DAIRY DELIGHTS

Constant innovation keeps pushing Maison Riviera to new heights PG. 11

CREATING HEALTHY COOKIES WITH OKARA PG. 24

+ FOOD SAFETY PG. 18 BUILDING A LISTERIA-RESILIENT FACILITY

Constant innovation keeps pushing Maison Riviera to new heights PG. 11

CREATING HEALTHY COOKIES WITH OKARA PG. 24

+ FOOD SAFETY PG. 18 BUILDING A LISTERIA-RESILIENT FACILITY

Rely on the Comitrol® Processor Line by Urschel for free-flowing coarse to smooth particle solutions.

Labor saving: Continuous single pass operation without operator adjustments. Optional HMI.

Choose from interchangeable reduction heads, impellers, and set-ups, including feeding method and motor size, to fit your production needs.

The Urschel global network of sales and support has expanded. Urschel Canada is now open in Ontario with full coverage throughout Canada.

Contact Urschel Canada to learn more: 647-910-5017 | canada@urschel.com

ED ITOR | Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

ASSOCIATE PUBLISHER | Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

MEDIA DESIGNER | Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR | Cheryl Fisher cfisher @annexbusinessmedia.com 416-510-5194

AUDIENCE DEVELOPMENT MANAGER | Anita Madden amadden @annexbusinessmedia.com 416-510-5183

GROUP PUBLISHER/VP SALES | Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO | Scott Jamieson sjamieson@annexbusinessmedia.com

Publication Mail Agreement No. 40065710

Subscription rates Canada 1-year – $86.65 per year Canada

Food in Canada is published 6 times per year by Annex Business Media. Occasionally, Food in Canada will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

No part of the editorial content of this publication can be reprinted without the publisher’s written permission @2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Tel: 416-442-5600 Fax: 416-442-2230

ISSN 1188-9187 (Print) ISSN 1929-6444 (Online)

I hope your summer is going well. This year, I decided to use the longer days of summer to visit as many F&B processing plants as possible. Discussions around the tariffs were inevitable, as we export 80 per cent of processed food and beverage products to the U.S. But the thing that stayed with me the most was the impact of recent immigration policy changes on F&B processors.

F&B processing is the largest manufacturing industry in Canada, employing 318,400 Canadians. It accounted for 20.3 per cent of total manufacturing sales in 2024. Canada has approx. 8,800 F&B processing establishments, with the vast majority (92 per cent) being small businesses.

Labour is one of the biggest challenges facing processors. According to Food Processing Skills Canada (FPSC), the Canadian F&B manufacturing industry needs to hire and retain approx. 92,500 people between 2023 and 2030. This is driven primarily by the need to replace an estimated 66,800 retirements and age-related exits while factoring in industry growth and labour productivity gains.

For years, the industry has relied on newcomers to fill crucial positions on the plant floor for several reasons including the benefit of paying low wages and holding onto a little more of the profits, if any.

Brent Cator, owner and president, Cardinal Meat Specialists, Brampton, Ont., explained that another major reason is the reluctance of young Canadians to engage in manufacturing work.

In his 40 years of experience in the meat packing business, Cator has found newcomers are hard working as well as willing to learn the required skills. At Cardinal Meats, workers who came from an agency employee have become plant managers.

Blair Hyslop, co-CEO of Mrs. Dunster’s Bakery, Sussex, N.B., has had a similar experience. He employs around 250 people and 55 to 60 per cent of them were not born in Canada.

“Our business is being managed by people who moved to this country and are trying to have an impact. They’re working alongside and training other people. They’re not adding to the burden of lack of infrastructure; they’re actually contributing to it,” he shared.

Recent changes to Canada’s immigration policies means we are going to seeing a reverse migration of sorts. People who came to Canada with the hope of becoming permanent residents and citizens will be forced to leave after their work permits expire. I’m not questioning the government’s decision to decrease immigration. Housing and health care capacity didn’t grow as much as

Nithya Caleb

population, resulting in an affordability crisis. The government had to curb immigration levels, but is it beneficial to send away people who have successfully integrated into the Canadian workforce?

“The Greater Toronto Area is the third largest further food processing region in North America. If you don’t have a population who is interested in plant manufacturing work, we have a real problem on our hands,” said Cator. “It’s a balance. Obviously as a country we want to do the right thing, but we can’t ignore our food industry that counts on people working manufacturing jobs. We need that.”

“We’ve taken a national approach to immigration,” added Hyslop. “We think that we have the same problems across the country, and that’s not true. If you talk to most business leaders in Atlantic Canada, they’ll tell you that we need more immigration here, not less. In New Brunswick, we still need more people if we want our companies to grow.”

Automation is often cited as the answer to the industry’s labour crisis. However, the technologies still require human intervention. Without adequate staff, our domestic food supply chain is at risk. We need an immigration policy that doesn’t affect operations in Canada’s largest manufacturing industry.

Nithya Caleb ncaleb@annexbusinessmedia.com

Dr. Amy Proulx

t’s quintessentially Canadian to link our food systems to the land. First Nations, Inuit, and Metis peoples crafted foodways that nourished their communities based on a vast knowledge of the food and medicinal uses of foraged plants. Entire Canadian industries are based on foraged products. Maple syrup, wild rice, and wild blueberries are produced using carefully managed forests, lakes, and lands, combined with modern food processing methodologies. There is a significant industry for harvesting wild mushrooms across Northern Canada, with both fresh distribution and dried products. Distilleries and breweries are looking for unique flavours and are working with traditional foragers to source plants for botanical extracts.

Food processors are now looking for unique ways to express Canadian flavour using foraged products. With the rise of this trend, food safety issues have come to the forefront.

First off, there are situations where lookalike plants and fungi can be problematic. Identification of harvested plants and fungi takes a high level of experience. It is possible to introduce false positives into the food chain, as well as declare false negatives, preventing people from commercializing harvests. Recent advances in AI, such as iNaturalist and Google Lens, make it tempting for anyone to think they are capable foragers. However, the identification models for these are notoriously flawed.

Recently, public health inspectors in my region could not identify locally harvested wild mushrooms, despite their positive identification features. Therefore

there must be a community of experts and knowledge keepers who can help train workers in proper identification methods.

Harvesting from areas with low chemical contamination is another food safety priority. Harvesting from heavily travelled roadways, railway zones and historical waste disposal areas and mine tailings could increase the chances of chemical contamination. Roadways and railway zones are often treated with pesticides and herbicides for vegetation control and are not regulated in the same ways as farm operations that have pesticide retention periods. Soil contamination can be problematic for heavy metals in areas where waste disposal or mining has occurred. Understanding the history of the land is essential for safe foraging. Additional chemical analyses for raw materials or finished products may be prudent.

Many wild foraged products are collected in remote and rural areas of Canada, providing meaningful employment opportunities. These areas also have longer distribution times, meaning good hygiene and manufacturing practices are essential for extending shelf life and quality. Foragers are food handlers; therefore, they need to learn good practices for handling products and have proper equipment for collection and storage. It’s entirely possible to perform

good food handling practices while in remote and resource-limited settings.

Appreciating the differences between traditional and medicinal use of plants versus the safe use of plants in today’s context is another food safety aspect of foraging. Traditional uses of plants are now being re-evaluated using a modern scientific context. For example, sassafras root was traditionally used for root beer, teas and brewery products; however, the United States Food and Drug Administration identified safrole, a compound which caused cancer in rat models, and imposed a ban on its use for many years, impacting Canadian producers. While this ban has been repealed, most companies now use safrole-free industrial extracts of sassafras instead of wild-harvested products. Wild ginger and mayapple are other plants with traditional food uses that have since been shown to have carcinogenic properties.

Foraging is an important part of Canadian food systems tradition, and a wonderful way to express Canadian identity through processed foods. Tradition and food safety can successfully combine for commercialization success.

Dr. Amy Proulx is program co-ordinator for the Culinary Innovation and Food Technology programs at Niagara College, Ont. She can be reached at aproulx@niagaracollege.ca.

