Ready to gain even more advantages in the woods? At no additional cost, our Skidder Transmission Assurance Program covers warrantable transmission repairs and replacements on qualified John Deere skidders for six years or 12,000 hours, whichever occurs first.1

It’s just another way we’re helping you OUTRUN expectations, whatever you’re up against. JohnDeere.ca/skidders

6-YEAR/12,000-HOUR SKIDDER TRANSMISSION COVERAGE

NorSask Forest Products has shown a remarkable capacity for weathering challenges and embracing renewal.

NorSask mill, located in the boreal forest of northwestern Saskatchewan, is owned by the Meadow Lake Tribal Council (MLTC). It holds the distinction of being the first 100 per cent First Nation-owned sawmill in Canada – and remains one of the few in the world.

asnook@annexbusinessmedia.com

When I first took the helm as editor of Canadian Forest Industries about a decade ago, one of my first long-form features was about the countdown to the end of the Softwood Lumber Agreement, which expired on October 12, 2015. As much as I’d like to think that the timing of me coming back as interim editor of the publication coinciding with tariffs and duties being on everyone’s mind is unique, I know better when it comes to the forest products sector and the contentious trade relationship that exists between the U.S. and Canada.

As industry leaders across Canada scramble and bite their nails in anticipation of new potential tariffs from U.S. President Donald Trump’s administration, I can’t help but think about the companies active in our country’s softwood lumber sector and the constant disruption and uncertainty they’ve navigated decade after decade.

Outside of the stability that the Softwood Lumber Agreement (SLA) offered the sector from 2006 to 2015, the Canada-U.S. softwood lumber dispute has been one of the longest-running trade disputes between our two countries. So, when President Trump speaks of tariffs and duties in his speeches, this is one industry that is accustomed to navigating these types of challenges.

Currently, Canada’s softwood producers already pay significant duty rates. On Sept. 24, 2024, the U.S. Department of Commerce announced the amended final results for its review of the anti-dumping order for Canada’s softwood lumber products. The duties paid for softwood lumber imports increased significantly for producers last year. They are as follows:

So, when President Trump speaks about the possibility of imposing a 25-per-cent tariff on all Canadian goods, it’s more than fair to understand that Canada’s forest products sector gets its back up. There have been reports that some Canadian softwood lumber producers are willing to add any additional U.S. tariffs directly to the costs for their customers south of the border. Whether this would happen is uncertain, but it could generate disruption and panic buying within the sector. That said, it’s nice to hear that our softwood lumber producers are standing up for themselves.

During the president’s inaugural address celebrating his second term in office on Jan. 20, President Trump didn’t promise to impose the 25-per cent tariff as previously threatened but is still seriously considering some form of tariff or duties on all Canadian goods. As various levels of our government and dozens of industry representatives travel to Washington to negotiate any potential duties and tariffs, most companies have no choice but to wait and see what the final decision will be and adapt to the best of their abilities.

My sympathies for Canada’s softwood lumber sector having to navigate more potential costs also go out to U.S. home buyers, who will undoubtably pay more for a new home to compensate for any additional expenses incurred by the homebuilders. It’s often said that certain expletives roll downhill – that goes double for production costs. Every tariff and duty added to goods end up hurting the consumer’s pocketbook in the end. Hopefully cooler heads will prevail in regard to duties and tariffs, and the softwood lumber market can regain some degree of certainty.

Anyone else long for the days of the SLA?

The Canadian Mill Services Association (CMSA) has acquired the quality control (QC) department of the BC Council of Forest Industries (COFI), integrating COFI’s QC operations, grade stamps, and employees into CMSA.

As of Dec. 31, 2024, COFI ceased offering QC services,

encouraging former clients to join CMSA. This merger allows CMSA to provide comprehensive QC services, including grade stamping, plant health certification and educational support while maintaining COFI and ILMA grade stamps.

The merger addresses

LíÍ wat Forestry Ventures (LFV), in partnership with Stillwater Consulting, Chartwell Resource Group, and the LíÍ wat Nation’s Lands & Resources Department, is spearheading an Old Growth Stewardship Data Collection Project within the Nation’s traditional territory.

The initiative aims to assess old-growth forests to guide sustainable management practices, balancing cultural, ecological, and

challenges in B.C.’s forest industry, such as mill closures and resource constraints, aiming to ensure sustainable, high-quality service. CMSA general manager Kris Reklinski said, “This merger strengthens our ability to deliver cost-effective quality control and grade inspections.”

economic values. Currently, only 15-20 per cent of LíÍ wat’s forests are actively managed for timber, leaving the remainder at risk from pests, disease, and wildfire.

“This project helps us understand the state of old-growth and identify culturally important areas,” said Klay Tindall, general manager of LFV.

Supported by provincial funding, the project began with 24 days of training in early 2025, focusing on ecological knowledge, cultural heritage, and forest inventory skills. Data collection started in October, with crews analyzing plots to understand forest variations and uncover factors affecting biodiversity.

The Government of Canada is advancing efforts to decarbonize heavy emitting industries in British Columbia, including the forestry sector, with a $12.5 million investment in six projects aimed at developing clean technologies to reduce industrial emissions.

Among the funded projects, the University of British Columbia will focus on using byproducts from the pulp and paper industry to capture CO2 emissions, capitalizing on the waste streams from forestry operations. This initiative is part of a broader effort to integrate renewable energy solutions into carbon capture processes and accelerate the transition toward a low-carbon future.

Another project, led by Highbury Energy Inc., is exploring ways to replace natural gas with renewable fuel gas produced from wood residues at the Cariboo Pulp and Paper Mill in Quesnel. The study will evaluate the feasibility of using advanced gasification technology to provide an alternative fuel source for the mill’s lime kiln, helping reduce the carbon intensity of operations in the forestry sector. These initiatives, funded under the Energy Innovation Program, demonstrate the government’s commitment to supporting the clean technology advancements necessary for achieving net-zero emissions in British Columbia’s forestry and industrial sectors.

Western Forest Products’ hourly employees represented by United Steelworkers Local 1- 1937 (USW) have voted to ratify a new collective agreement, replacing the collective agreement that expired on June 14, 2024.

The new six-year collective agreement has a retroactive effective date of June 15, 2024, will expire June 14, 2030 and provides for the following general wage increases: year 1 – four per cent;

The BC Council of Forest Industries (COFI) has named Kim Haakstad as its new president and CEO. Haakstad brings over 20 years of leadership experience, including roles as Deputy Chief of Staff to the BC Premier and in North America’s agri-tech sector. She also serves on the board of B.C.’s DIGITAL Global Innovation Cluster, bringing expertise in technology integration to the forest industry.

Haakstad succeeds Linda Coady, who was recognized for advancing Indigenous reconciliation and the environmental and economic values of B.C.’s forests.

COFI chair Greg Stewart praised Haakstad’s strategic insight and leadership, expressing confidence in her ability to navigate challenges and opportunities in B.C.’s forest sector.

Source: COFI

years 2 to 5 – three per cent each; and year 6 –greater of three per cent or the rate of inflation.

The new agreement also includes enhancements to certain benefits and terms of mutual interest for the USW and the Company. It will apply to the roughly 1,000 members of Western’s hourly workforce represented by the USW, as well as those third-party contractors who adopt Western’s collective agreement.

