THE CHANGING LANDSCAPE OF NZ WINE

The purpose of this commentary is to share insights on global demand, supply from Marlborough, forecasted Sauvignon Blanc carryover inventory levels, and Marlborough Sauvignon Blanc grape price trends. Consumers across the globe continue to enjoy the taste of New Zealand wine, over the past year an estimated 1.2 million bottles are consumed every day.

This level of consumption has been consistent over the past decade through an established global distribution network partnering with gatekeepers and connecting with consumers. This is an achievement worthy of recognition. However, this global demand for New Zealand wine has plateaued in recent years, since 2019 the current June 2025 MAT 324ML has only grown 0.1% per year (CAGR %).

The current landscape continues to be challenging due to shifting consumer trends (moderation & health), floods, government regulation, inflation, and economic uncertainty. A clear strategy, flexibility, and laser focus in executing the business plans will help navigate through this period.

The winegrower business model is based on the three Vs: viticulture, vinification, and vendre (to sell)*. Due to the oversupply position, to sell profitability has become the biggest challenge and future success will be based on understanding what resonates with the wine consumer, strong customer relationships, innovation, access to new export markets, greater penetration into existing markets, brand positioning, and connecting with consumers to encourage purchase at higher price points.

* The Wine Economist August 2024

KEY INSIGHTS:

