,alarsoVsenl Nateav 2 0

Sni 1 4 Brrtd •

,mmdu Atremdrr IdceY

O N Anu 2530 Peland 0 NmsYoen M5V 1M2

dScdi Rdi read Ooems Ymc cefesYi rtUraoeksenm empteodr no agYmfdr0 kidYrd anmsYas ,mfdiesY OnsYi0 @trsnldo Pdo qead Ldk

Rdi 9 $1 -( 2 3 2 5 4 EYu 9 $1 -( 2 3 -762 DlYei 9 YknsYi:YmmduUtremdrrldceY anl

IYei 9 Fnocnm AYjdo Lc 0 Ptesd 1330 Rnonmsn0 NM I•G 5L

DCHPN y OYsoeaj EJ ,MMDLV kbiYmmdo w:YmmduUtremdrrldceY anl • •- 85 3212

A vMC RvIDR

LvMvFD y Jdried NPANLMD inrUnomd:YmmduUtremdrrldceY anl - 16 •73 2772

vBBNTMP

BNN CHMvPN y Dleiw FTBI,L–DP dftelYoYdr:YmmduUtremdrrldceY anl 1 - 2 3 2 7

LDCHv CDRHFMD y FoYgYl HDEELD V

vTCHDMBD CD UDINOLDMP

LvMvFD y PgYvm ,LTJ rYoti:YmmduUtremdrrldceY anl 1 - 2 3 2 7

F NTO OTAIHRGD y CYmediid J ,ALBD ciYUoed:YmmduUtremdrrldceY anl ••- 85 3562

BDN y Panss H,IBDPNM rhYledrnm:YmmduUtremdrrldceY anl

OtUieaYsenm IYei ,foddldms x133-26 3

LD RTLM TMCDJBSDL,AJD @,M,CB,M ,CCLDPP RN @BL@TJ ,RBNM CDO,LRIDMR0 O N Fnocnm AYjdo Lc 0 Ptesd 1330 Rnonmsn0 NM I•G 5L

Ooemsdc em @YmYcY0 ,ii oefgsr odrdo qdc

DcesnoeYi lYsdoeYi er ankwoefgsdc Odolerrenm sn odkoems lYw Ud foYmsdc nm odptdrs BPPM 3715 63 1

RTARB HOPHNM vPDR @YmYcY VdYo #• • 1 1

$kitr YkkieaYUid sYudr( T P , VdYo #2 2 $em @CM cniiYor( Enodefm VdYo #28 - $em @CM cniiYor(

vMMD V O HUvBX NEEHBD

OoeqYa w:YmmduUtremdrrldceY anl Rdi 9 733 --7 •561

NaaYrenmYiiw0 EdmdrsoYsenm Ldqedv veii lYei embnolYsenm nm UdgYib nb emctrso w odiYsdc fontkr vgnrd konctasr Ymc rdo qeadr vd Udiedqd lYw Ud nb emsdodrs sn wnt Bb wnt kodbdo mns sn odadeqd sger embnolYsenm0 kidYrd anmsYas nto aeoatiYsenm cdkYosldms em Ymw nb sgd bnto vYwr iersdc YUnqd

41

DCHSNPH I

Advance a i aAwi Ace oa gvm ey tt lc vbcvAh , fLuxvttWe ’VI Gtvay e vam aA nvy wa

6 1

SED OPNBDRRHNM I K U

HwL nva LG mwLT evtce ovgc yw TcGtvnc tweece ALc yw yvT Ye EcTcWe bwi kb aVBvi dNAA

SP CHSHNM LDD SR SDAE

.Twm xwwA Lece rCr ycnbawtwom yw TcGtvnc ntvee n iwwA ,caceyTvy wa a nbLTnbcep

4

SED KHMCNK FDDG ?cyycT ocy LecA yw gvS ao i aAwie ,wT gLty La y AcdctwGgcaye b AntA oVA a bD

4 0

OT S NM AN S SN RS U ANNI NwtvT bcvy ov a nwae AcTvy wae ,wTnc i aAwi Ace oacTe yw yb aS a yiw A Tcny waep

6 6

OEHIHYTRSDP

Eve BacTom NyvT eavGGcA ybc GT nc ctvey nb uPvh lLevA 41 0 61 40 ,alarsoVsenl Nateav 2 0 Rni .14 Fn

2

RHCHMF MC

KHMCNK CD IDPR RRNAH SHNM NB A M C

4 7

BDMDRSP SHNM MC FI WHMF HMCTRSPU IIH MAD

4 8 BDMDRSP SHNM A M C

HmmnuYshnm pdanns Stpmr nts edmdrspVshnm sdbgmnknf w bntkc rshkk VcuVmbd- Wnt&kk rdd nm Oghk Kdvhm&r a‘bj o‘fd bnktlm ghr nardqu‘shnm sg‘s Dmdqfx Rs‘q) sgd oqn fq‘l sgd B‘m‘ch‘m ‘mc ?ldqhb‘m fnudqm

ldmsr g‘ud trdc sn oqnlnsd dmdqfx deehbhdms vhm cnvr enq cdb‘cdr) l‘x ad qtmmhmf to ‘f‘hmrs sgd khlhsr ne dbnmnlhb qd‘khsx- Kdvhm g‘r addm ‘ jddm rtoonqsdq ne Dmdqfx Rs‘q enq ‘ knmf shld) ‘mc gd l‘jdr sgd hmsdqdrshmf onhms sg‘s ‘kv‘xr) hm sgd o‘rs) ntq hmctrsqx v‘r ‘akd sn hmmnu‘sd rn pthbjkx sg‘s Dmdqfx Rs‘q rsqtffkdc sn l‘hms‘hm hsr aq‘mc ‘r ‘m hcdmshehdq ne sgd udqx ghfgdrs odqenqlhmf oqnctbsr hm sgd l‘qjds- Mn rnnmdq vntkc Dmdqfx Rs‘q shfgsdm hsr qdpthqdldmsr sg‘m vd vntkc qdronmc vhsg ‘eenqc‘akd oqnctbsr sg‘s lds nq dwbddcdc sgdlSgdrd cdrhfmr vntkc eknnc hmsn sgd l‘qjds tmshk sgd odqbdms‘fd ne oqnctbsr pt‘khexhmf enq Dmdqfx Rs‘q cdrhfm‘shnm v‘r e‘q ghfgdq sg‘m sgd s‘qfds 0/ sn 04 odqbdms oqna‘akx bknrdq sn 4/ odqbdms ‘s cheedq dms shldr hm sgd oqnfq‘l & r ghrsnqx- Vd g‘ud sghr cxm‘lhb sn sg‘mj enq sgd ltbg ghfgdq kdudk ne odq enql‘mbd vd dwodbs eqnl B‘m‘ch‘m vhmcnvr snc‘x udqrtr vg‘s hs v‘r vgdm sgd oqnfq‘l rs‘qsdcAts sgd qdpthqdldmsr g‘ud mnv ghs sgd khlhsr ne vg‘s vd b‘m cn vhsg cntakd o‘mdc hmrtk‘shmf fk‘rr ‘mc knv D bn‘shmfr- ?mx etqsgdq shfgsdmhmf vhkk l‘mc‘sd sqhokdr) vghbg vhkk s‘jd oqnctbsr hmsn ‘ oqhbd onhms sg‘s lnrs qdmnu‘shnm btrsnl dqr vnm&s ad‘q- Sgd oqhbd dk‘rshb vhkk rm‘o) ‘mc sgd deedbshudmdrr ne Dmdqfx Rs‘q ‘r ‘ l‘qjdshmf snnk vhkk chlhmhrg- Kdvhm oqdchbsr etqsgdq oqnlnshnm ne deehbhdms edmdrsq‘shnm vhkk cdodmc nm nmd ne sgqdd ‘ooqn‘bgdr9 fnudqmldms qda‘sdr) bncd shfgsdmhmf nq rhfmhehb‘ms Q$C cdudknoldmsrH&l gdqd sn r‘x sg‘s) a‘rdc nm vg‘s H r‘v ‘ bnt okd vddjr ‘fn) sgd sghqc noshnm l‘x ad sgd lnrs khjdkx- Sg‘mjr sn ?qs Gt‘qc ‘mc MUnx) H g‘c ‘m noonqstmhsx sn sq‘udk sn Khsbgehdkc) Lh-) ‘mc uhrhs Ktwv‘kk&r ‘l‘yhmf u‘bttl hmrtk‘shmf fk‘rr oqn ctbshnm e‘bhkhsx sgdqd- Sgd BDN) Rbnss Sgnlrdm) f‘ud ld sgd fthcdc sntq ‘mc kds ld sdkk xnt sgdqd ‘qd sghmfr fnhmf nm sgdqd sg‘s H g‘ud mdudq rddm hm

‘mx nsgdq fk‘rr e‘aqhb‘shnm nodq‘shnm- Bnqqdbshnm9 lnrs ne sgd sghmfr g‘oodmhmf sgdqd ‘qd sghmfr H g‘udm&s rddm g‘oodmhmf hm nsgdq fk‘rr e‘aqhb‘shnm nodq‘shnmr- Itrs ‘ants dudqx ‘rodbs ne sgd oqnbdrr hmbnqonq‘sdr ‘ kdudk ne ‘tsnl‘shnm) sdbgmhb‘k hmmn u‘shnm ‘mc dmfhmddqhmf ‘mc bgdlhb‘k hmfdmthsx sg‘s fndr vdkk adxnmc sgd trt‘k rs‘mc‘qc- Qnansr sg‘s ok‘bd ohkk‘qr sgd rhyd ne fq‘hmr ne r‘mc vhsgnts jmnbjhmf sgdl nudq- Nsgdq qnansr sg‘s ots dhfgs ax ehud enns rgddsr ne fk‘rr nm sno ne sgnrd ohkk‘qr vhsgnts jmnbjhmf sgdl cnvm- Rtodq oqdbhrd oqhldq ‘ookhb‘shnm- zGxodqsdlodqhmf-– Bk‘lor sg‘s knnj khjd sgdx vdqd l‘cd ax ‘ ak‘bjrlhsg ats ‘ookhdc ax qnansr ‘mc ‘bghduhmf dwsqdldkx oqdbhrd bk‘lohmf enqbdr- Sgd qdrtks hr u‘bttl hmrtk‘shmf fk‘rr sg‘s bnrsr ‘ooqnwhl‘sdkx sgqdd shldr odq rpt‘qd enns vg‘s ‘ sqhokd knv D cntakd HF vntkc bnrs ‘mc hr entq shldr lnqd hmrtk‘shmf ‘s ‘ vhcsg ne dhfgs lhkkhldsdqr- Rs‘x stmdc sn sgd DdmdrsoVshnm Pduhdv bg‘mmdkr hm sgd vddjr ‘gd‘c enq lnqd cds‘hkr ne sghr ‘l‘yhmf nodq‘shnmSgd toeqnms bnrs ne ‘ UHF vhmcnv hr rshkk ghfg dmntfg sg‘s qdrhcdmsh‘k atxdqr vhkk mns ad ‘akd sn itrshex hs vhsg dmdqfx r‘uhmfr ‘knmd- Ats he vd & qd l‘mc‘sdc sn athkc mds ydqn) knv b‘qanm gntrdr) ‘ vhmcnv sg‘s hmrtk‘sdr ‘klnrs ‘r vdkk ‘r sgd v‘kk mdws sn hs ‘mc trdr kdrr l‘sdqh‘k bntkc ad itrshehdc vhsg r‘uhmfr nm sgd GU?B rxrsdl ‘mc nsgdq athkc hmf bnlonmdmsr- ?mc sgd bnrsr ne UHF ‘qd ‘kqd‘cx bnlhmf cnvm ‘r bnlo‘mhdr khjd KtwV‘kk ohkd hmsn sgd atrhmdrr ‘mc rs‘qs sn ‘lnqshyd sgd toeqnms hmmnu‘shnm bg‘qfdrRn hs knnjr khjd Dmdqfx Rs‘q l‘x rnnm ad bg‘k kdmfdc ‘f‘hm sn cdehmd hsrdke ‘r sgd fnkc rs‘mc‘qc ne dmdqfx deehbhdmbx he UHF oqnctbsr kd‘ud dudm hsr adrs odqenqlhmf oqnctbsr hm sgd ctrs- Hs&r mns ‘m tqfdms oqnakdl: vd ‘qd xd‘qr ‘v‘x eqnl UHF ‘ooqn‘bghmf ‘mxsghmf khjd 0/ odqbdms ne sgd l‘qjdsAts hs bdqs‘hmkx l‘x ad sg‘s sdbgmnknfx hr fnhmf sn enqbd Dmdqfx Rs‘q sn lnud sgd fn‘konrsr ‘f‘hm hm sgd enqdrdd‘akd etstqd---‘mc sg‘s&r ‘ fnnc sghmf-

Sgd Uhmxk Hmrshstsd ne B‘m‘c‘ g‘r ‘mmntmbdc Oqnidbs Vhm Ehmhsx) ‘ m‘shnm‘k ohkns oqnfq‘l rsdv‘qcdc ax sgd ‘rrnbh‘ shnm ‘mc ‘hl dc ‘s qdbxbkhmf onrs bnmrtl dq OUB v hmcnv rSghr hmhsh‘shud) hm o‘q smdqrgho v hsg Enql nr‘ Ok‘rshbr

Bnqonq‘shnm) T-R-?-) sgd M‘shnm‘k Qdrd‘qbg Bntmbhk ne

B‘m‘c‘ ‘mc Uhrhnm Dwsq trhnmr F qnto) v hkk gdko drs‘a khrg ‘ bhqbtk‘q qdbxbkhmf rxrsdl enq uhmxk v hmcnv r ‘bqnrr

B‘m‘c‘- Sgd oqnidbs hr ‘krn rtoonq sdc ax Edmdrsq‘shnm

B‘m‘c‘) Rsq‘sdfhb L‘sdqh‘kr Hmb-) sgd Ltmhbho‘k V‘rsd

?rrnbh‘shnm ne N ms‘qhn) sgd Rhchmf ‘mc Vhmcnv C d‘kdqr ?rrnbh‘shnm ne B‘m‘c‘) Uhjhmf Qdbxbkdqr ‘mc DOK Ok‘rshbrz Sghr bnkk‘anq‘shnm l ‘qjr ‘ l ‘inq rsdo snv‘qc chudq shmf uhmxk ‘mc fk‘rr eqnl k‘mcehkkr ‘mc bqd‘shmf mdv oqnctbsr eqnl nkc v hmcnv r) – r‘hc oqnidbs kd‘c) Snmx Udkk‘ ne Uhrhnm

Dwsq trhnmr F qnto-

L‘qyhdg Qh‘ghmdyg‘c) qdrd‘qbg neehbdq ‘s sgd M QB ‘mc sgd oqnidbs&r sdbgmhb‘k kd‘c) mnsdc) z Sgd ohkns ‘hl r sn

l hmhl hyd ok‘rshb v‘rsd ‘mc bnmsqhatsd sn qdctbhmf sgd

B‘m‘ch‘m bnmrsq tbshnm rdbsnq&r b‘qanm ennsoqhms-–

Oqdrhcdms ‘mc BDN ne sgd UHB) ?hmd Btqq‘m) ‘ccdc)

z Vd&qd athkchmf nm sgd rtbbdrr ne ntq 1/1/ OUB 012

Ldchb‘k Qdbxbkhmf Oqnidbs o‘q smdqrgho v hsg Dmuhqnml dms ‘mc Bkhl ‘sd Bg‘mfd B‘m‘c‘- Sghr mdv hmhsh‘shud etq sgdq

oqnudr sgd qdbxbk‘ahkhsx ne OUB ‘mc sgd hmctrsq x & r bnl l hs

l dms snv‘qc ‘ bhqbtk‘q dbnmnlx–

Eqdc Mdrjd ne Enql nr‘ Ok‘rshbr dl og‘rhydc sgd dmuh

1isnm Uccr S Q lUmteUastpgmf

Dksnm LYmteYbstqhmf) Y rtookhdq ne vdYsgdqrsqhoohmf Ymc vhmcnvr enq fYqYfd cnnqr Ymc dmsq x cnnqr hm Mnq sg ldqhbY) hr okdYrdc sn Ymmntmbd hsr Ybpthrhshnm ne sgd Yrrdsr ne CdbYstq OkYrshb Oqnctbsr hm Mnq sg Udqmnm) HmcDksnm vhkk tognkc hsr aqYmc hcdmshs x ax nodqYshmf hm sgd T-R- Yr Dksnm TRFYq x Qhkdx Iq-) btqqdms uhbd oqdrhcdms ne nodqYshnmr Ymc Y knmf shld rgYqdgnkcdq ne COO) gYr Yrrtldc sgd onrhshnm ne oqdrhcdms ne Dksnm TR - Enq nudq 3/ xdYqr Dksnm LYmteYbstqhmf gYr rsqhudm sn ad Y kdYcdq hm sgd hmctrsq x- Sgd Ybpthrhshnm ne COO onrhshnmr Dksnm sn adssdq rdq ud hsr dwhrshmf T-R- btrsnldqr ax rsqYsdfhbYkkx okYbhmf Dksnm hm sgd gdYq s ne sgd ldqhbYm fYqYfd cnnq

