MODERN.CLEAN.SAFE.

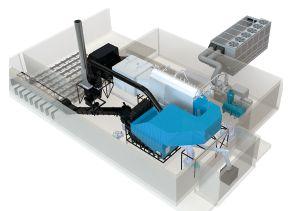

Residential wood biomass heating technology from Viessmann

Celebrating 100 years in the business, Viessmann has been providing homeowners with industry-leading heating solutions for generations.

The Vitoligno 300-C wood pellet-fired boiler is a modern, compact and fully-automatic heating solution for residential and light commercial applications.

High efficiency up to 85%

Environmentally-friendly, carbon neutral heating

Easy conversion from automatic to manual fuel feed

Easy to obtain, locally and sustainably sourced wood fuel

WINNER of the 2015 German Design Award

CANADIAN BIOMASS

INDUSTRIAL

Green gas

The Kwadacha Nation are the new operators of North America’s first wood gasification system for district energy.

A low-carbon horizon

Scaling Up 2017 speakers share lessons learned.

Bio-pipelines

Natural gas pipelines that crisscross the Edmonton area will soon flow with an injection of renewable natural gas (RNG) from wood waste.

Conveyor safety

The top 10 conveyor hazards and their solutions.

“IThe bio-age?

Government policy should spur the bioeconomy in 2018

t’s clear we’re at the threshold of the bio-age.”

It was a powerful statement from Kim Rudd, parliamentary secretary to the minister of natural resources, at an industry event in Ottawa late November.

And if it at all reflects the sentiment at Natural Resources Canada, it’s a call to action for biomass producers to make noise in the marketplace. There is a strong reason to think 2018 will be a banner year for biomass.

Making good on its election promises, the Liberal government is moving forward – albeit with the usual bureaucratic glacial pace – with two policies that will help reduce Canada’s contribution to greenhouse gases (GHGs). These policies will help bridge the price gap between fossil fuels and lower carbon alternatives like wood pellets and other biofuels.

Also in December McKenna gave an update on national carbon pricing, giving provinces and territories until the end of 2018 to submit their own plans. To be approved these plans must meet the equivalent of $10 per tonne of carbon a year rising to $50 a tonne by 2022. While Alberta and B.C. already have plans in place that will meet the standard, other provinces and territories will need to take action next year.

In December Environment and Climate Change Minister Catherine McKenna announced the release of the federal Clean Fuel Standard with the aim of publishing draft regulations by late this year. The standard, she said, will “give Canadians better access to clean fuels and will make a significant cut in Canada’s carbon pollution.”

According to the government release, the Clean Fuel Standard will be a “flexible regulation” with a range of compliance options, and will set carbon intensity according to the entire lifecycle of a fuel.

Scott Lewis, vice-chair of Renewable Industries Canada, said the Clean Fuel Standard will “bring to Canada a credit trading market for biofuels that is essential in our ability to continue to bring low carbon fuels to consumers at competitive prices, while allowing for some flexibility in compliance.”

Now is the time for wood pellet and biofuel companies to share their low carbon solutions with consumers who will soon have new incentives to choose greener options.

Lack of awareness is still the No. 1 hurdle to growing the local wood pellet heating market. Consumers need to hear the good news story of how wood pellets provide efficient home heating at a comparable price long term. With that goal in mind, the Wood Pellet Association of Canada launched www.woodpelletheat.ca, a website dedicated to sharing information on wood pellets as a renewable heat and power source.

For years the bio industry in Canada has been calling for favourable government policy to spur the growth of the bioeconomy. The Clean Fuel Standard and national carbon pricing are a response from government. These polices, if implemented as promised, will help usher in the “bio-age” in Canada. Canadian biomass companies should react by ramping up their marketing efforts in 2018 and getting in front of the movement. •

Volume 18 No. 1

Editor - Maria Church (226) 931-1396 mchurch@annexweb.com

Associate Editor - Tamar Atik (416) 510-5211 tatik@annexweb.com

Contributors - Gordon Murray, Taylor Fredericks, William Strauss, Seth Walker.

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexbusinessmedia.com

Account Coordinator - Stephanie DeFields Ph: (519) 429-5196 sdefields@annexweb.com

National Sales Manager - Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexweb.com

Quebec Sales - Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

Western Sales Manager - Tim Shaddick tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Svetlana Avrutin

Circulation Manager - Beata Olechnowicz bolechnowicz@annexbusinessmedia.com Ph: (416) 442-5600 ext. 3543

COO - Ted Markle tmarkle@annexbusinessmedia.com

President/CEO Mike Fredericks

Canadian Biomass is published six times a year: February, April, June, August, October, and December. Published and printed by Annex Business Media.

Publication Mail Agreement # 40065710

Printed in Canada ISSN 2290-3097

Subscription Rates: Canada - 1 Yr $56.00; 2 Yr $100.00 Single Copy - $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $91.60 US; Foreign – 1 Yr $104.00 US

CIRCULATION mchana@annexbusinessmedia.com Tel: (416) 510-5109 Fax: (416) 510-6875 or (416) 442-2191 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2018 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

www.canadianbiomassmagazine.ca

BIOMASS update

CHAR ACQUIRES ALTECH GROUP, PLANS TO PRODUCE BIOCOAL

Mississauga, Ont.-based CHAR Technologies has closed on its acquisition of Toronto’s Altech Group and has announced plans to manufacture and sell a biocoal product branded as CleanFyre. The GHG neutral product will be marketed as a cost-effective coal replacement.

“CleanFyre will leverage both Altech’s experience and expertise, and CHAR’s platform pyrolysis technology, the same technology used to

create SulfaCHAR, to create a solution with strong market pull and significant growth opportunity,” CHAR CEO Andrew White said in a news release.

CHAR currently produces SulfaCHAR, which can be used to remove hydrogen sulfide from gas streams, with a focus on methane-rich and odorous air. SulfaCHAR can also be used as a sulfur-enriched biochar for agriculture.

Altech – an environmental

BBI’S TIM PORTZ NAMED EXECUTIVE DIRECTOR OF PFI

Pellet Fuels Institute has selected Tim Portz as its new executive director beginning Jan. 2.

Portz previously served as the executive editor of BBI International’s Biomass Magazine and Pellet Mill Magazine, and has been a renewable industry observer, reporter, and commentator for nearly a decade.

“Tim has established himself as a consistent and outspoken champion for biomass energy – specifically the wood pellet sector,” PFI states in its release.

With BBI International, Portz developed the agendas of the International Biomass Conference & Expo and the International Fuel Ethanol Workshop.

Prior to BBI, Portz worked in sales and sales management for global printing company RR Donnelley. He graduated from the University of Iowa with a bachelor of fine arts. Born and raised in central Iowa, Portz, his wife, and their two sons now live in Minneapolis.

consulting company and provider of air pollution control and water treatment technology – currently has 12 employees. CHAR acquired all of the outstanding shares in both Altech Environmental Consulting Ltd. and Altech Technology Systems Inc.

“The acquisition of the Altech Group adds over 30 years of experience in environmental technologies and professional engineering consulting,” CHAR chairman

Bill White said in the release. “Altech provides CHAR with a growth catalyst to move much of our engineering design inhouse, while at the same time allows us to greatly expand our technology solutions offering for industrial clean air and clean water.”

Alexander Keen, founder and CEO of Altech, said in the release, “CHAR brings an exciting future for Altech. Our joint efforts going forward will bring tremendous opportunities.”

True North Timber to buy Rentech’s Atikokan pellet facility

Rentech’s Atikokan, Ont., wood pellet facility has entered into an asset purchase agreement with Ontario’s True North Timber, according to the company’s latest news release.

The facility supplies wood pellets to Ontario Power Generation’s 100 per cent biomass-fuelled generating station in Atikokan. Earlier this year the 100,000 tonnecapacity facility reduced its production to 45,000 tonnes per year to meet the OPG contract.

Rentech’s Wawa, Ont., pellet facility remains idle, and the company has applied to the Ontario Superior Court of Justice for the appointment of a receiver and manager to facilitate the sale or liquidation of that facility.

Rentech also announced its subsidiary, Rentech WP U.S. Inc., filed a voluntary petition for relief under the United States Bankruptcy Code. “The purpose of the bankruptcy filing is to seek to sell the assets of the company’s Fulghum Fibres and New England Wood Pellet subsidiaries and facilitate an orderly wind-down of Rentech Inc.,” the release states.

BIC HONOURED BY CANADIAN CHAMBER OF COMMERCE

The Canadian Chamber of Commerce has named Sarnia, Ont.based Bioindustrial Innovation Canada (BIC) one of Canada’s Resource Champions.BIC was recognized as part of the chamber’s Canada’s Resource Champions Award, created to support natural resource development and trade across the country. Since its establishment in 2008, BIC has made it its mission

to invest in and support companies that are just starting out who develop clean, green and sustainable technologies. It currently has 16 organizations in its portfolio.

“It’s good to be recognized for the work we’re doing in the renewable space,” Sandy Marshall, executive director of BIC, told the Sarnia Observer

The federal government has released its Clean Fuel Standard with the aim of publishing draft regulations by late next year.