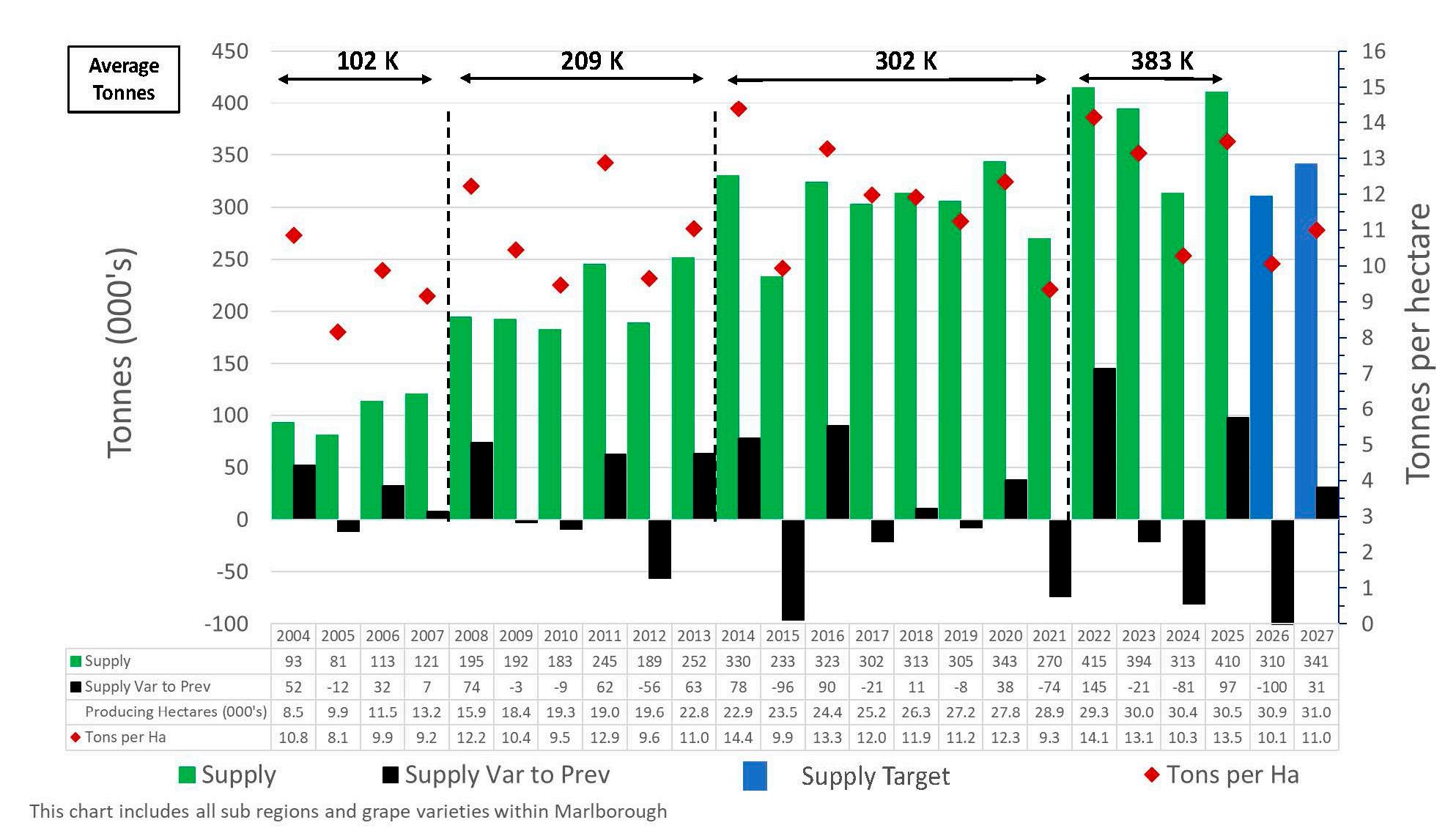

1. Marlborough grape supply for vintage 2025 is 410k tonnes, 31% or 97k tonnes above vintage 2024 and 20% or 68k tonnes above our target of 342k T (the target was set to improve demand supply equilibrium).

2. Global demand for New Zealand wine has plateaued in recent years, since 2019 the June 2025 MAT 324ML has grown 0.1% per year. F26-27 is forecast to hold at 324ML, this is a best- case scenario that acknowledges the challenging sales landscape and an oversupply of inventory. Risk not factored into the forecast relates to government regulation (taxes and tariffs) and downstream impact on pricing strategies.

3. NZ Wine export June 2025 MAT is $2.1 billion, this has only declined 0.6% (-$12m) year on year. Resulting from a 2% increase in volume and a 5% decline in the $ per litre ($7.27 LT) from both packaged and non-packaged exports.

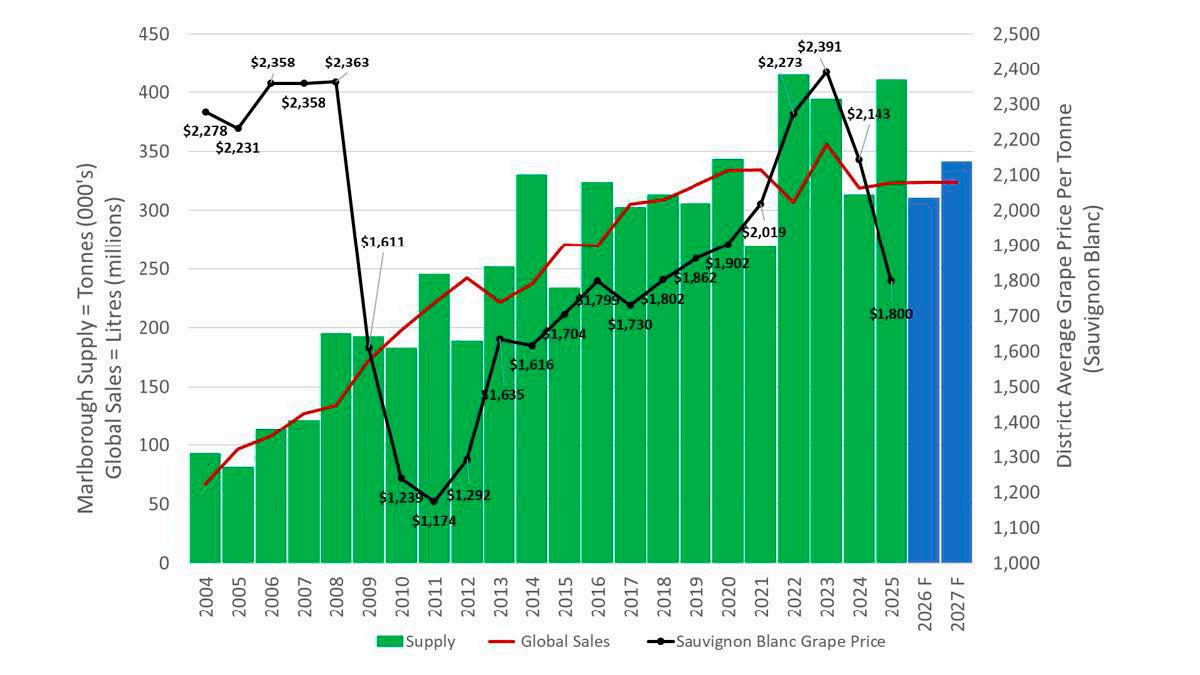

4. A step change in supply from Marlborough began in vintage 2022. The average tonnes between vintage 2022-2025 is 383k tonnes, a 27% or 81k tonne increase above the vintage 2014-2021 average.