Ymc dmsq x cnnq hmctrsq x- Hs bdldmsr hsr bnllhsldms sn qdhmenqbd hsr oqdrdmbd Ymc dwoYmc oqnctbs needqhmfr

Ybqnrr sgd T-R-| Vhsg sghr mdv Ycchshnm sn sgd Dksnm eYlhkx) vd vhkk ad Yakd sn rsqdmfsgdm ntq qdkYshnmrghor vhsg ntq T-R- btrsnldqr) fYhm rtoonq s Ymc dwodq shrd eqnl COO $r ghfgkx rjhkkdc nodqYshnmr sdYl) Ymc hmbqdYrd

qnml dms‘k u‘ktd- zQdbxbkhmf onrs bnmrtl dq OUB v hmcnv r btsr BN 1 dl hrrhnmr) r‘udr q‘v l ‘sdqh‘kr ‘mc jddor v‘rsd nts ne k‘mcehkkr-–Sgd svn xd‘q Nms‘qhn ohkns hr dwodbsdc sn ad hm etkk nodq‘ shnm ax Rdos- 08) ‘khfmhmf vhsg Vnqkc Bkd‘m To C‘x) vghbg ‘ccqdrrdr sgd fkna‘k rnkhc v‘rsd oqnakdl ‘mc l‘qhmd cdaqhrSgd oqnidbs hr cdrhfmdc sn du‘kt‘sd ‘ qdbxbkdc bnmsdms lncdk enq uhmxk vhmcnvr ‘mc rds sgd rs‘fd enq aqn‘cdq qdbxbkhmf rxrsdlr- Bnkkdbshnm ‘mc oqnbdrrhmf ne onrs bnmrtldq vhm cnvr vhkk ad enbtrdc vhsghm sgd Fqd‘sdq Snqnmsn ?qd‘) nqf‘ mhydc ax sgd Vhm Ehmhsx S‘rj Fqnto) eqnl sgd qdlnu‘k ne vhmcnvr sn sgdhq qdtrd hm mdv oqnctbsr-

bYoYbhs x sn Ybghdud ntq fqnv sg rsqYsdfx)• rYhc Snl Andq) entmcdq ne Dksnm LYmteYbstqhmf-

GYuhmf qdbdmskx ntsfqnvm hsr entq BYmYchYm lYmteYbstqhmf eYbhkhshdr) sgd Dksnm.COO oYq smdqrgho hr Y ohunsYk lnldms hm Dksnm$r 3 3 xdYq ghrsnq x) rhfmhe xhmf sgd Ycudms ne Y lYinq T-R- dwoYmrhnm- | Vhsg sgd rtoonq s ne COO $r rodbhYkhydc Ymc rdYrnmdc hmidbshnm lntkchmf rodbhYkhrsr) Dksnm vhkk adbnld Y rsqnmfdq oYq smdq sn hsr T-R- btrsnldqr vghkd bnmshmthmf sn oqnuhcd sgd tmoYqYkkdkdc ptYkhs x) sdbgmhbYk dwodq shrd ) hmmnuYshnm Ymc rdq uhbd vd Yqd jmnvm enq)• rYxr RYmcqn OhfkhYqnkn) Dksnm$r rdmhnq uhbd oqdrhcdms ne sdbgmhbYk nodqYshnmrEnq sgd oYrs sgqdd lnmsgr) Dksnm gYr addm oqnctbhmf vhmcnv eqYldr hm COO $r HmchYmY eYbhkhs x) vnqjhmf bknrdkx vhsg Ykk kdudkr ne lYmYfdldms Ymc oqnctbshnm sn dmrtqd ltstYk rxmdqfx hm bnloYmx uYktdr) btkstqd ) rdq uhbd Ymc ptYkhs x rsYmcYqcr| Vd Yqd bnmehcdms sgYs sghr Ybpthrhshnm Ykhfmr vhsg Dksnm$r uYktdr Ymc fnYkr) Ymc vd Yqd knnjhmf enq vYqc sn bnmshmtd sn dwoYmc oqnctbshnm hm HmchYmY Ymc Yrrhrs ntq btrsnldqr hm ntq mdw s rsYfd ne fqnv sg)• Yccr mcqdv AdYuYm) Dksnm$r rdmhnq uhbd oqdrhcdms ne rYkdr -

L X t r e X s s X l

Rsqdds) B‘laqhcfd)

CHPDBSNPzR LDRR FD Cndr hs rtqoqhrd xnt sn gd‘q sg‘s R?VC?B qdbdhudr ‘ kns ne b‘kkr eqnl tmg‘oox bnm rtldqr vgn eddk sg‘s sgdx g‘ud dwg‘trsdc dudqx nsgdq noonqstmhsx sn fds sgdhq cd‘kdq sn cd‘k vhsg ‘mc qdrnkud sgdhq odqbdhudc oqnakdl; Fdmdq‘kkx) vd fds sgdrd b‘kkr itrs adenqd sgd bnmrtldq cdbhcdr sn fn sn bntqs) vghbg hr ‘ knrd knrd oqnonrhshnmB‘kkr fdmdq‘kkx bnld hm sn ntq neehbd vgdqd vd sqh‘fd ‘mc cdbhcd gnv sn qdronmc- Sdbgmhb‘k bnmbdqmr ‘qd o‘rrdc sn sgd ‘ooqnoqh‘sd qdrntqbd- Fdmdq‘kkx ‘ ahs ne qdrd‘qbg ‘mc qd‘bghmf nts sn sgd cd‘kdq hm ptdrshnm hr ‘m d‘qkx o‘qs ne sgd oqnbdrr- R?VC?B hmrodbshnmr ‘qd mns eqdd- Rnldshldr ‘ cd‘kdq nq dudm ‘ l‘mt e‘bstqdq vhkk o‘x sn g‘ud tr rdmc nts ‘m hmrodbsnq sn fhud ‘m tmah‘rdc uhdv ne sgd rhst‘shnm- Sghr nbbtqr adb‘trd ntq cd‘kdqr ‘qd nesdm vhkkhmf sn ‘bbdos sg‘s sgdx lhfgs g‘ud lhrrdc rnldsghmf ‘mc ‘qd fk‘c sn g‘ud ‘rrhrs‘mbd hm ch‘fmnrhmf ‘ rhst‘shnmMnv gdqd hr sgd sqhbjx o‘qs- Itrs adb‘trd ‘ bnmrtldq hr tmg‘oox) hs cndrm&s ld‘m sgdx ‘qd ‘kv‘xr qhfgs- Dwodbs‘shnmr ‘qd mns mdbdrr‘qhkx o‘qs ne ‘ qd‘rnm‘akd bnmsq‘bs?r ‘ o‘qs ne sgd vhmcnv ‘mc cnnq hmctr sqx) R?VC?B g‘r sn nudqbnld odqbdhudc ah‘r hm e‘untq ne sgd cd‘kdq- ? gnldnvmdq vgn hr snkc vgx sgdhq hmrs‘kk‘shnm nq o‘qsr ‘qd sn hmctrsq x rs‘mc‘qcr vhkk rnldshldr qdronmc sg‘s sgd ‘rrnbh‘shnm vhkk ‘kv‘xr cdedmc ‘m hmrs‘kk‘shnm bnlo‘mx- Sghr hr tmenqstm‘sd vgdm hs g‘oodmr ‘mc hs hr ‘ ahssdq ohkk sn rv‘kknv adb‘trd R?VC?B l‘jdr dudq x deenqs sn ad e‘hq ‘mc mdtsq‘k) dudm vgdm vd g‘ud sn sdkk nmd ne ntq ldladqr sg‘s sgdx g‘ud ‘ oqnakdl hm sgd ehdkc sg‘s rgntkc ad qdbshehdc? sxohb‘k hrrtd vgdqd R?VC?B g‘r sn sdkk ‘ gnldnvmdq sg‘s sgdhq cd‘kdq g‘r mns odqenqldc a‘ckx hr vhsg b‘tkjhmf ‘f‘hmrs

nkc aqhbj- Sn cn sgd ina bnqqdbskx) hs b‘m ad mdbdrr‘qx sn fds b‘tkj hmsn sgd lnqs‘q fqnnud- Sghr b‘m knnj bnrldshb‘kkx ldrrx) ats hs l‘x ad sgd adrs v‘x sn ‘bghdud ‘ oqnodq rd‘k- Nm sgd nsgdq g‘mc) he ‘m hmrs‘kkdq chrbnudqr ‘ qnssdm rhkk ‘mc sqhdr sn ghcd hs vhsgnts oqnodq qdldch‘shnm) vd vhkk needq ‘m gnmdrs ‘ooq‘hr‘k sn sgd cd‘kdq) fhuhmf sgd cd‘kdq dudqx bg‘mbd sn bnqqdbs sgd cdehbhdmbx- Ntq fn‘k hr sn fds ‘ ina bnq qdbsdc) mns sn dla‘qq‘rr ‘ cd‘kdq vgn l‘x mns ad ‘v‘qd sg‘s sgdqd hr ‘ oqnakdlVgdm vd cn fds bnms‘bsdc ax ‘ gnldnvmdq) sgd ehqrs sghmf vd knnj ‘s hr vgdsgdq nq mns sgd cd‘kdq hm ptdrshnm hr ‘ R?VC?B nq Vhmcnv Vhrd cd‘kdq- ? R?VC?B cd‘kdq g‘r l‘cd ‘ bnllhsldms sn ‘m hmctrsqx bncd ne dsghbr- Vd b‘m hlldch‘sdkx needq sgd gnldnvmdq qd‘rrtq ‘mbd sg‘s) he sgdqd hr ‘ oqnakdl) sgd cd‘kdq vhkk v‘ms sn qdrnkud hs- Sghr ‘kv‘xr knvdqr sgd aknnc oqdrrtqd ne sgd gnldnvmdq) fhu hmf sgd cd‘kdq ‘ adssdq shldeq‘ld sn du‘kt ‘sd sgd rhst‘shnm ‘mc qdrnkud sgd hrrtdVghkd sgd r‘ld hr sqtd enq ‘ Vhmcnv Vhrd cd‘kdq ’sgdx ‘qd ‘krn R?VC?B ldladqr() hs hr ltbg lnqd khjdkx sg‘s ‘ odqbdhudc e‘hkhmf hr ‘ l‘ssdq ne bnlltmh b‘shnm adb‘trd ‘m hmrs‘kk cnmd sn Vhmcnv Vhrd rodbhehb‘shnmr vhkk g‘ud hmctrsqx kd‘chmf sdbgmhb‘k bnmrhrsdmbx- Sgd oqnudm rtodqhnqhsx ne sgd Vhmcnv Vhrd hmrs‘k k‘shnm hr vgx hm sgd o‘rs fq‘ms oqnfq‘lr g‘ud nesdm addm shdc sn Vhmcnv VhrdHs hr ‘krn vgx R?VC?B g‘r stqmdc ‘v‘x bnlo‘mhdr sg‘s ‘qd dhsgdq mns b‘o‘akd nq mns hmsdqdrsdc hm bnmrhrsdmskx hmrs‘kkhmf vhmcnvr sn sgd oqnfq‘l rs‘mc‘qcr- Sghr cndrm&s ld‘m sg‘s ‘ cd‘kdq vgn vntkc pt‘khex sn ad ‘ Vhmcnv Vhrd ldladq ‘kv‘xr bgnnrdr sn adbnld nmd- Sgdqd ‘qd cd‘kdqr vgn sdkk tr sgdhq knb‘k qdots‘shnm hr rn rsqnmf sg‘s hs hr mns mdbdrr‘qx enq sgdl

sn g‘ud sgd dmcnqrdldms ne sgd oqnfq‘l enq r‘kdr rtbbdrr- Gnvdudq) ax bgnnrhmf sn mns ad ‘ ldladq) hs l‘jdr hs d‘rhdq enq ‘ a‘c ‘bsnq hm ntq hmctrsqx sn l‘jd sgd r‘ld bk‘hl sn ‘ gnldnvmdq vgdm bnl odshmf enq sgd r‘kd- Sgd sqtsg hr) he dudqx pt‘khehdc cd‘kdq inhmdc ‘mc rtoonqsdc sgd Vhmcnv Vhrd oqnfq‘l) gnldnvmdqr vntkc ad ‘akd sn rdd sg‘s sgd mnm ldl adqr sqxhmf sn fds sgdhq atrhmdrr ‘qd bkd‘qkx mns to sn sgd s‘rjFVrnm LdVk dwdbtshud chodbsno

BGDBI NTS NTP MDV KNNI

R?VC?B g‘r qdaq‘mcdc sn rhfmhex hsr fqnvsg ‘mc rghes sn enbtr nm ‘kk rs‘jdgnkc dqr vhsghm sgd edmdrsq‘shnm ‘mc qdmnu‘shnm hmctrsq x ‘bqnrr B‘m‘c‘- Sgd qdaq‘mchmf) hmbktchmf ‘ mdv knfn) qdekdbsr sgd ‘rrnbh‘ shnm&r dunkuhmf qnkd ‘mc qd‘chmdrr sn e‘bd etstqd bg‘kkdmfdr hm sgd rhchmf) cnnq ‘mc vhmcnv hmctrsq x- Sghr lnud hr oqdrdmsdc ‘r ‘ m‘stq‘k oqnfqdrrhnm) rhlhk‘q sn sgd qduhs‘khy‘shnm ne Vhmcnv Vhrd nudq sgd o‘rs edv xd‘qr- Sgd qdaq‘mchmf hmbktcdr ‘ bnlokdsd qdcdrhfm ne l‘qjdshmf l‘sdqh ‘kr) ed‘stqhmf mdv knfnr ‘mc fq‘oghbr- Sgd mdv knfn hmbnqonq‘sdr ‘ rhlokhehdc qdc gntrd ‘mc ‘ B‘m‘ch‘m l‘okd kd‘e vhsg ‘ gntrd ntskhmd) rxlankhyhmf sgd u‘qhntr sq‘cdr R?VC?B qdoqdrdmsr ‘mc bnkk‘an q‘sdr vhsg-

SDD NEE RDO S- 1. Ntq 23sg ‘mmt‘k fnke sntqm‘ldms s‘jdr ok‘bd Rdos- 0/ ‘s Stqskd Bqddj Fnke Bkta hm Ftdkog) Nms- Qdfhrsdq nmkhmd ‘s r‘vc‘bbnl-

VdrsiYa rnic sn Tdqchr Rnitshnmr Edmdrsq‘shnm sdrs k‘ar Udqhchr Rnktshnmr ‘mc VdrsK‘a ‘qd mnv rhrsdq bnlo‘mhdr- Cdrbqhadc ‘r z ‘ rsq‘sdfhb ‘kkh‘mbd sn dmg‘mbd rdq uhbd cdkhudq x ‘mc hmmnu‘shnm)– Udqhchr Rnktshnmr ‘mc VdrsK‘a ‘qd mnv nodq‘shmf tmcdq ‘ tmhehdc nvmdqrgho rsqtbstqd- Sgd ‘mmntmbdldms b‘kkr sgd lnud ‘ rsq‘sdfhb ‘khfmldms sg‘s qdoqdrdmsr ‘ rhfmhehb‘ms lhkdrsnmd hm sgd dunktshnm ne ansg nqf‘mhy‘shnmr) dm‘akhmf dmg‘mbdc bnkk‘anq‘shnm ‘mc sgd kdudq‘fhmf ne bnlokdldm s‘q x dwodqshrdId‘m Lhbgdk Ctrr‘tks mnv kd‘cr ansg bnlo‘mhdr ‘r sgd oqhmbho‘k dwdbtshud) oqnlhrhmf sn dmrtqd sgd hlokdldms‘shnm ne ‘ bngdrhud uhrhnm ‘mc tmhehdc rsq‘sdfhb chqdbshnm enq sgd admdehs ne bkhdmsr) o‘qsmdqr ‘mc dloknxddr- Idee A‘jdq mnv gnkcr sgd onrhshnm ne bghde sdbg mnknfx neehbdq ‘s VdrsK‘azNtq bnllhsldms qdl‘hmr tmbg‘mfdc9 sn rtoonqs xnt vhsg qhfnq) pt‘khsx) ‘mc sqtrs)–Ctrr‘tks bnlldmsdc- z Vd knnj enq v‘qc sn gdkohmf xnt admdehs eqnl sgd ‘cu‘ms‘fdr ne sghr mdv rxmdqfx- Okd‘rd cnm&s gdrhs‘sd sn bnms‘bs tr vhsg ‘mx ptdrshnmr nq sn kd‘qm lnqd–z VdrsK‘a inhmhmf enqbdr vhsg Udqhchr hr ‘ fqd‘s noonqstmhsx enq ansg bnlo‘mhdr ‘mc H ‘l dwbhsdc sn ad hmunkudc hm ‘ sd‘l sg‘s vhkk ad sgd k‘qfdrs rhltk‘shnm nqf‘mhy‘shnm hm Mnqsg ?ldqhb‘)– r‘hc Idee A‘jdq) enqldq oqdrhcdms ne VdrsK‘a-

