Canadian process industries talk tariffs

Canadian process industries talk tariffs

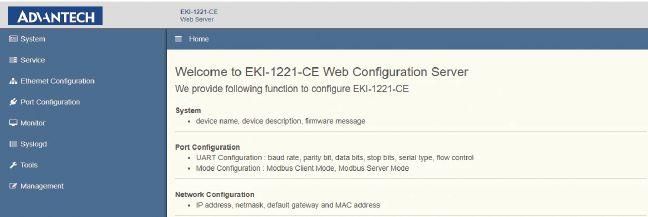

Starting at $278.00 (EKI-1221-CE)

Advantech serial-to-Ethernet Modbus gateways provide easy integration of Modbus RTU/ASCII and Modbus TCP networks for convenient centralized machine communication management. Use these Modbus gateways to make quick and easy connections of multiple isolated serial devices to an industrial Ethernet network.

shipping does not apply to items requiring LTL transport, but those shipments can take advantage of our negotiated super-low at rates (based on weight) that include brokerage fees.

• Two 10/100 Ethernet ports for LAN redundancy

• Up to four software selectable RS-232/422/485 ports

• Up to 16 peer connections under Modbus Client mode and up to 32 peer connections under Modbus Server mode on each serial port

• Up to 64 simultaneous Ethernet connections

• Easy setup and troubleshooting via easy-to-use web interface that provides configuration, monitoring, and troubleshooting tools

$500

The approximate collective annual revenues of the GIC member companies.

Industries across the globe are constantly pushing towards the targets of a net-zero future and building a circular economy. This is particularly true for the chemical sector.

A new coalition was formed at the World Economic Forum that is focused on achieving these goals. It is the Global Impact Coalition (GIC). The GIC originally began under the Low Carbon Emitting Technologies (LCET) initiative in 2019 before being rebranded in November 2023. It is an independent non-profit association supported by founding members BASF, SABIC, Covestro, Clariant, LyondellBasell, Mitsubishi Chemical Group, and Syensqo (formerly Solvay).

The GIC has been focused on several projects designed to help the chemical industry achieve its goals of building a circular economy and achieving its net-zero target.

To learn more about these projects and the GIC, I recently spoke with Charlie Tan, CEO of the GIC. Tan was extremely helpful in discussing these projects in detail.

One key project for the association is its Automotive Plastics Circularity pilot project, designed to address the challenges involved with improving recycling rates of end-of-life vehicle (ELV) plastics.

“The wide variety of plastics, often bonded with other materials, complicates identification and separation, making recycling both technically challenging and economically unviable,” Tan explained.

“The Global Impact Coalition’s Automotive Plastics Circularity pilot aims to address these challenges by uniting stakeholders across the automotive value chain to develop scalable, closed-loop recycling systems. By using a new approach to ELV dismantling that groups automotive plastics into similar polymer types, facilitating the subsequent shredding and sorting plastic fractions, the pilot will address the biggest obstacles to efficient ELV plastic recycling. Ultimately, the pilot seeks to transform plastic waste into valued resources, enabling automakers to meet sustainability targets for recycled plastics.”

This project has the potential to have a significant affect on reducing the environmental impact of automotive plastics, and changing how the world manages and recycles ELV plastics.

The association is also working on the GIC Direct Conversion project that explores converting biomass and/or plastics waste into C2+ compounds that can be

supplied to the chemical industry.

“Through gasification, this process generates syngas (a mixture of hydrogen and carbon monoxide) as well as higher hydrocarbons such as ethylene, acetylene, and ethane, which are essential building blocks for polymer production. If successful, this approach could provide a lowenergy, low-emission, and cost-efficient alternative to traditional fossil-based feedstocks, significantly advancing circularity in the chemical industry,” Tan explained.

You can see more about this project at: https://globalimpactcoalition.com/project/direct-conversion-gasification.

This GIC is currently in the process of assessing the environmental impact and techno-economic feasibility of the process before moving toward piloting, Tan noted.

Another intriguing project is the GIC Sustainable Olefins project, which involves exploring innovative methods to produce olefins—such as ethylene and propylene—through the conversion of sustainable methanol derived from waste streams. Tan stated that this approach offers “a low-emission alternative to traditional fossil fuel-based production methods, aligning with the chemical industry’s net-zero objectives.”

Learn more about this project at: https://globalimpactcoalition.com/project/sustainable-olefins.

The GIC is also busy working on its Sustainable Methanol project that evaluates the supply-demand balance for sustainable methanol sources from waste materials. This project directly supports the GIC’s Sustainable Olefins project by exploring the most viable sourcing options to ensure a stable, cost-competitive supply with a low carbon footprint, Tan explained.

These are only a few examples of the important work being performed by GIC members. So, how can Canada’s plastics and chemicals sectors help move these initiatives forward?

One way is work with the GIC by becoming a member or forming a project partnership with the association.

To learn more about the GIC, visit: https://globalimpactcoalition.com.

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal Customer Service Tel: 416-510-5113

Fax: (416) 510-6875

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Audience Manager Anita Madden 416.510.5183 amadden@annexbusinessmedia.com

Brand Sales Manager Pat Lorusso 416.518.5509 plorusso@annexbusinessmedia.com

Editor Andrew Snook 416.510.6801 editor@cpecn.com

Account Coordinator Barb Vowles 416.510.5103 bvowles@annexbusinessmedia.com

Group publisher/VP Sales Martin McAnulty mmcanulty@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

CPE&CN is published bi-monthly by: Annex Business Media 111 Gordon Baker Rd, Suite 400, Toronto, ON M2H 3R1 T: 416-442-5600 F: 416-442-2230

ANDREW SNOOK, editor editor@cpecn.com

© All materials in this publication are copyright protected and the property of Annex Business Media., the publishers of Canadian Process Equipment & Control News magazine.

For permission on reprinting or reproducing any materials, e-mail your requests to cpe@cpecn.com

Canadian Postmaster send address corrections to: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Canadian Process Equipment & Control News assumes no responsibility for the validity of claims in items reported.

Annex Privacy Officer privacy@annexbusinessmedia.com Tel: 800-668-2384

PUBLICATION MAIL AGREEMENT #40065710

Printed in Canada ISSN 0318-0859

Volume 53 No.2 April 2025 Subscription

The Prospectors & Developers Association of Canada (PDAC) celebrated another landmark gathering with PDAC 2025, which brought together 27,353 participants to explore premier business prospects, investment opportunities, and professional networks in the global mineral exploration and mining sphere. Showcasing more than 1,100 exhibitors—including government representatives, corporate leaders, and technical specialists from across the world—PDAC 2025 upheld its reputation as the industry’s most influential convention.

“Year after year, the PDAC Convention is the place to be for unveiling the latest market insights, advances in technology, and for fostering essential partnerships,” said PDAC president Raymond Goldie. “In 2025, we continued that legacy by bringing together not only a wide array of educational programming focused on crucial areas such as capital markets, Indigenous engagement, career development, and sustainability, but also a dynamic trade show and company presentations to investors, offering exhibitors and attendees invaluable opportunities for business growth and collaboration.”

Beyond highlighting trailblazing innovation and thought leadership, PDAC 2025 provided a vital platform for dialogue between industry stakeholders and government officials. PDAC’s leaders used this forum to emphasize the impact of forward-looking public policy on maintaining Canada’s competitive edge in the mineral sector.

“Minerals are the backbone of modern technology and are indispensable to our daily lives, highlighting the essential role of mineral exploration and mining in Canada’s economic strength and resilience,” Goldie noted. “This week, PDAC was encouraged by the federal government’s commitment to extend the Mineral Exploration Tax Credit (METC) for two years. Our priority now is to ensure that this commitment becomes law, and we’ll continue pushing for it to have a permanent place in Canada’s fiscal framework.”

Goldie extended his heartfelt appreciation to everyone who helped make PDAC 2025 such a success—volunteers, speakers, sponsors, delegates and PDAC’s staff. The association eagerly anticipates welcoming participants back for PDAC 2026, taking place from March 1 to 4, 2026.