Unlock possibilities with Dairy-Lo ®, Lactalis Canada‘s unique fat replacer made from 100% Canadian dairy. Dairy-Lo ® has proven to be an excellent tool to reduce the overall fat content in classic recipes while delivering desired functionalities of fat such as mouthfeel, creaminess, opacity but also water binding and texture.

Dairy-Lo ® can be used in a wide range of applications: A Low-Fat Dairy Solution with a Creamy Mouthfeel! An Innovative Tool to Provide Great Taste without the Need of the Upcoming Front of Package Labelling

Premier Canadian Dairy Ingredients Manufacturer: Butter | Cream Cheese | Cheese | Fluid & Evaporated | Functional Proteins | Milk Powders | Milk Replacers | Whey Powders | Whey Replacers lactalisingredients.ca

Email: ingredientsinfo@ca.lactalis.com

Gary Gnirss

ecently, we have been asked by clients if their artificial intelligence-based research into Canadian food labelling and compliance regulations returns accurate results. The results usually lead to wrong conclusions. To prove, I asked several leading free AI-based chatbots the same food compliance questions. Please note the comments below are not an exhaustive assessment of AI vs. food compliance. It is, however, fair to say that none of the AI programs answered all questions correctly.

I started by asking AI bots to find regulatory references for rules related to aspartame labelling. Most of the agents delivered what I was looking for quickly and provided a concise result. One AI referenced a former version of the regulations. However, AI agents provided answers faster than a typical web search.

I then asked them to find the Canadian regulations prohibiting the addition of vitamins to foods. This question required a bit more context to unravel. None of the AI agents found what I was looking for, which was D.03.002, FDR. All made up stories, hoping for the best. The results were fascinatingly incorrect. Some suggested that only vitamins in the List of Permitted Supplemental Ingredients are permitted. Others suggested only those noted in Division 24, FDR (Foods for Special Dietary Use), and 16 FDR (Food Additives), are permitted.

When asked which food ethoxyquin (a food additive) is permitted in Canada, only one AI agent gave the correct answer.

AI agents were then asked to evaluate a made-up list of ingredients for a cooked pasta product to see if it was compliant

with Canadian regulations. Most did not respond with any meaningful results other than to focus on added vitamin K, which is not permitted in pasta. One program offered detailed results, making it look like it an expert. Sadly, it was incorrect. Among the ‘misses’ was potential mustard allergen in

The current danger in fully relying on AI for food compliance is that the results are likely to be incorrect, inconclusive, or lacking critical information.

canola lecithin and water. The AI agent incorrectly said the lecithin must be stated as ‘Canola lecithin (emulsifier)’ and that vitamins and minerals of an enriched wheat flour must be declared.

I asked the agents to summarize basic food labelling rules. Most of them provided a good overview of the requirements. Some missed the need for best-before dates and country of origin requirements on imported foods. The result was basically a list of label features, but nothing in detail, such as how and where to place the information. Perhaps that should be a secondary prompt. I then uploaded a PDF of a U.S. food label and asked them to evaluate it for compliance with Canadian food labelling requirements. The results were interesting. I was pleasantly surprised the agents could even attempt this. Most of them correctly

assessed the label was not compliant with Canadian rules. All Al programs highlighted that French was missing. Some of them said the NFT and ingredient list were incorrect without providing reasons. One tried to crunch the nutrient information to see if FOP (front of package nutrition information) might be required, particularly for sodium. An FOP was not needed, but at least it prompted more thinking. One noted the label was missing a metric net content declaration, but then incorrectly suggested how to fix that with ounces in parentheses after the metric.

Where AI failed miserably was in addressing claims. Unlike with analyzing quantifiable nutrient values, claims require more context. The U.S. label included a low net carb claim with 26g of carbohydrate. One agent said the claim was wrong, good, and that it should be stated as ‘free of carbohydrates.’ One AI bot identified the net carb claim as being an issue by stating the Canadian Food Inspection Agency (CFIA), “generally advises against such claims as they can be misleading.” The same agent picked on the health claim on the label by stating, “Broad health claims like ‘healthy’ are generally discouraged or require specific substantiation if they imply a general health benefit.”

The danger in fully relying on AI for food compliance is that the results are likely to be incorrect, inconclusive, or lack critical information. Regulatory professionals need not worry about being replaced by AI, just yet. The technology can, however, help professionals more efficiently research compliance references.

Gary Gnirss is president of Legal Suites, specializing in regulatory software and services. His email ID is president@legalsuites.com.

Carol Zweep

he dairy industry continues to innovate through a sustainable approach. Efforts have been made on the farming side to decrease greenhouse gas emissions (by bovine methane reduction), water use, land utilization, and feed consumption. The dairy sector is also embracing innovative and sustainable packaging solutions.

From past to present

Packaging plays a crucial role in ensuring the freshness and quality of dairy products. Dairy packaging has come a long way. Fresh milk was delivered to homes in reusable glass bottles, and cheese was wrapped in paper. Demands for extended shelf life and consumer convenience, combined with processing changes, have seen an evolution in dairy packaging. Fresh milk has transitioned from glass bottles to cartons, plastic jugs, and pouches. Ultra-high-temperature (UHT) processing and aseptic packaging enabled milk to become a shelf-stable commodity. The shelf life of cheese has been extended with the use of modified atmosphere packaging in conjunction with barrier packaging.

and innovation

Many of the current packaging innovations focus on sustainability. This includes practices such as package reuse, material reduction, and recycling, as well as the development of compostable and bio-based packaging. Companies have embraced the circular economy for plastic packaging by designing for recyclability. The attention to sustainability will not only influence

packaging materials choice, but also encompass the entire process, from design and production to disposal. Several companies are leading the way with innovative packaging that supports sustainability. FrieslandCampina aims for 100 per cent recyclable packaging and is using packaging made from renewable plant-based materials. Lactalis Group’s strategy is to reduce packaging material use and incorporate post-consumer recycled material into its HDPE milk bottles. Nestle uses recyclable materials and QR codes on their packaging to provide consumers with nutrition information as well as data on the environmental impact of their products. Amcor has developed recycle-ready barrier dairy packaging that replaces non-recyclable multi-layer laminates. Tetra Pak has introduced plant-based polymers in their dairy cartons, thereby reducing the use of non-renewable, fossil fuelbased polymers.

and product tutorials).

Integration of QR codes and near field communication (NFC) tags allows information (e.g. product nutrition and health benefits) to be shared with consumers or turns packaging into a platform for storytelling. Research and development efforts are being made in nanotechnology and active and intelligent packaging. Nanotechnology introduces nano-sized particles that will improve mechanical strength and gas barrier properties without interfering with recycling efforts. Active packaging can incorporate antimicrobials and antioxidants to extend food shelf life. Embedding sensors into intelligent packaging can provide real-time data on product quality, environmental conditions, and supply chain integrity. These solutions still need to overcome technical, regulatory, and commercialization barriers.

Technological advancements have introduced smart packaging, which changes how brands interact with consumers, track products, and check authenticity. RFID tags facilitate traceability and efficient supply chain logistics. Interactive packaging like augmented reality-enabled packaging allows consumers to experience immersive content (e.g. virtual tours

The dairy packaging industry is evolving and is driven by demand for convenience, sustainability, and innovation. Brands embracing these trends are well-positioned to thrive in a competitive market. The future of dairy packaging minimizes environmental impact while maintaining functionality and promoting consumer engagement.

Carol Zweep is an associate with PAC Global. She is also a packaging researcher at Conestoga Food Research & Innovation Lab, Conestoga College.

Marsha Druker

very day across Canada, warehouses fill with shipments of fresh produce, freighted up from the fields of California and Florida. Nearly 60 per cent of the food we eat comes from the U.S., a trade relationship that has shaped everything from pricing to logistics. It’s also enabled a dangerous kind of complacency: if food goes to waste, we’ve always been able to bring in more. This mindset has defined Canada’s food system for decades. According to a Second Harvest report, we waste more than $58 billion worth of edible food every year, enough to feed 17 million people annually.

