DISPLAY YOUR WAY

Headless HMI lets you decide

Headless HMI

With the C-more headless HMI, you can display your factory floor data how and where you choose. The new CM5-RHMI has all the powerful functionality of the C-more Touch Panel HMIs, but without display size restrictions. This HDMI-enabled device works with televisions, monitors, projectors, and most any other HDMI display device or use the C-more Remote HMI mobile app and/or the embedded Web Server if you prefer no local display at all. The choice is yours!

Features include:

• HDMI video/audio output with multiple resolutions

• Audio: use USB audio adapter (not included)

• Video: VGA 640x480, SD 720x480, XGA 1024x768, HD 1280x720, FHD 1920x1080

• Works with most HID-compatible resistive and pCap touch screen monitors

• Multiple connections

• Ports: (2) Ethernet, (1) 3-pin RS485, (1) RS232 / RS422 / RS485 (serial), these ports support programming and device connections

• USB-B port for programming, monitoring, and configuration

• (4) USB-A ports for USB HID devices such as USB hub, pen drives, touch screen displays, keyboard, mouse, and bar-code scanners

• SD card slot for log files, project memory, or graphic media

• 90MB of user memory

• The USB A port allows support for most industrial touch screen monitors in the market

policies

Fast free standard shipping* is available for most orders over $49 U.S., and that includes the brokerage fees (when using an AutomationDirect nominated broker). Using our choice of carrier, we can reach most Canadian destinations within 2 to 3 days.

*Free shipping does not apply to items requiring LTL transport, but those shipments can take advantage of our negotiated super-low at rates (based on weight) that include brokerage fees.

See Web site for details and restrictions at: www.automationdirect.com/canada

FREE Software!

The easy-to-use C-more HMI design software can be downloaded free of charge from our webstore. Get started on your project today or take it for a test drive. Download as often as you need, no license or key required.

your copy now at: www.go2adc.com/cmoreswcm5 Orders over $49 get FAST FREE SHIPPING

267%

The increase since 2020 in wholesale electricity prices near major data centre concentrations. (Bloomberg)

The AI Bubble is Bad for Industry

Just recently, the Bank of America Global Research monthly fund manager survey revealed that 54% of investors now believe that we are in an AI bubble. In the past year this conclusion has steadily moved from the realm of the fringe iconoclast (Ed Zitron) to the institutional professional. Nvidia’s investment of $100 billion USD into OpenAI, much of which will in turn go to buy Nvidia chips, was perhaps the moment that many started to worry that the circular transactions might actually look spherical — that there might not be an organic market for these services, sufficient to sustain such astronomic stock values. Profitability might in fact matter.

AI itself is no doubt a profound technological development for industry, which will boost performance, efficiency, innovation, and lower maintenance and upkeep costs, to say nothing of the fraught question of labor. The question we here at CPECN need to ask is this: of what consequence is an AI bubble for Canadian process industry?

Comparisons keep getting made to the dotcom bubble and subsequent crash, when $5 trillion USD was wiped from the stock market. Certainly this was a disaster. But out of that period, the infrastructure requisite for the emergence of a mature internet had been built, and new players emerged — Google, Yahoo, Amazon et al. The dotcom bubble was the crisis that paradoxically demonstrated that the ‘internet superhighway’ was here to stay.

So perhaps we should temper our worst fears, no? Whatever happens over the next year or two in terms of the markets, the infrastructure has been laid down — AI has arrived. OpenAI and Nvidia may be only of this moment, but the benefits of AI for industry will plausibly sustain into the medium and long term.

But the real question is what impact the bubble conditions are having on industry. The technology itself is a boon to owners and operators of plants and pipelines, but how should we treat the hyped economic behaviour around that technology? At the current moment, the prospects of AI for industry are inseparable from the bubble conditions in which it is being delivered, and those conditions are adverse.

Let us look at three examples of bubble-driven economic behaviour that have become impediments for industry:

THE SCRAMBLE FOR GRID CAPACITY

Consider first the matter of electrical infrastructure. Alberta’s grid can accommodate 12 gigawatts at peak demand. Feverish data center developers have requested 16 gigawatts across 29 projects — more electricity

than the province’s entire industrial base currently consumes. The result is that the Alberta Electric System Operator has capped new data center connections at a mere 1.2 gigawatts until 2028. In Ontario, the queue stands at 6,500 megawatts of requested capacity, equivalent to the entire output of Bruce Power. When a chemical manufacturer or food processor seeks to expand operations, they now face multiyear delays. Meanwhile, data center developers shop identical speculative projects to multiple utilities, hedging their bets while others wait. The grid infrastructure that Canadian industry built over decades has become a bottleneck, with access rationed to accommodate irresponsible speculation.

ELECTRICITY COSTS DRIVEN BY SPECULATION

The financial burden follows swiftly. Wholesale electricity prices near major data center concentrations have climbed as much as 267% since 2020, with industrial users absorbing the increases through their rates. Ontario’s system operator projects that data centers will consume 13% of new electricity demand by 2035; Hydro-Québec identifies them as the single largest item in its supply plan through 2032. All this while the economics remain speculative at best; hyperscalers spent $200 billion on AI infrastructure in 2024 while generating a mere $30 billion in AI revenue. Process manufacturers operating on thin margins now subsidize this infrastructure gamble through steadily rising power costs.

COMPETITION FOR SKILLED TRADES

Finally, there is the question of labor. Data center construction demands vast crews of electricians, plumbers, and HVAC specialists across multi-year timelines. In Alberta alone, related spending reached $42.5 billion in 2025, competing directly with manufacturers already facing severe skilled trades shortages. Premium wages on data center sites drain the talent pool, leaving process industries unable to complete expansions at projected costs.

All of this could be worth it if AI delivers the epochal profit and transformation that has been promised. But the floor for satisfying expectations is worryingly high, and the costs are being paid right now.

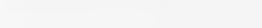

Volume 53 No.6 December 2025

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal Customer Service

Tel: 416-510-5113

Fax: (416) 510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Audience Manager Anita Madden 416.510.5183 amadden@annexbusinessmedia.com

Brand Sales Manager Pat Lorusso 416.518.5509 plorusso@annexbusinessmedia.com

Editor Justin Yule 438.483.7451 jyule@annexbusinessmedia.com

Account Coordinator Kristine Deokaran 416.510.6774 kdeokaran@annexbusinessmedia.com

Group Publisher/ Director of Production Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

CPE&CN is published bi-monthly by:

Annex Business Media 111 Gordon Baker Rd, Suite 400, Toronto, ON M2H 3R1 T: 416-442-5600 F: 416-442-2230

© All materials in this publication are copyright protected and the property of Annex Business Media., the publishers of Canadian Process Equipment & Control News magazine.

For permission on reprinting or reproducing any materials, e-mail your requests to cpe@cpecn.com

Canadian Postmaster send address corrections to: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Canadian Process Equipment & Control News assumes no responsibility for the validity of claims in items reported.