5. There is a direct correlation between demand, supply and the Marlborough Sauvignon Blanc grape pricing. After three record harvests in 2022, 2023 and 2025 combined with a levelling in demand volume the oversupply position increases. The directional decline in grape pricing is forecast to continue, the level of decline is dependent on individual winegrower businesses managing a balance between future demand and supply.

6. Sauvignon Blanc carryover inventory levels increase to 63ML (V25), a direct result of plateauing demand volume combined with the large V25 Marlborough harvest. Future pricing strategies will determine if the carryover forecast will increase, particularly if tariffs, excise tax increases, and new recycling taxes are passed on to the consumer.

MARLBOROUGH SUPPLY TRENDS

Marlborough grape supply is in the 4th phase of growth. This latest phase from the last four vintages (V22-25) averaged 383k tonnes. This step change in supply is a result of producing hectares increasing to 30.5k. Since V19 producing hectares have increased 3,293 ha (+12%) and in this same period global demand volume has plateaued. Productivity of vineyards has improved over recent vintages with higher tonnes per producing hectare (V22 = 14.1 T, V23 = 13.1 T, V25 = 13.5T) compared to historic yields. Since 2004 only two other vintages (V14 and V16) have been above 13T per hectare. In hindsight the supply from V25 is estimated to be 68k T above what was required to fulfill the global demand volume forecast in F26.

We have introduced a vintage target for 26 and 27, this includes all sub regions and grape varieties from Marlborough. It is demand led calculating the Marlborough supply required to achieve a New Zealand wine global demand volume of 324ML per annum in F26 and F27. The balancing of supply with demand is important for price stability and improved operating cashflow, inventory levels, and profit delivery.

As a historic marker the V26 target is inline with V24 and V18, the V27 target is inline with V20 (which was a record at the time). The immediate challenge is to ensure supply alignment with demand which will be managed by nature (V12, V15, V21 and V24) or through operational management by reducing yield per hectare or the longer-term impact of less producing hectares.

Source: Vintage 2004 – 2025 statistics from New Zealand Winegrowers Annual Report and 2025 Vintage Survey Report. Supply Target tonnes are from JPEW Advisory Ltd and are indicative only.

KEY POINTS:

• The last four vintages have step changed Marlborough supply to new levels of producing hectares and yields. Since V23 this step change has placed the wine industry in an oversupply resulting in downward pressure on grape and wine prices.

• The V26 supply target of 310k T is perceived to be low relative to recent harvests however it is only 11% below the 7-year supply average from Marlborough.

• This chart includes all sub regions and grape varieties within Marlborough.

•Climate change, water availability, bud initiation, labour supply, trunk disease, time lag of new planted and producing hectares and nursery supply are all recognised as impacting on harvest yields.