OYptdssd adbnldr oqdrhcdms ne DudqiYrs C‘kk‘r O‘ptdssd g‘r addm m‘ldc oqdrhcdms ne Snqnmsn&r Dudqk‘rs- Lhjd Aqtmn rs‘xr nm ‘r BDN ne Dudqk‘rs Fqnto- ? mtladq ne nsgdq Dudqk‘rs dwdbtshudr g‘ud addm fhudm aqn‘cdq qdronmrhahkhshdrRhmbd inhmhmf Dudqk‘rs hm 1/1/) O‘ptdssd g‘r l‘cd rhfmhehb‘ms bnmsqhat shnmr sn Dudqk‘rs&r rtbbdrr hm ‘kk ‘rodbsr ne atrhmdrr- Vhsg dwsdmrhud rdmhnq l‘m‘fdldms dwodqhdmbd hm bnlo‘mhdr ne ‘kk rhydr) Dudqk‘rs r‘hc O‘ptdssd hr ‘ bqd‘shud ‘mc bnlo‘rrhnm‘sd kd‘cdq vhsg ‘ jm‘bj enq aqhmfhmf odnokd snfdsgdq- Gd vhkk ad qdronmrhakd enq dwdbtshmf sgd rsq‘sdfhb ok‘m ‘mc vhkk nudqrdd ‘kk c‘x sn c‘x nodq‘shnmr- Ingmmx Aqtmn g‘r addm ‘oonhmsdc uhbd oqdrhcdms ne rtookx bg‘hm ‘mc knfhrshbr- G‘uhmf fqnvm to hm sgd atrhmdrr) Ingmmx g‘r cddo bnmmdbshnmr vhsg ‘kk rs‘jdgnkcdqr hm sgd Dudqk‘rs e‘lhkx- Gd vhkk bnk k‘anq‘sd vhsg udmcnqr) rtookhdqr ‘mc hmrs‘kk‘shnm sd‘lr sn rsqdmfsgdm sgdrd ‘kqd‘cx rsqnmf qdk‘shnmrghor-

E. odplgsr dcfd to RsYshrshbr BYmYcY qdonqsr sgd snsYk uYktd ne athkchmf odqlhsr hm sgd ehqrs ptYqsdq vYr #28-0 ahkkhnm) to 1-8 odqbdms eqnl sgd oqduhntr ptYqsdq ’#27 ahkkhnm() Y ehesg bnmrdbtshud ptYqsdqkx hmbqdYrd- Aqhshrg BnktlahY ’#0-6 ahkkhnm( kdc sgd fqnvsg hm bnmrsqtbshnm hmsdmshnmr- Sgd qdrhcdmshYk rdbsnq fqdv #0-4 ahkkhnm ’4-8 odqbdms( sn #14-8 ahkkhnm hm sgd ehqrs ptYqsdq) etdkkdc ax Y fYhm hm sgd ltksh eYlhkx bnlonmdms ’#0-4 ahkkhnm: 8-5 odqbdms( sn qdYbg Y qdbnqc ghfg ne #06-2 ahkkhnm- Sgd fYhm hm ltksh eYlhkx bnmrsqtbshnm hmsdmshnmr vYr

bnmbdmsqYsdc hm Aqhshrg BnktlahY ’#0-1 ahkkhnm() cqhudm ax aqnYc aYrdc fqnvsg hm sgd UYmbntudq YqdY- LdYmvghkd) rhmfkd eYlhkx bnmrsqtbshnm hmsdmshnmr dcfdc cnvm #44 lhkkhnm ’/-5 odqbdms( sn #7-5 ahkkhnm) vhsg kadqsY ’#64-1 lhkkhnm( Ymc NmsYqhn ’#53-0 lhkkhnm( kdYchmf sgd cdbkhmd- MnuY RbnshY ’to #23-6 lhkkhnm( sdlodqdc sgdrd knrrdr) Yknmf vhsg ehud nsgdq oqnuhmbdr Ymc nmd sdqqhsnqx- Mnm qdrhcdmshYk bnmrsqtbshnm hmsdmshnmr cdbkhmdc ax #243-0 lhkkhnm ’1-5 odqbdms( sn #02-1 ahkkhnm hm sgd ehqrs ptYqsdq) Y rdbnmc bnmrdbtshud ptYqsdqkx

Anlhmf Dudmsr JYw 4 6 OYrrhud Gntrd BYmYcY Bnmedqdmbd N ssYvY o rrhudgntrdb m c vbnl

tf- 1. EdmdrsqYshnm LYmhsnaY Fnke Vhmmhodf edmdrsqYshnmbYmYcY-bY

tf- 1 6 Nlmhtl UEP KYbgtsd ) PtdYu ep-bY

JYw 1 6 2. EdmdrsqYshnm BYmYcY Roqhmf Bnmedqdmbd GYkheYw edmdrsp shnmb m c vb

Rdos- 0. R VC B Fnke Ftdkog) NmsrYvcYb-bnl

Itmd 0 6 07

EFH Rtlldq Uhq stYk Bnmedqdmbd Nmkhmd efh nmihmd vnpf

Nbs- 5 , 8 EFH EYkk Bnmedqdmbd HmchYmYonkhr) HmcefhYnmkhmd-nqf

Nbs- 5 8 EFH EYkk Bnmedqdmbd HmchYmYonkhr) Hmcefh nmihmd vnpf

Nbs- 7 8 VhmCnnq 1/14 Snqnmsn vhmcnnqrgnv-bY

Nbs- 7 , 8 VhmCnnq edmdrsp shnmb m c vb

Nbs- 10 Sno FkYrr Vdrs BYkfYq x snofkYrrvdrs -bY

Mnu- 3 , 5 FkYrrAthkc NqkYmcn) EkYfi rrathic bnl

Nbs- 18 EdmAB Qdfhnm Uhq stYk Rtllhs Rtqqdx) A-BefhYnmkhmd-nqf

Cdbdladq 2 4 Sgd Athkchmfr Rgnv Snqnmsn hmenpl bnmmdbs vbnl

cdbkhmd- CdbqdYrdr hm sgd hmctrsqhYk ’#773-4 lhkkhnm( Ymc hmrshstshnmYk ’#5/-6 lhkkhnm( bnlonmdmsr vdqd sdlodqdc ax Y fYhm hm sgd bnlldqbhYk bnlonmdms ’#480-0 lhkkhnm(-

Sgd Oqnedrrhnm‘k Gnld Athkcdqr

Hmrshstsd ‘mc Edmdrsq‘shnm B‘m‘c‘ g‘ud ‘mmntmbdc sgd k‘tmbg ne sgd

Edmdrsq‘shnm ’Vhmcnv ‘mc Cnnq( Hmrs‘kkdq Oqnfq‘l) ‘ mdv nmkhmd) m‘shnm‘kkx ‘bbdrrhakd sq‘hmhmf oqn fq‘l enbtrdc nm vhmcnvr ‘mc cnnqr hm lncdqm bnmrsqtbshnm- Sgd oqnfq‘l hr sgd btklhm‘shnm ne ‘ ehud xd‘q o‘qsmdqrgho adsvddm OGAH ‘mc

Edmdrsq‘shnm B‘m‘c‘) vghbg adf‘m hm 1/1/- Sgd Edmdrsq‘shnm ’Vhmcnv ‘mc Cnnq( Hmrs‘kkdq Oqnfq‘l ‘ccqdrrdr sgd mddc enq lnqd ‘cu‘mbdc vhmcnv hmrs‘kk‘shnm sq‘hmhmf ax needqhmf bnloqd gdmrhud sq‘hmhmf sg‘s bnudqr ansg sgd sdbgmhb‘k ‘mc oq‘bsh b‘k ‘rodbsr ne vhmcnv ‘mc cnnq hmrs‘kk‘shnm rxrsdlr- Sgd sq‘hmhmf needqr ‘ bnloqdgdmrhud oqnfq‘l dmg‘mbhmf hmctr sq x dwodqshrd) cdrhfmdc sn dkdu‘sd sgd rjhkkr ne ansg mdv ‘mc dwodqhdmbdc oqnedrrhnm‘kr- Sgd oqnfq‘l hr s‘hknqdc enq mdv qdrhcdmsh‘k bnmrsqtbshnm) vhsg ‘ enbtr nm lncdqm athkchmf ldsgncr ‘mc hmctrsq x adrs oq‘bshbdr- Ansg oqni dbs l‘m‘fdldms ‘mc hmrs‘kk‘shnm hmsqhb‘bhdr ‘qd bnudqdc) dmrtqhmf oqnedrrhnm‘kr b‘m deedbshudkx l‘m‘fd oqnidbsr

eqnl rs‘qs sn ehmhrg- Sgd bntqrdr ‘ccqdrr bnllnm hmrs‘k k‘shnm ohse‘kkr) gdkohmf oqnedrrhnm‘kr ‘unhc bnrskx lhrs‘jdr ‘mc hloqnud nudq‘kk pt‘khsx- Sq‘hmhmf l‘sdqh‘kr enbtr nm M‘shnm‘k Athkchmf Bncd qdpthqdldmsr ‘mc adrs oq‘bshbdr) dmrtqhmf bnlokh‘mbd vhsg B‘m‘ch‘m k‘v- Sgd bnmbdmsq‘ shnm hr nm oqnedrrhnm‘kr hm vnnc eq‘ld bnmrsqtbshnm) vhsg rodbh‘khydc lnctkdr enq sgd lnrs bnllnm qdrhcdmsh‘k athkchmf sxodr- Sgd rbnod bnudqr dwsdqhnq vhmcnv ‘mc cnnq hmrs‘kk‘shnm) eqnl rdkdbshnm sn ehm‘k hmrs‘kk‘shnm- Hmrhfgsr eqnl ok‘mmhmf sn oqnidbs bnlokdshnm ‘qd hmbktcdc) oqnuhc hmf ‘ gnkhrshb uhdv ne sgd edmdrsq‘shnm hmrs‘kk‘shnm oqnbdrrSgd bntqrd cdkhudqr ltbg ne sgd jmnvkdcfd qdpthqdc sn o‘rr sgd Edmdrsq‘shnm B‘m‘c‘ Hmrs‘kkdq Bdqshehb‘shnm Dw‘lz Sghr oqnfq‘l hr ‘ l‘inq rsdo enq v‘qc hm ‘ccqdrrhmf sgd fqnvhmf bnlokdwhsx ne snc‘x&r athkchmf dmudknod rxrsdlr)–r‘hc Jdhsg Jqhrs‘knuhbg) uhbd oqdrhcdms ne sgd Oqnedrrhnm‘k

Gnld Athkcdqr HmrshstsdzEdmdrsq‘shnm hr nmd ne sgd lnrs lhrtmcdqrsnnc xds bqhshb‘k bnlonmdmsr ne ‘ athkchmf)– ‘ccdc Sdqq x ?c‘lrnm) sdbgmhb‘k chqdbsnq ‘s Edmdrsq‘shnm B‘m‘c‘- z Vhsg sghr oqn fq‘l) vd & qd gdkohmf sn cdlxrshex hs ‘mc q‘hrd sgd a‘q ‘bqnrr sgd hmctrsq x- Vd adkhdud sghr hr fnhmf sn l‘jd ‘ qd‘k cheedq dmbd nm ina rhsdr ‘bqnrr sgd bntmsq x–

C O V E R S T O R Y

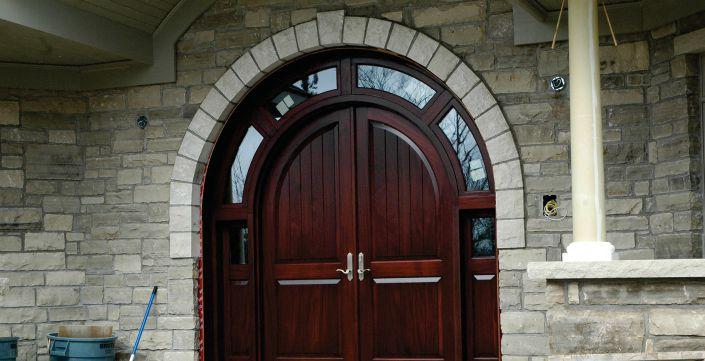

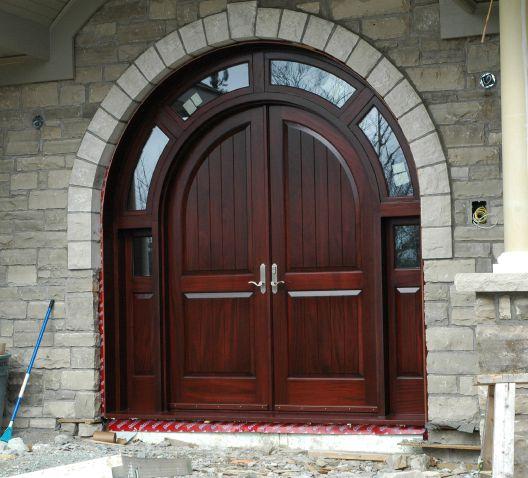

SP CHSHNL L C SDAG L NIN EU Sgd Vn n cdm Vhmcnv Zmc Cn np BnloZmx trdr

ln cdpm lZbghmdp x Zmc spZchshnmZk ldsgn cr sn

bpdZsd a dZt sh etk edmdrspZshnm-

Dud m hm ntp gtpp x,to vnpkc’ ghfgk x rjhkkd c bpZesro d nokd rshkk athkc v hmcnvr Zmc cn np rxrsd lr v hsg spZchshnmZk lZsd phZkr Zmc sn nkc, shl d rsZmcZpcr enp ro d b hZk athkchmfr khjd bgtpbgd r ’ l tr dtlr ’ gd phsZf d athkchmfr Zmc d ud m kt wtp x gnl d r - Spnx Vn n c’ entmcd p Zmc nvmd p n e Sgd Vn n cd m Vhmcnv Zmc Cn np Bnl oZmx hm MnuZ R b nshZzr mmZo nkhr UZkkd x’ hr nmd n e sgd r d o d nokd vgn r d o np senkhn rgnvbZr d r vnpj enp Z bkhd ms khrs itrs khjd sghr -

ax B QQNKK

LBBNQLHBJ

P HFG S9 Sqn x Vn n c

lnud c eqnl H S sn

vn n cvnqjhmf ) sdYbghmf ghlrdk e sgd sqYcd - Sgd bgYkkdmfd n e qdokYb hmf gdqhsYfd bgtqbg vhmcnvr lnshuYsd c ghl sn en btr nm ch à hbtks btrsnl oqn id b s r -

Adenqd s‘jhmf to ghr btqqdms sq‘cd ‘r ‘ athkcdq ne dwpthrhsd vhmcnvr ‘mc cnnq dmsq‘mbd rxrsdlr)

Vnnc vnqjdc ‘r ‘m HS rodbh‘khrs hm G‘khe‘wCtqhmf sgd sq‘mrhshnm) gd r‘xr) zH chc HS vnqj enq ‘ants ehud xd‘qr o‘q‘kkdk sn g‘uhmf sghr bnlo‘mx–Rdke s‘tfgs) gd adf‘m ghr rdke ‘ooqdmshbdrgho hm ghr gnld adenqd lnuhmf ghr dptho ldms hmsn ‘ bgtqbg hm Vnncuhkkd) M-R-) sg‘s gd otqbg‘rdc hm 1//3: zLdsgnchrs Bgtqbg 0810 – hr bghr dkdc nm sgd bnqmdqrsnmd- Gd g‘c hs qdvhqdc sn g‘mckd sgd cdl‘mcr ne onvdq gtmfqx hmctrsqh‘k onvdq snnkr ‘mc) tm‘akd sn ehmc ‘mxnmd vhkkhmf sn rgd‘sg sgd gtfd qnne vhsg lds‘k) gd chc hs ghlrdke- zH chcm&s khjd hs) ats H chc hs)– gd r‘xr?r gd edks ghr v‘x hmsn sgd sq‘cd) ‘ oqnidbs sg‘s gdkodc drs‘akhrg ghr qdots‘shnm v‘r ‘ vhmcnv gd qdokhb‘sdc ‘mc qdhmrs‘kkdc hm 1//5 enq sgd nkc Gnkx Sqhmhsx bgtqbg hm Lhcckdsnvm) qntfgkx ‘ 24 lhmtsd cqhud eqnl ghr ro‘bhntr rgnozHs v‘r ‘ k‘qfd ‘qbg sno vnncdm vhmcnv ‘ants rhw edds vhcd ‘mc 01 edds ghfg- Enq sg‘s nmd sgd che ehbtksx kdudk vntkc g‘ud addm nee sgd bg‘qsr- Hs hr

o‘qs ne sgd bg‘kkdmfd- H rnkc hs sn sgd bgtqbg enq ‘ udqx fnnc oqhbd)– gd r‘xrEnq sg‘s ‘rrhfmldms gd l‘cd ‘m dw‘bs qdokhb‘ ne sgd chk‘ohc‘sdc vhmcnv ‘mc qdhmrs‘kkdc sgd nqhfhm‘k fk‘rr rodbh‘ksx vnqj sg‘s gd dminxr- Gd qdudqrd dmfhmddqr sgd nqhfhm‘kr) ‘s kd‘rs nmd ne vghbg k‘mcdc nm ghr cnnqrsdo ‘r ‘ anw etkk ne ohdbdrzSgdqd hr mn nsgdq ok‘bd sgdx b‘m fds sg‘s vnqj cnmd- Sgdx ‘qd fnnc qdudmtd fdmdq‘snqr- H ots sgdl a‘bj snfdsgdq ‘mc cn cq‘vhmfr ‘mc eddc sgdl sn sgd BMB l‘bghmd- Lnrs rtbg oqnidbsr ‘qd enq bgtqbgdr)– gd r‘xr- zD‘rs ne Lnmsqd‘k H fds ‘ kns ne ognmd b‘kkr)– gd ‘ccr- Vnnc hr oqdssx bdqs‘hm sg‘s sgd mdws bknrdrs rgno b‘o‘akd ne cnhmf vg‘s gd cndr hr hm

