as a source of electricity; investing in smart grids and renewable electricity; establishing carbon pricing and caps on GHG emissions; and increasing spending on energy efficiency.

New Brunswick’s wood pellet sector is well positioned to help the government meet its climate commitments, to improve the provincial economy, and to create more jobs, but needs participation from government and government-owned NB Power to make this happen.

Presently, New Brunswick has four wood pellet plants producing about 190,000 tonnes annually. They are owned by Groupe Savoie, H.J. Crabbe & Sons, Marwood, and Shaw Resources. Northern Energy Solutions is trying to develop a new 200,000 tonne a year plant near Miramichi, but is finding it challenging to secure an offtake agreement. J.D. Irving is studying the potential for a 100,000 tonne-a-year plant in St. Leonard, the feasibility of which is highly dependent on finding a secure outlet for pellets. Ironically, the majority of New Brunswick’s wood pellets are exported through the Port of Belledune to European power plants as a clean replacement for coal, while NB Power uses the very same port to import coal to burn in its Belledune Generating Station. To date, NB Power has been reluctant to consider wood pellets, despite the obvious success of many power plants in Europe, Asia, and even Ontario in converting to wood pellets.

New Brunswick’s producers have had some success in developing a wood pellet heating market within the province. A limited number of public institutions – schools, hospitals, and churches – have installed wood pellet boilers for heating. Some homeowners have installed wood pellet stoves as a lower cost alternative to oil and electrical heating systems. Yet the province’s wood pellet industry would be capable of so much more with the support and engagement of government and NB Power. Growing the wood pellet industry would provide many important benefits for the citizens of New Brunswick including:

• Growing employment and investment in rural communities.

• Growing an industry based on using waste materials generated by the sawmill industry.

• A cost-effective, reliable, and climate-beneficial way to reduce pollution and meet the government’s objective to stop using coal in N.B.

• Lowering heating costs and emissions in N.B.’s homes, businesses, and public institutions.

• Reducing dependence on foreign imports of oil and coal, keeping money circulating within N.B.’s economy for local benefit.

There are some practical ways that government and NB Power can help:

1.

USE WOOD PELLETS AT NB POWER’S BELLEDUNE GENERATING STATION

In the CAP, the province has committed to work toward eliminating coal-fuelled electricity generation as quickly as possible. The government and NB Power should recognize that wood pellets are a cost-effective, reliable, sustainable, and carbon-beneficial fuel for replacing coal as has been proven at many power stations around the world. NB Power should implement wood pellet co-firing at Belledune Generating Station as soon as possible and the province should provide support through financial incentives, policy and legislation.

2. CONSIDER THE ECONOMIC AND SOCIAL BENEFITS OF WOOD PELLETS WHEN EVALUATING OPTIONS FOR HEATING PUBLIC BUILDINGS

In the CAP, the government has committed to phase out the use of fuel oil for heating publicly funded buildings. The government should consider the local economic and social benefits of wood pellets in addition to their climate benefits when evaluating options for replacing fuel oil.

3. PROVIDE FINANCIAL INCENTIVES AND POLICY SUPPORT FOR RESIDENTIAL, COMMERCIAL AND INSTITUTIONAL WOOD PELLET HEATING SYSTEMS

According to the CAP, the province has committed to support the uptake of increased renewables for both electricity generation and residential/business heating in New Brunswick through financial incentives, policy and legislation. The province and NB Power should co-operate in providing such

incentives for commercial, institutional, and residential heating. This could potentially be done through a rental program similar to what has been done for hot water heaters and/or through rebates for new and replacement heating installations.

4. RECOGNIZE THE TECHNICAL AND ECONOMIC BENEFITS OF WOOD PELLETS OVER ELECTRICITY

The government and NB Power should recognize the technical and economic benefits of wood pellets over electricity. Wood pellet heating appliances are commonly at least 80 per cent efficient, compared to 35 per cent efficiency for coal-generated electricity used for heat. Increasing the use of wood pellets for heat would help NB Power to reduce peak electricity demand during winter cold periods and enable its customers to lower their home heating costs. Moreover, a wood pellet stove can be coupled with a small emergency electricity generator to provide secure heat during power outages, such as occurred during 2017’s devastating New Brunswick ice storm.

5. EDUCATE THE PUBLIC ABOUT THE BENEFITS OF WOOD PELLETS

It would be beneficial for the province and NB Power to host a website with up-to-date information about the cost of energy from all sources as well as a comparison table to enable consumers to compare the different options when deciding on a heating source. There should be a co-ordinated,

joint-marketing campaign undertaken by the wood pellet producers, distributers of pellet burning appliances, government, and NB Power to increase the awareness of any new programs implemented, the cost savings of using a pellet-burning appliance and the New Brunswick job creation/retention resulting from increased wood pellet consumption. The province has successfully undertaken a similar campaign to raise awareness of mini-split heat pumps, which greatly increased sales of that technology.

With the introduction of its climate action plan, Transitioning to a Low-carbon Economy, the government has made a major commitment to combatting the effects of climate change. New Brunswick’s wood pellet industry is well-positioned to play its part, but needs the support and engagement of GNB and NB Power to make this happen. •

PDI Drying Systems

Designed to meet the diverse needs of today’s manufacturers.

We provide innovative equipment that is cost-effective with environmentally compliant performance, responsive to even the most stringent guidelines. Our customized solutions use advanced technology to ensure a consistent, quality finished product, giving our customers a competitive edge.

PDI Drying Systems utilize precise airflow management and retention time controls, ensuring consistent outlet moisture.

We also provide Energy Systems and Engineering Services.

• LOW FUEL CONSUMPTION

• COMPLETE CONTROLS INTEGRATION

• STRUCTURALLY ENGINEERED DRUMS AND RINGS

• LOW HORSEPOWER REQUIREMENTS

• CUSTOM FLIGHTING PACKAGES

Innovative Design

Powerful compost

Grimsby anaerobic digester keeps compost out of landfills

By Maria Church

JoePanetta’s stomach has a big appetite. It runs on a diet of peppers, corn, sugars, fats, and a healthy dose of swine and chicken manure.

Panetta’s “stomach” is his metaphor for the Grimsby Energy anaerobic digester that recently began adding electricity to Ontario’s energy grid.

“It’s like the inside of a stomach; if you start feeding it too much stuff it starts getting uncomfortable. It needs the right menu. That’s exactly what digesters are – big stomachs,” Panetta explains to Canadian Biomass during a facility tour in late August.

