THE CHALLENGING LANDSCAPE OF NZ WINE

The current landscape continues to be the most challenging I have seen for a considerable time. We have seen a correction in export demand which has occurred after a step change in supply from Marlborough, with record harvests in 2022 and 2023. The realignment between demand and supply has resulted in higher inventory levels, changing demand patterns, and a new harvest with lower yields. All placing pressure on the future cashflows for winegrower and grape grower businesses.

A change in consumer demand is partly due to moderation, resulting in lower consumption due to health and lifestyle choices combined with pressure on disposable income. This is impacting the frequency and intensity of wine consumption.

The complexity of the current landscape is also affected by ongoing inflation and input cost pressures that are having a direct impact on the growing risk of lower profitability. This challenge is not new or unique to NZ winegrower businesses. The purpose of this commentary is to share insights on global demand, supply from Marlborough, forecasted Sauvignon Blanc carryover inventory levels, and the downstream impact on grape pricing (Marlborough Sauvignon Blanc).

Demand management (including pricing strategy and promotional investment) becomes a key lever in future success which is reliant on increasing access to new export markets, greater penetration into existing markets, and connecting with consumers to encourage purchase at higher price points.

KEY INSIGHTS:

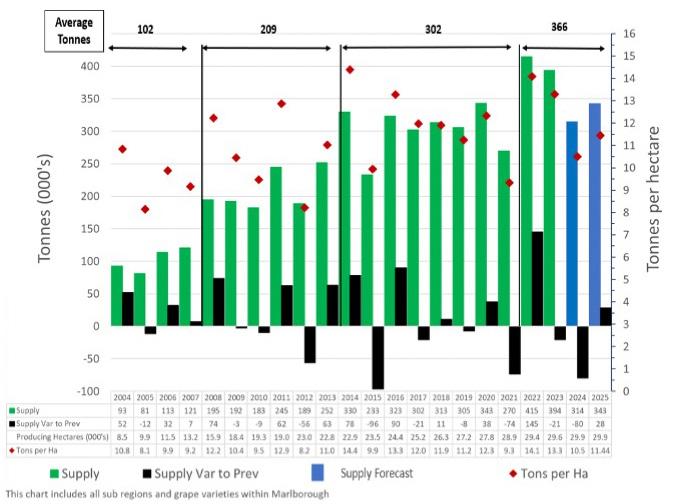

1. Marlborough grape supply for the 2024 vintage is 313K tonnes, 21% or 81K tonnes below the 2023 vintage. This is the result of producing hectares moving above 29,900 combined with lower tonnes per producing hectare.

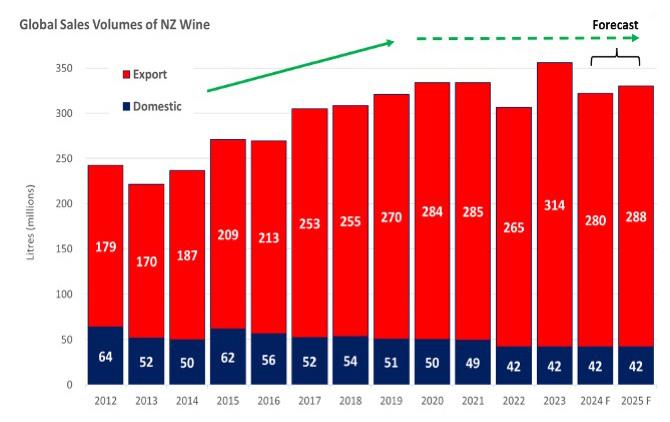

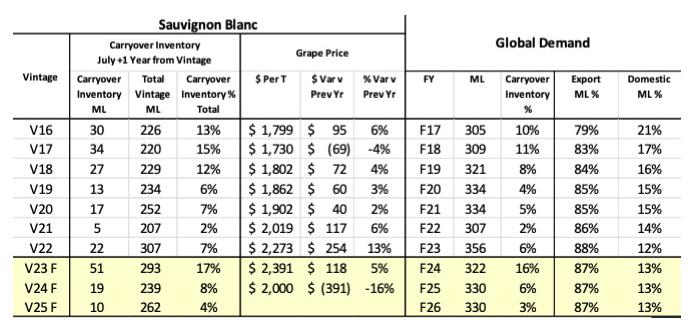

2. Global demand volumes have not grown since FY20 and the FY25 forecast is inline with the (20192023) 5-year average of 330ML. The FY24 forecast has been reset to 322ML which is inline with FY19. The FY25 forecast of 330ML assumes a stable domestic market at 42ML and 3% export growth from the FY24 forecast.

