Staff holds Skuna Bay Salmon, a premium brand of Grieg Seafood BC that’s sold in North America. Throughout the pandemic, salmon farmers kept operations going

Staff holds Skuna Bay Salmon, a premium brand of Grieg Seafood BC that’s sold in North America. Throughout the pandemic, salmon farmers kept operations going

BY JENNIFER BROWN

As salmon farmers in North America brace for what market demand will look like heading into 2021, they are also feeling optimistic they will be part of the global economic recovery in a postCOVID world.

“I think that one of the positive outcomes of the pandemic for the industry is that we’ve proven how reliable we are as a contributor to the economy,” says Rocky Boschman, managing director of Grieg Seafood in Campbell River, British Columbia. “We’ve done five years of learning in six months.”

“I think that many levels of government have learned a lot more about our industry in the last short while because they have become interested in terms of what industries can contribute to a postCOVID recovery.”

BY LYNN FANTOM

Done with coho, farm shifts focus back to sablefish

BY MATT JONES

British Columbia fish farm Golden Eagle Aquaculture is done with coho salmon.

After trying to prove over the past eight years that growing salmon to market size using recirculating salmon aquaculture (RAS) was economically viable, company president Terry Brooks conceded there would be little use in soldiering on.

The company purchased the facility on Vancouver island in 2012 from Swift Aquaculture. At that time, Brooks thought RAS could be financially successful so long as production didn’t exceed demand.

But “the market wouldn’t pay the price for salmon raised in RAS, even when competing in a niche market,” he now says.

Brooks says the company exceeded the capacity of a niche market very quickly. Having outgrown the niche market, the farm was now competing with other farms and wild-caught product, and margins are low.

In April 2020, he decided to close the growout site for coho and refocus on what had been the company’s bread and butter for the past 15 years: sablefish.

continued

In the past, Infectious Hematopoietic Necrosis (IHN) has resulted in devastating economic losses to the Canadian salmon industry.1

The success of APEX-IHN® vaccination programs has meant that the risk of IHN is not often spoken about, and yet the potential threat of infection from wild fish remains ever present.

Don’t let IHN become the ‘elephant in the room’, keep protecting your salmon, and your profits, with APEX-IHN®

“All-time high” volumes sold in the retail market helped Mowi offset some losses in its bottom line in the second quarter of 2020.

In the United States, the world’s largest salmon producer saw a three-percent growth in consumption during Q2 – the period when the full impact of the coronavirus pandemic was first seen.

“The strong demand in retail has offset some of the shortfall (caused by the lockdowns)…. Retailers have also sold increasing volumes through e-commerce, home delivery and in-store pickup. Many new customers who had not previously shopped online are now doing so regularly, having discovered how easy it is,” said Mowi. It noted that sales of pre-packed salmon products were particularly positive.

The Group launched the Mowi Pure brand in the e-commerce segment in the US through Amazon Fresh early this year, just before the pandemic struck. It plans to “reinvigorate” the brand when the COVID-19 situation in the US improves.

“This is an impressive result and demonstrates yet again the importance of Mowi’s downstream strategy,” it said.

But overall, Mowi’s Q2 profitabillity was down by €112.6M ($133.6M) or 53 percent, in Q2 over the same quarter in 2019 because of lower salmon prices. Lockdowns and disruptions in trade flows and logistics due to the pandemic dramatically impacted foodservice demand, leading to inventory buildup (of mainly frozen Chilean salmon), thus dragging down prices, it said.

But fate of 18 BC farms located in the study area is still up in the air

Fish farms in the Discovery Islands in British Columbia pose “minimal risk” to Fraser River sockeye salmon, according the latest scientific studies from Fisheries and Oceans Canada (DFO).

Risk assessments of nine salmon pathogens were conducted to help decide the fate of 18 salmon farms in the area, whose licenses are up for renewal this December.

Critics have blamed the farmed salmon industry for the decline in the population of wild salmon in the Fraser River in BC. In 2009, Canada established a commission to address those concerns.

One of the recommendations of that commission is to abolish the 18 farms in the Discovery Islands by September 2020 unless there is proof they pose only a “minimum risk of serious harm to the heath of migrating Fraser River salmon.”

The latest findings echo a 2015 document entitled “Information Regarding Concerns about Farmed Salmon - Wild Salmon Interactions” that provincial fish pathologist Dr Gary Marty presented to the BC Provincial Government. In that document, Marty said BC farmed Atlantic salmon “pose no more than a minimal risk of serious harm to the health of migrating wild salmon.” He also said that less than one percent of Atlantic salmon die of diseases that might be infectious to wild Pacific salmon.

DFO’s findings and Marty’s 2015 statements are both consistent with the findings of the Cohen Commission into the decline of Fraser River sockeye salmon released in 2012: "Data presented during this Inquiry did not show that salmon farms were having a significant negative impact on Fraser River sockeye."

VR feed barge is equipped with a waterborne feeding system, which is said to offer better environmental and cost benefits

Photo: AKVA Group

waterborne feeding technology first introduced at the Aqua Nor exhibition last year is beginning to find commercial applications as the technology matures.

Waterborne feeding, where the feeding system uses water instead of air to transport pellets into salmon pens, offers better environmental and cost benefits compared to the traditional airborne feeding, says developer AKVA Group.

The Norwegian technology firm installed the waterborne feeding system into an AC 600 VR feed barge acquired by salmon producer SinkabergHansen. The salmon farmer initially leased the barge from AKVA in Autumn 2019 to try out the new technology. It proceeded to acquire it in October 2020.

“The largest bottleneck for introducing this new environmentally friendly and cost-saving technology in the market is to show that the waterborne feeding system is stable in operation and provides at least the same growth rate as airborne feeding. In this context, this feed barge sale to SinkabergHansen, and the collaboration with them, is very important for further market development,” says Hans-Øyvind Sagen of AKVA Group Nordic. He sees opportunities for existing barges to adopt the waterborne feeding technology.

One of the major benefits cited is the reduced energy requirement of waterborne feeding by 70 to 90 percent compared to traditional airborne feeding. By replacing air with water, the system is significantly gentler on both the feed and the feeding pipe, thus reducing feed breakage, noise and microplastic discharge, said the developer. Pellet density is also not an issue, and the capacity is said to be more than double compared to the traditional air feeding system.

“The environmental and cost benefits of waterborne feeding are so great that we see it as justifiable to invest in this type of feeding technology,” said Svein-Gustav Sinkaberg, CEO of the salmon producer.

But the question as to why wild salmon populations in the Fraser River are fluctuating remains a complex issue. Following the release of the Discovery Islands findings, DFO Minister Bernadette Jordan acknowledged that there are a number of things, for instance climate change, that are impacting the wild Pacific salmon stock. “There is no one silver bullet that’s going to deal with the challenges that we’re seeing,” she said.

DFO and seven First Nations communities whose territories border the area where the farms are located were discussing the future of the 18 fish farms as of press time.

The first batch of salmon smolts have been transferred into Cermaq’s iFarm pens in Norway – a small step that could well become a giant leap for salmon aquaculture, if the iFarm technology proves successful.

The pens are equipped with iFarm, a technology that allows the individual monitoring of each fish for factors such as growth, sea lice, disease, lesions and others aspects that affect fish health and welfare.

It uses artificial intelligence and machine learning in identifying each fish in a net pen. Each iFarm system can house approximately 150,000 fish, but each of them can be monitored individually.

Think of it like being in a doctor’s waiting room with other patients. When it’s your turn, you are ushered in – on your own – to the doctor’s office.

“When the fish rise to the surface to refill their airbladders, they are guided through a portal, or chamber, where a sensor can quickly scan, recognize and record data on that specific fish using recognition data based on each fish’s unique markings and structure,” Cermaq explained.

The sick individual is then treated. And because the entire stock doesn't have to be treated, the extent of treatments – and associated costs – are dramatically reduced.

Cermaq says the knowledge and experience gained from the first stocking of fish will be used to optimize the design for the second stocking, which is planned in 2021.

