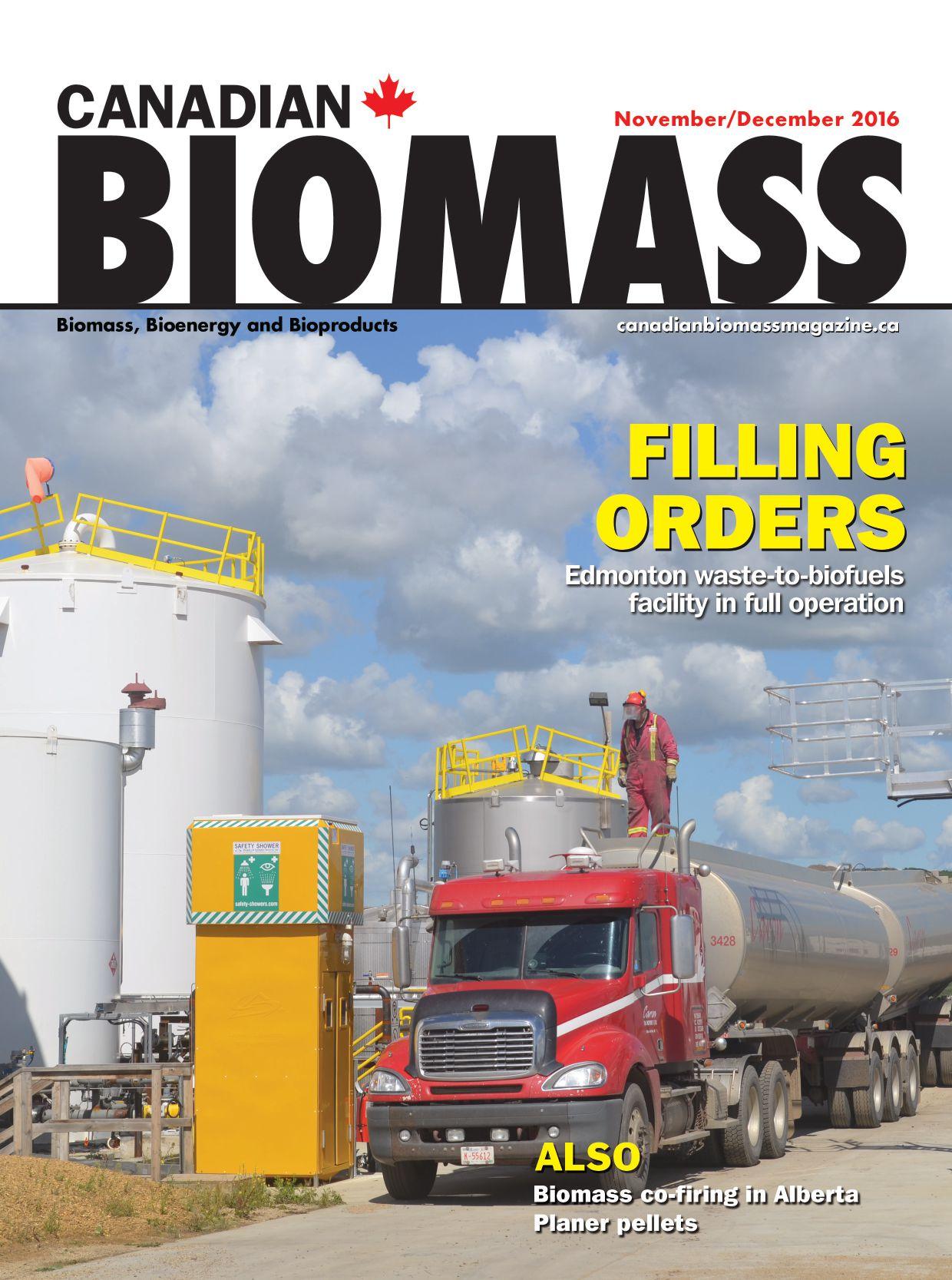

The $100-million Enerkem Alberta Biofuels waste-to-biofuels commercial scale plant recently completed Phase 2 of the facility’s construction and is now filling orders for biomethanol.

5 Going strong for 35 years

Peterson continues looking to the future.

With more than 20 biomass heating systems installed and serviced across Atlantic Canada, Thomas Industrial has become a leader in renewable energy, and an important educator and stakeholder in Atlantic Canada.

Foothills Forest Products had a difficult time finding a home for the shavings being produced by its planer mill, so the company decided to go into the wood pellet business.

A look at the potential benefits of co-firing in Alberta and mitigating the social and economic risks of the Climate Leadership Plan.

Wood pellet industry faces challenges, but also growth.

Canadian Biomass was on hand to watch one of the first tanker trucks fill up on biomethanol to fill a commercial order this past August at Enerkem’s waste-to-biofuels facility in Edmonton.

’ve been to a enough biomass conferences to have a basic understanding of one of the industry’s largest hurdle: public opinion.

A speaker at the recent BioCleantech Forum explained the challenge of public opinion well. Most technologies relating to biomass are relatively new, he said, and as with all new technologies they must be tested, and often fail. But in this industry, when technologies fail, they fail spectacularly in the public spotlight.

I’ve been in the media business long enough to understand that the news cycle is a constantly hungry beast that responds to public demands. The public wants a solution to climate change, but they don’t want to pay for it, and they don’t want to be misled. It’s big news when any of the above happens because of a biomass technology. That makes it understandable when industry players prefer to keep a low profile. Yet we should be doing the exact opposite. To get our spot on stage we need to feed the beast. Share your story with the media. Yes, share with us at Canadian Biomass, but also with your local newspaper and national news sources. Worst-case scenario, you write a few emails and make a few calls that are ignored by busy reporters. Best-case scenario, story by story the public gains an understanding of what biomass companies can do, and are doing, to help offset carbon emissions and build a greener Earth.

The forest industry, too, is tuned into climate change. Natural Resources Canada’s 2016 State of Canada’s Forests annual report, released in September, is themed around climate change. (cfs.nrcan. gc.ca/stateoftheforests.)

“Using wood-based biofuels for heat and power can be a cost-competitive, economically sustainable and reliable alternative to non-renewable energy sources,” the report states.

The authors spotlight Whitesand First Nation, an off-grid community 250 kilometres north of Thunder Bay, Ont., where a plan is in place to build a pellet manufacturing plant and a heat and power biomass facility. Another interesting note in the report speaks to public perception of woody biomass: “Given the current and projected impacts of climate change on Canada’s forests, it may seem counterintuitive to think that forests can also be part of the climate change solution. However, the carbon-storing capacity of forests, together with the ability of wood products to replace fossil-fuel-intensive products, can contribute to keeping CO2 out of the atmosphere.”

While government has an important role to play in setting policy direction to grow Canada’s bioeconomy, the role of biomass companies must include educating the public about that “counterintuitive” solution. Story by story, companies can perhaps change the public’s mindset to make biomass an intuitive solution.

Volume 16 No. 6

Editor - Andrew Snook (905) 713-4301 asnook@annexweb.com

Editor - Maria Church (416) 510-5143 mchurch@annexweb.com

Contributors - Gordon Murray, Taylor Fredericks, Dan Shell, Mahmood Ebadian, Ryan Jacobson, Fahimeh Yazdanpanah, Shahab Sokhansanj.

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexweb.com

Market Production Manager Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

National Sales Manager Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexweb.com

Quebec Sales Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

Western Sales Manager Tim Shaddick - tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Brooke Shaw

Circulation Manager Carol Nixon – cnixon@annexweb.com 450-458-0461

Canadian Biomass is published six times a year: February, April, June, August, October, and December. Published and printed by Annex Business Media.

Publication Mail Agreement # 40065710

Printed in Canada ISSN 2290-3097

Subscription Rates: Canada - 1 Yr $49.50; 2 Yr $87.50; 3 Yr $118.50 Single Copy - $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $60 US; Foreign – 1 Yr $77 US

CIRCULATION

Tel: (416) 442-5600 ext 3552 Fax: (416) 510-5170 blao@annexbizmedia.com

80 Valleybrook Drive, Toronto, ON M3B 2S9

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

There are many people on your side who are ready to help. The associations in the biomass industry all want to see your company succeed. This industry is too new for players not to be engaged.