With fresh food historically cheap, plentiful, and reliably trucked in from the south, both dependence and inefficiency were easy to ignore. But not anymore. Canada’s food system is facing new pressures. The food waste crisis is a massive food security risk and an economic liability. It’s also one of the most immediate, actionable ways to strengthen our food system. We’ve already grown the food, moved it, processed it, stocked it, and often even purchased it and taken it home. Recapturing even a fraction of the $58 billion in wasted food could meaningfully increase domestic availability, without planting a single new acre.

The potential ROI for food waste solutions is tremendous. Global estimates peg food waste reduction as a $400-billion opportunity. Food waste solutions are coming from every corner of the country, but I’m particularly inspired by the solutions right in my backyard in Ontario.

To illustrate this potential, let’s take a hypothetical journey, exploring how

We have talent, the technology, and the collaborative ecosystem to become a global leader in food waste reduction.

solutions being developed by Ontariobased foodtech startups could eliminate waste in a batch of local spinach as it travels through the food supply chain. Part of the crop is destined to be blanched, frozen, and sold as a foodservice ingredient. At the processing facility, Index Biosystems’ edible BioTags (microscopic markers made from inert baker’s yeast) are applied at key control points along the production line. These tags serve multiple functions. They validate clean breaks between production runs, verify the effectiveness of sanitation protocols, and track the flow of ingredients through the system. If contamination is detected weeks or months later, the facility can identify the exact batches that were affected and avoid the broad, wasteful recalls often resulting in the disposal of perfectly safe food.

Elsewhere, fresh spinach is washed and wrapped in an advanced packaging solution currently being developed by Nfinite Nanotech. Their Spatial Atomic Layer Deposition nanotechnology applies a bio-based coating just one atom thick to recyclable paper packaging, injecting it with shelf-life extension qualities for fresh produce. The result is spinach that stays crisp and saleable for days longer.

The packaged spinach is now ready for distribution. In Ontario, it can be

ordered through Jitto, a sourcing platform designed for independent grocers and rural retailers. By incorporating data such as local sales trends and weather forecasts, the system helps reduce over-ordering and associated spoilage.

Each technology addresses a different point. Together, they help transform a delicate, short-lived product into one that can reliably move through the supply chain with minimal loss.

This potential has not gone unnoticed. Federal support for food waste solutions has swelled in recent years. Agriculture and Agri-Food Canada’s Food Waste Reduction Challenge and broader innovation priorities are supporting innovators and creating positive momentum. But we need to accelerate that momentum because Canada’s modern food system was largely built around the assumption of reliable access to cheap, fresh imports from the U.S. An assumption that is now a liability, and we can no longer afford to waste food.

Supporting food waste innovation is one of the fastest and most cost-effective levers we can pull to build a more selfreliant food economy. By investing in the kinds of solutions explored here, we can increase domestic food availability, improve resilience in the face of disruption, and make better use of the resources we already have. We just need to stop seeing food waste as an inevitability and start treating it as an opportunity.

Marsha Druker is Canadian Food Innovation Network’s regional innovation director for Ontario. She can be reached via email at marsha@cfin-rcia.ca.

— BY VAISHNAVI DHANDEKAR —

For over a century, Maison Riviera has been a beacon of innovation, quality, and passion in the Canadian food and beverage industry. What began as a small family business in the picturesque village of Sorel-Tracy, Que., has blossomed into a nationally recognized brand, renowned for its dedication to crafting delicious, nutritious, and inclusive products. From its humble roots as Laiterie Chalifoux to its current status as a trailblazer in both dairy and plant-based alternatives, Maison Riviera’s story is one of resilience, adaptability, and an unwavering love for food that nourishes body and soul.

Maison Riviera’s journey began in 1920 when Alexandrina Pelletier and her husband Napoleon Chalifoux decided to sell surplus milk from their farm to neighbours in Sorel-Tracy. By 1945, the company had evolved from a small family-run operation into a thriving dairy enterprise, becoming one of the first in the region to obtain a pasteurization licence.

The 1950s marked another transformative chapter as the company ventured into cheese production. In 1959, Maison Riviera produced its very first cheese. This innovation laid the groundwork for future breakthroughs, including the adoption of European ultrafiltration technology in 1989, a move that revolutionized the company’s ability to produce lactose-free cheeses.

Fast forward to 2015, and Maison Riviera once again disrupted the market with its Petit Pot Collection, a line of decadent European-style yogurts housed in tiny, elegant glass jars. Developed in collaboration with the Alsace Lait co-operative, this premium product quickly won multiple awards and captivated the hearts (and taste buds) of Canadian consumers. The Petit Pot Collection epitomizes Maison Riviera’s unique ability to seamlessly blend tradition with innovation, offering a luxurious, yet sustainable product that stands out in a crowded marketplace.

Never one to rest on its laurels, the company made another bold move in 2019 by stepping into the plant-based arena with its Vegan Delight range, crafted entirely from coconut milk. This strategic addition responded to the growing demand for dairy alternatives, and today, plant-based products make up half of Maison Riviera’s yogurt production—an impressive testament to the brand’s adaptability and forward-thinking approach.

Despite its many successes, Maison Riviera has had to navigate its fair share of industry challenges. The Canadian yogurt market is dominated by three major players, who control a staggering 96

per cent of sales, making it difficult for smaller brands to secure shelf space and compete on marketing budgets. But according to Jennifer Beauchamp, director of marketing at Maison Riviera, the company’s smaller size is actually a competitive advantage.

“We are small, so we can be agile. We can challenge ourselves. We don’t have 20 structures to go through for decision-making or R&D that takes three to four years to develop products. We’re challenging our teams to turn around products in six months,” said Beauchamp.

This ability to pivot quickly has allowed Maison Riviera to carve out a niche in the industry, launching more products like plant-based kefirs, oat-based beverages and yogurt.

Balancing its deep-rooted dairy heritage with the surging demand for plant-based alternatives has also been a delicate dance.

As Émilie Laurin, general manager of Maison Riviera, described it, “When plant-based started to become an important consumer demand, we saw an opportunity [to create] truly delicious products that were healthy and well designed with nutrition and selective ingredients in mind.”

By adapting its facilities to produce both dairy and plant-based products under one roof, the company has reinforced its commitment to evolving with consumer needs while staying true to its core values. With plant-based yogurts now comprising half of its production, the company anticipates even greater demand in the coming years.

Maison Riviera’s impact on the food and beverage industry extends far beyond its product lineup. The company has consistently been ahead of the curve, from pioneering ultrafiltration technology to its latest venture into upcycling. In 2025, Maison Riviera launched its first upcycled product line—a drinkable yogurt made with upcycled fruits and milk permeate, a byproduct of milk production. This forward-thinking initiative, certified by the Upcycled Food Association, underscores the company’s dedication to sustainability and responsible sourcing.

“We’re finding ways to revalourize even parts of the milk production. It is not something other companies have done,” said Beauchamp. “Usually, milk permeate is sold to animal feed or dried, but we’re incorporating about 30 per cent of it into our yogurt products. It’s about thinking about innovation in a different way.”

Sustainability will also remain at the forefront of Maison Riviera’s strategy. The company has transitioning from imported glass jars to lightweight, locally produced PET plastic jars that are more easily recyclable.

Beyond product innovation, Maison Riviera is deeply committed to its local roots and community.

“We are about all things Canadian, and our employees are mostly based in Quebec,” said Beauchamp. “We live and breathe local, and that’s going to be more and more our focus.”

As Maison Riviera looks toward the future, its mission remains clear: to continue innovating, championing sustainability, and responding to the evolving preferences of Canadian consumers.

The remarkable growth story of an Atlantic Canada bakery rooted in tradition and community — BY

JACK KAZMIERSKI—

For Blair and Rosalyn Hyslop, owning Mrs. Dunster’s Bakery is a lifelong dream come true. What started as a home-based business in 1968, with Ingrid Dunster making six donuts at a time in a cast iron pot in her kitchen, is now one of the largest commercial bakeries in Atlantic Canada with customers (retail, foodservice as well as institutions) across Canada and in Maine.