Conifex Timber is transitioning to a two-shift operation at its sawmill on Jan. 6, supported by an amended $41-million credit agreement with PenderFund Capital Management.

The move, driven by improving lumber prices, is expected to lower costs and increase cash flow in the first quarter of 2025.

“The additional borrowings will be used to fund a build-up in sawlog inventories to support our transition to a two-shift operation at our sawmill complex,” said chairman and CEO Ken Shields. “The benefits of spreading our fixed costs over a larger base coupled with additional product sales are expected to lower our cash costs and boost the operating cash flow we expect to achieve in the first quarter of 2025 from what we presently achieve on a one-shift basis.”

The five-year loan includes $5 million available immediately, with $11 million subject to financial diligence. Pender will receive up to 5.9 million warrants and the right to appoint a board director under the agreement.

Mercer Celgar is partnering with Skemxist Solutions, an Osoyoos Indian Band (OIB) company, to jointly operate a log sort yard in Okanagan Falls, B.C. The collaboration aims to promote sustainability, responsible forestry, and economic opportunities rooted in cultural values and community connection. Skemxist Solutions will

create skilled jobs for OIB members, provide training programs that meet industry standards, and maximize fibre utilization, including timber from fire-damaged forests. Managed by the OIB and supported by Mercer Celgar, the initiative prioritizes cultural respect, operational efficiency, and environmental stewardship.

Reader Service Print and digital subscription inquires or changes, please contact Angelita Potal, Customer Service Tel: 416-510-5113 Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

INTERIM EDITOR - Andrew Snook (416) 510-6801 asnook@annexbusinessmedia.com

GROUP PUBLISHER - Anne Beswick (416)510-5248 • Mobile: (416) 277-8428 abeswick@annexbusinessmedia.com

ACCOUNT COORDINATOR - Shannon Drumm (416) 510-6762 sdrumm@annexbusinessmedia.com

MEDIA DESIGNER - Curtis Martin cmartin@annexbusinessmedia.com

AUDIENCE DEVELOPMENT MANAGER Barb Adelt (416) 510-5184 badelt@annexbusinessmedia.com

NATIONAL SALES MANAGER - Josée Crevier Ph: (514) 425-0025 • Fax: (514) 425-0068 jcrevier@annexbusinessmedia.com

WESTERN SALES Tim Shaddick 1660 West 75th Ave Vancouver, B.C. V6P 6G2 Ph: (604) 264-1158 Kevin Cook lordkevincook@gmail.com Ph: (604) 619-1777

CEO - Scott Jamieson sjamieson@annexbusinessmedia.com

NorSask Forest Products has shown a remarkable capacity for weathering challenges and embracing renewal.

BY SARAH STOTLER

“A single, scrappy sawmill like NorSask Forest Products LP that has survived in the Canadian landscape and North American lumber commodity markets is a rare species,” remarks Kelly Lehoux, mill manager of NorSask Forest Products. But NorSask is more than just a survivor. The stud mill, located in the boreal forest of northwestern Saskatchewan, is owned by the Meadow Lake Tribal Council (MLTC). It holds the distinction of being the first 100 per cent First Nation-owned sawmill in Canada – and remains one of the few in the world. Additionally, 75 per cent of its employees self-identify as having Indigenous ancestry.

NorSask is fiercely proud of the jobs and revenue that it brings to the local community. Not only does the mill provide approximately 120 full-time positions but there are also hundreds of related and indirect jobs in supporting woodland operations and forest sector activity.

Profits from the mill fuel economic growth in the MLTC First Nations and support existing on-reserve education, healthcare, youth and elder programs, housing, and other community social and infrastructure needs. NorSask also plays an active role in the local community supporting many

NorSask’s stud mill provides approximately 120 full-time positions, along with hundreds of related and indirect jobs in supporting woodland operations and forest sector activity.

organizations that are in need of corporate sponsorship. Norsask strongly believes in community and helping to achieve positive outcomes.

The MLTC is comprised of nine Meadow Lake area First Nations, five Cree First Nations and four Dene. The First Nations that currently form the MLTC include:

• Birch Narrows Dene Nation

• Buffalo River Dene Nation

• Canoe Lake Cree Nation

• Clearwater River Dene Nation

• English River First Nation

• Flying Dust First Nation

• Makwa Sahgaiehcan First Nation

• Ministikwan Lake Cree Nation

• Waterhen Lake First Nation

Meadow Lake Tribal Council Resource Development Inc. (MLTC RDI) serves as the holding company for all business interests of the MLTC. It’s governed by a twelve-member board consisting of the Tribal Chief, a representative from each First Nation and two independent

directors, with the goal of creating economic opportunities, financial return and employment for its member First Nations. In 2012, the board established MLTC Industrial Investments LP (MLTCII) to professionally manage and expand its portfolio of businesses.

A key focus has been growth in the forestry sector. In addition to NorSask Forest products, MLTC acquired NorthWind Forest Products in 2018 to improve the utilization of various timber sizes and reduce waste. NorthWind specializes in fencing, poles, rails and oversized timber products.

The mill’s history began in 1971 when it was constructed by the New York-based company, Parsons and Whittemore, as a source of softwood chips for the Prince Albert Pulp Mill. A decade later, in 1981, the province of Saskatchewan acquired both mills from Parsons and Whittemore. Although the pulp mill was later sold, the province continued to operate the Meadow Lake sawmill until

1987. At that point, fearing a sale to an outside investor might result in the mill’s assets being divided, the employees established a company called TechFor Services Limited and raised capital through share sales to purchase the mill themselves.

MLTC partnered with TechFor and together they ended up with a 50/50 partnership of the mill. Later Millar Western Industries acquired a 20 per cent stake in NorSask. The partners invested in modernizing the mill, allowing it to significantly improve its production and profitability.

In early 1998, the Meadow Lake Tribal Council purchased 100 per cent of NorSask Forest Products, making it the first 100 per cent First Nation-owned sawmill in Canada.

Today, NorSask boasts an annual lumber production capacity of up to 150 million fbm/year, thanks to continuous capital upgrades over the last 50 years. Recent investments include the addition of the MLTC Bioenergy Centre, a refurbished

planer, a new lumber auto-grader, a new kiln and a variety of other improvements. The mill operates on two eight-hour shifts with a graveyard and weekend maintenance shift.

NorSask’s mill process begins in the 280,000 m³ log yard, where Liebherr wheel loaders manage the incoming logs. The logs range from 4” to 22” in diameter, and are primarily White Spruce, Jack Pine and Balsam Fir.