Maria Church, Editor

No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2016 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication. www.canadianbiomassmagazine.ca

By Dan Shell, Hatton-Brown Publishers

Celebrating its 35th anniversary in 2016, major grinder and pulpwood biomass processing machine supplier Peterson is continuing to expand its facility while fostering the ongoing development of new machines and machine innovations.

The company has grown from regional equipment innovator to national and now international major player in the chipping and grinding equipment market. In its fourth decade of business, Peterson continues to expand and develop new business, says marketing manager Michael Spreadbury.

Peterson started out as Wilber Peterson & Sons in Springfield, Ore., a heavy construction outfit founded in 1961 by Wilber Peterson, whose son, Neil, inherited his fathers desire to innovate and develop more efficient and productive ways of operating with different types of equipment and innovations.

The company had opened a satellite chip mill in the late 1970s, and the Petersons were soon working on ways to produce cleaner, higher-quality chips. They eventually came up with a chain flail delimber design. Peterson Pacific was formed in 1981 to produce the machines, which gained a loyal following of chip producers.

Founder Neil Peterson worked with paper companies such as Longview Fibre, Union Camp and Scott Paper in demoing the delimber, making multiple trips “back east” to show off the new machine. In 1986 Peterson introduced the 4800 delimber/debarker, followed in 1989 by the Model DDC 5000, which added chipping and made the 5000 an all-in-one machine. Peterson made its first wood waste recycling grinder in 1990, leading to its successful line of horizontal feed wood grinders in use around the world.

As demand for its products gained momentum, the company expanded, building a 60,000 sq. ft. plant in 1993 at its current location in northwest Eugene, Ore. and in 2000 expanded again by adding another 50,000 sq. ft. to the manufacturing facility.

In 2001 Peterson diversified into a new product when it acquired the manufacturing rights to BloTech blower trucks. The move into the erosion control and commercial landscaping industries complements Peterson’s grinding machines that produce the mulch used in such applications.

Another big milestone came in 2007, when Peterson was acquired by Astec Industries.

Spreadbury notes that one of the first things Astec Industries did after acquiring Peterson was make a major $1 million investment in the machine shop. And in the years since, when Peterson has asked for capital investments Astec has stepped up as long as the company is showing progress and a solid plan for the future.

Peterson has moved over the years to bring more of its manu-

Peterson started out as Wilber Peterson & Sons in Springfield, Ore., a heavy construction outfit founded in 1961.

facturing and fabrication activities in-house, to where 98% of all Peterson products are produced and fabricated at the Eugene plant. There, the company operates with more than 110,000 sq. ft. of modern manufacturing space.

And most recently, Astec invested by buying the property next door to the Eugene facility, doubling Petersons footprint, and paving the way for future expansion. Though the work will be done in stages, there are already plans to double the fabrication shop’s size.

Another big development for Peterson is the addition of the Telestack line of bulk material handling products and telescoping portable radial stackers, a nice complement to Peterson’s chipping and grinding equipment. An Astec Industries sister company, Telestack specializes in handling free-flowing bulk materials of all types, from ores, coal and aggregates to wood chips, pellets, grains and more. The stacking conveyors will be branded as Peterson products and sold and serviced through Peterson’s dealer network in North America.

“Peterson is now well placed to offer full service solutions for composting and mulching operations that need grinding, screening, and conveying products” says Spreadbury. “This is a very exciting time for us as we continue to flush out our catalog of full-service solutions in stationary electric or diesel machines, and are now a one-stop-shop for businesses looking for reduction and sorting services.” •

Alberta Innovates Corporation, a consolidation of existing Alberta Innovates crown corporations, launched this week.

The single corporation will continue to fund and drive provincial research and innovation – building on Alberta’s strengths in health, environment, energy, food, forestry/fibre, and emerging technology sectors.

“We need to build an economy for the future. A consolidated Alberta Innovates will do even more to support our world-class researchers, entrepreneurs and academic institutions as we work together to create jobs and diversify our economy,” said Minister of Economic Development and Trade Deron Bilous.

“Alberta Innovates is dedicated to catalyzing a strong

Viridis Energy Inc. has closed on the sale of the Okanagan Pellet brands to American Biomass Corporation Inc. The sale includes all international trademarks, domain names, and other assets associated with the brand.

The purchase, by American Biomass Corporation is on an earn out basis and will depend on the volume sold in the year following closing.

“Okanagan Pellets have been extremely popular with our retailers and consum-

ers alike,” said Christopher Robertson, CEO of Viridis Energy. “We are very pleased that American Biomass can now build on that history with the successful transition of Okanagan to them.”

“We are excited to add the Okanagan Wood Pellet brand for our wholesale customers,” said David Nydam, CEO of New Hampshire based American Biomass. “Okanagan is one of the highest quality brands in New England with tremendous brand loyal-

innovation ecosystem that delivers 21st century solutions to Alberta’s most compelling opportunities and challenges,” said Judy Fairburn, chair of Alberta Innovates Board of Directors.

The consolidation will also help ensure Albertans receive the best return on their investment in research and innovation, Bilous said. The corporation’s new executive moves from 20 to 11 positions, saving $2.5 million a year. The reduction comes with a one-time $1.5 million severance cost.

A subsidiary corporation to Alberta Innovates, InnoTech Alberta Inc., also launches Nov. 1. It will provide research services to help test new technology on a larger scale across the province.

ty from both retailers and consumers. We are proud to be able to provide these super premium pellets to the retailers throughout New England and beyond.”

American Biomass will begin offering these high quality softwood pellets to retailers im-

A new white paper from FutureMetrics compares two scenarios for lowering carbon emissions in the power generation sector, one involving natural gas and the other wood pellets.

The paper analyzes the net present value of the total costs for a new natural gas combined cycle power plant versus converting an existing pulverized coal power plant to run on industrial wood pellets. Those costs are used to calculate the cost of each avoided tonne of CO2 emissions.

The paper shows that when comparing the two scenarios, and when factoring in the reduction in CO2 emis -

mediately, just in time for the peak demand in wood pellets.

“Interest in this brand has been extremely strong” added Nydam. “Retailers are delighted to have this strong brand with its strong consumer following on their shelves this winter.”

sions from each technological solution, the solution that provides significantly higher CO2 reduction at a lower net monetary cost per avoided tonne is by repurposing existing pulverized coal power plants to run on industrial wood pellets.

The paper also offers some thoughts on policy. The paper is accompanied by a new dashboard that allows the user to experiment with the assumptions used in the model.

This white paper and dashboard and other white papers and dashboards can be freely downloaded from the FutureMetrics website at www.futuremetrics.info.

Sustainable Biomass Partnership (SBP) announced that Dorothy Thompson is to retire as a director and chairman of the board.

Thomas Dalsgaard, who has been a director of the company since 2013, succeeds Dorothy Thompson as chairman.

“I am delighted to have the opportunity to chair the SBP Board. I should like to thank Dorothy for all the work she has put into SBP from its origination to where it is today,” Dalsgaard said. “I look forward to continuing the roll-out of SBP in the market and, in close dialogue with our stakeholders, including the advisory board, biomass producers, regulators and NGOs, seeking continuous improvement and development of the system. SBP is a unique certification system for woody biomass, mostly in the form of wood pellets and woodchips, used in industrial, large-scale energy production. When it comes to meeting regulatory requirements for legal and sustainable sourcing of feedstock I am committed to ensuring that the system is fit-for-purpose and robust.”

Shaw Resources’ Belledune pellet operation in New Brunswick has become the first in Canada to receive Sustainable Biomass Partnership (SBP) certification.

Rene Landry, director of pellet operations, says the certification is another step as Shaw Resources strives to be a world-class producer.

“We’re not the biggest producer out there, but we understand the importance of SBP to the utility and to the industry to establish credibility and to prove that wood pellets are a renewable source of energy with carbon benefits,” Landry said.

The Belledune industrial pellet plant was built in 2007 and began operating in 2008. The plant uses hardwood and softwood species sourced from local sawmills as well as processed roundwood. Belledune became officially SBP certified on Oct. 20, after a certification process by PwC that began in January.

The SBP scheme is relatively new – it launched in March 2015 – so there was an evolution to the process, Landry said.

“It was a lot of hard work because it was so new to everybody – new to the certification scheme, new to the certifying body [PwC] and new to us,” he said. Support from their suppliers was an important component.

The plant has also recently received PEFC Chain of Custody certification, which was factored in during the SBP process.

