Quiet operation with the highest payload, guaranteed by the large, sturdy undercarriage and maximum handling while achieving lower fuel consumption – the LH 50 M Industry has it all. And with a variety of attachments this high performer is always optimally matched to your respective application.

www.liebherr.ca

Visit us at:

DEMO International 2024 – Exhibit A-23

September 19-21, 2024 – Ottawa/Gatineau, Canada

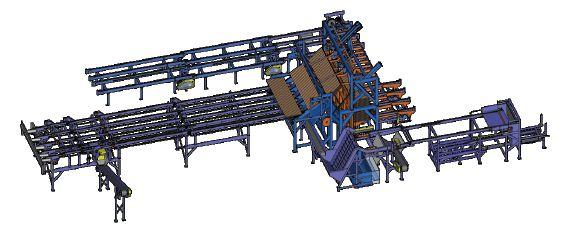

Log Max Forestry Inc., based out of Moncton, New Brunswick are pleased to announce that they have entered into an exclusive Canadian distributorship agreement with Plantma AB, the Swedish manufacturer of the PlantMax X2 planting machine.

The PlantMax X2 unit is typically mounted on a forwarder chassis, 14 ton size class or larger and incorporates a mid-mounted MidiFlex scarifier. Site preparation, soil compaction and seedling planting is completed in one pass! As a bonus, in the planting off-season the carrier can be converted back to a full-time forwarder within 3-5 days.

The PlantMax X2 is performs whether rain or shine, day or night with data collection recorded throughout the process.

For more information on how the PlantMax X2 unit can assist you in your silviculture needs, contact your Log Max Forestry Inc. rep at 506-869-2325 or visit plantmaforestry.com

JENNIFERellson

jellson@annexbusinessmedia.com

Summer 2024 has delivered a blazing wake-up call: the Jasper wildfire didn’t just raze a town – it sparked a pivotal conversation on how we confront the escalating wildfire crisis.

This catastrophic blaze, among the most devastating in recent history, forced over 25,000 residents to evacuate and left a third of the town in ruins. The intensity of this disaster has made it crystal clear: we need a radical overhaul in our approach to wildfire management and sustainable forestry practices.

The Jasper wildfire, fueled by bone-dry conditions and unrelenting winds, surged through the town like a runaway freight train. It destroyed around 300 buildings and vital infrastructure, leaving the community and economy reeling.

This disaster serves as a stark reminder of the increasing frequency and intensity of wildfires exacerbated by climate change. As temperatures rise and weather patterns become more unpredictable, the forestry industry is at a critical juncture and must adapt to these new challenges.

The forestry industry is at a crossroads, and the old ways just won’t cut it anymore.

To tackle the wildfire threat head-on, we need more resilient and sustainable forest management strategies. This includes enhancing fire prevention measures, investing in reforestation with a mix of fire-resistant tree species, and leveraging advanced technologies for better forest health monitoring.

Innovation is key, but so is collaboration. Indigenous communities, with their deep-rooted knowledge and practices, offer invaluable insights for modern forestry techniques.

By joining forces, the forestry industry and Indigenous groups can craft more holistic and effective strategies for forest management and wildfire prevention.

Combining Indigenous wisdom with cutting-edge science creates a powerful approach to forest management. Techniques like controlled burns, practised for centuries by Indigenous peoples, can help reduce the risk of uncontrollable wildfires. Integrating these time-tested methods with modern technology lays the groundwork for a robust and sustainable forestry framework.

As we navigate the complexities of climate change and its impact on our forests, the lessons from the Jasper wildfire are clear. We need adaptive management practices, technological innovation, and collaborative efforts to ensure our forests remain resilient and our industry stays robust.

The future of forestry hinges on our ability to rise to these challenges and embrace a reality where wildfires are a fact of life, but not an insurmountable threat.

So, as you leaf through this magazine, take a moment to appreciate the remarkable stories of resilience, innovation, and teamwork within our industry. Let’s celebrate our successes, learn from our experiences, and continue to unite in our mission to keep our forests thriving and our industry strong.

Among CFI’s lineup of special events and awards, the Top 10 Under 40, and the annual Women in Forestry Virtual Summit every March, are especially close to my heart.

It’s incredibly inspiring to see the forest industry buzzing with passionate, talented young leaders. Their colleagues, friends and loved ones are equally enthusiastic, ensuring these rising stars receive the recognition they deserve.

This year’s nominees are a powerhouse of talent – so be sure to grab your copy of CFI’s September/ October issue to see who made the cut!

I’m delighted to share that our Top 10 Under 40 awards have once again generated a flurry of nominations. Last year, we had so many stellar entries that we expanded the list to the top 20 superstars. Will history repeat itself? Stay tuned for our next issue to find out!

Element5, an Ontario-based cross-laminated timber manufacturer is getting a $3.5-million boost from the provincial government through the forest sector investment and innovation program.

The funding will more than triple Element5’s production, create 32 new positions, increase revenue by more than 300 per cent and boost the company’s export sales by almost 600 per cent.

The $100-million total expansion allows Element5 to produce wood beams and columns in addition to panels, serving a broader

segment of the $2-billion global mass timber market.

Work on the plant expansion started in 2023 and will increase

Company Location Timeline Details

Tolko Industries Williams Lake, B.C. One day

Mercer International Okanagan Falls, B.C. July 2024

West Fraser

100 Mile House, B.C. No interruption

Tafisa Lac-Mégantic, Que. June 2024

Hampton Lumber Fort St. James, B.C. July 2024

Canfor has announced that Susan Yurkovich, currently senior vice-president of global business development, will succeed Don Kayne as president and CEO starting Jan. 1, 2025.

Yurkovich has held executive roles in both forestry and energy, such as president and CEO of the BC Council of Forest Industries and executive vice-president at BC Hydro.

the Element5 footprint to over 350,000 square feet, set to produce another 50,000 cubic meters of glulam a year starting in 2025.

Mill shut during local wildfire evacuation alert

Upgrade and expansion

Silo fire – immediately exitinguished

Back to regular operations after explosion

5-week curtailment, low log availability

Source: Madison’s Lumber Reporter

Reader

Mercer Mass Timber (MMT) will receive up to $7 million from the BC Manufacturing Jobs Fund to modernize its Okanagan Falls facility and increase glulam production by 25 per cent.

The funding will enable MMT, a subsidiary of Mercer International, to improve production efficiency and expand the variety of mass-timber products manufactured, including CLT and high-quality glulam.

MMT plans to rehire employees previously laid off when the former business closed, creating 28 local jobs. Photo: Annex Business Media

The Forest Products Association of Canada (FPAC) has responded positively to the recently launched Canada Green Buildings Strategy (CGBS), viewing it as a step toward a more sustainable future for Canada’s built environment.

The CGBS aims to make homes and buildings more energy-efficient, emphasizing affordability and emission reductions. The strategy calls for retrofitting existing structures and constructing new, energy efficient buildings to address the housing crisis and cut costs.

While commending the strategy’s recognition of wood as a low-carbon building material, FPAC suggests that further emphasis could be placed on biomass energy, particularly in rural and remote communities.

Jason Fisher is the new executive director of the Forest Enhancement Society of BC (FESBC) starting Sept. 4, 2024, replacing Steve Kozuki, who is retiring.