“My wife, Rosalyn, and I met 37 years ago,” says Blair. “We always talked about owning a business together one day, but career and family got in the way. So in 2014, when Mrs. Dunster’s Bakery was up for sale, we thought it was the opportunity that we had been waiting for since we met, so we decided to purchase it.”

When the Hyslops bought the business, they had 50 employees.

“Eleven years later, we’re now six times larger than we were when we started,” says Blair. “We’ve grown an average of 20 per cent per year over the last 11 years, but three of those years—during COVID—we didn’t grow at all, so really our growth rate in the remaining eight years would be more like 30 or 35 per cent a year.”

Currently, Mrs. Dunster’s Bakery owns and operates two facilities in New Brunswick. Their bakery in Moncton makes bread, rolls, and pizza shells. The company’s head office in Sussex, N.B., is home to a sweet goods bakery that makes cookies,

squares, brownies, as well as Mrs. Dunster’s famous donuts.

“We still fry our donuts in lard using Ingrid Dunster’s grandmother’s original recipe,” says Blair. “So it’s your grandmother’s donut, the way your grandmother would have made it.”

Both the bread, rolls, and pizza shell side of the business, as well as the cookie and donut side of the business are growing quickly.

“The Moncton facility was built four years ago and was the first commercial bakery built in Atlantic Canada in 20 years,” he says. “When we first started in this facility,

Headquartered in Sussex, N.B., Mrs. Dunster’s Bakery is one of Atlantic Canada’s leading producers of sweet treats and savoury rolls.

we were running at 25 per cent capacity. Today, we’re running seven days a week and we’re looking at tearing down the walls to grow the facilities even further.”

The 40,000-sf bakery in Moncton was built in November 2020, right in the middle of the pandemic, and against all odds, it was erected in time to prevent a possible shutdown of production.

“We had eight weeks before we had to move out of our old facilities,” says Blair, “and both the trades and our employees rallied together to build the bakery on time. It’s a real testament to the spirit here in Atlantic Canada.”

In addition to erecting a new bakery in Moncton, the Hyslops invested over $3 million to renovat their Sussex facility.

“We added 25 per cent capacity to the facilities in Sussex, and we really

think we’re going to grow our business in both bakeries,” says Blair.

Over the years, the Hyslops have made acquisitions to expand their portfolio.

“Today, Mrs. Dunster’s is the coming together of three different family bakeries,” says Blair. “The Snair’s Golden Grain Bakery [Borden-Carleton, P.E.I.], which we acquired in 2015, the McBuns Bakery in Moncton, which we acquired in 2017, and of course, Mrs. Dunster’s.”

Snair’s and McBuns Bakery operations have been consolidated at the Moncton plant. The Snair’s white bread as well as some of the more unique products, including molasses bread are produced at the Moncton facility.

The bigger facilities needed new equipment that could meet the Hyslop’s needs at the time, as well as keep up with future demands, as the company continues to grow. The bakery has Cinelli mixers, moulders, and ovens as well as a Reiser Vemag HP-20R with a sixlane rounding table.

“Unlike some of the larger bakeries, we have one line for bread and one line for

Precision and consistency are key factors in bakeries. Equipment like roll dividers must deliver accurate dough balls with perfect texture. Otherwise, the bakery will incur significant waste.

rolls,” he says. “So we need the equipment to be reliable and dependable. When it’s down, it’s damaging to our business.”

For instance, even though the Reiser Vemag was a significant investment for Mrs. Dunster’s, it was the right choice for the company at the time.

“We were on a very steep growth curve,” says Erin McClure, COO at Mrs. Dunster’s Bakery. “We were looking forward to the future, and we wanted to ensure we could meet not only today’s capacity, but also future demand.”

Blair adds, “Reiser came in with a roll divider for us that’s not only reliable, dependable and accurate all of the time, but also has significantly increased capacity for us to accommodate our growth.”

While reliable equipment is a must, so are capable employees. That’s why the Hyslops have gone to significant lengths to attract and retain quality staff.

“We have purchased houses for employees, for newcomers, when they land here in Canada so that they have an affordable place to live until they can find a place of their own,” says Blair. “We’ve become experts in immigration and recruitment because we had to.”

He explains that 11 years ago, when they bought the bakery, only one of their 50 employees was an immigrant.

“Today, we have 250 employees, and 55 or 60 per cent of them were not born in Canada,” says Blair. “We now have 13 different

nationalities working for us, and we speak 24 different languages at Mrs. Dunster’s.”

Blair adds he has quite a few employees who came to Canada to start a new life and he has never had any issues with finding staff.

“We’ve taken a national approach to immigration,” he says. “We think that we have the same problems across the country, and that’s not true. If you talk to most business leaders in Atlantic Canada, they’ll tell you that we need more immigration here, not less. In New Brunswick, we still need more people if we want our companies to grow.”

He’s especially concerned because many of the people in New Brunswick who are working towards their permanent residency might have to leave because they don’t yet have required work hours to qualify for permanent residency. Mrs. Dunster’s could lose 56 employees, and they’ll have to train a whole new set of employees, which is a ‘ridiculous prospect’ for the bakery.

The success of Mrs. Dunster’s Bakery is undeniable, and the growth of the business is enviable, and possibly even unstoppable.

“We believe we’re going to double again in the next three to five years, just based on the conversations we’re having now with customers,” says Blair. “And then I think we’ll double again in the subsequent five years. We’ve never had problems growing; we’ve never set out to grow; we’ve really just followed our nose, followed our customers; we’ve done what we feel is right, and the consequence of that has been growth.”

Produce your entire line of buns and rolls with a single, versatile Vemag Dough Divider

n Gently handles dough

n Unmatched scaling accuracy

n Precisely scales a wide range of dough portions

n Produces a variety of crumb structures

n Handles absorption rates from 45% to 95%

n No divider oil needed

n Fast, easy changeovers

n Come run your product with us at the Reiser Customer Center.

and reclaim, and zig

How consumer demands for protein, sustainability and supply chain resilience have become competitive advantages for the dairy ingredients industry.

The North American dairy ingredients market is experiencing a significant shift: consumers are increasingly favouring high-protein foods, clean labelling and sustainable sourcing, while the industry faces complex challenges around formulation costs, supply chain reliability and the need for transparent, collaborative partnerships. Aamir Asgarali, Vice-President of the Ingredients division at Lactalis Canada, shares insights on these trends and how the sector is well-positioned to respond.

What are the most significant trends you’re seeing in dairy ingredient demand across North America?

AA / High-protein foods remain a significant and growing trend. Historically, protein was often associated with exercise and muscle recovery, and that use still exists, but its importance in a general diet has become more mainstream. The broader trend is toward well-being, focusing on a balanced diet that includes fats, carbohydrates and protein. Functional foods targeting specific health benefits are also becoming more common. We see demand for the ingredients sector to simply

increase protein content, better produce other types of food through function, and provide ingredients that support gut health and complement natural sugars. This increased awareness is driven by greater public knowledge and information sharing, especially among newer generations who are more aware of the importance of protein and the impact of clean labelling. Environmental concerns are also a growing factor. Today’s consumers have higher expectations from their food suppliers, and this translates into manufacturers needing to make ingredients available and functional.

How are changing consumer preferences around nutrition, sustainability and clean labelling reshaping the landscape of dairy ingredients? AA / While nutrition, sustainability, and clean labelling have always been present in the dairy industry to some degree, they are now mainstream, which creates a great opportunity for dairy products. Dairy farmers are historic stewards of the land, caring for their animals, water and environment, long before consumers demanded it. Clean labelling, while not traditionally associated with dairy solutions, is now a clear opportunity to communicate the good. For example, whey protein was once considered low-value, but it has become one of the most dynamic proteins, in addition to offering functionality like moisture retention, stability, and emulsification – and all with a clean label. Cheese offers a balanced profile of fat, protein, vitamins and nutrients, and dairy products and ingredients contain nutrients that are highly bioavailable, offering benefits that are easy for the body to access. Ingredient suppliers need to reconsider how we approach the market and what information is shared with our customers, food manufacturers and consumers. Dairy has always been a nutritious natural food, and we as an industry need to communicate this to the public, focusing on awareness and information sharing about dairy’s benefits to food manufacturers and consumers.