Landry says he expects other Canadian producers are in the process of getting certified or will be soon.

“From the utilities standpoint, if you’re going to be doing business you need to be SBP certified,” Landry said. “The key is credibility of the industry and ultimately proving that the raw material comes from a sustainable, renewable, legal source.”

In September, SBP announced that it has certified 50 organizations.

Cellulosic Sugar Producers Cooperative (CSPC) has initiated an equity campaign to develop a corn stover and wheat straw to dextrose supply chain in southwestern Ontario. CSPC will engage with growers in the region to supply corn stover and wheat straw to a planned dextrose facility previously announced by Comet Biorefining (Comet) to be located in Sarnia, Ont. As part of the supply chain, CSPC members will own an equity stake in the facility, which will need 75,000 tonnes of biomass based on 55,000 acres. As part of the equity campaign, CSPC will co-ordinate field demonstrations of stover aggregation and will hold outreach ‘town hall’ meetings for

prospective members.

Becoming a producer is open to individuals and farming corporations who can provide biomass (corn stover, wheat straw) to the co-operative and are an approved member of the Co-op. It is anticipated that the great majority will initially be farmers concentrated within a 100-kilometre radius of Sarnia, Ont.

A producer will be asked to buy subscription shares. Those subscriptions shares provide voting rights within the Co-op. The producer will also be required to sign a producer agreement committing acres of biomass and equity investment. The equity will be used by the Co-op to invest into the

dextrose plant. The producer will receive a payment for each tonne of biomass that they supply and patronage out of the cash flow from the dextrose plant.

“Producers need to take an active role in developing new markets based on new technologies coming to market as we partner with Comet Biorefining,” stated Dave Park, CSPC president and director of Grain Farmers of Ontario.

“We are extremely pleased to be partnering with CSPC as we both enter the next phase to develop this value chain for producing dextrose from corn stover and wheat straw,” added Andrew Richard, founder of Comet Biorefining.

IBy Gord Murray

n 2014, EU Member States agreed on a new Climate and Energy Framework that sets new targets for the year 2030: (1) at least 40% cuts in GHG emissions (from 1990 levels), (2) at least 27% share for renewable energy, and (3) at least 27% improvement in energy efficiency. To implement these targets, the EU is currently in the process of updating its climate and energy policies. Since new policies are to be decided on in late 2016 or early 2017, it is essential that EU policymakers are well informed about the climate benefits of biomass energy. An issue that has been contentious is the carbon neutrality of biomass.

Last month, the European Forest Institute released the report, Forest biomass, carbon neutrality and climate change mitigation. This report – prepared by 11 scientists from Europe, the United States, and Canada: Goran Berndes, Bob Abt, Antti Asikainen, Annette Cowie, Virginia Dale, Gustaf Egnell, Marcus Lindner, Luisa Marelli, Davide Pare, Kim Pingoud and Sonia Yeh – reviews various international perspectives and provides recommendations for policymakers.

The report confirms that in industrialized countries, forest biomass feedstocks typically come from forests managed for the production of pulp and saw logs, and provision of other ecosystem services. Feedstocks consist mainly of sawdust, small diameter trees, and thinnings. In processing feedstocks into bioenergy, supply chain emissions from harvesting, processing and transportation are just a small fraction of the biogenic carbon flows. With efficient handling and shipping, forest biomass transported over long distances can deliver high GHG emissions reductions.

According to the authors, non-GHG factors can affect climate change. The impact of changes in land use can impact global and local climate by affecting how much radiation is either absorbed or reflected. For example, land covered in forest is effective at absorbing radiation, while land covered in snow will reflect radiation back into the atmosphere.

In evaluating carbon balances and climate impacts, the authors argue that the exact timing of CO2 emissions is less important than how much carbon is emitted in total in the long run. This means that we should focus on how biomass harvesting for energy influences carbon stocks over the long term, since this in turn influences cumulative net CO2 emissions. There are various methods that researchers use to assess the climate change mitigation effects of forest bioenergy including:

Definition of a counterfactual no-bioenergy scenario: How do forest markets, forest management, and forest carbon stocks evolve in the absence of bioenergy production?

Spatial system boundary: Are carbon balances assessed at the forest stand level or at the forest landscape (system) level?

Temporal system boundary: What is the time period of assessment and how does it compare with the forest rotation period? When is the accounting begun in relation to the first harvest for bioenergy?

Scope: Are economic and social aspects included? Is the bioenergy system assessed in isolation or does the study examine how forest management as a whole responds to bioenergy incentives?

It is important to understand the appropriate context for the chosen method in order to draw the correct conclusions

and policy implications.

The report discusses how biomass extraction can affect forest management. Reviews have concluded that there are no consistent, unequivocal and universal effects of more intense biomass harvest on forest soils. With respect to water, forest bioenergy systems are judged compatible with maintaining high-quality water supplies. As for biodiversity, biomass removal, the quality of dead wood left behind is more important for biodiversity than quantity, with larger logs and stumps being more valuable than slash. Stumps and an appropriate amount of residual wood should be left on site.

The authors argue that instead of debating about carbon neutrality of biomass, we should be concerned with the net climate change effect of bioenergy in the context in which it is produced. Studies should analyze bioenergy systems as components in value chains or production processes that also produce material products, such as sawnwood, pulp, paper and chemicals. They reported that the efficiency of biomass conversion and the GHG displacement associated with the use of bioenergy and other forest products are very influential on the assessed mitigation value of forest bioenergy, regardless of feedstock; and the mitigation value grows over time as the quantity of displaced GHG emissions accumulates.

Forest bioenergy should be considered as just one of several products in a value chain that also includes material products, such as sawnwood, pulp, paper and chemicals. The forest product portfolio could potentially include bioenergy products that, according to some studies, do not provide near/medium-term GHG savings. But it is not certain that exclud-

ing these feedstocks from bioenergy markets will result in a new product portfolio with a higher contribution to climate change mitigation in the short and longer-term. Regarding the need to balance short-term GHG targets with strategies that pursue long-term temperature stabilization goals, the authors caution that focusing exclusively on short-term GHG targets may result in decisions that make the longer-term objectives more difficult to meet. For example, a decision to prioritize carbon sequestration and storage in forests managed for wood production may help in meeting near-term GHG targets. However, this could mean an end-point where forests store more carbon but have a lower capacity for producing bioenergy and other forest products.

The authors advocate that policies to drive climate change mitigation should recognize the roles that forests and forest industries play in the EU GHG balance: they sequester and store carbon and displace fossil fuels and other products that would otherwise cause GHG emissions. Their recommendations include:

• Researchers who plan to assess GHG balances and the climate effects of forest bioenergy should involve policymakers and stakeholders in defining their research questions to increase the likelihood that results are relevant and useful.

• It is critical for policies and regulations to create a situation where the promotion of bioenergy and other non-fossil energy options leads to fossil fuel displacement rather than competition among non-fossil options.

• Policymakers need to consider policies that incorporate regional forest and energy sector conditions and avoid one-size-fits-all policies.

• A generic categorization system, which specifies only some forest biomass types as eligible bioenergy feedstocks, may prevent the effective management of forest resources to economically meet multiple objectives, including climate change mitigation. There is a risk that bureaucracy and costly administration may discourage investment in bioenergy.

• Policies regarding the cascading use of forests should be applied with flexibility and consideration of what is optimal for specific regional circumstances.

• Policymakers should utilize knowledge and experience from European regions where biomass utilization has been a long-lasting practice.

• The use of forest biomass for energy is likely to make economic and environmental sense if accompanied by a package of measures to promote best practices in forest management for climate change mitigation.

The debate about the benefits of bioenergy in mitigating the effects of climate has often been contentious. Special interest groups have presented conflicting opinions, often without proper scientific support.

This report was written by independent scientists not representing any special point of view. Its balanced findings should be useful to regulators as they develop bioenergy policy in support of Europe’s new targets under its Climate and Energy Framework. •

By Taylor Fredericks

Therewas a time when Daron Thomas, the president of New Brunswick-based Thomas Industrial Sales Ltd., had his doubts about the viability of biomass.

“I remember when our company first came across biomass possibilities back in the ‘80s,” he says. “The problem back then was that there was so much uncertainty around these types of projects. Consistent sourcing was an issue, and

the efficiency and emissions levels for a lot of the equipment wasn’t anywhere near what it is today.”

