From

By Mari-Len De Guzman

By Mari-Len De Guzman

Grow Opportunity has partnered with our sister publications Greenhouse Canada, Canadian Security and Canadian Packaging to host the 2019 Grower Day Conference and Tradeshow, on June 18 and 19 in St. Catharines, Ont., focused on horticulture and cannabis cultivation.

Grower Day is a two-day event. The first day’s conference agenda are geared toward hor ticulture professionals interested in vegetable and ornamental plant cultivation.

The second day, on June 19, is the “all-about-cannabis” conference, which features a line-up of exceptional speakers in the cannabis industry. From organic growing and sustainability to security management and product packaging, Grower Day has something to offer to growers and cultivators in or thinking about getting in the cannabis industry.

Sustainability is top-ofmind among responsible cannabis producers – from the growing of the plant to product packaging. Our Grower Day conference will feature Steven Bourne and Brandon Hebor from Rafterra Global, who will discuss how technology innovations are enabling sustainable cannabis production.

The Green Organic Dutchman’s David Perron will provide an overview of organic cannabis cultivation.

Other notable speakers for the cannabis portion of Grower Day on June 19 include: Patricia Korosi, sector specialist with Agriculture and AgriFood Canada, who will discuss the opportunities for industrial hemp and hemp-based product development in Canada; George Routhier, CEO of PipeDreemz, who will discuss the ABCs of SOPs for cannabis production; and Jayson Goodale, senior consultant at C annabis Compliance Inc. who will be presenting the business case for outdoor grow.

The 2019 Grower Day Conference and Tradeshow is happening on June 18 and 19 in St. Catharines, Ont.

Recognizing that running a cannabis enterprise takes more than just the knowledge of cultivating the plant, we partnered with Canadian Security and Canadian Packaging magazines to bring in experts in their industries to offer their insights on the business operations side.

Curious about product

safety? Hear from Alan Cavers, engineering manager at ULC Standards, about proposed standards outlining the minimum requirements for safe cannabis production.

With security systems being one of the biggest capital investments for licensed producers, for indoor, greenhouse and outdoor grow facilities, you won’t want to miss our keynote presentation by 3 Sixty Secure Corp. president David Hyde. Hyde is one of the foremost authorities on security in the cannabis industry.

Gr ower Day is also your opportunity to see the latest innovations in products and services. Over 42 exhibitors will be on site to provide insights on solutions to your operational challenges.

Save the date for June 18 and 19 and attend the 2019 Grower Day. Seating is limited so register early. Visit www. growerday.com for details and to register. ***

Nominations are still open for the 2019 Canada’s Top Growers Award. There’s still time to nominate an outstanding and deserving cannabis grower.

Visit www.canadastopgrowers.com for details and to nominate y our favourite grower.

May/June 2019 Vol. 3, No. 3 growopportunity.ca

EDITOR

Mari-Len De Guzman mdeguzman@annexbusinessmedia.com 289-259-1408

ASSOCIATE EDITOR Tamar Atik tatik@annexbusinessmedia.com 416-510-5211

ASSOCIATE PUBLISHER Adam Szpakowski aszpakowski@annexbusinessmedia.com 289-221-6605

NATIONAL ADVERTISING MANAGER Nashelle Barsky nbarsky@annexbusinessmedia.com 905-431-8892

ACCOUNT COORDINATOR Mary Burnie mburnie@annexbusinessmedia.com 519-429-5175 888-599-2228 ext 234

CIRCULATION MANAGER Barbara Adelt badelt@annexbusinessmedia.com 416-442-5600 ext.3546

MEDIA DESIGNER Brooke Shaw

GROUP PUBLISHER/VP SALES Martin McAnulty mmcanulty@annexbusinessmedia.com

COO

Scott Jamieson

PRESIDENT & CEO Mike Fredericks

MAILING ADDRESS

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES 1 year subscription (6 issues: Jan/Feb, Mar/Apr, May/Jun, Jul/Aug, Sep/Oct, Nov/Dec):

1 year offers: Canada $25.50 + Tax USA $36.00 USD FGN $41.00 USD GST # 867172652RT0001

SUBSCRIPTIONS

Roshni Thava rthava@annexbusinessmedia.com Tel: 416-442-5600, ext. 3555 Fax 416-510-6875 or 416.442-2191 111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1

ANNEX PRIVACY OFFICE privacy@annexbusinessmedia.com Tel: 800.668.2374

ISSN: 2561-3987 (Print) ISSN: 2561-3995 (Digital) PM 40065710

Occasionally, Grow Opportunity will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. We recognize the support of the Government of Ontario

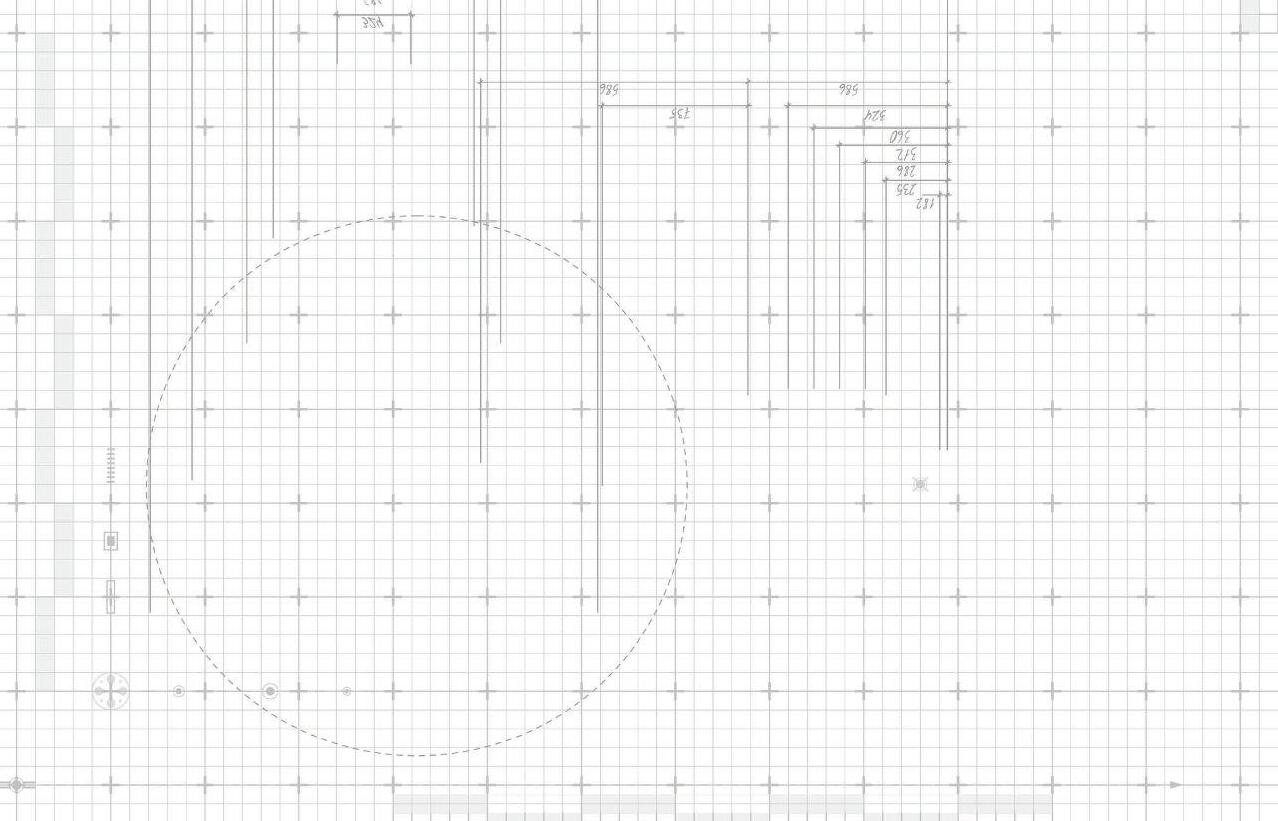

SHYIELD® One-Step Disinfectant Cleaners are the 1st disinfectants designed specifically for use in Cannabis Facilities with relevant use directions and efficacy claims. Registered with Health Canada, SHYIELD® disinfectants can improve your sanitation program by ensuring:

Consistency — Prevent microbial contamination with effective products & protocols

Sustainability

VANCOUVER – Cannabis company

Zenabis Global has received conditional approval to graduate its listing from the TSX Venture Exchange (TSXV) to the Toronto Stock Exchange (TSX).

“Moving to the main board of one of the largest exchanges in the world is a critical milestone for the company in terms of demonstrating the strength of our business and expanding our investment appeal to a broader and global audience,” stated Andrew Grieve, chief executive officer of Zenabis.