AAMIR ASGARALI Vice-President, Ingredients Division

What are some of the most common formulation challenges that food manufacturers are facing, and what are some effective solutions?

AA / This is a hot topic for food manufacturers. Foods need to be formulated with a lot more science to meet diverse expectations. Clean and front-ofpack labelling are important, because things need to taste good in addition to meeting consumer needs. This leads to other challenges, like cost inflation and formulation complexity. Natural foods often associated with clean labels tend to be more expensive. Manufacturers face the challenge of balancing consumer demands with business sustainability – all while ensuring the product tastes good. Dairy offers a strong solution to many of these challenges. The milk drop is the perfect food: it meets water requirements in formulations, while also providing protein, carbohydrates and minerals. It also meets requirements for functionality and clean label. This is why I see strength in the dairy industry – natural dairy products may cost more, but their multifunctional benefits and consumer appeal make them a valuable investment.

How is the Canadian dairy ingredient supply system positioned to meet domestic demand considering challenges within the global dairy market?

AA / The Canadian dairy industry operates on a supply management system, which provides stability

through challenging times. Fortunately, we are a collectively strong industry, with passionate farmers and innovative individuals in the ingredients industry. Canada’s strong, highyielding milk supply and topquality ingredients have a great reputation, and we consistently have enough domestic production to meet local requirements. From an ingredients perspective, Canada imports quite a bit. While global trade has faced disruptions, our domestic production is robust, and ingredients are generally openly traded internationally, allowing us to complement our portfolio through imports.

The Canadian dairy ingredient industry is well-educated on the supply outlook, pricing, quality, and functionality. We are fortunate to have ample land, fresh water, and space, enabling farmers to consistently produce and even increase milk output. Professionals in the ingredients industry are also well educated on our supply capabilities and functionality of our products. This makes Canada well-positioned to meet demand and follow global trends, providing both Canadian and international solutions.

How can ingredients and food manufacturers effectively collaborate to ensure a reliable ingredient supply?

AA / It’s important to know who you’re working with and understand their interests and capabilities. Managing risk is not only about having multiple suppliers in case one isn’t enough. Manufacturers need to have confidence and regular

conversations with their supplier teams. The integrity of your supply comes from more than what you see on paper in a portfolio. You need to feel confident in the people you’re working with and know that if there’s a risk in the supply chain, the supplier will have a continuity plan in place. Having one trusted supplier that cares about its customers often goes much farther than having multiple mediocre suppliers.

Effective collaboration is not about who you “buy from” – it’s a “work with” partnership. This involves fully understanding your partner’s team and leveraging all divisions, including procurement, research and development, and supply chain teams to enable a sale. In today’s trade landscape and ingredient availability, effective collaboration must extend beyond your own product portfolio. A supplier that works with a manufacturer will help navigate issues like trade complexities, scheduling challenges or product development hurdles by involving technical teams and finding solutions. Suppliers should ensure consistency so manufacturers can plan their production. This also helps to control costs by offering an alternative if an ingredient becomes too expensive.

There are a lot of stakeholders when it comes to feeding the world. Suppliers must genuinely care about their customers’ success, not just making a sale. These relationships should be built on mutual respect and trust – consumers rely on it.

Lactalis Canada Ingredients is a premier dairy ingredients supplier, offering one of the most extensive products ranges in the country. From specialty and functional powders to condensed milks, butter, cream cheese and cheese, providing versatile options to meet a wide range of manufacturing needs. Lactalis Canada Ingredients is backed by a team of experts with deep industry expertise, partnering with customers to deliver innovative, tailored ingredient solutions. For more information, visit lactalisingredients.ca

Listeria monocytogenes (Lm) continues to be a major concern in food and beverage processing, particularly in environments where ready-to-eat (RTE) foods are produced. The bacteria’s ability to thrive in cold, moist environments (cold processing areas and chillers), resist low pH, freezing and high salt concentrations, and form biofilms makes it resilient and capable of persisting even in competitive microbial environments. It is a naturally occurring micro-organism commonly found in soil, sewage, untreated water, plants, slaughterhouse waste, etc.

To date, outbreaks have been detected across various food categories such as deli meats, leafy greens, melons, soft cheeses, RTE meat and poultry, and supplement shakes. Some foods are naturally contaminated with Listeria from their growth environment, while others are exposed to cross-contamination at the processing stage. Contaminated foods can cross-contaminate others, support bacterial growth, or allow Listeria to survive due to inadequate lethality treatments or kill steps.

The potential for the growth of Lm in food depends on factors such as pH, water activity, food formulation, background micro-organisms, the use of food addi-

tives, storage conditions, and shelf-life.

Biofilms in food processing

Lm strains can attach to surfaces and form biofilms, which are stubborn, complex, and multilayered. Interactions with other micro-organisms in the biofilm can enhance their ability to form thicker biofilms that are relatively more stable than monospecies. Some strains can strongly adhere to a variety of surfaces without forming biofilms, such as stainless steel, glass, polypropylene, rubber and food surfaces like chicken skin and beef. These biofilms protect Lm from desiccation, acids, and antimicrobial agents.

Occurrence and spread

The prevalence of Lm in a food production environment depends on several factors, including the type of food, processing method, incoming raw material, the effectiveness of cleaning and sanitation, the sanitary design of equipment and facilities, employee training, etc.

Some strains of Lm persist in the food environment for prolonged periods (months to years) and are hard to eliminate since they thrive in hidden, inaccessible spaces of equipment and premises that harbour dirt

Listeria monocytogenes is a naturally occurring micro-organism commonly found in soil, sewage, untreated water, plants, and slaughterhouse waste.

A list of targeted risk factors related to infrastructure, operations or humans that require control for effective mitigation and prevention of Listeria.

and organic matter supporting microbial growth. Transient populations are removed by routine cleaning and disinfection procedures but may recur from time to time. Most outbreaks have been linked to persistent Lm occurring in food production environments, which have necessitated recalls that affect public health and business reputation.

The spread of Listeria in processing environments can be attributed to environmental reservoirs (floors, walls, drains, etc.), raw materials, soil, biofilms, humans (soiled hands, gloves, shoes), equipment surfaces (hollow parts, tools, wheels, trolleys, etc.), contaminated cleaning aerosols and overhead drip, poor air and traffic flow, etc.

The focus of food processors, based on regulatory requirements and consumer health, is to implement effective Listeria mitigation and prevention strategies coupled with pathogen environmental monitoring and product testing programs for Listeria detection and control. Proven strategies when applied correctly can counteract the risk factors for Listeria spread, growth, and survival in food processing environments and the products themselves.

The purpose of hygienic zoning is to minimize the chances of transient strains from entering more sensitive areas identified in the food production facility. Hygienic zoning is site-specific and must keep in mind the relevance of the product and its ability to support pathogen growth. The design of cleaning and sanitation programs must be based on the outcome of the hygienic zoning, with highrisk areas requiring more demanding cleaning approaches.

Consumer demands for cleaner labels, natural ingredients, better nutritional profiles and great tasting foods have been on the rise. Conventional approaches such as sterilization, pasteurization, acidification, drying, etc., have been used to control Lm in food. However, they are harsh and disruptive to the nutritive and sensory properties of foods. Several novel control strategies that have emerged provide comparatively better results, but greater efforts are required to scale them up to an industrial level.