Annex Privacy Officer privacy@annexbusinessmedia.com Tel: 800-668-2384

PUBLICATION MAIL AGREEMENT #40065710

Printed in Canada ISSN 0318-0859

Subscription

JUSTIN YULE, editor jyule@annexbusinessmedia.com

CANADIAN CHEMICAL INDUSTRY WATCHES EUROPEAN CRISIS UNRAVEL

Sir Jim Ratcliffe, founder and chairman of Ineos — one of the world’s largest chemical producers, has warned that Europe’s chemical industry is at a “tipping point,” with approximately half of Europe’s ethylene production capacity projected to close before 2030. Twenty-one major European chemical sites are already shutting down, representing more than 11 million tonnes of capacity.

Chemical output has declined by 30 per cent in the United Kingdom, 18 per cent in Germany and 12 per cent in France. Eight of the world’s 10 largest chemical companies are scaling back or withdrawing from Europe, while all of the United States’ top 10 producers are investing and expanding domestically.

“We’re at the 11th hour,” Ratcliffe said, calling for removal of green taxes and levies

and tariff protection. “We need actions, not sympathetic words or there won’t be much of a European chemical industry left to save.”

The situation highlights competitiveness challenges for Canada’s chemistry industry. As global chemical production shifts away from Europe and toward the United States, Canadian producers must ensure the country maintains competitive energy costs and policy frameworks to attract investment in the sector.

U.S. STAKES IN CANADIAN MINERS THREATEN SOVEREIGNTY, EXPERTS WARN

Canadian governance experts are raising alarms over U.S. government investments in Canadian-headquartered mining companies, warning the moves threaten national control over critical mineral resources. The U.S. government’s acquisition of a 10 per cent stake

US$35.6 million creates dangerous conflicts of interest, according to Richard Leblanc, a professor of governance, law and ethics at York University.

“It is uncommon for a government to have a stake in a domestic company, but it’s even more uncommon for a foreign government,” Leblanc said. The arrangement grants Washington board representation rights and option to increase ownership. It came alongside a U.S. presidential executive order directing road construction to Alaska’s Ambler mining district, where Trilogy holds joint venture interests. “To have an outside investor who can have regulatory approval, is that a conflict of interest? It absolutely is,” Leblanc said. “What this creates is a super shareholder.”

The deal follows Washington’s minority stake in Lithium Americas, another Canadianheadquartered company. Sara Ghebremusse, an assistant professor at UBC’s Allard School of Law, said conflict concerns are clear but likely not a Trump administration priority. Leblanc urged Ottawa to scrutinize the transaction with great care. “This could be a test case for what the Canadian government is prepared to accept,” he said. “That would also have implications for Canadian sovereignty, for Canadian defence, for our ability to govern our own Canadian companies.”

ADAPT OR DIE

How African Resource Nationalism Is Rewriting the Rules for Canadian Miners

By Justin Yule

The confrontation that unfolded in Mali throughout 2024 and 2025 between Toronto-based Barrick Gold and the new government there reads like a cautionary tale for Canadian mining companies operating across Africa. The conflict had its roots in Mali’s revised 2023 mining code, which increased state participation requirements to 35% (combining 20% state ownership with 15% for private Malian investors), imposed higher royalty rates, and stripped away tax exemptions that had been negotiated under previous agreements. When Barrick resisted operating under these new terms, the government responded forcefully. In November 2024, Mali imposed an export ban on Barrick’s Loulo-Gounkoto complex. What followed was a dramatic escalation: government authorities seized approximately three metric tons of gold valued at $318 million from Barrick facilities, detained four company executives, and ultimately forced a complete suspension of operations in January 2025. According to Barrick’s press releases, the company characterized the government’s actions as illegal interventions that violated established mining agreements. By June 2025, a Malian court had appointed a government administrator to assume operational control of the complex, effectively stripping Barrick of decision-making authority over one of its flagship African assets. The financial toll was severe. Barrick CEO Mark Bristow acknowledged the company was spending $15 million monthly merely to maintain the idle mine while production guidance for 2025 was slashed from 3.9 million ounces to between 3.2 and 3.5 million ounces. In February 2025, Reuters reported that Barrick ultimately signed an

agreement to pay the Malian government $438 million to resolve the dispute, secure the release of detained employees, recover seized gold, and restart operations. The Malian government, however, did not sign the deal, and the sitaution remains unresolved.

CÔTE D’IVOIRE

The Mali dispute is not an isolated incident of resource nationalism; it was simply the most dramatic manifestation of a continental shift. Just months later, in October 2025, a very different story unfolded in neighboring Côte d’Ivoire. Barrick announced that it had reached an agreement to sell its Tongon gold mine and exploration properties to Atlantic Group, a privately held Ivorian conglomerate, for up to $305

“African governments, observing how critical their resources have become to global supply chains, are asking a perfectly reasonable question: why should arrangements negotiated decades ago, when these minerals had fraction of their current strategic value, continue to govern their extraction today?”

Map of the West African Region

million. The transaction marked the first time that the mine, since it opened in 2010, would be under complete Ivorian ownership. In characterizing the sale, Barrick described it as “a transition to local stewardship” that would preserve Tongon’s operational excellence and community benefits.

The Tongon sale was not simply a commercial decision, it was enabled and encouraged by Côte d’Ivoire’s legislative framework. The country’s 2014 Mining Code requires companies applying for exploration and exploitation permits to be incorporated within Côte d’Ivoire. According to the Extractive Industries Transparency Initiative’s reporting on Côte d’Ivoire, the government passed legislation in 2024 creating a beneficial ownership register, mandating disclosure of who ultimately controls extractive companies operating in the country. While the framework stops short of Mali’s confrontational approach, it creates systematic pressure toward localization. The Ministry of Mines, Petroleum and Energy has publicly supported these “new domestic ownership structures in the sector,” according to multiple industry reports documenting the transaction.

THE BIG PICTURE

What occurred in Mali and Côte d’Ivoire represents two sides of the same coin: African nations asserting sovereign control over their mineral resources in response to rapidly changing global conditions. Mali’s military junta chose confrontation, export bans, asset seizures, and forced renegotiation. Côte d’Ivoire’s elected government chose legislation, incorporation requirements, and market incentives that encourage voluntary transitions to local ownership. Côte d’Ivoire (GDP 86.5 billion USD) is the richer country, while Mali (GDP 26.6 billion USD) ranks among the ten poorest nations on earth and has fewer tools at its disposal. While the outcomes differ dramatically for foreign mining companies, the underlying impulse from African nations is identical — and entirely rational.

TOP RIGHT

The global energy transition has created unprecedented demand for critical minerals. Lithium, cobalt, copper, nickel, and rare earth elements have become strategic resources essential for electric vehicles, renewable energy systems, and advanced technologies. According to the International Energy Agency, demand for critical minerals could increase by as much as six times by 2040 under current climate policies. Sub-Saharan Africa holds substantial reserves of these minerals: the Democratic Republic of Congo produces approximately 70% of the world’s cobalt, while other African nations possess significant deposits of graphite, manganese, and platinum group metals. African governments, observing how critical their resources have become to global supply chains, are asking a perfectly reasonable question: why should arrangements negotiated decades ago, when these minerals had fraction of their current strategic value, continue to govern their extraction today?