Festo recently announced the appointment of Dr. Wilm Uhlenbecker as the company’s new CEO for the North American Business Region, effective April 1, upon the retirement of Carlos Miranda.

A family-owned global business with

more than $3.7 billion in revenue and 20,000 employees, Festo is recognized as one of the world’s leading automation suppliers and innovators. The company’s global headquarters is in Esslingen, Germany. This year, Festo is celebrating its 100th anniversary and more than 50 years in North America.

Uhlenbecker began his career in 1994 as a management trainee at Robert Bosch GmbH. By

Continued on page 6

Continued from page 5

2003, he was the assistant to the Robert Bosch CEO and Supervisory Board chairman. He has held senior leadership positions throughout his career and, in 2019, was named President NA of Brose Group.

He holds a Ph.D. in mechanical engineering and a MBA degree, both earned at RWTH Aachen University in Aachen, Germany. Uhlenbecker will report directly to Thomas Böck, Chairman of the Board. He started at Festo on Jan. 15.

“As a family business entering its second century, everyone at Festo takes the long-term view and prizes innovation, sustainability, customer service, and support of coworkers,” Miranda said. “After extensive meetings with Dr. Uhlenbecker, I know that he shares these values, which are essential for everyone taking a leadership role at Festo. I am proud to be making the announcement of his appointment and extremely proud of my 24 years at Festo.”

“Carlos Miranda is an innovator,” Uhlenbecker said. “Festo North America today has a state-of-the-art distribution, custom manufacturing, and training center in Mason, OH, that serves North America and was built on his watch. Festo’s sales force is the most highly trained and motivated I’ve encountered, as are its distributors. And its dedication to customer success and innovative solutions is phenomenal. Festo North America is not on the cusp of growth; it’s growing.”

Miranda began his career as a sales manager at Trottner McJunkin in 1990. He joined Festo in 2001 as the sales director for Festo Mexico and, by 2004, was named CEO of Festo Mexico. In 2010, he was promoted to president, Festo Americas, and in 2017, he was named president and CEO of Festo North America, which includes Mexico, the United States, and Canada.

Heidelberg Materials recently announced an agreement with Pronto, a U.S.-based autonomous technology pioneer, to deploy Pronto’s Autonomous Haulage System (AHS) to over 100 trucks operating across various sites worldwide in a first wave. The AHS leverages advanced sensors, cameras, and artificial intelligence to autonomously operate haul trucks in complex and dynamic environments. Designed to seamlessly retrofit an existing fleet, the technology offers a

scalable and cost-efficient solution to accelerate the upgrade of Heidelberg Materials’ heavy mobile equipment.

“Meeting industry challenges with technological innovation has always been a central part of our target to create a more productive and sustainable future,” said Dr. Dominik von Achten, Chairman of the managing board of Heidelberg Materials. “As a company leading the way in transforming our sector, we strongly believe in fostering strategic collaborations across industries. This partnership will accelerate the adoption of cutting-edge solutions across our sites and regions, leveraging synergies on a global scale.”

“Implementing the latest technologies across our production sites is an important driver of operational excellence and digital innovation at Heidelberg Materials,“ said Axel Conrads, chief technical officer and member of the managing board. “By teaming up with Pronto, we will deploy a scalable solution to our fleet of haul trucks that will contribute significantly towards our production efficiency, safety, and sustainability efforts, while also addressing the challenge of recruiting skilled operatives.”

The global agreement follows a pilot project of Pronto’s technologies at Heidelberg Materials’ quarry in Bridgeport, Texas, and its subsequent deployment on a mixed OEM (original equipment manufacturers) fleet of haul trucks. The system’s rollout will be expanded to more than a dozen sites across North America, Europe, and APAC.

The approach reflects Heidelberg Materials’ strong focus on leveraging the advantages of its global setup when scaling local pilot projects to full industrial usage. Besides the ability to introduce standardised operating

models across its sites, the company benefits from fast simultaneous implementation in different regions and knowledge transfer across teams.

Thunder Bay Pulp and Paper (Thunder Bay), a leading northern bleached softwood kraft and northern bleached hardwood kraft pulp, paper, newsprint and directory producer, has announced the appointment of K. William (Bill) MacPherson as CEO, effective February 10, 2025.

The Thunder Bay mill has been a leading pulp and paper operation in Ontario for more than a century.

MacPherson brings more than 35 years of pulp and paper industry leadership experience to Thunder Bay, most recently serving as vicepresident of paperboard manufacturing for Graphic Packaging International. Prior to Graphic, MacPherson was managing director at Mercer International, Canada, and mill manager for Domtar in Kingsport, Tenn. Earlier in this career, he held engineering leadership positions at Weyerhaeuser and Willamette Industries.

“Over the past 18 months, we’ve established the mill as a stable, independent operation. Now, we are ready to accelerate our growth, and Bill is a deeply experienced operator who can lead Thunder Bay into the future,” said Randy Nebel, Chairman of the Thunder Bay Board of Directors.

“As we begin our second century of operations, I look forward to working with Bill as we strengthen our operations and build our reputation in this new era as a steadfast driver of the local economy,” said Kent Ramsay, Thunder Bay president.

“I am honoured to join Thunder

Bay and continue the work underway to solidify the mill’s position as a trusted employer, reliable producer and pillar of the Thunder Bay community,” said MacPherson. “I look forward to leading this business as our team grows our operations while preserving the wellearned legacy of the mill in this region and beyond.”

The Province of B.C. has announced that it is making key amendments to regulations under the Low Carbon Fuels Act to prioritize Canadian biofuels in B.C.’s transportation fuels.

The announcement is designed to help stabilize the province’s biofuel market while supporting companies such as Tidewater Renewables in Prince George, Parkland in Burnaby, and Consolidated Biofuels in Delta.

“British Columbians deserve a reliable, sustainable and Canadian fuel supply,” said Minister of Energy and Climate Solutions Adrian Dix. “By increasing the Canadian biofuel content in our transportation fuels, we will support local producers, protect jobs and reduce our dependence on foreign energy. This action reflects our commitment to cleaner energy, economic growth and a resilient future for British Columbians.”

The province stated B.C. and other Canadian biofuel producers “have long felt the impact of the competitive advantage American producers have over Canadian producers because of U.S. subsidies, which have increased under the U.S. Inflation Reduction Act.”

“We welcome the Government of B.C.’s changes to the Low Carbon Fuels Act and the commitment to strengthen the Canadian biofuel sector,” said Jeremy Baines, president and CEO, Tidewater Renewables. “This is a good first step in levelling the playing field with imported biofuels that take advantage of overlapping foreign and Canadian policies, and moving toward an economically viable Canadian renewable fuel industry. Tidewater is committed to being a leader in the energy transition, continuing to develop made-in-B.C. energy solutions, creating good-paying jobs in British Columbia and continuing to supply low-carbon fuels, helping British Columbia and Canada meet emissionreduction targets.”

Effective Jan. 1, 2026, the minimum 5-per-cent renewable-fuel requirement for gasoline must be met with eligible renewable fuels produced in Canada. The renewable-fuel requirement for diesel is 4 per cent and will immediately be increased to 8 per cent. Beginning April 1, 2025, the renewable content of diesel fuel must be

produced in Canada.

“This news is welcome support for local homegrown biofuel producers. Securing and growing local production reduces reliance on imports, while maintaining one of the most progressive carbon-reduction programs in Canada,” stated Dan Treleaven, CEO of Consolidated Biofuels Ltd.

“We are pleased to see today’s amendments to the Low Carbon Fuels Regulation. These changes will provide certainty to B.C. and Canadian biofuel producers, while connecting

the Canadian biofuel supply chain and supporting the province’s clean-energy economy. In the face of potential U.S. tariffs, these changes will create jobs here in B.C., while doing our part for the climate,” added Mark Zacharias, executive director for Clean Energy Canada.