The iFarm project trial will run until 2025.

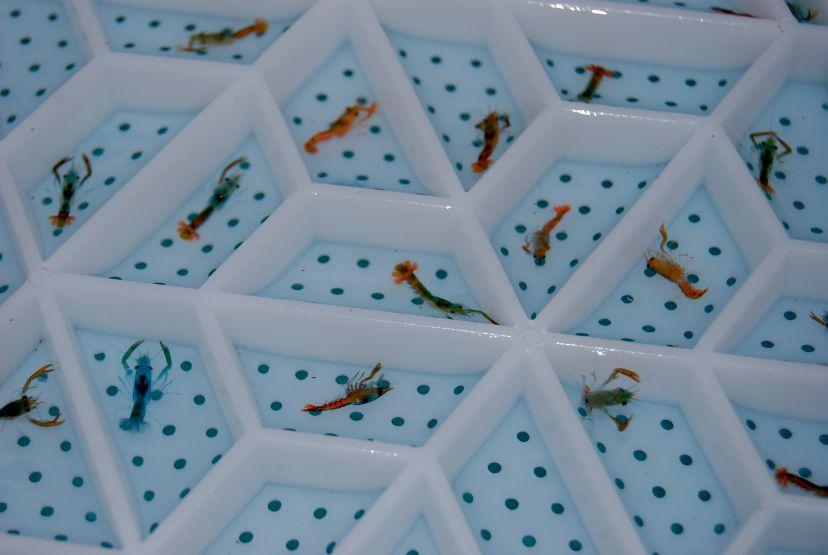

Roughly 10 months since stocking its first commercial batch of 400,000 salmon eggs (pictured) into its Bluehouse hatchery in Miami, Florida, Atlantic Sapphire made its first harvest in September. The occasion shows the company’s triumph over adversity, which included the COVID-19 pandemic, an emergency harvest of nearly 200,000 fish in July, and skepticism by some over the company’s ambitious goals. By the end of the year, it hopes to harvest 1,000 metric tons. The goal is to reach 220,000-tonne production per year by 2031.

Several groups have applied for oyster farming permits in Texas since the state opened applications online in August, according to industry sources.

“One sure indication of the interest in and optimism for the industry is that several groups have applied for permits to grow oysters commercially on the Texas coast,” said Dr Joe Fox, Marine Resource Chair with the Harte Research Institute for Gulf of Mexico Studies at Texas A&M University-Corpus Christi.

“The permitting process is daunting but will likely become more streamlined as both regulatory agencies and operators become more familiar with the process and farming itself,” said Fox, a former Texas A&M AgriLife Research scientist.

The groundwork is being laid to help this emerging industry succeed. Scientists at the Texas A&M AgriLife Research Mariculture Laboratory are developing the state’s capability to provide growers a reliable local supply of oyster seeds.

They are also working on a selective breeding program focused on developing oyster lines that are suited to the unique environmental conditions along the Texas coast.

Authorities and research partners acknowledge the state must develop oysters that are unique and that add value for the consumer with regards to taste and nutritional value.

“People are willing to pay a little more for a quality product with a unique taste profile. And it also helps if the product is produced locally and has a good ‘story’ to go with it. I think producing premium half-shell oysters specific to certain areas of the Texas Gulf Coast will make a both a great experience and story for the consumer,” said Mario Marquez, who was recently hired as a Texas Sea Grant aquaculture specialist to help in facilitate the industry’s development.

In an earlier interview with this publication, Fox estimated that the oyster industry could bring in $70-$90 million in economic benefit to Texas.

The world’s first commercial salmon farm that uses semi-closed containment system exclusively may be in operation by 2023, if all go according to plan.

A new Scotland-based company called Loch Long Salmon aims to raise 15,000 to 20,000 tonnes of salmon per annum. It plans five sites, each with 4,000-tonne capacity.

Semi-closed farming systems are touted to eliminate sea lice due to the airtight bag that separates the fish from the ocean environment, and because the water that’s pumped into the enclosure is from the deep ocean, where sea lice aren’t known to thrive.

According to industry estimates, sea lice treatments cost the industry $1 per kilogram of farmed salmon. Not having to treat for sea lice, the company believes it will be able to offset the operational costs of a semi-closed containment farm, estimated to be twice that of a conventional farm.

“Our philosophy is that we should eliminate rather than treat the problem – and we can do that with these systems,” said the company. It noted that semiclosed systems have been tested in Norway for the past eight years and have been shown to be successful.

The company is only on fund-raising stage. It will have to jump through many hoops before it even stocks the first fish. Now, the hard work begins.

A Scottish company plans to raise Atlantic salmon in semienclosed cages. It could potentially be the first in the world to do so on a commercial scale, if plans pan out

Editor Liza Mayer

Tel: 778-828-6867

lmayer@annexbusinessmedia.com

Advertising Manager Jeremy Thain

Tel: (250) 474-3982

Fax: (250) 478-3979

Toll free in N.A. 1-877-936-2266 jthain@annexbusinessmedia.com

Media Designer Svetlana Avrutin

Account Manager Morgen Balch mbalch@annexbusinessmedia.com

Audience Development Manager / Subscriptions

Urszula Grzyb

Tel: 416-510-5180 ugrzyb@annexbusinessmedia.com Fax: 416-510-6875 or 416-442-2191

Regular Contributors: Ruby Gonzalez, John Nickum, Matt Jones, Lynn Fantom

Annex Privacy Officer

Privacy@annexbusinessmedia.com

Tel: 800-668-2384

Group Publisher Todd Humber thumber@annexbusinessmedia.com

COO Scott Jamieson sjamieson@annexbusinessmedia.com

Oysters in Atlantic Canada may have developed resistance to ocean acidification due to their long history of exposure to low pH conditions, a new study shows.

Ocean acidification describes the decrease in seawater pH due to the oceans absorbing excess carbon dioxide from the atmosphere. The deaths of millions of oyster larvae in the Pacific Northwest in 2007 due to ocean acidification highlighted how climate change, found to be the culprit behind the phenomenon, could devastate the industry and coastal economies.

“The change in ocean pH presents a challenge for marine life. A major consequence is that shellfish, like oysters, have a harder time making shells,” says Jeff Clements, research scientist at Fisheries and Oceans Canada and lead author of the study.

Clements and his team examined Eastern oysters (Crassostrea virginica) from SaintSimon Bay in northern New Brunswick. They found that exposure to low pH actually increased the reproductive development of adult oysters. Furthermore, although the hatchery-reared oyster larvae in low pH tended to be smaller and had a higher percentage of deformities, their survival was actually higher under low pH.

Martin Mallet, co-author of the study and hatchery manager at the L’Étang Ruisseau Bar oyster hatchery where the study was conducted, says “the estuarine waters in which these Eastern oysters have evolved show large natural fluctuations in pH, including regular episodes of low pH, due to freshwater runoffs and photosynthesis fluctuations.” Regular exposure to low pH episodes may have aided in the oysters’ resilience in this area, the researchers said.

Both Clements and Mallet acknowledge the need for further, longer-term study to determine the effects of chronic exposure to low pH. But they say their results provide room for “cautious optimism.”

“To our knowledge, this is the first study showing such positive effects of low pH on this species of oyster, which is quite promising. This isn’t just good news for the oyster industry in Atlantic Canada, but it’s also great news for industry and government collaborative research in the region,” says Clements.

T

he lack of a predictable, affordable and efficient permitting process for offshore aquaculture in the US has significantly hindered the growth of the industry, but a bill now in the US Senate for consideration aims to change that.

The AQUAA Act, or S. 4723, is expected to expand US aquaculture and create jobs and economic growth in coastal and agricultural communities. It is a bipartisan bill filed by Senators Roger Wicker (R-Miss), Brian Schatz (D-Hawaii) and Marco Rubio (R-Fla).

“This is a major milestone for the US seafood community,” said the group, Stronger America Through Seafood (SATS). The group helped push the US Congress to back the AQUAA Act, which is short for Advancing the Quality and Understanding of American Aquaculture.