Fisher is a registered professional forester who was born, raised, and still resides in Prince George. He has worked within the Ministry of Forests and was a part of the team that helped develop FESBC’s structure. Photo: Annex Business Media

James K. Irving, chairman of J.D. Irving, a Canadian conglomerate based in Saint John, N.B., passed on Friday, June 21. Irving spent 76 years at his family’s company until his death at age 96.

The conglomerate includes businesses in forestry, pulp products, agriculture, shipbuilding, and transportation, and also owned Brunswick News, publisher of the Telegraph-Journal, Daily Gleaner, Times & Transcript, until its sale in 2022. Photo: J.D. Irving.

The Osoyoos Indian Band (OIB) and Infinity-Pacific Stewardship Group have launched Siya Forestry, a joint venture aimed at advancing sustainable forestry practices in B.C.’s Okanagan, Kootenay, and Boundary regions. The partnership combines the expertise of Nk’Mip Forestry LLP, a subsidiary of the OIB, with Infinity-Pacific to address ecological values and community development through a First Nations perspective.

416-510-5113 Email: apotal@annexbusinessmedia.com Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

EDITOR - Jennifer Ellson (438) 483-7451 jellson@annexbusinessmedia.com

GROUP PUBLISHER - Anne Beswick (416)510-5248 • Mobile: (416) 277-8428 abeswick@annexbusinessmedia.com

ACCOUNT COORDINATOR - Shannon Drumm (416) 510-6762 sdrumm@annexbusinessmedia.com

MEDIA DESIGNER - Curtis Martin cmartin@annexbusinessmedia.com

AUDIENCE DEVELOPMENT MANAGER Serina Dingeldein (416) 510-5124 sdingeldein@annexbusinessmedia.com

NATIONAL SALES MANAGER - Josée Crevier Ph: (514) 425-0025 • Fax: (514) 425-0068 jcrevier@annexbusinessmedia.com

WESTERN SALES

Tim Shaddick 1660 West 75th Ave Vancouver, B.C. V6P 6G2 Ph: (604) 264-1158

Kevin Cook lordkevincook@gmail.com Ph: (604) 619-1777

CEO

How advances in equipment and technology positively impact steep slope harvesting.

BY RYER BECKER

Since the days of the axe and crosscut saw, innovation and ingenuity have defined the logging industry. From the earliest adaptations of the chainsaw to current development efforts around machine automation, the logging industry has embraced an innovation mindset to move the industry forward. While not all attempts have proven successful, it is this continued pursuit of improvement that has helped equip the logging industry with the tools necessary to address the many challenges facing the management of our forest resources.

Over the last 10 to15 years, significant advancements in mechanization and technology

have resulted in changes to logging operations around the world. In many cases, these advances have provided improved solutions for steep slope operations and other environments which have historically proved challenging for mechanized, ground-based operations. Given the steep terrain encountered throughout much of the northwestern U.S., many logging contractors in the region have

ABOVE: In addition to offering the potential for improved production, contemporary, mechanized harvesting equipment also supports safer timber harvests. Photos: Ryer Becker.

quickly adopted these mechanized systems.

In addition to offering the potential for improved production, contemporary, mechanized harvesting equipment also supports safer timber harvests. Historically, two of the most hazardous tasks performed on logging operations have been manual tree felling and hooking on cable operations. While these are important roles in many operations, the increased availability of mechanized alternatives has prompted contractors to pursue safer and more productive options when feasible. Mechanization places workers within reinforced, ergonomic, and conditioned equipment cabs, providing protection from falling debris, extreme heat and cold, and inclement weather. It also reduces fatigue and bodily wear and tear and minimizes the risk of injury associated with slips, trips and falls.

Leveling cabs and winch-assist systems are two technologies advancing ground-based timber harvest operations throughout the northwestern United States. For many contractors without cable logging capabilities, these advances provide new opportunities to work in areas that previously would have been too challenging, unproductive, or unsafe for traditional ground-based equipment. Mechanization increases contractor competitiveness and access to timber harvest opportunities that were previously infeasible. Contractors running cable logging sides have also benefitted from many of these same advancements.

While feller bunchers remain the primary felling option throughout the region, since 2014 shovel loggers have become a staple of many logging operations. Shovel loggers offer contractors a productive felling and forwarding solution on both gentle and steep terrain. A shovel logger equipped with a directional felling head allows a single operator to both fell and shovel trees. The machine has been used as an effective alternative to some short line cable operations on marginal cable ground throughout the region.

Elsewhere in the region, winch assisted mechanized felling and pre-bunching ahead of a yarder has been shown to increase production versus manual felling operations, while also capturing the added safety benefits.

In the northwestern U.S., most operations entail whole tree extraction to the landing or roadside using skidders, shovels or yarders. The integration of tethered systems has also resulted in the use of winch assisted grapple skidders. Some new equipment offerings have been purposely designed for these applications. For instance, the Tigercat 635H swing boom skidder combines the power, low ground pressure and functionality of a six-wheel drive skidder with the added versatility of a swing boom.

When working on steep, rugged terrain, it can be challenging to manoeuvre a skidder to the positions necessary to gather bunches. The swing boom allows the operator to easily access bunches along the skid trail with limited travel. The ability to keep the skidder correctly positioned on the slope improves stability and safety while decreasing the amount of ground traversed by the skidder for less site disturbance. Despite the advances in ground-based logging equipment, various timber harvesting scenarios in the northwestern U.S.

still necessitate cable logging systems. New advances in equipment are increasing the safety and capabilities of these logging operations, and mechanized grapple carriages are being increasingly integrated into yarding systems. The use of these new carriages reduces worker exposure to hazardous conditions as there is no requirement to send workers over the hill to set chokers. When combined with contemporary hydraulic yarders, contractors can conduct safe and productive operations in the most challenging conditions.

Designed for the most demanding applications, FORESTLAND is BKT’s most recent and innovative bias tire for the agro-forestry sector, but it can also be employed in some agricultural operations such as landscaping and light mulching. Its polyester carcass and specific tread compound make it particularly cut-and-chip resistant, while the robust sidewall ensures a long product life cycle. FORESTLAND’s key features are excellent traction on soft terrain, good grip on any ground thanks to stiff and reinforced tread lugs, a high level of stability thanks to the strong bead construction and top self-cleaning properties.

For info: 514 -792-9220

The ingenuity of the expert contractors on the ground will continue to push the logging industry towards a safer, more sustainable, and productive future, says author Ryer Becker.

Ensuring the execution of safe, sustainable, and productive timber harvesting operations across all conditions is vital for promoting the continued health and resilience of forestlands and a successful logging industry. As mechanization and advanced technologies continue to transform timber harvesting operations throughout the northwestern U.S., contractors continue to learn how best to utilize the full capabilities of these systems. Forest operations occur in dynamic environments with numerous operational and environmental factors in play. While a one-size-fits-all approach is not feasible, understanding the capabilities and limitations of the different available technologies allows contractors to identify how these different pieces of equipment can best serve their unique operational needs. The ingenuity of the expert contractors on the ground will continue to push the logging industry towards a safer, more sustainable, and productive future.

Ryer Becker is a research assistant professor of forest operations in University of Idaho’s College of Natural Resources in the Department of Forest, Rangeland, and Fire Sciences. He holds a bachelor’s degree in ecological forest management and forest operations from Paul Smith’s College and received his master’s and PhD degrees from the University of Idaho. His research focuses on the integration of mobile technologies, remote sensing, and GIS into the planning and execution of timber harvesting and forest operations. More recently, his work has focused on workforce development and education efforts.