Environment and Climate Change Minister Catherine McKenna said the standard will “give Canadians better access to clean fuels and will make a significant cut in Canada’s carbon pollution.”

The standard will require fuel producers, importers, or distributors to reduce the greenhouse gas emissions produced during any part of a fuel’s lifecycle, including production, transportation to processors and end users, and when the fuel is combusted.

According to the government release, the Clean Fuel Standard will be a “flexible regulation” with a range of compliance options. The goal is to reduce Canada’s greenhouse gas emissions by 30 million tonnes a year by 2030.

NAIT DEVELOPING TECH FOR TRUCKS TO BURN BIOMETHANOL-BASED FUEL

The Northern Alberta Institute of Technology (NAIT) is partnering with industry to develop a new technology that will enable long-haul trucks to use low-carbon fuel.

NAIT researchers in the School of Applied Sciences and Technology have partnered with Mack Trucks, Oberon Fuels and Westcan Bulk Transport to develop a technology that manages moisture for dimethyl ether (DME) – an alternative to diesel fuel made from either natural gas or biomethanol. The technology will remove any residual water from the fuel before it enters the engine, which would mitigate corrosion and low performance.

The research is funded by $368,000 from the Alberta Ministry of Economic Development and Trade.

Researchers plan to test the technology on Mack trucks from Westcan’s fleet travelling Highway 2 between Edmonton and Calgary.

“Alberta is leading the way by investing in DME, one of the few truly carbon-negative fuels available, and the only one that can deliver the power needed for heavy-duty applications,” Rebecca Boudreaux, president of Oberon Fuels, said in the release.

WPAC MAKES STRONG CASE FOR PELLETS IN NEW BRUNSWICK FEDERAL

Each year thousands of tons of wood pellets are shipped out of the Port of Belledune in New Brunswick to fire biomass generating stations in Europe, while thousands of tons of coal are shipped in to power the Belledune coalfired generating station, just a stone’s throw away.

This ironic image dominated conversation at the NB Wood Pellet Forum held by the Wood Pellet Association of Canada and Canadian

Biomass in Fredericton in December.

“It seems crazy that we are using the Port of Belledune to ship wood pellets to Europe, and the same port to bring in coal. Why not keep those wood pellets here?” WPAC executive director Gord Murray asked the audience of about 75 stakeholders, ranging from consultants and pellet producers to government and NB Power representatives.

New Brunswick has four pellet plants in operation with two others in the planning stages and the potential for many more, Murray said. The two largest, Groupe Savoie and Shaw Resources, produce 90,000 and 100,000 tonnes per year respectively, but a majority of what is produced is sent to the U.K. and Western Europe.

This year the federal government announced its intention to phase out coalfired electricity Canada wide. New Brunswick is one of four provinces that still produce electricity with coal.

The Belledune Generating Station was built just 23 years ago. “It would become the classic stranded asset if it was shut down. It has many more years left,” FutureMetrics’ William Strauss told the

crowd. A solution to avoid shut down is to either co-fire with pellets, or to retrofit the station to full-fire wood pellets.

Belledune would require approximately 1.6 million tonnes of pellets a year to run, Strauss said. There is no denying that wood pellets are more expensive to produce than coal, he said, so government policy needs to close the gap. “It is without question the lowest cost method to reduce GHG emissions.”

A vibrant pellet industry would also create jobs in the province, stimulating the local economy, Strauss said. He estimates about 2,700 jobs would be required to supply wood pellets to Belledune. Imported coal, by comparison, has no local economic benefit.

Consider ‘what ifs’

OHow process hazard analysis can help the pellet industry

By Gord Murray, WPAC executive director

n Nov. 8, a group of 37 Canadian wood pellet producers, insurance risk engineers and representatives of WorkSafeBC gathered in Richmond, B.C., for a one-day training course called Introduction to Process Hazard Analysis for the Wood Pellet Industry. The Wood Pellet Association of Canada Safety Committee organized the event, which was sponsored by WorkSafeBC. Jamie Merriam of ACM Facility Safety, an electrical engineer and process safety management expert was the instructor.

Process Hazard Analysis (PHA) is just one of 14 elements of process safety management (PSM) which include:

• Process safety information

• Process hazard analysis

• Operating procedures

• Training

• Contractors

• Mechanical integrity

• Hot work

• Management of change

• Incident investigation

• Compliance audits

• Trade secrets

• Employee participation

• Pre-startup safety review

• Emergency planning and response

PSM mainly applies to manufacturing industries and is focused on identifying what could go wrong and what safeguards must be implemented to prevent hazardous events from occurring. Unlike occupational health and safety (OHS), which focuses on individuals, PSM focuses on safeguarding or eliminating hazards associated with often-complex processes. The wood pellet industry has made significant progress in improving safety by focusing on OHS, but that alone is not enough. The

WPAC Safety Committee believes that the next quantum improvement in safety performance will come from implementing PSM across the wood pellet industry.

To this end, WPAC has begun rolling out PSM training modules. The first, Introduction to Management of Change, was held in June 2017. PHA was the second training module. WPAC has two more modules planned for 2018.

PHA is a key element of process safety management. PHA includes a set of procedures for carefully reviewing what could go wrong and what safeguards must be implemented to prevent hazardous events from occurring. PHA provides information to help employers and workers to make decisions that will improve safety.

A PHA analyzes the potential causes of fires, explosions, releases of toxic

Canadian wood pellet producers, insurance risk engineers and representatives of WorkSafeBC gather in Richmond, B.C., for a one-day training course called Introduction to Process Hazard Analysis for the Wood Pellet Industry.

substances and other hazardous events. It considers the equipment, instrumentation, human actions and other factors that might affect the process. A PHA attempts to determine potential failure points, methods of operations and other factors that can lead to accidents.

A team tasked with performing a PHA should include potentially affected operators, supervisors, engineers, and other workers who have knowledge of the process being analyzed. It is helpful to have an experienced facilitator lead the PHA. PHAs must address hazards, previous incidents, engineering and administrative controls; potential consequences of failure of controls; facility siting; human factors; and the range of possible safety and health effects caused by the failure of controls.

There are a variety of methods for completing a PHA. Common methods include:

Checklists: using established codes, standards and well-understood hazardous operations as a checklist against which to compare a process.

What if: using a team to create and answer a series of “what-if” type questions. Hazard and Operability Study (HAZOP): carrying out a structured, systematic review that identifies equipment that is being used in a way that it was not designed to be, and which might create hazards or operational problems.

Failure Mode and Effect Analysis (FMEA): systematically studying the consequences of failure (breakdown) of certain operational hardware such as transmitters, controllers, valves, pumps, etc.

Fault-Tree Analysis: creating a model showing what undesirable outcomes might result from a specific initiating event (for example, a conveyor stops operating). It uses graphics and symbols to show the possible order of events that might result in an accident.

Upon completing a PHA, employers must establish a system or set of procedures that will promptly deal with the findings of the PHA team and recommendations. Any actions taken to correct hazards uncovered by the PHA

must be communicated to the workers in the area and to any other workers who might be affected. Follow-up is a critical part of any PHA because if recommendations are not followed, accidents could result in serious injury, loss of life, and legal liability from the company’s failure to act.

Implementing process safety management is significantly more complex and requires a much greater commitment than solely relying on occupational health and safety. Successful PSM implementation will take time, perhaps even several years before PSM is fully ingrained in wood pellet operations. However, the effort will go a long way toward creating a state where the wood pellet industry is completely accident free. The group of 37 participants who took the PHA course now have the responsibility of sharing the knowledge they gained with their industry colleagues back home and continuing with the job of implementing PSM across the wood pellet industry. •

Green gas

Kwadacha Nation installs wood gasification system

Chief Donny Van Somer of the Kwadacha Nation can still vividly recall the moment almost seven years ago when he first began thinking about the possibility of reducing his community’s carbon footprint with renewable energy.

Now, after years of research, partnership-building, and hard work, that dream has become a reality, with the Kwadacha Nation the proud new operators of North America’s first wood gasification system for district energy.

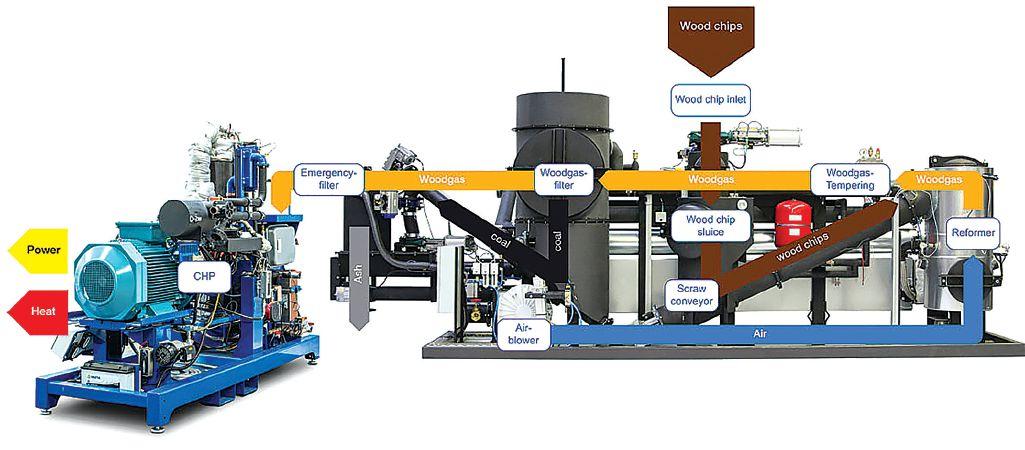

The system, composed of three linked Borealis CHP biomass generators and a

By Taylor Fredericks

dryer, became operational in April last year, and will be used to provide heat to greenhouses, a local school, and electricity for the majority of the community. Each of the three units independently produces 45 kW of electricity and 108 kW of heat in the form of hot water.