David Kelly, CEO of Innovasea and a member of the SATS Board of Directors, commented: “Congress is recognizing the vital role aquaculture is going to play in our nation’s efforts to improve food security in wake of COVID-19. This legislation supports a straightforward regulatory framework to ensure the industry has the opportunity to grow safely and responsibly.”

< A legislation that aims to boost US offshore aquaculture is now at the US Senate for consideration

Photo: ©Alexander Sánchez / Adobe Stock

Stretched food supply during the early days of the pandemic heightened consumer appreciation of farmers

It’s been a long time coming but the Best Aquaculture Practices (BAP) third-party certification program finally has a salmon farm certified under the BAP standards.

That farm is what is known in North America as Kvarøy Arctic (Kvarøy Fiskeoppdrett is the company name in Norway).

“The news was exciting for us as it represents a big step for BAP in Norway’s well established salmon-farming sector. We appreciate Kvarøy Fiskeoppdrett’s support and enthusiasm in pursuing BAP certification,” said Steven Hedlund, spokesman for the Global Aquaculture Alliance, the organization behind BAP.

The first aquaculture facility to be certified in Norway under BAP standards was a processing plant, in 2013. That marked BAP's first entry into the country.

“We recognize that it can take longer to break into some markets due to the establishment of other aquaculture certification programs. With the addition of the two Kvarøy Fiskeoppdrett salmon farms, that’s three BAP-certified facilities in Norway now,” said Hedlund.

Amajority of consumers stand ready to rally around farmers in support of their efforts to put food on tables around the globe, according to a recent Cargill study.

Consumer recognition for the challenges and expectations farmers face grew amid the COVID-19 pandemic, as processing and transportation bottlenecks, especially in the protein industry, stretched the global food supply.

In the latest Feed4Thought survey, Cargill found nearly one-third of consumers in the United States, Brazil, Vietnam and Norway have a renewed appreciation for animal agriculture.

“When consumers experienced bare shelves at grocery stores, they were reminded of the critical role livestock and aquaculture farmers play in global food security,” said David Webster, president of Cargill Animal Nutrition & Health.

Beyond the critical role of feeding the world, consumers also see farmers overwhelmingly as stewards of the earth’s natural resources and animal care experts.

The study suggested that consumers believe technology can help farmers address the challenges they face. In the US, younger consumers were more likely to want an increased connection between farmers and technology, the study found.

The BAP standards address environmental and social responsibility, animal welfare, food safety and traceability. Nearly 2,800 processing plants, farms, hatcheries and feed mills in 36 countries and six continents are now BAP-certified.

Another third-party certification system, the Aquaculture Stewardship Council, has certified 242 salmon farms in Norway since 2014.

farm

is

US authorities have invited the American public to have a say in the proposed yellowtail fish farm in federal waters off the coast of southern California.

In mid-September, NOAA fisheries kicked off the Environmental Impact Statement process for the Pacific Ocean AquaFarms project. The fish farm is envisioned to grow and harvest 1,000 metric tons of California yellowtail (Seriola dorsalis) initially. In the long term, it is expected to scale up to 5,000 metric tons as it proves its environmental and economic sustainability.

Pacific Ocean AquaFarms (POA) is a joint-project between ocean-science research institute HubbsSeaWorld Research Institute and investment group Pacific6 Enterprises.

“We see this as a game changer for the US, which today imports the vast majority of its seafood, half of which is farmed,” said Robert Gordon, a Founding Partner at Pacific6. “Our project will show how aquaculture, subject to our nation’s stringent environmental and food safety standards, will be done right.”

POA anticipates that environmental review and permitting will take 18 to 24 months. Construction should take one year followed by two years growing the first crop of fish, POA said. Commercial-scale harvesting will then begin and grow over several years to full production.

Golden Eagle Aquaculture farm on Vancouver Island, BC. Its sablefish production has a 'green' or best choice rating from the Monterey Bay Seafood Watch program

‘People appreciate having a fish that’s

RAS still plays a key role at Golden Eagle, but only in the hatchery phase. “Our hatcheries on land are RAS but we transfer the fish to grow in open net pens,” says Claire Li, the company’s sustainability director. “Sablefish are not well suited to RAS because they’re a ground fish. In the wild, their habitat is 2,000 feet down. Our nets go down 150 feet, they’re quite far down in the water column. It would be quite expensive to replicate those conditions on land.”

Li adds that Japan, the world’s largest consumer of the species, is a “dependable market” for Golden Eagle. The company sells its fish under the brand Gindara Sablefish.

Growth in the company’s sablefish production enabled it to expand into other markets. It has made inroads into the US and European markets, and has begun domestic distribution in Canada.

Sablefish has been filling the market void created by Chilean sea bass, a fish with similarly rich, buttery flavor because of their high-fat content, adds Li. “The decline of Chilean sea bass supply in the past couple of years has left a gap in the market for a similar white fish.”

“It’s been a really great opportunity for us to step into that market, especially with a product that’s local to Canada,” she continued. “I think people appreciate having a fish that’s produced in North America. There’s a sense of quality that comes from Canadian production. It is highly valued in international markets.”

The company faces competition from wild-caught sablefish from Alaska due to the sheer volume of the Alaskan product, noted Li. The COVID-19 pandemic compounded market challenges, prompting the company to find stronger retail markets.

“Our fish is very well suited to white tablecloth restaurants and sushi restaurants,” she says. “We’ve been very focused on foodservice. But we’d like to expand into retail, especially because there’s been such an uptick in retail sales recently.”

Brooks says that the partnerships they have developed have been instrumental in pursuing that goal. “We’re very fortunate, having been in the North American marketplace for the last 15 years, we have very good connections with fish brokers in the US,” he says.

“And those are the very same fish brokers that now have to figure out how to put their products into retail. So we’re just working with them and they’re basically guiding us through.” In a sector where so many companies have come and gone in the past 15 years, Li is quick to give credit to the knowledge and expertise of the staff and management for the company’s longevity.

“It hasn’t been easy taking what was a wild species and developing it into a domesticated product,” she says. “Scientists at the hatchery have led in closing the loop on sablefish aquaculture, breeding them and getting them to market size. And Terry himself has a lot of experience, having started in salmon aquaculture and having come from a long line of commercial fishermen. That experience has been crucial.”

Feed companies have made progress in developing feed formulations that reduce the need to harvest fish from the ocean. New feed ingredients include insects, microalgae, and so-called “single cell proteins” (SCPs), which include both yeast and bacteria grown from inexpensive feedstocks and industrial waste.

But it is easier to claim sustainability on environmental metrics than to prove it.

To meet this need, life cycle assessments (LCAs) have emerged as an increasingly popular accounting tool because they conform to a standardized methodology to measure a product’s environmental impact. Still, during the last few years, only a handful of LCAs related to aquaculture feed have been produced.

One of these, “Environmental Benefits of Novel Nonhuman Food Inputs to Salmon Feeds,” has made an important contribution to understanding progress, as well as the complexities, of aquafeed composition.

The study looked at soy protein concentrate because it is a widely used fishmeal substitute, and because its use diverts this resource “away from direct human consumption and creates new environmental challenges.” The study compared soy protein against two novel SCPs: bacteria and yeast.

The researchers from the University of California, Santa Barbara and the Norwegian University of Life Sciences evaluated each of the three “from cradle-to-factory-gate” on seven indicators of environmental harm:

• climate change

• acidification

• eutrophication in fresh and marine water (the cause of algal blooms, dead zones, and fish kills)

• land use

• water use, and

• primary production requirement (use of plants and other photosynthesizers that are the gateways for energy to enter food webs)

First, researchers compared meals representing 660 grams of protein each. For this study, the bacteria meal was created by feeding the microorganisms with fossil methane (plus a chemical input), then harvesting, condensing, and heat-drying them. For the yeast protein

concentrate, yeast cells were fed a wheat byproduct from biofuels production, then it was similarly manufactured.