These days, however, Thomas has few reservations about the value and long-term prospects of biomass. With more than 20 biomass heating systems installed and serviced across Atlantic Canada, Thomas Industrial has become a leader in renewable energy, and an important educator and stakeholder in Atlantic Canada. This year alone, the

multidisciplinary heating company has been awarded three public biomass contracts—including heating systems for two schools and one correctional facility—in addition to three other biomass projects currently in the works.

The key, Thomas has found, is in the technological advancements and educational opportunities that have come to characterize biomass development in recent years.

“Now, we view biomass in the same

way we would any other fuel source,” he says. “It’s a known commodity, and that makes working on these kinds of projects a lot easier.”

Founded by Daron’s father, Gordon Thomas, in the summer of 1968, Thomas Industrial began in a modest home office with only two employees and a handful of product lines, most of which they still represent today. With time, the company established itself as a reputable supplier of heating, water, and wastewater solutions, and set up operations in a multi-unit building in the Fredericton Industrial Park in Fredericton, N.B.

When Daron became president of Thomas Industrial in 1990, he oversaw the company’s move into their own building—and current centre of operations—in the Vanier Industrial Park in Fredericton, and continued his father’s legacy, helping to grow the company into the multiple office sales and service organization it is today.

It wasn’t until eight years ago, however, that Thomas Industrial first understood the promise and potential of modern biomass technology.

“When we decided to take another look into the biomass market, I had no idea how far the technology had come,” Thomas says. “It was an entirely different world.”

Thomas credits his company’s relationship with Viessmann Manufacturing—an international manufacturing firm with a dedicated biomass department supporting the Canadian market—with their decision to enter the biomass market.

Drawing on an existing partnership in Prince Edward Island established by Viessmann’s acquisition of the European company KOB, Thomas Industrial began to service Viessmann KOB wood pellet boilers in the region. This firsthand access to operational installations was an important step for the company, both in terms of furthering its understanding of the technology and demonstrating its potential to interested customers.

Using this newfound knowledge and expertise, Thomas and his team have worked to build the biomass market in Atlantic Canada ever since. As relatively early adapters, Thomas acknowledges that the process has not always been easy.

“There is a lot of possibility, but there

has also been some pain, just in terms of learning on the fly and working with an entirely new fuel source,” he concedes. “Still, we know we’re headed in the right direction and we’re really starting to see some of the fruits of our labour now.”

Five of Thomas Industrial’s six projects this year will use Viessmann’s Pyrot KRT 540 kW wood pellet boiler, with the sixth relying on the Pyrot KRT 300 kW, which relies on wood chips instead of pellets.

Just as his father taught him, however, Thomas knows that good industrial business depends on more than just good machines. To that end, Thomas Industrial places great emphasis on educating stakeholders and supporting the growth of biomass in the region.

“Biomass technology requires local

support, solid engineering, exhaustive knowledge of controls and controls integration, and quality technology,” he says. “The reality is that the technology for many of the trades—from plumbers to pipe fitters, electricians to control technicians—is new. We need to provide the support so these projects work to the customers’ expectations.”

And while biomass business is better than it has ever been in Atlantic Canada, Thomas still believes the best it yet to come.

“I have no doubt that other companies will be able to benefit on the work that we’ve done,” he says. “I believe we’ll continue to see significant growth and development in our region for years to come.” •

By Andrew Snook

Several years ago, Foothills Forest Products had a difficult time finding a home for the shavings being produced by its planer mill operations at its sawmill in Grand Cache, Alta.

So instead of trying to find a buyer for them, the sawmill owners decided to go into the wood pellet business and added a pellet operation to its existing mill.

The wood pellets that the plant produces service the residential heating market in northern Alberta as well as the oil and gas sector. The spilt is about fifty-fifty between pellets heating homes in the area and heading to the oil patch for use as an absorbent on the roads.

The wood products company, owned by C&C Resources Inc., has an annual pellet production of 15,000 tonnes –which is relatively small, but there’s room for growth.

“There’s going to be more demand for pellets,” says Mark Stevens, general manager for Foothills Forest Products. “Presently our pellet production is quite small, but the system has the flexibility to utilize a far greater proportion of residuals from the mill.”

Some of the residuals from the sawmill and planer mill are also sent to a Volcano boiler that provides heat for the sawmill’s two shifts and for the dry kiln.

The sawmill produces 110 million bdft. of dimensional lumber annually, ranging in size from six-foot-long to 16-foot-long 2x3s to 2x10s. The boards are predominantly made from lodgepole pine, but the mill also processes spruce and balsam in its operations.

The pellet plant has an annual production of 15,000 tonnes.

One advantage of using strictly planer mill shavings to produce pellets is that the production process does not require a drying system, which cuts down on costs.

“With the shavings coming from the planer they’re close enough to being dry that the pelletizing process leaves a moisture content of less than seven per cent,” explains Stevens. “We measure the moisture and don’t bag the pellets unless we’re on target.”

The shavings are collected from the planer mill and blown into a dry silo then are sent to a hammermill to be processed before being fed into one of the mill’s two pelletizers. The pellets then travel along a conveyor that is split into two paths. One path sends the wood pellets to a silo for bulk storage, while the other path sends the pellets over to the bag line where the pellets are bagged and sealed.

Although the market for wood pellets for the oil and gas sector has been on a decline

The wood pellets that the plant produces service the residential heating market in northern Alberta as well as the oil and gas sector.

due to lower oil prices, the potential use of wood pellets in another part of the province’s energy portfolio has pellet producers in the province excited about the possibility of a new major domestic market.

There have been talks about the possibility of using biomass, including wood pellets, for co-firing in coal plants to

help the province reach its future emissions targets without stranding expensive infrastructure assets. One challenge for Foothills Forest Products when it comes to co-firing is its remote location. The sawmill and pellet plant is nestled in the Alberta Foothills, about a two-hour drive north of Jasper and a four-and-a-half hour drive west of Edmonton.

“Distance is a challenge for us since we’re far from the major urban centres,” Stevens says. “Co-firing opportunities are not as close as would be ideal, but on a larger scale they could go into northern Alberta and B.C.”

By finding a productive use for its planer mill shavings through the generation of pellets, Foothills Forest Products is positioning itself well for a potential biomass boom related to co-firing while keeping its operations diverse. A winning combination for sure. •

By Mahmood Ebadian, Ryan Jacobson, Fahimeh Yazdanpanah, Shahab Sokhansanj, Biomass

InNovember 2015, the government of Alberta released its ambitious Climate Leadership Plan. This plan aims to accelerate the transition from coal to renewable electricity sources, put a price on carbon emissions and set emissions limits for oil sands operations. This plan will encourage the big GHG emitters in the province to find and implement innovative and sustainable solutions to reduce the carbon intensity of their industrial activities. However, such a decarbonization transition will bring with it social and economic challenges, especially during uncertain economic situations.

One of the primary goals of the Climate Leadership Plan is to phase out coal by 2030 and replace it with renewable energy and natural gas-fired electricity. Currently, about 40 per cent of the electricity supply in Alberta is provided by the coal-fired power fleet. By 2030, 12 of Alberta’s 18 coal-fired generating stations will reach 50 years of operation and be retired unless they are able to meet GHG emissions standards set by the federal coal regulations. The shutdown of the remaining six stations by 2030 will leave the power plants operators with stranding assets, as the capital invested in these stations will not have been recovered by then. In addition, the accelerated shutdown affects the workers in the coal-dependent com-

munities, as well as other sectors whose survival depends on these workers and their families, such as healthcare, schools, and grocery stores.

Therefore, the accelerated retirement of coal mines and their associated power plants can put thousands of direct and indirect jobs in 30 municipalities in jeopardy. Another effect on these communities will be the disappearance of the tax revenues generated by these coal mines and power plants. These revenues are currently used to fund various community services. For example, TransAlta’s coal plants, which provide more than one-third of the province’s power, create over $1.3 million in municipal tax rev-

enue and $2.6 billion in total federal and provincial tax income and sustain about 5,000 jobs per year.

In addition, the complete coal phase-out can adversely affect the reliability of the electricity grid and the stability of prices for consumers if the alternatives cannot fill the gap by 2030.