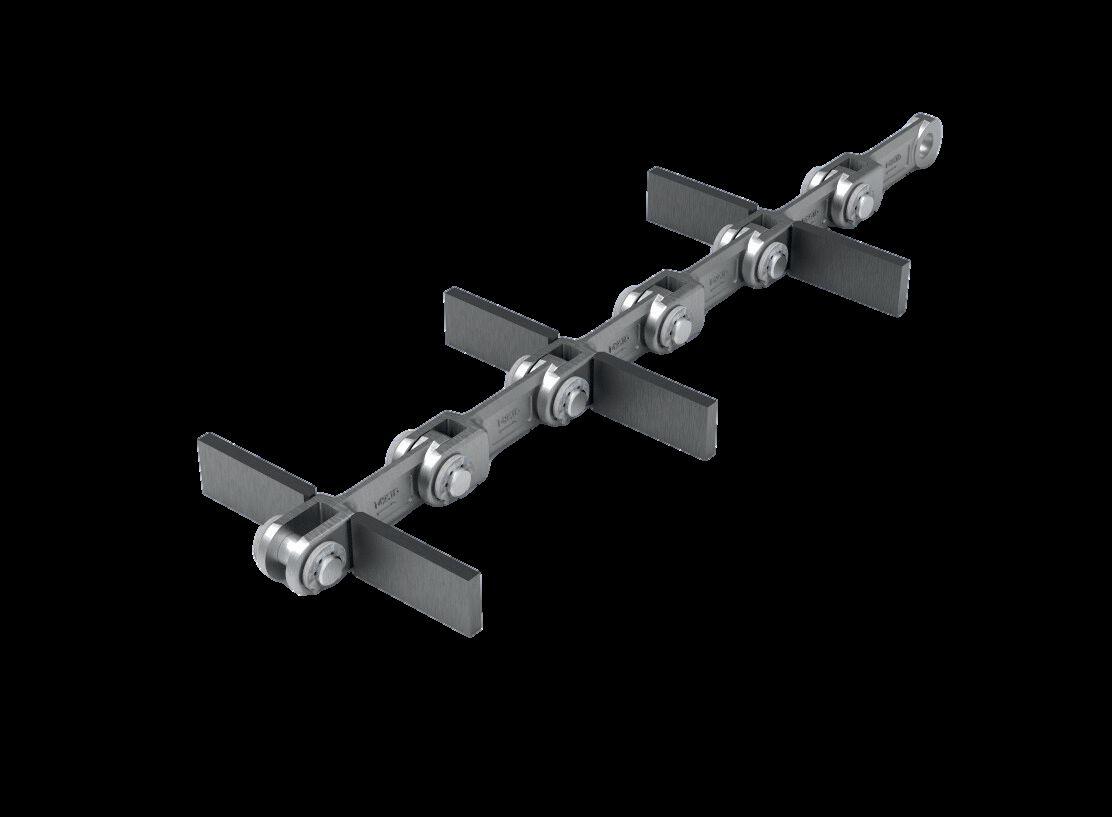

Logs enter the mill via two Comact-manufactured entry decks and wave feeders. Two Valone Kone debarkers remove the bark before the logs are cut into 9’ lengths at two Comact-manufactured slasher decks. The processed logs are then sorted into bins and depending on size, are directed to one of NorSask’s three Optimil canter lines – large, small or Pee-Wee. Chips from the canters are sent to Paper Excellence’s neighbouring Meadow Lake Mechanical Pulp mill.

Residual biomass, including trim ends, sawdust, planer shavings, bark and off-sized chips, are utilized in the new

MLTC Bioenergy Centre, which is the largest facility of its kind in Saskatchewan. The centre not only generates enough power for approximately 5,000 homes but also uses excess energy to produce and heat glycol, which in turn heats the mill’s recently installed (2022) Mühlböck CDK kiln.

Lumber is dried in either the aforementioned Mühlböck CDK kiln or one of two Wellons natural gas batch kilns. The dried lumber then enters the planer mill, where it is processed by a highspeed planer. Handling, singulating, trimming and stacking gear is from Carbotech.

In 2024, NorSask added a Comact GradExpert lumber grader to the planer mill’s arsenal. It’s AI-powered and utilizes real-time sampling and high-speed simulation tools enabling informed decisions and process optimization. Finally, a SmartMill Smart Fence accurately positions the boards prior to trimming.

NorSask primarily produces 2x4 and 2x6 in various lengths up to 9’. Approx-

imately 40 per cent of this lumber is sold to the Canadian market while the remaining 60 per cent goes to the US market.

NorSask holds several tenures within Saskatchewan’s commercial forest zone. Lehoux explains, “The government of Saskatchewan is generally very supportive of the entire forest sector and works to ensure that adequate timber is available from the commercial forest zone to support mill operations.” Despite this, the mill has been significantly impacted by log supply issues due to wildfires in recent years.

NorSask is a 50 per cent owner of Mistik Management Limited, with the Meadow Lake Mechanical Pulp Mill owning the remaining half. The partnership grants NorSask rights to all coniferous trees in the Mistik 1.8 million hectare FMA area. Additionally, NorSask is a shareholder in Sakâw Askiy Management Inc., which manages a 3.3

Introducing the revolutionary Hybrid Sawline by Comact, a true game-changer for modern sawmills. Featuring double limitless profilers, circular saws, an advanced sideboard splitter module, and bandsaws, this cutting-edge system is designed to handle a wide range of log sizes with unparalleled efficiency and precision. This unprecedented flexibility ensures that every log follows the most efficient path, maximizing throughput and yield.

Maximum versatility: seamlessly processes a variety of log sizes in a single line for unbeatable performance

Optimized recovery: AI-powered real-time adjustments maximize material yield

Cost efficiency: reduces waste, energy use, and equipment needs

Enhanced productivity: maintains high-speed performance with minimum downtime

Low maintenance: a modular design and quick-swap circular saws simplify upkeep

million hectare FMA. The majority of the mill’s fibre resources are sourced from these two areas. Numerous local logging contractors, including many small First Nation-owned businesses, support the harvesting operations.

Mistik works with co-management advisory boards to combine modern science with traditional knowledge. The board members are typically members of the local community who are knowledgeable about traditional areas of cultural importance and wildlife, such as outfitters, trappers, traditional use, grazing permittees, wild rice growers and cabin owners.

When it comes to market conditions, Lehoux says, “The current market conditions over the last 24 months have been particularly difficult for sawmills, one of our key goals is surviving the low ebbs in the lumber market. Inflationary pressures on parts and supplies have also been exceedingly challenging.”

However, just like the tough and resilient boreal forest NorSask calls home, the company has shown a remarkable capacity for weathering challenges and embracing renewal. NorSask is sure to not only survive but thrive in the challenging Canadian landscape.

Deadwood Innovations was founded by locals from what was once a quintessential forestry town. We witnessed the evolution and impacts from a stabilized, yet segmented equilibrium, to a centralized supermill supply-heavy system. The initial technology concept was basic and required significant capital and efforts to develop, but we were open about this when focusing on an equity partnership with Nak’azdli Whut’en. This partnership was built on generations of trust in the community and aligned intentions to do things the right way for the right reasons.

With a mutual understanding of intentions, we proceeded as partners and shifted focus to technical development. The development process has been highly iterative, but we’ve relentlessly and successfully developed a process that is commercially ready and scalable and determined a fit for the product in the marketplace. This is a remarkable achievement in any industry. We are now positioned to drive evolution and revitalize a sector that was once held in prestigious regard. Other industrial sectors are moving forward, and forestry is no longer innovation stagnant – it will progress too.

With this optimism, it is short-sighted to disregard what has been, and is, working well at an industry level. For the industry in Canada to evolve, with new technologies like Deadwood’s leading the way, the primary sector must be a solid foundation.