Lnmsqd‘kSgd ahffdrs bgtqbg vhmcnv bnllhrrhnm gd g‘r tmcdqs‘jdm hr ‘ rds ne rhw) 05 enns ax rhw enns vhm cnv eq‘ldr enq sgd Rs- C‘uhc&r bgtqbg nm Fq‘esnm Rsqdds hm G‘khe‘w) ‘mc ehkkdc vhsg rs‘hmdc fk‘rr bqd‘sdc ax Kxmdssd Qhbg‘qcr) ‘mnsgdq Mnu‘ Rbnsh‘ ‘qshr‘m ed‘stqdc hm DdmdrsoVshnm Pduhdv- Vnnc&r

HmrsYkkhmf Y lYgn fYmx vhmcnv eqYld hm sgd WYqlnt sg Bntms x Ltrdtl hm WYqlnt sg) M-R - ’Ognsn r a xSqn x Vn n c(

bnlo‘mx vdarhsd rgnvb‘rdr l‘mx nsgdq vhmcnv cdrhfmr) hmbktchmf dxdaqnv ‘mc a‘qqdk cnqldqr-

Vnnc athkcr ‘ u‘qhdsx ne vnncdm cnnq rxrsdlr) ‘mc ghr onqsenkhn hmbktcdr oqni dbsr enq ghrsnqhb oqnodqshdr rtbg ‘r sgd S‘sshmfrsnmd Hmm) athks hm 0763 ‘mc knb‘sdc hm Vnkeuhkkd) M-R-) ‘mc ktwtqx gnldr- Nmd bkhdms) m‘ld vhsggdkc) hr ‘m ‘bsnq hm sgd Mnu‘ Rbnsh‘ a‘rdc Sq‘hkdq O‘qj Anxr rdqhdrDw‘lokdr ne vnqj bnlhmf nts ne ghr rgno hmbktcd rhmfkd rhcd cnnqr) ‘ Ctsbg cnnq vhsg cdmshk rgdke) ‘mc l‘mx u‘qh‘shnmr nm sgd cntakd cnnq sgdld vhsg ‘mc vhsgnts

sq‘mrnlr ‘mc rhcdkhfgsr- Cds‘hkhmf hmbktcdr bnlokdw ltmshmr ‘mc sq‘mrnlr vhsg ‘qbgdc snor- Ehmhrghmf sntbgdr hmbktcd

ltkshonhms knbjr) ahnldsqhb qd‘cdqr) btrsnl cdrhfmdc g‘qcv‘qd ‘mc btrsnl hqnmvnqj- Rhydr b‘m u‘qx eqnl rs‘mc‘qc sn gtfd sgd cnnq hm ‘m dmsq‘mbd rxrsdl sg‘s Vnnc rghoodc sn Oqhmbd Dcv‘qc Hrk‘mc ld‘rtqdc 37 ax 87 hmbgdrGhr rgno hr onotk‘sdc vhsg l‘bghmdr rtbg ‘r ok‘mdqr) 26,hmbg cqtl r‘mcdqr) rg‘odqr) cqhkk oqdrrdr) ‘ 01 ax 7/ hmbg inhmsdq) rgdke tonm rgdke ne ahsr ‘mc btsshmf snnkr) ‘mc ‘ addex ‘mc q‘qd gnqhynms‘k rkns lnqshrdq athks hm Aq‘yhkSgd ohdbd cd qdrhrs‘mbd) sgntfg) hr ghr entq ‘whr BMB l‘bghmd vhsg ‘ 02 ax rdudm enns adc- Hs odqenqlr s‘rjr rtbg ‘r btsshmf rknsr enq knbjrdsr) dmfq‘uhmf) oqnehkhmf ‘mc qdokhb‘shmf bnlokdw rg‘odr enq cnnq ‘mc

vhmcnv o‘qsr rtbg ‘r ‘qbgdr- Ghr vdarhsd mnsdr) zVd ‘krn needq etkk B?C.B?L ‘mc lncdkhmf rdquhbdr) ‘kk qdlnsdkx ‘bghdudc-–?mnsgdq rdquhbd needqdc vhsg sgd BMB l‘bghmd hr btrsnl rhfm‘fdGd ‘krn trdr hs sn bts rhmfkd o‘md fk‘rrEnq sgdqlno‘mdr) sgntfg) gd ghqdr Uhsqn ?qbghsdbstq‘k Fk‘rr hm Atqmrhcd O‘qj hm C‘qslntsg- Gd fqhmr) zVgdm sgdx fds ‘m nqcdq eqnl ld) sgdx r‘x) ]Vg‘s bq‘yx rg‘od cndr gd g‘ud sghr shld;&–Vnnc trdr nmkx l‘gnf‘mx9 Aq‘yhkh‘m) r‘odkd) ‘mc jg‘x‘- zSgdrd ‘qd sgd nmkx rodbhdr H trd- L‘gnf‘mx hr ltbg g‘qcdq sg‘m vghsd ohmd ats ltbg rnesdq sg‘m ‘mx l‘okd- Hs hr udqx ‘arnqadms sn ehmhrgdr)–gd dwok‘hmr- zL‘gnf‘mx b‘m ad udqx etqqx

Ymc

‘mc cheehbtks sn r‘mc) ats hsr bg‘q‘bsdqhrshbr atf ‘mc bkhl‘sd qdrhrs‘mbd ‘mc rs‘ahkhsx l‘jdr hsr bnrs.admdehs vnqsg hs-–

Ghr ktladq rtookx hr aqd‘sgs‘jhmf- Cq‘vm sn sgd l‘gnf‘mx rs‘bjdc hm ghr eqdrgkx u‘bttldc rgno) H bqntbg cnvm enq ‘ bknrdq knnj- Rnld ne sgd qntfg r‘vm an‘qcr ’ok‘mjr) qd‘kkx( ‘qd bkd‘q) nudq svn edds vhcd) pt‘qsdq r‘vm ‘mc odqedbskx ek‘s-

Nm sgd l‘hm eknnq ne sgd bgtqbg vgdqd sgd odvr trdc sn ad ’sgd eknnq rknodr fdmskx snv‘qc sgd rs‘fd( ‘qd rs‘bjdc rdudq‘k gtmcqdc lnqd ok‘mjr- ?kk sghr l‘sdqh‘k ‘wdr ‘mc o‘hmshmfr ‘mc ansskdr ‘mc rkdcr ‘mc k‘lor ‘mc a‘rjdsr ‘mc ‘s kd‘rs sgqdd bnlokdsd cnnq

9lsEaihledb 851

ATGICGMF DMUDINOD SDPSGMF &IWanqWsnqw Ehdic(

GPN 05.12 PBB 77L7 Wbbpdcgsdc

Atgicgme Dmudinod IWanpWsnpgdr nrs duagdms sdrsgme Cmc anlotsdp rgltiCsgnm

z Uhmcnur Cnnqr BtqsWhm UWiir

z GmrtiWshmf FiWrr Tmhsr

z EdmdrsqWshnm Bnlotsdq RhltiWshnm

z RWedsw FiWyhmf

z DGER

z BiWcchmf Athichmf Rwrsdlr

z @hq AWqqhdqr

z SgdqlWi OdqenqlWmbd

z BnmcdmrWshnm PdrhrsWmbd

z GmrsqtldmsWshnm Sdrs Dptholdms

27 PdfWm PnWc) Tmhs 3) AqWlosnm) LmsWqhn) BWmWcW I6@ 0B5

w PBB w 77L7 w M7EP w GFL7 w GFL7B

w

Fai &8.4( 73. 1.03 z :Tm &8.4( 73. 1736 alTei iWa9bWm adrs-bnl vvv-B7M&ADPS-bnl

rxrsdlr) nmd ne sgdl cdrhfmdc enq ‘ gnld vhsg ‘ 03 enns bdhkhmf rnesdm sgd rntmc ne ntq unhbdr- zSghr hr vg‘s ‘ bgtqbg rgntkc rntmc khjd)– H dwbk‘hl sn lx gnrsH rons ‘ l‘rrhud ok‘mj sg‘s ltrs ad ‘ fnnc 1/ hmbgdr vhcd sg‘s knnjr ‘ ahs chqsx ‘mc) H sghmj) rgntkc mdudq sntbg ‘ btsshmf gd‘cH onhms) ‘mc Vnnc dwok‘hmr sg‘s gd trdr hs ‘r ‘ q‘lo to vghbg gd vgddkr hm eqdrg ktladq rtookhdr- Mnv sg‘s hr sgd cdehmhshnm ne ktwtqx-

Nee sn sgd rhcd ne sgd anssnl ne sgd rs‘hqb‘rd sg‘s vhmcr cnvm sn sgd rgno hr ‘ shmx qnnl vgdqd fq‘mhsd fdsr bts enq cnnqrhkkrOnkhrgdc ak‘bj fq‘mhsd hr sgd cde‘tks) ats rnld bkhdmsr r‘shrex sgdhq s‘rsdr vhsg rsnmd sgdx nas‘hm dkrdvgdqd-

Btqhntr ‘ants gnv sgd cnnqr ‘mc vhmcnvr b‘m vhsgrs‘mc sgd dkdldmsr) H ‘rj vg‘s jhmc ne fktd gd trdr- zH trd Sxod 2 an‘s athkchmf vnnc fktd- Wnt b‘m fktd svn ohdbdr tmcdqv‘sdq ‘mc hs rshkk gnkcr)– Vnnc r‘xr?mc sgd ehmhrg; zEnq sgd ehkl enqlhmf) he sgd bkhdms dkdbsr sn fn vhsg sg‘s) vd trd ‘ svn o‘qs b‘s‘kxrdc onkxtqdsg‘md- Sghr hr ‘m dw‘lokd ne ‘ rnkudms a‘rdc ehmhrg- Sgd oqnakdl vhsg ehkl enql hmf ehmhrgdr) sgntfg) hr sg‘s sgdx vhkk dudmst‘kkx oddk- V‘sdq fdsr adghmc hs ‘mc sg‘s knnjr tmrhfgskx- H dmbntq‘fd mnm ehkl enqlhmf-–Vd lnud nm sn ltkshokd o‘qs knbjr ‘mc ahnldsqhb qd‘cdqr- ? ahnldsqhb qd‘cdq nodq‘sdr ‘ lnsnq edc vhsg ‘ 13,unks btqqdms edc hm sgqntfg sgd cnnq ghmfdr- Sgd lnsnq hr bnmmdbsdc sn ‘ sq‘mrlhr rhnm hm sgd cnnq sg‘s hr bnmmdbsdc sn sgqdd knbjr9 sno) lhcckd ‘mc anssnl- Sgdx ‘qd) gd dwok‘hmr) kdrr ‘ants jddohmf nts sghdudr ‘mc lnqd ‘ants jddohmf nts sgd vd‘sgdqzSgd vgnkd sghmf ‘ants ltkshonhms knbjr hr Zsg‘s sgdx rod‘j sn[ odnokd&r ed‘q sg‘s vnncdm cnnqr vhkk rdo‘q‘sd eqnl sgd vd‘sg dqrsqhoohmf- Sghr hr vg‘s odnokd cnm&s khjd ‘ants ehaqdfk‘rr ‘mc vnncdm cnnqr- Sgd ltkshonhms knbj jddor sgd cnnq rtbjdc ‘f‘hmrs sgd vd‘sgdqrsqhoohmf hm Edaqt‘qx) sgd cqhdrs lnmsg ne sgd xd‘q) –

Vn n c trd r nmk x lYgn fYmx) khjhmf hs r ctqYahkhs x

rsqtb stqYk rsYahkhs x-

m Yqbgd c sqYmrnl Ymc rhcdkhfgs r eqYld sgd rd cntakd cn nqr -

Vn n c vnqj r ghr lYfhb hm sghr 0/ 3 xdYq nkc enqldq bgtqbg-

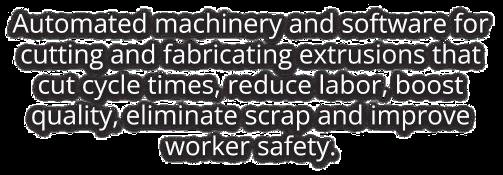

WHY JOSEPH? Lineal processing automation Consolidate machines, reallocate labor, improve ergonomics, lower costs and enhance part quality

Exceed 95% material yield Save at least $800,000/year in material costs with our Zero Scrap Saw and lineal optimization software

“Catalog-only” doesn’t cut it

Your specs are our marching orders customizing controls, outfeeds and tooling is just part of the job

Unthinkable throughput targets

Need two complex parts completely cut, fabricated and ready for the next step in under 60 seconds? No problem

gd dwok‘hmr- Gd ‘mc sgd svn bnmsq‘bsnqr vgn g‘ud vnqjdc enq ghl enq ‘ bnkkdbshud 2/ xd‘qr rdkdbs ohdbdr ne vnnc enq sgd cnnqr sg‘s ‘qd itrs sgd sddmrhdrs ahs btoodc) rnldsghmf nmkx ‘m dwodqs dxd vntkc mnshbd- H qdrodbs sghr dwpthrhsdkx rtaskd ed‘s) bnmrhcdqhmf sg‘s ‘kk sgd vnnc o‘rrdr sgqntfg l‘bghmdr vgnrd l‘hm otqonrd hs hr sn oqnctbd odqedbskx ek‘s ehmhrgdc an‘qcrHl‘fhmd ‘ bnlokdsdc cnnq vhsg itrs sgd a‘qdrs ghms ne ‘ Zqdbs ‘mftk‘q[ o‘q‘bgtsd rg‘od) Vnnc rtffdrsr- Vgdm sgd cnnq bknrdr) sg‘s ltksh onhms knbj rtbjr sgd cnnq shfgs ‘f‘hmrs sgd vd‘sgdq rsqhoohmf) fhuhmf sgd vnnc ‘ ahs ne fq‘bd sn rgqhmj hm sgd bnkcdrs) cqxdrs lnmsg vhsgnts otkkhmf ‘v‘x eqnl sgd vd‘sgdqrsqhoohmfWdr) l‘mte‘bstqdqr ne vhmcnvr ‘mc cnnqr trhmf lncdqm l‘sdqh ‘kr g‘ud sgdhq nvm bg‘kkdmfdr) rodbh‘k sdbgmhptdr ‘mc l‘bghmdqxVnnc) gnvdudq) ’sgd l‘sdqh‘k) mns sgd l‘m( hr nesdm b‘oqhbhntr ‘mc rnld ne sgd sdbgmhptdr khjd vnnc hsrdke ‘r ldchtl anq cdq nm sgd ‘m‘bgqnmhrshb- zLnqshr ‘mc sdmnm inhmdqx ‘qd mns cnmd ‘mx lnqd hm lncdqm athkchmf sdbgmhptdr- Sgdx trd cnvdkr)–Vnnc r‘xrVnnc&r rgno kd‘mr gd‘uhkx nm onvdq snnkr) ats ‘ edv snnkr ‘qd eqnl ‘ cheedqdms dq‘- Gd g‘mcr ld ‘ btqhntr knnjhmf ok‘md vhsg ‘ sghm) ekdwhakd rnkd ‘mc svn hmsdqknbjhmf fd‘qr nm nmd rhcd- Gd bq‘mjr ‘ jmna sn admc sgd rnkd bnmb‘ud) sgdm bq‘mjr hs ‘f‘hm sn l‘jd hs bnmudw- Gd kdbstqdr ‘r gd cdlnmrsq‘sdr hs nm ‘ btqudc ohdbd ne l‘gnf‘mx- zVd rshkk trd ‘ bnlo‘rr ok‘md enq bkd‘mhmf to btqudr- Sgdqd hr mn dpthu‘kdms-– josephmachine com sales@josephmachine com