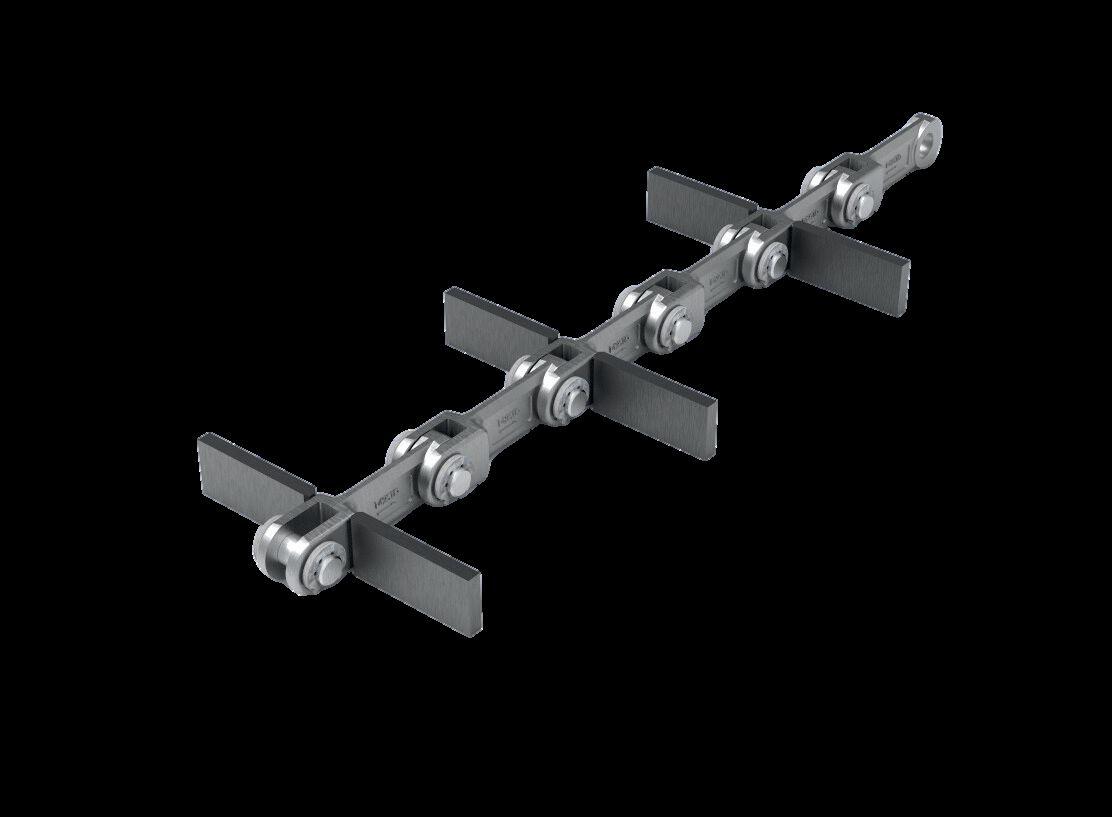

Olofsfors is the market leader in bogie tracks for CTL machinery and wheel tracks for skidders and wheeled feller bunchers. Under the brand names, ECO-Tracks and ECO-Wheel Tracks, Olofsfors offers the widest range of track models and linkage systems for various machine configurations and ground conditions. Superior quality, performance and a proven track record for increased productivity and durability.

NO MATTER THE CONDITIONS - OLOFSFORS HAS YOU

How telematics technology enhances logging efficiency, improves safety, and streamlines equipment management.

BY STOJAN AREZINA

You wear many hats – from heavy equipment maintenance to timber harvesting. Understanding telematics can refine your logging operation and free up time for strategic decision-making.

In today’s forest industry, many technologies are available like telematics machine monitoring. These technologies can boost efficiency, improve crew safety and keep your operation running smoothly. Let’s delve into telematics and how a fleet monitoring service allows you to focus on the forest while it keeps an eye on your equipment.

Today’s forestry equipment, including log loaders, is likely already equipped with fleet tracking technologies, called telematics, to track and report data in real time.

Telematics systems can provide a better under-

ABOVE: Today’s forestry equipment, including log loaders, is likely already equipped with fleet tracking technologies, called telematics, to track and report data in real time. Photo: Annex Business Media.

standing of how, when and where equipment is operating. The location is provided in longitude and latitude, and the mapping software automatically changes to the closest address.

Many fleet tracking technologies use a terminal that is installed on equipment to gather and communicate data wirelessly via cellular or satellite service. The machine’s data is then sent to a website where you and your dealer can monitor the following:

• Machine performance

• Operating hours

• Fuel usage

• Engine idle time

• Work time

• Engine temperature

• Hydraulic oil temperature

• Fault codes

A telematics monitoring service can help you in a variety of ways. Here are a few examples:

Better allocate resources: Telematics data can show you exactly where and how often your equipment is being used. By analyzing this data, you can determine if you are underusing your assets or whether it is time to invest in adding to your equipment fleet. Adjusting your fleet size to meet your needs can also help reduce equipment costs.

Fine-tune bids: If you want to create accurate estimates on future projects, telematics can help by providing you with data on machine hours and fuel usage to determine operating costs and labor costs for more accurate billing.

Promote better operator behavior: Data collected through telematics systems can be used to solve business challenges and improve operator performance, such as reducing prolonged idle time or improper use of equipment. By monitoring this data, you can correct these issues to promote a more productive and safer job site. You can also identify areas where you can reduce operating costs to extend component lifecycles and reduce the frequency of unplanned maintenance. Save on downtime: Your dealer may be able to diagnose a problem without physically being in the same location as the machine for faster response time. This will help save unnecessary machine downtime and reduce travel time for your dealership’s service department. When a technician does need to visit your job site, they will be better prepared to fix your issue because of telematics data shared with the dealership. Improve fuel efficiency: Telematics data can help you improve equipment fuel usage and efficiency. The system monitors equipment idle,

helping you identify machines that are working under or over capacity. Reducing idle times can also extend engine life and reduce repair and maintenance costs. And you can monitor power mode

operation and adjust the power mode to do the same work while using less fuel.

Help prevent unauthorized operation: Use telematics history reports to keep a close eye on your machine and

see where it’s been operated. A geo-fence, or an invisible/virtual boundary, can be created through the machine’s GPS system. If your machine leaves the virtual fence, it will send a notification and can alert the authorities about possible equipment theft.

A time fence or curfew on each machine can also be created. If the machine is operated outside of working hours, an email or SMS text notification can be sent to you. This helps prevent unauthorized operation and potential vandalism to the machine and job site.

Telematics systems are unique to each equipment manufacturer – these systems have a variety of benefits to help you make smarter decisions about how to best manage your fleet.

Stojan Arezina is a telematics manager at DEVELON. Stojan has a bachelor’s degree in electrical engineering from the University of Wisconsin-Milwaukee. He has more than 14 years of experience working in the fields of engineering, heavy construction equipment and telematics management systems.

Operating

Backed by Brandt – the besttrained support team around, available 24/7/365 so you can keep working.