According to risk analysis firm Verisk Maplecroft, whose resource nationalism index was reported in March 2025, forty-seven developing countries have seen significant increases in government involvement in the mining and energy sectors since the first quarter of 2020, with seventeen of these countries producing critical minerals. The firm’s analysis reveals that resource nationalism is no longer a regional phenomenon but a global trend concentrated precisely where critical mineral deposits exist. The data shows that governments are not acting capriciously but responding systematically to changed economic realities: minerals that were once primarily industrial commodities have become geopolitical assets, and host governments are recalibrating ownership structures and revenue-sharing arrangements to reflect this transformation. The trend is particularly pro-

Barrick employees at the Loulo-Gounkoto mine

nounced in sub-Saharan Africa, where thirty-one countries have reformed their mining codes since 2014 to increase government and local community participation, according to legal analyses of investment disputes. These reforms follow a consistent pattern: higher royalty rates, increased state equity participation, local content requirements, and stricter environmental and social standards.

A NEW WAY TO DO BUSINESS

For Canadian mining companies, the critical question is not whether to adapt to this new reality, but how. Two Canadian companies experiences in Mali illustrate divergent approaches that may define the industry’s future in Africa. Barrick Gold represents what increasingly looks like the old way: negotiating agreements under favorable historical terms, resisting new frameworks, and ultimately facing confrontation when governments want change. B2Gold Corp. may represent the new way: proactively engaging with evolving regulations, accepting increased state participation, and maintaining operational continuity through partnership rather than confrontation.

B2Gold describes itself as a “responsible mining company” committed to operating “in accordance with international best practices” and maintaining “positive relationships with host governments and local communities.” This self-conception appears to inform the company’s strategic approach to

Loulo-Gounkoto is one of the world’s largest gold producers and contributed over $1 billion to Mali’s economy in 2023

“For Canadian mining companies, the strategic imperative is clear: Africa’s mineral wealth remains essential to global supply chains, particularly for critical minerals needed for energy transition, but the terms of access are fundamentally changing.”

Africa. Rather than viewing government demands for increased participation as threats to be resisted, B2Gold has treated them as legitimate expressions of sovereignty to be accommodated within a partnership framework. This philosophy proved decisive when Mali’s regulatory environment shifted.

While Barrick’s Mali operations descended into crisis, B2Gold’s Fekola complex in the same country continued with uninterrupted production. According to B2Gold’s website, in September 2024 the company announced it had “agreed to terms with the State of Mali in connection with the ongoing operation and governance of the Fekola Complex.”

The agreement resolved all outstanding disputes arising from Mali’s 2023 mining code, settled tax assessments and customs disputes from 2016 to 2023, and established a framework for expanding operations. Critically, B2Gold negotiated that its existing Fekola mine would continue under the 2012 mining code through 2040, while new projects at Fekola Regional would operate under Mali’s 2023 code with its increased state participation requirements.

The contrast in outcomes is striking. While Barrick fought Mali’s new framework and saw operations suspended, B2Gold adapted and received expedited approvals. In July 2025, as reported on the company website, B2Gold received government approval to commence underground mining at Fekola, with the expansion expected to extend the mine’s operational life significantly. B2Gold CEO Clive Johnson stated in company disclosures that the company had “seen a significant reduction in risk since finalizing the settlement agreement” and that expatriate teams, including mine management, “regularly travel in and out of Mali without issue” — a pointed contrast to Barrick’s detained executives.

Barrick’s communications, by contrast, emphasized legal rights under existing agreements, characterized government actions as violations of international law, and pursued international arbitration through the International Centre for Settlement of Investment Disputes. The company’s April 2025 press release stated that while it signed a negotiated

settlement agreement, “the Malian government has failed to execute it” and that “a small group of individuals placing personal or political interests above the long-term interests of Mali and its people” were obstructing resolution. Whether this characterization is accurate is almost beside the point — the framing positions the company in opposition to the host government rather than in partnership with it.

NEW TERMS ACROSS AFRICA

The emerging pattern across Africa suggests that B2Gold’s model may be more sustainable than Barrick’s, regardless of which company has legal right on its side. Beyond Mali, resource nationalism is reshaping mining operations continent-wide. Burkina Faso’s government established SOPAMIB, a state mining entity that has assumed control of mines formerly owned by international companies. Tanzania has revised its mining code to require domestic business participation and local processing of minerals. The Democratic Republic of Congo’s 2018 mining code revision increased state participation to include a 10% free share in all mining projects. Zimbabwe’s proposed Minerals Amendment Bill mandates government equity stakes in major projects.

For Canadian mining companies, the strategic imperative is clear: Africa’s mineral wealth remains essential to global supply chains, particularly for critical minerals needed for energy transition, but the terms of access are fundamentally changing. Companies can resist this change and face confrontation, operational disruption, and potential expropriation. Or they can adapt — accepting increased state participation, prioritizing genuine partnership with host governments, demonstrating transparent benefit-sharing with local communities, and building operations under the assumption that resource sovereignty will continue strengthening rather than weakening.

The Canadian mining industry’s future in Africa depends on recognizing that the Malian and Ivorian approaches — confrontation versus legislation — produce the same outcome: greater African control over African resources. What differs is the journey. Companies that proactively adapt to this reality, as B2Gold has done, can continue building profitable, long-term operations. Those that resist, clinging to agreements negotiated under very different political and economic circumstances, will increasingly find themselves in crisis.

A fundamental question emerges: can a western mining company operating in a hostile posture against its host government achieve sustainable success in contemporary Africa? The historical record shows that such an approach once succeeded because Western companies could invoke powerful external mechanisms — diplomatic pressure, international arbitration systems weighted toward investor protection and, in extreme

cases, interference by their home governments — to neutralize expressions of local sovereignty. But the geopolitical architecture that sustained those mechanisms has eroded. African nations have diversified their international partnerships, reducing dependence on traditional western allies. Rising powers offer alternative sources of investment and technology without the colonial baggage. International norms increasingly privilege sovereignty over investor rights. In this transformed landscape, confrontation has be-

come a losing strategy.

The choice facing Canadian mining companies is not between the old way and the new way — the old way is ending whether companies accept it or not. The choice is between adapting voluntarily, maintaining partnerships and operational continuity, or being forced to adapt through confrontation, with all the costs that entails. B2Gold’s continued success in Mali while Barrick faces crisis demonstrates that adaptation is both possible and profitable.

BUILT TO LAST

The GTA Industrial Real Estate Market Is Not Backing Down

By Alistair Pickering, VP Industrial at Oxford Properties Group

fter years of explosive growth driven by e-commerce and supply chain recalibration, the industrial real estate market is now navigating a more complex environment. Slower pre-leasing and cautious investor sentiment due to tariffs have led some to question whether the boom is over. However, it is important not to mistake recalibration for retreat.

As the fourth-largest industrial real estate market in North America, the GTA remains a key hub for industrial and logistics growth, now and into the future. While we have seen development deliveries ease over the last two years, the long-term fundamentals for this asset class remain and will continue to drive demand.