For more information on British Columbia’s Low Carbon Fuel Standard, visit: https://www2.gov.bc.ca/gov/content/industry/ electricity-alternative-energy/transportationenergies/renewable-low-carbon-fuels.

Whether level, limit level, density, interface or mass flow: Radiation-based process instrumentation delivers precise measuring results in industrial production and handling processes, and that even under the most difficult operating conditions.

Flexibility through detector variety: You can choose between different types of detectors. Detector can thus be optimized for widely different applications becoming the specialist for your particular measuring task.

Advantages

Simple mounting and operation

Maintenance-free operation

Easy adjustment

Self-monitoring and diagnosis

Developed acc. to IEC 61508

Compact device with integrated inputs for temperature or belt speed

Profibus PA

Foundation Fieldbus

Display and adjustment module

PLICSCOM

VEGACONNECT and DTM

VEGA Tools app Housings

Aluminium double chamber

Stainless

By

During the Prospectors & Developers Association of Canada’s PDAC 2025 Convention that took place in March in Toronto, Canadian Process Equipment & Control News sat down for a one-on-one interview with Patrick Lahaie, senior partner with McKinsey & Company, to discuss the outlook for Canada’s mining sector.

Despite all of the uncertainty taking place due to the impact of current and potential tariffs, Canada’s mining sector is still poised for growth in the long term.

“If you look at the next decade, it’s an industry where we see demand quite positively,” Lahaie says.

One of the main reasons for the positive outlook for the sector is the continued industrialization of the world.

“We continue to see areas of the world, such as Africa or Southeast Asia, going through industrialization and continued population growth, which does will require material. These are strong drivers of global material demand,” Lahaie says.

The second big driver for the mining sector is the energy transition.

“The interesting component of that is that it’s now changing the mix of specific material demand. What we’re seeing, which is really interesting as well, is that the evolution of technology is also having a pretty rapid effect on evolution of demand,” Lahaie explains. “For example, the change in types of batteries is changing the types of materials that are being used for these batteries, and therefore, the mix of demand is evolving.”

While demand for specific materials is evolving, the general consensus at McKinsey & Company for most commodities is that the growth rate of demand over the next decade is going to outpace the historical growth rate.

When asked about Canada’s challenges

for growing its mining sector, Lahaie says the country’s hurdles are not that different from most countries.

“It’s interesting to look at Canada. It has challenges, but I think the world has challenges that are not so different either,” he says.

One of the biggest challenges for the mining sector across the globe, including Canada, will be fulfilling demand with existing assets.

“Most commodities will not be able to fulfill the demand through supply of existing assets. In addition, these existing assets are getting older, the ore grades are becoming not as interesting, and costs have inflated significantly, and

therefore, there’s a massive productivity issue that faces mining and metals companies to be able to get more out of the assets that they have today,” Lahaie explains. “So, the first challenge is really one of productivity, and that will be true for the world, and would be true for growth.”

The second challenge is related to attracting the capital necessary to improve productivity. In McKinsey’s 2024 Global Materials Perspective report, analysis suggests that $5 trillion of capital employment will be required between now and 2035 to be able to fulfill the coming demand for metals and minerals.

“Sixty per cent of that $5 trillion USD, so essentially $3 trillion, is sustaining capital that needs to go into getting existing assets to operate better,” Lahaie says, adding that historically, the industry has not had the best track record for efficiently deploying capital. “On average, 25 per cent of mining projects suffer schedule delays on top of real cost overruns of approximately 40 per cent. And so, the second big challenge in this industry is how do we make sure we improve our practices of deploying capital, so that the ROI is attractive enough for investors to say, ‘You know what, let’s do it.’”

The third challenge that the mining sector needs to overcome is the existing labour shortage has been plaguing the industry for many years.

“One of the realities that we’ve seen in this industry is that there’s been a lot of churn in labour. Some labour is actually fleeing – the people are retiring – but at the same time, there are less graduates that we’re attracting into the industry,” Lahaie says. “There’s a real cultural and labour challenge that the industry faces.”

In many sectors, companies view the latest technologies, such as automated vehicles and processes as the enabler of increased productivity. Lahaie says that in addition to raising productivity, new technologies can also be used to attract the next generation of talented workers into the sector.

Lahaie says the latest technologies should be looked upon as an opportunity for improving labour shortages on two fronts. In addition to replacing specific jobs with automation, technology can also be used to attract the gen-

eration of talented workers into the sector.

“The reality is that when you start looking at the labour pool and the types of skills that are going to be required of metals and mining companies five to ten years from now, it’s very different than what it was five to ten years ago. And so, how can we use technology, not only as a way to transform our operation, but also actually make it cool to work in mining, because minerals are required to be able to make the world a better place,” Lahaie says. “This industry could actually have a recruiting pitch to new generations of talent, but that’s going to require organizations to be out there and working together.”

Another advantage that some the latest technologies are offering the mining sector is the ability to recover more mineral out of mining processes, so companies are able to get more yield.

“This could have positive impact on the environment as well, because we can mine less ore to be able to get more yield,” Lahaie adds.

Every year at the PDAC Convention, McKinsey hosts an executive mining event. This year’s edition hosted 40 executives from the mining sector where McKinsey presented on the outlook of the sector followed by a question period for attendees. One of the questions brought up during the event was not something typically heard within the mining sector.

“The executive mentioned with all of the uncertainty that we’re living with today, how can we pivot that into a moment of opportunity so that we get our sector to be much more of an eco-

Prospectors & Developers Association of Canada’s PDAC 2025 Convention drew 27,353 professionals from the mining industry to Toronto this past March.

system where the different players actually exchange, learn from each other, and make themselves stronger, rather than meet a few times per year at conferences,” Lahaie says. “I found that quite interesting. Maybe there was a bit of a moment in time to mobilize ourselves as a sector, so that the ecosystem is more powerful, because there are some pretty strong, noteworthy organizations.” Lahaie left the executive event with a new assignment stemming from that question period.

“I took away a to-do list to actually go and do a little bit of research on this and see if I can find some other sectors that we can learn from that have some strong ecosystems. I don’t know the answer yet,” he says.

By Andrew Snook

ince the inauguration of U.S. President Donald Trump on January 20, 2025, almost every industry across Canada has been disrupted due to new tariffs that have either been implemented or continue to be threatened.

At the time of the publication of the April issue of Canadian Process Equipment & Control News , the U.S. had imposed 25-per-cent tariffs on all goods imported from Canada and Mexico not covered under the Canada-United States-Mexico Agreement (CUSMA). For those products covered under CUSMA, President Trump granted a one-month exemption until April 2, 2025, with 10-per-cent tariffs placed on non-CUMSA energy products and non-CUSMA potash. There was also a 25-per-cent tariff placed on all Canadian steel and aluminum steel imports.

Industry leaders from across Canada have expressed their concerns regarding the potential damage these tariffs, and retaliatory tariffs placed by the Canadian government, would have on the Canadian and American economies.

“Tariffs are taxes and costs will rise, with consumers and businesses alike shouldering the weight of these tariffs at a time when cost-of-living is already high in both countries,” said Greg Moffatt, president and CEO for the Chemistry Industry Association of Canada (CIAC). “While a tariff and policy response from Canada is warranted, we must not lose sight of the pressing need to future-proof our economy.”

Moffatt spoke to us from his hotel in Washington, D.C., after meeting with the U.S. Chamber of Commerce, alongside the Canadian Chamber of Commerce, discussing the importance of keeping positive trade relationships between the U.S. and Canada.

“It’s very helpful to get perspective on what’s driving the agenda,” Moffatt says.

One of the challenges with navigating tariffs for the chemistry industry is that unlike certain sectors that might produce a handful of different products, the chemistry industry is far more complicated.

“Chemistry isn’t one thing, it’s many, and some of it is exported, principally into the U.S.,” Moffatt explains. “Others are sold into a domestic market to meet a uniquely Canadian or localized demand for those products. So, first and foremost, it’s not a one-size-fits-all.”

Complicating things further is the impact on the plastics value chain, also represented by CIAC.