A ‘hurdle’ is a control measure aimed at eliminating, inactivating or inhibiting unwanted micro-organisms (e.g. pasteurization, use of preservatives, acidification, etc.). Hurdle technology incorporates the use of a combination of hurdles to provide a synergistic effect, which secures the microbial safety and stability, organoleptic and nutritional quality, and the economic viability of food products. The selection of hurdles to be applied in a combination depends on the type of food, water activity, density, microbial profile,

Risk assessment and controls for Listeria mitigation

Risk factor to be controlled

Infrastructure / Equipment

Inadequate area separation of raw and RTE food handling

Common entrance and exit points for smokehouses

Bolting of infrastructure and equipment supports to the flooring—unsealed at the floor and immovable during cleaning

Open hollows in product conveyors

Drainage flow from raw to RTE food side; lack of drainage backflow prevention devices; open trench drains alongside RTE food handling stations

Use of temporary repairs and delayed maintenance in/overhead product handling zones

Poor weld quality on food carts / product lines; dead legs on beverage transfer lines, etc. making cleaning difficult

Operational Practices

Wheeling of open product trolleys / carts over standing water

Poor cleaning and maintenance of air handling units, condensate catch pans and drains leading to overflow/drip

Insufficient disinfectant in foot dip stations

Opting for high pressure cleaning over low pressure systems (e.g. low-pressure foam cleaning)

Open plant cleaning / wet cleaning during food production

Inadequate rinse water temperatures to remove protein and fat residues on surfaces; incorrect disinfectant concentrations and contact times leading to ineffective disinfection

Lack of colour coding and incorrect storage of cleaning tools for food / non-food areas

Human Behaviour

Poor competence to comprehend the concept of niches and identify them for corrective measures in the food environment

Torn or contaminated glove use and poor hand washing

Primary food safety concerns

Product contamination

Niches; environmental contamination

Niches, environmental and product contamination

Aerosol, environmental and product contamination

Niches, drip, product and environmental contamination

Niches, product contamination

Splashes, product contamination

Niches, drip, potential aerosols, product and environmental contamination

Environmental contamination

Aerosols, environmental and product contamination

Aerosols, environmental and product contamination

Product contamination

Environment and product contamination

Environmental and product contamination

Product contamination

* Note: Environmental contamination often leads to product contamination due to cleaning activities and aerosols, traffic and human movement, product handling, etc.

Non-food Production

Offices, maintenance workshop, general employee welfare facilities (washrooms, dining, recreation, etc.), waste areas, etc.

Transition Sites before entering food production areas (entry rooms, lockers, changing rooms, hallways, etc.)

Food receiving, storage, general processing areas

General sanitation requirements

Handwash stations, foot washing/foot dips, air showers, protective clothing, etc. Food Production

High Risk Open RTE food or final product handling areas (e.g. interim storage areas, packaging sections, etc.)

Apply GMPs—cross contamination controls, equipment maintenance, personal hygiene, cleaning and disinfection, linear workflow, etc.

Risk based/ stricter sanitation controls for pathogen prevention, restricted entry, dedicated tools / equipment, additional personal hygiene precautions, etc.

* Note: Hygienic zoning can be depicted against a simple site-specific schematic diagram with colour coding.

residual effects on sensory and nutritional properties, etc.

The table on the right outlines a summary of the various novel strategies that can be used in combination to control Lm in foods and food production environments.

The objectives of pathogen environmental monitoring (PEM) are to determine the sources and harbourage sites of persistent Lm, verify control measure effectiveness, and determine potential threats, if any, to food, food contact surfaces, and the food environment.

Thermal

Non-thermal

Biocontrol

Natural

Chemical agents

Microwave; Ohmic heating; Radio frequency; Direct steam injection

High pressure processing; Pulsed electric field; Ultrasound; Ionizing irradiation; Ultraviolet

Bacteriophages; Bacteriocins; Competitive bacteria

Spices and herbs; Essential oils; Plant extracts; Organic acids

Chlorine and chlorine dioxide; Quaternary ammonium compounds; Hydrogen peroxide; Ozone; Nitrites; Phosphates; Peracetic acid

PEM must be designed based on a risk assessment of the facility, keeping in mind the nature of the food to support Lm growth.

While hygienic zoning directs PEM (sample types, sample plans, etc.) towards higher risk areas, the microbial results may necessitate redesign of the hygienic zoning when corrective measures call for modifications of food handling practices and food premises.

According to the U.S. Food and Drug Administration, Health Canada and the Canadian Food Inspection Agency (CFIA), PEM must be included in hazard evaluation for RTE foods exposed to the environment before packaging and do not receive any kill step to minimize Lm, such as deli meats, cold cuts, smoked seafood, prepackaged salads, fresh cut fruits and vegetables, refrigerated ready to eat meals, etc. Subtyping techniques are generally used to determine persistent Lm in the environment (e.g. whole genome sequencing [WGS], which can help determine persistent Lm strains). Overall, Listeria mitigation and prevention strategies must be risk-based, dynamic, suitable to the product needs and consumer expectations within the regulatory framework and form a critical part of an evolving HACCP-based food safety management system.

Nina Da Costa is a life protection enthusiast with proficiency in food and water safety, quality, health & safety, and sustainability. She is an accomplished management systems developer, auditor, trainer, speaker and author. She can be reached at ninadacosta99@gmail.com.

— BY KAREN BARR —

When it comes to alternative sweeteners, it can be a challenge for food manufacturers to make products that meet consumer requirements in terms of taste and texture. It isn’t always as simple as swapping one sweetener for another. Beyond sensory appeal and product quality, manufacturers must also consider consumer trends and government regulations.

Traditionally, sugar or sucrose has been used for its various properties in food manufacturing. Sweetness is just one attribute. Sugar is also used to balance flavour, preserve food, to add volume, and to achieve preferred texture, mouthfeel, colour, and taste. Given the varied roles, it’s difficult for manufacturers to find an exact replacement for sugar. Nevertheless, consumers are demanding products low in cane sugar as well as in artificial sweeteners.

Lynsey Walker, vice president of marketing and communications for the Canadian Health Food Association (CHFA), is seeing a clear consumer shift toward more natural options.

“Consumers are shifting away from products containing artificially derived sugar alternatives, such as aspartame, Ace-K, and sucralose. For Canadians avoiding cane sugar but still seeking a sweet treat, we are seeing a trend towards naturally derived sweeteners, such as xylitol, erythritol, stevia, date sugar, and monk fruit juice concentrate,” Walker says.

According to a report by Claight, the stevia market grew to US$761 million in 2022, with a forecasted annual growth rate of 10.8 per cent through 2028. Mondor Intelligence Industry Reports’ Monk Fruit Sweetener Market Size & Share Analysis - Growth Trends & Forecasts (2025-2030) revealed that North America was

the largest market for the sweetener. Globally, monk fruit sweeteners are expected to be valued at US$267.8 million by 2032.

Walker explains monk fruit extract is still only approved as a tabletop sweetener in Canada. In the U.S., many natural food products are utilizing monk fruit extract and allulose as sugar alternatives. These are not currently approved for use in Canada.

Allulose naturally occurs in fruits like figs and raisins. Under Health Canada’s Food and Drug Regulations, allulose is considered a novel food ingredient needing further study. While the U.S. Food and Drug Administration approves its use as an additive in food, some reviews have shown side effects, such as gas and bloating.

Fruit was the standout sweetener at the 2025 CHFA NOW Vancouver show.

“These products utilize the natural sweetness of fruit to recreate familiar treats, enabling consumers to satisfy their sweet tooth without relying on overly refined ingredients, while maintaining nutrition and fibre,” Walker says.

Based in London, Ont., Protein Candy specializes in creating innovative formulations that prioritize taste and texture. The company’s Classic Fruit Sour flavour was named the 2025 Product of the Year Canada in the Healthy Snacks category, voted on by over 4,000 Canadian consumers.

“We’ve delivered four unique SKUs, each with only 4g of sugar and 14g of protein per bag without any chalky aftertaste. The result is a macro-friendly, chewy candy that’s fruity and satisfying. It’s a first-of-its-kind offering in the confectionery aisle,” says Morgan

Kingdon, director of marketing for Protein Candy. “We took inspiration from traditional and low-sugar candy-making techniques, but ultimately, we started from scratch.”

Protein Candy combines monk fruit juice concentrate and stevia leaf extract to provide a plant-based sweetness. Monk fruit concentrate is 100-250 times sweeter than sugar, while stevia leaf extract is 200-300 times sweeter.

“Developing these candies took hundreds of benchtop iterations to find the right blend. Some of our other ingredients also contribute to mild sweetness, so it becomes a balancing act,” Kingdon says.