The government of Alberta has acknowledged the social and economic challenges associated with its Climate Leadership Plan and has made the commitment to support the alternative options and approaches that minimize these challenges. Among the alternative

options, natural gas and wind power have received the most attention. These two options are certainly part of the solution to reduce the carbon intensity of the power fleet and fill the electricity supply gap. However, natural gas and wind will not directly remediate the job losses in the coal-dependent communities, the lost tax revenues from the retired mines and generating stations or any stranding assets in these communities. Complementary approaches such as compensation of the stranded value of closed mines and power plants and the affected communities are being considered as a way to cope with these issues. Are these the only options and approaches? Is there an option that can directly deal with these issues?

As a renewable and sustainable alternative option, biomass can provide benefits similar to that of natural gas and wind power in terms of GHG reduction and power supply security. However, what makes biomass a more attractive option is the fact that it can be introduced as a direct replacement for coal at the coal-fired power plants. This leaves open the possibility that the remaining six generating stations will continue operating and providing the same employment and tax revenues in the coal-dependent communities that they currently do. Using biomass in these generating stations will also avoid stranding assets.

This is not the end of the story. Using forest biomass to replace coal creates jobs in the upstream logistics system. Biomass must be harvested, collected, chipped and transported to wood pellet plants by trucks. At pellet plants, the received biomass is usually dried, ground and pelletized and the produced wood pellets are transported to coalfired power plants using rail or trucks. A majority of these operations take place in rural areas and small towns where the wood fibre is produced. Both the forest industry and the wood pellet sector in Western Canada have established the know-how to produce, harvest, collect, store, handle and transport commercial quantities of wood fibre to local, regional and international markets. In addition, these sectors have a well-trained,

Figure 4. Number of potential jobs created in the wood pellet logistics system as a result of using forest biomass as feedstock in the six generating station units.

veteran workforce to manage these logistics systems in cost-efficient manners.

Now, the question is what quantity of untapped sources of forest biomass

is available in Alberta? Is the available volume able to meet the annual feedstock demand for six generating stations, as we discussed above?

According to a study conducted by the government of Alberta in 2010, two

main untapped sources of forest biomass are logging residues and non-merchantable timbers. With the current level of allowable annual cut (AAC) (22.45 million m3), there are approximately 2.9 million oven dry tonnes (M odt) of unharvested standing timbers and up to 4.0 M odt of logging residues available for industrial uses other than the conventional forest industry. In addition, the undersized trees within the merchantable stands are being considered as a source of biomass in the province. These trees are not included in the AAC but could be harvested if a market is found for this fibre source. It is estimated that there are over 1.8 M odt of this source of biomass available in Alberta. In addition to public forestlands, private forestlands have the potential to provide over one million odt of biomass for coal-fired power plants.

In addition, a portion of the feedstock demand of the coal-fired power plants can be procured from B.C. With the current level of AAC (75 million

m3) there are about 5.4 M odt and 2.9 M odt of unutilized logging residues and standing timbers available in B.C. This unutilized fibre is primarily in the form of non-sawlog/non-merchantable timbers within merchantable stands. In total, the potential availability of forest biomass including sawmill residues, logging residues and non-merchant standing timbers is estimated to be over 9 M odt and 8 M odt in Alberta and B.C., respectively. In addition, the wood pellet sector in these two provinces is currently producing over 1.7 million tonnes of wood pellets per year. A portion of this capacity may be available for the Alberta coal power fleet, depending on market conditions.

The total generating capacity of the six generating station units that need to operate beyond 2030 to recover their capital costs is 2,570 MW. If all six units were retrofitted to 100 per cent wood pellets, these units would demand about 11 million tonnes of wood pellets annually. Such a domestic wood pellet market would create about 6,724 jobs; including 4,697 jobs in forest operations, 597 jobs in biomass transportation and 1,430 jobs in pellet production. On average, the conversion of each of these units to burn 100 per cent wood pellet will create over 1,000 jobs in the upstream biomass logistics system.

Therefore, in addition to stabilizing the job market in the coal-dependent communities, using biomass as feedstock for these units will create new jobs in local communities and rural areas where forest biomass is produced. In today’s uncertain economic situation, the provincial and federal governments in Canada attempt to protect the existing jobs and stabilize the job market by developing and implementing solid policies and incentive programs. Creating new jobs, especially in rural areas, would be a huge success for these provincial governments and the communities involved.

Determining which power stations should be retrofitted to 100 per cent wood pellets, and meeting the subsequent wood fibre demand, will require a collective effort from the government of Alberta, the power station operators and

other stakeholders to find the optimal solution.

There is no shortage of feasible and low-carbon alternative power generation options in Alberta including natural gas, wind, solar and biomass. An effective combination of these alternatives should be supported by the government in order to mitigate the social and economic risks of its decarbonized energy transition.

When it comes to biomass as an alternative option, three facts are established: 1) There are large quantities of unutilized forest biomass available in Alberta and its western neighbour, B.C., to support the retrofit of the six generating station units; 2) Using biomass as feedstock in these units will avoid the unnecessarily stranding assets; and, 3) The retrofit to 100 per cent wood pellets will protect the jobs in coal-dependent communities as well as create a significant number of jobs in rural areas where wood fibre is produced. •

•

•

•

•

•

•

By Andrew Snook

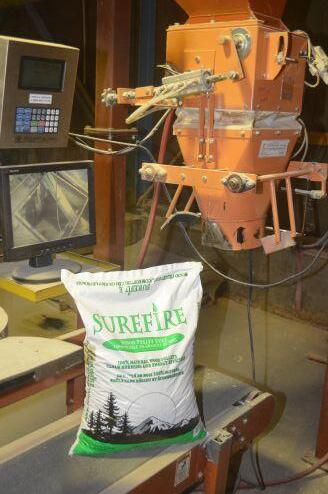

The$100-million Enerkem Alberta Biofuels waste-to-biofuels commercial scale plant recently completed Phase 2 of the facility’s construction and is now filling orders for biomethanol.

Canadian Biomass was on hand to watch one of the first tanker trucks fill up on methanol to fill a commercial order this past August at the Edmonton Waste Management Centre where the Enerkem facility is being constructed over three phases. Although the plant is now in full operation for the production of biomethanol, a third phase of construction is underway that will allow Enerkem to also produce bioethanol. That final phase is expected to be complete by mid-2017 with production of bioethanol underway in the second half of 2017.

As for the biomethanol, Enerkem reached an off-take agreement with the Methanex Corporation, the largest methanol producer in the world, which will purchase as much biogas as the facility can produce. The processing capacity of the facility is 300 dry metric tons per day of feedstock input. The full production capacity of the plant is estimated at 40 million litres of ethanol.

This past August, Enerkem’s Edmonton-based biorefinery became the first plant in the world to be certified by the International Sustainability and Carbon Certification (ISCC) system for the conversion of municipal solid waste into biomethanol.

“I think it’s going to become increasingly important for companies to validate their emission and environmental benefits through these types of certification agencies,” says David Lynch, general manager of research and development for Enerkem. “We’re quite proud to be the first waste-to-biofuels company to have that.”

Lynch sees huge opportunities for his company’s technology to expand throughout Alberta in areas like Calgary and other heavily populated regions that could accommodate one or more facilities like the one in Edmonton.

“There’s waste available to build more facilities and this has a huge impact on greenhouse gas reductions,” he says. “We’re also complementing the local fuel supply with a very low carbon fuel that has a very beneficial environmental result.”

The Edmonton facility is considered the minimum size

LEFT MAIN: The full production capacity of the plant is estimated at 40 million litres of bioethanol.

INSET: Trucks lineup to unload at the Edmonton Waste Management Centre, where Enerkem’s waste-to-biofules facility is located.

for a full scale Enerkem waste-to-biofuels facility.

“This is a standard size scale built around the scale of the gasifier,” Lynch explains. “That gasifier is designed to handle about 100,000 dry metric tons of waste each year, which translates to about 300 dry metric tons each day, and then when you add the moisture content it comes to about 350 tons per day. That’s the core, standard scale module for Enerkem. So for facilities and opportunities that needed more, we would place multiple gasifiers.”

In the case of Calgary, for example, Lynch says the city’s waste supply is large enough to fuel between four and six of the Enerkem gasifier plants, but that doesn’t necessarily mean that six plants should be built there.

“You don’t want to complete with recycling,” Lynch says. “The thing we focus on is making sure that we’re complementing current recycling and composting efforts.”