Panetta is a board member and project manager of Grimsby Energy based in Grimsby, about a 45-minute drive south of Toronto skirting Lake Ontario.

The digester is one of an estimated 17 operating in the province to turn biomass – including municipal compost and farm waste – into biogas to generate electricity. Grimsby Energy’s digester distinguishes itself by being the only one buried 15 feet below ground. As Panetta explains, the goal behind burying the digester chambers is to better withstand Canadian winters.

“We are the first ones to actually bury the tanks because of our winter. In Germany [where the technology came from] it’s not quite as cold so they have theirs exposed. We also have two huge bladder tanks that hold the biogas inside a building. They are indoors because if they are outside they have been known to split in bad weather,” Panetta explains.

Excavation for the project began in late 2015 and involved digging a 300-foot by 275-foot hole 18 feet deep. Construction of actual tanks started in May 2016 and finished on Dec. 20, 2016.

The new digester began producing biogas on July 15. That initial gas – called dirty gas – was flared off for a few weeks as the feedstock worked its way through the system. And on Aug. 10 the facility officially began producing electricity for the Ontario power grid.

Once it’s in full production, four full-time staff members in two eight-hour shifts will feed the digester 60 tonnes of feedstock a day, which will produce 1 MW of power per hour daily.

HURDLES

Unsurprisingly, Grimsby Energy’s biggest challenge to launch was red tape. It took almost five years to get the project approved by the various government bodies. “We had to address

approximately 16 different bodies to get final approval,” Panetta says.

“It’s a brand new technology and people just do not understand the concept. Even our government bodies are not 100 per cent up to speed so when you talk to them about a bio digester, they need to understand it first,” he says.

Once approved, a few other speed bumps set the team back unexpectedly. During the construction of the site, small air pockets in the concrete fill caused leaks in the buried tanks. It

Joe Panetta is a board member and project manager of Grimsby Energy based in Grimsby, Ont. The company’s anaerobic digester began adding electricity to Ontario’s energy grid in August.

took workers several months to find and fix the problem.

The southern Ontario weather presented its own challenges. This spring the Grimsby area experienced higher than average rainfall. “We had six pumps running constantly,” Panetta says. “But there is nothing you can do about the weather.”

And finally a surmountable challenge was finding the right equipment provider to suit Grimsby Energy’s specific needs – most importantly to bury the seven massive holding tanks 15 feet underground. Now that it’s complete, the digester boasts an advanced array of technologies equal to that of the thousands of similar facilities sprinkled across Europe.

Germany-based Novatech GmbH supplied the engineers and parts for the digester tanks, including the agitators, motors and pumps. Bahler Construction built the seven

tanks, two of which span 72-feet across, and the other two almost 100 feet. Dibotec supplied the electrical system for the digester, which consisted of a 40-foot container full of electrical components that connect the machinery on site. The brain of the operation is a single computer installed in the facility’s small office building.

The project’s engineer and electrical contractor Gerhard Klammer from Pure Energy handled all the electrical switchgear and helped secure the 1MG Jenbaucher engine on site as well as many other duties.

DIGESTER DIET

The digester is fed from a weekly menu. Ingredients are carefully selected according to how they will affect the resulting biogas.

“We need to make sure we get the right mixture in there. We don’t want it to start foaming, or have too much acid in there. We have to be very careful to balance it out,” Panetta explains.

Digester foreman Adam Farkas comes up with the menu each week and sends the list over to Novatech for approval to make sure they have a good mix. At the time of the tour, the digester was being fed grape pomace, grasses, corn, oil, sugars, hay, wheat and rye grasses. The plan is to have a steady feedstock that is 90 per cent organics and 10 per cent sugar and water to thin out the material.

The residual biosolids from the system – about 90 per cent of what is put into the digester – is collected and used as organic farm fertilizer.

HOOKING UP

Grimsby Energy has a 20-year feed and tariff (FIT) contract with the province that allows the digester to contribute 24

The digester is one of 17 operating in the province to turn biomass – including municipal compost and farm waste – into biogas to generate electricity.

MW of electricity a day, but with its current capacity it will be producing excess biogas. Panetta hopes to sell the excess as renewable natural gas that can be added to nearby natural gas pipelines.

“We have so much capability of producing so much more renewable natural gas. We definitely have that as another product, and we have a third product, which is heat. We could probably supply enough heat for three municipal buildings,” Panetta says. “It’s another revenue for generating profits.”

In Germany, he says, it’s common for digesters to be located next to schools, government buildings or apartments to supply heat.

In the future, Grimsby Energy would also consider technologies that maximize the efficiency of anaerobic digesters, such as that being tested by GE Water and Process Technologies and new food products grown from the University of Guelph in Ontario, Panetta says. The technology on trial, called biological hydrolysis, moves one stage of the anaerobic digestion upstream from the main tank in order to increase the production of biogas.

But for now, as Grimsby Energy’s anaerobic digester continues to grow its supply chain and ramp up biogas production, the facility will continue to supply its 1MW per hour of electricity fed by 60 tonnes of organic, farming waste, and other biomass.

“We’ve been approached by other interested

Excavation for the project began in late 2015 and involved digging a 300-foot by 275-foot hole 18 feet deep. Construction of actual tanks started in May 2016 and finished on Dec. 20, 2016. Photo courtesy Grimsby Energy.

municipalities and we will give assistance,” Panetta says. “We have the experience, the knowledge, expertise and know where to not make the same mistakes, and yes we would make a second one.

“We are keeping organics out of the landfill, making electricity to sell to the grid, making a profit for our municipality and giving the end result digestate back to the farmers to spread on their lands – 100 per cent nutrient organic fertilizer. It just makes sense,” he says. •

Low temperature belt dryer

How to stop a pellet plant explosion

By Tamar Atik

Onesingle ounce of oxygen. That’s all it would have taken for an explosion to have occurred at Pacific BioEnergy’s Prince George, B.C. facility in August 2017.

It was Thursday, Aug. 24 when chairman and chief executive officer Don Steele found out that one of the wood pellet fuel company’s silos began smouldering overnight. Steele was hosting a group of seven guests who had flown from Nagoya, Japan for a tour of the facility.

“I advised them,” Steele explains. “I said we could go up and have a look. We might even go on the property and they wouldn’t see much. But, at that point in time we were evacuating.”

Although reported as a fire in mainstream media, the incident was a smouldering situation.

Wood pellet consultancy company FutureMetrics’ John Swaan founded Pacific BioEnergy Corporation in 1994. His direction on-site is one of the main reasons why an explosion didn’t take place.