Final approval of the listing is subject to certain customary conditions after which the company said it will release a statement immediately upon issuance of the TSX Bulletin confirming the date on which the listed securities of Zenabis will be delisted from the TSXV and commence trading on the TSX. Upon listing on the TSX, the company’s common shares and outstanding listed common share purchase warrants will continue to trade under the symbols “ZENA” and “ZENA.WT”.

Zenabis owns six indoor and greenhouse facilities across Canada, four of which are intended for cannabis cultivation.

The average cost of a gram of dried cannabis has gone up by more than 17 per cent since legalization, with consumers in New Brunswick and Manitoba seeing the biggest sticker shock, according to Statistics Canada. The government agency said the average price per gram post-legalization was $8.04, about 17.3 per cent higher than the pre-legalization price of $6.85. The highest average post-legalization price per gram was in the Northwest Territories at roughly $14.45 per gram compared with the lowest price of $6.75 per gram in Quebec – THE CANADIAN PRESS

Cannabis company

Tweed and waste management company

TerraCycle have joined forces to launch a Canada-wide recycling program called the Cannabis Packaging Recycling Program.

Smiths Falls, Ont.-based cannabis producer Canopy Growth Corporation has announced plans to acquire New York City-based cannabis company Acreage Holdings, Inc. in a US$3.4 billion deal.

The acquisition is subject to approval of each company’s shareholders, as well as the B.C. Supreme Court. Special meetings between the shareholders are expected to take place in June 2019, according to a release.

companies’ shareholders.”

Acreage is a multi-state operator in the U.S. cannabis sector. It owns or has managed service agreements in place for cannabis-related licenses across 20 states (giving it the right to develop), including 87 dispensaries and 22 cultivation and processing sites. Its board of directors includes former Canadian Prime Minister Brian Mulroney and former Speaker of the U.S. House of Representatives, John Boehner.

The Grow-Off cannabis growing competition is expanding to Oregon and Canada, in addition to its annual California and Colorado events. The Grow-Off creates science-based contests to determine who truly grows the best cannabis, independent of human preference.

The companies will also execute a licensing agreement granting Acreage access to Canopy Growth’s line-up of brands such as Tweed and Tokyo Smoke, along with other intellectual property. Until then, the two companies will continue to operate independently.

“Our right to acquire Acreage secures our entrance strategy into the United States as soon as a federally-permissible pathway exists,” said Bruce Linton, chairman and co-CEO of Canopy Growth. “By combining Acreage’s management team, licenses and assets with Canopy Growth’s intellectual property and brands, there will be tremendous value creation for both

“When the right is exercised, having access to Canopy Growth’s deep resources will enable us to innovate, develop and distribute quality cannabis brands across the U.S. and continue expanding our U.S. footprint,” said Acreage Holdings chairman, CEO and president Kevin Murphy. “At the same time, a confluence of factors are making it much more difficult for a multi-state operator to achieve its full potential, including the enormous amount of cash required to scale.”

Murphy has taken on the role of president in light of George Allen’s immediate departure from the company.

Reinforced hook

Low and high humidity resistant

Minimizes carrier material on the crop

Optimum breeding conditions

Contains the well-renowned predatory mite Amblyseius swirskii

You can now achieve greater success in the biological control of thrips. Ulti-Mite Swirski can perform up to twice as well as other products under sub-optimal conditions.

ww w.koppert .ca

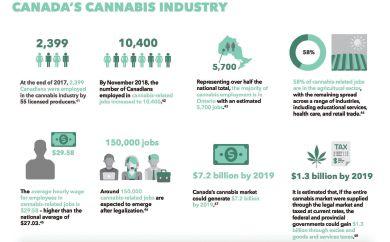

The Ontario Chamber of Commerce (OCC) has released its report, Supporting Ontario’s Budding Cannabis Industry, outlining the province’s competitive advantage and how to capitalize on Canada’s first-mover status in this fast-moving industry.

“With Ontario home to more than half the licensed producers of recreational cannabis in Canada and the majority of cannabis employment held right here in Ontario, we are positioned to lead Canada’s recreational cannabis industry on the world stage,” said Michelle Eaton, OCC’s vice-president of communications and government relations. “Ensuring the private retail market is successful is critical to the long-term viability of the sector. As Ontario’s business advocate, we are committed to shaping responsible public policy to establish us as a competitive, global leader.”

The report provides a comprehensive analysis of Ontario’s cannabis market from the perspective of industry and the role public policy can play to ensure the legal market remains competitive by seizing economic opportunity, eliminating the illegal market, and safeguarding public health and responsible adult consumption.

The report makes a number of recommendations on a wide range of issues impacting the sector including: setting up the private retail market for success, addressing Ontario’s supply shortage, getting regulations around edibles right, and nurturing Ontario’s talent pool.

“The province has a role to play in ensuring the legal market remains competitive and seizes the opportunity to be a global leader in the recreational cannabis space,” added Eaton. “We are the first G7 country to federally legalize recreational cannabis use and other nations will look to us when developing their own regulations.”

While many questions remain, including how private retail will unfold in Ontario, the OCC said it will be working with all levels of government, investors, entrepreneurs, business owners, and post-secondary institutions to establish balanced regulations that consider both public safety and economic growth.

The new Quebec Cannabis Industry Association (QCIA) officially launched on April 16.

Arising from reflections of a working group of Quebec cannabis companies, the QCIA’s mission is to represent Quebec’s cannabis industry and to constructively and responsibly contribute to the sector’s development, according to a release

The QCIA said it wants to play an active role in the ongoing collective discussions about the cannabis industry and ways to regulate it. The association said it will also support public health and safety objectives underpinning the legalization of cannabis, namely to reduce the harm associated with consumption by supplying high- quality products subject to rigorous quality control, and to redirect the proceeds of cannabis to the legal market.

“The cannabis industry in Quebec is growing fast. The need to bring industry leaders together to encourage growth in this sector has become increasingly evident,” said Michel Timperio, chairman of QCIA’s board of directors and president of the cannabis division of Neptune Wellness Solutions. “There is also a need to collectively address Quebec-specific issues and to have the industry’s voice heard in the development of the regulatory framework, in collaboration with the Government of Quebec and all stakeholders.”

The QCIA said it will focus primarily on provincial jurisdiction issues and will collaborate with the Cannabis Council of Canada(C3), the national association of Canada’s licenced producers, on matters of federal jurisdiction.

“There are still some unknowns related to cannabis and the industry; that is why we want to engage with many organizations to continue to build this sector together,” Timperio added.

The founders of the association include Great White North Growers, HEXO, MTL Cannabis, Neptune Wellness Solutions, Origine Nature, ROSE LifeScience, Terranueva, and Verdélite Sciences, which are current and future licensed producers and processors of cannabis for medical and recreational use with facilities located in Quebec.

Companies governed by the Cannabis Act, or those awaiting a licence for operations in Quebec, are eligible to become members of the QCIA. The association said it welcomes new members regardless of the category of licence they hold or have applied for under the Canna bis Act.

“The Quebec cannabis market is emerging and that is why we encourage as many licenced producers and processors, and those awaiting the issuance of their licence, to become a member of the association,” Timperio said.

Your fire. Our fuel. We put the brands that matter, in your hands, when you need them. With 6,000+ skus in stock across 11 North American distribution centers, Hawthorne is built to accelerate your growth.

By Tamar Atik and Mari-Len De Guzman

Big data will play a key role in helping the cannabis industry’s ability to help patients, according to Noah Kauffman, head of sales at Strainprint Technologies, in his presentation at the Cannabis Meets Healthcare forum on April 25 at O’Cannabiz , held at the International Centre in Mississauga, Ont.

“We need to move beyond ‘stoner knowledge’,” Kauffman says. Using data collected from its Strainprint app – a crowdsourcing platform that allows users to track their medical cannabis experience (inputting the type of strain used, condition it was used for, outcomes, dosage, etc). The platform builds on the users’ data to provide insights for patients and health care providers about the various cannabis strains and what patients globally are using them for. There are hundreds of cannabis strains that are available and apart from anecdotal evidence, there are no set standards or recommendations for which strains work best for certain conditions and what dosage. Strainprint data, for example, shows patients are reporting varying levels of efficiency for muscle pain, with variables that include the THC/CBD ratio and strains used. “We are aggregating data to help frontline health-care providers,” Kauffman says.

Session takeaway: If every medical cannabis user would keep a journal and make a record of which strains they used, when and for what condition or symptoms, and what the outcomes for every use are, it can build up vast amounts of data that may provide insights into proper dosing for medical cannabis.

There is currently a diversity problem, especially at the board level, Lisa Campbell, chief executive officer of Lifford Cannabis Solutions, told the room at the exclusive Women in Weed session on April 26 at O’Cannabiz..

Ten women, each an influencer in her own right, shared their views on what women have accomplished so far in the cannabis industry, and what still needs to be done.

“Everyone in this room should be uplifting other women in the industry, even if it’s a competitor of yours,” said Brianna Martyn, co-founder and director of operations for Starbuds.