Mara Mennicken, founder and head chocolatier of the Good Chocolatier in Vancouver, B.C., swaps unrefined coconut sugar for cane sugar at a 1:1 ratio.

“The granule size is similar. Yet, our chocolate ends up tasting a little less sweet. My goal is for the delicious cacao flavour to be the first taste, with sweetness coming in second,” Mennicken says.

Monk fruit concentrate is also used to craft Good Chocolatier products. The company initially used monk fruit powder before it was banned in Canada.

“The powder is just ground down and feels like a cleaner form, while the juice concentrate can taste more artificial and is more processed, even with similar sweetness levels. I always use the highest strength, so I only need a tiny bit. Approximately 1 tsp of monk fruit juice concentrate can replace 200g of coconut sugar,” Mennicken says. Some products are crafted to incorporate maple syrup or honey, such as chocolate bars (e.g. 70% Honey Raspberry, 85% Honey &

Dates, and 75% Maple Crunch Pecan). The recipe is adjusted to accommodate liquid sweeteners.

“Coconut sugar is still used in the main base. It goes into the grinder with cocoa nibs and is refined into the chocolate mass. The liquid ingredients are added after the tempering stages,” Mennicken says.

Since honey and maple syrup have distinct and stronger flavours, only a small amount is needed.

“If I’m making a 4-kg batch and usually use 800g of coconut sugar, I might reduce the coconut sugar to 600g before adding the maple syrup or honey,” Mennicken explains.

The chocolatier admits that it is a trial-and-error process. When developing a recipe, the exact amount of maple syrup or honey added is dependent on factors such as the amount of fat in the chocolate. This determines how much liquid sweetener can be added without the chocolate losing temper. Mennicken states that adding liquid will slightly alter the thickness and crystallization of the product.

For consumers who prefer fruit as an alternative sugar, Bob’s Snails crafts pure fruit snacks like rolls, stripes, and gummies without added sugar, preservatives, or colours. Fruit is combined, pressed, and baked at a low temperature.

“Dates are nature’s candy,” says Cameron Morris from Humble Group USA, Napa, Calif. “About 18 months ago, we noticed a trend that consumers were shopping for dates beyond just ingredients for baking. Fitness enthusiasts and athletes were buying dates for a sweet treat. Dates are dense, nutritional, and slow to raise blood sugar because of the fibre content,” Morris adds.

Humble Group first started testing various flavour profiles. With an already sweet, naturally flavoured date as a base for a candy, the team wasn’t sure if they needed to add a natural sweetener to complement or balance the taste. It turns out they didn’t. There are seven flavours including Sour Cola, Sour Apple, Cookie Dough and Creamy Peanut Butter.

As manufacturers continue to create new food products to satisfy consumer demand for something sweet, it’s vital to be watchful of changing trends in ingredients and government regulations. Taste, sensory appeal, and product quality need to stay at the top of the mind for manufacturers.

Exploring okara’s potential as a sustainable, nutrient-rich food ingredient — BY

Food waste remains a pressing global issue, contributing to eight per cent of the world’s total greenhouse gas emissions. With increasing awareness of environmental concerns, the food industry is under pressure to adopt more sustainable practices. One emerging solution is the circular food economy, which repurposes food byproducts into new products for human consumption. This approach not only mitigates waste, but also creates value across the production chain. This study explored the potential of okara, a byproduct of soymilk production, as an ingredient to improve the nutritional profile of cookies while aligning with the principles of sustainability.

Okara, the hydrated insoluble fibre left after filtering soymilk, is often discarded or used as animal feed. However, it is rich in calcium, protein, isoflavones, and vitamin B, making it a nutrient-dense ingredient with great potential for upcycling. In Japan alone, approximately 800,000 t of okara are discarded annually, representing a significant underutilization of resources. Soy-based products, including soymilk and tofu, are widely recognized for their high protein content and heart-related health benefits. These attributes make okara an appealing candidate for developing functional foods that promote health and sustainability.

Despite its nutritional value, the use of okara in food applications has been limited due to its high moisture content and perishable nature. Drying and converting okara into flour can extend its shelf life and make it easier to incorporate into food products, such as baked goods. This process aligns with growing consumer interest in plant-based nutrition and reducing food waste.

The primary objective of this study was to determine the nutritional and functional properties of cookies made with okara flour as a partial substitute for wheat flour. Although previous research has highlighted the use of other byproducts, such as brewer’s spent grains and apple pomace, for upcycling into baked goods, limited studies have

investigated okara in cookies. By evaluating cookies’ protein, moisture, ash, and starch contents, this research aimed to uncover the benefits of incorporating okara flour into a widely consumed product.

In addition to nutritional analysis, texture and colour properties were assessed to ensure consumer acceptance. The study sought to strike a balance between enhancing nutritional value and maintaining desirable sensory attributes, such as texture and appearance.

Okara used in this study was sourced from a soymilk production plant and dried using a food waste dryer at 160 C for over seven hours, converting it into a shelf-stable flour. Ingredients for the cookies included vegan margarine, brown sugar, molasses, liquid egg, all-purpose flour, and baking soda. These ingredients were selected to create a vegan-friendly product, catering to the growing demand for plant-based foods.

Nutritional analysis was conducted using various methods: Dumas Combustion Analysis for protein content, gravimetric methods for moisture and ash content, and enzymatic kits for quantifying starch. Texture analysis was performed using a texture analyzer, measuring

parameters such as hardness and fracturability. A spectrophotometer was employed to assess colour attributes, including lightness (L*), redness (a*), and yellowness (b*).

The addition of okara flour significantly enhanced the nutritional profile of the cookies. Okara cookies exhibited higher protein, moisture, and ash content compared to control cookies made entirely with all-purpose flour. This indicates an increase in mineral content and overall nutritional value. The high protein content in okara aligns with consumer preferences for protein-enriched foods, particularly among health-conscious individuals and athletes.

In contrast, control cookies contained more total starch, including resistant and digestible starch. This is attributable to the higher starch content in wheat flour. While starch contributes to the structure and texture of baked goods, reducing its content can be advantageous for individuals seeking lower glycemic index foods.

Texture analysis revealed okara cookies were softer and more fracturable than control cookies. These properties can be attributed to the higher moisture content of okara flour, which contributes to a chewier texture. This texture profile is desirable for many consumers, particularly in the context of cookies.

Colour analysis showed okara cookies were darker and redder than control cookies, which appeared lighter and yellower. The Delta E value, a measure of colour difference, confirmed a perceptible difference between the two types of cookies. The darker colour of okara cookies could be due to Maillard reaction, which occurs during baking and is influenced by the protein content of the dough.

The findings of this study underscore the potential of okara as a sustainable and nutritious ingredient in baked goods. The higher protein and mineral content of okara cookies makes them a healthier option compared to traditional cookies. Additionally, the chewier texture and darker colour offer a unique sensory experience.

The use of okara aligns with several industry trends, including sustainability, plant-based nutrition, and functional foods. As consumers become more aware of the environmental impact of their food choices, products made from upcycled ingredients are gaining traction. Okara cookies represent a tangible example of how food waste can be transformed into value-added products.

However, there are challenges to consider. The higher moisture content of okara flour may affect the shelf life of the final product, necessitating further research on preservation methods. Additionally, consumer acceptance studies are needed to gauge the market potential of okara-based products. Factors such as taste, texture, and packaging will play a crucial role in determining their success.

The incorporation of okara into cookies also highlights the potential for scaling up production. By collaborating with soymilk manufacturers, bakeries can source okara as a low-cost ingredient, reducing waste at the source and creating economic opportunities. This approach supports the circular food economy.

Upcycling okara into cookies represents an innovative step toward reducing food waste while delivering nutritional and functional benefits. This study demonstrates that okara can enhance the protein and mineral content of cookies without compromising their sensory qualities. As the food industry embraces sustainability, okara and other byproducts can play a vital role in creating value-added products that benefit both the environment and consumers.