What was the winning solution? Nitrogen injection.

In an industry where the potential for explosions is all too common, this was the first time that a North American pellet operation successfully put out a smouldering issue.

“We have a number of incidents that have happened in our industry, mostly in Europe, that have not gone successfully,” Swaan says.

“There were some references that I shared with Don and his key people on-site,” Swaan recalls from the day. “And then his vice-president of operations gathered his key people around and took a look at what the options might be and looked at the references. I shared the report about how best to handle these situations that was done in a research centre in Sweden.” (Find a link to the report at www.canadianbiomassmagazine.ca/pellets/how-to-stop-a-pellet-plant-explosion-6531)

“So we did some calculations, and based on those calculations, a decision was made with Don and his people to say ‘OK, let’s bring in the nitrogen,’” Swaan says.

“A simple reaction would be to try and open the silo up to put out the fire, which would have been catastrophic,” Steele

The silo incident at Pacific BioEnergy’s Prince George, B.C., facility was the first time that a North American pellet operation successfully put out a smouldering issue. Photos courtesy John Swaan.

says. “Any oxygen entering would have been disastrous. It was a tremendously risky proposition.”

The silo holds 3,500 tonnes of pellets – the energy equivalent of about 10,000 barrels of oil. The incident had the potential to evacuate the entire surrounding city.

Nitrogen injection equipment was brought to the facility from neighbouring Alberta within eight to 10 hours. Alberta’s oil fields have prompted the province’s first responders to be prepared for fire suppression missions to prevent explosions.

The smouldering material in the silo was injected with nitrogen for a few days until it was safe enough to remove in small amounts. Nitrogen arrives as a liquid and needs to be turned into a vapour.

“I think the first principle of it is, liquid nitrogen is an inert gas,” Steele says. “In other words, it can’t explode or burn. So you use it to push the oxygen out of the container and then try and seal it off. We tried with foam and various things, but once you’ve got the oxygen content below a certain level, about 10 per cent, you’ve minimized the risk of an explosion. So then you can start pulling the material out.

“We basically wetted it down, and over a course of seven days eliminated the risk, moved the material out, quenched the fire risk and then stockpiled it over in another part of our property,” he says. “I think the key thing is nobody overreacted… I don’t even think there was a Band-Aid.”

Swaan and Steele say co-operation between industry and first

responders is what ensured a safe outcome.

“This kind of incident has the potential for major, major injury. Our people knew how to safely handle the material and the first responders and fire department knew how to look after our people to keep them out of harm’s way,” Steele says. “They had the respiration equipment, they had the fire hoses, they had the ability and the technique for putting out a fire. Our people knew how to move the material through and safely evacuate the silo.”

Half a million dollars-worth of material and product was destroyed and a lot of equipment was damaged, but Steele says everybody’s safety makes the situation a success.

“It’s a happy beginning actually, because we’re beginning now to refit and add to our knowledge of our product and how to handle it,” he says. “And I think the whole industry is going to learn something from it too.”

“I say anything that can be fixed with money is not a problem. You can’t fix people with money, particularly if they’re severely injured or killed.”

“It’s not a matter of ‘if’ a silo fire could happen, it’s ‘when,’” Swaan says. “But the good news is that we now as an industry have a lot of new learnings. We have experience that we can now share with the industry so that we can make it a safer industry for these types of situations.”

Steele says, “The key thing is, think before you act, use other information, use your judgement, move deliberately, keep everybody safe.” •

Green operations

Town of Riverview opts for biomass-fuelled operations centre

By Andrew Snook

In2013, the Town of Riverview, a suburb of Moncton, N.B., had a workspace problem. The town’s public works garage needed to be replaced with a larger, more functional workspace for the town’s Department of Engineering and Department of Public Works and Parks.

The town identified the need for the new facility in its 2013 Strategic Planning process and was able to approve the $16.6 million needed for the construction of the new facility in its budget in 2015.

In August 2015, the town broke ground on the construction of the new 57,535-sq.-ft. facility. In the fall of 2016, construction on the new Riverview Operations Centre was complete, which

included administration space for municipal staff – which can be upwards of 62 people, depending on the time of year – and storage for the Parks and Facilities’ vehicle and equipment fleet. In addition to the main building, the project included the construction of an 11,744-sq.-ft. salt and sand shed, and an 8,159-sq.-ft. cold storage building for construction materials. Foulem Construction was awarded the contract to build the facility.

GREEN HEATING

The town had a variety of energy options but was interested in green energy solutions. During the design phase with Exp Engineering, the prime building consultant, a lease-to-own

energy arrangement was determined to offer the best overall solution. The town was able to exclude the boiler system from their cost, forgo the operation, maintenance and long term liability of the heating plant, and pay metered energy price more than competitive to other fuel sources. The lease to own arrangement provided a wide range of flexible alternatives for the future.

The energy lease tender encouraged local interest, from mechanical contractors, energy suppliers, and engineering organizations. Design Built Mechanical of Charlo, N.B. submitted the winning tender, together with their engineering partner, MCW.

The design included a biomassfuelled system with a Viessmann Pyrot

300 wood-fired boiler (300kW) to heat the facilities. The Pyrot 300 produces a maximum water temperature of 250F, a maximum water pressure of 30 psig, and is fuelled by locally-sourced wood chips that are supplied by ACFOR, a local forest restoration and energy company based in Cocagne, N.B. ACFOR provided locally sourced fuel as part of their forest management agreement with local partners.

Design Built Mechanical provided a self-contained mechanical plant including the boiler, fuel storage, buffer tank, heat exchangers, pumps and other ancillary equipment for a complete heating system just outside of the main operations centre. An integrated control panel monitors and controls the heating plant and measures/calculates the monthly energy consumption.

“Everything was manufactured at their site then connected on site,” explains Daron Thomas, president of Thomas Industrial Sales. “They laid it all out in 3D AutoCAD. The building was built around the system, delivered to sight, and connected to the mechanical services in the operations building. Underground insulated PEX pipe delivers hot water to the mechanical system.”

The biomass system was completed with a 40-ton wood chip storage building, offering weeks of peak load operation in the winter. The delivered wood chips, with moisture content below 15 per cent, provide the Town of Riverview with renewable energy. Much of the fuel is sourced locally from an area surrounding the town’s water supply.

An electric boiler and small holding tank provide back up energy for the building. The boiler plant is matched to the main building and, besides the stainless steel chimney, looks like a storage building

“The fuel provider has several similar operating systems in P.E.I., and brought a lot of knowledge to the table,” Thomas says. “ACFOR is a forward-thinking partner, who we hope to engage in the future on similar projects.”