Strong performance metrics for both SCPs suggest important future opportunities. “Yeast protein concentrate showed drastically lower impacts in all categories compared to soy protein concentrate. Bacteria meal also had lower impacts than soy protein concentrate for five of the seven indicators,” according to the study.

The nuance of the assessment in this case came when the novel ingredients were incorporated into a feed composition. Researchers tried two formulations, one adjusting the novel ingredient to meet consistent protein levels, while holding all other ingredients constant. The other substituted the novel ingredients on an equal-mass basis and varied the other ingredients to produce feeds with equivalent protein and lipid concentrations.

The relative trends remained fairly constant, according to the study, but benefits of the novel ingredients were “dampened” by high impacts from the other ingredients, particularly fishmeal and oil.

That is not to say that the study, in the end, threw cold water on the realistic prospects of novel ingredients. On the contrary, it concluded that “these novel single cell protein meals are both strong alternatives to soy protein concentrate in salmon feeds, and improvements in these technologies could help make them even more beneficial.”

Future work is promising, especially as the biotech start-ups specializing in SCP production form joint ventures with both ingredients companies and energy producers.

For example, Delaware-based White Dog Labs touts a deal with Cargill for its product produced by fermentation with corn feedstock. Another SCP leader, Calysta, has partnered with British Petroleum, which will supply power and gas to Caylsta’s feed protein plants.

Says Dr Joshua Haslun of Lux Research, who has studied the aquafeed ingredients landscape since 2015: “A company has all of this waste – what are they going to do with it? Is it better to produce something of extremely high value or get rid of it in the traditional way?”

– Lynn Fantom

To pursue the complexity related to new feed ingredients, Aquaculture North America (ANA) spoke with Wenche Grønbrekk, the head of sustainability and risk for the Cermaq Group, a subsidiary of Mitsubishi Corporation. She also serves as senior advisor to the United Nations Global Compact, which guides the global business community in advancing UN goals.

Wenche Grønbrekk, head of sustainability and risk,

How people define “sustainability” is one of the first challenges. “It’s changed meaning through the years,” says Grønbrekk, who has been working in corporate sustainability for almost 15 years. “It has different meanings on different continents. But what we’re seeing now is alignment – which I particularly like –around the SDGs.”

Group, says innovation in feed is crucial in making the industry more sustainable

Those SDGs are the United Nations’ Sustainability Development Goals adopted in 2015, with an eye toward 2030. Several carry relevance for the aquaculture industry and feed production.

For example, “End hunger” encompasses aquaculture’s ability to help feed a growing population by 2030; “Life below the water,” the conservation of the oceans and marine resources like forage fish; “Life on land,” the deforestation risks of soy production; and “Responsible consumption and production,” the advantages and risks of producing novel feed ingredients, among other considerations.

Sustainability matters in a wide range of aquaculture activities. To emphasize the point and underscore Cermaq’s position related to novel aquafeed, Grønbrekk says: “We need to produce more seafood sustainably in the future to answer to the needs of a growing world population. And as a consequence, we need more feed. Just to be clear, we very much welcome innovation in this space.”

The premise that aquaculture needs new feed ingredients to grow was quantified in a recent study in Nature – Food conducted by researchers from UC Santa Barbara, the University of Tasmania and the International Atomic Agency. Using UN aquaculture growth projections, they forecast the forage fish required to produce the fishmeal and fish oil needed in 2030 to be over 24 million tonnes.

That is important since supply of these marine ingredients has been flat for 40 years, averaging about 29 million tonnes, with just over 20 million used for animal feeds.

But, applying the highest thresholds of plausible replacement by novel ingredients, their simulations predicted that aquaculture’s global forage fish demand could drop dramatically to 8.5 million tonnes.

Already, the inclusion of fishmeal and fish oil in salmon feed has declined, according to the UN Food and Agriculture Organization. In addition, the industry has turned to the use of fish trimmings and byproducts to supplement forage fish.

Cermaq notes that it has reduced marine ingredients to less than 30 percent of its salmon feed.

Plant-based ingredients, particularly soy, have taken up the slack. But this replacement strategy diverts important protein sources away from direct human consumption (remember, one of the SDGs is “End hunger”) and may create new environmental challenges.

Cermaq, like other leaders, has moved to manage the impact of soy production on deforestation. The result has been a whole new set of sustainable sourcing guidelines and goals to stop conversion of natural forests, steward conserved ones, and intensify agricultural yields sustainably.

So, the challenges with feed cut in many directions. As Dutch researcher Björn Kok points out, feed likely accounts for more than 90 percent of the cumulative environmental impact of aquaculture supply chains. Feed also makes up the largest share of total production costs, hovering around 50 percent. (If novel aquafeed manufacturers propose their products at a premium due to sustainability claims, then the complexity compounds.)

teins, insects, microalgae, canola oil – are being tested and evaluated by the industry “We engage with these initiatives and we always monitor new knowledge related to new ingredients,” she says.

For example, Cermaq helps set the research agenda related to fish feed in the Norwegian Research Council and Norwegian Seafood Research Fund, which is financed by the industry through a levy on exports. “This is one way we are working to bring new ingredients to market, test them, and develop knowledge. As we obtain knowledge on innovations, we can ensure they get the right attention and priority,” she says.

One of the initiatives Cermaq sees on the forefront of advancing novel protein-based resources for salmon farming is the innovation center Foods of Norway, hosted by the Norwegian University of Life Sciences. Through new technology, the center is developing microbial ingredients such as yeast from blue and green biomass. Sometimes referred to as single cell proteins, this new aquafeed category is gaining high marks from academics in “cradle to factory gate” assessments of their environmental impacts (see story on opposite page).

“Everything new is not necessarily better than what we have built up sustainably for a long time.”

Algae are now a component of some of the feeds Cermaq uses, but such new ingredients are a small part of the total, Grønbrekk notes. Many different sources – single cell pro-

Lallemand Animal Nutrition, an official partner of Foods of Norway, describes the circularity of the process as converting “low-value non-food biomass from forestry and agricultural industry into high-value feed.”

As “interesting and promising” as such innovation is, scaling requires significant capital, time, and scrutiny. “Everything new is not necessarily better than what we have built up sustainably for a long time,” Grønbrekk adds.

The scientists back her up. The novel aquafeed industry is in its early stages, and “further investigations on novel aquafeeds across all dimensions of sustainability are needed,” write the authors of the research “Global adoption of novel aquaculture feeds could substantially reduce forage fish demand by 2030” in Nature-Food.

Even that title is a mouthful, but sustainability is not a matter of a single word. And that seems to be the point Molvik was making.

By John Nickum

Hugh Warren III, longtime executive vice president of the Catfish Farmers of America, passed away in early July. I had been warned that “Hugh’s time was short” because of a terminal illness, but his passing was nonetheless a shock. It left an enormous void in my life. Hugh was a special person in my life, just as he was a special person for literally thousands of other people. Hugh had a unique ability to make people feel that they were “special.” Conversations, or the work, were not about him even when he was seeking help or needing a favor; it was about you. His humility and focus on other individuals enabled Hugh to successfully represent the Catfish Farmers of America.

Hugh’s ability to find humor in everyday life and routine activities was unique among the “would-be influencers” I encountered while serving as national aquaculture coordinator for the US Fish and Wildlife Service (UFWS) and vice chair of the Joint Subcommittee on Aquaculture (JSA) representing the Department of the Interior. The decade from 1985 through 1995 was a time of optimism and fun for those of us in the JSA. We worked together toward the common goal of “Helping Aquaculture Grow,” a that goal shaped the practical animal husbandry activities. Not only did the federal agencies share a common goal, but we also enjoyed each other’s company. I believe shared laughter is an essential ingredient for working effectively as a team.

Although Hugh represented an organization that arguably could be called the “face of American Aquaculture,” he sprinkled his conversations and presentations with lighthearted stories about the foibles of his constituents while still presenting their needs effectively. Decisionmakers in

I called him to confess I had repeated incorrect information... does he have any suggestion to help me “eat a little crow”? Hugh replied: “Well, us southern boys find it goes down a little easier if it’s slathered with BBQ sauce."