In addition to potential opportunities for growth in Alberta, Enerkem is also looking at potential expansion of its facilities in the Montreal, Toronto and Vancouver areas, in addition to international opportunities.

This past October, Enerkem submitted a proposal for construction of a US$200 million waste-to-biofuels refinery in Rosemount, Minn. in partnership with Minnesota-based SKB Environmental. The

biorefinery would be built and operated next to an SKB landfill.

The company is also in talks with other U.S. companies, as well as companies in the Netherlands, U.K., Germany and China.

“There’s a real need on the waste side, just to dispose of the waste,” Lynch says. “Then you’ve got all the opportunities on the product side. Not only can you produce methanol and ethanol, but the methanol and ethanol are key intermediates that go into a lot of other products and chemicals. For example, you could get into things like acetic acid, acrylic acid, ethylene propylene – all sorts of things where you may not realize where they are used right away, but they are used in basically everything.”

To produce the additional chemicals, Enerkem only needs to bolt on an additional unit to the methanol production process.

“We’ve got a core process that produces methanol from waste and we’ll then bolt on the ethanol portion to give us the capability to go to ethanol,” Lynch says. “That could just as easily be a methanol-to-ethylene portion, or methanol to propylene, or methanol to acrylic acid, so you’ve got the full optionality to really go to whatever you want. And methanol itself is a ubiquitously used chemical that’s used everywhere around the world… but just by itself it’s a great fuel and it’s a great feedstock.”

The project has come a long ways since it started out as a research for a pilot project at the University of Sherbrooke in 1999. In 2003, the pilot project began and the results were promising.

“We successfully demonstrated about 20 different feedstocks including different types of biomass and ways of recycling plastics and plastic blends with biomass,” Lynch explains. “The economics looked good. We demonstrated that we could clean the syngas on a pilot scale and run that through a methanol reactor.”

After years of careful planning and obtaining the necessary financing, the waste-to-biofuels industrial demonstration plant was commissioned in 2009 in Westbury, Que. with the facility processing 48 tons a day of feedstock input. Enerkem was able to complete its design process development around the demo plant, which helped the company plan out its full-scale commercial plant.

“One of the biggest challenges with these biomass facilities is scale-up, so we really wanted to make sure we did a thorough job and didn’t skip and steps,” Lynch says. “We wanted to make sure we took our time and proved every step of our technology before we went to the next step.”

The biggest challenge Lynch sees moving forward will be related to deployment.

“We’ve got our first plant here up and running, but how do you do this three or four times a year around the world,” he says. “I think there’s going to be a big growth challenge. We’re bracing for that now by planning ahead with our next facilities coming.”

To enable its international growth, the company has developed its plants based on a standardized modular approach with pre-fabricated modules. This allows to deploy more than one project at a time.

Feedstock variation around the world could also present some challenges.

“Not all garbage is created the same,” Lynch says. “It’s a matter of anticipating the problems and testing, so we’re evaluating the different feedstocks.”

If the company continues to grow as planned, facilities like the one in Edmonton could have a significant impact in reducing greenhouse gases everywhere. •

Wood pellet industry faces challenges, but also growth

By Maria Church

Withthe wood pellet industry hurting from low fuel prices, warm winters, and unhelpful government policies in many countries, is there a light in the gloom? The potential of global markets was the topic de jour during the annual Wood Pellet Association of Canada conference, which took place in Harrison Hot Springs, B.C. from Sept. 20 to 22, 2016.

The short answer, according to William Strauss from FutureMetrics, is Japan. Strauss stressed that the Japanese market has potential to boost growth for Canadian pellet producers, specifically in Western Canada, but also for those in Central and Eastern Canada.

“We all know that we are in a plateau right now in terms of production,” Strauss said.

According to his estimates, there is currently 2.5 million tonnes of over capacity, however, with new projects and policies, that overage will be soaked up by 2018, and demand will overtake supply by 2020.

John Bingham from Hawkins Wright has similar numbers; he estimates that

global demand for pellets will increase to 27 million tonnes by 2020 based on new projects in the pipelines in the United States, Japan, United Kingdom and other European countries.

Japan, specifically, Strauss said, with its carbon reduction mandate, is an emerging market that could change the game.

“We think there is a high likelihood of significant demand over the next decade,” Strauss said, estimating that by 2020 there could be demand in excess of 15 million tonnes.

That demand would be best met by producers in Western Canada due to proximity. If pellet producers in Western Canada were kept busy with the Japanese market, those in Eastern Canada would increasingly send their supply of wood pellets to Europe.

The United States as a market is a wild card for pellet producers, with the implementation of the U.S. Clean Energy Plan tied to the election this fall.

Speaking as part of a panel discussion of producers, Vaughan Bassett from Pin-

nacle Renewable Energy said the pellet industry as a whole needs to push to produce biomass without subsidies. He agreed with Strauss that Asia is a target market, and an opportunity for Canadian pellet producers to, “demonstrate that they are strong suppliers to the market.”

Other discussion on the panel was sparked by a query from moderator Arnold Dale, vice-president of Bioenergy Ekman & Co., who asked: is it the role of pellet producers to promote end-user products?

“I always feel that a local market is the best market,” Dale said.

Getting local companies or government offices and schools to convert to wood pellets creates small but sustainable demand, he argued. Panellists seemed to agree with Dale, while noting that that strategy makes the most sense for small producers in heating markets, less so for large-scale industrial producers.

Day 2 of the conference continued discussions about potential growth in current and new markets. Rachael

Levinson with Argus Media gave a global overview of biomass power projects coming online, and their expected demands. The U.K. is still the largest consumer of pellets, she said, which is not likely to change in the near future. Brexit is on everyone’s mind, but it will be two years before it has any substantial effect.

Speaking to biomass’ future in the Netherlands, Henry Pease with RWE Supply & Trading said there is an expectation that government investments made between 2013 and 2020 will increase demand to 3.5 million tonnes. Pease stressed that attaining certifications, including the Sustainable Biomass Partnership (SBP) certification, is becoming increasingly important for pellet producers.

FPInnovation’s Charles Friesen updated conference goers on the current state of Canadian fibre supply. Canada is a world leader in large-scale production of forest biomass, but transportation costs mean that much of that biomass is left in the forest.

“There is lots of material if you are willing to pay,” Friesen said.

He also noted that proactive measures to eliminate the mountain pine beetle will eventually dry up the ready supply of beetle-affected wood.

Discussions then turned to Alberta and its Climate Leadership Plan.

FutureMetrics’ William Strauss opened the talk by providing evidence

that Alberta does indeed have potential for full-conversion of certain power projects, but education is key. Utilities and policy makers, he said, need to know about the benefits of using wood pellets.

Jamie Stephen, founder of Torchlight BioResources, made a strong point about how low natural gas prices have created a unique power generation station in Alberta. Wind and solar, he said, are not the competitors to wood pellets in the province – the competition is gas. According to Stephen’s models, using purely wood pellets for large-scale power generation will be a hard sell to utilities when the operating cost of gas is so low, even after factoring in Alberta’s carbon levy. An alternative, Stephen said, would be to supplement pellets with low-cost feedstock.

If attendees had just one takeaway from Day 2 of the conference, the WPAC’s Safety Committee would like it to be about process safety management. “Process safety management” was the buzzword of the safety discussion at the conference, which kicked off with WPAC Safety Committee chair Scott Bax.

“Safety is all about your people,” Bax said, who is the senior vice-president of operations for Pinnacle Renewable Energy Inc. “We know the return to business from an engaged, active safety culture is incredible.”

Process safety management, Bax said, has been embraced by WPAC as a method to help companies create that safety culture.

Ellis Whalen with ABCS Safety Training explained process safety management as a blending of engineering and management skills to design and maintain safe processes.

“It is your responsibility to make sure your employees are competent and trained to perform their tasks,” Whalen said.

Implementing process safety management involves hazard assessments, the development of operating procedures, training, and auditing.

Cherie Whelan, the new director of Safe Companies for the BC Forest Safety Council, told conference goers to expect a flood of near-miss reports from the council, which she said can help other companies learn to implement safer processes.

“Start sharing [near miss incidents] within your own organization, your industry, and then with the BC Forest Safety Council,” she said.

WPAC Safety Committee is planning to hold a one-day process safety management training session in the coming months.

The conference wrapped with presentations on new technology in the industry from Firefly AB, Player Design Inc., Fike Corporation, Dryer One and Smart Heating Technology.