To optimize the boiler’s efficiency, Thomas Industrial Sales also installed a 6,000-litre buffer tank to allow for extended run times. The hot water from

the buffer tank is then pumped via two Armstrong variable speed pumps at a flow rate up to 120 USgpm into the distribution system in the building’s mechanical system. The heating system includes fan style heaters, radiation floor heating, and conventional hot water heaters. Control of the system, not just the boiler, is paramount.

Cameras have also been installed in several areas inside the boiler room to help Design Build keep a close eye on the system to ensure it’s operating efficiently. The owner pays for heat they purchase only, so smooth operation

and reliability are key.

The biomass system is owned by Design-Built Mechanical with an extended contract in place to supply energy to the Riverview Operations Centre, allowing the town to reduce its expenses related to the construction of the operations centre, while ensuring a long-term, low-cost energy supply and supporting local businesses.

“They’re turning waste into low energy fuel,” Thomas says.

“It makes perfect sense for everyone. The municipality wins, the industry wins, and the environment wins.” •

The hot water from the buffer tank is pumped via two Armstrong variable speed pumps at a flow rate up to 120 USgpm into the distribution system in the building’s mechanical system.

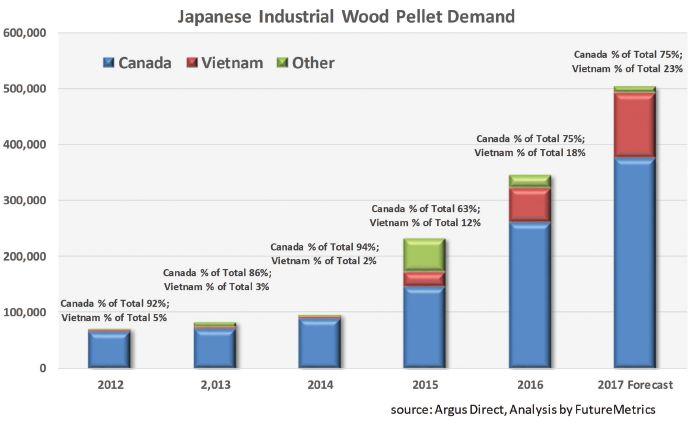

Pellets in Japan Policies

will drive demand for industrial wood pellets

By William Strauss

aggregate demand for industrial pellets used to replace coal in power generation is estimated to be about 14.2 million metric tons. That is the equivalent of a bulk carrier ship carrying 40,000 tonnes about every day.

The majority of demand growth for industrial wood pellets after 2019 is expected to come from Japan and South Korea.

JAPAN VERSUS SOUTH KOREA

Both the Japanese and S. Korean markets for industrial wood pellets are driven by policies that are quite different. However, both policies result in creating a demand for industrial wood pellets as a coal replacement in power plants.

How the supply for those wood pellets is secured in each country is also quite different.

Japanese buyers, supported by a long-term feed-in-tariff (FIT), prefer long-term offtake contracts with set terms for prices. The basis for the policies in Japan is the decarbonization of the power sector, which requires suppliers to show that the pellet supply chain meets sustainability criteria. Japanese buyers therefore prefer to engage with counterparties from countries with strong rule of law (for comfort with the durability, consistency, and security of the supply agreement), strong forest management practices, and stable macroeconomic conditions.

S. Korean buyers, incentivized by the need to comply with the S. Korean renewable portfolio standards (RPS) supported by renewable energy certificates (RECs), and to a lesser degree from carbon trading in the Korean Emissions Trading scheme (KETs), are currently seeking the lowest cost pathway to compliance. Some of the RPS compliance for generating a proportion of power from renewable sources has been from wind and solar generation. But some compliance has been via co-firing pellets. S. Korea, to date, has procured pellet fuel under a short-term tendering strategy that has producers competing several times per year to win supply bids to the individual utility buyers. S. Korean buyers prefer short-term supply contracts from low-cost producers.

JAPANESE POLICY

Japan is guiding its power generation industry with four interlinked areas of policy: carbon reduction, the “best energy mix for 2030,” required efficiencies for power generation, and the FIT.

The only policy instrument that provides a monetary incentive is the FIT.

The majority of demand growth for industrial wood pellets after 2019 is expected to come from Japan and South Korea.

Carbon emissions targets

Japan has already implemented a target reduction of CO2 emissions that requires all power companies to reduce CO2 per kWh by 35 per cent from 2013 levels by 2030. This is a reduction from 0.57kg of CO2/kWh to 0.37kg of CO2/kWh. It is currently a voluntary target but a few major utilities are already co-firing wood pellets at modest one to three per cent ratios.

There are a few pulverized coal (PC) power stations currently co-firing wood pellets in Japan, and there are some having discussions for pellet fuel supply with major producers. Those stations that are either currently co-firing or in discussions about fuel supply add up to about 18,700 MWs. Graphic 1 shows the pellet

demand at these stations under three co-firing ratios. At the higher co-firing ratios, the plants may need modifications and/or retrofits to pulverizers, burners, pneumatic fuel conveyance systems, and some other components.

It is unlikely that co-firing ratios for the large utility generators will exceed 15 per cent as will be discussed more fully in the section on the FIT.

The voluntary policy for carbon emissions mitigation may change to required reductions. Japan has committed to the international agreement for CO2 reduction. That target is for a 27 per cent reduction by 2030.

Some of that CO2 reduction will be achieved with renewables and some with nuclear. The government’s energy mix goals show how this might be achieved.

Best energy mix

The Japanese government’s analysis (from METI, the Ministry of Economy, Trade, and Industry) expects the nation to demand about 1,065 million MWhs in 2030. The government’s strategic plan includes a breakdown of the desired energy mix in 2030. The nation will be expected to produce power based on the breakdown shown in Graphic 2.

Within the renewables, biomass is 4.3 per cent of the 245 million MWhs per year allocated to renewables. To meet that demand in 2030, Japan will have to have generation capacity of just over 6,000 MWs from biomass. If 30 per cent of that 6,150 MWs (1,845 MWs) are generated from

pellets, Japan will consume about 7.4 million metric tons per year of pellets.

To meet that demand in 2030, Japan will have to have generation capacity of just over 6,000 MWs from biomass. If 30 per cent of that 6,150 MWs (1,845 MWs) are generated from pellets, Japan will consume about 7.4 million metric tons per year of pellets.