“We’re representing resin manufacturers, molders and converters that actually convert the resin into products. We represent recyclers. We represent brand owners that are bringing products into the marketplace. And so, again, not onesize-fits-all there,” Moffatt says. “When you look at the molders or converters, some of those entities are small- and medium-sized enterprises. In many cases, they’re privately owned, and they employ less than 100 employees. And for those folks that are selling the lion’s

share of their products into the U.S., it’s an existential event.”

Adding to the challenge of navigating U.S.-imposed tariffs for these small- and medium-sized producers is the prospect of being impacted by retaliatory tariffs imposed by the Canadian government.

“They very well could be importing inputs from the U.S. into their manufacturing process,” Moffatt says. “Some of the products that our members produce go back and forth across the border many times before they actually end up in a finished good – you hear about that in the automotive sector. You hear about that in the technology sector, and chemistry and plastics are inputs into 95 per cent of the things that we touch on a day-in and day-out basis. So, this is a serious issue. It will be impactful.”

According to the CIAC, Canada’s chemistry and plastics products represent $115 billion in trade with the U.S.,

Industry leaders from across Canada have expressed their concerns regarding the potential damage U.S. tariffs, and retaliatory tariffs placed by the Canadian government, would have on the Canadian and American economies.

and the U.S. having a small trade surplus of $2.5 billion. Approximately 77 per cent of Canada’s chemistry exports are destined for the U.S. and 54 per cent of Canada’s chemistry imports come from the U.S. The overwhelming majority of Canada’s plastics and resin exports (94 per cent) are shipped to the U.S., with an estimated value of $19 billion. About 64 per cent ($16 billion) of Canada’s plastic and resins are imported from the U.S.

Moffatt stated that the cost of a new car could increase by $4,000 with the new tariffs being implemented. It will also spike the cost of new housing builds, another sector where the chemistry sector provides a wide variety of materials for building envelopes, windows, and more. At the time of our interview, tariffs have been collected for two days for goods crossing across the border from Canada into the U.S. Moffatt said the tariffs are essentially taxes and they are an attack on the profitability of businesses on both sides of the border.

“On the industrial chemicals side, for the most part, our members are 24-seven, 365-day continuous process manufacturers and they don’t store a lot of

“Tariffs are taxes and costs will rise, with consumers and businesses alike shouldering the weight of these tariffs at a time when cost-ofliving is already high in both countries,”

products on site. They rely on a reliable and functioning rail system to move their products to customers, and it’s a continuous process. Those folks would have been captured by this,” he says.

Moffatt is hoping that CUSMA-compliant goods will continue to be unaffected by tariffs on both sides of the border.

“This notion that CUSMA compliant goods would not be affected going forward, that is the right signal,” he says. “What you’re also hearing is that the North American economy is highly integrated. It’s not just in chemistry and plastics. It’s in agriculture. It’s in autos. It’s in clean technology. Across the spectrum, the North American economy is highly integrated, and I believe that message is starting to filter through.”

While it is difficult to say whether the announced tariffs will accelerate the re-

With a mix of education from thought-leaders and networking dinners at classic Calgary spots, you will leave the conference better informed, connected and engaged. Come and learn about new ideas to address challenges in the marketplace and learn how to adapt in an evolving industry. Sessions include Tracking the Global Energy Transition, State of the Oil and Gas Industry, Redefining Literacy in the Age of AI and much more.

newal or renegotiation of CUSMA, Canada must be ready for the possibility.

“We need to be open to it. There is nothing that we’re going to do internally that is going to change the fact that the U.S. is our largest trading partner. They’re our neighbour. They’re the closest market. They’re one of the largest markets. We need to be open, and we need to be ready.”

Canadian Manufacturers & Exporters (CME) president Dennis Darby also discussed the potential damage that could be done to both countries’ economies with the implementation of the tariffs.

“Canada and the U.S. share an integrated manufacturing sector that has been built up over decades supporting millions of jobs on both sides of the border,” Darby stated. “At a time of global economic uncertainty, our two

countries should be working together to strengthen North American industry –not implementing measures that will hurt businesses, workers, and consumers in both nations.”

The Canadian Association of Petroleum Producers (CAPP) president and CEO Lisa Baiton also released a statement in response to the implementation of across-the-board U.S. tariffs, stating that the association and its member companies are “deeply disappointed in the U.S. Administration’s decision to impose across-the-board tariffs on Canadian goods.”

“As Canadians we must now recognize the relationship with our closest friend, ally, and trading partner has fundamentally changed. In this moment, we must act with urgency to focus on the Canadian national interest,” Baiton stated.

CAPP stated that without a stronger global market reach and energy security that Canada has “little leverage” in its trade relationship with the U.S.

“North American and global oil and natural gas markets are complex, which make it difficult to predict how the application of a 10-per-cent tariff on Canadian oil and natural gas will impact supply, demand and trade patterns,” Baiton stated. “What we do know is that our greatest competitive advantage through economic cycles is our energy advantage. Canadian oil and natural gas producers have demonstrated they are innovative and resilient and will find the best ways to mitigate the impact of tariffs and realign themselves to thrive in a dynamic global market.”

The Mining Association of Canada (MAC) stated that in lieu of tariffs, the two countries should focus on how to deepen their collaboration on a partnership for critical minerals that started in 2020 during President Trump’s first term in office under the Joint Action Plan on Critical Minerals Collaboration.

“The minerals and metals industry in Canada stands ready to strengthen our relationship with the United States, ensuring the free flow of these essential resources that drive economic growth, defense capabilities, and technological advancement on both sides of the border,” stated Pierre Gratton, president and CEO of MAC.

Canada’s mining industry is a vital sector that contributes $161 billion annually to the country’s GDP, and accounts for 21 per cent of Canada’s total domestic exports. The mining sector employs approximately 694,000 people directly and indirectly across the country,

and is proportionally the largest private sector employer of Indigenous peoples in Canada, and a major customer of Indigenous-owned businesses, the MAC stated.

While Canada continues to build on and secure its vitally important trade relationship with the U.S., the country also needs to prepare itself for adapting to a new economic future, and that starts with much-needed regulatory changes.

“MAC members produce mineral and metal products that are globally traded. U.S. tariffs will lead Canada’s mining sector to pursue new and deepen existing alternative markets, as well as alternative sources of inputs necessary for the continued operation of mining facilities. This will hurt U.S. businesses,” Gratton stated.

While Canada continues to build on and secure its vitally important trade relationship with the U.S., the country also needs to prepare itself for adapting to a new economic future, and that starts with much-needed regulatory changes.

“Our regulatory system needs to change. There’s not enough government money, taxpayer money, to solve the problem. We need to focus on enabling the expenditure of private capital in a way that we haven’t in the last 10-plus years. We need to change the way we do things in Canada,” Moffatt says.

One of the ways Canada can make the country more attractive to private

sector financing is through increased investment in critical transportation infrastructure.

“We need to double down on our investments in critical transportation infrastructure – roads, rail, ports,” Moffatt says. “There is a near annual disruption of labour in Canada’s critical transportation system. We need to sit down, business and labour and government, and come up with a framework that deals with issues of competitive wages and benefits without holding the Canadian economy hostage.”

The constant labour disruptions have hurt Canada’s reputation as a trading partner, Moffatt says, adding that fixing this issue is the first step towards trading more with other markets.

The CIAC recently released a statement saying, “Canada needs a competitiveness framework specifically designed to attract investment and stimulate economic growth.” In that statement, the CIAC suggested that the federal and provincial governments prioritized the following strategic initiatives:

• Comprehensive tax and regulatory reform: Canada must implement pro-growth tax and regulatory policies that attract investment, encourage innovation, and drive economic expansion.

• Critical trade infrastructure investments: Strengthening infrastructure, including ports, rail, and road networks, is essential for maintaining Canada’s position as a reliable trading partner.

• Labour stability: Ongoing labour disruptions have damaged Canada’s reputation as a dependable supplier. Addressing labor stability is crucial for ensuring continued economic resilience.