3. Current export MAT April 2024 of $2.06 billion has declined 14% year on year. Resulting from a 14% decline in volume and a 1% increase in the $ per litre ($7.63 LT) from both packaged and non-packaged exports.

4. The recent 9-month declining trend in export volumes reversed in February 2024, the current MAT April 272ML is forecast to grow to 280ML by June 2024. The FY25 export volume forecast 288ML acknowledges a challenging sales landscape due to the impact of inflation, input cost pressures including duty and excise increases, and future sensitivity to volume growth as price increases are implemented.

5. There is a direct correlation between demand, supply and the Marlborough Sauvignon Blanc grape pricing. After two record harvests in 2022 and 2023 combined with a softening in demand the current landscape has moved into a temporary over supply position, resulting in the lower 2024 vintage grape price forecast of $2,000 per tonne.

6. Carryover levels build from the record V22 supply where carryover inventory increased to 22ML. The current focus is to manage the V23 carryover which is forecast at 51ML due to a reduction in the F24 global demand and the high V23 supply. This level of carryover inventory will be the highest since 2016. The July – December 2024 period will be unusual as the V23 carryover will continue to be sold whilst the V24 wines are released to customers.

MARLBOROUGH SUPPLY TRENDS

The Marlborough 2024 vintage has been confirmed at 313K tonnes, 21% or 81K tonnes below V23. Frost in some sub regions, an up and down flowering period, and continuing dry conditions has resulted in a reduction in bunches, smaller bunch sizes, and berry size variability. The availability of water supply has also influenced the final yield. Historically vintages 2021, 2015, and 2012 had similar corrections.

Marlborough grape supply is in the 4th phase with the last three (V22-24) vintages averaging 374K tonnes. This is a result of producing hectares moving above 29,500 and the high tonnes per producing hectare (V22 = 14.1 T, V23 = 13.3 T), compared to historic yields. Since 2004 only two other vintages (V14 & V16) have been above 13T per hectare. In hindsight the supply from V22 & 23 was 45-50K T above what was required to fulfill the global demand volume in FY23 and FY24.

We have introduced a V25 forecast of 343K T. This is a demand led forecast calculating the supply required from Marlborough to achieve a global demand of 330ML in F25 and F26. This V25 forecast is an indicator of supply required with manageable levels of carry over inventory to ensure Marlborough supply is aligned with global demand volume forecasts.

KEY POINTS:

• The last three vintages have step changed Marlborough supply to new levels of producing hectares and yields.

• This chart includes all sub regions and grape varieties within Marlborough.

• Climate change, water availability, bud initiation, labour supply, trunk disease, time lag of new planted and producing hectares and nursery supply are all recognised as impacting on harvest yields.

Source: Vintage 2004 – 2024 statistics from New Zealand Winegrowers Vintage Survey Report. Vintage hectares from Marlborough Wine Industry Growth projected hectares in production.

NZ WINE GLOBAL SALES TRENDS

The FY24 forecast has been reset to 322ML which is inline with FY19. This is a downgrade from our March FY24 forecast of 336ML. The FY25 forecast of 330ML assumes a stable domestic market at 42ML and 3% export growth compared to the FY24 forecast 280ML

Global demand volumes have not grown since FY20 and the FY25 forecast is inline with the (2019-2023) 5-year average of 330ML.

The recent 9-month declining trend in export volumes reversed in February 2024, the current export MAT April 272ML result is forecast to grow to 280ML by June 2024. The FY25 volume forecast acknowledges a challenging sales landscape due to the impact of inflation, input cost pressures including duty and excise increases, and future sensitivity to volume growth as price increases are managed to improve profitability for gatekeepers and winegrower businesses.

Whilst the current landscape is challenging global demand forecast builds in future growth as NZ Sauvignon Blanc remains in demand within export markets, NZ wine sold domestically is holding, premium price segments continue to grow, low or no alcohol is growing, and younger consumers are more confident and knowledgeable when engaging with wine.

Another dynamic is a change in consumer demand resulting from moderation with lower consumption due to health and lifestyle choices, combined with pressure on disposable income. This is impacting the frequency and intensity of wine consumption. Also, competition from other countries of Sauvignon Blanc source (US, Chile, South Africa) and cross category (spirts, RTDs, beer, non alcohol) competition are influencing consumer choice.