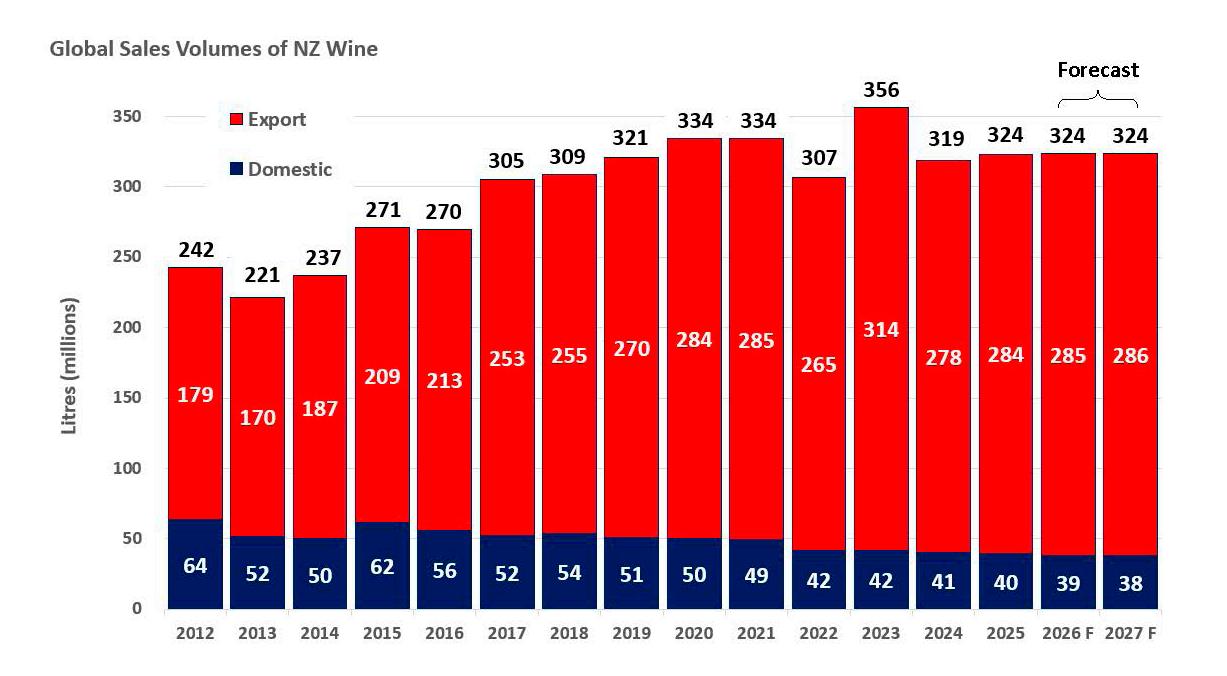

NZ WINE GLOBAL SALES TRENDS

Note: global demand is measured in financial years. Each year is based on a 30th June year end, inline with NZ Winegrowers.

Since F19, NZ wine global demand volumes have ranged between 307 to 356ML. The latest F25 result of 324ML is 2% lower than the 7-year average (2019-2025) of 328ML.

The F26-27 forecast of 324ML assumes a domestic market at 38-39ML and marginal export growth. This forecast is best viewed as a best-case from a volume perspective and factors in the oversupply position and pressure on pricing that is expected to continue.

The forecasts are directional and acknowledge that the challenging sales landscape will continue due shifting consumer trends, government regulation, inflationary impact on costs, and economic uncertainty. Risk not factored into the volume forecast relates to government regulation (taxes and tariffs) and downstream impact on pricing strategies. This risk could have a material impact on future sales volumes if prices increases are passed onto the consumer.

New Zealand excise tax continues to increase (pegged to inflation), changes to UK excise rates. US tariffs, and the UK Extended Producer Responsibility (EPR) regulations adversely impact net sales revenue for winegrower businesses. The additional regulation will be absorbed or passed on depending on winegrower pricing strategies. Price increases are sensitive to maintaining sales volumes (price elasticity) but necessary to improve profitability for gatekeepers and winegrower businesses.

This tension between supply, price, and profit is expected to continue until the wine industry supply position is balanced.

Whilst the current landscape is challenging consumers adore the taste of New Zealand Sauvignon Blanc as they trend towards white and lighter style wines. The trading up trend continues as consumers seek quality and will pay a premium price, this is evident in the domestic market with the growth in Sauvignon Blanc brands positioned above $20 per bottle retail.