According to recent Altus Group data, Toronto’s industrial real estate availability rate hovers around 4.9%, a figure that, while higher than recent lows, still reflects a healthy balance between supply and demand. What we are witnessing is in fact simply a maturation of the asset class.

Speculative builds are largely on pause. Logistics facilities are being refined and redeveloped. As global supply chains continue to evolve, well-designed industrial assets will remain central to resilience and efficiency.

Let us explore what this all means for businesses assessing their current and future real estate needs.

MAKING SENSE OF AVAILABILITY

Availability has risen slightly, but the market is coming off years of supply constraints and has now hit a plateau.

As stated in CBRE’s 2025 outlook for the industrial market, while demand has softened, this is just a moment in time. Figures show that demand for industrial real estate in Canada tends to rebound

quickly when fundamentals are strong. In fact, in recent times, the sector has only faced one quarter of meaningful negative net absorption (net absorption is a key metric commercial real estate professionals use to measure the change in occupied space over a period).

One important indicator is population growth in the GTA, which continues to be a strong driver for industrial space. Despite federal government policy curbing immigration across Canada, it is widely believed it will remain among the fastest growing G7 countries across population, GDP, and employment growth. All of which will result in increased demand for logistics space —

“Speculative builds are largely on pause. Logistics facilities are being refined and redeveloped. As global supply chains continue to evolve, well-designed industrial assets will remain central to resilience and efficiency.” - Pickering

particularly in key hubs.

Historical data backs up this consistent link between demographic expansion and industrial absorption, which is why many real estate developers and asset managers, like our team at Oxford Properties, continue to have deep conviction in the sector.

THE IMPACT OF NEARSHORING AND LEGACY LEASES ON DEMAND

There is no doubt that shifting trade dynamics, geopolitical instability, and tariffs have made it more challenging for logistics businesses to assess their needs. While the future remains uncertain, companies should be prepared to meet rising demand driven by reduced reliance on U.S. supply chains and by increased nearshoring.

The growing “Buy Canadian” movement is a clear signal of this shift. Companies are increasingly seeking domestic logistics solutions, reducing reliance on U.S. infrastructure and fueling a need for modern, flexible industrial space. But businesses should recognize this space may come at a higher price – in fact, some may already have.

James Snow Business Park, Milton, ON

As market conditions continue to shift, customers are likely to face rent increases having rolled off historically low pre-pandemic lease agreements. Rents have peaked and are now moderating closer to the $19-20 per square foot range; however, the cost of developing new or replacement space is already trending above that level. As legacy leases expire, businesses are being prompted to reassess their space needs and secure new facilities that better align with current and future logistics demands.

For example, Large Class A industrial space, particularly facilities over 500,000 square feet, is becoming increasingly competitive. Businesses looking to adjust their footprint will soon face challenges in securing suitable space quickly.

That is where having the right real estate partner becomes essential, one that can offer a range of space sizes and strategic guidance tailored to your evolving logistics needs.

QUALITY AND MODERN SPACE MATTERS

Amid an influx of new supply and softening demand, one thing has become crystal clear. Businesses want quality space that mirrors the values and ethos of their company and offers a clear path forward to growth.

On the ground, we are hearing more frequently from customers about the importance of sustainable features and responsible building processes. Customers are not only asking about operational efficiencies that can help reduce their immediate environmental impact, but are also seeking real estate partners who can support their long-term ESG goals. As demand for greener, more efficient industrial space grows, incorporating sustainable design and construction practices will be essential for attracting and retaining customers in this evolving market.

Oxford’s investment in James Snow Business Park, a 3.3 million square foot industrial and commercial development in the GTA, reflects our strong belief in the long-term potential of the industrial sector and in quality space. With solid leasing activity in the mid–bay units already, the facility was built with future cycles in mind and emphasizes sustainability at the forefront — featuring a biophilic design with 3.85 MW of solar energy (equivalent to seven football fields), an enhanced natural environment, and expansive green space and trails.

This kind of forward-looking development is well aligned

“Customers are not only asking about operational efficiencies that can help reduce their immediate environmental impact, but are also seeking real estate partners who can support their long-term ESG goals.”

with where the GTA industrial market is heading. While the market is shifting, the fundamentals remain strong. There is space available now, but demand will return, and likely sooner than expected. Businesses that plan ahead, especially with sustainability and flexibility in mind, will be best positioned. In short, industrial real estate is evolving and reorienting. And for those with a long-term lens, the next chapter will be one of strategic opportunity and renewed momentum.

Alistair Pickering brings more than 35 years of real estate management and development expertise across Canada and Europe to his current role as Vice President, Industrial. As a leader of Oxford Properties Group’s Canadian Industrial property management and leasing operations team, Alistair ensures seamless service delivery and operational excellence for Oxford’s customers and partners. Since joining the company in 2009, he has leveraged his extensive industry experience, including previous leadership roles as the Development Manager at Panattoni Development Company and the Head of Property for a division of ICI PLC.

DESIGNING OR MAINTAINING AN FPSO VESSEL FLUID YSTEM?

Pay Attention to Your Tube Fittings

By Nick Bjelac

s they seek to maintain profitable upstream operations and capitalize on oil fields around the world, companies in the oil and gas industry are increasingly turning to floating production storage and offloading (FPSO) vessels. While these vessels can perform the same functions as fixed oil and gas platforms, they also offer the ability to relocate, making them invaluable for addressing new opportunities or responding to shifts in economic conditions or geopolitics. Along with these advantages come additional considerations in designing, operating, and maintaining the smallbore fluid systems in critical FPSO packages that contribute to long-term reliable operation: topside umbilical termination assemblies (TUTA) and hydraulic power units (HPU), for instance. Where these packages are concerned, it is vital to pay attention to your tube fittings.

AINTERMIX VS. INTERCHANGE

An FPSO vessel’s fluid and analytical

instrumentation systems depend on hundreds of components to operate safely and efficiently. Even a small failure can lead to leaks, hazards, and downtime. In a harsh oceanic environment, this means it is well worth considering specifying fittings with higher-quality alloys to better resist corrosion while maintaining leak-tight performance. Alloys are not all created equal, which brings us to the issues of tube fitting intermix and interchange.

So what is the difference? Let us start with intermix. This is when various tube fitting components like nuts, ferrules, and bodies from two or more manufacturers are assembled to make a completed fitting. Sometimes you see tube bodies from one manufacturer combined with internal parts from another and then sold as “compatible” with the brand on the tube. By comparison, interchange is when a tube fitting from one manufacturer that has been installed on a piece of tubing is disassembled, and the tubing, nut, and ferrules are then reassembled into a tube fitting body from another manufacturer.

Intermix and interchange are slightly different, but neither is recommended, since both processes essentially create a wholly new and untested fitting design. Every manufacturer’s design standards and procedures are unique, so while their fittings may be designed for the

TOP

An FPSO can perform the same functions as fixed oil and gas platforms, while also offering mobility.

BELOW

Intermix and interchange can mismatch swaging mechanisms and torque requirements, impacting sealing effectiveness.

same basic function, they can differ in important ways including material composition, electroplating, and surface hardening.