Note: each year is based on a 30th June year end. Source: New Zealand Winegrowers reports: NZ Domestic Market Reports and NZ Wine Export Reports. Forecasts are from

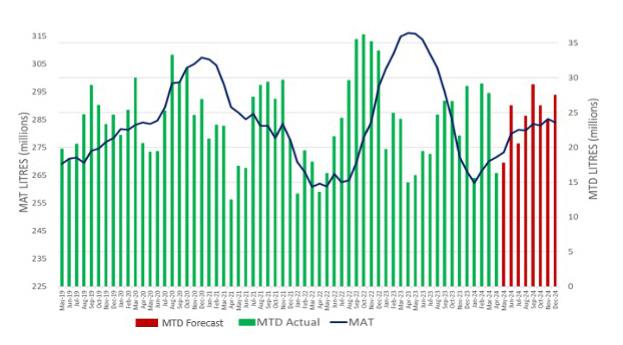

NZ WINE EXPORT SALES TRENDS

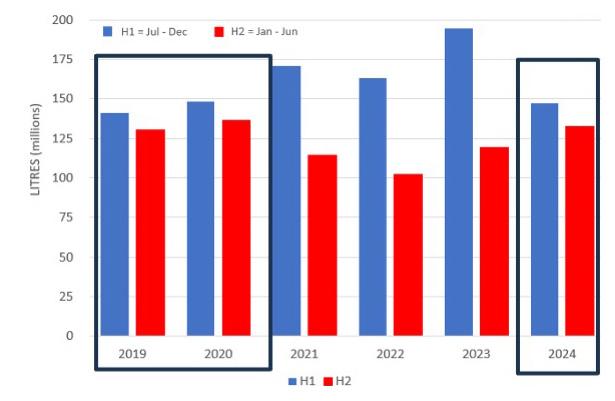

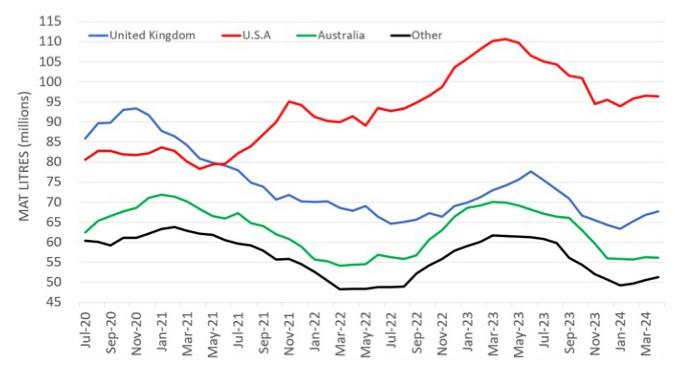

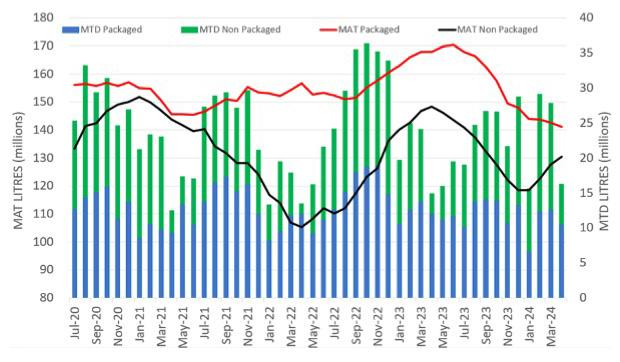

The seasonality of export demand changed over the last 4 years. The charts below illustrate the monthly volatility creating a strong weighting of H1 export demand throughout the 2020-2023 period.

Monthly forecasts ( May-Dec 2024) are based on a rebalancing of the timing of NZ shipment demand between H1 and H2, moving back to a H1:H2 weighting that mirrors 2018 and 2019. This rebalancing is driven from lower in-market stock levels, consistency of supply, and continued depletion growth (off shelf or wine list) in key export markets. This change in the seasonality of export demand will have an impact on winery storage capacity and cashflow as higher levels of inventory will be required to be held leading into the new vintage.