Congress and agencies serving aquaculture enjoyed time spent with Hugh. After Hugh finished speakin to them about catfish economy and explaining the “catfish tote the note,” they find themselves wanting to address the needs of the catfish farmers.

I met Hugh for the first time at a JSA meeting. He was the epitome of a “relaxed southern gentleman” while being introduced to the group of approximately 20 bureaucrats – representatives of the various agencies and departments

that comprised the JSA. He explained that he was a farmer and a businessman with deep roots in the cotton and soybean fields of Mississippi. But as the representative of the Catfish Farmers he would not be bringing a list of demands to us. He would, however, try to help us understand the problems and needs of farmers he represented. During a break, he sought each of us out and spent those minutes getting to know us as individuals. Somehow, he had learned that I was born and reared on a small Midwest farm. He hoped our mutual experiences as farm boys might provide common ground for solving problems related to fish-eating birds – birds that were protected by my agency, the USFWS.

Hugh admitted that he had little background with birds and fish, so I should be prepared to use my teaching experience to help him understand the reasoning behind some of the USFWS regulations protecting the fish-eating birds. He said: “When my guys see those birds feasting in their fish ponds, they see them flying away with $20 bills in their beaks; one for every fish they eat! You gotta admit those big ol’ cormorants are just about the ugliest bird that ever disgraced our skies. Please explain why they are protected.” I explained the history of the Migratory Bird Treaty Act and how it applied to catfish farming. Hugh nodded and commented, “I think I understand, but are there any provisions for emergencies.” He did not ask for special treatment, but sought a mutually acceptable solution to the problem.

Several years later I sent an email note to Hugh telling him that my great, great grandmother was a descendant of Mayflower passenger, Richard Warren. I asked him if he also was a descendant of Richard Warren. Twenty minutes later my phone rang, it was Hugh: “How ya doin’ cuz?” he asked. On another occasion I called him to confess that I had repeated incorrect information that I had received from USFWS Law Enforcement officials. Does he have any suggestion to help me “eat a little crow”? He replied: “Well, us southern boys find it goes down a little easier if it’s slathered with BBQ sauce.”

By Lalou Ramos

ig Data is a tech buzzword that gets mixed reviews across all industries. Stories about how our personal data and online activities are being tracked to influence buying decisions or advance political agenda give Big Data a bad name. In truth, it is neither bad nor good. Big Data is, simply put, a large volume of data produced in increasing volumes and with ever-increasing speed. It is much more data than you normally deal with on your computer. It is being used to transform businesses, including aquaculture. You may not know it, but your farm is most likely already using Big Data. Let’s try to dig deeper into the concept through this Q&A.

Big Data sounds harmless as information has long been available anywhere. So why are people concerned about it?

There are concerns about personal and proprietary information being stolen. However there are technologies in place you can apply to protect your data as well as laws governing how data must be taken, shared or stored.

Can I just not concern myself with Big Data? Data is power. Information is a resource you can use to your advantage. In business, insights are valuable because they allow you to make informed decisions. The best insights are information taken from as many relevant sources.

Can you cite some examples about how Big Data is relevant to seafood farmers like me?

Big Data benefits all industries, including aquaculture. For instance, it enables you to know and understand the needs of your customers and clients better. An example of this is a tool called CRM, or customer relationship management. Utilizing Big Data, CRM helps identify who your customers are, how they behave and interact with you. Big Data is also behind the programs that help you manage supply chain from inventory to procurement of raw materials and shipment. Companies with huge, diverse workforce use information from Big Data to analyze employee performance, set working standards and enhance their productivity. In addition, market data helps you set appropriate price for your products and services.

Aren’t those technologies too complex and costly for small farmers?

Well, small players do not need to process Big Data themselves; it is done for them. Applications and programs have been developed to make it easy for farmers to extract information and insights. Those programs are designed with easy-to-use interfaces and require minimum technology experience. You do not even have to buy the programs and install them. They are available in cloud and can be accessed through affordable subscriptions. Nowadays, those tools are no longer exclusive to big players with deep pockets. Big Data democratizes fish farming, providing a level playing field for both small and bit players.

What technologies based on Big Data should I pay attention to?

All the emerging technology in aquaculture are powered by Big Data. The sensors that enable you to automate fish feeding take information in real time from your farm. How it establishes the conditions necessary to release the feed for your fish are based on information from Big Data. The same holds true for things like water and fish health monitors. The beauty of using these technologies is that while they make you more efficient and productive and your business profitable, they also give you the opportunity to refine the technology further.

How does that happen and why will it benefit me?

The data taken by these sensors from your farms and those of others are collected and become part of Big Data, which are then stored, analyzed and applied. Those insights will be used to further refine the technology to make it more useful to you. By simply using technology powered by Big Data, you are helping the industry move forward.

www.praqua.com info@praqua.com +1-250-714-0141

‘We want to be

says

Throughout the pandemic, salmon farmers in North America kept operations going, in some cases adding staff, as Grieg Seafood BC did. The company hired 20 additional people to help manage the harvest.

“The biggest challenge to us was that almost overnight, 50 percent of our traditional business went away, and that’s the hotels, restaurants and foodservice,” says Boschman. “But very quickly we adapted to continue supplying all of that extra volume into retail, which was the only channel we had left.”

Determined to try to do business as “normal” as possible and protect jobs, Grieg and others muscled through the pandemic, maintaining operations and production, while making the safety of employees a priority.

“We haven’t had any interruption in harvesting,” says Boschman. “This was our biggest harvest year ever. We’ve managed to continue to harvest every single week, in some cases more than two million pounds a week and move that through the processing plants and distribution channels into the market.”

The “Blue Economy” was even referenced in the Throne Speech delivered September 23 to Parliament in Ottawa. It noted a need to “grow Canada’s ocean economy to create opportunities for fishers in coastal communities while advancing reconciliation and conservation objectives.”

“We can and want to be in that space,” says David Kiemele, managing director of Cermaq Canada. “Indigenous relationships are immensely important to us here on the Coast. We enjoy several very positive and long-standing agreements here on the coastline. Indigenous oversight, governance of our operations, and being transparent is what we’re all about.”

LAUNCHING INTO NEW MARKETS

When COVID-19 emerged in March and salmon farmers were deemed an essential service, companies focused on how to continue production while keeping operations safe for employees.

“One of the biggest challenges was finding ways to keep our people safe to continue to operate and allow our product to enter the market,” says Kiemele. “There were a lot of changes to processes that needed to take place across all of our facilities to make sure we could continue to operate. There were some nervous moments, but I can’t say enough about the work ethic and professionalism of the team here, and we’ve navigated through the situation quite successfully to date.”

Kiemele describes the impact of the pandemic as a “complete decimation of the foodservice industry” with restaurants and cafes closing down.

“But what we did see, that somewhat counterbalanced the decrease in foodservice, was the increase in retail,” he says.

Like so many seafood companies, the impact of COVID-19 prompted Cooke Aquaculture to consider alternative means of getting the product to market. In May, Cooke’s distribution company in Nova Scotia, AC Covert, launched a new home delivery service of seafood boxes available online across Nova Scotia, New Brunswick and Prince Edward Island.

The company has since expanded the overnight delivery to Ontario, Manitoba, Alberta, and Saskatchewan.

“The pandemic challenges required us to pivot our thinking as a seafood company and how we can supply our fresh, sustainable product to those who enjoy it,” says Joel Richardson, vice-president of public relations, Cooke Inc. “The design and delivery of these seafood boxes have been a hit in Atlantic Canada, and we thought it was a perfect time to offer it to our customers in different areas of the country.”

Creative Salmon general manager Tim Rundle said while the pandemic has been challenging for multiple reasons, he’s proud of how the entire team at Creative has pulled together.