• Diversification of trade markets: Expanding into new markets beyond North America—both east and west—is vital for economic growth and long-term prosperity.

“North American and global oil and natural gas markets are complex which make it difficult to predict how the application of a 10-per-cent tariff on Canadian oil and natural gas will impact supply, demand and trade patterns,”

“Increasing our economic competitiveness should be the guiding principle for all policy actions in the weeks and months ahead. We need all stakeholders in Canada to recognize and address the gravity of the changing economic landscape,” Moffatt stated.

The MAC stated that the Canadian federal and provincial governments should use this moment in history to “address long-standing barriers to Canadian economic growth, including the removal of internal trade barriers, complex, expensive and lengthy regulatory processes and uncompetitive tax policies.”

“It is time for all governments to double down to create the conditions for improved competitiveness, investment, productivity and prosperity,” Gratton stated.

CAPP stated that Canada urgently needs a policy overhaul to create “a streamlined and durable regulatory framework that allows projects with viable markets and motivated investors to succeed.”

“Strengthening market access and trade relationships is critical to economic growth. Diversifying exports beyond North America into Asian and European markets will promote long-term stability,” Baiton stated. “At home, securing Ontario and Quebec’s energy supply must be a national priority. We are at a significant moment in Canada’s history – we need to seize this moment. The choices we make

today will determine whether we become a global energy leader or continue to fall behind. With decisive leadership, smart reforms, and a renewed commitment to investment, we can unlock the full potential of our natural resources, support our partners and make new ones, create jobs, and build a more prosperous and resilient economy for Canadians.”

While initiatives like expanding trade into global markets and more strongly securing the country’s energy security would certainly benefit

Canada’s economy, it is unrealistic to think the U.S. will not always be Canada’s biggest trade partner.

“Let’s not kid ourselves, we will always be trading with the U.S., and Mexico, because they’re our closest neighbours,” Moffatt said. “But there’s some things that we need to do in Canada to reset and make Canadian business, Canadian workers, more competitive and more productive, and generate more value and wealth for Canadians and for the Canadian government.”

Reaching a sustainable future is like kayaking. With a skilled partner, you can make the right decisions.

Reaching a sustainable future is demanding in many ways. Obstacles and change must be well anticipated to make the right decisions. We are ready to tackle these challenges with you! We will help you to improve your processes to meet specific production requirements, operational optimization, or sustainable manufacturing efforts. Let’s team up to improve!

Monitoring Solution with stainless steel pipes for ideal process water conditions and reliable conductivity values to protect your electrolyzer.

Do you want to learn more? www.ca.endress.com

By Ryan Kershaw

Getting information from point A to point B effectively has been a goal of manufacturing operations ever since the dawn of the factory back in the 1700’s. Why information moves around plants has typically stayed the same, but how information moves has changed significantly, which has allowed who is able to use this information when and for what purpose to have evolved over the centuries. One of the biggest promises of Industry 4.0 is the advancement of communication, to create an ecosystem where information flows freely from the plant floor to the enterprise or from outside of the plant to better inform operations. It’s been a long

road, but this promise is starting to become more of a reality.

To look forward, it’s usually best to start in the past. While the earliest form of communication in plants, and one that is still used today, is verbal, the earliest form of automated communication, or machine to machine, was mechanical. Gauges were some of the earliest ways to relay physical information from a process to an operator, allowing them to adjust controls to maintain the operation of a process. While these devices still required an operator to act on the information, other devices like the Watt governor, named after its inventor James Watt, started to bring automated control into the plant. These devices provided some of the earliest examples of automated communication where one machine communicated directly to another without the intervention of an operator.

In the case of the Watt governor, the speed of the machine was related back to an automated valve to control the flow of steam, allowing the speed of the

One of the biggest promises of Industry 4.0 is the advancement of communication.

engine to be automatically regulated. A significant drawback to this type of control was its rigidity and difficulty in moving information across long distances. Fortunately, pneumatic controls addressed many of these issues. This form of communication allowed for more flexible communication between machines, both in regard to where the signal could be sent to, but also the type of information that could be relayed. This form of communication introduced standards that continued to be used even in future generations, such as scaling a process variable over a standard signal (3-15psi in many cases), plus the use of a floating zero to help differentiate between a scaled zero and a communications failure. While this form of communication has been since the 1800’s, some of its advantages, especially in hazardous areas, mean it is still in use today. However, the complication of running lines and ensuring that there are no leaks in the system mean that many of the pneumatic applications today are

limited to on/off communications.

Electrical signals evolved alongside the adoption of electricity and have been a mainstay of plant communications ever since the beginning of the Second Industrial Revolution. This type of communication comes in many different forms from relays to analogue to the digital forms that are used today. Older on/off signals were used to start and stop motors and can be used to take signals from instrumentation like bimetallic thermostats and pressure switches to control motors, heaters and other types of equipment. Analogue signals improved upon this to allow for more information to be moved from one point to the next. Even though this was a jump in technology, it still relied on older standards from pneumatic communication such as scaling and a live zero, resulting in the 4-20mA standard still widely used today.

With the increased capabilities of field equipment and the increased requirements of enterprises for a better understanding of what was happening on the factory floor, the standard 4-20mA signal started to become a bottleneck. One of the advances that has tried to solve this is the HART protocol. This protocol overlays a digital signal over the 4-20mA signal. The one huge advantage was that it still allowed for the 4-20mA signal to be used as it was before, so no upgrading was needed. However, for equipment that could take advantage of it, this protocol allowed for basic and slow digital communications, allowing for three extra values to be pulled from the analog signal.

Bus communications were the next evolution of the electrical signal, starting with simple ones like ModBus. While these communication methods did not have a large amount of bandwidth or speed, they did offer a significant increase in the data that was available. This advanced with the introduction of faster and lighter weight protocols and the introduction of NET protocols like ProfiNet. While these offered higher speeds and higher bandwidths, they did have some drawbacks. For one, they needed more processing power, which limited their adoption in simpler field devices. They were also limited in their use in hazardous applications where their power requirements meant that they couldn’t be used in many intrinsically safe applications. Nowadays, Ethernet, and especially 2-wire Ethernet, has started to take hold in many applications and is able to be used in many hazardous area applications.

One of the biggest costs of networking has always been physically running cable. While the cable itself may not be a significant cost, the labour needed to

Electrical signals evolved alongside the adoption of electricity and have been a mainstay of plant communications ever since the beginning of the Second Industrial Revolution.

install it, along with cable trays, repeaters, and other pieces of equipment meant that connectivity came at a cost. Wireless technology came with a big promise to reduce these costs. However, while Wi-Fi and cellular data is used daily by literally billions of people and devices, manufacturers were much slower to adopt this technology. Two major concerns slowed adoption in this space: reliability and security. Manufacturers were concerned that wireless signals would not be as dependable as wired ones. This is a concern with commercial applications, but a dropped call is a nuisance, whereas a lost connection in manufacturing can have significant consequences. As for security, industrial applications were extremely wary of sending information out into the void where they had little control over who could potentially intercept a signal. With wired communication this was an ex-

tremely minor concern, so wired kept its advantage. Protocols such as WirelessHART and ISA100 looked to overcome these challenges with the introduction of security protocols and reliability advancements such as mesh networks. One other technology that is starting to make noise is private 5G. This technology uses the same technology that is found in commercial cell devices but is separated from public 5G services to help keep data private.

Sharing data has been the goal of industrial field devices ever since their introduction, so what is the difference between regular field devices and IIoT? It really comes down to the amount of data that is being generated and how it is connected. In fact, there isn’t really a defined line between what is and isn’t IIoT. IIoT, or Industrial Internet of Things, is the industrialized version of the more commercial IoT, or Internet of

Things. IoT was a major shift for commercial technology communication. One of the best early examples was the Nest Thermostat. Prior to that device, thermostats were standalone devices, but the introduction of the Nest Thermostat changed that by introducing a device that was constantly connected, always improving, and designed to be used by anyone and connect via a standard Wi-Fi signal. The success of Nest led to a major boom of connected devices, now you can find connectivity baked into just about anything. This approach was duplicated for the industrial ecosystem but needed to be adjusted to accommodate the needs of this area. Communication was managed differently, with direct internet communication exchanged for more stringent communication within the organization, and data set up in a more standardized way.