The Tl’Oh Upgrader is currently in the final stages of detailed design. At the time of writing, the majority of the capital has been secured for plant construction, and some of the first-year operating capital has been committed. The go-to-market (and new) value chain involves harvesting underutilized aspen timber, sawing it into lumber, upgrading it at Tl’Oh and selling it into the indoor and outdoor markets.

• Nameplate capacity: 14,250 m³/year

• Capital mix: Venture capital (Chrysalix), private equity, government grants and debt. Nak’azdli Whut’en has majority equity in the facility,

which is located on Nak’azdli Reserve.

• Schedule: Construction is scheduled to start in Q1 2025, with commissioning and start-up in Q1 2026.

Objectives of the first-of-its-kind commercial plant

• Demonstrate technology: Prove that the technology works safely at scale. Notably, the Tl’Oh Upgrader facility and business are scoped and scaled to sustain long-term operations.

• Forestry 2.0™ principles: Implement innovative practices that enhance sustainability and efficiency.

• Economic reconciliation: Strengthen economic opportunities and partnerships with First Nations communities.

• New forestry value chain: Establish a new value chain that leverages underutilized resources and advanced technologies.

Deadwood Innovations has developed a proprietary Chemi-thermo process that transforms undervalued and underutilized tree species, like fast-growing aspen trees into high-quality hardwood. This technology increases the strength and stability of the feedstock, ensuring the resulting product meets high standards of quality and durability. By utilizing colony species like aspen, which regenerates quickly and does not require replanting, we reduce the need for old growth forest harvesting and enhance carbon sequestration. This approach not only supports sustainable forestry practices but also creates new economic opportunities and promotes environmental stewardship.

In Canada, forestry was once a revered industry celebrated for its contributions to prosperity and development. It is now often misunderstood and cast off as an unsustainable vestige of our heritage. By moving towards innovation in the industry and working with primary producers and traditional forestry practices, we can restore the industry’s reputation and herald it as a beacon of prosperity, ingenuity and sustainability. This concept, called Forestry 2.0, has been our guiding principle since our inception.

The STIHL MSA 220 T is the most powerful top-handle chainsaw in the STIHL battery-powered lineup, boasting power and performance similar to professional gas top-handle chainsaws. Featuring high chain speed and durable parts such as the magnesium motor housing and a brushless motor, the MSA 220 T is designed for a heavy workload. An LED operator display provides quick status updates to help keep pros moving. The MSA 220 T provides the power and dependability professional aborists trust from STIHL chainsaws.

Note: Top handle chainsaws should only be used by trained arborists.

BY PAUL JANNKE

Mortgage rates have been on a roller-coaster ride over the past three months. After hitting a low for the year (6.08 per cent) in September, the 30-year mortgage increased steadily through the end of October. Rates then held flat for a few weeks before climbing back up to 6.81 per cent in the last week of November. They have since fallen back to 6.6 per cent in midDecember.

In mid-December, the U.S. Federal Reserve’s open market committee (Fed) cut its benchmark rate to between 4.25 per cent and 4.5 per cent. At the same time, they changed their guidance, signalling that they would likely make fewer cuts in 2025 (two versus four). So, while we expect mortgage rates will be lower in 2025, we do not expect them to fall by much. The residential improvement market is the

largest consumer of lumber. Spending in this sector has surged in recent years, averaging $240 billion in 2022-24. This is a 21 per cent jump compared to the $198 billion average from 2019 to 2021. This increase is likely due in part to rising interest rates, which have motivated homeowners to invest in their existing properties rather than face the higher costs associated with moving.

However, we anticipate a slight dip in residential improvement expenditures in 2025-26 as this backlog of projects is completed. That said, several factors will continue to support strong spending in this market. Rising home equity, limited availability of starter and trade-up homes, the aging of existing hoU.S.ing stock and homeowners’ desire to hold onto low mortgage rates will likely keep expenditures

at an elevated level of around $230 billion.

We expect housing starts to be 1.347 million units in 2024, a 5.3 per cent decline from 2023, their lowest level since 2020. With mortgage rates remaining elevated in 2025, we do not expect much relief for the year. Our forecast calls for housing starts to edge only slightly higher to 1.38 million units for the year. We do expect mortgage rates will continue to trend lower through 2025 and into 2026. This, combined with the strong fundamentals (extremely high pent-up demand and demographic tailwinds) underlying softwood lumber’s main end-use markets, as well as the historically low inventories of homes for sale, will help push starts up to 1.501 million in 2026.

The declines in residential-improvement expenditures next year will mostly offset growth in housing starts, with North American consumption forecast to increase just 0.7 per cent for the year. We expect North American consumption growth to increase to 4.8 per cent in 2026 as the recovery in the U.S. economy and end-use markets builds momentum. Our forecast calls for demand to average 59.6 BBF in 2025-26, about 1.0 BBF or two per cent above the 58.6 BBF average of 2022-24.

Slow U.S. consumption growth, coupled with sawmill closures and higher import duties on Canadian lumber, will lead to lower U.S. imports from Canada in 2025. We do expect Canadian shipments to the U.S. to increase some in 2026 as U.S. consumption rises. Still, at an average of 11.3 BBF, U.S. imports of Canadian lumber in 2025-26 will be 8 per cent below their 2022-24 average.

Mirroring the trend in Canadian lumber imports, we anticipate a decline in offshore lumber imports. This decrease is driven by several factors, including weakened U.S. demand, lower lumber prices, and increased production costs in Europe (the primary source of U.S. lumber imports outside of Canada). Supply constraints in Europe are pushing timber prices higher, making exports to the U.S. less competitive. Conversely, U.S. offshore lumber exports are projected to rise slightly in 2025-26, as competitively priced southern pine gains traction in international markets.

Putting all this together, demand on North American mills (consumption plus

exports minus imports) is expected to grow 1 per cent in 2025 and 4.8 per cent in 2026.

Weaker demand has caused more capacity closures, so even with the new capacity coming online in the U.S. South, we expect North American capacity to fall 0.4 per cent this year. This will allow the demand/capacity ratio to increase only slightly to 79 per cent. In 2025, we expect demand to grow, while timber supply constraints in the West and low prices in the South cause capacity to fall further. With prices now at or below variable costs, producers will likely curtail production sooner than we saw last spring/summer. Having recently experienced significant losses, producers have less financial leeway and tolerance for further losses. As buying ramps up in the new year and production is curtailed, the demand/capacity ratio will increase to 81 per cent. Finally, we expect the demand/capacity ratio to increase to 84 per cent in 2026 as demand growth rebounds robustly.

Canadian lumber shipments to the U.S. are currently subject to a 14.40 per cent combined duty rate. On March 5, 2024, the

U.S. DOC initiated its sixth Administrative Review (AR6) of the antidumping and countervailing duties on certain softwood lumber products from Canada. AR6 covers the period January 1, 2023, through December 31, 2023. Given low prices in 2023, we expect the duty rates will increase to 30 per cent once the final determination in AR6 is published in August 2025. These factors will significantly impact lumber prices. We forecast an 8.1 per cent rebound in the Framing Lumber Composite (FLC) in 2025. However, without more significant curtailments, prices will likely languish. We do think those curtailments will come once the duties jump up to around 30 per cent. This should push prices higher in Q3, and we then expect prices to jump 16 per cent in 2026. Weak demand, low dealer inventory levels, and low mill production will likely contribute to market volatility throughout the forecast period.