BY ÉMILIE PARENT-BOUCHARD

BY KEVIN FERNANDEZ

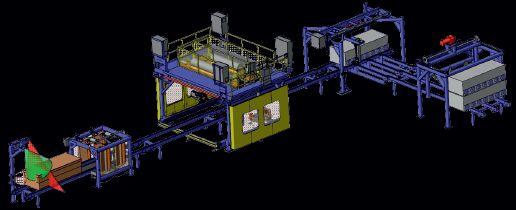

Resolute Forest Products aims to transform its Senneterre facility into a self-sufficient hub centered around lumber, thanks to investments totaling $57 million over recent years.

The modernization project for the planing mill has faced multiple delays, but may have ultimately benefited the forest community located at the crossroads of Abitibi-Témiscamingue and Northern Quebec. These delays allowed the project to be refined, ensuring that the final result would better meet the needs of the region.

As concerns persist about the supply chain and the viability of some Quebec businesses, Senneterre is strategically positioned with its state-of-the-art infrastructure. This positioning not only provides a competitive edge but also reinforces the town’s role as a key player in the forestry sector.

At the Resolute Forest Products Senneterre facility, everything is transformed and nothing is wasted.

Plant manager André Boucher describes the sawing, drying, planing, and energy production facility as a self-sufficient complex. The plant’s design ensures that all materials are utilized efficiently, with minimal waste and maximum productivity.

The process begins with debarked logs being fed into the plant. As the logs are sawed, they produce sawdust and wood chips, which are sold to other parties.

“Everything that comes in goes out. When the log comes in, we debark it in the sawing plant, and all the bark goes into the boilers. I have a boiler here, and I have one at the power plant,” Boucher says, referring to the 34.5-megawatt biomass power plant acquired from Boralex for $10 million in 2022.

“Then the debarked wood is processed through the plant, producing sawdust. The sawdust is sold, as are the wood chips,” Boucher explains further.

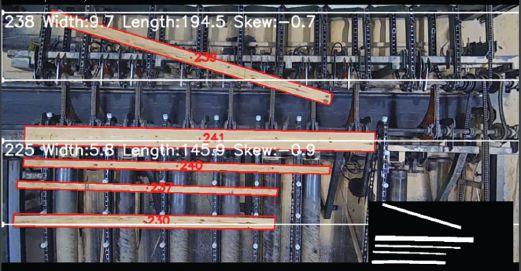

After that, the lumber is dried at the facility in Lac-Clair, a few kilometres from the main site, and then returned to the new planing mill, says Boucher, adding that there is excitement about the potential of the new GradExpert Comact optical scanner from BID Group, which maximizes the yield from each board.

Boucher, who brings 30 years of industry experience, including 11 years as a plant manager on both sides of the Ontario border, working for Greenfirst before moving to Senneterre, emphasizes the importance of this facility in the company’s strategy.

The new planing mill represents a significant investment in technology and infrastructure, he says, and is the cornerstone for building Senneterre’s future.

The state-of-the-art facility required a $47 million investment, which included acquiring a Gilbert Products planer, a Novilco continuous decanter, a Jamec board sorter and trimmer, and a

DO2 Solutions packager. The plant is still in the start-up phase, but it promises high-level performance.

WHEN MODERNIZATION MEANS JOB MAINTENANCE ... AND MORE!

Boucher describes the start-up phase as a green start, highlighting

the challenges and adjustments required as they transition to the new system.

“This is what we call a green start, starting from scratch. We knew that the new planing mill would require much more wood than the old one,” he beams.

“Since last November, we’ve experienced what I call ‘the big tornado’. So, now we need four shifts for sawing instead of three. At the same time, we started with one shift, then increased to two, and now three shifts at the new planing mill.”

Even though Boucher has been managing continuous changes since last November –including schedules, recruitment, gradual employee transfers, and supply inputs for each operation in the complex – Boucher is pleased to be able to maintain the approximately 200 jobs in Senneterre, in addition to forest jobs. He is also surprised by the productivity gains from the new installations.

“We’ve achieved much higher production rates than we expected. There were hours when we processed up to 67,000 board feet per hour,” he says with a smile, noting that this is nearly double the production target for the start-up period.

“It makes one wonder if we should add more machines. Everything is up for discussion right now – will we run three shifts because we won’t have enough volume for four? Should we look elsewhere because other companies might sell wood?”

The advantageous situation in Senneterre has even led some employees from the Comtois sawmill, whose operations in

Lebel-sur-Quévillon were suspended last March, to travel the 90 kilometres separating the two forestry towns.

Boucher adds that market and supply uncertainties have forced Resolute to make tough decisions.

“I’m sure there are people looking at Senneterre and wondering why they didn’t do this at Comtois. But it’s simply because Senneterre is centrally located.” Plus, Senneterre has a thermal power plant. He says the acquisition was strategic, which is

why the investments went to Senneterre.

“Yes, we have a transfer of employees from Comtois. For those interested in coming to work, the doors are open during the downtime.”

Mayor Nathalie Ann Pelchat of Senneterre says she is pleased with Resolute’s investments in her municipality, but adds that she remains cautious due to the current downturn in the industry.

She also expresses solidarity with her counterpart in Lebel-sur-Quévillon, with whom she developed a strong bond during last summer’s forest fires.

“If it weren’t for the investments, I would be wondering if I was next to be affected by a closure,” she says, recalling Senneterre’s reliance on a single industry.

“I believe Resolute is doing everything possible to make their investments pay off. While it’s reassuring, the low price of wood and widespread closures elsewhere are concerning. We’re closely monitoring the situation,” she adds.

Despite ongoing challenges – such as the race to process burnt wood, final adjustments to reach full planing capacity, and worker recruitment – Boucher remains optimistic about Senneterre’s future.

He envisions additional projects, such as installing kilns powered by the facility’s thermal plant, which could enhance synergy and efficiency.

“The idea for the future is to have projects in Senneterre for kilns powered by the power plant,” he muses.

“This is why Resolute is looking to make Senneterre a hub. The power plant is here, the supply is adequate, it’s centralized, and there’s potential for future projects at the plant entrance,” Boucher adds.

“It all depends on how quickly we can demonstrate the project’s payback and how quickly we can scale up the projects. We’re not in a position where we’ll close tomorrow. It’s a period where everything is new. We’ve been through tougher times, but now everything is new, exciting, and fun,” he concludes, also hoping to attract talent with these brand-new facilities that allow for envisioning Senneterre’s future.

BY ANDREW SNOOK

In British Columbia’s forestry sector, there has been no year in recent history filled with more preventable tragedies than 2012.

In January of 2012, the Babine Forest Products sawmill in Burns Lake suffered an explosion that resulted in the deaths of two workers while injuring 20 others. A few months later in April 2012, about a 2.5-hour drive from Burns Lake in B.C.’s Northern Interior, the Lakeland Mills sawmill in Prince George exploded, killing another two workers and injuring 22 more people. The investigations into these explosions found one culprit responsible: combustible dust. Since that time, regulations have been tightened to ensure better management of combustible dust throughout the province.

B.C.’s management of combustible dust was the topic of the closing keynote presentation for the 2024 Global Dust Safety Conference, which took place earlier this year.

The presentation, Upcoming release process for the proposed British Columbia regulations for combustible dust. Why they are needed and what it means for industries in B.C., was presented by Rodney Scollard, senior policy and legal advisor, and Mike Tasker, CRSP occupational safety officer with WorkSafeBC.