Future research should focus on optimizing formulations to improve shelf life, exploring additional applications of okara in other food products, and conducting large-scale consumer acceptance studies. By addressing these challenges, the potential for okara to contribute to a more sustainable food system can be fully realized.

The growing interest in upcycled foods presents an opportunity for innovation and collaboration across the food industry. Ingredients like okara can help bridge the gap between environmental responsibility and consumer demand for nutritious, high-quality products.

* The author, a food scientist, conducted this research while pursuing her master’s degree in food science at the University of Guelph, Ont. Dr Iris Joye was her advisor for this project.

—

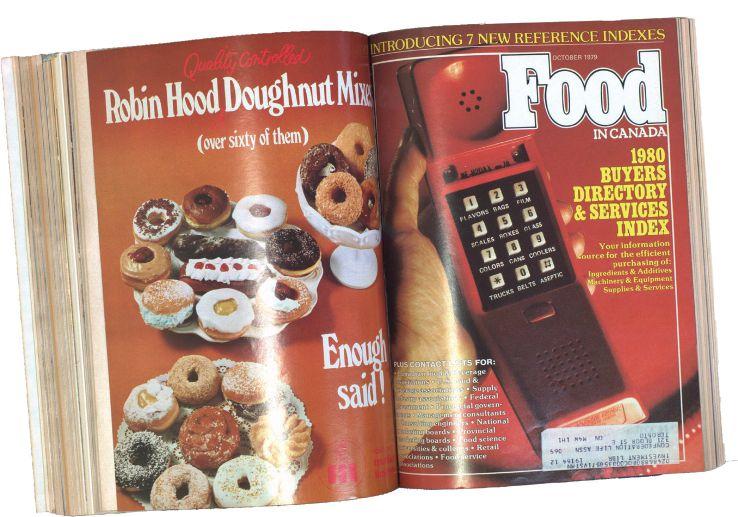

We continue our 85th anniversary coverage. In this issue, we focus on the period between 1968 and 1981. This era witnessed significant advancements in packaging and beverage processing. Several far-reaching food-related regulations were passed during that period. We also saw major consolidation in the industry.

In the early 1970s, four of Canada’s 16 breakfast cereal manufacturers accounted for 95.3 per cent of all goods shipped by the industry. Four of eight sugar refiners controlled 92.4 per cent of the market. The top four vegetable oil millers were handling 81.8 per cent of all shipments. The top four flour millers accounted for 76.9 per cent of the sales. The top four slaughtering and meat processors, representing one per cent of the industry, delivered 55 per cent of the shipments.

In the early 1970s, it was decided that provincial marketing boards would handle annual production quotas for turkey. We had around 13,000 turkey producers in the 1970s.

In 1973-74, the industry came together to standardize retorting practices. They published the Canadian Food Industry Code of Practices for Heat Processing of Low-Acid Products in Hermetically Sealed Containers. They also organized a series of five-day courses for retort operators and supervisors. It took a long time, but in 1975, the federal government gazetted its first set of

regulations regarding the use of protein materials to ‘extend’ and ‘simulate’ meat and poultry food products. They specified the inclusion of seven vitamins and five minerals in these products.

In 1977, federally inspected slaughter of beef was 3.8 million head, 3 per cent increase over 1976. It was estimated that 46 per cent of beef sold in retail was in the boxed form.

In the late 1970s, Quebec led the country in hog production, more than 30 per cent of the national total.

Another large step in the direction of supply management boards was taken in 1979 when then agriculture minister Eugene Whelan created a national chicken marketing agency. The agency set annual production targets. It also developed a cost of production formula

to help provincial boards determine pricing. There was considerable debate about the use of nitrate in meat curing. Some were calling for the discontinuation of the practice. At that time food researchers in the federal government stressed a ban would cause food poisoning outbreaks and the end of the ham, wiener and bacon industry in Canada. A study by the Meat Packers Council of Canada found the minimum economic loss to the bacon industry would be $301.6 million. While there was no official ban on the use of nitrate, the debate motivated companies to lower the amount of nitrate being used in the curing process.

In the early 1970s, many provinces joined the national supply management program for manufacturing milk and cream, as well

as the national egg marketing plan. In Nov. 1977, Canadian production of specialty cheese stood at 106,505,000 lb, a 14 per cent increase over 1974. The sale of 2 per cent milk continued to grow during this period. However, the 1977 picture of butter sales was dismal. In 1966, butter production was 329,655,000 lb. By 1977, production was down to 249,249,000 lb.

A 12 per cent sales tax on confectionery was lifted after 50 years in the early 1970s, a welcome news for the industry.

The Quebec baking industry got some help in 1973. For years, bread had been the favourite loss-leader sales gimmick of retailers. The Quebec government ruled that going forward, the use of loss-leader advertising of bread can only be employed at

point of sale. Sadly, imports of bakery products from south of the border impacted the industry. In British Columbia and Alberta, as much as 100,000 units were imported from Washington state every week. Bread was cheaper to manufacture in the U.S. as flour cost was $2 per cwt lower in the U.S. than in Canada. Labour cost was also 21 per cent lower in Seattle than in Vancouver.

The sale of whole wheat bread continued to grow while bran bread and stone-ground wheat bread was becoming popular.

Canada’s first peanut processing plant was opened in the early 1980s in Windham, Ont. Owned by grower Jim Picard, the plant then had the capacity to process 5,000 tons of products.

The federal government approved the manufacture and sale of fish protein concentrates in Canada for human use in 1970.

In 1973, Canada began fishing cod in the Labrador-Northern Grand Banks area of northwest Atlantic where a large stock was found. The freezer-trawler had to be strengthened to operate in ice.

For the first time, Coho and Chinook salmon from Canada’s first Pacific salmon farm, Mocassin Valley Marifarms, a division of Pacific Diesel Brake, went on sale in 1974.

In 1977, Canada took full control of all fisheries within a 200-mi territorial limit

on both the Atlantic and Pacific coasts. This helped the industry recover. The value of shipments rose steeply. In 1978, with $1.1 billion in exports, Canada became the world’s leading exporter of fishery products.

In the 1970s, Environment Canada issues guidelines on industry effluents. Standards were set for the fishing, potato processing, meat and poultry, dairy and fruit and vegetable processing industries.

In 1969, Canada banned the use of artificial sweetener cyclamate, as it was carcinogenic. This was devastating for the most rapidly growing section of the soft drink industry— sugar-free beverages. The estimated loss to the industry was more than $15 million.

Saccharin, which was first synthesized in 1879, was embraced by the industry after cyclamate was banned. By 1974, sales bounced back to the same level as they were before the ban. Reintroduced diet soft drinks accounted for 11 per cent of the market share. In 1977, tests showed saccharin was associated with cancer of the bladder in lab rats, and the government banned its use. The industry protested this ban as they had no viable artificial sweetener to use until August 1981 when aspartame was approved.

In 1977, for the first time, imported wines had a greater market share (51.35 per cent) than domestic products. Quebec allowed grocery stories to sell Quebec wine.

In 1977, low-calorie, reduced alcohol beers were introduced in Canada.

In 1979, Canada banned the use of 1.5-L soft drink bottles due to safety concerns as the bottle could shatter under certain circumstances. Nine months after the ban, the industry was still sitting on more than $40 million of inventory.

From the 1960s, consumers were concerned about environmental issues and waste. The beverage industry was criticized for using one-trip packaging. Governments started enacting rules to limit litter. British Columbia led the way by making it mandatory for

bottlers to refund two cents on the return of any soft drink package in 1970. Similar systems were adopted in other provinces.

All non-returnable soft drink containers were banned in Alberta in 1972. Saskatchewan outlawed one-trip soft drink and beer packaging in 1973. By 1974, 25 per cent of the soft drink industry’s products were being merchandised in returnable bottles.

In 1976, Ontario banned the use of plastic containers, aluminum cans, and non-returnable glass containers larger than 1.5 L.

The retail value of frozen food sales increased by 115 per cent between 1960 and 1968. In 1977, retail sales of frozen foods was $748,316.900. Frozen fruit production stood at 127,277,000 lb.