For any organization looking to get the most out of their data, one thing to keep in mind is that the amount of data being transmitted will be limited by the lowest bandwidth section of the network. For instance, if a smart field device uses a 4-20mA signal, then only one parameter will be transmitted. If the network at the plant level is still using an older Bus network, then the data transmitted will be limited by the bandwidth at that section.

While industrial communication networking technology may be a little behind that of commercial technology for several reasons, it is still progressing in both speed and bandwidth. Device-level connections can now feature megabit-level speeds, while speeds further

from the line can easily get up to the gigabit-level. This means that more information than ever can be moved between any two points on the network. It’s not uncommon for larger plants to generate terabytes of data each day. With this level of network capability, companies other than those that have typically been active in the space are now entering the market such as hyperscalers (i.e. Google, Microsoft, AWS, etc.), telecommunications (i.e. Orange, Telus, etc.), and commercial computer companies (i.e. Hewitt Packard, Dell, etc.).

These new capabilities have meant that companies are starting to reconsider their plant information architecture. ISA-95 and the Purdue Model have been the standard models for years and centered around information moving up and down the organization one level at a time. While this has served the industry well for a few decades, it is based on older technology and limits speed and connectivity that newer technology can bring. Due to this, companies are starting to base their plant information networks on new architectures that allow for fewer levels between different points of the network, the ability to send information anywhere within the network easily, and the ability to bring in and send data to non-traditional internal and external points. Two of the best examples of this new network architecture are the Industrial Data Hub and the Unified Namespace (UNS).

Modern manufacturers use data to create competitive advantages, so the

For any organization looking to get the most out of their data, one thing to keep in mind is that the amount of data being transmitted will be limited by the lowest bandwidth section of the network.

better data they can get and the faster they can get it, the more advantages the company can leverage. This is true for all areas in the manufacturing sector. Quality benefits from being able to spot problems quicker and can leverage the data to develop ML and AI (machine learning and artificial intelligence) tools that can help to avoid issues all together. Finance benefits from having a better view of how equipment is being used, allowing them to make better, more informed decisions about capital investments. Management can use the data to get a better idea of how the organization is performing, and where to focus their efforts. So, why are advanced communication networks not in place in all manufacturing facilities? One major reason is it can be extremely hard to quantify any returns, and without being able to quantify the returns of an investment, an ROI is impossible to calculate, which means there is less of a chance a project will be funded. However, without the proper infrastructure in place, it is extremely difficult to implement and scale advanced applications. Most of the really interesting I4.0 advancements such as ML/AI, AR/VR, predictive analytics, and many others, require a solid infrastructure to move past the pilot stage or single installation. Advanced automation requires advanced communications, it’s that simple.

RYAN KERSHAW is the director of industrial process and controls at Thing-Zero and lives in Maple, Ontario.

AutomationDirect has added METEcon multi-wire connectors that feature quality and cost-effective inserts and housings. Inserts are available in multiple pole configurations from 2 poles plus ground up to 108 poles plus ground, with screw or crimp termination types and sizes ranging from 26 to 12 AWG, 10 to 80 Amps. METEcon housings are made of die-cast aluminum with a polyester powder finish or self-extinguishing thermoplastic. They are suitable for use in electrical panels, power connections, and other industrial applications. Crimp contacts ensure a gas-tight, corrosion-free connection with very low contact resistance. AutomationDirect www.automationdirect.com

The Model KAL-A thermal flow sensor for water-based liquids features KOBOLD’s revolutionary temperaturecompensating electronics. The compact, one-piece thermal flow sensor with no moving parts provides reliable readings largely unaffected by temperature or physical characteristics of a wide variety of water-based process liquids. This breakthrough is made possible through the use of state-of-the-art microprocessor technology. The microprocessor can be field calibrated to the liquid properties and operating range in a simple, five-minute set-up procedure. This intelligence, coupled with a no-moving-parts design, make the KAL-A flow sensor a superior performer in many applications. To further enhance the versatility of the

KAL-A, it is offered in a 3-A compliant version. The thermal flow sensor applies the KAL’s advanced microprocessor-based technology to the problem of flow rate detection. Although the calorimetricly sensed output is non-linear in nature, it is extremely repeatable. The KAL-A incorporates the same 8-segment LED display found in the flow switch, with an optional PNP setpoint alarm relay if desired.

Kobold USA www.koboldusa.com

Moore Industries’ SLA Multiloop and Multifunctional Safety Logic Solver and Alarm has earned Factory Mutual (FM) approval as a Non-Incendive

instrument. This approval allows the SLA to be used in Class I, Division 2, Groups A, B, C, and D Hazardous (Classified) locations in both the United States and Canada. The SLA is a part of the Moore Industries FS Functional Safety Series and these new approvals mean that the SLA provides reliable alarming and safety shutdown capabilities in hazardous environments.

The SLA also carries exida certification for use in Safety Instrumented Systems (SIS) and is SIL 2/3 capable. With the new FM safety certification, the SLA can now be used in both General (safe) and Hazardous Locations. This means that the SLA can be used in situations where potentially explosive gases, vapors, dust or fibers may be present including: oil and natural gas refining, extraction, and transporting; offshore rigs; and chemical and pharmaceutical plants. The SLA is designed to deliver optimal performance in safety loops in hazardous process conditions and bridges the gap between single-loop logic solvers and costly safety PLCs. Moore Industries www.miinet.com/sla.

for growth with

By Andrew Snook

On Vancouver Island in Nanaimo, B.C., operates one of the most unique pulp mills in the country, Harmac Pacific (HARMAC).

A Northern Bleach Softwood Kraft (NBSK) pulp mill, HARMAC was built as three separate production lines from 1950 to 1963. After being shut down in the fall of 2007 under Pope & Talbot Ownership, it was restarted in October 2008 as a division of Nanaimo Forest Products, running a single line at a rate of 226,000 tonnes per year. The following year, the company restarted the second line, and, through significant capital investments, was able to boost the mill’s capacity to 365,000 tonnes of NBSK pulp a year.

HARMAC sells its high-quality kraft pulps across the globe with the majority of sales taking place in Asia. The pulps are created from custom blends of Douglas fir, western hemlock, balsam fir, interior SPF (spruce, pine and fir), and western redcedar. The pulp mill also produces secondary income through the generation of power for BC Hydro.

Currently, the HARMAC mill employs approximately 350 people. While this is relatively small compared to some pulp mill operations, the employee-ownership relationship is incredible unique for a Canadian pulp mill. The mill is 25-percent employee owned. The organizational structure has allowed the company to move from traditional owner-employee relationships to one “based upon employee ownership and common interest, focused on a commitment to the profitable operation of the business,” the company stated.

“There is an improved union-management relationship

The lower furnace of HARMAC’s #6 Recovery Boiler was nearing end-of-life, so planning a replacement commenced. The biggest challenge was figuring out the structural engineering portion of the project for installing the lower furnace.

as we are all common shareholders,” explains HARMAC’s Mason Rowat, area supervisor for recovery and steam plant operations. “Business decisions are made on site, which leads to responsiveness and adaptability to changing markets.”

The lower furnace of HARMAC’s #6 Recovery Boiler was nearing end-of-life, so planning a replacement commenced. The biggest challenge was figuring out the structural engineering portion of the project for installing the lower furnace.

“We also decided to modernize the boiler’s dissolving tank, so we had to make some pretty significant changes to all of our piping systems and building structure incorporate these design changes as well,” Rowat says.

In addition, HARMAC’s #6 Recovery Boiler was paired with outdated air systems, which presented several challenges in the planning stages.