“We have continued with all of our operations, with, of course, the required changes to focus on the health and safety of staff. We will continue to monitor the entire situation

so we can continue to adjust as needed,”Rundle says.“Creative Salmon makes up only about 3 percent of the farmed salmon production in British Columbia.We are certified to the Canadian Organic Aquaculture Standard and farm Chinook (King) salmon,so those pieces set us apart.

“We are always open to engaging with people interested in our unique product and in finding new customers.”

While the foodservice sector is still depressed,Kiemele says it has come back somewhat over the last few months as restrictions were lifted in Canada.But as the weather turns cold in North America,outdoor dining options are coming to a grinding halt.

Dean Dobrinsky,human resources director at Mowi Canada West,says the company has also made a more significant shift from wholesale distributor to retail.

“We have to chase markets where we need to,”he says.“All of this has been a reminder of how dedicated and nimble our employees can be in that they took on a massive change to work practices,safety equipment,safety process – we did all of that and production continued,and no one got hurt.We’re taking it all day by day.”

Reliability in water jetting pumps takes on a whole new meaning when you’re in the business of cleaning net pens in the fish farming industry. Our pump systems, specifically designed for the aquaculture market, address the demands of harsh conditions of open seas, foul weather and corrosive effects of salt water while delivering the renowned performance and durability NLB has been known for since 1971.

NLB pump units also offer compatible interface with the industry’s leading head cleaning systems.

WANT TO LEARN MORE?

Visit NLBCORP.COM or call us at (248) 624-5555.

BY LIZA MAYER

Canada is just skimming the surface when it comes to utilizing its coastline that's viable for aquaculture. That could, and should, change, said the head of the Canadian Aquaculture Industry Alliance (CAIA).

Canada produces 2.1 tonnes per kilometer of farmable coastline. In comparison, Norway produces 52.5 tonnes per kilometer, and the United States, 9.6 tonnes. (see infographic).

The figures show how Canada, which has a much longer farmable coastline than the two countries, hasn’t come close to realizing the opportunities in aquaculture despite the clear positive impact the industry has on local communities, said Tim Kennedy, president and CEO of CAIA.

“We have not seized the opportunity in Canada for sustainable aquaculture of all types,” Kennedy told participants at the 5th Indigenous Resource Opportunities in October, a First Nations-led virtual conference focused on sharing success stories of BC’s indigenous communities.

Canada is now the eighth largest volume producer of seafood in the world. The goal is to become the top three sustainable fish and seafood producer by 2040, said Kennedy. That goal is enshrined in the recently released Canada’s Blue Economy Strategy 2040, a roadmap CAIA developed with its wild-capture counterpart, the Fisheries Council of Canada.

The pandemic has only heightened the industry’s important role and the opportunities to participate in it, said Kennedy. He noted that 70 percent of the seafood Canadians consume is imported and only 30 percent is local supply.

Kennedy believes “there’s a huge opportunity for indigenous partners to recognize that need and to look at branding product in very special ways,” such as, perhaps, branding farmed Atlantic salmon from BC as “Reconciliation Salmon,” he suggested.

“Let's have a vision that we can all get behind,” said Kennedy as regards the 2040 goal. “We think this is something that we can work on… on measurability, on metrics. And we think that we should and can be the very best producer of top quality seafood in the world. That’s our vision and we'd really enjoin others to join us in that partnership.”

Conference chair, host, and president of the Nanwakolas Council, Dallas Smith, acknowledged the evolving relationship between the farmed salmon industry and the First

ScaleAQ is a world-class supplier of cameras for the global aquaculture industry. Since 1985, we have been helping aquaculture operators to perfect feeding using video images from their cages, and we know of several cases where our cameras continue to work superbly after more than 20 years under water. With solid experience and documented high quality products, ScaleAQ is the natural choice when you want a future-oriented camera solution that will last for many years to come.

• We offer the most light sensitive cameras available on the market. Choose from a wide range: from digital HD to analog SD cameras.

• Proprietary software supplied with every camera system. Can also be adapted to third-party solutions through open APIs for camera and winch control.

• Follow the moving fish with our proprietary multiwinch, both horizontally and vertically in the cage – also a great tool for checking your net and carrying out inspections for dead fish.

• We offer maintenance programs that ensure maximum uptime for your camera system.

'We have not seized the opportunity in Canada for sustainable aquaculture of all types,' says Tim Kennedy, head of the Canadian Aquaculture Industry Alliance

Nations in whose territories salmon farms are sited. His First Nations community has a partnership with Grieg Seafood BC.

“It’s nice we're not just thought of as a landholder (of farm sites) you’ve got to pay rent to, but that there's actual training opportunities that are developed to get our people meaningfully involved,” said Smith.

But he also noted the need for “meaningful jobs” – not just manual labor – for indigenous people that would allow them to move up the ladder and “build a career that's really going to support their families.”

Kennedy acknowledged this continues to be a challenge but the industry’s relationship with First Nations is evolving in important ways, he said. This includes hiring indigenous people at entry level and training them “so we're seeing management-level partnerships. There’s more to do, there's no question about it, but I know that the companies are committed to that.”

At Grieg Seafood BC, indigenous employees work as farm managers, farm technicians, in hatchery maintenance, and as operations specialists, said Marilyn Hutchinson, the company’s director of Indigenous & Community Relations.

“Like the other BC farming companies, we work with colleges and universities to facilitate the training required to support their successful employment,” Hutchinson said. She added that there are opportunities to contract out some services with indigenousowned businesses, such as water taxi services, barging, meal catering and environmental monitoring. All of these “support a nation's own goals for economic self-sustainability,” she said. “The more we contract with indigenous companies, the greater their financial capacity to grow and provide other services to our sector.”

Hutchinson sees a future where indigenous involvement in the farmed salmon industry would be greater. “I know there will be indigenous ownership of salmon farms, or shared ownership, or sub licensing or joint ventures – one of many different mechanisms that will see our indigenous partners leading the growth of aquaculture in BC. It has already started but the pace of this change is accelerating because the leaders are asking for it to happen now,” she said.

79,562*

19,924

*Data: RIAS Inc. (2014) Canada's Aquaculture Industry: Potential production Growth and Footprint. *Only considers provinces with marine coastline suitable for aquaculture (excludes all three Prairie provinces, Ontarioo, and Canada three territories).

Already, there are aquaculture businesses where First Nations are more than just the landowners, but owners and custodians of the businesses. One of these is Coastal Shellfish Corp, a business in Prince Rupert, BC, that's 95-percent owned by First Nations. It is the only commercial scallop hatchery operating in North America today, and represents $25-million in indigenous investment since 2003.

BY JENNIFER BROWN

Leaders of associations that represent the industry in North America found a silver lining to the coronavirus pandemic, with demand for salmon emerging in better shape than other sectors supplying the foodservice industry.

“It’s been tremendously positive in the face of a very challenging situation,” says John Paul Fraser, executive director of the British Columbia Salmon Farmers Association. “I’m so impressed by everyone’s resilience – this group of people is determined to make improvements and see things through.”

On the other side of the country, Newfoundland Aquaculture Industry Association (NAIA) executive director Mark Lane says the global crisis has allowed the sector to promote salmon farmers’ importance to the economy.

“I feel COVID-19 has further united the industry, locally, regionally, nationally and internationally,” he says. “Since the beginning of COVID-19, we have been participating in regular stakeholder meetings. These meetings enable the industry to speak directly with all key decision-makers in the federal and provincial governments.”

Salmon farmers were declared an essential service by authorities early on in the pandemic, which was vital especially to those workers in small communities who depend on jobs in the sector. In British Columbia alone, salmon farming is responsible for 7,000 direct and indirect jobs, and more than two-thirds of Canada’s farmed salmon production occurs in BC.

“I think being designated an essential service by the government really helped people get a sense of confidence that what they were doing matters, and that was a boost for everyone,” says Fraser. “But that doesn’t mean it was easy, it was really hard, and in some cases expensive to make

adaptations. There is a lot of uncertainty when you don’t know when that next delivery of PPE [personal protective equipment] is going to arrive or what you actually need to be in compliance.”