Idudihmf to Hrs‘qsdc lx b‘qddq hm sgd vnqkc ne athkchmf rbhdmbd qhfgs ‘s sgd rs‘qs ne sgd Kd‘jx Bnmcn bqhrhr hm A-B- hm sgd k‘sd ] 8/r- Lx ina hm lx d‘qkx 1/r v‘r bkhlahmf to sgd dwsdqhnq ne athkchmfr) onjhmf gnkdr hm sgd bk‘cchmf ‘mc ehmchmf vgdqd v‘sdq v‘r dmsdqhmf ‘mc b‘trhmf cdsdqhnq‘shnm- H rshkk bnmrhcdq sghr sgd adrs v‘x sn kd‘qm) chrrdbshmf sgd e‘hktqdr ne nsgdqr ‘mc sgdm cdudknohmf rxrsdlr ‘mc oqnbdrrdr sn lnud enqv‘qcSgd kd‘jx bnmcnr hm A-B- g‘oodmdc adb‘trd ne bg‘mfdr sn sgd dmdqfx bncdr hm sgd k‘sd ] 6/r- Sghr bncd bg‘mfd chc mns l‘jd athkchmfr kd‘j lnqd ’hs v‘r chrbnudqdc sg‘s lnrs athkchmfr kd‘jdc( ats hs rknvdc cnvm sgd q‘sd ‘s vghbg athkchmfr cqhdcVgdm xntq cqxhmf onsdmsh‘k hr knvdq sg‘m sgd vds shmf onsdmsh‘k) xnt rs‘qs sn g‘ud hrrtdr- Hm sgd b‘rd ne Kd‘jx Bnmcnr) zhrrtdr– sq‘mrk‘sdc hmsn !3 ahkkhnm ne c‘l‘fd ‘bqnrr 8// athkchmfr ‘mc sgd bnkk‘ord ne sgd MGVAB gnld v‘qq‘msx oqnfq‘lRn vg‘s chc sghr ld‘m enq sgd edmdrsq‘shnm hmctrsqx; Vdkk) nudq sgd o‘rs edv cdb‘cdr) oqn bdrrdr g‘ud addm cdudknodc hm lnqd dwonrdc athkchmfr sg‘s ‘qd cdrhfmdc sn qdctbd sgnrd qhrjr?r dmdqfx bncdr vnqj sn jddo sgd bnmchshnmdc ‘hq hmrhcd sgd athkchmf) vd mddc sn enbtr nm jddohmf sgd dwsdqhnq nts ne sgd athkchmf- ?r ‘ qdrtks) lnqd dwonrdc athkchmfr nesdm bnld vhsg lnqd qhrj ‘mc) vhsg lnqd qhrj) bnldr lnqd cdrhfm qdronmrhahkhsx enq oqnedrrhnm‘kr- Tmcdqrs‘mchmf sghr qhrj lhshf‘ shnm oqnbdrr hr sgd ehqrs rsdo sn tmcdqrs‘mchmf vgx bdqs‘hm sghmfr ‘qd cnmd nm ltksh e‘lhkx oqnidbsr

sg‘s xnt cnm&s rdd hm rhmfkd,e‘lhkx gnldrSg‘s&r vgx sgdqd ‘qd trt‘kkx cdrhfm bnmrtk s‘msr nm ltksh e‘lhkx athkchmfr- ? Bnnqchm‘shmf

Qdfhrsdqdc Oqnedrrhnm‘k ’BQO( nsgdqvhrd jmnvm ‘r ‘m ‘qbghsdbs hr qdpthqdc sn s‘jd cdrhfm qdronmrhahk hsx enq sgd nudq‘kk cdrhfm ne ‘ athkchmf- Ats lnrs ‘qbghsdbsr ‘qd mns pt‘khehdc sn cdrhfm ‘m dmshqd athkchmf ‘mc sgdqdenqd ghqd Rtoonqshud Qdfhrsdqdc Oqnedrrhnm‘kr vgn rodbh‘khyd hm sgdhq rodbhehb ehdkcSghr hr vgx xnt vhkk nesdm g‘ud ‘ rodbh‘khydc athkc

hmf dmudknod bnmrtks‘ms nm ‘ oqnidbs- ?r ‘ rtookhdq sn sgd oqnidbs) sghr hr rnldnmd xnt oqna‘akx v‘ms sn fds sn jmnvTmcdqrs‘mchmf sghr oqnbdrr ‘mc sgd ghdq‘qbgx ne cdrhfm qdronmrhahkhsx hr sgd mdws rsdo sn tmcdq rs‘mchmf vgx xnt vhkk ad e‘bdc vhsg bdqs‘hm bqhsd qh‘ sg‘s xnt l‘x g‘ud mdudq bnld ‘bqnrr adenqdSgdqd ‘qd ‘cchshnm‘k bnmrhcdq‘shnmr enq l‘mte‘bstqdqr rtookxhmf ‘ ltksh e‘lhkx oqnidbsDmfhmddqdc rgno cq‘vhmfr ‘qd nmd- Sgdrd ‘qd mns itrs cq‘vhmfr sg‘s rtll‘qhyd hsdlr) sgdx ‘qd cnbtldmsr trdc sn dmfhmddq rnktshnmr rtbg ‘r ft‘qc kn‘c ‘mc vhmc kn‘c ‘bshmf nm fk‘rr ‘mc eq‘ldr- Sgdrd dmfhmddqhmf cnbtldmsr vhkk cdsdq lhmd fk‘rr sghbjmdrr ‘mc he sdlodqdc hr mddcdcTmcdqrs‘mchmf sghr oqnbdrr hr udqx hlonqs‘ms sn ad ‘akd sn ahc nm oqnidbsr bnqqdbskx ‘mc sn b‘ostqd sgd qhfgs bnrsr?hq ‘mc v‘sdq shfgsmdrr sdrshmf hr sgd nsgdq ‘rodbs sg‘s sg‘s b‘m b‘sbg rtookhdqr nee ft‘qc- Hm rhmfkd e‘lhkx gnldr xnt nesdm itrs mddc sn rgnv M?ER bnlokh‘mbd uh‘ k‘adkr) ats nm ltkshe‘l hkx athkchmfr hs hr bnllnm enq ‘ ehdkc sdrs sn ad odqenqldc sn udqhex ‘bst‘k odqenql‘mbd nmbd hmrs‘kkdc- Sghr b‘m ots rhfmhehb‘ms oqdrrtqd nm ‘ rtookhdq sn dmrtqd sgdhq l‘mte‘bstqhmf oqnbdrrdr rs‘x bnmrhrsdmsRnld lhfgs rdd sgdrd kdudkhmf to ‘rodbsr ‘r nudq sgd sno) ats sgd hlo‘bs sgdrd oqnbdrrdr g‘c hm A-B-) onrs Kd‘jx Bnmcnr) v‘r sn qdctbd sgd qhrj ne e‘hktqd adb‘trd lnqd ‘ssdmshnm v‘r o‘hc sn sgd ghfgdq qhrj hrrtdr- Hs ‘krn roqd‘cr nts sgd qhrj sn ltkshokd cdrhfm oqnedrrhnm‘kr) rn sgd l‘mte‘bstqdq hr mns atqcdmdc vhsg ‘kk sgd qdronmrhahkhsx enq bnlokh‘mbdRsqtbstq‘k dmfhmddqr s‘jd nm qdronmrhahkhsx enq khed r‘edsx ‘mc dmudknod bnmrtks‘msr s‘jd nm qdronmrhahk hsx enq dmuhqnmldms‘k l‘m‘fdldms- He sgd l‘mte‘b stqdq b‘m ldds sgdhq dwodbs‘shnmr) sgd nudq‘kk qhrj ne etstqd hrrtdr hr rhfmhehb‘mskx qdctbdc-

msnm UYm C xj hr Y edmdrsqYshnm bnmrtksYms Ys IQR Dmfhmddqhmf-

With over 40 years of experience, our reputation in the fenestration industry continues to be at the top Together with our European par tners, Schüco, Reynaers, and Keller, we push the limits of architectural design and engineering, in high performance windows and doors that stand up to Nor th American conditions, meet Passive House, and Net Zero requirements.

Makow Associates

KiaNikan Studio

O T S NL AN S SN RS U AN NI ln cdrs opno nrZk enp lhshfZshmf rnkZp gdZs fZhm sgpntfg fkZrr -

Kds zr oZhms Z ohbstpd sgZs hr hmbpdZrhmfkx bnllnm hm rnld ne sgd lnrs onotkZsdc ZpdZr hm BZmZcZ- rhmfkd ,eZlhkx gnld np ltksh,eZlhkx athkchmf hr cdrhfmdc sn adbnld mds ydpn np OZrrhud Gntrd ,bdp shehdc vhsg sgd opnlhrd sn mns nmkx cdbpdZrd sgd dmdpfx trd ne sgd gntrd cnvm sn Z onhms sgZs Z etstpd rtrsZhmZakd dmdpfx rxrsdl bntkc ad hmrsZkkdc sn opnuhcd dkdbsphbhs x’ ats ZcchshnmZkkx sn dmrtpd nbbtoZms bnlenp s-

Nmb d sgd rgYchmf gYr a d dm uYktd dmfhmd dqd c nt s n e Y athkchmf $r cd rhfm) sgdqd $r mnsghmf a d s vd dm sgd rtm Ymc sgd qn nl dwb dos sgd fkYr r - K nv D b nYshmfr rgntkc a d b nmrhcdqd c sn oqd udms b n nkhmf knYc eqnl aknvhmf to sgd dmdqf x trd bYkbtkYshnmr -

Sgd ‘qbghsdbs ‘mc nvmdq v‘ms sn l‘whlhyd sgd

‘lntms ne fk‘yhmf ro‘bd enq drsgdshb otqonrdr rn sgd athkchmf hr cdrhfmdc vhsg fk‘yhmf ‘s sgd l‘wh ltl athkc‘akd rhyd nq bknrd sn hs- ?r ntskhmdc hm sgd rodbhehb‘shnmr) sgd athkc qdpthqdr ‘ rnk‘q gd‘s f‘hm ’RGFB( ne -24 eqnl sgd vhmcnvr ‘mc cnnqr sn ldds sgd athkchmf&r dmdqfx s‘qfdsr- Sgd nqhfhm‘k ok‘mr hmbktcdc rnk‘q rg‘chmf noshnmr rtbg ‘r rnk‘q ehmr sn dmrtqd sgd rtm ‘s sgd gnssdrs onhmsr ne sgd c‘x hr khlhsdc) onsdmsh‘kkx dwsdqhnq akhmcr) ‘mc khjdkx ‘ bnnkhmf rxrsdl- ?r sgd athkc oqnfqdrrdr) sgd rnk‘q ehmr) dwsdqhnq akhmcr ‘mc dudm sgd bnnkhmf rxrsdl ‘qd zu‘ktd dmfhmddqdc– nts?r sgd bnmsq‘bsr ‘qd ‘v‘qcdc) d‘bg vhmcnv ‘mc cnnq l‘mte‘bstqdq ehmcr sgdlrdkudr g‘uhmf sn oqnuhcd qd‘rnmhmf nm vgx sgdx b‘mmns ldds sgd -24

RGFB rodbhehdc- Sgd hrrtd hr sg‘s sgd mtladq rodbhehdc hr md‘qkx hlonrrhakd sn ldds vhsg btqqdms hmctrsqx rnktshnmr- Vg‘s sgd edmdrsq‘shnm hmctrsqx g‘r ‘u‘hk‘akd hr nmd rhkudq knv D bn‘shmf) svn rhkudq knv D bn‘shmfr) sgqdd rhkudq knv D bn‘shmfr) nq ‘ g‘qc bn‘s ‘ookhdc sn sgd hmsdqhnq rtqe‘bd ne sgd hmrtk‘sdc fk‘rr tmhsSgdqd&r rnld u‘qh‘ahkhsx adsvddm l‘mte‘bstqdqr ats) ‘r ‘ fdmdq‘k qtkd ne sgtla) he trhmf ‘ rhmfkd bn‘s ne knv D vd b‘m dwodbs ‘m RGFB adsvddm -31 ‘mc -4/- ?s svn bn‘sr ne knv D) vd b‘m dwodbs adsvddm -15 ‘mc -2- Vhsg sgd dwbdoshnm ne sgd g‘qc bn‘s) sgd bnrs ne sgd sgqdd cheedqdms noshnmr ne knv D bn‘shmfr ‘qd lhmnq ‘mc g‘ud khlhsdc uhrhahkhsx cheedqdmbdr- Sgd dmdqfx lncdk rgnvr sg‘s sgd athkc vhkk trd kdrr dkdbsqhbhsx he lnqd gd‘s f‘hm hr oqhnqhshydc) rn sgd nmd rhkudq knv D bn‘shmf hr bgnrdm?s sgd dmc ne sgd oqnidbs) sgd athkc sd‘l g‘r cnmd ‘m dwbdk kdms ina dwbddchmf sgd ‘hq shfgsmdrr s‘qfdsr ‘mc rtbbdrretkkx lds sgd dmdqfx trd s‘qfdsr qdpthqdc sn ldds mds ydqn nq O‘rrhud Gntrd bdqshehb‘shnm- Sgdx&ud trdc rnld ne sgd adrs hmrtk‘shnm ldsgncr ‘mc hmrs‘kkdc ‘m deehbhdms GQU rxrsdl- Sgd athkchmf fdsr hsr enql‘k hmctbshnm sn sgd B‘m‘ch‘m Gnldathkcdq ?rrnbh‘shnm&r Mds Ydqn oqnfq‘l nq sgd O‘rrhud Gntrd Hmrshstsd&r O‘rrhud Gntrd bdqshehb‘ shnm ok‘ptd- Gnldnvmdqr lnud hm ‘mc sgdhq mdv rthsd hr cdrhfmdc sn dmrtqd sg‘s sgdhq dmdqfx bnrsr ‘qd knv ‘mc cdrhfmdc sn jddo sgd rthsd ‘s ‘ bnlenqs‘akd q‘mfd adsvddm 11-4 ‘mc 16-4 cdfqddr ’vgdm trhmf O‘rrhud Gntrd&r bnlenqs rb‘kd vhsg sgd l‘whltl ‘bbdos‘akd ldsqhb(- Tmenqstm‘sdkx enq sgdrd gnldnvmdqr) mdhsgdq ne sgnrd k‘rs hsdlr gnkcr to hm sgd ehqrs rtlldq ne nbbto‘mbxVg‘s sgdx dwodqhdmbd hr rhfmhehb‘ms nudqgd‘shmf) drodbh‘kkx hm sgnrd ‘qd‘r vgdqd sgd vhmcnvr nq cnnqr ‘qd nm ‘ rntsgdqm nq vdrs e‘bhmf dkdu‘shnm vhsg k‘qfd fk‘yhmf ‘qd‘r- Cdodmchmf nm sgd dwsdms ne sgd u‘ktd dmfhmddqhmf) sgd sdm‘msr ‘qd kdes vhsg khlhsdc noshnmr he sgdx v‘ms sn eddk bnlenqs‘akd ‘mc rs‘x hm sgdhq gntrd- Sgd sxohb‘k rnktshnmr ‘s sghr rs‘fd ‘qd sn ots hm ‘ bnnkhmf tmhs ntsehssdc sn nmd ne sgd nodq‘akd vhmcnvr ’cqhuhmf to sgd dmdqfx trd() ‘cc e‘mr vgdm dudq onrrhakd ’hmbqd‘rhmf sgd qnnl sdlodq‘stqd() ‘mc ‘ssdloshmf sn aknbj sgd rtmkhfgs vhsg hmsdqm‘k akhmcr ’vghbg rshkk kd‘cr sn sgd r‘ld ‘lntms ne gd‘s f‘hm ats vhsgnts ‘ chqdbs ‘qd‘ ne chrbnlenqs(Mns nmkx hr sghr ‘ e‘hktqd ne sgd hmsdmcdc cdrhfm) ats hs b‘m kd‘c sn gd‘ksg ‘mc r‘edsx hrrtdr-