Minimum generation efficiency requirements

The Japanese regulators have set minimum generation efficiency requirements for all large coal power generation stations. The minimum requirement will be 41 per cent and will have to be met by 2030. Currently only the ultra‐supercritical pulverized coal plants meet this requirement.

The Japanese Ministry of Economy, Trade and Industry (METI) has allowed the formula for calculating efficiency to be modified to encourage the use of wood pellets as a substitute for coal to “change” the efficiency calculation. Typically, efficiency (or heat rate) is based on the energy output versus the energy input. For example, if 100 MWs of energy are put into the boiler and 35 MWhs of electricity is generated, the efficiency is 35 per cent.

The modification to the calculation is to allow any MWhs generated from wood pellets to be subtracted from the denominator. Thus the calculation for the example would now be:

If the plant was producing 35MWhs and the total power is 100 MWhs but the power from pellets is 15 MWhs, the “efficiency of

the plant would be 35/(100‐15) = 41 per cent. In other words, PC power plants with efficiencies below 41 per cent can co-fire wood pellets to achieve the minimum efficiency requirement.

The supercritical and subcritical plants that continue to operate will have to co-fire pellets if, for no other reason, to meet this requirement.

Given 17 GJ/tonne pellets, these selected power plants will have to consume about 2.13 million tonnes of pellet fuel.

Feed-in-Tariff

Of the four policy instruments in Japan, the FIT provides the direct financial support to power generators that will compensate them for the higher cost of generation with pellet fuel.

The FIT scheme started in July 2012. Under the FIT, electric power transmission and distribution companies are obliged to purchase electricity generated from renewable energy sources on a fixed-period contract at a fixed price. The cost for purchasing the renewable power is paid by electricity users in the form of a nationwide equal surcharge on power bills.

Since 2012, purchase prices of the FIT have been reexamined by METI. The FIT price for solar PV has been lowered and some new categories have been created for wind, hydro and biomass.

The FIT for pellet fueled power generation will be lowered to ¥21/kWh in October 2017 from its current ¥24/kWh (from about $0.22 to about 0.19 per kWh at 111 yen per dollar). The duration of the FIT is 20 years from the start of the project. However, the FIT is not adjusted for inflation. It is a fixed payment per MWh for 20 years.

(If the Japanese utility is to avoid the risk of the fuel becoming too expensive given the fixed FIT, they will have to engage

Graphic 1

Graphic 2

in offtake agreements that are based on a known starting $/tonne with a fixed escalation rate. The cost of pellets cannot go too high over the term of the offtake agreement such that the cost of generation causes the power station to have their bottom line go negative. There are many inputs to determine the “levelized cost of energy” and the expected revenues from the sale of coal generated power and the portion generated from wood pellets that does receive the FIT. FutureMetrics can provide detailed analytics on identifying and minimizing the risks in an offtake agreement for supplying pellets to Japan.)

There is no upper limit restricting the size of a power plant benefiting from the FIT for new power plants. But there is a de‐facto limit due to permitting. If the power plant is less than about 110 MWs, then a full environmental assessment is not required. For a small plant the assessment takes one or two years. For proposed plants that are larger than about 110 MWs, the full assessment requires at least five years. Most of the current and planned FIT projects are smaller independent power producers (IPPs).

Due to the carbon policy, the “best energy mix” policy, and the required minimum efficiency requirement, some of the major power generators will be forced to co-fire pellets. The major power generators who need to co-fire pellets at their existing power stations will likely be allowed to benefit from the FIT (for the MWhs generated by pellets) and co-fire at the rate of up to about 15 to 20 per cent. However, as noted above, at a 10 per cent co-firing ratio, it is possible to reach the “best energy mix” criteria. At a co-firing ratio of 10 per cent by selected major utility power plants, the demand for wood pellets is expected to exceed seven million tonnes per year.

JAPANESE GROWTH

There are numerous projects planned and many are currently either co-firing wood pellets or running dedicated systems using pellets or low grade biomass or palm kernel shell (PKS).

(For example: according to reports, U.S. wood pellet producer Enviva, and sponsor Enviva Holdings, has signed an initial agreement with a Japanese trading house for 650,000 t/yr of supply to a dedicated biomass-fired power plant in Japan. The dollar‐denominated, 15-year contract is

3

expected to commence in 2022, subject to documentation of the definitive agreement and contract particulars, and will fully cover the power plant’s needs. The dedicated plant is the largest announced in Japan to date. Enviva is in discussions with other large Japanese trading houses, utilities and independent power producers that are looking to build more than a combined 1.7GW of biomass-fired generation capacity. The negotiations are “well on track.” Those projects would create more than 7mn t/yr of wood pellet demand, although Enviva does not expect all the capacity to be constructed. Enviva has been eyeing the growing Japanese biomass market in recent years, but, as yet, only minimal U.S. wood pellet exports have made it to Japan, which sources most of its imports from Canada’s west coast. Japan imported 150,500t of wood pellets from Canada in the first half of this year, compared with just over 100t from U.S.)

Most of the currently running dedicated systems are relatively small circulating fluidized bed (CFB) boilers that do not have pulverized fuel systems. CFB boilers can burn a wide range of biomass fuels, including wood pellets. However, most will likely use palm kernel shell (PKS). PKS is not pulverizable and cannot be used in PC boilers.

Actual demand though 2016 and forecast demand for 2017 is shown in Graphic 3. Canada continues to be the major supplier of wood pellets to Japan and is expected to be a major supplier into the 2020s.

A significant proportion of current biomass demand in Japan is satisfied by the

import of palm kernel shell (PKS). All PKS imported into Japan comes from Indonesia or Malaysia.

CONCLUSION

The large power stations owned by the major Japanese utilities are being guided into decarbonization with the limits on CO2 per MWh, with compliance to the “best energy mix,” and with improved efficiency that allows the wood pellet generated portion of the total power output to “improve” efficiency.

The 20-year duration of the FIT, starting at very generous rates that are more than double the average spot rate in Japan, will support long-term and stable demand for industrial wood pellets. (In the summer months on very hot days the spot rate may exceed ¥25/kWh. The average over a year is under ¥10/kWh.) However, given that the FIT is fixed for 20 years, those long-term agreements with Japanese buyers will likely require known starting prices and fixed price escalators.

Given a set starting price and a fixed annual increase in price, inflation risk will be borne by the producers. Understanding that risk and setting the terms of the agreement are critical to the financial durability of the deals. Nonetheless, there is an expected large and stable market in Japan bringing significant potential for healthy sustainable growth in industrial pellet production.

FutureMetrics is a leading consultant in the wood pellet sector. William Strauss is its president and founder. Visit www.futuremetrics.com.