Because tube fitting components from different manufacturers are not explicitly designed to work together and there is no industry-wide commercial design standard for them, intermixing or interchanging can lead to:

• Reduced sealing effectiveness due to mismatched swaging mechanisms and torque requirements

• Increased risk of fatigue failure and compromised performance

• Incompatible or inconsistent sealing surfaces brought on by variations in geometry, tolerances, design, and material properties

• Potential voiding of manufacturer warranties

Both intermixing and interchanging components result in an untested fitting design.

The consequences can be more than costly: by introducing unnecessary risk into system operation, intermixing brands or interchanging brands of fittings may also compromise worker safety. Any resulting failure will certainly outweigh any short-term savings of intermix and interchange.

SINGLE-SOURCING

The Internal Organization of Oil and Gas Producers (IOGP)’s JIP-33 is an initiative aimed at making dramatic improvements in the specification, procurement, and delivery of oil and gas equipment. JIP-33 specifically calls tube fitting intermix and interchange ‘bad’ engineering practice. Single-sourcing your tube fittings from one reliable supplier is a good way to avoid potential interchange and intermix, even by accident.

Because FPSO fluid systems are especially susceptible to corrosion and may have elevated pressure requirements, you will want to work with a single supplier in planning for the procurement of products rated to perform in their operating environment. Some suppliers can also make asset registries reflecting every product on the vessel so that it is easier to ensure the right components are available to maintain and repair fluid systems. Given how isolated oil fields can be, keeping systems operating smoothly with available parts is key.

For example, an FPSO’s chemical injection (CI) units need to maintain highly accurate and repeatable chemical dosage into the production well to maintain reliable production. A typical CI system may involve hundreds of individual connections where leak-tight performance is essential to protect both personnel and the environment, and any form of downtime can result in significant production losses.

sessions. Field engineers from suppliers and manufacturers can help crews detect the root causes of fluid system issues, train your operations teams to more effectively detect and prevent leaks, and provide other solutions to challenges discovered along the way.

With good reason, FPSO vessel deployments are on the rise. Proper fluid system components and maintenance practices will help keep them running safely and efficiently, powering the future.

Nick Bjelac joined Swagelok in 2020 and serves as the fittings product line manager, where he drives innovation and strategic growth. Throughout his career, he has focused on product development, lifecycle management, and customer-centric solutions tailored to industries such as oil and gas, pharmaceuticals, and semiconductors. Nick holds a B.S. in Physics and Engineering from John Carroll University and a M.A. in Engineering Management from Duke University.

When constructing operational component packages for use on an FPSO, you should aim to identify any small-bore tubing system-related knowledge gaps and consider bringing in specialists to evaluate critical fluid systems during the design process or during dry dock

Challenges with noise and dust? For us it’s no problem.

From large stones to the smallest grains: Bulk solids come in all types, shapes and sizes, but choosing the right measurement technology is surprisingly easy. With our level and pressure sensors, you can effortlessly keep an eye on all your important process values – and still have time to crack the really hard rocks. Everything is possible. With VEGA.

vega.com

FLOW AND TOTAL COST OF OWNERSHIP

A Harmony Between Engineers and Accountants? By Ryan Kershaw

ccountants and engineers both deal in numbers, but much like how the Latin alphabet is used by many languages, the two sides tend to have difficulties understanding each other. The two sides can learn a lot from each other, however; sometimes in surprising applications. One of those applications is piping and flow applications. How can accountants help here? TCO.

Let’s start with defining TCO, otherwise known as Total Cost of Ownership (or alternatively Operation). This accounting practice looks at all costs involved in building a system, both the upfront costs and the ongoing costs. The upfront costs are fairly simple to calculate: add them up and away you go. However, the ongoing costs need to be adjusted for time (a dollar now is worth more than a dollar tomorrow) and that time frame needs to be established. Add the costs all together and you get a good picture what the equipment is going to cost over its lifetime with maintenance, utilities, and other costs included.

So why would engineers care about this, especially when it comes to piping and flow applications? Two words: Pressure Drop. Pressure drop is an inherent cost when it comes to a system that needs to move a fluid from point A to point B. Each additional psi, kPa, or bar lost through the system means an extra unit needs to be generated at the source. Each additional unit that needs to be generated comes at the expense of power, which also means extra cost. Further, more pressure means higher stresses on the compressor and components in line. Fortunately, most components have lower pressure drop alternatives. Orifice plates have a bunch of them, venturi tubes, thermal mass meters, averaging pitot tubes, you name it. Piping can be

“Figuring out costs in the first year is easy. It is the cost, simple as that. After that though, we need to consider opportunity costs and interest.” — Kershaw

changed to something less rough. Valves can be changed for something with a higher Cv. There are many ways to address this issue, though most of the alternatives come at a cost higher than the standard product, which can be an issue. This is where an accountant can come in handy.

Again, with TCO the ongoing costs are adjusted for time and added to the initial cost of a project to create a total cost over the lifetime of the equipment. Focusing solely on pressure drop for this application, how can this be costed out? The big question is the energy cost per pressure unit. Estimates vary widely, but 50W/

psi seems to be a safe, even conservative, estimate. Now that we know the energy cost, what about the financial one? Being from Ontario, I’ll use the local average rate of $0.12/kWh. Using a bit of math, each extra psi is going to cost about $0.006/hr, or if we’re running 250 days a year, 12 hours a day, $18/psi/year. It doesn’t seem like much, but industrial equipment should last longer than a year, so let’s extend it out a bit. Figuring out costs in the first year is easy. It is the cost, simple as that. After that though, we need to consider opportunity costs and interest. Essentially, how much would that money be worth if you

didn’t get it for a certain amount of time. Think about it this way, would you rather get a dollar today or a year from now? While I won’t got into the math, saving $18 a year is going to be worth about $150 today provided the equipment lasts about 10 years and depending on which interest rate you used (I went with 6% FYI), which again, is probably conservative for well-designed industrial equipment.

What does this all mean? Essentially, every psi of pressure drop that can be eliminated will be like saving $150 today when calculating the Total Cost of Ownership. Change out the orifice plate for an averaging pitot tube and reduce the pressure drop by 2psi? Congratulations, there’s an extra $300 in your pocket. What about an alternate valve that has a higher Cv? This will vary based on your application, but thanks to the position of dp in the Cv calculation

(Cv=Q*sqrt(SG/dp) where Q=flow rate in GPM, SG = Specific Gravity, and dp = Pressure Drop), increasing the Cv will have a major impact on the pressure drop. In a water application, with 100 GPM, doubling the Cv will decrease the pressure drop from 8psi to 2psi. In monetary terms, that’s a $900 savings with our figures.

Speaking of valves, the ability to keep them open as much as possible helps significantly, so providing better control on the input side of the system will help to reduce the amount of control that is needed later on. This takes some extra effort in terms of engineering and controls but is worth it at the end.

However, with everything engineering, there are limitations and tradeoffs that need to be taken into account. When it comes to valves, a full port ball valve will offer a much higher Cv than a globe valve, but the former cannot match the latter when it comes to control. Even with ball valves that are designed with control applications in mind, they might not provide the level of granularity that the applications need. Orifice plates on the other hand typically have suitable replacements for most applications, but the familiarity that most I&C personnel have with the technology can lead them to still be included in the spec. As for piping, well there are usually overriding pressure, temperature, and compatibility con-

cerns that need to be addressed which can limit the selection.