They reviewed proposed upcoming regulation changes regarding combustible dust in the province; provided a background on what drove regulation change in B.C. over the past decade; the timeline for the new regulations to come into effect; the roadmap to combustible dust hazard assessment and management provided in the regulations; and what these changes may mean for industries in B.C.

When the sawmill explosions took place in 2012, WorkSafeBC had enacted Workers Compensation Act policies related to the general duties of employers, workers and supervisors in relation to

how they identify and manage the risk associated with wood dust. The currently proposed regulations expands on the policies related to wood dust.

“The provisions we have currently around combustible dust, and controlling the hazards associated with it, is very limited, and not very detailed,” Scollard explained. “So, there’s been this drive now to introduce specific dust-related regulations within our occupational health and safety regulation. And in doing so, these new regulations will ultimately replace those three current policies that were introduced after the 2012 incidents.”

While the focus of WorkSafeBC has understandably been on regulations related to combustible wood dust, the proposed regulations would expand the types of dusts within the regulations.

“Most of our focus from a regulation perspective has been devoted to combustible wood dust. Certainly, that is an issue that we needed to address. So, under the proposed regulation, it’s been greatly expanded to any dust that is handled or generated at the workplace,” Tasker said. “That ‘handled or generated’ is an important aspect. We’re not talking about the dust that might accumulate on a windowsill. We’re talking about dust that is either handled or generated. So, handled or generated through pulverizing processes, grinding processes, material size reduction processes, and that sort of thing. Handled meaning things like conveying it, moving it, storing it, those kinds of examples.”

The type of dust within the proposed regulation could include wood, agricultural, and plastic dust, as well as manufactured powders and lint.

“If it’s combustible, then it’s covered by the regulation,” Tasker said. Dust that is in sealed commercial packaging is excluded from the proposed regulation.

“A sealed bag of shavings for a rabbit cage in a pet store is not covered by this regulation, it’s excluded,” Tasker said.

While the current version of the proposed regulation on the WorkSafeBC website, Part 6, Substance Specific Requirements: Combustible Dusts, is not the finalized approved version of the regulation, Tasker said he believes it is very close to a final version.

“We don’t know exactly what the final version of the regulation is going to look like. However, I think, in my personal opinion, we’re getting pretty close to that,” he told attendees. “We’ve been working through the consultation process now for over a year, where we’re pretty clear on what has been recommended and what has been adopted. So, I don’t foresee a lot of significant changes. But we just want to make it clear that the version of the regulation that you may access from our website is still a working draft, until it actually gets finalized and approved by our board of directors, and then moves forward through the rest of the approval process.”

When putting together the proposed regulations, Tasker said they tried to find a balance between performance-based regulation and prescriptive-based regulation.

“Because this regulation is intended to cover workplaces that are both simple and complex, very large to very small, we had to strive to find a scalable regulation that could be applied across the board, regardless of the size or complexity of your operation,” he said. “In order to do that, we had to find a balance between those two regulatory methodologies.”

To address the performance-based aspect of the regulation, they expanded the requirements around conducting a risk assessment, so the risk assessment takes into consideration the characteristics of the dust, as well as the machinery and equipment that exists at a given workplace. It also expands the requirements for employers that have combustible dust, to have a combustible dust management program, Tasker explained.

“We also have a section that is more specific, more prescriptive in nature, that stipulates specific control measures that must be in place for particular risks or particular types of equipment. And it does provide some guidance specifically to those,” Tasker said.

An assumption clause has been put into the proposed regulations to help address a notion of understanding about particular dusts, while reducing costs for employers.

“For every employer to take representational samples of every dust they have, and to send it to a lab for testing, paying the money for that, and all the associated costs with it, was just overly burdensome, especially for small- and medium-sized employers,” Tasker said. “We also recognize that some dusts are easily recognizable as combustible. We don’t need to conduct those tests in order to understand and manage those dusts.”

To simplify things for employers, the assumption clause states if a workplace handles or generates a dust, employers must assume it’s ignitable and deflagrable, unless they do one of two things: test the dust or show evidence that it is not combustible.

“If you believe that the dust that you have at your workplace is not a combustible dust, you can send a sample to a lab, follow [WorkSafeBC’s] methodology and confirm that it is, in fact, not

a combustible dust,” Tasker said. “Because we understand that there’s access to published data on various dusts, if you believe that your dust at your workplace is not combustible, you can rely on that objective published data, provided that it’s been derived from the prescribed testing method that’s indicated in the regulation.”

Once a company has dealt with the assumption clause, they can proceed to the next step in the process, which is to begin

a risk assessment. Every employer that has a combustible dust at the workplace is required to conduct a risk assessment in consultation with a qualified person.

“Within the regulation, it outlines the risk assessment process that needs to be followed; the types of things that need to be considered, in order for it to be a valid risk assessment. And we also provide language as to when that risk assessment has to be reviewed and updated,” Tasker said. “For example, if there’s a change in materials or machinery or processes, then

there’s a requirement to go back and review and update your risk assessment to reflect those changes.”

For the definition of a qualified person used by WorkSafeBC for the proposed regulation, the organization adopted the universal definition of qualified that WorkSafeBC relies on in Occupational Health and Safety Section 1.1.

“We didn’t come up with a specialized definition of qualified for the purposes of combustible dust,” Tasker explained.

After a risk assessment is completed and combustible dust has been identified in a workplace, the next step is to develop a combustible dust management program outlining how to manage that risk, and what controls need to be put in place.

“Those controls can be many, can be few, depending on the on the nature of the workplace and the nature of the risk,” Tasker said. “This program is a written program that has to be developed by the employer, and once again, under consultation with a qualified person. And within the regulation, we also stipulate the basic elements of a combustible dust management program in order for it to be considered adequate to manage the risk.”

The risk assessment and specific requirements that flow from within the proposed regulation are aimed at tackling these factors:

• What is the type and amount of fuel (dust) that’s present at the workplace? How much of it and what type is it?

• What sources of ignition are around in that workplace that could ignite the dust?

• What degree is there potential is for confinement of the dusts?

• What is the possibility of the dust being dispersed or suspended in the air?

• And to a lesser extent, what amount of oxygen is present?

“That’s really what a lot of the provisions and requirements in the draft are flowing from, and what they’re aiming towards is having the employer control those five factors at their workplace,” Scollard explained.

At the time of this article’s publication, the proposed regulation was still undergoing consultation and is subject to change.

BY STAFF REPORT

At the 2024 Global Dust Safety Conference, Diane Cave from Element6 Solutions shed light on common pitfalls in Dust Hazard Analysis (DHA) reports, drawing from over two decades of experience in dust collection systems. Here’s a summary of the top five mistakes she identified:

5. Excessive filler content Cave emphasizes that DHA reports should avoid lengthy resumes or repetitive information. Focus should be on delivering concise, relevant content. “A DHA report isn’t a sales pitch or a summary of codes. It’s about methodically examining and communicating risks.”

4. Poor hazard identification Reports often delve into irrelevant theoreti-

cal discussions or address non-DHA-related hazards. Effective reports should concentrate on dust-related hazards and avoid extraneous details.

3. Disorganization and lack of clarity

Many DHA reports suffer from poor organization, making them difficult to read. Common problems include incorrect equipment names and unclear process descriptions. Cave advises using the facility’s terminology and including visual aids, such as photos, to enhance understanding.