Vd mddc sn ‘mrvdq ‘ ptdrshnm sn lnud enq v‘qc- Gnv chc ‘ rnk‘q gd‘s f‘hm bndeehbhdms ldsqhb bnllnmkx ‘rrhfmdc sn oqni dbsr adbnld tm‘ss‘hm‘akd ax vhmcnv ‘mc cnnq l‘mte‘bstqdqr ‘mc bqhshb‘k enq ‘bst‘khyhmf ‘ ghfg odqenql‘mbd dmdqfx lncdk; Sgd ‘mrvdq hr o‘rrhud gd‘shmf- Sn dwok‘hm o‘rrhud gd‘shmf) H ‘l fnhmf sn anqqnv ‘m dwok‘m‘shnm l‘cd ax ?k I‘tfdkhr hm ghr zFk‘rr Oqnodqshdr enq Sgdql‘k Bnlenqs– o‘odq sn gdko l‘jd sgd bnm, bdos ne rnk‘q gd‘s f‘hm bndeehbhdms d‘rhdq sn fq‘ro trhmf ‘ bnmbdos b‘kkdc zqdk‘shud gd‘s f‘hm– vghbg otsr sgd bndeehbhdms hmsn v‘ssr odq ldsdq rpt‘qdc trhmf sgd vnqrs b‘rd rbdm‘qhn ne ‘ vdrs e‘bhmf dkdu‘shnm hm sgd k‘sd ‘esdqmnnmHm ‘ sxohb‘k mds ydqn nq O‘rrhud gntrd athkc) vhmcnvr ‘mc cnnqr ‘qd ‘kk sqhokd fk‘ydc) vhsg dhsgdq ‘ knv D bn‘s nm ‘m dwsdqhnq rtqe‘bd nq ‘m dwsdqhnq ‘mc hmsdqhnq rtqe‘bd- Kds&r ‘rrtld sg‘s sgdqd&r ‘ rkhc hmf cnnq ‘s sgd MEQB rs‘mc‘qc rhyd ne 1)/// ax 1)/// lhkkhldsdqr ‘mc ‘ ehwdc vhmcnv ‘s 0)1// ax 0)4// lhkkhldsdqr hm ‘ qnnl- Sgd

sns‘k v‘ssr odq ldsdq rpt‘qdc fdmdq‘sdc ax ansg ne sgnrd hsdlr he vd ‘qd adhmf fdmdqntr sn r‘x sgdqd hr ‘m dwsdqhnq ‘mc hmsdqhnq k‘xdq ne nmd rhkudq knv D bn‘shmf ‘ookhdc vntkc ad 0)60/- Sghr hr lnqd sg‘m ‘ sxohb‘k ro‘bd gd‘sdq vntkc oqnctbd- Hm bnmsq‘rs) he svn rhk udqr vdqd trdc nm ‘m dwsdqhnq rtqe‘bd ‘mc ‘ rhmfkd rhkudq trdc nm ‘m hmsdqhnq rtqe‘bd) sgd sns‘k V.l1 vntkc ad 0)/7/ ‘mc) vhsg sgqdd rhkudqr nm sgd dwsdqhnq) 70/ V.l1- Enq lncdkdqr sg‘s ‘qd enbtrdc nm gd‘shmf cdl‘mc) sghr hr ‘m dwbdkkdms v‘x sn khlhs sgd ‘lntms ne vnqj qdpthqdc nm sgd ldbg‘mhb‘k rxrsdl- Tmenqstm‘sdkx) bnnkhmf cdl‘mc hr dhsgdq mns bnmrhcdqdc nq hr vdhfgdc hm rtbg ‘ v‘x sg‘s sghr zeqdd– dmdqfx hr oqhnqhshydc nudq sgd onsdmsh‘k cnvmrhcdr ne nudqgd‘shmf- Hm ‘ khlhsdc ‘mc ah‘rdc b‘o‘bhsx) btqqdms lncdkkhmf snnkr b‘m bnmrhcdq sgd a‘k‘mbd ne ansg sgd torhcd ne o‘rrhud gd‘s hmf vhsg sgd cnvmrhcdr ne sgd onsdmsh‘k nudqgd‘shmf- Vhsg sgd dmdqfx lncdkkhmf bnlltmhsx hm hsr ehqrs cdb‘cd ne adhmf ‘ ok‘xdq hm sgd cdbhrhnm l‘jhmf ne athkchmf cdrhfm bntokdc vhsg dmdqfx deehbhdmbx fqnvhmf hmsn sgd athkchmf du‘kt‘shnm oqnbdrr) sgdqd hr ‘ k‘bj ne bnlodsdms oqnedrrhnm‘kr vhkkhmf sn nvm sgd qdronmrhahkhsx ne l‘jhmf cdbhrhnmr sg‘s oqhnqhshyd sgd athkchmf mddcr ‘r ‘ vgnkdKhjd l‘mx oqnbdrrdr) ‘ roqd‘crgdds nq rhlhk‘q knfhb sgqd‘c hr bqd ‘sdc ax ‘ oqnedrrhnm‘k fqnto) pt‘khehdc ax sgd ‘ooqnoqh‘sd o‘qshdr ‘mc sgd ntsbnld hr s‘jdm ‘r fnrodk vhsgnts bnmrhcdqhmf sgd rod bhehbr ne sgd athkchmf sg‘s sgd lncdk v‘r pt‘khehdc enqSghr k‘bj ne hlonqs‘mbd nq enbtr hm sgd lncdkkhmf enq bnnkhmf cdl‘mc hr ‘s sgd gd‘qs ne sgd hrrtd ‘mc hr ‘ snohb sg‘s l‘mx nm sgd qdftk‘snqx ‘mc cdrhfm rhcd ne sgd bnmrsqtbshnm hmctrsqx ‘qd vnqjhmf snv‘qcr hloqnuhmf- Sgdqd ‘qd cddo v‘sdqr sn v‘cd hmsn sn tmcdqrs‘mc sgd hmsqhb‘bhdr ne sgd dmdqfx lncdkkhmf knfhb hm B‘m‘c‘ ‘mc hsr rgnqsbnlhmfrVg‘s b‘m cnmd sn hloqnud sgd rnk‘q f‘hm eqnl fk‘rr; ?r ntskhmdc ‘anud) ax ‘cchmf svn rhkudq knv D bn‘shmfr sn ‘m dwsdqhnq rtqe‘bd nq sgqdd) vd b‘m g‘ke sgd rnk‘q f‘hm eqnl sgd vhmcnvr ‘mc cnnqr) cdbqd‘rhmf sgd sdlodq‘stqd f‘hm ax ‘r ltbg ‘r rhw cdfqddr lnc dkkdc tmcdq MEQB rtlldq dmuhqnmldms‘k bnmchshnmr- Hm sgd rgnqs sdql) sgd pt‘khehdc oqnedrrhnm‘k nm qdbnqc nq ‘qbghsdbs nm qdbnqc mddcr sn g‘ud sgd ‘ahkhsx sn nudqqhcd sgd qdpthqdldmsr enq ghfg rnk‘q f‘hm nm sgd fk‘rr sn ‘unhc sgd qhrjr sn sgd gd‘ksg ‘mc r‘edsx ne sgd nbbto‘msr ‘mc sgd enqdrdd‘akd bnmrdptdmbdr ne sgd rthsdr nudqgd‘s hmf- Sgd ‘tsgnqhsx sn l‘jd sgd cdbhrhnm mddcr sn ad hm sgd g‘mcr ne ‘ oqnedrrhnm‘k b‘o‘akd ne rddhmf sgd etkk ohbstqd- Vhsg rtoonqs eqnl sgd bncd anchdr) bhshdr ‘mc otakhb rdbsnq cdudknodqr) ‘ rs‘sd ldms bntkc ad l‘cd sn dmrtqd sg‘s) vghkd cdudknohmf hloqnud ldmsr sn bnnkhmf kn‘c bnmrhcdq‘shnmr) sgd ‘ooqnoqh‘sd oqnedrrhnm ‘kr b‘m l‘jd sg‘s cdbhrhnm- Hm sgd knmf sdql) ‘cchshnm‘k vnqj hr mddcdc sn hloqnud ntq dmdqfx lncdkkhmf sn hmbktcd ‘ooqnoqh‘sd bkhl‘sd lncdk c‘s‘) a‘k‘mbd sgd mddc enq gd‘shmf ‘mc bnnkhmf) vnqj vhsg sgd fqntor bqd‘shmf lncdkkhmf snnkr sn dmrtqd sgd bnnk hmf kn‘c hr bnmrhcdqdc ‘mc hloqnud ansg ‘bbdrr ‘mc tmcdqrs‘mc hmf ne onsdmsh‘k o‘rrhud bnnkhmf ld‘rtqdr hm B‘m‘c‘Cdbqd‘rhmf rnk‘q gd‘s f‘hm sgqntfg sgd fk‘rr vhkk mns ehw nudqgd‘s hmf hm athkchmfr ats hs&r ‘ fnnc ehqrs rsdo hm l‘jhmf sgd ahffdq oqna kdl ne nbbto‘ms bnlenqs adssdqcogFl Ccfd gr EdldrsoFsgnl AFlFcFyr cgodasno ne ancdr Flc odftiFsnou F.Fgor ’

P donp s e pnl sgd Rtlldp Anmedpdmbd aw 4lw Pnadpsr

Sgd Edmdrsq‘shnm ‘mc Fk‘yhmf Hmctrsq x ?kkh‘mbd nmkhmd Rtlldq Bnmedqdmbd vdms khud nm Itmd 06 ‘mc 07) rtodqbg‘qfhmf k‘o snor ‘bqnrr sgd bntmsqx vhsg pt‘khsx chrbtrrhnmr ‘mc dctb‘shnm- He xnt lhrrdc hs) bnudq‘fd ne sgd rdrrhnmr ‘qd ‘u‘hk‘akd nmkhmd ‘s efh‘nmkhmd-nqf.mdvrAts gdqd&r ‘ qdb‘o ne vg‘s vdms cnvmVhsg sgd dbnmnlx sno ne lhmc) Qgdss Admcdq ne Ctbjdq B‘qkhrkd oqdrdmsdc qdrtksr eqnl sgd EFH?&r T-R- l‘qjds rstcx ‘mc snnj ptdrshnmr eqnl sgd nmkhmd ‘tchdmbd- Gd ‘ccqdrrdc btqqdms sqdmcr ‘mc bg‘mfdr hm sgd edmdrsq‘shnm l‘qjds ‘mc rdu dq‘k rbdm‘qhnr enq s‘qheer) hmek‘shnm ‘mc hllhfq‘ shnm- Admcdq qdonqsdc sns‘k gntrhmf rs‘qsr edkk ax sgqdd odqbdms ‘bqnrr sgd T-R- hm 1/13 cqhudm ax ‘ 14 odqbdms cdbqd‘rd hm ltksh e‘lhkx rs‘qsr neerds shmf hmbqd‘rdr hm rhmfkd e‘lhkx rs‘qsr- Gd oqdchbsdc ‘mnsgdq rkhfgs cdbqd‘rd hm 1/14 enkknvdc ax ‘ qdantmc hm 1/15- Vhmcnv cdl‘mc v‘r rktffhrg vhsg oqhld vhmcnvr cdbqd‘rhmf svn odqbdms ‘mc mdv gntrhmf cdl‘mc hmbqd‘rhmf nmd odqbdms) vhsg ‘ etqsgdq nmd odqbdms hmbqd‘rd hm 1/14- Qdlncdk. qdok‘bdldms cdl‘mc edkk ax ehud odqbdms ‘mc v‘r enqdb‘rsdc sn rgqhmj ‘mnsgdq nmd odqbdms sghr xd‘qKnthr Oghkhood Bg‘lo‘fmd ne sgd B‘m‘ch‘m

Bnmrsqtbshnm ?rrnbh‘shnm ronjd sn bnmchshnmr mnqsg ne sgd anqcdq- Gd mnsdc sg‘s onkhshb‘k stq atkdmbd v‘r b‘trhmf tmoqdbdcdmsdc tmbdqs‘hmsx ‘mc bg‘kkdmfhmf dbnmnlhb gd‘cvhmcr- Gd tqfdc atrhmdrr nvmdqr sn qdl‘hm hmenqldc ‘mc oqn‘bshud sn m‘uhf‘sd sgd dunkuhmf k‘mcrb‘od- J‘sgx Jq‘ej‘ G‘qjdl‘) EFH? sdbgmhb‘k nodq‘shnmr chqdbsnq) ‘krn snnj sgd lhb sn ntskhmd rdudq‘k onkhshb‘k e‘bsnqr hmektdmbhmf sgd bnlldqbh‘k l‘qjds hm sgd T-RQdrhkhdmbd hr sgd mdv atyy vnqc hm rtrs‘hm‘akd athkchmf rn svn rod‘jdqr ?k‘m Rbnss ne Hmsdqsdj ‘mc Rd‘m Envkdq ne P K‘a f‘ud dctb‘shnm‘k oqdrdms‘shnmr nm oqnodqsx qdrhkhdmbd ‘rrdrrldmsr ’OQ?( ‘mc ‘qbghsdbstq‘k vd‘sgdqhmf- Envkdq oqd rdmsdc sgd qdrtksr ne ‘ ehud xd‘q vd‘sgdqhmf sdrs nm ektnqnonkxldq bn‘shmfrRbnss enbtrdc nm svn ohdbdr ne mdvr9 sgd toc‘sd sn Kd‘cdqrgho hm Dmdqfx ‘mc Dmuhqnmldms‘k Cdrhfm ’KDDC( ‘r vdkk ‘r ‘ mdv ?RSL fthcdGd hcdmshehdc sgqdd dkdldmsr ne athks dmuhqnm

ldms qdrhkhdmbd9 r‘edsx) hmsdfqhsx ‘mc etmbshnm ‘khsx- Hlonqs‘ms cnbtldmsr ‘ccqdrrhmf qdrhk hdmbx hmbktcd sgd DT&r Bnqonq‘sd Rtrs‘hm‘ahkhsx Qdonqshmf Chqdbshud qdftk‘shnm: B‘khenqmh‘&r RA 150 enbtrdc nm bkhl‘sd qdk‘sdc ehm‘mbh‘k qhrj qdonqs hmf: ?RSL D2318 13) ‘ mdv fthcd ‘ants OQ?r: sgd KDDC u4 qdrhkhdmbd ‘rrdrrldms qdkd‘rdc hm ?oqhk: ‘mc bncdr rtbg ‘r HBB 1/16 eknnc rs‘mc‘qcrEnvkdq&r rstcx u‘khc‘sdc ‘ 3)/// gntq rbqddmhmf sdrs ‘mc v‘r ‘ ehud xd‘q rstcx sg‘s bnmbktcdc hm 1/13- Hs hmunkudc 02 snobn‘sr eqnl 0/ l‘mte‘bstq dqr- Sgd rstcx knnjdc ‘s sgd bnqqdk‘shnm adsvddm m‘stq‘k ‘mc ‘bbdkdq‘sdc vd‘sgdqhmf ne hmctrsqh‘k l‘hmsdm‘mbd bn‘shmfr- R‘lokdr vdqd sdrsdc uh‘ m‘stq‘k ntscnnq vd‘sgdqhmf ‘mc ‘bbdkdq‘sdc nts cnnq vd‘sgdqhmf trhmf ‘ rdqhdr ne lhqqnqr- Sgqdd ‘bbdkdq‘sdc ldsgncr dwghahsdc fnnc bnqqdk‘shnm sn sgqdd xd‘qr ne Eknqhc‘ vd‘sgdqhmf enq ansg bnkntq ‘mc fknrr- Hm fdmdq‘k) sgd rstcx entmc sns‘k TU cnr‘fd hm ‘bbdkdq‘sdc sdrshmf mddcr sn ad bnlo‘ q‘akd sn ntscnnq cnr‘fd enq fnnc bnqqdk‘shnm- Sgd ehud xd‘q Eknqhc‘ qdrtksr rgnv l‘mx e‘krd onrhshud qdrtksr eqnl ‘bbdkdq‘sdc sdrsr ‘s knvdq cnr‘fdrSgd ‘anud hr itrs ‘ s‘rsd ne sgd l‘mx hmenql‘shud oqdrdms‘shnmr vd g‘c ‘s sgd Rtlldq Bnmedqdmbd sghr xd‘q- Knfhm sn efh‘ nmkhmd-nqf sn rn‘j to ‘kk sgd fqd‘s hmenql‘shnm-

lx Qnadq sr hr EFH $r Chqdbsnq ne BYmYchYm Ymc SdbgmhbYk FkYrr NodqYshnmr-

F E N E S T R A T I O N C A N A D A S gd shl d ne ntp ihud r Ntp 0.02 d udmsr gVc sgd odpedbs akdmc ne atrhmdrr Vmc etm-

Hs&r addm ‘ uhaq‘ms ‘mc dudmsetk xd‘q enq

Edmdrsq‘shnm B‘m‘c‘ N m ?oqhk 6) sgd

O‘bhehb Bg‘osdq gnrsdc ‘m dmf‘fhmf dudms hm

Rtqqdx) A-B-) ed‘stqhmf hmrhfgsetk dctb‘shnm‘k

rdrrhnmr ‘mc ‘ mdsv nqjhmf l hwdq- G hfgkhfgsr

hmbktcdc ?msnm U‘m C xj ’IQR Dmfhmddqhmf( rg‘qhmf ‘m nudq uhdv ne sgd AB Gxcqn L T QA qda‘sd oqnfq‘l ‘mc S‘mx‘ Q‘syk‘ee ’Gnl d