This article originally appeared in the October 2017 issue of Wood Bioenergy. •

Graphic

Coal no more

Coverage from WPAC’s 2017 convention

By Tamar Atik

Transitioning away from coal. That was the main theme at this year’s WPAC conference in the nation’s capital.

Executive director of the Wood Pellet Association of Canada (WPAC) Gordon Murray said the industry received the confirmation it needed regarding the government’s commitment to reducing GHG emissions and making bioenergy more widespread across Canada.

“All of our focus, being here in Ottawa, has been to educate not only the producers, but the regulators, government people, and the power utilities who did show up in good numbers, about the benefits of biomass here in Canada,” Murray said. “We’re not going to have a successful industry unless we can demonstrate to the public and the governments how sustainable biomass is.”

Acting director general for Natural Resources Canada Rory Gilsenan said Canada is increasing its coal to biomass conversion to achieve reduced GHG emissions by 2030. “Biomass is Canada’s natural advantage,” he told the audience. “Your industry, the wood pellet industry, is part of a transformation of the forest sector.”

That transformation was spearheaded in Canada by Ontario Power Generation (OPG). Referring to its conversions to biomass at its Atikokan and Thunder Bay generating stations, which use white wood pellets and advanced wood pellets respectively, Murray said he hopes other power utilities will soon follow suit. “We’re really encouraged that companies like Capital Power have done a lot of work, and we’re optimistic that they’re going to make some positive moves with biomass,” he said.

Capital Power’s Sandy Fleming echoed that sentiment in his presentation, saying “We’re very confident that it’ll be easy to defend this type of fuel [as a primary replacement].”

The conference agenda included an international panel of speakers whose companies have made the jump to biomass. Rick Taylor from Drax Power, Preben Messerschmidt from Ramboll, Yves Ryckmans from Laborelec and Rob Mager from OPG each discussed their respective companies’ conversion journeys from coal to biomass.

“Wood pellets are part of the solution to a greener world,” said WPAC president Rene Landry. “Today, we are only just scratching the surface of our industry’s potential.”

President and founder of FutureMetrics William Strauss said wood pellets are part of Canada’s decarbonisation strategy. “This is not a small industry that clawed its way into existence.” He said leveraging existing carbon plants is a reasonable, logical solution to decarbonisation, adding that no other solution provides the most benefit. Strauss noted that wood pellets emit 90 per cent less CO2 than coal and said, “Canada has all the right ingredients to join

other nations who are already using pellet fuel.”

There was also a deep focus on safety. Keynote speaker Candace Carnahan’s “See something…say something!” session drove that message home as she re-visited her personal workplace injury that cost her a leg.

That’s also what Pinnacle Renewable Energy’s vice-president of operations Scott Bax focused on, telling the crowd, “You have to really want change.”

On the global pellet outlook, Hawkins Wright’s Fiona Matthews said total global demand in 2016 came in at 28.6 Mt (million tonnes), with a 26 per cent demand growth in Asia compared to only two per cent in Europe.

Europe’s heating market, however, has rebalanced more quickly than anticipated because of both colder weather and lower oil prices. U.K. imports increased by 7Mt in 2016 and supply and demand are now more balanced on the continent after a difficult couple of years.

Canada was the second largest exporter of wood pellets to Europe in 2016. Canada’s global demand also came in at 3.6 Mt compared to 12.3Mt for the U.S.

As Pinnacle Renewable Energy’s Vaughan Bassett said, “Canada can, and we should.”

Join us for WPAC 2018 from Sept. 18-19 in downtown Vancouver! •

Wood Pellet Association of Canada executive director Gordon Murray addresses the crowd at the 2017 WPAC conference.

Pellet power

An update on Ontario’s biomass generating stations

By Gordon Murray

TheWood Pellet Association of Canada (WPAC) held its annual conference in Ottawa in September 2017. Only a few months before, Prime Minister Justin Trudeau had announced the Pan-Canadian Framework on Clean Growth and Climate Change, the new national plan to meet Canada’s emissions reduction targets, grow the economy, and build resilience to a changing climate. WPAC wanted to make sure that government understood how wood pellets could be used to generate power and heat while helping Canada fight climate change and meet the country’s 2030 emissions reduction targets.

WPAC organized a two-day post-conference tour to Ontario Power Generation’s Atikokan and Thunder Bay biomass generating stations, its Kakabeka hydro-electric generating station, and to Confederation College’s Biomass Energy Facility. The group of 15 tour participants included scientists, engineers, consultants, and commercial executives from Canada, Austria, Germany, Norway, the Netherlands, Sweden, and the United States. Darcey Bailey, OPG’s production manager west, was the group’s tour guide. Not only is Bailey a professional engineer and the person responsible for overseeing the operation of the two biomass power plants as well as

several hydro-electric generating stations, he was directly involved in the planning, engineering, and construction of the biomass conversions of Atikokan and Thunder Bay, and he exudes enthusiasm at all times. The group was extremely fortunate to have him as a guide.

A few of the topics we discussed during our visit included: (1) why the two biomass conversions took place, (2) why the two plants continue to operate, and (3) what their future might hold.

The genesis of the Atikokan and Thunder Bay coal-to-biomass conversion projects was in 2001, when Ontario had five coalfired generating stations providing 25 per cent of the province’s electricity. That year, Ontario announced that it would close the Lakeview Generating station, which it accomplished in 2005. In 2003, the province announced its intention to close its remaining coal-fired generating stations. Atikokan closed in 2012, followed

The government of Ontario is proposing to build an East-West tie line expansion and a transmission line to Dryden and points

would be to increase the capacity of Atikokan and Thunder Bay generating stations.

An

Wawa

Pickle Lake

by Lambton and Nanticoke in 2013 and Thunder Bay in 2014. By the time the final plant had closed, Ontario had reduced its GHG emissions from electricity generation by more than 80 per cent. In 2005, the province issued 53 smog advisories; now there is no longer a need for smog advisories.

The conversion of the 205-megawatt Atikokan Generating Station to white wood pellets was completed in 2014 at a cost of $170 million. The original plant was built in 1985 at a cost of $800 million. Thunder Bay Generating Station converted one of its two 153-megawatt units to advanced wood pellets for $5 million in 2015. Both plants are used as peaking plants to help with local load balancing, with Atikokan operating about 10 per cent of the time and Thunder Bay operating about two per cent of the time.