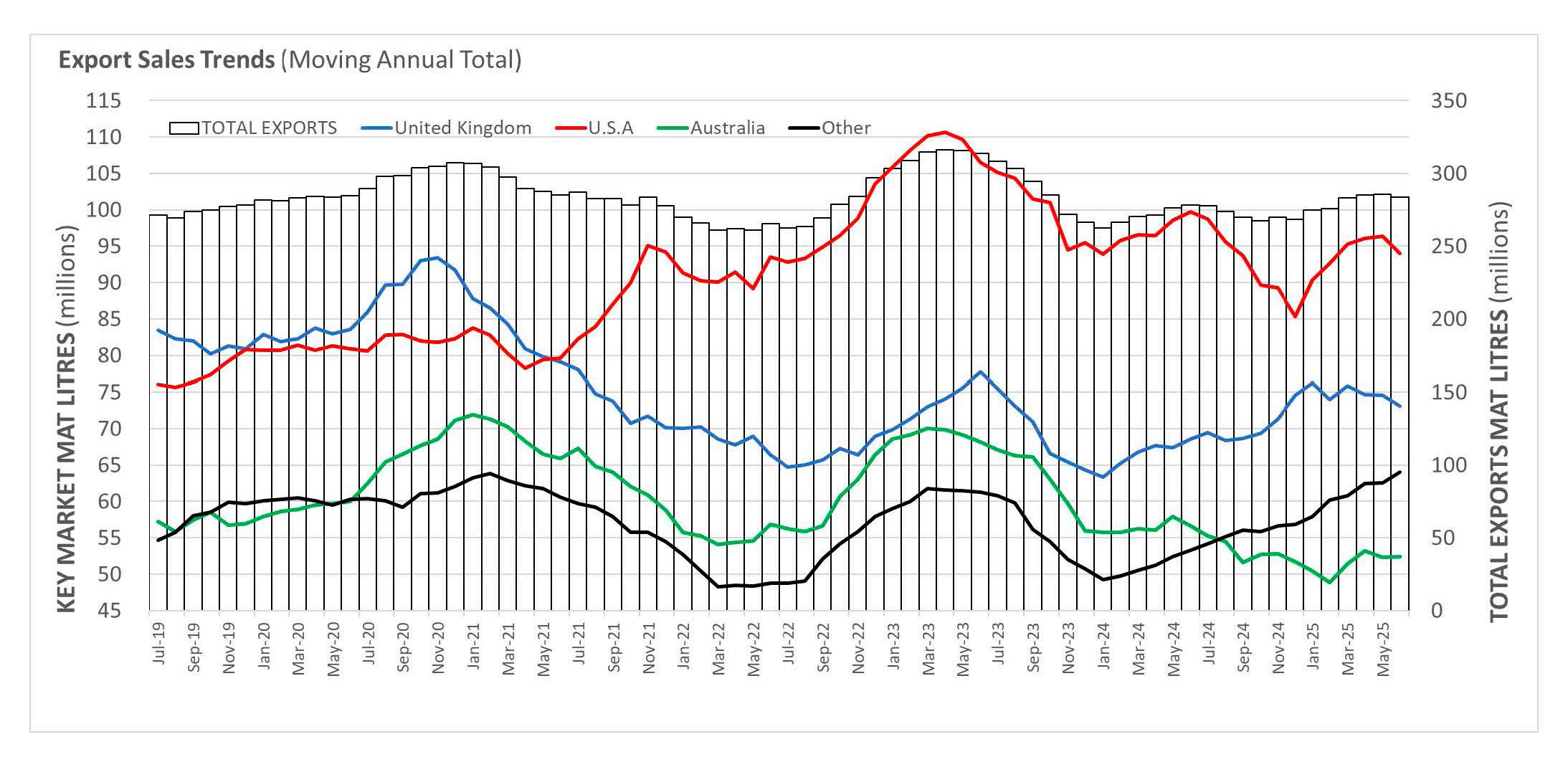

SIGNIFICANT CHANGES IN THE EXPORT MARKET MIX

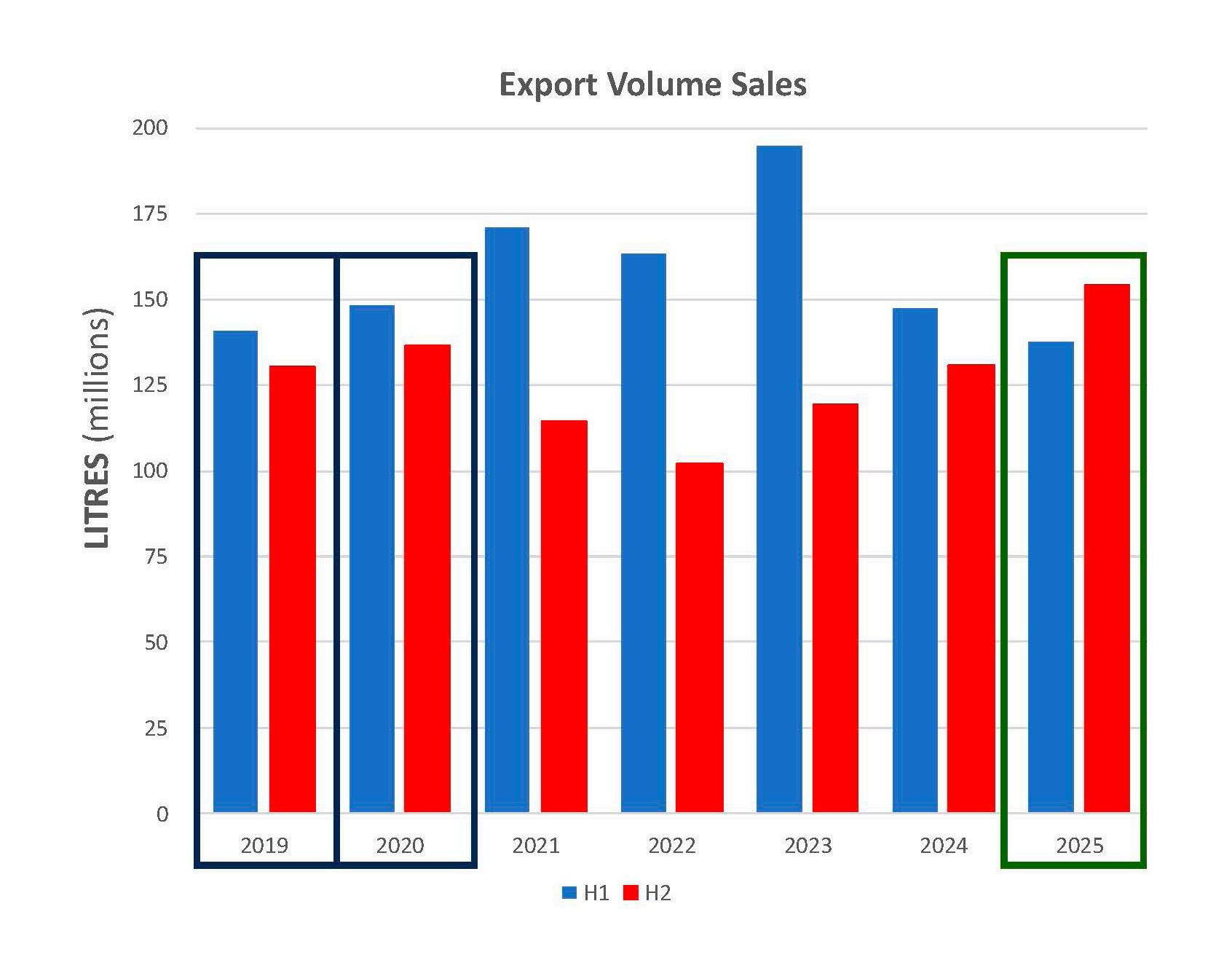

The June 2025 export MAT is 284ML, compared to June 2019 MAT 270ML the compounded annual growth rate over seven years has plateaued to 0.8%.

Recent export trends relate to market mix and the timing of the export demand

In the past seven years the change in the export market mix has been significant. Total export volume has increased by 14ML. Volume growth has been driven from the US countering declines in the UK and Australia. Within Other markets sales volume in Europe holds followed by growth in Asia. Since January 2024 the recent growth trend in Other markets is lead by Canada, Europe and Asia.

The government regulations with taxes and tariffs will place pressure on the current UK and US MAT volume particularly if most of the additional cost in passed onto the consumer resulting in higher prices.

F25 resulted in H2 (January–June) being higher than H1 (July-December). F24 returned to a similar H1:H2 weighting as in F19 and F20. This will be important to monitor due to downstream impact on cashflow.

Source: New Zealand Winegrowers reports: NZ Wine Export Reports 2025.

THE CORRELATION

OF DEMAND & SUPPLY WITH GRAPE PRICING TRENDS

This chart illustrates the historic relationship between total Marlborough supply with the New Zealand wine global sales volume, we then overlay the Marlborough Sauvignon Blanc grape price trend to identify a correlation and lag in timing. Supply constraints (decline in vintage supply) adversely impacts global sales volume the following financial year (July to June) highlighted with V12, V15, and V21. The F24 decline in global demand is different as it is not due to a supply constraint but the challenging trading landscape which has continued into F25. As previously highlighted, on average the global demand volume has remained relatively static since FY19, this is illustrated in the F26-27 forecast.