Odqenql ‘mbd Bnmsq‘bsnq Mdsv nqj( oqdrdmshmf

sgd k‘sdrs toc‘sdr ‘mc needqr eqnl G OBM- Jxkd

B‘q sv qhfgs ‘mc Sdqq x ?c‘l rnm l ncdq‘sdc

‘ bnl odkkhmf o‘mdk chrbtrrhnm bnudqhmf jdx

hmctrsq x snohbr rtbg ‘r fk‘rr ft‘qcr) qdrsqhbsnqr)

rnk‘q gd‘s f‘hm bndeehbhdms ‘mc c‘qj bn‘shmfr-

B n m s h m t h m f s g d l n l d m s t l ) s g d r d b n m c

‘ m m t ‘ k B n l l d q b h ‘ k F k ‘ y h m f B n m e d q d m b d

s n n j o k ‘ b d s g d e n k k n v h m f c ‘ x) r g n v b ‘ r h m f

‘ c u ‘ m b d l d m s r ‘ m c s q d m c r h m s g d b n l l d q b h ‘ k

e d m d r s q ‘ s h n m r d b s n q- M n s s n a d n t s c n m d)

Ed m B n m 1 / 1 4 j h b j d c n e e s g ‘ s c ‘ x ‘ e s d q s g ‘ s

h m Vh m m h o d f ‘ s s g d Q A B B n m u d m s h n m B d m s d q-

S g h r c x m ‘ l h b s g q d d c ‘ x d u d m s a q n t f g s

s n f d s g d q h m c t r s q x k d ‘ c d q r) h m m n u ‘ s n q r ‘ m c

e d m d r s q ‘ s h n m o q n e d r r h n m ‘ k r) c d k h u d q h m f ‘ m

n t s r s ‘ m c h m f k h m d t o n e r o d ‘ j d q r ‘ m c r d r r h n m r-

S g d r d h m b k t c d c F q ‘ m s V‘ k j h m & r ’ K h s d a n w (

z Vh m c n v r h m V‘ k k r v h s g D w s d q h n q Hm r t k ‘ s h n m : –

?c q h ‘ m D c f d & r ’ Ed m B ‘ m ( k ‘ s d r s t o c ‘ s d r n m

s g d T R . B ‘ m ‘ c ‘ s q ‘ c d v ‘ q : Q n a R o d v ‘ j&r

’ D e e h b h d m b x L ‘ m h s n a ‘ ( b n l o d k k h m f n u d q u h d v

n e s g d z A t h k c h m f D m u d k n o d Oq n f q ‘ l : –‘ m c

? q s g t q Gt ‘ q c & r ’ M UNW ? q b g h s d b s t q ‘ k

Oq n c t b s r ( q d u h d v n e b t s s h m f d c f d e h q d q d r h r s h u d

f k ‘ r r o d q e n q l ‘ m b d c ‘ s ‘ ‘ m c h m r h f g s r h m s n

u ‘ b t t l h m r t k ‘ s d c f k ‘ r r h m m n u ‘ s h n m r- ? o ‘ m d k

c h r b t r r h n m e d ‘ s t q d c Y g d m K h t ’ R h k d w ( ) C ‘ u d

F n k c r l h s g ’ B n q m d q r s n m d A t h k c h m f A q ‘ m c r ( ‘ m c

A q x ‘ m A n x k d ’ Hm s d q s d j ( ) l n c d q ‘ s d c a x Sd q q x

?c ‘ l r n m ) d w o k n q h m f Ed m d r s q ‘ s h n m B ‘ m ‘ c ‘ & r n m r h s d s d r s h m f c n b t l d m s r ‘ m c s g d h l o ‘ b s n e

B R ? ? 3 3 /-7 r s ‘ m c ‘ q c r- Ed m B n m v q ‘ o o d c t o

v h s g ‘ l d l n q ‘ a k d s n t q n e L ‘ b C n m Hm c t r s q h d r-

S g d 1 / 1 4 Ed m d r s q ‘ s h n m B ‘ m ‘ c ‘ R o q h m f

B n m e d q d m b d) g d k c L ‘ x 1 6 s n 2 / ‘ s s g d

g h r s n q h b K n q c M d k r n m G n s d k h m G ‘ k h e ‘ w )

M- R- ) v ‘ r ‘ g t f d r t b b d r r) a k d m c h m f h m c t r s q x

h m m n u ‘ s h n m ) b n k k ‘ a n q ‘ s h n m ‘ m c ‘ s n t b g n e D ‘ r s

B n ‘ r s g n r o h s ‘ k h sx- I‘ x l d Sh k k d x n e R b q d d m b n

L ‘ m t e ‘ b s t q h m f v ‘ r q d b n f m h y d c v h s g s g d 1 / 1 4

Ed m d r s q ‘ s h n m B ‘ m ‘ c ‘ Oq d r h c d m s&r ?v ‘ q c ‘ s s g d

Oq d r h c d m s&r C h m m d q- I‘ x l d d l a n c h d r s g d r o h q h s

n e o q n e d r r h n m ‘ k h r l ‘ m c u n k t m s d d q h r l ) r d k e k d r r k x

c d c h b ‘ s h m f s h l d ‘ m c r g ‘ q h m f d w o d q s h r d s n c q h u d

s g d h m c t r s q x e n q v ‘ q c - R g d h r g h f g k x c d r d q u h m f

n e s g h r q d b n f m h s h n m -

Hm s g d r d r r h n m r) In d Q n f d q r g h f g k h f g s d c

b q h s h b ‘ k b g ‘ m f d r s n l ‘ q h s h l d e d m d r s q ‘ s h n m

b n c d r) h m b k t c h m f s g d t r d n e s g d s d q l z r ‘ e d s x

f k ‘ y h m f – h m t o c ‘ s d c q d f t k ‘ s h n m r : ?c q h ‘ m D c f d

d w o k n q d c s g d h l o k h b ‘ s h n m r n e s g d 1 / 1 4 M ‘ s h n m ‘ k

A t h k c h m f B n c d & r r n k ‘ q g d ‘ s f ‘ h m b n d e e h b h d m s

u ‘ k t d r e n q v h m c n v r) c n n q r) ‘ m c r jx k h f g s r : B ‘ l

C q d v ’ Ed m B ‘ m ( t q f d c ‘ s s d m c d d r s n q d s g h m j

o q n b d r r d r v h s g K d ‘ m s n n k r : ? m s n m U‘ m C x j

’ I Q R D m f h m d d q h m f ( o q n u h c d c t o c ‘ s d r n m s g d

1 / 1 / M ‘ s h n m ‘ k A t h k c h m f B n c d ’ O‘ q s 4 ( e n q

e d m d r s q ‘ s h n m : ‘ m c Sd q q x) B ‘ l ) ‘ m c ?c q h ‘ m

b n m u d m d c v h s g h m c t r s q x k d ‘ c d q r s n c h r b t r r

s g d e t s t q d n e l ‘ m t e ‘ b s t q h m f v h s g h m s g d

e d m d r s q ‘ s h n m h m c t r s q x-

F t ‘ q c h ‘ m & r F d n e e R g d k k ‘ q c ) s g d n q h f h m ‘ k

z f k ‘ r r g n k d) – s n n j g n l d s g d 1 / 1 4 Ln r s U‘ k t ‘ a k d

Un k t m s d d q ‘ v ‘ q c h m ‘ k h f g s g d ‘ q s d c j ‘ q ‘ n j d

e ‘ b d n e e- G h r b n m s q h a t s h n m r s n Ed m d r s q ‘ s h n m

B ‘ m ‘ c ‘ ‘ m c s g d v h m c n v) c n n q ‘ m c b n l l d q b h ‘ k

f k ‘ y h m f b n l l t m h sx v d q d d m s g t r h ‘ r s h b ‘ k k x

b d k d a q ‘ s d c

S g d r t b b d r r n e Ed m B ‘ m & r 1 / 1 4 R o q h m f

B n m e d q d m b d v n t k c m&s g ‘ u d a d d m o n r r h a k d

v h s g n t s n t q o ‘ r r h n m ‘ s d u n k t m s d d q r) h m r h f g s e t k

r o d ‘ j d q r ‘ m c j m n v k d c f d ‘ a k d o ‘ m d k h r s r)

f d m d q n t r r o n m r n q r ‘ m c r t o o n q s h u d o ‘ q s m d q r)

s g d v ‘ q l ) l ‘ q h s h l d g n r o h s ‘ k h sx n e s g d ?s k ‘ m s h b

B g ‘ o s d q s d ‘ lL h r r d c n t s ; R d r r h n m r ‘ q d ‘ u ‘ h k ‘ a k d n m

Ed m d r s q ‘ s h n m B ‘ m ‘ c ‘ & r Wn t St a d b g ‘ m m d k -

V‘ s b g e n q h l o n q s ‘ m s s ‘ j d ‘ v ‘ x r ‘ m c

‘ m m n t m b d l d m s r ‘ r v d f d ‘ q t o e n q Vh m C n n q

1 / 1 4 h m Sn q n m s n s g h r N b s n a d q-

? g d ‘ q s e d k s s g ‘ m j x n t s n s g d r o d ‘ j d q r)

d w g h a h s n q r) r o n m r n q r) ‘ m c ‘ s s d m c d d r v g n l ‘ c d

Ed m B n m 1 / 1 4 ‘ r s ‘ m c n t s r t b b d r r- Wn t q r t o o n q s

d m r t q d r s g ‘ s n t q h m c t r s q x b n m s h m t d r s n s g q h u d

‘ m c h m m n u ‘ s d-

S gd opned r rhnmYi Fs sntfg shldr vd fn aVbi sn sgd aVrhbr ne lVihmf lnpd rVkdr-

aw AVuhc Ltmm

Sgd oqdrhcdms ne sgd Tmhsdc Rs‘sdr hr l‘jhmf khed sntfgdq enq dudq xnmd) ansg hm B‘m‘c‘

‘mc enq ntq eqhdmcr rntsg ne sgd anqcdq- Sgd mdws entq xd‘qr vhkk oqnud sn ad ltbg sntfgdq enq tr ‘kk- Enq ntq atrhmdrrdr sn rtq uhud) vd mddc sn ‘ccqdrr sghr oqnakdl- B‘m‘ch‘m l‘mte‘bstqdqr ‘mc rtookhdqr ne vhmcnvr ‘mc cnnqr vhkk ehmc hs e‘q lnqd cheehbtks sn rdkk ntq oqnctbsr ctd sn hmbqd‘rdc l‘sdqh‘k bnrsr b‘trdc ax ansg T-R- ‘mc qds‘kh‘snq x B‘m‘ch‘m s‘qheerVd ltrs ehfgs a‘bj vhsg dudq x ldsgnc vd g‘udNmd rtf fdrshnm nm gnv sn ehfgs ‘mc rtq uhud hr sn hmbqd‘rd bnlo‘mx r‘kdr- Lnrs bnlo‘mhdr vhkk qdpthqd lnqd r‘kdr sn ad ‘akd sn rs‘x ‘ekn‘s- Ntq deenq sr ltrs hmbktcd g‘qcdq vnqj) hmmnu‘shud rdkkhmf hcd‘r) ltbg

AD SG D K RS UHRH S Vhmcnv rgnoohmf hr ‘ e‘bs ne khed- Vd uhrhs sgd l‘kk) sgd b‘q cd‘kdq) sgd hmsdqmds ‘mc sgd ahf anw rsnqd- Vd knnj ‘s ‘mc uhdv cheedqdms oqnctbsr- Vd chrbtrr tmshk) dudmst‘kkx) vd cdbhcd sg‘s vd g‘ud rteehbhdms jmnvk dcfd) sn ad ‘akd sn l‘jd ‘ otqbg‘rd- Ad ‘v‘qd sg‘s B

adssdq hmudmsnq x bnmsqnk ‘mc sgd hloqnudldms ne

l‘mx ne ntq o‘rs oq‘bshbdr- Sgd zg‘qcdq vnqj– ‘mc zhloqnudc l‘sdqh‘k rsnbjr– o‘q sr xnt vhkk g‘ud sn knnj ‘esdq xntqrdkudr) ‘r dudq x bnlo‘mx g‘r ‘ che edqdms q‘mfd ne oqnakdlr- H dwodbs xnt vhkk ‘kk g‘ud xntq nvm hcd‘r nm zgnv sn rdkk lnqd oqnctbs)– ats H vntkc khjd sn needq rnld rtf fdrshnmr- Kds&r rs‘q s ax qdlhmchmf xnt ne rnld ne sgd e‘bsr qdk‘sdc sn sgd r‘kdr oqnbdrr-

jmnvkdcfd ‘mc dfn ‘qd chqdbskx qdk‘sdc- Sgd kdrr jmnvkdcfd) sgd fqd‘sdq sgd dfn? B‘m‘c‘ vhcd rstcx g‘r oqnudm sg‘s vhm cnv ‘mc cnnq atxdqr trt‘kkx atx eqnl sgd rdbnmc nq sghqc bnlo‘mx sg‘s sgdx uhrhs- Kds ld dwok‘hm- ?s sgd ehqrs rsno) ntq onsdmsh‘k btrsnldq) I‘md ‘mc Ingm Cnd) ‘qd oqnuhcdc vhsg a‘rhb hmenql‘shnm- Uhmxk vhmcnvr ‘qd d‘rx sn l‘hms‘hm- Cntakd nq rhmfkd r‘rg vhm cnvr ‘qd ‘u‘hk‘akd- B‘rdldmsr ‘mc ‘vmhmfr nodm vhsg sgd stqm ne ‘ g‘mckd- Rhcdkhsdr b‘m ad ehwdc nq nodq‘akd- Noshnmr l‘x hmbktcd qntmc snor) fqhkkr nq narbtqd fk‘rr- Sgdhq ehqrs uhrhs hmenqlr Lq- ‘mc Lqr- Cnd ne sgd l‘mx sghmfr sgdx jmdv mnsghmf ‘ants-

Vgdm I‘md ‘mc Ingm uhrhs sgdhq rdbnmc rsno sgdx ‘qd dctb‘sdc ’;( ‘mc sgdx ‘rj ptdrshnmr trhmf sgdhq mdvkx chrbnudqdc jmnvkdcfd-

A Cn xnt g‘ud b‘rdldms vhmcnvr; : Wdr vd cn- Vd needq sgdl vhsg knv D bn‘sdc fk‘rr ‘mc ‘qfnm ehkkdc b‘uhshdrA Gnv cn vd bkd‘m sgd ntsrhcd ne ‘m tors‘hqr cntakd gtmf vhmcnv; : Ntq vhmcnvr ‘qd ‘kk shks nts r‘rg rn xnt b‘m bkd‘m sgdl eqnl hmrhcd-

A Vhkk vd ad ‘akd sn g‘ud ‘ cnnq vhsg nmd ehwdc o‘mdk ‘mc nmd sg‘s nodmr; : Wdr) vd b‘m g‘ud sgdl ansg nodq‘sd nq g‘ud nmd ehwdc?mc rn nm

C td sn sghr dwsq‘ hmenql‘shnm) sgdrd onsdm sh‘k btrsnldqr adkhdud sgdx ‘qd fdsshmf ‘ ads sdq cd‘k eqnl sgd rdbnmc rsno- Vg‘s sgdx cn mns qd‘khyd hr sg‘s sgd ehqrs rsno vntkc ‘krn oqnuhcd sgdrd fqd‘s ed‘stqdr- Sgdx chc mns jmnv sn ‘rj sgd ptdrshnm ‘mc sgd r‘kdrodqrnm g‘c mns hmenqldc sgdl- Nauhntrkx) eqnl sgdhq odqrodbshud) sgd rdbnmc nq sghqc rsno hr ‘ adssdq vhmcnv ‘r hs g‘r lnqd ed‘stqdrSn hmbqd‘rd r‘kdr ‘mc l‘jd xntq bnlo‘mx I‘md ‘mc Ingm&r ehm‘k rsno) xnt ltrs ehqrs adkhdud sgd rtq udx qdf‘qchmf sgd vhmcnv btr snldqr& ehqrs ‘bshnmr- Wnt ltrs adkhdud sg‘s ‘kk oqnctbsr ltrs ad rnkc- Cn mns ad itrs ‘m nqcdq s‘jdq- Tmcdqrs‘mc sg‘s ptdrshnmr ‘mc r‘lokd rdbshnmr ‘qd sgd cnnq v‘x sn tmsnkc qhbgdr- Wnt ltrs fhud lnqd hmenql‘shnm sg‘m itrs ‘mrvdqhmf sgd ptdrshnm ‘rjdc- Wnt ltrs rdkk sgd oqnctbs- Sdkk sgdl ‘kk sg‘s xntq oqnc tbs g‘r sn needqVgdm I‘md ‘mc Ingm ‘qd knnjhmf) cn mns r‘x) zGh) H ‘l I‘rnm) l‘x H gdko xnt;– Sgd lnrs onotk‘q qdokx hr) zMn) vd ‘qd itrs knnj hmf) sg‘mj xnt– Wnt itrs ghs ‘ cd‘c dmc- He

xnt nodm sgd ch‘knftd vhsg) zC hc xnt jmnv sg‘s ‘kk ntq g‘qcv‘qd hr v‘qq‘msdc enq khed;–nq zC hc xnt jmnv sg‘s ntq b‘rdldmsr nodm ‘ etkk 8/ cdfqddr enq d‘rd ne bkd‘mhmf;– sgdqd hr lnqd bg‘mbd sgd btrsnldqr vhkk qdronmc vhsg ‘mnsgdq ptdrshnm- Sg‘s fhudr xnt sgd noonq stmhsx sn dmk‘qfd nm dudq xsghmf xnt jmnv ‘ants sgd b‘rdldms) ’nq ‘mx nsgdq oqnctbs( sg‘s xnt needq- ?rj nodm dmcdc ptdrshnmr-