Outside of the direct monetary gains of eliminating pressure loss in the system, there are the indirect benefits as well. If a compressor or pump doesn’t need to operate at a higher level it should last much longer, reducing the need for maintenance and repair. Like most motors, these typically have a sweet spot where they are most efficient, so care needs to be taken when it comes to sizing.

So, should designers and engineers be worried about what a few psi of pressure drop is going to do

Best in Class Accuracy.

Pulsar Measurement now offers some of the most accurate instrumentation products available for flow and level measurement. We design, manufacture, and support products you can

to the bottom line? Probably not, but this exercise should highlight the need to think about the overall cost of the equipment, not just the upfront portion. Pressure drop is one concern, and one that has a real monetary impact, but it is one of many. For equipment suppliers, it can be difficult to convince end users to pay more upfront to save more later, but better equipment can have major benefits over the long run. Much of this can come from the lack of knowledge around how the financial side of the house thinks about long-term benefits and how their value decreases over

time. Getting the two sides to understand each other better can have significant positive benefits. Accountants are constantly concerned about the operating costs of a company, and engineers usually have some pretty good ideas about how to address them. Both side use numbers, so it should be a relatively easy translation problem to solve.

Ryan Kershaw is the Director of Industrial Process and Controls at Thing-Zero and lives in Maple, Ontario.

RETHINKING INDUSTRIAL ALARMS FOR A SAFER SMARTER PLANT

By Bob Myles, Moore Industries

As industrial environments become increasingly complex and digitized, the expectations placed on alarm systems are also growing. This article examines the evolving role of alarms — from basic notifications to intelligent safeguards — and discusses how modern alarm design, integration, and management strategies are reshaping operational safety and efficiency.

THE EVOLVING ROLE OF INDUSTRIAL ALARMS

Alarms have always served a foundational role in industrial process control, alerting operators to abnormal or unsafe conditions. However, with the advancement of automation technologies and

increasing regulatory demands, these systems can no longer remain passive tools. Alarms must now function as intelligent components of a broader safety and operational framework.

Modern industrial processes, whether in refining, power generation, chemical manufacturing, or water treatment, are tightly integrated and highly sensitive to disturbances. As a result, alarm systems must move beyond simple signaling and become capable of initiating protective actions, enabling predictive diagnostics, and contributing to real-time decision-making.

ALARMS AS FUNCTIONAL SAFETY ELEMENTS

In high-risk industries, alarms often serve as independent protection layers

A modern control room showcases advanced alarm systems that have evolved from basic alerts to intelligent safety tools.

within Safety Instrumented Systems (SIS). When used in this capacity, they must comply with international functional safety standards such as IEC 61508 and be designed to meet appropriate Safety Integrity Levels (SIL).

The need for alarms in these applications goes much beyond mere announcement. Alarms must provide deterministic behavior, robust fail-safe outputs, internal diagnostics, and minimal response time. In SIL-rated implementations, alarms may also perform voting logic (e.g., 1oo2 or 2oo3 schemes) to ensure high reliability and fault tolerance.

Such alarms are frequently found in applications such as:

• Overpressure protection in pipelines and vessels

• Overspeed monitoring in turbines and compressors

• Emergency shutdowns in upstream oil and gas installations

• High-integrity burner and boiler management systems

In each case, alarm devices form an essential part of the safety lifecycle, and their failure to operate as designed can have severe consequences.

THE EMERGENCE OF SMART ALARM SYSTEMS

With the increasing prevalence of digital communication protocols, alarms are now capable of much more than binary signal generation. Smart alarm devices can communicate diagnostic information, track event histories, and report process values or signal degradation before thresholds are breached.

By integrating alarm status and health data into distributed control systems (DCS), historians, or asset management platforms, operators gain enhanced visibility into the condition of the process and instrumentation network. This not only supports faster incident response but also enables proactive maintenance strategies and continuous improvement efforts.

ADDRESSING ALARM OVERLOAD THROUGH RATIONALIZATION

One of the persistent challenges in alarm system design is the risk of alarm flooding— where too many alarms occur during a process upset, overwhelming the operator and increasing the chance of a missed critical event. This issue is often rooted in poor alarm configuration, lack of prioritization, or failure to consider operator response time.

Effective alarm rationalization involves:

• Assigning priorities based on risk and consequences

• Implementing hysteresis and time delays to prevent chattering

• Applying latching logic where appropriate

• Avoiding redundant or duplicate alerts

• Ensuring alarms are tied to actionable operator responses

Adhering to industry guidelines such as ISA-18.2 and EEMUA 191 helps organizations develop alarm systems that are manageable, meaningful, and aligned with operational objectives.

INTEGRATION, DEPLOYMENT, AND ENVIRONMENTAL CONSIDERATIONS

Modern alarm devices must support a variety of deployment scenarios, including retrofit installations, standalone panels, and integration with SCADA or DCS platforms. Universal signal compatibility, multiple mounting options (DIN rail, field enclosures, panel mount), and software-based programming tools all enhance flexibility.

Additionally, many alarms must operate in harsh industrial environments—extreme temperatures, high vibration, corrosive

atmospheres, and electrical noise. Devices selected for critical alarm functions should be tested and certified to withstand these conditions and maintain reliable operation throughout their lifecycle.

The future of industrial alarms lies in their transformation from basic alert mechanisms into intelligent, integrated components of a larger operational ecosystem. As regulatory expectations increase and plants pursue higher

levels of reliability and safety, alarms must support more than just awareness—they must enable action.

A proactive approach to alarm system designing, including proper selection, integration, and lifecycle management - can reduce risk, improve performance, and enhance operator confidence. By rethinking alarm strategies today, industrial organizations position themselves for safer, smarter operations tomorrow.

A CLOSE CALL IN THE OILFIELD: PART II

A Tale from a Long Career

By Arvind Jaini and Gobind Khiani

Note: This is part II of a story begun in October’s issue of CPECN. A crude oil storage tank at an Indian pumping station in the 1980s began catastrophically imploding when a jammed relief valve created a vacuum with oil pumping out faster than air could enter to replace it.

THE CLIMB

The ladder up the tank was a climb I had made a thousand times. My hands knew the rungs, my feet the rhythm. But that night, each rung felt like a question: “Can we make it to the top?” Still, we climbed. Courage, I have learned, is not the absence of imagination — it is the will to move despite what your imagination won’t stop showing you. At the top, the hiss was no longer a sound but a presence, pressing into every corner of awareness. The relief valve sat frozen, stubborn as truth itself, refusing to give us the honesty we needed. No manual could capture the weight of that moment. It was just two people and a piece of iron, locked in a contest to be settled by grip and grit.

We worked as a pair — one bracing, the other straining — then switched places. At first, the valve mocked our effort, as if time and neglect had welded it shut. Maybe it was residue, maybe misalignment, maybe simple bad luck. Finally, the faintest budge: a fraction of movement, small but undeniable. We urged it on. Then … release.