Paul Jannke is a lumber analyst and principal of the North American wood products analysis and information source, Forest Economic Advisors, LLC (FEA). www.getfea.com.

PAULsmith

Paul Smith is a saw filing consultant and founder of Smith Sawmill Service, now part of BID Group. You can reach him at Paul.Smith@bidgroup.ca.

In today’s world of high-tech, modern, automated equipment we must not forget the basics of saw filing. Even with a saw filing room full of today’s high-tech equipment, that operates hands-off and even lightsoff, it will not produce a high-performing saw without the knowledge of basic saw filing being incorporated. The knowledge that a seasoned, professional saw filer can provide is still invaluable. An apprentice saw filers’ training is only as good as their knowledge of simple everyday filing practices.

Some basics that should not be ignored:

• Cleanliness, proper measurements and tolerances cannot be kept in a dirty environment. This goes for everything in the saw filing room, including the saws themselves. A dirty saw cannot be gauged correctly. Saw guides should be treated as fine China. Would be good to be able to call the saw filing room the clean room. It’s that important!

• Gullets should always be maintained with sharp corners to hold sawdust. Otherwise, one needs to learn about the effects of spillage.

• Constant check on feed speed and rpms to ensure tooth bite and gullet area remains correct. Today, machinery feed speeds can be increased or changed easily and without notice. These types of changes without planning can cause havoc for a saw filer.

• Well-kept tools. Straight and tension gauges must be kept in good condition. Measuring tools should be routinely checked for accuracy. Granite blocks to be effective should be protected against damage.

• Spline arbors become worn and because of this need to be monitored. Don’t allow your saws to drop into a worn groove.

• Collars for fixed saws should be checked and resurfaced when worn.

• Saws must start the run sharp. No burrs, no broken teeth or nicked corners.

• Saw plate thickness should be kept in check with guide clearance. Saw plates may wear too thin for the guides. Also, check the new saw plate to be assured the plate is not too thick for your guides.

• Saws must have proper tension when ready to put in the mill. However, they must start out flat. When hammering, use a light film of oil on the plate to keep from damaging the steel with the hammer; use the proper weight and type of hammer for benching.

• Hammer anvils should be well-maintained and covered for protection when not in use.

• Saw hammers must be kept well-maintained and polished to ensure minimal, if any, marking on the saw body. Deep or excessive hammer marks damage the saw.

• It’s always a good practice to use a piece of board to test the strength of the weld on carbide teeth that is soldered in. A good tap on the top cutting edge will let you know if a tip is secure in the plate. Never allow the solder to be wider than the tooth itself.

• It’s also a good practice to keep a mill bastard file handy to check for hardness. Simply run the file right behind the tooth or below it in the gullet area to make sure the tooth is properly annealed and not too hard. If a file skips over the plate without cutting into the steel the tooth is not properly annealed and the shoulder will most likely be lost.

The best and most advanced equipment will not necessarily provide you with the best running saws without a qualified saw filer’s attention to detail. The old saw filer’s handbook can still give the apprentice a good advantage. However, old rules and formulas are not always the normal with today’s equipment. Limits are pushed much more than once believed possible. Today’s feed speeds will most likely not be listed in the old handbooks. Making sure you keep the basic saw filing rules will assure you’re well on the way to providing good running saws. Even future technology, robots and equipment will not perform the saw filing basics needed to put up good saws. It takes pride and common sense to operate a modern sawmill both yesteryear and today.

Don’t allow failure because a simple practice is not followed.

BY JENNIFER ELLSON

In 2024, Canadian Forest Industries conducted its fourth Canadian Contractor Survey. The results offer a snapshot of the constantly evolving logging industry. The survey highlights both the challenges and opportunities that will shape its future.

As in past years, the survey highlights the resilience and adaptability of Canada’s logging contractors. From managing large-scale operations in the B.C. interior to navigating unique challenges in Nova Scotia, contractors remain a cornerstone of the nation’s forestry sector. This year’s findings offer valuable insights into the trends shaping the industry and underscore the importance of proactive planning to ensure its continued success.

A key theme emerging from the data is the aging workforce. Nearly a quarter of contractors are now over the age of 65, signalling a pressing need for effective succession planning.

At the same time, the operational landscape is changing. Logging hours are declining, and many contractors are adjusting their harvest periods to account for economic pressures and labour shortages. Despite these shifts, the resilience of the industry is clear.

Financial pressures are another recurring theme, with rising costs for machinery, fuel, and labour. While there have been slight improvements in profit margins,

Photo: Link-Belt

many contractors are still struggling to maintain profitability.

Technology is increasingly playing a role in these efforts, with tools like GIS mapping and mobile apps becoming commonplace. Embracing these advancements could unlock greater productivity, safety, and environmental benefits, and help Canada’s logging industry remain competitive on the global stage.

Sixty-five per cent of respondents indicated that their logging rates have increased during this period – 20 per cent higher than in CFI’s 2020 Contractor Survey. Of these, 35 per cent reported an increase of five per cent or less, 16 per cent saw their rates climb by more than five per cent, while 14 per cent of respondents said their rates went up by more than 10 per cent. The remaining respondents were either unsure of their rate changes or worked with companies that have not been in existence for the full five years.

However, not all respondents have experienced growth – 17 per cent reported that their rates have remained unchanged over the last five years and seven per cent of the respondents indicated a decrease in their logging rates.

In the 2024 survey, 72 per cent of respondents felt that an 11 per cent or higher profit margin was fair. The overall trend shows a modest increase in profit expectations, but the outlook varies sharply by region.

The percentage of contractors on the B.C. Coast who feel that 11 per cent or more is a fair profit margin has dropped to 74 per

cent, down significantly from 95 per cent in 2020. In the B.C. Interior, 78 per cent stated that 11 per cent or more is fair, consistent with responses from the 2020 Contractor Survey.

In contrast, Alberta remains steady, with 100 per cent of respondents continuing to view 11 per cent or more as a fair profit margin.

In Ontario, 59 per cent of contractors now consider 11 per cent or more to be a fair margin, up from 50 per cent in 2020. Quebec has also seen a modest rise, from 61 per cent in 2020 to 66 per cent in 2024. In Atlantic Canada, the percentage of contractors who feel that 11 per cent or more is a fair profit margin has increased to 69 per cent from 51 per cent in 2020.

The trend of an aging workforce in the logging industry is intensifying, with the average age of respondents at 55 years, up from 52 in 2020 and 49 in 2018.

Regional differences in age are notable with the B.C. Interior’s average age the highest at 59 years. In contrast, Ontario and Quebec both maintain an average age of 52 years.

When asked about their roles, 61 per cent of respondents identified as owners or partners of logging businesses, with another 17 per cent working for forest company woodlands operations. The remaining roles were filled by operators, drivers, and mechanics (10 per cent) and managers or supervisors (eight per cent).