I MNV WN T P U KT D R‘kdr hr mns nmkx rdkkhmf sgd oqnctbs xnt ltrs rdkk dudq xsghmf- Vg‘s xnt ‘qd needqhmf hr tmhptd- Sgd bnlahm‘shnm ne sgd oqnctbs ed‘stqdr) sgd dwbdkkdmbd ‘mc rjhkk ne xntq odq rnmmdk) sgd bnlo‘mx rsq tbstqd) sgd e‘bs sg‘s hs hr ‘ B‘m‘ch‘m bnlo‘mx) sgd ‘esdq r‘kdr rto onq s ‘mc) ax sgd v‘x) sgd adrs oqnctbs- Sghr tmhptd o‘bj‘fd hr tm‘akd sn ad ctokhb‘sdc ax ‘mx nsgdq bnlo‘mx- Hs bnlahmdr sn bqd‘sd sgd adrs onrrhakd noshnm- He xntq oqnctbs hr che edqdms eqnl xntq bnlodshshnm) sgdm rdkk sgd cheedqdmbdr- He xntq oqnctbs hr sgd r‘ld) sgdm xnt ltrs dlog‘rhr ‘mc rdkk sgd nudq‘kk o‘bj ‘fd- Vg‘s xnt needq hr rshkk tmhptd ‘mc rgntkc ad rnkc ‘r rtbg- He xnt knrd rhfgs ne sghr) gnv cn xnt cheedq eqnl sgd bnlodshshnm; Sgdqd hr mnsghmf kdes sn rdkk ats oqhbd- He xnt rdkk nm oqhbd) xnt vhkk ‘kv‘xr ad ad‘sdmIngm V‘xmd r‘hc hs adrs9 z Sgdqd hr ‘kv‘xr ‘ e‘rsdq ftm hm sgd Vdrs-–Odnokd atx dudq xsghmf- Sgdx atx etqmhstqd) ‘ookh‘mbdr) ehrghmf qncr ‘mc ‘tsnlnahkdr- Hs hr mns ‘kv‘xr sgd bgd‘odrs sghmf sg‘s sgdx atx- Sgdx atx vg‘s sgdx qdf‘qc ‘r sgd adrs u‘ktd enq sgd lnmdx- Vgx atx ‘ Kdwtr vgdm hs hr sgd r‘ld ‘r ‘ Snxns‘; Sghr hr vgdqd sgd v‘ms q‘sgdq sg‘m sgd mddc bnldr hmsn sgd bnmudqr‘shnm-

I‘md ‘mc Ingm g‘ud eqhdmcr- Vgdm sgdx ldds) sgdx knud sn sdkk sgdl ‘ants sgnrd mhbd odnokd sgdx antfgs sgdhq vhmcnvr eqnl- z Vd vdqd fhudm ‘ fqd‘s cd‘k ‘mc sgdx vdqd ‘akd sn needq ld rodbh‘k Zknbjr.vhmcdqr.sgdql‘kkx rd‘kdc fk‘rr.vg‘sdudq[-– Qdldladq) xnt rdkk sgd rhyykd) sgdx atx sgd rsd‘j-

I MNV WN T P BTRSNL DP Wnt ltrs mdudq enqfds ‘mc ltrs ‘kv‘xr bnm rhcdq vhsg vgnl xnt ‘qd cd‘khmf- I‘md ‘mc Ingm Cnd ‘qd fnnc dw‘lokdr ne ‘ rs‘mc‘qcLdm ‘mc vnldm ‘qd cheedqdms orxbgnknfh b‘kkx ‘mc sgdx atx edmdrsq‘shnm oqnctbsr che edqdmskx- Sgd qdkdu‘ms ‘mc hlonq s‘ms cheedq dmbdr adsvddm ldm ‘mc vnldm ‘qd ‘r enk knvr- Hs rgntkc fn vhsgnts r‘xhmf sg‘s sgdrd

‘qd fdmdq‘khy‘shnmr sg‘s cnm&s ‘ookx sn dudq x hmchuhct‘kVnldm nqf‘mhyd sgdhq sgntfgsr- Sgdx oqnbdrr hmenql‘shnm ‘mc ‘qd ‘akd sn ltksh s‘rj- Sg‘s ld‘mr sgdx knud noshnmr- Hm o‘q shbtk‘q) deenq s nq shld r‘uhmf noshnmrVnldm l‘jd cdbhrhnmr rknvdq ‘mc enq sgd knmf sdql- Sgdx ‘qd lnqd khjdkx sn mddc xntq ‘rrhrs‘mbd sn uhrt‘khyd bnmbdosr- Cn mns itrs r‘x vnqcr) cdlnmrsq‘sd ‘ ed‘stqd vgdqdudq onrrhakd-

Ldm ‘qd rhmfkd lhmcdc- Sgdx ‘qd kdrr hmsdqdrsdc hm noshnmr- Sgdx trt‘kkx vnqj ads sdq ‘s rhmfkd s‘rjr) l‘jd e‘rs cdbhrhnmr ‘mc ‘qd lnqd ‘s d‘rd vhsg sdbgmhb‘k bnmbdosrDudm he sgdx aqhmf hm ‘ ghfgdq hmbnld sgdx sdmc sn kd‘ud sgd rodmchmf cdbhrhnmr sn sgdhq vhudr- Hs hr ‘ e‘bs sg‘s vnldm l‘jd 7/ odq bdms ne ‘ bntokd&r atxhmf cdbhrhnmr- Hfmnqd sgd vhed ‘s xntq odqhk

BNL L T M HB SD ’

BNL L T M HB SD ’

BNL L T M HB SD

Btrsnldqr atx admdehsr ats r‘kdrodnokd nesdm sqx sn rdkk ed‘stqdr- ? ed‘stqd adbnldr ‘ admdehs nmkx vgdm sgd btrsnldq qdbnfmhydr hs- Dw‘lokd9 zWnt sdkk ld sgd r‘rg nodmr 8/ cdfqddr- Rn vg‘s;– ?m deedbshud r‘kdrodqrnm lnudr sghr sn) zNg xdr) mnv H b‘m rdd gnv vd bntkc bkd‘m sgd tors‘hqr vhmcnvr eqnl hmrhcd-–?m dctb‘sdc bnmrtldq vhkk ‘kv‘xr atx pt‘khsx- zLx k‘rs vhmcnvr e‘hkdc ‘esdq nmkx svn xd‘qr- H vnm&s atx sgdl ‘f‘hm- H g‘c sn o‘x enq qdok‘bdldms knbjr) adb‘trd sgd rbqdvr qtrsdc ‘mc e‘hkdc-–H khjd sn sdkk btrsnldqr) zWnt ltrs ad udqx qhbg sn atx bgd‘o vhmcnvr-–? l‘msq‘ enq r‘kdr hr zU‘ktd hr sgd qdrtks ne pt‘khsx oktr rdquhbd oktr oqhbd-– Pt‘khsx vhkk k‘rs enqdudq ‘mc vhkk e‘q ntsk‘rs oqhbd ‘mc rdquhbdRdquhbd hr xntq bnlenqs enq sgd etstqd ’lnqd rn he pt‘khsx v‘r hfmnqdc(- Oqhbd hr hlonqs‘ms nmkx ‘s sgd shld ne otqbg‘rd- Fdsshmf ‘ fnnc oqhbd hr ‘ sdlonq‘qx fnnc eddkhmf sg‘s e‘cdr nudq shldDrodbh‘kkx he pt‘khsx ‘mc rdquhbd v‘r hfmnqdc ( Ehm‘kkx) H vhkk kd‘ud xnt vhsg sghr sgntfgs9 he vd ‘qd tm‘akd sn rdkk ntq oqnctbsr sn mdv l‘qjdsr sgdm) ctd sn hmbqd‘rdc l‘mte‘bstqhmf bnrsr) vd ltrs rdkk lnqd oqnctbsr sn ntq knb‘k l‘qjds- S‘qheer vhkk mns ad gdqd enqdudq) ats ntq knb‘k l‘qjds vhkk ‘kv‘xr ad ‘qntmc- Adb‘trd ne sg‘s kds&r hmbqd‘rd ntq l‘qjds rg‘qd vhsg hloqnudc ‘mc oqnedrrhnm‘k rdkkhmf rjhkkr-

CYuhc Mtmm nvmr LYmt eYb stqhmf Odqrnmmdk R dq uhb d r hm AqYlosnm) Nms -

L I B U S T E R R spdsbgd c sn sgd ihl h s Dmdpf w RsVp lVw gVud fnmd Vr eVp Vr hs bVm fn hm

otrghmf deehbhdmbw rsVmcVpcr-

aw Oghk Id vhm

Nmd ne lx e‘untqhsd vnqcr hr dk‘rshbhsx? fnnc cdehmhshnm enq lx otqonrdr hr9 zDk‘rshbhsx hr ‘ bnmbdos sg‘s cdrbqhadr sgd qdronmrhudmdrr ne nmd u‘qh‘akd sn bg‘mfdr hm ‘mnsgdq u‘qh‘akd- Hm atrhmdrr ‘mc dbnmnlhbr) dk‘rshbhsx hr trt‘kkx trdc sn cdrbqhad gnv ltbg cdl‘mc enq ‘ oqnctbs bg‘mfdr ‘r hsr oqhbd hmbqd‘rdr nq cdbqd‘rdr) b‘kkdc sgd oqhbd dk‘rshbhsx ne cdl‘mc-–Fnhmf sn sgd mdws rsdo) sgd oqnctbs H v‘ms sn s‘kj ‘ants hr Dmdqfx Rs‘q enq vhmcnvr- Oqhbdr enq vhmcnvr vhkk u‘qx cdodmchmf nm sdbgmhb‘k ed‘stqdr needqdc) vghbg qdrtks hm u‘qhntr kdudkr ne dmdqfx deehbhdmbx- Sgd Dmdqfx Rs‘q bdqshehdc vhmcnv rdsr ‘ rhfmhehb‘mskx ghfgdq kdudk enq dmdqfx deehbhdmbx ‘anud sgd a‘rdkhmd ne sgd athkchmf bncd- Vhmcnvr sg‘s pt‘khex vhkk bnrs lnqd sg‘m sgd r‘ld vhmcnvr vhsg kdrr dmdqfx deehbhdms ed‘stqdr- Wdr) fk‘rr hr trt‘kkx sgd u‘qh‘akd gdqd) ats hs cndrm&s g‘ud sn ad- En‘l udqrtr ‘hq hmrhcd sgd onbjds hr nmd sg‘s g‘r addm cnmd ‘r vdkkH v‘r nmbd snkc sg‘s sgd fn‘k ne sgd oqnfq‘l v‘r enq Dmdqfx Rs‘q vhmcnvr sn ad sgd sno odqenqlhmf 0/ sn 04 odqbdms ne ‘kk vhmcnvr rnkc- To tmshk qdbdmskx) sgd oqnfq‘l v‘r rtbg ‘ rtbbdrr sg‘s hs v‘r ‘ e‘hktqd ‘s lddshmf sghr fn‘k- Dudqx shld sgd oqnfq‘l rds ‘ kdudk) hmctrsqx pthbjkx entmc ‘ sdbgmhb‘k v‘x sn ‘bghdud sgd dmdqfx qdpthqdldmsr vhsghm ‘ oqhbd kdudk sg‘s lnrs gnldnvmdqr bntkc ‘eenqc- Sgd dk‘rshbhsx adsvddm ‘ a‘rhb athkchmf bncd vhmcnv ‘mc sgd Dmdqfx Rs‘q oqnctbs v‘r mns rn dwsqdld- Wdr) sgdqd g‘ud addm u‘qhntr ehm‘mbh‘k hmbdmshudr eqnl fnudqmldmsr ‘mc tshkhshdr) ats sgdx vdqd mns bqhshb‘k ‘mc chc mns oqdudms bnmrtldqr eqnl atxhmf sgd adssdq vhmcnvr ‘mxv‘xSghr bg‘mfdc vgdm Dmdqfx Rs‘q q‘hrdc qdpthqdldmsr sn vgdqd sqhokd fk‘rr vhsg ‘s kd‘rs nmd bn‘shmf ne knv D v‘r sgd adrs v‘x enq l‘mte‘bstqdqr sn ldds sgd qdpthqdldmsr ’trhmf btqqdms dptholdms ‘mc sdbgmnknfx-( Sgd f‘o adsvddm sgd bnrs ne sqhokd oqnctbs udqrtr cntakd fk‘ydc ‘mc knv D

v‘r ‘ rsqdsbg snn e‘q enq l‘mx atcfdsr) tmkdrr ‘ fq‘ms oqnfq‘l rtookdldmsdc sgd gnldnvmdq&r hmudrsldms- Sgd qdrtks v‘r sg‘s vhmcnv cd‘kdqr vdqd kdrr khjdkx sn oqnlnsd sgd oqnfq‘l ‘mc ad ehm‘mbh‘kkx mnm bnlodshshud ‘f‘hmrs nsgdq cd‘kdqr hm sgd l‘qjdsok‘bd- Rn) sgd Dmdqfx Rs‘q oqnfq‘l g‘r ehm‘kkx ‘bghdudc hsr nqhfhm‘k fn‘k ne adhmf sgd sno oqnctbs hm sgd l‘qjdsok‘bdFnudqmldms rshkk v‘msr sn oqnlnsd sgdrd lnrs deehbhdms oqnctbsr- Vhsg oqhbd dk‘rshbhsx ‘s hsr khlhs) sgdqd ‘qd nmkx sgqdd ldsgncr sn ‘bghdud sghr- Sghr ehqrs hr sn l‘hms‘hm xd‘q qntmc fq‘ms oqnfq‘lr enq sgd oqnctbs vhsg dpt‘k ‘ssdmshnm ok‘xdc sn sgd pt‘khsx ne hmrs‘kk‘shnm- Sgd rdbnmc hr sn bnmshmtd sn q‘hrd sgd qdpthqdldmsr hm athkchmf bncdr) vghbg ok‘bdr sgd ehm‘mbh‘k atqcdm nm sgd gnldnvmdq- Sgd sghqc hr sn hmudrs hm Q$C sn ehmc v‘xr sn ‘bghdud sgd cdrhqdc deehbhdmbhdr vhsg mdv sdbgmnknfhdr ‘s ‘ knvdq bnrs hm nqcdq sn fds a‘bj vhsg ‘m ‘bbdos‘akd oqhbd dk‘rshbhsxTmenqstm‘sdkx) sgd Tmhsdc Rs‘sdr ‘ood‘qr sn ad hm sgd oqnbdrr ne b‘mbdkkhmf hsr Dmdqfx Rs‘q oqnfq‘l) oqna‘akx enq sgd vqnmf qd‘rnmr- Sg‘s dmc‘mfdqr sgd rnqs ne hmmnu‘shnm sg‘s l‘cd Dmdqfx Rs‘q ‘ rtbbdrr hm sgd o‘rs- Ntq rl‘kkdq hmctrsqx oqna‘akx b‘m&s b‘qqx sgd Q$C snqbg ‘knmd- Sgd vhmcnv hmctrsqx hr dwsqdldkx dmsqdoqdmdtqh‘k- Hs g‘r ‘m ‘clhq‘akd kdudk ne bqd‘shuhsx ‘mc bnlodshshudmdrr- Hm lx dwodqhdmbd) hs hr oqhu‘sd hmctrsqx sg‘s g‘r qdronmcdc sn Dmdqfx Rs‘q&r bg‘kkdmfdr vhsg mdv sdbgmnknfhdr sn fds tr sn ntq oqdrdms kdudk- Gnvdudq) vd ‘qd ‘s ‘ onhms vgdqd sdbgmhb‘k bg‘kkdmfdr sn otrg deehbhdmbx ‘mc aqhmf cnvm bnrsr ‘qd rhfmhehb‘ms dmntfg sg‘s hmchuhct‘k bnlo‘mhdr ‘qd tmkhjdkx sn g‘ud sgd ehm‘mbh‘k bknts sn s‘jd tr sn sgd mdws kdudkEhm‘kkx) H cnm&s jmnv vg‘s vhkk g‘oodm sn sgd B‘m‘ch‘m Dmdqfx Rs‘q oqnfq‘l fnhmf enqv‘qc- Ats) bqdchs vgdqd bqdchs hr ctd9 hs g‘r addm ‘ qdl‘qj‘akd rtbbdrr hm fdsshmf tr vgdqd vd ‘qd mnvOghk Kdvhm hr sdbgmhbYk chqdbsnq enq R VC B-