“It’s hard to believe looking back, but this is a project that we have been thinking about for years now,” explains Van Somer. “I remember negotiating with a mining company on a mine that was underway in our region back around 2011, and it occurred to me then that

our lands and our country deserved a greener future.”

Whatever inkling Van Somer might have had then about what such a future might look like, he admits he still had much to learn about the effort required to realize it.

FROM FOSSIL FUELS TO FAST FRIENDS

Located in Fort Ware, B.C., the Kwadacha Nation is an off-the-grid remote community more than 570 kilometres north of Prince George. Home of the Tsek’ene people, the community has an estimated population of 380, and approximately 80

The wood gasification system, composed of three linked Borealis CHP biomass generators and a dryer, became operational in April last year. Photos courtesy Borealis Wood Power Corp.

homes. Due to its remote location, the community has traditionally relied on costly diesel generators to provide electricity, and propane for heat.

Looking for sustainable, green initiatives that might help to reduce their ecological footprint, the Kwadacha council quickly identified reduced reliance on greenhouse gas-producing diesel and propane as a priority. From there, the question became how an off-the-grid community might achieve such a goal.

“We began consulting with some people associated with some of Canada’s green initiatives, and researching what it would take to make our community greener from an energy perspective,” explains Van Somer.

While Chief Van Somer and the Kwadacha council were looking for the kind of technology and innovation that could provide their community with reliable and sustainable energy at an affordable price, Dale Thomas, director of operations, and the team at Borealis Wood Power Corp., were busy looking for their first major biomass project in Canada.

Founded in 2012, Borealis is the exclusive distributor of the Borealis CHP generator, a 45kW combined heat and power (CHP) wood gasification system developed and manufactured by German-based Spanner Re2 GmbH, a longtime supplier of biomass heat and power systems in both Europe and Japan.

With exclusive Canadian rights to Spanner’s technology – which utilizes modular, pre-assembled units that can be linked up to provide additional power – Borealis caught the attention of Van Somer and the Kwadacha council.

“It took us almost two years of research before we discovered Spanner and their technology,” says Van Somer, “and it was at that point that we linked up with Dale and Borealis. For us, the Borealis unit, which burns dry wood, made a lot of sense, especially after the big epidemic of pine beetle generated so much biomass in the region. We also liked Borealis because they’re smaller units, but you can go as big as you want by linking multiple units in tandem, which was appealing to us.”

Following a visit in 2014 to a Borealis facility in Burlington, Ont., where a running demonstration had been set up, it became clear to Van Somer and council that they had the technology they were looking for.

“It really began with the Kwadacha Nation, and Fort Ware,” says Thomas, reflecting on the beginnings of their successful partnership. “They were actually our first project, and one of the first groups that we talked with.”

There are more than 650 installations using this technology around the world

with more than 15 million operating hours. The Borealis units can be containerized or installed into an existing building and are flexible enough to meet a range of needs. There is also progress on using the gasification unit to supplement diesel in regular diesel systems, and even a smaller and more compact unit that produces 9kW of electricity and 22kW of heat.

FIGHTING FOR FUNDING

With the question of which technology to pursue now settled, the next challenge for the Kwadacha Nation was engaging likeminded stakeholders to secure funding and support for the project.

As Van Somer soon found out, this was no easy process, particularly when it came to working with important provincial allies like BC Hydro.

“It was initially a challenge for us getting BC Hydro to buy in,” he explains. “With their Remote Community Electrification Program, they’re mandated to provide off-the-grid communities like ours with BC power, which typically

means running these communities off diesel. That obviously went against the grain of what we were trying to do.”

Making matters more complicated, the project represented the first ever use of Spanner’s technology in North America, as well as the first time a wood gasifier of this size had been installed on a community micro-grid. Undeterred, Van Somer and the rest of council worked hard to educate potential partners, and after years of negotiations, secured a twoyear Electricity Purchasing Agreement (EPA) to sell electricity to BC Hydro starting in January 2016.

“It took us about four years,” Van Somer concedes, “but we knew we weren’t going to quit.”

Building off the momentum of their EPA with BC Hydro, the Kwadacha Nation went on to secure a long list of funding partners for the project, including the Fraser Basin Council, Indigenous and Northern Affairs Canada, Natural Resources Canada’s Indigenous Forestry Initiative, and the Province of British Columbia’s Community Energy Leadership Program, among others.

Project partners include Borealis, the BC Bioenergy Network, R. Radloff & Associates Inc., the Kwadacha Natural Resources Limited Partnership, Elstad Contracting Ltd., and Synex Energy Ltd.

THE FUTURE ARRIVES

Construction began on the project in the summer of 2016, with early work focused

on preparing BC Hydro’s district energy lines to run hot water from the existing generating station to the new installation.

The system itself – comprising three linked Borealis CHP generators, and shipped in a custom container fashioned from connecting three shipping containers – was assembled in Germany during that same summer, and arrived in Fort Ware in October 2016. The modular, pre-assembled nature of Spanner’s technology made for easy installation once the product arrived.

“It made it a lot easier to do in a remote community like Fort Ware,” Thomas notes. “It only took us about a day to do all the hard line connections in the container itself, which then left us to connect the technology to the district energy lines and wood supply.”

Construction was completed in March, with the facility beginning commercial operation the following month. As part of the purchase agreement, Spanner and Borealis technicians provided three months of site training for all local operators.

In addition to the jobs created by construction and the need for permanent operators, the facility should also prove to be a boon for local forestry outfits. The technology runs using natural wood chips with a G30-G40 size category and a maximum humidity of 15 per cent, which makes the abundance of standing dead pine in the area an ideal source of fuel. A timber supply analysis conducted by the Kwadacha Nation found that there are

almost four million cubic metres of available volume within 30 kilometres of Fort Ware and 500 metres of an existing road, representing over 400 years of supply.

Thomas spent several weeks in Fort Ware and says he was impressed with the ingenuity and resourcefulness of community members who have been operating the units since March. “The skills in Fort Ware adapt well to the Spanner Re2 system. With a strong mechanical ability and common sense these systems don’t need to be operated by specialists from afar,” he says.

Both the Kwadacha Nation and Borealis believe this project is bigger than just a single community, and may serve as an example for other remote communities looking to reduce their reliance on fossil fuels.

“There’s huge potential here in Canada,” says Thomas, who hopes to see Spanner’s technology become a common sight across the country. “We certainly have the biomass capability, and we’ve seen how far the technology has come.”

Van Somer, for all that he knows about how challenging such a project can prove, couldn’t agree more. “It’s important for all of us to think of better ways to generate and use energy in our communities, both here and across the country,” he says. •

The Kwadacha Nation believes this project may serve as an example for other remote communities looking to reduce their reliance on fossil fuels.

The technology runs using natural wood chips with a G30-G40 size category and a maximum humidity of 15 per cent.

Boiler breakdown

The newest boiler technology for Canadian customers

Staff report

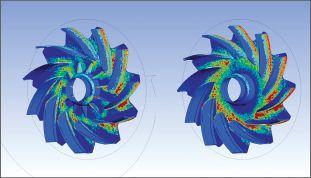

PROCESSBARRON

ProcessBarron has developed proprietary techniques using computational fluid dynamics (CFD) analysis to “particle-track” the heavier, wear-agent particles in the gas stream. Particles greater than 15 microns are the ones that create the erosion. Using CFD, rotor geometry is augmented or altered to control the path of these heavy particles through the rotor. By minimizing their contact in highly stressed areas of the rotor to eliminate the erosion, a substantial increase in rotor life is possible. www.processbarron.com

COMPTE FOURNIER

Produits Forestier de Petit Paris, a 7.5 MW (25.6 MBTU) boiler installation was the company’s third project using steam energy. Installed in 2016 it was designed to produce five to 16 t/h steam for the dry kiln of the sawmill. It’s the first biomass boiler, which can provide an efficiency superior to 90 per cent using bark with high humidity (greater than 65 per cent). The boiler room consists of a 7.5 MW (25.6 MBTU) boiler that is fed with an automatic moving floor and independent conveyor equipment. www.compte-fournier.com/en/