The female execs also acknowledged the men who are uplifting women and urged both genders to work together to create a diverse industry.

“Find the cannabis strain that works for you – and keep a journal.”

– Noah Kauffman, head of sales, Strainprint Technologies

“Men shouldn’t be sitting at a table and making decisions for women,” said Jenna Valleriani, post doctoral fellow at the BC Centre on Substance Abuse.

“Give everybody a chance, but you don’t have to work with people who do not collaborate,” Valleriani said to a room filled with applause. The first step to reach women is having women at the decision-making table, she added.

“There’s a simple way to not have an all-male board. Don’t have an all-male board,” said Rebecca Brown, founder and president of Crowns. Creating networks between women is part of that, but we have to call up the men in the industry, Brown noted. Not call out, but call up. “The industry is in need of solutions... I think there is a lot of opportunity for anyone who has a smart take on how the industry can do that.”

“Inclusivity from the top down is what we need to look at,” noted High Society Supper Club’s Reena Rampersad. In terms of communication and market insights, knowing the regulations is going to be the be-all and end-all for a lot of start-ups, Rampersad said. “Working within the legal framework is a very niche area right now that needs fulfillment.”

Marketers know that women drive sales, said Gill Polard, founder and editor of Her(B) Life, on the current landscape for women in cannabis. “Be aware and look deep into why things are being marketed to women,” she said, adding that, “authenticity is key to how women can reach other women and move forward.”

Session takeaway: Women and men need to uplift each other to create a diverse industry with no gender discrimination, and women need to claim their role in the space.

Montreal-based security company

GardaWorld presented the security best practices session for grow operators at O’Cannabiz.

Finding a basic balance between compliance and protection is how operators should select a security provider, said Adolfo Proietti, business development director at GardaWorld. He advised grow operators to look at a security supplier that understands the most recent regulatory changes and compliances.

He added that a supplier should be certified to identify gaps in the current environment and then create an action plan to improve on that. A supplier should also provide background checks and security screening, Proietti recommended.

Session takeaway: In this relatively new industry, cannabis producers are still learning best security practices, but the key is to take measures to safeguard your high-value products like you would in any other industry.

The edibles business panel at O’Cannabiz discussed what’s to come for the edibles market.

There are challenges with the current regulatory proposals and the industry hopes to work with the government to shape the final legislation on cannabis-infused products.

The proposed Health Canada regulations mandate separate facilities for cannabis-infused products.

Neil Marotta, president and CEO of Indiva, said this is a good thing to avoid accidental consumption by children, for example.

SCS Consulting’s Brian Sterling disagreed citing well-established cleaning guidelines in place for the food and beverage industries. The panelists said they are cautiously optimistic about the coming edibles regulations.

Session takeaway: The industry must work with government to achieve effective legislation for the market.

Eight panelists spoke to a room full of investors that wanted to know what’s next now that legalized Canadian cannabis, “the biggest investment story of the year,” has made its entry.

They discussed the current cannabis landscape and offered advice to investors in the room.

“What needs to happen that I haven’t seen in the industry is there needs to be a consolidated effort to go to the government and educate them,” said Codie Sanchez,

managing partner at Cresco Capital Partners, on what policy efforts need to take place. On collaboration with big pharma, Sanchez said, “big companies should be scared.” She said big companies are trying to figure out how to invest in the cannabis space and if they don’t, they’ll be left out. The pharma industry has enough money to impose its will on the cannabis industry, noted Hamish Sutherland, president and chief executive of White Sheep Corp. “[Cannabis is]

already a $50B industry in the U.S. If you de-stigmatize it, it’s going to be $150B, but folks are not ready for that,” he said.

Matt Shalhoub, managing director of Green Acre Capital, closed the panel by saying, “Huge revenue growth will happen in Canada, but it’s not going to happen in the next quarter or two.”

Session takeaway: De-stigmatization of cannabis is the key to unlocking even more investment opportunities in the market.

When Carla Boose’s long-time service dog Trek became very ill, she resolved to do everything she can to help him. So she did her research and ultimately found CBD to help manage Trek’s condition and help give her furry friend a second chance at a well-deserved happy life.

“Being able to introduce CBD into his life, I am sure that this has been a life-changer for him and certainly for us, too, to be able to still have him in our lives,” says Boose, who works at the Ontario Cannabis Store as a manager for diversity and inclusion.

Boose, along with several veterinary professionals, were speaking at a panel session at O’Cannabiz last April exploring the use of cannabis for veterinary medicine. During the session, the speakers agreed in calling for regulations that will govern medical cannabis for pets.

“A lot of veterinarians are just starting their journey of learning about endocannabinoids,” says Dr. Sarah Silcox, founder and president of the Canadian Association of Veterinary Cannabinoid Medicine (CAVCM). Veterinary clinics are seeing an increase in the number of clients who are asking about CBD-based therapies for their pets, according to Silcox. The current state of regulations for medical cannabis does not provide an avenue for veterinarians to prescribe CBD for their patients, and advocates are calling on the legislature to add veterinarians to the authorization list for medical cannabis so their pet patients can have access to CBD.

“Veterinarians being able to authorize (cannabis for pets) through the licensed producers is the best way to go,” says Ian Sandler, founder and CEO, Grey Wolf Animal Health, who was also in the O’Cannabiz panel. Last year, Vaughan, Ont.-based licensed producer CannTrust announced a partnership with Grey Wolf to develop cannabis products designed for the pet market. .

Session takeway: Medical cannabis research initiatives should also explore efficacy for our four-legged friends.

Aurora Cannabis and Aphria Inc. say they were among the three companies selected by the German government to cultivate and distribute medical cannabis in the European country. Both companies say the decision by Germany’s Federal Institute for Drugs and Medical Devices is provisional and subject to a mandatory 10-day waiting period, which allows unsuccessful bidders to submit a challenge before the final contract is signed.

If finalized, the cannabis produced by both Aurora and Aphria will supply the German medical cannabis market, which is the largest in Europe according to a recent report by Brightfield Group.

Both cannabis companies say the provisional decision awarded them each the maximum number of five of the 13 available lots in the tender, over a period of four years. Berlin-based Denecan received the remainder, according to reports.

Jefferies analyst Owen Bennett said in a note that the decision is positive for Aurora, as it helps to validate the quality of its medical operations and puts the Edmonton-based company in good stead when attempting to enter other markets.

Brightfield Group estimates that Germany’s medical cannabis market was worth US$73 million in 2018 and is forecast to grow to US$2.7 billion in 2023.

Aeroponic cannabis grower James E. Wagner Cultivation Corporation has begun cultivation activities at its second facility located in Kitchener, Ont. (JWC 2). Four of the eight flowering rooms and vegetative space in Phase 1 of JWC 2 are now in full production.

JWC said it expects that over time, 43 new strains of cannabis will be introduced for production at JWC 2.

CannTrust’s cultivation and processing permit under Health Canada Cannabis Regulations was amended to include the final 20 per cent of its Phase 2 expansion.

This latest news means that the entire 450,000 sq. ft. of the Vaughan, Ont.-based licensed medical cannabis producer’s perpetual harvest greenhouse in Pelham, Ont., is now fully licensed.

kilograms per acre in 2019. Total 2019 production from this harvest is expected to be approximately 75,000 kilograms.

Aurora Cannabis is kicking off the search for Canada’s Top Budmaster through a national competition. The program will recognize cannabis professionals across the country who are guiding consumers as they navigate the new world of legal cannabis.

“We have always been confident that our processes meet and exceed regulatory standards, and we now have further validation of this from our regulators,” said Peter Aceto, chief executive officer. “With this approval, CannTrust is set to meet its plan to reach 50,000kg of annualized capacity at the perpetual harvest greenhouse and continue providing award-winning products in a cost-effective manner.”

The last 20 per cent of the Phase 2 expansion is expected to be operating at full capacity by the end of Q2 2019.

Pending Health Canada approval, the company anticipates planting on its previously announced outdoor land acquisition of 81 acres in Q2 2019 and expects to realize a yield of approximately 1,000

With additional land under letter of intent anticipated to be secured in the near term, the company’s outdoor cultivation operation is expected to total 100,000 to 200,000 kilograms in the second half of 2020. Yields from outdoor cultivation will primarily be used for extraction for products that will be permitted based on proposed regulations for additional cannabis products, which include edibles and inhaled extract products.

The company’s Phase 3 expansion of its perpetual harvest greenhouse is expected to add a further 50,000 kilograms of capacity beginning in the second half of 2020. Phase 3 includes productivity and automation enhancements over Phases 1 and 2. Production from the Phase 3 expansion is also subject to Health Canada approval.

CannTrust’s combined cultivation operations are expected to reach a total annual capacity of 200,000 to 300,000 kilograms in the second half of 2020.

And where there’s mold, there’s crop loss.