“During boiler air system modeling, it became clear that modernizing the lower furnace from a sloped floor towards the front wall to a decanting style was essential, but it was also necessary to update the primary, secondary, and tertiary air systems, as well as install a new tertiary air fan,” Rowat says. “These changes were crucial for drastically improving boiler performance.”

The project, which HARMAC’s management selected Valmet to design and build, was completed

in 2023. In addition to the upgrades to the air system, port rodders, and spout deck, it also included the installation of new spouts, dissolving tank agitators, and a bed camera to improve functionality and safety.

“We took note of the projects that Valmet had completed at other mills, so we knew the products they were putting out were state of the art, and were going to suit our needs,” Rowat says.

The key features that sold HARMAC on Valmet’s system were the decanting floor and the spout mini-hood systems.

“Combining both upgraded boiler performance as well as spout deck safety was instrumental in moving forward with Valmet’s design,” Rowat says. “Generally, the new style decanting furnaces, just the way that they’re designed, have a lower tendency to run-off with improved smelt reduction efficiency. The individual spout “micro-hoods” provide a greater degree of protection in comparison to traditional recovery boiler spout decks. Each spout has its own individual “micro- hood”, which prevents smelt spatter and splashing.”

Rowat was also impressed with the system’s steam shattering design.

“The design was state of the art, where there’s two nozzles in lieu of the standard one, so it breaks up the smelt more efficiently, which reduces the risk of dissolving tank damage during periods of heavy smelt flow,” he says.

One reason HARMAC opted to work with Valmet for the project was due to the new air system design and decreased emission rates.

“The new air system had performance guarantees relating to both the reliability and sustainability of our largest recovery boiler, which aligned with Harmac’s goals. Reduced environmental emissions and longer run-times in-between washes have both been achieved since the project was completed,” Rowat says.

The project ended up achieving a 95-percent reduction efficiency with sulfur dioxide (SO₂) levels below 25 ppm, carbon monoxide (CO) below 300 ppm, and particulates exiting the economizer below 9 grams. These results surpassed internal targets and aligned with HARMAC’s sustainability objectives.

Casey Beirne, product manager for recovery and energy projects at Valmet, says the company’s air system design was a key part of making this a successful project.

“We did what we call ‘Twin Ports.’ So, instead of one large port, we put two ports next to each other, and it acts as one large air mass, and that helps with the penetration of the air. That’s very important for mixing, and minimizing emissions,” Beirne says.

Another benefit of installing the new air system was a reduction in maintenance-related downtime.

“We’ve increased the time between having to take downtime to perform a water wash on the boiler. There’s less carryover and plugging in the boiler. So, that’s huge improvement for

us in terms of reliability,” Rowat says.

Aside from reduced washes, with the new air systems and furnace design, the time required for water washing the boiler reduced from approximately 40 hours to between 25 to 30 hours.

It has been just under two years since the commissioning of the new system. To date, HARMAC’s management has been very happy

with their system upgrades. Rowat notes that this project has created room for HARMAC to grow in the future in a more sustainable manner.

“The recovery boiler is a very important component of a pulp mill’s up-time. Looking ahead, Harmac continues to focus on optimizing and modernizing our processes to efficiently increase production while reducing our carbon footprint. This project achieved both targets.” he says.

By Michael Wright

As I have stated previously, it is advisable to standardize motor power ratings and frame sizes in order to reduce the overhead costs of spares inventory. Another way to reduce inventory is to limit the number of different motor speeds used at your facility.

In North America, 3-phase “induction” motors are available with nominal speeds of 3,600, 1,800, 1,200, 900, and 600 RPM. The 3,600 RPM motors are typically only used for high-speed applications, 600’s and 900’s are rare and expensive, and 1,800’s and 1,200’s are common as dirt.

Motor power is the product of torque and speed. Therefore, for any given horsepower, an 1,800 RPM motor will only produce 2/3 as much torque as one with a nominal speed of 1,200 RPM. So, given that more motor torque requires a larger shaft, heavier bearings, and usually, a larger frame size, a higher torque motor costs more than a faster one of the same

power rating. Therefore, a 1,200 RPM motor will cost about 25 per cent more than would an 1,800 with an equivalent power rating.

For this reason, suppliers bidding on belt-driven equipment packages will often bid on supplying them with an 1,800 RPM motor even when one rated at 1,200 would allow for a more reliable sheave (pulley) arrangement.

For example, a large centrifugal pump operating at 800 RPM could be driven by a 900, a 1,200, or an 1,800 RPM motor. Given that belt drives prove to be the most reliable when the sheave ratio is a close to 1:1 as possible, the 900 RPM motor with its 1:1.125 sheave ratio would appear to be the best option. Unfortunately, few companies make these motors, the delivery is long, and they are roughly twice the price of an equivalent one rated at 1,800 RPM.

Now, going for the cheapest solution; an 1,800 RPM motor with a sheave ratio of 1:2.25 might just be workable. This

Motor power is the product of torque and speed. Therefore, for any given horsepower, an 1,800 RPM motor will only produce 2/3 as much torque as one with a nominal speed of 1,200 RPM.

would be half of the cost of the 900 RPM option because not only is the motor cheaper, but it is smaller and lighter, making the motor base cheaper as well. This can lead to problems if the motor sheave ends up being too small, the pump sheave ends up being too big, or if there is too little distance between the pump and motor to let the motor sheave properly grip the V-belts. But, if it can be made to work, it is the cheapest option.

However, the 1:2.25 ratio may not be workable on an identical pump operating elsewhere in the plant because of slightly different torque requirements or a lack of room to provide enough distance between the pump and motor.

This means that the cheapest solution for the supplier is to submit a bid with two separate packages; one with an 1,800 RPM motor and a sheave ratio of 1:2.25 along with a second package with an identical pump, but this time with a 1,200 RPM motor and a 1:1.5 sheave ratio.

Given that the 1,800 RPM motor will

be about 25-per-cent cheaper than the 1,200 and will also be mounted on a smaller, lighter, and cheaper motor base, many project engineers will choose this “low bidder” because it will reduce the capital cost on a project.

However, from an operations and maintenance standpoint, the short-term benefit of the “CAPEX” saving will result in the need to stock more spare motors, deal with more motor failures due to the smaller shafts and bearings in the 1,800 RPM motors, and probably stock more sheaves and V-belts in “spares” due to the different drive configurations on similar pumps.

So, in general, the specifications for any

In general, the specifications for any plant expansion or upgrade should be written so that the suppliers can only bid on belt drive equipment packages that will provide for the smallest number of spares required and the best reliability possible.

plant expansion or upgrade should be written so that the suppliers can only bid on belt drive equipment packages that will provide for the smallest number of spares required and the best reliability possible. This will help to weed out suppliers who will low ball you with equipment packages that will barely make it through the warranty period before they become a maintenance nightmare.

MICHAEL WRIGHT is an electrical engineer with more than 50 years of experience in heavy industry. Although he has done an extensive amount of PLC/DCS programming and upgrading of power systems, he is a very strong generalist with

a broad knowledge of hydraulics, pneumatics, power transfer, welding practices, mining equipment, mobile equipment, process control strategies, pumping systems, rock mechanics monitoring, mechanical maintenance practices, MRO procurement contracts, energy management, and cost control. As such, he specializes in problem prevention as a subject matter expert (or as a fixer on “problem projects”). It is his belief that safety is not a “priority” but is a way of life; that good engineering makes life simpler and easier for others; and that the best ideas come from those with calloused hands and dirty coveralls. Michael can be reached at: mawright@sasktel.net.