OUTOTEC

Turn waste into power with Outotec’s robust waste to energy technology. Outotec’s

proven solutions generate valuable energy from variable wastes, ranging from municipal sources such as SRF, RDF, construction and demolition waste, to commercial and industrial wastes and a wide variety of agricultural wastes. The technology works even with difficult fuels, such as those with a high moisture or ash content, and offers the possibility to use fuels over a large range of calorific values, from eight to 30 MJ/kg. Outotec’s technology boasts minimal emissions and low carbon in ash, with over 99 per cent carbon burn-out, and ensures compliance according to local regulations. The system eliminates bottom ash, with only clean, ready-to-recycle, non-combustible material from fluidized bed.

www.outotec.com

Industrial grade wood fired burner with Hurst “clean-burn” stoker design. Modular packages are available from 5 MMBTU/ HR to 250 MMBTU/HR with operating temperature ranges from 200 F to 2,000 F. These proven solid fuel burner systems are a leading choice in lumber dry kilns, boiler applications, oil heaters, rotary dryers, brick kilns and more. Hurst manufactures seven different types of biomass stoker/gasifiers, which have used 2,000 plus different types of biomass fuels. www.hurstboiler.com

Smart Heating Technology offers highly efficient 93-95 per cent multi-fuel biomass boilers compliant with ASME in Canada. The boilers range from 100 kW to 2,000 kW. Other products Smart Heating Technology offers include: Smart Mobile Micro Cabins 100 - 500 kW; Smart Boiler Cabin Solutions 100-2,000 kW; Special Mobile Cabins incorporating oil/gas boilers; electrical generators; C02 filtration units; hotair units; and air-conditioning units. The Smart Cabin is a complete plug and play solution. There are also Smart Dryers for wood material, construction material and wheat crop drying, as well as Smart Emergency Energy Cabins for remote locations. www.smartheating.cz

JANSEN

Jansen Combustion and Boiler Technologies, Inc. specializes in improving the performance, capacity, reliability, and safety of industrial boilers that burn difficult fuels, such as biomass, refuse derived fuel, and pulping liquors. Jansen has provided engineering evaluations of over 70 Canadian boilers and has carried out 18 boiler upgrade projects in Canada. Most recently, Jansen has upgraded boiler combustion systems at: CKPI, The Pas, Man.; Harmac Pacific, Nanaimo, B.C.; Daishowa Marubeni, Peace River, Alta.; and West Fraser, Hinton, Alta.; Catalyst, Pt. Alberni, B.C.; Domtar, Windsor, Que.; and Cariboo, Quesnel, B.C. www.jansenboiler.com

HURST BOILER

SMART HEATING TECHNOLOGY

Precision Energy Services (PES) biomass boilers and energy systems convert a plant’s waste into energy. In 2017, PES commissioned the second paper mill sludge-to-energy system for Atlantic Packaging in Toronto. The PES’ fluidized bed boiler system produces 35,000 PPH of steam and hot gas gases to dry 100,000 tons per year of sludge, offsetting natural gas consumption and tipping fees paid for sludge disposal, resulting in a three-year payback. PES supplied the sludge handling system, fluidized bed combustion, boiler system, ash system and gas cleaning system. www.pes-world.com

MESSERSMITH

Messersmith systems allow a 10:1 turn down ratio. Fuel is moved onto the specially designed grates in the combustor to be burned. The system can burn biomass fuels such as wood chips, sawdust, whole tree chips or other clean biomass with moisture contents from three per cent to 50 plus per cent. High combustion temperatures and PLC control of combustion air results in

clean, efficient combustion with low emissions and only a small amount of ash. Messersmith Biomass Boiler Systems are able to deliver hot water, as well as low or high pressure steam, as well as power generation. www.burnchips.com

KRANN

biomass boiler uses a low-emission gasifier/furnace as its heat source. The furnace has a stationary grate with no moving parts. It produces very low particulate emissions, typically with no flue gas cleaning equipment. The flyash accumulation on boiler heat transfer surfaces is greatly reduced thus minimizing equipment cleaning and shutdowns. The system ranges from 1 MW to 15 MW of heat output and can be used for boilers (steam, water, hot oil), drying, CHP, etc., as a cost-effective alternative to traditional wood burners. It can handle a wide range of moisture and ash content fuels. The heating system includes fuel storage, gasifier/furnace, boiler, ash discharge and exhaust and is fully automated. www.krann.ca

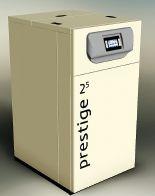

WOODCO ENERGY

Woodco Energy, the Irish manufacturer of biomass boilers, recently launched its Prestige range of pellet boilers in the Canadian market. The boilers underwent UL/CSA accreditation in 2017 and are fully approved for sale in Canada. The prestige is available

in 25 kW and 37 kW models. Uniquely the Prestige range can use thermal oil as a heat medium (instead of water) thereby allowing it to be the used with its new co-gen (microCHP) unit. The co-gen can provide up to 10 per cent electricity, so the 25 kW Prestige can provide 2.5 kW electrical power via the co-gen unit. The prestige is also available in a 37 kW model. The company has enquiries from Yukon, N.W.T. and Ontario for Woodco’s co-gen units and CSA approval is likely to be obtained this spring. Cogen will available for sale in Canada immediately thereafter.

www.woodco-energy.com

AFS ENERGY SYSTEMS

AFS Energy Systems recently installed an AFS 600-HP Overfed Reciprocating Grate Stoker steam boiler system with automatic ash removal at the EMD Millipore new central heating plant in Jaffrey, N.H. The system is fuelled by wood chips at a wet basis moisture content of 55 per cent and 600-HP propane boiler system. Included was a dual scrape type fuel bunker receiving, storage and material transfer system with vibrating conveyor with overs screen, permanent magnet, overs belt conveyor and overs grinder.

Krann

The system replaced fourteen oil-fired boilers for heating and process loads. www.AFSenergy.com

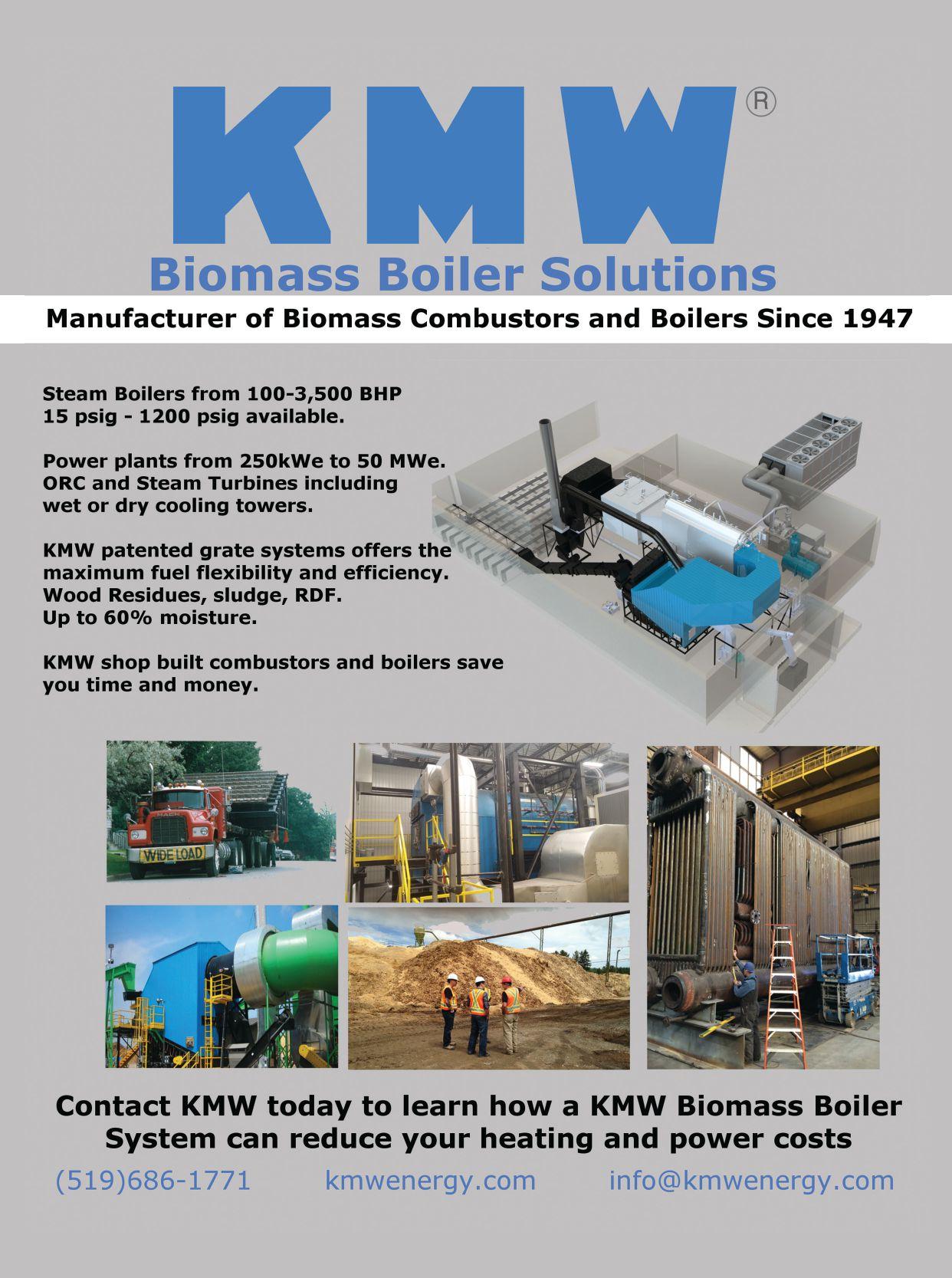

VIESSMANN

The compact Vitoligno 300-C wood pellet-fired boiler is an efficient and environmentally friendly heating solution for residential homes or light commercial applications with up to four boilers in a cascade system. The boiler features an input range of 44 to 193 MBH at a modulation ratio of 1:3, as well as ultra-low energy consumption. Almost everything is automatic – from pellet fuel feed to combustion chamber cleaning and ash removal. The boiler can also be easily converted to manual fuel feed. The Vitoligno 300-C is equipped with stateof-the-art safety mechanisms that ensure close monitoring of the entire system. Modern combustion technology ensures high

efficiency of up to 85 per cent, as well as low emissions that meet the stringent regulations of the European Clean Air Act. www.viessmann.ca