Unlike condensing technologies that can actually grow and distribute mold, Agam’s liquid desiccant dehumidification technology captures & neutralizes fungal spores, continuously cleaning the air.And since we use a salt solution, not refrigerants, we’re also helping make plant cultivation a lot greener.

Visit EnvirotechCultivation.com/agam to watch Agam VLHC in action. Plants, People, Passion

The Cannabis Beverage Producers Alliance (CBPA) officially launched on April 24 at a press conference in Toronto, outlining its recommended guidelines for the imminent cannabis-infused beverage industry.

The group, led by former Nova Scotia premier Darrell Dexter, is a not-for-profit advocating for consumer- and industry-friendly regulations governing cannabis beverages. CBPA is comprised of 10 companies from the alcoholic beverage and cannabis industries. According to Deloitte’s 2018 report on the cannabis industry, 31 per cent of potential consumers are interested in trying cannabis beverages.

In speaking about marketing and branding messaging for cannabis-infused beverages, Hill Street Beverage Company’s chief executive Terry Donnelly said cannabis beverages should be clearly labelled for consumers. Current proposed regulations mandate that terms such as fermented grape juice or fermented extract of cereal grains will replace wine or beer, which Donnelly said will be confusing to consumers.

“The removal of the alcohol from the finished wine and beer output still allows for the remaining to be structurally defined and legally described as a wine or a beer,” he said.

A separate building regulation also mandates that all licensed cannabis producers that currently have conventional food and beverage products must have a separate facility to manufacture or process cannabis-infused products. “This is a significant barrier to entry for the marketplace, particularly for small and mid-size producers and it’s going to potentially lead to a monopolized environment of the large macro producers,” said Paddy Finnegan, business unit manager for food and beverage at Lakeside Process Controls. He added the extra cost for small to mid-size producers will make it difficult to compete with the illicit market. Finnegan said the CBPA would like to engage with Health Canada to test cannabis-infused products to make sure they contain the appropriate strains and concentrations, and also test both conventional and infused products to ensure there’s no cross-contamination.

Lisa Campbell, CEO of Lifford Cannabis Solutions spoke about parity with alcohol and demonstrated with a cork and cage cap that using that type of seal on cannabis beverages will prevent children from accidentally opening bottles.

June Nicholson, executive vice-president of partnerships and government affairs at Hill Street Beverage Company and co-chair of the CPBA, held up two cans of beer, one conventional and one infused, to show how cannabis-infused products won’t be branded as creatively to ensure consumers know what they are purchasing.

The CBPA said Health Canada is currently reviewing approximately 7,000 submissions received during a public consultation period around how edible products will be regulated.

– TAMAR ATIK

Cannabis genetics and plant propagation company Kanata Earth Genetics Inc. and the Saskatchewan Research Council (SRC) are collaborating to provide cannabis testing services to Canadian licensed producers.

SRC’s extensive analytical testing portfolio coupled with Kanata Earth’s genomic services will provide licensed cannabis producers with a complete solution for their testing needs, Kanata Earth said in a release.

Based in Saskatoon, Kanata Earth is a research company led by some of Canada’s most senior plant biologists and cannabis experts. It offers analytical testing services via SRC and will also provide genetic enhancement services to the cannabis industry. The company is

also developing proprietary cannabis products and a genomics platform for high throughput breeding.

“We’re delighted to help bring SRC to the wider cannabis industry,” stated Kanata Earth president Shane O’Farrell. The SRC is one of Canada’s leading providers of applied research, development and demonstration, and technology commercialization.

“As the cannabis industry has grown, we’ve seen clients’ needs change and we have incorporated the latest methods and technologies to meet demand,” said SRC’s vice-president of environment, Joe Muldoon. “We are excited to work with Kanata Earth to leverage our strengths to provide licensed producers with truly unique solutions.”

By Mohyuddin Mirza

The lack of understanding around temper ature and how it influences other environmental conditions in a cannabis grow facility can result in sub -optimum crops. I have seen them.

Nearly all processes in cannabis production from seed germination to drying and curing and final product quality is affected by temperature. It affects cannabis growth, development, production, quality, plant health, flowering and flower development, speed of flowering, and the occurrence of diseases and insects. The structure of plant, branching, internode length of stems and branches all depend on temperature.

I was talking to a grower recently who told me that thrips have been driving him “crazy.” Actually, thrips on cannabis are as problematic as in any other crops, such as cucumbers, and can become difficult to control or manage. Some growers are very worried about spider mites as well. Temperature affects the lifecycle of these insects, and they could multiply quickly at warmer temperatures. As an example, in the case of western flower thrips, which are more common on cannabis, the lifecycle varies from 14 to seven days at temperatures between 20 and 36 degrees Celsius.

Somehow, I am finding that cannabis growers are using much warmer temperatures than necessary just because others are doing it. Above 25C is definitely warm for cannabis plants especially if humidity is low. If night temperatures are also warmer, around 21C, then the lifecycle of these insects short-

Dr. Mohyuddin Mirza is the chief scientist with Cannabis Nature Company in Edmonton, Alta., and a consultant for the industry. Email him at drmirza@cannabisnature.ca

ens and causes serious problems. There are several factors that contribute to why growers miss important opportunities to provide good temperature controls:

• Outside temperatures

• Absence of ideal climate control

• Lack of understanding of how the plant responds to temperature

• Inability to read signals from

the plants or what they’re trying to ‘say’

• Poor distribution of heat/temperature within the crops

To achieve ideal temperatures in cannabis cultivation, one must understand there are many variables that need to be considered and understood. These include:

• Daytime temperature

• Nighttime temperature

• Average day, night and 24-hour temperature

• The relationship between temperature and humidity and dew point

• Temperature differentials

• Temperature ramping from day to night and night to day

Our set points on computers are “air temperatures” and we must know the leaf temperatures. The real influences on growth and development depend on leaf temperatures.

To measure leaf temperatures, the handheld infrared meters are very reliable. In greenhouse situations, I have found that the leaf temperature is generally 3C to 5C higher than the air temperature inspite of cooling systems. In indoor facilities, I have seen higher leaf temperatures compared to air temperature due to the high pressure sodium lights’ infrared component.

Here’s a step-by-step guide to understanding the role of temperature.

Day temperature or light period temperature. In greenhouse situations, where sunlight comes in, the temperature is influenced by solar radiation. Supplemental lights are turned on/off based on watts/m2. The most important aspect is to understand the role of this temperature in photosynthesis. The process of photosynthesis is relatively stable

between a range of 18C to 25C. Above that temperature, although photosynthesis slows down, it is the “photorespiration” that increases and thus, the plant energy balance changes more towards cooling itself.

In order to have good quality plants, we need a ratio of 3:1, that is photosynthesis, three times higher than respiration so that plant energy is used for its needs rather than being used to keep itself cool. Set points is one thing but what the plant is perceiving is another thing. The plant is not actively growing during this period, it is just manufacturing and storing the food it made but does not like to use it up for cooling.

Night time temperature. During dark periods, which is about eight hours at vegetative stage and 12 hours during flowering stage, the plant is breaking down

the food it stored through the process of respiration. Carbon dioxide and water are produced as a by-product, that is why the relative humidity is higher at nighttime.

What is a good nighttime temperature? It all depends on the light the plant has received during daytime. My recommendation for greenhouse cannabis growers is to use the light figures of the day to manage the night temperature. It should be around 17C to 18C, but it can be lower for a few hours to attain the 24 hours average, which you want based on the vegetative or generative status. We have learned from cucumbers and tomatoes that after a high daylight (over 1,500 joules/cm2), the night temperature can be dropped to 16-17C to achieve a 24hour average of around 20C. The same principle can be used for cannabis. It is during the night period that plants

transfer the assimilates to various parts of the cannabis plant. So pay attention to day average and night average and your computer should be able to assist you. This will build a balanced plant with strong leaves and shoots.

24 hours average temperature. Cannabis plants grow based on 24 hours average temperature. If the cannabis plant is grown at the same day average and night average, it will have very short internodes and thus become very compact. The elongation of internodes depends on the temperature differential. So read your plant and see what type of plant structure fills your needs. Short and stocky plants are better then long and lanky plants.

In the next installment of this column, I will focus on temperature and humidity, dew points and the importance of temperature ramping.