In the last report we introduced a V25 supply target of 342k T (to align supply with demand) for Marlborough, the actual supply was 410k T or 68K T above the target. This will prolong the oversupply position which will continue to place pressure on future pricing.

The vintage 2025 grape price forecast for Marlborough Sauvignon Blanc is $1,800 per tonne, this is indicative only as this price will be influenced by many variables. The impact of the V25 supply intake is a continued decline in grape pricing.

The chart above illustrates a correlation between levels of supply, demand, and the movement in grape prices. After three record harvests in 2022, 2023 and 2025 combined with a plateauing of global demand the oversupply position will continue.

Grape pricing beyond vintage 2025 may improve however any future movement in grape price will be dependent on the performance of global demand in F26-27 and how supply is managed in V26-27.

tonne: Marlborough Sauvignon Blanc.

SAUVIGNON BLANC CARRYOVER LEVELS

We wanted to understand how much Sauvignon Blanc was sold from July the year after vintage (V16 carryover = the volume of V16 sold after July 2017). This is referred to as carryover inventory on the basis that a vintage is usually released in July of the same year as vintage.

Our approach is to extrapolate the Sauvignon Blanc volumes sold from global demand then calculate the levels carryover inventory.

Historical patterns illustrate V16-18 carryover inventory was +10% of the total Sauvignon Blanc supply, grape pricing was level and the carryover inventory cover to global sales ranged between 8-11%. Between V19-22 carryover inventory dropped to 2% in V21. Over this period grape prices increased from $1,862 to $2,273 per tonne.

Carryover levels build to 22ML from V22 supply, it then increases to 53ML for V23. The decline in the V24 grape price correlates with the high V23 carryover position where winegrower businesses manage high inventory levels and weaker demand. The lower V24 supply combined with a lower grape price will adversely impact vineyard profitability after two successful years. This has the potential to repeat in V26.

The F25 global demand is 324ML, this is forecast to hold in F26-27. Once the V23 carryover inventory is sold it will result in a lower V24 carryover inventory level due to the lower V24 harvest. A key lever to manage future carryover levels is stability in the demand volumes.

In the table above the V25 carryover forecast is 63ML, an increase of 45ML from the previous vintage. This increase is the result of a record Sauvignon Blanc harvest of 402k T (across all wine growing regions) combined with a plateauing of global demand. A V26 Sauvignon Blanc supply target of 235ML (inline with V19 and V24) will reduce the V26 carryover level to 30ML (assuming global demand remains level with F25 and F26).

Source: New Zealand Winegrowers Final Annual Grape Prices per tonne: Marlborough Sauvignon Blanc. All the demand and supply volumes are sourced from New Zealand Winegrower reports. JPEW Advisory Ltd provide the forecasts highlighted in yellow. Note: Global Demand is ex NZ shipments based on the NZWG reporting year which is July – June.

JOHN WILSON

+64 27 837 3420 | john.wilson@jpew.co.nz | www.jpew.co.nz

WE PROVIDE SPECIALIST WINE INDUSTRY SERVICES, ADVICE, AND INSIGHTS TO IMPROVE YOUR BUSINESS PERFORMANCE.

REQUEST A FREE NO OBLIGATION CONSULTATION.

DISCLAIMER This document is published solely for informational purposes. It has been prepared without taking account of your objectives, financial situation, or needs. Before acting on the information in this document, you should consider the appropriateness and suitability of the information , having regard to your objectives, financial situation and needs, and, if necessary seek appropriate professional or financial advice. We believe that the information in this document is correct and any opinions, conclusions or recommendations are reasonably held or made, based on the information available at the time of its compilation, but no representation or warranty, either expressed or implied, is made or provided as to accuracy, reliability or completeness of any statement made in this document. Any opinions, conclusions or recommendations set forth in this document are subject to change without notice and may differ or be contrary to the opinions, conclusions or recommendations expressed. Neither JPEW Advisory Limited nor any person in volved in the preparation of this document accepts any liability for any loss or damage arising out of the use of all or any part of this document. Any projections and forecasts contained in this document are based on a number of assumptions and estimates and are subject to contingencies and uncertainties. Different assumptions and estimates could result in materially different results. JPEW Advisory Limited does not represent or warrant t hat any of these valuations, projections or forecasts, or any of the underlying assumptions or estimates, will be met.