FINK MACHINE

With over 100 installations across Canada and into the U.S. Fink supplies high quality CSA and ASME factory certified Viessmann boilers. Fink has experience ranging from small 100 kW single building heating systems to larger multiple building district heating, including a private DH system with 11 clients and 1.5 km of piping. Fink pioneered the use of containerized boiler systems in Canada from shipping containers to custom prefabricated boiler enclosures.

www.finkmachine.com

KMW ENERGY

KMW Energy Inc. has the expertise to offer complete biomass energy systems for any project including hot water, hot oil, low-pressure and high-pressure steam for power generation. Boilers range in size from 150 HP to 3,500 HP per system and complete power plants are available in the range of 250 kW to 25 MWe. Construction cost and time are kept to a minimum by shop building and shop testing all equipment. KMW’s patented grate system provides the industries best fuel flexibility for utilization of low cost biomass fuels including wet bark, mill sludge, bio solids, and MSW. Recent projects include a 14 MW power plant in Portugal, 150 Million

BTU/hr combustion system in Quebec, 8.5 MW CHP plant in New England, 250 BHP hot water boiler in N.S. and 150 BHP hot water boiler in Ontario. www.kmwenergy.com

KEDEL PELLET BOILERS

The affordable and reliable Kedel pellet boiler is a fully automated heating appliance that offers 87 per cent efficiency and that can be fully monitored and adjusted from any computer or smartphone. It features a 30year warranty and its use can result in savings of 20 to 60 per cent on heating costs as well as a carbon footprint reduction of as much as 90 per cent when replacing an oil appliance. This self-cleaning boiler is suitable for new construction or retrofits and can be installed in cascaded designs. Other features include an 02 sensor, 10:1 step-less modulation and a stainless steel burner, and the appliance is manufactured to ISO9001 standards. www.thsdistribution.ca

ENGEMAN

Engeman boilers have reached a new quality, efficiency and safety level. Engeman boilers are built according to the ASME standard using high-level raw materials and with strict quality. They can produce from 100 up to 2500 BPH of saturated

steam at pressures of up to 300 PSI, for several different applications. Engebio boilers can burn woodchips, sawdust, and other kinds of biomass like coffee husks, rice rusks, corncobs, etc. They have heat efficiency between 82 and 88 per cent, low fuel consumption, lower set up cost, are easy to operate and maintain, use a variety of fuels, feature production automation and low emission of pollutants. www.engeman.ind.br/en

SÄÄTÖTULI

Säätötuli Canada distributes biomass boilers based on the proven Finnish Säätötuli technology. Single boiler hot water solutions are available from 545,942 BTU/hr (160 kW) up to 5,118,213 BTU/hr (1,500 kW), and hot air furnaces for 1,706,071 BTU/hr (500 kW). Units can be combined to increase output. Automation boxes and pressure vessels are manufactured in

Canada and comply with ASME, CSA and UL. Säätötuli’s efficient burners can process all kinds of solid fuels, including wood pellets, woodchips, hog chips, agro pellets and many more. For wood based fuels, Säätötuli’s equipment complies with all the local emission regulations in Canada. Containerized heating systems also available for easy installation and moving.

www.saatotuli.ca

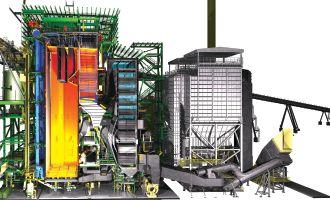

ANDRITZ

Andrtiz is a global supplier of state-of-theart plants and equipment for renewable energy generation. The company supplies boilers and gasifiers based on bubbling (BFB) and circulating (CFB) fluidized bed technologies. Plants are custom-tailored to each application, based on capacity, fuel, and customer requirements. The plants are modern, well-proven with over 90 installations globally, and demonstrate unmatched fuel flexibility. Boiler designs include: PowerFluid CFB boilers for up to 800 t/hr of steam generation from biomass such as wood waste, RDF, and other residuals with high calorific value; EcoFluid BFB boilers for up to 450 t/hr of steam generation from

• Canada’s leading supplier of commercial biomass heating systems

• ASME and CSA certified • 100 kW – 12 MW (0.3 MMBTU – 36 MMBTU) • Over 100 energy efficient systems installed

Built on over sixteen years of experience with

biomass such as bark, sludge, rejects, and other residues.

www.andritz.com

SOLAGEN

SolaGen has the versatility to offer combustion systems that can utilize any available fossil or biomass fuel: dry, wet, or densified. These systems are designed and manufactured “in house” and therefore are perfectly matched to SolaGen’s rotary dryers, steam and hot water boilers, thermal oil heaters, or other process heating systems. Energy output capacities from 50 kW to 93 MW per hour have been supplied to a variety of industries.

www.solageninc.com

Evergreen BioHeat Ltd. is Canada’s distributor of Fröling biomass heating units. It carries the S3 (logwood), P4 (pellet), T4 (pellet and woodchips) and industrial sized TM (pellet and woodchips) boiler lines from 8 kW through to multiple MW commercial installations. The new T4 can efficiently burn both wood chips and pellets due to its intelligent fully-automatic system. The T4 ensures a high level of efficiency (up to 94.6 per cent) with very low emissions. Well-planned use of energy-saving drives ensures extremely low energy consumption.

www.evergreenbioheat.com

BINDER

Binder Energietechnik GmbH has produced large-scale biomass boilers ranging in power from 100 kW - 20,000 kW at its production facility for more than 30 years. About 200 boilers are manufactured each year at the Binder factory in Styria, Austria. In addition to higher operating pressures as well as different insertion and installation situations Binder provides an optimum solution for your requirements. Binder also offers a variety of combustion systems for a wide range of fuels like cherry pits, chicken litter, cacao shells and much more. All boilers are designed and manufactured according to current standards. For international markets like North America and Canada, Binder offers ASME compliant boilers. www.binder-gmbh.at/en

EVERGREEN BIOHEAT

A low-carbon horizon

Scaling Up 2017 speakers share lessons learned

By Tamar Atik

It’sa long road to scaling up, but success is possible.

That was a key theme at the Scaling Up conference, which took place in Ottawa in late November. While biomass is the only renewable resource that can substitute carbon for fossil fuels, rapid success is far from assured.

David Mackett knows this struggle well. He has led community development initiatives for Whitesand First Nation since 2009. That’s the year that the northern Ontario reserve’s Community Sustainability Initiative (CSI) began moving forward with the goal of eliminating the use of diesel within the community.

But Whitesand’s sustainability vision dates back to 1992. “The community took it on their own to say ‘We want to do something different,’” Mackett said. That first proposal for change was turned down but the community never gave up. “That’s our social capital on this project. Never give up, keep moving forward.”

Whitesand First Nation is located in northern Ontario near Thunder Bay. The on-reserve population is 500 with a small land base of one square-kilometre.

Mackett said there was little value going to the community from past forestry as the trees were harvested and transported

for processing elsewhere. There was diesel-generated electricity, high-unemployment. “It’s similar to many First Nations across Canada,” he said. “I’m blunt about it, but we looked at how we could change this and we moved forward.”

The CSI is based on five pillars of sustainability: society, culture, capacity, economy and ecology. “It’s really about improving the livelihoods of people,” Mackett said. “It’s not just an energy project, it’s a sustainability project.” The community-owned project will be the first in Ontario to replace the primary-use diesel generators. The project has completed the required Renewable Energy Approval and is also supported by a 20-year renewable Power Purchase Agreement with the Independent Electricity Supply Operator.

As a result of the CSI, Whitesand’s “Bio-Economy Centre” has started site preparation through a joint contribution of $4.2 million from the federal and provincial governments and Whitesand. The site preparation will enable full construction of a wood merchandising yard, a 5MW biomass combined heat and power plant, and a 90,000-metric wood pellet facility. The project will create approximately 60 fulltime jobs generating approximately $3.5 million in wages a year.