The aging workforce signals an urgent need to attract younger workers to the sector in order to maintain a steady workforce as senior contractors retire.

On average, Canadian logging contractors plan to stay in the industry for another 12 years. The survey data reveals that while some contractors have made progress in succession planning, there is still a significant number without any clear plan in place. Overall, 34 per cent of contractors reported having no plan for what will happen to their business after they retire.

Around 26 per cent of contractors plan to pass their operations on to their children. This family-oriented approach is more common in certain regions, such as Ontario, where 41 per cent of contractors expect their children to assume control. Similarly, B.C. Coast contractors reported 33 per cent of them expecting their children to take over their businesses.

While family succession is a common path, other contractors are looking to sell their businesses or shut them down entirely. Approximately 29 per cent of respondents expect to either shut down their operations and auction off assets (17 per cent) or sell to another contractor (12 per cent).

Quebec has the highest percentage of respondents without succession plans (48 per cent), followed by Nova Scotia. However, Nova Scotia stands out with a combined 71 per cent of contractors

reporting no succession plan in place (38 per cent), and who plan to sell or auction their equipment (33 per cent) and shut down their businesses after retiring.

Forestry equipment operators and drivers across Canada are, on average, earning $33 per hour – a notable increase from the $30/hour reported in 2020.

Operators in the B.C. Coast continue to earn the most, with an average rate of $43 per hour, while Alberta and the B.C. Interior follow closely with $39/hour. Meanwhile, operators in Atlantic Canada continue to earn the least, with

Nova Scotia operators reporting an average of $24/hour.

The survey also revealed that the proportion of companies paying their operators over $30 per hour has increased significantly, rising from 36 per cent in 2020 to 54 per cent in 2024.

Regional differences remain stark. In the B.C. Coast, 33 per cent of contractors pay between $36-$40 per hour, with 25 per cent paying $41-$45 per hour, and a remarkable eight per cent offering over $50/hour. In contrast, in Nova Scotia, 60 per cent of operators earn between $21$25 per hour, and no operators earn more than $30/hour.

The most widely adopted technology across the industry is GIS for mapping and spatial analysis, used by 58 per cent of respondents. Reported use of GIS was above the national average in Alberta (80 per cent), Nova Scotia (72 per cent), B.C Interior (67 per cent) and Ontario (67 per cent).

Mobile apps for field data collection and reporting are adopted by 39 per cent

of survey participants. In Alberta and the B.C. Interior, mobile app adoption is particularly high, with 80 per cent and 57 per cent of respondents, respectively, using these tools.

Automated logging equipment was also being implemented into operations by 39 per cent of contractors surveyed. This technology is especially prevalent in Ontario (60 per cent), Quebec (57 per cent), and Nova Scotia (56 per cent).

Thirty-seven per cent of respondents use telematics systems for fleet management and equipment tracking. Adoption rates for telematics systems also varied by region with the B.C. Coast and B.C. Interior reporting the highest usage at 78 per cent and 57 per cent, respectively.

Other technologies, such as remote sensing technologies (e.g., LiDAR and drones) and logging software for inventory management and planning, also see adoption, though to a lesser extent. Remote sensing technologies are used by 22 per cent of respondents, with Nova Scotia showing the highest adoption rate at 39 per cent. Logging software for inventory and planning is adopted by 17 per cent of respondents, with Alberta and Ontario seeing the highest usage at 40 per cent and 27 per cent, respectively.

Contractors identified several key areas where opportunities for improving operations and profitability exist. As in previous surveys, the most frequently mentioned opportunity is improved

co-operation with governments and forest companies, with 63 per cent of respondents highlighting this as a critical factor. This has been a consistent theme since 2018, reflecting a long-standing need for stronger collaboration among contractors, government agencies, and forest companies to streamline operations, resolve issues, and improve access to resources.

In 2024, there was a notable increase in partnerships with First Nations commu-

nities being recognized by contractors as an important opportunity to improve operations and/or profitability. This year’s survey had 32 per cent of respondents note this as an opportunity compared to 18 per cent in 2020 and 13 per cent in 2018. This was most common in the B.C. Interior and B.C. Coast where 53 per cent and 42 per cent of contractors noted this opportunity, respectively.

To read the full 2024 Contractor Survey, visit: www.woodbusiness.ca.

FEATURES:

• Extreme duty, uni-body frame

• High productivit

• Primary and secondary anvil

• High quality chip

• Oversize infeed Available in 2 models

Sawmill and 48404HV Veneer (shown)

•Extreme duty construction

• Oversize infeed

•Large rear acce door for easy &

•Powered feed w

Exploring the role of EPDs in driving procurement decisions, and how they provide transparent, reliable data for sustainable product design and supply chain management.

BY RHIANNAH CARVER

Supply chain sustainability is increasing in importance across businesses and industries, with Environmental Product Declarations (EPDs) emerging as an important tool for procurement decision-making. By assessing the environmental impacts of supply inputs from inception to disposal, EPDs offer businesses valuable insights and comparable data for procurement decisions and product design. Beyond regulatory requirements or customer expectations, the underlying life-cycle analysis (LCA) is a fundamental part of forward-thinking sustainability strategies.

Stella-Jones, a North American manufacturer of pressure-treated wood products, understands the growing significance of EPDs in driving sustainable procurement.

On October 18, the company published its first-ever EPD – a significant milestone not only for Stella-Jones but for the broader utility pole manufacturing industry in North America. This achievement is particularly notable as it aligns with the new Product Category Rules (PCR) Part B, which set standardized guidelines for Utility Pole EPDs.

Stella-Jones took an active role in the development of this PCR. The company represented the Treated Wood Council and collaborated with alternative materials manufacturers to help shape the new guidelines. With prior experience in industry-level LCAs, Stella-Jones took this initiative a step further by providing a detailed, product-spe-

cific life cycle analysis for Red Pine utility poles treated with chromated copper arsenate (CCA). This shift toward product-specific EPDs aligns with evolving regulations, like the U.S. Federal ‘Buy Clean Initiative’ and state-based regulations, which increasingly require transparency in environmental performance.

While most EPDs currently focus on construction materials, there is a growing trend for more comprehensive EPDs across various infrastructure sectors. Stella-Jones recognizes the importance of staying ahead of regulatory changes and views this project as an opportunity to lead the way within its industry.

In 2023, Stella-Jones partnered with Pathways, an AI-powered LCA and EPD solution provider, who were seeking leaders in the materials manufacturing space to further develop their AI and data tools to advance the capabilities of EPD creation. Traditional LCAs have long faced challenges due to their reliance on manual data collection and their ability to provide only a snapshot in time of a product’s environmental impact.

The tool, developed in collaboration with Stella-Jones, integrates directly with the company’s data systems, enabling continuous tracking of life cycle impacts. This real-time, data-driven approach enhances the accuracy and relevance of LCAs, making them a powerful tool for decision-making within businesses. Through the visualization of impacts at various stages of their value chain, companies can make more informed decisions regarding supply chain and manufacturing processes.