2. Ambiguous language

The use of vague, overly technical language is a significant issue. Terms like “might consider” or “should think about” can lead to inaction.

Instead, use direct, decisive language. “If something is necessary, state it clearly. Avoid convoluted jargon and be concise.”

1. Lack of clear recommendations

The most critical mistake is the absence of actionable recommendations. Reports often fall short by merely listing unmet codes without offering a clear path forward. The goal is to clearly communicate the risks and guide the reader on how to address them effectively.

Cave’s presentation underscored the importance of clarity and precision in DHA reports. By avoiding these common mistakes, professionals can ensure their reports are more effective in identifying and mitigating dust-related hazards.

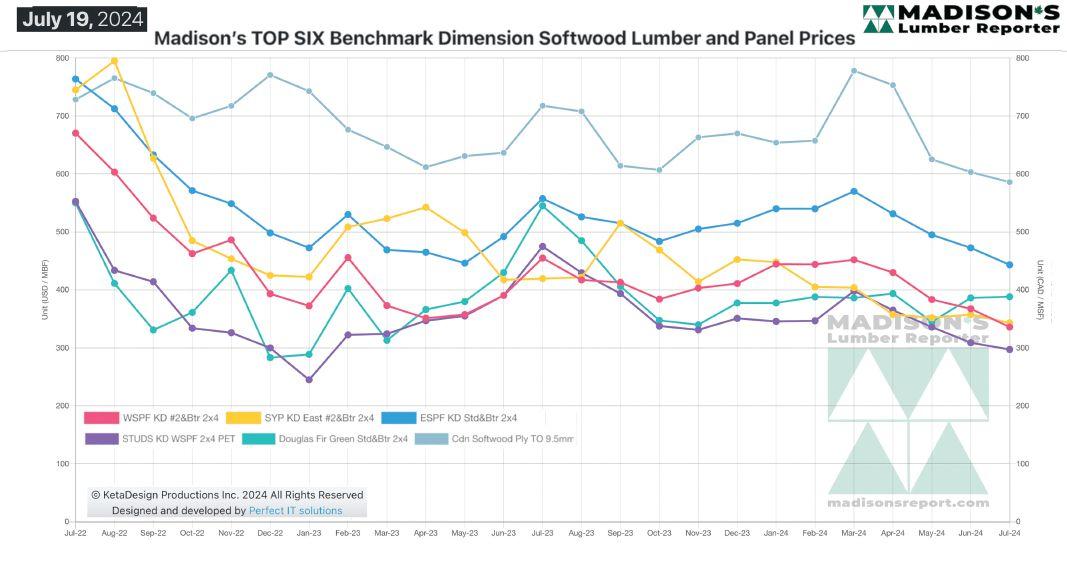

BY KETA KOSMAN

The July post-dual national holidays in Canada and the United States did nothing to jolt an increase in lumber sales.

As true summer weather was upon North America, any hopes of a seasonal jump in demand for lumber did not materialize.

Sawmills and wholesalers alike prepared to hang “Gone Fishing” signs at their desks, so little inquiry was there in mid-July.

The rotating lumber production curtailments and sawmill downtime at least prevented prices from falling too much below cost-of-production, but low sales volumes did not provide encouragement for any immediate improvement.

While no one was stocking inventory, and supply was quite tight, demand was soft enough to not cause concern among customers.

So far this season, builders and contractors have

been able to get the wood they needed for ongoing construction jobs easily enough, so have felt no urgency to hold inventory.

A good metric to confirm the decreased manufacturing volumes is sawmill utilization rates. This data come out monthly from the Western Wood Products Association (WWPA), based in Portland, Oregon.

The latest issue of the WWPA’s Lumber Track has Canadian softwood lumber production as a per cent of practical capacity relatively even compared to the same time last year, at 72 per cent in April 2024, while the U.S. is at 78 per cent, which is down from 80 per cent in April 2023.

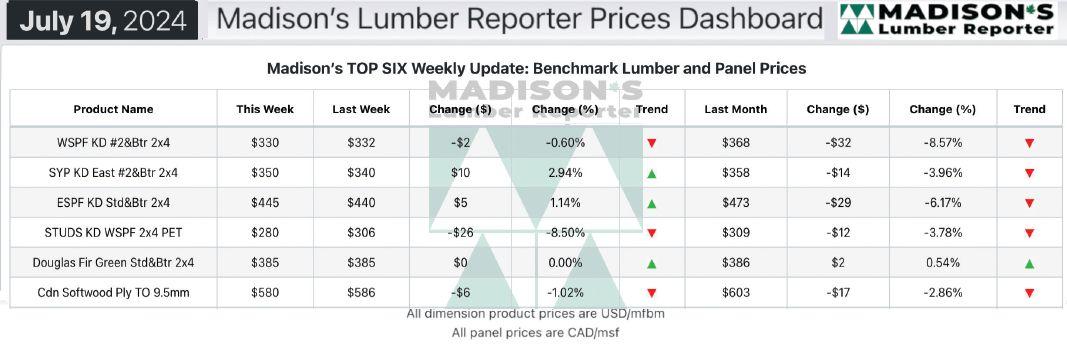

In the week ending July 19, 2024, the price of benchmark softwood lumber item Western SprucePine-Fir 2x4 #2&Btr KD (RL) was US$330 mfbm.

That week’s price is down $2, or one per cent

from the previous week, when it was $332. That week’s price is down $38, or 10 per cent from one month ago, when it was $368.

Compared to the same week last year when it was $458 mfbm, that week’s price was down $128, or 28 per cent .

Compared to two years ago, when it was $664, that week’s price is down by $334, or 50 per cent.

KEY LUMBER PRICES AND MARKET CONDITIONS TAKE-AWAYS –JULY 2024:

• Wide dimension was the only remotely profitable commodity group.

• Buyers had a prevailing and reinforced expectation of quick truck shipments at a discount.

• Sawmill asking prices were a mixed bag.

• Downside momentum abated due to persistently low prices, general fatigue, and less Euro wood coming into Eastern ports.

• Too many suppliers competed for limited business.

• Discounted plywood and OSB material flowed into U.S. markets.

The Madison’s Lumber Prices Index for the week ending July 19, 2024 was $367 mfbm.

This is down $2 from the previous

week when it was $369, and is down 26 per cent from the same week last year, when it was $499.

A dramatic drop in multi-family starts

the previous month brought total housing starts in the U.S. for May down significantly.

The latest data release showed a bounce back up in multi-family starts, which was

Allied brings 49 years experience to help you meet current NFPA Standards with: system design/documentation, spark detection, isolation, grounding, PLC, venting, blast path management, clean-up systems and duct audits — CWB certified and member SMACNA.

Sawmill – Biomass – Boardplants – Pulp & Paper – Power Generation – Mining 50 years of Industrial Air Systems www.alliedblower.com

Source: Madison’s Lumber Reporter.

enough to drive total housing starts upward.

Total U.S. housing starts in June were 1.36 million units, up three per cent from the upwardly revised 1.31 million units in May, and down more than four per cent from June 2023, when it was 1.42 million units.

Single-family housing starts, which account for the bulk of homebuilding, fell more than two per cent in June compared to May, at a seasonally adjusted annual rate of 980,000 units.