Mikael Jidenius from Firefly shared tips for preventing fires in the wood pellet industry, and explained how a quality spark detection systems can help reduce risk. Research shows that pellet facilities should be equipped to detect both sparks and dark or hot particles in the process, Jidenius said.

Tyler Player, owner of Player Design Inc., presented on rotary dryer performance with green fuel combustion. According to several test sites, Player said, a rotary dryer can reduce carbon dioxide emissions by more than 50 per cent, and helps reduce sparking.

The 2017 Wood Pellet Association of Canada AGM and Conference is scheduled for Sept. 18 to 20 at the Ottawa Marriot Hotel. Go to www.pellet.org for more information.•

ANDRITZ is one of the world’s leading suppliers of technologies, systems, and services relating to equipment for the biomass pelleting industry. We offer single machines for the production of solid and liquid biofuel and waste pellets. We have the ability to manufacture and supply each and every key processing machine in the pellet production line.

For the latest news, equipment and pellet profile features, visit www.canadianbiomass.ca.

ANDRITZ Feed & Biofuel A/S Europe, Asia, and South America: andritz-fb@andritz.com USA and Canada: andritz-fb.us@andritz.com

www.andritz.com

Surrey, B.C.-based Industrial Equipment Manufacturing Ltd. engineers and manufactures a diverse range of quality bulk materials handling equipment in numerous industries around the world including pulp and paper mills, sawmills, mining facilities, ports and marine facilities, grain elevators and various bulk loading facilities. Conveyors are available in a number of different styles including belt conveyors, high-lift conveyors, chain conveyors, screw conveyors and underground conveyors. Features include: transfer towers, load chutes, discharge chutes with belt cleaners, platforms and walkways. For clients in forest and wood processing, IEM specializes in designbuild solutions, manufacturing a range of quality, reliable products, including the IEM Debarker – an effective debarker and residual fibre recovery system. www.iem.ca

Fox Venturi Eductors have been used to convey alternative fuels, ag-waste, pet coke, wood pellets, and shredded tires to cement kilns in Canada and globally since the 1980’s. Venturi eductors supply pneumatic conveying with no moving parts, with no shafts or seals to maintain, and with no fugitive dust – an alternative to rotary valves when handling biomass.

Using air at 3-12 psig, Venturi Eductors can convey alt fuel up to 300 feet and sorbents and PAC up to 800 feet. Available in line sizes from two inches to 16 inches, and available with ceramic or tool-steel liners for handling highly abrasive materials with high silica content. Fox can supply eductors with matching blowers, bends, valves, etc. www.foxvalve.com

The simple and highly effective Skalper belt cleaner removes carry-back from the conveyor system, which leads to many adverse complications and costly downtime for repairs and maintenance. The Skalper’s one-piece urethane blade maintains precise contact with the belt at all times, effectively removing dust and residue before it can enter the return side of the system. This dramatically reduces maintenance labour costs and downtime. The unique self-adjusting E-Z Torque Tensioning System with its rubber corrugated dust covers and UHMW bushings ensure no build-up in the spring

tensioning area while providing smooth, non-binding tensioning.

www.asgco.com

Biomass Engineering & Equipment designs and manufactures SMART Conveyors for wood processing industries. The twin chain design is totally enclosed and dust tight. SMART Conveyors are available in five sizes to accommodate a wide range of capacities. Key features include: space saving inclines up to 75 degrees; twin chains are totally supported in wear strips; one-half the power requirements of other systems; maintenance friendly design –change curve wear strips from outside the conveyor without breaking the chain; shaft-mounted inverter duty drives; modular construction; claw paddle design limits stresses on the paddle system; minimal support structure required due to robust design.

www.BEandE.net

S. Huot has built a global reputation for providing world-class engineering design, manufacturing and management of custom-designed bulk material handling equipment. Its team of engineers is conscious of the raw material handling challenges of the forest industry operations. The goal: reduce acquisition and operational costs for your

various departments including engineering, project management, production, health and safety, maintenance, environment and procurement.

www.shuot.com

Process Barron has been designing, building, and installing underpile drag reclaimers for 30 years. Underpile drag reclaimers can be used for a variety of materials, and the Process Baron’s are custom made to fit the application and calibrated to ensure a steady fuel flow. They can range from one to six strands wide depending on the application and volume requirements. If redundancy is needed, multiple reclaimers can be put side by side. With low maintenance

requirements, rugged construction, and high capacity capabilities, these underpile drag reclaimers are very economical for customers that are looking for a reliable and semi-automated feed system.

www.processbarron.com

The Baum BE29F heavy-duty, new NFPA designed rotary airlock knife feeder valves are standard dimensions, but can be customized to a specific application. Engineers review the application and evaluate the design based on KST values for the material, temperature, Pred pressure and ambient conditions. Units are built in carbon steel to match the specific NFPA-69 12.2.3.2 requirements. Special interlocking switches, and controls are also required to

match the installation environment. Each valve is uniquely built and documented. The Baum BE29F is ideally suited for all NFPA airlock installations.

www.baumpneumatics.ca

Axis Conveyor is a company specializing in custom design and manufacturing of conveyors. Its main product line is the Drag Chain conveyor. The Drag Chain conveyor moves bulk material inside a piping system with discs that are mounted on a moving chain. The inlet and outlet of the conveyor being flanged allows for a completely sealed and dust-free system. The material conveys at low speed keeping the integrity of the product. The conveyor can move material from 1 to 1,200 cubic

There’s a saying that gets tossed around a lot here:

“It just runs.”

Our pellet mills and hammermills aren’t the prettiest. But they’re rock-solid. And they run— year after year after year.

But “It just runs” isn’t just about our products.

It’s about our company that literally spans centuries.

And it’s about our ongoing relationships with our customers—how we’ll always be there for you.

Give us a call, and find out just how CPM can run for you.

Your Partner in Productivity

CPM Biomass Group 601-932-9080 • www.cpm.net

CPM/Europe BV +31 75 65 12 611 • www.cpmeurope.nl Client:

www.axisconveyor.com

The Brunette SmartVIBE Vibrating Conveyor is a uniquely simple vibrating conveyor. Utilizing a patented torsion bar system, it has eliminated all coil springs from the conveyor. The design optimizes low cost maintenance and maximum up-time efficiencies and is fully balanced. It can maximize throughput with its secondary trough, and even adjust feeds speeds with the use of a VFD without having to stop for rebalancing. The Brunette SmartVIBE is suitable for many industries including sawmilling, biomass, recycling, pellet manufacturing, plywood, OSB, food processing and agro industries. It is available in different widths and lengths, complete with size specific screening options and metal detection. www.brunettemc.com

The Walinga UltraVeyor push system moves bulk by air, maximizing accessibility for any handling or storage facility. Move bulk safely without potentially dangerous augers or airborne particulates and dust. Ultra-Veyor systems are designed to be highly efficient and easy to maintain with all moving components and service points located on the base unit. The system is typically installed semi-permanently, but is built with integrated forklift lift points to make base unit relocations a

breeze. Walinga Ultra-Veyors handle the requirements of most operations with models ranging from 10 to 75-plus tonnes per hour. Ultra-Veyor Systems are flexible, expandable and designed to for easy installation.

www.walinga.com

Designed to handle a variety of products, including biomass and wood waste, Keith Walking Floor systems offer many benefits. The horizontal unloading of a moving floor system eliminates many of the hazards using tipping trailers to unload in the field. Trailers with walking floor systems can safely unload on uneven ground; provide a controlled material discharge; and can unload in windy conditions. There is no risk of hitting overhead power cables or trees during unloading. Walking floor systems unload a range of bulk products, and are ideal for backhauling. They also unload pallets, drums, bales and rolls. www.keithwalkingfloor.com

Since the early 1980s, Samson Materials Handling has developed a range of solutions dedicated to the reliable intake, storage and export of general bulk cargoes, including many unusual and cohesive materials such as biomass fuels. Flexibility is at the core of its product concept from truck intake using the Samson surface feeder through to mobile stacking and ship loading solutions that are able to operate from existing berths. Samson is part of the Aumund Group of Germany specializing in bulk handling solutions that provide the very highest levels of performance and reliability.