By Andrew Snook

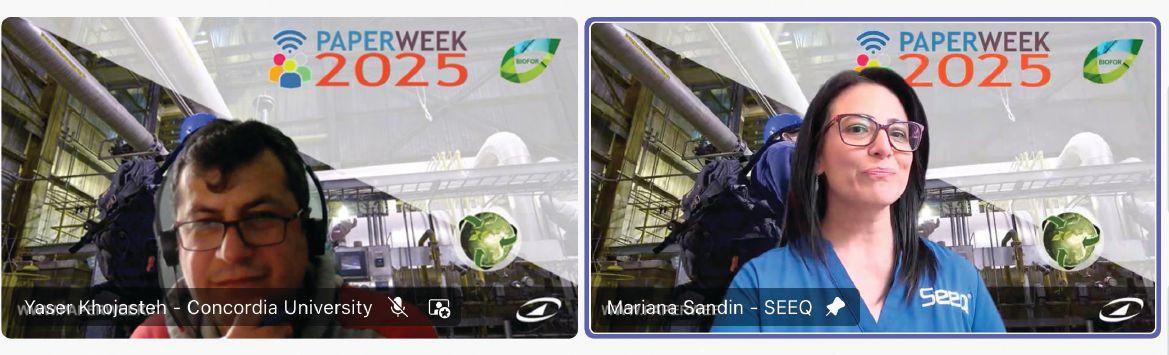

During the PaperWeek/ BIOFOR conference, which took place from February 10 to 13 at The Fairmont Queen Elizabeth in Montreal, one key session was focused on simulation and digitalization for sustainable operation.

Hosted by session chairs Yaser Khojasteh, Concordia University, and Paul Stuart, Polytechnique Montreal, the session featured keynote presentation, “Digital Intelligence Meets Human Ingenuity: Autonomy, Agility, and Environmental Renewal,” presented by Mariana Sandin, Industry Principal at Seeq Corporation.

In addition to an MBA from the University of St. Thomas in Houston, Texas, and a bachelor’s degree in chemical engineering, Sandin has a wide variety of TAPPI certifications and acknowledgements including being the recipient of TAPPI’s Glen T. Renegar Award in 2020 for her contributions as the Chair of the PIMA IT Committee.

Sandin’s presentation focused

on how digital intelligence, AI, ML (machine learning), and advanced analytics are contributing to the goals of autonomy, agility, and environmental renewal in the pulp and paper and biomass industries.

Sandin started her presentation by discussing the state of autonomous mills today.

“When we think of autonomous mills, we think of a mill with the lights out, not a single human in it. But the reality is that today, a lot of our mills, or at least sections of our mills, are still running in a very manual way,” she said. “Whenever there is a sheet break, operators go in, they have to take the paper out of the rail, they have to put it back on the rail. I’ve seen this done with a stick, so it’s not necessarily an autonomous operation running.”

While some mills still rely heavily on manual operations, there are some that have invested more heavily in the latest technologies – particularly, greenfield mills – that are equipped with paper machines with

hundreds of thousands of different signals providing information and adding some insights into the real-time operations.

Over her 20 years in the industry, Sandin says she has witnessed the progress of the industry, especially when it comes to companies generating data from operations, how to extract it, and how to they are deriving value from simple analysis.

“So, the autonomous picture, although it may seem far, it is not impossible. I do believe that digital technologies, and especially AI, has positioned the industry, or various sections of it, to be fully autonomous,” she said.

One example that Sandin noted was where mills have automated warehouse operations, equipping them with robots to move and deliver product.

“Everything is designed so that a human is only supervising the operations of that warehouse, of that asset. But can the paper mills, can the pulp mills, can a biorefinery operate the same way? I believe it could, but we need to invest in the R&D to make it happen. Because right now, the bestcase scenario is that you have hightech portions of that mill with manual portions of operations working together, and there are still some silos and things that need to be interconnected,” she said.

Sandin stated that the pulp and paper sector has proven its ability to be agile and resilient through its reactions to changing trends within the industry.

“The first thing I remember when I first joined the industry, the big thing, paperless communications, especially media, moving to mobile devices – a phone, a tablet – and the industry adapted,” she said. “At the same time, you had e-commerce coming in, so it adapted from copy paper to packaging grades and that shows the agility and resilience of the operations.”

Around that same time, Sandin was introduced to biorefinery operations and the opportunities these held for the pulp and paper and biomass sectors in terms of how to turn waste into value-added products.

“So, the industry has been shifting, and it has been doing it at a pace that I expect will accelerate in the next few years. It’s not all about packaging grades. It’s also about how we play with other materials to make them even more sustainable and build true circular economies,” she said.

Another aspect of the pulp and paper and biomass sectors is that

OPPOSITE PAGE

Mariana Sandin discusses her presentation with session co-Chair Yaser Khojasteh during the PaperWeek/BIOFOR Conference.

companies are focused on is how to create a circular bioeconomy.

Sandin says there are opportunities for the recycling of the renewable materials used in these operations.

“There is a huge potential on the recycling of that material. But if we are coating things with wax or other non-renewable materials, how do we make that happen? How can we accelerate that sustainability in circular supply chains? This involves not only the manufacturers, but also the suppliers, and the consumers of paper products,” she said.

Sandin adds that industry wants to create more sustainable operations, not just because it’s good for the planet, but also because it’s profitable.

“We know that by reducing waste, reducing the raw materials, or taking advantage as much as we can of the raw materials that go into the process, there is going to be more to gain for all the people involved in the value chain, she said.

So, how can companies continue to improve their resilience, agility, while building up a circular economy during a time when productivity is in decline due to loss of talent and aging assets, and a lack of new approaches to leverage new technology?

Sandin says there are digital technologies available that can help the pulp and paper sector accelerate and find ways of improving in the future, even during a time when productivity of the industry is in decline.

“Even if the productivity of the industry as a whole is declining, profitability doesn’t have to follow. We can achieve more with the resources that we have now. For those leading the way, this could mean a 30-per-cent increase in operating margin growth according to LNS,” she said.

Mills that are intentional about leveraging insights from the data analysis

have a potential of increasing OEE between 2 to 4 per cent.

“We see this consistently. And they do that by reducing the waste that they have in their operations; reducing the chemicals or having a better mix of chemicals to meet the specifications of quality in different paper grades; and, of course, the reduction of downtime,” Sandin said.

“Executives want to increase revenue, increase margins, they want to have better return on the assets.”

This is where digitalization, AI and ML can have major impacts in operations. Sandin said that leveraging IT groups can be hugely beneficial.

“We still think of IT as the guy that comes and helps with the laptop, or as a guy that comes and connects an Ethernet cable when I don’t have access to the web. But if we really leverage what these IT and digitalization groups have to offer, we can change to a data-driven mindset. We can have better real-time operational awareness outside of the control room,” Sandin said. “We can do continuous improvement in real time, and because of AI now, we have the means to capture and include what I call the ‘tribal knowledge’ from a company, and this is going to help to forecast episodes or events of a breakdown.”

Sandin stated that the levels of success of operations incorporating these technologies into their operations is reliant on many different factors.

“It’s so unique for every asset that you need to be able to capture that knowledge and all the different variables that are unique to you, so that AI can be helpful and can be more proactive and

more prescriptive, but it requires that technology is seen as a core competency,” she told the crowd.

Sandin added that this hits the mark with all the things that C-Suites tend to deem as important.

“Executives want to increase revenue, increase margins, they want to have better return on the assets, reduce the cost of goods sold. But it needs to happen with all sorts of different constraints – meeting environmental requirements, net-zero targets, reducing waste, and increasing growth rates.”

This can only be done if companies have a good digital technology foundation, if people are upskilled to actually leverage those tools, and if there is a change management program in place that will help companies identify their baselines, where they want to go, and how they are going to meet the gaps based on their cultures and unique conditions.

“And how do we integrate the value chain to this? Because it’s not just about the mill working in isolation. How are your providers helping you to schedule service parts? Can they be more proactive and tell you what’s going on based on performance? How can you connect to your chemical supplier in real time, managing inventories remotely, so that you can be more agile and be on top of market demand?” she asked.

This can be supported by a company’s IT organization.

“So, if somebody here is not in IT, and is fully in operations, and is not working with your data scientists or your data analysts, you’re missing big time, because they can help you make things better with really very little footprint on your day to day. IT and OT need to work together,” Sandin told the crowd.

She closed her presentation asking if the audience was ready to lean in and take advantage of the digital technologies today.

By Diane Cave