It however rose 5.4 per cent compared to June 2023 when it was 930,000 units.

Total building permits rose three per cent month-over-month to 1.45 million units, from 1.40 million in May, and fell three per cent compared to June 2023

when it was 1.50 million.

Single-family permits dropped more than two per cent from May’s 1.0 million, at a rate of 980,000 units.

It is important to note that year-to-date new housing construction is actually up this year compared to 2023.

For the first six months of 2024, singlefamily starts are up 16 per cent, from 449,400 units (not seasonally-adjusted) in the same time last year, to 521,800 units.

Likewise, single-family permits for January to June this year are up 13 per cent to 511,500 units, compared to 453,800 units for the same time in 2023.

While there was no boost to lumber sales during this spring building season, the upward trend of new housing starts year-

to-date does bode well for stable lumber demand in the remainder of this year.

Meanwhile, as manufacturing volumes have remained lower than in the past for more than one year, there is a possibility that some customers will be caught short of their needed inventory.

Keta Kosman is the owner of the weekly Madison’s Lumber Reporter, the premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. Established in 1952, it publishes current Canadian and U.S. construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and provides access to historical pricing as well.

If you’re involved in the filing room or managing the circle saw budget, you’ve likely asked or been asked, “When should a saw be discarded?”

Sometimes the answer is clear even to a layperson: if the saw is severely bent, cracked, or missing a piece from the rim, it’s clearly beyond repair and should go straight to the scrap metal dumpster. But what about when the issue isn’t so obvious? What guidelines do experienced filers use to decide when a saw should be retired?

Safety, safety, safety: Most filing rooms have adopted the rule that a saw is not to be welded or drilled out if the gullet or body of the plate is cracked. When plates were thicker and edgers weren’t high-speed, many of the old filers would drill out and stop a crack from getting out of hand. This practice has pretty much been eliminated due to safety regulations. The savings just don’t justify the

risk to employees and equipment.

Time is money: An experienced filer understands that both time and downtime equate to money. Therefore, if a saw shows measurable signs of wear and metal fatigue, it is typically culled to avoid further losses.

An experienced filer understands that both time and downtime equate to money. Therefore, if a saw shows measurable signs of wear and metal fatigue, it is typically culled to avoid further losses. The filer knows he can keep hammering and possibly achieve what he’s looking for with his gauges, but will the work hold up under pressure?

Consider the saw plate like a piece of elastic: after being stretched repeatedly, it eventually loses its ability to hold its shape. A saw, similarly, will become impractical and uneconomical to repair if it’s worn out. Culling a saw with a bent or creased plate should

be an easy decision. However, deciding how much hammering or bench work to perform before culling can be challenging. If a saw plate has lost so much tension that it’s as flimsy as a dish rag, it’s best to cull it. Even if tension can be restored to make the saw appear functional, it often won’t hold true or perform reliably before its next scheduled change. While straightening the plate, leveling tension, or balancing tension may be sufficient to keep a saw in operation, excessive hammering can cause metal fatigue and compromise performance.

Planning is crucial: A filer may struggle to cull saws even when necessary if the mill doesn’t have enough replacements available. Delays in ordering or stocking new saws can force filers to repair ones that are beyond practical repair, potentially leading to excessive downtime or increased repair costs. Mills with double arbors might manage to extend the life of a saw by moving it to the top arbor, but proper budgeting for saw replacements is far more cost-effective than dealing with miscut or downgraded lumber.

Tipping the scales: Some filers like to have a hard and fast rule when it comes to

discarding or culling saws. Over the years, they’ve observed that performance and run times suffer when a saw is retipped beyond its effective lifespan. These filers often calculate the optimal number of retips for their specific operation and establish a rule that a saw will be culled after reaching this limit. For the frugal minded or someone that hasn’t studied the numbers, this will often appear wasteful. But experience and statistics usually don’t lie. Over-tipping, especially without gullet grinding, can lead to spillage, body wear, overheating, and downtime. Data is crucial when using these parameters to cull saws. Another factor regarding the tips is how many broken shoulders a filer is willing to repair rather than discard the saw. Some won’t weld any and others limit it to a percentage of tips. Certainly, the age of the saw will play into their decision to keep or cull.

Clean and cool: If any amount of babbitt is caked on the side of the saw plate, it’s a good sign that heat has damaged the plate. All babbitt must be thoroughly cleaned off before the saw can proceed with repairs. After cleaning, the plate should be inspected to determine if further work is

needed or if the saw should be culled.

A seasoned filer can quickly determine whether to cull a saw or repair it for another run. First, they inspect the teeth to see if they can be sharpened or need retipping. If either option is feasible, they then evaluate the saw plate itself. They check for damage or cracks, assess its levelness, and look for problematic knots that might require excessive hammering.

In modern hammer rooms, flat anvils are commonly used. By applying a small amount of oil to the plate and laying it flat on the anvil, a filer can pull up on the plate. If they detect a slight suction holding the plate, it indicates that the plate is likely flat enough to be restored to good condition without extensive work.

Over 30 years ago, when I founded Smith Sawmill Service in Texas, the Texas comptroller classified saw blades as taxable tools, based on their belief that these tools had a lifespan of six months or more. However, advancements in high-speed equipment and thin-kerf sawing have rendered this lifespan theory outdated. Today, saws are no longer taxable in Texas under the manufacturing sales tax guidelines.

BY TERESA HANNAH

Loggers invest considerable sums in log harvesting and hauling equipment, but often allocate few to understanding the economics of their business. Yet failing to do so can be devastating for such a capital-intensive business. As an economist by training, I think a lot about these things.

It may seem that successful loggers instinctively know whether their operations are on track to meet production targets and turn a profit. The reality, however, is that these instincts are typically honed through the meticulous tracking of key statistics. These metrics will likely vary from one business to the next but will share some common themes that allow owners to course-correct and

improve operational efficiency over time.

Taking the time to identify the statistics that are most critical for your particular logging operation is crucial because:

• They can help you understand the difference between production and productivity.

• They help you allocate your equipment and operators to maximize productivity.

• They help you and your team see patterns of inefficiency so that you can work together to correct the inefficiencies.

Successful loggers also understand that using the right computerized tools to track and report upon

ABOVE: No matter the size of your operation, disciplined and consistent data tracking coupled with use of an industry-specific database system to manage and report on that data is key to a stable future for your business.

VISIT US AT LOGGING DEMO SITE BOOTH SB 25 2024 LOGGING DEMO

LUCAS BRYANT

I’ve never run a bar that withoutlong a rebuild

Designed with 3/8" thick alloy-steel and precision-milled grooves for a broad range of harvesting equipment, the 3/4" pitch guide bars are built to tackle the toughest wood in the harshest conditions.

Upgraded, specialized bar material holds its original form, even under the toughest conditions.

The new EnduraMax™ replaceable nose, with improved materials and a new attachment design, lasts longer with better wear.

their data is critical, just like it’s critical to use the right equipment in the woods.

Recently, I asked two clients – SPF Forestry in Northern Alberta, a relatively new player as a stump-to-dump contractor for West Fraser, and Hec Clouthier & Sons, a long-established logging contractor in central Ontario with a 90-year history – to share their insights about the metrics they monitor.

“I’m a production guy, not an accountant. I focus on hours per meter of wood harvested and hours per stem cut,” says Jeff Stoesz, one of the founders of SPF.