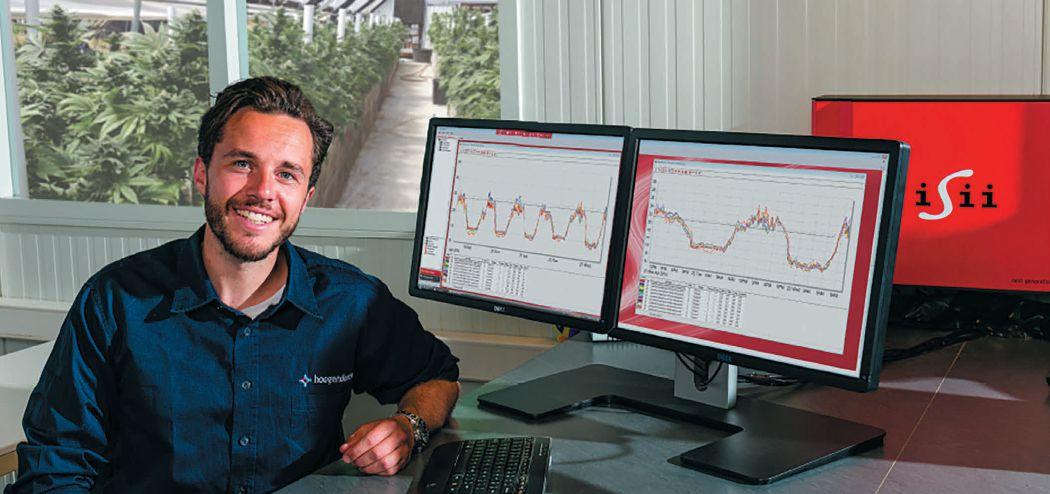

So you have full control over the growth of your cannabis plants

Hoogendoorn’s next generation iSii monitors and controls all climate,irrigation and energy equipment in all types of facilities such as greenhouses and buildings. The iSii is equipped with advanced controls that work according to the principles of Plant Empowerment. This way light, temperature, humidity and CO2 are aligned with each other for a maximum photosynthesis. In addition, to prevent water stress, irrigation is driven by the evaporation energy and water balance of the crop. With the iSii process computer, you set the base for high quality production.

info@hoogendoorn.ca | www.hoogendoorn.ca

By Matt Maurer

At the stroke of midnight on Oct. 17, 2018, the first sale of recreational cannabis was made in St. John’s, N.L. The transaction was processed at a Tweed store, and Canopy Growth’s chief executive officer Bruce Linton was not only on hand, he was manning the cash register.

Canopy left very little to chance in its quest to be behind the historic first sale of recreational cannabis in Canada, and I don’t mean the fact that the customer had their debit card hovering over the Interac machine as the countdown to midnight was on. In reality, the seeds for this publicity event were planted nearly a year earlier.

In December 2017, the Government of Newfoundland and Labrador announced that Canopy would be constructing a production facility within the province. In the same press release, the government announced that Canopy would be eligible to receive up to four licences to operate retail stores,

Bruce Linton, Canopy Growth chairman and co-CEO, was on site at the company’s Tweed store in St. John’s, Newfoundland on the very first day of legalization of recreational cannabis in Canada.

with at least one of those stores being located in St. John’s. Everyone else who wished to operate a retail store in the province would have to go through the request for proposal (RFP) process and hope to secure one of a limited number of available licences.

All of that work simply to ensure that Canopy would have a store in a province with a population of just over 500,000, representing about 1.5 per cent of the country’s total population? Canopy’s ability to work around the RFP process was shrewd – dropping a facility in Newfoundland in order to open four stores did seem a bit peculiar at the time it was announced. However, on Oct. 17, 2018, it became readily apparent that Canopy’s design of being the face behind the first legal recreational cannabis transaction – both figuratively and literally – was hatched over a year prior.

In Ontario, Oct. 17th came with much less fanfare. Leading up to legalization, the provincial Liberal government announced that it would roll out a completely

publically owned retail system featuring both government-owned and operated bricks and mortar stores as well as online sales. However, in June 2017 the Conservative Party took power after the provincial election and thereafter announced that while the government would continue to roll out a publically-owned and operated online sales platform, private enterprise would now be responsible for running bricks and mortar stores within the province. However, those stores would not be licensed nor in a position to open until the spring of 2019. As such, when the clock struck midnight in Ontario, there was no smiling face behind a cash register nor any lineups around the block. Instead, a simple website went live and almost immediately encountered a number of problems attempting to handle orders that flooded in from eager consumers.

For the first six months of legalization Ontario residents were only able to purchase cannabis (legally) online. Given the heavily restrictive advertising and promotion rules set out in the federal legislation, the ability to teach consumers about a company’s product is difficult on a good day. Being deprived of physical stores where employees can answer questions and educate consumers about the differences between products makes a difficult job closer to impossible.

However, this spring is the dawn of a new era in retail sales in Ontario. The provincial government has now licensed nearly every one of the 25 stores that were effectively awarded through a lottery draw that was conducted in mid-January 2019. The opening of these stores offers cannabis companies a massive opportunity to win the hearts and minds of consumers in this country.

Many will tout British Columbia as the home of cannabis in Canada, while other commentators have argued that Alberta may become the future hub of cannabis-related activity within the country. However, there is simply no denying that Ontario consumers, those living in a province with a population of 13.5 million, representing nearly 40 per cent of the entire population in the country, will be the engine that drives the cannabis industry in Canada.

The awarding of the 25 licences through a lottery opens a unique opportunity for cannabis companies to

GH_AndyLang_June2016 copy.pdf 1 2017-10-17 9:45 AM

begin building brands and customer loyalty. Although some of the lottery winners did partner with established industry players, none of the winners themselves were previously participants in the cannabis industry. The Alcohol and Gaming Commission of Ontario has mandated that the winners cannot sell their licence nor give up decision making or control of their stores for at least a year. As a result, cannabis stores in Ontario will be stocked by decision makers who have no prior association with the industry and who ought to be open and impressionable.

The opportunity to grab

shelf space and positive recommendations to potential customers from store staff is open for the taking. Both are invaluable given the limited tools that are available to companies to differentiate themselves directly to consumers.

Having worked with a quarter of the stores that have opened in Ontario, I have seen first-hand some of the strategies being employed by cannabis companies to reach these store owners and managers (in a legal way). I have seen the tremendous value that some companies put on building these relationships. Unfortunately, I

have also seen many who appear to not recognize the opportunity that is in front of them.

There are 175 federal licencees, not including accessory companies. Producing “high-quality, lowcost” cannabis is one thing. Getting it sold is another.

Canopy built a multimillion dollar facility in Newfoundland for, arguably, the right to smile out at the world at 12:00 am on Oct. 17th. That plan was hatched nearly a year in advance. If you don’t think some cannabis companies have been waiting for this moment for a long time coming, think again.

What’s your plan?

LEARN MORE AND REGISTER ONLINE AT:

JUNE 18TH

Flourishing in the technological age

Topics include:

• Biofungicides: Microbe vs. microbe

• Managing pests in the digital age

• Clean water: Filter by design

• Grounds for a DIY mix

• Software solutions for greenhouse automation

• The payback on mechanization: A tale of two growers

• Lighting & plant science: A deep dive into using smart LED lighting

• How to co-exist with your cannabisgrowing neighbour

JUNE 19TH

Cultivating your cannabis enterprise

Topics include:

• Innovation in cannabis cultivation

• Safety in cannabis product

• Going organic

• The business case for outdoor grow

• All about hemp

• Procedures and protocols

• Business briefs

• Product packaging

• KEYNOTE: Security and Risk Management for your Cannabis Business

By Karina Lahnakoski

GMP” is the hot buzzword in the global cannabis industry right now as individual cannabis companies take note and begin the journey to implementation. However, blindly following the trend and implementing Good Manufacturing Practices (GMP) without strategic consideration and a sound business model may prove counterproductive.

As markets legalize, each jurisdiction is setting a stake in the ground and declaring their regulatory requirements for cannabis products, first seen with Canada and Good Production Practices (GPP), and now with the European Union and GMP. This impacts not only day-to-day operations, but strategic considerations, sustainability of businesses, and even the future of Canadian cannabis industry.