It will also reduce and eliminate approximately 1.1 million litres of diesel fuel used annually to generate electricity, which is currently provided by Hydro One Remote Communities diesel generators. Whitesand is also planning to convert home heating from diesel fuel to a combination of wood pellet stoves and boilers. This will reduce the current use of 300,000 litres a year of fuel for home heating.

Being conceived in the early ‘90s, the project took many years to come to fruition. “It’s very frustrating, and you can expect delays in projects like this in Ontario, but you just have to keep pushing,” Mackett said. “Whitesand took control of its own future, by being the proponent of the project.”

“You have to build a relationship first with the community,” he said. “When you look at a project like ours, carbon reduction translates to poverty reduction. And that’s the same message to First Nations across Canada that are on diesel. People tend to shy away from the issues, and they don’t want to drill down deeper and find the solutions,” Mackett said.

Sébastien Corbeil did want to find a solution when confronted by challenges in getting technology and innovations to a commercial scale. As he highlighted, failure isn’t a bad thing.

The Bio-Economy Centre site preparation at Whitesand First Nation in northern Ontario. Photo courtesy of Ed Fukushima, Great North Bio Energy.

Corbeil is president and chief executive officer of Quebec company CelluForce, which deconstructs wood fibres and breaks them all the way down into nanofibrils and cellulose chains. The resulting material can be applied in a variety of markets from gas to polymers.

Starting from wood pulp, Corbeil said supply of feedstock is not an issue. He said selecting applications is the biggest challenge.

Celluforce’s story dates back to 2005 when FPInnovations began looking at commercially producing nanomaterials.

When the technology was ready, Celluforce was launched in 2011 by Domtar and FPInnovations – its first shareholders.

A $35-million demo plant was built in Windsor, Que. It was the world’s first Cellulose NanoCrystals (CNC) production plant, but it wasn’t successful. The investment was steep, and money ran out.

Domtar didn’t reinvest, convinced there was no market for the product. Sustainable Development Technology Canada (SDTC), and oil-field services company Schlumberger brought in some more capital and invested. The latter became the first customer.

Brazilian pulp and paper company Fibria also joined in on investment, and Celluforce

had a dedicated team in it for the long-run.

Corbeil said though it failed, the operating plant provided a good learning opportunity on how to improve footprint and cost of operations. “In retrospect, it was a good thing. It allowed us to learn a lot about how to improve the process,” he said.

“It also gave us credibility. Companies need to have faith in you and some confidence to invest.” He added it is key to keep refining and to work twice as hard on developing applications.

Corbeil said Celluforce explains to potential shareholders how long it takes to

develop a new product. “It actually takes longer than drug and aircraft introduction.” He said investors need to have patience with product development.

“Educating customers on how to use the product and how to disperse it is very important on how to speed up the process,” he said, noting that Celluforce’s partners being in the manufacturing sector has helped the company.

Perhaps a speedier process combined with the fact that Canada has more biomass per capita than any other country means the potential is great. •

ROADMAP TO THE BIOECONOMY

“It’s clear we’re at the threshold of the bio-age,” Kim Rudd, parliamentary secretary to the minister of natural resources, tells the crowd at an industry event held in Ottawa.

Industry members attended Natural Resource Canada’s Bioenergy for the Future conference at the Fairmont Chateau Laurier in late November to learn more about the International Energy Agency’s (IEA) most recent publication, Technology Roadmap: How2Guide for Bioenergy.

“The IEA studies global energy trends and outlooks and the rollout of the roadmap basically highlights the importance of bioenergy,” said Fernando Preto, a research scientist with CanmetENERGY-Ottawa, NRCan. The roadmap lays out some of the steps to achieve this bioenergy goal, including more international collaboration.

IEA’s Adam Brown outlined four key actions:

1.) Promote short-term deployment of mature options; 2.) Stimulate the development and deployment of new technologies;

3.) Deliver the necessary feedstock sustainably, backed by a supportive sustainability governance system; 4.) And the need to develop capacity and catalyze investment via international collaboration.

Brown said a stable policy environment is vital for all of these bioeconomy initiatives to work. The ideal policy landscape requires a level playing field, a low-risk investment climate and catalyzing and supporting innovation, he said.

Enerkem’s Marie-Hélène Labrie presented on the company’s success scaling up its municipal waste-to-energy technology. It makes transportation fuels and chemicals from garbage instead of petroleum by chemically recycling carbon contained in garbage in less than five minutes. Enerkem’s approach was successful because it focused on municipal solid waste as the feedstock from the outset, Labrie said. The company then worked to leverage commercially available catalysts, like the Enerkem Alberta Biofuels facility, to reach its goal. Enerkem wants waste to be seen as a resource to make sustainable products.

“They’ve done just about anything they could do right. Now they’re reaping the rewards of that tenacity,” Travis Robinson from the Bioenergy Program, CanmetENERGY-Ottawa, said of Enerkem’s success.

“If all the bioenergy companies out there were like Enerkem, things would be very easy,” he said. “We’d probably have a lot more bio-products on the market today.”

Any successful scaling-up story had issues first that were overcome in order to reach that success, Robinson said. •

The Whitesand First Nation community-owned project will be the first in Ontario to replace the primary-use diesel generators. Photo courtesy of Ed Fukushima, Great North Bio Energy.

Bio-pipelines

Project adds RNG to Alberta’s natural gas grid

By Maria Church

Natural gas pipelines that crisscross the Edmonton area will soon flow with an injection of renewable natural gas (RNG) from wood waste.

Vancouver-based G4 Insights is demonstrating its proprietary pyrocatalytic hydrogenation technology that produces RNG from lignocellulosic biomass at an ATCO Gas Distribution site in Edmonton beginning in February. The project will see a demonstration unit hooked up to ATCO’s natural gas grid – a first for the company and the technology in Canada.

“This is the next step of development. We’re enhancing the equipment to support continuous operation and we will also test a new module for injecting the gas into the grid. It’s a step towards commercialization,” says Edson Ng, project lead and principal of G4 Insights.

The demonstration unit will process 100 kilograms a day of forestry biomass and produce one gigajoule a day of RNG, or biomethane, which is the equivalent of about 30 litres of gasoline.

“Natural gas is typically 95 plus per cent methane so that is why our gas is compatible with the grid,” Ng says. As a fuel, the G4 biomethane reduces GHG carbon emissions by 80 per cent compared to fossil natural gas.

G4 Insights formed in 2008 in Burnaby, B.C., by founders Ng, Matt Babicki, Bowie Keefer, and Brian Sellars. After years of tech development, the company demonstrated its equipment in California in 2015 and in Quebec in 2016. Both projects successfully produced RNG in batches to fill natural gas-fuelled vehicles.

ATCO took interest in the project around the same time. “G4 Insights was looking to install a demonstration plant that would be able to add the gas to a distribution system,” Imad Khaled, manager of facilities engineering at ATCO, tells Canadian Biomass during an interview at their Edmonton site where the G4 project will be located.

G4 Insights’ Matt Babicki, left, and Edson Ng, right, stand in front of equipment for the ATCO Gas RNG demonstration project. Built at G4’s Vancouver location, the equipment will be dissembled and shipped to ATCO’s facility in Edmonton. Photo courtesy G4 Insights.

“The amount of gas they are going to produce is like a grain drop in an ocean. Our site here flows massive volumes of gas to the city,” Khaled says. “The advantage of this site is the fact that we have all the space, and all of the equipment.”

The site includes the G4 plant that produces the gas, a trailer for the operator on site, a sea-can to store the wood, and a natural gas generator as a power source, all of which is located about 20 feet away from ATCO’s main distribution building for the Edmonton area. A small pipe runs from the plant into the distribution building and attaches to one of the natural gas lines. Once testing is complete, small amounts of the RNG will be injected into those main pipelines.

G4’s equipment is built and tested at its Vancouver office. The equipment destined for the ATCO site will be disassembled, trucked to Edmonton and then fully installed in February. RNG will be produced on site by March. A full-time G4 operator will run the plant, and ATCO’s Shawn Cummins will monitor the gas. “I’m looking forward to working with them and learning about the equipment,” Cummins says.

TECHNOLOGY

G4’s pyrocatalytic hydrogenation process uses moderate heat and a catalyst to convert biomass into methane and water. This is unlike a wood gasification process, which uses high heat to create syngas. Syngas must then be converted into methane.

The G4 plant is fed by wood residuals either from sawmills or harvesting operations (tree tops and branches) that have been processed through a hammer mill to create particles roughly five-millimetres long.

Wood particles are first treated to fast pyrolysis – a process that rapidly heats the particles, vapourizing them to create pyrolysis gas. “In that volatile gas state, we flow the pyrolysis gas over a catalyst in the gas conditioning section. The catalyst, combined with the pyrolysis gas, plus added hydrogen, that sets the perfect condition to form methane,” Ng says.

The process happens in a single step. Hydrogen is added internally through steam methane reforming – a process that creates hydrogen from methane. So a portion of the end product methane is recycled back into the system and converted into hydrogen. Heat for the system

is generated through a burner fuelled by the waste biochar.

The only input into the system is wood chips, and the only products are methane, bio ash solids and CO2. “The bio ash is mineral rich which can be returned to the forest as a fertilizer enhancement and the emitted CO2 is carbon neutral because it is created by the combustion of biochar,” Ng says.