The inaugural EPD from Stella-Jones focuses on Red Pine utility poles treated with CCA, used by utility customers across Canada and in areas of the United States. The EPD includes detailed information about the company’s supply chain, covering the procurement and transportation of Red Pine poles, as well as data from the seven Stella-Jones facilities that manufacture the poles. One of the standout features of the new software solution is its ability to incorporate customer-specific data, such as in-service life and disposal methods, to create tailored LCAs upon request. The tool connects to the Smart EPD platform, allowing for more seamless publication of any future EPD iterations.

Looking ahead, Stella-Jones plans to expand its use of the Pathways tool and publish more EPDs for its product lines. By continuing to innovate and improve its sustainability efforts, the company aims to support the advancement of environmental stewardship throughout the utility pole manufacturing industry.

Stella-Jones is committed to working closely with customers, suppliers, and other stakeholders to explore opportunities for improving sustainability across its value

chain. The company believes that transparency in environmental impact reporting is a key driver of meaningful change. Through the adoption of comprehensive and accurate EPDs, Stella-Jones hopes to foster productive discussions, encourage innovation, and contribute to a more sustainable and resilient future for the industry.

Rhiannah Carver is the senior director of sustainability at Stella-Jones

FORESTMAX is BKT’s new radial tire for tractors. Mainly developed for forestry applications FORESTMAX can also be employed for some specific farming operations such as soil milling and stone breaking. The cut-and-chip resistant tread compound and the steel-belted structure significantly minimize the risk of punctures in the woodland or in severe soil conditions. That’s not all: Its multi-ply polyester casing and the reinforced sidewall are designed to withstand the harsh forestry operating conditions and the toughest of soils. The tire features a robust open shoulder providing best traction and top stability even on rugged and uneven terrains. The combination of tread resistance and the shoulder design stand for optimum self-cleaning properties along with a long tire life making FORESTMAX your ideal partner in the forest. Choose FORESTMAX, choose BKT.

Joe Dias

Eastern Zone Manager

Directeur Régional, Est du Canada

BKT Tires (Canada) Inc.

Cell: 514-792-9220

Web: www.bkt-tires.com

International relations have garnered increased attention due to the recent US federal election, last month’s COP16 United Nations Biodiversity Conference, and the ongoing COP29 United Nations Climate Change Conference, now in its second week. Canada’s response and its position are paramount, yet this remains a blind spot for the Trudeau government, with Canada’s Minister of Environment and Climate Change, Steven Guilbeault, criticizing his provincial counterparts in recent remarks:

“Many provinces simply won’t even engage in the subject of conservation right now… that’s the biggest roadblock to ensuring we achieve our targets.”

A concept known as Goodhart’s Law is when a measure becomes a target and ceases to be a good measure – in other words, if a target is too narrow in scope and neglects other factors, unintended consequences are likely to occur. This applies to the federal government’s continued emphasis on one target (of 23 under the Convention of Biological Diversity) to measure success: conserve 30% of land, waters, and seas by 2030 (referred to as ‘30 by 30’).

It is an instinctual reaction to situations where we feel something is at risk of disappearing to try to protect it – as if Canada’s lands, waters, and forests can be placed in a museum and preserved forever. But our natural environment is constantly changing. Plants compete against each other for sunlight and resources, changing the structure of forests and wildlife habitat every year. Natural disturbances like fire, wind, and insect outbreaks are important drivers that restart this process.

Given this, “protection” is typically best applied for specific conservation values or on a more local scale. There are also unintended consequences of passive management at a large scale, as it can re-

sult in the buildup of fuels (from beetle kill, natural succession, or other disturbances), resulting in catastrophic fires. This year, we witnessed almost 100,000 acres of Jasper National Park burned, resulting in the evacuation of 25,000 people and the tragic death of a firefighter. In Ontario, approximately 90 percent of Woodland Caribou Provincial Park has burnt (and in some areas re-burnt) over the past 15 years.

From a carbon emissions perspective, Canada’s 2023 wildfire season emitted 647 million metric tons of carbon – five times more than Canada’s total annual emissions and comparable to the annual emissions of large nations.

Human-caused climate change has accelerated the pace and scale of change across the landscape, requiring a larger suite of tools, such as proactive forest management techniques, to better adapt to these changes and proactively manage risk. While protection and passive management have their place, they are not the only options available to support all biodiversity goals and targets – nor should they be the best measure of progress in supporting biodiversity.

In contrast to Minister Guilbeault’s suggestion, a “moral compass” in the form of new federal laws is not needed to drive progress. It is already happening. What is needed is to give provinces autonomy to use a diverse set of tools to develop local solutions for biodiversity through the sustainable management of their natural resources. The forest sector is well-equipped to support collaborative conservation efforts with Indigenous and local communities while ensuring economic development and providing low-carbon alternatives to energy sources and building materials.

The Montreal Wood Convention is set to return in 2025 with an impressive lineup of events and speakers, promising attendees a vibrant platform for networking, learning, and innovation in the wood products industry. Running from April 8 to 10 at the Queen Elizabeth Hotel, this year’s convention is on track to surpass 2024’s record attendance of 1,150 participants and 112 booths, with most exhibit spaces already booked.

The organizers described the event as an annual meeting that is important for the wood industry in North America and worldwide, with the presence of key industry players, the convention is able to bring the wood industry together.

Among the highlights is the much-anticipated keynote address by Jon Montgomery, Olympic gold medallist and charismatic host of The Amazing Race Canada. Montgomery became a national icon during the 2010 Vancouver Winter Olympics, where he clinched gold in the skeleton event.

At the luncheon, Montgomery will share his personal journey, emphasizing the importance of curiosity, embracing challenges, and stepping outside one’s comfort zone. His talk will offer insights on goal setting, perseverance, and tackling challenges with passion and purpose.

In addition to Montgomery’s keynote, the convention will feature:

• The Lumber Word podcast live taping: Hosted by Ashley Boeckholt of Sitka Forest Products, this podcast about lumber trading will be presented live on Thursday morning, April 10.

• Women of Lumber & Forestry (WOLF) side event: Returning this year, WOLF will host a dedicated session inside the Queen Elizabeth

Hotel on Tuesday, April 8, spotlighting the contributions of women in the forestry sector.

• Industry seminar on economy and markets: Renowned economist Benjamin Tal will return for the third consecutive year to deliver fresh insights on economic trends and their impact on the North American construction sector. As Managing Director and Deputy Chief Economist at CIBC Capital Markets Inc., Tal’s deep expertise and engaging delivery have made his sessions a standout feature of the convention. Attendees will also have the opportunity to ask questions live during the seminar.

“Last year highlighted the incredible value of bringing together producers and buyers of wood products in Montreal to build meaningful business connections and foster sustainable, long-term partnerships,” said Sven Gustavsson, director of the Montreal Wood Convention.

“For 2025, we’re building on that success and elevating the experience with exciting new features and opportunities.”

A cornerstone of the convention remains its robust economic insights, presented by industry experts. Sven emphasized that the event goes beyond being a simple tradeshow. “At its core, the Montreal Wood Convention is a dynamic learning experience, a hub for innovation, and a premier platform for business opportunities,” Gustavsson told CFI

MWC’s communications advisor Alex Fortin emphasized that with a mix of insightful programming, exclusive networking opportunities, and inspirational speakers like Jon Montgomery and Benjamin Tal, the Montreal Wood Convention 2025 promises to leave participants energized and better equipped to navigate the challenges and opportunities in the global wood market.