The sound that followed will live in me as long as memory allows. Air rushed like a gale, tearing through the narrowest gap

“Finally, the faintest budge: a fraction of movement, small but undeniable. We urged it on. Then … release.”

with the urgency of a tide returning home. Others might call it a freight train. For me, it was a storm of oxygen and nitrogen, a roar that shook the rungs beneath our boots and climbed up into our bones.

There was no time to marvel. We scrambled down as the tank steel plates began to regain shape — groans, echoes, the unsettled conversation of metal forcing back to shape. To call it a “return to normal” would be false. Nothing returns unchanged. But the folds relaxed, the

shell found a new balance, something close to peace.

At ground level, another tremor set in — the aftershock of adrenaline. Relief is never neat; it carries awe, gratitude, and a thin edge of anger at how close you came to a thing you dare not name. We checked the gauges again, hands now wiser to the fact that even steel has to bend under natures forces. The tank was breathing once more. And so were we.

LESSONS IN HUMILITY AND ENGINEERING

Near-misses are powerful teachers, but only if we are willing to learn from them. The experience of nearly losing a tank taught us invaluable lessons, forcing us to transform emotions into procedures and raw memory into decisive action.

After the intense debrief that night, we slept with the quiet understanding that we had just been granted an extension.

WHAT WENT WRONG: THE CHAIN OF FAILURES

A series of events and human factors led to the near-catastrophe. A single point of failure, the pressure-vacuum relief valve, failed by jamming shut. This transformed a routine level adjustment into a severe structural threat. Another critical issue was flow imbalance: negative pressure was created inside the tank when the pump-out rate exceeded the inflow. With the relief valve non-functional, the tank’s structure buckled under the negative pressure. Automation had masked the risk; our automated system and standard checks missed the early signs of the failing valve. The system appeared normal until the moment of crisis, as it wasn’t instrumented to monitor the tank’s breathing capacity. Complacency had obscured judgment. A long history of routine operations created overconfidence. The relief valve became part of the unnoticed “background,” and in that complacency, a critical risk was allowed to grow.

THE CHANGES WE IMPLEMENTED

From this near-miss we developed concrete and proactive changes to prevent a recurrence:

We enhanced inspection protocols by establishing a more rigorous and frequent inspection and testing schedule for all pressure-vacuum relief valves and associated flame arrestors. Where possible, we installed redundant breathing paths, and we also reconfigured system defaults to fail-open, ensuring the tank can always vent to the atmosphere in a fault condition. We implemented procedural checks for critical steps: the resumption of downstream pumping now requires a two-person verification. The procedure includes a mandated cross-check to confirm that the tank’s breathing equipment is fully functional, ensuring a minute spent on checks saves hours of potential repair. We incorporated this incident into all training. There is a powerful difference between reading about a procedure and hearing the story of a tank folding like a tin can. Real stories create visceral memory and build safer habits that endure under stress.

THE HUMAN LAYER

Responsibility is felt, not assigned. On char ts, roles are neat and clear. In practice, responsibility is the half-second between hearing a changed pitch and deciding to move. Luck favours preparation — and sometimes merely favours. Had the shell folded differently, had the roof buckled while we were still up top, this account might be told by someone else. Acknowledge luck without mistaking it for skill, and preparation without pretending it rules the world.

Confidence can live with caution. We didn’t

stop trusting the system. We learned to trust it in a more adult way — seeing both its strengths and its fragility, without romanticizing either.

TECHNICAL LESSONS THAT ENDURE

Steel remembers. Once a shell buckles — even elastically — its load paths change. Inspections must reach beyond what the eye can see. Microscopic yielding and residual stresses can be hidden. Breathing belongs to a system, not a part. A valve is only one link in a chain of screens,

flame arrestors, housings, and vent paths. Dust, insects, condensates, waxy residues all conspire over time. Maintenance is about the whole pathway breathing, not just the valve.

Operations breed their own hazards. Doing the “right” thing — pulling harder from storage to meet downstream demand— exposed a latent weakness. Normal operation isn’t safe simply because it is normal.

WHAT REMAINS WITH ME

Over decades I have drilled, revised procedures, and spoken to teams about safety, reliability, and performance. The night at PS8 never leaves those conversations — it is not a trophy or a trauma, but a compass. What stays with me is sound — the hum of engines, steady until they weren’t — the sharp hiss of a tank straining to breathe through a blocked throat — the roar of air reclaiming space — the groan of steel deciding whether to return to shape. These noises transform abstractions, pressure, vacuum, stress, into lived reality.

What stays with me is the ordinariness of our choices. We didn’t save the world. We simply did our jobs urgently, without spectacle. Most high-risk industries are built from such moments. If heroism exists, it is cumulative, carried in thousands of quiet decisions: the bolt retightened, the question asked, the adjustment made. I feel gratitude for the colleague who ran without being told, for training that shaped instinct, for equipment that yielded to human hands, for a night that returned our station, dented but intact, and returned us to our families.

After incidents like this, the temptation is to bury them under justification and jargon. You can wrap a story in charts

“Automation had masked the risk; our automated system and standard checks missed the early signs of the failing valve. The system appeared normal until the moment of crisis, as it wasn’t instrumented to monitor the tank’s breathing capacity. Complacency had obscured judgment.”

until the reality is muffled. We did the root cause analyses. But what matters is simpler and harder: remembering that every system, however robust it looks, is fragile — and treating it with the respect you’d give the weather.

When I was younger, I thought leadership in the oilfields meant decisiveness and technical mastery, and it does, partly. Later I learned two more dimensions: the discipline of honoring routine without letting it dull you, and the humility to listen to machines, to colleagues, to the quiet voice that wakes when a familiar sound is wrong.

The oil kept flowing after that night. The bell helicopter still patrolled the line. The border post kept its watch. The station carried its crease, and so did we. Weeks later, if the light hit right, you could see faint ripples in the tank where the shell had folded and then sighed back out. The oilfields hold forces far larger than any individual. Yet our hands are on the valves. The bargain is to meet those forces with reverence, to bring our craft, and to tell the stories that keep the next person alert. A close call is not just an anecdote. It is an inheritance. And on late evenings, when a hum shifts by a hair, it is a summons to run.

Gobind Khiani, a distinguished alumnus of the University of Calgary, is a seasoned change-maker in the energy sector. He is on the Board of Directors for Energy Sustainability Training for Young Engineers and Geoscientists, Canadian Prairie Group of Chartered Engineers, and also serves as Chairman of the End User Group at API 609 and Vice-Chairman of Standards Council of Canada.

Arvind Jaini, now retired, served as the CEO of Oil India International Limited (OIIL) and held directorship positions in all overseas subsidiaries of Oil India Limited. He extensively travelled worldwide as part of teams led by the Company’s Chairman and the Ministry of Petroleum and Natural Gas, Government of India. He has contributed significantly to the seamless functioning of cross country pipelines.