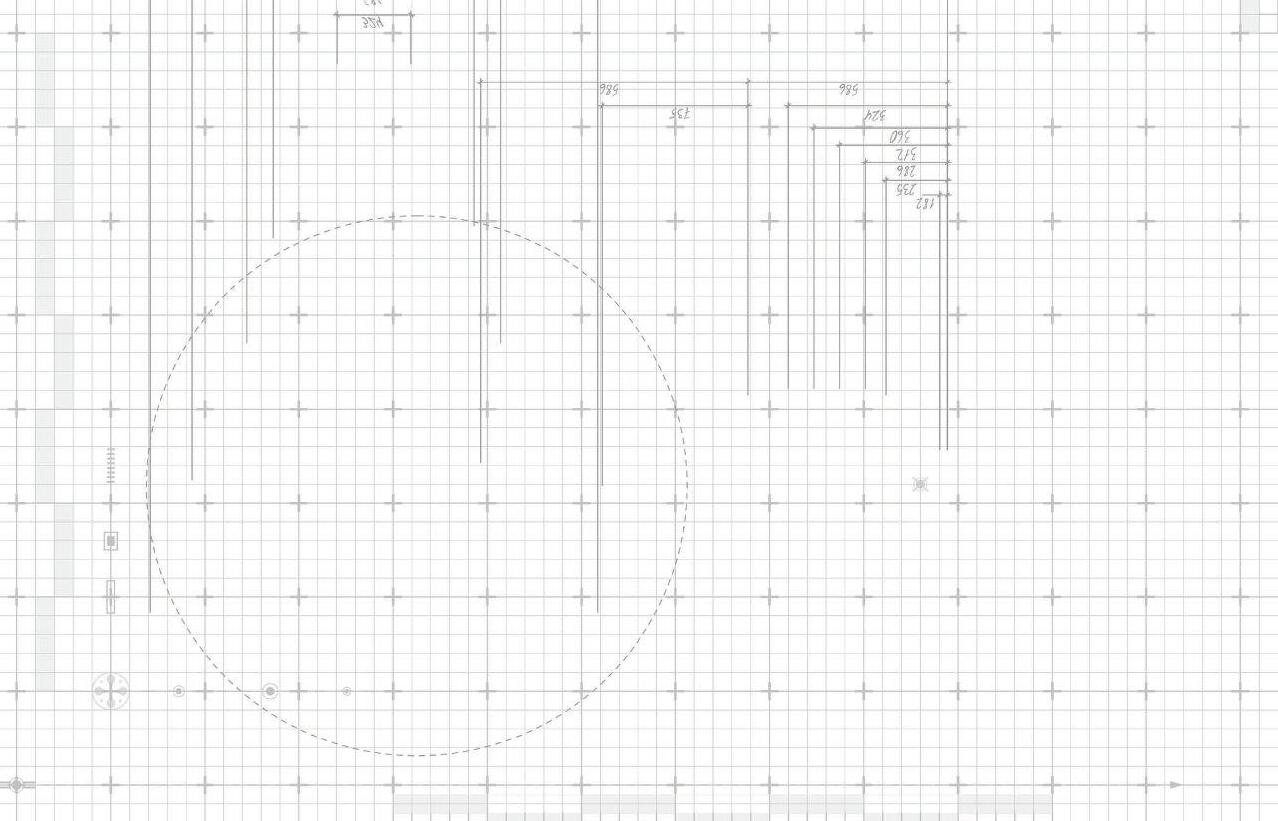

The regulatory choices being made are a result of a combination of available regulations, government objectives, and the types of products being legalized. As a result, there is little alignment in the industry, as is evident in Figure 1. For businesses planning to engage in trade, this misalignment of regulations creates additional hurdles for cannabis businesses.

Currently, the industry eagerly watches as markets in the EU open to cannabis legalization, which is the driver behind the desire for EU-GMP implementation. For businesses wanting to produce in, or export to the EU, implementation of EU-GMP makes perfect sense. Certainly, in Canada,

this new potential market for products is receiving much attention and creating the GMP buzz. More than ever, cannabis firms need to have their strategy planned early on to include product type, market, and supply chain compliance and then the regulatory needs of their company.

Here are some tips for becoming GMP compliant:

GMP is not a requirement to sell medical cannabis, recreational products, or food grade c annabis raw materials in Canada. If you’re a food business, or selling to the edible markets, your focus should not be on EU-GMP, but GPP and Safe Food for Canadian Regulations (SFCS).

There are products that would require the implementation of GMP, but not EU-GMP. If you are supplying a drug manufac-

turer with cannabis product classified as API (active pharmaceutical ingredient) for a dr ug destined for the U.S., EU-GMP won’t achieve your goals. Your product, and how it is used in the supply chain is critical.

The enormity of a GMP implementation program should not be underestimated and the timelines to attain it are not short. The EU-GMP standard is the same manufacturing standard that is applied to human drug products such as vaccines. It is very strict, and implementation programs are not straightforward. Implementation is multi-faceted, requiring knowledge from commercial horticultural (to meet Good Agricultural and Collection Practices, GACP) to medicinal Quality Management Systems (QMS) requirements.

The typical process for a GMP implementation program includes:

Confirming infrastructure meets the standard: The implementation of GMP requires the site to accept the infrastructure requirements of EUGMP, which are quite prescriptive. If the facility is pre-existing, the ability of a site to address serious gaps in infrastructure requirements are limited from an engineering and cost perspective.

Define where in the operation GPP (if applicable) vs GACP vs GMP applies: The regulatory requirements will dictate the standards to be applied in different areas of the facility. This includes ensuring your facility is segregated appropriately, and that the flow of personnel, materials, equipment, and product is conducive to achieving a controlled facility. Existing facilities often find concerns in segregation and may require costly retrofit or engineering controls.

Quality Management System (QMS) updates: The implementation program hinges on performing a gap assessment between the existing Karina Lahnakoski

QMS and the desired QMS. All systems in a facility will be impacted and must be fully implemented prior to being certified to GMP. An audit by a qualified cannabis GMP auditor is the best way to assess the gaps and determine when the updates are compliant.

Implementation of quality programs: Implementation of QMS programs can span from months to years and largely depend on having qualified resources focused on the implementation of GMP. Two major GMP programs that often take the most time are establishing a validation program (and supporting validation data) as well as establishing shelf-life

data to support the expiration date of the products.

In the near term, there will not be an alignment of regulations between jurisdictions. The independent evolution of the C anadian system, the state-mandated systems within the U.S., and the requirement for EU-GMP in the EU countries mean that the international cannabis community will be left with regulatory barriers that impact business. Understanding your product, strategy, and the markets are key to successful business planning.

QUALITY MANAGEMENT SYSTEM (QMS) REQUIREMENTS FOR CANNABIS IN VARIOUS JURISDICTIONS COUNTRY/ JURISDICTION

or Recreational

• Good Production Practices, Health Canada

• EudraLex Volume 4 - EU Guidelines to Good Manufacturing Practice Medicinal Products for Human and Veterinary Use, European Commission Health and Consumers Directorate

• Quality requirements for manufacturing medical cannabis products (IMCGMP), General Ministry of Health

• Guidance on GMP compliance for the manufacture of medicinal cannabis for supply under ‘approved access’ provisions, Therapeutic Goods Administration.

It affects an entire industry when a data breach occurs. In Canada’s cannabis sector, the two most-recent breaches in the news involved personal information – in the second case, very personal. In November, data from 4,500 Ontario Cannabis Store (OCS) customers was stolen using the Canada Post package delivery tracking tool. No more detail on what happened has been presented. At the end of 2018, a medicinal cannabis referral firm located in Calgary, called Natural Health Services, also had a breach involving a whopping 34,000 patients. Although the details are not yet clear, it looks as though this breach went beyond names and addresses to access of private medical information.

Treena Hein

The purpose of these attacks – what the thieves might want to do with the data – is also not clear. But whatever the reason, we can be certain that data security is a critical issue in the cannabis sector.

Different types of cannabis businesses must secure different types and amounts of data. Licensed cannabis producers, which generally sell medicinal cannabis online, might sell recreational products in Manitoba and Saskatchewan, and also have physical stores in some provinces. As such, they have a lot of data to secur e, including sensitive medical information. Then there are govern -

ment-run online purchase systems for r ecreational products, such as OCS in Ontario, which must secure names, delivery addresses and more. Privately-owned and government-run stores selling recreational cannabis in various provinces would have very little client data to manage – and none at all for customers who pay in cash.

However, even in a store scenario where customers use cash customer-specific data, like email addresses, m ight be requested and subsequently stored for mailing and marketing purposes, such as online newsletters or special offers , says Ryan Lalonde, CEO at Buddi, a Vancouver-based platform for cannabis retailers providing cannabis education and pr oduct information.

In the cannabis sector, beyond personal data of customers, data which might be tak en from a company could include intellectual property, research

3 Sixty Secure understands the challenging landscape of the transportation and logistics environment, which is why we offer a comprehensive approach to a range of services:

• ARMOURED/NON-ARMOURED TRANSPORT

• ARMED/UNARMED GUARDING

• CHAIN-OF-SIGNATURE PROCESSES

• CANNABIS CARGO LIABILITY INSURANCE

• TEMPERATURE-CONTROLLED CARGO SPACE

• AIR TRANSPORT OPTIONS

• GPS-TRACKING AND GEO-FENCING

TECHNOLOGY

results and financially-sensitive information, “all of which make [cannabis firms] especially attractive targets for cyberattacks,” notes business services provider Ernst & Young (EY) in a recent web article. These attacks, which commonly involve ransomware, malware and phishing, “are becoming more prevalent, severe, and sophisticated,” the company adds.

Any discussion of data security must include the fact that while data breaches involving personal information are reported, attacks that don’t generally aren’t. That is, there is no way to know exactly how many data attacks are actually occurring within any industry, or the degree of success of these attacks.

Data security in the cannabis sector is not just about cyber attacks. Indeed, cybersecurity attorney Kathryn Rattigan states in an article in the National Law Review published in January, that “additionally, many of the same threats apply to the cannabis industry as those that affect all other businesses that are collecting data – use of public wi-fi by employees, loss of paper records, connected smart devices to your company’s network, and email phishing scams.”