www.samson-mh.com/en/samson

RUD Chain is an industry leader in the design and manufacturing of case hardened round link chain and components for conveying. The case hardened chain, sprockets, wheels, couplings, and chain attachments are designed for use in a harsh environment. The substantial decrease in component wear results in reduced maintenance and downtime. RUD Chain products are commonly used in fuel delivery and ash handling conveyors.

www.rud.com

Tubular Gallery Conveyors provide complete material containment, environmental integrity and minimal upkeep. Applications include transfer between buildings, crossing over roads, railways, right of ways and green spaces, in mill yards, terminals and process facilities. Product is completely retained and no grounds cleanup is needed below the gallery. Benefits include ease of servicing during all seasons, a safe manageable environment, the protection of products and personnel from wind and weather, and the elimination of fugitive dust. Shop pre-assembly in sections can include service piping, cable trays, lights, heating and ventilation. Installation time and cost is reduced. GRIP assists customer to determine optimal conveying solutions.

www.conveycanada.ca

Continental provides a full range of mechanical bulk handling and storage equipment including en-masse chain conveyors, screw conveyors, belt conveyors as well as storage and reclaim solutions. Robust designs coupled with over 50 years of wood industry and related experience assures quality conveying systems that provide maximum plant uptime. En-masse chain conveyors offer steep

angle conveying solutions with capacities up to 930 cubic metres per hour while slewing screw reclaimers for stockpiles or silos can reclaim up to 1200 cubic metres per hour. All equipment is purpose designed and built by a team of experienced engineers, technicians and craftsmen for the exacting requirements of the pellet, biomass, fuel or wood processing industries serviced. www.continentalconveyor.ca

Superior Industries’ TeleStacker Conveyor eliminates material segregation by stockpiling materials in windrows to ensure the stockpile meets spec. The conveyor design has multiple axle options, which include the company’s patented FD Axle, XTP Swing Axle and Pit Portable Axle. Its patented FB Undercarriage is designed to offer the conveyor the best structural support and safety possible. It is also equipped with the Superior-designed PilePro Automation system that helps achieve 30 per cent larger desegregated stockpiles. www.superior-ind.com

Grinder and chipper companies that exhibited at DEMO 2016.

Staff report

The DiamondZ DZH4000 is built with a C18 Caterpillar engine and is available in Tier 2, Tier 3, Tier 4i and Tier 4 final, offering up to 765hp. It delivers production rates up to 120 tons per hour and offers easy transportability, operation and maintenance. It is available in three model options: DZH4000 transport model, DZH4000TK Track mounted and DZH4000TKT Track and transport.

http://frontline-machinery.com

Bandit Industries now offers new options and designs for the Model 2680XP, 3680XP and 4680XP Beast Recyclers that allow the machines to excel in processing dense, stringy green waste like palms, vines and coastal vegetation. The cuttermill features a 30-tooth setup with 2”

wide teeth as opposed to the standard 60-tooth, 1” wide arrangement. While a 60-tooth set up is still the best for grinding larger diameter wood, in leafy and stringy material void of larger material the 30-tooth setup is extremely efficient. The mill RPM has been increased to help clear the mill faster, while the mill housing itself is opened up. A new proportional drive system for hydraulics on the Beast’s feed system helps to deliver maximum feeding rates without overfeeding the machine. This new system will monitor engine loads and automatically adjust the feed rate to match. The new system can also switch over to six different feed speeds. www.banditchippers.com

Rotochopper’s B-66 series grinders process a wide range of raw materials including whole trees, slabwood, railroad ties, asphalt roofing shingles, round and square bales, sorted C & D,

wood chips and pallets into engineered fibre commodities. It is built with features designed to maximize uptime and end product control including a domed slat infeed conveyor; gap-less infeed transition; patented slab ramp adjustable shear plane; patented concentric powerfeed lift with internal radial piston drive; hydraulic screen installation system; and a patented replaceable mount rotor. Optional features include a biomass rotor package for producing short fibre fuels from round wood; crawler tracks with highway transport dolly and a simultaneous grind and colour system.

www.rotochopper.com

The 3200 Track Wood Hog Horizontal Grinder from Morbark is built with a CAT C18, Tier II, 765-hp engine. It features an externally adjustable breakaway torque limiter; a live floor with four strands of WDH-110 chain in staggered configuration; a variable speed infeed system with 30” diameter top compression feed roll with internal drive/replaceable scraper for feed wheel teeth; and a Strickland undercarriage with double grouser pads. The grinder is also equipped with an 18-hammer/ raker pattern; Wearwolf inserts; and 3” hex screens.

www.morbark.com

Peterson brought out their 5000H whole tree chipper to demonstrate the many benefits of in-field chipping. The allin-one chipper will debark, delimb, and

make paper grade pulp and paper chips in one single process. The 5000H can fill a standard chip van with clean chips in less than 15 minutes! Equipped with a large feed throat, the 5000H can accept up to a 23 inch (56 cm) diameter single tree or multiple smaller stems. The 5000H can be configured with a three or four pocket disc, with several optional sheave sizes to make precisely the chip you need. The standard threepocket disc produces chips from 5⁄8 to 1 1/4 inches (16–32 mm) long, while the optional four-pocket disc produces chips from 1Ž2 to 1 inches (13–25 mm) long. Chipping production rates up to 100 tons (90 tonnes) per hour can be achieved depending on chip size and wood characteristics.

www.petersoncorp.com

Terex Environmental Equipment brought machines from its CBI and Ecotec product lines and featured its TBG 650 Horizontal Grider (CBI 5800BT) at DEMO, along with its CBI 7544 Flail and Disc Chipper process material. The TBG 650 wood waste grinder is engineered for land clearing, logging companies, mulch yards and yard waste and demolition wood processors requiring reliability and highvolume throughput. The machine features a high-lift upper feed roll for easy maintenance, a high torque, hydrostatic feed system, interchangeable carbide layer tips and diverter pan. The CBI 7544 Flail and Disc Chipper uses a beltdriven gearbox to drive the majority of its hydraulics, and features a bidirectional bark pusher, which gives the ability to discharge the debris to either side of the machine.

www.cbi-inc.com

Slant Disc Chippers . . .

Industry -preferred design with stable infeed across spout width.

. . .

High capacity and high performance.

Whole Log Chippers . . .

Robust and long-lived.

Look to us for chippers that produce:

more than 90% acceptable chips

few pin chips and overthick chips

an increased ration of large to small accepts chips Excellence in Chip Processing

Phone: (425) 258-3555

Fax: (425) 252-7622

Web Site: www.acrowood.com

E-mail: sales@acrowood.com

IBy Jeff Passmore, CEO, Passmore Group Inc.

magine a future world where our grandchildren will be purchasing all their paints, plastics, energy, and personal care products without ever knowing that once upon a time, these items were not derived from biomass.

For as the OECD has said in its Bioeconomy 2030 report, by the 2025 – 2030 period, the bioeconomy will have reached “an estimated world market of between USD 2.6 and 5.8 trillion.”

But transitioning to the bioeconomy will

today could be made from carbohydrates (biomass) instead of from fossil hydro carbons.

Forest/wood residue, agriculture residues such as straw, and dedicated crops and grasses can be sources of this ‘biomass.’ Products from these materials include paper, packaging, engineered wood products, wood pellets, biofuels, insulation, and most recently biochemical and biomaterials including paints, solvents, lubricants, plasticizers, cosmetics, textiles, inks, diapers, fragrances, fertilizers, composites – the list goes on.

“Canada has 10 per cent of the world’s forests – over 700 million acres – and 160 million acres of farmland.”

not just happen. And while Europe, the U.S. and more recently China, are aggressively pursuing this new industrial revolution, Canada, if we want to stay competitive with our trading partners, needs to get a coherent, 20 year bioeconomy effort launched.

Indeed, according to the communique issued following the first Global Bioeconomy Summit in November 2015 in Berlin “more than 40 countries are actively promoting bioeconomy with a view to meeting the grand societal challenges of sustainable development.”

This is the opportunity that now presents itself to Canada – an opportunity that, as part of achieving our low carbon agenda, the Trudeau government should consider getting up to speed on. Why low carbon? Because most consumer products we use

And whether we’re talking farm or forest, or even marine, Canada is well endowed. Canada has 10 per cent of the world’s forests – over 700 million acres –and 160 million acres of farmland. Seventy percent of that farmland is in Saskatchewan and Alberta. What an opportunity to create new jobs and renew prairie agriculture!