Northwest Ontario is a vast region dominated by forestry and mining, which in recent years has declined, substantially reducing electricity demand. Current average regional demand is about 700 MW with peak demand in the 1,100 to 1,200 MW range. The region has 687 MW of hydro-electric generating capacity and 358 MW of biomass generating capacity: 205 MW at Atikokan and 143 MW at Thunder Bay. Northwest Ontario has three grid interconnections with Minnesota, Manitoba, and via a 400-kilometre transmission line from Thunder Bay east to Wawa and the rest of the Ontario grid.

Despite recent declines in forestry and mining, there are approximately 25 new mines under development in northwest Ontario, many of which are expected to be in production by 2020. One area – the Ring of Fire – is a massive planned chromite mining and smelting development that is expected to be as significant in terms of economic activity as Alberta’s oil sands.

Moreover, the province is under pressure to connect a large number of remote northern communities to the electrical grid. There are many remote communities in the northern part of the region that are not connected to the grid and produce their own power from expensive diesel generators. Ontario’s Independent Electricity System Operator (IESO) has concluded that there will be significant new electricity demand in northwest Ontario. Consequently, the province is planning two new

high capacity 230 KV double-circuit transmission lines: one to parallel the existing 115 KV line to Wawa, and a second line to run northwest from Thunder Bay to areas north of Dryden and eventually to the Ring of Fire.

Considering that northwest Ontario has three grid interconnections and is planning additional high capacity transmission lines into the region, it raises the question as to why the Atikokan and Thunder Bay biomass conversions were needed. There are many compelling reasons:

1. To extend the life of valuable existing assets. Many millions of dollars were invested in building the two generating stations and they had significant useful life remaining. The cost of converting the plants from coal to biomass was a fraction of their original construction cost.

2. To provide regional energy security. The regional hydro-electric generating stations have only enough capacity to cover average base-load demand, provided they are all operating at 100 per cent capacity without any downtime. It is risky to rely entirely on low-capacity long-distance grid connections for balancing.

3. To provide community economic support. With the recent decline of regional forestry and mining, the two generating stations provide important jobs and economic activity. In the case of Atikokan, the generating station provides about $2 million of municipal tax revenue and is a vitally important employer.

4. To provide future regional base load electricity. Recent estimates have put the cost to build the 230 KV East-West Tie Line between Thunder Bay and Wawa at $777 million. The

transmission line to Dryden and Points North could cost another $1 billion or more. These costs are to be shared by all OPG rate payers. Ontario rate payers have recently been expressing outrage at the rapidly rising cost of electricity and there may be too much political risk in proceeding with such expensive new projects.

5. To maintain diversity in Ontario’s electricity mix. Ontario’s electricity mix consists of nuclear, hydro, natural gas, wind, solar, and biomass powered electricity. The province is committed to maintaining a diverse renewable energy mix.

WPAC is an enthusiastic supporter of the biomass conversions of OPG’s Atikokan and Thunder Bay power stations. Our members export millions of tonnes of wood pellets to power stations in Europe and Asia where they have had great success in using wood pellets as a replacement for coal to reduce GHG emissions. Despite this, most Canadian coal power producers remain unwilling to consider wood pellets. Ontario Power Generation is a refreshing exception and it is highly beneficial to be able to point to their two biomass generating facilities as local success stories.

On Sept. 15, 2017, immediately before WPAC’s Ottawa conference, the Canadian Council of Forest Ministers announced a Forest Bioeconomy Framework for Canada. WPAC is optimistic that this will bring increased focus and attention on bioenergy and that other power utilities will follow OPG’s lead by bringing more biomass power projects to other regions of Canada. •

Gordon

Murray is the executive director of the Wood Pellet Association of Canada.

Ontario’s Electricity Sector GHG Emissions.

Biomass dryers

Staff Report

EARTH CARE PRODUCTS

ECP’s patented Z8 Rotary Dryer is the heartbeat of its proprietary process equipment for dehydration of all forms of biomass. The patented reverse-flow, impinging-stream dryer design with increasing thermal-velocities provides maximum heat-transfer offering multi-stage dehydration within drum embodiment. The material first passes through a single-pass section and then through a reverse-flow triple-pass section, and then repeats the process. The patented design provides uniform dehydration of all particle sizes with no overheating of fines with increased production capacity while minimizing VOC emissions. The Z8 Rotary Dryer can be designed as a drop-in replacement for existing Single-Pass and Conventional Triple-Pass Rotary Dryers. www.ecpisystems.com

WYSSMONT

The Wyssmont Turbo Dryer thermal processor has long been producing solvent recovery systems, heat recovery systems, and environmentally sealed dryers that may be especially designed with condensers or scrubbers for products such as biomass, biofuels and biowaste. Applications with biomass, biofuels, biowaste that may emit toxic gases when pyrolyzed, are only a few of the alternative energy and

environmental applications in Wyssmont’s long history. Other related applications include recovery of oil and carbon black from the heat treatment of rubber tires. The Wyssmont Turbo Dryer thermal processor has recently added to its accomplishments: the first torrefaction dryer in the U.S. www.wyssmont.com

DIEFFENBACHER

Dieffenbacher high-capacity drum dryers are well recognized for their efficiency and reliability. They are the ideal solution for drying of wood particles for particleboard and pellet production, strands for OSB production, disintegrated seasonal annual crops and other biomass. The dryer internals are designed according to the material characteristics for high thermal efficiency and low moisture fluctuation. Dieffenbacher drum dryers meet high safety standards. The perfect integration of energy system and drum dryer creates additional value for customers, from the planning phase through the complete lifecycle. www.dieffenbacher.de/en

PDI

PDI specializes in the design and supply of custom rotary dryers and energy systems for the wood products industry. PDI’s exclusive burner technology utilizes either green or dry fuel. Combined with single pass dryers, PDI delivers a drying and energy system that is cost-competitive and versatile. PDI offers a custom solution for manufacturers in the engineered wood products, wood pellet,

and animal bedding markets. From feasibility studies and engineering, to equipment supply, to turnkey manufacturing operations, PDI offers comprehensive support for all the wood products industry’s drying and energy needs.

www.playerdesign.net

THOMPSON DRYERS

A Thompson Biomass Dryer System dries temperature-sensitive, organic materials safely at a high capacity with thermal efficiency around 85 per cent with minimal air pollution, little material degradation and low fire risk. Thompson Dryers offers the most cost-effective and energy-efficient biomass dryer available today. Designed to operate for 8,400 hours per year, Thompson biomass dryers are fabricated to the same rigid criteria that has kept some Thompson systems running continuously for over 60 years. With Thompson’s proprietary internal flighting package, the dryer is able to dry both small and large chips in your product feed uniformly, inside and out, to the desired dryness.