Lalonde notes that for each type of data, there is a set of proper corresponding actions to take to secure it. Data on paper, for example, must be locked up (physical security) and when no longer needed, fully destroyed. Access to digital information should be restricted to appropriate personnel (organizational security) and that access should be monitored. All access should require strong passwords and stored in an encrypted format with firewalls in place (technological security). There should also be a regular deletion of digital data that is no longer required.

Precautions aside, since a breach is always a risk,

experts also recommend making preparations for that eventuality. “Definitely have a plan in place,” says Lalonde, “to replace the data set, detect what was compromised, notify c ustomers if required, and so on.”

Br yson Tan, EY Canada associate partner (cybersecurity), agrees that a data breach response plan is impor tant, noting also that the design and management of that response plan may be one of the data securit y tasks that cannabis firms choose to outsource.

“Companies should test their incident and crisis management plans on an ongoing basis so they are adequately prepared in the face of an active cyber attack.”

“ What a company outsources or does in-house depends on the approach it takes and the level of complexity,” he explains. “Firms with a good IT team can certainly do some of the basics in-house, like firewalls, configuration management, encryption and security monitoring (monitoring for malicious activity). A lot of operating systems have encryption included, so a sharp IT person on staff can handle its management.”

However, more complex tasks, such as penetration testing (simulated hacks to test for weaknesses) and breach response, are often outsourced.

“At the point of a breach, you really need an experi-

enced team to call on,” notes Tan. “This team will do everything possible to seal the breach, figure out what happened and take other appropriate actions. It’s invaluable to have access to the right

resources and skill set when you need them most. Not only will the situation be handled effectively, but having that expert team takes the pressure off your staff in terms of making the best deci-

sions about what to do next and who needs to be in volved, whether that’s certain company IT or HR personnel, external counsel and so on.”

Any breach response plan worth its salt will include steps for accessing backup data and restoring affected systems. This means that as a standard operating procedure, all pertinent data should be regularly and continuously copied and stored in a separate storage system.

Tan notes that this is quite achievable in a cost-effective manner and may reduce overhead and capital costs. “Moreover, companies should test their incident and crisis management plans on an ongoing basis,” he says, “so that they are adequately prepared in the face of an active cyber attack.”

Not only must firms test their plans, but they also – in Tan’s view – must

ensure they do not let their technology become outdated. Allowing this, along with other possible lapses , makes a firm “more susceptible to attacks, with a potentially crippling effect on day-to-day operations. T hat’s why it’s so important for cannabis companies to implement proactive, ongoing efforts to re-organize and update cybersecurity measures in today’s climate.”

In terms of storage security, there are many experts who highly recommend storage on servers only within Canada – as storing data on servers located in the U.S. for example, could put it at risk for access by law enforcement agencies. However, there are others who think it’s perfectly fine, so each company must weight the pros and cons in doing due diligence.

As to whether firms should outsource storage of large data instead of using their own servers, Tan believes there are benefits and challenges to both avenues – but the same warning applies. That is, if you have your data stored with an outside party, it’s critical that ongoing risk assessments as well as other security management

duties are being performed through an independent third party. Otherwise, Tan warns, “there could be even greater risk.”

For his part, Balaji Gopalan recommends using the large ‘public’ cloud storage companies to store any digital health- care information: Amazon, Google or Microsoft.

“Smaller providers may not ha ve the security protocol commitments needed,” explains the co-founder of MedStack, a Toronto-based firm offering automated infrastructure management specifically for application developers in health care. “Unless you’re leveraging a platform purpose-built for health-care compliance, you will also need a security ‘DevOps-skilled’ (development and operations) team to create secure infrastructure to interface with these storage systems.”

Cannabis firms should also look into cyber liability insurance to help deal with a breach. “Definitely explore your options to manage risk, just as you do with other forms of insurance,” says Tan. Looking at all sectors of the economy, EY’s 2018-19 Global Information Security Survey (GISS) indicates that 65 per cent of r espondents from around the world don’t have cyber insurance.

“Firms with a good IT team can certainly do some of the basics in-house, like firewalls, configuration management, encryption and security monitoring.”

Gopalan believes every cannabis company should have cybersecurity insurance, and adds that the cost of premiums is related to the degree of security that the insurance company perceives to be present.

“I can’t say that an insurance company will refuse to insure a cannabis or any other firm with poor systems, but your rates will be high because you are a higher risk,” he notes. “We decided to work with an insurance firm to really have them understand the security of our system, and this firm now offers preferential rates to our health-care app developer customers because our platform ensures that th eir risk of a data breach is so low.”

Tan also believes that executives of all stripes need to boost their data securit y knowledge level. In EY’s survey, only 16 per cent of respondents believe their boards have sufficient information security knowledge to fully evaluate cyber risks.

“Clearly there is a gap that must be addressed,” he says, “and companies across all industries would be wise to invest accordingly and implement a robust cyber strategy with sophisticated technology and security measures in place.”

“ The reality is,” says Tan, “that cyber attacks are a matter of ‘when’ rather than ‘if’ for any company.”

For more

Download a free report from Ernst & Young entitled, ‘Managing cyber risk in Canada’s new cannabis sector ’ here: ww.ey. com/Publication/vwLUAssets/ EY-cannabis-cyber-risken/$FILE/EY-cannabis-cyberrisk-en.pdf

Treena Hein is a freelance writer based in Toronto.

Up Close

Mari-Len De Guzman is the editor of Grow Opportunity. Email her

In the same month that Canada legalized recreational marijuana for adult use, Peter Aceto assumed the role of chief executive officer at CannTrust, one of the first movers in the medical cannabis space. Since legalization, the company has made a big play for the recreational market, but continues to grow and focus on its medical cannabis patients, which now stands at 67,000.

Six months into legalization and in his new role, Aceto is taking his company to greater heights, with plans to enter the edibles space and already working to develop products for the pet market. Grow Opportunity caught up with the chief executive at CannTrust’s head office in Vaughan, Ont., to check in on the LP’s progress navigating this new paradigm of a fully legalized cannabis industry.

Q: Coming from the financial services industry, how have you managed the transition from both a professional and industry perspective?

Peter Aceto: It was a really conscious choice for me to be a part an industry that’s in its early stages, where the rules and regulations aren’t clear. It’s on the ground floor of a new industry, which isn’t just going to be a Canadian industry. It’s going to be global, so it’s very exciting to be a part of that.

In my past job, what I did was a new way of banking. It started in Canada and ended up in nine countries around the world. I was the eighth employee and we ended up with thousands of employees around the world, doing something innovative. It was a regulated environment, which this is as well. And dealing with those exciting opportunities of rapidly growing and scaling.

There’s a lot of things about this role that

are different – because of this vertical integration, because of licensing. In this business we do genetics, we grow plants, we harvest plants, we do manufacturing, we do labeling and production, we do shipping. We do medical research. We have retail customers, we have patients. It’s fun because it’s so broad and there’s so much to learn. So it’s fun to be a part of that, and to try and frame what that industry is going to be like.

Q: Talk about CannTrust’s product strategy.

PA: We put it in three segments. The first segment is medical cannabis. CannTrust, I think, really is the Canadian leader in medical cannabis. We have the third most patients in the country, but we are the fastest growing. Our patients were all obtained organically, as opposed to through acquisi-

tion. We were started by pharmacists. We are really known for the standardization of our products, really focused on dried cannabis, but also oils and capsules, which is why physicians refer us to their patients.

As soon as the rec market became legal in October 2018, we wanted to sell those products in the recreational market as well. We are one of few licensed producers in nine provinces. We created four retail brands – Liiv, Xscape, Synr.g and Peak Leaf. We have won multiple awards for the quality of our products. It’s very, very validating that through our methods, it turns out we are producing the highest quality products that are most-preferred by consumers.

Third, the rules are about to change. We are not 100 per cent sure what the rules will be. They published a draft, we provided our comments. We are waiting to see. We want

to leverage that medical brand and what we have done on medical, our early success on recreational, and really be a leader in new, innovative product types – whether it’s vape pens, coffees and teas or beverages, a variety of them. We want to leverage these things so we can be a leader in those areas as well.

Q: Health Canada has released the draft regulations for what the extracted products market will look like. Having seen and commented on the draft, what would you like to see in the final regulations?

PA: A lot of people talk about supply and demand, that there has been a high demand for cannabis and that the supply has not been there. I think that when these new rules come out, that’s going to get even worse. The demand is going to be so much higher because really, people don’t want to

smoke anything. I think maybe people who are interested in experimenting with cannabis are waiting for a way to get it in a very different way.

We would like the rules and regulations to permit us to do many other different formats for cannabis, both medical and recreational. And do it in a way that is user-friendly and cost-effective, but also safe. The regulators are trying to eradicate the black market, trying to make sure only people at the right age are getting access to the product and they want to make sure that the product is safe.