Compared to shellfish farmers, and despite a glut of product on the market from other jurisdictions such as Chile, salmon farmers are emerging from the first six months of the pandemic somewhat better than other seafood producers.

“Salmon probably came through a little better although the displacement in markets worldwide has caused a lot of overseas product to come into the United States. That has made it a competitive-price climate for our salmon folks,” says Sebastian Belle, executive director of the Maine Aquaculture Association.

SUPPLY CHAIN DISRUPTION

For many companies, the challenge was finding new ways to get their product to market, which involved starting delivery companies or direct distribution to consumers via the internet. Some even started selling to local farmers’ markets, while others launched marketing campaigns.

“There has definitely been a change in some of the traditional distribution channels, and the question for everybody is, what are the costs associated with those new distribution channels? And will those new distribution channels maintain themselves if and when we get back to some form of normal? We don’t know the answer to that yet,” says Belle. “I do think the emergence of those directto-consumer distribution channels will fundamentally and structurally change the seafood business as we go forward.”

Developing new marketing plans to promote local products is a priority for salmon farmers on the East Coast,

says Tom Smith, executive director of the Aquaculture Association of Nova Scotia.

“That’s a silver lining of COVID – we’ve started to work on direct-to-consumer marketing. In fact, our salmon farmers have a very vibrant direct-to-consumer marketing campaign launched during COVID through True North Seafoods,” he says. “That has opened a channel we didn’t have before. We needed to look at new supply chains, and our salmon farmers are addressing that.”

Smith is concerned the large amount of salmon in the market now will hurt the industry’s overall health over the next year.

“It’s been tough for worldwide supply and in Nova Scotia we have some dumping going on, specifically Chilean salmon that have come into the market priced way below what it should be. It’s going to jeopardize the profitability of the industry,” he says. “The salmon industry is a very profitable industry worldwide, but dumping product flies in the face of that and isn’t good for the future sustainability of the industry.”

Smith says there are signs the market is starting to bounce back.

“Harvesting continues on a planned schedule, but it is a struggle to make sure there is a market for those products. At the same time, smolts are being brought in and getting ready for the 2021 season and beyond, so the market has to adjust.”

In Newfoundland, two of the largest construction projects on the island are aquaculture related, says Lane of NAIA.

Grieg Seafoods and Mowi are currently investing $76 million and $65 million, respectively, into hatcheries in Marystown and Stephenville. As well, Cooke Aquaculture’s five-year capital investment plan underway in Newfoundland is over $220 million, including hatchery and post-smolt facilities, processing plant upgrades, harvest vessel upgrades, seawater site and equipment upgrades.

In August, the province elected Andrew Furey as Premier, and Lane says the association has spoken to him about the industry’s importance to the people in coastal communities.

“As a politician, he needs to fully understand the importance and contributions that our industry makes to this province,” says Lane.

Looking ahead, Lane says one of the highest priorities is to continue community outreach and to educate the general public about the industry, its sustainability, environmental friendliness, as well as its contributions to the economy and food security.

“Early in the new year, we will be launching Aquaculture 101 (aquaculture101.com). With a world-class website, online learning resources, courses, VR and 360 immersive learning experiences, this portal will be one of the world’s most comprehensive online learning platforms related to aquaculture,” says Lane.

The largest ticket item that had to take a back seat for the association in Newfoundland was co-hosting a conference with the World Aquaculture Society and Aquaculture Association of Canada.

“We were anticipating close to 2,000 people descending on historic St John’s to host Canada’s largest-ever aquaculture conference,” says Lane. “Of course, we were all very disappointed but like in all aspects of our day-today business, it's safety and people first. Postponing the conference until September 2021 was the responsible course of action.”

Belle says in Maine, association members currently don’t have plans to curtail production at this point.

“If the COVID situation is unresolved and vaccines aren't developed, and if the restaurant industry, in particular, doesn’t recover, then you may see some impact in terms of what people are choosing to seed out on the farms, but there is no real way to respond to that in the short term,” he says.

The Maine Aquaculture Association will be providing financial management support to farmers as they manage through the balance of 2020 and into next year.

“We are definitely shifting some of our priorities. We are ramping up financial and business management services in particular for new farmers who don’t have the financial reserves to weather a downturn in the marketplace, focusing on risk management skills to help them survive in a down period,” says Belle.

“As a politician, he needs to fully understand the importance and contributions that our industry makes to this province.”

Acontinuing issue for British Columbia’s salmon farmers is the federal government’s pledge to phase out open net-pen salmon farming by 2025.

However, following discussions with stakeholders and additional research, a transition plan will be put in place, but net-pen farms won’t end.

John Paul Fraser, executive director of the British Columbia Salmon Farmers Association, says there has been on-going dialogue with the Minister of Fisheries and Oceans Bernadette Jordan.

“You can’t chart a future without understanding the current practices, and that’s what has been valuable about this process,” says Fraser. “The minister has been clear about the need to have a respectful, thoughtful process. I would say the conversation has just begun, and there’s a greater degree of understanding of what closed containment, and other production technologies offer both on the plus and the downside.”

The end result may not be closed containment but rather an approach that improves environmental performance.

“I think there is greater awareness that big companies already adhere to rigorous environmental standards and third-party non-government standards that are voluntary but extremely rigorous, like ASC,” says Fraser.

David Kiemele, managing director of Cermaq Canada, says the consultation is expected to start in the fall and the winter. “Coming up with a responsible plan by 2025 to transition from open net-pen farming can mean a lot of different things. We’re focused on finding a pathway forward to sustainably and responsibly grow salmon in the ocean on British Columbia’s coast.”

Environmental impact occurs with land-based operations as well, Kiemele points out.

“I’m not against land-based farming, but if there is a huge push to moving fish onto land, it simply won’t happen on Vancouver Island. There is a reason why some of the other land-based projects aren’t happening on the same coastlines where fish are grown in the ocean — it’s a costly exercise. There are environmental impacts from land-based farming just like any farming activity,” he says.

Meanwhile, the government will be issuing additional recommendations on alternative aquaculture technology based on technical work done by Nova Scotia-based Gardner Pinfold Consultants Inc, and as part of a multistakeholder process.

The government report, released in February, reviewed the state of salmon production technology and explored four technology options: land-based and floating closedcontainment; offshore technologies; and hybrid systems that combine both land and marine-based systems.

The study also identified measures to support technology development and adoption in BC.

Critical to the industry is the recognition that hybrid technology is a potentially viable and important new path for BC where the salmon are raised for less time in the ocean and more time on land.

“I think there will be a good conversation about what kind of cleantech or other incentives and risk-mitigation measures the government might consider to support innovation. We’ve had a very open and positive discussion around what might be needed,” Fraser says.

C– Jennifer Brown

ermaq may have abandoned its plans to expand its operations in Nova Scotia, but the province remains full of potential for the farmed salmon industry, says David Kiemele, managing director of Cermaq Canada.

In April, as the pandemic was ramping up, Cermaq was trying to finalize a $500-million expansion deal in the province, but it all came to a halt. While some thought it was due to community concerns, Kiemele says several factors were at play. At the forefront was the need to secure more sites than were available.

When Cermaq announced in 2018 its plans for the project in Nova Scotia, the company needed a certain number of sites to make it viable.

“That was a key component,” says Kiemele. “We were not blind to the fact we would see some level of opposition. There is still a lot of education taking place, and some views of salmon farming are not the most positive, but that was not the primary reason we decided not to venture ahead. It was more around real estate. We needed to make decisions about where sites could go. We were awarded Options to Lease from the province, but they have timelines you need to abide by, and they can lapse.”

Cermaq had some significant decisions to make, which would have triggered large-scale investment for the next phase of the project, all while COVID-19 cases were rising.

“That was the straw that broke the camel’s back, to be honest,” he says. “I was on a plane weekly going back and forth, meeting with existing processors and having community meetings. All of that became nearly impossible with COVID-19, so it was the right move to take a step back and reconfigure. We have come back into the BC landscape and are focused here.”