“The great news here is that the energy conversion efficiency is about 70 per cent.

So 70 per cent of the energy in the wood going into the process is available as renewable natural gas going into the grid,” he says.

CHALLENGES

From conception in 2008 G4 has jumped numerous hurdles to get to this demonstration phase. As with almost all clean energy technology, the cost of development is high.

“These projects are outside the window of typical venture capitalists. The

A Division of Hoffmann Inc.

amount up front is much larger and the payback is much longer,” Ng says. “We’ve been very fortunate to keep working with groups in the energy sector and gas industry because they understand what the long-term objectives are. It’s a great relationship.” Governments, too, are important project funders. “We’ve have great support from Natural Resources Canada, National Research Council of Canada, Alberta Innovates, and California Energy Commission,” Ng says.

“Part of our success is that we have to be very flexible with the resources we have on hand to match our available funding. We’re a private company so it’s all internally funded. We’re not venture backed,” he says.

For ATCO, the next challenge is in the long-term economics, Khaled says. “Throughout the project we are going to learn how much the gas will cost. Edson and the team ran their numbers and they believe they can come in at a competitive cost and this will be the proof,” he says.

FUTURE

ATCO’s Gas Distribution division is hosting the demonstration unit for the next six months. Over that period it will consume 10 dry tonnes of forestry biomass and produce 180 gigajoules of RNG. G4’s ideal timeline for scale up will see a pilot plant installed and operational in late 2018 – location to be determined. “It will be in Canada and it will be in collaboration with the Canadian Gas Association and the major gas utility players in Canada,” Ng says.

By 2020 Ng expects to entertain a commercially viable plant – ideally located at a sawmill or rural gas distribution centre – that would process about 36 dry tonnes of biomass and put out 450 gigajoules per day. By 2025 they hope to supply a commercial plant that processes 750 dry tonnes per day and has an output of 10,000 gigajoules per day. “That’s enough to support about 45,000 homes,” Ng says.

The Canadian Gas Association, of which ATCO is a member, has set a target of 10 per cent RNG-blended natural gas by 2030. Currently the main source of commercial RNG in Canada is via biogas produced from anaerobic digesters at municipal wastewater treatment and agriculture facilities.

In Alberta, ATCO has 40,000 kilometres of distribution pipeline and 18,000 kilometres of transmission pipeline. “Looking at how much pipe we have in the ground and looking at how much forestry we have, we are set up for plants like this is rural communities,” Khaled says. “To us, we see very high potential there.

“We believe this is the future and this will keep our industry relevant,” he says. •

ATCO’s Shawn Cummins, Imad Khaled, and Markus Li give Canadian Biomass a tour of the facility where G4 Insights will be injecting its RNG produced from wood waste.

CONVEYOR SAFETY

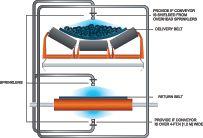

SAFETY BEHAVIOURS PINCH POINT AIRBORNE DUST FUGITIVE MATERIAL

PROBLEM:

Industry knowledge indicates that for every fatality, increasingly larger numbers of lost workday cases, injuries, near misses and unsafe behaviours occur.

SOLUTION: Statistically speaking, the most effective way to reduce fatalities is to eliminate the exposure to risk before it can occur, reducing unsafe behaviours through ongoing training and emphasis on best practices.

PROBLEM: The pinch point between the belt and a carrying idler can lead to an entrapment injury, and rolls can fall if the structure is damaged.

SOLUTION: Every return roll that is less than seven feet in elevation should be guarded to protect workers from the pinch points. Guards over a walkway or roadway should be designed to protect against a falling roll with a catch basket, no matter what their elevation.

PROBLEM:

Airborne dust can contribute to potential health or safety hazards, environmental issues, regulatory challenges, explosion risks, higher equipment maintenance costs and poor community relations.

SOLUTION: Effective belt support and sealing deliver improved containment. The single most effective way to prevent belt conveyor-related injury is to minimize fugitive material.

PROBLEM: Fugitive material is one of the single greatest contributors to conveyorrelated injuries, increasing maintenance and placing workers in close proximity to the moving conveyor.

SOLUTION: Engineered transfer points can incorporate a number of technologies to ensure material containment, including modular chutes, impact cradles, stilling zones, skirt seals and even integrated air cleaners.

PROBLEM: Belt lock out/tag out procedures often do not remove all forms of energy. Conveyor belts can also have stretch resulting in stored/ potential energy that can increase risk to workers.

SOLUTION:

Develop a block-out procedure and train employees on it, which is the only way to protect workers against stored energy from the stretched belt and the sudden movement it can cause.

TOP 10 LIST

SHORTCUTS FIRES

PROBLEM:

Unsafe practices such as taking a ‘shortcut’ by crossing under an operating belt conveyor can lead to injury.

SOLUTION: Secure walkways with handrails. Walkways should be provided at any point at which workers may need to cross the conveyor path.

PROBLEM: If the belt slips or stops moving and the drive pulley continues to rotate, temperatures are quickly reached at the pulley/ belt interface that are sufficient to cause ignition of the belt, pulley lagging, or combustible bulk materials.

SOLUTION: Suggested points of application for a firesuppression system along a belt conveyor.

LACK OF GUARDING

PROBLEM: The removal of guarding – and the nonreplacement of guarding after maintenance procedures are completed – can create a risk when the conveyor is restarted.

SOLUTION: Effective guarding is needed to control the hazards from a number of unique conveyorrelated components and circumstances.

NEGLECTED SAFETY EQUIPMENT

PROBLEM: Neglected safety equipment (such as the broken cord on this pullrope emergency-stop switch) creates a hazard, preventing workers from acting quickly to shut down the conveyor.

SOLUTION: Emergency stop cords should be placed throughout the length of the conveyor and regularly inspected for signs of wear or damage.

MIS-TRACKING BELTS

PROBLEM:

Mis-tracking belts can cause significant spillage – as well as damage to belts and support structures – and may even create a potential fire hazard.

SOLUTION:

Conveyor belt tracking systems mitigate misalignment along the conveyor path, rather than correcting it after the fact, to promote greater efficiency and safety.

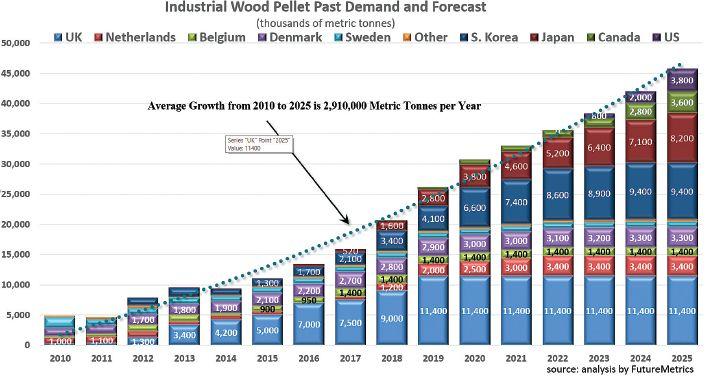

Increasing demand

Industrial wood pellet markets – 2018 to 2025

By William Strauss and Seth Walker

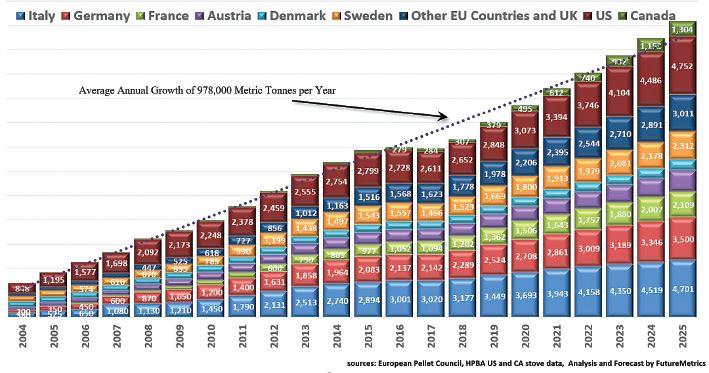

Global pellet markets have increased significantly over the last decade, mostly because of demand from the industrial sector. While pellet heating markets make up a significant amount of global demand, this overview will focus on the industrial wood pellet sector. Chart 1 shows FutureMetrics’ forecast for heating pellet demand by country.

Pellet heating markets have been challenged in recent years by low alternative heating fuel costs (oil and gas prices) and warmer than average winters in North America and Europe. FutureMetrics expects that a combination of higher oil prices and de-carbonization policies will return demand growth to trend in the 2020s.

For the last several years, the industrial wood pellet sector was as large as the heating pellet sector, and is expected to become significantly larger over the next decade.

The industrial wood pellet market is driven by carbon emissions mitigation and renewable generation policies. Industrial wood pellets are a low carbon renewable fuel that easily substitutes for coal in large utility power stations.

Pellets can be substituted for coal in two ways, either a full conversion or co-firing. For a full conversion, an entire unit at a coal station is converted from using coal to using wood pellets. This requires modifications to the fuel handling, feed systems, and burners. Co-firing is the combustion of wood pellets along with coal. At lower co-firing ratios, minimal modifications to existing pulverized coal facilities are required. In fact, at lower blends (under about seven per cent) of wood pellets, almost no modification is required.