BY ANDREW SNOOK

Leaders from across the forest products sector will be descending on Prince George, B.C. from April 2 to 4 for the COFI 2025 Convention.

Organized and operated by the BC Council of Forest Industries (COFI), the convention offers attendees a wide variety of panels and presentations over two days, as well as multiple networking opportunities with leaders of B.C.’s forestry sector and beyond.

“The 2025 COFI Convention in Prince George comes at a time when the forest sector is facing

transformation and turbulence. Looking at where we stand along themes such as competitiveness and sustainability, this event will explore market diversification, industry innovations, and solutions to critical challenges like wildfire and fibre access. It’s the must-attend gathering to shape the future of B.C. forestry,” says COFI’s director of communications Travis Joern.

With the additional threat of new tariffs looming, B.C.’s forest sector is currently facing challenges from many different directions.

“With shifting market dynamics, evolving Canada-U.S. trade relations, and pressing issues like fibre supply and resilience to wildfire risks, the 2025 COFI Convention will provide an essential forum to chart a path forward,” Joern says. “Leaders across the sector will collaborate on bold strategies for a competitive and sustainable forest industry in B.C. and beyond.”

Panel discussions for the COFI 2025 Convention will offer some interesting insights:

1. Looking though a different lens: Transformation through innovation

2. Advantage/Disadvantage B.C.? Where do we stand on forest sector competitiveness and sustainability?

3. Markets: Building resilience through diversification

4. The next 4 years: Canada-U.S. relations and forest products trade

5. The elephant in the room: Let’s talk about fibre

6. Landscape to local: Integrated solutions to conservation, community safety, and wildfire

“At the 2025 COFI Convention, we’ll tackle the big questions: How can B.C. lead in forest sector competitiveness? What role do innovation, reconciliation, and trade diversification play in driving growth? Join us in Prince George to be part of the solutions that will define the next chapter for forestry in B.C.,” Joern says.

The 2025 COFI Convention will kick off with a study comparing B.C. with forest jurisdictions elsewhere in the world on key competitiveness and sustainability indicators.

“Speakers and participants will look at how new developments – on Indigenous reconciliation, trade and product diversification, and wildfire resilience and fibre utilization – are combining to create new opportunities for growth and investment. Don’t miss the opportunity to be part of the conversations and partnerships at the centre of a strong, sustainable, and diversified forest economy in B.C. and beyond,” Joern says.

The Northeast’s biggest and best forest industry show returns to Bangor, Maine in May 2025!

Thousands of hard-working people are planning to gather in May to conduct some serious business and to have some fun. The LOGGERS’ EXPO features a wide array of supplies and services, heavy equipment and trucks — for loggers and land clearers, tree care professionals and firewood dealers, sawmillers and landowners. This year’s show also features the Weiler Log Loading Competition, the Komatsu Forwarder Competition, and the famous Axe Women Loggers of Maine

MAY 16-17, 2025

CROSS INSURANCE CENTER, BANGOR, MAINE

For information about attending or exhibiting at the Loggers’ Expo: visit northernlogger.com email expo@northernlogger.com call 315-369-3078

Sponsored by

Charting a path through uncertainty in B.C.’s forest sector.

The B.C. forestry sector is at a critical juncture, grappling with intersecting challenges such as constrained fibre supply, price volatility, policy transitions, a new provincial government and a shifting political landscape ahead of a federal election.

B.C. Premier David Eby has highlighted the vital role of resource sectors like forestry in the province’s prosperity and the need to be more agile and responsive. Speaking at the Truck Logger Association Convention in January, Premier Eby recognized that “this industry is very much under siege,” with the threat of tariffs, and acknowledged that provincial policies have been a source of frustration for the industry.

Many sawmills in B.C. are operating below the 80 per cent capacity required for profitability, according to analyst Russ Taylor. Adding to these pressures is the US administration’s intention to double the rate of duties on Canadian softwood lumber, with the potential for additional, economy-wide tariffs.

To address these challenges, the Premier outlined priorities for his government including cutting red tape, expediting decision-making, and improving alignment between government and industry. Swift and decisive action in these areas will be essential to supporting forest industry operations.

Despite differing perspectives, there is broad consensus among industry stakeholders, First Nations, labour groups, communities, and government that the status quo is unsustainable. To navigate complex policy debates and find solutions, meaningful progress begins with shared priorities. Strengthening partnerships and collaborations can drive economic reconciliation and advance forest landscape planning. Innovations in thinning and silviculture can reduce wildfire risks, improve forest health and maximize biomass utilization to minimize waste. A predictable fibre supply is crucial to the success of all these initiatives.

Forests Minister Ravi Parmar has called for bold measures to restore confidence in the sector. His mandate includes directives to deliver permits promptly and efficiently, and to ensure a sustainable land base that can provide predictable access to a minimum

harvest of 45 million cubic metres per year. These efforts will involve bringing together industry, First Nations, and communities through forest landscape planning tables to chart a path forward for the stewardship of B.C.’s forests and forest industry.

This work will also include a review of B.C. Timber Sales (BCTS). A review that includes independent input and analysis will be an important step to address fibre supply availability in B.C. and re-establish the province as an attractive destination for forest-product manufacturing investment.

While these signals are encouraging, the real challenge lies in translating commitments into tangible actions. B.C. must actively participate in the “Team Canada” approach to international trade disputes and bolster the sector by supporting a stable investment climate, reducing operational costs and addressing permitting bottlenecks.

Working together, the forest sector can present a cohesive message to the government and other partners on the solutions to the challenges we face. To help us come together, the BC Council of Forest Industries (COFI) will hold its annual Convention on April 2-4, 2025, in Prince George – the heart of B.C.’s natural resource economy.

Under the theme “Where Do We Stand? Strategies for Competitiveness and Sustainability,” the 2025 COFI Convention will assess the sector’s current standing and lay out the steps we can take to move forward. A comparative study of BC’s forestry sector against global benchmarks in competitiveness and sustainability will highlight strengths, gaps, and opportunities. This analysis will lay the foundation for discussions on overcoming barriers and seizing new opportunities.

Other themes include market barriers and trade diversification; transformation through innovation; hot takes on new technologies; and ‘the elephant in the room’ – fibre supply.

With over 600 delegates expected, the convention promises to encourage collaboration, spark innovative ideas and chart a path toward a strong, sustainable future for B.C.’s forest sector.

Eliminate Wood Waste. Generate Power. Charge Electric Vehicles. Off-Grid.

No Grinding Required Clean, Fast Burns Produces Electric & Thermal Energy EV Battery Charging Station

Air Burners® BioCharger® levels the field in the fight against climate change. It converts wood and vegetative waste into nutrient-rich biochar while generating power to charge electric vehicles, equipment, and tools onsite. The revolutionary self-contained energy solution closes the loop so you can get the job done off-grid. Developed in collaboration with Volvo Construction Equipment and Rolls Royce, the BioCharger is the green-friendly, cost-effective answer to eliminate and convert green waste to renewable energy and keep your operation fully charged and ready to work.

Contact us for a quote today.