BARRICK TO SELL TONGON MINE INTEREST FOR UP TO $305 MILLION

Barrick Gold Corp. has agreed to sell its interests in the Tongon gold mine and certain exploration properties in Côte d’Ivoire to Atlantic Group for total consideration of up to $305 million. The deal includes $192 million in cash, which covers a $23-million shareholder loan repayment due within six months of closing. Additional contingent payments of up to $113 million are tied to gold prices over 2.5 years and resource conversions over five years.

Atlantic Group, a privately held pan-African conglomerate founded 48 years ago, operates in financial services, agriculture and industry across 15 countries in Africa. The company is owned by an Ivorian entrepreneur. The transaction involves the purchase of Barrick’s interests in two Ivorian subsidiaries that hold the mine and exploration permits.

The Tongon mine poured its first gold in 2010 and was originally scheduled for closure in 2020. The mine’s lifespan has been extended through exploration work. Since 2010, Tongon has generated more than $2 billion for Côte d’Ivoire’s economy through taxes, infrastructure development, salaries and payments to local suppliers.

TECHLIFT COMPLETES ACQUISITION OF ÉQUIPEMENTS EMU

Techlift has completed the acquisition of competitor Équipements EMU, making it the largest independent Quebec-owned dealer in the materials handling equipment industry. The company announced it will introduce the Heli brand at its new branches following the transaction. Équipements EMU offers a range of materials handling equipment from pallet trucks to 100,000-lb. (45,359-kg) capacity forklifts, as well as warehouse optimization solutions.

“With this transaction, Techlift has achieved its goal ahead of schedule: becoming Quebec’s leader in forklifts and handling equipment by 2030,” the company stated. The acquisition more than doubles Techlift’s workforce to more than 230 employees, including 100 field technicians. Guillaume Joyal, president of Techlift, a Heli

distributor in Canada, said the company is proud to expand its network through the acquisition.

“This means being closer to our clients, simplifying access to our services, and making Heli equipment available throughout our network in Quebec,” Joyal said. Techlift stated that Heli has been its leading product line for nearly 20 years. The company plans to pursue strategic acquisitions and maintain its growth strategy, aiming to build the largest network of handling equipment dealers in the country.

SHERWIN-WILLIAMS OPENS COATINGS FACILITY IN SASKATOON

Sherwin-Williams General Industrial Coatings has opened a 20,000-squarefoot facility in Saskatoon, Saskatchewan. The Cleveland, Ohio-based company says the location will strengthen its ability to serve customers across central Canada. The facility is situated between existing operations in Winnipeg and Calgary.

Sherwin-Williams says the location addresses service challenges created by harsh winter conditions in the region. The Saskatoon site includes dedicated sales and technical service representatives and automated tinting equipment for colour consistency. The company hosted a grand opening event that included facility tours and Innovation Days educational sessions on finishing solutions and industry developments.

View of downtown Abidjan, the economic capital of Côte d’Ivoire.

Wolong Electric America adds High-power Motors to Product Line

Wolong Electric America has introduced high-power, low-voltage motors to its Quantum horizontal motor line. The two-pole, three-phase, 460-volt motors offer up to 1,500 horsepower and are intended for horizontal pumping applications in oil and gas and natural gas compression facilities. The company says the power range has typically required multiple units or medium-voltage machines. www.wolong-electric.com

PackworldUSA Introduces PW4400 Series Heat Sealer

PackworldUSA has introduced the PW4400 Series heat sealer for packaging applications. The unit includes a touch-screen control system that displays temperature, time and pressure readings. The interface allows operators to program and lock parameters. The series uses variable resistance control technology for temperature regulation. Time, temperature and pressure settings are programmable. Cooling cycles can be managed by time or temperature. An automatic calibration function provides zero and multi-point calibration. www.packworldusa.com

Altech Corp. Releases Dual-rated AC/DC Disconnect Switches for Industrial and Manufacturing Applications

The product line includes the LSF and RT series, both rated for 600 volts AC and 60 volts DC, allowing a single switch to handle both alternating and direct current applications. The LSF series is designed for DIN-rail and base mounting. It accommodates an extended handle application in which a shaft extends beyond an electrical enclosure, allowing an external

handle to interlock with it and prevent the enclosure from being opened while power is on.

www.altechcorp.com

NETZSCH Introduces TORNADO T1 XXLB-F Rotary Lobe Pump

NETZSCH Pumps USA has introduced the TORNADO T1 XXLB-F rotary lobe pump, designed for large-scale industrial pumping applications. The pump delivers flow rates up to 6,160 gallons per minute (1,400 cubic metres per hour) and differential pressures up to 174 pounds per square inch (12 bar). It is intended for use in wastewater treatment, biogas facilities, membrane filtration, tank depots, pulp mills and refineries. www.netzsch.com

Festo AI-powered

System Monitors Pneumatic

Cylinders

to Reduce Machine Downtime

Festo has launched an AI-enabled monitoring system designed to predict maintenance needs for pneumatic cylinders. The system, called AX Motion Insights Pneumatic, monitors pneumatic cylinders for wear and irregularities without requiring additional sensors. It uses artificial intelligence to detect anomalies in the behaviour of pneumatic drives and cylinders, providing a “health score” that indicates the risk of failure for each cylinder. www.festo.com

Ultrasonic Flowmeter for Natural Gas Distribution Added to Endress+Hauser Product Line

Endress+Hauser Canada has added the

FLOWSIC500 compact ultrasonic flowmeter to its product portfolio. The device is designed for custody transfer and delivery point metering in natural gas distribution and processing applications. Developed by SICK, a strategic partner of Endress+Hauser for process automation, the FLOWSIC500 is now available through Endress+Hauser and its authorized representatives. www.ca.endress.com

KROHNE Releases New Radar Level Transmitters

Industrial process instrumentation company

KROHNE has released two new radar level transmitters, the OPTIWAVE 1530 and OPTIWAVE 1560, designed for measuring levels in solids and liquid applications. The transmitters use FMCW (frequency-modulated continuous wave) radar technology and are intended for use in silos, tanks, stockpiles, bunkers and vessels with internal obstructions. Target industries include metals, minerals, mining, and water and wastewater treatment. www.krohne.com/en-cA

ABB Introduces Gas Chromatograph with Enhanced Cybersecurity Features

ABB has introduced the GCP100 gas chromatograph, a new analytical instrument designed for real-time monitoring of gas mixtures in natural gas, biogas, oil and petrochemical operations. The device is part of the company’s GCPro series and includes integrated cybersecurity capabilities. The GCP100 is designed to help plant operators monitor process stability and product quality. According to ABB, the instrument incorporates cybersecurity features that aim to protect industrial data while providing analytical insights. www.new.abb.com/ca

Amplify Content Studio is a full-service custom content studio, helping companies share their story, build brand awareness and garner trust through original content.

There are so many ways to reach a target audience. We’ll craft you content for any medium:

• Thought leadership – long-form or short-form articles

• Blogs, whitepapers, infographics and case studies

• Webinars, podcasts and video

• Tradeshow marketing content, with in-house commercial printing services

• Automated content marketing supported by first-party data ....and so much more!

Connect with an account manager or scan to learn more

Pat Lorusso

T: 416-518-5509

plorusso@annexbusinessmedia.com