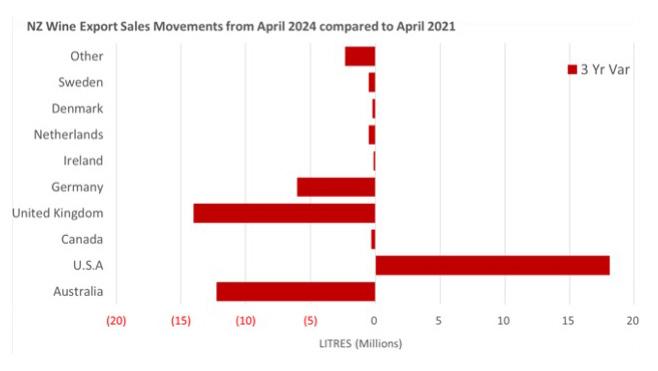

SIGNIFICANT CHANGES IN THE EXPORT MARKET MIX

In the past three years the change in the export market mix has been significant. From April 2021 the USA have achieved step change growth. The current USA MAT April 96M is 18ML or 23% above April 2021. All other key markets have been in decline however the recent performance since Feb 2024 illustrates a turnaround in export demand where volumes have stabilised.

Total export MAT April 272ML is 18ML or 6% lower than April 2021. This volume decline has not occurred in the export $ value where the total export MAT April $2.06b is $0.16b or 8% above April 2021. This $ value growth is due to the improved FOB $ per LT. The current $7.63 per LT which is $1.11 per LT or 17% above April 2021. Packaged wine FOB $ per LT has been the driver of this value growth where the current MAT April $10.28 per LT is $1.58 per LT or 18% above April 2021. The FOB $ per LT in unpackaged wine has also improved over this three-year period by 20%.

CHANGES IN THE EXPORT PACKAGING TYPE

The mix of the packaging type each month has historically been 53% packaged and 47% non packaged of total export volume. Since January 2024, this mix has reversed resulting in the recent growth in non packaged export volume and continued decline in packaged wine. The recent turnaround in total export volume performance is driven from non packaged exports, primarily to the USA and UK. This may be partly due to a recent change in supply chain planning with a move to store and bottle more wine in the USA.

Packaged wine exports are in decline across all key markets and the timing correlates with the increase in the packaged $ per L since June 2023. This is a trend we will monitor to understand if the packaged wine MAT volume decline is due to price elasticity (lower volume shipped due to price increases) or a change in supply chain planning with a move to bottling in market.

Source: New Zealand Winegrowers reports: NZ Wine Export Reports.

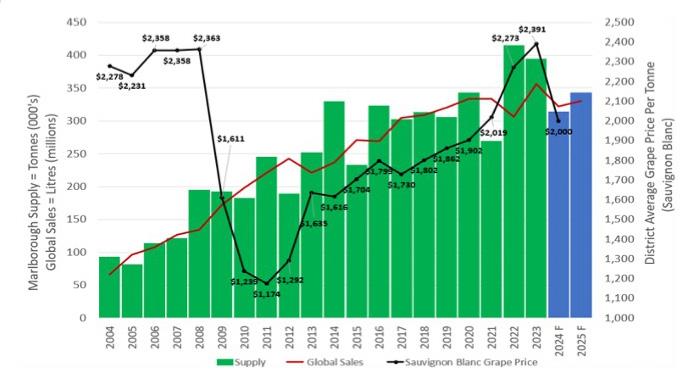

THE CORRELATION OF DEMAND & SUPPLY WITH GRAPE

PRICING TRENDS

This chart illustrates the historic relationship between total Marlborough supply with the global sales volume, we then overlay the Marlborough Sauvignon Blanc grape price trend to identify a correlation. Global sales volume over the last 20 years has been a great NZ success story. Supply constraints (decline in vintage supply) adversely impacts global sales volume the following financial year (July to June) highlighted with V12, V15, and V21. The global demand forecast decline in F24 is different as it is not due to a supply constraint but the challenging trading landscape. As previously highlighted, on average the global demand volume has remained relatively static since FY20.

We have introduced a V25 supply forecast of 343K T. This is a demand led forecast calculating the supply required from Marlborough to achieve a global demand volume of 330ML in F25 and F26.

From the steady rise in grape prices between 2013-2021 there was an 18% increase from 2020 to 2023, resulting in a record $2,391 per tonne for vintage 2023.