Kiemele says, for now, Cermaq is not considering a replacement project but acknowledges Nova Scotia has considerable potential for the industry.

“Nova Scotia has a bright future from an aquaculture point of view,” says Kiemele. “They have a farmable coastline, but time is required and the more we can share information about our industry and the benefits and value we wish to bring in the areas we operate, the better for everyone.”

Like

Debut comes amid surprising findings that the local community is unaware just how important salmon farming is to the local economy

Misconceptions about salmon farming have hurt public perception of the industry. A digital campaign called Deeper Dive by the British Columbia Salmon Farmers Association hopes to change that.

Launched in October, Deeper Dive addresses 10 topics related to the sector that are often misunderstood by the public. Science-based information is delivered in animated graphics, making technical topics such as sea lice, Piscine orthoreovirus (PRV) and land-based farming easy to understand.

“We have used science and research to address concerns about the salmon farming sector for years,” says John Paul Fraser, executive director of the BC Salmon Farmers

COVID-19 has shifted conversations away from many things but not the BC salmon farmers’ commitment to best practices. Two of them achieved Aquaculture Stewardship Council (ASC) certification during the pandemic.

Mowi Canada West now has all of its farms in British Columbia certified to the ASC standards. The company comes full circle with the certification of its final farms (its 27th and 28th) in the province. Mowi was the first in North America to have a salmon farm certified to ASC and the first in the Mowi Group to complete certification of all its sites. It says it may now label its salmon as ASC certified when sold in stores.

Grieg Seafood BC also achieved a similar feat in the middle of the pandemic with the certification of five of its Sunshine Coast salmon farms. “ASC certification is very challenging in the best of times, and it required a lot of hard work from people in our company that were focused on that alone. We’re very dedicated to the idea of ASC, and we’ve come a long way in the last year, and now we’re on track to have all of our farms ASC certified in 2021,” says says Rocky Boschman, managing director, Grieg Seafood BC.

Association. “Until now, we did not have a public platform where everyone can view the collective research in a way that is easy to understand and shareable in social media.”

TASK FORCE'S FINDINGS

The platform’s roll out coincides with the release of findings by a task force that looked into the challenges of the farmed salmon industry, forestry and tourism in Campbell River, BC.

The coastal town accounts for almost one quarter of aquaculture employment in the province. Three of the world’s leading aquaculture companies – Mowi, Cermaq, and Grieg Seafood – have their North American head offices in town.

Lack of awareness and understanding of the role of salmon farming, as well as the “urban narratives and agendas of third parties” threaten the industry, said the Campbell River Business Recovery Task Force.

It found that members of the community and even their elected leaders are unaware just how important the three industries are to the local economy.

“I was surprised to see that, even in the case of Campbell River with its longstanding economic base in primary industries, the task force commented on a lack of recognition of the large positive impacts of related investment, jobs and business activity. Aquaculture people should be concerned," commented Stewart Muir, head of the nonprofit Resource Works, an advocate for the responsible use of BC's natural resources.

The task force referred to the three sectors as “first-dollar industries,” meaning the money they generate is spent and re-spent throughout the community through wages and local purchasing of good and services.

“There is a direct connection between the health of firstdollar industries to the number of schools, retail options, scope of health care, the number of parks, property values and general community amenities and attractiveness that are hallmarks of this community,” the task force said.

It believes it is the responsibility of the community and elected leaders to “understand what is at stake when any one of these sectors is threatened.”

“Threats come sometimes from market headwinds and lack of awareness but other times by impediments driven by urban narratives and agendas of third parties; either of which have little or no connection to this community, care for or have any understanding of it. There must be a balance between industry and social interests, something that is not evident today. We believe that all of the community’s political representatives need to understand this balance and vigorously defend it.”

It recommended that community members and elected leaders engage with the industries, be aware of their respective importance to the community at large; and be ready to defend them from “outside interests.”

The task force will re-convene by 1 March 2021 to track the progress of its various recommendations.

– Liza Mayer

One of BC’s RAS pioneers is ready to take model farm on the road

BY MATT JONES

All Photos: Taste of BC Aquafarms

The

Steve Atkinson is a skeptic of mega RAS farms. He believes the future of salmon farming using recirculating aquaculture technology (RAS) lies in building 100- to 400-tonne farms instead of the 10,000- to 90,000-tonne facilities being built around the world.

That’s what guided Atkinson when he set out to build Taste of BC Aquafarms in Nanaimo, British Columbia in 2012. The land-based steelhead farm has a hundredtonne annual capacity. It was one of the very first closed containment salmon farms in production in North America.

“Right from the beginning, our goal was to develop, demonstrate and test the viability of land-based salmon aquaculture at a small to medium scale,” says Atkinson. “We wanted to come up with a module with known outcomes that could be replicated in other locations.” Atkinson wasn’t the only one testing RAS technology to raise salmonid to market size at that time. But Taste of BC Aquafarms is the only one that has been in operation continuously to this day. And that says a lot.

“Most of the other attempts had one goal: to displace net cage salmon aquaculture. They were largely driven and financed by NGOs. I want to build a new industry, not displace an old one,” he says.

PRUDENCE PAYS

Some things stand out when looking back at the journey of Taste of BC Aquafarms. For one thing, Atkinson has always been very conservative in spending. This set Atkinson apart from his contemporaries. He says they outspent him 10 to one but never produced any fish. If

Since July, the land-based steelhead farm in Nanaimo, BC has been seeing consistent weekly harvests of 2 tonnes of steelhead weighing upwards of 2kg each

Staff Ben Oldham holds an unusually large 4.8-kg steelhead from Taste of BC Aquafarms. ‘Every once in a while we get one that grows way above the curve,’ says company president Steve Atkinson

Taste of BC had spent $30 million during the early years, he says the company would likely have drowned in debt.

Moreover, the farm has no “crazy overheads.” This helped the company recover from a bacterial gill breakout that killed a massive number of fish a year ago.

But there was no shortage of challenges. In land-based RAS, the application of crucial elements such as oxygen and light levels or feeding regimes have to be tweaked over time until one reaches optimal output. “One issue would come up, we’d solve it and then three more arrived,” says Atkinson.

After years of learning, Taste of BC has reached a pivotal moment. Since July 2020, the farm has been seeing consistent weekly harvests of 2 tonnes of steelhead weighing upwards of 2kg each.

“For the first time, our farm is full with over 30 tonnes of biomass. Each tank is staged the way it’s supposed to be with fish at the right size. We’re harvesting our target – two tons a week and we’re selling that every week.” The company sells its fish under the brand Little Cedar Falls. He admits the farm is not profitable yet, but it is on its way. The constancy of harvests “will put us in a profitable position,” says Atkinson.

“We have now a full farm, with all fish performing above our target growth projections on a constant basis. All of our production is top quality with no downgrades. They meet market standards as to size, colour, taste etc.”

The volume of the weekly harvest “is a size you can handle,” he adds. “A local market almost anywhere could probably handle that volume. You can service a province or a major city.”

While working towards profitability, Atkinson keeps an eye on the environment. The farm is working on refining

a liquid fertilizer derived from fish manure, a product it developed with two students from the Vancouver Island University. The hope is for the product to help generate revenue as well as recycle the fish waste.

“The bottom line is we are running a good business. One that brings in profit, treats the environment with respect, and produces high quality seafood for all to enjoy,” the company writes in its website.

The next step will be to find the right financing partner to truly bring Atkinson’s vision of a modular, replicable farm to fruition. With the company’s model and their story, he feels it should be a fairly easy sell.

“We’re a success story,” says Atkinson. “Not a huge success story, but I’d rather be a small success story than a big dream.”

Wenger Extrusion Solutions for RAS Feed Production

Wenger innovative extrusion solutions deliver clean, durable, nutritional feeds specifically designed for the most e cient RAS operations. Feeds produced on Wenger systems maintain their integrity better and longer, for clean and clear water. So you feed the fish, not the filter.

Learn more about the Wenger RAS advantage. Email us at aquafeed@wenger.com today.