www.thompsondryers.com

ALTENTECH

The Altentech Biovertidryer has been uniquely engineered to dry virtually any type of biomass from wood fibre, including hog fuel, to agricultural by-products consistently, safely, and cost effectively. Some of the significant advantages it offers include: Lower emissions with no additional filtration systems; less energy needed for better drying results; temperature and operation adjustments effective in minutes; output widely adjustable from approximately five to 15 plus tons per hour; reduced temperature and the elimination of turbulence greatly reduces any chance of fire or explosions; and small footprint and modular with over 70 per cent less real estate coverage than a rotary drum dryer. www.altentech.com

GEA

After pioneering Distiller’s grains drying in the Scottish whisky industry in the 1960’s and 70’s, GEA has become the preferred supplier of drying technology in

the bio-ethanol industry providing distinguished product quality. To increase efficient energy usage, systems can be heated by turbine exhaust gases or utilize exhaust gas-recycle which also renders the system inherently safe. The Feed-Type Ring Dryer is designed for drying feed and fibrous materials where extended drying times are required without product damage. Features include a cold disintegrator for breaking up agglomerates and a manifold for recycling heavier and wetter particles back to the disintegrator. GEA also has considerable experience in drying other moist materials including corn fibre/gluten, wheat and corn feed, cellulose and lignin. This dryer is capable of evaporative capabilities of up to 30 tons per hour. GEA will pair the Ring Dryer with a Fluid Bed Cooler for final powder conditioning. www.gea.com

SÄÄTÖTULI CANADA

The Säätökuivaus continuous dryer dries large quantities of woodchips with accurate and homogeneous final moisture content. The dryer is divided into three

separate sections. Woodchips move between an upper and a lower conveyor through the sections. The dryer can use any hot air source. With Säätötuli 2x500kW biomass hot air generators, the dryer will convert about 14.1 ton of green woodchips (55 per cent moisture content) into seven ton of pellet-grade woodchips (5 per cent moisture content) per hour. The Säätökuivaus batch dryer has a 16-cubic meter tank for woodchips. The dryer pushes hot air through the batch and monitors the weight in real-time to obtain the right moisture content. The bottom of the dryer is equipped with hydraulic scrapers and an unloading auger.

www.saatotuli.ca

UZELAC

The triple-pass dryer for wood chips and biomass by Uzelac Industries has a number of unique advantages over similar dryers. Its bolt-on tire design reduces maintenance and increases tire life, while the overhead drive reduces wear on the rollers. Access doors on the outer and intermediate cylinders allow for easy inspection and cleaning of all three

Our competitors say we’re old and slow to change. That our machines are ugly. That we’re not on the cutting edge.

We say, “Yup.”

“Old” means we’ve been around for over 100 years—and we’ll be here for 100 more.

“Slow to change” means we don’t do fads. Oh, we’ll turn on a dime to make changes that our customers need. But fads? Nah. We’d rather protect your investment.

“Not cutting edge” means we’re proven. We build what works and we stick with it.

And “ugly”? Well. You don’t need to be pretty to make a damn good pellet mill.

cylinders of the drum. Uzelac Industries also custom-designs and manufactures its own equipment, offers project management and 3D modeling, and supports hundreds of dryer installations in North America with parts and service, with 37 years of experience in drying biomass, biosolids, rendering and minerals.

www.uzelacind.com

SWISS COMBI

SWISS COMBI belt dryers are used for continuous drying of various wood products and other biomass by using waste heat sources from industrial processes or power plants. Belt dryers are available up to ca. 28t/h of water evaporation and 424m2 drying surface. Heat sources for the dryers include steam, hot water, glycol, thermal oil, and hot and dry gas. Drying temperature can range from 55 to 110 C, and can produce material with a moisture content of less than two per cent. Dryers can be equipped with a freezing protection housing to make sure that the belt washing system works throughout the whole year and wet incoming product can be easily handled.

www.swisscombi.eu

STELA

Stela Laxhuber GmbH is an international operating company specialized in low temperature belt drying technology. One of the greatest benefits using high efficiency belt dryers reflects by usage of waste heat or other low-temperature sources. The latest development of the stela RecuDry system with heat recovery scores an energy saving around 35 to 55 per cent compared to common standard drying systems.

www.stela.de

PRODESA

Prodesa supplies a low-temperature belt dryer for wood. This technology enables the use of waste energy from other processes such as hot air (direct), hot water or steam (indirect). It works at low temperatures, and emissions are very low as it keeps the lignin content in the product. This is a very important advantage when the dry product is used to produce pellets. Other advantages include: low PM emissions < 10 mg/Nm3; use of waste energy at low temperature. This enables combining belt drying with cogeneration plants; minimum fire risk; automatic operation; and optimum product quality.

www.prodesa.net

DRYER ONE

Dryer One opens up new possibilities for the drying of forest wood and biomass products, as well as optimizing waste. Dryer One is a drying machine low temperature (max 85-90 C 210 F), designed to meet the increasingly high demands for dryers: increasing volumes, higher productivity requirements, higher quality standards, cost reduction, energy savings, flexibility, no risk of fire, and considerably reduces dust emissions and VOCs pollution. Dryer One dryers can easily adapt to all situations, especially when used as an annexed unit to a gas burner, biomass burner or a cogeneration plants. Dryer One also offers a phyto-Sanitation unit, “PHYTO SAN” by Dryer One. This enhances your capabilities to export/import wood chips and biomass products to all continents. Process for heat treatment equipment for sanitation of wood chips or biomass works at low temperatures without chemical fumigation.

www.dryer-one.com

HIGH-CAPACITY CHIPPER

PRODUCES PIN CHIPS

The new WSM Pin Chipper is a high capacity fibre-preparation machine that converts lower value mill residuals (shavings and hogged wood) and alternate fibre supply sources into a high percentage of “pin chips” with long fibre length.

The WSM Pin Chipper is available in rotor diameters of 42”, 48”, and 60” and rotor lengths from 36” to 88” long and typically operates with 200-800 hp. Modular and adjustable tooling includes either rigid or swing hammers with replaceable tips, combined with modular sizing screens allow adjustment to product sizing. Field proven performance at rates up to 75 tph, and when combined with a WSM pre-screen the processing rate is confirmed at rates of 150+ tph. System integration into your woodyard is no problem – WSM offers complete infeed and outfeed options to help you supplement your chip supply with lower cost fibre from the WSM Pin Chipper.