I think a challenge that we all face is how do we make sure we achieve those things. But in the same way, have good quality products, with not too much packaging, and cost-effective to produce.

I think the rules and regulations are going to continue to evolve, and I think our ex-

pectation is it’s good, that we will have the ability to bring these new products to market.

Q: Speaking of supply and demand, there have been statements and speculations about whether the widespread shortage in legal cannabis products will soon come to an end or continue over the long term. What is your take on it?

PA: I have a very clear view about the supply and demand problem. Today, we are allowed to provide dried flower, oils and capsules. If nothing else changed, CannTrust and the other suppliers will be able meet supply in 12 months from now.

However, with the new change of the regulations to allow edibles, and all sorts of different things, I just think that that’s going to exacerbate the problem, and maybe push

it out for another four quarters, to be very honest. Because so many more consumers are going to be interested in trying products that are different, creating a lot more demand. And I think all the LPs are going to have the same supply issues. We’re trying to figure out how to grow these high-quality plants in a reliable way, and we’re working on our value chain to be efficient and lowcost that get product to customers, and now we have to do it in five, six, seven other product categories.

To me, I see this as a very exciting challenge. I think CannTrust has actually been particularly good at it. But I think the primary issue is we’re all figuring out our processes. We have hired hundreds of people in the last 12 months and we need to train them. And we have to train them. We are using machinery to automate, but none of these machineries were designed for the cannabis industry. It was designed for the pharmaceutical industry, for candy, confectionary industry. And we are figuring out how to optimize the machinery and improve all the time.

I am seeing improvements every day, but I think that they need to continue. I think that is a lot of the reason why we’ve seen some of the supply and demand issues that we have.

Q: We are now more than six months into this legalized recreational cannabis industry. What insights have you learned?

PA: There are probably four things that are really noticeable for me.

The first thing is the demand for cannabis. I must admit, I was surprised to see how high that demand is for cannabis on the recreational side. Maybe it should not have surprised me, but it actually surprised me.

The second thing that I think was really interesting to learn was that although medical cannabis has been legal for five years, really, in the eyes of most Canadians, cannabis became legal six months ago. To see the impact it’s having on our medical business was a really big surprise for our business. Not so much for me, I sort of saw it that way, but people here at CannTrust were a little

“If medical cannabis is going to be broadly accepted as a medicine in Canada or around the world, we need to do the research to really prove it.”

– Peter Aceto

bit worried that the legalization of recreational cannabis will have a negative impact on the medical business. But what we found is that consumers are talking about cannabis all the time, where they didn’t really talk about it before. They are going to their physicians and saying, ‘Hey I am having trouble sleeping, I have pain. You’re prescribing these medications to me, can you teach me about cannabis?’ And our physicians can teach you about cannabis.

We are seeing a large demand from physicians to take advantage of our education, and we are seeing a lot more patients being referred to our business from physicians – as well as the whole community. Even my mother, who is in her 70s, it’s becoming apparent that a bunch of her friends are using cannabis for pain, for sleep, for other issues. That level of awareness on the medical side and how it has actually changed our medical business is exciting.

The third thing is the whole supply chain. People’s expectations that there would be lots and lots of products available to meet the demand seem a little surprising to me. The complexity of growing a plant and how long that takes and harvesting it, and the reliability of exactly how much you’re going to get, and what the quality of it is, and how it works its way through manufacturing, testing, packaging and ultimately into customers’ hands – that takes time. And there are some bottlenecks. We have learned

about how challenging that can be and I think outside of CannTrust, people don’t seem to have an appreciation for that complexity. That is important for all of us.

The fourth thing – maybe the most exciting of all – is the international perspective. We are seeing countries, regulators, businesses reaching out to us on a regular basis to think about medical cannabis and cannabis in general for their country: how should they do it in Germany; how should they do it in Australia. Licensed producers or people who want to be licensed producers are reaching out to us for our know-how and our knowledge – like our partnerships in Europe, our partnerships in Australia, and we are certainly evaluating others.

So it’s that quick awareness internationally of the opportunity and coming to Canadians for our knowledge and expertise. These are the four big things that I really noticed in those six months.

Q: What are some of your personal learnings since coming into this role and coming from a different industry?

PA: I sit right here by our call centre. We have 67,000 patients today and we are growing all the time. I listen to our call centre agents, talking to our patients all the time. I’ve listened to some of the conversations. I’ve actually spoken to some of these patients myself. I now know the role cannabis is playing in helping make so many people’s lives better. They are sometimes very young people who are suffering from multiple seizures a day, there are people who are going through chemotherapy and it’s helping them through their cancer treatment. It’s helping people who can’t sleep, and can’t live because they can’t sleep – and a variety of other things in-between.

For me to actually learn this and experience it myself, the people who we are actually helping, is mind-opening for me.

What I found with the legalization of the rec market is we’re just starting to see it on TV, starting to see it on the news, and famous people would come forward. I think it’s just rapidly changing people’s perspectives.

I also go to communities where people are not at that place. Here we are in Toronto, where maybe it’s moving a lot faster, but there are other places in the country that have a long way to go. I am in it every day, so I see the front edge of it, but I have to realize that probably the majority of our population is not quite there yet and it’s going to take a lot more time.

Q: One big way of gradually changing the stigma around cannabis use is through scientific evidence. Why

should licensed producers care about the science?

PA: I talk to medical professionals all the time. We’ve got well over 2,000 – probably closer to 2,500 – physicians that are referring patients to us. And we’ve got foreign-trained doctors who work for us to help educate physicians across the country.

There are published studies about the health effects of cannabis and cannabinoids, the current state of evidence and recommendations for research. CannTrust is also trying to build the body of evidence. For medical cannabis we need proof. For this to be pharmaceutical grade for doctors to prescribe, we need proof that cannabinoids help. We have a really robust relationship with McMaster University and they’ve got the biggest pain clinic in Canada.

I’ve met multiple patients who are no longer on opioids, and are using cannabis to

sort of get back to a semblance of a normal life. We are also doing a study in Australia, with Gold Coast University, who is doing an ALS study. There is no cure for ALS today, there isn’t even a medicine that reduces ALS symptoms. We have ALS patients here who have reported to us that using cannabis has improved symptoms for ALS. So we need to do this, we need to do the clinical trials to prove that this is, in fact, the case so that people can begin to prescribe cannabis to help things like this.

Building the body of evidence and building the science to truly prove to health care practitioners and to people that cannabis can help them with indications and ailments is part of our responsibility. If medical cannabis is going to be broadly accepted as a medicine in Canada or around the world, we need to do the research to really prove it.

Mari-Len De Guzman is the editor of Grow Opportunity. Email her at mdeguzman@annexbusinessmedia.com

By Mari-Len De Guzman

Producing high quality cannabis products does not begin and end in the growing of the plant – no matter how great the genetics. It’s possible to lose or degrade the quality by botching the post-harvest processing.

Health Canada’s demand forecast for both recreational and medical cannabis stands at 926,000 kilograms per year. Shortly after adult-use recreational cannabis was legalized in October 2018, widespread supply shortage became increasingly apparent. Licensed producers are ramping up production to increase supply, with some bigger LPs forecasting production capacities for built facilities in the hundreds of thousands of kilograms of dried flower per year.

Shortage of quality cannabis products in the legal marketplace has not helped with efforts to eradicate the black market and transition consumers to the regulated suppliers. Price and quality are the perceived common denominators for sticking with the black market.

Meanwhile, it’s crunch time for licensed producers across the country as they tr y to catch up with increasing demand by building bigger facilities and expanding production capacities. And they have to do it in a way that does not compromise the quality of their cannabis products.

“More focus and concentration need to be put on the quality of your product and producing it properly,” says master grower and cannabis grow consultant David Kjolberg. “The more time and effort they put into that part of the process, the easi-

er the other end will be for them. For marketing, it’s easy to sell great stuff – it’s not so easy to sell garbage.”

Proper cultivation of great cannabis plants is only half the battle when it comes to achieving high-quality cannabis products that Canadian cannabis connoisseurs have come to expect. The other half of the battle is won in post-harvest processing: drying, curing and packaging.

Oftentimes, the drying and curing can make all the difference for the end-consumer.

“You can take average genetics (cannabis plant), and with proper drying and curing, you can make a very enjoyable

smoke. It’s not going to get any better, but it will be more enjoyable,” says Kjolberg.

Compromising quality for more products to market is not the way to go. There may be a perception that mass-produced products may compromise the quality. When it comes to cannabis production: is more less better? Not necessarily, Kjolberg says.

“It doesn’t matter how much cannabis you produce, if you are set up properly to dry and cure, and you have people who are actually experienced and skilled in drying and curing cannabis, you can still dry and cure as much as you can produce.”

An ideal cannabis production facility, no matter the size, will have dedicated spaces for growing, trimming, drying and