How does he monitor these figures?

He collects daily time sheets from his team, complete with detailed machine hours and estimated cubic meters and stem counts from his machines. He also systematically uses the Logger’s Edge software to analyze this data block by block.

I asked if he could give examples where tracking these metrics helped him make course corrections during the year.

“Absolutely it has. In fact, I share the information daily with our workers. It helps motivate them to either keep doing what they are doing if they are on track, or look for ways to catch up if they are behind on the production,” said Jeff. “It also helps me counsel green employees who aren’t

meeting their production targets in a confidential, data-driven way, which helps motivate them to do better. It’s amazing what showing people their numbers can do!”

He also noted that it triggers discussion about why they are falling behind. For example, West Fraser had them in some really rough terrain, and the skidders were not able to keep up with the processors. They could easily see from the numbers in the reports that they needed to add more skidders to the block to keep up. “We didn’t want a chaotic end to the season scrambling to get the wood out before the roads got too muddy. Having this information helped us achieve our targets in a more orderly and manageable way.”

Shannon Clouthier, co-owner of Hec Clouthier & Sons, says they focus on costs per phase of operation. But it is not exactly a straightforward exercise. How do they do that?

To cost their equipment, they rely on tools within Logger’s Edge to estimate a standard cost for each of their machine types based on information such as purchase price, utilization percentages for each machine, and fuel burn rates. They enter that information into the cost buildup model to estimate the machine hourly costs for bunching, loading, etc.

To cost their labor, they track each worker’s hourly wage rate. They use the software to automatically marry up these hourly costs with machine and labor hours from time sheets in the system. By marrying up the inputs on a job with the output harvested, they can see their costs per phase on a block-by-block basis.

Once a year, they then compare the total costs in their accounting package to the costs across all the blocks for the season. Differences can result because they may not have accounted for certain overhead costs when doing their equipment costing or labor uplifts. The reconciliation forces the hand on analyzing where expenses may have notably changed from the prior year. Often, those variations relate to changes in repair costs or shop overhead costs that were not accounted for in the overhead assumptions used in the software.

No matter the size of your operation, disciplined and consistent data tracking coupled with use of an industry-specific database system to manage and report on that data is key to a stable future for your business. Successful loggers trust their instincts, but they rely on the power of data to verify those instincts.

Teresa Hannah is president of Caribou Software, based in Hinton, Alta. She has a degree in economics from University of California, Davis.

The Peterson line of forestry and environmental recycling equipment offers toptier solutions for all your wood processing needs. Our robust horizontal grinders, drum chippers, and flails ensure unparalleled efficiency and reliability. Don’t miss your chance to see this premier lineup of high-quality, durable equipment up close and learn why our customers trust Peterson for industry-leading performance and innovation.

John Mullinder is the author of Little Green Lies and Other BS: From “Ancient” Forests to “Zero: Waste, and Deforestation in Canada and Other Fake News. A former TV reporter in his native New Zealand and foreign correspondent for Maclean’s magazine and Financial Post, he ran Canada’s Paper & Paperboard Packaging Environmental Council for 30 years. www.johnmullinder.ca

The environmental media is full of grim warnings on how much primary forest the world is losing and its impact on biodiversity and our ability to reduce GHG emissions. But what exactly is primary forest, and how much does Canada have?

There is worldwide agreement on four key aspects of primary forest: naturally generated (not planted by man); comprises native (not introduced) tree species; no visible indications of human activities; ecological processes not significantly disturbed.

The last two require some clarification because data to support them is sometimes tenuous or does not exist, or the extent of their impact is debateable or disputed. According to the UN FAO, primary forest exists if there has been no known significant human intervention or “the last significant human intervention was long enough ago to have allowed the natural species composition and processes to have become re-established.” The FAO estimates that about one-third of the world’s forests can be considered primary. More than half of these forests are found in Brazil, Canada and Russia.

So how much primary forest does Canada have? A simple enough question, but in reality, a much harder one to answer. Academic agreement on a definition is one thing, but being able to actually measure primary forest is something else. The FAO freely acknowledges the challenge: “most countries use proxies based on land use and/or land cover to extrapolate data on primary forest, and these proxies vary.”

Canada does not have any original data specifically on primary forest so it relies on estimates based on extrapolations from multiple sources and methodologies, after using a combination of remote sensing from satellites, thousands of photo plots, and estimates by foresters on the ground.

Perhaps the easiest part of this highly complicated process is to assess Canada’s unmanaged forest, much of it remote and inaccessible and left in a wilderness state. What might also be relatively easy to measure is Canada’s legally protected forest. Human activities like harvesting, mining, and hydro-electric

development are banned in nearly 95 per cent of it.

The most difficult area to estimate for primary forest is what is called Canada’s managed forest (48 per cent of the total, according to an industry study.) Managed forest does not mean harvested. This is forest land under a provincial or territorial government forest management plan using the science of forestry. But there’s a glitch here because the federal government uses a broader definition of managed forest. For carbon-reporting purposes, it includes both formal protected areas, plus hectares under fire suppression plans, and long-term forest management. Confusing!

And now, time for the answer or at least a best guestimate. Using proxy indicators such as forest land protection areas and proximity to human settlement and access (mainly through roads), the NRCan team reporting Canada’s performance for the FAO’s latest report came up with a total: 205.1 million hectares. That translates into 59 per cent of Canada’s forest lands meeting the UN definition of primary forest in 2020, a pretty impressive number. It also raises all sorts of other questions. There is an underlying assumption that primary forest necessarily provides greater benefits than other forests. Many forest scientists contest this assertion, arguing that eco-system-based management practices can emulate natural disturbance regimes and provide a mosaic of habitats with a natural range of variability. And in terms of carbon sequestration, research suggests that conservation is not always the optimal strategy, particularly where climate change is increasing wildfire risk.

Clearly, there is a need to improve the gathering of data on our forests. How best can Canada achieve its goal of conserving 30 per cent of its lands and waters by 2030? Will Canada ever stop harvesting trees from primary forests? Should it? And, how does Canada avoid trade barriers being placed on wood and pulp sourced from its primary forests by countries that themselves have already removed most of their own primary forests? Some big questions there!

Cutting capacity: Up to 8.5 million board feet of wood in two-shift operation.

Log diameters: 10 to 42 in, lengths: 10 to 16 ft 2 in (20 ft on request)

100% self-sufficiency: Cut your own logs, optimize production costs.

Space-saving: Optimum use of floor space from 5,400 ft² to a maximum of 10,800 ft².

Long-term predictable prices: Own production ensures stable product prices.

Sustainability and regional added value: Use of local wood, recycling of all wood waste.

Board dimensions: Wide range possible through chipper head, band and rip saws.

Green footprint: up to 75% yield, maximising log utilisation.

MAXIMIZE YOUR RECOVERY.

ROBOTS DESIGNED TO PICK AND SORT TRIM BLOCKS BASED ON THEIR GRADE AND VALUE

• Precision and efficiency

• Consistent decision-making

MAXIMIZE PRODUCTION WHILE ENHANCING SAFETY.

A VERSATILE SYSTEM THAT CAN BE DEPLOYED AT ANY STAGE OF THE PROCESS, OFFERING A WIDE RANGE OF APPLICATIONS

• Real-time identification of production anomalies

• Superior functionality; no false detections and oversight across 100% of the production line