Chart 2 shows the historical actual demand and FutureMetrics’ demand forecast for industrial wood pellet markets. Aggregate demand in 2017 is estimated at 15.9 million metric tonnes.

As shown in Chart 2, demand in the U.K. and EU is expected to plateau by 2020. However, major growth is expected in Japan and South Korea in the 2020s. We also expect Canada and U.S. to have some pulverized coal power plants using industrial wood pellets by 2025.

PELLET DEMAND

New large utility co-firing and conversion projects in Japan, the EU and U.K., and

South Korea, and many smaller independent power plant projects in Japan, are forecast to add about 24 million tonnes per year to current demand by 2025. Most of the expected growth is from Japan, and South Korea.

FutureMetrics maintains a detailed project-specific database on all the projects that are expected to be consuming wood pellets.Most of the supply of pellets for planned new demand in the EU

and U.K. has already been arranged with major existing producers. However, the Japanese and S. Korean markets offer opportunity for new capacity that is, for the most part, not in the pipeline as of today.

EUROPE AND ENGLAND

Early growth (2010 to the present) in the industrial wood pellet sector came from western Europe and the U.K. However, growth in Europe is slowing and is expected to level out in the early 2020s. The remaining growth in European industrial wood pellet demand will come from projects in the Netherlands and U.K.

Demand by the Dutch utilities is still uncertain, as coal plants have delayed final investment decisions around co-firing modifications until they are given assurances that their coal plants will be able to continue to operate. Most analysts, including FutureMetrics, expect these issues to be resolved and Dutch demand will likely grow by at least 2.5 million tonnes per year over the next three to four years. It is possible that Dutch demand will increase to up to 3.5 million tonnes per year if all four of the coal stations that have been awarded subsidies proceed with their plans.

Two U.K. projects, EPH’s 400MW Lynemouth power station conversion and MGT’s Teeside greenfield CHP plant, are currently either in commissioning or under construction. Drax recently announced that it will convert a fourth unit to run on pellets. How many hours that unit will run in a year is unclear at this time. However, given that the investment decision has been made, FutureMetrics estimates that unit 4 will consume an additional 900,000 tonnes

per year. Each converted unit at the Drax station can consume about 2.5 million tonnes per year if they run at full capacity all year. FutureMetrics projects total new probable demand in Europe and England at 6.0 million tonnes per year.

JAPAN

Biomass demand in Japan is primarily driven by three policy components: The Feed in Tariff (FiT) support scheme for renewable energy, coal thermal plant efficiency standards, and carbon emissions targets.

The FiT offers independent power producers (IPPs) a set price for renewable energy over an extended contract period – 20 years for biomass energy. Currently, under the FiT, electricity generated from “general wood,” which includes pellets, imported woodchips, and palm kernel shell (PKS), receives a subsidy of 21 ¥/ kWh, down from 24 ¥/kWh prior to Sept. 30, 2017. However, the scores of biomass IPPs that have received the higher FiT are locked in at that rate (about $0.214/kWh at current exchange rates).

Japan’s Ministry of Economy Trade and Industry (METI) has produced a so-called “Best Energy Mix” for 2030. In that plan, biomass power accounts for 4.1 per cent of Japan’s total electricity production in 2030. This is equivalent to over 26 million metric tonnes of pellets (if all the biomass were wood pellets).

In 2016, METI released a paper describing best available technology (BAT) efficiency standards for thermal plants. The paper develops minimum efficiency standards for power generators. As of 2016, only about one-third of Japan’s coal

Our competitors say we’re old and slow to change. That our machines are ugly. That we’re not on the cutting edge.

We say, “Yup.”

“Old” means we’ve been around for over 100 years—and we’ll be here for 100 more.

“Slow to change” means we don’t do fads. Oh, we’ll turn on a dime to make changes that our customers need. But fads? Nah. We’d rather protect your investment.

“Not cutting edge” means we’re proven. We build what works and we stick with it.

And “ugly”? Well. You don’t need to be pretty to make a damn good pellet mill.

CHART 1 - FutureMetrics’ forecast for heating pellet demand by country.

generation comes from plants that meet the BAT efficiency standard. One way to comply with the new efficiency standard is to co-fire wood pellets.

Plant efficiency is normally calculated by dividing energy output by energy input. So, for example, if power station uses 100 MWh of energy input to produce 35 MWh, that plant is operating at 35 per cent efficiency.

METI has allowed energy input from biomass co-firing to be deducted from the input. If the same plant described above cofires 15 MWh of wood pellets, the plant’s efficiency under the new calculation would be 35 MWh / (100 MWh – 15 MWh) = 41.2 per cent, which is above the efficiency standard threshold. FutureMetrics has calculated the tonnage of wood pellets that will be required by Japanese power plants to bring the lower efficiency plants in to compliance in the recently released Japanese Biomass Outlook report by FutureMetrics. The report contains detailed data on the expected demand for wood pellets, palm kernel shell, and wood chips in Japan and the policies that are driving that demand.

The FutureMetrics’ forecast for pellet demand by the smaller independent power producers (IPPs) is about 4.7 million tonnes per year by 2025. This is based on analysis of about 140 IPPs that are detailed in the Japanese Biomass Outlook.

Total potential demand in Japan from utility power plants and from IPPs could exceed 12 million tonnes per year by 2025.

SOUTH KOREA

Demand for industrial wood pellets in S. Korea has grown rapidly in recent years, a

trend that could continue over the next several years. In 2017 S. Korean pellet imports were about 2.25 million metric tonnes.

S. Korea is guiding the power generation industry with a Renewable Portfolio Standard (RPS). The RPS program requires the 13 largest power companies (with installed power capacity larger than 500 MW) to steadily increase their renewable energy mix from two per cent in 2012 to 10 per cent by 2024.

For power companies to meet their RPS targets they can: (1) Invest in renewable energy installations themselves and receive renewable energy certificates or RECs based on the MWhs generated from renewable sources, or (2) purchase RECs in the RPS marketplace to meet their obligation.

If the power company fails to accumulate the required number of RECs based on the RPS mandate, they pay a fine. The penalty is equal to 150 per cent of the average market price of the RECs for that year for each REC they are deficient.

REC prices in S. Korea have been very high in recent years. FutureMetrics analysis shows that at current REC prices, S. Korean utilities can significantly increase

the profitability of generating electricity by co-firing pellets.

But the market price for RECs can vary significantly, unlike the guaranteed FiT in Japan; this creates a difficult problem for the market. Most pellet producers and project lenders/investors will not commit to the capital expense of a new pellet plant without a long-term offtake agreement. To date, S. Korean utilities have not engaged in long-term offtake agreements. Demand growth has spurred rapid growth in production capacity in Vietnam to satisfy S. Korean tenders. But that demand is already pushing the limits of Vietnam’s capacity to produce low cost pellets, which are mainly produced from residuals from the wooden furniture industry. It is difficult to conceive of how pellet production capacity can keep up with the expected growth in the S. Korean demand without long-term agreements. Yet, with the risk of falling REC prices, S. Korean utilities cannot engage in long-term agreements.

Based on data from announced co-firing and full-firing projects, S. Korean demand is expected to reach about nine million tonnes per year by 2024 if REC prices remain high enough to compensate for the expected higher cost of pellets as competition in the region increases. The pellet market into S. Korea is already tightening. Pellet prices in Vietnam have risen from around $95 to $133 per tonne (FOB Vietnam) in the last six months.

SUMMARY

There is a high degree of confidence around the continued development of European industrial pellet markets. Japanese demand, once IPP projects are up and running and large utilities receive FiT benefits, should also be stable and is likely to grow as forecast. Future demand in S. Korea is more difficult to estimate due to the uncertainty in prices of RECs. Overall, FutureMetrics estimates the potential new demand for industrial wood pellets through 2025 is in excess of 26 million tonnes per year. •

William Strauss is the president and founder of FutureMetrics. Seth Walker is the senior economist and director of business development for FutureMetrics. Access full research reports at www.FutureMetrics.com.

CHART 2 - The historical actual demand and FutureMetrics’ demand forecast for industrial wood pellet markets.

BELT TRACKER CONTINUOUSLY ADJUSTS REVERSING CONVEYORS

A new powered conveyor belt tracker from Martin Engineering delivers immediate and continuous precision adjustment of hardto-track reversing conveyors, helping operators reduce spillage and extend the life of belts and other system components. Able to effectively center the belt regardless of the travel direction, the robust unit has demonstrated greater durability and longer service life than previous designs, translating to a reduced cost of ownership. Versatile enough to run on 110V / 220V power or a plant’s existing compressed air, the Martin Tracker Reversing can even be specified with the company’s unique Roll Gen System, which uses the kinetic energy of the moving belt to produce a supply of electricity sufficient to power sensors, scales, lights and other devices when no power is readily available. www.martin-eng.com

COLORIZER INCREASES THROUGHPUT CAPACITY

Rotochopper has launched its Generation 2 Colorizer.