The vintage 2024 grape price forecast for Marlborough Sauvignon Blanc is $2,000 per tonne, inline with the 2021 grape pricing. It is estimated the grape pricing will fall within a range between $1,900 to $2,400 per tonne. This is dependent on the grape pricing strategy of each winegrower business.

This forecasted correction in grape pricing is the first since vintage 2017 however the size of the forecasted correction is higher.

The chart above illustrates a correlation between levels of supply, demand, and the movement in grape prices. After two record harvests in 2022 and 2023 combined with a softening in demand the current landscape has moved into a temporary over supply position, resulting in the lower forecasted grape price in vintage 2024.

Grape pricing beyond vintage 2024 may improve however any future movement in grape price will be dependent on the performance of global demand in 2024 and 2025 (each demand year is based on a 30th June year end) and how supply is managed in V25.

Source: New Zealand

Winegrowers Final Annual Grape Prices per tonne: Marlborough Sauvignon Blanc.

SAUVIGNON BLANC CARRYOVER LEVELS

We wanted to understand how much Sauvignon Blanc was sold from July the year after vintage (V16 carryover = the volume of V16 sold after July 2017). This is referred to as carryover inventory on the basis that a vintage is usually released in June of the same year as vintage.

Our approach was to calculate the Sauvignon Blanc export volumes sold as carryover inventory believing this sample size is large enough to build a picture.

Historical patterns illustrate V16-18 carryover inventory was +10% of the total Sauvignon Blanc supply, grape pricing was level and the carryover inventory cover to global sales ranged between 8-11%. Between V19-22 carryover inventory dropped to 2% in V21. Over this period grape prices increased from $1,862 to $2,273 per tonne.

Carryover levels build from the record V22 supply where carryover inventory increased to 22ML. The current focus is to manage the V23 carryover which is forecast at 51ML. This level of carryover inventory will be the highest since 2016. The July – December 2024 period will be unusual as the V23 carryover will continue to be sold whilst the V24 wines are released to customers.

The expected decline in the V24 grape price correlates with the high V23 carryover position where winegrower businesses manage high current inventory and weaker demand. The lower V24 supply combined with a lower grape price will adversely impact vineyard profitability after two successful years.

The F24 global demand forecast (highlighted yellow in the table above) is 330ML and this is expected to hold in F25. It is expected the V23 carryover inventory will be sold resulting in a lower V24 carryover inventory level due to the lower V24 harvest. The key lever to manage this is to achieve the F24-26 global demand forecasts.

The V25 total Sauvignon Blanc forecast of 262ML is based on a supply required from Marlborough of 343KT, inline with V20. This V25 supply required forecast will align with global demand volume and ensure a V25 forecast carryover inventory of 10ML.

Source: New Zealand Winegrowers Final Annual Grape Prices per tonne: Marlborough Sauvignon Blanc. All the demand and supply volumes are sourced from New Zealand Winegrower reports. JPEW Advisory Ltd provide the forecasts. Note: Global Demand is ex NZ shipments based on the NZWG reporting year which is July – June.

JOHN WILSON

+64 27 837 3420 | john.wilson@jpew.co.nz | www.jpew.co.nz

WE PROVIDE SPECIALIST WINE INDUSTRY SERVICES, ADVICE, AND INSIGHTS TO IMPROVE YOUR BUSINESS PERFORMANCE.

REQUEST A FREE NO OBLIGATION CONSULTATION.

DISCLAIMER This document is published solely for informational purposes. It has been prepared without taking account of your objectives, financial situation, or needs. Before acting on the information in this document, you should consider the appropriateness and suitability of the information , having regard to your objectives, financial situation and needs, and, if necessary seek appropriate professional or financial advice. We believe that the information in this document is correct and any opinions, conclusions or recommendations are reasonably held or made, based on the information available at the time of its compilation, but no representation or warranty, either expressed or implied, is made or provided as to accuracy, reliability or completeness of any statement made in this document. Any opinions, conclusions or recommendations set forth in this document are subject to change without notice and may differ or be contrary to the opinions, conclusions or recommendations expressed. Neither JPEW Advisory Limited nor any person in volved in the preparation of this document accepts any liability for any loss or damage arising out of the use of all or any part of this document. Any projections and forecasts contained in this document are based on a number of assumptions and estimates and are subject to contingencies and uncertainties. Different assumptions and estimates could result in materially different results. JPEW Advisory Limited does not represent or warrant t hat any of these valuations, projections or forecasts, or any of the underlying assumptions or estimates, will be met.